2 Fiscal Data Management

Fiscal Data Management is the set of features under RFMCS that manages fiscal attribute creation and item/entity fiscal classification. The association of fiscal-related attributes to items and entities is required to support fiscal document generation, tax calculation, and fiscal reporting.

Fiscal Data Management centralizes fiscal attribute creation and fiscal classification data without impacting the Retail Merchandising Foundation Cloud Service (RMFCS) foundation data creation process. Items and entities created in RMFCS are available for fiscal classification in Fiscal Data Management.

Manage Fiscal Attributes

Fiscal attributes are created and maintained in Fiscal Data Management via REST services. Consult the Retail Fiscal Management Cloud Service Inbound and Outbound Integration Guide for details.

Depending on specific country-level requirements, Fiscal attributes are created and made available as part of the RFMCS installation. For Brazil, a set of pre-defined attributes is made available as part of the initial installation of the product. Pre-defined attributes for other countries are made available on-demand and at Oracle´s discretion.

Besides the list of pre-defined attributes, customers can create user-defined attributes.

Pre-defined Attributes

Depending on country-specific requirements, a set of pre-defined attributes are made available along with Fiscal Data Management feature in RFMCS. The list of predefined attributes for Brazil is available in the Retail Fiscal Management Operations Guide.

Note:

The association of any of the pre-defined attributes to its specific entity (items, locations, suppliers, and so on.) are not delivered as part of the RFMCS installation. This association or “fiscal classification” is part of the implementation activities.

For the pre-defined attributes that require a list of values, the list is also be provided as part of the installation. However some attributes have their list of values provided by the Government or external entities. For customers to have the autonomy to keep these lists updated, a REST service is available to have the list of values updated.

For example, NCM is a code used in MERCOSUR countries. It is provided by governments and must be associated with items. The valid list of NCM codes can be updated frequently so customers can use the service for that purpose.

User-defined Attributes

User-defined attributes can be created in Fiscal Data Management via REST service. There is no UI for that purpose. The new service has user-defined attributes created and/or updated so they can be leveraged by RFMCS in fiscal document creation integration and in tax integration.

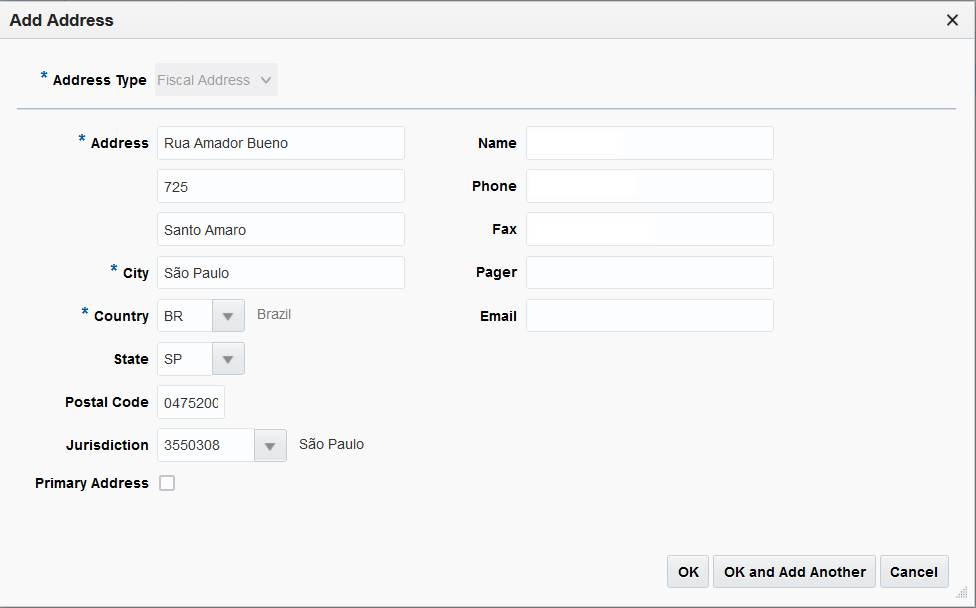

Fiscal Address

A new address type is available for MFCS along with RFMCS installation. Type ‘08’ Fiscal address is a non-mandatory field in the address screen, but it is validated in RFMCS transactions.

The fiscal address is used in RFMCS processes as the address to be validated. A lack of this address results in validation failures.

Figure 2-1 Fiscal Address

Manage Fiscal Classification

Fiscal classification or reclassification is the process of associating fiscal attributes to items and entities (locations, suppliers, partners). This process is supported via Fiscal Data Management screens, in the foundation integration subscription APIs, or via the REST web services.

Items and entities must exist and must be approved in RMFCS to be available for fiscal classification via Fiscal Data Management screens.

For the foundation subscription APIs such as Item subscription API, the creation of the item in RMFCS and the association with fiscal attributes in Fiscal Data Management happens at the same time.

