36 Release Suspended Tax Using an Interactive Process

This chapter contains these topics:

36.1 Releasing Suspended Tax Using an Interactive Process

To release suspended tax using an interactive process

Access the Process Vouchers Interactive screen

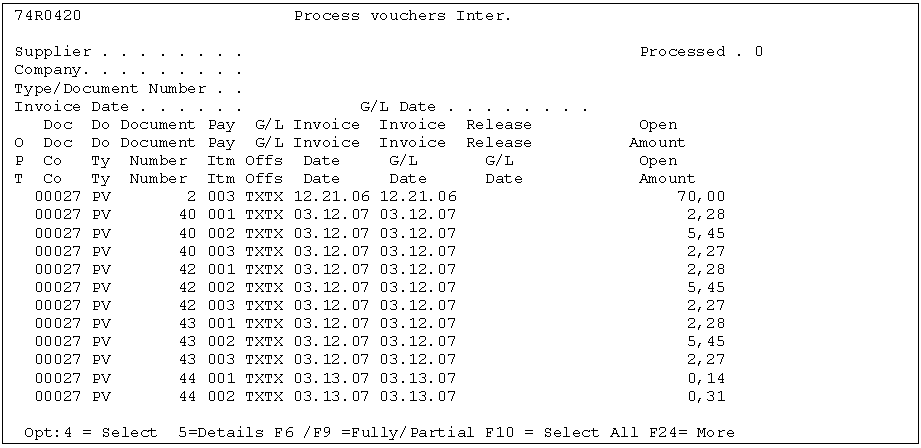

Figure 36-1 Process Vouchers Interactive screen

Description of "Figure 36-1 Process Vouchers Interactive screen"

If you release suspended VAT manually, it is either for total VAT amount or partial VAT amount. You can release it to the VAT account and sent to write-off P&L account. When it is sent to the write-off account, you must enter a reason code. The reason code plus AAI prefix from Suspended VAT Constants file builds the AAI, which must point to the account to use to write-off VAT amount.

The VAT release of selected vouchers is handled through an interactive application.

Several search fields are available to find the desired vouchers. The search fields are:

-

Company

-

Supplier

-

Document Type

-

Document Number

-

Process Yes or No (to inquiry already released transactions)

-

Invoice date

-

G/L date

All vouchers that meet the search criteria display in a subfile. It can display vouchers processed or not processed. If the voucher is processed, the program allows to display with option 5, a windows with the corresponding additional data, journal entry document number, journal number document type, g/l date, purchase book date, account number, and amount.

You use option 4 to select the vouchers to which the suspended VAT must be released and written to write off account.

Function key F10 is available to select all vouchers from the subfile, if applicable.

There are two modes to release selected suspended VAT vouchers:

-

Full release to VAT account

-

Partial release to VAT account and/or Write Off account

36.1.1 Full Release to VAT Account

Use the F9 function key to indicate that full release of VAT amount must be done for selected vouchers.

A new screen displays where the selected vouchers, only, displays for a final review and to change the G/L date for the VAT released journal entry and purchase book date. Example of a Full release to VAT account:

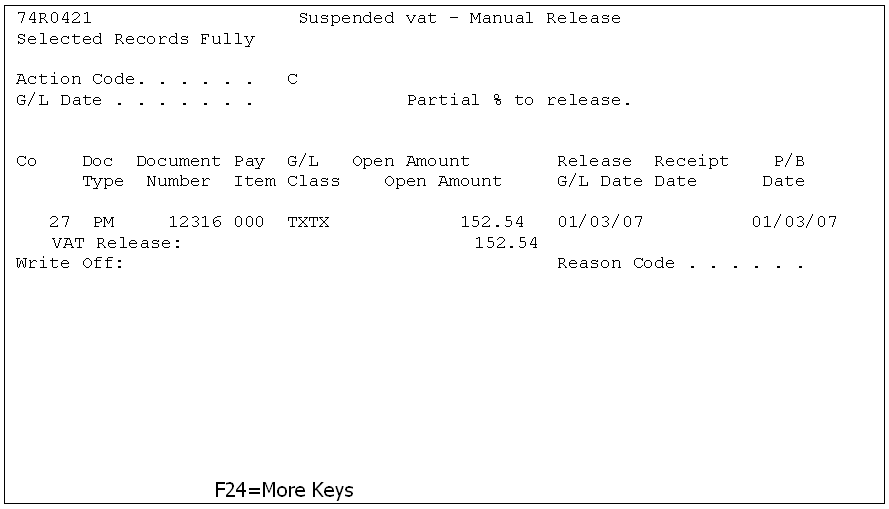

Figure 36-2 Suspended VAT - Manual Release screen

Description of "Figure 36-2 Suspended VAT - Manual Release screen"

You cannot modify the VAT amount. The only subfile fields that you can modify:

-

Invoice receipt date

If this is the first time a VAT release for the voucher is being done, the invoice date is blank. You can enter the invoice date.

