3 Set Up Alternate Chart of Accounts and User Defined Codes

This chapter contains these topics:

3.1 Setting up an Alternate Chart of Accounts

From General Accounting (G09), choose Organization and Account Setup

From Organization and Account Setup (G09411), choose Accounts by Business Unit

You can define the local chart of accounts in the Account Master file (F0901) by object and subsidiary, or in category codes 21, 22, and 23. This might depend on the use of your corporate chart of accounts, especially if your company is multi-national.

You can set up an alternate chart of accounts if your corporate reporting requirements are different than the local reporting requirements of the country in which you are doing business. For example, if you set up the local chart of accounts by object and subsidiary, but you need to provide fiscal reports that reflect a chart of accounts that is different from your local chart of accounts, you can set up and maintain an alternate chart of accounts in category codes 21, 22, and 23.

Whether you define the local chart of accounts by object and subsidiary, or in category codes 21, 22, and 23, the accounts that you set up in the category codes are referred to in JD Edwards World software as "alternate descriptions" of your accounts.

Note:

The software identifies individual accounts in your chart of accounts based on a system-assigned number that is unique for each account. This number is the Account Short ID. The Account Short ID is the key the system uses to distinguish between accounts when you access, change, and delete the account information in any of JD Edwards World tables. The system stores the short identification number in data item AID.To set up an alternate chart of accounts

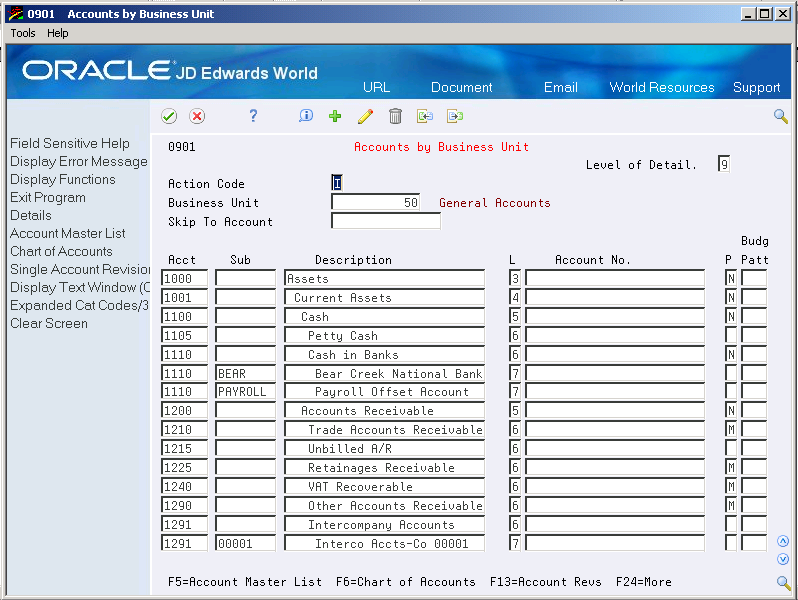

On Accounts by Business Unit

Figure 3-1 Accounts by Business Unit screen

Description of "Figure 3-1 Accounts by Business Unit screen"

-

Choose the Expanded Category Codes/3rd Account Formats function.

-

To specify a business unit, complete the following field:

-

Business Unit

-

-

To enter an alternate chart of accounts, complete the following fields:

-

Account

-

Subsidiary

-

Description

-

Level

-

Posting Edit

-

Category Code 21 (Statutory)

-

Category Code 22

-

Category Code 23

-

| Field | Explanation |

|---|---|

| Object Account | The object account portion of a general ledger account. The term "object account" refers to the breakdown of the Cost Code (for example, labor, materials, and equipment) into subcategories (for example, dividing labor into regular time, premium time, and burden). If you are using a flexible chart of accounts and the object is set to 6 digits, JD Edwards World recommends that you use all 6 digits. For example, entering 000456 is not the same as entering 456, because the system enters three blank spaces to fill a 6-digit object. |

| Subsidiary | A subdivision of an object account. Subsidiary accounts include more detailed records of the accounting activity for an object account. |

| Description | A user defined name or remark. |

| Account Level of Detail | A number that summarizes and classifies accounts in the general ledger. You can have up to 9 levels of detail. Level 9 is the most detailed and 1 the least detailed. Example:

