Understanding Banking

Understanding Banking

This chapter provides an overview of banking and discusses how to:

Define banks and branches.

Set up funding.

Define deposit schedules.

Define recipients.

Assign recipients to deductions and payees.

Define payee net pay elections.

Run the banking process.

Review banking results by calendar group.

Use banking information with local country processes.

Use retroactive calculations in banking.

Understanding Banking

Understanding Banking

This section discusses:

The banking process

Setup requirements

Batch processing

Banking process flow

The Banking Process

The Banking Process

In Global Payroll, the banking process includes:

Setup.

Batch processing.

Tasks for local country extensions.

This chapter discusses setup and batch processing. For more information about how banking works with local country extensions, see the banking section in the corresponding Global Payroll country extension documentation.

Note. If your organization doesn't have direct deposit or electronic transfer for payees, you may not need to use the banking feature.

Setup Requirements

Setup Requirements

This section discusses:

Bank setup requirements

Funding setup requirements

Disbursement setup requirements

Bank Setup Requirements

Banks and branches are financial institutions that fund payroll or receive payroll calculations.

To set up banks:

Define bank information on the Bank Table page.

Set up banks on the Bank Table page, including basic information for all financial institutions involved in the payroll funding and disbursement process. You must complete this page before a bank can be identified as a source bank account or as a recipient.

Specify branch information on the Branch Table page (optional).

Define which branches apply to the banks. A bank can have one or more branches.

Note. Not all countries require bank branch information.

See Defining Banks and Branches.

Funding Setup Requirements

Funding refers to the source of payroll money.

To set up funding:

Define electronic funds transfer (EFT) formats, by country, on the Electronic Transfer Formats page.

Specify source banks for payroll on the Source Bank Accounts page.

Source banks are where payroll disbursements come from. For each source bank, you identify the appropriate bank/branch, account number, and EFT format.

Define the level of funding on the Pay Entities - Source Bank Link page.

Each organization can have various levels of funding sources (source banks). One organization might fund its entire payroll from a single bank; another might define funding at a lower level, such as by company.

See Setting Up Funding.

Disbursement Setup Requirements

Disbursement refers to payroll amount destinations. Net pay disbursements can go to payees, and deduction amounts can be disbursed to recipients, such as a healthcare provider or a government agency.

To set up disbursements:

Define deposit schedules on the Deposit Schedules page.

Define recipients on the Deduction Recipients page.

Recipients can be entities (general recipients) or individuals (individual recipients).

Assign recipients to deductions.

This procedure varies with recipient type.

Identify an individual's bank account information and disbursement details on the Bank Account Information page and the Net Distribution page.

This is necessary for disbursing an individual's net pay electronically.

See Defining Deposit Schedules, Defining Recipients, Assigning Recipients to Deductions and Payees, Defining Payee Net Pay Elections.

Batch Processing

Batch Processing

Batch processing for banking occurs in the Global Payroll core application and in the country extension.

To process bank payment information:

Finalize the pay run on the Payroll/Absence Run Control page.

Before running the banking process, you must finalize the payroll run or approve the items to pay.

Run the banking process, using the Payment Preparation page.

The banking process is a batch job that takes the results of payroll calculations and populates the payment table (GP_PAYMENT), which includes details on each recipient. It identifies the recipient, the amount owed, the source bank, and the account number.

Note. You must run the banking process in the same order in which you run your payrolls. For example, if you have finalized a payroll for both November and December and try to run the banking process on the December payroll before running it on the November payroll, the process will result in an error.

Run the local country batch process.

Each country has unique file format requirements for transmitting data electronically. Individual processes have been developed for each country that extract data from the payment file and format it appropriately.

Note. For more information about local country batch processing, see the banking section in the corresponding Global Payroll country extension documentation.

You can view the results of the banking process (step 2) and the results of the local country batch process (step 3) using the Review Payments by Cal Group component.

See Also

Reviewing Banking Results by Calendar Group

Banking Process Flow

Banking Process Flow

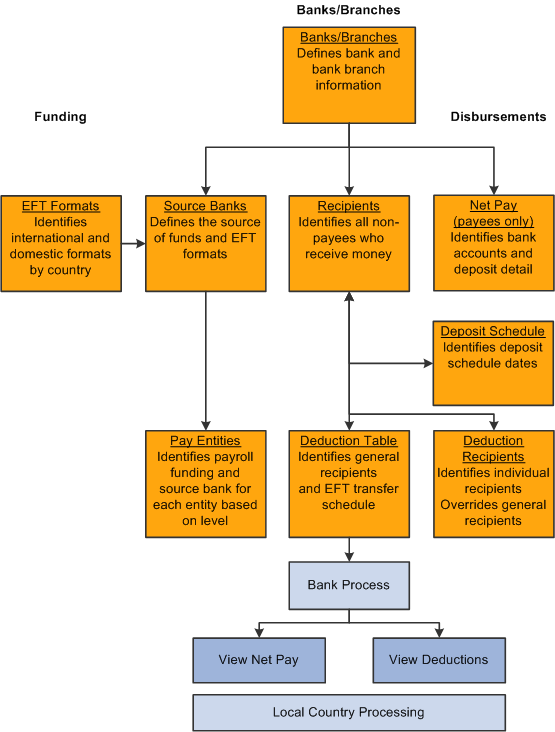

This diagram illustrates the flow of the banking process:

The banking process in Global Payroll

Defining Banks and Branches

Defining Banks and Branches

To define banks and bank branches, use the Banks (BANK_EC) component.

This section provides an overview of bank and branch definition and lists the pages used to define banks and branches.

Understanding Bank and Branch Definition

Understanding Bank and Branch DefinitionYou set up bank and bank branch information on the Bank Table page and the Branch Table page.

The pages for defining banks and bank branches are common to all PeopleSoft Enterprise Human Resources applications and are documented in the PeopleSoft Application Fundamentals for HRMS PeopleBook.

For a summary of the function of each page, see the overview of setup requirements in the previous section.

See Also

Setting Up Banks and Bank Branches

Pages Used to Define Banks and Bank Branches

Pages Used to Define Banks and Bank Branches|

Page Name |

Definition Name |

Navigation |

Usage |

|

BANK_EC |

Set Up HRMS, Common Definitions, Banking, Banks, Bank Table |

Set up basic information for all financial institutions. |

|

|

BANK_BRANCH_EC |

Set Up HRMS, Common Definitions, Banking, Banks, Branch Table |

Define branch information for a bank. Not all countries require bank branch information. |

See Also

Setting Up Banks and Bank Branches

Setting Up Funding

Setting Up Funding

To define electronic transfer formats, use the Electronic Transfer Formats (EFT_NAME) component. To define source banks, use the Source Bank Accounts (SRC_BANK) component. To define the default source bank for a pay entity and to link a source bank to a pay entity, use the Pay Entities (GP_PYENT) component.

This section discusses how to:

Define electronic funds transfer formats.

Define source banks.

Define the default source bank for pay entities.

Link source banks to pay entities.

Pages Used to Set Up Funding

Pages Used to Set Up Funding|

Page Name |

Definition Name |

Navigation |

Usage |

|

EFT_NAME |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Banking, Electronic Transfer Formats, Electronic Transfer Formats |

Define a country's electronic funds transfer (EFT) formats. An EFT is a standard interbank file format. |

|

|

SRC_BANK |

Set Up HRMS, Common Definitions, Banking, Source Bank Accounts, Source Bank Accounts |

Define the source of funds and EFT formats. |

|

|

GP_PYENT_PRCS_DTL |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Entities, Processing Details |

Define the default source bank for the pay entity. |

|

|

GP_PE_SBANK_LNK |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Entities, Source Bank Link |

Define source banks for the companies, department, establishments, or pay groups within the pay entity. Note. This is an optional setup task. If you leave the Source Bank Link page blank, the system uses the default source bank defined at the pay entity level on the Processing Details page. |

Defining Electronic Funds Transfer Formats

Defining Electronic Funds Transfer Formats

Access the Electronic Transfer Formats page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Banking, Electronic Transfer Formats, Electronic Transfer Formats).

|

Country Code |

Displays the country code you selected to access this page. |

|

EFT Format Name |

Enter a name. An EFT format is a country-specific value that's understood by locally run Structured Query Reports (SQRs). After defining the EFT format name, use this information on the Source Bank Accounts page to indicate the EFT format from which the money is coming. Note. For more information about EFT formats for local countries, see the banking section in the corresponding Global Payroll country extension documentation. |

Defining Source Banks

Defining Source Banks

The page for defining source banks is common to all Human Resources applications and is documented in the PeopleSoft Application Fundamentals PeopleBook.

For a summary of the function of the Source Bank Account page, see the overview of funding setup requirements in this chapter.

See Also

Defining the Default Source Bank for Pay Entities

Defining the Default Source Bank for Pay Entities

Use the Source Bank ID field on the Source Bank Link page to define the default bank for the pay entity. If you don't define source banks on the Source Bank Link page, the system uses the default bank you have set up on the Pay Entities - Processing Details page.

The Processing Details page is described in another chapter in this PeopleBook.

See Also

Entering Processing Details for a Pay Entity

Linking Source Banks to Pay Entities

Linking Source Banks to Pay Entities

Access the Source Bank Link page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Entities, Source Bank Link).

Payroll can be funded from more than one source bank. Use this page to define all the source banks used to fund payroll for a pay entity. Leave this page blank if you want to fund payroll from the pay entity's default source bank that you defined on the Processing Details page.

|

Organization Link Option |

Select the level of organization at which you're funding payroll. Options are: Company, Department, Establishment, and Pay Group. See Entering Processing Details for a Pay Entity. Note. If a value in this field changes, the system clears all entries in the Organization Link List group box. |

|

Load All Organization Units |

Click this button to populate the Organization Link List group box. The system populates a list of all active organization units, based on the effective date. |

Organization Link List

In this group box, select a source bank ID for each organization unit that you selected in the Organization Link Option field.

|

Organization Unit |

Select an organization unit for the Organization Link Option level that you defined. |

|

Source Bank ID |

Enter a source bank ID for each organization unit. |

Example

A pay entity has 10 pay groups. Only 2 of those pay groups use unique source banks; the other 8 use the same source bank.

To set up source banks for this pay entity, you select Pay Group in the Organization Link Option field.

There are two ways to set up the Organization Link List group box:

List all 10 pay groups in the Organization Link List.

For the 8 pay groups with the same source bank, list the same source bank ID. For the 2 pay groups with unique source banks, list the unique values for those source bank IDs.

Define the default source bank ID for the 8 pay groups on the Processing Details page, and enter only two rows for the 2 unique pay groups on this page.

Note. If you leave the Organization Link List group box blank, the system assumes that you're using the default source bank ID that is defined on the Processing Details page.

See Also

Defining Deposit Schedules

Defining Deposit Schedules

To define deposit schedules, use the Deposit Schedules (DEP_SCHED) component.

This section provides an overview of deposit schedules and discusses how to identify dates when payments are debited.

Understanding Deposit Schedules

Understanding Deposit SchedulesWhen you run the banking process, the system assigns a deposit date based on the time of the run and the deposit schedule that's associated with the deduction.

For deductions that are assigned a deposit schedule, the system looks up the date that comes the soonest after the run date.

For deductions without an assigned deposit schedule and net pay, the deposit date is the run date.

Example

Run February payroll on the 25th of the month.

|

Deduction |

Deposit Schedule |

Deposit Date |

|

Net pay |

No deposit schedule assigned |

The date that the banking process is run. |

|

Income tax |

Quarterly on the last day of the quarter |

March 31 |

|

Union dues |

Monthly on the first day of the month |

March 1 |

This example illustrates that the deposit date can filter which transactions are transmitted to the bank in a subsequent process.

Managing Deposits

You have flexibility in defining deposit schedules. So if many deposits are due at month's end, you can create a deposit schedule with a debit date of the last day of the month. Associate these dates with payees and recipients. Run the payment process, telling the system to create a report that includes all the information in the deposit schedule.

Page Used to Define Deposit Schedules

Page Used to Define Deposit Schedules|

Page Name |

Definition Name |

Navigation |

Usage |

|

DEP_SCHED |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Banking, Deposit Schedules, Deposit Schedules |

Identify dates when payments are debited from the source bank account. |

Identifying Dates When Payments Are Debited

Identifying Dates When Payments Are Debited

Access the Deposit Schedules page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Banking, Deposit Schedules, Deposit Schedules).

Schedule Generation Parameters

Use this group box to define details for generating deposits.

|

Day Unit of Measure |

Define the type of schedule that you're building. Options are Day, Month, Quarter, Week, and Year. Your selection affects time increments for the debit dates. So if you select Month, the time increment between debit dates is one month. |

|

Units in Period |

Define the frequency for the Day Unit of Measure field. If you indicate Month there and enter 1 here, this schedule occurs once a month. If you enter 2, this schedule occurs once every two months. |

|

Begin Date and End Date |

Enter the approximate schedule dates. When the system builds schedules, it builds them in this date range. |

|

Relative Start |

Select the relative start of the deposit schedule dates. Options are First Day (of the month) and Last Day (of the month). Specifies the day that the deposit date intervals start. For example, if you select Month in the Day Unit of Measure field and Last Day in the Relative Start field, the schedules have deposit dates at the end of the month. |

|

Days Adjustment |

Specify how many days to adjust between the relative start date and the deposit date. Say you select Month in the Day Unit of Measurefield, Last Day in the Relative Start field, a frequency of 1, and +10 in the Days Adjustment field. The system, on the 10th of each month, generates monthly schedule dates that start the 10th of the following month. Note. The Relative Start and Days Adjustment fields are unavailable for entry if the Day Unit of Measure field is set to Day or Week. |

|

Generate Dates |

Click this button to generate a list of debit dates in the Deposit Dates group box. |

Deposit Dates

This group box is populated based on what you defined in the Schedule Generation Parameters group box. It displays the generated dates when deposits are due, based on those parameters.

Defining Recipients

Defining Recipients

To define deduction recipients and to select recipients' deposit schedules, use the Deduction Recipients (RECIPIENT) component.

This section provides an overview of recipient definition and discusses how to:

Define recipients.

Select recipients' deposit schedules.

Understanding Recipient Definition

Understanding Recipient DefinitionRecipients are entities or individuals who receive voluntary and statutory deductions that are withheld from payees. Global Payroll recognizes two types of recipients:

General recipient, such as a government agency.

Receives the amount that's withheld from all payees who have a specific deduction.

Individual recipient, such as a spouse who receives child support payments.

Receives the amount that's withheld from one or more payees.

Note. A general recipient is often an entity and an individual recipient is often a person, but this isn't a requirement.

Each recipient has a disbursement schedule. You can create unique deposit schedules to identify deposit dates.

Note. Before you can define a recipient, you must first define general bank information on the Bank Table page.

See Also

Pages Used to Define Recipients

Pages Used to Define Recipients|

Page Name |

Definition Name |

Navigation |

Usage |

|

RECIPIENT |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Banking, Deduction Recipients, Define Deduction Recipients |

Define general and individual recipients for deductions. |

|

|

RECIPIENT_ADR_SP |

Click the Address Information link to access the Recipient Address page. |

Define recipients' address information. |

|

|

BANKACCT_IBAN_SEC |

Click the Edit IBAN link. |

(GBR, FRA, BEL, ESP, CHE, DEU, ITA, and NLD) Generate and edit the International Bank Account Number (IBAN). This page is documented in the PeopleSoft Enterprise HRMS 9.1 Application Fundamentals PeopleBook. |

|

|

RECIPIENT_DEP_INFO |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Banking, Deduction Recipients, Recipient Deposit Schedule |

Select recipients' deposit schedule. |

See Also

Defining Recipients

Defining Recipients

Access the Define Deduction Recipients page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Banking, Deduction Recipients, Define Deduction Recipients).

|

Address Information |

Click the Address Information link to access the Recipient Address page, where you'll define country and address information for the recipient. |

|

Payment Method |

Select the payment method. Options are Bank Transfer, Cash, Check, Postal Order and Wire Transfer. Note. Bank account information only becomes available when Bank and Wire Transfer are selected. |

|

Country Code |

Enter a country code. |

|

Bank ID and Bank Branch ID |

Select the bank ID and, if applicable, the branch ID, for the recipient. Note. Not all countries require branch ID information. |

|

Account Number and Account Name |

Enter account information for the recipient. |

|

Currency Code |

Specify the currency code in which the recipient is paid. The code you enter in this field is for informational purposes only and is not used by the banking process. |

|

IBAN and Edit IBAN |

(GBR, FRA, BEL, ESP, CHE, DEU, ITA, and NLD) Displays the IBAN number for the account. Click the Edit IBAN link to access the International Bank Account Nbr page where you can generate and edit IBAN information for the bank account. |

Recipient Category

|

Individual |

Select if the recipient receives an amount, such as a court order deduction, that is withheld from one or more payees. |

|

General |

Select if the recipient receives the amount withheld from all payees who have a particular deduction. General recipients, such as local and national governments for taxes, insurance companies for insurance benefits, and unions for union dues, are entities that receive an amount that might include many payee values. |

See Also

Selecting Recipients' Deposit Schedule

Selecting Recipients' Deposit Schedule

Access the Recipient Deposit Schedule page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Banking, Deduction Recipients, Recipient Deposit Schedule).

|

Deposit Schedule |

Select the deposit schedule that specifies the recipient's payment frequency. Define deposit schedules on the Deposit Schedules page. |

|

Purpose 1 and Purpose 2 |

Enter information that's included on the bank transfer file, such as bank routing numbers or names. |

Assigning Recipients to Deductions and Payees

Assigning Recipients to Deductions and Payees

This section provides an overview of recipient assignments and discusses how to:

Link individual recipients to a deduction and a payee.

Define recipients' account information.

Link general recipients to deductions.

Understanding Recipient Assignments

Understanding Recipient Assignments

After defining recipients, you assign them to deductions and payees. Where to assign recipients depends on the type of deduction.

When assigning recipients, you'll do the following:

Link individual recipients to deductions and payees through the payee-level Deduction Recipients page.

Link general recipients to deductions through the Recipient page of the Deduction component.

The sections below discuss each recipient type in detail.

If you have a deduction whose recipient is unique by payee, such as a garnishment deduction that goes to an individual, you assign a recipient on the payee-level Deduction Recipients page.

Note. The payee-level Deduction Recipients page is found under Global Payroll & Absence Mgmt, Payee Data, Net Pay/Recipient Elections, Add Deduction Recipients and is discussed in this section.

See Linking Individual Recipients to a Deduction and a Payee.

If you have a deduction whose recipient is a general entity, such as an insurance payment that goes to an insurance carrier, you establish the recipient information on the deduction definition, telling the system to sum up the amounts from all payees who have this deduction and send the total to one recipient.

When you link a general recipient to a deduction, you choose between:

Selecting the recipient by recipient ID.

Selecting a formula that determines which general recipient receives the deduction.

The formula is resolved during the Calculate phase of the batch process, when the deduction is resolved. The result is stored in the Earnings and Deductions results table. When you run the banking process, the system retrieves the recipient ID from the results table.

Note. You can override the general recipient of a deduction for a particular payee, on the payee-level Deduction Recipients page.

The Recipient page in the Deduction component is discussed in another chapter in this PeopleBook.

See Defining Deduction Elements.

Pages Used to Assign Recipients to Deductions and Payees

Pages Used to Assign Recipients to Deductions and Payees|

Page Name |

Definition Name |

Navigation |

Usage |

|

GP_RCP_PYE |

|

Link an individual recipient to a deduction and a payee. Override the general recipient of a deduction for a specific payee. |

|

|

GP_RCP_PYE_SP |

Click the Bank Account Information link on the Add Deduction Recipients page. |

Define a new recipient's bank account information. |

|

|

GP_RCP_DED |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Payroll Elements, Deductions, Recipient |

Link a general recipient to a deduction. |

See Also

Selecting a General Recipient for a Deduction

Linking Individual Recipients to a Deduction and a Payee

Linking Individual Recipients to a Deduction and a Payee

Access the Add Deduction Recipients page (Global Payroll & Absence Mgmt, Payee Data, Net Pay/Recipient Elections, Add Deduction Recipients, Add Deduction Recipients).

|

Element Name |

Select the deduction for which to define recipient information. |

|

Recipient Tag |

Enter the recipient tag. Tags are used for multiple resolution of deductions. A given payee could have one or more recipient tags and the tags are associated either with a recipient ID or with a recipient name. Tags are numeric. A Recipient Tag that is associated with an 'Individual' Deduction Recipient must have a value greater than zero. This will ensure the zero Recipient Tag is available if the General Deduction Recipient needs to be assigned to this employee along with individual recipients. The system will add the amount that resolves when there is no earning or deduction assignment. |

|

Recipient ID |

Select the recipient ID for a predefined recipient (recipients are set up using the Deduction Recipients component). To define a new recipient, leave this field blank and complete the Recipient Name field. When you select an existing recipient, the system displays the recipient name next to the Recipient ID field. Click the recipient name link to access the Define Deduction Recipients component (RECIPIENT) where you can view and update the recipient's details. |

|

Recipient Name and Bank Account Information |

If you want define a new recipient, enter the name of the recipient. When you complete this field, the system displays the Bank Account Information link. Click this link to access the Information for Recipient page where you enter the payment method and the recipient's bank account information. |

|

Deposit Schedule |

Select a deposit schedule for the recipient. |

|

Purpose 1 and Purpose 2 |

Enter information that's included on the bank transfer file, such as bank routing numbers or names. |

|

Deduction Assignment |

Click the Deduction Assignment link to access the Earning/Deduction Assignment page. |

Defining Recipients' Account Information

Defining Recipients' Account Information

Access the Information for Recipient page (click the Bank Account Information link on the Add Deduction Recipients page).

The fields on this page are identical to those on the Define Deduction Recipients page.

See Also

Linking General Recipients to Deductions

Linking General Recipients to Deductions

To link a general recipient to a deduction, access the Recipient page in the Deductions component and select the deduction recipient. The Recipient page is discussed in another chapter in this PeopleBook.

See Also

Selecting a General Recipient for a Deduction

Defining Payee Net Pay Elections

Defining Payee Net Pay Elections

This section provides an overview of payee net pay elections and discusses how to:

Enter payees' bank account information.

Specify net pay elections.

(ESP) Specify the inter-bank payment code.

Understanding Payee Net Pay Elections

Understanding Payee Net Pay ElectionsAfter setting up banking information for your organization, you can define bank account and net pay election information for each payee.

Note. Payees can manage their own personal payroll information, such as updating personal bank account information and payroll payment distribution instructions, on self-service pages in PeopleSoft Enterprise ePay. These pages are discussed in the ePay PeopleBook.

See Managing Pay Information for Global Payroll.

Pages Used to Define Payee Net Pay Election Information

Pages Used to Define Payee Net Pay Election Information|

Page Name |

Definition Name |

Navigation |

Usage |

|

PYE_BANKACCT |

Global Payroll & Absence Mgmt, Payee Data, Net Pay/Recipient Elections, Maintain Bank Accounts, Maintain Bank Accounts |

Enter bank account information for a payee. Use this information to track worker direct deposit information. |

|

|

BANKACCT_IBAN_SEC |

Click the Edit IBAN link. |

(GBR, FRA, BEL, ESP, CHE, DEU, ITA, and NLD) Generate and edit the International Bank Account Number (IBAN). |

|

|

GP_NET_DIST |

Global Payroll & Absence Mgmt, Payee Data, Net Pay/Recipient Elections, Specify Net Pay Elections, Specify Net Pay Elections |

Define how a payee's net pay is distributed between the payee's bank accounts. |

|

|

Inter-bank Payment Scheme |

GPMX_PYE_BANKACCT |

Global Payroll & Absence Mgmt, Payee Data, Net Pay / Recipient Elections, Maintain Bank Accounts, Maintain Bank Accounts. Click the Other Required Information link. |

(MEX) Enter the Clave Bancaria Estandarizada (CLABE) number associated with the payee's bank account. |

|

Bank Prenote Information USA |

GPUS_PRENOTE |

Click the Prenote Information link on the Maintain Bank Accounts page. This link is available only if you select the Prenote Process Allowed check box on the Installation Settings USA page. |

Indicate whether prenotification files (used in Federal Schedule Reconciliation) need to be generated. |

Entering Payees' Bank Account Information

Entering Payees' Bank Account Information

Access the Maintain Bank Accounts page (Global Payroll & Absence Mgmt, Payee Data, Net Pay/Recipient Elections, Maintain Bank Accounts, Maintain Bank Accounts).