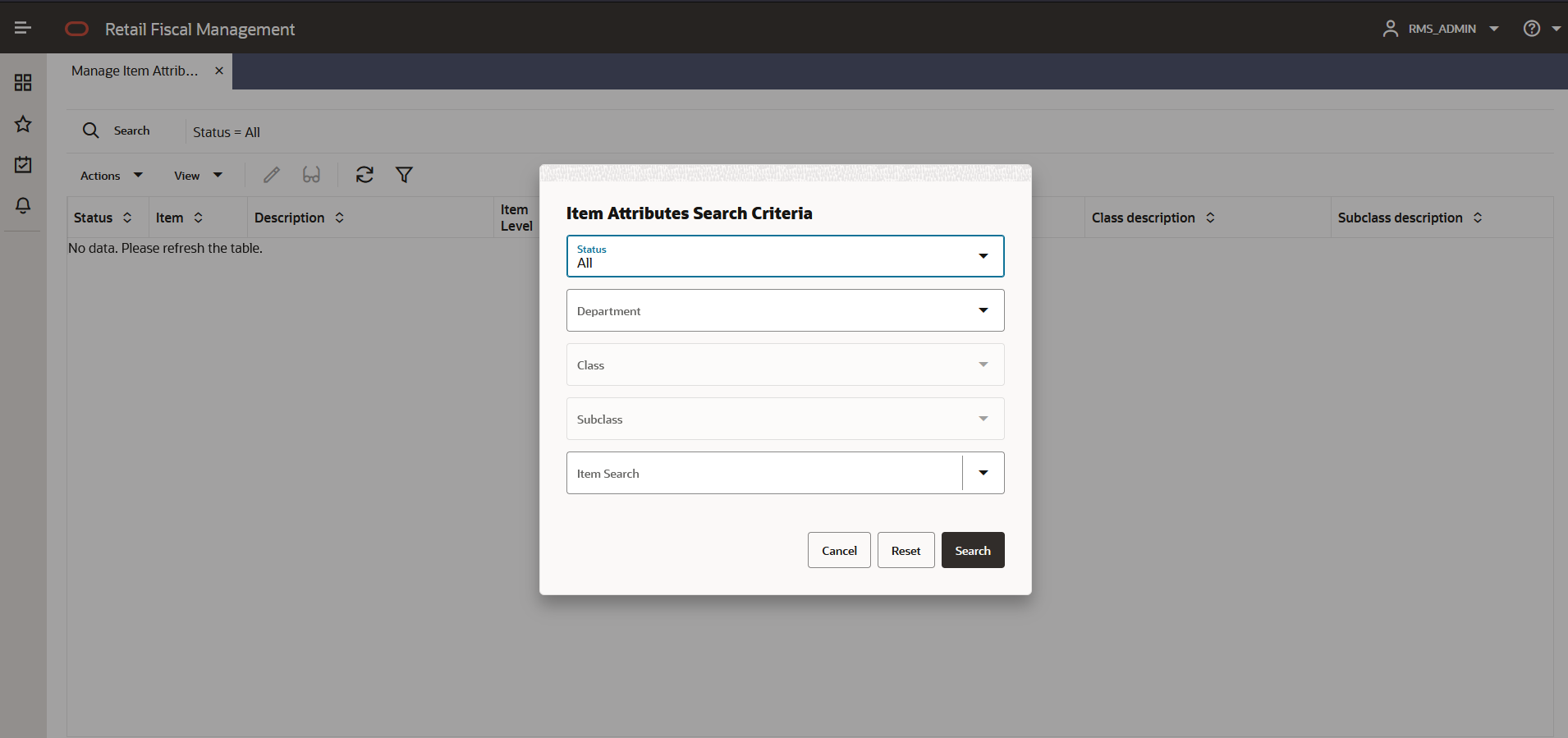

Manage Item Attributes

From the Fiscal Data Management screens, it is possible to visualize and maintain the association of items with the existing fiscal attributes. This functionality is accessed from the main RFM task list under Attributes > Manage Item Attributes.

Figure 2-2 Manage Item Attributes — Search

When opening the screen, a search popup is displayed with filtering options:

-

Status of items with regards to having fiscal attributes.

-

All

-

With Fiscal Attributes: Items with the mandatory attributes

-

Updates do Process: items with updated attributes

-

No Fiscal Attributes: items without at least one mandatory attribute.

-

-

Department. List of departments (data from MFCS)

-

Class: List of Classes filtered by the department selected (data from MFCS)

-

Sub-Class: List of Sub-Classes filtered by the Class selected (data from MFCS)

-

Item: Search of items filtered based on all previous criteria.

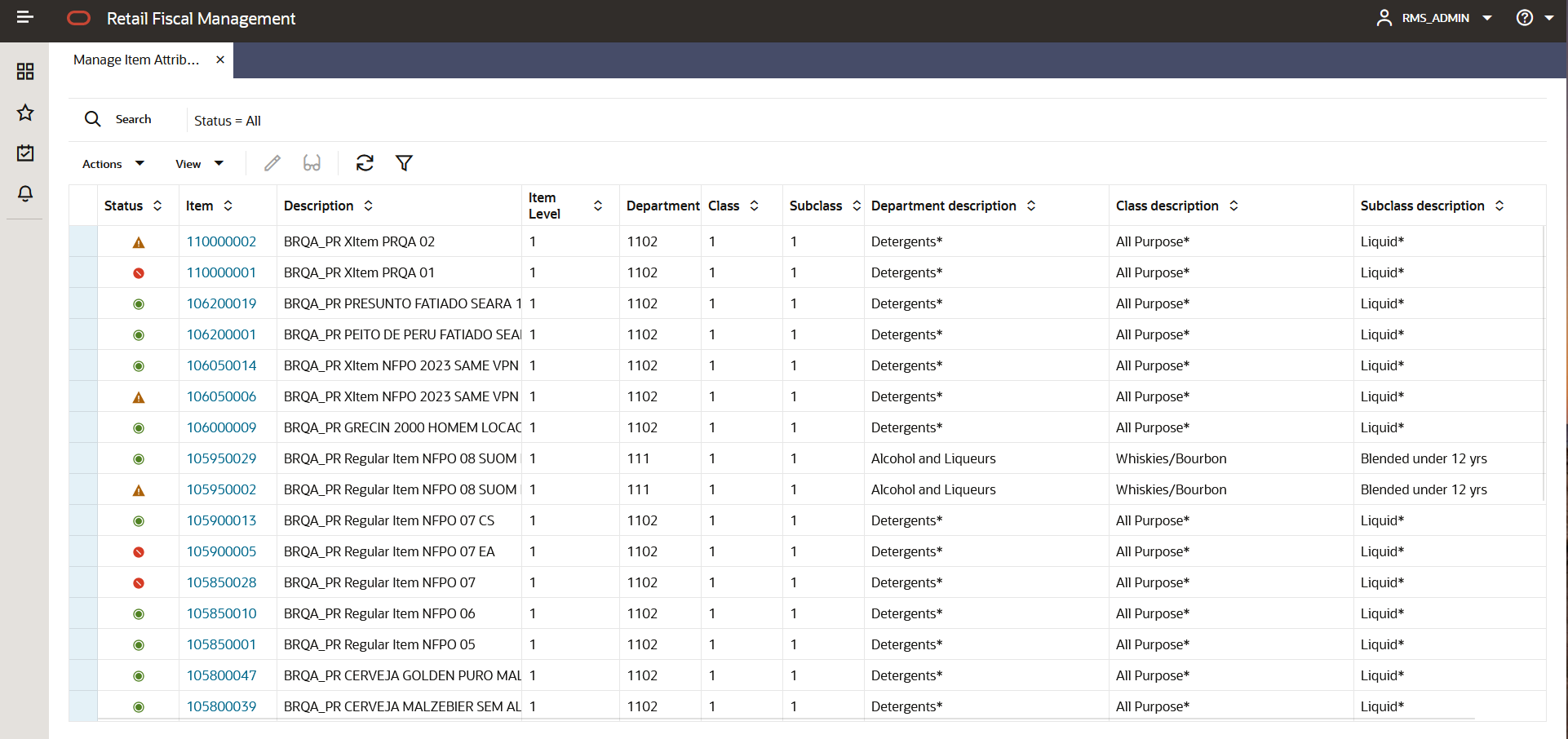

Based on the search criteria informed, the item fiscal attribute grid list is displayed:

Figure 2-3 Manage Item Attributes

Table 2-1 Manage Item Attributes Screen Fields

| Field | Description |

|---|---|

|

Status |

Icons to demonstrate the current status of the item regarding the fiscal attributes.

|

|

Item |

Item code |

|

Description |

Item description |

|

Item Level |

Item level |

|

Department |

Item department |

|

Class |

Item class |

|

Subclass |

Item subclass |

|

Department description |

Item department description |

|

Class description |

Item class description |

|

Subclass Description |

Item subclass description |

From this screen, it is possible to select an item to edit or visualize its attributes. The taskbar has the Edit and View options and the item code has a hyperlink that opens the edition mode if the user has such a profile.

By clicking in any of the above options the item detail fiscal attribute screen is displayed.

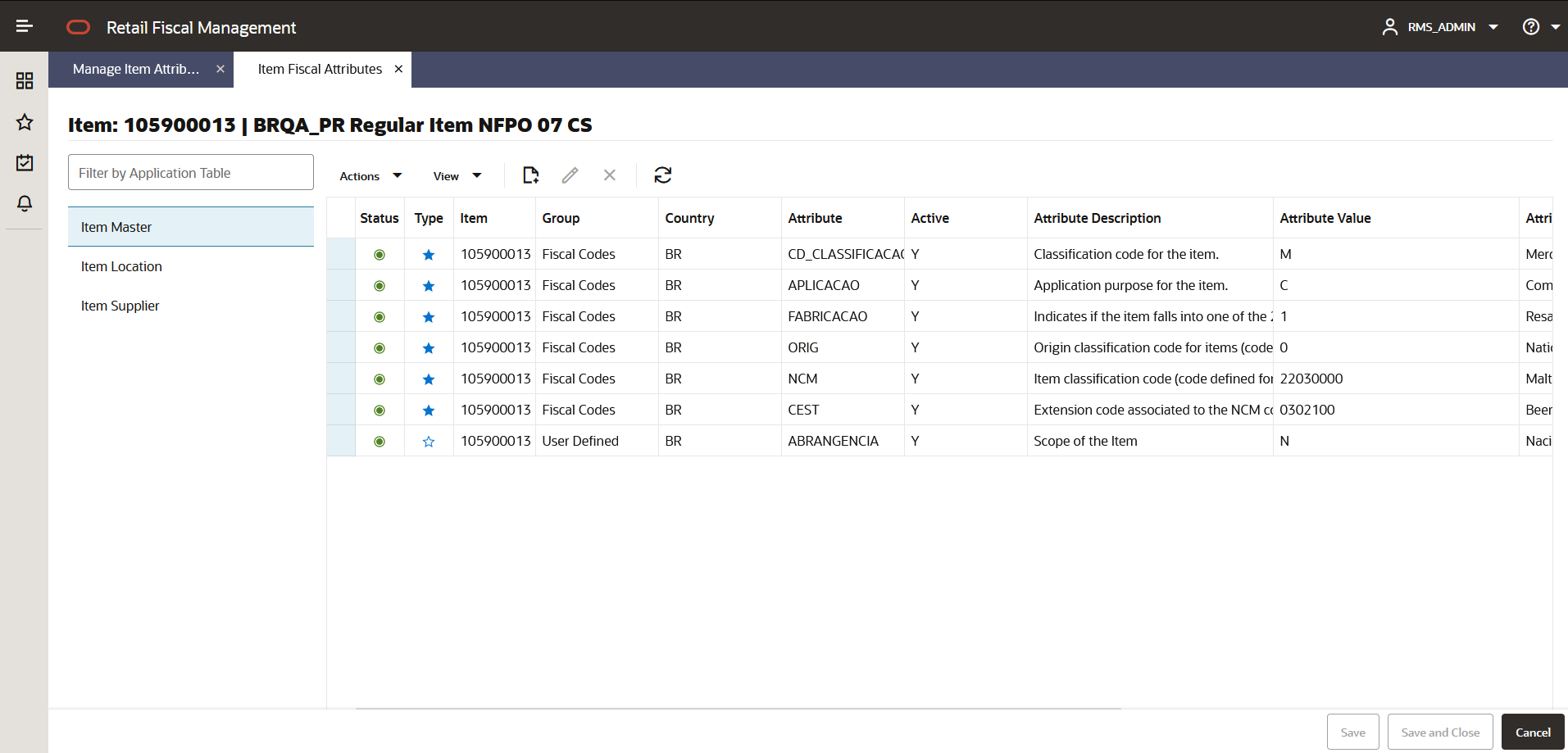

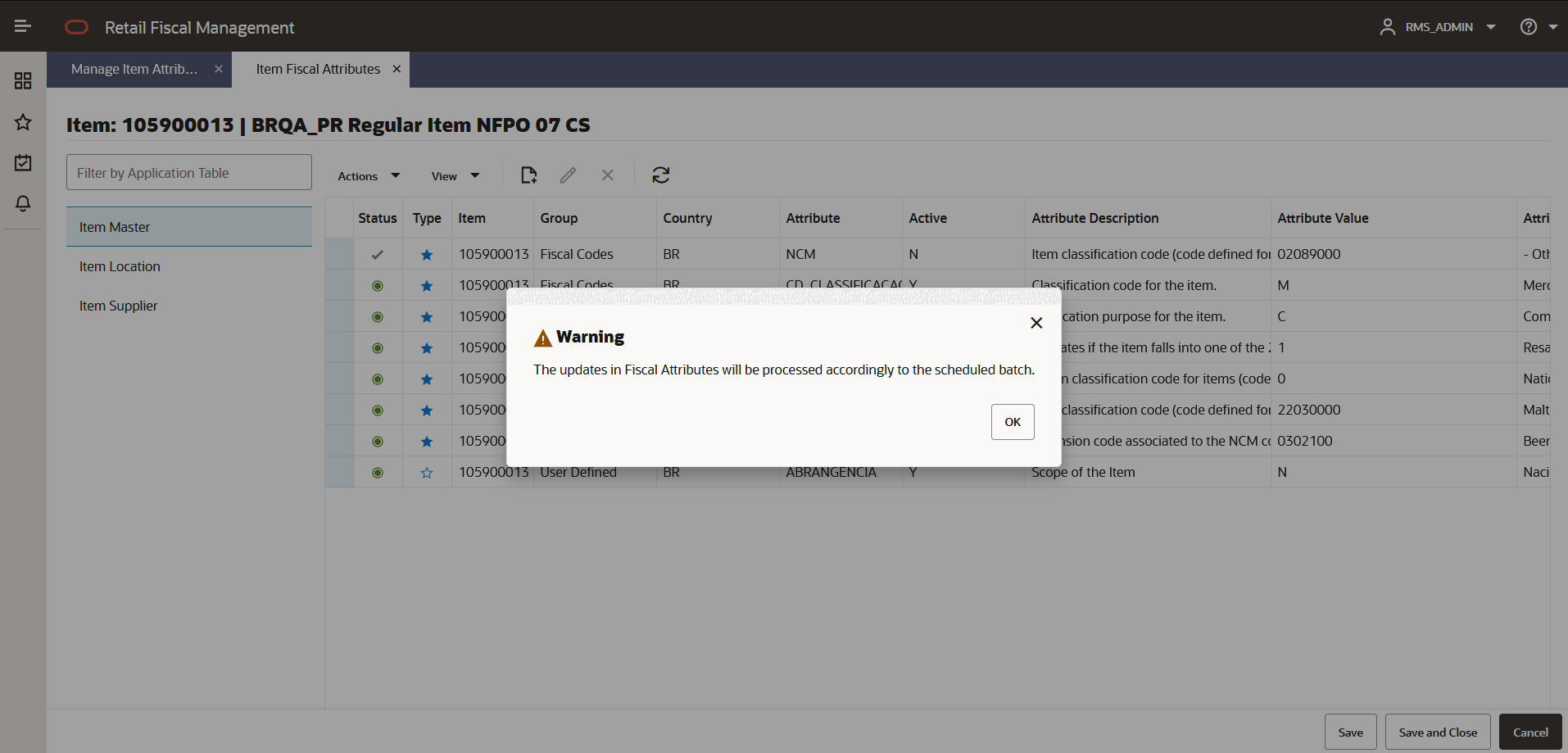

Figure 2-4 Item Fiscal Attributes

From this screen, it is possible to see all attributes associated with the item for each “template” (item master, item Location, Item Supplier). By clicking on any of the application tables on the left, the grid is refreshed on the right.

By clicking on the Create button, it is possible to make a new association of a fiscal attribute to the item being edited. In this case, a popup opens:

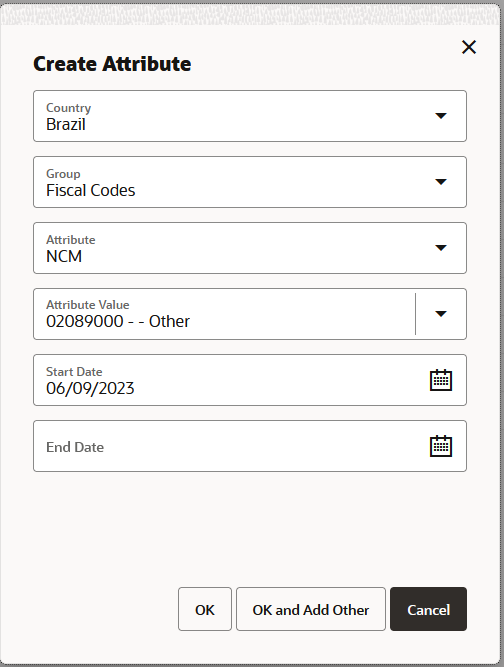

Figure 2-5 Create Attribute

This popup will have the following options:

Country: with the list of countries that have at least one fiscal attribute available.

-

1 – Fiscal Codes,

-

4 – User defined.

Only groups with valid attributes are listed.

Attribute: the list of valid attributes associated with the selected country/group are displayed in the order of mandatory and screen sequence defined in the fiscal attribute setup. Once the attribute code is selected, an additional field is be displayed dynamically right below it, for the Attribute value.

Attribute Value: has the available list of values associated with the attribute selected. Depending on the attribute this field may be a free-text or a list of values.

Start Date: The date when the attribute associated with the item is considered active. This date must be equal or greater than VDATE.

End Date: The date when the attribute associated with the item is finished.

Once the fields are completed, the OK button saves the new attribute association to the item. If OK and Add Other is clicked, the popup is refreshed for users to create another association. Cancel exists the operation without saving it.

After saving the newly created attribute association, the status of the attribute in the grid is changed to “Edited”. The edited classification is confirmed via a background batch. In order to have a successful classification, all mandatory attributes must be informed.

Figure 2-6 Create Attribute Warning Message Box

Table 2-2 Item Fiscal Attributes Screen Fields

| Field | Description |

|---|---|

|

Status |

Icons to demonstrate the current status of the item regarding. the fiscal attributes.

|

|

Type |

Star icon to identify the type of the fiscal attribute:

|

|

For the Item Supplier template only: Supplier |

Supplier code to which the item is already associated |

|

For the Item Supplier template only: Supplier Name |

Supplier name |

|

For the Item Location template only: Location type |

Type of the location to which the item is already associated (WH or ST) |

|

For the Item Location template only: Location |

Location code |

|

For the Item Location template only: Location Name |

Location name |

|

Group |

Fiscal attribute group |

|

Country |

Fiscal attribute country |

|

Attribute |

Fiscal attribute code |

|

Description |

Fiscal attribute description |

|

Attribute Value |

Fiscal attribute value |

|

Attribute Value Description |

Fiscal attribute value description |

|

Start Date |

This column has either the attribute creation date (the date where the attribute was associated with the item) or in case of a change performed by the screen, the informed date when the change is to be complete. It can be a future date. |

|

End Date |

This column has the end date to which the attribute link to the item is no longer valid. In case of changes in attributes like a change in NCM for example, the user can put a future end date to the existing NCM while creating a new record with the new code. |

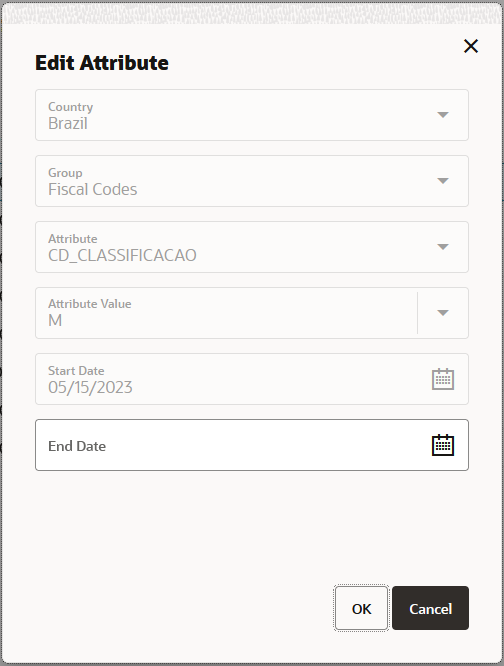

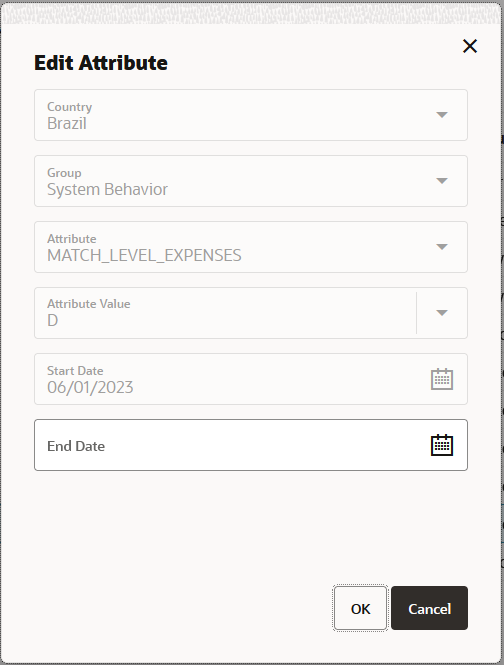

Figure 2-7 Edit Attribute

The edit button in the Entity Fiscal Attributes screen allows the edition of the End Date field only.

Manage Entity Attributes

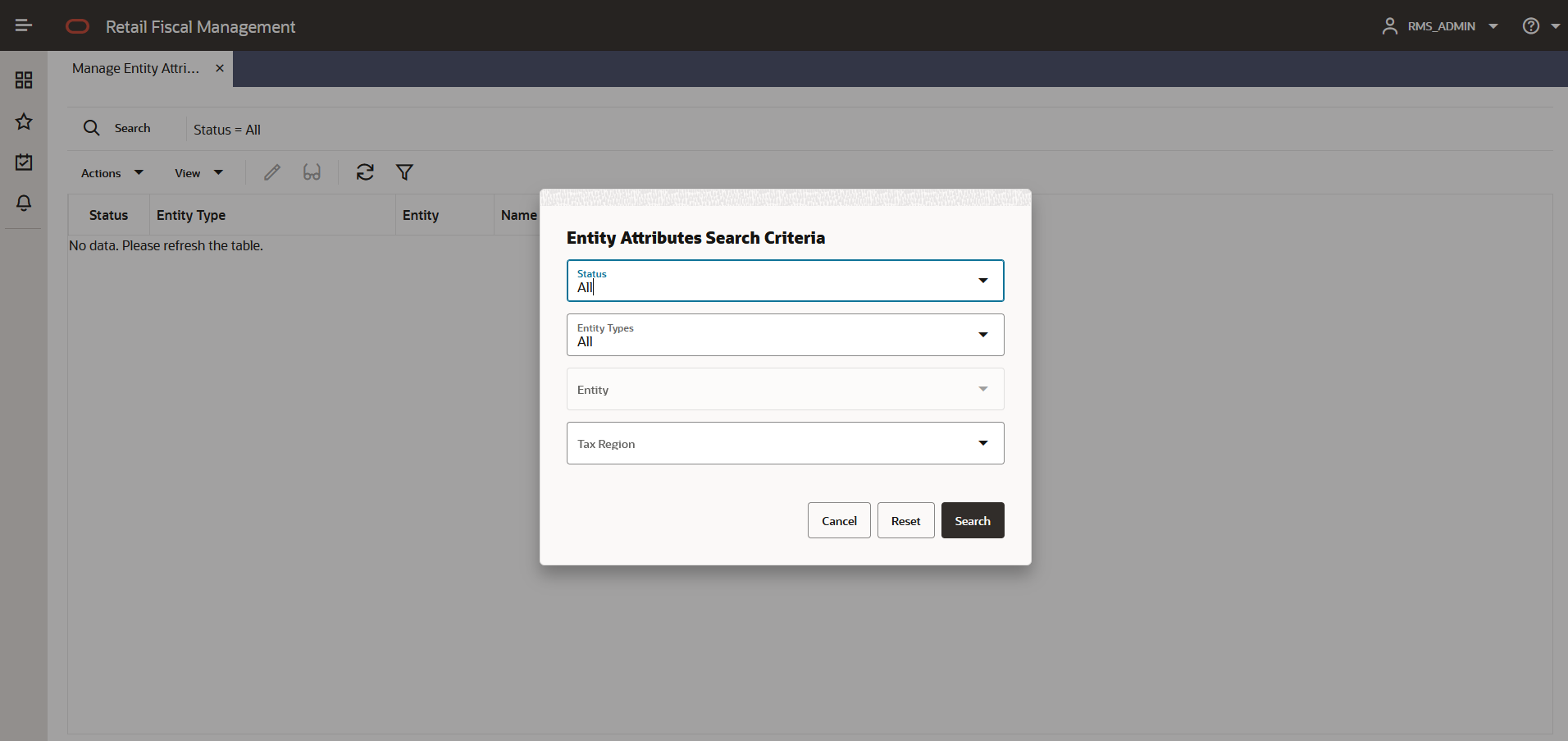

From the Fiscal Data Management screens, it is possible to visualize and maintain the association of entities (locations, supplier sites, and partners) with existing fiscal attributes. This functionality is accessed from the main RFMCS task list under Attributes > Manage Entity Attributes.

Figure 2-8 Manage Entity Attributes - Search

When opening the screen a search popup is displayed with filtering options:

-

Status of entities with regards to having fiscal attributes.

-

All

-

With Fiscal Attributes

-

Updates do Process

-

No Fiscal Attributes

-

-

Entity Type.

-

All

-

Stores

-

Warehouses

-

Suppliers

-

Supplier Sites

-

Partners

-

-

Filter Entity: based on the Entity Type Chosen a list of entities is listed.

-

Tax Region: List of tax regions to which the entities are associated.

Based on the search criteria informed, the entity fiscal attribute grid list is displayed:

Figure 2-9 Manage Entity Attributes

Table 2-3 Manage Item Attributes Fields

| Field | Description |

|---|---|

|

Status |

Icons to demonstrate the current status of the entity regarding the fiscal attributes.

|

|

Type |

Entity type based on the main filter options: Location, Supplier, Partner |

|

Entity Type |

For location: Store, Warehouse For Supplier: Supplier Site For Partner: list of Partner types from MFCS |

|

Entity |

Entity code |

|

Name |

Entity name |

|

Tax Region |

Tax region code |

From this screen, it is possible to select an entity to edit or visualize its attributes. The task bar has the Edit and View options and the entity code also has a hyperlink that opens the edition mode if the user has such a profile.

By clicking in any of the above options the item detail fiscal attribute screen is displayed.

