Understanding Production Costs

Understanding Production Costs

This chapter provides an overview of frozen standard costing for make items and discusses how to:

Use the Cost Rollup process (CEPCROLL) to calculate product costs.

Perform a cost rollup.

Review calculated costs.

Update production costs.

Review standard costs.

Calculate costs for PeopleSoft Supply Planning.

Understanding Production Costs

Understanding Production Costs

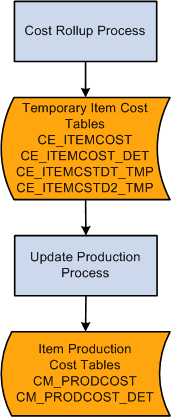

The Cost Rollup process can calculate the costs for make or buy items within a manufacturing or distribution environment. These new costs are temporarily stored in the CE_ITEMCOST and CE_ITEMCOST_DET tables where you can review them using several PeopleSoft inquiry pages. If you discover that the new standard costs are incorrect, then you can change the cost foundation, bill of materials (BOM), or routings and then run the Cost Rollup process again. Once you are satisfied with the results, run the Update Production job (CEREVAL) to move the new standard costs into the CM_PRODCOST table that the system uses to cost manufacturing and inventory transactions. The new frozen standard costs are used for future manufacturing, production variances, and valuing inventory. Both the Cost Rollup and Update Production processes accommodate yield by operation transactions by calculating yield loss costs at the operation sequence level, maintaining extended precision cost fields, and storing detailed cost rollup calculations.

For production IDs, completions are recorded at the last operation. Completed items from Work in Process (WIP) are putaway as finished goods. These putaways are posted to TRANSACTION_INV. Completions may also be directed into another production ID.

If the end item is standard cost, the system debits the standard costs to finished goods and credits WIP. This may leave a remainder in WIP if the standard is different than the cost in the production ID. This remainder is cleared from WIP as a variance. When production IDs are closed for accounting, the variances between standard and production costs are computed by the Production Close process and stored in the SF_VARIANCES record. These variance transactions account for the difference between the standard cost of the end items putaway into finished goods and the total costs of the components, plus conversion cost consumption. WIP is cleared either to finished goods or as a variance for all completed and closed production IDs.

This diagram illustrates setting up frozen standard costs for makeable items. The Cost Rollup process calculates the frozen standard costs and stores the costs in the temporary item cost tables for review. The Update Production process (Cost Update/Revalue process page) moves the new standard costs into the production tables used to cost manufacturing and inventory transactions:

Managing frozen standard costs for makeable items

Once you have set the foundation for costing, you can calculate and update item costs. In a manufacturing environment, PeopleSoft Cost Management supports standard costing and enables you to easily perform cost simulations, standard cost updates, inventory, inspection, and WIP revaluations using a system that is well interfaced with other PeopleSoft Supply Chain Management applications.

Within a standard cost environment, you calculate the cost of makeable items based on the cost of purchased items, the makeable items product structure, and the list of tasks necessary to put the components together to form the subassembly or assembly.

Once you calculate and approve the item costs, you must put them into effect as the new frozen standard cost in production. Costs based on engineering bill of materials (EBOM) are calculated but are not used to update the standard cost for the item in production. When you have completed this process, PeopleSoft Cost Management revalues all inventories in the inspection, raw material, WIP, and finished goods storage areas at the new standard cost. Additionally, PeopleSoft Cost Management revalues any assemblies or subassemblies in process in production at the new standard. PeopleSoft Cost Management also records an accounting transaction to adjust the general ledger (GL) inventory balances.

You can maintain many standard costs for various production options and cost approaches, however, there is only one frozen standard cost per item that transcends all standard cost profiles and cost books for a business unit.

When production begins, PeopleSoft Cost Management tracks the cost of production, including any variances from the expected results. You have visibility into potential production variances before production is completed, which gives you time to analyze potential problems before they are booked to the GL.

See Also

Defining the Cost Foundation for Makeable Items

Common Elements Used in This Chapter

Common Elements Used in This Chapter

|

Conversion Code |

Define labor, machine, and other conversion costs in the manufacturing process. Use production conversion codes to define conversion rates associated with work centers or tasks. In the case of subcontracted tasks or operations, the rate should represent the cost of preparing and sending the item to the subcontractor for outside processing. |

|

Conversion Overhead Code |

Define the different types of overhead costs used in the manufacturing process. Use production overhead codes to define conversion overhead rates associated with work centers or tasks. You can specify up to four production overhead codes for the work center or task. |

|

Cost Element |

Categorize the components of an item's cost. When you perform a cost rollup, you maintain an item's cost by cost element. Cost elements also help define the debit and credit ChartField combinations in transaction processing. |

|

Cost Type |

Creates separate costing groupings with different methods of costing, such as current, revised, or forecasting. The cost type also defines how purchased components are calculated. |

|

Cost Version |

Once you have determined the cost types, you can use cost versions to determine how many iterations or versions of costs you want to calculate. By using different versions for a cost type, you can maintain a history of the different costs calculated for each cost type. You can base these cost versions on different sets of assumptions, such as different BOMs (manufacturing versus engineering), effective dates, different labor rates, or different budgets that determine the overhead expenses. |

|

Lower Level Costs |

Costs associated with the components used on the assembly. |

|

Source Code |

Identifies an item as make, buy, floor stock, expense, or planning. This determines how the system uses the item during the Cost Rollup and Update Production processes. |

|

Standard Cost Group |

Standard cost groups (also know as cost groups) enable you to group together a set of items for cost roll up and update, comparing costs and reporting inventory value. |

|

This Level Costs |

Costs associated with manufacturing a specific assembly item. |

|

Costing Conversion Overhead Rates |

Establishes the rates to use for overhead costs based on the units produced, labor and machine hours, or labor and machine costs. The rates are based on business unit, cost type, cost version, conversion overhead code, and cost element. You can establish several different rates. |

|

Costing Conversion Rates |

Establishes the rates to use for labor and machine costs in the production process. You can enter fixed run, run, postproduction, and set up rates for both labor and machine. The rates are based on several factors including business unit, cost type, cost version, conversion code, and cost element. This structure gives you flexibility to set up and use several different rates. |

