Understanding Direct Debit Processing

Understanding Direct Debit Processing

This chapter provides an overview of direct debit processing, lists prerequisites, lists common elements, and discusses how to:

Create and work with direct debits.

Cancel direct debits.

Remit direct debits to the bank.

Review accounting entries and correct errors.

Review direct debits.

Understanding Direct Debit Processing

Understanding Direct Debit Processing

Direct debits are a contractual method for collecting payment and receipts. The vendor and customer set up a contract that enables the vendor to collect an amount due for specific goods or services directly from the customer's bank through electronic funds transfer (EFT). Some banks require a cover letter for the EFT files they receive.

You can set up the direct debit data to require the creation, transmission, and confirmation of a direct debit prenote, which is a zero dollar electronic payment that is sent to the customer's bank to confirm the accuracy of customer's bank information. Prenotes help to eliminate additional processing or handling fees due to the transmission of incorrect customer account information to the customer's bank, and reduce any delays in receivable collections based on direct debit transactions. The Create Direct Debit process (AR_DIRDEBIT) must process and confirm the prenote before it can process any associated direct debit transactions.

This section discusses

Remittance methods

Direct debit process flow

Remittance Methods

Remittance Methods

PeopleSoft Receivables provides two processes to remit direct debits to the bank.

You can generate an EFT file in PeopleSoft Receivables and send it to the bank manually or by using a third-party integration.

You can use the PeopleSoft Cash Management Financial Gateway option to create an EFT file and send it to the bank.

When you create the bank account into which the funds should be deposited, you specify the EFT format layouts to use if the payment method is Direct Debit on the Collection Methods page. You can assign multiple layouts to the bank account, but you must specify the default layout. You specify the remittance method for each layout: Financial Gateway or EFT file (Format EFT). When you create a direct debit profile, the system populates the EFT Layout field with the default layout for the bank that you selected for the profile. You can override the layout with any other layout assigned to the bank account. You can also override the layout when you run the Create Direct Debits Application Engine process (AR_DIRDEBIT) with any layout assigned to the bank. The Create Direct Debit process assigns the remittance method to each direct debit based on the remittance method associated with the EFT file layout on the run control page.

See Also

Understanding the Direct Debit Remit Process

Direct Debit Process Flow

Direct Debit Process FlowPerform the following tasks to create direct debits and send them to the bank for collection:

Run the Create Direct Debits process (AR_DIRDEBIT) to create direct debits and build a worksheet.

If direct debits are set up to require the creation, transmission, and reception of direct debit prenotes, the Create Direct Debit process creates prenotes. These prenotes must be sent to the customers bank and confirmed before the direct debit transactions associated with the prenotes can be processed.

Approve, reject, or hold the direct debits using the direct debit worksheet.

Change the direct debit's status to Remitted on the direct debit worksheet.

Run the Receivable Update process (ARUPDATE) to post the direct debit groups, update the item and customer balances, update item activity, and generate accounting entries.

Warning! When running the Receivable Update process after the Create Direct Debits process, if the Direct Debit Group field is Direct Debit, on the Create Direct Debits page, then the calculation of the direct debit due date must be less than, or equal to, the Receivable Update process run date to close the direct debit. The calculation of the direct debit due date results from the option selected in the Due Date Option field of the Create Direct Debits run control page. If the calculation of the direct debit due date is greater than the Receivable Update process run date, then the direct debit is not closed.

(Optional) Cancel direct debits that have a Remitted status, but have not been submitted to the bank.

If you remit direct debits using the PeopleSoft Cash Management Financial Gateway option, you can cancel the direct debit after you send it to Financial Gateway if the dispatch status is Awaiting Dispatch, Hold, or Error.

Note. You must run the Receivable Update process after you cancel a direct debit. Running this process reverses the accounting entries that the Receivable Update process created for the direct debit and reopens the items in the direct debit.

Remit the direct debit to the bank by running either the Create EFT through FG System Application Engine process (AR_FG_PROC) or the Format EFT Files SQR process (FIN2025).

Note. If you want to automatically run Receivable Update and generate the EFT files when you run the Create Direct Debit process, you can create a job definition to combine the four processes: AR_DIRDEBIT, ARUPDATE, AR_FG_PROC, and FIN2025. You can also run just three processes in one job and omit either the AR_FG_PROC or FIN2025 processes. You must also select the Auto-Remit Direct Debits option on the Create Direct Debits page. The multiprocess job runs all three or four processes for all direct debits to which the Create Direct Debits process assigns the Accepted status.

(Optional) Reconcile the direct debit with the bank statement using the PS_BNK_RCN_DEBIT reconciliation rule.

See Also

Prerequisites

Prerequisites

This section provides the tasks you perform before you process direct debits:

Define direct debit collection information for your bank account to which you will send the EFT files on the Collection Methods page.

Define the customer's bank account information and link it to a remit from customer on the MICR Information - Customer Bank page.

Warning! If you use Financial Gateway to submit EFT files to the bank, you will get an error when you run the Create EFT through FG System process, if you skip this step.

Create the direct debit profiles.

Set up electronic banking if you use Financial Gateway as your remittance method.

Define the direct debit information for customers that pay by direct debits on the Bill To Options page.

Set up automatic numbering for direct debit IDs.

Select DD ID for the number type and DD_ID for the field name.

Define automatic entry types for direct debit processing.

(Optional) Assign a direct debit profile to an entry type.

Define the EFT file layout that you use on the EFT File Layouts page or the Layout Catalog page for Financial Gateway.

(Optional) Set up EFT Reason codes for bank EFT confirmation files.

See Also

Setting Up Automatic Entry Types

Defining Additional Processing Options

Entering Additional Billing, Purchasing, Payment, and Write-Off Options for Bill To Customers

Setting Up Automatic Numbering

Setting Up Common Components for Bank Statement, Payment, and Payment Acknowledgment Processing

Common Elements Used in This Chapter

Common Elements Used in This Chapter|

Displays the status of a direct debit. Values are: Accepted: The direct debit is approved and you can mark it ready for posting and remittance. Complete: The direct debit has completed processing. No Action: The direct debit group has been rejected, and the items in the direct debit will be available for selection the next time you create direct debits. Pending: You either selected the direct debit for edit or it is pending approval due to exceptions. See Maintaining Direct Debit Details. Rejected: All direct debits have been rejected because you have cancelled a direct debit after you changed the status to Remitted. Also, the Receivable Update process changes the status to Rejected if you receive a rejection reason in the bank confirmation file that requires the cancel action. You can select these direct debits again the next time you create direct debits. Remitted: The direct debit is ready to be posted and sent to the bank for collection. |

Creating and Working with Direct Debits

Creating and Working with Direct Debits

This section provides an overview of the Create Direct Debit process and discusses how to:

Create direct debits.

