2.1 OFS CRR CS goAML Cloud Service

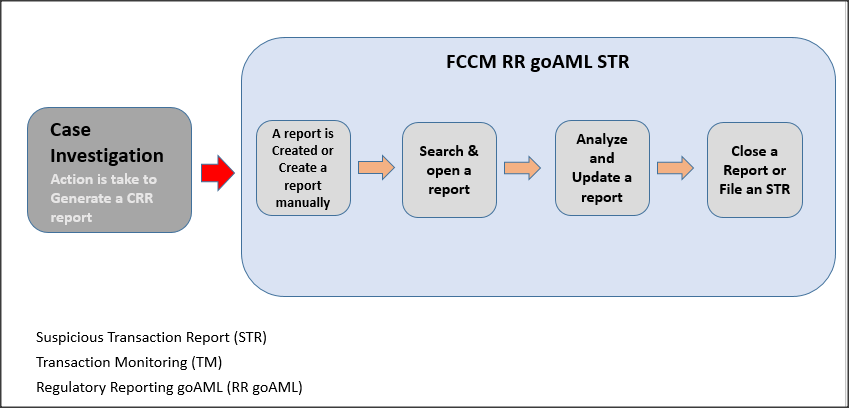

The Oracle Financial Services Compliance Regulatory Reporting Cloud Service (OFS CRR CS) goAML STR application is used to analyze the reports and take appropriate action on the report for a resolution.

Reports are created in the OFS CRR CS goAML STR application as a result of the Generate goAML STR action taken on a case or cases in the Oracle Financial Services Case Management application. The business data (transaction, account, and entity details) and operational data (narratives, documents, and comments) related to the case which led to the creation of a report are available in the OFS CRR CS goAML STR application. Using this information, authorized users analyze reports and report them to the FIU or close them by providing appropriate details.

Figure 2-1 Report Life Cycle in the OFS CRR CS goAML STR Application

- Generatean OFS CRR RR Report:After analyzing a suspicious case, if it is required to report to the regulator, you can take action to generate a report. For more information, see the Acting on Cases chapter in the OFS TM User Guide

- Createa Report:A report is created in the OFS TM Case Investigation application and the related information is passed to the OFS CRR CS goAML STR application using web service. The newly created report is available in the OFS CRR CS goAML STR application and it is assigned to a spe- cific user with a due date to take appropriate action by that date. When you identify a report of suspicious behavior that is not reported through the OFS TM Case Investigation application but want to report it to the regulator, you can manually create a new report using the Create New Report option in the OFS CRR CS goAML STR application.

- Search and Open a Report: To analyze the existing reports, you must open reports from the repost list or search using basic, advanced, or views search criteria. For more information, see Opening a Report

- Analyze a Report: To take any kind of action on a selected report, you must thoroughly analyze the details. You must verify the details of the report such as involved accounts, transactions, reporting entity details, related documents, narratives, and audit history.

- Act on a Report: Post analysis, you must take action on the selected report to close or report it to the regulator based on your privileges.