Delivered Tax Elements

Delivered Tax ElementsThis chapter discusses:

Delivered tax elements.

Federal tax calculation.

State tax calculation.

Overriding tax and payment method.

Generating tax reports.

Delivered Tax Elements

Delivered Tax ElementsThis section discusses:

Delivered federal tax elements.

Delivered state income tax elements.

Delivered Federal Tax Elements

Delivered Federal Tax Elements

This section discusses:

Delivered federal tax arrays.

Delivered federal tax brackets.

Delivered federal tax supporting elements.

Delivered federal tax variables.

Delivered federal tax formulas.

Delivered federal tax deductions.

Delivered federal tax accumulators.

Delivered federal tax sections.

Delivered federal tax element groups.

.

This table lists the federal tax-related arrays delivered with PeopleSoft Global Payroll for United States:

|

Array |

Description |

|

TAX AR EE FED DATA |

Retrieves employee tax data (Forms W-4 and W-5). |

|

TAX AR EE FED OTH |

Retrieves federal employee tax information from the payee tax profile. |

|

TAX AR ER COM DATA |

Retrieves employer tax data from the COMPANY table. |

|

TAX AR ER FED DATA |

Retrieves employer federal tax data from the Company Federal Tax Data table. |

|

TAX WA EE FED DATA |

Writable array that stores federal employee tax information. |

|

TAX AR REPORTING COMPANY |

Retrieves the Employer Identification Number (EIN) information from the Year End Tax Reporting Company table. |

Delivered Federal Tax Brackets

This table lists the federal tax-related brackets delivered with PeopleSoft Global Payroll for United States:

|

Bracket |

Description |

|

TAX BR FWT RATES |

Provides federal withholding tax (FWT) rates based on taxable income and marital status. |

|

TAX BR EIC RATES |

Provides earned income credit (EIC) rates based on taxable income and EIC status. |

Delivered Federal Tax Supporting Elements

This table lists the federal tax-related supporting elements delivered with PeopleSoft Global Payroll for United States:

|

Supporting Element |

Description |

|

TAX DT PRD DATE |

From the period begin date, extracts three distinct numbers for year, month, and day. |

|

TAX DT ST YEAR |

Calculates the first day of the year. |

|

TAX DR YR DAYS |

A duration representing the number of days from the first day of the year. |

|

TAX RR 1/100 CENT |

Rounding rule that causes the system to disregard any fractional part of a cent of collected tax unless it amounts to one-half cent or more, in which case it increases it to 1 cent. |

|

TAX DT EN YEAR |

Calculates the end-of-year date. |

|

TAX DT HIR DATE |

Calculates the hire date. |

|

TAX DR HIRE DAYS |

Calculates the days from hire. |

|

TAX DR YEAR DAYS |

Calculates days from start of year. |

Delivered Federal Tax Variables

This table lists the federal tax-related variables delivered with PeopleSoft Global Payroll for United States:

|

Variable |

Description |

|

TAX VR AD AMT FWT |

Additional amount to withhold. |

|

TAX VR AD PCT FWT |

Additional percent to withhold. |

|

TAX VR BALANCES |

Balances initialized. |

|

TAX VR EIC BRK GRS |

EIC bracket gross. |

|

TAX VR FWT S |

FWT supplemental. |

|

TAX VR FWT SAV |

Saved value for FWT calculation. |

|

TAX VR FWT STATUS |

Federal tax status. |

|

TAX VR HIR DY |

Hire day. |

|

TAX VR HIR MO |

Hire month. |

|

TAX VR HIR YR |

Hire year. |

|

TAX VR MAR SAV |

Marital status saved. |

|

TAX VR REP COMPANY |

Reporting company. |

|

TAX VR RPT TYPE |

Report type. |

|

TAX VR RSLT AMT |

Tax amount. |

|

TAX VR RSLT GRS |

Tax gross. |

|

TAX VR RSLT NL GRS |

Non limited tax gross. |

|

TAX VR RSLT PIN |

Tax element number. |

|

TAX VR RSLT RATE |

Tax rate. |

|

TAX VR CRD PCT |

Tax rate credit. |

|

TAX VR EIN |

Federal employer identification number (EIN). |

|

TAX VR CPAY MST ID |

Common Paymaster Tax ID |

|

TAX VR METHOD |

Tax method (A = Annualized, C = Cumulative, S = Supplemental). |

|

TAX VR PMT |

Payment option (R = Supplemental wages paid with regular wages, S = Separate payment). |

|

TAX VR EXP FUT |

Exempt from federal unemployment tax (FUTA) indicator (Y/N). |

|

TAX VR MAR STAT |

Payee marital status used for tax calculation (S = Single, M = Married, W = Married but withhold at higher single rate) as indicated on the W-4 form. |

|

TAX VR NB ALLOW |

Number of allowances as indicated on the W-4 form. |

|

TAX VR EIC STATUS |

EIC status (N = Not applicable, S = Single, M = Married, B = Both spouses filling) as indicated on the W-5 form. |

|

TAX VR FICA EE |

Federal Insurance Contributions Act (FICA) status for employee (N = Subject, E = Exempt, M = Medicare only). |

