Understanding Absence Rules

Understanding Absence Rules

This chapter provides an overview of absence rules for Australia and discusses how to:

Deduct leave hours from regular hours.

Use delivered absence primary elements.

Accrue entitlement and pro rata leave (non-OGO).

Accrue and take other types of leave.

Calculate and take OGO long service leave.

Pay leave in advance.

Note. The PeopleSoft system delivers a query that you can run to view the names of all delivered elements designed for Australia. Instructions for running the query are provided in the PeopleSoft Enterprise Global Payroll PeopleBook.

See Also

Understanding How to View Delivered Elements

Understanding Absence Rules

Understanding Absence Rules

Managing absences and periods of leave in Australia is complex, because business practices and state legislation vary on issues such as the rate and frequency at which leave accrues and whether it becomes immediate entitlement or starts as pro rata leave.

Note. An absence entitlement can be an actual entitlement that is wholly or partially taken, it can be pro rata which is wholly or partially taken (while still pro rata), or it can be taken on its transfer to entitlement on a specified anniversary. In this chapter, the term entitlement refers to entitlements only, and the term pro rata refers to pro rata only. The term absence entitlement refers to both.

The PeopleSoft system provides 17 absence entitlement elements and 14 absence take elements. These elements demonstrate how Global Payroll can process typical leave requirements in Australia. They cover annual leave and long service leave—including OGO, sick leave, and other types of leave such as maternity leave, jury service, and workers' compensation.

Deducting Leave Hours from Regular Hours

Deducting Leave Hours from Regular Hours

When leave is paid to employees who work regular standard hours, the hours paid as leave must be deducted from the regular standard hours.

To achieve this, the leave earnings appear in a section in the process list that is resolved before regular pay. The same earnings contribute to the ERN AC REDUCE HRS accumulator. The unit in the calculation rule for the REGPAY STDHR earnings element is formula ERN FM REGSTD UNIT, and the ERN AC REDUCE HRS accumulator subtracts from the regular hours calculation within the formula.

Using Delivered Absence Primary Elements

Using Delivered Absence Primary ElementsPrimary absence elements are absence entitlements—entitlement or pro rata—and absence takes. In the two tables following we cross reference entitlements to takes and takes to entitlements in the description column.

Delivered Absence Entitlements

Delivered Absence Entitlements

The following table lists the delivered absence entitlements in Global Payroll for Australia:

|

Name |

Description / Corresponding Take |

|

Annual Leave |

|

|

ANN ENTHRS |

Annual Leave Hours Entitlement / ANN TKEHRS |

|

ANN ENTDYS |

Annual Leave Days Entitlement / ANN TKEDYS |

|

ANN PRODYS |

Annual Leave Days Pro Rata / ANN TKEDYS |

|

ANN ENTHPH |

Annual Leave Hours Per Hour Entitlement / ANN TKEHPH |

|

Long Service Leave |

|

|

LSL ENTWKF |

LSL Federal Entitlement Weeks / LSL TKEWKF |

|

LSL PROWKF |

LSL Federal Pro Rata Weeks / LSL TKEWKF |

|

LSL ENTWKO |

LSL Other (State) Entitlement Weeks / LSL TKEWKO |

|

LSL PROWKO |

LSL Other (State) Pro Rata Weeks / LSL TKEWKO |

|

Long Service Leave (OGO) |

|

|

PSH LSLENTFT |

LSL Entitlement Full Time incl PSH / PSH LSLTKEFT |

|

PSH LSLENTPT |

LSL Entitlement Part Time incl PSH / PSH LSLTKEPT |

|

PSH LSLPROFT |

LSL Pro rata Full Time incl PSH / not used |

|

PSH LSLPROPT |

LSL Pro rata Part Time incl PSH / not used |

|

Sick Leave |

|

|

SCK ENTDYS V |

Sick Leave Variable Days Entitlement / SCK TKEDYS V |

|

SCK ENTDYS F |

Sick Leave Fixed Days Entitlement / SCK TKEDYS F |

|

SCK ENTHRS |

Sick Leave Hours Entitlement / SCK TKEHRS |

|

SCK PROHRS |

Sick Leave Hours Pro Rata / SCK TKEHRS |

|

Other |

|

|

GENERIC ENT |

Generic Per Absence Entitlement / Various Takes |

Delivered Absence Takes

Delivered Absence Takes

The following is a list of the delivered absence takes in Global Payroll for Australia.

|

Name |

Description / Take Uses |

|

Annual Leave |

|

|

ANN TKEHRS |

Annual Leave Take Hours Entitlement / ANN ENTHRS |

|

ANN TKEDYS |

Annual Leave Take Days Entitlement / ANN ENTDYS, ANN PRODYS |

|

ANN TKEHPH |

Annual Leave Take HoursPerHour Entitlement / ANN ENTHPH |

|

Long Service Leave |

|

|

LSL TKEWKF |

LSL Take Federal Entitlement / LSL ENTWKF, LSL PROWKF |

|

LSL TKEWKO |

LSL Take Other (State) Entitlement / LSL ENTWKO, LSL PROWKO |

|

Long Service Leave (OGO) |

|

|

PSH LSLTKEFT |

LSL FullTime Months Take / PSH LSLENTFT |

|

PSH LSLTKEPT |

LSL PartTime Months Take / PSH LSLENTPT |

|

Sick Leave |

|

|

SCK TKEDYS V |

Sick Lve Take Variable Days / SCK ENTDYS V |

|

SCKTKEDYS F |

Sick Leave Take Fixed Days / SCK ENTDYS F |

|

SCK TKEHRS |

Sick Leave Take Hours Entitlement / SCK ENTHRS, SCK PROHRS |

|

Others |

|

|

WCOMPTKE |

Workers' Compensation Take / GENERIC ENT |

|

LWOP TKE |

Leave Without Pay Take / GENERIC ENT |

|

MATERNITY TKE |

Maternity Leave Take / GENERIC ENT |

|

JURY SERVICE TKE |

Jury Service Leave Take / GENERIC ENT |

Accruing Entitlement and Pro Rata Leave (Non-OGO)

Accruing Entitlement and Pro Rata Leave (Non-OGO)

Annual leave, long service leave, and sick leave are accrued by hours, days, weeks or months, and as either entitlement only or pro rata and entitlement.

