1 Understanding the Oracle Retail Financial Integration for Oracle Retail Merchandise Operations Management and Oracle Financials (Cloud Fusion Financials)

Note:

Any reference to Oracle Financials in this book refers to only Oracle Fusion Cloud Financials (CFIN) application., The E-Business Suite (EBS) and PeopleSoft Financials are not supported with RICS cloud version.

This chapter provides an overview of the Oracle Retail Financial Integration (RFI) for Oracle Retail Merchandise Operations Management (MOM) and Oracle CFIN and discusses:

-

Key benefits

-

Participating applications

-

Retail Sales Financial business process flow

-

Retail Inventory Financial business process flow

-

Retail Procure to Pay business process flow

-

Solution assumptions and constraints

Overview

The Oracle Retail Financial Integration (RFI) provides integration to a robust enterprise financial system (CFIN) which complements the Oracle Retail Merchandising system in a retail customer environment.

From here on any reference in the document to Oracle GL / AP / Paybles should be interpreted as a reference to Oracle fusion CFIN (GL /AP / Procurement). This would assume CFIN is being integrated with RFI.

Oracle Retail Financial Integration (RFI) includes the following four processes:

-

Life Cycle Data Management - This process provides data synchronization for the initial load prior to implementation and incremental data creation and maintenance after implementation. This process synchronizes the supplier data from the Financials System (CFIN/Procurement) to the Oracle Retail Merchandising System (RMS).

-

Inventory Valuation (Retail stock ledger) - This process enables the posting of accounting entries generated from transactions that change the value of sellable products at a retailer's inventory locations (stores and warehouses) to the appropriate ledgers from Oracle Retail Merchandising - stock ledger to Oracle General Ledger (Oracle GL). This process records the financial impact of changes in the sellable inventory in store and warehouse locations. Valuation of sellable inventory in the stores and warehouses is based on the processing of transactions for movement, pricing, costing, and sale of the inventory. This valuation is captured and processed in Oracle Retail stock ledger. These transactions include sales, shipments from warehouse to store, store receipts, store transfers, returns to vendors, price changes, stock counts, and shrinkage due to theft or damage.

-

Retail Revenue Recognition - This process enables posting of accounting entries generated from sales and returns transactions from the retailer's stores for revenue and cash reconciliation to the appropriate ledgers. In this process, the data flows from Oracle Retail Sales Audit (ReSA) to Oracle GL. This process records the financial impact of sale/return, cash reconciliation, and void transactions from stores. The Revenue Recognition process begins when store transactions (sales and returns) are processed by ReSA. For each store transaction, ReSA generates the appropriate accounting entries to be posted to the Oracle GL. Each accounting entry has a valid account code segment combination based on the transaction type, business unit, and location (store or warehouse).

-

Retail Merchandising Procure to Pay - This process begins with the Oracle Retail Invoice Matching (ReIM) application. Invoices from suppliers for retail merchandise are matched to the original purchase order (PO) for the merchandise and the receipt of the merchandise by the retailer. A proper match of invoice, PO, and receipt trigger the payment authorization of the supplier's invoice. Invoices may be authorized for payment prior to receipt of goods for which prepayment is required. When the authorization for payment is generated, the appropriate accounting distribution is also generated to support the payment authorization. The Retail Merchandise Procure to Pay integration automates the processing of invoice payments, adjustments, and write-offs from ReIM to Oracle Payables and GL. Other accounting transactions are generated from ReIM to write off aged receipts that were never invoiced and to post accounting distribution for manually paid or prepaid invoices after receipt.

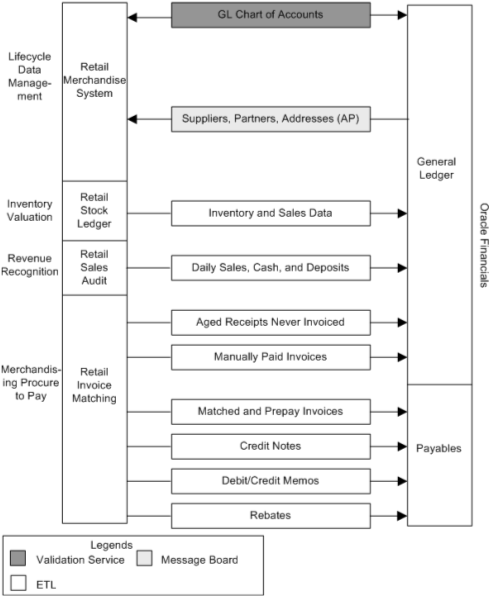

This diagram illustrates the Oracle Retail to Oracle Financials process flow:

Figure 1-1 Oracle Retail to Oracle Cloud Financials Application RFI Process Flow

RFI does not synchronize chart of accounts from Oracle GL to Oracle Retail but only validates chart of accounts available in Oracle Retail against Oracle GL. Chart of accounts are combinations of account code segments. Because transaction types are defined and assigned combinations of code segments for proper handling of the financial impacts in Oracle Retail, the code combinations are validated by a service provided by the Oracle GL. This ensures that the accounting entries generated by the transactions are valid when they are posted to Oracle GL.