Using the Cost Rollup Process to Calculate

Product Costs

Using the Cost Rollup Process to Calculate

Product Costs

The Cost Rollup process calculates the standard cost for an item based on:

|

Bill of Materials (BOM) |

The BOM contains the component materials for the end item. These component material costs can be purchased components and subassemblies (both manufactured and subcontracted). The Cost Rollup process includes the cost of purchased items, the lower-level costs of manufactured subassemblies, and the cost of subcontracted assemblies. For configured items, the component list from the production order is used instead of the BOM. |

|

Routing |

(Optional) The routing contains information about the operations and work centers required for producing the item. Associated with the routings are the labor, machine, subcontracting, and overhead rates that the system uses for the cost rollup of a particular cost type and version. The Cost Rollup process uses the costing rate type for labor and machine setup, run, fixed run, and postproduction times or rates. For configured items, the system uses the operation list from the production order instead of the routing. |

This diagram illustrates the calculation of the cost of manufactured items. The Cost Rollup process calculates the standard cost based on the BOM and routing of the item. The cost type and cost version combination determine the rates and additional costs used to calculate the cost:

Calculating the cost of a manufactured item

The Cost Rollup process uses several elements to compute the frozen standard costs, including:

|

Cost Type |

Define different cost types, such as current, revised, and forecasted costs, to create a working space for cost calculations. You perform cost rollups based on cost types. For example, you can set up a cost type of CUR for the current production costs. |

|

Cost Version |

Cost versions are a subset of cost types that enable you to have different versions or simulations of the costs. For example, for the cost type CUR (current production costs), you could have a current production version (PRD1) and an engineering version (ENG1) for cost calculations. |

|

Cost Element |

Cost elements categorize the different components of an item's cost, such as, material, labor, and machine costs. They are used on reports and inquiries of the rolled up costs of a manufactured item. They can also be used to post accounting entries for inventory transactions. You could create the cost elements, for example, 300 for recording labor setup costs, 301 for recording labor run, and 501 for overhead - machine based costs. |

|

Production Conversion Codes |

Production conversion codes define labor, machine, and other conversion costs in the manufacturing process. Use conversion codes to define conversion rates associated with work centers or tasks. For example, you could create the conversion code 4403 (painter) for conversion costs related to painting. |

|

Production Overhead Codes (conversion overhead codes) |

Production overhead codes define the different types of overhead costs that are used in the manufacturing process. Use conversion overhead codes to define conversion overhead rates associated with work centers or tasks. For example, you could create the production overhead codes of 6504 for depreciation and 6507 for electricity usage. |

|

Costing Conversion Rates |

Define the rates to use for labor and machine costs in the production process. You can create a variety of costing scenarios using different cost types, cost versions, and production conversion codes. For example, you can set the labor setup rate to 8 per hour for the CUR cost type, PRD1 cost version, 4403 (painter) conversion code, and store the results in the cost element 300 (labor setup). Then you can create a different labor run rate of 9 per hour for the CUR cost type, PRD1 cost version, 4403 (painter) conversion code, and store the results in the cost element 301 (labor setup). |

|

Costing Conversion Overhead Rates |

Establish the rates to use for overhead costs based on the units produced, labor or machine hours, or labor or machine costs. You can establish several different rates based on business unit, cost type, cost version, conversion overhead code, and cost element. For example, you can set up the depreciation costs as 5 /machine hour for the CUR cost type, PRD1 cost version, 6504 (depreciation) conversion overhead code, and store the results in the cost element 501 (overhead - machine based). |

|

Work Centers and Tasks |

Once you have set up the cost foundation, use the production conversion codes and the production overhead codes to define the labor and machine cost for the work centers or tasks. You can specify up to four production overhead codes for the work center or task. For example, for the work center, PAINT01, you can add the conversion code 4403 (painter) for conversion costs related to painting. You can also add the conversion overhead code of 6504 for depreciation on the paint machines. |

|

Item Routing |

You then define the item's routing to include these work centers and tasks within the operation sequences. The routing also defines the operation time for any operation sequence. For example, for the operation sequence 50, you could record that is takes 2 hours of labor setup, 4 hours of labor run, and 1 hour of machine time. |

|

Item |

The item definition for a manufactured item includes the item routing to be used and the BOMs. This information is recorded on the Define Business Unit Item - Manufacturing page. For example, for the item SR1001 (touring bike) this page defines where to get the item routing and BOM. |

|

Cost Rollup Process |

The Cost Rollup process uses the item routing, cost type, and cost version to determine the labor, machine, subcontracting, and overhead costs. For example, if the cost rollup process uses the cost type of CUR and the cost version of PRD1, with the item ID SR1001, then the conversion costs for the operation sequence 50 would be:

|

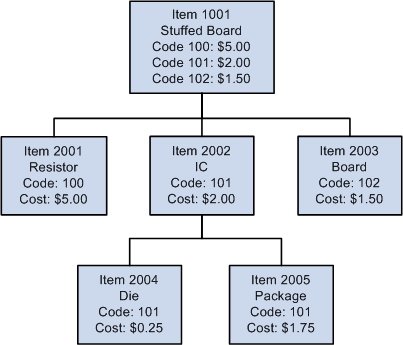

The Cost Rollup process must calculate the cost at each level of the product structure, as well as the final cost. For example, if an item has a BOM or component list like the one in this diagram, the cost rollup must calculate the cost of item 2002 before it can calculate the cost of item 1001. This diagram illustrates the cost rollup of a multi-level product structure:

Example of a cost rollup

In this example, the costs associated with items 2004 and 2005 would be lower-level or component-level costs for item 2002. The cost of 2002, when you add it to items 2001 and 2003, becomes the lower-level or component costs for item 1001. The labor, machine, and overhead costs associated with manufacturing item 2002 are this-level or assembly-level costs for 2002. However, they would become lower-level or component-level costs when associated with item 1001. Item 1001 would have its own set of this-level or assembly-level costs, associated with putting items 2001, 2002, and 2003 together.

See Also

Understanding PeopleSoft Manufacturing

Rounding Rules in Manufacturing

Understanding the Types of Cost Rollups

Understanding the Types of Cost Rollups

You can use the Cost Rollup process to determine the standard cost for makeable items, configured items, engineering items, purchased items, and simulations. Only cost rollups of manufactured, purchased, and configured items can be used to update production costs (the CM_PRODCOST table). The system calculates engineering and simulation costs for reporting and comparison purposes.

