Understanding the Manufacturing Standard

Cost Foundation

Understanding the Manufacturing Standard

Cost Foundation

This chapter provides an overview of the manufacturing cost foundation and discusses how to:

Define the standard cost foundation.

Calculate the cost of purchased components.

Add additional costs.

Understanding the Manufacturing Standard

Cost Foundation

Understanding the Manufacturing Standard

Cost Foundation

Before you calculate the cost of purchased components or make items, define the basic codes and tables that PeopleSoft Cost Management uses to build and categorize an item's cost; including, the labor, machine, subcontracting, and overhead rates. The system enables you to create multiple scenarios for standard costing by using cost types and versions.

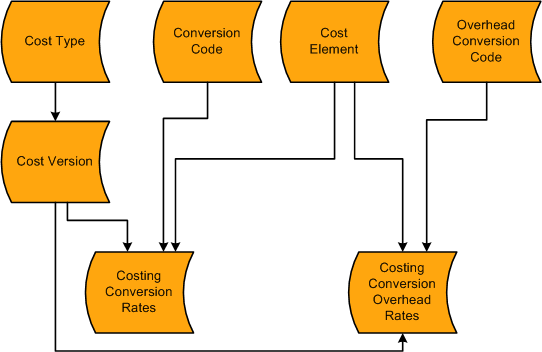

This diagram illustrates the elements that are used to define the costing structure. The cost type and cost element are used to build the costing conversion rates and the costing conversion overhead rates along with the conversion code or the overhead conversion code. The cost version is used in combination with the cost type to define the costing conversion rates:

Cost foundation for makeable items

You can define how the system calculates the cost of purchased components by using the cost type page for the end item.

You can add additional costs to a manufactured item by using the Additional Item Costs page. These costs are applied after all labor, machine, material, and overhead costs are added.

Defining the Standard Cost Foundation

Defining the Standard Cost Foundation

Before you can calculate the standard cost of purchased or makeable items, you can define the basic codes and tables that PeopleSoft Cost Management uses to build and categorize an item's standard cost.

This section discusses how to:

Define cost types.

Define cost versions.

Create standard cost groups.

Define cost elements.

Define conversion codes.

Define conversion overhead codes.

Create costing conversion rates.

Create costing conversion overhead rates.

Copy cost structures.

Copy rates.

Update conversion rates.

Pages Used to Define the Standard Cost Foundation

Pages Used to Define the Standard Cost Foundation

|

Page Name |

Definition Name |

Navigation |

Usage |

|

CE_TYPE |

Set Up Financials/Supply Chain, Product Related, Cost Accounting, Cost Types |

Define cost types. |

|

|

CE_VERSION |

Cost Accounting, Item Costs, Define Rates and Costs, Cost Versions |

Define cost versions. |

|

|

CM_COSTGROUP |

Set Up Financials/Supply Chain, Product Related, Cost Accounting, Standard Cost Groups, Cost Groups |

(For standard costing only) Create cost groups. |

|

|

CM_ELEMENT |

Set Up Financials/Supply Chain, Product Related, Cost Accounting, Cost Elements |

Define cost elements. |

|

|

CE_CONCODE |

Set Up Financials/Supply Chain, Product Related, Cost Accounting, Production Conversion Codes |

Define production conversion codes. |

|

|

CE_OHCODE |

Set Up Financials/Supply Chain, Product Related, Cost Accounting, Production Overhead Codes, Conversion Ovhd Codes |

Define conversion overhead codes. |

|

|

CE_CONRATE |

Cost Accounting, Item Costs, Define Rates and Costs, Conversion Rates, Costing Conversion Rates |

Create cost conversion rates. |

|

|

CE_CONOH_RATE |

Cost Accounting, Item Costs, Define Rates and Costs, Overhead Rates, Costing Conv Ovhd Rates |

Create cost conversion overhead rates. |

|

|

CE_COPY_COST_STRUC |

Cost Accounting, Item Costs, Define Rates and Costs, Copy Cost Structures |

Copy cost structures. |

|

|

CE_COPY_COSTS |

Cost Accounting, Item Costs, Define Rates and Costs, Copy Cost Types/Versions |

Copy cost rates. |

|

|

Update Conversion Rates |

CE_MANFRZ_CON |

Cost Accounting, Item Costs, Update Costs, Update Conversion Rates |

Update conversion rates. |

See Also

Defining Cost Types

Defining Cost Types

Access the Cost Types page (Set Up Financials/Supply Chain, Product Related, Cost Accounting, Cost Types).

Create separate costing groupings with different methods of costing, such as current, revised or forecasting. The cost type also defines how purchased components are calculated.

Defining Cost Versions

Defining Cost Versions

To define cost versions, use the Cost Versions component (CE_VERSION).

Access the Cost Versions page (Cost Accounting, Item Costs, Define Rates and Costs, Cost Versions).

Use the Cost Versions page to define the different cost versions for a cost type. You can create unlimited cost versions for any cost type. By using different versions for a cost type, you can maintain a history of the different costs that are calculated for each cost type. You can base these cost versions on different sets of assumptions, such as different bills of material (BOMs; manufacturing versus engineering), effective dates, different labor rates, or different budgets that determine the overhead expenses.

|

Version Type |

Determines the BOM and routing that the Cost Rollup process (CEPCROLL) uses to calculate the cost of make items. Values are: Production: Rolls up manufacturing data only and uses the primary BOM and routing only, each with a code of 1. Use this option to roll up the costs for a manufactured or configured item. This is the only option that produces cost calculations that can update the live production tables. Engineering: Rolls up with either manufacturing or engineering data, with any combination of BOM and routing codes. Use this option exclusively for engineering roll-ups and comparisons. Simulation: Only rolls up with manufacturing data, but can use any combination of BOM and routing codes. Use this option to create what-if scenarios for makeable items. |

Each cost version can have a status of pending, denied, or approved. You can update frozen standard costs used for accounting purposes only if the cost version status is approved. Cost versions that are related to engineering or simulation always have a status of pending.

Creating Cost Groups

Creating Cost Groups

To create standard cost groups, use the Cost Groups (CM_COSTGROUP) component.

Access the Standard Cost Groups page (Set Up Financials/Supply Chain, Product Related, Cost Accounting, Standard Cost Groups, Cost Groups).

Standard cost groups, also known as cost groups, enable you to group together a set of items for standard cost roll up and standard cost update, comparing costs and reporting inventory value. Add items to the cost group by entering the standard cost group on the item's Define Business Unit Item - General: Common page. Then, enter a standard cost group on the Cost Rollup page or the Cost Update/Revalue page instead of defining a range of item IDs.

Defining Cost Elements

Defining Cost Elements

To create cost elements, use the Cost Element (CM_ELEMENT) component.

Access the Cost Elements page (Set Up Financials/Supply Chain, Product Related, Cost Accounting, Cost Elements).

Cost elements categorize the components of an item's cost that are tracked through the PeopleSoft Inventory system. The debit and credit ChartField combinations in transaction processing can also be defined by cost element.

See Also

Defining Conversion Codes

Defining Conversion Codes

To define conversion codes, use the Conversion Codes component (CE_CONCODE). Use the Production Conversion Code component interface to load data into the tables for this component.

Access the Production Conversion Codes page (Set Up Financials/Supply Chain, Product Related, Cost Accounting, Production Conversion Codes).

Production conversion codes can be used to categorize labor, machine, and other conversion tasks and activities within work centers in the manufacturing process. Use conversion codes to define conversion rates that are associated with work centers or tasks.

Defining Conversion Overhead Codes

Defining Conversion Overhead Codes

To define cost conversion production overhead codes, use the Conversion Overhead Codes component (CE_OHCODE_CODE). Use the Conversion Overhead Codes component interface to load data into the tables for this component.

Access the Production Overhead Codes page (Set Up Financials/Supply Chain, Product Related, Cost Accounting, Production Overhead Codes, Conversion Ovhd Codes).

Production conversion overhead codes categorize the different types of overhead costs absorbed during the manufacturing process. Use conversion overhead codes to define conversion overhead rates that are associated with work centers or tasks. You can specify up to four conversion overhead codes for the work center or task.

Creating Cost Conversion Rates

Creating Cost Conversion Rates

To define cost conversion rates, use the Costing Conversion Rates component (CE_CONV_RATE). Use the Costing Conversion Rates component interface to load data into the tables for this component.

Access the Conversion Rates page (Cost Accounting, Item Costs, Define Rates and Costs, Conversion Rates, Costing Conversion Rates).

Establish these rates to capture labor and machine costs in the production process. You can enter fixed run, run, post-production, and set up rates for both labor and machine. The rates are based on several factors, including business unit, cost type, cost version, conversion code, and conversion rate type. Each conversion rate type then points to a cost element. Multiple conversion code definitions can point to the same or different cost elements. This structure gives you flexibility to set up and use several different rates. Link these rates with a work center or task where they are used to determine the labor, machine, and subcontracting costs of an item's routing operation.

For each conversion rate type that you want to associate with a specific conversion code, enter a rate.

|

Conversion Rate Type |

Enter fixed run, run, post-production, or set up rates for either labor or machine. These rate types correspond to the costing rate types that are defined for a task, and ultimately, to an operation on an item's routing or operation list. You do not need to enter a cost for each conversion rate type. However, if any costing time type on the task, routing, or operation list does not have a corresponding cost, then the system does not include that portion of the routing or operation list cost in the item cost. This enables you to call out task types which have different cost implications for the same conversion code in different cost types or versions. Likewise, if you specify a cost in the conversion rates but do not include the corresponding costing times in the routing or operation list, those costs are not included. |

|

Rate |

Enter conversion code rates. Use production conversion codes to associate conversion rates with multiple work centers or tasks. Use the Rate Maintenance/Defaulting group box on the Manufacturing Options - MFG Business Unit Options page to determine whether to enter conversion rates for work centers or tasks. |

|

Per |

Specify how the rate should be applied. You can enter conversion rates as an amount per Hour for labor and machine setup, fixed run, and post production. For labor and machine run, you can specify an amount per Hour or Unit. |

|

Cost Element |

Enter the cost element that is associated with this conversion cost. This cost element must have the category of conversion on the Cost Elements page. |

For subcontracted tasks or operations, the conversion cost should represent the charge from the vendor for the outside processing. If the vendor charges you a flat amount per unit, enter that charge as a per unit cost. If the vendor quotes you a rate per hour, enter that rate as a labor-setup, run, or fixed-run rate and enter the corresponding time that it takes the vendor to complete the task on the item's routing or operation list.

See Also

Setting Up Manufacturing Business Unit Options

Creating Cost Conversion Overhead Rates

Creating Cost Conversion Overhead Rates

To define cost conversion overhead rates, use the Costing Conversion Overhead Rates component (CE_CONV_OH_RATE). Use the Overhead Rates component interface to load data into the tables for this component.

Access the Overhead Rates page (Cost Accounting, Item Costs, Define Rates and Costs, Overhead Rates, Costing Conv Ovhd Rates).

The conversion overhead rates represent the overhead expenses that are associated with the production of the assemblies. Enter the cost conversion overhead rates to use for overhead costs based on the units produced, labor and machine hours, or labor and machine costs. The rates are based on business unit, cost type, cost version, conversion overhead code and cost element. You can establish several different rates. In the case of subcontracted tasks or operations, it should represent the cost of preparing and sending the item to the subcontractor for outside processing.

Select the rate type that you want to associate with the rate code. Valid rate types include:

|

Per Unit Amount |

Select to apply cost to the item on a per unit basis. |

|

% of Labor Amount (percentage of labor amount) |

Select to base on the standard labor costs that the operation requires. To determine the amount of overhead cost, the system first calculates the total labor cost of the operation, then multiplies that cost by the factor that is specified in the Conversion Overhead % field. |

|

Amt per Labor Hr (amount per labor hour) |

Select to base on the standard labor hours that the operation requires. As with labor cost determination, it determines the number of hours that are necessary to complete the operation by adding labor setup, run, fixed-run, and post-production times (converted to hours), and then multiplies that time by the amount that is specified in the Conversion Overhead Rate field. |

|

% of Machine Amount (percentage of machine amount) |

This is similar to the percent of labor amount method except that the overhead cost is based on the machine costs that are associated with the operation. To determine the amount of the overhead cost to apply, the system first calculates the total machine cost of the operation, then multiplies that cost by the factor that is specified in the Conversion Overhead % field. |

|

Amt per Machine Hr (amount per machine hour) |

This is similar to the amount per labor hour method except that the overhead cost is based on the machine hours that are necessary to complete the operation. The system determines the number of hours that are necessary to complete the operation by adding machine setup, run, fixed-run, and post-production times, converted to hours, and multiplies that time by the amount that is specified in the Conversion Overhead Rate field. If you don't specify costing machine hours or run rates for the operation, the system does not apply overhead costs. |

|

Cost Element |

Enter the cost element that is associated with this conversion cost. This cost element must have the category of conversion overhead on the Cost Elements page. |

Copying Cost Structures

Copying Cost Structures

Access the Copy Cost Structures page (Cost Accounting, Item Costs, Define Rates and Costs, Copy Cost Structures).

Copy the cost foundation structures: cost types, cost elements, production conversion codes, and production overhead codes from one setID to another. This process copies only the codes that are associated with each record and not the rates or costs that are associated with those codes.

Copying Rates

Copying Rates

Access the Copy Cost Types/Versions page (Cost Accounting, Item Costs, