Understanding Managing Fees and Account Analysis

Understanding Managing Fees and Account Analysis

This chapter provides an overview of bank fees and account analysis and describes how to:

Set up fee structures.

Compare fee structures.

Perform account analysis.

Use the Account Analysis Manager.

Create fee entries.

Understanding Managing Fees and Account Analysis

Understanding Managing Fees and Account Analysis

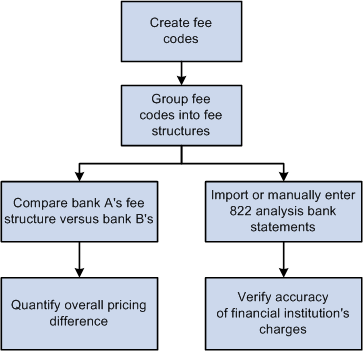

With the Account Analysis feature, you can configure fee codes and fee structures for use in bank fee comparisons and statement analyses.

Account analysis enables you to define how bank fees are calculated for your enterprise and organizes them into fee structures. A fee structure enables you to group, in one place, all the fees that a particular bank charges. You can use fee types that match the standards documented in Treasury Management Association (TMA) Guide to Account Analysis and Service Codes, published by the Association for Financial Professionals (AFP). Examples of fee types are tiered pricing, base fee, and minimum/maximum fees.

By defining and analyzing this data, you can reduce your fee expenses in two ways:

Comparing fees for up to five banks, and determining which bank has the best fee structure for your requirements.

Catching bank charge errors by comparing an EDI 822 Account Analysis bank statement against the data.

Overview of bank account fee analysis

Common Elements in this Chapter

Common Elements in this Chapter|

Analysis Start Date and Analysis End Date |

Defines the calendar period that the system analyzes. When running an account analysis, the system includes all the activities between these two dates in the analysis. |

|

Bank Code |

Displays the identifier code for a specific bank. |

|

Fee Code |

Displays the identifier code for a specific fee. |

|

Fee Structure Code |

Displays the identifier code for a specific fee structure. |

|

Period Beginning and Period Ending |

Defines the beginning and ending dates for a specified time period. |

|

Day Count Basis |

Select from the following options:

|

Setting Up Fee Structures

Setting Up Fee Structures

To define fee codes, use the Fee Codes component (DEFINE_FEE_CODE_GBL).

This section discusses how to:

Create fee transaction tables.

Define fee codes.

(Optional) Enter SQL Where Criteria.

Set up fee structures.

Define fee structures.

(Optional) Edit base fee calculations.

Pages Used to Set Up Fee Structure

Pages Used to Set Up Fee Structure|

Page Name |

Definition Name |

Navigation |

Usage |

|

Fee Transaction Tables |

FA_FEE_TRAN_PNL |

Set Up Financials/Supply Chain, Product Related, Treasury, Fee Transaction Tables |

Set up transaction tables. |

|

Fee Code Definition |

FA_FEE_CD_PNL |

Set Up Financials/Supply Chain, Product Related, Treasury, Fee Codes |

Set up fee codes. |

|

SQL Where Criteria |

FA_FEE_SQLWHERE_SP |

Click Where Clause on the Fee Code Definition page. |

Establish criteria for the fee analysis metric. |

|

Fee Structures - Structure Accounts |

FA_FEE_ACCT |

Banking, Account Analysis, Fee Structures |

Set up fee structures. |

|

Fee Structures - Structure Definition |

FA_FEE_STRUCT |

Select the Structure Definition tab on the Structure Accounts page. |

Define fee structures. |

|

Fee Calculation Type - Fee Structure |

FA_FEE_STRUCT_SEC |

Click Fee Definition on the Fee Structure Definition page. |

Edit the base fee calculation for certain fee calculation types. |

Creating Fee Transaction Tables

Creating Fee Transaction Tables

Access the Fee Transaction Tables page (Set Up Financials/Supply Chain, Product Related, Treasury, Fee Transaction Tables).

Define the names of the transaction tables that you will use with your fee codes. The transaction tables contain the underlying transactions, which the system references when processing fees. After you save the transaction tables, you can reference the table when you define each fee code.

Defining Fee Codes

Defining Fee Codes

Access the Fee Code Definition page (Set Up Financials/Supply Chain, Product Related, Treasury, Fee Codes).

|

Description |

Create both a description and fee code and that matches the TMA TS 822 or that matches your financial counterparty account analysis standards. |

|

Code Seq Num (code sequence number) |

Assign a fee code to determine the order in which the fee codes appear on your account analysis screens. |

Specify whether this fee type applies to transactions involving a Letter of Credit, Deal Fee, Facility Fee, or EFT Fee. You can select multiple options.

Define how the fee metrics will be tracked in your system.

|

Fee Validation Information |

If the fee can be tracked in your system, select the check box. In certain circumstances, you may not want to validate all fees. In this case, leave the check box deselect. |

|

Transaction Table |

Reference the fee validation information to a fee transaction table (defined in the prior section). After you save this value, click the Transaction Tables button to view the specific table definition. |

|

Transaction Date Field |

Select the date type field name used to determine the fee (for example, ACCOUNTING_DT = accounting date). |

|

Aggregate Type |

Select Count, Avg (average), Min (minimum), Max (maximum), or Sum. The available aggregate fields to which the aggregate parameters can be applied are prompted for you from the selected transaction table. After selecting the Aggregate Field, click the Where Clause button to select operators and describe the value that the Aggregate Field must match. |

Define how the accounting process handles bank fees.

|

Selecting this check box determines if a fee may be expensed or amortized. If a fee is amortized, accounting templates for booking the fee and amortization of the fee are required. If a fee is expensed, it may not be amortized and only the template for booking the expense is required. |

|

|

Fees may be amortized or accrued on various day count basis. Select this check box to enable modification of the Day Count Basis type on the Fee Entry page when creating a fee. If not selected, the Day Count Basis type on the Fee Entry page automatically defaults to the fee set up information, and cannot be modified. |

|

|

Override Template on Fee Panel |

Select this check box to allow editing of the Template field on the Fee Entry page. |

|

If this fee code is VAT applicable, select the check box, and specify the appropriate Expense Template. All VAT transactions recorded in Treasury Management are assumed to be transactions on services, not transactions on goods. When you create a VAT-applicable fee, the Physical Nature field displays Services. |

|

|

Day Count Basis |

Select from the following:

|

|

Amortized |

If you opt to amortize the fee over time, select both an Expense Template and Accrual Template. |

|

Expensed |

If you opt to only expense the fee, select an appropriate expense template value. |

See Also

Creating Fee Transaction Tables

Validating Account Analysis Information

Creating VAT Transactions for Fees

Entering SQL Where Criteria

Entering SQL Where Criteria

Access the SQL Where Criteria page (click Where Clause on the Fee Code Definition page).

Select operators and describe the Value that the Aggregate Field must match to pass the fee analysis. When you enter multiple criteria lines, a logical and is implied.

Setting Up Fee Structures

Setting Up Fee Structures

Access the Fee Structures - Structure Accounts page (Banking, Account Analysis, Fee Structures).

There two components to a fee structure:

Account information. Each structure is defined according to the bank and the account to which the fee structure will be charged.

Accounts in the fee structure, and their associated currency.

Fee Structure Accounts

|

Charge to Bank Account |

Select a bank account to record any fees charged to this fee structure. |

Accounts in Fee Structure

Enter the bank account or accounts that are associated with a particular fee structure.

Defining Fee Structures

Defining Fee Structures

Access the Fee Structures - Structure Definition page (Select the Structure Definition tab on the Structure Accounts page).

|

Fee Calculation Type |

Select one of the following values:

|

|

Fee Definition |

Depending on the Fee Calculation Type, you can click to further define the metrics of the fee on the Fee Structure page. |

|

Validate Fee |

Select this check box to validate the particular fee code against both the cost and volume as defined in the fee structure and the volume as defined in the fee code setup and fee transaction tables. |

Editing Base Fee Calculations

Editing Base Fee Calculations

Access the Fee Calculation Type − Fee Structure page (Click Fee Definition on the Fee Structure Definition page).

The fee calculation type must have an editable fee definition to access this page. Enter a new base fee, expressed as a decimal, for fee calculation.

Comparing Fee Structures

Comparing Fee Structures

This section discusses how to compare fee structures.

Use these pages in this section to compare them with each other and to analyze the results. You can compare as few as two or as many as five fee structures at one time. You can also create multiple comparison scenarios and save them for future use. If the underlying structure changes, you can rerun the saved comparison and view the new results.

Pages Used to Compare Fee Structures

Pages Used to Compare Fee Structures|

Page Name |

Definition Name |

Navigation |

Usage |

|

Fee Structure Comparison |

FA_CHARGE_COMP |

Banking, Account Analysis, Fee Structure Comparison |

Compare different fee structures that are applied to the same account, and also create and save multiple comparison scenarios for future use |

|

Fee Structure Comparison Results |

FA_CHARGE_RSLTS |

Click Compare Fee Structures on the Fee Structure Comparison page. |

Analyze fee structures' comparison. The page also displays the optimal fee structure choice. |

Comparing Fee Structures

Comparing Fee Structures

Access the Fee Structure Comparison page (Banking, Account Analysis, Fee Structure Comparison).

To compare fee structures:

Enter up to five Fee Structure Codes for comparison in the Fee Structures group box.

Click Compare Fee Structures.

The Fee Structure Comparison Results page appears. Each fee structure you selected on the Fee Structure Comparison page is calculated and displayed. The fee structure of optimal choice, based on the comparison of fees, is identified to the right of the Guide to Account Analysis field. A Charge Difference column appears on the page only if you are comparing two fee structures.

Performing Account Analysis

Performing Account Analysis

This section discusses how to:

Manually create statements.

Automatically import statement information.

Validate account analysis information.

Once bank fee codes and structures have been set up, you can perform account analysis on your bank statements to verify fee charges and catch potential errors. EDI 822 statements can be entered either manually or automatically imported using PeopleSoft banking functionality. You use the Account Analysis pages to enter bank statement balance, service, and rate information, as well as balance adjustments and service adjustments, where necessary. After entering a statement, you can validate that statement to ensure correct volumes, balances, and charges. This should help decrease your research time into statement exceptions.

See Also

Setting Up Electronic Banking Using Financial Gateway

Common Elements in this Section

Common Elements in this Section|

Adjustment Date |

Displays the balance adjustment or service charge adjustment entry date. |

|

Fee Code |

Displays the identifier code for the specified fee. |

|

Pay Method |

If you leave the Pay Method field blank, the system applies the charge to the balance compensable service charges.

|

|

Service Charge or Service Charge Amount |

Displays the service charges assessed to your account by the bank. |

Pages Used to Perform Account Analysis

Pages Used to Perform Account Analysis|

Page Name |

Definition Name |

Navigation |

Usage |

|

Fee Statements - Information |

FA_BNK_STMT_HDR |

Banking, Bank Statements, Enter Fee Statements Select the Information tab. |

Enter statement and analysis date information, and select a statement method. You can also view bank contacts. |

|

Fee Statements - Rates |

FA_BNK_STMT_RATE |

Banking, Bank Statements, Enter Fee Statements Select the Rates tab. |

Enter rate information for statement fee codes |

|

Fee Statements - Balance Compensation |

FA_BNK_STMT_ANYL |

Banking, Bank Statements, Enter Fee Statements Select the Balance Compensation tab. |

Enter balances, earnings and other totals. |

|

Fee Statements - Balance Adjustments |

FA_BNK_STMT_BADJ |

Banking, Bank Statements, Enter Fee Statements Select the Balance Adjustments tab. |

