35 Set Up Suspended Tax

This chapter contains these topics:

35.1 Setting Up Suspended Tax

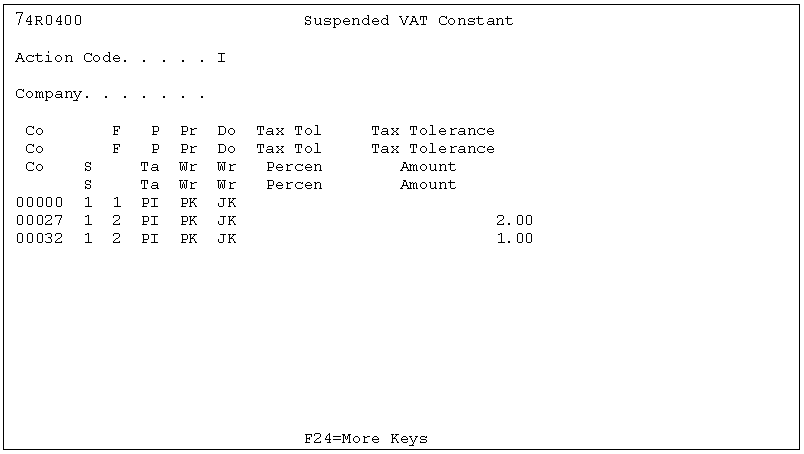

Figure 35-1 Suspended VAT Constant screen

Description of "Figure 35-1 Suspended VAT Constant screen"

Complete the following fields.

| Field | Explanation |

|---|---|

| Company | Company number. If this setup is the same for all the companies, then it is enough to set up for company 00000. Otherwise, it must be defined for each company with different set up than company 00000. |

| Enable Suspended Tax | Turn on /off to activate suspended VAT. |

| Purchase Book Date | Enter 1 for voucher invoice date, 2 for voucher G/L date, or 3 for JK G/L date.

When the Suspended VAT can be released, enter the date to be used for purchase book as well. 3 assumes the voucher G/L date same as purchase book date. |

| AAI for VAT account | Defines the prefix for VAT account to be used when releasing VAT. It is user defined but existing PI AAI from current suspended VAT can be used. |

| AAI for write-off account | Defines the prefix for write-off account used when writing-off VAT. |

| Document Type | Define the document type to assign to the tax released / write-off journal entry. |

| Tolerance Amount | Defines the tolerance amount to solve rounding issues. When the absolute value of an open amount to release is smaller than this amount, then it is considered a rounding difference and treated accordingly.

It is possible to have zero tolerance. If you select zero tolerance and indicate a %, which computing results in an amount that is over only for a few cents the open amount due to rounding issue, the program sends an error message but you can manually change the amount to match the total amount to release. If the computed amount is under for a few cents, due to rounding issues, the program accepts that amount as valid and leaves the cents as open amount for a future VAT release for the open amount. In the case of using a tolerance amount, the program verifies if the computed amount to release is different from the open amount and the difference is smaller or equal to the tolerance defined, then the program adjusts the amount automatically to match the open amount. Therefore, there is no open amount left for a few cents or the need for the user to manually change the amount to release. If you are doing partial VAT release and the remaining amount to write-off, then the automatic rounding algorithm is applied to the Write off amounts. |

| Tolerance % | Same as above but defined as % of total VAT instead of a fixed amount. Both methods for defining tolerance cannot be used. |

Caution:

If new localization suspended VAT is enabled, then base software suspended VAT must be disabled to avoid conflicts such as duplicate journal entries for suspended VAT.35.2 Setting Up Suspended Tax User Defined Codes

To run the suspended tax program correctly, you must set up the following User Defined Codes (UDCs):

-

Batch Types (98/IT)

-

Document Types with Suspended Tax Hold (00/DH)

-

Tax Areas using Suspended Tax (00/XA)

-

Write Off Reason Code (74R/RC)

-

Tax Areas w/Suspended Tax Hold (00/TH)

You can access these UDCs from the Advanced International Processing menu (G09319).

