Understanding Consolidation and Equitization

Understanding Consolidation and Equitization

This chapter provides an overview of consolidations with related equitization functionality and discusses how to:

Determine consolidation ChartFields.

Select an approach to intercompany and intracompany transactions.

Define consolidation trees.

Set up elimination units.

Specify consolidation ledgers.

Define elimination sets.

Define subsidiary ownership and minority interest sets.

Set up consolidation sets.

Use ChartField value sets.

Perform consolidation.

Consolidate across summary ledgers.

Map dissimilar charts of accounts.

Use equitization.

Define business unit trees and elimination units for equitization.

Specify ledgers for each business unit in an equitization.

Define ownership sets for equitization.

Define equitization rules.

Define an equitization group and journal options.

Perform equitization.

Produce consolidation and equitization reports.

Use the ledger interface utility.

Understanding Consolidation and Equitization

Understanding Consolidation and Equitization

This section discusses:

Organizational structure and consolidations.

Elimination of intercompany transactions.

Elimination of intercompany investments and calculating minority interests.

Components of the consolidation process.

Incremental processing of Consolidations.

Equitization and Changes in Subsidiary Ownership.

TimeSpans in the Consolidation and Equitization Processes.

Effective Dates and Ownership Sets in Consolidation and Equitization.

Organizational Structure and Consolidations

Organizational Structure and ConsolidationsOrganizations often have complex structures with multiple business or operating units and legal entities with varying degrees of ownership. If your organization comprises more than one business unit or operating entity, you can consolidate these organizations when you report on overall operations, presenting financial statements that accurately describe your financial status.

For example, assume Consolidated Manufacturing is a multinational company that has a controlling interest in a United States business, as well as numerous other subsidiaries worldwide. The balance sheet for Consolidated Manufacturing lists its United States investment as an asset. Consolidated Manufacturing also owns several buildings used by subsidiaries that record the payment of rent to corporate headquarters through intercompany accounts. While these companies are separate legal entities, they represent one unified economic entity. To gain a complete picture of the entire organization, you combine (consolidate) all the assets and liabilities of each business unit, eliminating intercompany transactions and minority interest relationships by creating consolidation elimination journal entries.

You use trees to define the relationships among business units in a consolidation, creating a separate consolidation tree for each configuration. Included in each consolidation tree are the business units being consolidated and the elimination units to which eliminating journal entries are directed.

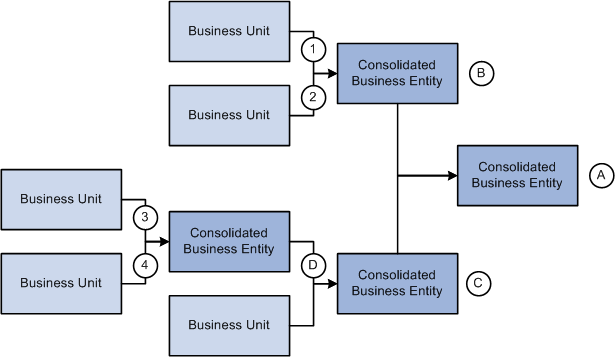

In the following example operating business units 1 and 2 are consolidated in consolidated business entity B and operating business units 3 and 4 are consolidated in business entity D. Consolidated entity D is further consolidated with an additional operating business unit not directly related to business unit 3 and 4 to consolidated business entity C. Finally, the consolidated business entities B and C are combined in the overall consolidation business entity A.

Consolidate any combination of business units

Elimination of Intercompany Transactions

Elimination of Intercompany Transactions

While there may be situations that require you to report gross consolidations (combining business unit ledger balances without eliminations), in most cases, you want to eliminate or cancel out the effect of intercompany transactions.

In General Ledger, you can track intercompany transactions using Due From and Due To accounts that are automatically created by the Journal Edit process, which calls the Inter/IntraUnit Processor. These Due From and Due To rows in the ledger are candidates for elimination when you run the Consolidations process. The following example shows such a transaction when company B0002 buys software for company B0001:

|

Business Unit |

Account |

Debit |

Credit |

|

B0001 |

651001—Software License Expense |

5,000 |

|

|

B0001 |

142000—Due From/To B2 |

5,000 |

|

|

B0002 |

141000—Due From/To B1 |

5,000 |

|

|

B0002 |

200000—Accounts Payable |

5,000 |

When the transactions are exclusively within the organization, you can eliminate the whole transaction when you set up your Consolidations process. In the following example, Company B0001 sold services to Company B0002. The Revenue and Expense accounts need to be eliminated in addition to the Due From and Due To accounts:

|

Business Unit |

Account |

Debit |

Credit |

|

B0001 |

142000—Due From/To B0002 |

3,000 |

|

|

B0001 |

500200—Revenue-Services Sold |

3,000 |

|

|

B0002 |

653000—Expense-Computer Networks |

3,000 |

|

|

B0002 |

141000—Due From/To B0001 |

3,000 |

Using the Affiliate ChartField with a Single Due From/To Account

The Affiliate ChartField is specifically reserved to map transactions between business units when using a single intercompany account. This table provides an example of intercompany payables and receivables among three business units that each use the Affiliate ChartField:

|

Business Unit |

Account |

Affiliate |

Amount |

|

B0001 |

140000—Due From/To Affiliates |

B0002 |

<5,000> |

|

B0001 |

140000—Due From/To Affiliates |

B0003 |

1,000 |

|

B0002 |

140000—Due From/To Affiliates |

B0001 |

5,000 |

|

B0002 |

140000—Due From/To Affiliates |

B0003 |

<3,000> |

|

B0003 |

140000—Due From/To Affiliates |

B0001 |

<1,000> |

|

B0003 |

140000—Due From/To Affiliates |

B0002 |

3,000 |

Using Different Due From/To Account Values

Another method of tracking activity between business units is to use different ChartField values—typically different accounts—for intercompany transactions. Instead of using the Affiliate ChartField, you could use the following accounts to identify the same transactions that were shown in the previous exhibit:

|

Business Unit |

Account |

Amount |

|

B0001 |

142000—Due From/To B0002 |

<5,000> |

|

B0001 |

143000—Due From/To B0003 |

1,000 |

|

B0002 |

141000—Due From/To B0001 |

5,000 |

|

B0002 |

143000—Due From/To B0003 |

<3,000> |

|

B0003 |

141000—Due From/To B0001 |

<1,000> |

|

B0003 |

142000—Due From/To B0002 |

3,000 |

In both examples, the same accounting information is present, but fewer account numbers are required when the Affiliate ChartField is populated. This also means that you need to define fewer elimination sets. An elimination set represents a related group of intercompany accounts that record both sides of each transaction between units.

In the case of the following intercompany receivable and payable relationship, you require only one elimination set if you use the Affiliate ChartField:

|

Elimination Set |

Business Unit |

Account |

|

One |

NA |

140000—Due From/To Affiliates |

If you do not use the Affiliate ChartField, three elimination sets are required:

|

Elimination Set |

Business Unit |

Account |

|

One |

B0001 B0002 |

142000—Due From/To B0002 141000—Due From/To B0001 |

|

Two |

B0001 B0003 |

143000—Due From/To B0003 141000—Due From/To B0001 |

|

Three |

B0002 B0003 |

143000—Due From/To B0003 142000—Due From/To B0002 |

See Also

Using Inter/Intraunit Processing in General Ledger

Using Interunit and Intraunit Accounting and ChartField Inheritance

Elimination of Intercompany Investments and Calculating Minority Interests

Elimination of Intercompany Investments and Calculating Minority Interests

In consolidating the books of a subsidiary with those of the parent company, you credit the parent with the portion of the subsidiary that it actually owns and exclude what outside investors own. The value of minority interests is reported in terms of the aggregate net assets (equity) rather than in terms of a fractional equity in each of the assets and liabilities of the subsidiary.

To reflect minority interest, General Ledger generates an adjustments entry that debits the investment of the parent in the subsidiary account and credits a minority interest account. The system calculates the adjustment by multiplying the percentage of minority interest in the subsidiary by the total equity of the subsidiary.

Effectively, the combined result of the adjustments and eliminations entries is to express the value of the parent investment in terms of the assets and liabilities of the subsidiary offset by a minority interest liability. The equity ownership for each subsidiary in the consolidation is eliminated, with only the parent company's equity accounts and minority interest account remaining. Consolidated capital stock and retained earnings is equal to the balances of the parent.

Components of the Consolidation Process

Components of the Consolidation Process

Consolidations are made up of four elements: data, scopes, rules, and process.

|

Data |

Ledger data is entered and posted through daily journal processing. Data also includes specifying which ledger to use during Consolidations for each business unit. Detail ledgers, as well as summary ledgers, can be used as the basis for consolidation. Ledgers outside of the General Ledger database can be loaded into the database for processing. |

|

Scopes |

Scopes define which business units are included during the consolidation process and how consolidation entries are created. Scopes are created using consolidation trees and elimination units. |

|

Rules |

Rules determine which ledger entries are identified and eliminated by defining elimination and minority interest sets. These are used in defining the consolidation set that specifies the elimination and minority interest sets to apply. |

|

Process |

Based on defined rules and scopes, the Consolidations background process generates consolidating journals and calculation log entries from source ledger data. New entries to the Ledger table are used to generate consolidated reports. The Undo feature enables you to reprocess consolidation as many times as necessary. |

Incremental Processing of Consolidations

Incremental Processing of Consolidations

PeopleSoft Enterprise General Ledger provides incremental processing of consolidations by recognizing lower level tree nodes that were previously processed when running the current consolidation. The Consolidation process uses the Consolidation Set, As Of Date, currency, and tree name of the process request to identify the tree nodes that have been processed, thereby enabling processing of only the nodes under a specified higher-level tree node that have not yet been processed. Incremental processing of consolidations enables you to consolidate in stages while avoiding reprocessing of portions of the overall organization that have already been successfully consolidated.

When reprocessing a consolidation that was previously run (commonly done for late transactions or discovery of errors) and you need to reprocess lower-level nodes, you can select the Undo Previous Process and the Include All Lower Level Nodes check boxes on the Consolidation Request page. When you select the Include All Lower Level Nodes check box, the undo process identifies all previously processed lower-level nodes and reverses them. If this option is not selected, the undo process only reverses the entries that were created from a single process by matching Consolidation Set, As Of Date, currency, tree name, tree level, and tree node as indicated on the current run control.

Equitization and Changes in Subsidiary Ownership

Equitization and Changes in Subsidiary Ownership

The Equitization process generates the entries to reflect the equity pickup of subsidiary earnings on the parent's books. It updates the value of the parent's investment and equity income accounts for changes in the subsidiary's value. When the value of an investment in a subsidiary changes for a parent company during the fiscal year, often it is without a physical event (transaction) having been recorded; however, the value of the investment of the parent in the subsidiary must be modified. You can use the PeopleSoft Equitization process when no physical accounting event will have occurred, but the value of the parent investment in the subsidiary has changed.

For example, net income or net loss of a subsidiary increases or decreases the investment value and affects the equity of the parent in that subsidiary.

PeopleSoft General Ledger enables you to set up multiple equitization rules for multiple business units that have complex parent-subsidiary relationships and create journal entries to record the changes within a single process. A ledger for a parent entity can be different from that of its subsidiary but you have the option to generate elimination entries for consolidated reporting.

Equitization can be run alone or in conjunction with consolidation and can share the consolidation tree with the Consolidations process, as well as the ownership sets.

Note. Equitization supports only the Business Unit field as the processing entity. This is unlike the Consolidation process, which allows consolidation of fields other than business unit, such as the Operating Unit field.

TimeSpans in the Consolidation and Equitization Processes

TimeSpans in the Consolidation and Equitization ProcessesYou can specify a TimeSpan on the Consolidation Set and the Equitization Group to indicate the type of balances to be posted for consolidation and equitization. If the TimeSpan is a year-to-date type of TimeSpan (for example, BAL), then a valid Journal Reversal Option should be selected; otherwise, there should be no reversal of the consolidation or equitization entries if they are intermediate periods. This is because distinct periods are consolidated that do not include prior periods in the current process. A warning message is issued by the system if the reversal option is selected with a TimeSpan option other than BAL.

Using intermediate TimeSpans (other than year-to-date types) is generally more efficient for processing consolidation and equitization; however, exercise caution when using non-year-to-date type TimeSpans. If changes have been made in ledgers for accounting periods that were previously processed for intermediate periods, it will be necessary to reprocess consolidation and equitization for those periods.

The following conditions must be met to have valid TimeSpans for Consolidation or Equitization:

The TimeSpan calendar must be the same as the Calendar for the Business Unit and Ledger Group to be processed.

The TimeSpan must be for the current year, that is, the Start Year and End Year must be 0, with Type defined as Relate to Current Year.

If the Time Span is a year to date time span for the Consolidation Set and the Equtization Group, then the reversal option must be either the Beginning of Next Period or the End of Next Period. For any TimeSpan other than BAL or YTD, the reversal option must be Do Not Generate Reversal.

Note. Incremental processing of consolidations occurs regardless of what TimeSpan is selected for processing. Incremental processing is not available for the equitization process.

Effective Dates and Ownership Sets in Consolidation and Equitization

Effective Dates and Ownership Sets in Consolidation and EquitizationConsolidation and Equitization support the use of multiple effective-dated subsidiary ownership sets. Effective dates dictate to which period of the fiscal year a certain ownership set is applied. There are two options for selecting the dates within the Consolidations Set and Equitization Group:

By Period End Dates.

By Process Request as of Date.

If you choose to select ownership sets by Period End Dates, the process selects the effective ownership date to use based on each accounting period being processed.

Adjustment Periods are processed with the current (latest) accounting period.

The effective ownership date can also be determined By Process Request As of Date and only the most recent Ownership Set definition is used. Regardless of the option selected, the journals that are created by the consolidation process are dated as of the process request date.

When changing parents and percentages, always add a new effective dated row for the new ownership set so as not to change history. That is to say, do not change the effective date on an existing ownership set that has been used in a previous run if you want to retain the consolidated information, nor should you change the subsidiary entity on an existing ownership set.

Common Elements Used in This Chapter

Common Elements Used in This Chapter|

View Detail |

Link that accesses another page for more detailed information. |

|

Ledger Template |

The ledger template name is used to prompt correct ChartField names. If you specify a summary ledger template as the ledger template in setting up consolidations, the system displays the Ledger field, where you enter the summary ledger name. |

Determining Consolidation ChartFields

Determining Consolidation ChartFields

You can base your consolidations on the business unit or another ChartField.

This section discusses how to:

Consolidate on business unit.

Consolidate on a ChartField other than business unit.

Consolidating on Business Unit

Consolidating on Business Unit

Although you can consolidate based on any ChartField, General Ledger is delivered with consolidations enabled for the business unit. If you use a different ChartField for your consolidations, substitute that ChartField name when you see a reference to business unit.

Consolidating on a ChartField Other Than Business Unit

Consolidating on a ChartField Other Than Business Unit

For some organizations, the system is set up to use ChartFields such as operating unit or department instead of business unit to function as separate units. Because they are all conducting the same or similar business practice and have the same structure, all the units are under one PeopleSoft business unit setup. Transactions between these operational units are recorded and need to be eliminated for financial reporting of the business unit. General Ledger enables you to set up the consolidation among the operational units the same way you would to consolidate among business units.

For example, to consolidate on the operating unit ChartField:

If you are using an affiliate field to mark interoperating unit transactions, activate the Operating Unit Affiliate field on the Standard ChartField Configuration page, and associate the Operating Unit field to it.

Add operating units that function as the elimination operating units to the operating unit definition.

Assign the attribute ELIM_UNIT equal to Y for these elimination units.

Build a consolidation tree that rolls up operating unit values, including regular and elimination operating units.

Set up elimination sets.

When you define an elimination set using the Affiliate approach, do not include the ChartField on which you are consolidating.

Set up the consolidation set.

Specify Operating Unit in the Entity field, and enter the business unit for the operating units.

Define and process a consolidation request.

Create reports that are based on the consolidation tree to show consolidated results.

See Also

Elimination of Intercompany Transactions

Summarizing ChartFields Using Trees

Enterprise PeopleTools PeopleBook: PeopleSoft Application Engine, "Using Meta-SQL and PeopleCode"

Enterprise PeopleTools PeopleBook: PeopleSoft Tree Manager, "Creating Trees"

Selecting an Approach to Intercompany and Intracompany Transactions

Selecting an Approach to Intercompany and Intracompany TransactionsYou can record activity between business units with the use of the Affiliate ChartField or with separate accounts. The Affiliate ChartField maps transactions between business units while using a single intercompany account. Alternatively, you can use different ChartField values, typically different accounts, for intercompany transactions.

If the consolidation is on business unit, the consolidation process assumes that it is an intercompany consolidation, and the affiliate is the Affiliate field name.

If the consolidation is on anything other than business unit, the process assumes that it is an intracompany consolidation within a single business unit. For intracompany elimination when the Affiliate method is used or where the Affiliate field is required for querying the ledger data, the field name is the associated affiliate field for that ChartField, as defined on the Standard ChartField Configuration page.

See Also

Using Interunit and Intraunit Accounting and ChartField Inheritance

Using Inter/Intraunit Processing in General Ledger

Elimination of Intercompany Transactions

Defining Consolidation Trees

Defining Consolidation Trees

You define a consolidation based on relationships among the business units and their related elimination units (units to which eliminating journal entries are directed). Each consolidation hierarchy uses a separate consolidation tree. You can consolidate an unlimited number of business units within each tree, and you can define an unlimited number of consolidation trees.

This section discusses how to:

Define consolidation scopes with trees.

Add detail values.

Defining Consolidation Scopes With Trees

Defining Consolidation Scopes With Trees

Because you likely have several consolidation configurations to accommodate management and statutory requirements, General Ledger enables you to set up any number of consolidation trees. Consolidated business entities appear as nodes, and business units and eliminations units appear as detail values on the tree.

For example, World Wide Consolidation comprises 22 business units in Europe, Asia Pacific, and North America. For financial reporting requirements, the company created a tree that defines the legal entity relationships among these business units, as well as those located elsewhere (Tree Manager, Tree Manager).

The World Wide Consolidation node (WW_Consolidation) represents the final point of consolidation and the relationship among consolidated entities—Europe, ASIA/PAC, and NORTH_AMERICA—and the corporate level elimination unit, ELIM1.

Adding Detail Values

Adding Detail Values

The detail values in a Consolidations tree always consist of the ChartField values that form the basis for consolidation and elimination units. Elimination units are stored in the same table as consolidating ChartField values because they share identical attributes; that is to say, if your consolidating ChartField values are business units, the elimination entities are also defined as business units.

In such a case, the system maintains all your detail values in the general ledger Business Unit table. You can, however, set up consolidations based on any other ChartField.

See Also

Summarizing ChartFields Using Trees

Setting Up Elimination Units

Setting Up Elimination Units

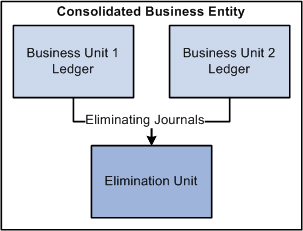

With Consolidations, you can automate intercompany eliminations and more accurately analyze consolidated results. When you consolidate business units, the system creates eliminating journal entries. Eliminating journals are directed to an elimination unit, a type of business unit that is designed specifically to support consolidated reporting.

Eliminating journal entries are directed to the elimination unit

The consolidated business entity does not have its own ledger. It is actually a reporting construct made up of the combined ledger balances of the selected business units and the intercompany offset amounts posted to the ledger for the elimination unit.

This section discusses how to:

Add an elimination unit.

Assign ledgers to elimination units.

Page Used to Add an Elimination Unit

Page Used to Add an Elimination Unit|

Page Name |

Definition Name |

Navigation |

Usage |

|

BUS_UNIT_TBL_GL1 |

Set Up Financials/Supply Chain, Business Unit Related, General Ledger, General Ledger Definition, Definition |

You can use this page to define each elimination unit directly. You can also define elimination units from the consolidation tree. |

Adding an Elimination Unit

Adding an Elimination Unit

Access the General Ledger Definition - Definition page (Set Up Financials/Supply Chain, Business Unit Related, General Ledger, General Ledger Definition, Definition).

Add and maintain elimination business units the same as you would add any business unit on the General Ledger Definition page. Make sure to select the Consol - For Elimination Only check box, as this is what distinguishes an elimination unit from other units and its treatment for the consolidation process. You can also add elimination units to the consolidation tree in the same way that you add any detail ChartField value.

The placement of the elimination units on the tree tells the consolidation process what business units' intercompany activity is eliminated within the elimination unit. For example, the ELIM5 elimination unit in the consolidated management reporting tree, CONSOLIDATE_CORP, is defined as the elimination unit for the ASIA/PAC consolidation; therefore, intercompany activity between Japan and Australia are eliminated within ELIM5 .

Assigning Ledgers to Elimination Units

Assigning Ledgers to Elimination Units

Assigning a ledger to an elimination unit is done the same way that you handle regular business units. The base currency of the ledger must be the same currency used for consolidation.

See Also

Defining Ledgers for a Business Unit

Defining Your Operational Structure

Specifying Consolidation Ledgers

Specifying Consolidation Ledgers

To specify a consolidation ledger, use the Consolidation Ledger Sets component (LEDGER_SET).

For each business unit involved in Consolidations, you can specify one ledger as the Consolidation ledger. The Consolidations process uses this ledger as the source and identifies transactions to be eliminated. Consolidation journals reference this ledger for elimination units.

In cases where business units have different base currencies in their primary ledgers, and translation ledgers are maintained for reporting on a single currency, you can use Translation ledgers as Consolidation ledgers. Consolidation does not perform any currency translation. The currency that you specify must have complete balances in place resulting from regular journal posting or from the Currency Translation process.

You specify a ledger for a business unit on the Ledger Sets page. With a common Consolidation chart of accounts, you can also consolidate at a summary level.

Page Used to Define Ledger Sets

Page Used to Define Ledger Sets|

Page Name |

Definition Name |

Navigation |

Usage |

|

LEDGER_SET |

General Ledger, Consolidate Financial Data, Consolidation, Consolidation Ledger Sets, Ledger Set |

Select the combination of business units and ledgers that you want to consolidate for a specific consolidation configuration. |

Defining a Ledger Set

Defining a Ledger SetAccess the Ledger Set page (General Ledger, Consolidate Financial Data, Consolidation, Consolidation Ledger Sets, Ledger Set).

Automatic Populate Scroll

The Automatic Populate Scroll section enables you to select the parameters that will populate the scroll with the ledgers that you can use. After you choose parameters, click the Refresh button to populate the page.

Note. When you click the Refresh button, the system provides you with only the best guess of ledger names. Review the ledger names populated by the system . and select the ledger that you want to use in the consolidation.

|

Tree |

Determines the business units that will appear in the scroll. All business units in a particular tree will appear in the scroll. |

|

As of Date |

Use to select a tree if you have multiple trees with the same name. |

|

Currency |

Populates the Ledger column with the ledgers that have the same base currency defined. |

Specify Ledgers to Use

When you click Refresh, the system populates the scroll area with the following:

|

Business Unit |

Populates the valid values in the selected tree for the specified ledger template. |

|

Ledger |

Displays a ledger associated with each business unit that has the specified currency as its base currency. You can associate a different ledger with the business unit by selecting a new one in the drop-down list box. |

You can also enter business units and their associated ledgers individually by adding a row. The new business unit does not have to be part of the earlier specified tree.

Note. All business units involved in the consolidation process must have a row defined on the Ledger Set page so that the system knows which ledger to use for each business unit during the consolidation process.

See Also

Specifying Consolidation Journal Options

Defining Elimination Sets

Defining Elimination Sets

The elimination set defines a related group of intercompany accounts. When eliminated, the balances of this group of accounts should normally net to zero. To maintain a balanced journal entry, the system posts any amounts that remain after the elimination to a user-defined out-of-balance ChartField. When you run the consolidation, the system processes each elimination set specified in your consolidation definition.

To define elimination sets, use the Elimination Sets component (ELIMINATION_SET).

This section discusses how to:

Define an elimination set.

Enter an elimination set.

Audit elimination sets.

Pages Used to Define Elimination Sets

Pages Used to Define Elimination Sets|

Page Name |

Definition Name |

Navigation |

Usage |

|

ELIMINATION_SET1 |

General Ledger, Consolidate Financial Data, Consolidation, Elimination Sets, Elimination Set |

Define parameters for the elimination. |

|

|

ELIMINATION_SET2 |

General Ledger, Consolidate Financial Data, Consolidation, Elimination Sets, Elimination Lines |

Define which accounts you want to eliminate. When you define these accounts, the level of detail required depends on whether you are using the Affiliate ChartField. |

|

|

RUN_GLS2005 |

General Ledger, Consolidate Financial Data, Reports, Elimination Sets Audit, Audit Elimination Sets |

Set up criteria to run the GLS2005 SQR for auditing elimination sets. Determines if any duplicate lines exist in consolidation definitions. The system uses the criteria that you enter to generate the Audit Elimination Sets report. |

Defining an Elimination Set

Defining an Elimination Set

Access the Elimination Set page (General Ledger, Consolidate Financial Data, Consolidation, Elimination Sets, Elimination Set).

|

Ledger Template |

Select the ledger template that is used by the ledgers in your consolidation. If you specify a Summary Ledger template as the ledger template, the system displays the Ledger field, where you enter the summary ledger name. The system also displays a detail link; click it to access the Summary Ledger Definition page. |

|

Description |

Identifies the elimination for prompt lists. |

|

Comments |

Describe what the elimination set does. This field is particularly useful for documenting each set in a complex consolidation. |

|

Entity Field |

Select the field on which you are consolidating. This is the field on which you have previously structured your consolidation and on which you have built your consolidation tree. It is usually the business unit. However, if you have setup your system to use other fields, such as Operating Unit or Department for the business entity and are tracking interunit transactions among these entities, you use Operating Unit or Department as the Entity Field. |

Out of Balance Debit and Out of Balance Credit

If the activity within a given elimination set does not net to zero, PeopleSoft General Ledger directs the out-of-balance amount to the Out of Balance field values that you specify on this page.

|

Field Name |

Specify special ChartFields for the out-of-balance amounts. For example, you can enter a department for both the debit and credit field name in addition to an account Value. For summary ledger templates, the Field Name prompt lists all the ChartFields for the summary ledger template, and the Value prompt is based on how the summary ledger is defined. |

Entering an Elimination Set

Entering an Elimination SetAccess the Elimination Lines page (General Ledger, Consolidate Financial Data, Consolidation, Elimination Sets, Elimination Lines).

|

Match Affiliate Value |

Select the check box if you use the Affiliate approach for elimination. For a summary ledger that does not have an Affiliate ChartField, the Match Affiliate Value check box is deselected and display-only. |

Values to Eliminate

|

Field and Value |

When each intercompany transaction is recorded in a unique account, the Business Unit and the Account or ALTACCT ChartField and their respective values are required. If you use the Affiliate ChartField, and its respective value is already a business unit, do not enter the Business Unit ChartField. The system evaluates business unit and affiliate relationships when you perform the consolidation based on data in the ledger. In addition to the Account or ALTACCT ChartField, you can specify other ChartFields to further narrow the scope of the transaction being eliminated. This applies regardless of which method you use for tracking intercompany activity. To prevent duplication, the system does not allow you to enter the same ChartFields and ChartField values within the same elimination line. |

Auditing Elimination Sets

Auditing Elimination SetsAccess the Audit Elimination Sets page (General Ledger, Consolidate Financial Data, Reports, Elimination Sets Audit, Audit Elimination Sets).

Report Request Parameters

|

SetID |

SetID for the consolidation set. |

|

Consolidation Set |

Select the Consolidation Set for which you want to run the elimination set audit. |

|

As of Date |

Enter the point of reference date for the effective-dated setup information. |

Defining Subsidiary Ownership and Minority Interest Sets

Defining Subsidiary Ownership and Minority Interest Sets

General Ledger evaluates minority interest relationships at the time a consolidation is run, based on the data in the minority interest sets and Ownership table. It calculates the adjustment prior to generating elimination entries.

You define the relationship for the subsidiary business unit, the parent company that owns the majority of that subsidiary, and any other minority owners. You do not specify minority owners that exist outside your organization.

If a minority parent exists in the same consolidation tree as a majority parent, General Ledger makes a second adjustment to reflect the minority parent's ownership percentage. Because the original adjustment creates a liability for the minority interest, the second adjustment effectively reduces that liability because a minority parent is included in the consolidated results. This means that you do not overstate your minority interest liability.

General Ledger supports any number of minority parents and generates the adjustment entry at the appropriate point in the consolidation according to the consolidation tree level.

To define subsidiary ownership and minority interest sets, use the Subsidiary Ownership component (CONSOL_OWNERSHIP) and the Minority Interest Sets component (MINORITY_INTEREST).

This section discusses how to:

Define subsidiary ownership.

Define the minority interest source.

Define a minority interest target.

Pages Used to Define Subsidiary Ownership and Minority Interest Sets

Pages Used to Define Subsidiary Ownership and Minority Interest Sets|

Page Name |

Definition Name |

Navigation |

Usage |

|

CONSOL_OWNERSHIP |

General Ledger, Consolidate Financial Data, Consolidation, Subsidiary Ownership |

Define the relationships for the parent company, subsidiary, and any other minority owners. |

|

|

MINOR_INT_SOURCE |

General Ledger, Consolidate Financial Data, Consolidation, Minority Interest Sets, Minor Int Source |

Identify the subsidiary equity and parent investment accounts. |

|

|

MINOR_INT_TARGET |

General Ledger, Consolidate Financial Data, Consolidation, Minority Interest Sets, Minority Int Target |

Specify the minority accounts of the majority parent company. |

Defining Subsidiary Ownership

Defining Subsidiary OwnershipAccess the Subsidiary Ownership page (General Ledger, Consolidate Financial Data, Consolidation, Subsidiary Ownership).

|

Entity Field |

Select the consolidating entity field. This is usually the business unit, but you can consolidate based upon other fields, like Operating Unit. This field should be the same field upon which your consolidation tree is based. |

|

Subsidiary Entity |

Organizational unit owned by the parent. |

Note. Add a new effective-dated row to reflect valid changes in subsidiary ownership. When adding new effective-dated rows, make changes only to the Specify Parents group box. The Subsidiary Entity field must stay constant, as that is the subsidiary for which you are defining ownership.

Specify Parents

|

Parent |

Owner of the subsidiary. |

|

Owner % |

Amount of the subsidiary owned by the parent. List any minority owners that exist within your system by adding rows. |

|

Controlling Entity |

Indicates which parent is the subsidiary's majority owner. Use this option to indicate a particular parent business unit for which elimination entries will be created. The parent company selected as the controlling entity holds the minority interest liability. Only one parent entity can be the controlling entity. |

Note. To prevent duplication, the system does not allow you to enter the same parent entity value twice.

|

Equitize |

Indicates whether equitization should be run for specified parent entities. The system processes this ownership set only when the subsidiary entity and all the parent entities marked for equitization are included in the consolidation tree. |

|

Parents Ownership % |

Total should be less than or equal to 100%. |

|

Minority Interest % |

Percentage of minority shareholder ownership. |

Defining the Minority Interest Source

Defining the Minority Interest Source

Access the Minor Int Source (minority interest source) page (General Ledger, Consolidate Financial Data, Consolidation, Minority Interest Sets, Minor Int Source).

|

Subsidiary Equity |

Specifies the ChartField value set that identifies the subsidiary's equity accounts. |

|

Parent Investment |

Specifies the ChartField value set that identifies the asset account where the subsidiary is carried on the parent company's books. |

|

Match Affiliate Value |

Select the check box if you are using a single investment account and have populated the Affiliate ChartField with the subsidiary. |

See Also

Defining a Minority Interest Target

Defining a Minority Interest Target

Access the Minor Int Target (minority interest target) page (General Ledger, Consolidate Financial Data, Consolidation, Minority Interest Sets, Minority Int Target).

Minority Interest

|

Field Name and Value |

Identifies the parent's equity or liability account for minority ownership in the subsidiary. After General Ledger generates the minority interest adjustment, it eliminates the majority parent's investment account against the subsidiary's equity accounts. |

Out of Balance Debit and Out of Balance Credit

|

Field Name and Value |

If the elimination does not balance, the system directs the remaining amount to the appropriate out-of-balance account or ChartFields. You can specify special ChartFields for the out-of-balance amounts. For example, you can enter a department for both the Debit and Credit ChartFields in addition to an account. |

Setting Up Consolidation Sets

Setting Up Consolidation Sets

After you define consolidation relationships in your tree and specify intercompany elimination and minority interest sets, you are ready to define the options and controls that tell General Ledger how to process the consolidation.

To set up consolidation sets, use the Consolidation Set component (CONSOL_DEFINITION).

This section discusses how to:

Specify consolidation journal options.

Specify set options.

Pages Used to Set Up Consolidation Sets

Pages Used to Set Up Consolidation Sets|

Page Name |

Definition Name |

Navigation |

Usage |

|

CONSOLIDATION1 |

General Ledger, Consolidation, Consolidation Set, Journal Options |

Specify consolidation process options. |

|

|

CONSOLIDATION2 |

General Ledger, Consolidation, Consolidation Set, Set Options |

Specify which elimination and minority interest sets the consolidation will include. |

Specifying Consolidation Journal Options

Specifying Consolidation Journal Options

Access the Journal Options page (General Ledger, Consolidate Financial Data, Consolidation, Consolidation Set, Journal Options).

|

Entity Field |

Select the consolidating entity field. This is usually the business unit, but you can consolidate based upon other fields, like Operating Unit. This field should be the same field upon which your consolidation tree is based. |

|

Business Unit |

When consolidating on other than BUSINESS_UNIT, General Ledger displays a Business Unit field that enables you to designate the business unit as the high order key in the consolidation. |

|

Ledger Set |

Specifies a combination of business units and ledgers that act as a centralized location for consolidations. |

|

TimeSpan |

Select a user-defined TimeSpan for which to process the consolidation. You can select to process year-to-date balances or quarterly and period balances (such as QTR1 , QTR2, QTR3, QTR4 or PER). If you select a year-to-date TimeSpan, the Consolidation Reversal option must be either Beginning of Next Period or End of Next Period; otherwise, the reversal option must be Do Not Generate Reversal. A warning message is issued if the reversal option is not appropriate for the selected TimeSpan. Note. Performance may be impacted when using a BAL or YTD TimeSpan due to increased volume of data when processing effective-dated ownership sets. Using quarterly or period TimeSpans improves performance. When upgrading to 9.1, be careful to use BAL as the TimeSpan, as Consolidations has historically processed BAL balances. |

Elimination Journals

|

Journal ID Mask |

Enables you to specify a prefix for naming consolidation journals. A 10-character alphanumeric ID identifies journals. The system automatically appends the prefix that you specify to the journal IDs. For example, if you specify the journal ID mask to be ELIM, the elimination journal IDs might be ELIM0001, ELIM0002, and so on. Alternatively, the value NEXT causes General Ledger to assign the next available journal ID number automatically. It is very important to reserve a unique mask value for Consolidations to ensure that no other process creates the same journal ID. |

|

Source |

Any valid value from the Sources table entry that identifies the source of the consolidation journals. |

|

Document Type |

Required for consolidation journals if Document Sequencing is enabled. Document Sequencing requires that you have a document type for all of the journal entries that you create. |

In the following example, Department is the additional ChartField, and the elimination lines contain the following amounts:

|

ChartField Used in Eliminations - Account |

ChartField Used to Group By − Department |

Product |

Posted Total Amount |

|

1100001 |

100 |

XYZ |

100.00 |

|

2200001 |

100 |

XYZ |

- 80.00 |

|

1100001 |

200 |

NA |

200.00 |

|

2100001 |

200 |

NA |

-190.00 |

During Consolidations, the system generates journal entries that represent year-to-date (YTD) elimination amounts based on the type of account specified in the elimination set. For profit and loss accounts, the system totals the YTD amount based on the sum of periods 1 through n, and for balance sheet accounts periods 0 through n. To facilitate period-based reporting, General Ledger generates a reversing journal for the subsequent period. The resulting net amount on the elimination unit ledger represents the current period YTD amount less the reversal amount generated by the eliminations for the prior period.

Elimination Reversals

|

Beginning of Next Period, End of Next Period or Do Not Generate Reversal |

Indicate whether you want to generate elimination reversal entries for the beginning of the next period, the end of the next period, or not generate a reversal at all. The system directs the journal entries to the respective elimination units as specified in the consolidation tree. |

Elimination Includes ChartFields

Select the ChartFields that you want to include in elimination. The ChartFields that are defined for a consolidation definition relate to the ChartFields that are specified for the elimination set:

If elimination set ChartFields provide more detail than consolidation definition ChartFields, the system summarizes the elimination journal entries at the level of detail defined by the elimination set.

For example, if you specify Account as the consolidation definition and Account and Project for your elimination set, the system includes account and project detail when it summarizes elimination journal entries.

If consolidation definition ChartFields provide more detail than elimination set ChartFields, the system expands the elimination journal entries, summarizing at the level of detail defined by the consolidation definition.

For example, if you specify Account, Department, and Product as the consolidation definition and Account and Project as the elimination set, the system expands the elimination journal entries to include account, department, and product detail when it summarizes them.

See Also

Specifying Set Options

Specifying Set OptionsAccess the Set Options page (General Ledger, Consolidation, Consolidation Set, Set Options).

|

All Elimination Sets Apply |

Select to indicate that you want to use all of the elimination sets that are defined for the setID when processing this consolidation set. |

|

Default Minority Int Set (default minority interest set) |

Specifies which minority interest set to use for the calculation. Based on the Subsidiary Ownership setup, Consolidations includes all parent and subsidiary sets, provided that all entities involved are within the consolidation scope (the consolidation tree). |

|

Effective-Date Ownership Sets |

Select one of the following options for the effective dates that dictate to which period of the fiscal year the Ownership Sets apply:

Note. The journal entries that are created by the Consolidation process are dated as of the process request date, regardless of the effective date of the ownership sets. To illustrate the Period End Date(s) option, assume that you are running the Consolidation process through June 30, 2009. Additionally, assume that there are two effective-dated ownership sets with one dated January 1, 2009 and the other dated April 15, 2009. Given these effective dates, the Consolidation process applies the Ownership Set that is effective from January 1 to periods 1 through 4 balances, and uses the April 15 Ownership Set for periods 5 through 6 balances. If using the Process Request As Of Date option, the Consolidation process applies the April 15 ownership set for all periods that are included in the consolidation. |

Elimination Sets to Process

|

Elimination Set |

If you want to use only a portion of the elimination sets, specify the sets by adding rows in this section. |

Minority Interest Sets Override

|

Ownership Set |

Associated with the minority interest set for consolidation set override purposes. |

|

Minority Interest Set |

Specifies the minority interest set on a certain ownership set for consolidation set override purposes. This override can be useful, for example, when you use different equity accounts for certain subsidiaries, and thus define separate minority interest sets. |

Using ChartField Value Sets

Using ChartField Value Sets

Use ChartField value sets to define sets of ChartFields used in consolidation and equitization processes. You can specify individual values, select values from specified tree levels and nodes, or use ranges of detail values. You should use trees or ranges whenever possible to reduce future maintenance if ChartField values change.

You can set up ChartField value sets with the same name but different setIDs for different groups of business units, if ChartField values as part of the consolidation rules are different by business units. For example, Parent Investment on the Minority Interest Set Definition page is specified as a ChartField value set entry. You can define two ChartField value sets both named ACCT_INVESTMENT, but one under setID SHARE and one under SET01 with each having its own set of accounts specified. The setID for the ChartField value set is resolved at runtime, based on the TableSet Control for Record Group FS_12, for each business unit processed.

You can set up ChartField value sets for either detail ledgers or summary ledgers. Specify the summary ledger name, as well as the ledger template. You cannot use a tree to select values for summary ledgers.

See Also

Defining and Using ChartField Value Sets

Performing Consolidation

Performing Consolidation

This section discusses how to:

Initiate consolidation processing.

View the consolidation process log.

Use the consolidation dashboard.

Pages Used to Perform a Consolidation

Pages Used to Perform a Consolidation|

Page Name |

Definition Name |

Navigation |

Usage |

|

CONSOL_REQUEST |

General Ledger, Consolidate Financial Data, Consolidation, Request Consolidation, Consolidation Request |

Identify consolidation parameters that the system will process and how often the GLPOCONS COBOL process will run. |

|

|

CONSOL_PROCESS_INQ |

General Ledger, Consolidate Financial Data, Review Results Online, Consolidation Process Log |

View how and when consolidation processes are run. This page also shows you the parameters used for undoing previous consolidation processes. |

|

|

CONSOL_PROCESS_MON |

General Ledger, Consolidate Financial Data, Review Results Online, Consolidation Dashboard |

View the consolidation process status at the tree node level. You can also query the calculation log based on user-specified criteria. |

Initiating Consolidation Processing

Initiating Consolidation ProcessingAccess the Consolidation Request page (General Ledger, Consolidate Financial Data, Consolidation, Request Consolidation, Consolidation Request).

Request Parameters

|

SetID |

Select the setID of the consolidation set for which you want to run the consolidation process. |

|

Currency |

Currency used in the consolidation. |

|

Consol Set (consolidation set) |

Select the consolidation set to use for the consolidation process. |

|

As of Date |

Serves as a point of reference for determining the year and period to consolidate for each ledger in the consolidation. If business units use different calendars, the system evaluates the year and period for each. This date is also used to access the effective-dated setup. |

Consolidation Options

|

Create Journal Entries |

General Ledger creates journals that can be edited and posted. |

|

Create Calculation Log |

Creates a calculation log that contains the amounts generated by each elimination and minority interest set at each tree node. After the system creates the log, you can inquire on the calculation log with the Consolidation Process Monitor page, or run the Consolidation Out of Balance (GLS2003) and the Minority Interest Eliminations and Adjustments (GLS2004) SQRs. The Consolidation Out of Balance report examines the elimination sets for the consolidation as of the date specified, indicates which elimination sets are in balance and which are not, and shows you the details of any out-of-balance condition. The Minority Interest Eliminations and Adjustments report details the majority and minority parent eliminations and adjustments based on the hierarchical relationship of business units present in the tree. |

|

Include Adjustment Period(s) |

Includes balances from the adjustment periods specified in the consolidation set when calculating the elimination. |

|

Edit Journal(s) |

Provides the ability to identify an edit error and process the consolidation again. The system clears journals from the original process before regenerating. Not available if Document Sequencing is enabled at the system or business unit level. |

|

Post Journal(s) |

Posts journals during consolidation processing. Not available if Document Sequencing is enabled at the system or business unit level. |

|

Undo Previous Process |

Select the Undo Previous Process check box when you need to rerun a consolidation for a period that has already been processed. Selection of this check box clears the entries that were created by the previous consolidation for the requested processing periods. If the elimination journals are not yet posted to General Ledger, the process deletes them. If they have been posted, the process removes the amounts from the ledger before it deletes the journals. The same applies to elimination reversal entries. The system identifies the previous process by looking at the key fields in a consolidation process log that stores information about previous processes. You can view the process log on the Consolidation Process Log page. The extent of the Undo process is based upon whether the Include All Lower Level Nodes check box is also selected. Selecting the Undo Previous Process option alone reverses only the outcome from a single process with matching Consolidation Set, As Of Date, currency, tree name, tree level, and tree node as designated on the current run control. |

|

Include All Lower Level Nodes |

Click this option after selecting the Undo Previous Process check box if you want to remove the results of previous consolidation processing of lower-level nodes before processing the tree again at the same or higher levels or nodes. |

|

Undo − Do Not Delete Journals |

Select this option to undo the previous consolidation process without deleting the previously-generated journals. This option is primarily useful to countries where document sequencing is required or in companies that use data warehousing or a metadata storage process. If the previous journals were deleted, as in the Undo Previous Process option, the sequencing of documents and metadata would no longer agree with the data. Be careful if you select this option and have journals from the Consolidation process that have not been posted, you can accidentally post those journals and cause eliminations to be double-booked. |

Note. If the process ends prematurely during an Undo process, unlock the journals for the process instance before rerunning the Undo process.

Scope of Consolidation

|

Tree |

Specify the applicable tree for the consolidation. |

|

Scope |

Chose Process the Whole Tree to processes all entities defined in the consolidation tree. If you choose Process a Level or Process a Tree Node, the Level and Node fields become available. |

|

Level |

Processes all business units at and below a particular tree level. Identify the level in the edit box. |

|

Node |

Processes consolidated business units at and below a particular tree node. Identify the node in the edit box. |

Tree Effective Date Option

|

Use As of Date |

Uses the date defined for the consolidation. |

|

Use Override Date |

Select and use any date that you define in the Tree Override Date field. For example, you may want to consolidate based on a tree that is not yet active to test (using current figures) its effect on future consolidations. |

See Also

Using Commitment Control in General Ledger

Viewing the Consolidation Process Log

Viewing the Consolidation Process Log

Access the Consolidation Process Log page (General Ledger, Consolidate Financial Data, Review Results Online, Consolidation Process Log).

This information is useful if you want to undo a previous consolidation process, but have forgotten what parameters were used for that process.

The fields on this page are the same as those found on the Consolidation Request page.

See Also

Initiating Consolidation Processing

Using the Consolidation Dashboard

Using the Consolidation DashboardAccess the Consolidation Dashboard page (General Ledger, Consolidate Financial Data, Review Results Online, Consolidation Dashboard).

The Consolidation Dashboard provides an easy way to view and analyze the results of a given consolidation set by date.

|

Tree |

The Tree Control area displays the consolidation process status of a given Consolidation Set and Tree, between a certain From Date and To Date. |

Calculation Log Criteria

|

Elim. Set (elimination set) |

Specify an elimination set to inquire on consolidation results related to that elimination set. |

|

Minor Set (minority interest set) |

Specify a minority interest set to inquire on consolidation results related to that minority interest set. |

|

Unit |

Specifies a business unit to inquire on consolidation results related to that business unit. If there is an error involving a business unit, you can click the Exception button to the right of the Unit edit box to display information in the Message dialog box. |

|

Node |

The consolidation tree is color-coded with the status of each node. Click the node on the tree and click the Exception button to the right of the Node edit box. The system displays a message about the node status in the Message dialog box. |

|

Message |

Displays messages regarding the consolidation processing status of a business unit or a node. If there is an error status and the error has been corrected, you can rerun the same process. The consolidation process resumes from the point where the error occurred. Status codes include:

|

Consolidation Calculation Log

|

Consol Entity (consolidation entity) |

The business unit or the values of your consolidation entity (for example, operating unit). |

|

Identifier |

Stores either the elimination set or the minority interest set. |

|

Entry Type |

Identifies one of the following entry types: elimination, majority parent adjustment, majority parent elimination, or minority parent adjustment. |

Consolidating Across Summary Ledgers

Consolidating Across Summary Ledgers

Processing consolidation on summary ledgers offers the following advantages:

The process time is reduced because the volume of summary ledgers usually is much smaller than detail ledgers.

This is especially true if you are using existing summary ledgers that you are already maintaining.

You can achieve the purpose of consolidating business units with dissimilar charts of accounts through summarizing detail ledgers using trees.

The following are the main differences when setting up or running the consolidation process using summary ledgers:

Whenever a ledger template needs to be specified, instead of using a detail ledger template (for example, STANDARD), use the summary ledger template of your choice (for example, S_ACTDIV).

This includes your elimination set, minority interest set, consolidation ledger set, and consolidation set.

Because detail ledgers are not involved, the system does create journals.

The consolidation calculation log holds the information about how summary ledgers are updated.

Summary ledgers used for consolidation must be up-to-date before you process the consolidation so that, for example, any last-minute journals are rolled up to the summary ledgers properly when posted to its detail ledgers.

Summary ledgers can be incrementally updated either through journal posting or by running a separate Summary Ledger process.

Specifying Summary Ledger Consolidations

Specifying Summary Ledger Consolidations

To set up consolidation on summary ledgers:

Specify the summary ledger template.

For all the summary ledgers that are used for consolidation, you must specify the consolidation log and consolidation equity temporary records for summary ledger templates on the Ledger Template − Record Definitions page. If you plan to use the Affiliate field to identify intercompany transaction balances in summary ledger, your summary ledger must retain the affiliate values.

Define elimination sets on the summary ledger.

To consolidate on the summary ledger, use the Elimination Sets page to define elimination sets based on a summary ledger. You must specify both a ledger template and the name of the summary ledger so that the system knows how to prompt for ChartField and ChartField values.

If the affiliate value is kept in the summary ledger table, and you want to use the Affiliate method of elimination, check the Match Affiliate Value option on the Elimination Lines page. If the Affiliate field is not one of the fields in the summary ledger template, you must specify the business unit value in the elimination set.

Define minority interest sets on the summary ledger.

Specify the appropriate ledger template and ledger for the summary ledger on the Minor Int Source (minority interest source) page.

On the Minor Int Target (minority interest target) page, ensure that the Subsidiary Equity and Parent Investment values are ChartField value sets based on the same summary ledger.

Define consolidation ledger set.

Use the Consolidation Ledger Set page to specify the summary ledger names to be used for each business unit for consolidation.

Define consolidation sets on the summary ledger.

Use the Journal Options page to specify the appropriate ledger template and ledger for the summary ledger. The ledger set used for consolidation processing should be based on the same summary ledger.

On the Set Options page, ensure that elimination sets are based on the same summary ledger.

See Also

Mapping Dissimilar Charts of Accounts

Mapping Dissimilar Charts of Accounts

You can perform consolidations across an organization's ledger balances when entities have different ChartField structures. This is important when consolidations must be performed over entities that are not maintained in PeopleSoft General Ledger.

Create a Consolidation chart of accounts that represents a single, common reporting structure. This Consolidation chart of accounts must be mapped to each business unit's different chart of accounts to be included in the consolidation rules.

The Consolidation chart of accounts can be structured at any level of summarization. This flexibility enables you to define a Consolidation chart of accounts at a lower level of detail than is required for reporting, but at a higher level than the individual business unit chart of accounts. Using trees over the Consolidation account, you can summarize up to the required level of external reporting.

The real value of consolidations functionality is the ability to bring in data from many disparate ledger systems and map to a common parent company chart of accounts.

To map dissimilar charts of accounts, use the ChartField Mapping Set component (CF_MAPPING_SET) and the ChartField Value Mapping component (CF_VALUE_MAPPING).

This section provides an overview of a consolidation and discusses how to:

Define a ChartField mapping set.

Map ChartField values.

Understanding a Consolidation

Understanding a ConsolidationConsider this example of three mutually exclusive and disparate charts of accounts. Assume that all business units are set up in General Ledger, and there is a different chart of accounts for each setID.

SetID MFG represents a manufacturing company, FS is a financial institution, and HC is a healthcare facility.

|

Acct # - MFG |

Acct # - FS |

Acct # - HC |

Account Description by SetID |

|

500000 |

500000 |

500000 |

MFG - Cost of Goods Sold FS - Interest on Checking HC - Cost of Goods Sold |

|

510000 |

510000 |

510000 |

MFG - Production Var-Labor FS - Interest on Savings HC - Lost Charges − Unbillable |

|

511000 |

NA |

511000 |

MFG - Production Var − Mat'l FS - NA HC - Lost Charges - Supplies |

|

512000 |

NA |

512000 |

MFG - Production Var − Ovhd FS - NA HC - Lost Charges - Other |

|

513000 |

NA |

513000 |

MFG - Purchase Price Var. FS - NA HC - Purchase Price Var. |

|

514000 |

NA |

NA |

MFG - Exchange Rate Var. FS - NA HC - NA |

|

520000 |

520000 |

520000 |

MFG - Inventory Scrap FS - Interest − Wholesale HC - Inventory Adj. − Obsolete |

|

530000 |

NA |

530000 |

MFG - Inventory Adjustments FS - NA HC - Inventory Adj. - Other |

|

540000 |

540000 |

540000 |

MFG − Discount Expense FS - Group Insurance HC - Discount Expense |

|

610000 |

530000 |

610000 612000 613000 614000 |

MFG - Salaries FS - Salaries HC - Salaries |

Notice the difference in the numbering of accounts and the account descriptions. For example, account number 500000 is used for a different purpose in each setID. For purposes of consolidation, we must map each set of accounts to a single, common Consolidation chart of accounts.

This table illustrates a subset of a Consolidation chart of accounts to which individual accounts by setID must be mapped:

|

Consolidation Account |

Consolidation Account Description |

MFG |

FS |

HC |

|

500000 |

Cost of Goods Sold |

500000 |

NA |

500000 |

|

590000 |

Indirect Mfg. And Prod Costs |

510000 511000 512000 513000 520000 530000 |

NA |

NA |

|

600000 |

Salary Expense |

610000 |

530000 |

610000 612000 613000 614000 |

|

799000 |

Other General and Administrative Expenses |

540000 |

540000 |

510000 511000 512000 513000 520000 530000 540000 |

|

801000 |

Interest on Deposits |

NA |

500000 510000 520000 |

NA |

|

898000 |

Foreign Exchange |

514000 |

NA |

NA |

As a result of the mappings, each setID has been correlated to a single, common Consolidation chart of accounts.

The example illustrates mapping at the setID level, which presumes that there are one or more business units that share a common chart of accounts under a specific setID.

Pages Used to Map Dissimilar Charts of Accounts

Pages Used to Map Dissimilar Charts of Accounts|

Page Name |

Definition Name |

Navigation |

Usage |

|

CF_MAPPING_SET |

General Ledger, Consolidate Financial Data, Load Ledgers, ChartField Mapping Set |

Define which ChartFields are associated with mapping. |

|

|

CF_VALUE_MAPPING |

General Ledger, Consolidate Financial Data, Load Ledgers, ChartField Value Mapping |

Convert external data loaded in the Staging table to the PeopleSoft Ledger table. |

Defining a ChartField Mapping Set

Defining a ChartField Mapping SetAccess the ChartField Mapping Set page (General Ledger, Consolidate Financial Data, Load Ledgers, ChartField Mapping Set).

Mapping Set Details

|

Ledger Template |

Populates the ledger template ChartFields area when a ledger template is specified. |

Ledger Template ChartFields

When you specify a ledger template, the system populates this area with the ledger template ChartFields. You can select which ChartFields are associated with mapping.

|

Option |

Select one of the following options for each ChartField:

|

|

Value Set Name |

When you select the Map to New Values option for a ChartField, the Value Set Name field becomes available. Select the Value Set that contains the mapping of source values to target values for the ChartField. |

|

View Detail |

Click to go to the ChartField Value Mapping page. |

Mapping ChartField Values

Mapping ChartField ValuesAccess the ChartField Value Mapping page (General Ledger, Consolidate Financial Data, Load Ledgers, ChartField Value Mapping).

|

Target SetID |

Select value to indicate the setID to which you are mapping. |

Mapped Business Units

|

Business Unit and SetID |

Select the business unit and setID you want to map. Click the Add button to map additional business units. If the business units to be processed come from an external source, then setID values serve as a group name to group business units with the same chart of account structure together so that they can share the mapping rules. |

Mapped Values

|

Target Values |

ChartField Value is the Consolidation chart of accounts target ChartField value to which the selected source values will be converted. |

|

Source Values |

SetID links the source value ranges with business units defined in the Mapped Business Units section that have the same setID value.

|

A conversion process reads the mapping setup and converts external data that is either loaded to the Staging table, or to the Ledger table itself but under certain ledger names, and populates the PeopleSoft Ledger table. Consolidation is then performed on the Ledger table.

Using Equitization

Using Equitization

During the accounting year the equity of a subsidiary can change affecting the ownership value of a parent in that subsidiary. For example, net income or losses of a subsidiary increases or decreases the investment and owner equity of the parent. General Ledger enables you to set up multiple equitization rules for multiple business units that have complex parent-subsidiary relationships and create journal entries within a single process. A ledger for a parent entity can be different from that of its subsidiary and, as one of the options, you can generate elimination entries for consolidated reporting.

Note. Equitization supports only the Business Unit field as the processing entity. This is unlike the Consolidation process, which allows consolidation of fields other than business unit, such as the Operating Unit field.

This section discusses a:

Review of an equitization example.

Review of components of the Equitization process.

Reviewing of an Equitization Example

Reviewing of an Equitization Example

In this example, Company M0004 owns 70% of company M0002. In January of 2003, M0002 had a net income of 100 in period 1. An equitization rule is set up to select expense and revenue accounts as the equitization source, and investment and equity income as the target (debit and credit, respectively). The Equitization process creates journals to book 70 to the M0004 ledger investment account and −70 to its equity income account, as indicated by the entries in this table:

|

Equitization Source and Target Account Types |

M0002 |

M0004 |

|

NA |

Period 1 |

Period 1 |

|

Cash, Receivables, and so on |

100 |

230 |

|

Investment in M0002 |

NA |

70 a |

|

Revenues |

<1000> |

<2230> |

|

Expenses |

900 |

2000 |

|

Income before equity adjustment |

<100> |

<230> |

|

Equity income |

NA |

<70>a |

|

Net income |

<100> |

<300> |

Viewing an Example of Multiple Parent/Subsidiary Ownership

If, in addition to the M0002 to M0004 relationship, F0001 owns 20% of M0002 and 60% of M0004, the equity income from subsidiaries for F0001 is 200, with 20 from M0002 and 180 from M0004, as indicated by the b entries:

|

Equitization Source and Target Account Types |

M0002 |

M0004 |

F0001 |

|

NA |

Period 1 |

Period 1 |

Period 1 |

|

Cash, Receivables, and so on |

100 |

230 |

NA |

|

Investment in M0002 |

NA |

70 a |

20 b |

|

Investment in M0004 |

NA |

NA |

180 b |

|

Revenues |

<1000> |

<2230> |

<1500> |

|

Expenses |

900 |

2000 |

1000 |

|

Income before equity adjustment |

<100> |

<230> |

<500> |

|

Equity income |

NA |

<70> a |

<200> b |

|

Net income |

<100> |

<300> |

<700> |

The Equitization process determines the correct sequence to process. It equitizes from M0002 to M0004 and F0001 first, and then M0004 to F0001, so that the 70 from the first step is included as part of the net income in the second.

Creating Elimination and Minority Interest Entries

An option of the Equitization process enables you to generate elimination and minority interest entries as by-products. If specified, the Equitization process creates the elimination entries that reverse target amounts. As in the Consolidations process, these entries go to the proper elimination business units in the consolidation tree and are used in consolidated reporting. In the following example, elimination entries are generated for elimination business unit ME001:

|

Elimination Entries |

M0002 |

M0004 |

ME001 |

|

NA |

Period 1 |

Period 1 |

Period 1 |

|

Cash, Receivables, and so. |

100 |

230 |

NA |

|

Investment in M0002 |

NA |

70 a |

<70) c |

|

Minority interest liabilities |

NA |

NA |

<30> c |

|

Revenues |

<1000> |

<2230> |

NA |

|

Expenses |

900 |

2000 |

NA |

|

Income before equity adjustments |

<100> |

<230> |

NA |

|

Equity income |

NA |

<70> a |

70 c |

|

Minority interest expenses |

NA |

NA |

30 c |

|

Net income |

<100> |

<300> |

100 |

If year-to-date elimination for investment is handled in the Equitization process, the Consolidations process should not generate eliminations again.

This option creates entries to offset the equitized source amount for subsidiary entities. It may be useful for special reporting purposes:

|

Equitized Source Offset Entries Account Types |

M0002 |

M0004 |

|

NA |

Period 1 |

Period 1 |

|

Cash, Receivables, and so on. |

100 |

230 |

|

Investment in M0002 |

NA |

70 a |

|

Revenues |

<1000> |

<2230> |

|

Expenses |

900 |

2000 |

|

Equity income |

NA |

<70> a |

|

Retained earnings offset |

100 d |

NA |

|

Equitized income summary |

<100> d |

NA |

Reviewing of Components of the Equitization Process

Reviewing of Components of the Equitization Process

The Equitization process includes the following components:

|

Data |