Use the direct debit worksheet to manage direct debits.

Maintain direct debit details.

Understanding the Create Direct Debits Application Engine Process

Understanding the Create Direct Debits Application Engine Process

The Create Direct Debits process (AR_DIRDEBIT) selects the items that match your selection criteria and creates direct debits for them. It creates one direct debit for all open items with the same business unit, currency, and due date for each bill to customer that has a Direct Debit payment method. Each direct debit includes only one item if you selected the One Item Per Direct Debit check box in the direct debit profile.

The process also assigns one of the following statuses to each direct debit:

Accepted: If the direct debit does not have any exceptions, it assigns it the Accepted status, which means that you can remit the direct debit.

Remitted: If you are using the Auto-Remit option for the run request, it assigns direct debits without exceptions the Remitted status, which means that it is ready to post so you can remit it to the bank.

This means that all direct debits for a single run request must be approved before the process will use the Auto-Remit option.

Pending: If the direct debit has exception conditions, it assigns it the Pending status.

The process uses the bank holiday rules defined for the bank account that you assigned to the customer on the Correspondence Options page to adjust the estimated settlement date if it falls on a holiday. You define the bank holiday rules for the bank account on the Collection Methods page.

If you enabled document sequencing, the Create Direct Debit process assigns a document sequence number to the direct debits when it creates them.

The Create Direct Debit process may not process any items for one or more customers and may write a message to the message log indicating that no items were processed for at least one customer. This can occur if all of the following conditions are true:

The Exclude Credit Items check box is not selected on the Direct Debit Profile - Profile page.

The Net Debit/Credit Amounts? check box is selected on the Direct Debit Profile - Profile page.

The Create Negative Direct Debit check box is not selected on the Direct Debit Profile - Profile page.

The total of all credits to be processed for the customer is greater than the total of all debits to be processed for that customer.

Understanding the Set Up and Processing of Direct Debits with Prenotes

Understanding the Set Up and Processing of Direct Debits with Prenotes

A direct debit prenote is a zero dollar electronic payment that is sent to the customer's bank to confirm the accuracy of customer's bank information. Prenotes help to eliminate additional processing or handling fees due to the transmission of incorrect customer account information to the customer's bank, and reduce any delays in receivables collections. After setting up various components to enable prenote processing, the Create Direct Debit Application Engine (AR_DIRDEBIT) process creates the prenote transactions. These prenotes are sent to the customers bank. After receiving confirmation of the prenote information from the bank, any associated direct debit transactions are processed.

If the customer's bank sends a confirmation, the system updates the prenote status to Confirmed and the related Direct Debits are processed the next time that the Create Direct Debits process runs. If the bank does not send a confirmation, after a specified number of days the pending prenote is set to confirmed.

Note. Normally the bank only sends a response if the prenote is incorrect.

You set up various components to enable the creation, transmission, and confirmation of direct debit prenotes. The setup includes these components:

Direct Debit Profile

You can select the Prenote Required check box on the Profile page of the Direct Debit Profile component (Set Up Financials/Supply Chain, Product Related, Receivables, Payments, Direct Debit Profile). You must also select an EFT Layout. The system runs an edit on the EFT Layout that you select to ensure that you selected an EFT Layout that can be used for transmitting direct debit prenotes.

These EFT layouts are used for transmitting direct debit prenotes manually or through third-party integration.

|

EFT File Layout Code |

Description |

Country |

|

BACS |

Use for outbound transmissions. |

United Kingdom |

|

CPA005 |

Use for outbound transmissions. Canada Pay Association. |

Canada |

|

UFF |

Use the Universal File Format for outbound transmissions. |

United States |

|

SEPA |

Use for Single European Payment |

Europe |

These EFT layouts will be used for transmitting direct debit prenotes using the Financial Gateway option in PeopleSoft Cash Management.

|

Format ID |

Format Name |

|

820 ACH |

EDI 820 payment format for ACH |

|

PPD |

NACHA PPD payment format |

|

CCD |

NACHA CCD payment format |

|

CCD+ |

NACHA CCD+ payment format |

|

CTX |

NACHA CTX payment format |

|

PAYMENTEIP |

PeopleSoft XML Format, PAYMENT_DISPATCH EIP Message |

Customer Information Component

You must select Direct Debit as the payment method in the Payment Method Options group box on the Bill To Options page (Customers, Customer Information, General Information) in order for the Prenote for Direct Debit group box to appear on the page. You can select the Prenote Required check box in this group box, select the status of the prenote, enter the number of days required to elapse before the prenote will be automatically confirmed by the system, and select a reason code, if applicable. You can also click a link on this page to view the prenote history. The statuses for a prenote include:

New

When you select the Prenote Required check box, the system automatically updates the status to New. This status indicates that the Create Direct Debit process has not yet been run to create prenotes.

Pending

The Create Direct Debit process creates the prenote and sets the status to Pending. At this stage the prenote has not been sent to the bank. The prenote remains in this status until the prenote is sent, you hear back from the bank, or the prenote is automatically confirmed. Automatic confirmation occurs when the days prior to confirmation have elapsed, which causes the Create Direct Debit process to set the prenote status to Confirmed and processes the direct debit.

Confirmed

The bank notifies you that the Direct Debit account information is correct or the entered time period has elapsed, which enables the Create Direct Debit process to process the direct debit transactions associated with the prenotes.

Rejected

The bank notifies you that the Direct Debit account information is not correct, which prevents the Create Direct Debit process from processing the direct debit transactions associated with the prenotes. These transactions cannot be processed until the account information is corrected and the prenotes are confirmed.

External Accounts Component

You must select Direct Debit as the Payment Method in the Payment Information group box and the Prenote Required check box on the Collection Methods page to enable this bank to receive prenotes (Banking, Bank Accounts, External Accounts) for a selected external bank account. Once you select Direct Debits, an Electronic Layouts grid appears where you can select the EFT Layouts used by this bank.

eBill Payment – My Preferences Component

You select Direct Debit as the Default Payment Method on the My Preferences for eBill Payment page. If the payment method is Direct Debit in the My Preferences for eBill Payment page (eBill Payment, My Preferences), and the prenote status is New, Pending or Rejected, a warning appears to inform the user that direct debit transactions will not be processed until the prenote is confirmed.

Bank Integration Layout Component

You must select the Supports Prenotes check box on the Bank Integration Layout page (Banking, Administer Bank Integration, Bank Integration Layouts) to use PeopleSoft Cash Management Financial Gateway for transmitting prenotes with the selected bank.

Reason Codes Component

PeopleSoft created a new reasontype for prenotes as system data to enable users to define the error messages. PeopleSoft sample data contains these three reason codes for prenotes (Set Up Financials/Supply Chain > Common Definitions > Codes and Auto Numbering > Reason Codes): Reason codes help the user to better describe the reason for prenote status change. The reason codes can be selected on the Bill To Options page (Customers, Customer Information, General Information)

BANKEFT

This reason code indicates that the status was changed by EFT File process.

CREATEDD

This reason code indicates that the status was changed by Create Direct Debits process.

MANUAL

This reason code indicates that the status was changed manually.

See Setting Up Direct Debit Profiles.

See Entering Additional Billing, Purchasing, Payment, and Write-Off Options for Bill To Customers.

See Defining Collection Methods.

See Modifying Default Preferences.

Direct Debit Processing with Prenotes

After setting up for direct debit processing and indicating that prenotes are required, the prenote process flow uses the following steps:

You run the Create Direct Debit process (AR_DIRDEBIT) to create prenotes, which are sent to the customer's bank using one of these methods:

Generate an EFT file in PeopleSoft Receivables and send the prenote to the customer's bank manually, or use a third-party integration.

Send the prenote to the bank automatically using PeopleSoft Cash Management Financial Gateway.

The customer's bank can confirm the prenote using one of these methods:

Manually, through a third party system, or using phone, email, or other means.

Send the prenote back to PeopleSoft Receivables using PeopleSoft Cash Management Financial Gateway.

Allow the specified time set up in PeopleSoft Receivables for the prenote to elapse, which results in an automatic confirmation of the prenote in PeopleSoft Receivables.

The Create Direct Debit process logs a message in the Message Log if it automatically changes the Prenote Status for a customer to Confirmed after the elapse of the specified number of days. The message "(x) Customer(s) automatically updated with a Prenote Status of Confirmed," where X represents the number of customers updated.

Important! The Create Direct Debit process will not pick up the associated direct debit transactions when a prenote is required and not confirmed. The required prenotes must be sent to the bank and confirmed before the direct debit transactions associated with the prenotes can be processed.

Once the prenotes are confirmed, the Create Direct Debit Application Engine process creates the direct debit transactions associated with the confirmed prenotes, and assigns one of the following statuses to each direct debit:

Accepted

If the direct debit does not have any exceptions, the system assigns it a status of Accepted, which means that you can remit the direct debit.

Remitted

If you are using the Auto-Remit option for the run request, it assigns a status of Remitted to direct debits without exceptions. This status indicates that the system is ready to post so you can remit it to the bank.

Important! All direct debits included in a single run request must be approved before the process will use the Auto-Remit option.

Pending

If the direct debit has exception conditions, the system assigns it a status of Pending.

Important! An unconfirmed prenote is not considered an exception condition and will not change the status of the direct debit transaction to Pending. All direct debit transactions with required prenotes must have the prenote confirmed before the direct debit transaction can be processed.

Run the Receivable Update process (ARUPDATE) to post the direct debit groups, update the item and customer balances, update item activity, and generate accounting entries.

Note. ARUPDATE only processes the direct debit transactions and does not process prenotes, because prenotes are not associated with any accounting entries.

Remit the direct debit to the bank by running either the Create EFT through the FGAT System Application Engine process (AR_FG_PROC) or the Format EFT Files SQR process (FIN2025).

Note. When the prenote status is changed either manually by the user or by the Create Direct Debit process, the prenote history is updated.

Once prenotes are processed, an exception report provides a list of direct debit prenotes that failed due to incorrect bank details when an error notification is received from the customer's bank. You can cancel the prenote depending on the status.

The customer record contains information indicating whether a direct debit prenote was sent and the status of the prenote. The customer can view the status of the direct debit by clicking the View Prenote History link on the Bill To Options page (Customers, Customer Information, General Information).

Pages Used to Create and Work with Direct Debits

Pages Used to Create and Work with Direct Debits|

Page Name |

Definition Name |

Navigation |

Usage |

|

DD_REQUEST |

Accounts Receivable, Direct Debits, Administer Direct Debits, Create Direct Debits, Create Direct Debits |

Create direct debits by running the Create Direct Debits process. |

|

|

DD_WORKLIST |

|

Approve, hold, or reject direct debits. Mark the direct debits as ready for remittance to the bank. Create an EFT file for the direct debits on the worksheet. |

|

|

DD_WORKSHEET_SEC |

Click the DD ID(direct debit ID) link for the direct debit on the Worksheet page. |

View or change details about a direct debit, such as the bank account or individual items. |

|

|

Multiple Revenue Line Distribution |

AR_MLR_SEC |

Click the Revenue Distribution link on the Worksheet Detail page. |

Determine how to distribute revenue to control budgets for partial payments when an item has multiple revenue lines. |

|

CUST_BANKINFO_SEC |

Click the Customer Bank Details link on the Worksheet Detail page. |

View the customer's MICR ID. |

|

|

ITEM_XGROUP_SEC |

Click the Item in Other Groups link on the Worksheet Detail page. |

View other worksheet groups in which a direct debit item is selected. This page also displays any pending item groups that are not posted that the item is in. |

|

|

CUST_INFO_SEC |

Click the More Cust Info link on the Worksheet Detail page. |

View customer information. |

|

|

Item Activity |

ITEM_DATA2 |

Click the Item Activity Detail link on the Worksheet Detail page. |

View item activities. |

Creating Direct Debits

Creating Direct Debits

Access the Create Direct Debits page. (Select Accounts Receivable, Direct Debits, Administer Direct Debits, Create Direct Debits, Create Direct Debits.)

Item Selection Criteria

|

Due Date Option |

Select Max Due (maximum due date) to process open items with due dates that are the same as or earlier than the date that you enter. When you select this option, the field that follows becomes Max Due Date (maximum due date). Select Days Prior to process items before the due date. For example, if you enter 10 in the Days Prior to Due Date field, the process selects all items that are due within 10 days from the current date. Warning! If the Direct Debit Group field is Direct Debit, then the calculation of the direct debit due date must be less than, or equal to, the Receivable Update process (ARUPDATE) run date to close the direct debit. The calculation of the direct debit due date results from the option selected in the Due Date Option field of the Create Direct Debit run control page. If the direct debit due date is greater than the Receivable Update process run date, then the direct debit is not closed. |

|

Direct Debit Profile ID |

Select the profile whose processing parameters you want to use. This restricts the selection of open items to those customers who have the same profile. |

|

Direct Debit Group |

Select the direct debit group assigned to the customers whose items you want to process. This restricts the selection of open items to those customers who have the same group. |

|

Auto-Remit Direct Debits |

Select to automatically assign a Remitted status to direct debits with no exceptions. If any of the direct debits that the process creates have exceptions, their status is Pending on the direct debit worksheet. Set the default for this field on the Receivables Definition - Accounting Options 2 page. |

|

Include Items from eBill Payment |

Select to include items from PeopleSoft eBill Payment in this process run. EBill payment items will be selected based on the Payment Date that was set in eBill Payment. To ensure payments are received by the Payment Date of the item, Lead Time will be considered. Lead time represents the number of business days that will be subtracted from the Payment date for an item to determine when the Direct Debit process needs to select that item for payment. |

|

Bank Code and Bank Account |

Enter the bank code and account number where the funds are collected. The system populates the Bank Code and Bank Account fields based on the values in the direct debit profile ID that you select. To send the funds to a different bank account, override the bank information. |

|

EFT Layout Code (electronic file transfer code) |

Enter the EFT layout code used to request the funds. The system populates the layout code from the direct debit profile ID that you select. To use a different layout, override the code. |

|

Settle By |

Displays the remittance method that you assigned to the EFT layout on the Collection Methods page for the bank account. Values are: 01 Financial Gateway: Sends the settlement request to PeopleSoft Cash Management Financial Gateway. Financial Gateway creates the EFT files and submits them to the bank. You receive acknowledgement statuses from Financial Gateway. 02 Format EFT: Generates an EFT file in PeopleSoft Receivables, which you send to the bank manually or through a third-party integration. The Create Direct Debits process assigns the remittance method to each direct debit that it creates. When you run the other direct debit processes, each process checks the Settle By field for the direct debit to determine whether to process the direct debit. |

Prenotes may be required, which are processed using the Create Direct Debit process.

See Add link to Understanding the Set Up and Processing of Direct Debits with Prenotes

Last Run

|

|

When the process is complete, click the Direct Debits button to display the direct debit worksheet number, Last Run On date and time, and status information for the process that was just run. |

Using Direct Debit Worksheets to Manage Direct Debits

Using Direct Debit Worksheets to Manage Direct Debits

Access the Update Direct Debits - Worksheet page. (Select Accounts Receivable, Direct Debits, Administer Direct Debits, Update Direct Debits, Worksheet.)

|

Accounting Date |

The accounting date is set to the current date if you leave the field blank. This field is available only when the worksheet can be remitted; that is, when the status of each direct debit in the worksheet is set to the Accepted value or the No Action value. The system edits the accounting date to ensure it is in an open accounting period. |

Entering Selection Criteria

In the Selection Criteria group box, select the direct debits that you want to display.

|

Status |

Select the status for the direct debits. Options are: Accepted, Complete, No Action, Pending, Rejected, or Remitted. |

|

Exception |

Select all the direct debits or only those that have the specified exception condition. |

|

DR/CR (debit or credit) |

Select :

|

|

Direct Debit Amounts >= (direct debit amounts greater than or equal to) |

Enter a direct debit amount value. When you click the Change Criteria icon, the system displays the direct debits that have an amount greater than or equal to this specified amount. |

|

|

Click the Change Criteria button to update the list of direct debits based on your new selection criteria. |

Use the following buttons to act on individual direct debits.

|

|

Click the Select All button to select all displayed direct debits on the worksheet (select all check boxes). If you prefer, you can select individual direct debits by selecting the check box to the right of each direct debit. This option works only in conjunction with the Approve and Reject buttons. |

|

|

Click the Approve button to approve all selected direct debits. The system changes their status to Accepted. |

|

|

Click the Reject button to reject all selected directs debits. This means that the associated items will be available for selection the next time you create direct debits. The system changes their status to No Action. |

Use the following buttons to act on the entire worksheet. You cannot use these buttons to work on individual direct debits.

|

|

Click the Remit to Bank button to mark all approved direct debits with a Remitted status. This means that the direct debits are ready to be posted and remitted to the bank. This button is available only when the status of all the direct debits in the worksheet is either Accepted or No Action. None of the direct debits can have a Pending Acceptance status. Note. You must run Receivable Update before you can create the EFT file and remit it to the bank. |

|

|

Click the EFT button to generate an EFT file. See Generating an EFT File for Direct Debits on a Worksheet. |

|

|

Click the Print button to run the Remittance Advice report using Crystal Reports. |

Note. None of the options on the worksheet are available while the Receivable Update process is processing the direct debits. To determine whether it is processing the direct debits, view the DD Control (direct debit control) page for the direct debit group. It displays the message, In Progress if the Receivable Update process is currently processing the group.

Maintaining Direct Debit Details

Maintaining Direct Debit Details

Access the Worksheet Detail page. (Click theDD ID (direct debit ID) link for a direct debit on the Update Direct Debits - Worksheet page.)

Use the information at the top of the page to view or change details about the direct debit.

|

Bank and Account |

Displays the bank account where the funds are deposited. |

|

Due Date |

Displays the date that the funds should be deposited in your organization's bank account. Override the date if needed. |

|

MICR ID (magnetic ink character recognition ID) |

Displays the MICR ID associated with the customers bank account from which the funds are withdrawn. Change the ID to another account if needed. |

|

Revenue Distribution |

Click to access the Multiple Revenue Line Distribution page where you distribute revenue to control budgets for partial payments when an item has multiple revenue lines. See Distributing Amounts for Multiple Revenue Lines for Control Budgets. |

|

Document Sequencing |

Click to view document sequencing information. |

|

Customer Bank Details |

Click to view or change information about the customer's bank account (identified by the MICR ID). |

|

|

Click the Edit button to change information for the direct debit. The status on the Worksheet page changes to Pending. The fields on the Worksheet Detail page become available to edit. |

|

Sel (select) |

Remove items from the direct debit by clearing their check boxes. When you deselect an item, the total amount of the direct debit decreases and the item is available for selection in another direct debit request. |

|

Item Balance |

To partially pay for an item, change the amount to the amount you want to pay. This decreases the amount of the direct debit. The Receivable Update process adjusts the balance for the item when you post the direct debit group, and the remaining balance of the item will be available for selection in another direct debit request. |

|

Event |

Enter the entry event code to generate the appropriate supplemental accounting entries for the item activities. Federal financial systems require supplemental accounting entries. |

After you make changes, select another action by clicking one of the following buttons. This changes the status of the direct debit on the Worksheet page.

|

|

Click the Approve button to change the direct debit's status to Accepted. |

|

|

Click the Reject button to reject the direct debit and change its status to No Action. The items in the direct debit will be available for selection in another direct debit request. |

|

|

Click the Hold button to put the direct debit On Hold. The status on the Worksheet page remains Pending. If you put a direct debit on hold, you cannot change the status to Remitted. You must first approve the direct debit. |

If the direct debit has exceptions, the Exceptions group box appears and displays a list of all the exceptions that apply to the direct debit. The exceptions can be any of the following:

|

C (exceeds credit approval limit) |

The amount of the direct credit exceeds the amount of the credit approval limit for the direct debit profile that you used to create the direct credit. You can:

|

|

D (exceeds debit approval limit) |

The amount of the direct debit exceeds the amount of the debit approval limit for the direct debit profile that you used to create the direct debit. You can:

|

|

F (foreign currency) |

The currency for the direct debit is different than the currency of the bank to which you are remitting it. You can:

|

|

N (due date within notice period) |

The number of days between the invoice date (as of date) and the due date for the items in the direct debit is less than the agreed upon number of days for direct debit notice period that you specified for the bank on the Collection Methods page. You can:

|

|

P (missing customer bank details) |

You did not define the bank details for the customer in the Customer Bank page. You can:

|

See Also

Using Document Sequencing in PeopleSoft Receivables

Cancelling Direct Debits

Cancelling Direct Debits

This section provides an overview or direct debit cancellations and discusses how to select and cancel direct debits.

Understanding Direct Debit Cancellations

Understanding Direct Debit CancellationsThe timing of direct debits cancellations depends on which remittance method that you use. In both cases, you can cancel the direct debit after you mark the direct debit as ready to remit on the direct debit worksheet and run the Receivable Update process. If you remit direct debits by generating an EFT file in PeopleSoft Receivables, you must cancel the direct debit before you generate the EFT file.

If you remit direct debits using PeopleSoft Cash Management Financial Gateway, you can cancel the direct debit after you run the Create EFT Through FG System process as long as the dispatch status is Awaiting Dispatch, Error, or Flagged for Hold. You can cancel a completed direct debit, if the dispatch status is Error.

If you remitted the direct debit through Financial Gateway and you cancel the direct debit, the system triggers the Payment Cancellation message (PAYMENT_CANCEL) to notify Financial Gateway. You must save the page to trigger the message. Financial Gateway returns an acknowledgement message in real time. When you refresh the page, the status changes to Canceled.

Note. If there is a problem with cancelling the direct debit in Financial Gateway, the status changes to Error. Click the Transaction ID link to determine the reason for the error. Then try to cancel the direct debit again.

After you cancel a direct debit, you run the Receivable Update process. This changes the status of the direct debit to Rejected, reopens the items included in the direct debit, and creates accounting entries to reverse the accounting entries that the process created when you posted the direct debit group.

Note. If you cancel a direct debit prenote, the prenote status is reset to New and a new prenote is generated during the next run of the Create Direct Debit process.

Pages Used to Cancel Direct Debits

Pages Used to Cancel Direct Debits|

Page Name |

Definition Name |

Navigation |

Usage |

|

DD_CANCEL |

Accounts Receivable, Direct Debits, Administer Direct Debits, Cancel Direct Debits, Cancel Direct Debits |

Cancel a direct debit. |

|

|

Review Payment Details |

PMT_LIFE_CYCLE_INQ |

Click the Transaction ID link on the Cancel Direct Debits page. |

Review the history of the direct debit processing in Financial Gateway and all the settlement details. |

Selecting and Cancelling Direct Debits

Selecting and Cancelling Direct DebitsAccess the Cancel Direct Debits page. (Select Accounts Receivable, Direct Debits, Administer Direct Debits, Cancel Direct Debits, Cancel Direct Debits.)

If the direct debit does not have a remitted status, you cannot cancel it using this page. Instead, you can reject it on the direct debit worksheet page.

|

Cancel |

Select the direct debits that you want to cancel. |

|

Reason |

Indicate why the direct debit must be canceled. |

|

Event |

Enter the entry event code to generate the appropriate supplemental accounting entries for the cancel activity for the item in the direct debit. Federal financial systems require supplemental accounting entries. |

|

Acctg Date (accounting date) |

Enter the accounting date. If you leave this field blank, the system uses the current date as the accounting date. Often, the cancellation date (the date the bank rejects the direct deposit) is different from the current date. |

|

Transaction ID |

Displays the ID assigned to the direct debit by Financial Gateway. Click to access the Review Payment Details page, where you view all the details about the direct debit settlement and the history of the settlement processing by Financial Gateway. |

|

Dispatch Status |

Displays the status of the direct debit settlement in Financial Gateway. You can only cancel payments with these status: Error, Flagged for Hold, or Awaiting Dispatch. After you save and refresh the page, the status changes to Canceled. |

Remitting Direct Debits to the Bank

Remitting Direct Debits to the Bank

This section provides an overview of the direct debit remit process and discusses how to:

Enter override options for the Format EFT File process.

Generate an EFT file for direct debits on a worksheet.

Generate an EFT file for all direct debits.

Generate a cover sheet for an EFT file.

Cancel an EFT file.

Receive confirmation from the bank EFT file.

Correct direct debits not matched in the bank EFT file.

Run the EFT Direct Debit Inbound Exception report (AR3750X).

Email the direct debit remittance advice

Understanding the Direct Debit Remit Process

Understanding the Direct Debit Remit Process

When you remit direct debits to the bank, you run one or more processes to generate the EFT files. The process that you run depends on your setup. If you selected the Send to Financial Gateway check box for an EFT file layout on the Collection Methods page for the bank, you run the Create EFT through FG System process. Otherwise, you run the Format EFT Files process.

Note. When you run the Create Direct Debit process, it checks to see what EFT process type was assigned to the file layout that you entered on the run control page and updates the Settle By field on the Direct Debit Control record (DD_CONTROL) with the EFT process type used to generate the EFT file. The Format EFT File process and Create EFT through FG System process each check the Settle By field to determine whether it should process a direct debit.

Format EFT File Process

When you run the Format EFT File process to generate the EFT file in PeopleSoft Receivables, you must either manually submit the EFT file to the bank or use a third-party integration to submit it. You can optionally generate a cover letter for each EFT file if one is required by the customer's bank.

This diagram shows the process flow when you generate the EFT file in PeopleSoft Receivables, submit it to your organization's bank, which sends it to your customer's bank who sends the payment back to the bank again.

Process for EFT files generated in Receivables

If an EFT file has an error or if the bank rejected the file, you can cancel the EFT file and generate it again. If you do not regenerate the EFT file, you must cancel the direct debit.

Create EFT Through FG System Process

When you run the Create EFT through FG System (create electronic file through Financial Gateway process) process, PeopleSoft Cash Management Financial Gateway generates the EFT file and sends the file to the bank. The Create EFT through FG System process triggers the Payment Request message (PAYMENT_REQUEST) and sends a message containing direct debits to Financial Gateway. Financial Gateway generates the EFT file and submits it to the bank the next time you run the Payment Dispatch process (PMT_DISPATCH or PMT_DISP_BT).

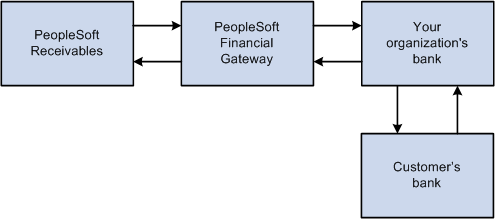

This diagram shows the flow of the direct debit transaction if you select PeopleSoft Cash Management Financial Gateway to remit direct debits. PeopleSoft Receivables sends the direct debit transaction to PeopleSoft Financial Gateway, which sends it to your organization's bank, which sends it to the customer's bank. The customer's bank sends a payment to your organization's bank which sends it to Financial Gateway, which updates PeopleSoft Receivables.

Process for EFT files generated in Financial Gateway

Check the message log for the Create EFT through FG System process to verify that the process completed successfully and sent a message for each direct debit. If it did not complete successfully, determine what the problem is and rerun the process.

When Financial Gateway receives the message, it sends a Payment Acknowledgement message (PAYMENT_RESPONSE) for each direct debit and assigns each direct debit a transaction ID. The message contains the transaction ID and the dispatch status. When PeopleSoft Receivables receives the Payment Acknowledgement message, it adds the transaction ID and the dispatch status to the Direct Debit Control record for each direct debit. Initially the status is either Error or Awaiting Dispatch. If you want to be notified when there is an error, you can set up event notification for Financial Gateway. Note that the event notification is set up for one person or one role per event and each time that event occurs the person or people associated with the role are notified. So, they will receive notification when the error event occurs in PeopleSoft Cash Management and PeopleSoft Payables too.

If you want to monitor the dispatch status of direct debits sent to Financial Gateway in PeopleSoft Receivables, use the DD Control page. You can drill down to view the details and history of the settlement in Financial Gateway from the page. Financial Gateway sends a Payment Acknowledgement message each time the dispatch status for the direct debit (settlement) changes in Financial Gateway. The status changes that Financial Gateway sends to PeopleSoft Receivables are:

Awaiting Dispatch: The settlement is waiting to be sent to the bank in Financial Gateway.

Flagged for Hold: Someone put the settlement on hold in Financial Gateway.

Dispatched to Bank: Financial Gateway sent the EFT file to the bank.

Received by Bank: The bank sent a message indicating that it received the EFT file.

Paid: The bank sent a message indicating that the funds were collected for the direct debit. If the transaction corresponds to a Direct Debit prenote, then the prenote status is set to confirmed.

Error: The bank cannot pay the direct debit due to insufficient funds or another reason, or there is a problem processing the settlement request in Financial Gateway.

Use the DD Control page to access the error details for the direct debit in Financial Gateway. If the transaction corresponds to a Direct Debit prenote, then the prenote status is set to rejected.

Canceled: You cancelled the direct debit in PeopleSoft Receivables and the settlement is cancelled in Financial Gateway.

If Financial Gateway sends a message that indicates the direct debit is in error, cancel the direct debit. Cancelling the direct debit, changes the status to Rejected. You must run the Receivable Update process to reopen the items in the direct debit and reverse the accounting entries. Then you correct the problem that caused the error, and create the direct debit again, approve it, and remit it again.

Important! PeopleSoft Receivables does not update the cash account when it receives a message from PeopleSoft Financial Gateway that the direct debit is paid. The cash account is updated when you run the Receivable Update process on the due date. If you use the Cash Clearing option for a bank, PeopleSoft Receivables updates the Cash account on either the due date or when you run bank reconciliation depending on the cash control method that you use.

See Working with Payments in Financial Gateway.

Bank Collection Confirmation Receipts

Some banks send an EFT file to confirm the collection of the payment. If banks send confirmation EFT files, you perform these tasks:

Run the AR_DD_BNK Application Engine process to receive the bank EFT file that indicates whether the payments were collected.

Correct the payment records from a bank EFT file that do not match direct debits on the system to enable them to match existing direct debits.

Run the EFT Direct Debit Inbound Exception report to obtain a list of direct debits in the bank EFT file that failed collection due to incorrect bank details. You can run this report only if you received a bank EFT file.

You correct the bank details for the customer on the MICR Information - Customer Bank page and then approve and remit the direct debit again.

Remittance Advice Email

PeopleSoft Receivables provides the ability to deliver direct debit (DD) remittance advice information to customer contacts through e-mail. Depending on customer contact and direct debit profile setup, you can notify a customer contact that they have instructed their bank to withdraw money from their bank account.

Follow these steps to setup and email the remittance advice:

When setting up the direct debit profile, select the Email Notify option on the Direct Debit Profile page.

When setting up the customer:

The primary address location and the contact are used to select the contact email where the remittance advice is sent on the Correspondence Options page.

On the Bill To Options page, the Payment Method field value must be DD (direct deposit) and the Direct Debit Profile ID field value must be one that has the Email Notify option selected.

When setting up the customer contact:

The contact must have the Primary Bill To option selected on the Contact Customer page.

The Email ID field for the contact must have a valid Email address on the Contact page.

The Document Code field value must be PRAD and the Preferred Communication field value must be E-mail only on the Contact Additional Information page.

Note. Only the contacts for the primary bill to customer receives an email for the remittance advice. Non-primary bill to contacts do not receive an email even if they have a document code of PRAD and a preferred communication of E-mail only.

The remittance advice email is sent:

Through the Financial Gateway.

The Financial Gateway automatically creates email notifications for the direct debit transactions that go through the Financial Gateway, immediately after the bank returns a positive message to the Financial Gateway that confirms the receipt of the transaction.

The AR_FG_PROC message sends a payment request for direct debits to the Financial Gateway. This is an asynchronous message.

Through the Email Advice process (AR_EMAIL_ADV).

Use the Email Advice process to email a direct debit remittance advice that is related to the direct debit transactions that are not processed through the Financial Gateway. For example, you only need to send a direct debit remittance advice email through this run control page for the direct debit transactions that are created by the EFT SQR programs such as FIN2025.