Accruing and Taking Annual Leave

Accruing and Taking Annual Leave

This section discusses each of the annual leave entitlements and their respective take elements.

Hours Per Year—Entitlement Only

This is absence entitlement ANN ENTHRS. It has to determine the accrual rate per frequency and is based on a standard annual accrual of 152 hours and 38 standard weekly work hours (38 × 4 weeks leave per year = 152).

The absence element's entitlement value on the calculation page is formula ANN FM ENTHPY. This formula prorates the annual hours accrual for each employee because their standard hours (on JOB) may not be your organization's standard weekly work hours set in variable LVE VR ENT STD HRS on the Supporting Elements Override page of the absence entitlement. The standard annual entitlement, 152, is set in variable ANN VR ENTHRS.

(Standard weekly hours for employee ÷ Entitlement standard weekly hours) × Annual entitlement = ANN FM ENTHPY

35 / 38 × 152 = 139.999999

Note. The rounding rules handle the fractions. Standard weekly hours for the employee are calculated by formula LVE FM WK STD HRS, which annualizes and deannualizes the employee's standard hours because the work period (in the Job record) may not be weekly, and the proration of the annual accrual is based on weekly hours.

The annualized accrual is deannualized by the absence calendar frequency when the calendar is run. The deannualized accrual adds to the absence entitlement's _ENT and _BAL accumulators.

Accumulators are stored by EMPL ID/EMPL RCD and begin at hire date or rehire in the first instance. When a new accumulator instance is automatically created for a new year to date (YTD) period, the previous value of the _BAL accumulator is rounded and rolled over into the new YTD accumulator instance. The other accumulators are reset to 0.

The related absence take, ANN TKEHRS, decrements the absence units from the _BAL accumulator and stores them in the _TKE accumulator.

The units (hours) to decrement are resolved by the take's hours-based day formula, LVE FM HRS ABS PH which:

Determines if the day is a public holiday.

If it is, the system does nothing further because there are no entitlement hours used or annual leave paid for that day.

Checks for scheduled and partial hours and returns partial hours if there are any.

If there are no partial hours, it checks for a decimal value in the User Defined 1 field on the Absence Event Input Detail page.

If there is a value (any value) it halves the scheduled hours.

If it isn't a public holiday, there are no partial hours and no halving, and there are scheduled hours, the formula returns the scheduled hours.

The units returned become the paid units (DAY COUNT PD) and unpaid units (DAY COUNT UNP) depending on available absence entitlement.

These units are mapped to the appropriate earnings elements (ANN and LWOP, respectively), which the system processes as positive input when the payroll calendar is run. The value of DAY COUNT PD is also mapped to the LVLD (leave loading) earnings element if a leave loading is required.

Note. Any value in the decimal field will halve the hours

taken. You can use this to take twice as long a leave period at half hours

per day, which is effectively half pay per day.

The day formula includes a check to see if a forecasted leave duration

(in hours) is overridden in the User Defined 3 field

on the take's Calculation page. If it is, that duration represents the whole

leave period so the system stops using the day count formula to determine

the leave duration in hours.

Days Per Year—Pro Rata and Entitlement

This scenario requires two absence entitlements, ANN PRODYS and ANN ENTDYS, which this discussion refers to as entitlement and pro rata, respectively. The pro rata day entitlement, ANN PRODYS, determines the accrual rate per frequency. Its entitlement value on the calculation page is numeric 20 and the specified frequency is A (annual).

The entitlement value, 20, is deannualized according to the calendar period frequency for each employee.

Note. When an employee works less than five days per week and therefore accrues less than 20 days per year, you can enter an employee level override on the Entitlement/Take Assignment page to change the entitlement unit value; for example, from 20 to 16 for an employee working a four-day week.

When you run the absence calendar, the deannualized value is accrued to the pro rata year-to-date _ENT and _BAL accumulators. The year in the year-to-date is set when the accumulator's begin option is Specify Date, and the begin month and begin day are generic variables LVE VR HIRE MONTH and LVE VR HIRE DAY, which hold the employee's hire month and day, respectively. The accumulators are stored by EMPL ID/EMPL RCD.

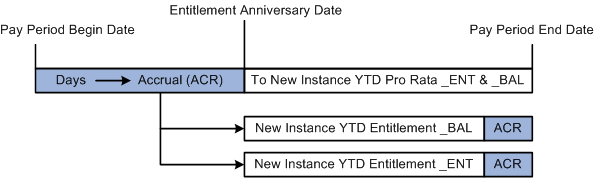

When the system automatically creates new instances of the accumulators at the hire date anniversary, the previous values of the entitlement _ENT and _BAL accumulators are rolled over into their new instances and the previous values of the pro rata _ENT and _BAL accumulators are rounded and rolled over into the new instances of the entitlement _ENT and _BAL accumulators. The following diagram shows this:

The current calendar period is then split into pre-hire anniversary and post-hire anniversary periods, using generic date element LVE DT HIRE ANN DT. The pre-hire anniversary days are then used in formula ANN FM P2EDYS EMBR to work out the proportion of the accrual that belongs to the pre-hire anniversary period. This value is then sent to variable ANN VR PP2EDYS MBR, which adds to the entitlement _BAL and _ENT accumulators. The following diagram shows this (ACR stands for accrual).

Accrual for the days before hire anniversary becoming entitlement

The pre-hire anniversary accrual variable, ANN VR PP2EDYS MBR, also subtracts from the pro rata _ENT and _BAL accumulators. This reduces the pro rata _ENT and _BAL balances by the amount of the accrual that was accrued in the previous accumulator period.