The Cost Rollup process performs in basically the same way for the different types of items. The only difference is where the cost calculation obtains the information to determine the material and labor costs for the item.

|

Type of Item in Rollup |

Material Costs From |

Labor, Machine, Subcontracting, Overhead Costs From |

Can Update Std Costs? |

|

Manufactured |

Primary manufacturing BOM code 1. |

Primary production routing code 1 or the reference item routing, if one is specified for the item. |

Yes |

|

Configured |

Component list. |

Operation list. |

Yes |

|

Engineering |

Any manufacturing BOM or engineering BOM. BOM code 1 is used for all lower levels. |

Any production routing or engineering routing. Routing code 1 is used for all lower levels. |

No |

|

Simulation |

Any manufacturing BOM code. BOM code 1 is used for all lower levels. |

Any production routing. Routing code 1 is used for all lower levels. |

No |

Rolling Up Configured Items

There are two options for calculating standard cost for a configured item using the Cost Rollup process:

|

Costing |

The Cost Rollup process calculates the item's cost based on its BOM and routing. The standard cost is stored by item ID. One item could have multiple configuration codes but all configurations of the same item use the same standard cost. |

|

Configuration Costing |

The Cost Rollup process calculates the item's cost based on the component list and operation list from the latest production ID. The system stores the standard cost according to the combination of item ID and configuration code. Choose configuration costing by selecting the check box on the Define Item - Configuration page. |

The roll up of a configured item using configuration costing does not include co-products, by-products, or yield by-operation details. However, the system maintains detailed costs for configured items according to component ID and operation sequence. It stores these detailed costs in the CE_ITEMCOST_DET and CM_PRODCOST_DET tables. It also summarizes these costs according to cost element and stores them in the CE_ITEMCOST and CM_PRODCOST tables.

See Also

Establishing Configured Production Costs

Defining Configuration Attributes for an Item

Rolling Up Costs with Multiple Outputs

Rolling Up Costs with Multiple Outputs

If the output of a production run is more than one item, then the cost is allocated. Multiple outputs include:

Co-products.

By-products.

If a single manufacturing process generates multiple items, you can allocate the batch cost across the primary and co-products to determine the per unit cost of each end item. When it explodes a co-product for a multiple output BOM during Cost Rollup process, the system uses the Associated Primary BOM to determine the correct lower-level structure. An associated primary must therefore exist in this case for the rollup to occur. The BOM and routing code combination that the system used to explode the co-product must also exist.

Note. The system calculates a co-product's cost by multiplying the total cost of the batch (including the recycle and waste by-product costs) by the cost percentage for the co-product (as specified on the BOM Maintenance - Outputs page), then dividing by the expected output quantity of the co-product.

By-products can be of two types: recycle and waste. The system calculates cost relief for recycled by-products by multiplying the quantity and the cost of the recycle by-product. This cost relief is subtracted from the lower-level costs. The system treats recycled by-products as a negative cost, because they can be used as an input to another process. The cost used is determined by the purchase cost as specified for the cost type that you selected on the Cost Rollup page.

Note. A recycled by-product must have the same cost element (with a cost category of material) as another component or waste by-product; otherwise, the item is not costed. This reduces the chance of a material element producing a negative value. If the cost element becomes negative, due to a recycle by-product cost relief, the system does not cost the item and an error message is printed on the Cost Rollup Audit page.

The system treats waste by-products as positive or zero cost. They either add to the cost of the product, such as the cost of disposing it, or have no associated cost. The system determines the cost used for waste by-products by multiplying the quantity and the cost of the waste by-product. It adds this cost to the material costs.

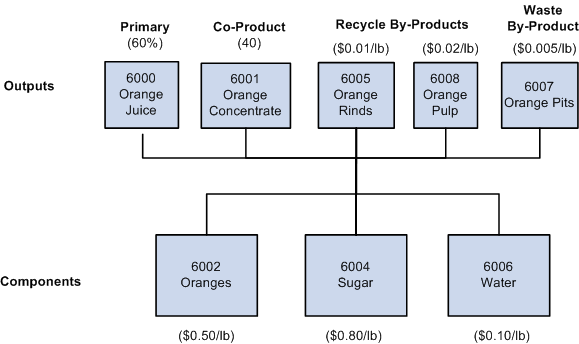

This diagram illustrates an example of a cost rollup with multiple outputs:

Example of a cost rollup with multiple outputs

In this example for orange juice processing, you have these outputs: primary (orange juice), co-product (orange concentrate), recycle by-products (orange rinds and orange pulp), and waste by-product (orange pits). The components are oranges, sugar, and water.

Calculate the material costs by multiplying the quantity of each component by the standard cost:

Oranges: (5lb * 0.50) = 2.50

Sugar: (1lb * 0.80) = 0.80

Water: (10Gal * 0.10) = 1.00

Total Material Costs = 4.30

Calculate the by-product costs as:

Orange Rinds: (2lb * 0.01) = -0.02 (Cost is negative, because the recycled by-products are viewed as a cost benefit.)

Orange Pulp: (1lb * 0.02) = - 0.02

Orange Pits: (2lb * 0.005) = 0.01 (Cost is positive, because it is a disposal cost.)

Total By-Product costs = - 0.03

Total Costs = Material Costs + By-Products Costs = 4.30 + (-0.03) = 4.27

To determine the primary and co-product costs, multiply the total costs by the cost percentage.

Orange Concentrate = 40% * 4.27 = 1.71

Orange Juice = 4.27 − 1.71 − 2.56

Calculate the standard cost of the primary and co-product by dividing the apportioned costs by the output quantity of each item.

See Also

Rolling Up Costs for Yield by Operation

Items

Rolling Up Costs for Yield by Operation

Items

For yield by operation transactions, the Cost Rollup process calculates the yield loss for each operation sequence where the operation yield is less than 100 percent.

The Cost Rollup process performs these steps to calculate yield by operation transactions:

Calculates and inserts costs into the temporary tables CE_ITMCSTDT_TMP and CE_ITMCSTD2_TMP by applying the operation yield at the operation sequence where they are first introduced.

Each subsequent operation sequence uses the results of the previous operation sequence. Subsequent costs take the form (cost (from original OpSeq) / operation yield percent) - cost from original OpSeq.

All components with an invalid or zero operation sequence are applied to the first operation sequence that you defined for the routing code specified. All by-products with an invalid or zero operation sequence are applied to the last operation sequence for the routing code. For by-products, the process uses the operation yield of this last operation sequence.

This example demonstrates how subsequent costs are created as existing costs from earlier OpSeqs move through subsequent OpSeqs where Operation Yield<100 percent.

The first operation sequence (OpSeq 10) has an operation yield of 100 percent. The cost is 10. Processing begins at the second OpSeq, because the first OpSeq processing is already complete.

The second operation sequence (OpSeq 20) has an operation yield of 96 percent. Using the formula (Cost (from original OpSeq) / Operation Yield Percent) - Cost (from original OpSeq), then the additional cost for the cost originally introduced in OpSeq 10 would be 10/96% - 10 = 10.4167-10=0.4167.

The third operation sequence (OpSeq 30) has an operation yield of 98 percent. The additional cost for the cost originally introduced in OpSeq 10 would be ((10/96%)/98%) – 10/96%) = (10.6293-10.4167)=0.2126.

Therefore, the total cost is 10 + 0.4167 + 0.2126 = 10.6293 (which is the same as 10 * expected completions at OpSeq 30 = 10 / (.96*.98) = 10.6293.

Once the system processes all the specified operation sequences, it moves the cost data into the CE_ITEMCOST_DET table.

Performing a Cost Rollup

Performing a Cost Rollup

You can calculate the cost of makeable items by running the Cost Rollup process.

To calculate product costs:

Verify the cost foundation has been defined for the items. See the chapters, "Structuring Your Cost Management System" and "Defining the Cost Foundation for Makeable Items."

Check the item default values, including the source code, standard cost group (optional), and cost element in the Define Business Unit Item component.

Confirm that the items have a BOM.

If you are rolling up the costs to a configured item, verify that you have a component list on the production ID.

(Optional) Confirm that the items have an item routing.

If you are rolling up the costs to a configured item, verify that you have an operation list on the production ID.

Use the Cost Rollup page to run a cost rollup and calculate the new standard cost for the items.

See Also

Defining the Cost Foundation for Makeable Items

Pages Used to Perform the Cost Rollup Process

Pages Used to Perform the Cost Rollup Process

|

Page Name |

Definition Name |

Navigation |

Usage |

|

MFG_ATTRIB |

Items, Define Items and Attributes, Define Business Unit Item, Manufacturing |

Select the source code for each item. The source code determines whether or not an item is included in the Cost Rollup process. |

|

|

GEN_ATTRIB_INV |

Items, Define Items and Attributes, Define Business Unit Item, General |

Enter the cost element for each item. The Cost Rollup process and Update Production process use cost elements to categorize the components of an item's cost. For purchased items that are components of a manufactured item, enter the current purchase cost. This insures that a default price is available for cost rollup. |

|

|

EN_BOM_MAINT |

Manufacturing Definitions, BOMs and Revisions, Maintain BOMs and Revisions, Manufacturing BOMs, Summary |

Verify that a BOM exists for the makeable items. |

|

|

EN_RTG_SUMMARY |

Engineering, Routings, Define Engineering Routings, Summary Manufacturing Definitions, Resources and Routings, Routings, Define Routings, Summary |

Verify that a routing exists for the makeable items. |

|

|

CE_ROLLUP_REQ |

Cost Accounting, Item Costs, Update Costs, Cost Rollup, Cost Rollup |

Run this process to calculate the standard cost for makeable items. Based on the cost type and version, you can rollup any combination of BOM and routing for production, configured, engineering, simulations. The process calculates the cost of co-products and by-products. |

See Also

Understanding the Manufacturing Standard Cost Foundation

Defining Item Default Values

Defining Item Default Values

These default values influence the Cost Rollup process.

The item's source code determines how the item is used for the Cost Rollup and Update Production processes. Define each item's source code on the Define Business Unit Item - Manufacturing page. The options are:

On the Define Business Unit Item - Manufacturing page, specify which production routing the item uses when the system determines the assembly item's this level labor, material, and overhead costs.

The item's average order quantity indicates the typical batch or lot size that you use to produce this item. Define each item's average order quantity on the Define Business Unit Item - Manufacturing page. This is the quantity that you expect to produce in one production ID or production schedule based on the BOM.

If a BOM quantity on a bill is greater than 1, the component's per order quantity is spread over the BOM quantity. For example, Assembly A has a BOM quantity of 100; Component B used on A has a per order quantity (QPA, or quantity per assembly) of 1500. Therefore, the use of B for a single A is 15 (1500/100). When entering the QPA, the BOM maintenance supports a precision of 4 places to the right of the decimal. You have the option to define the calculated QPA precision that the system maintains when it determines the item's cost. On the Installation Options - Manufacturing page, you select a precision anywhere from 4 to 10 places to the right of the decimal. If the BOM and associated process results in multiple outputs (primary, co-products, and by-products), the BOM quantity must be set to the item's average order quantity.

If you use economic order quantities or average order quantities with setup, fixed run, and postproduction times, the system must prorate the cost of these processes over the order quantity to determine a per unit cost. The system determines per unit setup, fixed run, and postproduction cost by dividing the cost of each process by the average order quantity. Typically, the system calculates this at the operation level, then sums it to provide the total cost.

(Optional) You can use cost groups to select a set of items to process for the Cost Rollup process and the Update Production process (Cost Update/Revalue process page). Enter the group in the Standard Cost Group field on the Define Business Unit Item - General page.

The Cost Rollup process and Update Production process (Cost Update/Revalue process page) use cost elements to categorize the components of an item's cost. Cost elements are also used when costing a transaction. Enter the cost element for the item's material costs on the Define Business Unit Item - General page. For both purchased and makeable items, enter a cost element in the material cost category.

Used in Manufacturing Check Box

You must identify any items that are used in PeopleSoft Manufacturing. Select the Used in Manufacturing check box on the Item Business Unit Definition - General: Costing page for any item that:

Has a BOM or routing.

Is a component on a BOM or component list.

Is associated with a production area.

Is used on a production ID or production schedule.

See Also

Defining Basic Business Unit Item Attributes

Using the BOMs

Using the BOMs

The manufacturing bill, engineering bill, or component list determines the structure of the item and therefore the associated lower-level costs.

PeopleSoft Cost Management uses BOM yield or component yield loss to account for the loss of components during the manufacturing process. For costing purposes, the cost of the assembly item can, therefore, take into account the expected loss of components in production. In this instance, the system inflates the cost of the component by the component's yield.

Cost rollups do not include the cost of floor stock, expensed, subcontract supplied, or non-owned items. Consigned items are included in the item's cost as they are considered owned upon consumption.

If you roll up an assembly item that has no owned components, only non-owned and parts supplied by a subcontractor (Subsupply flag is set to Yes), the cost rollup does not calculate any lower-level material costs but still rolls up labor costs for that item.

See Also

Using Item Routings

Using Item Routings

The production routing, engineering routing, or operation list documents the operations that are necessary to assemble the item. In the Cost Rollup process, the system considers only the routings or operation lists of those items whose source code you have defined as Make.