|

TAX VR FICA ER |

FICA status for employer (N = Subject, E = Exempt, M = Medicare only). |

|

TAX VR TIP EE |

Tipped status (N = Not tipped, D = Directly, I = Indirectly). |

|

TAX VR GRS |

Gross given by payroll. |

|

TAX VR GRS A |

Annualized gross given by payroll. |

|

TAX VR GRS C |

Cumulative gross given by payroll. |

|

TAX VR GRS S |

Supplemental gross given by payroll. |

|

TAX VR GRS TOT |

Non limited gross given by payroll. |

|

TAX VR FWT PRE TAX |

Pre-tax deductions. |

|

TAX VR BASE GRS |

Base gross given by payroll. |

|

TAX VR FWT MAR |

Payee marital status for the purpose of federal tax calculation. |

|

TAX VR FREQ TYPE |

Frequency type. |

|

TAX VR FREQ FACT |

Calculated frequency factor based on pay period. |

|

TAX VR AN GRS |

Calculated annualized gross. |

|

TAX VR AN EXE |

Calculated annualized exemption. |

|

TAX VR BRK GRS |

Bracket gross from tax brackets. |

|

TAX VR LOW GRS |

Low gross amount from tax brackets. |

|

TAX VR RATE |

Tax rate from tax brackets. |

|

TAX VR LOW TAX |

Low tax from tax brackets. |

|

TAX VR LOW CREDIT |

Low credit from tax brackets. |

|

TAX VR AN FWT TOT |

Calculated total annualized tax amount. |

|

TAX VR PRD FACT |

Tax period. |

|

TAX VR FWT |

Calculated FWT. |

|

TAX VR FWT A |

Calculated annualized FWT. |

|

TAX VR FWT C |

Calculated cumulative FWT. |

|

TAX VR AMT |

Calculated tax amount. |

|

TAX VR PRD YR |

Period year. |

|

TAX VR PRD MO |

Period month. |

|

TAX VR PRD DY |

Period day. |

|

TAX VR FED EX ALL |

Federal exemptions allowances. |

|

TAX VR FED SUP R |

Federal supplemental wage rate. |

|

TAX VR OAS EE LIM |

Old age, survivors, and disability insurance (OASDI) employee gross limit. |

|

TAX VR OAS EE RATE |

OASDI employee tax rate. |

|

TAX VR OAS EE PY L |

OASDI employee payment limit. |

|

TAX VR OAS ER LIM |

OASDI employer gross limit. |

|

TAX VR OAS ER RATE |

OASDI employer tax rate. |

|

TAX VR OAS ER PY L |

OASDI employer payment limit. |

|

TAX VR MED EE RATE |

Medicare employee tax rate. |

|

TAX VR MED ER RATE |

Medicare employer tax rate. |

|

TAX VR FUT GRS LIM |

FUTA gross limit. |

|

TAX VR FUT RATE |

FUTA tax rate. |

|

TAX VR EIC GRS LIM |

EIC gross limit for single certificate. |

|

TAX VR EIC PYS LIM |

EIC payment limit for single certificate. |

|

TAX VR EIC GRJ LIM |

EIC gross limit for joint certificate. |

|

TAX VR EIC PYJ LIM |

EIC payment limit for joint certificate. |

Delivered Federal Tax Formulas

This table lists the federal tax-related formulas delivered with PeopleSoft Global Payroll for United States:

|

Formula |

Description |

|

TAX FM EIC POST |

Post-process EIC. |

|

TAX FM EIC PRE |

Pre-process EIC. This formula manages exemption statuses and the gross accumulators. |

|

TAX FM FUT POST |

Post-process FUTA. |

|

TAX FM FWT POST |

Post-process FWT. |

|

TAX FM FWT PRE |

Pre-process FWT. This formula manages exemption statuses and the gross accumulators. |

|

TAX FM FWT S/AGGR |

Supplemental FWT aggregate. |

|

TAX FM FWT S/PCT |

Supplemental FWT percent. |

|

TAX FM INIT EVENT |

Tax initialization event list. |

|

TAX FM MED EE POST |

Post-process medicare employee. |

|

TAX FM MED ER POST |

Post-process medicare employer. |

|

TAX FM OAS EE POST |

Post-process OASDI employee. |

|

TAX FM OAS ER POST |

Post-process OASDI employer. |

|

TAX FM FED POST |

Federal post-process formula. |

|

TAX FM INIT |

Tax initialization. Runs before all earnings resolution to set the values required before any calculation: frequency factor, common paymaster ID, marital status, and technical initialization for OASDI, Medicare, and FUTA balances. |

|

TAX FM FWT |

Calculates the total FWT based on regular, cumulative, and supplemental wages. |

|

TAX FM FWT AN |

Calculates withholding tax based on an annual gross and the tax brackets. |

|

TAX FM FWT A |

Calculates withholding tax using the annualized method. |

|

TAX FM FWT C |

Calculates withholding tax using the cumulative method. |

|

TAX FM FWT SP |

Calculates withholding tax using the supplemental method when supplemental wages are combined with regular wages. |

|

TAX FM FWT SA |

Calculates withholding tax using the supplemental method when supplemental wages are paid separately from regular wages. |

|

TAX FM OAS EE |

Calculates OASDI employee tax. |

|

TAX FM OAS ER |

Calculates OASDI employer tax. |

|

TAX FM MED EE |

Calculates Medicare employee tax. |

|

TAX FM MED ER |

Calculates Medicare employer tax. |

|

TAX FM FUT |

Calculates the FUTA employer tax. |

|

TAX FM EIC |

Calculates the Advanced EIC based on the EIC marital status and the tax brackets. |

|

TAX FM PERIOD |

Sets the period number. |

|

TAX FM EE FED DATA |

Lookup formula that retrieves employee tax data from forms W-4 and W-5. |

Delivered Federal Tax Deductions

This table lists the federal tax-related deductions delivered with PeopleSoft Global Payroll for United States:

|

Deduction |

Description |

|

FWT |

Federal withholding tax. |

|

OASDI EE |

OASDI employee tax. |

|

OASDI ER |

OASDI employer tax. |

|

MEDICARE EE |

Medicare employee tax. |

|

MEDICARE ER |

Medicare employer tax. |

|

FUTA |

FUTA tax. |

|

EIC |

Advanced EIC. This is a negative deduction. |

Note. All of the tax deductions use post-process formulas to manage manual payments (the taxable gross must be calculated based on the tax amount entered manually) and to trigger writable arrays containing tax amounts and grosses.

Delivered Federal Tax Accumulators

This table lists the federal tax-related accumulators delivered with PeopleSoft Global Payroll for United States:

|

Accumulator |

Description |

|

FWT ARR |

Federal Income Tax (FIT) withholding. |

|

FWT PTDA |

FIT withholding. |

|

FWT YTDA |

FIT withholding. |

|

FWT GRS N |

Taxable gross (subject to FWT) - Customer Maintained. |

|

FWT GRS |

Taxable gross for FWT. |

|

FWT GRS PTD |

Period-to-date taxable gross for FWT. |

|

FWT GRS TOT |

Taxable gross total for FWT. |

|

FWT GRS TOT YTD |

Year-to-date taxable gross total for FWT. |

|

FWT PRE TAX N |

Before tax deductions - Customer Maintained. |

|

FWT PRE TAX |

Before tax deductions. |

|

FWT PRE TAX PTD |

Period-to-date before tax deductions. |

|

OAS EE AMT CUR |

OASDI employee amount. |

|

OAS EE AMT PREV |

OASDI employee amount. |

|

OAS EE AMT TOT |

OASDI employee amount. |

|

OAS EE AMT YTD |

Year to date OASDI amount for employee (used in year-end reports). |

|

OAS EE GRS CUR |

OASDI employee gross. |

|

OAS EE GRS LIM |

OASDI employee taxable gross. |

|

OAS EE GRS PREV |

OASDI employee gross. |

|

OAS EE GRS TOT |

OASDI employee gross. |

|

OAS EAR AMT CUR |

OASDI employer amount. |

|

OAS ER AMT PREV |

OASDI employer amount. |

|

OAS ER AMT TOT |

OASDI employer amount. |

|

OAS ER GRS CUR |

OASDI employer gross. |

|

OAS ER GRS LIM |

OASDI employer taxable gross. |

|

OAS ER GRS PREV |

OASDI employer gross. |

|

OAS ER GRS TOT |

OASDI employer gross. |

|

OASDI EE ARR |

OASDI employee tax. |

|

OASDI EE YTDA |

OASDI employee tax. |

|

OASDI ER ARR |

OASDI employer tax. |

|

OASDI ER YTDA |

OASDI employer tax. |

|

OAS EE GRS N |

OASDI employee gross - Customer Maintained. |

|

OAS EE GRS |

OASDI employee gross. |

|

OAS EE GRS YTD |

Year-to-date OASDI employee gross. |

|

OAS EE GRS LIM YTD |

Year-to-date OASDI employee gross limited. |

|

OAS ER GRS N |

OASDI employer gross - Customer Maintained. |

|

OAS ER GRS |

OASDI employer gross. |

|

OAS ER GRS YTD |

Year-to-date OASDI employer gross. |

|

OAS ER GRS LIM YTD |

Year-to-date OASDI employer gross limited. |

|

MED EE AMT CUR |

Medicare employee amount. |

|

MED EE AMT PREV |

Medicare employee amount. |

|

MED EE AMT TOT |

Medicare employee amount. |

|

MED EE AMT YTD |

Medicare employee YTD. |

|

MED EE AMT YTD |

Year to date Medicare amount for employee (used in year-end reports). |

|

MED EE GRS CUR |

Medicare employee gross. |

|

MED EE GRS LIM |

Medicare employee taxable gross. |

|

MED EE GRS LIM YTD |

Medicare employee YTD taxable gross. |

|

MED EE GRS PREV |

Medicare employee gross. |

|

MED EE GRS TOT |

Medicare employee gross. |

|

MED ER AMT CUR |

Medicare employer amount. |

|

MED ER AMT PREV |

Medicare employer amount. |

|

MED ER AMT TOT |

Medicare employer amount. |

|

MED ER GRS CUR |

Medicare employer gross. |

|

MED ER GRS LIM |

Medicare employer taxable gross. |

|

MED ER GRS LIM YTD |

Medicare employer YTD taxable gross. |

|

MED ER GRS PREV |

Medicare employer gross. |

|

MED ER GRS TOT |

Medicare employer gross. |

|

MEDICAL EE ARR |

Medical. |

|

MEDICAL EE MTDA |

Medical. |

|

MEDICAL EE PTDA |

Medical. |

|

MEDICAL EE QTDA |

Medical. |

|

MEDICAL EE YTDA |

Medical. |

|

MEDICAL ER ARR |

Medical employer paid. |

|

MEDICAL ER MTDA |

Medical employer paid. |

|

MEDICAL ER PTDA |

Medical employer paid. |

|

MEDICAL ER QTDA |

Medical employer paid. |

|

MEDICAL ER YTDA |

Medical employer paid. |

|

MEDICARE EE ARR |

Medicare employee tax. |

|

MEDICARE EE YTDA |

Medicare employee tax. |

|

MEDICARE ER ARR |

Medicare employer tax. |

|

MEDICARE ER YTDA |

Medicare employer tax. |

|

MED EE GRS N |

Medicare employee gross - Customer Maintained. |

|

MED EE GRS |

Medicare employee gross. |

|

MED EE GRS YTD |

Year-to-date Medicare employee gross. |

|

MED ER GRS N |

Medicare employer gross - Customer Maintained. |

|

MED ER GRS |

Medicare employer gross. |

|

MED ER GRS YTD |

Year-to-date medicare employer gross. |

|

FUT AMT CUR |

FUTA amount. |

|

FUT AMT PREV |

FUTA amount. |

|

FUT AMT TOT |

FUTA amount. |

|

FUT GRS CUR |

FUTA gross. |

|

FUT GRS LIM |

FUTA taxable gross. |

|

FUT GRS PREV |

FUTA gross. |

|

FUT GRS TOT |

FUTA gross. |

|

FUTA ARR |

Federal unemployment tax. |

|

FUTA TYDA |

Federal unemployment tax. |

|

FUT GRS N |

FUTA gross - customer maintained. |

|

FUT GRS |

FUTA gross. |

|

FUT GRS YTD |

Year-to-date FUTA gross. |

|

FUT GRS LIM YTD |

Year-to-date FUTA gross limited. |

|

EIC GRS N |

EIC gross - customer maintained. |

|

EIC GRS |

EIC gross. |

|

EIC GRS YTD |

Year-to-date EIC gross. |

|

EIC GRS LIM YTD |

Year-to-date EIC gross limited. |

|

EIC GRS LIM |

EIC taxable gross. |

|

EIC ARR |

Earned income credit. |

|

EIC YTDA |

Earned income credit. |

Delivered Federal Tax Sections

This table lists the federal tax-related sections delivered with PeopleSoft Global Payroll for United States:

|

Section |

Description |

|

TAX INITIALIZATION |

Tax initialization. |

|

FEDERAL TAX EE |

Federal tax calculation for employees. |

|

FEDERAL TAX ER |

Federal tax calculation for employers. |

Delivered Federal Tax Element Groups

PeopleSoft Global Payroll for United States delivers the following federal tax-related element groups: TAX EG FED EE.

|

Element Group |

Description |

|

TAX EG FED EE |

Federal tax deductions. |

|

TAX EG FED ER |

Federal tax deductions employer. |

|

TAX EG W-2 |

W-2 YTD accumulators. |

|

TAX EG W-2AS |

W-2AS YTD accumulators. |

|

TAX EG W-2GU |

W-2GU YTD accumulators. |

|

TAX EG W-2PR |

W-2PR YTD accumulators. |

|

TAX EG W-2VI |

W-2VI YTD accumulators. |

|

TAX EG YE IND |

Year-end indicators. |

|

TAX EG YE VAR |

Year-end variables. |

Delivered State Income Tax Elements

Delivered State Income Tax Elements

This section discusses:

Delivered state income tax arrays.

Delivered state income tax brackets.

Delivered state income tax variables.

Delivered state income tax formulas.

Delivered state income tax deductions.

Delivered state income tax accumulators.

Delivered state income tax sections.

Delivered state income tax element groups.