3 Assets, Liabilities, Revenues, Expenses 4 Current Assets, Fixed Assets, Current Liabilities, and so on 5 Cash, Accounts Receivable, Inventories, Salaries, and so on 6 Petty Cash, Cash in Banks, Trade Accounts Receivable, and so on 7 Petty Cash - Dallas, Petty Cash - Houston, and so on 8 More Detail 9 More Detail Levels 1 and 2 are reserved for company and business unit totals. When using the Job Cost system, Levels 8 and 9 are reserved for job cost posting accounts. Screen-specific information In the Level of Detail field at the top of the Account Structure by BU screen, enter a level of detail (LOD) number. This limits the account information to accounts whose LOD is equal to or greater than the LOD you specify. Leave this field blank to display all LODs. After you press Enter to inquire on a business unit, the level of detail appears in the L field next to each account. |

| Posting Edit: | A code that controls G/L posting and account balance updates in the Account Master file (F0901). Valid codes are:

blank Allows all posting. Posts subledgers in detailed format for every account transaction. Does not require subledger entry. B Only allows posting to budget ledger types starting with B or J. I Inactive account. No posting allowed. L Subledger and type are required for all transactions. Posts subledgers in detailed format for every account. The system stores the subledger and type in the Account Ledger and Account Balances tables. If you want to report on subledgers in the Financial Reporting feature, you should use this code. M Machine-generated transactions only (post program creates offsets). N Non-posting. Does not allow any post or account balance updates. In the Job Cost system, you can still post budget quantities. S Subledger and type are required for all transactions. Posts subledgers in summary format for every transaction. The system stores the subledger detail in the Account Ledger table. This code is not valid for budget entry programs. U Unit quantities are required for all transactions. X Subledger and type must be left blank for all transactions. Does not allow subledger entry for the account. |

| Category Code - G/L 021 | Category code 21 associated with the Account Master file (F0901). This is a user defined code (system 09, type 21) for use in flex account mapping and in printing selected account information on reports. |

| Category Code - G/L 022 | Category code 22 associated with the Account Master file (F0901). This is a user defined code (system 09, type 22) for use in flex account mapping and in printing selected account information on reports. |

| Category Code - G/L 023 | Category code 23 associated with the Account Master file (F0901). This is a user defined code (system 09, type 23) for use in flex account mapping and in printing selected account information on reports. |

See Also:

-

Appendix A, "Alternate Chart of Accounts"for more information about maintaining an alternate chart of accounts

-

Working with Accounts in the JD Edwards World General Accounting I Guide

-

Reviewing Your Chart of Accounts in the JD Edwards World General Accounting I Guide

3.2 Setting Up User Defined Codes for Brazil

From Localizations - Brazil (G76B), enter 29

From Localization Setup - Brazil (G76B41B), choose User Defined Codes

From User Defined Codes - Brazil (G76B411), choose an option

User Defined Codes may also be accessed from the General Systems menu G00

Many fields throughout JD Edwards World software accept only user defined codes. You can customize your system by setting up and using user defined codes that meet the specific needs of your business environment.

User defined codes are either soft-coded or hard-coded. You can customize any user defined code that is soft-coded to accommodate your specific business needs. You can also set up additional soft-coded user defined codes. You cannot customize a user defined code that is hard-coded.

You can access all user defined code tables through a single user defined code screen. After you select a user defined code screen from a menu, change the System Code field and the User Defined Codes field to access another user defined code table.

Caution:

User defined codes are central to JD Edwards World systems. You should be thoroughly familiar with user defined codes before you change them.Note:

You may use any available item or address book category code for UDCs that have a numeric value in the type section of this chapter. For example, the Address Book Free Zone Indicator UDC must be system 01, but you may select any available category code.See Also:

Section 9.2, "Setting Up UDCs"

Section 36.4, "Set Up User Defined Codes for Electronic Notas Fiscais"

Set up the following user defined codes to process business transactions: