Understanding the Cash Flow Statement Preparation

Understanding the Cash Flow Statement Preparation

This chapter provides an overview of the GL Cash Flow Application Engine (FR_CALCULATE) process and discusses how to:

Set up and create the cash flow worksheet.

Run the GL cash flow statement process.

View the transition grid and meet audit requirements.

Note. This documentation deals with using the PeopleSoft Cash Flow process to create the cash flow statement and discusses the features provided to facilitate specific cash flow tasks. A thorough understanding of accounting theory and procedures that are necessary for the creation of the cash flow statement with all the associated implications of fiscal years, varying currencies, and your organization's consolidations is assumed.

Understanding the Cash Flow Statement Preparation

Understanding the Cash Flow Statement Preparation

This section discusses:

Terms and functionality.

Setup and processing flow.

Cash flow worksheet.

Transition grid.

Reporting currency and the foreign exchange (Fx) adjustment.

Data Source.

Element.

TimeSpans and calendars.

Cash flow worksheet recalculation.

Security.

Terms and Functionality

Terms and Functionality

General Ledger provides the GL Cash Flow Application Engine process and its associated functionality for use in the preparation of the cash flow statement using either the direct or indirect method.

This table lists functionality, concepts, and assumptions that are important in understanding and preparing the cash flow statement using the GL Cash Flow process:

|

Term or Functionality |

Description |

|

Ledger sets enable you to associate different ledgers to individual business units to be used in various processes, including the GL cash flow process. |

|

|

ChartField value sets define a combination of ChartField values on one or more ChartFields, based on a list of values, a range of values, or a tree. |

|

|

Data source definitions determine the table or tables and fields from which balances are retrieved. You can add filters for added selection criteria to refine the data set to be used. |

|

|

Elements provide the means to define the details of the calculation of the amount for a line on the cash flow worksheet. Each line on the statement can have one element. Element definitions consist of data source definitions and additional filters and ChartField value sets used for selection criteria. There are three basic categories of elements and four element types:

Note. There is a one-to-one relationship between lines and elements. A line can have only one element, but the element for a line can be formulated from other lines and their elements. The element determines the nature of a line to the degree that the line and the element might be referred to as one and the same thing in discussing the GL Cash Flow Statement process. |

|

|

The cash flow process creates output, one row for each element for the transition grid. If multiple business units are to be processed, one element for each business unit is created by the process. The transition grid is display only and contains the data rows pulled from the defined sources as per the element definitions at the element level as opposed to the source level data. The transition grid enables you to review balances for the various elements at a granular level and shows what makes up the cash flow line items. PeopleTools functionality enables you to download this information to Microsoft Excel to fulfill the hard copy requirement for cash flow statement audit reporting. |

|

|

The delivered cash flow statements are examples and models for your cash flow statement. You must enter the lines that will ultimately be presented on your cash flow statement. The worksheet enables you to maintain the aggregation of these lines. The basic structures for the direct and indirect methods are delivered. You can add lines to these basic structures at multiple levels, delete, and modify line description and determine their relative levels. There are basically three types of lines on the worksheet:

At the line item detail level the cash flow process supports only the Detail, Derived and Label type elements. Worksheet line items can make use of only one element to present the line amount. The cash flow process looks up the Worksheet, Element, and Data Source definitions to calculate the amount for a worksheet line item. The cash flow statement can be generated using the Worksheet component, either with the Print Page function, or you can down load the results to Microsoft Excel for further manipulation. |

|

|

A line on the worksheet cannot be a part of its own calculation. |

The cash flow process makes use of a worksheet template in which you define the lines required for your cash flow statement using the element definitions to specify the data and calculations behind the cash flow statement lines and using data source definitions to identify the source of cash flow data, such as transaction or ledger tables.

You create the cash flow worksheet in the format of the desired end result, which is your cash flow statement itself. You can add lines at multiple levels, delete or modify line descriptions, and determine the relative level for a line in the worksheet hierarchy.

Each line on the cash flow statement can be simply a label or use an element or a group of line items that you define for the cash flow statement for your particular organization. For example, a line labeled Receipts from Customers can have a definition for the line that includes details such as, its data source, if the line itself is derived from a combination of other elements, and its calculation sequence. When you add or modify lines and elements, you define the sequence for utilizing them as well as the calculations involved. You can also define summary lines for totals and subtotals. You can identify a line with a manual element to be used for information that you want to enter manually because it is not to be automatically generated from underlying transaction or ledger tables.

You also define the data sources to be utilized for data collection. For example, the data source for the Receipts from Customers line might include a calculation using sales and the change in the accounts receivable balance for the year-to-date period that is being reported as determined from information derived from the ledger table.

As a further example, receipts from the sale of plant and equipment can be derived from the asset management accounting entry tables rather than ledgers because the fixed asset accounts contain both sales and payments for assets as separate amounts in PeopleSoft Enterprise Asset Management.

Data sources are available based on existing PeopleSoft products and supported functionality. You can add additional data sources; however, PeopleSoft recommends use of the ledger, asset management, and treasury transaction tables. The use of transaction tables in other General Ledger feeder systems, such as payables and receivables, can cause performance problems as their volume grows throughout the reporting period.

After specifying the scope and timeline for the cash flow statement, you can run the cash flow statement process to pull data from the defined data sources and create a transition grid according to your element definitions. The cash flow statement process populates the transition grid at the element level, which is then summarized into the worksheet.

With the appropriate setup you can run the process to pull data from a consolidated position and using ledger sets and related functionality you can also accommodate multicurrency translations to produce a consolidated cash flow statement involving multinational divisions.

You can produce the cash flow statement by downloading the worksheet to MicroSoft Excel by executing the print command from the browser.

Also, using the Printable Options utility you can print statement details from the worksheet definition and see the statement from the perspective of the worksheet lines that shows the details as to how each line item has been defined and which elements the line item references.

Setup and Processing Flow

Setup and Processing Flow

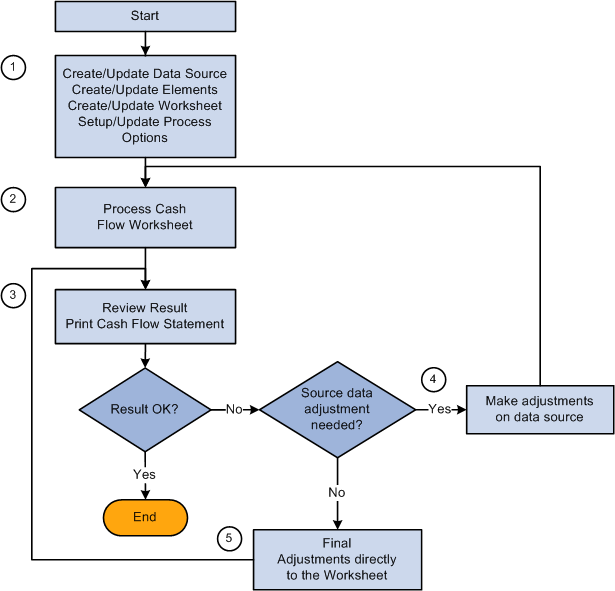

This diagram shows cash flow statement creation and processing functionality at a high level:

Cash flow statement setup and process flow

This list presents the basic setup and processing steps, the components used, brief descriptions, and associates these with the numbered steps in the preceding diagram:

|

Step |

Description |

|

|

1. Basic Setup:

|

Use these components:

|

Ledger sets for cash flow statements enables you to specify more than one ledger for a business unit or multiple business units and ledgers for a cash flow statement. ChartField value sets enable you to provide the scope of the ChartFields for an element by entering selected values or ChartField trees. Use the three remaining components for setup, making changes to setup and creating new worksheets or to copy existing worksheets by using the Copy Worksheet function on the worksheet page. |

|

2. Process the cash flow worksheet. |

Use the Worksheet (FR_WORKSHEET) component and the GL Cash Flow Statement (FR_CALCULATE) application engine process. |

From the worksheet component you can run the cash flow calculation process. |

|

3. Review results and print the cash flow statement. |

Use the Worksheet (FR_WORKSHEET) and the Transition Grid (FR_TRANSITION_GRID) components. |

Printing can be done using the Printable Page feature of the worksheet from the browser. You can also print using the Transition Grid page to provide a more detailed audit trail of the calculated balances. |

|

4. Make adjustments to data sources. |

Use components in various PeopleSoft applications. |

Use components that create and update the ledger or source transaction tables. For example, you might need to make adjustment using the components associated with the Journal Entry, Edit, and Post processes. |

|

5. Make final adjustment directly to the cash flow worksheet. |

Use the Worksheet (FR_WORKSHEET) component. |

Enter adjustments that are not supported by data sources already in the system. |

Cash Flow Worksheet

Cash Flow Worksheet

Using the worksheet you can define, review, and print the cash flow statement.

You can create the structure of your worksheet by adding and modifying or deleting lines from the worksheets for the direct or indirect method that are delivered as sample data. The support of the two methods is inherent in the setup of the worksheet structure and the underlying setup that you create.

Use the basic worksheet template to create completely new worksheets. The basic template also includes heading label lines for balance sheet and profit and loss statement. You can retain these if you want to expand the worksheet with the additional lines required and included the information for the other financial statements, or you can delete them and show only the cash flow statement lines.

As you establish the structure of your cash flow statement, each line must be further defined by creating and associating an element with it, or by deriving its value from other line items, or by defining the line as a label that carries no value. In most cases you aggregate all detail line items to parent line items at higher levels, but there may be cases where you might choose to leave lines alone but hide them from the final report. When you save the worksheet the process issues a warning message to alert you if there are such line items to help prevent unintended orphan lines.

The system automatically maintains line sequence as you add or delete lines on the worksheet and the system logically resequences lines after your changes. You use line numbers when setting up dependencies between lines. For example, if line 10 of the worksheet is defined as the sum of lines 5 through 9, these lines cannot be deleted until the definition of line 10 is modified.

If you add a line between lines 5 and 9, the system automatically adjusts to include these changes in the derivation of line 10. However, the new line item added is not included in the derivation of line 10. When lines are added their relative relationship are not automatically retained. You must redefine the element relationships after making line additions, for any new line item added.

You can lock specific line amounts so that further processing of the statement does not recalculate that line. You can also unlock selected lines; however, if a dependency exists between line 10 and lines 5 through 9 as described in the previous example, the locking of line 10 also locks lines 5 through 9.

Continuing the example of the locking feature, if line 10 is included in the calculation of other lines, such as line 20 or 25 of a worksheet, these lines become dependent on line 10 and also on lines 5 through 9. Under these circumstance, unlocking any of the lines 5 through 9, not only unlocks line 10 but also lines 20 and 25. It also follows that locking line 20 or 25 locks line 10 and lines 5 trough 9. However unlocking line 20 or 25 does not unlock a previously locked line 10.

You can share cash flow statement formats across business units and use them for consolidated reporting by the units. Worksheet IDs identify specific cash flow worksheets. A worksheet can be copied utilizing the Copy Worksheet feature and supplying a new worksheet ID and then modify it to suit different accounting and reporting requirements. You can also create different versions or scenarios of a cash flow statement using the copy feature and specifying different worksheet IDs.

Multiple business units are specified in the form of a business unit tree, and the results can be presented by report entity, which can be one of the business units, or a tree node at any level on the worksheet. When the report entity is a tree node, the balances shown for the line items are summarized amounts of all the business units under that tree node.

Transition Grid

Transition Grid

The transition grid enables you to view the results of the calculation of each element as you produce the cash flow statement, and when the statement is complete the transaction grid can be printed out using Microsoft Excel for a hard copy audit record.

Reporting Currency and the Foreign Exchange (Fx) Adjustment

Reporting Currency and the Foreign Exchange (Fx) Adjustment

You can process the cash flow statement for one or more business units having different base currencies using one or more ledgers. PeopleSoft Asset Management and Treasury tables are also sources for the cash flow statement. The transaction amounts must be available in the base currency of the applicable business units. For example, when an Asset Management transaction occurs in GBP it is converted in the normal processing of the transaction to the base currency of the applicable business unit which in this instance is defined as EUR and then to the reporting currency USD for the cash flow statement. The base currency amounts are the basis or starting point for the cash flow statement.

Where the base currency of the source is not the same as the reporting currency, translation to the reporting currency is required using the Fx Adjustment function, which uses average rates as prescribed by FASB and IAS rules.

If the scope is one business unit and the cash flow statement is built on source data where the base currency equals the reporting currency, no Fx adjustment is necessary for the direct or indirect methods. If the scope is based on consolidated business units and the base currency of the ledgers or transaction tables is different than the reporting currency, then a translation is necessary.

When the system performs a translation, the following applies for all elements where the base currency does not equal the reporting currency:

Calculate the opening balance utilizing the opening rate and populate the Beginning Balance field on the transition grid with the value.

Calculate the closing balance utilizing the closing rate and populate the Ending Balance field on the transition grid with the value.

