Understanding Deductions

Understanding Deductions

This chapter provides an overview of deductions for New Zealand and discusses how to calculate deductions for:

Social Club.

Membership fees.

Union fees.

Writs.

Child Support

Court orders.

Advance Payback.

Loan repayment.

Superannuation Government Fund – employee and employer contributions.

Superannuation National Provident fund – employee and employer contributions.

Superannuation Gross Up Fund – employer contribution.

KiwiSaver – employee and employer contributions.

Note. The PeopleSoft system delivers a query that you can run to view the names of all delivered elements designed for New Zealand. Instructions for running the query are provided in the PeopleSoft Enterprise Global Payroll 9.1 PeopleBook.

See Also

Understanding How to View Delivered Elements

Understanding Deductions

Understanding Deductions

We have created a number of deductions to demonstrate the flexibility of the Global Payroll rules to meet common processing requirements such as the preservation of minimum net pay.

Note. The User Key 2 on the Earnings Accumulators page and Deduction Accumulators page for all earnings and deductions is CMN VR BALGRP ID (Balance Group ID). Use balance group numbers (IDs) to maintain separate employee balances. You set an employee's balance group number on the Job Data, Payroll page— JOB_DATA2. The balance group number will need to be manually incremented if you are required to record separate balances within a financial year.

Delivered Deduction Elements

Delivered Deduction Elements

The following table lists the delivered deductions for New Zealand. In this table, the first column combines the deduction name and description. A (gc) in the row indicates that the deduction has a generation control. A (po) indicates a post processing formula, (pr) indicates a pre processing formula. The other four columns indicate the deduction calculation rule of Unit × Rate, Unit × Rate × Percent, Amount.

Note. The tax deductions are included in the table but discussed in greater detail in the taxation chapter.

See Managing Tax Calculations.

|

Name and Description |

Unit (or Base) |

Rate |

% |

Amount |

|

PAYE TAX PAYE Tax (gc) |

TAX FM PAYE TAX |

|||

|

EXTRA EMLMNT Extra Emolument Tax (gc) |

TAX FM XE TAX |

|||

|

WITHHOLDING Withholding Tax (gc) |

TAX FM WITHOLD TAX |

|||

|

CHILD SUPPRT Child Support (po) |

Payee Level |

|||

|

STUDENT LOAN Student Loan Repayments (gc) |

TAX FM SL TAX |

|||

|

SSCWT Spec Super Contr Withhold Tax |

TAX VR SSCWT AMNT |

|||

|

SOCIAL CLUB Social Club (gc) |

8.00 |

|||

|

MEMBSHP FEES Membership Fees (gc) |

DED FM MEMBERSHIP |

|||

|

UNION Union Fees (gc) |

DED FM UNION |

|||

|

WRIT Writ |

Base (Accum - DISPOSABLE EARNING) |

Payee Level |

||

|

COURT ORDER Court Order (gc) |

Base (Accum - DISPOSABLE EARNING) |

Payee Level |

||

|

TRANS REC Transport Loan Recovery (gc) (po) |

Base (Accum - TRANS ADV AMT) |

Variable Numeric LN VR REC AMT |

||

|

LOAN REPAY Loan Repayment (gc) |

Accum - LOAN BALANCE |

|||

|

SUP GOV EE Super Government Fund – EmpEE |

Base (Accum - NZL GROSS) |

Payee Level |

||

|

SUP GOV ER Super Government Fund – EmpER (po) |

Base (Accum - NZL GROSS) |

DED FM SUP GOV ER |

||

|

SUP NPF EE National Provident Fund – EmpEE |

Base (Accum - SUPERABLE SALARY) |

6 |

||

|

SUP NPF ER National Provident Fund – EmpER (gc)(po) |

Base (Accum - SUPERABLE SALARY) |

6 |

||

|

SUP GRSUP ER Super Gross Up Fund – EmpER (po) |

Payee Level |

|||

|

XE GRS UP Extra Emolument for Gross Up |

TAX FM XE TAX |

|||

|

KIWI DD EE KIWI Deduction Employee |

Base (Accum - KIWI AC GROSS) |

Payee Level |

||

|

KIWI DD ER KIWI Deduction Employer (po) |

Base (Accum - KIWI AC GROSS) |

Payee Level |

Payee Level |

Making Social Club Deductions

Making Social Club Deductions

The social club deduction reduces the employee's after-tax income by a nominated amount. The amount is paid monthly. The system annualizes and deannualizes the amount to resolve it correctly for the various pay calendars.

A generation control, DED GC SOCIAL CLUB, has formula DED FM SOC BIGGER that ensures that the system applies the deduction only in the larger of the segments within the period. A second GC formula checks that the payee is active.

Deducting Membership Fees

Deducting Membership Fees

The earning in a fortnightly period determines the amount of the membership fee deduction which may be percentage or a flat amount. The calculation rule amount is the formula DED FM MEMBERSHIP that determines if the accumulator that houses the earning that the fees are based upon, MEMB EARNINGS, is less than the value of the deduction's system element override DED VR MEM MAX AMT for a fortnight. If the amount is below the DED VR MEM MAX AM, the system multiplies the accumulator value by 1 percent . If not less than DED VR MEM MAX AMT, the amount is the value of the DED VR MEM MAX AMT variable. The formula also converts frequencies other than fortnightly to a fortnightly amount

Deducting Union Fees

Deducting Union Fees

The calculation rule amount for the Union deduction is the formula DED FM UNION. The formula passes the value of the accumulator UNION EARNINGS to the variable DED VR UN ERN FN and the bracket DED BR UNION RATES determines the amount of the deduction based on the variable value. Frequencies other than fortnightly are converted to a fortnightly amount.

Generation control DED GC UNION LAST uses DED FM UNION LAST to ensure that the deduction is taken only in the last segment of the period.

Calculating the Writ and the Court Order Deductions

Calculating the Writ and the Court Order Deductions

The calculation rule for both these deductions is base x percent where the base in the DISPOSABLE EARNINGS accumulator (NZL GROSS – NZL TAX) and the percentage is set at the payee level.

The court order deduction has generation control DED GC COURT ORDER. It uses DED FM PROC STATUS to check the value of DED FM VR PROC STATUS to ensure that the system only takes the deduction if the status of the court order is Approved. You enter the status on the Assign Garnishments NZL (GPNZ_GARN_DTLS) page and the array GPNZ_PROC_STATUS passes the status value to the variable.

Pages Used to Administer Garnishments

Pages Used to Administer Garnishments|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPNZ_GARN_DTLS |

Global Payroll & Absence Mgmt, Payee Data, Garnishments/Court Orders, Assign Garnishments NZL, Assign Garnishments NZL |

Assign garnishments to an employee. |

|

|

GPNZ_PROTECT_NET |

Global Payroll & Absence Mgmt, Payee Data, Garnishments/Court Order, Specify Protected Net Pay NZL, Specify Protected Net Pay NZL |

Specify amount of employee's net pay to protect from garnishment. |

Creating Earnings Advance and Recovery

Creating Earnings Advance and Recovery

Some earnings are loans or advances; therefore, when they are paid, the system must automatically create a deduction that is processed over subsequent pay runs, recovering the loan or advance.

The PeopleSoft system provides the following elements, accumulators, formula, and generation control to demonstrate this:

|

Name |

Type |

Usage |

|

TRANS ADV |

Earnings element. |

Adds advance amount to paycheck when advance occurs. |

|

TRANS ADV AMT |

Accumulator. |

Stores amount of advance. |

|

TRANS BAL AMT |

Accumulator. |

Stores reducing balance. |

|

TRANS REC |

Deduction element. |

Deducts portion of advance from paycheck in subsequent pay runs. |

|

ADV FM GC CHECK |

Advance recovery check formula. |

Adjusts the deduction if taking it all would cause the goal amount to be exceeded. |

|

ADV GC REC IND |

Advance recovery generation control. |

Controls execution of advance recovery check formula. |

Deducting the Loan Repayment

Deducting the Loan Repayment

The LOAN REPAY deduction deducts any outstanding loan amounts on termination of the payee. It is an amount calculation. The amount is the value of the LOAN BALANCE accumulator. Any balance becomes the amount of the deduction.

The deduction's generation control, CMN GC TERM STAT, has formula CMN FM TERM STAT, which determines whether to resolve the payment of various earnings and deductions.

The formula checks for either a termination date in the pay period or a termination action date in the pay period. It checks for both to accommodate situations where you have not entered the termination until the pay period after the pay period in which the termination occurred. If the formula only checked for the termination date, the deduction would not be processed because the termination date would be outside the current pay period begin and end dates.

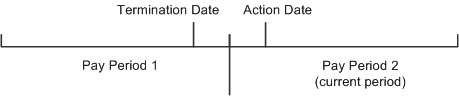

The following diagram illustrates a timeline where the termination action date is in the current pay period, but the termination date is not.

Termination date and termination action date are in different pay periods

Deducting Government Superannuation Contributions

Deducting Government Superannuation Contributions

There are two superannuation deductions, one for the payee's contribution, the other for the employer's contribution. The payee's contribution deduction, SUP GOV EE, has a calculation rule of base x percent where the base is the payee's NZL GROSS accumulator amount and the percent is set at payee level.

The employer's contribution deduction, SUP GOV ER, has a calculation rule of base x percent. The base is the payee's NZL GROSS accumulator value and the percent is formula DED FM SUP GOV ER. The formula checks the payee's contribution percent and matches that contribution up to a maximum set on the deduction's system element override DED VR SUPGOV MAX.

A flat amount post-process formula, TAX FM SS FLAT RATE, on the employer's deduction calculates the Specified Superannuation Contribution Withholding Tax (SSCWT).