The absence take, ANN TKEDYS, related to both the pro rata and entitlement absence elements (indicating that pro rata days can be used despite not having become entitlement yet) firsts looks to the entitlement balance to decrement absence units before looking to the pro rata balance to further decrement absence units (where the entitlement units are depleted).

The units (days) to decrement is resolved by the take's Day Formula, LVE FM DYS ABS PH which:

Determines if the day is a public holiday.

If it is, it does nothing further because no entitlement hours are used and no annual leave is paid for that day.

Checks for scheduled and partial hours; if there are partial hours, the system returns the fraction of the day the hour represents and then rounds them.

Partial hours ÷ Scheduled hours = Fraction of day absent

2 ÷ 8 = 0.25

The formula includes variable LVE VR DYS ABSENT, which holds the cumulative value of the results of the day formula as it resolves for each day in the leave period. It starts as 0. In this example, its value after the resolution for day 1 would be 0 + 0.25 = 0.25.

If there are no partial hours, it checks for a decimal value in the User Defined 1 field on the Absence Event Input Detail page.

If there is any value, it adds 0.5 to LVE VR DYS ABSENT. Assuming this is the case, in this example Day 1 + Day 2 = 0.75.

If it isn't public holiday, there are no partial hours or halving, but there are scheduled hours, then the formula adds 1 to LVE VR DYS ABSENT.

The units returned become the paid units (DAY COUNT PD) and unpaid units (DAY COUNT UNP) depending on available absence entitlement days and pro rata days.

The positive input for this absence take is earnings ANN and LWOP. The units for these earnings are formulas LVE FM DY DCP HRS and LVE FM DY DCUP HRS, respectively. The formulas multiply the DAY COUNT PD and DAY COUNT UNP by the scheduled hours, so the system can pay the leave in hours.

Note. Any value in the decimal field halves the hours taken.

You can use this to take twice as long a leave period at half hours per day

which is effectively half pay per day.

Anything but a partial day returns either 0.5 or 1, because a day can

only be a partial hours fraction, a half day or a full day.

Hours Per Hour—Entitlement Only

This leave entitlement is ANN ENTHPH, and there is no pro rata leave. Leave accrues as a fraction of an hour per hour worked. The hourly accrual rate (the fraction) is derived from 4 × 38 hour weeks, or 152 hours per year.

The hour fraction, stored in variable ANN VR ENTHPH, is set to 0.076712. That figure comes from:

(152 ÷ 52.14308 (the weekly annualization factor)) ÷ 38 = 0.076712

Accumulator ANN AC ENTHPH REG stores the units of hourly pay for the calendar period, and ANN ENTHPH entitlement's formula ANN FM ENTHPH multiplies the accumulated hours by the variable when the absence calendar is run and populates its _ENT and _BAL accumulators.

Note. The formula also checks to see if the employee hasn't been terminated. If he has, the formula returns ANN VR ENTHPH × TER VR FINAL HRS.

The absence take for this leave accrual is ANN TKEHPH, and its day formula is LVE FM HRS ABS PH—the same day formula that take ANN TKEHRS uses.

Note. If you pay more than 38 hours per week, this entitlement accrues more than the annual maximum of 152 hours (unless there are balancing reductions in other weeks).

Accruing and Taking Long Service Leave

Accruing and Taking Long Service Leave

This section discusses each of the long service leave (LSL) entitlements and their respective absence takes. There are two absence entitlements and two pro rata entitlements—one of each for federal long service leave and other (or state-based) long service leave. They are LSL ENTWKF and LSL PROWKF for federal and LSL ENTWKO and LSL PROWKO for other (or state).

Long Service Leave Pro Rata and Entitlement—Federal

This scenario is based on 13 weeks LSL after 15 years of service. Pro rata balances transfer to entitlement on the completion of the first 15 years service and then annually.

The pro rata element LSL PROWKF accumulates the leave using variable LSL VR ENTWKF, which has a value of 0.86667 as the maximum yearly accrual value in weeks

15 years × 0.866667 weeks = 13 weeks (rounded)

When the absence calendar is run, the accrual value is deannualized depending on the calendar period frequency of the employee and the value passed to the LSL pro rata year-to-date _BAL and _ENT accumulators. Both accumulators have an initialize rule that transfers their balances to new instances. The initialize rule formulas are LSL FM PROWKF BMBR for _BAL and LSL FM PROWKF EMBR for _ENT. The formulas resolve to the value of system element PREV VALUE ACCM and add to the new instances.

The entitlement element LSL ENTWKF handles the transfer of the pro rata balances to entitlement using its formula LSL FM MVE P2EWKF, which:

Checks if the duration LSL DR DYS FR HIRE (days from hire) returns days more than or equal to variable LSL VR 15 Y IN D (15 years expressed in days, or 5, 478) and that the LSL ENTWKF_ENT accumulator is 0 (which indicates that nothing has been transferred to this life-to-date accumulator).

If duration does return more than 5,478 days and the entitlement _ENT balance is 0, the formula passes the value of 15 years of accrual to the entitlement and decrements the pro rata.

By the same method, the formula also transfers the pro rata _ADJ and _TKE balances to their respective entitlement accumulators.

If the conditions in step 2 are not met, the formula determines if the duration returns more than 5,478 days, and it verifies that the pro rata _ENT balance is more than or equal to 0.86667.

This condition indicates that another year's worth of pro rata leave has accrued. Because pro rata becomes entitlement annually after the initial 15 years transfer, the formula transfers the four pro rata balances to their respective entitlement balances by the same method.

Note. In step 3, the formula checks the balance of the pro rata _ENT accumulator, because if it checked only for a non-0 balance in the entitlement accumulator after the initial 15 years transfer, subsequent transfers would occur every time the absence calendar runs instead of waiting for a year's worth of accrual in the pro rata accumulator.

The absence take, LSL TKEWKF, related to both the pro rata and entitlement absence elements (indicating that pro rata days can be used despite not having become entitlement yet), firsts looks to the entitlement balance to decrement absence units before looking to the pro rata balance to further decrement absence units (where the entitlement units are depleted).