When calculating conversion costs for an operation, you must consider the crew size of the operation. For example, if the crew assigned to a work center consists of three people, multiply the labor run cost by three.

As it does with crew size, the system multiplies the machine cost of an operation by the number of machines assigned to the work center in which the operation takes place.

When the conversion rate associated with the code assigned to the operation is expressed in terms of a cost per unit, as opposed to a labor or machine rate per hour, you must specify the corresponding costing time type on the routing or operation list in order for the system to include the cost. For example, suppose that you specified a labor run cost of 1.00 per unit in the conversion code associated with the operation. There must be a costing labor run time in the routing or operation list in order for the system to include that 1.00 in the item's cost.

When you specify an operation's costing times and run rates in terms of days, the system factors the rate by the work center's average daily capacity to determine the total number of hours it requires to complete the operation.

See Also

Rolling Up Costs

Rolling Up Costs

Access the Cost Rollup page (Cost Accounting, Item Costs, Update Costs, Cost Rollup, Cost Rollup).

Use the Cost Rollup page to perform a cost rollup for a single item, a range of items, a group of items, or all items for any BOM and routing combination within a business unit, as well as for any cost type and cost version.

When rolling up one or all items, consider these points:

When rolling up all items, the system determines the costs of all outputs and all lower level buy items.

If rolling up a single item and the single item specified is a primary item on the BOM code selected, it is costed and updated along with any co-products whose associated primary BOM item is the primary product selected.

You can select a co-product as the single item to roll up.

In this instance, the system determines the BOM on which the co-product is made by looking at the co-product's associated primary BOM. Using this BOM, the co-product's cost is calculated. However, the Primary Product's cost is not calculated nor updated.

The details for yield by operation transactions are captured by calculating yield loss costs at the operation-sequence level, maintaining extended precision cost fields, and storing detailed cost rollup calculations

These errors can occur during the Cost Rollup process. Use the Cost Rollup Audit page to check for these errors:

An invalid BOM code or routing code exists.

A co-product is to be rolled up, but a BOM or routing code does not exist for the primary product.

For example, suppose that you try to roll up a co-product with BOM code 2 and routing code 2. However, if its associated primary item does not have a BOM and routing code combination of 2, 2, then an error occurs and the rollup does not take place.

The cost element for a recycle by-product does not exist on the Define Business Unit Item component.

No BOM exists for a Make item.

A cost type's Purchase Cost Used is Forecasted or Last Price, and you did not enter a forecast price or last price paid for a buy item.

An error occurs and the rollup does not take place.

See Also

Understanding the Manufacturing Standard Cost Foundation

Reviewing Calculated Costs

Reviewing Calculated Costs

Before updating the production records with the new costs calculated by the Cost Rollup process, you can review the new cost using several inquiry pages.

This section discusses how to review BOM costs for manufacturing and engineering.

Pages Used to Review Calculated Costs

Pages Used to Review Calculated Costs

|

Page Name |

Definition Name |

Navigation |

Usage |

|

CE_ITEMCOST |

Cost Accounting, Item Costs, Review Costs, Costs by Cost Version |

Displays item costs by type and version. |

|

|

CE_ITEMCOST_DET |

Click the Cost Element link on the Costs by Cost Version page. |

Displays the detailed costs maintained by component ID and operation sequence. |

|

|

CE_NOCSTVER_INQ |

Cost Accounting, Item Costs, Review Costs, Items without Cost by Version |

Displays all items that do not have a calculated cost. Use after running the Cost Rollup process to verify that new standard costs were created for the cost type and version. |

|

|

CE_ROLLUP_STAT |

Cost Accounting, Item Costs, Review Costs, Cost Rollup Audit |

Use to determine what items were not costed for a specific Cost Rollup process and to view the related error message text. |

|

|

EN_BOM_INQ_COSTED |

|

Displays component costs based on the item's manufacturing BOM or engineering BOM. You must run the Cost Rollup process for the BOM code and routing code combination to display the costs on this page. |

|

|

EN_BOMCOST_OUT_SP |

Click the Output Cost link on the Costed BOM or Costed EBOM inquiry pages. |

Displays the costs details for the output items from this BOM. This inquiry compares previously rolled up costs for a cost type and cost version (the Cost Version Item Cost column) to the current cost of assembly (the Inquiry Item Cost column) to determine the costing impact of BOM changes to an assembly. |

|

|

EN_ITEMCOST_OUT_SP |

Click the Output Items link on the Output Costs page. |

Displays the detailed item costs by cost element for the output item, including materials, labor, machine, and overhead costs. |

|

|

EN_ITEMCOST_SP |

Click the Component ID link on the Costed BOM page or the Costed EBOM page. |

Displays the detailed item costs by cost element for the component item. |

|

|

EN_BOM_LIST_OUT_SP |

Click the Co-Products link on the Costed BOM page or the Costed EBOM page. |

Lists products from this BOM including primary and co-products. Displays details about each product including resource percentage and cost percentage. |

|

|

CE_COST_INQ_SUM |

|

Displays costs by item routing, including conversion and overheard conversion costs attached to the item routing by task or work center. Material costs can also appear if you enter a BOM code. Enter unit, item ID, cost type, cost version, routing code, and BOM code (optional). Select the Cost as Batch check box to view the costs and quantities for the entire batch instead of a single unit of the item. Then click the Search button to retrieve costs by operation sequence. All routing codes and BOM codes are available. You do not have to run the Cost Rollup process to retrieve the costs. Note. This inquiry is designed for a single assembly and only at the highest level. |

|

|

CE_COST_OPSQDTL_SP |

Click the OpSeq Details link in the operation list on the Review Costed Routing - Operations page or the Review Costed Eng Routings - Operations page. |

Displays the extended costs of one operation sequence by cost element for each conversion code and conversion overhead code. Displays summarized cost of yield loss from prior operations (Previous OpSeq Cost Applied). |

|

|

CE_COST_INQ_DTL |

Select the Component/Output tab of the Review Costed Routing component or the Review Costed Eng Routings component. |

Displays the components added to each operation sequence and the output from each operation sequence. |

|

|

CE_COST_INQ_ADDL |

Select the Additional Costs tab of the Review Costed Routing component or the Review Costed Eng Routings component. |

Displays the additional calculated costs added to this combination of business unit, item ID, cost type, and cost version. These costs are entered on the Additional Item Costs page. They are applied after all labor, machine, material, and overhead costs have been added. |

|

|

MESSAGE_LOG |

Background Processes, Review Message Log, Message Log-Search |

Review the status of any background process and view messages for any errors that occurred during the Cost Rollup or Update Production processes. |

Reviewing BOM Costs for Manufacturing and

Engineering

Reviewing BOM Costs for Manufacturing and

Engineering

Access the Costed BOM page (Manufacturing Definitions, BOMs and Revisions, Review BOM Information, Costed BOMs, Costed BOM) or the Costed EBOM page (Engineering, BOMs and Revisions, Review EBOM Information, Costed EBOM, Costed EBOM).

Another method of viewing a manufactured or engineering item's cost is to use the Costed BOM page or the Costed EBOM page. You can display the costs of an assembly, its components, and outputs according to cost type and cost version. This is especially useful for determining the costing impact of manufacturing BOM changes on an assembly. Use cost types for costing simulations, to perform what-if analyses, or to calculate new standard costs prior to updating. Cost versions are iterations of a particular cost calculation for a cost type. You can have multiple versions for each type. You cannot use these inquiry pages for configured items.

|

Cost as Batch |

If the output is one single item ID, then select this check box to view the costs and quantities for the entire batch instead of a single unit of the item. If the item has co-products, then the costs and quantities of the batch appear. In addition, for each of the components, the check box controls whether the per unit costs are multiplied by the BOM quantity to get a batch cost instead of a per unit cost. |

|

Depth |

Enter the number of levels of the BOM to include. To ensure the costs include all changes at the lower levels and choose the maximum depth of a BOM. This is important for revision-controlled BOMs. |

|

Output Costs |

Click this link to access the Output Costs page, where you can view all lower-level costing details for each output product based on the costing percentage split. Also, the Output Items link on the Output Costs page enables you to view these costs by cost element. |

|

Co-Products |

Click this link to access the Output List page, where you can view any co-products associated with the component. This link is only available if co-products are present. |

|

Component ID |

Click this link to access the Component Detailed Costs page, where you can view the detailed costs of the component according to cost element. |

Note. Due to rounding differences, it is possible you could see a small variance (+ or − 0.0003) between the cost version costs and the inquiry costs in this inquiry. This occurs when the system displays the costed BOM results for an item that is either a batch item or has batch assembly items at lower levels.

See Also

Updating Production Costs

Updating Production Costs

To update standards costs in the production tables, use the Update Production Costs component.

Once you have reviewed and approved the calculated product costs for manufactured and configured items, you can move them into the production cost records using the Cost Update/Revalue process page. This process:

Moves the item cost details from the temporary table CE_ITEMCOST_DET to the Production Cost details table CM_PRODCOST_DET.

The cost element summarizes the data and places it in the Production Cost table CM_PRODCOST. The data is stored by effective date, cost type, and cost version. The CM_PRODCOST_DET record captures the details for yield by operation transactions by storing yield-loss costs at the operation-sequence level and maintaining extended precision cost fields calculated by the Cost Rollup process.

Calculates the change in inventory value for all material in storage areas (including raw material, finished goods, inspection, and material issued to WIP inventory locations) based on the new standard costs at the time of the update and the existing standard production costs for the item. If you are using the negative inventory feature and at the time of a revaluation there is an item that has negative inventory (for example, WIP bin component with a negative inventory) then the system changes the item's standard cost and generates inventory revalue (transaction group 200) entries.

Revalues assemblies and subassemblies in process based on changes to an item's product structure, cost, routing, or rates.

The change in value reflects the revaluing of all outputs, including co-products, by-products, and teardown outputs. The revalue process only considers production IDs and schedules that have a status of In Process, Pending Complete, Complete, and Closed for Labor.

Updates the operation list with any new routing costing labor or machine times and run rates.

This occurs only if a match between the operation list and routing occurs for the operation sequence, work center, and task (optional).

Writes the difference in inventory value and WIP value to revaluation records for posting to the general ledger.

Copies the conversion rates and conversion overhead rates used to determine the production costs into a production rate record.

Once the system completes the update, it uses these rates to determine earned labor, machine, subcontracting, and overhead costs for WIP for any completions once the update is performed.

The Cost Update/Revalue process page does not move product costs for an engineering or simulated cost version into the production cost record. However, you can run the process in report-only mode. This enables you to determine the effects of proposed engineering changes on inventory value.

Page Used to Update Production Costs

Page Used to Update Production Costs

|

Page Name |

Definition Name |

Navigation |

Usage |

|

RUN_CES5001 |

Cost Accounting, Item Costs, Update Costs, Cost Update/Revalue, Update Production |

Updates the costs and performs inventory and WIP revaluation. |

Revaluing Inventory

Revaluing Inventory

Revaluing inventory is the process of updating an item's cost and accounting for the change in inventory value due to the change in standard cost for the item. The process involves calculating the difference in inventory value, recording the difference, and updating the standard costs for the items. Once you record the updated information, you can post it to the GL through the normal transaction accounting cycle. Because the system bases the revaluation on a snapshot of the inventory, you want to ensure that the inventory value is as correct and accurate as possible to reflect the correct financial picture.

Prior to running the Cost Update/Revalue process page to revalue inventory, you must:

Put away all pending inventory in the appropriate storage areas using the Complete Putaway process (INPPPTWY).

This includes all items that you received from vendors that require inspection, assemblies that have been completed in WIP and are issued back to stock or to another WIP location, as well as any receipts from another inventory business unit. This ensures that the system can account for all inventory and can calculate and post the correct revaluation amount.

Run the Deplete On Hand Qty process (IN_FUL_DPL) to ensure that the item's quantities at the business unit level match the item's quantities at the location level.

You must issue all staged items in order for the system to complete the update for the quantity on hand.

Run the Transaction Costing process (CM_COSTING) to ensure that all transactions already created throughout the PeopleSoft applications have been costed.

The transactions do not need to be posted.

Prohibit material movement for the business unit by selecting the Prohibit Material Movement check box on the PeopleSoft Inventory Definition page.

No inventory transactions should take place while the Cost Update/Revalue process page is revaluing inventory. When it updates the standard costs, the system multiplies the change in standard cost by the quantity on hand for the item in each storage area. By prohibiting material movement, you ensure that the quantity on hand is accurate.

Check the Process Monitor to ensure that someone else in the organization is not running the Cost Update/Revalue process page.

If you are updating all item costs within the business unit, you should not run two Cost Update/Revalue processes simultaneously.