See Also

Deducting National Provident Fund Contributions

Deducting National Provident Fund Contributions

There are two NPF deductions and the payee's and employer's deductions are calculated exactly the same way. The calculation rule is base x percent where the base is the SUPERABLE SALARY accumulator, and the percentage is the legislated value.

A flat amount post-process formula, TAX FM SS FLAT RATE, on the employer's deduction calculates the Specified Superannuation Contribution Withholding Tax (SSCWT).

See Also

Using the SSCWT Gross Up Tax Calculation

Using the SSCWT Gross Up Tax Calculation

We have provided the SUP GRSUP ER deduction to demonstrate the correct use of the SSCWT gross up tax calculation. The calculation rule is an amount where the amount, set at payee level, is initially entered as a grossed up amount. The deduction's post-process formula, TAX FM SS GRS UP, calculates the SSCWT. It also adjusts the grossed up amount to the value that's correct for the net amount.

Note. The system uses the other gross up deduction, XE GRS UP, in the Net-to-Gross functionality. The deduction's calculation rule is formula TAX FM XE TAX, which calculates the employee's extra emolument tax amount.

See Also

Understanding Net-to-Gross Payment Calculation

Deducting Employee and Employer KiwiSaver Contributions

Deducting Employee and Employer KiwiSaver Contributions

This section provides an overview of KiwiSaver calculations and retro pay and discusses how to enter employee KiwiSaver details.

Understanding KiwiSaver Calculations and Retro Pay

Understanding KiwiSaver Calculations and Retro PayKiwiSaver deductions are a fixed percentage of gross pay. To ensure that deductions are taken from retro pay, the system is configured to calculate deductions based on the delivered KIWI AC GROSS accumulator. This accumulator consists of just the NZL GROSS accumulator, which in turn has all regular earnings plus retro earnings.

Therefore, whenever there are retro changes to an employee's earnings, the deltas of the earnings are forwarded, and the KiwiSaver deductions are calculated on the combined gross (current gross + retro earnings).

The result of this configuration is that when a paycheck includes both regular pay and retro pay, there is only one KiwiSaver deduction, which is based on the combined gross. There are not separate KiwiSaver deductions for current earnings and retro earnings.

Page Used to Enter Employee KiwiSaver Details

Page Used to Enter Employee KiwiSaver Details|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPNZ_EE_KIW_DTL |

Global Payroll & Absence Mgmt, Payee Data, Pension Information, Maintain KiwiSaver Details NZL, Maintain KiwiSaver Details NZL |

Enter employee KIWISaver contribution details when employees enroll in the KiwiSaver scheme, opt in, opt out, or elect a contribution holiday. |

Entering Employee KiwiSaver Details

Entering Employee KiwiSaver Details

Access the Maintain KiwiSaver Details NZL page (Global Payroll & Absence Mgmt, Payee Data, Pension Information, Maintain KiwiSaver Details NZL, Maintain KiwiSaver Details NZL).

Kiwisaver Option

Indicate the reason you are entering or updating Kiwisaver details for the employee.

Note. It is your responsibility to verify that employees meets all IRD requirements for enrolling, opting in, opting out, or taking a contribution holiday. The system displays certain warning messages regarding these requirements, but does not verify employee eligibility or prevent you from saving.

|

New Enrollment |

Select this option if the employee is a new hire and satisfies required criteria for automatic enrollment in the KiwiSaver scheme. The effective date for new enrollment should be the employee's hire date. |

|

Opt In |

Select this option when an employee who has not been contributing begins to contribute. Select this option if an employee does not satisfy the automatic enrollment criteria and hence has to be enrolled manually, or if an employee is reenrolling after a contribution holiday. |

|

Opt Out |

Select this option when an employee who has been contributing stops contributions. |

|

Contribution Holiday |

Select this option when an employee who has been contribution takes a contribution holiday (temporarily stops contributing). A contribution holiday row is eventually followed by an opt in row. |

Total Contribution Rate

|

Rate |

Displays the sum of the employee contribution rate and any percentage-based employer contribution rate. |

Employee Contribution Rate

|

Rate |

Employees can choose a contribution rate of either 2%, 4%, or 8%. |

Employer Contribution Rate

|

Employer's Contribution is in addition to the Employee's Contribution |

Select this check box if the employer contribution is in addition to the contribution percentage that the employee chose, or deselect it to indicate that the employer contribution is being used to reduce the amount of the employee contribution. Selecting this check box does not reduce the employee's contribution. Instead, it indicates that the amount entered as the employee contribution rate has already been reduced by the amount of the employer contribution. The system uses this information when validating that the employee contribution meets required minimums. For example, if an employee signs up for a 4% contribution, and the employer is going to share the cost by contributing 2% (so that the employee only ends up contributing 2%), enter an employee contribution rate of 2%, an employer contribution rate of 2%, and deselect this check box. |

|

Rate or Flat Amount |

Enter the employer's contribution as either a percent of salary or as a flat amount. |