Delivered State Income Tax Arrays

This table lists the state income tax-related arrays delivered with PeopleSoft Global Payroll for United States:

|

Array |

Description |

|

TAX AR ER ST DATA |

Retrieves employer tax data (Company/State Table). |

|

TAX AR SWT TBL |

Retrieves state calculation method and other special tax information from the State Tax table. |

|

TAX AR SWT WAG BRK |

State tax rates. |

|

TAX AR SWT STD DED |

State tax standard deductions. |

|

TAX AR SWT ALLOW |

State tax allowances. |

|

TAX AR SWT PERSCR |

State tax personal credit. |

|

TAX AR SWT EXCL |

State pre-tax deductions exclusions. |

|

TAX AR SWT WG BR 2 |

State tax wage bracket. |

|

TAX AR EE WRK ST |

Work state. |

|

TAX AR LOCAL TAX |

Retrieves local tax rate data. |

Delivered State Income Tax Brackets

This table lists the state income tax-related brackets delivered with PeopleSoft Global Payroll for United States:

|

Bracket |

Description |

|

TAX BR ANN MTHD |

Returns the formula for calculating taxes using the annualized tax method. |

|

TAX BR REG MTHD |

Returns the formula for calculating taxes for supplemental income paid with regular wages or paid separately. |

Delivered State Income Tax Variables

This table lists the state income tax-related variables delivered with PeopleSoft Global Payroll for United States:

|

Variable |

Description |

|

TAX VR AD AMT SWT |

Additional amount to withhold. |

|

TAX VR AD PCT SWT |

Additional percent to withhold. |

|

TAX VR SWT EIN |

State income tax EIN (Employer Identification Number) from the Company State Tax table. |

|

TAX VR STATE |

U.S. state or territory. |

|

TAX VR GRS S SPC |

Gross given by payroll. |

|

TAX VR GRS S TOT |

Gross given by payroll. |

|

TAX VR FORM REG |

Formula for regular wages. |

|

TAX VR FORM SEP |

Formula for separate payment. |

|

TAX VR SWT |

Calculated State Withholding Tax (SWT). |

|

TAX VR SWT A |

Calculated SWT annualized. |

|

TAX VR SWT C |

Calculated SWT cumulative. |

|

TAX VR SWT S |

Calculated SWT supplemental. |

|

TAX VR SWT MAR |

Payee's marital status used for state tax calculation. |

|

TAX VR SWT PRE TAX |

Pre-tax deductions for SWT. |

|

TAX VR AD ALLOW |

Additional allowances (payee level). |

|

TAX VR NBR DEPEND |

Number of dependents. |

|

TAX VR FWT CR LIM |

State tax FWT credit limit. |

|

TAX VR SWT STD DED |

State tax standard deductions. |

|

TAX VR PCT OF FWT |

State tax percent of FWT. |

|

TAX VR AN FICA |

Calculated annualized FICA. |

|

TAX VR FICA CR LIM |

State tax FICA credit limit. |

|

TAX VR SWT ALLOW |

State tax exemption allowances. |

|

TAX VR SWT ALL 2D |

State tax exemption, more than two allowances. |

|

TAX VR SWT ALL ADD |

State tax additional allowances. |

|

TAX VR SWT PERSCR |

State tax personal credit. |

|

TAX VR SWT GRS LIM |

State taxable gross limit. |

|

TAX VR SWT DED MIN |

State tax standard deductions minimum. |

|

TAX VR SWT EX AMT |

State tax annual exemption amount. |

|

TAX VR SWT SPC EX |

State tax special annual exemption amount. |

|

TAX VR SWT DED 2D |

State tax standard deductions for two dependents or more. |

|

TAX VR SWT ALL LIM |

State tax exemption allowances limit (high income allowance). |

|

TAX VR SWT ROUND |

State tax rounding rule (nearest dollar). |

|

TAX VR SWT EX LIM |

State tax gross limit (threshold). |

|

TAX VR SWT EX BPCT |

State tax exemption percentage below. |

|

TAX VR SWT EX APCT |

State tax exemption percentage above. |

|

TAX VR SWT WK AMT |

State tax work amount. |

|

TAX VR SWT WK DED |

State tax work deduction. |

|

TAX VR SWT WK EX |

State tax work exemption amount. |

|

TAX VR SWT MLTPY |

State tax special multiplier. |

|

TAX VR AN SWT TOT |

Calculated total annualized tax amount. |

|

TAX VR PCT SUP SPC |

State tax percentage on special supplemental wages (bonuses and stock options). |

|

TAX VR PCT SUP |

State tax percentage on supplemental wages. |

|

TAX VR JURISDICT |

UI jurisdiction. |

|

TAX VR STATE EIC |

State EIC. |

|

TAX VR ANN MTHD |

Annualized method. |

|

TAX VR REG MTHD |

Supplemental, paid with regular wages method. |

|

TAX VR SEP MTHD |

Supplemental, paid separately method. |

|

TAX VR PRE STATUS |

Previous status. |

|

TAX VR SWT MAX FWT |

Maximum FWT exemption. |

|

TAX VR CATEGORY |

Tax category. |

|

TAX VR DED NUM |

Before tax deduction pointer. |

|

TAX VR BRK TYP |

Bracket type. |

|

TAX VR SWT ALL 2D |

Allowance, two dependents. |

|

TAX VR SWT ADD ADJ |

Additional amount adjustment. |

|

TAX VR SWT DED MAX |

Standard deduction maximum. |

|

TAX VR SWT DED PC1 |

Standard deduction percent 1. |

|

TAX VR SWT DED PC |

Standard deduction percent. |

|

TAX VR SWT DEP CR |

State tax dependent credit. |

|

TAX VR SWT GRS LI2 |

State taxable gross limit 2. |

|

TAX VR SWT SAV |

Saved value for SWT calculation. |

|

TAX VR SWT STATUS |

State tax status. |

|

TAX VR EFFDT |

Tax rates effective date. |

|

TAX VR LOWTAX AMT |

Amount for a low-income tax credit. |

|

TAX VR LOWTAX PCT |

Percent for a low-income tax credit. |

|

TAX VR OPT DED |

Optional deduction amount. |

|

TAX VR STD DED ALW |

Standard deduction allowable amount. |

|

TAX VR TAX LOC CD |

Tax location code. |

|

TAX VR LOCALITY |

County code. |

|

TAX VR RES TAX RT |

Resident tax rate. |

Delivered State Income Tax Formulas

This table lists the state income tax-related formulas delivered with PeopleSoft Global Payroll for United States:

|

Formula |

Description |

|

TAX FM ST POST |

State post-process formula. |

|

TAX FM STATE EIC P |

Post-process state EIC. |

|

TAX FM SWT A/P FWT |

SWT — Ann/Percent of FWT. |

|

TAX FM SWT POST |

Post-process SWT. |

|

TAX FM SWT PRE |

Pre-process SWT. This formula manages exemption statuses and the gross accumulators. In addition, it retrieves payee tax data information such as marital status and allowances. |

|

TAX FM SWT S/+PCTS |

SWT — Multiple rates. |

|

TAX FM SWT S/P FWT |

SWT — Sup/Percent of FWT. |

|

TAX FM SWT S/PCT |

SWT — Percent of tax gross. |

|

TAX FM SWT |

Calculates SWT based on regular and supplemental wages. |

|

TAX FM SWT AN |

Calculates SWT based on an annual gross and the tax brackets. |

|

TAX FM SWT A |

Calculates SWT using the annualized method. |

|

TAX FM SWT C |

Calculates SWT using the cumulative method. |

|

TAX FM SWT A/BRK |

Calculates SWT on Regular Wages - States using state tax rates. |

|

TAX FM SWT A/FWT |

Calculates SWT on Regular Wages - States using an FWT wage bracket. |

|

TAX FM SWT A/F-CR |

Calculates SWT on Regular Wages - States using an FWT credit in the tax calculation. |

|

TAX FM SWT A/F/ALL |

Calculates SWT on Regular Wages - States using an FWT credit in the tax calculation and a specific allowance calculation. |

|

TAX FM SWT A/F-CR2 |

Calculates SWT on Regular Wages - States using an FWT credit in the tax calculation (2nd method). |

|

TAX FM SWT A/PFWT |

Calculates SWT on Regular Wages - States using a percent of FWT only in the tax calculation. |

|

TAX FM SWT A/FICA |

Calculates SWT on Regular Wages - States using a FICA Credit in the tax calculation. |

|

TAX FM SWT A/SPC* |

Calculates SWT on Regular Wages - States using a special multiplier in the tax calculation. |

|

TAX FM SWT A/SPC*E |

Calculates SWT on Regular Wages - States using a special exemption table in the tax calculation. |

|

TAX FM SWT A/STDED |

Calculates SWT on Regular Wages - States using a standard deduction threshold in the tax calculation. |

|

TAX FM SWT A/EX-CR |

Calculates SWT on Regular Wages - States using a special formula to calculate the "Exempt/Personal Credit" amount. |

|

TAX FM SWT A/ANEX |

Calculates SWT on Regular Wages - States using an annual exemption amount in the tax calculation. |

|

TAX FM SWT A/+ALW |

Calculates SWT on Regular Wages - States using an additional allowance number. |

|

TAX FM SWT S/AGGR |

Calculates SWT on Supplemental Wages - Aggregate. |

|

TAX FM SWT S/%GRS |

Calculates SWT on Supplemental Wages - Percent of taxable gross. |

|

TAX FM SWT S/%FWT |

Calculates SWT on Supplemental Wages - States using a percent of FWT only in the tax calculation. |

|

TAX FM SWT S/+PCTS |

Calculates SWT on Supplemental Wages - Multiple Rates. |

|

TAX FM SWT S/NO-AN |

Calculates SWT on Supplemental Wages - Aggregate - No Annualize. |

|

TAX FM SWT S/T/PCT |

Calculates SWT on Supplemental Wages - Aggregate - No Tax else percent. |

|

TAX FM SWT S/SPC |

Calculates SWT on Supplemental Wages - Special Table. |

|

TAX FM STATE EIC |

Calculates the state advanced EIC. |

|

TAX FM EE ST DATA |

Look-up formula that retrieves employee tax data (Forms W-4 and W-5). |

|

TAX FM SWT DED |

Look-up formula that retrieves standard deduction rates. |

|

TAX FM SWT ALL |

Look-up formula that retrieves allowance rates. |

|

TAX FM SWT CRD |

Look-up formula that retrieves credit rates. |

|

TAX FM SWT EXCL |

Look-up formula that retrieves the elements excluded from the taxable gross calculation. |

|

TAX FM SWT WG BR 2 |

Calculates annualized SWT based on state wage bracket data. |

|

TAX FM SWT PR ALW |

Calculates Puerto Rico-specific allowances using the Automatic or Optional methods. |

Delivered State Income Tax Deductions

This table lists the state income tax-related deductions delivered with PeopleSoft Global Payroll for United States:

|

Deduction |

Description |

|

SWT |

State withholding tax (SWT) |

|

STATE EIC |

State EIC |

Note. All of the tax deductions use post-process formulas to manage manual payments (the taxable gross must be calculated based on the tax amount entered manually) and to trigger writable arrays containing tax amounts and grosses.

Delivered State Income Tax Accumulators

This table lists the state income tax-related accumulators delivered with PeopleSoft Global Payroll for United States:

|

Accumulator |

Description |

|

SWT GRS N |

Taxable gross subject to SWT - Customer Maintained. |

|

SWT GRS |

Taxable gross subject to SWT. |

|

SWT GRS PTD |

Period-to-date taxable gross subject to SWT. |

|

SWT GRS SPC N |

Taxable gross supplemental special earnings (bonus and stock options) subject to SWT - Customer Maintained. |

|

SWT GRS SPC |

Taxable gross supplemental special earnings (bonus and stock options) subject to SWT. |

|

SWT GRS SPC PTD |

Period-to-date taxable gross supplemental special earnings (bonus and stock options) subject to SWT. |

|

SWT GRS TOT |

Taxable gross total for SWT. |

|

SWT GRS TOT YTD |

Year-to-date taxable gross total for SWT. |

|

SWT PRE TAX N |

Before tax deductions - Customer Maintained. |

|

SWT PRE TAX |

Before tax deductions. |

|

SWT PRE TAX PTD |

Year-to-date before tax deductions. |

|

SWT GRS DRIVER |

SWT driver accumulator. |

|

SWT GRS S |

SWT gross. |

|

SWT GRS SPC S |

SWT special gross. |

|

SWT PRE TAX EXC |

SWT before tax exclusions. |

|

SWT PRE TAX S |

SWT before tax. |

|

SWT ARR |

State income tax. |

|

SWT PTDA |

State income tax. |

|

SWT YTDA |

State income tax. |

Delivered State Income Tax Sections

This table lists the state income tax-related sections delivered with PeopleSoft Global Payroll for United States:

|

Section |

Description |

|

TAX INITIALIZATION |

Tax initialization. |

|

STATE TAX EE |

State tax calculation for employees. |

Delivered State Income Tax Element Groups

One state income tax-related element group is delivered with PeopleSoft Global Payroll for United States: TAX EG STATE EE.

Federal Tax Calculation

Federal Tax CalculationThis section discusses how to:

Calculate federal tax.

Calculate FWT.

Calculate OASDI.

Calculate Medicare tax.

Calculate FUTA.

Calculate the EIC.

Calculating Federal Tax

Calculating Federal Tax

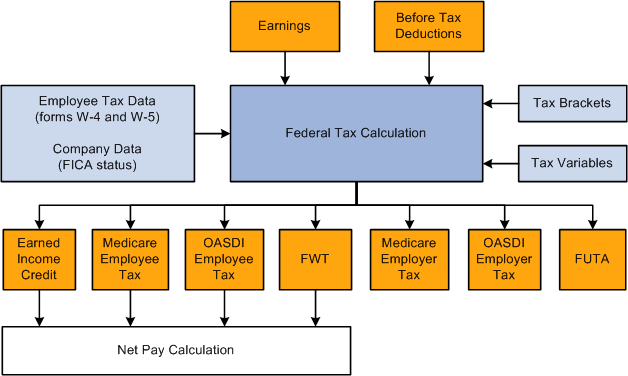

This diagram illustrates the flow of federal tax calculation:

Federal tax calculation

This diagram presents an overall view of the calculation of federal income tax. It shows how the system uses employee data, company data, earnings, deductions, and supporting elements to calculate the various federal taxes and credits for payees and employers. The system then uses the taxes and credits calculated for payees to calculate net pay.

Calculating FWT

Calculating FWT

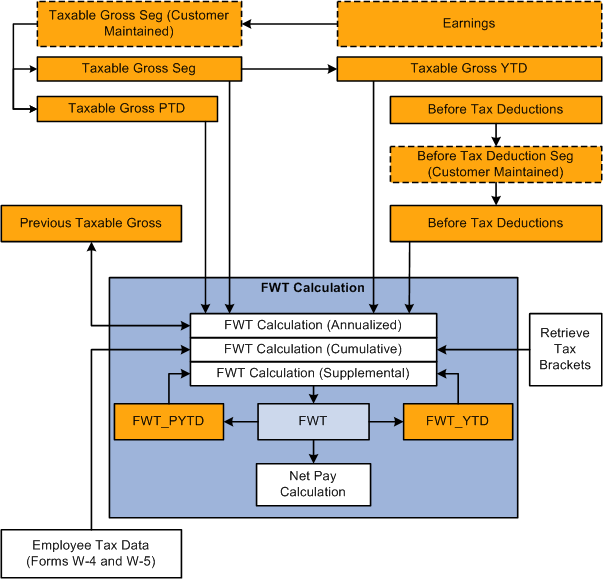

This diagram illustrates the flow of FWT calculation:

FWT calculation

The system calculates FWT as a deduction (FWT) using the formula TAX FM FWT. The system includes this deduction in net pay calculation.

The calculation has three phases, based on tax method:

Annualized

Cumulative

Supplemental (aggregate/percent)

The calculations are based on the bracket TAX BR FWT RATES, which contains the tax rates and set of variables that store key values such as exemption allowances and supplemental wage rate.

Note. The default tax method is annualized. You can override the method that the system uses to calculate FWT.

See Overriding Tax and Payment Methods.

Calculating OASDI

Calculating OASDI

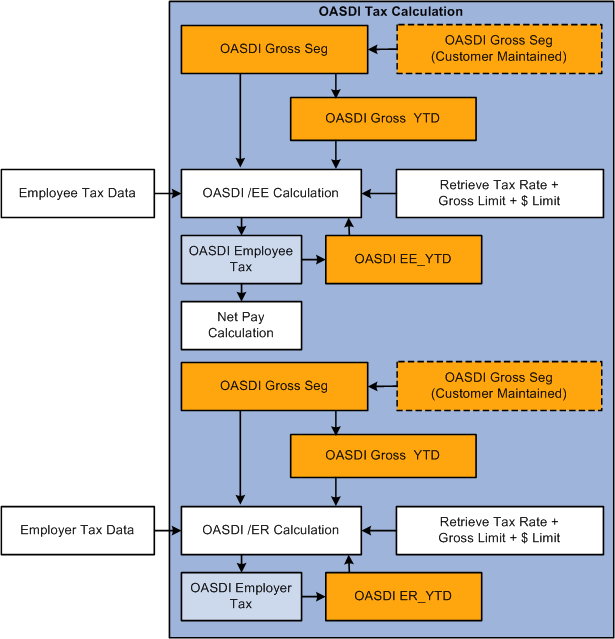

This diagram illustrates the flow of the OASDI calculation:

OASDI tax calculation

The system calculates OASDI employee tax as a deduction (OASDI EE) using the formula TAX FM OAS EE. The system includes this deduction in the net pay calculation. The calculations are based on a set of variables that store key values such as gross limits, tax rates, and payment limits for OASDI. Year-to-date OASDI tax for a payee is stored in the OASDI EE YTDA accumulator. The system then refers to this accumulator to enforce the yearly OASDI limit during calculation.

The system calculates OASDI employer tax as a deduction (OASDI ER) using the formula TAX FM OAS ER. Because this deduction applies only to employers, the system does not include it in net pay calculation. The system stores year-to-date OASDI employer tax in an accumulator (OASDI ER YTDA), just as it does for year-to-date OASDI employee tax. Likewise, the system uses the accumulator to enforce yearly limits on OASDI employer tax.

Calculating Medicare Tax

Calculating Medicare Tax

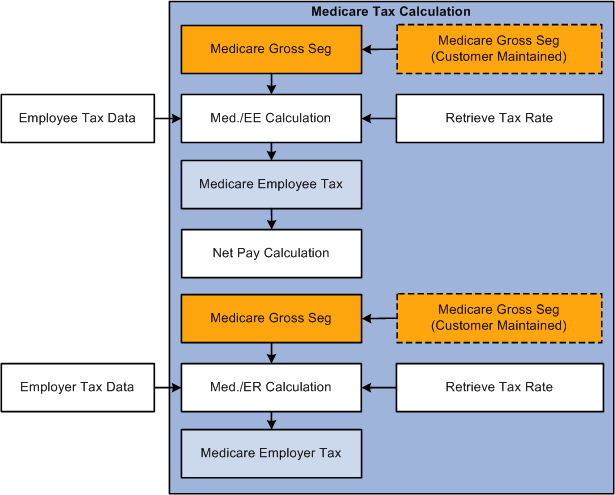

This diagram illustrates the flow of Medicare tax calculation:

Medicare tax calculation

The system calculates Medicare employee tax as a deduction (MEDICARE EE) using the formula TAX FM MED EE. The system includes this deduction in net pay calculation. The calculations are based on a variable that stores the tax rate for Medicare.

The system calculates Medicare employer tax as a deduction (MEDICARE ER) using the formula TAX FM MED ER. Because this deduction applies only to employers, the system does not include it in net pay calculation.

Calculating FUTA

Calculating FUTA

This diagram illustrates the flow of FUTA calculation:

FUTA calculation

The system calculates FUTA as a deduction (FUTA) using the formula TAX FM FUT. The system includes this deduction in net pay calculation. The calculations are based on a variable that stores the tax rate for FUTA.