|

Account ID |

Populated by the system with a number assigned to the bank account information. |

|

Type |

Select the bank account type for the payee. Options are Building Society Roll Number, Checking, Current Account, Giro Account, Regular, and Savings. |

|

Country Code, Bank ID, and Bank Branch ID |

Select this information for the payee. |

|

International ACH Bank Account |

Select to indicate that the bank is located outside the territorial jurisdiction of the United States. Note. This field appears only if you have PeopleSoft Enterprise Payroll for North America or PeopleSoft Enterprise Global Payroll for United States installed. |

|

Account Number and Account Name |

Enter account information for the payee. |

|

Account Name |

Enter the account name for the person. |

|

Prenote Information |

(USA) Click this link to access the Bank Prenote Information USA page. |

|

Currency Code |

Select the code of the currency in which the account is maintained. The code you enter in this field is for informational purposes only and is not used by the banking process. |

|

Other Required Information |

(MEX) Click this link to access the Inter-bank Payment Scheme page, where you can enter the Clave Bancaria Estandarizada (CLABE) number. This link is available only if you select MEX in the Country Code field. |

|

IBAN and Edit IBAN |

(GBR, FRA, BEL, ESP, CHE, DEU, ITA, and NLD) Displays the IBAN number for the account. Click the Edit IBAN link to access the International Bank Account Nbr page where you can generate and edit the IBAN for the bank account. |

|

AC Account Name (alternate character account name) |

Appears if you enabled alternate character (AC) functionality on the Primary Permission List Preferences page. |

|

Specify Net Pay Elections |

Click to go to the Specify Net Pay Elections page where you can view and update net pay details for the payee. |

(MEX) Specifying the Inter-bank Payment Code

(MEX) Specifying the Inter-bank Payment Code

Access the Inter-bank Payment Scheme page (click the Other Required Information link on the Maintain Bank Accounts page).

|

CLABE |

Enter the Clave Bancaria Estandarizada (CLABE) number associated with the payee's bank account. The CLABE number is a numeric 18-digit standardized bank code for domestic Inter-bank fund transfers. |

Specifying Net Pay Elections

Specifying Net Pay Elections

Access the Specify Net Pay Elections page (Global Payroll & Absence Mgmt, Payee Data, Net Pay/Recipient Elections, Specify Net Pay Elections, Specify Net Pay Elections).

|

Run Type Name |

Select for the net pay elections. You can define distributions by run type, such as one distribution for a regular run and another for expenses. |

|

Default Election |

Select to indicate the default run type. When the banking process runs, the system checks the run type defined on the pay calendar and seeks a match on the net distribution for the payee. If it finds none, it uses the distribution of the row marked Default Election. |

|

Order Number |

Enter an order number. This refers to distribution order priorities. Prioritize if a payee has distribution amounts indicated for an account type. Let's say that a payee wants 100 distributed to a savings account every month and everything else distributed to a checking account. The distribution to the savings account gets higher priority. |

|

Payment Method |

Select the payment method for the payee. Options are Bank Transfer, Cash, Check, Postal Order, and Wire Transfer. Note. You can create only one row with payment method Check or Cash. The system does not allow multiple checks or cash amounts per payee for a pay period. |

|

Account ID |

Select the bank account ID for the payee if you selected Bank Transfer or Wire Transfer as the Payment Method field. Your choices come from definitions for the Account ID field on the Maintain Bank Accounts page. Note. No Account ID is needed if the Payment Method is Cash, Check, or Postal Order. |

|

Primary Account |

Select if this is a payee's primary account. If a payee has set up distribution amounts for allocation to several accounts and a net pay amount remains after allocation, the extra amount goes to the primary account. Note. If the net pay becomes a negative amount, it will go into the primary account. |

|

Partial Allowed |

Select to have partial amounts distributed from a net pay distribution. Let's say a payee distributes 1200 monthly as follows:

One month, the payee's net pay is only 1050. The system still distributes 500 to the checking account and 400 to the savings account, but it cannot distribute the full 300 to the retirement account. If Partial Allowed is selected, the system distributes the partial amount, which is 150 in this case. If Partial Allowed isn't selected, the system allocates 150 to the payee's primary account. Nothing is deposited in the retirement account. |

|

Percent |

If the distribution to an account is calculated by a percentage of the net payment, enter that percentage. |

|

Amount |

If the distribution to an account is to be calculated by an amount, specify that amount. Note. You can define a net distribution in percentages, amounts, or both. The total cannot exceed 100 percent. Any amount remaining after percentage allocation is allocated to the primary account, unless otherwise specified. |

|

Maintain Bank Accounts |

Click to go to the Maintain Bank Accounts page where you can view and update bank account information for the payee. |

Overriding Payment Method

You can override the payment defined for a payee, run type, or calendar group using the system element PAYMENT MTHD. This element is resolved during the payroll process and its value is stored in the GP_PYE_SEG_STAT results table. The banking process checks the value stored in this table and if it has a value for payment method, this means that an override payment method is defined for the segment. If there is no value, the normal payment method defined for the payee is used. The payment methods available as overrides are Check, Cash, Postal Order or Primary Account.

There are no rules delivered in the Global Payroll core application to update the system element PAYMENT MTHD. Refer to your Global Payroll country extension PeopleBook for information about how this system element is used.

Running the Banking Process

Running the Banking Process

This section provides an overview of the banking processing and discusses how to create payments for net payments and deductions in a calendar run.

Understanding the Banking Process

Understanding the Banking Process

To prepare payments, the system uses the Payroll Results table that is created when you run payroll. The Global Payroll Banking Application Engine process (GP_PMT_PREP) populates a table, GP_PAYMENT, that contains payment information . The process creates payments for each segment and stores net pay by calendar period ID for each employee ID, employee record, and run type. The system does not store net pay if the value is zero, except for manual payments.

Note. The process that creates payment files is a local function documented in the corresponding local country documentation.

