7 One View Reporting for Human Capital Management

This chapter provides overview information, processing options, special processing, and reports for the following applications:

-

Section 7.1, "One View Employee Address Book Inquiry (P080110)"

-

Section 7.3, "One View Canadian Tax History Inquiry (P7713)"

-

Section 7.5, "One View Pay History Detail Inquiry (P071862)"

-

Section 7.6, "One View DBA History Detail Inquiry (P071902)"

7.1 One View Employee Address Book Inquiry (P080110)

Access the One View Employee Address Book Inquiry application (P080110) from the Employee Inquiries (G05BEEI1) menu. Use One View Employee Address Book Inquiry to report employee and address book information. One View Employee Address Book Inquiry uses the One View Employee Information Address Book business view (V080110A), which includes columns from the Employee Master Information table (F060116), Address Book Master table (F0101), and the Address Book - Who's Who table (F0111). Additionally, columns from the Address Book - Phone Numbers table (F0115), the Electronic Address table (F01151), and the Address by Date table (F0116) are included in the application.

This application provides a wealth of data and is extremely flexible in the types of reports that can be generated. Choose from over 350 columns to report employee and address book information including employee details, address, phone, email, and contact information. Along with delivered reports, One View Employee Address Book Inquiry can provide reports for many purposes. Some examples of other reports include employees by company and business unit and employees by address book category code.

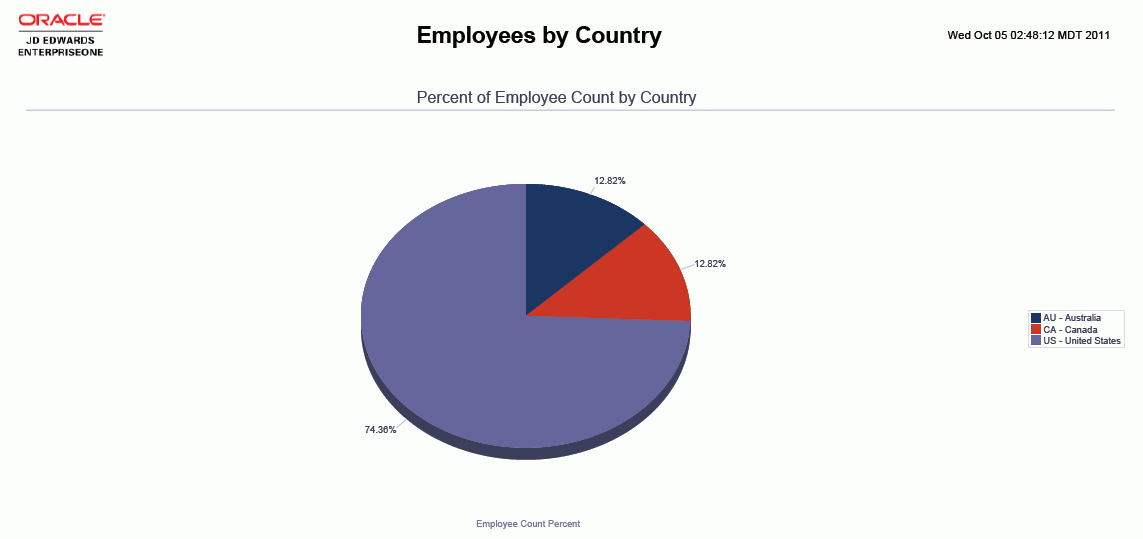

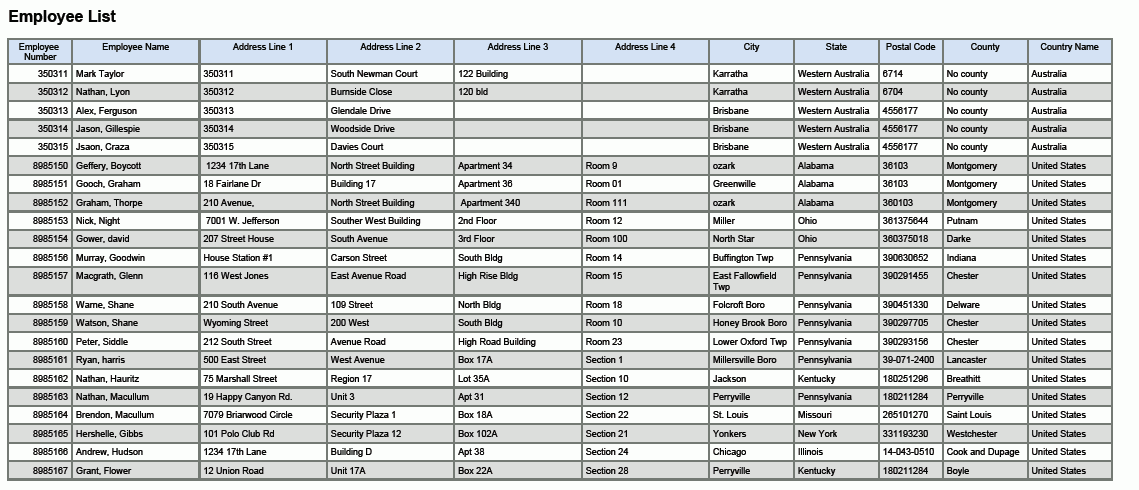

One View Employee Address book Inquiry is delivered with several predefined reports. These reports are Employees by Country, Employee Contact Information by Supervisor, and Emergency Contacts. With these delivered reports, you can access key employee and address book information for operational or analysis purposes.

7.1.1 Processing Options

Processing options enable you to specify the default processing for programs and reports.

7.1.1.1 Phone Details

- 1. Use Default Phone Type

-

Specify whether to use the default phone type value from UDC (01/PH). When this processing option is set to "1", leave the first phone type field blank from the processing option "Enter up to 3 Phone Types".

Values are:

Blank: Do not use default phone type value.

1: Use default phone type value.

- 2. Enter up to 3 Phone Types

-

Specify up to three user defined codes (01/PH) that indicate either the location or use of a telephone number.

Values include:

Blank: Business telephone number

FAX: Fax telephone number

HOM: Home telephone number

7.1.2 Special Processing

By default, this application includes employee address, phone number, and email details. Use the Display Only check box to include information only for the items checked.

7.1.3 Reports

The reports delivered with the One View Employee Address Inquiry application are:

-

Emergency Contacts

-

Employee Contact Information by Supervisor

-

Employees by Country

7.1.3.1 Emergency Contacts

This report contains a table that includes employees and their emergency contact information.

7.1.3.2 Employee Contact Information by Supervisor

This report contains employee contact information by supervisor in a table format. The report includes employee phone number and email information.

The table contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Employee Number |

| Application called | Address Book (P01012) |

| Form called | W01012A |

| Version called | ZJDE0001 |

7.2 One View Tax History Inquiry (P07136)

Access the One View Tax History Inquiry application (P07136) from the U.S. History Inquiries (G07BUSP14) menu. Use One View Tax History Inquiry to analyze summary tax history. One View Tax History Inquiry uses the One View Tax History business view (V06136C), which includes columns from the F060116 and the Employee Tax History table (F06136). This application provides a wealth of data and is extremely flexible in the types of reports that can be generated. Choose from approximately 300 columns in the business view to analyze tax history by elements such as tax id, company, business unit, tax area, and tax type. Along with delivered reports, One View Tax History Inquiry can provide a variety of reports for analyzing tax history.

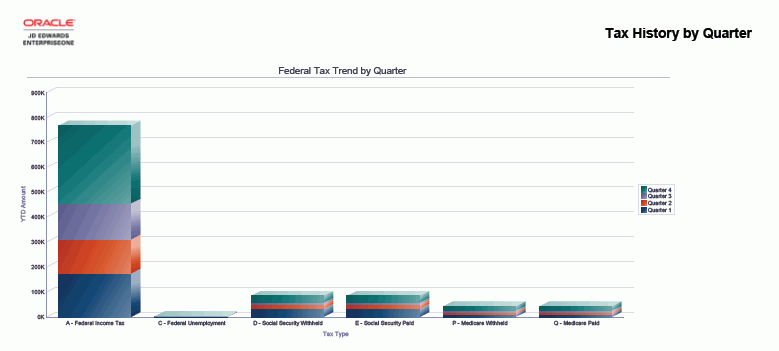

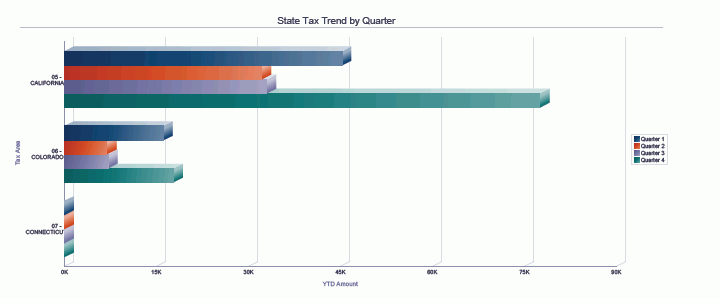

One View Tax History Inquiry is delivered with several predefined reports. These reports are the Year-to-Date (YTD) Pay and Tax Register, Tax History by Quarter, and Social Security and Medicare Tax by Quarter. These delivered reports include tax information such as quarterly and year-to-date balances by tax area and tax type.

