9 Process SEPA Direct Debits

This chapter contains the following topics:

9.1 About the SEPA Direct Debit Process

You can process SEPA (Single Euro Payment Area) direct debits when you run your automatic debit process (Process Automatic Debits - P03575) or as a stand-alone process that you run after you run the automatic debit process in final mode. When you run the automatic debit process in final mode and specify the SEPA Direct Debit XML Generation program (P7403575) as the country-specific format program, the process generates an XML file in the correct format for SEPA direct debits. You then send the file to your bank in the same manner as you send other media to your bank. If you choose to run the SEPA Direct Debit XML Generation program as a stand-alone process, you first run the automatic debit process in final mode without specifying a country-specific format program, and then run the SEPA Direct Debit XML Generation program.

When you run the Process Automatic Debits program in final mode, the system populates the Automatic Debit Select and Build file (F0357) with records that include invoice information. The SEPA Direct Debit XML Generation program reads the F0357 records, and validates them against the address book, bank, and mandate files. If all required information is present in the files, the system generates the XML file for SEPA direct debits and includes the invoice, bank, and mandate information in the XML file. For example, the system includes bank account information, the effective date of the mandate, as well as codes that identify whether the mandate is recurring, for one-time use, and other status information in the XML file.

After the system generates the XML file, you copy the file to the media that you use to submit files to your bank using your existing process.

9.1.1 P7403575 Program Input Data

When you run the SEPA Direct Debit XML Generation program, the system reads these files:

-

Auto Debit Invoice Select and Build (F0357)

-

Bank Transit Master File (F0030)

-

Address Book Master (F0101)

-

Mandates - SEPA Direct Debits (F740320)

-

History Amendment - SEPA Direct Debits (F740322)

As the system reads the F0357 records, it compares the customer address book number in that file to the customer address book numbers in the F740320 and F740322 files. The system validates the mandate information, such as whether an active mandate exists for the customer. The system also validates information from the address book and bank files, such as the Tax ID and IBAN.

9.1.1.1 Mandate and Mandate Amendment Information

The system includes information from mandates in the XML file, such as the debtor's IBAN and BIC number, and the creditor's scheme ID (country code, national ID, and so on).

If you amend mandate information that is included in the XML file, you must send information about the amendments to your bank the first time that you process the SEPA direct debit collection using an amended mandate. The process automatically includes the required amended information.

Every time that you run the SEPA Direct Debits XML Generation program (P7403575), the system reads the Mandates - SEPA Direct Debits file (F740320) and History Amendment - SEPA Direct Debits file (F740322). The system determines whether to include amendment information by comparing the most recent date on which you used the mandate (F740320) to the date of the amendment (F740322). If the amendment was already reported, then the system does not include the amendment information in the debt collection file that you are currently processing. If the amendment was made after the last debit, then the system includes the amended information in the XML file that it generates.

If you amend mandates, the system includes this amended information the next time that you generate an XML file for the mandate:

-

Mandate Identification

-

Creditor Scheme Id

-

Creditor Name

-

Debtor IBAN number

-

Debtor BIC number

9.1.2 P7403575 Program Output and File Updates

When you run the SEPA Direct Debit XML Generation program as part of the automatic debit process or as a stand-alone process, the system generates these outputs:

-

XML file.

The system generates the XML file only when the records processed pass validations. See Section 9.1.2.1, "XML File"

-

Error report.

The system generates a PDF file showing errors when validation errors exist. See Section 9.1.2.2, "Error Report"

-

Receipt report.

The system generates this report only when you set the processing option to do so and the process completes with no errors. See Section 9.1.2.3, "Receipt Report"

9.1.2.1 XML File

The system generates the XML file only when the records processed pass these validations:

-

A valid mandate exists for each debtor for which you run the process.

A valid mandate has an Active status and has a date that is the day of or prior to the bank debit date.

-

All required bank information for the creditor and debtor is valid.

The system validates this bank information:

-

The debtor's bank account specifies that SEPA is enabled, and the BIC and IBAN numbers are valid.

The JD Edwards World software validates the entire IBAN, but validates only the country code in the BIC.

-

The creditor's bank account specifies that SEPA is enabled, and the BIC and IBAN numbers are valid.

The JD Edwards World software validates the entire IBAN, but validates only the country code in the BIC.

-

-

The debtor's mailing name, mailing address, country, and tax information are set up in the address book record.

-

The ultimate debtor's mailing name and tax ID exist in the address book record.

-

The creditor's mailing name, mailing address, country, and tax information are set up in the address book record.

-

The ultimate creditor's mailing name and tax ID exist in the address book record.

-

Required processing options in the P7403575 are set up with valid values.

See Also Appendix A, "Error Codes for the P7403575 - SEPA Direct Debits XML Generation Program"

9.1.2.1.1 XML File Structure

You can specify in the processing options of the P7403575 program whether to generate a structured or unstructured XML file. You can also specify whether to include a single invoice or multiple invoices within the RmtInf (remittance information) element of the XML file. You generate a structured or unstructured file, and specify single or multiple invoices based on the needs of your bank.

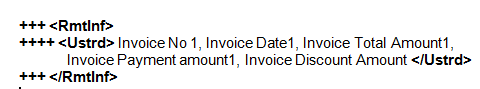

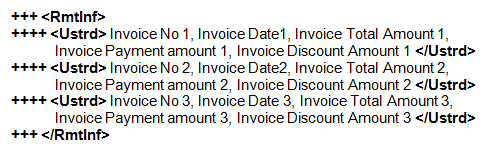

When you generate an unstructured file, the XML output includes the invoice information for each invoice within the Ustrd (unstructured) element. If you specify to write a single invoice, then the system includes only one Ustrd element within each RmtInf element. If you specify to write multiple invoices, then the system can include multiple Ustrd elements with each RmtInf element.

This image shows an example of an unstructured XML file that includes a single invoice in the RmtInf element:

Figure 9-1 Example of Unstructured, Single Invoice

Description of "Figure 9-1 Example of Unstructured, Single Invoice"

This image shows an example of an unstructured XML file that includes multiple invoices in the RmtInf element:

Figure 9-2 Example of Unstructured, Multiple Invoices

Description of "Figure 9-2 Example of Unstructured, Multiple Invoices"

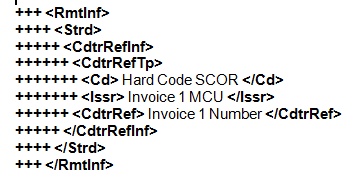

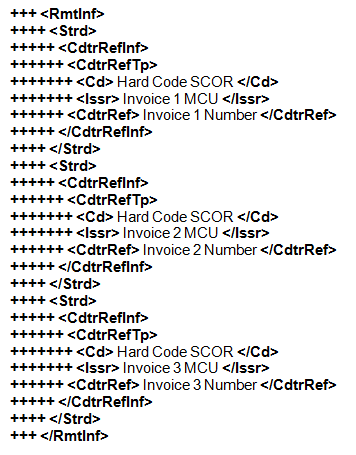

When you generate a structured file, the XML output includes additional elements to parse the file. As with the unstructured format, you can specify whether to include one invoice within each RmtInf element or multiple invoices.

This image shows an example of a structured file with a single invoice:

Figure 9-3 Example of Structured, Single Invoice

Description of "Figure 9-3 Example of Structured, Single Invoice"

This image shows an example of a structured file with multiple invoices:

Figure 9-4 Example of Structured, Multiple Invoices

Description of "Figure 9-4 Example of Structured, Multiple Invoices"

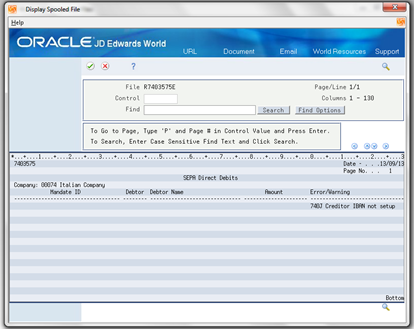

9.1.2.2 Error Report

If validations fail, the system generates an error report that lists the errors.

Figure 9-5 Error Report for SEPA Direct Debit

Description of "Figure 9-5 Error Report for SEPA Direct Debit"

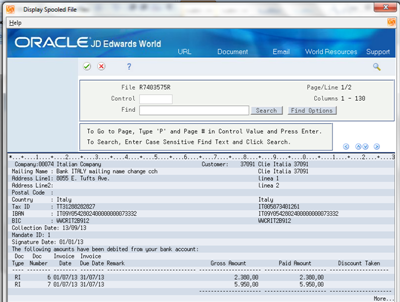

9.1.2.3 Receipt Report

You can set a processing option in the SEPA Direct Debits XML Generation program (P7403575) to generate an additional report with information about the invoices processed. The system generates the report only when the process completes with no errors. If you do not choose to generate the report with the invoice information, the system generates a report that shows only the batch number.

You can give a copy of the report to your customers to provide information about the invoices that were processed.

Figure 9-6 Receipt Report for SEPA Direct Debits

Description of "Figure 9-6 Receipt Report for SEPA Direct Debits"

9.1.2.4 Updates to F740320 (Mandate Information)

When you successfully generate the XML file, the SEPA Direct Debits XML Generation program updates the following fields in the F740320 file:

-

Last collection date.

The system updates the last collection date with the date on which you generated the XML file.

-

Transaction counter.

The system increments the transaction counter by 1 each time that you generate an XML file that includes the mandate.

-

Sequence type

If the sequence type is FRST (first), the system changes the sequence type to RCUR (recurring) so that the mandate can be used for additional files.

If the sequence type is OOFF (one-off), the system changes the sequence type to FNAL (final), so that the mandate cannot be used for additional files.

If the sequence type is RCUR (recurring), then the system does not make a change to the sequence type in the F740320 file.

-

Active field.

If the sequence type is OOFF (one-off) or FNAL (final), the system changes the value in the active field to N (inactive) so that the system does not use the mandate for any additional collection files.

9.2 Generate SEPA Direct Debits

You can generate the bank file and reports for SEPA direct debits as part of the automatic debit process or as a stand-alone process.

9.2.1 Data Selection

You specify data selection for the SEPA Direct Debits XML Generation program only when you run the program in stand-alone mode. When you run the Process Automatic Debits program in final mode with the SEPA Direct Debits XML Generation program specified as the country-specific payment format, the system uses the data selection from the Process Automatic Debits program and not from the SEPA Direct Debits XML Generation program.

9.2.2 Additional Parameters

You must set up these parameters for the SEPA Direct Debits XML Generation program to generate the SEPA direct debit XML file:

-

On the Transformation Template Maint. screen:

-

Specify a name for the template in the Template Name field.

You will enter the template name that you set up here in the Spooled File Export Parms screen.

-

Enter sepaddc.xsl in the Template File field.

-

In the Template Path field, enter the path of the IFS folder where the template file (sepaddc.xsl) is located.

-

Enter sepa.xml in the Output File field.

-

In the Output Path field, enter the path of the IFS folder in which you want the program to create the sepa.xml output file.

See "Transformation Template Setup" in the JD Edwards World Notifications Guide.

-

-

On the Spooled File Export Parms screen:

-

Enter sepa.xml in the Import Export File field.

-

Specify a path in the IFS Path field.

-

Enable fields in the Export section as needed.

-

Enter Y in the Enabled Y/N field in the DISTRIBUTION section.

-

Enter the name of the template that you set up in the Transformation Template field.

-

Complete other fields as desired.

See "Work with Import/Export" in the JD Edwards World Technical Tools Guide.

-

You can also set up a Distribution Profile. See "Working with Distribution Profiles" in the JD Edwards World Technical Tools Guide.

9.2.3 Automatic Debit Process

From SEPA Direct Debits (G740002), choose Process Automatic Debits.

To generate the output XML file and reports as a part of the automatic debit process:

-

Create a copy of the XJDE0008 version of the Process Automatic Debits program (P03575) to use for SEPA direct debit processing.

-

Set the processing options in the SEPA Direct Debits XML Generation program (P7403575).

-

Set the processing options in the Process Automatic Debits program (P03575).

You must specify these values:

-

Specify J7403575A for the program in the Country Specific Format Selection processing option (option 10), and specify the version of P7403575 to run.

-

Enter 1 in the Multicurrency Processing processing option (option 24).

Set the other processing options as needed for your business requirements.

See "Automatic Debits - USA (P03575)" in the JD Edwards World Accounts Receivable Guide.

-

-

Set data selection to include the appropriate invoices, customers, and so on.

-

Run the Process Automatic Debits program (P03575) in final mode.

You should run the report in proof mode and correct errors before running the P03575 program in final mode.

9.2.4 Stand-Alone Process

From SEPA Direct Debits (G740002), choose Stand Alone Process

To generate the output file as a stand-alone process:

-

Run the P03575 program in final mode without specifying the P7403575 program in the Country Specific Format Selection processing option.

-

Run the P7403575 program from the SEPA Direct Debits (G740002) menu.

9.3 Copy the Bank File

You use your standard process to copy the bank file from the saved location to the media that you use to submit XML files to your bank.