Year-to-date FUTA for a payee is stored in the FUTA_YTDA accumulator. The system then refers to this accumulator to enforce the yearly FUTA limit during calculation.

Calculating the EIC

Calculating the EIC

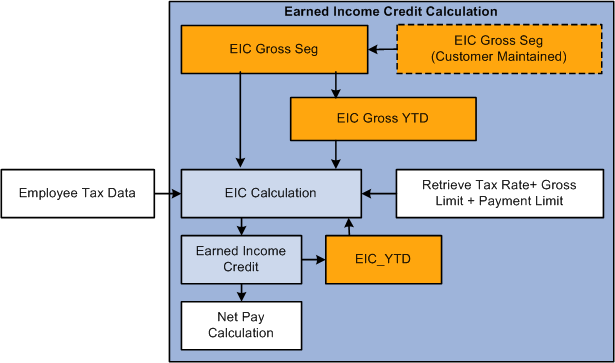

This diagram illustrates the flow of EIC calculation:

EIC calculation

The system calculates EIC as a negative deduction (EIC) using the formula TAX FM EIC. The system includes this deduction in net pay calculation. The calculations are based on a bracket (TAX BR EIC RATES) that contains the payment rates and a set of variables that store key values such as gross limit and payment limit for a single certificate or for joint certificates. Year-to-date EIC for a payee is stored in the EIC_YTD accumulator. The system then refers to this accumulator to enforce the yearly EIC limit during calculation.

State Tax Calculation

State Tax CalculationThis section discusses how to:

Calculate state income tax.

Calculate SWT.

Calculate the state Earned Income Credit (EIC).

Calculating State Income Tax

Calculating State Income Tax

This diagram illustrates the flow of state income tax calculation:

State income tax calculation

This diagram presents an overall view of the calculation of state income tax. It shows how the system uses employee data, company data, earnings, deductions, and supporting elements to calculate SWT and state EIC for payees. The system then uses the taxes and credits to calculate net pay.

Calculating SWT

Calculating SWT

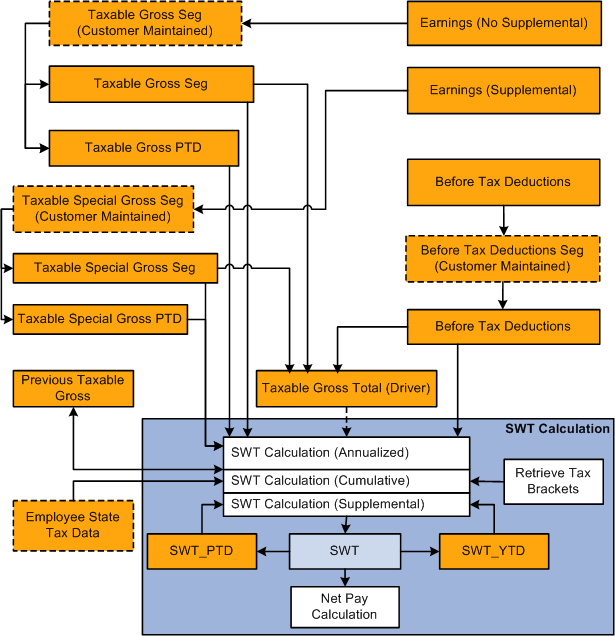

This diagram illustrates the flow of SWT calculation:

SWT calculation

The system calculates SWT as a deduction (SWT) using the formula TAX FM SWT. The system includes this deduction in net pay calculation. Because a payee may possibly earn income from multiple states during the year, the system uses an accumulator driver (SWT GRS TOT) to generate multiple resolutions of the deduction. For every state that applies to a payee, SWT GRS TOT drives a separate resolution of the SWT deduction. The calculation has three phases, based on the tax method and payment method for supplemental wages:

Annualized

Cumulative

Supplemental (paid with regular wages or in a separate payment)

The calculations are based on the State Tax table that determines which formula to apply for each state.

This table returns:

The formula to apply for regular wages.

The formula to apply for supplemental income paid with regular wages.

The formula to apply for supplemental income paid separately.

The rounding rule to apply.

Note. You can override the tax method and payment method that the system uses to calculate SWT.

See Overriding Tax and Payment Methods.

See Also

Generating Multiple Resolutions Using Accumulator Drivers

Calculating the State EIC

Calculating the State EIC

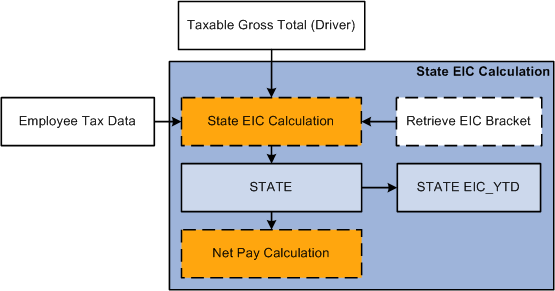

This diagram illustrates the flow of state EIC calculation:

State EIC Calculation

The system calculates state EIC as a negative deduction (STATE EIC) using the formula TAX FM STATE EIC. The system includes this deduction in net pay calculation. This deduction is driven by the accumulator SWT GRS TOT.

See Also

Generating Multiple Resolutions Using Accumulator Drivers

Overriding Tax and Payment Methods

Overriding Tax and Payment Methods

PeopleSoft Global Payroll for United States supports three tax calculation methods: annualized, cumulative, and supplemental. For taxes calculated using the supplemental method, the two supported payment methods that affect tax calculation are Paid with Regular Wages and Separate Payment. The tax calculation method and payment method are controlled by the variables TAX VR METHOD and TAX VR PMT, respectively. All of the earnings and deductions delivered with PeopleSoft Global Payroll for United States are associated with a default tax method and payment method. To make one-time or recurring changes to these values, you must use supporting element overrides (SOVRs).

Overriding Tax Methods

Overriding Tax Methods

The variable TAX VR METHOD, which controls the tax calculation method used by the system for each earning and deduction, has three possible values: A (annualized), C (cumulative), and S (supplemental). Most of the earnings delivered with PeopleSoft Global Payroll for United States have a default tax method of A. Exceptions exist, such as the BONUS earning, which has a tax method of S. You can change the tax method for an earning at the payee level on the Element Detail page of the Element Assignment By Payee component (GP_ED_PYE) for a recurring modification, and on the positive input component (GP_PI_MNL_ERNDED) for a one-time modification.

See Also

Overriding Payment Methods

Overriding Payment Methods

The variable TAX VR PMT, which controls the payment method that the system uses when calculating taxes on supplemental income, has two possible values: R (Paid with Regular Wages) and S (Separate Payment). This variable has a default value of R for all supplemental tax calculations, but you can override the payment method at the calendar level. You must create a separate calendar with a unique run type using the Calendars component (GP_CALENDAR).

