Understanding Average Balance Calculation

Understanding Average Balance Calculation

This chapter provides an overview of average balance calculation and discusses how to:

Prepare your system for average daily balancing (ADB).

Process average daily balances.

Produce average daily balance reports.

Understanding Average Balance Calculation

Understanding Average Balance Calculation

This section lists prerequisites, common elements and discusses:

Average daily balance setup.

Summary of capabilities.

Ledgers used by ADB.

Average balance calculations.

How ADB determines calculation method.

Incremental calculations.

Ad hoc calculations.

Adjustments in ADB.

Journal adjustments (998, 901, 902...) in ADB.

Management and regulatory ADB reporting.

Prerequisites

Prerequisites

Perform activities to set up ADB for the detail ledger that will be used to maintain the standard balances and daily balances when calculating the averages.

Before you can use the ADB feature, you must set up your business units and ledgers for ADB processing:

|

Setup |

Navigation |

What |

|

Business units |

Setup Financials/Supply Chain, Business Unit Related, General Ledger, General Ledger Definition |

Set up the business units for which you want to calculate average daily balances. Select the ADB Incremental Calculation Method link on the General Ledger Business Unit Definition page, and select the definitions that you run regularly (using the incremental calculation method) for this business unit. |

|

Detail ledgers |

General Ledger, Ledgers, Detail Ledger |

Set up these ADB detail ledgers:

|

|

Ledger groups |

General Ledger, Ledgers, Ledger Group |

Set up these ADB ledger groups:

Associate the ledger group with one of the ADB templates. |

|

ADB templates |

General Ledger, Ledgers, Templates Select each of these PeopleSoft ADB target ledger templates:

|

The ADB process determines where to store the calculated averages using the table defined in Record (Table) Name field on this template. Create a unique template for each unique table name depending on where you want to store the averages. For example, if you want to store all the averages to one table, you need only one template. To set up the template, select ADB Reporting Ledger in the Default Ledger Type field and click the button to select the default table names. You can accept the default table or choose another ADB target ledger table. |

|

Set Up Financials/Supply Chain, Business Unit Related, General Ledger, Ledgers For A Unit − Definition |

|

|

|

Set Up Financials/Supply Chain, Business Unit Related, General Ledger, Ledgers For A Unit − Definition Add the ADB ledger group to the business unit. This is where the ADB calculation process looks to determine what ledger group and ledger to use when calculating the averages. |

The calendar that you select determines how the average balances are stored. If you select a monthly calendar, for example, the current period reflects today's averages (or the day ADB was processed in the current month) and the prior period reflects the month-end average balances. Note. Do not selectReport Average Balances or any other ADB-related fields for these ADB target detail ledgers that you attach to a business unit in the Ledgers For a Unit component. |

Common Elements Used in This Chapter

Common Elements Used in This Chapter|

Target ADB Ledger (target average daily balance ledger) |

Stores the average balances. The detail ledger must be a different ledger. |

|

Incremental Method |

Indicates the method of calculating ADB that uses prior period calculated averages and daily balances to calculate the requested periods' averages. This is a more efficient processing method than the ad hoc method. |

|

Ad Hoc Method |

Indicates the method of calculating ADB that uses the daily ledger balances to calculate the requested periods' averages. This method uses more system resources than the incremental method. |

|

ADB (average daily balance) |

Average Daily Balance. |

|

Period Type |

Defines the time period for the ADB calculation (month to date, year to date). |

Average Daily Balance Setup

Average Daily Balance SetupAfter you complete the ADB prerequisites, you must perform the following activities before you can process average balances for a business unit:

Define the interrelationship of ledgers and ChartFields used in ADB on the ADB Definition page:

Define the ledgers and amount fields to be used in the ADB calculations and the interrelationship between the ADB ledger and target ADB ledger's amount fields (Definition page).

Define the ChartField and value that is used to store the ADB rounding adjustment (Rounding Adjustment page).

Define the association between the ADB and target ADB ledgers' ChartFields (ChartFields page).

Select the ADB Incremental Calculation Method link on the General Ledger Business Unit Definition page and select the definitions that you run regularly (using the incremental calculation method) for this business unit.

Access the ADB Process Request page to run the ADB Calculation process (GL_ADB_CALCX).

See Pages Used to Set Up Average Balances.

Summary of Capabilities

Summary of CapabilitiesThe Calculating Average Balances feature enables you to report your organization's financial position using average, rather than period-end, balances. You can:

Select which ChartField values are included in average balances.

Select the time periods for ADB calculations from month-to-date, quarter-to-date, and year-to-date options—or define your own time periods.

Report prior day and current average balances.

Summarize ADB target ledgers for summary ledgers.

Ledgers Used by ADB

Ledgers Used by ADBThere are two ledgers involved in ADB processing: the ADB ledger and the target ADB ledger.

The source ADB ledger (also known as the ADB ledger) stores the daily ledger activity that is used by the ADB process to calculate the average daily balances.

The target ADB ledger stores the calculated averages from the ADB process.

You can have as many target ADB ledgers as you need.

This design has several advantages:

Flexibility to maintain the average balances in different ledger tables:

Partition your averages to different target ledger tables, such as period type (MTD—month-to-date, YTD—year-to-date, and QTD—quarter-to-date), which can improve processing performance.

You can maintain all the averages in a single table.

Flexibility to define a calendar ID to maintain the calculated average daily balance history:

To maintain month-end balances, use only the monthly calendar ID, which represents the current day's averages.

To maintain daily balances, use the daily calendar ID.

See Also

Average Balance Calculations

Average Balance CalculationsChoose either the incremental or the ad hoc calculation method.

ADB uses either the incremental method or the ad hoc method to calculate average balances. This table summarizes the differences between the two methods:

|

Incremental |

Ad hoc |

|

Uses prior period stored aggregate balances and daily balances to calculate the requested periods' averages. |

Uses the daily ledger balances to calculate the requested periods' averages. |

|

Results in more efficient processing. |

Uses more system resources. |

How ADB Determines Calculation Method

How ADB Determines Calculation Method

By default, the ADB Calculation process uses the ad hoc method to calculate average balances.

In order to use the incremental calculation, you must define the ADB definitions and period type on the General Ledger Definition − Incremental Calculation Method page. Here's how period types relate to the ADB definition on that page:

|

ADB Definition |

Period Type |

|

Actuals MTD Averages |

MTD (month to date) |

|

Actuals QTD Averages |

QTD (quarter to date) |

|

Actuals YTD Averages |

YTD (year to date) |

In the sections that follow, there are examples of how these period types are used in calculations.

Incremental Calculations

Incremental Calculations

Incremental calculations are the most efficient way to calculate average balances. Each time that the system processes ADB calculations, it extracts only the daily balances that have been posted since the last time that it ran the ADB Calculation process. The process uses the prior period averages as the starting point to calculate the current period's average.

The ADB incremental calculation method determines average balance by dividing the aggregate amount by the number of days within the requested period type:

Average balance equals the aggregate amount divided by the number of accumulated days in the requested period type.

|

Aggregate Amount |

The aggregate amount equals today's ending balance plus the previous aggregate amount (the aggregate amount for the previous day of this period). If it is the first day of a period, the aggregate amount is equal to the ending balance and the average balance. |

|

Ending Balance Amount |

The ending balance amount equals today's daily balance plus the previous ending balance (the ending balance of the previous day of this period). If it is the first day of a period, the ending balance is the same as the aggregate amount and the average balance. |

The following two tables illustrate incremental calculation by showing how February 1 is calculated using two different time periods (period types): year to date and month to date.

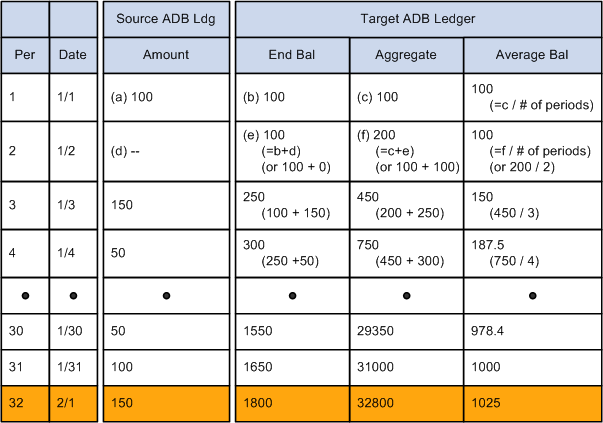

This table shows how the system calculates February 1 for a YTD (year to date) period.