Enter balance adjustment information. |

|

Fee Statements - Service Charges |

FA_BNK_STMT_SRVC |

Banking, Bank Statements, Enter Fee Statements Select the Service Charges tab. |

Enter statement service charge information. |

|

Fee Statements - Service Adjustments |

FA_BNK_STMT_SADJ |

Banking, Bank Statements, Enter Fee Statements Select the Service Adjustments tab. |

Enter adjustments to service charges found on the bank account analysis statement. |

|

Import Bank Statements |

BSP_IMPORT |

|

Submit an electronic request for bank statement information. |

|

Account Analysis Validation |

FA_BNK_STMT_VALID |

Banking, Account Analysis, Account Analysis Validation |

Validate a statement against a fee structure. |

Creating Statements Manually

Creating Statements Manually

This section discusses how to manually create statements:

Enter general statement information.

Enter statement rate information.

Enter balance compensation information.

Enter balance adjustment information.

Enter service charge information.

Enter service adjustment information.

Entering General Statement Information

Entering General Statement Information

Access the Fee Statement - Information page (Banking, Bank Statements, Enter Fee Statements, Information).

|

Statement Date |

Enter the date the statement is created or imported. |

|

Settlement Method |

Select Debit or Invoice. |

Bank Contacts

This information is associated with the Bank ID and Account #. The fields display the information you entered on the Financial Contacts page.

Entering Statement Rate Information

Entering Statement Rate Information

Access the Fee Statements - Rates page (Banking, Bank Statements, Enter Fee Statements, Rates).

|

Rate Date |

Enter the effective date for the Rate. |

|

Rate |

Enter a rate in decimal format. Rates can be any type, such as earnings rates for the current and next period, or reserve rates. |

|

Multiplier |

Specify a service multiplier, in decimal format. |

|

Days/Period |

Enter the number of days in the analysis period, generally 30 or 31. |

|

Days/Year |

Enter the number of days in the year, generally 365 or 366. |

Entering Balance Compensation Information

Entering Balance Compensation Information

Access the Fee Statements - Balance Compensation page (Banking, Bank Statements, Enter Fee Statements, Balance Compensation).

You enter balances, earnings allowance, and service charge summary information for a specified account on this page.

|

Balance Amount |

Enter the final balance amount for the indicated Fee Code from the 822 Statement. |

Entering Balance Adjustment Information

Entering Balance Adjustment Information

Access the Balance Adjustments page (Banking, Bank Statements, Enter Fee Statements, Balance Adjustments).

You can correct balance information for a specific account number.

|

Transaction Amount |

Enter the adjustment transaction amount. |

|

Days |

Indicates the number of days the balance adjustment is outstanding. For example, $10,000 for five days. |

|

Rate |

Displays the adjustment rate expressed as a decimal. |

|

Earnings allow Adjustment |

Enter the actual dollar amount being charged or reimbursed to the account by the bank. |

Entering Service Charge Information

Entering Service Charge Information

Access the Fee Statements - Service Charges page (Banking, Bank Statements, Enter Fee Statements, Service Charges).

Enter service charges from the bank account analysis statement on this page.

|

Price ID |

Refers to the fee calculation type. Select from the following:

|

|

Unit Price |

Enter the unit price per fee item. |

|

Count |

Enter the number of statement items for each fee code. |

|

Balance Equivalent |

Enter the account's balance equivalent, as defined by the bank. |

Note. If you use Flat Fee for the Price ID, the service charge equals the unit price. If you want the service charge to equal the unit price multiplied by the count, you must useTiered Price for the Price ID.

Entering Service Adjustment Information

Entering Service Adjustment Information

Access the Fee Statements - Service Adjustments page (Banking, Bank Statements, Enter Fee Statements, Service Adjustments).

Use this page to apply any adjustments to service charges found on the bank account analysis statement.

|

Payment Method |

Select from the following options:

|

Automatically Importing Statement Information

Automatically Importing Statement Information

Use PeopleSoft banking functionality to automatically import bank statement data from your financial institution to the account analysis application tables. Once the data is in the system, you can view and edit statement information on the Fee Statements - Balance Adjustment and Fee Statements - Service Adjustment pages.

See Also

Entering Service Charge Information

Setting Up Electronic Banking Using Financial Gateway

Processing Bank Statements in Financial Gateway

Validating Account Analysis Information

Validating Account Analysis Information

Access the Account Analysis Validation page (Banking, Account Analysis, Account Analysis Validation).

|

Fee Structure Code |

Select a fee structure code and click the Validate button. All exceptions, where the system does not match your bank statement, display in the Fee Exceptions grid. The types of exceptions appear according to column heading. The grid will indicate what type of exception was encountered and the amount of the discrepancy |

|

Count Variance |

Displays the difference between the Bank Item Count and your organization's Item Count. |

Using the Account Analysis Manager

Using the Account Analysis Manager

This section discusses using the Account Analysis Manager. You can examine your fee activity on an ad hoc basis for particular fee structures, for historical or current information.

Page Used for the Account Analysis Manager

Page Used for the Account Analysis Manager|

Page Name |

Definition Name |

Navigation |

Usage |

|

Account Analysis Manager |

FA_STMT_INQ_PNL |

Banking, Account Analysis, Account Analysis Manager |

Review fee activity on an ad hoc basis and perform other bank fee and account analysis tasks from a central location. |

Using the Account Analysis Manager

Using the Account Analysis Manager

Access the Account Analysis Manager page (Banking, Account Analysis, Account Analysis Manager).

Your search results appear in the Account Analysis Activity grid.

|

Validate Statement |

Click to access the Account Analysis Validation page and validate account analysis. |

|

Compare Fees |

Click to access the Fee Structure page and compare two to five fee structures. |

|

Edit Analysis Statement |

Click to access the Enter Fee Statements page and modify a specific account analysis statement. |

|

Load Analysis Statement |

Click to access the Import Bank Statement page and request electronic transmission of bank statement information. |

See Also

Validating Account Analysis Information

Automatically Importing Statement Information

Creating Fee Entries

Creating Fee Entries

This section discusses how to:

Create fee entries.

Create external transactions fee entries.

After establishing fee codes and structures, you can create fee entries for both delivered PeopleSoft fee sources and miscellaneous fee entries to track these expenditures. In addition, if you have enabled VAT (value added tax) processing in Treasury Management, the system automatically calculates, processes, and tracks VAT amounts for VAT−applicable fee entries.

See Also

Creating VAT Transactions for Fees

Pages Used to Create Fee Entries

Pages Used to Create Fee Entries|

Page Name |

Definition Name |

Navigation |

Usage |

|

Enter Fees |

FEE_GENERATOR_PNL |

Cash Management, Fees and Transfers, Enter Fees |

Create fees for deal, facility, EFT, and letter of credit sources. |

Creating Fee Entries

Creating Fee Entries

Access the Enter Fees page (Cash Management, Fees and Transfers, Enter Fees).

Fee Information

|

VAT |

Click the link to access the VAT Transactions Details page. The system performs an audit, checking that the business unit of the Bank Code is VAT enabled, and the Fee Code is configured for VAT and associated with a VAT applicable accounting template. The VAT Transactions Details page displays only if these conditions are met. |

Payment Information

|

Tran Date (transaction date) |

Enter the actual transaction date of the fee entry. The system automatically populates this field with the system date. |

|

Payment Date |

Enter the specified payment date of the fee entry. |

|

Pay Fee |

Select to pay the fee. Also select a Payment Method. |

|

Instructions (settlement instructions) |

Select settlement instructions for processing the fee entry payment. |

|

Expense Template |

Select an accounting template to record this fee entry as an expense. |

Accrual Details

|

Period Start and Period End |

Enter the beginning and ending dates of the accrual period. |

|

Accrual Template |

Specify the accounting template to record the accrual amount for this fee entry. |

Position Details

As the fee is processed through the system, you can view accrual details.

Cash Flow

As the fee is processed through the system, you can view approval and payment details.

See Also