Key Benefits

The following are the key benefits of RFI:

-

This integration is not a point-to-point integration between the Financial System (CFIN) and Oracle Retail applications. RFI implementation is independent of the version of integrated applications with some exceptions. An Oracle Retail Financial Integration (RFI) layer serves as an intermediate thin layer of application between Financial application (CFIN) and Oracle Retail Merchandise Foundation CS. This integration remains synchronized with the new releases of the edge applications.

-

Audited transaction data is exported to the Financial applications days before the traditional audit process permits. The Financials applications can use this timely data in a proactive manner, which results in increased productivity and operational efficiencies.

-

Total cost of ownership for Oracle and its customers is reduced.

Participating Applications Overview

This section provides an overview of the applications participating in the RFI:

-

Oracle Retail Merchandising System (Oracle Retail Merchandising Foundation Cloud Services)

-

Oracle Retail Sales Audit (Oracle Retail Merchandising Foundation Cloud Services)

-

Oracle Retail Invoice Matching (Oracle Retail Invoice Matching Cloud Services)

-

Oracle Payables (Oracle Retail Cloud Procurement)

-

Oracle General Ledger (Oracle Fusion Cloud Financials)

Oracle Retail Merchandising System

Oracle Retail Merchandising (RMS) is an integrated solution for global retailing. This solution enables retailers to better manage, control, and perform crucial day-to-day merchandising activities. From new product introduction to inventory management, RMS provides retailers with a complete end-to-end solution and is the most comprehensive and integrated solution for global retailing. For more information, see the Oracle Retail Merchandising Foundation Cloud Services guides.

Oracle Retail Sales Audit

Oracle Retail Sales Audit (ReSA) provides retailers with a flexible tool that evaluates and ensures accuracy and completeness of point of sale (POS) data. Real time access to this audited sales data ensures integrity of information throughout the retail enterprise. With a highly configurable sales audit application, the retailer can maintain existing business practices while providing for future options as the operations grow and change.

ReSA enables retailers to receive POS transaction data, cleanse it, and export the data to the Oracle Merchandising system and the Oracle Retail Data Warehouse. By providing corporate control and visibility to sales audit information, ReSA enables retailers to make better decisions to improve merchandise operations and transform the economics of their business. For more information, see the latest Oracle Retail Sales Audit guides under the Oracle Retail Merchandising Foundation Cloud Services.

Oracle Retail Invoice Matching

Oracle Retail Invoice Matching (ReIM) is a market-leading solution for retailers who need an automated application to better manage reconciliation and payment of purchase orders. This advanced solution enables account payables teams to resolve discrepancies on invoices quickly before payments are made. A highly automated, multidimensional matching engine minimizes time spent on manual reviews. Automated routing provides an effective method to ensure that accurate information is delivered to the right internal teams for resolution and compliance controls. For more information, see the latest Oracle Retail Invoice Matching Cloud Service guides.

Oracle Payables

Oracle Payables provides automated invoice and payment processing to ensure timely and accurate payment for goods and services. Best-practice business processes match purchase orders, receipts, and invoices and provide online approvals to identify exceptions and increase control over disbursements.

Oracle Payables delivers built-in controls to help an enterprise meet regulatory requirements, enforce compliance, reduce risk, and implement due-diligence best practices reducing cycle times and errors. Other features include a flexible, user-defined system setup, extensive vendor maintenance, digital signatures; financials sanction validation, and powerful inquiry and analytical capabilities. For more information, see the Oracle Financials Cloud and Procurement Guides.

Oracle General Ledger

Oracle General Ledger (GL) offers a fully automated close and consolidation solution for legal and management reporting, including support for Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). Transactions are automatically processed and validated according to the best-practice business processes and control settings. In addition, an enterprise can proactively control expenditures by automatically checking spending requests against budget. With real time reporting and information access, an enterprise can achieve complete visibility into financial results. For more information, see the Oracle Financials Cloud Guide.

Retail Sales Financial Business Process Flow

The Retail Sales Financial business process consists of the post channel sales, cash, and deposits from ReSA to Oracle GL integration flow.

This diagram illustrates the Retail Sales Financial business process flow:

Figure 1-2 Retail Sales Financial business process flow

ReSA sends summarized sales audit information to Oracle GL for the Sales Journal. The sales audit information includes channel sales, cash, and deposits. The ReSA Export processes select and format corrected and pre audited data from the ReSA database so that it can be sent to Financials system (CFIN)

ReSA includes programs to automatically extract the required totals data and to format it to generic data files from a financial staging table for import into Oracle GL via Bulk Data Integrator (BDI) and RFI. Sales audit data from ReSA is also posted directly to the RMS stock ledger and can be integrated into Oracle GL through the stock ledger to the financial staging table and the accounting entry table via BDI and RFI. Before data is imported into Oracle GL, a batch process writes balanced records to the financial staging table using the appropriate General Ledger account combinations (maintained in Cross Reference tables in ReSA).