35.2.1 Setting Up Batch Types (98/IT)

Ensure there is a UDC of SV, Suspended VAT in the Batch Types UDC table.

| Field | Explanation |

|---|---|

| SV | Suspended VAT |

35.2.2 Setting Up Document Types with Suspended Tax Hold (00/DH)

Some situations require you to postpone the suspended tax accounting. Rather than have the suspended tax processing for the receipts and payments occur automatically when the receipts or payment batch is posted, there are batch (P09861) and interactive (P092501) programs to perform the suspended tax processing at a later date.

Set up the Document Types with Suspended Tax Hold to identify those invoice and voucher document types where all suspended taxes are held until the batch or interactive program to process the taxes is run. For example, you might set up the following values:

| Field | Explanation |

|---|---|

| PV | Vouchers |

| RI | Invoice |

35.2.3 Setting Up Tax Areas Using Suspended Tax (00/XA)

Set up the Tax Areas using Suspended Tax to identify the tax areas for which to hold taxes in suspense. This allows you the flexibility to limit suspended tax processing to only invoice and voucher pay items for specific tax areas (rather than all invoices and vouchers or all for one company). For example, you can set up the following values:

| Field | Explanation |

|---|---|

| IVA18 | Tax suspended VAT |

35.3 Releasing Suspended Tax

There are two methods for releasing suspended tax on payments and receipts that were set on Hold (using UDC 00/DH): batch and interactive.

35.3.1 Enter a Voucher

When you enter a voucher that must go through suspended VAT processing, ensure to enter the correct document type and Tax area to ensure it proper processing.

Settings that vouchers must fulfill to go through suspended VAT processing:

-

Automatic release of suspended VAT

-

Document type not included in UDC 00/DH

-

Tax area included in UDC 00/XA

-

Batch type V

-

Tax explanation code V or VT

-

-

Manual release of suspended VAT (hold suspended VAT)

-

Document type included in UDC 00/DH

-

Batch type V

-

Tax explanation code V or VT

-

Tax area included in UDC 00/XA

Or

-

Tax area included in UDC 00/XA

-

Tax area included in UDC 00/TH

-

Batch type V

-

Tax explanation code V or VT

-

35.3.2 Post a Voucher

When you post a voucher, suspended VAT can be released for vouchers that meet the criteria described in the Enter a Voucher section of this guide.

The posting process has two sub processes that automatically execute one after the other:

-

Preposting

-

Posting

Localization included in each process: Preposting and Posting.

35.3.2.1 Preposting

This process performs edits to ensure integrity in the journal entry being created.

Localization is added to do the following additional edits when a batch type V (vouchers) is posted only:

-

If activated new setup of suspended VAT, check that base software suspended VAT constant is not enable as well

-

If suspended VAT must be automatically released by posting, then ensure that the AAI for VAT account is defined and valid

If an error is found, batch status is updated to E and prints a report with the detail of error.

35.3.2.2 Posting

If no editing errors were detected by preposting, then for each voucher which has tax that goes through suspended VAT process, the system:

-

Creates a record in a new file named Tax on hold. The system uses this new file to keep track of VAT to be release. One record for each voucher key / suffix / tax area GL Class is created

-

If voucher meets the condition to automatically release tax, then the system creates a journal entry to release. The journal entry has the following characteristics:

-

Batch type SV with the same batch number as the batch V

-

Credit the Suspended VAT account and debit VAT account (or opposite if voucher is a credit note)

-

The VAT account is taken from AAIs: prefix defined in the file Suspended VAT Constants + the G/L offset defined in the Tax Area. If tax area has more than 1 G/L offset, one journal entry for each voucher/suffix/G/L offset is created

-

The GL date of the JK doc must always be the same as the GL date of the voucher. The month of the Purchase Book is based on the default rule in the constants. If there is a need to vary from the default rule then the voucher must be entered with held VAT

-

Document type defined in Suspended VAT Constants file

-

Ledger type AA and if voucher is in foreign currency, then release for CA as well

-

Amount: Tax amount for each voucher/suffix/tax area GL offset stored in the new file Tax on hold

-

One record for each journal entry created to VAT account is created in the new file Tax released or not

-

Open VAT amount from new file Tax on hold is reduced by the amount of each journal entry created for key voucher / suffix / G/L class.