7.2.2 Special Processing

The One View Tax History application uses the following special processing:

-

A Form Exit is available for the One View PDBA History application.

-

For each tax history record, the application calculates taxable gross for each month as Gross Pay minus Excludable and In-Excess.

-

For each tax history record, the application calculates quarterly and year-to-date Gross Pay, Excludable, In-Excess, Taxable Gross, and Tax.

7.2.3 Reports

The reports delivered with the One View Tax History Inquiry application are:

-

YTD Pay and Tax Register

-

Social Security and Medicare Tax by Quarter

-

Tax History by Quarter

7.2.3.1 YTD Pay and Tax Register

The YTD and Tax Register report contains comprehensive year-to-date employee pay and tax information for all tax areas and tax area types by year, company, and tax history type. This report contains the following components:

-

YTD Employee Paid Taxes (bar graph)

-

YTD Employer Paid Taxes (bar graph)

-

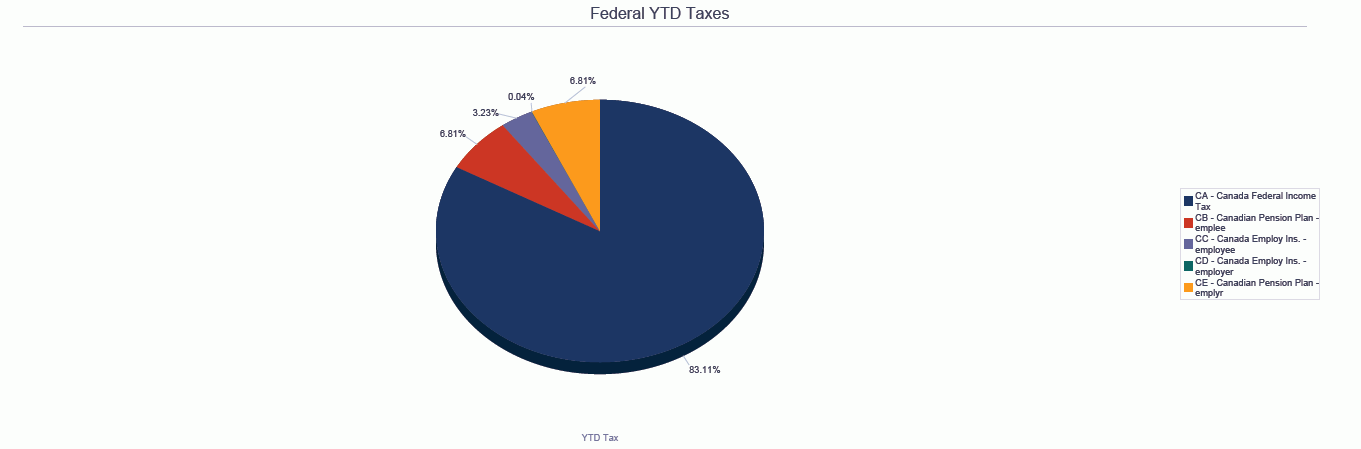

Federal YTD Taxes (pie chart)

-

State YTD Taxes (pie chart)

-

YTD Pay and Tax by Company (table)

-

YTD Pay and Tax Summary (table)

This report contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Tax Type |

| Table columns passed to application | Year, Company, Tax Id, Tax History Type, Employee Number, Tax Area, Tax Type |

| Application called | Tax History (P070920) |

| Form called | W070920C |

| Version called | ZJDE0001 |

7.2.3.2 Social Security and Medicare Tax by Quarter

The Social Security and Medicare Tax by Quarter report contains quarterly totals for employee pay and tax information for Social Security and Medicare tax types by year, company, and tax history type. This report contains the following components:

-

Employee Social Security and Medicare Tax (bar graph)

-

Employee Social Security and Medicare Tax (bar graph)

-

Social Security and Medicare Tax by Company (table)

The Social Security and Medicare Tax by Company table component contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Tax Type |

| Table columns passed to application | Year, Company, Tax Id, Tax History Type, Employee Number, Tax Area, Tax Type |

| Application called | Tax History (P070920) |

| Form called | W070920C |

| Version called | ZJDE0001 |

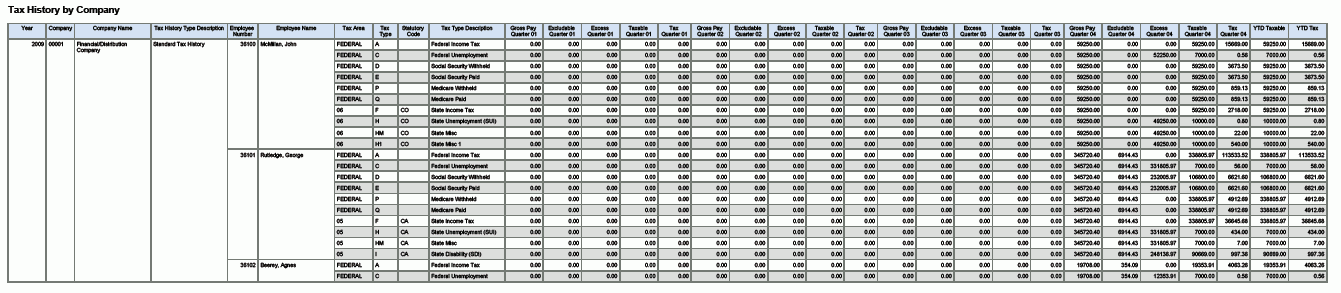

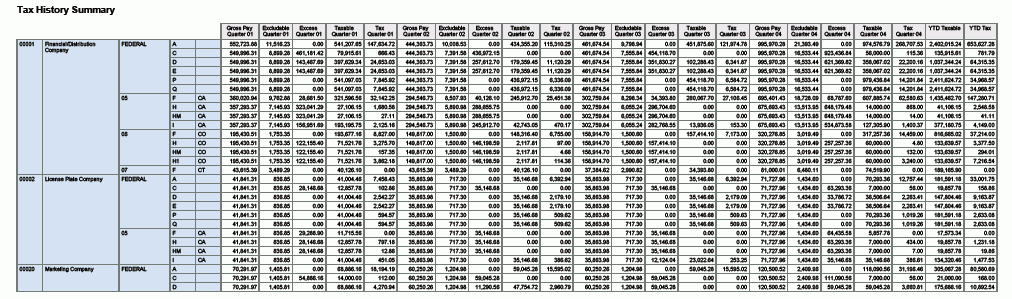

7.2.3.3 Tax History by Quarter

The Tax History by Quarter report contains quarterly totals for employee pay and tax information for all tax areas and tax area types by year, company, and tax history type. This report contains the following components:

-

Federal Tax Trend by Quarter (bar graph)

-

State Tax Trend by Quarter (horizontal bar graph)

-

Tax History by Company (table)

-

Tax History Summary (table)

The Tax History by Company table component contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Employee Number, Company |

| Application called | Tax History (P070920) |

| Form called | W070920A |

| Version called | ZJDE0001 |

The following report was generated by querying tax history for all employees and for all tax areas and tax types for a particular year.

7.3 One View Canadian Tax History Inquiry (P7713)

Access the One View Canadian Tax History Inquiry application (P7713) from the Canadian History Inquiries (G77BCAP14) menu. Use One View Canadian Tax History Inquiry to analyze summary tax history. One View Canadian Tax History Inquiry uses the One View Canadian Tax History (F7713-F060116) business view (V7713B), which includes columns from the F060116 and the Tax History table (F0713). This application provides a wealth of data and is extremely flexible in the types of reports that can be generated. Choose from approximately 300 columns in the business view to analyze tax history by elements such as tax id, company, business unit, tax area, and tax type for various periods of times such as month, quarter, and year. Along with delivered reports, One View Canadian Tax History Inquiry provides a variety of reports for analyzing tax history for federal and provincial taxes.

One View Canadian Tax History Inquiry is delivered with predefined reports. These reports are the Canadian YTD Pay and Tax Register and Canadian Tax History by Quarter. These delivered reports include tax information such as quarterly and year-to-date balances for employee- and employer-paid taxes.

7.3.2 Special Processing

One View Canadian Tax History Inquiry performs the following special processing:

-

A Form Exit is available for One View PDBA History Inquiry.

-

For each tax history record, the application calculates taxable gross for each month as Gross Pay minus Excludable and In-Excess.

-

For each tax history record, the application calculates quarterly and year-to-date Gross Pay, Excludable, In-Excess, Taxable Gross, and Tax.

