| Oracle® Retail Fiscal Management/RMS Brazil Localization Implementation Guide Release 14.2 F29404-01 |

|

Previous |

Next |

| Oracle® Retail Fiscal Management/RMS Brazil Localization Implementation Guide Release 14.2 F29404-01 |

|

Previous |

Next |

The batch overview provided in this chapter identifies the functional area description with the batch processes illustrated in the designs. This overview allows you to determine how a business function works behind the scenes.

Batch designs describe how, on a technical level, an individual batch module works and the database tables that it affects. In addition, batch designs contain file layout information that is associated with the batch process.

This chapter covers the following topics:

TaxWeb Tax Rules Integration and Maintaining Batches

fmtaxchg.pc

fmtaxupld.pc

l10n_br_exec_tax_recalc.ksh

l10n_br_fiscal_item_reclass_cost.ksh

l10n_br_fiscal_loc_reclass_cost.ksh

l10n_br_fiscal_loc_reclass_retail.ksh

l10n_br_fiscal_reclass_item_finish_retail.ksh

l10n_br_fiscal_reclass_item_process_retail.ksh

l10n_br_fiscal_reclass_item_setup_retail.ksh

l10n_br_refresh_extax_finish_retail.ksh

l10n_br_refresh_extax_future_cost.ksh

l10n_br_refresh_extax_process_retail.ksh

l10n_br_refresh_extax_setup_retail.ksh

l10nbr_taxweb_fisdnld.pc

fmtrandata.pc

fmfinpost.pc

import_SPED.pc

fmdealinc.pc

fm_async_queue_cleanup.ksh

fm_batch_avg_sales_price.ksh

fm_batch_freclass_sql.ksh

fm_generate_nf_stkcount.ksh

fm_reprocess_nf_status_f.ksh

fm_stock_position.ksh

fmedinf.pc

fmmanifest.ksh

fmprepost.pc

l10n_ld_iindfiles.ksh

Localization Purge Batch Process

fm_batch_clear_calc_stg_t.ksh

fmpurge.pc

l10nbrfreclsprg.pc

l10npurge.pc

| Module Name | fmtaxchg.pc |

| Description | |

| Functional Area | Tax changing Process |

| Module Type | |

| Module Technology | ProC |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

Use this batch program to process the item/location records affected by tax change.

The fmtaxchg RFM batch processes the records from FM_TAXCHG_HEADER and FM_TAXCHG_DETAIL tables with 'U' un-processed or 'E' error status.

The major functionality of this batch program is divided into the following three steps:

Making a call to RMS packaged function L10N_BR_WACADJ_SQL.WAC_UPDATE to update WAC and TRAN_DATA postings for cost variance. In case of unhandled exceptions and package errors, the batch stops further processing and an error is reported in error file.

Making a call to FM_T_EXT_TAXES_SQL and FM_S_EXT_TAXES_SQL with taxchg_ids for locations having control_rec_st_ind set to 'Y' in V_FISCAL_ATTRIBUTES, to update the ST history in MTR tables. In case of unhandled exceptions and package errors, the batch stops further processing and an error is reported in error file.

The STATUS column is updated to 'A' in FM_TAXCHG_HEADER table of WAC and ST history tables if the records are updated successfully.

| Module Name | fmtaxupld.pc |

| Description | |

| Functional Area | WAC and Substituição Tributária (ST) history update |

| Module Type | |

| Module Technology | ProC |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

Use this batch program to upload the 'Tax Change Upload' input file consisting of tax rule changes into the system for processing purpose.

FMTAXUPLD.PC is a Pro*C program that runs as a module in Adhoc. The purpose is to upload and process Tax Change input file consisting of tax rule changes. The module accepts Tax Change data contained in a flat file (ASCII text) and formatted to match the prescribed retail input file format.

All items are validated, FMTAXUPLD.PC writes a row into the FM_STG_TAXCHG_DTL table.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Ad hoc |

| Pre-Processing | N/A |

| Post-Processing | Fmtaxupld post |

| Threading Scheme | N/A |

Since this is a file-based upload, file-based restart/recovery logic is applied. The commit_max_ctr field should be set to prevent excessive rollback space usage, and to reduce the overhead of file I/O.

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| FM_STG_TAXCHG_DTL | No | Yes | No | Yes |

| ITEM_MASTER | Yes | No | No | No |

| ITEM_LOC_SOH | Yes | No | No | No |

| SYSTEM_OPTIONS | Yes | No | No | No |

| WH | Yes | No | No | No |

The input file name is not fixed, and it is determined by a run time parameter. Records rejected by the import process are written to a reject file. The reject file name is not fixed, and it is determined by a run time parameter.

| Record Name | Field Name | Field Type | Default Value | Description |

|---|---|---|---|---|

| FHEAD | File record descriptor | Char (5) | FHEAD | It describes the file line type. |

| Line number | Number (10) | 0000000001 | it is a sequential file line number. | |

| File Type | Char (4) | TXUP | It is the Tax change Upload. | |

| File create date | Char (14) | It is YYYYMMDDHH24MISS format. | ||

| FDETL | File record descriptor | Cha r(5) | FDETL | It describes the file line type. |

| Line number | Number (10) | It is the sequential file line number. | ||

| Action Type | Char (1) | Following is the type of mode: 'I'nsert or 'D'elete | ||

| NF number | Number (15) | The NF number is used only for delete scenario. | ||

| Series No | Char (20) | The series number is used only for delete scenario. | ||

| Item | Char (25) | It is the item number. | ||

| Location_id | Number (10) | It is the location ID. | ||

| Location_type | Char (1) | Following is the type of location: 'S'tore or 'W'arehouse | ||

| Quantity | Number (12) | Quantity * 10000 (4 implied decimal places), quantity of item at that location. It is used to update the MTR history tables. | ||

| Unit cost | Number (20) | Unit cost * 10000 (4 implied decimal places), Unit cost of the item. It is assumed that it will be in location currency. | ||

| ICMS unit amount | Number (20) | Imposto Sobre Circulação de Mercadorias e Serviços (ICMS) unit amount * 10000 (4 implied decimal places), ICMS amount changed per unit. It is assumed that it will be in location currency. | ||

| ICMSST unit amount | Number (20) | ICMSST unit amount * 10000 (4 implied decimal places), ICMSST amount changed per unit. It is assumed that it will be in location currency. | ||

| ICMSST Base Value | Number (20) | ICMSST Base Value* 10000 (4 implied decimal places), ICMSST Base value per unit for the item. It is assumed that it will be in location currency. | ||

| ICMSSTE unit amount | Number (20) | ICMSSTE unit amount * 10000 (4 implied decimal places), ICMSSTE amount changed per unit. It is assumed that it will be in location currency | ||

| ICMSSTE Base Value | Number (20) | ICMSSTE Base Value * 10000 (4 implied decimal places), ICMSSTE Base value per unit for the item. It is assumed that it will be in location currency. | ||

| New average cost | Number (20) | New average cost * 10000 (4 implied decimal places), New average cost of the item after tax law change. It is assumed that it will be in location currency. | ||

| FTAIL | File record descriptor | Char (5) | FTAIL | It describes the file record type. |

| Line number | Number (10) | It is a sequential file line number (total number of lines in the file). | ||

| Number of detail records | Number (10) | It is the number of FDETL lines in the file. |

| Module Name | l10n_br_exec_tax_recalc.ksh |

| Description | |

| Functional Area | TaxWeb Integration |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This batch job deals with executing fiscal entity reclass transactions for that day. This logic is performed on the effective date of the fiscal entity reclassification. This consists of updating the cost fields on ITEM_SUPP_COUNTRY_LOC, ITEM_SUPP_COUNTRY and updating the localization extension tables with the new fiscal attribute values.