Example 1: Payment Processing for Employee with Pay Increase

This table shows the net pay elections for an employee:

|

Payment Method |

Bank Account |

Primary Account |

Partial Amount |

Percent |

Amount |

|

Transfer |

DEF |

100 |

|||

|

Transfer |

ABC |

Y |

Y |

100% |

The employee has a pay increase effective December 15 and a net pay of 3500 for the month. This table shows the payroll results for December:

|

Segment |

Period |

Pay Entity |

Cal Prd ID |

Amount |

|

1 |

December 1–15 |

AP |

Monthly |

1500 |

|

2 |

December 15 — 31 |

AP |

Monthly |

2000 |

This table shows the results of running the banking process for this employee:

|

Payment Method |

Segment |

Amount |

Cal Prd ID |

Source Bank |

Bank Account |

|

Transfer |

1 |

100 |

Monthly |

Bank 1 |

DEF |

|

Transfer |

1 |

1400 |

Monthly |

Bank 1 |

ABC |

|

Transfer |

2 |

2000 |

Monthly |

Bank 1 |

ABC |

Example 2: Payment Processing for Employee with Multiple Jobs

This table shows the net pay elections for the same employee with multiple jobs, but only one net pay election defined:

|

Empl Rcd |

Payment Method |

Bank Account |

Primary Account |

Partial Amount |

Percent |

Amount |

|

0 |

Transfer |

DEF |

100 |

|||

|

0 |

Transfer |

ABC |

Y |

Y |

100% |

The employee works for different departments with different source banks, with a total net pay of 4100. This table shows the payroll results for December:

|

Empl Rcd |

Segment |

Period |

Pay Entity |

Cal Prd ID |

Amount |

|

0 |

1 |

December 1–15 |

AP |

Monthly |

1500 |

|

0 |

2 |

December 15 — 31 |

AP |

Monthly |

2000 |

|

1 |

1 |

December 1 —31 |

AP |

Monthly |

600 |

This table shows the results of running the banking process for this employee:

|

Empl Rcd |

Payment Method |

Segment |

Amount |

Cal Prd ID |

Source Bank |

Bank Account |

|

0 |

Transfer |

1 |

100 |

Monthly |

Bank 1 |

DEF |

|

0 |

Transfer |

1 |

1400 |

Monthly |

Bank 1 |

ABC |

|

0 |

Transfer |

2 |

2000 |

Monthly |

Bank 2 |

ABC |

|

1 |

Check |

1 |

600 |

Monthly |

Bank 3 |

No alloc |

In this example the amount for the employee's second job (empl rcd 1) is not allocated because no net pay election is defined for this job.

Page Used to Run the Banking Process

Page Used to Run the Banking Process|

Page Name |

Definition Name |

Navigation |

Usage |

|

GP_PMT_PREPARE |

Global Payroll & Absence Mgmt, Payment Processing, Run Payment Prep Process, Run Prepayment Prep Process |

Run a process that creates payments for net pay, individual recipient, and general recipient deductions for a calendar run. |

Creating Payments for Net Payments and Deductions in a Calendar Run

Creating Payments for Net Payments and Deductions in a Calendar Run

Access the Run Payment Prep Process page (Global Payroll & Absence Mgmt, Payment Processing, Run Payment Prep Process, Run Prepayment Prep Process).

|

Calendar Group |

Select the calendar group on which to run the process. The system processes any items (segments) that are approved or finalized by the payroll process. |

|

Stream Number |

If the Process Streams check box is selected and you select Calculate in the Processing Phases and Options group box, you must select the stream number to process. Each stream number represents a predefined range of payees. |

|

Process Streams |

The Process Streams check box is selected automatically if you selected the stream processing option when defining the calendar group. |

Processing Phases and Options

|

Calculate |

Select to have the system create the payment file by matching the finalized results from the payroll process with information you defined in banking setup. You can run the Calculate step repeatedly until you finalize the banking process. |

|

Update Statistics |

Select to have the banking system generate statistics to help the data administrator fine-tune system performance. |

|

Finalize |

After everything is calculated, select Finalize. (If you used stream processing for the Calculate phase, the system finalizes all streams for the calendar group simultaneously.) Note. If you're not using streams, you can select Calculate and Finalize at the same time. |

Calendar List

After you run the Calculate phase, this group box displays information for each calendar in the calendar run.

Streams

This group box displays all streams associated with the calendar group.

See Also

Reviewing Banking Results by Calendar Group

Reviewing Banking Results by Calendar Group

This section provides an overview of banking results and discusses how to:

View net pay

View deductions

Understanding Banking Results

Understanding Banking ResultsAfter you run the banking process, you can view net pay and deductions for a payee.

Note. See your local country documentation for more information about local country bank processing.

Pages Used to Review Banking Results

Pages Used to Review Banking Results|

Page Name |

Definition Name |

Navigation |

Usage |

|

GP_PMT_NP_VIEW |

Global Payroll & Absence Mgmt, Payment Processing, Review Payments by Cal Group, View Net Pay |

View payee net pay by calendar group. |

|

|

GP_PMT_DED_VIEW |

Global Payroll & Absence Mgmt, Payment Processing, Review Payments by Cal Group, View Deductions |

View deductions for recipients by calendar group. |

Viewing Net Pay

Viewing Net Pay

Access the View Net Pay page (Global Payroll & Absence Mgmt, Payment Processing, Review Payments by Cal Group, View Net Pay).

Note. If there are more than 300 rows of data, a message will appear indicating that if you want to view more records for the calendar group, you need to enter specific criteria.

Selection Criteria

Use the fields in this group box to select the employees you want to view. When you click the Select Matching Payments button, the system populates the Net Pay group box.

|

EmplID From and EmplID To |

Select the range of employees whose net pay you want to view. |

|

Pay Group |

Select the pay group for which you want to view net pay results. |

|

Payment Method |

Select the payment method for which you want to view net pay. Options are Bank Transfer, Cash, Check, Postal Order, and Wire Transfer. |

|

Payment Number |

Enter a payment number for the net pay. Note. For the Global Payroll core product, payment numbers are used for off-cycle manual payments. |

|

Payment Status |

Select the payment status for the banking results. Options are Finalized, Hold, Manually Paid, No Active Allocations, Prepared, Payment Transferred, and Void. |

|

Summarized (by Employee) |

Select this check box to view a summary of employee payments for each calendar period, payment method, and source bank. If you leave this check box deselected, the system lists the payments for each segment in the pay period. However, if you select this check box, the system lists the total amount for all segments with the same payment method and source bank. |

|

Select Matching Payments |

Click this button to populate the Net Pay group box with payments that match the criteria you have defined. |

|

Clear |

Click this button if you want to clear the data in the Net Pay group box. |

Payee Information

Select the Payee Information tab.

This tab displays the payment status, employee ID, name, record number, instance number, amount, currency code, payment method, and source bank ID that is associated with each payment.

|

Payment Status |

Displays the payment status. You can change the payment status only when the banking process has been finalized and you have not selected the Summarize (by Employee) check box. Options are: Hold: Use this status to stop a payment from being transferred to the bank. When you want to make the payment, change the status from Hold to Finalized. You cannot change the status to Hold after a payment has been transferred. Manually Paid: You cannot change the status of manual payments. Prepared: The system sets this status when you run the banking process and payments are first allocated. Payment Transferred: Indicates that the payment has been transferred to the bank. During local country processing, the system changes the status from Prepared to Payment Transferred. No Active Allocations: Indicates that no net pay elections are defined for the payee on the Net Pay Elections page. Finalized: The payment has been created and finalized. You can change the status of finalized payments to Void, or Hold. Void: Use this status to cancel a payment. Once you void a payment, you cannot unvoid it. Note. When you void a payment, the system voids the net pay and deductions that make up the payment. Note. If you are voiding a payment because you are using an off-cycle to correct or reverse a payment, setting it to void doesn't automatically create a recalculation of the payroll. You need to run the off-cycle for this to occur. |

Select the Calendar Information tab.

This tab displays the segment number, calendar ID, and pay group that is associated with each payment.

Select the Payment Information tab.

This tab displays the payment number and payment identification that is associated with each payment. These fields are blank except for manual payments entered in an off-cycle payroll for the core process.

Note. Some country extensions use payment numbers and payment identification for their regular banking processes and not only for manual payments.

See Also

Viewing Deductions

Viewing Deductions

Access the View Deductions page (Global Payroll & Absence Mgmt, Payment Processing, Review Payments by Cal Group, View Deductions).

Note. If there are more than 300 rows of data, a message will appear indicating that if you want to view more records for the calendar group, you need to enter specific criteria.

Note. Many of the fields on the Selection Criteria group box on the View Deductions page are similar to the fields on the View Net Pay page. These common fields are documented with the View Net Pay page. Fields unique to the View Deductions page are documented below.

See Viewing Net Pay.

|

Registered Recipient |

Select the recipient ID to view deductions for recipients defined on the Define Deduction Recipients page. |

|

Adhoc Recipient |

Select a recipient in this field if you want to view deductions for recipients defined on the Assign Deduction Recipients page. |

|

Recipient Type |

Select General Recipient Deduction or Individual Recipient Deduction. |

|

Summarized (by Recipient Info) |

Select this check box to display the total amounts paid to recipients. If you leave this check box deselected, the system lists the amounts paid to recipients for each payee. |

Select the Payee Information tab.

This tab displays information about the payee.

Select the Calendar Information tab.

This tab displays information about the calendar.

Using Banking Information with Local Country Processes

Using Banking Information with Local Country Processes

After setting up information in the Global Payroll core application, you can use this information when running local country processes to create payment files and payment reports.

Each country extension has its own SQRs and formats. You can write your own SQRs, extracting data from the output file that the system created in the core application in the banking process.

To prepare payments:

Finalize your payroll.

Run the banking process.

View payments on the View Net Pay page and the View Deductions page.

Print a report of payments after payment processing.

Refer to your country extension PeopleBook for information about the reports available.

Prepare recipient payments to generate payments for general recipients.

After the core banking process is finalized, an SQR process populates a table that country-specific processes use to generate payment files and reports for general recipients.

Prepare payee payments to generate payments for individual recipients.

After the core banking process is finalized, an SQR process populates a table that country-specific processes use to generate payment files and reports for individual recipients.

Note. In steps 4 and 5, the process isn't necessarily run by local SQRs. Whether you run the process with SQRs or not, the result is an interface file to banks or another medium for automated transfers.

Note. To see which local processes need to be run, refer to the banking chapter in your local country documentation.

Using Retroactive Calculations in Banking

Using Retroactive Calculations in Banking

This section provides an overview of the retroactive process in banking and discusses how to:

Select the corrective method for default retro processing.

Select the forwarding method for default retro processing.

Review deduction processing details.

Review an example of using the Use Current Results + Adjustment without selecting the To Process Banking check box.

Select the Use Current Results + Adjustment for banking.

Review an example of selecting the To Process Banking check box when forwarding is the default retro method.

Understanding the Retroactive Process in Banking

Understanding the Retroactive Process in Banking

In the banking process, making sure that the appropriate source bank funds transactions and the right recipients or net pay accounts are debited and credited can require retroactive calculations to correct previous calculations. To determine how to handle transactions, banking must recognize retro processing and the method used.

Define your payroll retroactivity defaults on the Countries page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, System Settings, Countries). This page is discussed in other chapters in this PeopleBook.

See Defining Country-Level Setup, Setting Up Retroactive Processing.

Selecting the Corrective Method for Default Retro Processing

Selecting the Corrective Method for Default Retro ProcessingIf you select Corrective as the Default Retro Method on the Countries page, the system completes the following steps when retroactive processing occurs:

Recalculates the elements of the pay run that are defined to be recalculated during retro.

Replaces previous calculations with the recalculated values for the elements of the pay run.

Updates balance and segment accumulators in the recalculated period.

Computes retro deltas and stores them in the recalculated period.

Computes the retro adjustment for elements of the pay run that are defined as forwarding element overrides (on the Retro Process Overrides page).

Determines if any differences exist between the net pay from the prior calculation and the recalculation.

Banking processes the differences. Reverses all segments for net pay entries from the prior calculation where the net pay isn't being forwarded.

Inserts new segment net pay entries from the recalculation where the net pay isn't being forwarded.

Distributes all net payments according to the net distribution sets matching the run type, the EmplID/Empl Record (employee ID and employee record), and period ID combination.

Deletes all entries where the sum is zero.

Note. If the net difference is negative, the system takes the amount and assigns it to the primary account.

Note. In the case of a payroll reversal, the banking process posts the reversal of the prior period and posts new calculated values in addition to the difference.

Selecting the Forwarding Method for Default Retro Processing

Selecting the Forwarding Method for Default Retro ProcessingIf you select Forwarding as the Default Retro Method on the Countries page, the system completes the following steps when retroactive processing occurs:

The system recalculates the elements of the pay run that are defined to be recalculated during retro.

Recalculated values for the elements are used to compute the retro deltas for the recalculated period, but do not replace the previous calculations.

The system updates segment accumulators only. (Although you can define balance accumulators to behave in a corrective manner at the accumulator definition level and on the Earnings/Deductions Accumulators pages even when the retro method is forwarding).

The system computes retro deltas and stores them in the recalculated period.

The system computes the retro adjustment for elements of the pay run that are defined to be forwarded (on the Retro Process Overrides page).

The banking process picks up only the net pay from the current period calculation because differences from the prior recalculated periods are included in the current period.

Reviewing Deduction Processing Details

Reviewing Deduction Processing DetailsThe deduction process completes the following, regardless of retro method:

Reverse deductions from all prior retro period calculations in the calendar group.

Reinstate reversed deductions where the payroll method is forwarding, because the purpose is to reassign the correct recipient.

Insert the new transactions for any recalculated deductions where the method is corrective.

This involves two steps, first for general recipients and then for individual recipients.

Remove entries resulting in 0 that have the same recipient ID.

Example of Banking without the "To Process Banking" Check Box Selected

Example of Banking without the "To Process Banking" Check Box Selected

This is what happens when the "To Process Banking" option is not selected.

This example illustrates the interaction between source bank, recipient, and payee accounts for net pay. February (February 1, 2004 − February 28, 2004) represents the current period, with retro processing going back to January (January 1, 2004 − January 31, 2004).

Company ABC uses Source Bank 123. Company DEF uses Source Bank 789.

Payee changes from Company ABC to Company DEF, effective February 1.

Company ABC changes from Source Bank 123 to Source Bank 456, effective February 15.

Earning 1 rate changes from 100 to 150, effective January 1.

Deduction 1 rate changes from 20 to 25, effective January 1; no recipient change.

Deduction 1 recipient changes from Recipient X to Recipient Y, effective February 1.

Deduction 2 recipient changes from Recipient A to Recipient B, effective January 1; no rate change.

Payee account distribution changes from Account 1 to Account 2, effective February 1.

|

Version/ Revision Number |

January 2004 Company ABC |

Distribution Information |

February 2004 Company DEF |

Distribution Information |

|

V1R1 |

Source Bank 123 |

Source Bank 789 |

||

|

Earning 1 = 100 |

Earning 1 = 150 |

|

||

|

Deduction 1 = 20 |

Recipient X |

Deduction 1 = 30 |

Recipient Y |

|

|

Deduction 2 = 15 |

Recipient A |

Deduction 2 = 15 |

Recipient B |

|

|

Net Pay = 65 |

Payee Account 1 |

Net Pay = 105 |

Payee Account 2 |

|

|

V2R1 |

Source Bank 456 |

|||

|

Earning 1 = 150 |

Difference of 50.00 |

|||

|

Deduction 1 = 25 |

Difference of 5 to Recipient X |

|||

|

Deduction 2 = 15 |

<15> Recipient A 15 Recipient B |

|||

|

Net Pay = 110 |

Difference of 45 to Payee Account 2 |

Explanation of January recalculation (V2R1):

Deduction 1

The difference between V1R1 and V2R1 results in 5.

The recipient is determined based on where the payee was when the deduction was first calculated (January V1R1). In this case, because there was no change in recipient for Deduction 1, the difference of 5 goes to Recipient X, funded by Source Bank 456.

Deduction 2

No difference exists.

There's a recipient change retroactive to January. From Recipient A, 15 is reversed and inserted to Recipient B. Each transaction is "charged" to Source Bank 456.

Net Pay

The difference between V1R1 and V2R1 results in 50.

The payee account distribution is determined based on the pay date of the current calendar (February). The difference, 50, goes to Payee Account 2 and is funded by Source Bank 456.

This example illustrates that net pay and deductions are allocated to Company (payment keys) and recipients are based on pay period, whereas source bank and payee accounts are selected based on when transactions are created.

Selecting the Use Current Results + Adjustment for Banking

Selecting the Use Current Results + Adjustment for BankingMost organizations that implement Global Payroll choose the default method that the application uses to process banking in relation to retro. These organizations need only specify, on the Countries page, the retro method, either forwarding or corrective, that is used by their organization or is most appropriate for their country extension of Global Payroll.

Other organizations prefer to post only V1R1 results to banking. The To Process Banking check box on the Countries page is an additional option that addresses this business requirement, and permanently changes the way that the system handles banking in relation to retro. The default setting for the To Process Banking check box is deselected. When you select it, you are telling the system not to reverse old payments in banking and to skip all sections and steps responsible for retro calculation (reversing) and instead implement results from V1R1 and adjustments only.

If you select the To Process Banking check box on the Countries page, the effect is different depending on the default retroactive method:

If the Default Retroactive Method is Corrective, the enhancement does not change the behavior of corrective retro in banking.

If the Default Retroactive Method is Forwarding, retroactivity changes as follows:

The system does not reverse prior amounts or post recalculated amounts during retroactive processing. Instead, the system implements current results (V1R1) plus adjustments in banking.

You may have to manually correct any discrepancies you identify in banking payments because retroactive changes to recipients or accounts cannot be reflected by the current results plus adjustment method.

In case of segmentation mismatch, the system always uses current results plus adjustments and posts results to the last available segment, regardless of the default retro method defined on the Countries page, or the check boxes you select in the Use Current Results + Adjustment group box.

Segmentation mismatch occurs when a segmented period is recalculated retroactively, and the segmentation dates of the original calculation don't coincide with those of the recalculation.

Note. Do not enable either setting in the Use Current Results + Adjustment group box if you are satisfied with the way the system currently handles retroactive processing in relation to banking and GL. These settings are not backward compatible.

Note. Once you enable one or both of the Use Current Results + Adjustment settings, you cannot change them back to the default setting. The check boxes become read-only and remain so.

Note. The tables used by and modified in banking and GL are independent. Consequently, you can select the To Process Banking and the To Process General Ledger check boxes independently of one another.

Note. The settings for Use Current Results + Adjustments are country-specific. The selections you make on the Countries page apply to that country only.

Example: Selecting the To Process Banking Check Box When Forwarding

is the Default Retro Method

Example: Selecting the To Process Banking Check Box When Forwarding

is the Default Retro MethodIn this example a deduction with a payment of 100 is made to Recipient 1 in January. In February the recipient is changed to Recipient 2, effectively dated in January, thus triggering retroactive processing. When the To Process Bankingcheck box is selected for banking, and forwarding is the default retro method, the system posts this recipient and amount information to banking results:

|

Month |

Version/Revision |

Amount |

Recipient |

Action |

|

January |

V1R1 |

100 |

1 |

Resolution (last period) |

|

February |

V1R1 |

100 + 0 |

2 |

Resolution (current period + adjustment) |

In this example, the system does not process the reversal and reinstatement. It processes only the current period plus adjustment. (The adjustment in this case is 0 because the amount of the deduction does not change.)