7.3.3 Reports

The reports delivered with the One View Canadian Tax History Inquiry application are:

-

Canadian Tax History by Quarter

-

Canadian YTD Pay and Tax Register

7.3.3.1 Canadian Tax History by Quarter

The Canadian Tax History by Quarter report contains quarterly totals for employee pay and tax information for all tax areas and tax types by year, company, and tax history type. This report contains the following components:

-

Federal Tax Trend by Quarter (bar graph)

-

Provincial Tax Trend by Quarter (bar graph)

-

Tax History by Company (table)

-

Tax History Summary (table) including description tables for Tax Area, Tax Type, and Statutory Code

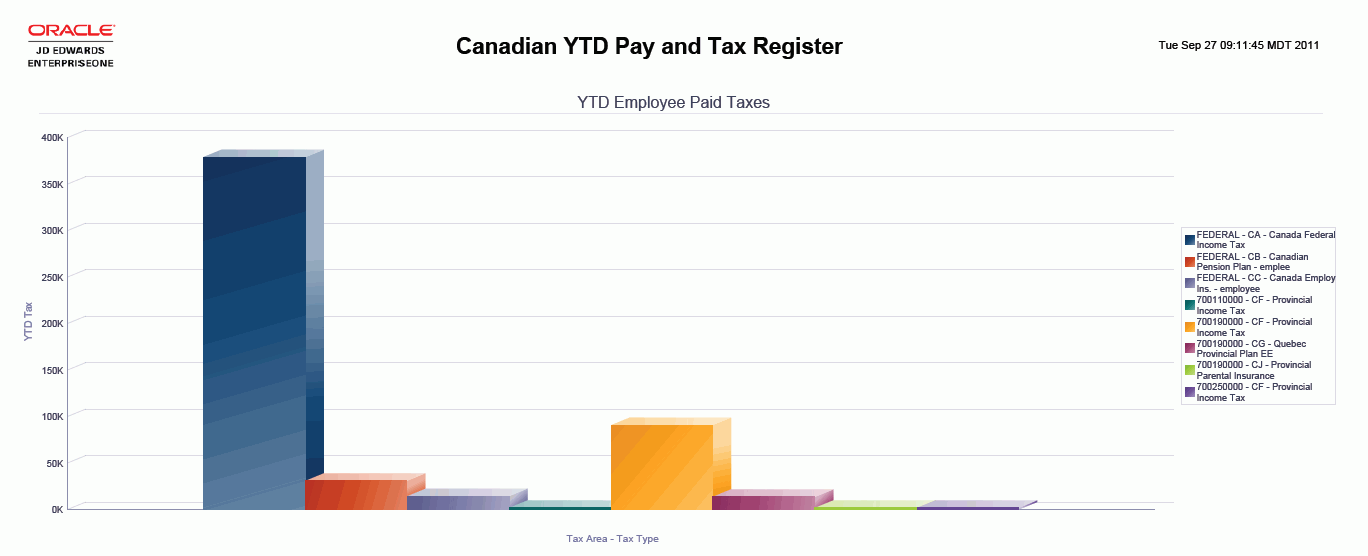

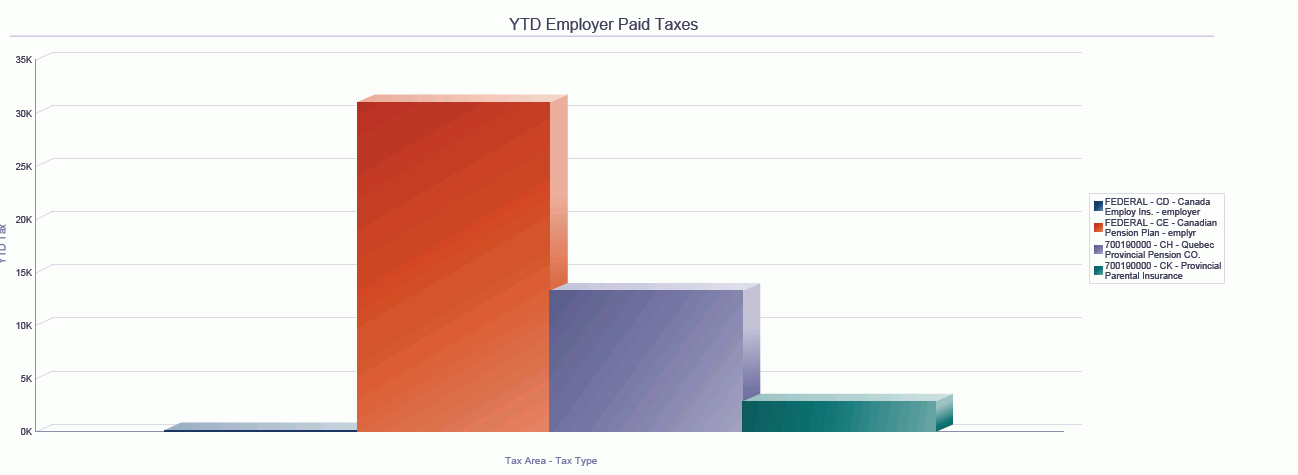

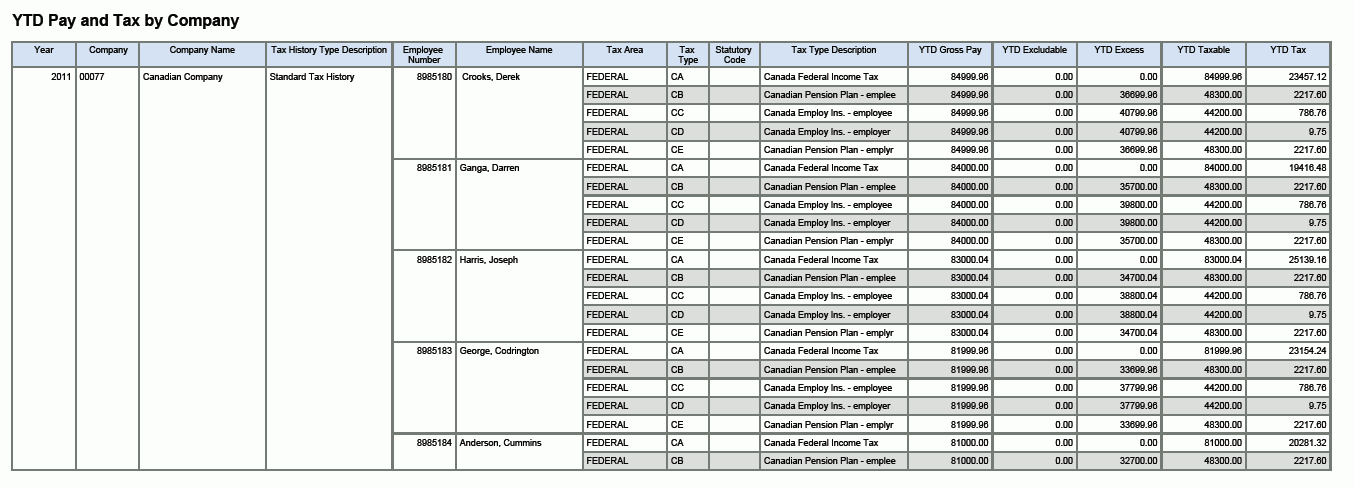

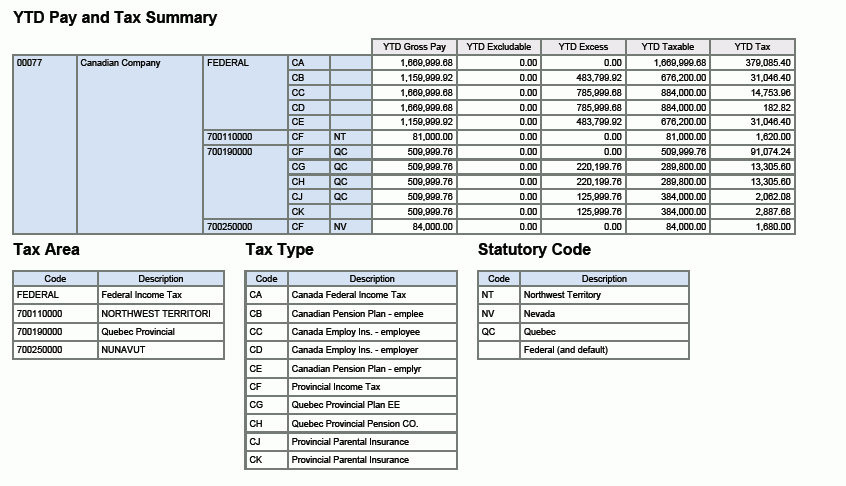

7.3.3.2 Canadian YTD Pay and Tax Register

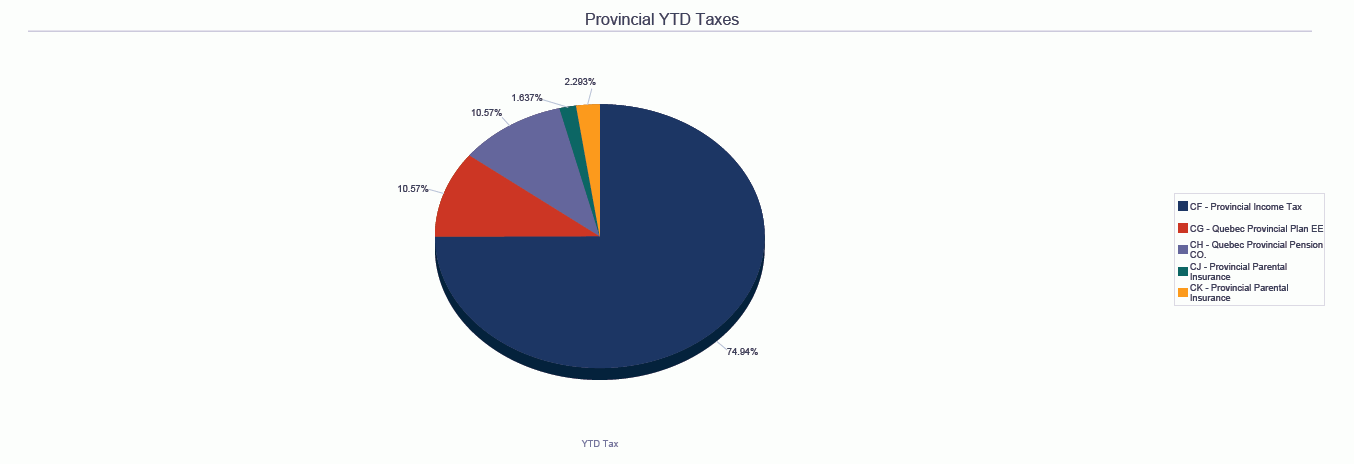

The Canadian YTD Pay and Tax Register report contains comprehensive year-to-date employee pay and tax information for all tax areas and tax types by year, company, and tax history type. This report contains the following components:

-

YTD Employee Paid Taxes (bar graph)

-

YTD Employer Paid Taxes (bar graph)

-

Federal YTD Taxes (pie chart)

-

Provincial YTD Taxes (pie chart)

-

YTD Pay and Tax by Company (table)

-

YTD Pay and Tax Summary (table) including description tables for Tax Area, Tax Type, and Statutory Code

This report contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Tax Area |

| Application called | Pay and Taxes by Month (P779901) |

| Form called | W779901D |

| Version called | ZJDE0001 |

The following report was generated by querying tax history for employees in all companies and for all tax areas and tax types for a particular year.

7.4 One View PDBA History Inquiry (P07146)

Access the One View PDBA History Inquiry application (P07146) from the U.S. History Inquiries (G07BUSP14) menu or from the Canada History Inquiries (G77BCAP14) menu. Use One View PDBA History Inquiry to analyze summary history for pay types, deductions, benefits, and accruals (PDBA). One View PDBA History Inquiry uses the One View PDBA History business view (V06146D), which includes columns from the F060116, the Employee Transaction History table (F06146), and the Payroll Transaction Constants table (F069116). This application provides a wealth of data and is extremely flexible in the types of reports that can be generated. Choose from over 180 columns in the business view to analyze your PDBA history by elements such as company, business unit, and PDBA number. Along with delivered reports, One View PDBA History Inquiry provides a variety of reports for analyzing summary history for pay types, deductions, benefits, and accruals.

One View PDBA History Inquiry is delivered with several predefined reports. These reports are the Year-to-Date PDBA Summary History, Year-to-Date 401k Report, and Balance Due report. These delivered reports include PDBA information such as monthly and year-to-date balances by PDBA number, employee and employer year-to-date 401k contributions, and employee balances due.

7.4.2 Special Processing

From the One View PDBA History Inquiry, a Form Exit is available for the One View Tax History Inquiry and the One View Canadian Tax History Inquiry.

For each record, the application calculates quarter 1, 2, 3, and 4 totals; and a year-to-date total for gross pay and hours. These calculations appear in the quarter and year-to-date total columns.

7.4.3 Reports

The reports delivered with the One View PDBA History Inquiry application are:

-

Year-to-Date 401K Report

-

Year-to-Date PDBA Summary History

-

Balance Due

7.4.3.1 Year-to-Date 401K Report

The Year-to-Date 401K report provides a year-to-date summary of 401k employee deductions and employer benefits, including employee year-to-date totals and totals by DBA. This report contains the following components:

-

Contributions by PDBA (bar graph)

-

Contributions by PDBA (table)

-

Employee and Employer Contribution Percentages (pie chart)

-

Contributions by Employee (table)

The Contributions by Employee table component contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Employee Number, PDBA Code, Company, Year, Tax History Type, Tax id |

| Application called | PDBAs History (P079951) |

| Form called | W079951B |

| Version called | ZJDE0001 |

7.4.3.2 Year-to-Date PDBA Summary History

The Year-to-Date PDBA Summary History report provides a year-to-date summary of pay types, deductions, benefits, and accruals by year and company with monthly balances and year-to-date totals.

This report contains the following components:

-

YTD Amounts - Pay Types (bar graph)

-

Pay Types (table)

-

YTD Amounts - Deductions (bar graph)

-

Deductions (table)

-

YTD Amounts - Benefits (bar graph)

-

Benefits (table)

-

YTD Amounts - Accruals (bar graph)

-

Accruals (table)

The Accruals table component contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Employee Number, PDBA Code, Company, Year, Tax History Type, Tax id |

| Application called | PDBAs History (P079951) |

| Form called | W079951B |

| Version called | ZJDE0001 |

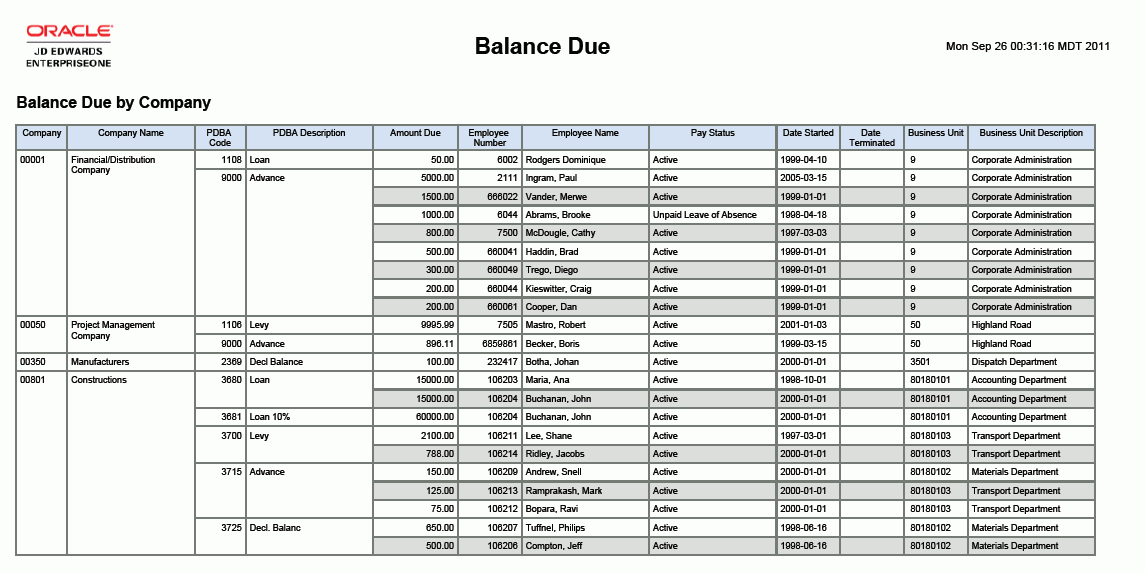

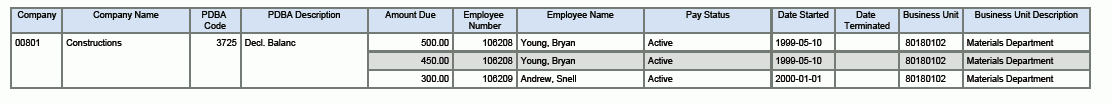

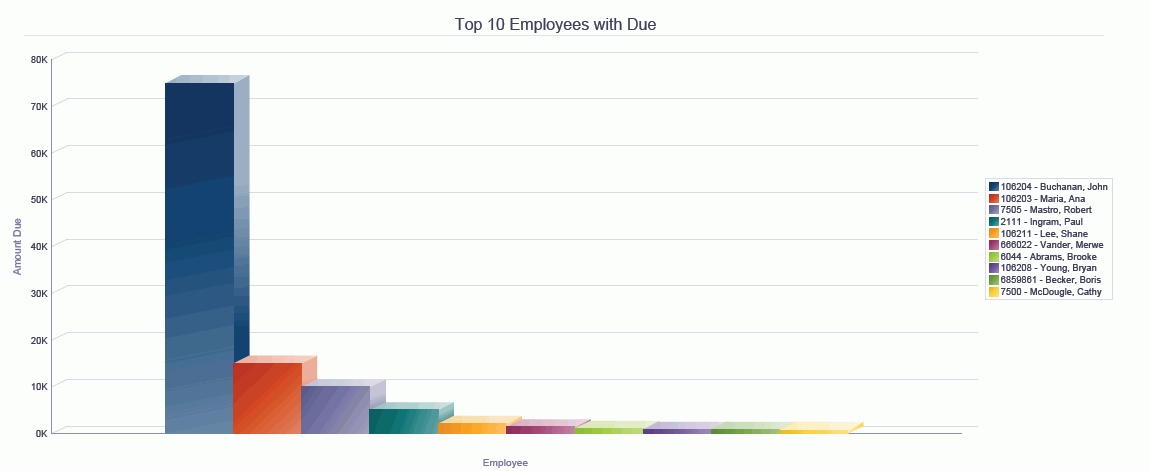

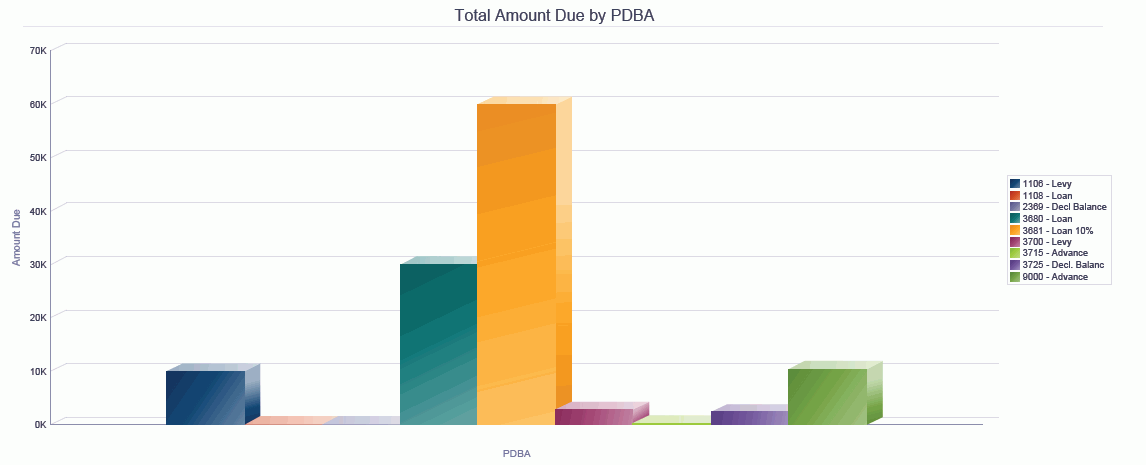

7.4.3.3 Balance Due

The Balance Due report is a report by DBA for employees with amounts due. This report contains the following components:

-

Balance Due by Company (table)

-

Top 10 Employees with Due (bar graph)

-

Total Amount Due by PDBA (bar graph)

-

Total Amount Due by PDBA (table)

The Total Amount Due by PDBA table component contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Employee Number, PDBA Code, Company, Year, Tax History Type, Tax id |

| Application called | PDBAs History (P079951) |

| Form called | W079951B |

| Version called | ZJDE0001 |

The following report was generated by querying PDBA history for all employees for a specific year.

7.5 One View Pay History Detail Inquiry (P071862)

Access the One View Pay History Detail Inquiry application (P071862) from the U.S. History Inquiries (G07BUSP14) menu or Canada History Inquiries (G77BCAP14) menu. Use One View Pay History Detail Inquiry to analyze timecard history transactions. One View Pay History Detail Inquiry uses the One View Pay History Detail (F0618-F060116) business view (V0618T), which includes columns from F060116 and the Employee Transaction History table (F0618). This application provides a wealth of data and is extremely flexible in the types of reports that can be generated. Choose from over 250 columns in the business view to analyze your timecard history by elements such as company, business unit, supervisor, work dates, or type of pay. Along with delivered reports, One View Pay History Detail Inquiry can provide reports for many purposes. Some examples of other reports include Pay History Trend, Recharge Analysis by Job, and Overtime Incurred by Supervisor.

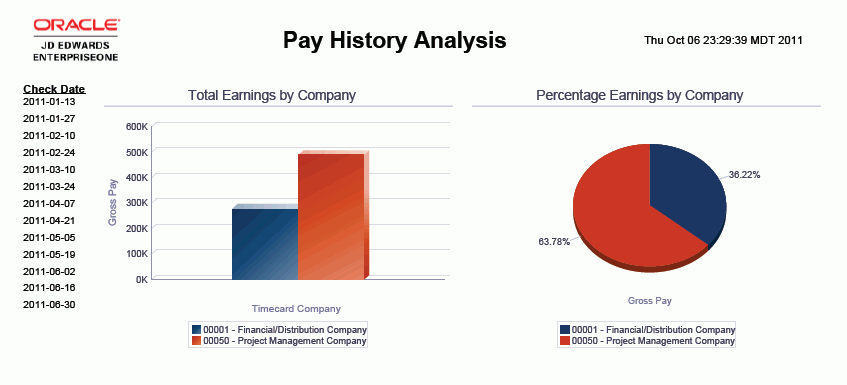

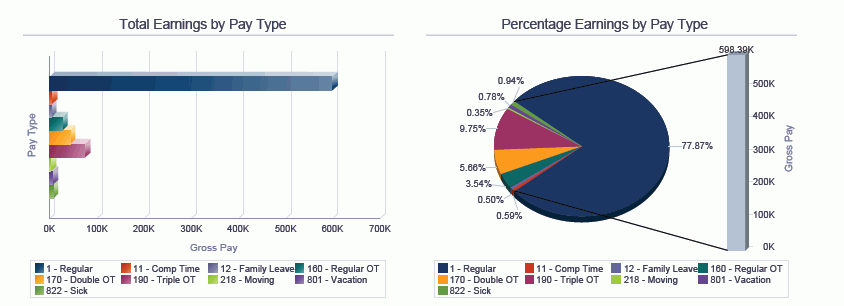

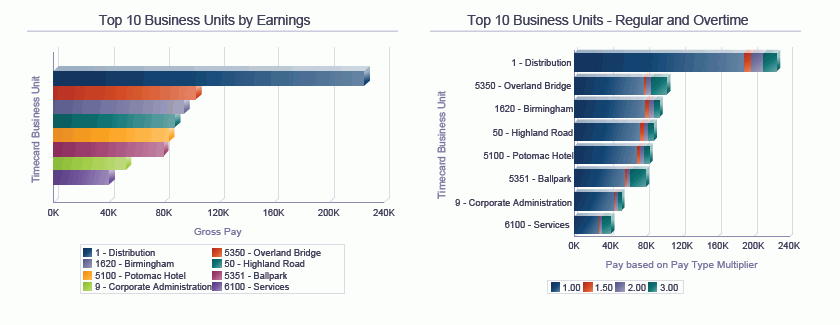

One View Pay History Detail Inquiry is delivered with several predefined reports. These reports are Earnings by Business Unit, Earnings by Pay Type, Leave Trend, Overtime Pay, and Pay History Analysis. With these delivered reports, you can see how payroll earnings are allocated across companies, business units, and types of pay. You can also see when and where types of pay, such as overtime and paid time off, occur to analyze costs and spot trends. The Pay History Analysis report gives you an even broader view of your transactions by providing multiple views of the same data by company, business unit, and pay type; and comparisons and trending for types of pay such as overtime and leave.

7.5.2 Special Processing

For overtime pay timecards with a Pay Type Multiplier greater than one, the application includes two additional calculated columns that separate Gross Pay into Overtime Regular Pay and Overtime Premium Pay. In the calculation, the portion of pay attributed to multiplier greater than one is considered overtime premium pay.

A Form Exit is available for the One View DBA History Detail Inquiry.

7.5.3 Reports

The reports delivered with the One View Pay History Detail Inquiry application are:

-

Earnings by Business Unit

-

Earnings by Pay Type

-

Overtime Pay

-

Leave Trend

-

Pay History Analysis

7.5.3.1 Earnings by Business Unit

This report contains earnings by business unit with employee detail by work date. It contains the following components:

-

Total Earnings by Business Unit (bar graph)

-

Percentage Earnings by Business Unit (pie chart)

-

Detail Earnings by Business Unit (table)

The Detail Earnings by Business Unit table component contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Employee Bi, PDBA Code, Year |

| Application called | PDBAs History (P079951) |

| Form called | W079951E |

| Version called | ZJDE0001 |

7.5.3.2 Earnings by Pay Type

This report contains earnings by pay type with employee detail by pay type and work date. It contains the following components:

-

Total Earnings by Pay Type (bar graph)

-

Percentage Earnings by Pay Type (pie chart)

-

Pay Type Earnings Summary by Business Unit (table)

-

Detail Earnings by Pay Type (table)

The Detail Earnings by Pay Type table component contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Employee No, PDBA Code, Year |

| Application called | PDBAs History (P079951) |

| Form called | W079951E |

| Version called | ZJDE0001 |

7.5.3.3 Overtime Pay

This report contains overtime pay with employee detail by type of overtime and work date. It contains the following components:

-

Overtime - Regular and Premium (bar graph)

-

Overtime - Percentage of Regular and Overtime (pie chart)

-

Overtime - Regular and Premium Detail (table)

The Overtime - Regular and Premium Detail table component contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Employee No, PDBA Code, Year |

| Application called | PDBAs History (P079951) |

| Form called | W079951E |

| Version called | ZJDE0001 |

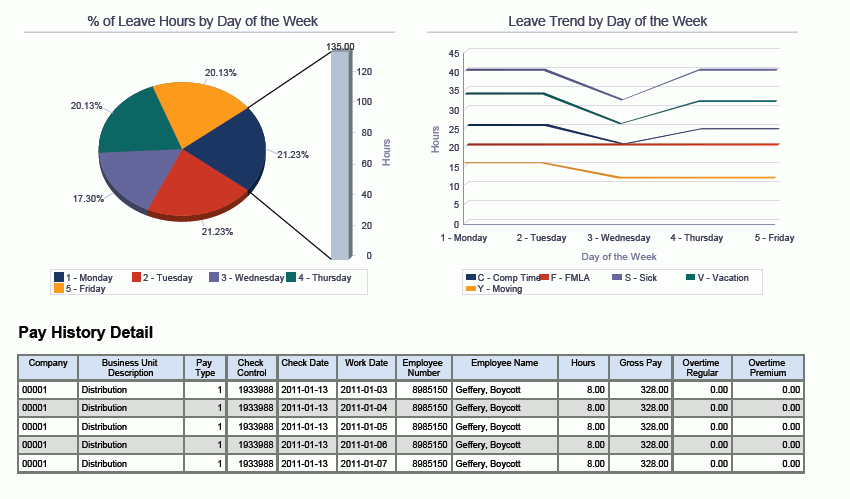

7.5.3.4 Leave Trend

This report contains leave occurrences by the day of the week with leave represented in hours and as a percentage, with supporting employee detail by work date and type of leave. It contains the following components:

-

Total Leave Hours by Day of the Week (bar graph)

-

Percentage of Leave Hours by Day of the Week (pie chart)

-

Summary of Leave Hours by Day of the Week (table)

-

Leave Details (table)

The Leave Details table component contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Employee Number |

| Application called | Leave Trend Inquiry (P076310) |

| Form called | W076310A |

| Version called | None |

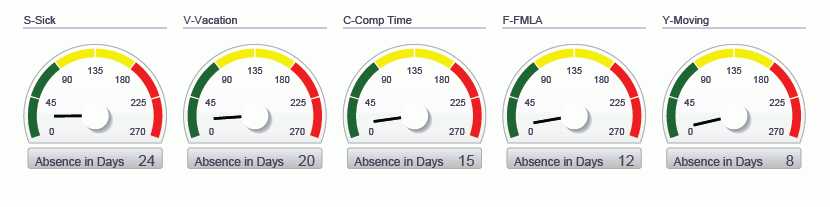

7.5.3.5 Pay History Analysis

This report provides a comprehensive pay detail analysis that includes elements such as total and percentage of earnings by company, business unit, and pay type. The Pay History Analysis report contains the following components:

-

Total Earnings by Company (bar graph)

-

Percentage Earnings by Company (pie chart)

-

Total Earnings by Pay Type (horizontal bar graph)

-

Percentage Earnings by Pay Type (pie chart)

-

Top 10 Business Units by Earnings (horizontal bar graph)

-

Top 10 Business Units - Regular and Overtime (horizontal bar graph)

-

Overtime - Regular and Premium Pay (horizontal bar graph)

-

Overtime -% Regular and Premium Pay (pie charts)

-

Absence in Days by Leave Type (gauges)

-

% of Leave Hours by Day of the Week (pie chart)

-

Leave Trend by Day of the Week (line graph)

-

Pay History Detail (table)

The Pay History Detail table component contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Employee No, PDBA Code, Year |

| Application called | PDBAs History (P079951) |

| Form called | W079951E |

| Version called | ZJDE0001 |

The following report was generated by querying pay history for all companies and pay types for a particular time period, such as a month, quarter, or year.

7.6 One View DBA History Detail Inquiry (P071902)

Access the One View DBA History Detail Inquiry application (P071902) from the U.S. History Inquiries (G07BUSP14) menu or from the Canada History Inquiries (G77BCAP14) menu. Use the One View DBA History Detail Inquiry program (P071902) to analyze detail history for deduction, benefit, and accrual (DBA) transactions. The One View DBA History Detail Inquiry program uses the One View DBA History Detail (F0719-F060116-F069116) business view (V0719K), which includes columns from F060116, the DBA Transaction Detail History table (F0719), and the Payroll Transaction Constants table (F069116). This application provides a wealth of data and is extremely flexible in the types of reports that can be generated. Choose from over 150 columns in the business view to analyze your DBA history by elements such as company, business unit, and DBA number. Along with delivered reports, One View DBA History Detail Inquiry can provide a variety of reports to meet requirements for DBA history detail reporting.

One View DBA History Detail Inquiry is delivered with several predefined reports. These reports are the 401k Report, Health and Welfare Report, Wage Attachments, and DBA History Analysis. These delivered reports highlight key DBA information such as employee and employer 401k contributions, health care costs, and wage attachments due by provider. The DBA History Analysis report gives you an even broader view of your transactions by providing multiple views of the same data by company, business unit, and DBA number.

7.6.2 Special Processing

Use the Summarization check box to summarize DBA transactions into one record based on Employee Number, Pay Period End Date, DBA Number, and Check Control Number. During payroll processing, benefits and accruals are prorated based on timecard work dates, which results in multiple transactions for a single DBA. In addition, deductions may be allocated to two months for transition payroll periods that cross months. Leaving the Summarization box unchecked will include the unsummarized DBA transaction detail.

A Form Exit is available for the One View Pay History Detail Inquiry.

7.6.3 Reports

The reports delivered with the One View DBA History Detail Inquiry application are:

-

401K Report

-

Health and Welfare

-

Wage Attachments

-

DBA History Analysis

7.6.3.1 401K Report

The 401K report contains employee and employer 401k contributions by DBA Code, including employee detail by check date. This report contains the following components:

-

401K Trend by DBA by Check Date (line graph)

-

Employee and Employer 401K Allocations (pie chart)

-

401K Employee and Employer Contribution Details (table)

7.6.3.2 Health and Welfare

The Health and Welfare report contains employee and employer costs for Health and Welfare DBAs, such as medical, dental and vision, by company and benefit group. This report contains the following components:

-

Health and Welfare Costs by Employee Home Company (bar graph)

-

Health and Welfare Cost Percentage by Employee Home Company (pie chart)

-

Health and Welfare Costs by Benefit Group (bar graph)

-

Health and Welfare Costs by Employee Home Company (table)

7.6.3.3 Wage Attachments

The Wage Attachments report contains wage attachment amounts by provider and DBA, including employee detail by check. This report contains the following components:

-

Wage Attachments by Provider/DBA (bar graph)

-

Trend by DBA by Check Date (line graph)

-

Employee Wage Attachment Listing (table)

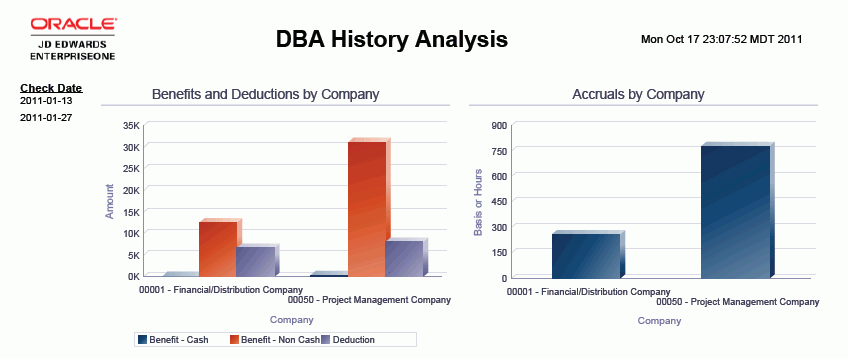

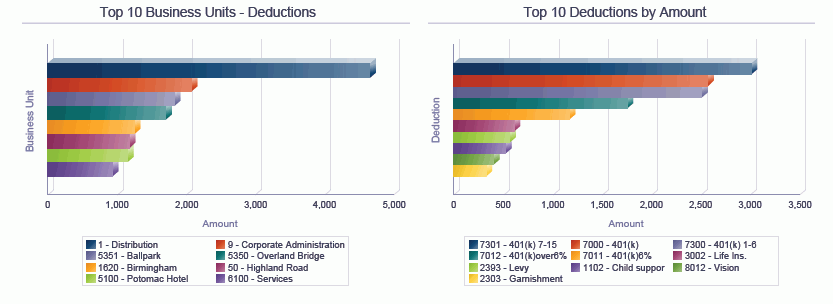

7.6.3.4 DBA History Analysis

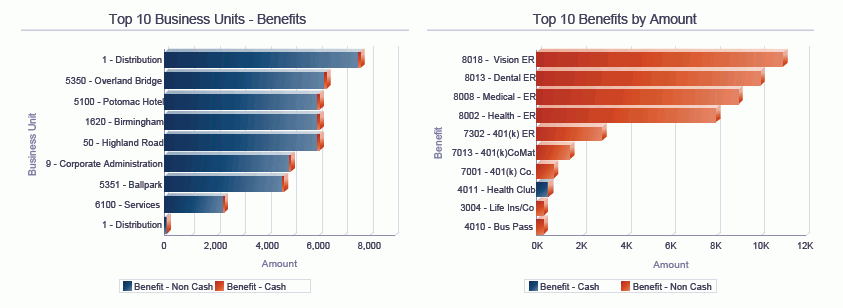

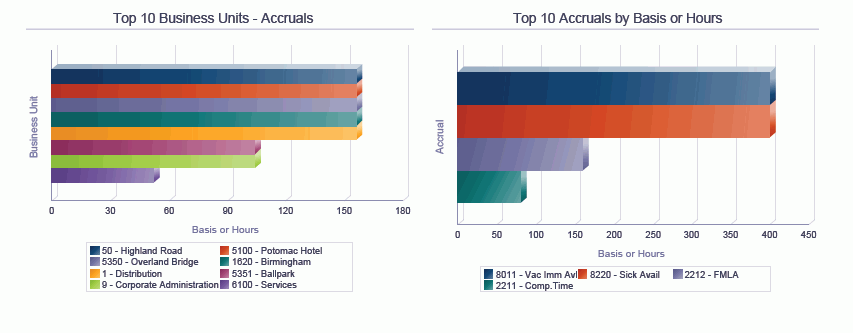

The DBA History Analysis report is a comprehensive DBA detail analysis report that includes elements such as DBAs by company, percentage by DBA, and Top Ten DBAs by business unit and amount.

This report contains the following components:

-

Benefits and Deductions by Company (bar graph)

-

Accruals by Company (bar graph)

-

Top 10 Business Units - Deductions (horizontal bar graph)

-

Top 10 Deductions by Amount (horizontal bar graph)

-

Top 10 Business Units - Benefits (horizontal bar graph)

-

Top 10 Benefits by Amount (horizontal bar graph)

-

Top 10 Business Units - Accruals (horizontal bar graph)

-

Top 10 Accruals by Basis or Hours (horizontal bar graph)

-

Percent by Deductions (pie chart)

-

Percent by Benefits (pie chart)

-

Percent by Accruals (pie chart)

-

DBA History Detail (table)

The DBA History Detail table component contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Employee Number, DBA Code |

| Application called | PDBAs History (P079951) |

| Form called | W079951D |

| Version called | ZJDE0001 |

The following report was generated by querying DBA history for all companies and DBAs for a particular time period, such as a month, quarter, or year.

7.7 One View Employee Benefits Inquiry (P08234)

Access the One View Employee Benefits Inquiry application (P08234) from the Benefits Administration, then Daily Processing (G08BB1) menu. Use One View Employee Benefits Inquiry to query employee benefits details. One View Employee Benefits Inquiry uses the One View Employee Benefits business view (V08234), which includes columns from the Employee Enrollment table (F08330), the Dep/Ben to Employee Plan X-Ref table (F08336), and the Employee Master(F060116). Additionally, details are retrieved from the Participant File table (F08901). This application provides the ability to create and run reports on nearly 250 columns in the view to analyze the employee's enrollment and their participant's (dependent or beneficiary) details.

7.7.2 Special Processing

This application contains the following special processing:

-

In the header, you can specify the year type as either fiscal or calendar. The fiscal year pattern is calculated based on the year entered in the header and the company of employee.

-

In the application grid, when you search with a value in any of the F08336 QBE columns, the results contain matching records from F08336 and also unmatched records from F08330. This is because F08330 and F08336 are joined using a left outer join. This is handled through the code for the QBE search, but not for an enhanced query since the system does not recognize them as QC columns and cannot validate them.

-

When the Employee and Dep/Ben option is selected, the records for the employee and their participants (dependents or beneficiaries) are retrieved. When Employee only is selected, only the employee records are displayed in the grid.

-

By default, the Emp Only and Calendar options are selected. The plan cost is calculated for an employee based on your date selection in the header.

7.7.3 Reports

The reports delivered with One View Employee Benefits Inquiry are:

-

Enrollment Demographics

-

Employee Enrollment Snapshot

-

Active Enrollment

-

Employee and Participant Active Enrollment

-

Employee Benefits Analysis

7.7.3.1 Enrollment Demographics

This report contains employee enrollments by age group, length of service, salary range, and gender. This report contains the following components:

-

Enrollment by Age Group (bar graph)

-

Enrollment by Length of Service Group (bar graph)

-

Enrollment by Salary Range (bar graph)

-

Enrollment by Gender (double bar graph)

-

Enrollment Demographics by Employee (table)

7.7.3.2 Employee Enrollment Snapshot

This report includes the employee enrollment details. The Employee Enrollment Snapshot report contains these components:

-

Enrollment by Home Business Unit (bar graph)

-

Benefits Enrollment Summary (table)

7.7.3.3 Active Enrollment

This report displays the active enrollments for the selected year. The Active Enrollment report contains the following components:

-

Enrollment by Month (bar graph)

-

Percent of Total Enrollment by Month (pie chart)

-

Employee Enrollment (table)

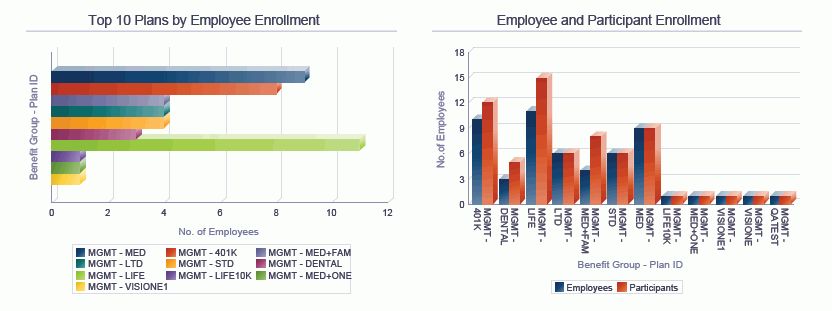

7.7.3.4 Employee and Participant Active Enrollment

This report displays employee enrollment and their participants' enrollment. The report contains the following components:

-

Employee and Participant Enrollment (bar graph)

-

Enrollment Details (table)

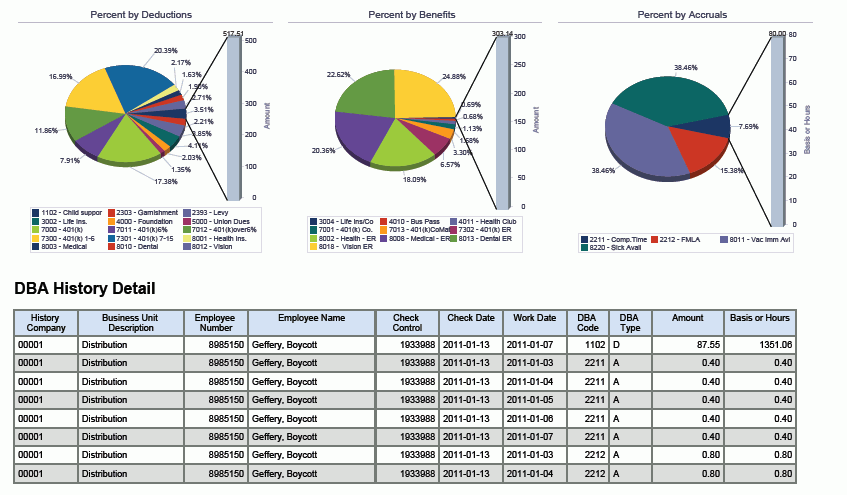

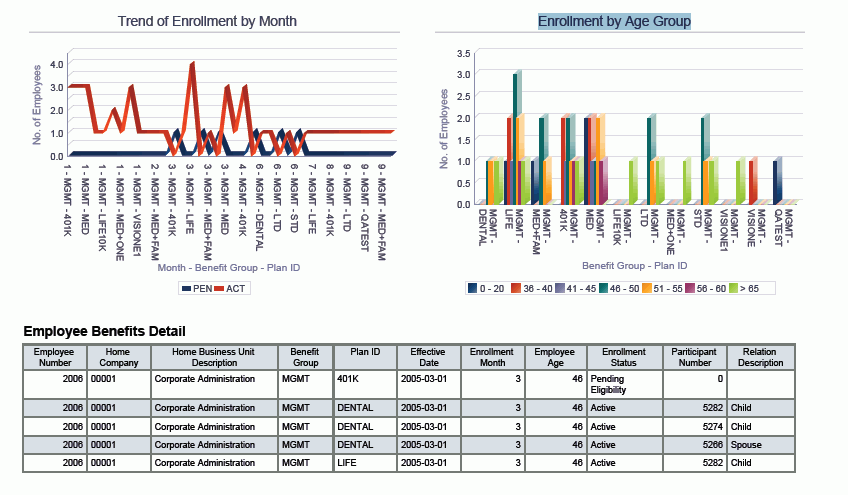

7.7.3.5 Employee Benefits Analysis

The Employee Benefits Analysis report is a comprehensive employee enrollment detail analysis report that includes elements such as enrollment of employee by company, percent of total cost, top 10 plans by employee enrollment, and trend of enrollment by month. The report contains these components:

-

Enrollment of Employee by Company (bar graph)

-

Enrollment Percentage by Company (pie chart)

-

Total Cost by Company and Plans (bar graph)

-

Percentage of Total Cost (pie charts)

-

Top 10 Plans by Employee Enrollment (horizontal bar graph)

-

Employee and Participant Enrollment (bar graph)

-

Trend of Enrollment by Month (line graph)