The units (weeks) to decrement are resolved by the take's day formula, LVE FM WKF ABS NPH. The formula checks the scheduled hours or partial hours for each day and converts them to fractions of a week because the units by which to decrement the leave balances are weeks. The formula does this by dividing all hours returned by the day formula by LVE FM WK STD HRS. The day formula LVE FM WKF ABS NPH:

Checks for scheduled and partial hours, and if there are partial hours, the system returns the fraction of the week the hours represent then rounds them.

Partial hours ÷ Standard weekly hours = Fraction of week absent

6 ÷ 40 = 0.15

The formula includes variable LVE VR WKS ABSENT, which holds the cumulative value of the results of the day formula as it resolves for each day in the leave period. It starts as 0. In this example, its value after the resolution for day 1 would be 0 + 0.15 = 0.15.

If there are no partial hours but there are scheduled hours, it converts the hours to a fraction of a week (0.2 for an eight-hour day) and then checks for a decimal value in the User Defined 1 field on the Absence Event Input Detail page.

If there is any value, it halves the value of the fraction of a week and adds the value to LVE VR WKS ABSENT. Assuming this to be the case after processing the second day, LVE VR WKS ABSENT is:

Day 1 + Day 2 = 0.15 + (0.2 / 2) = 0.25 weeks = LVE VR WKS ABSENT

If there are no partial hours but there are scheduled hours and there is no halving, the formula adds the scheduled hours—already converted to a fraction of a week—to LVE VR WKS ABSENT.

Day 1 + Day 2 + Day 3 = 0.15 + (0.2 / 2) + 0.2 = 0.45 weeks = LVE VR WKS ABSENT

The units returned become the paid units (DAY COUNT PD) and unpaid units (DAY COUNT UNP) depending on available absence entitlement weeks and pro rata weeks. The positive input for this absence take are earnings LSL and LWOP. The units for these earnings are formulas LVE FM WK DCP HRS and LVE FM WK DCUP HRS, respectively. The formulas multiply the DAY COUNT PD and DAY COUNT UNP (both in weeks) by the standard weekly hours so the system can pay the leave in hours.

Note. Any value in the decimal field halves the fraction of a week. You can use this to take twice as long a leave period at (weeks per day) ÷ 2, which is effectively half pay per week.

Long Service Leave Pro Rata and Entitlement—Other (State)

This scenario is based on 13 weeks LSL after either 10 or 15 years of service, depending on the state. Pro rata balances transfer to entitlement on the completion of the first 10 or 15 years service and then annually.

For the Australian Capital Territory, New South Wales, Queensland, Victoria, and Western Australia the accrual is 0.866667 weeks per year where:

15 years × 0.866667 weeks = 13 weeks (rounded)

For South Australia and Northern Territory the accrual is 1.3 weeks per year where:

10 years × 1.3 weeks = 13 weeks

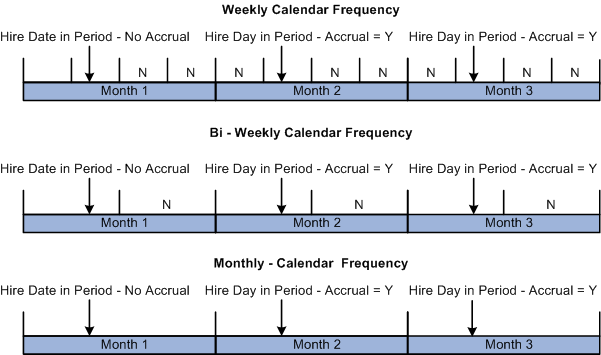

The accrual is granted for whole months only so the formula grants the accrual if the hire day value is in the calendar period (and the hire date is not in the period).

The following diagram shows when the accrual is and is not granted. The letter N indicates not granted (because the hire day is not in the period). You need to distinguish between hire date and hire day.

Accrual according to hire date and hire day

The pro rata element LSL PROWKO accumulates the leave using entitlement formula LSL FM ACCR FMTH which:

Determines if the employee's hire date is in the calendar period; if it is, it stops.

If the hire date is not in the period but the hire day is, a full month's accrual is due so the formula retrieves the employee's state from array AUS AR EE JOBJR.

Checks bracket LSL BR ACCRUAL, and using the employee's state, retrieves either 0.866667 or 1.3—the annual value.

Divides the accrual by 12 to get the monthly accrual and passes it to the pro rata _ENT and _BAL accumulators

The annual value is deannualized to the absence calendar frequency and that amount of entitlement.

The absence take, LSL TKEWKO, related to both the pro rata and entitlement absence elements (indicating that pro rata days can be used despite not having become entitlement yet), firsts looks to the entitlement balance to decrement absence units before looking to the pro rata balance to further decrement absence units (where the entitlement units are depleted).

The units (weeks) to decrement is resolved by the formula LVE FM WKO CALC, which does the same thing as LSL TKEWKF's day formula LVE FM WKF ABS NPH. The formula LVE FM WKO CALC is not, however, LSL TKEWKO's day formula. It is called by LSL TKEWKO's day formula, LVE FM WKO ABS ST, which has to check the state before resolving the daily hours into the take's number of weeks.

The formula LVE FM ABS ST determines whether the state value is NSW, QLD, or TAS and the day is not a public holiday; if that is the case, it resolves the day's hours into a fraction of a week using LVE FM WKO CALC. If the day is a public holiday in one of those states, the formula does not resolve the day's hours.

If the state is not NSW, QLD, or TAS, the day's hours are resolved by LVE FM WKO CALC, regardless of whether the day is a public holiday.

Accruing and Taking Sick Leave

Accruing and Taking Sick Leave

This section discusses each of the sick leave entitlements and their respective absence takes.

Accruing and Taking Variable Sick Leave—Days

This sick leave absence entitlement, SCK ENTDYS V, determines the correct sick leave grant of accrual that is to be 8 days in the first year and 10 days in subsequent years.

The entitlement's formula, SCK FM ENTDYS VI, grants the initial accrual by verifying that the _ENT balances is 0; if it is zero, it retrieves a value of 8 from bracket SCK BR DYS V.

The bracket uses duration GP YEARS OF SVC and it returns 8 (days) if there are no years of service (this is the employee's first year and the duration cannot return decimals of a year). A 0 duration returns bracket value 8.

When the absence calendar is run, the bracket value 8 is accrued to the year-to-date _ENT and _BAL accumulators.

The accumulators are stored by EMPL ID/EMPL RCD and begin on the hire date.

The absence take, SCK TKE DYS V, uses the absence entitlement balance to decrement absence units (days).

Eligibility criteria defined on the take (on the Period page of the take component) do not allow any payment of sick leave in the first three months of hire or rehire. The date element SCK DT WAIT 3/12 calculates the three-month period. It adds three months to the hire or rehire date, and that is the date on which the employee is eligible for the accrual.

The units (days) to decrement is resolved by the take's day formula, LVE FM DYS ABS PH, which is the same formula that annual leave take ANN TKEDYS uses.

The units returned become the paid units (DAY COUNT PD) and unpaid units (DAY COUNT UNP), depending on available absence entitlement days.

The positive input for this absence take are earnings SCK and LWOP.

The units for these earnings are formulas LVE FM DY DCP HRS and LVE FM DY DCUP HRS respectively. The formulas multiply the DAY COUNT PD and DAY COUNT UNP by the scheduled hours so the system can pay the leave in hours.

When the system creates a new instance of the year-to-date accumulator SCK ENTDYS V_ENT on the employee's hire or rehire anniversary, the accumulator's initialize rule, SCK FM ENDYS V, checks bracket SCK BR DYS V again.

This time, because GP YEARS OF SVC returns 1, the bracket returns 10.

Note. If the Use Next Lower interpolation method is set on the bracket's Lookup Rules page, the bracket returns 10 even when years of service are more than 1.

Accruing and Taking Fixed Sick Leave—Days

This sick leave absence entitlement, SCK ENTDYS F, determines the correct sick leave grant of accrual that is 10 days per year pro rated for the first year. The accrual is granted on January 1 for all employees.

The entitlement's formula, SCK FM ENTDYS FI, grants the initial accrual by verifying that the _ENT balances is 0; if it is 0, it retrieves a value from bracket SCK BR DYS F.

The bracket uses duration SCK DR REST OF YR, which calculates the period of time from hire (or rehire) to the end of the year and returns the duration as a decimal fraction of a year. The bracket prorates the 10 days maximum yearly accrual according to that fraction; for example, for a duration of 0.2 of a year, the accrual is 2 days.

The absence take, SCK TKE DYS F, uses the absence entitlement balance to decrement absence units (days).

The units (days) to decrement is resolved by the take's day formula, LVE FM DYS ABS PH, which is the same formula that annual leave take ANN TKEDYS and SCK TKEDYS V uses.

The units returned become the paid units (DAY COUNT PD) and unpaid units (DAY COUNT UNP), depending on available absence entitlement days.

The positive input for this absence take is the same as for SCK TKEDYS V.

When the system creates a new instance of the year-to-date accumulator SCK ENTDYS F_ENT at the end of the calendar year, the accumulator's initialize rule, SCK FM 1ST JAN, checks bracket SCK BR DYS F again.

Because the bracket's duration returns 1 this time, the bracket returns 10.

Note. The duration's To date is date element SCK DT 31ST DEC. The date's month and day are 12 and 31, respectively. Its year is the variable LVE VR PRD END YR. Therefore, as soon as the leave process is run in a new year, the duration always returns greater than one year, so the bracket always returns 10.

Accruing and Taking Pro Rata and Entitlement Sick Leave—Hours

The pro rata, entitlement and take processing of hours per year sick leave is the same as the annual leave days per year pro rata and entitlement, except it is in hours not days. The accrual is 76 hours per year.

The two entitlement elements are SCK PROHRS and SCK ENTHRS, and the pro rata element calculates the accrual and passes it from its own _ENT and BAL accumulators to the entitlement's ENTHRS _ENT and _BAL accumulators on the employee's hire anniversary.

The pro rata entitlement formula is SCK FM ENTHPY, which prorates an employee's standard work hours as a fraction of their leave entitlement standard hours.

(Standard weekly hours for employee ÷ Entitlement standard weekly hours) × Annual entitlement

(35 ÷ 38) × 76 = 70 (rounded)

The take element that uses the entitlement and pro rata elements SCK TKEHRS uses day formula LVE FM HRS ABS PH, the same as the annual leave days per year pro rata and entitlement.

Accruing and Taking Other Types of Leave

Accruing and Taking Other Types of Leave

This section discusses the rules for processing the following other types of leave:

Workers' compensation.

Maternity leave.

Leave without pay.

Jury service.

These types of leave are per absence entitlements, not frequency-based entitlements. They have the following common characteristics:

They are all based on a generic entitlement GENERIC ENT, for which the entitlement is formula LVE FM ENT HRS. GENERIC ENT also has the conditional formula LVE FM SCHED HRS (per absence entitlements must have a conditional formula).

The individual takes for these absences all use entitlement GENERIC ENT.

The individual takes for these absences all map to earnings OTHLV (except LWOP, which maps to LWOP).

Earnings OTHLV's calculation rule is Unit × Rate, where Unit is payee level (positive input by the take processing) and Rate is hourly rate (LWOP has the same calculation rule but its rate is variable 0).

The individual takes for these absences all use the day formula LVE FM HRS ABS PH, which is the same day formula used by the takes for Annual Leave—Hours, Annual Leave Hours per Hour, and Sick Leave—Hours.

None of the elements have a qualifying eligibility period except the maternity take.

Processing Other Leaves

Processing Other LeavesThis section discusses the general processing of per absence entitlement and explains the single exception.

The take's day formula determines the hours to be paid for each day in the leave period.

The absence entitlement's formula determines how many hours to grant as entitlement—either the partial hours or the scheduled hours.

The conditional formula then verifies that there are scheduled hours (that is, the employee would have been working). If there are scheduled hours, the entitlement is granted for the hours that the day formula has determined.

The taken hours, to which the employee is entitled according to the entitlement and conditional formulas, become DAY COUNT PD units for the earnings OTHLV or LWOP.

(There are no DAY COUNT UNP days because entitlement always equals the leave duration requirement.)

The take for maternity leave, MATERNITY TKE, has period eligibility formula LVE FM MAT QUAL DT. The two conditions are:

The duration of the leave is not more than one year.

The employee has worked for a year or more.

The formula uses duration LVE DR MAT QUAL to check the first condition and the date LVE FM MAT QUAL DT to check the second.

Calculating and Taking OGO Long Service Leave

Calculating and Taking OGO Long Service Leave

This section provides an overview of OGO long service leave and discusses how to:

Enter payee service history.

Calculate the adjusted service date.

Calculate OGO part-time and full-time pro rata and entitlement.

Take OGO long service leave.

Understanding OGO Long Service Leave

Understanding OGO Long Service LeaveThe rules for long service leave accrual and take for the Commonwealth Government (referred to as OGO) depend on data entry of prior and current service periods. The rules calculations include such things as full- or part-time work, an adjusted service date, days between different periods of service, and non-service days.

Note. Any organization can use this LSL processing method if it suits its business practice.

Leave is accrued as either part-time or full-time pro rata and entitlement, depending on the type of employment at the time of accrual.

This long service leave is based on three months' leave after 10 years, so the accrual rate is:

3 months ÷ (12 months × 10 years) = 0.025 months per month.

Pro rata leave becomes entitlement after the first 10 years and, thereafter, annually.

For the system to correctly calculate an employee's pro rata and entitlement balances—full- and part-time—you must record the employee's prior service history initially and thereafter maintain their current service history. Do this on the Define Prior Service AUS page.

Note. The elements that calculate long service leave—including the division between pro rata and entitlement—access the data entered on the Define Prior Service AUS page each time that you run an absence calendar, so it must be up-to-date.

Each time you run an absence calendar, the system:

Recalculates the adjusted service date.

Recalculates the duration from the adjusted service date to current period end date.

Subtracts the between service days.

Subtracts non service days.

Determines which part of the remaining duration accrues pro rata LSL leave and which part accrues entitlement LSL leave.

Determines how much of the entitlement is part-time leave and how much is full-time leave.

Checks for leave takes and reduces the part-time or full-time entitlement calculations by the amount of the take.

Calculates the part-time average hours for part-time leave takes.

Note. Only the pro rata full-time absence entitlement, PSH LSLPROFT, initiates the LSL accrual process rule using its entitlement calculation formula PSH FM LSL ENTLMNT. Absence entitlements PSH LSLPROPT, PSH LSLENTPT, and PSH LSLENTFT have numeric 0.00 as the entitlement calculation. When the rule has finished, the system updates _ENT, _BAL, and _TKE accumulators for all four absence entitlements.

Page Used to Calculate and Take Long Service Leave

Page Used to Calculate and Take Long Service Leave|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPAU_LSL_HISTORY |

Global Payroll & Absence Mgmt, Payee Data, Maintain Absences, Define Prior Service AUS, Define Prior Service AUS |

Enter details of periods of service. |

Entering Payee Service History

Entering Payee Service HistoryAccess the Define Prior Service AUS page (Global Payroll & Absence Mgmt, Payee Data, Maintain Absences, Define Prior Service AUS, Define Prior Service AUS).

|

Start Date and End Date |

Enter the start and end dates of the service period. Note. Enter service periods in any order. The system sorts them from newest to oldest when you save and refresh the page. |

|

Employer |

This is for information only. It is free-form text box |

|

Part Time |

Select this check box if the service period is part-time. The Std Hrs/Week field appears, where you can enter the average standard weekly hours for the period. The system uses the values in the calculation of the average weekly hours when determining the payment unit for part-time leave takes. |

|

Non Srv Days (non service days) |

Enter your manually calculated non-service days. These are the days in the employment period that do not accrue long service leave. Note. The accrual calculation includes any value that you enter here. No validation of rules exist, such as Count only if greater than 30 days in a calendar year. |

|

F/T Taken (full-time taken) and P/T Taken (part-time taken) |

Enter the duration of the leave take in decimal months (number of days ÷ 30). |

Note. The system calculates the between-service days from the date that you enter here. It is the duration in days of the period between the end date of one service period and the start date of the next.

The following table shows how the fields populate the variables through array PSH AR SVC PRD ROW.

|

Field |

Variable |

|

Start Date |

PSH VR SP START DT |

|

End Date |

PSH VR SP END DT |

|

Part Time |

PSH VR SP PT IND |

|

Std Hrs/Week |

PSH VR SP PT HRS |

|

Non Srv Days |

PSH VR SP NSD |

|

P/T Taken |

PSH VR SP TP TKNM |

|

F/T Taken |

PSH VR SP FT TKNM |

Calculating the Adjusted Service Date

Calculating the Adjusted Service Date

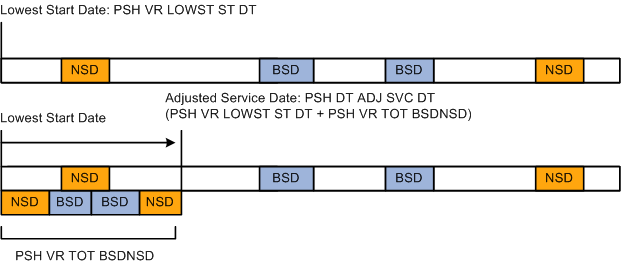

The system adjusts the initial service start date before calculating the duration of the service period upon which the accrual is based.

The diagram shows how non-service days and between-service days are totalled then added to the lowest (earliest) start date to reset the lowest start date to a later date. The variable and date elements are also shown.

Adjusting the service start date

Calculating OGO Part- and Full-Time Pro Rata and Entitlement

Calculating OGO Part- and Full-Time Pro Rata and Entitlement

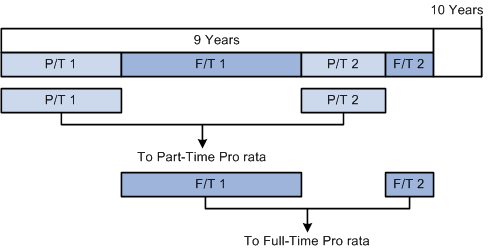

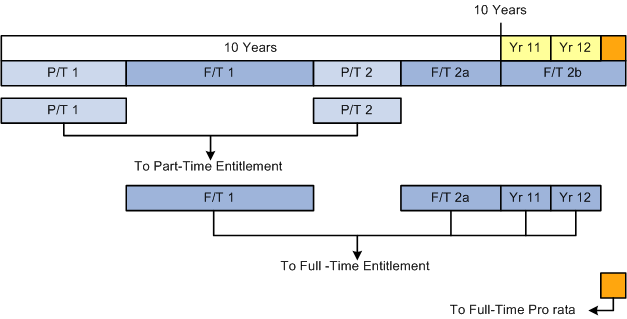

When you run an absence calendar, the system recalculates all the accrued part-time and full-time pro rata and entitled long service leave. The following two diagrams show the accumulators are increased—at 0.025 per month—for an absence calendar run, after 9 years of service and after 12.5 years of service. Both the _ENT and _BAL accumulators for the four accruals are updated. The accumulators are calendar period based.

Update of leave accumulators after 9 years

Update of leave accumulators after 12.5 years

Taking OGO Long Service Leave

Taking OGO Long Service Leave

The two absence take elements PSH LSLTKEPT and PSH LSLTKEFT have the same day formula, LVE FM MTH ABS PH. The formula resolves in a similar way to the Federal LSL take. It checks for a public holiday, partial or scheduled hours, and an adjustment made through the User Defined 1 field on the Absence Event Input Detail page. However, each day's hours are converted to months by dividing by the standard hours per month (LVE FM MT STD HRS).

Note. The two takes only check entitlement balances. Pro rata LSL cannot be taken.

The months returned become the paid units (DAY COUNT PD) and unpaid units (DAY COUNT UNP), depending on available absence entitlement weeks.

The positive input for these absence takes are the earnings elements LSL and LWOP.

The full-time units for these earnings are formulas LVE FM MT DCP HRS and LVE FM MT DCUP HRS, respectively.

The formulas multiply the DAY COUNT PD and DAY COUNT UNP (both in months) by the employee's standard monthly hours (hours from the Job record, annualized and deannualized to hours per month) so the system can pay the leave in hours at the employee's hourly rate.

The part-time units for these earnings are formulas LVE FM MT PTDCP H and LVE FM MT PTDCUP H, respectively. When calculating the units for part-time accrued LSL, the system must determine the average monthly hours for the employee over the entire period of service.

The average weekly hours value is the greater of:

The average of all part-time periods in the whole period of service.

The average of the last 12 months of part-time service if there is any part-time service in the last 12 months.

The average monthly hours replace the standard monthly hours (multiplied by the hourly rate) used for full-time LSL.

Note. The processing of taken leave for OGO LSL does not include decrementing entitlement balances. You must add any taken part-time or full-time leave on the Define Prior Service AUS page for the employee, and the accrual rules adjust the balances.

Paying Leave in Advance

Paying Leave in Advance

To set up leave pay in advance, use the Advance Types AUS (GPAU_ADV_TYPES) component.

Periods of leave and regular pay can be paid in a period (or calendar) earlier than the period (or calendar) in which they are normally.

Pages Used to Pay Leave in Advance

Pages Used to Pay Leave in Advance|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPAU_ADV_TYPES |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Absence Elements, Advance Types AUS, Advance Types AUS |

Define the first and last period advance processing options and link absence takes to the advance type. |

|

|

GPAU_ABS_EVENT_ADV |

Global Payroll & Absence Mgmt, Payee Data, Maintain Absences, Absence Event AUS, Pay in Advance AUS |

Enter an advance type and view the details of advance payments. |

Defining Absence Advance Types

Defining Absence Advance Types

Access the Advance Types AUS page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Absence Elements, Advance Types AUS, Advance Types AUS).

These are the key points about advance types:

You define which periods are advanced for an absence.

You specify the absence takes with which the advance type can be used.

A single advance type can be used with multiple absence takes.

Multiple advance types can use the same absence takes.

When you specify the absence take on an absence event entry, you can select only advance types with which the take has been associated.

If an absence take has not been associated with any advance types, you cannot pay the absence in advance when you specify that take for an event (because you can't select an advance type).

|

Advance Calendar Group |

Select to determine the calendar group in which to pay the advance. Select from: Payment After Absence Begin: The advance is paid in the calendar group that contains the first payment date after the absence begins. Payment Prior to Absence Begin: The advance is paid in the calendar group that contains the last payment date prior to the absence begin date. Period Absence Begins: The advance is paid in the calendar group that contains the period in which the absence begins. Period Prior to Absence: The advance is paid in the calendar group that contains the period immediately prior to the one in which absence begin date falls. |

|

Allow Override |

Select to enable an override of the calendar group that the system selects. The system calculates the calendar group using the preceding options above, but you can override it on the Pay in Advance AUS page of the Absence Event AUS component. |

