4 Tax Builder

Tax Builder is an ad-hoc batch job process that is not included in the batch window. It is responsible for reading all tax conditions configured in the tax rules in order to determine which item or items need the correspondent tax setup. This process assures that all tax setup is centralized in the Tax Rules configuration module as the tax setup tables are updated exclusively by the builder. Rules in Approved, Updated, or Active statuses are subject to be processed by the Tax Builder.

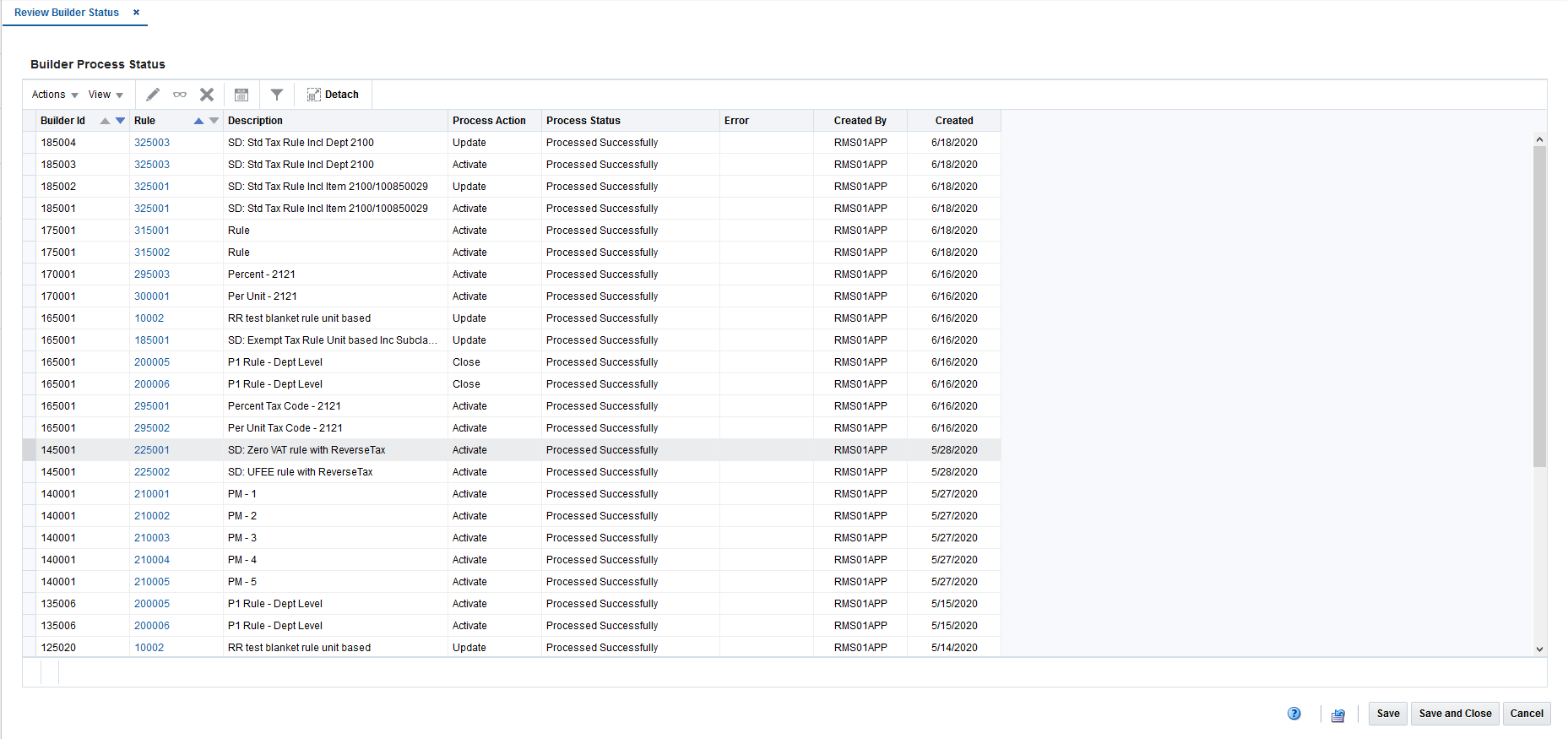

The Review Builder Status page displays details for each execution and rules with any errors that did not get approved. Access tax builder status from the Tasks menu by selecting Taxes > Review Builder Status.

Figure 4-1 Review Builder Status Page

From the Review Builder Status page, you can see all tax builder execution processes.

Table 4-1 Tax Builder Process Status

| Fields | Description |

|---|---|

|

Builder ID |

Internal process sequence |

|

Rule |

Tax Rule ID link |

|

Description |

Tax Rule description |

|

Process Action |

Possible values are: Activate, Update and Close. These are the actions applied to each rule processed |

|

Process Status |

Status of the processing |

|

Error |

Error description |

|

Created by |

User that executed the tax builder batch |

|

Created |

Execution date |