Incremental Calculation for YTD

The following table shows how the system performs incremental year to date calculations:

Year to date example: February 1 is the 32nd day of the period

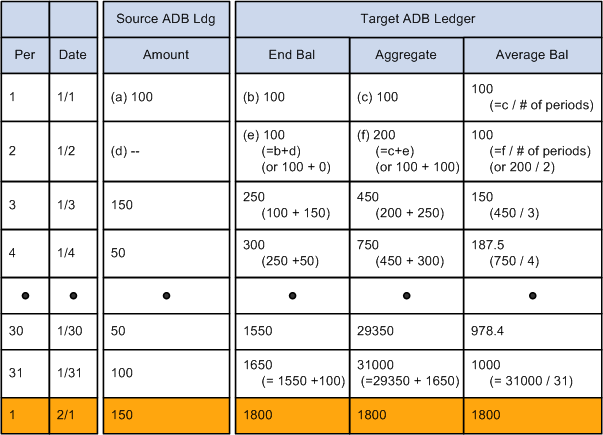

Incremental Calculation for MTD

ADB for the month-to-date (MTD) should not include the ending balance for the prior period as the beginning balance for the current period. MTD is for the month only and the calculation does not include any amounts from any other period.

The following table shows how the system calculates February 1 for a MTD (month to date) period:

Month to date example: February 1 is the first day of the second period

Ad Hoc Calculations

Ad Hoc Calculations

Ad hoc calculations require more system resources. Each time that the system processes ADB calculations, it extracts data for all the days within the period type from the ADB ledger. Therefore, you usually want the system to use the incremental calculation method for regularly scheduled averages (MTD, YTD, and QTD). Otherwise, you can use the ad hoc method.

The ad hoc calculation for average balance is the same as the incremental calculation:

Average Balance = Aggregate / number of days with in the requested period type

The difference is that the ad hoc method does not use prior period balances. Instead, it requires all the daily balances needed to calculate the requested period type. (The incremental process requires only the daily balances from the previous period.)

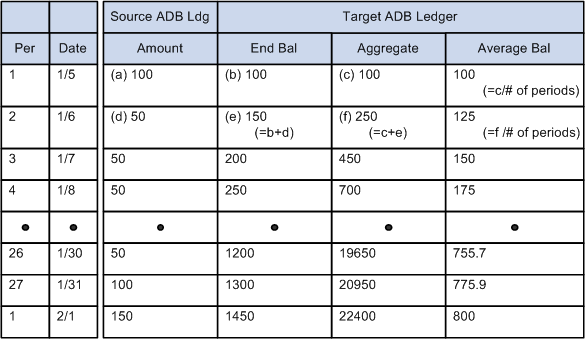

This table shows how the system calculates average daily balances for a date-to-date period type (DTD), starting January 5 through the request date of February 1. The ADB ledger uses a monthly calendar.

Calculation Using a DTD Period Type

This table shows incremental day-to-day calculations:

Incremental day to day calculations

In this case, even though February 1 is in the next period, the system still uses the previous day's ending balance and aggregate amount in the calculation.

In the sections that follow, there are examples of how these period types are used in calculations.

Adjustments in ADB

Adjustments in ADB

ADB adjustments are any transactions for a specific period that have been posted to the ADB ledger after ADB calculations have been run, which includes that period in the average balances.

For example, suppose average balances are calculated at 8:30 a.m. on Monday as of period 1. Additional transactions are posted to the ADB ledger at 9:00 a.m. that same day. These new transactions are considered ADB adjustments.

If the ADB process is using the incremental calculation method, the process automatically adjusts prior period balances before it calculates the requested period averages because the incremental calculation method uses prior period balances to calculate the current period averages (thus the adjustments must first be applied to those prior balances).

Note. The ADB process does not require you to go back and rerun prior month balances for the same fiscal year in order to adjust prior period balances. For example, if you have adjustments in May and June and the averages are already calculated up to July 31, you do not have to rerun the ADB Calculation process for the month end of May and June. You can rerun the ADB calculation process as of July 31 or as of August 1. The ADB process automatically adjust the prior months balances, for May and June, as long as the adjustments are within the same fiscal year. If you were to rerun the balances as of May 31, the process would not properly adjust the balances in June and July.

If the ADB process is not using the incremental calculation method, then the process does not have ending balances.

The ADB process adjusts all average balances starting from the minimum accounting period of the ADB adjustments, as long as that accounting period is within the same fiscal year as that of the requested period.

Keep in mind the distinction between ADB adjustments and adjusting journals (which are posted to special adjustment periods). They are different and are processed by ADB differently.

Journal Adjustments (998, 901, 902...) in ADB

Journal Adjustments (998, 901, 902...) in ADB

Adjustment journals are those journals that have been marked as adjustments in the journal header record. General Ledger posts these journals to special adjustment periods, which are defined on the Calendar Periods page. They are not posted to the period of the journal date. This prevents period-to-period reporting from being distorted by the adjustments.

ADB calculations support all adjustment periods.

For the most part, you will probably not want to include adjustment periods in ADB calculations, with the possible exception of year-to-date daily averages.

If you do choose to include journal adjustments, you have two points in the period that you can include the adjustments. You can include them at the beginning of the period, in which case the adjustment period (period 998, 901, 902) is considered the first day of the period, or you can include them at the end of the period, in which case the adjustment period is considered the last day of the period. For ADB definitions using the incremental calculation method, the process calculates the journal adjustments as of the last day of the period, regardless of the option selected. However, you can choose to run the ADB process using the ad hoc method on the ADB request if you want to include the adjustments as of the first day of the period. It is recommended that you use the ad hoc calculation method when including adjustment journals in the average balances. The impact of the journal adjustment period on average balances is illustrated in the following table.

This example assumes that Account 100000 has a zero beginning balance. During the course of the month, only two transactions were posted: one on December 1 and one on December 31 :

|

Account |

Journal Date |

Period |

Day Within Period |

Transaction Amount |

|

100000 |

December 1, 2009 |

12 |

1 |

100 |

|

100000 |

December 31, 2009 |

12 |

31 |

150 |

|

100000 |

December 31, 2009 |

998 |

300 < − adjusting entry |

The following table shows the results of not including period 998, including it at the beginning of the period or including it at the end of the period:

|

Period 998 Option |

ADB Calculation |

Result |

|

No Adjustment Period |

ADB = ( [100 * 31] + [150 * 1] ) / 31 [Aggregate of the December 1 amount] plus [aggregate of December 31 amount] divided by the number of days. |

104.84 |

|

As First Day of Report Period |

ADB = ( [400 * 31] + [150 * 1] ) / 31 |

404.84 |

|

As Last Day of Report Period |

ADB = ( [100 * 31] + [450 * 1]) / 31 |

114.52 |

See Also

Management and Regulatory ADB Reporting

Management and Regulatory ADB Reporting

When you enter journals, you identify an ADB date. The ADB date is the date that the system uses to determine in which accounting period the transaction is posted to the ADB ledger. Usually the ADB date and the journal date are the same, but in some cases they might differ.

General Ledger can maintain separate daily balances for the period, one that reflects the journal date and one that reflects the ADB date. You specify this requirement by selecting Maintain Regulatory Balances on the Ledgers For A Unit − Definition page.

When you select maintaining regulatory balances, for every journal that has an ADB date that differs from the journal date, the system creates two additional entries: an entry for the period based on the journal date and a reversal for the period based on the ADB date.

The following tables illustrate how ADB maintains regulatory balances. This first table identifies a journal with an ADB date different from the journal date on lines 3 and 4:

|

Jrnl Line |

BU |

Ledger |

Acct |

Jrnl Date |

ADB Date |

Amt |

|

1 |

US001 |

Corporate |

100000 |

January 1, 2009 |

January 1, 2009 |

100.00 |

|

2 |

US001 |

Corporate |

100000 |

January 2, 2009 |

January 2, 2009 |

200.00 |

|

3 |

US001 |

Corporate |

100000 |

January 3, 2009 |

January 1, 2009 |

50.00 |

|

4 |

US001 |

Corporate |

100000 |

January 4, 2009 |

January 2, 2009 |

50.00 |

This second table illustrates the daily balance stored only for the ADB date. This table shows the transactions as they are posted to the ADB ledger based on ADB date only:

|

BU |

Ledger |

Account |

Acct Period |

Posted Tran Amount |

|

US001 |

Corporate |

100000 |

1 |

150.00 |

|

US001 |

Corporate |

100000 |

2 |

250.00 |

This last table illustrates the daily balances stored based on both dates:

|

BU |

Ledger |

Acct |

Acct Per |

Per Seq* |

Posted Trans Amt |

Comments |

|

US001 |

Corporate |

100000 |

1 |

0 |

150.00 |

Balance posted from ADB date |

|

US001 |

Corporate |

100000 |

2 |

0 |

250.00 |

Balance posted from ADB date |

|

US001 |

Corporate |

100000 |

1 |

1 |

-50.00 |

Reversal for balances posted from ADB date |

|

US001 |

Corporate |

100000 |

2 |

1 |

-50.00 |

Reversal for balances posted from ADB date |

|

US001 |

Corporate |

100000 |

3 |

1 |

50.00 |

Balance posted from journal date |

|

US001 |

Corporate |

100000 |

4 |

1 |

50.00 |

Balance posted from journal date |

* The Period Seq (period sequence) field distinguishes the balance types: 0–balances posted from ADB date, 1−balances posted from journal date, and reversals for balances posted from the ADB date.

See Also

Defining Ledgers for a Business Unit

Preparing Your System for Average Daily Balancing

Preparing Your System for Average Daily Balancing

To prepare your system for average daily balancing, use the ADB Definition component (ADB_DEFN).

This section discusses how to:

Identify the ledgers.

Identify rounding adjustments.

Identify the ChartFields.

Pages Used to Set Up Average Balances

Pages Used to Set Up Average Balances|

Page Name |

Definition Name |

Navigation |

Usage |

|

ADB Definition - Definition (average daily balance definition - definition) |

ADB_DEFN |

General Ledger, Average Daily Balance, ADB Definition |

Identify the ledgers and their amount fields to be used in the definition. |

|

ADB Definition - Rounding Adjustment (average daily balance definition - rounding adjustment) |

ADB_ADJ |

General Ledger, Average Daily Balance, ADB Definition, Rounding Adjustment |

Identify the ChartFields in which the ADB rounding adjustment is stored. When averages are calculated from balanced ledger data, the calculated averages may not be in balance because of rounding. However, daily balances must be balanced. The ADB process creates rounding adjustments in order to bring the calculated averages back into balance. |

|

ADB Definition - ChartFields (average daily balance definition - ChartFields) |

ADB_CF |

General Ledger, Average Daily Balance, ADB Definition, ChartFields |

Identify the ChartField values from the ADB ledger that you include in the average balance calculations. |

Identifying the Ledgers

Identifying the LedgersAccess the ADB Definition - Definition page (General Ledger, Average Daily Balance, ADB Definition).

|

ADB Type (average daily balance type) |

Select from the following values: Management Balances: Calculates ADB from the daily balances posted from the ADB date. Regulatory Balances: Calculates the ADB from the daily balances posted from the journal date. |

|

Ledger |

Enter the name of the detail ledger associated with the ADB ledger. |

|

Target Ledger |

Select the ledger that stores average balances. (You must have created this ledger using the Detail Ledger, Detail Ledger Group, and Ledgers For A Unit pages. |

|

Batch Work Record |

Enter the name of the temporary table used during the ADB Calculation process. The default work table is LED_ADBTG_TAO |

|

Adjustment Period Option |

Select whether the ADB calculation includes the Period 998 balances. Values are: As First Day of Report Period: The system treats the period 998 balances as the first day of the report period's transaction (based on period type) and includes the balances in the ADB calculation. As Last Day of Report Period: The system treats the Period 998 balances as the last day of the report period's transaction (based on period type) and includes the balances in the ADB calculation. No Adjustment Period: The ADB calculation does not include period 998 balances. |

|

Map Amount Fields |

This section connects the Amount field of the ADB ledger to the target ADB ledger's amount, ending balance, and aggregate amount fields. Refresh returns default amount fields for the posted transaction amount, posted total amount, and posted base amount fields. You can map up to three amount fields. |

|

Ledger ADB Amount (ledger average daily balance amount) |

Displays the column in the ADB Amount Record table where the system stores daily balances for this ledger. When you click the Refresh button, all the amount fields for the ADB ledger appear. Click the Remove button to delete the amount fields for which you do not want to create average balances. |

|

Target ADB Amount (target average daily balance amount) |

Displays the column in the target ledger's table where the system stores the average balance. |

|

Target Ending Balance |

Displays the column in the target ledger's table where the system stores the ending balance. |

|

Target Aggregate Amount |

Displays the column in the target ledger's table where the system stores the aggregate amount. |

See Also

Understanding Processing of ADB

Journal Adjustments (998, 901, 902...) in ADB

Identifying Rounding Adjustments

Identifying Rounding AdjustmentsAccess the ADB Definition - Rounding Adjustment page (General Ledger, Average Daily Balance, ADB Definition, Rounding Adjustment).

|

Balanced ADB (balanced average daily balance) |

Select this check box to have the system automatically verify whether selected ledger amounts balance and to adjust average balance calculations for rounding discrepancies. The system also records related adjustments to the value of the rounding adjustment entry ChartField that you specify. To record average balances without automatic rounding adjustments, deselect the Balanced ADB check box. Note. If the Balanced ADB check box is selected, and the ADB Calculation process determines that the ADB is not balanced based on the ChartFields specified in the ADB Definition setup, the ADB Calculation process issues the following message and the target ledger is not updated: "Ledger amounts for ChartFields specified in the ADB (target ledger) is not balanced. Important! You must check the Batch Message Log to view this message." |

|

ChartField |

Locate the ChartField to use for automatic rounding adjustments. |

|

ChartField Value |

Specify a value for the ChartField to use for automatic rounding adjustments. |

Identifying the ChartFields

Identifying the ChartFields

Access the ADB Definition - ChartFields page (General Ledger, Average Daily Balance, ADB Definition, ChartFields).

|

|

Click this button to retrieve all the ChartFields defined for the ADB ledger (the source ledger). Click View All to display all of the ChartFields. The ADB calculation process creates an average balance for every ChartField combination listed. Click the Remove button (next to the Detail Ledger ChartField field) to delete unwanted ChartFields. For example, if your ledger has Account, Department, Product, Program, and Project ChartFields, but you want to have only average balances for Account/Department/Product ChartField combinations, delete the Program and Project ChartFields. |

|

ADB ChartFields (average daily balance ChartFields) |

Use to associate the ADB ledger ChartField with the target ADB ledger ChartField. |

|

Detail Ledger ChartField |

Enter the ChartField of the target ADB ledger associated with the ChartField of the ADB ledger. |

|

How Specified |

Specify how the ChartField values are to be summarized for use in the ADB Calculation process. |

|

All Detail Values |

Include all detail values of the selected ChartField. |

|

Selected Detail Values |

Summarizes the detail ChartField values that you select in the Value field in Specify Values/Range of Values/Tree Node group box. |

|

Range of Values |

Summarizes the range of values that you select in the Value and To Value fields in the Specify Values/Range of Values/Tree Node group box. |

|

Detail - Selected Parents |

Activates the Tree and Level fields in which you can select a tree name and level name (for trees with levels). Summarizes the values rolled up by the parent node that you select in the Specify Values/Range of Values/Tree Node group box. |

|

Selected Tree Nodes |

Activates the Tree and Level fields in which you can select a tree name and level name (for trees with levels). Summarizes the values rolled up by the tree node that you select in Value in the Specify Values/Range of Values/Tree Node group box. |

|

Children at a Level |

Activates the Tree and Level fields in which you can select a tree name and level name (for trees with levels). Summarizes every node at the specified level that is a child of the parent node that you select in the Specify Values/Range of Values/Tree Node group box. |

|

All Nodes at Selected Levels |

Activates the Tree and Level fields in which you can select a tree name and level name (for trees with levels). Summarizes every node at the specified level. |

|

Tree |

Enter a tree name if you are using trees to select your ChartField values for ADB processing. |

|

Level |

Enter a level if you are using trees to select your ChartField values for ADB processing, and the tree that you selected uses levels. |

|

Value |

Enter the tree node or ChartField value to use for ADB processing. |

|

To Value |

If you selected Range of Values in the How Specified group box, enter the to value of the range here. |

Processing Average Daily Balances

Processing Average Daily Balances

This section provides an overview of processing of ADB and discusses how to request the ADB process.

Understanding Processing of ADB

Understanding Processing of ADBOnce you establish the basis for average balance calculations, then initiate the background process that calculates the balances and updates the target ledger. If you want to run average balances for a ledger that has already been archived, you must restore the ledger and then run the ADB process.

ADB processing includes the following activities:

Journal Post (GLPPPOST).

The Journal Post process posts the daily balances into a holding table.

Post Daily Balances (GL_ADB_POST).

The ADB post process (GL_ADB_POST) posts the daily balances from the holding table into the ADB ledger (the source ledger containing the daily balances).

The ADB post process also posts ADB adjustments to the adjustment holding tables. (ADB adjustments are daily balances for a period that was posted after the ADB calculation process was run for that period.)

Note. Although the ADB post process is run from the journal post request, the ADB post process criteria is different from the journal post process for the posting of interunit journals. When posting interunit journals, the journal post process posts all of the non-anchor business units when posting the requested anchor business unit. The ADB post process only posts the anchor business unit. The non-anchor business units must be posted in separate requests.

Note. Instead of running the Journal Post process and the Post Daily Balances process separately, you can run the PS/GL Journal and ADB Post multiprocess job (GLADBPST) to post the journals and update the ADB ledger with the daily balances.

Note. The system prevents double posting in the event that

two ADB post processes (GL_ADB_POST) are running concurrently for the same

business unit. The ADB_PROCESS_STATUS field on the ADB ledger holding table

(LEDGER-ADB_HLD) locks the rows that are being posted to the ADB ledger.

If an abnormal termination or failure occurs on a step in the ADB post

process, perform the following steps before rerunning the process:

• Run the delivered DMS script ADBSTATUS.DMS in Data Mover to unlock

the rows in the ADB ledger holding table. You must modify the script to include

the process instance of the process that failed.

• Delete the failed request from the process monitor by selecting

the Delete Request radio button in the Update Process section of the Process

Detail page. This step is necessary to clean up data in the application engine

state records.

ADB Calculation (GL_ADB_CALCX).

The ADB Calculation process calculates average balances using transactions from the ADB ledger and the adjustment holding table and places the results (average balances) in the ADB target ledger.

The ADB Calculation process creates an ADB log entry. The ADB log is used by the ADB process to determine when the average balances (for a given definition, period type, and requested period) were calculated.

See Also

Understanding Average Balance Calculation

Archiving for Ledgers and Journals

Page Used to Process Average Daily Balances

Page Used to Process Average Daily Balances|

Page Name |

Definition Name |

Navigation |

Usage |

|

ADB Process Request |

ADB_REQ |

General Ledger, Average Daily Balance, ADB Process, ADB Process Request |

Identify the business unit, ADB definition, and period type that you want to process. Also specify whether you want to recalculate existing average daily balances. |

Requesting the ADB Process

Requesting the ADB Process

Access the ADB Process Request page (General Ledger, Average Daily Balance, ADB Process, ADB Process Request).

|

ADB (average daily balance) |

Enter the ADB definition. This field works in combination with the Period Type field to determine which calculation method the system uses. |

|

Request Type |

Select one of these request type options: Calc End of Per(calculate for period end date): Calculate only one period's average daily balance. The average balance is for the period end date. Calc Each Per (calculate for each period): Generate multiple periods' average daily balances, one for each day of the reporting period. |

|

Period Type |

Define the time period for the ADB calculation. This field works In combination with the ADB field to determine which calculation method the system uses. Select the Period Type option for average balance calculations. Values are: DTD (date to date): Calculates average balances from the specified begin date to the date specified in the Request Date Option (request date option) field. The begin date appears when you select this option. MTD (month to date): Calculates average balances from the first day of the month, which is the beginning date of the accounting period in which the run request date falls, to the date specified in the Request Date Option field. To use this option, the detail ledger for the business unit must be tied to a detail calendar that uses monthly periods. QTD (quarter to date): Calculates average balances from the first day of the quarter, which is the beginning date of the first accounting period in the quarter in which the run request date falls, to the run request date. To use this option, the detail ledger for the business unit must be tied to a detail calendar that uses monthly periods 1 through 12. Reg Date (regular date): Calculates average balances for a date range that you enter in Begin Date and End Date fields, which appear when you select this option. Reg Per (regular period): Calculates average balances from the beginning date of the from period to the ending date of the to period for the specified fiscal year. The from period, to period, and fiscal year appear when you select this option. YTD (year to date): Calculates average balances from the first day of the year, which is the beginning date of accounting period 1, to the run request date specified in the Req Date Option field. |

|

Fiscal Year |

If you selected Reg Per (regular period) in the Period Type field, enter the fiscal year for the period here. |

|

From Per (from period) |

If you selected Reg Per in the Period Type field, enter the beginning period here. |

|

To Per (to period) |

If you selected Reg Per in the Period Type field, enter the ending period here. |

|

Begin Date |

If you selected Reg Date in thePeriod Type field, enter the beginning date for the date range. If you selected DTD in Period Type field, enter the beginning date for the average balances calculation. |

|

End Date |

If you selected Reg Date in the Period Type field, enter the ending date for the date range. |

|

Request Date Option |

Specify the date option for the ADB process. Values are: Process Date: Uses the process date of the business unit as the request date for the ADB process. SYSDATE: Uses the system date as the request date for the ADB process. As-Of Date: Uses the date that you specify in the As of Date field, which appears when you select this option. |

|

|

If As Of Date is selected in the Request Date Option field, the As Of Date field and Update As of Date button appear above the Process Request group box. Click this Update As of Date button to globally update the as of date for requests that use the as of date option. If you want to update only the as of date for one of the ledgers listed, use the as of date in the process request row. |

|

Tree Date Optn (tree date option) |

Select the effective date of the tree used to select the ChartFields values to be processed. Values are: Use EndDt(use period end date): Sets the effective date to the end of the accounting period. Use OverDt (use override date): Activates a field in which you can enter a date other than the period end. |

|

Use Date Override |

If you selected Use OverDt in the Tree Date Option field, enter a date other than the period end date to be used as the effective date for the tree. |

|

Adhoc |

Select this option if you want to recalculate average balances using the ad hoc method. |

|

Description |

Identify this run of average balance calculations with a short description, such as the date and type of processing. |

See Also

How ADB Determines Calculation Method

Enterprise PeopleTools PeopleBook: PeopleSoft Process Scheduler, "Understanding PeopleSoft Process Scheduler"

Producing Average Daily Balance Reports

Producing Average Daily Balance Reports

This section provides an overview of ADB report processing and discusses how to:

Run the ADB definition report.

Run the ADB calculation report.

Understanding ADB Report Processing

Understanding ADB Report ProcessingTo run a report, select it from a menu and enter the necessary parameters. Once you enter the report parameters, you use PeopleSoft Process Scheduler to actually run the report. PeopleSoft Process Scheduler manages the processes, tracks the status, and generates the report behind the scenes while you continue to work on something else.

You can create your own reports or reformat report output. PeopleSoft offers a variety of reporting tools.

Note. Summary ledgers support summarization of ADB target ledgers. However, summarizing daily ledgers is not supported.

Pages Used to Produce ADB Reports

Pages Used to Produce ADB Reports|

Page Name |

Definition Name |

Navigation |

Usage |

|

ADB Definition Report (average daily balance definition report) |

RUN_GLS5500 |

General Ledger, Average Daily Balance, ADB Definition Report, ADB Definition Report |

Specify the run parameters for the ADB Definition Report. |

|

ADB Calculation Report (average daily balance calculation report) |

RUN_GLC5501 |

General Ledger, Average Daily Balance, ADB Calculation Report, ADB Calculation Report |

Specify the run parameters for the ADB Calculation Report. |

Running the ADB Definition Report

Running the ADB Definition Report

Access the ADB Definition Report page, supply the setID and ADB definition and run the report.

The following data is reported:

|

ADB Amount Record (average daily balance amount record) |

Displays the column in the ADB Amount Record table where the system stores daily balances for this ledger. |

|

Work Table Record |

Displays the name of the work table ledger. |

|

ADB Amount Field (average daily balance amount field) |

Displays the name of the ADB amount field and whether it has an adjustment period. |

|

Balanced ADB (balanced average daily balance) |

Indicates with a Y or N whether the system automatically verifies if selected ledger amounts balance. Also adjusts average balance calculations for rounding discrepancies. |

Running the ADB Calculation Report

Running the ADB Calculation ReportAccess the ADB Calculation Report page and complete the Report Request Parameters.