|

Run Type |

Select a run type. You need to set up the advance processing options for each run type because absence run types generally need to be treated differently from payroll runs. For the system to calculate absences correctly, they must run in the correct sequence. The system does not calculate absences correctly if the previous period's entitlements have not already been accrued. For absence run types, therefore, the options are usually set up to advance the whole first period and the gap period, regardless of the options set for the payroll run types. Note. An exception exists if an absence entitlement accrual is based on actual hours worked, such as ANN ENTHPH. This situation reverses the normal absence-then-payroll run sequence to payroll-then-absence. In this situation, you need to define a separate process list (for example, HRLY ACCRUED) with the hours-per-hour entitlement in a section (for example, ABS ENTHPH SEC) in that process list. You then need to create a separate run type for this process list and that run type needs to have the same first period and last period options as the payroll run type. |

|

First Period and Last Period |

These options determine how the system handles the period in which the absence begins. Select from the following values: Advance Absence, Reg in Normal (regular in normal): Only the part of the period while on absences is advanced. The rest of the period is paid in its normal calendar group. Advance Absence, Reg on Return (regular on return): Only the part of the period while on absences is advanced. The rest of the period is paid after the absence. Note. This is not an option for the last period. Advance Whole Period: The entire period is paid in advance. No Advance: The period is not advanced at all. It is paid at the normal time. |

|

Gap |

A gap occurs when a pay period is before the absence but the payment date falls during the absence. Select from the following values: Advance: The gap is paid in advance. Normal: The gap is paid at the normal time. On Return: The gap is paid at the normal time. |

|

Element Name |

Enter the absence take with which this advance type can be used. |

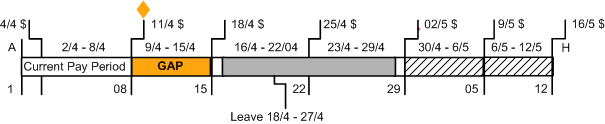

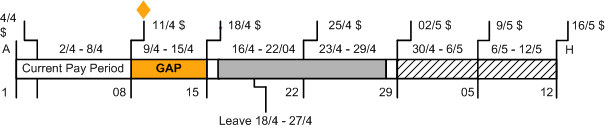

The following two diagrams show the On Return and Normal gap options in effect. For both scenarios, the first period and last period options are Advance Whole Period. A diamond indicates the advanced leave payment date and an asterisk indicates the gap pay date.

Gap on return

|

Payment Schedule |

16/4 - 17/4 Regular |

Pay Period Ending 08/4 (Paid 11/4) |

|

18/4 - 27/4 Leave |

Pay Period Ending 08/4 (so paid 11/4) |

|

|

28/4 - 29/4 Regular |

Pay Period Ending 08/4 (so paid 11/4) |

|

|

09/4 - 15/4 Gap |

Pay Period Ending 29/04 (so paid 02/5) |

Gap in normal

|

Payment Schedule |

16/4 - 17/4 Regular |

Pay Period Ending 08/4 (Paid 11/4) |

|

18/4 - 27/4 Leave |

Pay Period Ending 08/4 (so paid 11/4) |

|

|

28/4 - 29/4 Regular |

Pay Period Ending 08/4 (so paid 11/4) |

|

|

09/4 - 15/4 Gap |

Pay Period Ending 29/04 (so paid 18/4) |

Setting Payment Advance Details

Setting Payment Advance Details

Access the Pay in Advance AUS page (Global Payroll & Absence Mgmt, Payee Data, Maintain Absences, Absence Event AUS, Pay in Advance AUS).

This page is an addition to the Absence Event component. The page displays details of the advance payment according to the advance type that you enter.

Enter the advance type for the absence event. When you click the Calculate Advance button, the system displays information about how and when the advance payment is made based on the rules for the advance type.

The system displays the information in two group boxes, Advance Payments and Return Payments.

|

Advance Cal Grp (advance calendar group) |

This is the calendar group for the advance payment. |

|

Payment Date |

This is the payment date of the regular pay calendar in the calendar group. |

|

Period |

These are the From and To dates of the regular pay calendar in the calendar group. |

|

Pay Group |

This is the pay group in which the payment would be made if it were not advanced. |

|

Calendar ID |

This is the calendar in which the payment would be made if it were not advanced |

|

From and To |

These are the From and To dates of the period being advanced. |

|

Orig Pay Dt (original payment date) |

This is the payment date when the payment would be made if it were not advanced. |

|

Orig Cal Grp (original calendar group) |

This is the calendar group in which the payment would be made if not it were not advanced. |

|

Return Cal Grp (return calendar group) |

This is the calendar group in which any unadvanced payment is made. Note. None of the Return Payments fields are populated if the advance type advances all pay from the period in which the leave occurs, or if the advance type advances some of the pay and pays the balance in its normal period. |

|

Payment Date |

This is the payment date of the regular pay calendar in the calendar group. |

|

Period |

These are the From and To dates of the regular pay calendar in the calendar group. |

Calendar Periods Paid on Return

|

Pay Group |

This is the pay group in which the payment would have been made if not paid on return. |

|

Calendar ID |

This is the calendar in which the payment would have been made if not paid on return. |

|

From and To |

These are the From and To dates of the period being paid on return. |

|

Orig Pay Dt (original payment date) |

This is the payment date for the calendar in which the payment would have been made if not paid on return. |

|

Orig Cal Grp (original calendar group) |

This is the calendar group in which the payment would have been made if not paid on return. |

Note. If you select the Allow Override check

box when you define the advance type, you can override the advance or return

calendar group the system selected for this advance. You cannot, however,

change any calendars or calendar data for a system-selected or overridden

calendar group.

For leave be correctly paid in advance, you must specify a regular run

type in the Leave Paid in Advance group box on

the Pay Groups AUS page (select Set Up HRMS, Product Related, Global

Payroll & Absence Mgmt, Framework, Organizational, Pay Groups AUS).

You must select the check box on the Australian Information page for

all of the calendars that can be advanced (select Set Up HRMS, Product

Related, Global Payroll & Absence Mgmt, Framework, Calendars, Calendars

Groups AUS).

See Also

Entering Additional Pay Group Information

Entering Additional Calendar Information