The work is done in the L10N_BR_T_EXEC_RECLASS_SQL package.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Daily |

| Scheduling Considerations | Phase 3 |

| Pre-Processing | l10n_br_fiscal_item_reclass_cost.ksh |

| Post-Processing | sccext.pc |

| Threading Scheme | Not applicable |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| COST_TAX_RECALC | Yes | No | Yes | Yes |

| ITEM_COST_HEAD | Yes | No | No | No |

| COUNTRY_ATTRIB | Yes | No | No | No |

| MV_L10N_ENTITY | Yes | No | No | No |

| ITEM_SUPP_COUNTRY_LOC | Yes | No | Yes | No |

| ITEM_SUPP_COUNTRY | Yes | No | No | No |

| STORE_L10N_EXT | Yes | Yes | Yes | No |

| L10N_BR_T_RECLASS_ENTITY | Yes | No | No | No |

| WH_L10N_EXT | Yes | Yes | Yes | No |

| PARTNER_L10N_EXT | Yes | Yes | Yes | No |

| SUPS_L10N_EXT | Yes | Yes | Yes | No |

| L10N_BR_RECLASS_ENTITY_NV | Yes | No | No | No |

| L10N_ATTRIB | Yes | No | No | No |

| L10N_ATTRIB_GROUP | Yes | No | No | No |

| EXT_ENTITY | Yes | No | No | No |

| ITEM_COST_HEAD | Yes | Yes | Yes | No |

| ITEM_COST_DETAIL | Yes | Yes | Yes | Yes |

| Module Name | l10n_br_fiscal_item_reclass_cost.ksh |

| Description | |

| Functional Area | TaxWeb Integration |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This module creates cost changes for all item/supplier/origin country/location combinations that are affected by fiscal item reclassifications. The normal cost change processes will then take care of updating RMS with the new tax law information when necessary. If the default location is not ranged to an item being reclassified, the ITEM_COST_HEAD and ITEM_COST_DETAIL tables are handled directly.

This batch stores and maintains data that comes from the external tax engine like the TaxWeb Tax Rules.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | |

| Pre-Processing | N/A |

| Post-Processing | N/A |

| Threading Scheme |

| Table | Select | Insert | Update | Delete |

|---|---|---|---|---|

| GTAX_COST_CHANGE_GTT | Yes | Yes | Yes | No |

| L10N_BR_FISCAL_RECLASS | Yes | No | No | No |

| ITEM_SUPP_COUNTRY_LOC | Yes | No | No | No |

| ITEM_MASTER | Yes | No | No | No |

| ADDR | Yes | No | No | No |

| FUTURE COST TABLES | Yes | Yes | Yes | Yes |

| ITEM_COST_HEAD | Yes | Yes | Yes | No |

| MV_L10N_ENTITY | Yes | No | No | No |

| COUNTRY_ATTRIB | Yes | No | No | No |

| ITEM_SUPP_COUNTRY | Yes | No | No | No |

| ITEM_COST_DETAIL | Yes | Yes | Yes | No |

| SYSTEM_OPTIONS | Yes | No | No | No |

| SUPS | Yes | No | No | No |

| COST_SUSP_SUP_HEAD | No | Yes | No | No |

| COST_SUSP_SUP_DETAIL_LOC | No | Yes | No | No |

| COST_EVENT_RUN_TYPE_CONFIG | Yes | No | No | No |

| COST_EVENT | No | Yes | No | No |

| ITEM_COST_DETAILS | No | No | No | Yes |

| STORE | Yes | No | No | No |

| WH | Yes | No | No | No |

| partner | Yes | No | No | No |

| L10N_TAX_OBJECT_CONFIG | Yes | No | No | No |

| VAT_ITEM | Yes | No | No | No |

| Module Name | l10n_br_fiscal_loc_reclass_cost.ksh |

| Description | |

| Functional Area | TaxWeb Integration |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This module deals with processing cost logic of an entity fiscal entity reclassification. This consists of identifying the effected item/supp/country/loc rows, creating the new cost_tax_recalc records and sending them to the cost engine. This logic is preformed when the fiscal entity reclass is initially created.

The work is done in the L10N_BR_T_EXTAX_MAINT_SQL.FISCAL_LOC_RECLASS_COST package.

| Module Name | l10n_br_fiscal_loc_reclass_retail.ksh |

| Description | |

| Functional Area | TaxWeb Integration |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This module allows for recalculation of tax based on the changed fiscal attribute for store/warehouse/partner/supplier entities.

This consists of identifying the effected item/loc rows, calling the tax engine, and updating POS_MODS_TAX_INFO and GTAX_ITEM_ROLLUP. This logic is performed when the fiscal entity reclass is initially created.

The work is done in the L10N_BR_T_EXTAX_MAINT_SQL.FISCAL_LOC_RECLASS_EXTAX_SETUP package.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Daily |

| Scheduling Considerations | Phase 1 |

| Pre-Processing | None |

| Post-Processing | l10n_br_fiscal_loc_reclass_cost.ksh |

| Threading Scheme | N/A |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| L10N_BR_FISCAL_RECLASS | Yes | No | No | No |

| ITEM_LOC | Yes | No | No | No |

| ITEM_MASTER | Yes | No | No | No |

| V_PACKSKU_QTY | Yes | No | No | No |

| L10N_BR_T_RECLASS_ENTITY | Yes | No | No | No |

| L10N_BR_T_EXTAX_STG_RETAIL | No | Yes | No | No |

| ITEM_SUPP_COUNTRY | Yes | No | No | No |

| GTAX_ITEM_ROLLUP | Yes | Yes | No | No |

| ITEM_SUPP_COUNTRY_DIM | Yes | No | No | No |

| Module Name | l10n_br_fiscal_reclass_item_finish_retail.ksh |

| Description | |

| Functional Area | TaxWeb Integration |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This module picks up the group level tax call results that l10n_br_fiscal_reclass_item_process_retail.ksh places on L10N_BR_T_EXTAX_RES_RETAIL and L10N_BR_T_EXTAX_RES_RETAIL_DET and explodes them back to the item/location level. It then uses the item/location level information to write tax information to GTAX_ITEM_ROLLUP and POS_MODS_TAX_INFO tables.

This batch stores and maintains data that comes from the external tax engine like the TaxWeb Tax Rules.

The work is done in the L10N_BR_T_EXTAX_MAINT_SQL package.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Phase 1 |

| Pre-Processing | l10n_br_fiscal_reclass_item_process_retail.ksh |

| Post-Processing | l10n_br_fiscal_item_reclass_cost.ksh |

| Threading Scheme | Not applicable |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| L10N_BR_T_EXTAX_HELP_RTL_GTT | Yes | Yes | No | No |

| ITEM_LOC | Yes | No | No | No |

| ITEM_MASTER | Yes | No | No | No |

| ITEM_SUPP_COUNTRY | Yes | No | No | No |

| ITEM_SUPP_COUNTRY_DIM | Yes | No | No | No |

| L10N_BR_T_EXTAX_RES_RETAIL | Yes | No | No | No |

| L10N_BR_FISCAL_RECLASS | Yes | No | Yes | No |

| L10N_BR_T_EXTAX_DEST_GRP_HELP | Yes | No | No | No |

| V_BR_ITEM_FISCAL_ATTRIB | Yes | No | No | No |

| L10N_BR_EXTAX_HELP_NV_PAIR | Yes | No | No | No |

| ITEM_LOC | Yes | No | No | No |

| ITEM_MASTER | Yes | No | No | No |

| V_PACKSKU_QTY | Yes | No | No | No |

| GTAX_ITEM_ROLLUP | No | Yes | Yes | No |

| POS_MODS_TAX_INFO | No | Yes | Yes | No |

| L10N_BR_T_EXTAX_RES_RETAIL_DET | Yes | No | No | No |

| L10N_BR_FISCAL_RECLASS_NV | Yes | No | No | No |

| L10N_ATTRIB | Yes | No | No | No |

| L10N_ATTRIB_GROUP | Yes | No | No | No |

| EXT_ENTITY | Yes | No | No | No |

| ITEM_COUNTRY_L10N_EXT | No | Yes | Yes | No |

| Module Name | l10n_br_fiscal_reclass_item_process_retail.ksh |

| Description | |

| Functional Area | TaxWeb Integration |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This module picks the staged groups placed on L10N_BR_T_EXTAX_STG_RETAIL by l10n_br_fiscal_reclass_item_setup_retail.ksh and calls the external tax provider with them. The results of these calls are placed in the L10N_BR_T_EXTAX_RES_RETAIL and L10N_BR_T_EXTAX_RES_RETAIL_DET tables.

This batch stores and maintains data that comes from the external tax engine like the TaxWeb Tax Rules.

The work is done in the L10N_BR_T_EXTAX_MAINT_SQL package.

| Module Name | l10n_br_fiscal_reclass_item_setup_retail.ksh |

| Description | |

| Functional Area | TaxWeb Integration |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This module looks at all the valid item/location combinations in RMS for items having their fiscal attributes changed. It determines the unique fiscal attribute groups that cover all the item/locations combinations and puts the groups on a stage table (L10N_BR_T_EXTAX_STG_RETAIL).

This batch stores and maintains data that comes from the external tax engine like the TaxWeb Tax Rules.

The work is done in the L10N_BR_T_EXTAX_MAINT_SQL package.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Phase 1 |

| Pre-Processing | None |

| Post-Processing | l10n_br_fiscal_reclass_item_process_retail.ksh |

| Threading Scheme | Not applicable |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| L10N_BR_T_EXTAX_STG_RETAIL | Yes | Yes | Yes | Yes |

| L10N_BR_T_EXTAX_RES_RETAIL | No | No | No | Yes |

| L10N_BR_T_EXTAX_RES_RETAIL_DET | No | No | No | Yes |

| V_BR_T_STORE | Yes | No | No | No |

| L10N_BR_ENTITY_CNAE_CODES | Yes | No | No | No |

| V_BR_T_PARTNER | Yes | No | No | No |

| V_BR_T_WH | Yes | No | No | No |

| WH | Yes | No | No | No |

| L10N_BR_SUP_TAX_REGIME | Yes | No | No | No |

| ADDR | Yes | No | No | No |

| COUNTRY_TAX_JURISDICTION | Yes | No | No | No |

| COUNTRY | Yes | No | No | No |

| STATE | Yes | No | No | No |

| L10N_BR_EXTAX_HELP_NV_PAIR | Yes | Yes | Yes | Yes |

| L10N_BR_T_EXTAX_DEST_GRP_HELP | Yes | Yes | Yes | Yes |

| EXT_ENTITY | Yes | No | No | No |

| L10N_ATTRIB_GROUP | Yes | No | No | No |

| L10N_ATTRIB | Yes | No | No | No |

| L10N_BR_FISCAL_RECLASS | Yes | Yes | No | No |

| ITEM_LOC | Yes | No | No | No |

| ITEM_MASTER | Yes | No | No | No |

| ITEM_SUPP_COUNTRY | Yes | No | No | No |

| ITEM_SUPP_COUNTRY_DIM | Yes | No | No | No |

| V_PACKSKU_QTY | Yes | No | No | No |

| L10N_BR_T_TAX_CALL_STAGE_ROUTE | Yes | No | No | No |

| V_BR_ITEM_FISCAL_ATTRIB | Yes | No | No | No |

| V_BR_T_SUPS | Yes | No | No | No |

| V_BR_ITEM_COUNTRY_ATTRIBUTES | Yes | No | No | No |

| Module Name | l10n_br_refresh_extax_finish_retail.ksh |

| Description | |

| Functional Area | TaxWeb Integration |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This module picks the group level tax call results that l10n_br_refresh_extax_process_retail.ksh places on L10N_BR_T_EXTAX_RES_RETAIL and L10N_BR_T_EXTAX_RES_RETAIL_DET tables and explodes them back to the item/location level. It then uses the item/location level information to write tax information to GTAX_ITEM_ROLLUP and POS_MODS_TAX_INFO tables.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Phase 1 |

| Pre-Processing | l10n_br_refresh_extax_process_retail.ksh |

| Post-Processing | None |

| Threading Scheme | Not applicable |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| L10N_BR_EXTAX_REFRESH_CONFIG | No | No | Yes | No |

| L10N_BR_T_EXTAX_HELP_RTL_GTT | Yes | Yes | No | No |

| ITEM_LOC | Yes | No | No | No |

| ITEM_MASTER | Yes | No | No | No |

| ITEM_SUPP_COUNTRY | Yes | No | No | No |

| ITEM_SUPP_COUNTRY_DIM | Yes | No | No | No |

| L10N_BR_T_EXTAX_RES_RETAIL | Yes | No | No | No |

| L10N_BR_T_EXTAX_DEST_GRP_HELP | Yes | No | No | No |

| V_BR_ITEM_FISCAL_ATTRIB | Yes | No | No | No |

| L10N_BR_EXTAX_HELP_NV_PAIR | Yes | No | No | No |

| V_PACKSKU_QTY | Yes | No | No | No |

| GTAX_ITEM_ROLLUP | No | Yes | Yes | No |

| POS_MODS_TAX_INFO | No | Yes | Yes | No |

| L10N_BR_T_EXTAX_RES_RETAIL_DET | Yes | No | No | No |

| V_BR_ITEM_COUNTRY_ATTRIBUTES | Yes | No | No | No |

| Module Name | l10n_br_refresh_extax_future_cost.ksh |

| Description | |

| Functional Area | TaxWeb Integration |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This module obtains a list of fiscal attributes that have tax law changes scheduled against them since its last run. It then uses this information to determine what item/supplier/origin country/locations are affected by those scheduled tax law changes. These item/supplier/origin country/location combinations are then used to create new cost changes on the date of their tax law changes. The normal cost change processes then take care of updating RMS with the new tax law information when necessary.