-

Enrollment by Age Group (bar graph)

-

Employee Benefits Detail (table)

The Employee Benefits Detail table component contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Employee No |

| Application called | Enrollment with Eligibility (P08334) |

| Form called | W08334A |

| Version called | None |

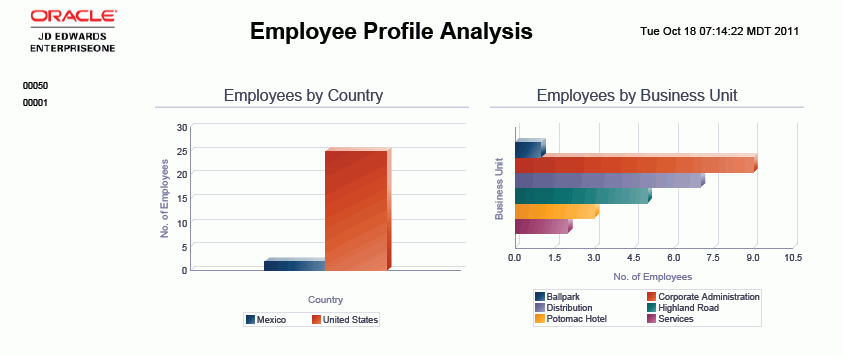

7.8 One View Employee Profile Inquiry (P080120)

Access the One View Employee Profile Inquiry application (P080120) from the Employee Inquiries (G05BEEI1) menu. Use One View Employee Profile Inquiry to report over the Employee Master tables and related information in the Job Master, Pay Grade/Salary Range, Business Unit Master, and Address Book tables. One View Employee Profile Inquiry uses the One View Employee Profile (F060116-F060117-F0101-F08001-F0006) business view (V060116X), which includes columns from the F060116, F0101, Employee Master - International Data table (F060117), Business Unit Master table (F0006), Job Information table (F08001), and the Employee Master Additional Information table (F060120). The P080120 also includes columns from the Employee Master - International Data table (F060117), Address by Date table (F0116), Address Book - Phone Numbers table (F0115), Electronic Address table (F01151), Employee Master - International Tag table (F060117A), Job Information table (F08001), Pay Grade/Salary Range table (F082001), and the Position Master table (F08101).

This application provides a wealth of data and is extremely flexible in the types of reports that can be generated. Choose from 500 columns in the business view to analyze employee information by company, business unit, job, pay grade, employment classifications, and reporting and category codes. Along with delivered reports, One View Employee Profile Inquiry can provide reports for many purposes. Examples of other reports include employees by company and business unit, mailing labels, and employees by address book category code.

One View Employee Profile Inquiry is delivered with several predefined reports. These reports are Employee Roster, Employee Roster with Address, Employee Seniority Report, Employee Compensation Review, and the Employee Profile Analysis. With these delivered reports you can view operational information about your workforce and analyze your workforce by factors such as FTE, seniority, and salary ranges. The Employee Profile Analysis interactive report gives you an even broader view of your workforce by providing multiple views of the same data by company, business unit, FTE, pay class, length of service, and age group.

7.8.1 Processing Options

Processing options enable you to specify the default processing for programs and reports.

7.8.1.1 Phone Details

- 1. Use Default Phone Type

-

Specify whether to use the default phone type value from UDC (01/PH). When this processing option is set to "1", leave the first phone type field blank from the processing option "Enter up to 3 Phone Types".

Values are:

Blank: Do not use default phone type value.

1: Use default phone type value.

- 2. Enter up to 3 Phone Types

-

Specify up to three user defined codes (01/PH) that indicate either the location or use of a telephone number.

Values include:

Blank: Business telephone number

FAX: Fax telephone number

HOM: Home telephone number

7.8.2 Special Processing

By default, the application includes employee address, phone number, and email details. Use the Display Only check box to include information only for the item(s) checked.

The application includes a calculation of employee length of service based on Date Started and age group based on Age.

7.8.3 Reports

The reports delivered with One View Employee Profile Inquiry are:

-

Employee Roster

-

Employee Roster with Address

-

Employee Seniority Report

-

Employee Compensation Review

-

Employee Profile Analysis

7.8.3.1 Employee Roster

To obtain a valid Employee Roster report, ensure that only the email and phone options are checked in the header of the One View Employee Profile Inquiry application.

This report contains the following components:.

-

Employee by FTEs (pie chart)

-

Total FTEs by Business Unit (bar graph)

-

Employees by EEO Job Category (bar graph)

-

Employees by Company (table)

7.8.3.2 Employee Roster with Address

To obtain a valid Employee Roster with Address report, ensure that only the address option is checked in the header of the One View Employee Profile Inquiry application.

This report contains the following components:.

-

Employees by Country (pie chart)

-

Employees by Country and State/Province (bar graph)

-

Employees Listing by Company (table)

7.8.3.3 Employee Seniority Report

To obtain the most usable Employee Seniority report, ensure that only the address option is checked in the header of the One View Employee Profile Inquiry application.

This report contains the following components:.

-

Employees by Length of Service (bar graph)

-

Top 10 Employees by Length of Service (bar graph)

-

Employees by Age Range (bar graph)

-

Employees by Date Started (table)

7.8.3.4 Employee Compensation Review

To obtain the most usable Employee Compensation Review report, ensure that only the address option is checked in the header of the One View Employee Profile Inquiry application.

This report contains the following components:.

-

Employees With Compa Ratio >= 1 (bar graph)

-

Employees With Compa Ratio < 1 (bar graph)

-

Employees by Tier/Ranking (bar graph)

-

Top 10 Employees by Salary (bar graph)

-

Employees by Locality (table)

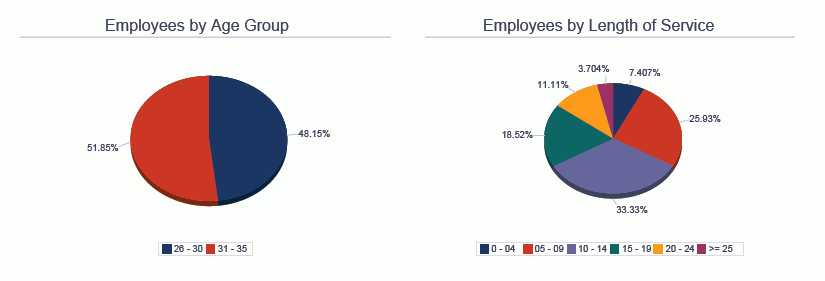

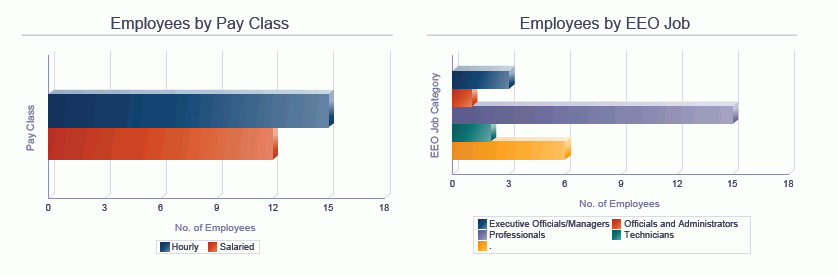

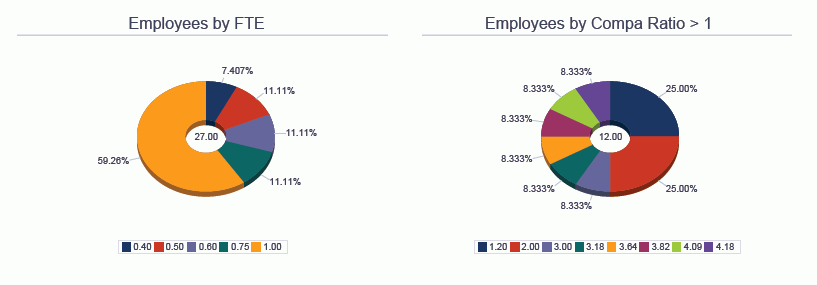

7.8.3.5 Employee Profile Analysis

The Employee Profile Analysis will run faster if only the address option is checked in the header.

This interactive report gives you complete control over the information shown on the graphs, charts, and table by providing filtering by various elements in the report.

This report contains the following components:.

-

Employees by Country (bar graph)

-

Employees by Business Unit (horizontal bar graph)

-

Employees by Age Group (pie chart)

-

Employees by Length of Service (pie chart)

-

Employees by Pay Class (horizontal bar graph)

-

Employees by EEO Job (horizontal bar graph)

-

Employees by FTE (donut graph)

-

Employees by Compa Ratio > 1 (donut graph)

-

Top 10 Employees by Salary (horizontal bar graph)

-

Top 10 Employees by Service (horizontal bar graph)

-

Employee Details (table)

The Employee Details table component contains drill back functionality as described in the following table:

| Functionality | Value |

|---|---|

| Table column containing drill back link | Employee Number |

| Table columns passed to application | Employee Number |

| Application called | Employee Profile (P060116) |

| Form called | W060116C |

| Version called | ZJDE0001 |

The following report was generated by querying active employees in all companies.