Pages Used to Remit Direct Debits to the Bank

Pages Used to Remit Direct Debits to the Bank|

Page Name |

Definition Name |

Navigation |

Usage |

|

PRCSDEFNOVRD |

PeopleTools, Process Scheduler, Processes, Override Options |

Enter override options for the Format EFT File process. |

|

|

DD_WORKLIST |

Accounts Receivable, Direct Debits, Administer Direct Debits, Update Direct Debits, Worksheet |

Create an EFT file for the direct debits on the worksheet. |

|

|

RUN_FIN2025_DD |

Accounts Receivable, Direct Debits, Remit to Bank, Create EFT File, EFT File Parameters |

Create an EFT file for all direct debits associated with a business unit that have a remitted status. Run the Format EFT Files process and the Create EFT through FG System process. |

|

|

RUN_FIN2025 |

Accounts Receivable, Direct Debits, Remit to Bank, Create Cover Sheet, Create EFT File Cover Sheet |

Creates a cover letter for the EFT files that you created by running the Format EFT Files process. (Some banks require cover letters. When you define the EFT layout, you need to indicate if you need a cover letter.) |

|

|

DD_EFT_CANCEL |

Accounts Receivable, Direct Debits, Remit to Bank, Cancel EFT Files, Cancel EFT File page |

Cancel an EFT file that you created by running the Format EFT File process, if it has an error or has been rejected by the bank. |

|

|

EFT_DD_INBOUND |

Accounts Receivable, Direct Debits, Remit to Bank, Receive Bank EFT File, Receive Bank EFT File |

Run the AR_DD_BNK process to load and process the bank EFT file. |

|

|

DD_IN_BANK_FILE |

Accounts Receivable, Direct Debits, Remit to Bank, Receive Bank Confirmation, Inbound Bank File for Direct Debits |

Change details for a payment record in a bank EFT file so that the record matches an existing direct debit. |

|

|

DD_IN_BANK_SEC |

Click the Details link on the Inbound Bank File for Direct Debits page. |

View bank details for the issuer and the customer for a direct debit that was not collected. |

|

|

EFT_DD_EXCEPT |

Accounts Receivable, Direct Debits, Remit to Bank, Bank Remit Exception Report, Bank Remit Exception Report |

Enter run parameters for the EFT Direct Debit Inbound Exception report (AR3750X). Use the report to see a list of direct debits that were uncollected for a specific reason. |

|

|

Email Remittance Adv (advice) |

RUN_AR_EMAIL_ADV |

Accounts Receivable, Direct Debits, Remit to Bank, Email Remittance Advice |

Email the direct debit remittance advice. Use this run control page to email a remittance advice that are created by EFT SQRs. |

Entering Override Options for the Format EFT File Process

Entering Override Options for the Format EFT File ProcessAccess the Override Options page (PeopleTools, Process Scheduler, Processes, Override Options).

If you run PeopleSoft Receivables on a DB2 database on a Windows NT or OS390 server, you must manually insert an owner ID parameter in the list of parameters for the process definition before you can run the Format EFT Files process.

|

Parameters List |

Enter Prepend. |

|

Parameters |

In the Parameters field next to the Parameters List field, enter %%OWNERID%% :EFT_WRK_PARM1 as shown in the example above. Note that there is a space between the owner ID parameter ( %%OWNERID%%) and :EFT_WRK_PARM1. |

Generating an EFT File for Direct Debits on a Worksheet

Generating an EFT File for Direct Debits on a Worksheet

Access the Update Direct Debits - Worksheet page. (Select Accounts Receivable, Direct Debits, Administer Direct Debits, Update Direct Debits, Worksheet.)

Generating an EFT File for All Direct Debits

Generating an EFT File for All Direct Debits

Access the Create EFT File page. (Select Accounts Receivable, Direct Debits, Remit to Bank, Create EFT File, EFT File Parameters.)

Run the processes to remit all direct debits associated with the selected business unit that have a remitted status and have been posted, but not submitted to the bank. Select one or both processes on the Process Scheduler Request page:

The Create EFT through FG System process sends the PAYMENT_REQUEST message to Financial Gateway to create and send the EFT file for all direct debits that have 01 Financial Gateway in the Settle By field.

The Format EFT Files process creates EFT files for all direct debits that have 02 Format EFT in the Settle By field.

Note. If any direct debits in the business unit have a remitted status, but have not been posted, you cannot run the process until you run the Receivable Update process.

When the Format EFT Files process completes, the location of the file varies depending on your Output Destination Options in the process definition for FIN2025.

If the output destination is user defined, the location varies, depending on the parameters you enter on the Process Scheduler Request page. The following table shows the user-defined options:

|

Output Type |

Output Destination |

Location of EFT File |

|

Web |

N/A |

Location you defined for the {FILEPREFIX} variable for SETENV.SQC in %PS_HOME%\sqr\. |

|

File |

Blank |

Location you defined for the {FILEPREFIX} variable for SETENV.SQC in %PS_HOME%\sqr\. |

|

File |

Path to folder |

Folder that you specify, such as C:\temp\EFT files\. |

If the output destination for the FIN2025 process definition is Process Definition, the location will always be in the folder that you define for the Output Definition for the process definition.

If the output destination for the FIN2025 process definition is Process Type Definition, the location will always be in the folder that you define for the output definition for the SQR process type definition.

Generating a Cover Sheet for an EFT File

Generating a Cover Sheet for an EFT File

Access the Create EFT File Cover Sheet page. (Select Accounts Receivable, Direct Debits, Remit to Bank, Create Cover Sheet, Create EFT File Cover Sheet.)

|

Language Option |

Click the Specified Language button or the Recipient's Language button and then select the Language Code. that will be used on this EFT file cover sheet page. |

|

EFT Layout Code (electronic file transfer layout code) |

Enter the code for the type of EFT file to use to submit the direct debit. |

|

Process Instance |

Enter the number of the process instance that was generated when the system created the EFT file. |

Cancelling an EFT File

Cancelling an EFT File

Access the Cancel EFT File page. (Select Accounts Receivable, Direct Debits, Remit to Bank, Cancel EFT Files, Cancel EFT File.)

Enter the Process Instance number associated with the EFT file that you want to cancel.

Receiving Confirmation from the Bank EFT File

Receiving Confirmation from the Bank EFT File

Access the Receive Bank EFT File page. (Select Accounts Receivable, Direct Debits, Remit to Bank, Receive Bank EFT File, Receive Bank EFT File.)

Enter the EFT Layout Code and the File Name for the EFT file for which you are trying to determine whether the payment collection was successful.

If the payment collection was not successful, the DD_AR_BANK process changes the status of the direct debit to Rejected on the Direct Debit Control record. The next time you run the Receivable Update process, it generates the appropriate accounting entries to reverse the payment and reopens the items that were in the direct debit.

Correcting Direct Debits Not Matched in the Bank EFT File

Correcting Direct Debits Not Matched in the Bank EFT File

Access the Inbound Bank EFT File for Direct Debits page. (Select Accounts Receivable, Direct Debits, Remit to Bank, Receive Bank Confirmation, Inbound Bank File for Direct Debits.)

The EFT Transactions grid contains a list of payment records that were in the bank EFT file that the AR_DD_BANK process could not match to direct debits in the system. You need to determine which direct debit in the system matches a payment record and update the information so that it matches a direct debit. When you save the page, the system changes the status of the direct debit based on the reason code assigned to the payment record.

|

Unit or DD ID (direct debit ID) |

Enter the business unit or direct debit ID of the direct debit on the system that matches the payment record. |

|

Reason Code |

If the reason code on the payment record does not match a reason code on your system, change the code to match the appropriate code defined on your system. |

See Also

Setting Up EFT Reason Codes for Direct Debits

Running the EFT Direct Debit Inbound Exception Report (AR3750X)

Running the EFT Direct Debit Inbound Exception Report (AR3750X)

Access the Bank Remit Exception Report page. (Select Accounts Receivable, Direct Debits, Remit to Bank, Bank Remit Exception Report, Bank Remit Exception Report.)

|

EFT Layout Code |

Enter the EFT file layout code for the EFT files that you submitted to the bank whose exceptions you want to include in the report. |

|

Reason Code |

Enter the code that identifies the reason why the collection failed. |

Note. If prenotes are required, the EFT Direct Debit Inbound Exception Report (AR3750X) displays a Prenote column, which indicates whether the transaction is a direct debit prenote.

Emailing The Direct Debit Remittance Advice

Emailing The Direct Debit Remittance AdviceAccess the Email Remittance Adv (advice) page (Accounts Receivable, Direct Debits, Remit to Bank, Email Remittance Advice).

Remittance advice emails for direct debits are typically sent through the Financial Gateway. The Email Advice process (AR_EMAIL_ADV ) is used to email a remittance advice that is not processed through the Financial Gateway and that is created by EFT SQR programs such as FIN2025.

The Remittance Post Date and Unit (business unit) fields are required.

Reviewing Accounting Entries and Correcting Errors

Reviewing Accounting Entries and Correcting Errors

After you run the Receivable Update process, you need to review the direct debit accounting entries and correct any errors that the system found on the error correction pages. The system edits for ChartField combination errors if you enabled ChartField combination editing on the Receivables Options - General 2 page for the business unit. You cannot post the direct debit until you fix the error if you selected Recycle in the ChartField Editing group box. If the system found ChartField combination errors perform these steps:

Delete the entries using the error correction pages.

Modify the combination edit rules so the combination is valid or modify the ChartField combination on the External Account page for the bank account if the error is on the Cash or Cash Control line.

Rerun the Receivable Update process.

The date that the cash account is debited depends on your PeopleSoft Receivables installation options and your bank account setup.

If you do not use cash control accounting, the process debits the Cash account when you remit the direct debit.

If you do use cash control accounting and you have identified the bank account as a cash-clearing account, the date that the cash will be recognized depends on whether you specified Due Date or Bank Reconciliation for the cash-clearing method. The Receivable Update process debits the Cash Control account when you remit the direct debit. Then it credits the Cash Control account and debits the Cash account based on your clearing method.

See Also

Reviewing Direct Debits

Reviewing Direct Debits

As you work with direct debits, you can use the inquiry pages to look up information about a single direct debit or all the direct debits created for a business unit.

This section discusses how to review direct debit control information.

Pages Used to Inquire on Direct Debits

Pages Used to Inquire on Direct Debits|

Page Name |

Definition Name |

Navigation |

Usage |

|

DD_CONTROL_DSP |

Accounts Receivable, Direct Debits, Review Direct Debits, All Direct Debits, DD Control |

View control information, such as the direct debit status, customer information, and the posting details. |

|

|

DD_ITEM_DSP |

Accounts Receivable, Direct Debits, Review Direct Debits, All Direct Debits, DD Items |

View basic information about each item in a direct debit. |

|

|

DD_INQUIRY |

Accounts Receivable, Direct Debits, Review Direct Debits, Direct Debit by Unit, Direct Debits by Unit |

View direct debits created for a business unit. |

|

|

ITEM_MAINTAIN |

Click an Item ID link on the DD Items page. |

Change and review information about items, with the exception of customer balance. |

Reviewing Direct Debit Control Information

Reviewing Direct Debit Control InformationAccess the DD Control page (Accounts Receivable, Direct Debits, Review Direct Debits, All Direct Debits, DD Control)..

|

Cancel Reason |

Displays the reason that a direct debit is cancelled. This field appears only if the direct debit is cancelled. |

|

Description and Account # (account number) |

Displays the bank account where the funds are deposited. |

|

MICR ID |

Displays the MICR ID of the bank from which the funds are withdrawn. |

|

Clearing |

Displays the cash clearing method used by the bank that receives the remitted direct debit: Due Date or Bank Reconciliation. This determines when the Receivable Update process creates the accounting entries to debit the Cash account and credit the Cash Control account. |

|

Transaction ID |

Displays the ID assigned to the direct debit by PeopleSoft Cash Management Financial Gateway. Click to access the Review Payment Details page where you view all the details about the direct debit settlement and the history of the settlement processing by Financial Gateway. This is very useful when you want to see the reason that the settlement is in error or why the settlement was put on hold in Financial Gateway. |

|

Displays the status of the payment in Financial Gateway. Values are: Awaiting Dispatch: Indicates that Financial Gateway received the PAYMENT_REQUEST message and assigned a dispatch status to the direct debit. Paid: Indicates that the bank has collected the funds from your customer's bank. Error: Indicates that Financial Gateway received the PAYMENT_REQUEST message, but there is a problem processing the direct debit. Click the Transaction ID link to determine what the problem is. Canceled: Indicates that you cancelled the direct debits in PeopleSoft Receivables. Flagged for Hold: Indicates that Financial Gateway is not currently processing the direct debit. Click the Transaction ID link to view the reason for the hold. Dispatched to Bank: Indicates that Financial Gateway sent the payment request to your organization's bank. Received by Bank: Indicates that your organization's bank received the payment request. |

Note. The Transaction ID and Dispatch Status fields display only if you submitted the payment request through Financial Gateway.