The work is done in the L10N_BR_T_EXTAX_MAINT_SQL package.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Phase 1 |

| Pre-Processing | None |

| Post-Processing | None |

| Threading Scheme | Not applicable |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| L10N_BR_EXTAX_REFRESH_CONFIG | Yes | No | No | No |

| L10N_BR_T_TAX_CALL_RES_FSC_CNT | Yes | No | No | Yes |

| L10N_BR_EXTAX_REFRESH_COST | Yes | Yes | No | Yes |

| V_BR_T_STORE | Yes | No | No | No |

| L10N_BR_ENTITY_CNAE_CODES | Yes | No | No | No |

| V_BR_T_PARTNER | Yes | No | No | No |

| V_BR_T_WH | Yes | No | No | No |

| WH | Yes | No | No | No |

| V_BR_T_SUPS | Yes | No | No | No |

| L10N_BR_SUP_TAX_REGIME | Yes | No | No | No |

| ADDR | Yes | No | No | No |

| COUNTRY_TAX_JURISDICTION | Yes | No | No | No |

| COUNTRY | Yes | No | No | No |

| STATE | Yes | No | No | No |

| L10N_BR_EXTAX_HELP_NV_PAIR | Yes | Yes | Yes | Yes |

| L10N_BR_T_EXTAX_DEST_GRP_HELP | Yes | Yes | Yes | Yes |

| L10N_ATTRIB | Yes | No | No | No |

| L10N_ATTRIB_GROUP | Yes | No | No | No |

| EXT_ENTITY | Yes | No | No | No |

| L10N_BR_T_TAX_CALL_STG_FSC_FDN | Yes | Yes | No | Yes |

| L10N_BR_T_TAX_CALL_STAGE_ROUTE | Yes | Yes | No | Yes |

| RETAIL_SERVICE_REPORT_URL | Yes | No | No | No |

| L10N_BR_T_TAX_CALL_STAGE_RMS | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_TAXCNTR | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_SRVCPRD | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_ECO_CLS | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_ITM_RL | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_ITM_TAX | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_ITM | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_ECO | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_FIS_ENTITY | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_ITEM | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_NAME_VALUE | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_ORDER | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_ORDER_EXP | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_ORDER_INFO | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_REGIME | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_FSC_FND | Yes | No | No | Yes |

| L10N_BR_EXTAX_REFRESH_GTT | Yes | Yes | No | Yes |

| GTAX_COST_CHANGE_GTT | Yes | Yes | Yes | No |

| ITEM_MASTER | Yes | No | No | No |

| ITEM_SUPP_COUNTRY_LOC | Yes | No | No | No |

| COST_SUSP_SUP_HEAD | No | Yes | No | No |

| COST_SUSP_SUP_DETAIL_LOC | No | Yes | No | No |

| COST_EVENT_COST_CHG | Yes | Yes | No | No |

| COST_EVENT | Yes | Yes | No | No |

| COST_EVENT_RESULT | Yes | No | No | No |

| COST_EVENT_RUN_TYPE_CONFIG | Yes | No | No | No |

| L10N_BR_FISCAL_RECLASS_NV | Yes | No | No | No |

| L10N_BR_FISCAL_RECLASS | Yes | No | No | No |

| VAT_CODES | Yes | No | No | No |

| COUNTRY_ATTRIB | Yes | No | No | No |

| FM_SYSTEM_OPTIONS | Yes | No | No | No |

| L10N_BR_T_EXTAX_STG_COST | Yes | No | No | No |

| L10N_BR_T_EXTAX_RES_COST | No | Yes | No | No |

| V_BR_ITEM_FISCAL_ATTRIB | Yes | No | No | No |

| ITEM_SUPPLIER | Yes | No | No | No |

| ITEM_LOC | Yes | No | No | No |

| COST_EVENT_DEAL | Yes | No | No | No |

| COST_EVENT_RESULT | No | Yes | No | No |

| Module Name | l10n_br_refresh_extax_process_retail.ksh |

| Description | |

| Functional Area | TaxWeb Integration |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This module picks the staged groups placed in the staging table L10N_BR_T_EXTAX_STG_RETAIL by l10n_br_refresh_extax_setup_retail.ksh and calls the external tax provider with them. The results of these calls are placed on the staging L10N_BR_T_EXTAX_RES_RETAIL and L10N_BR_T_EXTAX_RES_RETAIL_DET tables.

The work is done in the L10N_BR_T_EXTAX_MAINT_SQL package.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Phase 1 |

| Pre-Processing | l10n_br_refresh_extax_setup_retail.ksh |

| Post-Processing | l10n_br_refresh_extax_finish_retail.ksh |

| Threading Scheme | N/A |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| RETAIL_SERVICE_REPORT_URL | Yes | No | No | No |

| L10N_BR_T_TAX_CALL_STAGE_ROUTE | Yes | No | No | No |

| VAT_CODES | Yes | No | No | No |

| L10N_BR_T_EXTAX_STG_RETAIL | Yes | No | No | No |

| L10N_BR_EXTAX_HELP_NV_PAIR | Yes | No | No | No |

| L10N_BR_T_EXTAX_RES_RETAIL | No | Yes | No | No |

| L10N_BR_T_EXTAX_RES_RETAIL_DET | No | Yes | No | No |

| Module Name | l10n_br_refresh_extax_setup_retail.ksh |

| Description | |

| Functional Area | TaxWeb Integration |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This module obtains a list of fiscal attributes that have tax law changes scheduled against them since the last run. It then uses this information to determine what item/locations are affected by those scheduled tax law changes. It determines the unique fiscal attribute groups that cover those item/locations combinations and puts the groups on a stage table (L10N_BR_T_EXTAX_STG_RETAIL).

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Phase 1 |

| Pre-Processing | N/A |

| Post-Processing | l10n_br_refresh_extax_process_retail.ksh |

| Threading Scheme | N/A |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| L10N_BR_EXTAX_REFRESH_CONFIG | Yes | No | No | No |

| L10N_BR_T_TAX_CALL_RES_FSC_CNT | Yes | No | No | No |

| L10N_BR_EXTAX_REFRESH_RETAIL | Yes | Yes | No | Yes |

| L10N_BR_T_EXTAX_STG_RETAIL | Yes | Yes | No | Yes |

| L10N_BR_T_EXTAX_RES_RETAIL | No | No | No | Yes |

| L10N_BR_T_EXTAX_RES_RETAIL_DET | No | No | No | Yes |

| L10N_BR_T_TAX_CALL_STG_FSC_FDN | Yes | Yes | No | Yes |

| L10N_BR_T_TAX_CALL_STAGE_ROUTE | Yes | Yes | No | No |

| RETAIL_SERVICE_REPORT_URL | Yes | No | No | No |

| L10N_BR_T_TAX_CALL_STAGE_RMS | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_TAXCNTR | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_SRVCPRD | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_ECO_CLS | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_ITM_RL | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_ITM_TAX | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_ITM | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_ECO | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_FIS_ENTITY | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_ITEM | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_NAME_VALUE | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_ORDER | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_ORDER_EXP | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_ORDER_INFO | Yes | No | No | Yes |