See Also

Overriding Supporting Elements for a Calendar

Overriding State Codes and Tax Report Types

Overriding State Codes and Tax Report TypesThe variables TAX VR STATE (U.S. state and territory code) and TAX VR RPT TYPE (report type) control how the system processes and reports tax data at the state level. You can override the state and territory code and report type for a payee on the Element Detail page of the Element Assignment By Payee component (GP_ED_PYE) for a recurring modification, and on the positive input component (GP_PI_MNL_ERNDED) for a one-time modification.

Generating Tax Reports

Generating Tax Reports

This section discusses how to:

Generate the Tax Deposit and Liability report.

Generate the W-4 IRS report.

Pages Used to Generate Tax Reports

Pages Used to Generate Tax Reports|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPUS_RC_TAXDEPLIAB |

Global Payroll & Absence Mgmt, Taxes, Tax Deposit and Liability USA, Tax Deposit and Liability USA |

Generate pay period details on federal and state taxes withheld from employees. |

|

|

GPUS_RC_TAXSUMRPT |

Global Payroll & Absence Mgmt, Taxes, Tax Summary Reports USA, Tax Summary Reports USA |

Summarize period-to-date income tax, other federal taxes, and state taxes. |

|

|

GPUS_RC_QTRTAXRPT |

Global Payroll & Absence Mgmt, Taxes, Quarterly Tax Reports USA, Quarterly Tax Reports USA |

Summarize quarterly federal and state withholding tax details for employees. |

|

|

GPUS_RC_FEDTAXSTA |

Global Payroll & Absence Mgmt, Taxes, Federal Tax Data Status USA, Federal Tax Data Status USA |

View a list of employees with federal withholding exemption or those with more than 10 allowances. (If the Do Not Maintain Taxable Gross and Do Not Withhold Tax option is selected on the Federal Tax Data page, these employees will appear in the report.) This report summarizes exemptions for the selected employees. |

|

|

GPUS_RC_W4IRSRPT |

Global Payroll & Absence Mgmt, Taxes, W-4 IRS Report USA, W-4 IRS Report USA |

Generate the W-4 IRS report. This report lists employees with federal withholding exemption or those with more than 10 allowances. |

|

|

GPUS_RC_W4EXEMP |

Global Payroll & Absence Mgmt, Taxes, W-4 Exempt Payees Report USA, W-4 Exempt Payees Report USA |

List employees who fail to complete new W-4 forms by the due date. |

|

|

GPUS_RC_SELW4EXEMP |

Global Payroll & Absence Mgmt, Taxes, Identify W-4 Exempt Payees USA, W-4 Exempt Payees Report USA |

List employees whose federal tax data includes specified parameters. (If the Maintain Taxable Gross; FWT Zero Unless Specified in FWT Additional Withholding option and the Do Not Maintain Taxable Gross and Do Not Withhold Tax option are selected on the Federal Tax Data page, these employees will appear in the report.) |

|

|

GPUS_RC_W4RSTEXEMP |

Global Payroll & Absence Mgmt, Taxes, Reset W-4 Exempt Payees USA, Reset W-4 Exempt Payees USA |

Update future-dated records that currently specify W-4 exempt status. |

|

|

GPUS_RC_W4EPAYRPT |

Global Payroll & Absence Mgmt, Taxes, W-4 ePay Audit Report USA, W-4 ePay Audit Report USA |

List employees who enter W-4 information through self-service. Note. This report is available if you purchased ePay. |

|

|

GPUS_RC_SELW5PYES |

Global Payroll & Absence Mgmt, Taxes, Identify W-5 EIC Payees USA, Identify W-5 EIC Payees USA |

List employees without EIC status. |

|

|

GPUS_RC_W5RSTEIC |

Global Payroll & Absence Mgmt, Taxes, Reset W-5 EIC Payees USA, Reset W-5 EIC Payees USA |

Reset employee W-5 EIC status to None and update status on future-dated records. |

|

|

GPUS_RC_W5EICRPT |

Global Payroll & Absence Mgmt, Taxes, W-5 EIC Payees Report USA, W-5 EIC Payees Report USA |

List employees who fail to refile EIC eligibility by the due date. |

Generating the Tax Deposit and Liability Report

Generating the Tax Deposit and Liability Report

Access the Tax Deposit and Liability USA page (Global Payroll & Absence Mgmt, Taxes, Tax Deposit and Liability USA, Tax Deposit and Liability USA).

Report Request Parameters

|

Report Run By |

Define what you want the report run by. Values are Calendar Group ID, Payment Date Range, and Year and Quarter. |

|

Tax Year |

Enter the tax year for which you want to run the report. |

|

Tax Quarter |

Select the tax quarter for which to run the report. Values are 1st Quarter, 2nd Quarter, 3rd Quarter, and 4th Quarter. |

Population

|

Selection |

Select the population for which to run the report. Values are Federal EIN and Reporting Company. |

|

Federal EIN |

Select the Federal EIN. This field appears only if you select Federal EIN in the Selection field. |

|

Reporting Company |

Select the reporting company. This field appears only if you select Reporting Company in the Selection field. |

|

Payroll Cycle |

Select the payroll cycle when the report is run. Values are All Cycles, Off-Cycle Only, and On-Cycle Only. |

Generating the W-4 IRS Report

Generating the W-4 IRS Report

Access the W-4 IRS Report USA page (Global Payroll & Absence Mgmt, Taxes, W-4 IRS Report USA, W-4 IRS Report USA).

Report Request Parameters

|

Tax Year |

Enter the tax year for which you want to run the report. |

|

Tax Quarter |

Select the quarter for which you want to run the report. Values are 1st Quarter, 2nd Quarter, 3rd Quarter, and 4th Quarter. |

|

Electronic Processing |

Select if you want to process the report electronically. If you select this check box, the Population group box becomes unavailable for entry. |

|

Transmitter Control Code |

If you select the Electronic Processing check box, this field becomes available for entry. Enter a code for the electronic processing. |

Population

The Population group box is available for entry if the Electronic Processing check box is deselected.

|

Report Type Payee |

Select the category of payees for which the report is run. Values are All Payees, Payees using ePay, and Single Payee. |

|

Employee ID |

If you select Single Payee in the Report Type Payee field, enter the employee ID for which the report is run. |

|

Report Exemption Allowances |

Select the type of exemption allowance for the payee population being defined. Values are All, Claim Exempt, Exempt or > 10 Allowances, and More than 10 Allowances. |

See Also

PeopleSoft Global Payroll for United States Reports