-

Release G/L date

The default value for this date is the invoice GL date but you can enter a different date. The system uses this date in all subfiles but you can change the date.

-

Purchase book date

This date defaults to invoice date, voucher G/L date, /JK G/L date, based on the set up defined in Suspended VAT constants. You can change the date. If you change the date, the system displays a warning that it belongs to a different fiscal period than the Release G/L date.

36.1.2 Partial Release to VAT Account and/or Write Off Account

Use the F6 function key to indicate that partial release of VAT amount must be completed for selected vouchers.

When you use F6 to confirm a partial release, a different screen displays with information related only to selected vouchers for a final review and to allow changing some information.

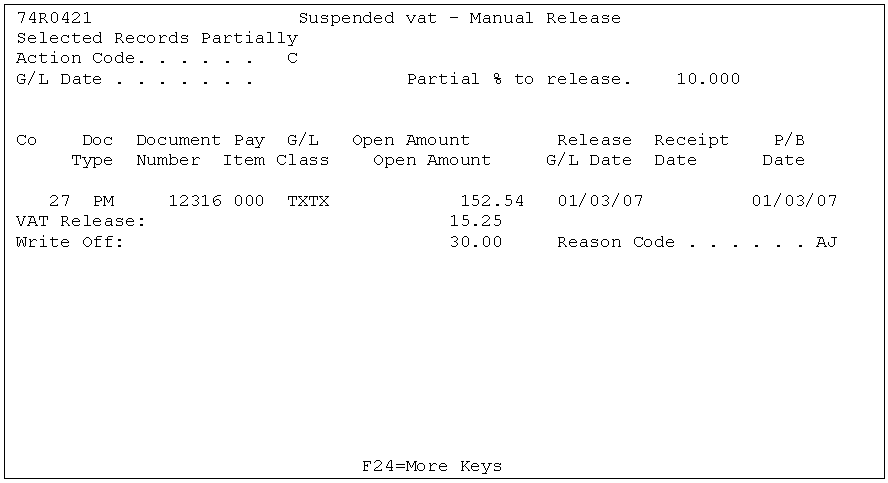

Figure 36-3 Suspended VAT - Manual Release (Partial/Write Off) screen

Description of "Figure 36-3 Suspended VAT - Manual Release (Partial/Write Off) screen"

The only subfile fields that you can modify:

-

Invoice receipt date

If this is the first time a VAT release for the voucher is being done, the invoice date is blank. You can enter the invoice date.

-

Release G/L date

The default value for this date is the invoice GL date but you can enter a different date. The system uses this date in all subfiles but you can change the date.

-

Purchase book date

This date defaults to invoice date, voucher G/L date, /JK G/L date, based on the set up defined in Suspended VAT constants. You can change the date. If you change the date, the system displays a warning that it belongs to a different fiscal period than the Release G/L date.

-

Amount to release

If you enter a partial % to release in the header field, then the system automatically adjusts the Amount to release column to display the partial amount suggested. If a partial % is not entered in header field, then the suggested amount to release defaults to open amount.

-

You can change that amount manually for individual vouchers

Amount to send to write-off. There is no default and you must manually enter the desired amount individually for each voucher. It is not required to enter write-off amount and release amount, thus the program can be used to partial release of VAT and remain an open amount to be released or write-off later.

-

Reason code for write-off

Mandatory if you enter write-off amount.

To indicate the default percentage to release, the system includes a processing option. This % can be modified individually for each voucher. This functionality is enabled to be used by some companies, where the partial release of VAT depends on end of month results for the company. The use of this option is optional.

In both modes (full or partial), you can confirm the selection with Enter, if no errors, the system creates a journal entry transaction for each voucher.

36.2 Void Released Suspended Tax

If you need to void a released tax for any reason, use the standard journal entry program instead of voiding the voucher.

When you void the journal entry for the release of suspended VAT:

-

Add the amount to open amount in the Tax on hold file

-

If the journal entry being voided is not posted, then the system deletes the records from the Tax released file as well

-

If the journal entry being voided is posted, then the system creates new entries in the Tax released file. The purchase book date for the new void entries in Tax released is the same as the G/L date entered for the voided records in F0911