| L10N_BR_T_TAX_STAGE_REGIME | Yes | No | No | Yes |

| L10N_BR_T_TAX_CALL_RES_FSC_FND | Yes | No | No | Yes |

| L10N_BR_EXTAX_REFRESH_GTT | Yes | Yes | Yes | Yes |

| V_BR_ITEM_FISCAL_ATTRIB | Yes | No | No | No |

| V_BR_T_STORE | Yes | No | No | No |

| L10N_BR_ENTITY_CNAE_CODES | Yes | No | No | No |

| V_BR_T_PARTNER | Yes | No | No | No |

| V_BR_T_WH | Yes | No | No | No |

| WH | Yes | No | No | No |

| V_BR_T_SUPS | Yes | No | No | No |

| L10N_BR_SUP_TAX_REGIME | Yes | No | No | No |

| ADDR | Yes | No | No | No |

| COUNTRY_TAX_JURISDICTION | Yes | No | No | No |

| COUNTRY | Yes | No | No | No |

| STATE | Yes | No | No | No |

| L10N_BR_EXTAX_HELP_NV_PAIR | Yes | Yes | Yes | Yes |

| L10N_BR_T_EXTAX_DEST_GRP_HELP | Yes | Yes | Yes | Yes |

| ITEM_MASTER | Yes | No | No | No |

| ITEM_LOC | Yes | No | No | No |

| ITEM_SUPP_COUNTRY | Yes | No | No | No |

| ITEM_SUPP_COUNTRY_DIM | Yes | No | No | No |

| V_PACKSKU_QTY | Yes | No | No | No |

| VAT_CODES | Yes | No | No | No |

| L10N_BR_T_TAX_CALL_RES_FSC_CNT | No | No | No | Yes |

| L10N_BR_T_TAX_CALL_STAGE_ROUTE | No | No | No | Yes |

| L10N_ATTRIB | Yes | No | No | No |

| L10N_ATTRIB_GROUP | Yes | No | No | No |

| EXT_ENTITY | Yes | No | No | No |

| Module Name | l10nbr_taxweb_fisdnld.pc |

| Description | |

| Functional Area | TaxWeb Integration |

| Module Type | |

| Module Technology | ProC |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This batch loads all fiscal attributes tables in ORFM from the external tax engine. If it is necessary to download or update a specific fiscal attribute, a parameter can be passed as input, but if it needs to download all of them, user can inform ALL as parameter.

For this batch, RTIL is used to retrieve the request to Taxweb Tax Engine to have latest updated fiscal attribute. The cutoff date to download the data from TaxWeb Tax Engine is fetched from field LAST_UPD_DATE in FISCAL_ATTRIB_UPDATES table. Each time this batch is executed, last execution date is updated in LAST_UPD_DATE field.

If any fiscal attributes are returned, they will be loaded (merged) to the corresponding table for that fiscal attribute. The tables loaded per attribute are as follows:

| Attribute | Loaded Table |

|---|---|

| NCM | L10N_BR_NCM_CODES |

| NCM_CHAR_CODES | L10N_BR_NCM_CHAR_CODES |

| NCM_IPI_CODES | L10N_BR_NCM_IPI_CODES |

| NCM_PAUTA_CODES | L10N_BR_NCM_PAUTA_CODES |

| FEDERAIL_SERVICE_CODES | L10N_BR_FEDERAL_SVC_CODES |

| MASSERVICE_CODES | L10N_BR_UNIFIED_SVC_CODES |

| CNAE_CODES | L10N_BR_CNAE_CODES |

| CEST | L10N_BR_NCM_CEST_CODES |

| NOP | FM_NOP |

| ALL | All above tables |

|

Note: A new attribute (CESTFULL) was created to maintain NCM and CEST codes relationship. When the batch is executed with this parameter, relationship table between NCM and CEST is refreshed when there are not exist in the TaxWeb integration. |

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | This program can run in ad-hoc basis whenever the new fiscal attributes needs to be downloaded from the TaxWeb Tax Engine. |

| Pre-Processing | N/A |

| Post-Processing | N/A |

| Threading Scheme | N/A |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| L10N_BR_NCM_CODES | Yes | Yes | Yes | No |

| L10N_BR_NCM_CHAR_CODES | Yes | Yes | Yes | No |

| L10N_BR_NCM_PAUTA_CODES | Yes | Yes | Yes | No |

| L10N_BR_FEDERAL_SVC_CODES | Yes | Yes | Yes | No |

| L10N_BR_UNIFIED_SVC_CODES | Yes | Yes | Yes | No |

| L10N_BR_CNAE_CODES | Yes | Yes | Yes | No |

| FISCAL_ATTRIB_UPDATES | Yes | Yes | No | No |

| L10N_BR_T_TAX_CALL_STAGE_FSC_FDN | Yes | Yes | No | Yes |

| L10N_BR_T_TAX_CALL_STAGE_ROUTE | Yes | Yes | No | Yes |

| RETAIL_SERVICE_REPORT_URL | Yes | No | No | No |

| L10N_BR_T_TAX_CALL_RES_FSC_CNT | No | Yes | No | Yes |

| L10N_BR_T_TAX_CALL_RES_FSC_FND | Yes | Yes | No | Yes |

| FM_NOP | No | Yes | Yes | No |

| L10N_BR_NCM_IPI_CODES | Yes | Yes | Yes | No |

| L10N_BR_NCM_CEST_CODES | Yes | Yes | Yes | No |

| Module Name | fmtrandata.pc |

| Description | |

| Functional Area | Financial Postings |

| Module Type | |

| Module Technology | ProC |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

| Module Name | fmfinpost.pc |

| Description | |

| Functional Area | Financial Postings |

| Module Type | |

| Module Technology | ProC |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Ad hoc |

| Pre-Processing | N/A |

| Post-Processing | N/A |

| Threading Scheme | N/A |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| FM_GL_OPTIONS | Yes | No | No | Yes |

| FM_COA_SETUP | Yes | No | No | No |

| FM_SOB_SETUP | Yes | No | No | No |

| FM_ACCOUNT_SETUP | Yes | No | No | No |

| FM_DYNAMIC_SEGMENT_SETUP | Yes | Yes | No | No |

| FM_GL_CROSS_REF | Yes | Yes | No | No |

| FM_GL_DYNAMIC_ATTRIBUTES | Yes | Yes | No | No |

| FM_TRAN_DATA | Yes | No | No | No |

| FM_FISCAL_DOC_HEADER | Yes | No | Yes | No |

| FM_SCHEDULE | Yes | No | Yes | No |

| FM_AP_STAGE_HEAD | Yes | Yes | No | No |

| FM_AP_STAGE_DETAIL | Yes | Yes | No | No |

| STG_FIF_GL_DATA | Yes | Yes | No | No |

| Module Name | Import_SPED.ksh |

| Description | |

| Functional Area | SPED |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This batch is used to post NF processed transactions (status = FP) into SPED staging tables for SPED (SPED - FM_SPED_FISCAL_DOC_HEADER and FM_SPED_FISCAL_DOC_DETAIL) reporting by Fiscal Partners.

It looks into the driving table, FM_SPED_LAST_RUN_DATE, for the last run date of SPED to fetch all closed NFs whose transaction amounts are also rolled up into ledger accounts based on gl_cross_ref in between last run date and sysdate from the main tables of ORFM. Once the records are successfully inserted, the batch updates the last _run_date date to sysdate.

It is recommended that run this batch job on a daily basis due to performance impacts. This batch has a pre-dependency on the ORFM Financial postings batch, so once this is completed and sets Nota Fiscal status to 'F'inancially 'P'osted (FP).

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | This program should run only after the successful completion of FMFINPOST.PC |

| Pre-Processing | fmfinpost.pc |

| Post-Processing | N/A |

| Threading Scheme | N/A |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| FM_FISCAL_DOC_HEADER | Yes | No | No | No |

| FM_FISCAL_DOC_DETAIL | Yes | No | No | No |

| FM_SCHEDULE | Yes | No | No | No |

| FM_FISCAL_DOC_TAX_HEAD | Yes | No | No | No |

| FM_FISCAL_DOC_TAX_DETAIL | Yes | No | No | No |

| FM_FISCAL_DOC_TAX_DETAIL_EXT | Yes | No | No | No |

| FM_FISCAL_UTILIZATION | Yes | No | No | No |

| FM_FISCAL_DOC_PAYMENTS | Yes | No | No | No |

| FM_SPED_FISCAL_DOC_HEADER | No | Yes | No | No |

| FM_SPED_FISCAL_DOC_DETAIL | No | Yes | No | No |

| ITEM_MASTER | Yes | No | No | No |

| FM_SPED_LAST_RUN_DATE | Yes | No | Yes | No |

| V_BR_ITEM_FISCAL_ATTRIB | Yes | No | No | No |

| V_FISCAL_ATTRIBUTES | Yes | No | No | No |

Use this batch program to create NFs in Approved status.

| Module Name | fmdealinc.pc |

| Description | |

| Functional Area | Deal income posting |

| Module Type | |

| Module Technology | ProC |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This batch program reads the data from RMS staging tables STAGE_FIXED_DEAL_HEAD, STAGE_FIXED_DEAL_DETAIL, STAGE_COMPLEX_DEAL_HEAD, and STAGE_COMPLEX_DEAL_DETAIL and creates the NFs in Approved status. If the NF creation fails for some fatal reason, the error is logged in the error file. This batch runs on a daily basis after vendinvc and vendinvf RMS batches.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Ad hoc |

| Pre-Processing | vendinvc and vendinvf RMS batches |

| Post-Processing | N/A |

| Threading Scheme | Multi-threaded based on deal_id |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| FM_FIXED_DEAL_LOC_DEFAULT | Yes | No | No | No |

| STAGE_FIXED_DEAL_HEAD | Yes | No | No | No |

| STAGE_FIXED_DEAL_DETAIL | Yes | No | No | No |

| STAGE_COMPLEX_DEAL_HEAD | Yes | No | No | No |

| STAGE_COMPLEX_DEAL_DETAIL | Yes | No | No | No |

| TSF_ENTITY_ORG_UNIT_SOB | Yes | No | No | No |

| MV_L10N_ENTITY | Yes | No | No | No |

| SYSTEM_OPTIONS | Yes | No | No | No |

| FM_SYSTEM_OPTIONS | Yes | No | No | No |

| FM_FISCAL_DOC_HEADER | Yes | Yes | No | No |

| FM_FISCAL_DOC_DETAIL | No | Yes | No | No |

| Module Name | fm_async_queue_cleanup.ksh |

| Description | |

| Functional Area | Queue cleanup |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

| Module Name | fm_batch_avg_sales_price.ksh |

| Description | |

| Functional Area | Calculation for average sales price for items |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This batch supports new legislation of state Minas Gerais (MG) for new calculation for average sales price for items.

This process should be executed monthly to calculate and store the unit average retail price for domestic sales to final consumers.

In general, this process should address:

Calculate and store the values of 'Unit Weighted Average Sales Price' per: (Item x Location) and (Item x State) for a specific period;

Should be scheduled to perform every month to calculate the values for some specific period (month/year). It could be reported (parameter) or deduced automatically.

Create a parameter to allow the user to inform the period to be processed:

For every new execution, if there is data for the period the pro-cess should delete all the data first and then start to calculate and store the new data.

If there is no period reported in the parameter, the schedule will execute the period preceding (mm/aaaa) the execution date.

| Module Name | fm_batch_freeclass_sql.ksh |

| Description | |

| Functional Area | Reclassification |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This batch process fiscal attribute reclassification schedules marked as offline and ready to be processed.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Ad hoc |

| Pre-Processing | N/A |

| Post-Processing | N/A |

| Threading Scheme | N/A |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| FM_FRECLASS_SCHEDULE | Yes | No | Yes | No |

| FM_FRECLASS_CONFIG | Yes | No | No | No |

| L10N_ATTRIB | Yes | No | No | No |

| FM_FRECLASS | Yes | No | No | No |

| ITEM_MASTER | Yes | No | No | No |

| FM_SYSTEM_OPTIONS | Yes | No | No | No |

| ITEM_COUNTRY | No | Yes | Yes | No |

| ITEM_SUPPLIER | No | No | No | No |

| ITEM_LOC | No | No | No | No |

| FM_FRECLASS_STG | No | Yes | No | Yes |

| Module Name | fm_generate_nf_stkcount.ksh |

| Description | |

| Functional Area | NF-e Integration |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This module creates a NF for inventory adjustment where there is some quantity discrepancy as result of general inventory process.

| Module Name | fm_reprocess_nf_status_f.ksh |

| Description | |

| Functional Area | NF-e Integration |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This module reprocesses all NF-e with status F (Post Sefaz Approve Error) to A (Approved).

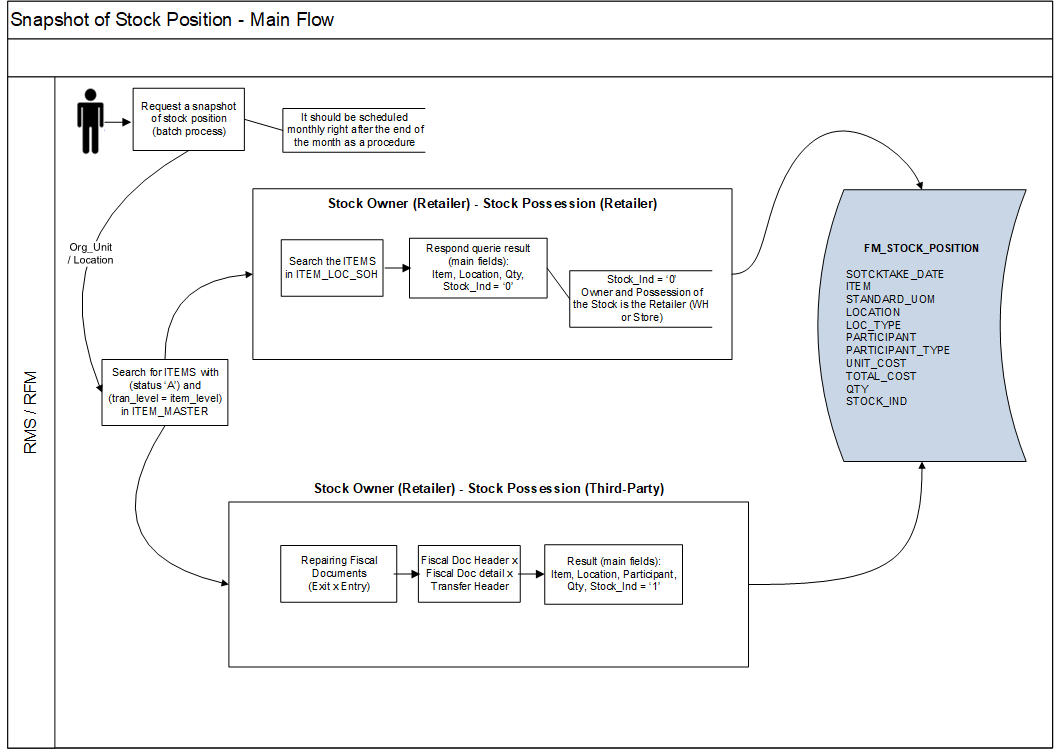

| Module Name | fm_stock_position.ksh |

| Description | |

| Functional Area | |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This module provides information about a snapshot of the stock position in RMS in table FM_STOCK_POSITION. This process is asynchronous, and this execution is controlled by parameters.