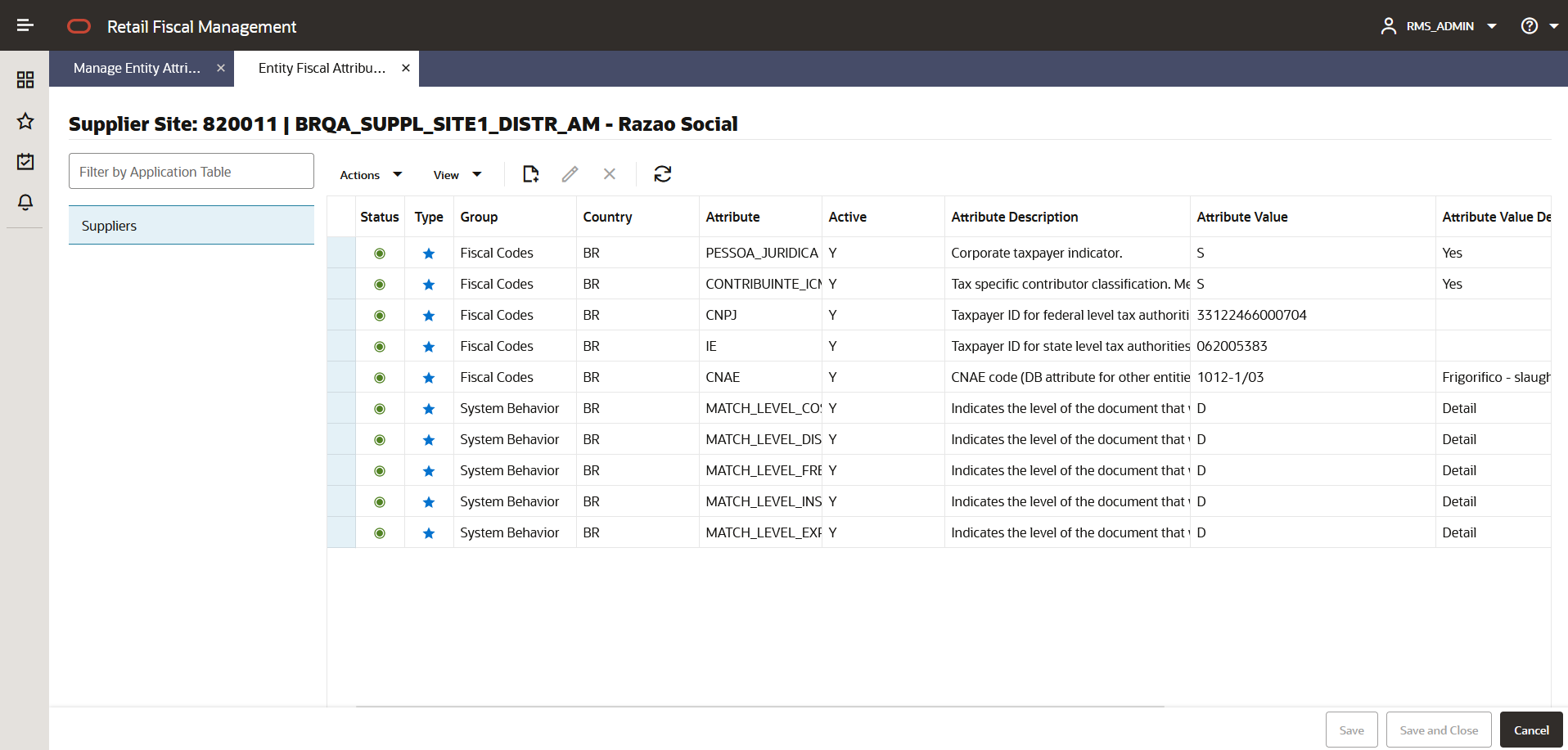

Figure 2-10 Entity Fiscal Attributes

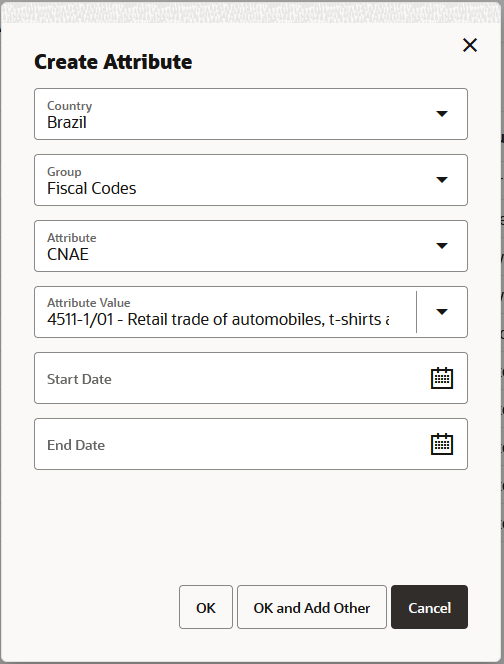

By clicking on the Create button, it is possible to make a new association of a fiscal attribute to the entity being edited. In this case a popup is opened:

Figure 2-11 Create Attribute

This popup has the following options:

Country: with the list of countries that have at least one fiscal attribute available.

Group: from the fiscal attributes group. Valid values are:

1 – Fiscal Codes,

2 – System Behavior,

3 – ST Tax Inscriptions,

4 – User defined.

Only groups with valid attributes are listed.

Attribute: the list of valid attributes associated with the selected country/group are displayed in the order of mandatory and screen sequence defined in the fiscal attribute setup. Once the attribute code is selected, an additional field is displayed dynamically right below it, for the Attribute value.

Attribute Value: has the available list of values associated with the attribute selected. Depending on the attribute this field may be a free-text or a list of values.

Start Date: the date when the attribute is associated with the item is considered active. This date must be equal or greater than VDATE.

End Date: the date when the attribute is associated with the item is finished.

Once the fields are completed, the OK button saves the new attribute association to the item. If OK and Add Other is clicked, the popup is refreshed for users to create another association. Cancel exists the operation without saving it.

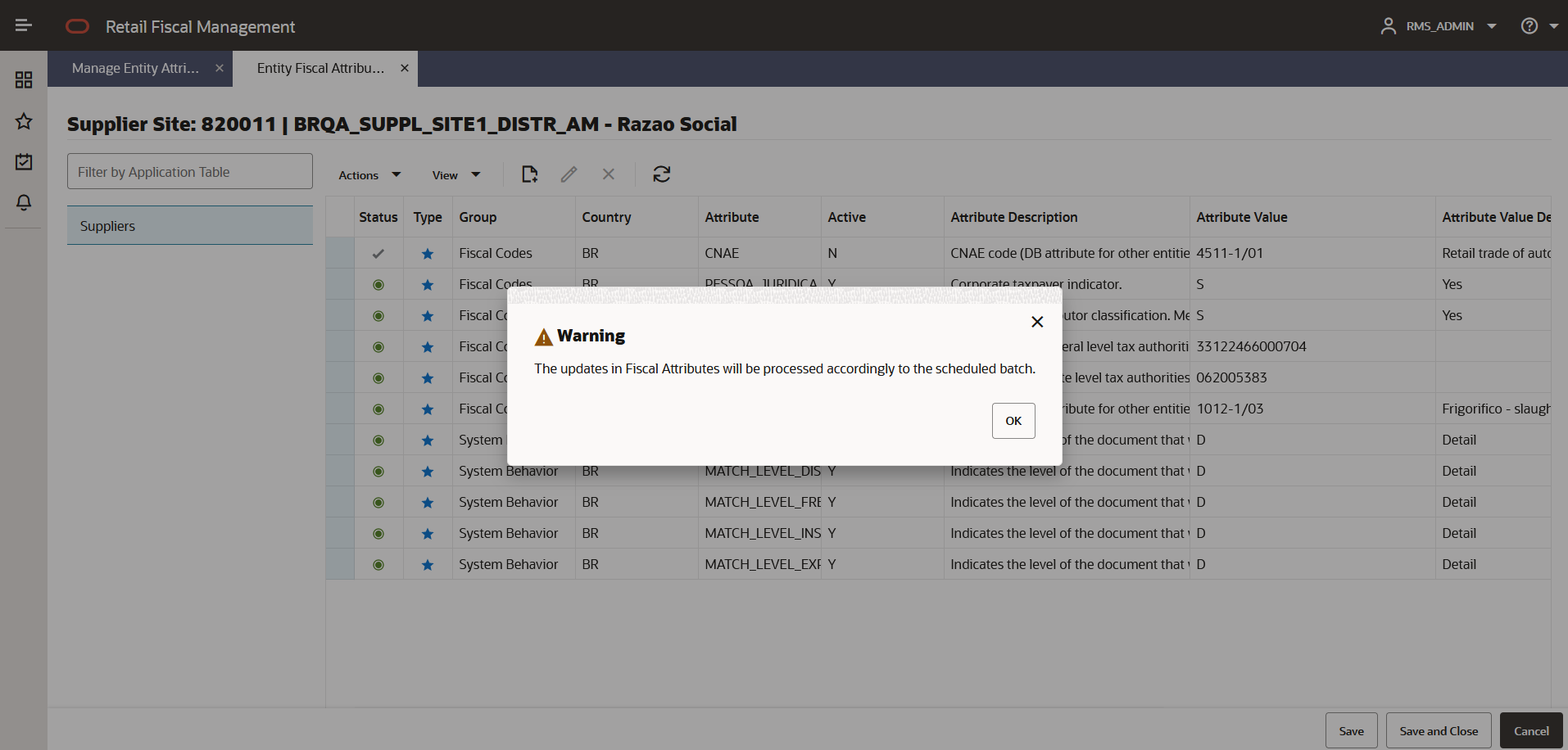

After saving the newly created attribute association, the status of the attribute in the grid is changed to “Edited”. The edited classification is confirmed via a background batch. In order to have a successful classification, all mandatory attributes must be informed.

Figure 2-12 Create Attribute Warning Message Box

grid.

Table 2-4 Entity Fiscal Attributes Screen Fields

| Field | Description |

|---|---|

|

Status |

Icons to demonstrate the current status of the entity regarding the fiscal attributes.

|

|

Type |

Star icon to identify the type of fiscal attribute:

|

|

Group |

Fiscal attribute group |

|

Country |

Fiscal attribute country |

|

Attribute |

Fiscal attribute code |

|

Description |

Fiscal attribute description |

|

Attribute Value |

Fiscal attribute value |

|

Attribute Value Description |

Fiscal attribute value description |

|

Start Date |

This column has either the attribute creation date (the date where the attribute was associated with the entity) or in case of a change performed by the screen, the informed date when the change is to be complete. It can be a future date. |

|

End Date |

This column has the end date to which the attribute link to the entity is no longer valid. In case of changes in attributes, the user can put a future end date to the existing attribute value while creating a new record with the new code. |

Figure 2-13 Edit Attribute

The edit button in the Entity Fiscal Attributes screen allows an edition of the End Date field only.