For journal entries also BDI and RFI process is used to load the accounting entries into the CFIN. RFI internally uses PL/SQL packages which transforms the data and generates a CFIN FBDI (File Based Data Integration) file. This file is then loaded into GL Interface tables by RFI via the CFIN ERP Integration of webservices, this load and handle the data on the CFIN side.

Retail Inventory Financial Business Process Flow

The Retail Inventory Financial business process consists of the following integration flows:

-

Post stock ledger from RMS to Oracle GL

-

Post write-offs (aged receipts, not invoiced to ledger) from RMS to Oracle GL

This diagram illustrates the Retail Inventory Financial business process flow:

Figure 1-3 Oracle Retail Inventory Financials (CFIN) business process flow

The stock ledger in RMS records financial results of the merchandising processes that occur in the Retail system, such as buying, selling, price changes, transfers, and so on. All of these transactions are recorded in the RMS stock ledger and rolled up to the subclass or location level for days, weeks, and months. Daily and period-based financial information is scheduled to be loaded into the Financials. RMS sends three levels of stock ledger information to Oracle GL:

Monthly - no access to detailed reference information

Daily by subclass, class, or department - no access to detailed reference information.

Daily by transaction

The stock ledger transactions to be loaded into Financials system (CFIN) are placed on the financial staging table through the use of table triggers or batch, by means of the appropriate General Ledger account combinations (maintained in the RMS cross-reference table in Oracle Retail).

For journal entries also BDI and RFI process is used to load the accounting entries into the CFIN. RFI internally uses PL/SQL packages which transforms the data and generates a CFIN FBDI (File Based Data Integration) file. This file is then loaded into GL Interface tables by RFI via the CFIN ERP Integration of webservices, this load and handle the data on the CFIN side.

Retail Merchandise Procure to Pay Business Process Flow

The Retail Merchandise Procure to Pay business process consists of the following integration flows:

-

Post matched prepaid invoices from ReIM to Oracle GL

-

Post manually matched paid Invoices from ReIM to Oracle GL

-

Post receipt write-offs from ReIM to Oracle GL

-

Post matched invoices for payment from ReIM to Oracle Payables

-

Post credit notes (matched or unmatched) for payment adjustment from ReIM to Oracle Payables

-

Post debit or credit memos for payment adjustment from ReIM to Oracle Payables

-

Post rebates for payment adjustment from ReIM to Oracle Payables

-

Post unmatched invoices for prepayment from ReIM to Oracle Payables

This diagram illustrates the Retail Merchandise Procure to pay business process flow:

Figure 1-4 Retail Merchandise Procure to Pay business process flow (1 of 2)

Figure 1-5 Retail Merchandise Procure to Pay business process flow (2 of 2)

The Retail Merchandise Procure to Pay business process flow enables posting of matched invoices, matched credit notes, debit and credit memos, rebates, and unmatched invoices for prepayment from ReIM to Oracle Payables. The payables invoices are placed in the Oracle Payables (AP) Interface tables. Then appropriate Invoice Import using BDI and RFI is run to move the payables invoice into the payables transaction tables.

For Invoices also BDI and RFI process is used to load the data into the CFIN. RFI internally uses PL/SQL packages which transforms the data and generates a CFIN FBDI (File Based Data Integration) file through RFI database. This file is then loaded into AP Interface tables via the CFIN ERP Integration of webservices, this service loads and handle the data on the CFIN side.

Solution Assumptions and Constraints

The following are the assumptions made for the RFI solution:

-

The Financials applications (CFIN) are implemented prior to the implementation of the RFI.

-

Oracle Retail manually creates and stores the valid charts of accounts in the appropriate GL Cross Reference tables (for ReSA, RMS, and ReIM).

-

The Retail stock ledger supports multiple currencies. All transaction-level information is stored in the local currency of the store or warehouse where the transaction occurred.

-

The currency rates are not passed to Retail. That interface is not supported between CFIN and Oracle Retail.

-

Oracle Retail sends the accounting date and the transaction date with its transactions. These dates should not be changed or manipulated in Oracle Financials application.

-

Accounting entry errors that are found from accounting entries are handled manually on both the Oracle Retail and Oracle Financials application side.

-

Use or sales tax accounting information is passed as part of the accounting entries between Oracle Retail and Oracle Financials.

-

Value-added tax (VAT) is calculated in Oracle Retail. VAT calculation is passed as a part of the accounting entry.

-

Oracle Retail stock ledger determines the valuation of inventory for merchandise being directly procured. This information is passed to Oracle Financials as the accounting entries.

-

RMS, through the Retail stock ledger, provides Financials with the value of ending inventory at cost using the method that the retailer indicates (cost method or retail method of accounting) by means of an adjusting entry.

-

Accounting entries are automatically posted to Oracle General Ledger.

-

Both Oracle Financials and Oracle Retail support multiple organizations in one application instance.

-

Before running the interfaces for data migration, XREF/DVM values in RFI_XREF_DVM table is validated against the transaction data set that needs to be posted from Oracle Retail to Oracle Financials.

The following is a constraint that occurs for the RFI solution:

-

Customers switching from one financial application to another are not compatible with this RFI.

Note:

Additional assumptions and constraints exist for each of the process integration flows. They are covered in the respective chapters.