Location

If executed without parameters, it will take the stock position snap-shot for all locations.

Data of Fiscal Documents

Business tables (default and always used)

History tables (optional depend on the parameter ('Y' or 'N'(default))

If choose 'Y' then Hot and Hist tables will be used;

If choose 'N' then only Hot Tables will be used.

The tables ITEM_MASTER and ITEM_LOC_SOH will be main source for the batch process.

ITEM_MASTER

status = 'A'

ITEM_LOC_SOH

item = item (ITEM_MASTER)

loc = <depending on the parameter informed in the schedule of the process>

loc_type = <depending on the parameter informed in the schedule of the process>

This scenario is about stock in possession of a Third-Party and the stock owner is the Retailer. This search will cover all the active Items for the specific Org Unit / Location. Below is the rule to search and retrieve the data from the source tables:

ITEM_MASTER

Status = 'A'.

FM_FISCAL_DOC_HEADER (or HIST) / FM_FISCAL_DOC_DETAIL (or HIST) /

FM_FISCAL_UTILIZATION

Requisition Type = 'REP';

Status NF: A, C or FP;

Utilization mode type = 'EXIT';

item = item (ITEM_MASTER)

loc = <depending on the parameter informed in the schedule of the process>

loc_type = <depending on the parameter informed in the schedule of the process>

Requisition No.

TSFHEAD

Transfer Parent No = Requisition No (FM_FISCAL_DOC_DETAIL)

The search must group and total values for the data found using the functional key below.

ITEM

LOCATION

LOCATION_TYPE

PARTICIPANT

PARTICIPANT_TYPE

UNIT_COST

After grouping following the rule above, the totals should be calculated according to the formula below:

Quantity of Stock with Third-Party Possession =

(sum(FM_FISCAL_DOC_DETAIL.QUANTITY for NF Exit Repairing) -

(sum(FM_FISCAL_DOC_DETAIL.QUANTITY for NF Entry Repairing))

If there is no NF Entry Repairing related to the NF Exit Repairing, then to apply the formula above, the quantity for NF Entry Repairing should be considered as zero value ('0').

If the result of the formula above is greater than zero (>0), then a line register should be inserted in the table FM_STOCK_POSITION. It means that there is a remaining quantity of merchandise stock in possession of the Third-Party.

If the result of the formula above is NOT greater than zero (<=0), then a line register should NOT be inserted in the table FM_STOCK_POSITION. It means that there isn't a remaining quantity of merchandise stock in possession of the Third-Party.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Ad hoc |

| Pre-Processing | N/A |

| Post-Processing | N/A |

| Threading Scheme | N/A |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| WH | Yes | No | No | No |

| STORE | Yes | No | No | No |

| ITEM_MASTER | Yes | No | No | No |

| ITEM_LOC_SOH | Yes | No | No | No |

| PACKITEM_BREAKOUT | Yes | No | No | No |

| FM_SYSTEM_OPTIONS | Yes | No | No | No |

| FM_FISCAL_DOC_HEADER | Yes | No | No | No |

| FM_FISCAL_DOC_DETAIL | Yes | No | No | No |

| TSFHEAD | Yes | No | No | No |

| FM_STOCK_POSITION | Yes | Yes | No | No |

| Module Name | fmedinf.pc |

| Description | |

| Functional Area | NF creation and searching for an item |

| Module Type | |

| Module Technology | ProC |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This batch is used to generate NF from EDI staging tables.

This EDI batch runs to create the NF from the entries in the EDI NF tables, in Worksheet status. This NF is not linked to any schedule. Errors can only be viewed in the error log file. A new column in the NF header table displays if the NF has been created manually or through the EDI batch process.

The FM_EDI_DOC_DETAIL table is modified to include a new field, called VPN. This field allows the user to specify the VPN number, if the user is not aware of the RMS item number.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Ad hoc |

| Pre-Processing | N/A |

| Post-Processing | N/A |

| Threading Scheme | Multi-threaded based on Supplier |

| Tables | Select | Insert | Update | Delete |

|---|---|---|---|---|

| FM_EDI_DOC_HEADER | Yes | No | Yes | No |

| FM_EDI_DOC_DETAIL | Yes | No | No | No |

| FM_EDI_DOC_PAYMENT | Yes | No | No | No |

| FM_EDI_DOC_COMPLEMENT | Yes | No | No | No |

| FM_EDI_IMPORT_HEADER | Yes | No | No | No |

| FM_EDI_IMPORT_DETAIL | Yes | No | No | No |

| FM_FISCAL_IMPORT_HEADER | Yes | Yes | No | No |

| FM_FISCAL_IMPORT_DETAIL | Yes | Yes | No | No |

| FM_EDI_DOC_TAX_HEAD | Yes | No | No | No |

| FM_EDI_DOC_TAX_DETAIL | Yes | No | No | No |

| FM_FISCAL_DOC_HEADER | Yes | Yes | No | No |

| FM_FISCAL_DOC_DETAIL | Yes | Yes | No | No |

| FM_FISCAL_DOC_COMPLEMENT | Yes | Yes | No | No |

| FM_FISCAL_DOC_PAYMENTS | Yes | Yes | No | No |

| FM_FISCAL_DOC_TAX_HEAD | No | Yes | No | No |

| FM_FISCAL_DOC_TAX_DETAIL | Yes | Yes | No | No |

| FM_UTILIZATION_ATTRIBUTES | Yes | No | No | No |

| FM_FISCAL_DOC_TAX_HEAD_EXT | Yes | Yes | No | No |

| FM_FISCAL_DOC_TAX_DETAIL_EXT | Yes | Yes | No | No |

| FM_ERROR_LOG | No | Yes | No | Yes |

| Module Name | fmmanifest.ksh |

| Description | |

| Functional Area | Fiscal Receiving |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This batch inserts in the FM_STG_NFE the record that indicates to the Partner DFe the "Manifestação do Destinatário SEFAZ" request for the "Operação Não Realizada" (status = NFE_C_P) and "Desconhecimento da Operação" (status = NFE_U_P) events.

Are eligible for the event "Operação Não Realizada": the fiscal documents that are in the FM_FISCAL_DOC_HEADER table inactive (status = I), and the fiscal document previews that are in the FM_IRL_STATUS table refused (status: 305- REFUSED BY DISAGREEMENT, 306 - REFUSED AUTOMATICALLY AFTER PRE-VALIDATION, 6- REFUSED RECEIVING or 802- PHYSICAL RECEIVING REFUSED).

Are eligible for the manifestation of the event "Desconhecimento da Operação" are the fiscal document previews that are in the FM_IRL_STATUS table refused exclusively by unknown (status: 304- REFUSED BY UNKNOWN OPERATION).