Calculate the variation, which is the ending balance minus the beginning balance using the average rate and populate the Variation field on the transition grid with the value.

Each element is translated if necessary and the Fx Adjustment value is only shown at the transition grid level for that element.

The Fx Adjustment is shown in composite at the worksheet level for the cash element because the Fx Adjustment is calculated for the cash element when preparing the actual cash flow statement. This composite Fx Adjustment is displayed on the worksheet with the difference between the beginning and ending cash position after the flows have been added and subtracted. The difference between the opening and closing cash balances is the composite, or sum of the flows and the individual element Fx Adjustment.

Data Source

Data Source

You define data sources to be utilized for data collection in creating your statement.

For example, the data source for the cash receipts from customers line comes from a calculation using sales and the change in the accounts receivable balance. The source of information for these is the ledger.

However, the receipts amounts from sale of plant assets is logically derived from the Asset Management accounting entry tables because the fixed asset accounts have a net number for sales and payments for assets in the ledger tables.

Sample data sources are delivered as sample data based on existing products and supported functionality.

Element

Element

The element provides predefined calculation formats for the various types of cash flow calculations that are applied to particular data sources to arrive at cash flow information for the worksheet.

TimeSpans and Calendars

TimeSpans and Calendars

Cash flow worksheet reports year-to-date balances based on the As Of Date entered on the cash flow worksheet. When the GL Cash Flow process is run, the system determines the fiscal year based on the As of Date for a business unit. After determining the fiscal year, the system fetches data for the fiscal year up to the As of Date. For example, if the As of Date on the Cash flow worksheet is 12/31/2000. Data is fetched from the first period of the fiscal year up to 12/31/2000.

Scenario 1: If the calendar for the business unit happens to be April to March, then data is fetched from April, 2000 to December 2000 in the above example.

Scenario 2: If the calendar for the business unit is January to December, then data is fetched from January 2000 to December 2000 in the above example.

Use time span to include adjustment period data.

If business units do not share the same calendar years you must take this into consideration and make adjustments to the consolidated cash flow statement to compensate for the differences.

Adjustment period data is not reported if an appropriate time span is not defined and specified on the cash flow worksheet. Period 0 balances are always reported on the cash flow worksheet, you are not required to specify a time span on the worksheet for period 0 balances.

Cash Flow Worksheet Recalculation

Cash Flow Worksheet Recalculation

Any of the following changes makes the calculated results obsolete or out of sync with the worksheet and some or all of the line items must be recalculated:

These conditions require recalculation of the worksheet:

When anything other than the description is changed on a data source definition.

When such things as the data source, reverse sign, filter, or ChartField value set are changed for an element.

When new effective dated rows are added to an element.

When changes are made to ChartField trees used in ChartField value sets.

When business unit trees used in the process scope are changed.

When source data is updated.

For all the above changes, you are responsible for keeping track of the changes and knowing the cash flow impact.

The following require recalculation but because any change is made within the worksheet component a warning message is issued if the changes affect rows that exist in the FR_WORKSHT_GRID and you are asked by the system if output data should be revised:

When worksheet line items are deleted from the worksheet.

When line items are changed to reference a different element.

When a derived line item is changed for its deriving source.

When the worksheet as of date is changed.

When worksheet process options, such as ledger set, TimeSpan, rate type are changed.

Security

Security

Worksheet and the Transition Grid are two different components and you can assign different access security to each component.

Business unit row level security is enforced by using a security view for the business unit prompt table for both the Worksheet Process Options page and on the Search Record for the Transition Grid component, when creating the cash flow statement you are not able to access data for business units for which you do not have access.

Note. From the outset, you must have security to all business units that are to be included in the creation of your cash flow statement. However, if your access to certain business units is restricted after the cash flow worksheet has been created, you will still be able to use that existing worksheet, created prior to the restriction of original access to any of the business units, to produce and see results from the restricted business units on the worksheet and transition grid.

The Cash Flow Process (FR_CALCULATE) validates security based on the business unit security setup, so if a business unit tree is used in the process, an error message is issued and the data for the business units that the user does not have access to is not processed.

Process options for the Cash Flow Worksheet are stored by user ID and another user ID cannot see or use the setup. Also a user ID cannot see the cash flow worksheet results generated by another user ID. However, a user can use the cash flow worksheet created by another user to generate cash flow worksheet results.

User ID and date-time stamp are stored on the FR_WORKSHT_GRID table when any override or manual entries are made. The system calculated original amounts are maintained and are not modified by override or manual entries.

Setting Up and Creating the Cash Flow Worksheet

Setting Up and Creating the Cash Flow Worksheet

To set up and create the cash flow worksheet use the Ledger Set (LEDGER_SET_FR), ChartField Value Sets (CF_VALUE_SET), Data Source (FR_DATA_SOURCE), Elements (FR_ELEMENT), and Worksheet (FR_WORKSHEET) components.

This section discusses how to:

Define ledger sets.

Define ChartField value sets.

Define data sources.

Define elements.

Define the cash flows worksheet.

Set display options for the worksheet.

Set process options for the worksheet.

View and print a cash flows worksheet to display definitions.

Copy a cash flows worksheet.

Add line items details.

Add line items to derived elements.

Pages Used to Set Up and Create the Cash Flows Worksheet

Pages Used to Set Up and Create the Cash Flows Worksheet

|

Page Name |

Definition Name |

Navigation |

Usage |

|

LEDGER_SET |

General Ledger, Cash Flow Statement, Ledger Set, Ledger Set |

Select the combination of business units and ledgers to include in the cash flow statement configuration. You can select multiple ledgers for a business unit and group specific ledgers for a set of business units to be used for the defining of the cash flow statement data sources. |

|

|

CF_VALUE_SET |

Set Up Financial/Supply Chain, Common Definitions, Design ChartFields, ChartField Value Sets, Setup ChartField Value Sets, ChartField Value Set |

Set up ChartField value sets to scope ChartField values for use in the cash flow statement process. |

|

|

FR_DATA_SOURCE |

General Ledger, Cash Flow Statement, Data Source, Data Source |

Use to define the source of cash flow data and to filter the data for use by the cash flow statement elements to produce the line item amounts. |

|

|

FR_ELEMENT |

General Ledger, Cash Flow Statement, Element, Element |

Select predefined calculation formats. |

|

|

FR_WORKSHEET |

General Ledger, Cash Flow Statement, Worksheet, Cash Flows Worksheet |

Set up new cash flow worksheets and copy cash flows worksheets. |

|

|

FR_WORKSHT_DS_SEC |

Click the Display Options link on the Cash Flows Worksheet page. |

View dependencies and different levels. |

|

|

FR_WORKSHT_PR_SEC |

Click the Process Options link on the Cash Flows Worksheet page. |

Set the business unit scope, time spans, and currency rates for beginning balances, closing and variations. |

|

|

FR_WORKSHT_PR_SEC |

Click the Process Cash Flow link on the Cash Flows Worksheet page. |

Visible only when the Status of the worksheet is Active, click this link to access the Process Cash Flow page to submit the cash flow process. |

|

|

FR_WORKSHT_DFN_SEC |

Click the Printable Definition link on the Cash Flows Worksheet page. |

View and print the element names, balance types, and derived line detail for each worksheet line rather than amounts. |

|

|

FR_WORKSHT_CPY_SEC |

Click the Copy Worksheet link on the Cash Flows Worksheet page. |

Copy an existing worksheet and create multiple worksheet versions. |

|

|

FR_WORKSHT_LN_SEC |

Click the Detail icon or the Add a New Row button to access the page. |

Add and define new lines or change lines on the worksheet. |

|

|

FR_WORKSHT_LIS_SEC |

Visible only for a derived element, click the Add Line Items link on the Line Item Detail for Line page. |

Use to add line items to a derived element. |

Defining Ledger Sets

Defining Ledger Sets

Access the Ledger Set page (General Ledger, Cash Flow Statement, Ledger Set, Ledger Set).

Ledger sets for cash flow statements are applicable to information that is to be derived from the ledger table for both balance sheet and profit and loss accounts. They differ from those prepared for consolidated balance sheet and income statements in that multiple ledgers can be associated with a business unit.

|

SetID |

Enter the set ID for the tree that includes the group of business units that are to be used in the cash flow statement. |

|

Tree |

Select the tree that includes the business units that are to be used in the cash flow statement. The system populates the valid business unit values found in the selected tree for the specified ledger template. All applicable business units appear in the scroll, but you can add or delete business units from the scroll. |

|

As of Date |

Enter the date applicable to the tree that you select to retrieve the appropriate version of the tree. |

|

Refresh |

Click this button after changing the setID or tree selection to repopulate the scroll with the associated business units. You manually enter the ledgers applicable to the business units. |

|

Business Unit |

In association with the ledger template, the setID and tree determine the business units that are populated by the system in the scroll. You can add or delete business units in the scroll. Business units that you add do not have to be part of the tree that you specified. |

|

Ledger |

Specify the ledger source for the data. The ledgers can have different base currencies. |

Defining ChartField Value Sets

Defining ChartField Value Sets

Access the ChartField Value Set page (Set Up Financial/Supply Chain, Common Definitions, Design ChartFields, ChartField Value Sets, Setup ChartField Value Sets, ChartField Value Set ).

You can define ChartField value sets to provide the scope of accounts to be included in the calculation of an element.

See Using ChartField Value Sets.

See Defining and Using ChartField Value Sets.

Defining Data Sources

Defining Data Sources

Access the Data Source page (General Ledger, Cash Flow Statement, Data Source, Data Source).

The ledger table, and the transaction tables from the Asset Management and Treasury applications are recommended sources. The latter two transaction tables only because consolidated amounts are carried in the ledger tables and details of the acquisition and disposition of assets are need for the cash flow statement. These necessary details are carried in the transaction tables only.

Other transaction tables are not recommended because they might grow extremely large during a year and might not be necessary on a detail level in the preparation of the cash flow statement.

|

Source Type |

Ledger: Select when the source types is ledger table and select the appropriate Ledger Template. Other: Select when the source type is other than ledger. |

|

Ledger Template |

This field is available when Ledger is selected as the source type. Select the template that is appropriate to the ledgers for the business units being reported and the element calculations. |

|

Source Record |

This field is available when Other is selected as the source type. Select the source record that carries the amounts appropriate to the business units being reported and the element calculations. |

Field Name

If Ledger is specified as the source type, the ledger template defines the fields where necessary data is to be found and the field name group box is not available. However, if Other is specified as the source type, provide the field names where the necessary data is stored.

|

Accounting Date |

Select the field that contains the dates appropriate to the cash flow statement and the period being reported. |

|

Base Currency |

Select the field to distinguish the rows that contain the base currency for the cash flow statement calculations. |

|

Gl Business Unit |

Select the field name to distinguish the general ledger business unit included in the cash flow statement. |

|

Base Amount |

Select the name of the field that contains the amounts in the base currency. |

Data Source Filter

The Data Source Filter enables you to filter data derived from the source tables based on various operators applied to the specified field and its values.

|

Field Name |

Enter the name of the field on which the data in the source record is to be filtered for use in the cash flow statement. |

|

Not |

Select to do the opposite of the operator value. |

|

Operator |

Select an operator, or action that is to be applied to rows that contain values for the Field Name selected. For example, include only rows from the treasury accounting line table (TRA_ACCT_LINE) in the cash flow calculations data source that have a value in the general ledger (GL_DISTRIBUTION) field. |

Defining Elements

Defining Elements

Access the Element page (General Ledger, Cash Flow Statement, Elements, Element).

|

Effective Date |

Enter an effective date for the element status. This date works in conjunction with the effective dating of the worksheet to provide the appropriate element for the cash flow statement. |

|

Status |

Set the status with effective dating. |

|

Element Type |

Enter an element type to specify one of the delivered types of calculation formats required for determining the underlying cash flows:

|

|

Data Source |

Enter the name of the appropriate data source definition. |

|

Update/Create |

Click to access the Data Source page and create or modify a data source as needed. |

|

Allow user override |

Select to enable the user to override the amount calculated by the process. Override amounts are calculated and tied to a user ID. You can override the calculated amount on the cash flow worksheet. By default the override amount is the same as the calculated amount until you override it. |

|

Reverse Amount Sign |

Select to reverse the sign resulting from the calculation. You must know the sign carried by transaction amounts in the various tables to understand when this check box must be selected. For example, the element type for sales is an ending balance element because it is an income statement line item and only the activity for the period is relevant to cash flow. An increase to cash flow derived by the sales element is defined with the Reverse Amount Sign check box selected when the amount is coming from the ledger table because it is held in that table as a negative amount. However, the Reverse Amount Sign check box is not selected if the sales element derives the sales amounts from the billing transaction tables because sales amounts are maintained as positive amounts in the billing tables. If another element determining cash flow is a variation in accounts receivable that is calculated as the ending balance minus the beginning balance for the period, then a reduction in accounts receivable is a negative amount. Because accounts receivables is normally recorded in the system tables as a positive and because this element is defined to calculate a decrease in the accounts receivable balance as a negative number, to properly reflected the decrease in accounts receivable as an increase to cash flow, it is necessary to reverse the sign of the variance. You must know from which source tables the data is coming and take into consideration the normal sign in which those amounts are maintained within the source tables, the calculation method within the element, and the impact of the amount on cash flow to know when to select the Reverse Amount Sign check box. |

|

Include Year End Close Entry |

Select and the calculations determined by the element includes the period 999 entries for year end closing. |

Defining the Cash Flows Worksheet

Access the Cash Flows Worksheet page (General Ledger, Cash Flow Statement, Worksheet, Cash Flows Worksheet).