In-process inventory includes two parts:

|

RIP |

Raw material or subassemblies that have been issued to the shop floor but have not yet been used in an assembly. RIP inventory value is part of the storage area location inventory and is fairly easy to calculate. It is derived by multiplying the quantity on hand for an item in the WIP storage location by its costs. |

|

WIP |

Items that are in various stages of assembly. Inventory value for material in process presents more of a challenge, because it involves incomplete sets of components associated with an assembly item. It also includes value-added material that has been scrapped and must take into account material that has been completed to stock and is no longer part of WIP. |

Calculating WIP Inventory

Calculating WIP Inventory

WIP value is not a value or amount that PeopleSoft Cost Management stores for end items using a frozen standard cost approach. It is calculated at any point in time using PeopleSoft records. To calculate WIP:

Add component costs.

Add earned conversion costs (labor, machine, subcontracting, and overhead).

Add waste by-products.

Subtract assembly scrap.

Subtract assembly completions (including co-products and recycled by-products).

Component Costs

PeopleSoft Cost Management bases the WIP component costs value on the quantity of the component issued to the production ID or production schedule. The quantity issued is stored on the component list. PeopleSoft Manufacturing updates the issue quantity when you record operation or assembly completions and the component is consumed from the WIP location or when the component is kitted directly to the production ID. PeopleSoft Cost Management derives the value for component costs by multiplying each component's issue quantity by the component's standard cost-by-cost element, then summarizing all the costs for all components. This enables the system to determine the lower-level costs for WIP. To calculate the old cost, PeopleSoft Cost Management uses the latest cost for the item in the Items Production Cost record. To determine the new cost, PeopleSoft Cost Management uses the item's cost for the cost type and version that you're using to update the cost.

Earned Conversion Costs

Earned conversion costs include the labor, machine, subcontracting, and overhead costs for this level only.Earned this level costs account for the value added to WIP. The system bases these costs on assemblies or operations that are complete. The WIP value report summarizes entries in the earned conversion cost record for each production ID or production schedule according to the cost category associated with the cost element. The WIP revalue first determines the old earned this level costs by summarizing the costs as stated in the Earned Conversion Cost record. Then, the new earned this level costs are calculated, taking into account any changes in routing times and their corresponding rates for the cost type and version that you select. PeopleSoft Cost Management posts any differences to the earned conversion cost record, so that when it summarizes, the old earned conversion costs plus the differences equal the conversion costs at the new standards.

Waste By-Product Cost

If the production ID or production schedule has multiple outputs, then include any waste by-product that has been reported complete and issued from the operation. Determine the waste by-product cost by multiplying the actual output quantity (quantity completed at the operation) by its standard cost. Any waste by-product costs are added to the overall cost of the WIP value. To determine the change in waste by-product cost, compare the current completion cost to the cost of the quantity completed and multiply by the new cost for the cost type and version selected for the update.

Assembly Scrap

Assembly scrap accounts for the value of partially completed assemblies that you have rejected. The cost must be subtracted, because the system does not include this assembly scrap value as part of WIP or finished goods. At the time the scrap occurs, the system determines the scrap cost by summarizing the components used up to that point, plus any value added up to the point that the scrap occurred. The system stores assembly scrap costs in an assembly scrap record and summarizes scrap costs in the WIP value report by cost category for the production ID or production schedule. As with components and earned conversion costs, the scrap cost for revaluation is recalculated based on the component costs using the cost type and version. These level scrap conversion costs are based on the new times and rates for the cost type and version.

Assembly Completions

Assembly completions take into account, for all outputs, the assemblies that are completed to stock, another production area, or issued directly to another production ID, and are therefore no longer part of the production ID or production schedule value. This includes the cost of co-products and recycled by-products. The value is derived by multiplying the quantity completed for all outputs as stated in the production header record by its cost from the item production cost record. To determine the new value of completions, the assembly quantity completed is multiplied by the cost for the selected cost type and version.

Revaluing WIP Inventory

Revaluing WIP Inventory

The inclusion or handling of a production ID or schedule in WIP depends on the production status. The system revalues any production ID or production schedule if the production status is not entered, firmed, released, canceled, or closed for accounting.

Processing Non-Matching Cost Elements

When processing non-matching cost elements, the WIP revalue involves matching cost elements from the old costs to cost elements for the new costs. In cases where there are no matches, the Cost Update/Revalue process still posts the difference to the variance record. In the case where the old cost record has a cost element that does not exist on the new cost record, the system posts a negative entry on the variance record for the entire old cost. If the new cost record has a cost element that does not exist on the old cost record, the system posts a positive entry for the entire new cost.

Processing Configurable Items

In the WIP revalue process, it is necessary to first determine if the item being revalued is a configured item that is using configured costing. When processing the component, the system verifies whether there is a configuration code on the component list for the item. If there is, the next check verifies whether the item is configured costed by reviewing the check box on the master item table. If the item is to be configured costed, the system matches the configuration code found on the component list to that on the item production cost record for the item and uses those costs to calculate any differences.

When the system processes assemblies, the same checks hold true. If the production order assembly item has a configuration code, the system verifies whether the item is to be configured costed. If the item is to be configured costed, then another match of the configuration code found on the header record is made to that on the item production cost record, and those costs are used to calculate any differences.

Processing Without Operation Lists

When a production ID or production schedule does not have an operation list, the conversion costs are earned by posting the this level costs from the item production cost record to the earned conversion cost record. Therefore, to calculate the earned conversion costs at the new standard, use this level costs for the cost type and version.

Floor Stock and Expensed Items

The system does not include floor stock or expensed items for purposes of inventory valuation and revaluation.

Operation List Updates

As part of the WIP revaluation process, the system updates the operation lists with the costing labor and machine set up, run, fixed run, and postproduction times and run rates. It makes an attempt to match the operations on the operation list to those on the items primary production routing or its referenced item routing. When the operation sequence, work center, and task code (if you use tasks) on the routing match the component list, the times and run rates in the operation list are updated with those from the routing. This ensures that the system does not create process change variances once you update the costs. If the item's reference routing changes and is different from the one that you used to create the operation list, no updates are made even if the operations, work centers, and task codes match.

The WIP Revaluation report displays the old cost, new cost, and variance.

Updating Production Costs

Updating Production Costs

Access the Cost Update/Revalue page (Cost Accounting, Item Costs, Update Costs, Cost Update/Revalue, Update Production).

Select the business unit, cost type, and cost version with which you want to update the standard costs. The status for the cost type and version type appears and must be set to Approved for versions related to manufactured and configured items.

The value in the Distrib. Type (distribution type) field changes to the distribution type associated with the inventory revaluation transaction group, but you can change it or you can leave it blank.

Note. PeopleSoft Cost Management copies to production the cost type and version's conversion rates and conversion overhead rates only when you have selected all items. The system copies these rates and uses them to calculate the earned labor and machine costs, as well as the applied overhead values for assembly completions and scrap. If you are updating a single item cost and have based that cost on new conversion rates, you must manually copy those rates into the production rate records.

Report/Update Options

You have three options for running this process:

Report Only - No Updates.

This is the only option available for versions related to engineering or simulation. Use this option to view the impact of the standard change without actually updating the costs and posting revaluation entries. Running this process in report-only mode gives you a preview of the financial impact of the standards change without affecting the current transaction costing or inventory valuation.

Revalue Inventory and Report.

This option updates the standard production cost record and calculates the change in all inventory values. Running this report enables you to analyze a specific item, production ID, or schedule quantity should a question arise regarding the revaluation.

Revalue Inventory - No Report.

This option updates all records discussed in this section but does not print a report detailing the changes to inspection, stores, WIP inventory locations, or to WIP inventory.

When reporting, you can also select to print a summary report only or to save variance results. When you choose to run the update in report-only mode and save variance results, you can review the revaluation results by viewing the Compare Cost Updates or the Cost Updates by Tolerance pages.

See Also

Reviewing Standard Costs

Reviewing Standard Costs

After updating the production records with the new standard costs calculated by the Cost Rollup process and applied by the Cost Update/Revalue process, you can review the standard costs using several inquiry pages.

Pages Used to Review Applied Standard Costs

Pages Used to Review Applied Standard Costs

Calculating Costs for PeopleSoft Supply

Planning

Calculating Costs for PeopleSoft Supply

Planning

You can define specific BOM and routing combinations that can be extracted to PeopleSoft Supply Planning. This ensures that planning processes use the most accurate costs as the main driver when making sourcing decisions.

To specify BOM and routing combinations that can be extracted to PeopleSoft Supply Planning:

Create BOM and routing codes for an item.

On the Define Business Unit Item - Manufacturing page, select the Use Prdn Option Maintenance option to enable the system to select all BOM and routing combinations that have the Incl Plan (include in planning) check box selected on the Production Option Maintenance - Definition page.

Use the Define Production Options component to link the BOM and routing codes together and (optionally) assign them to production areas.

Select the Include in Planning check box to specify which BOM and routing combinations should send to the planning engine.

Create production IDs and production schedules for the item.

Run the Production Option Costing process.

Verify the results using the Review Sourcing Templates component.

Run the Optimization Table Load process (PL_LOAD_OPT).

To use the Define Business Unit Item - Manufacturing page to specify BOM and routing combinations that can be extracted to PeopleSoft Supply Planning:

Create BOM and routing codes for an item.

On the Define Business Unit Item - Manufacturing page, select the Use BOM and Routing Defaults option to :

Limit the number of BOM and routing combinations that are extracted to PeopleSoft Supply Planning by entering a BOM code or a routing code on this page. If you enter a value in the BOM Code or Routing Code fields, then the Production Option Costing process only uses that value. You can use this feature to cost all BOMs with one routing or vice versa.

Cost every possible BOM and routing combination by leaving the BOM Code and Routing Code fields blank.

Create production IDs and production schedules for the item.

Run the Production Option Costing process.

This process rolls up production option costs based on the specific BOM and routing combinations.

Verify the results using the Review Sourcing Template component.

Run the Optimization Table Load process to pass costs to the planning engine.

Note. If the Production Option Costing process has not been run, PeopleSoft Supply Planning use the item cost based solely on the primary BOM and routing.

Sourcing Template

If there is a sourcing template for the item, then that template determines the sequence of production, purchase, and transfer options. If there is no sourcing template, then the template is loaded in lowest cost order.

Note. If the costing utility has not been run, then the system uses the item standard cost when creating the item's sourcing template.

Pages Used to Review Calculated Planning

Costs

Pages Used to Review Calculated Planning

Costs

|

Page Name |

Definition Name |

Navigation |

Usage |

|

MFG_ATTRIB |

Items, Define Items and Attributes, Define Business Unit Item, Manufacturing |

Select the Use Prdn Option Maintenance option to enable the system to select all BOM and routing combinations that have the Incl Plan (include in Planning) check box selected on the Production Option Maintenance - Definition page. |

|

|

EN_PDO_BR |

Manufacturing Definitions, Production Options, Define Production Options, Definition |

Use this page to define production options and effective-dated BOM and routing combinations that can be extracted to PeopleSoft Supply Planning. |

|

|

CE_PRDNCST_REQ |

Cost Accounting, Item Costs, Update Costs, Production Options Cost Update, Production Option Costing |

Calculates the production option costs for items, based on the as of date. This ensures that a more accurate cost, based on specific BOM and routing combinations, is sent to PeopleSoft Supply Planning for each production option. |

|

|

PL_SOURCE_DTL |

Supply Planning, Define Planning Attributes, Sourcing Templates, Review Sourcing Templates, Sourcing Inquiry |

Review the results of the Production Option Costing process. |

Using Production Option Costing Process

Using Production Option Costing Process

Access the Production Option Costing page (Cost Accounting, Item Costs, Update Costs, Production Options Cost Update, Production Option Costing).

The Production Option Costing process calculates the cost of items to be sent to PeopleSoft Supply Planning. This utility considers makeable items, including primary items and co-products (make items) but not buy items. If an associated primary BOM exists for an item and it is a co-product on an associated primary BOM and also has its own BOM, then both the item's BOM and its associated primary BOM are included in the costing.

For a routing with operation yield, this process captures the detailed costs at the operation-sequence level by calculating yield loss, maintaining extended precision cost fields, and storing detailed calculations in the CM_PRODCOST_DET record.

For single output BOMs, the system calculates, according to cost element, the BOM and routing combination total this level and lower-level cost, and then stores these values in the full cost fields. It then divides these values by the output quantity (same as BOM quantity for single output BOMs) to get the per unit cost.

For multiple output BOMs, the system also adds any waste by-products costs and subtracts recycle by-products costs from the full batch this level and lower-level costs. Therefore, in order to calculate the (per unit) cost for the primary and co-products, the system uses this formula:

Item Per Unit Cost = (Output Cost % * Full Batch Cost) / Output Qty