In addition to the eligibility status criterion, the batch considers the number of days defined through the MDEST_SEFAZ System Option. Only records that have status definition dates less than or equal to the VDATE added to the defined number of days are processed.

If the record has been successfully inserted into the FM_STG_NFE table, the batch changes the status of the fiscal document (status = NFE_MP), and the status of the fiscal document previews (status: 1001- WAITING SEFAZ CONFIRMATION) to Manifest Pending.

Single and daily execution of this batch is recommended.

| Module Name | fmprepost.pc |

| Description | |

| Functional Area | Pre/Post functionality for ORFM |

| Module Type | |

| Module Technology | ProC |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This batch program has pre/post module for fmtaxupld batch. It contains fmtaxupld_post function. This function processes the records from staging table FM_STG_TAXCHG_DTL, contains process_ind as 'N', and inserts the records into FM_TAXCHG_HEADER and FM_TAXCHG_DETAIL tables.This program considers the following four parameters:

Username/password to log on to Oracle

A program before or after which this script must run

An indicator indicating whether the script is a pre or post function

chunk_size for fmtaxupld only, which defines the number of records under one location that need to clubbed as single chunk

| Module Name | l10n_id_iindfiles.ksh |

| Description | |

| Functional Area | Item Induction |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

| Module Name | fm_batch_clear_calc_stg_t.ksh |

| Description | |

| Functional Area | Purge |

| Module Type | |

| Module Technology | Shell Script |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This batch is used to clear records from the stage tables.

New batch process to get all data informed in table FM_CLEAR_CALC_STG_TABLES and for each line call function.

FM_T_EXT_TAXES_SQL

CLEAR_STG_TABLES

After call the function delete the processed lines in table FM_CLEAR_CALC_STG_TABLES.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Ad hoc |

| Pre-Processing | N/A |

| Post-Processing | N/A |

| Threading Scheme | N/A |

| Module Name | fmpurge.pc |

| Description | |

| Functional Area | Purging Process |

| Module Type | |

| Module Technology | ProC |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This batch is used to purge the NF records from the transaction and history tables.

In production environment, as the number of transactions increases over a period of time; in order to keep the performance intact it is required to keep purging the data from the active tables of the application periodically. This batch purges the data from the active tables and stores them in history tables.

This batch should be scheduled to purge the data from history tables over a period of time.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | Ad hoc |

| Pre-Processing | N/A |

| Post-Processing | N/A |

| Threading Scheme | N/A |

| Table | Select | Insert | Update | Delete |

|---|---|---|---|---|

| FM_SCHEDULE_HIST | No | Yes | No | No |

| FM_FISCAL_DOC_HEADER_HIST | No | Yes | No | No |

| FM_FISCAL_DOC_DETAIL_HIST | No | Yes | No | No |

| FM_TRAN_DATA_HIST | No | Yes | No | No |

| FM_RECEIVING_HEADER_HIST | No | Yes | No | No |

| FM_RECEIVING_DETAIL_HIST | No | Yes | No | No |

| FM_FISCAL_DOC_TAX_HEAD_HIST | No | Yes | No | No |

| FM_FISCAL_DOC_TAX_DETAIL_HIST | No | Yes | No | No |

| FM_RESOLUTION_HIST | No | Yes | No | No |

| FM_CORRECTION_TAX_DOC_HIST | No | Yes | No | No |

| FM_CORRECTION_DOC_HIST | No | Yes | No | No |

| FM_NF_DOC_TAX_HEAD_EXT_HIST | No | Yes | No | No |

| FM_FISCAL_IMPORT_DETAIL_HIST | No | Yes | No | No |

| FM_FISCAL_IMPORT_HEADER_HIST | No | Yes | No | No |

| FM_NF_DOC_TAX_DETAIL_EXT_HIST | No | Yes | No | No |

| FM_NF_DOC_TAX_DETAIL_WAC_HIST | No | Yes | No | No |

| FM_FISCAL_DOC_PAYMENTS_HIST | No | Yes | No | No |

| FM_NF_DOC_TAX_RULE_EXT_HIST | No | Yes | No | No |

| FM_SPED_FISCAL_DOC_HEADER_HIST | No | Yes | No | No |

| FM_SPED_FISCAL_DOC_DETAIL_HIST | No | Yes | No | No |

| FM_SCHEDULE | Yes | No | No | Yes |

| FM_FISCAL DOC HEADER | Yes | No | No | Yes |

| FM_FISCAL_DOC_DETAIL | Yes | No | No | Yes |

| FM_TRAN_DATA | Yes | No | No | Yes |

| FM_RECEIVING_HEADER | Yes | No | No | Yes |

| FM_RECEIVING_DETAIL | Yes | No | No | Yes |

| FM_FISCAL_DOC_TAX_HEAD | Yes | No | No | Yes |

| FM_FISCAL_DOC_TAX_DETAIL | Yes | No | No | Yes |

| FM_RESOLUTION | Yes | No | No | Yes |

| FM_CORRECTION_TAX_DOC | Yes | No | No | Yes |

| FM_CORRECTION_DOC | Yes | No | No | Yes |

| FM_FISCAL_DOC_TAX_HEAD_EXT | Yes | No | No | Yes |

| FM_FISCAL_DOC_TAX_DETAIL_EXT | Yes | No | No | Yes |

| FM_FISCAL_DOC_TAX_DEATIL_WAC | Yes | No | No | Yes |

| FM_FISCAL_DOC_PAYMENTS | Yes | No | No | Yes |

| FM_FISCAL_DOC_TAX_RULE_EXT | Yes | No | No | Yes |

| FM_SPED_FISCAL_DOC_HEADER | Yes | No | No | Yes |

| FM_SPED_FISCAL_DOC_DETAIL | Yes | No | No | Yes |

| FM_FISCAL_ENTITY_OTHER | Yes | No | No | Yes |

| FM_FISCAL_ENTITY_OTHER_HIST | Yes | Yes | No | Yes |

| FM_EDI_FISCAL_ENTITY_OTHER | Yes | No | No | Yes |

| FM_NF_PURGE_DAYS_SETUP | Yes | No | No | Yes |

| FM_FRECLASS_STG | Yes | No | No | Yes |

| FM_FRECLASS | Yes | No | No | Yes |

| FM_FRECLASS_SCHEDULE | Yes | No | No | Yes |

| Module Name | l10nbrfreclsprg.pc |

| Description | |

| Functional Area | TaxWeb Integration |

| Module Type | |

| Module Technology | ProC |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This batch purges the processed reclassification data from L10N_BR_FISCAL_RECLASS table. The records to be purged are based on its processed_date or active_date less than the current vdate along with the status.

| Schedule Information | Description |

|---|---|

| Processing Cycle | Ad hoc |

| Scheduling Considerations | This program can run after the successful completion of the following scripts:

|

| Pre-Processing |

|

| Post-Processing | N/A |

| Threading Scheme | Threading based on reclassification ID |

| Module Name | l10npurge.pc |

| Description | |

| Functional Area | Purging Process |

| Module Type | |

| Module Technology | ProC |

| Catalog ID | N/A |

| Runtime Parameters | N/A |

This batch is used to purge records from the transaction and history tables.

In production environment, as the number of transactions increases over a period of time; in order to keep the performance intact it is required to keep purging the data from the active tables of the application periodically. This batch purges the data from the active tables and stores them in history tables.