PeopleSoft delivers a direct method cash flow worksheet as well as an indirect method cash flow worksheet to use as a guideline for each calculation method. You can modify these to fit your organization's particular requirements. The cash flow worksheet previously pictured depicts the direct method, whereas the following presents the indirect cash flow method.

|

Worksheet ID |

Click the Copy Worksheet link to create and name a new worksheet. |

|

Status |

Use to activate or inactivate a worksheet. An inactive worksheet cannot be processed and the Process Cash Flow link is not available. |

|

As of Date |

Enter a date to be used for prompting effective dated tables such as the Elements and to be used by the calculation process to pull the data for the worksheet. |

|

Display Options |

Click this link to open the Display Options page and alter the display of the worksheet. |

|

Process Options |

Click this link to set the processing options on the Process Options page. |

|

Process Cash Flow |

Click this link to calculate line amounts and update the report entity using the cash flow process. |

|

Printable Definition |

Click this link to access, view, and print the worksheet showing the element names, balance types, and derivation of line items rather than amounts. See Viewing and Printing a Cash Flow Worksheet to Display Definitions. |

|

Copy Worksheet |

Click this link to copy the worksheet giving it a new Worksheet ID and to create different versions of a worksheet. |

|

Line |

Lines are maintained by the system as you add or delete lines on the worksheet. Use the line numbers as reference in creating derived elements. |

|

Detail Level |

Determines the lines display format on the worksheet. There are multiple levels available to be used in organizing the format of the worksheet. You determine the level when you add a line. |

|

Derived From |

This is a display option of the elements making up a line that is set using the Display Options link. |

|

Seq (sequence) |

This is a display option of the calculation sequence maintained by the system for a line. |

Setting Display Options for the Worksheet

Setting Display Options for the Worksheet

Access the Display Options page (click the Display Options link from the Cash Flows Worksheet page).

|

Show Levels |

Select to display the levels you have set for each line item on the worksheet. |

|

Show Dependencies |

Select to display on the worksheet the lines that you determined to be used in calculating a particular line. |

|

Display Line Items of Level xx and up |

Select the line levels to be displayed on the worksheet. There are multiple levels that you can set for a line when you add or change the line. Levels control display only. |

Setting Process Options for the Worksheet

Setting Process Options for the Worksheet

Access the Process Options page (click the Process Options link on the Cash Flows Worksheet page).

|

Process for |

Specify the business unit and ledger or the business unit tree for multiple business unit and ledger set to be used for the cash flows worksheet. |

|

Tree SetID, Tree Name, and Tree Node |

Enter the applicable tree information or the business units included in the worksheet. |

TimeSpans

|

SetID |

Enter the setID for the time span used. |

|

TimeSpan |

Enter a TimeSpan defined to include adjustment period data. |

Currency Rate Types

|

Beginning balance rate type, Closing rate type, and Variation rate type |

Select the rate type to be applied to element calculations for beginning balances, ending balances, and the variations between the beginning and ending balances. These rates are applicable when presenting the cash variation due to currency rate changes in the conversion of base currency amounts to the reporting currency of the cash flow statement. |

Viewing and Printing a Cash Flow Worksheet to Display Definitions

Viewing and Printing a Cash Flow Worksheet to Display Definitions

Access the Cash Flows Worksheet printable definition page (click the Printable Definition link on the Cash Flows Worksheet page).

This page provides a view of the elements with the balance types and line dependencies for derived line elements.

Copying a Cash Flow Worksheet

Copying a Cash Flow Worksheet

Access the Copy Worksheet page (click the Copy Worksheet link on the Cash Flows Worksheet page).

|

New Worksheet ID |

Enter a new worksheet ID to make a copy of an existing worksheet and click OK. This will create a copy that you can access from the search page. |

Adding Line Items Details

Adding Line Items Details

Access the Line Item Detail for Line nn page (click the Detail icon from the Cash Flows Worksheet page).

|

Line Item Type |

Define the line as one of three types depending on its purpose and if it is dependent on other values:

|

|

Detail Level |

Enter 1, 2, or 3, and so on as the level. The level determines the format, or font for the line. |

|

Element |

Select the elements you previously defined to determine the calculation or output for the line. You can click the Update/Create link to update or create an element for the line. |

|

Balance Type |

Select one of the following to describe the line balance, or the output of the line:

|

|

Add Line Items |

Select to access a secondary page and add lines to the derived element for the line. |

|

Operator |

The possible operators are to add or subtract the value of a particular line from the line's other derived elements. |

Adding Line Items to Derived Elements

Adding Line Items to Derived Elements

Access the Selected Line Items to be Added to the Derived Element page (click the Add Line Items link from the Line Item Detail for Line nn page).

|

Select |

Select from the available lines the line or lines to add to the derived element and click OK. |

Running the Cash Flow Statement Process

Running the Cash Flow Statement Process

To run the Cash Flow Statement Process use the Process Cash Flow (FR_WORKSHT_RUN_SEC) component.

The section discusses how to run the GL Cash Flow Statement process.

Page Used to Run the Cash Flow Statement Process

Page Used to Run the Cash Flow Statement Process|

Page Name |

Definition Name |

Navigation |

Usage |

|

FR_WORKSHT_RUN_SEC |

Click the Process Cash Flow link on an active Cash Flows Worksheet page. |

Run the cash flow worksheet process to calculate amounts for the statement and rerun the worksheet to reset manual adjustments. |

Processing the Cash Flow Worksheet

Processing the Cash Flow Worksheet

Access the Process Cash Flow page (click the Process Cash Flow link on an active Cash Flows Worksheet page).

|

Reset All Manual Adjustments |

Select to deselect all manual adjustments when rerunning the worksheet. |

|

Maximum Wait Time (Minutes) |

Enter the maximum wait time before running the cash flow statement process. Maximum Wait Time determines how long the system waits for the process to be completed before returning to the Cash flow worksheet page. |

Viewing the Transition Grid and Meeting Audit Requirements

Viewing the Transition Grid and Meeting Audit Requirements

To view the transition grid and to meet audit requirements use the Transition Grid (FR_TRANSITION_GRID) component.

This section discusses how to view the transition grid and meet audit requirements.

Page Used to View the Transition Grid and Meet Audit Requirements

Page Used to View the Transition Grid and Meet Audit Requirements|

Page Name |

Definition Name |

Navigation |

Usage |

|

FR_TRANSITION_GRID |

General Ledger, Cash Flow Statement, Transition Grid |

Use to view the details of individual elements for a business unit. |

Viewing the Transition Grid and Meeting Audit Requirements

Viewing the Transition Grid and Meeting Audit RequirementsAccess the Transition Grid page (General Ledger, Cash Flow Statement, Transition Grid).

|

Unit |

Displays the business unit to which the element applies. |

|

Element Label |

Displays the element name. |

|

Ending Balance |

If appropriate, the ending balance for an element displays. Because the ledger balance shows net activity, ending balance is defined as the ledger balance for the period plus the beginning balance that is defined as period zero since all reporting periods are year to date. |

|

Beginning Balance |

Display the period zero balance for the element. |

|

Variation |

Variation is a work field calculated as the ending balance minus the beginning balance. For elements that are Activities the beginning balances are zero and variations equal the ending balances. |

|

In Flow and Out Flow |

Usually equals the variation or the difference between beginning and ending balance. |

|

Fx Adjustment (currency adjustment) |

If the balances in the ledger or transaction tables are in a base currency different from the reporting currency, then inflow and outflow might be different from ending minus beginning balance. This is because different exchange rates are used to calculate the flow. In these cases, the foreign exchange adjustment (Fx Adjustment) must be calculated. That is to say, the beginning balance plus the inflow or outflow with the Fx Adjustment equals the ending balance. |

|

Currency |

Displays the reporting currency. |

|

Modified By |

Displays the user ID for the user modifying the element. |

|

Datetime modified |

Shows the date and time the user made the changes to the element. |

Meeting Audit Requirements

Print the transition grid to provide hard copy for audit backup.

|

|

Select Download to transfer the information to Microsoft Excel to provide a hard copy for audit purposes. |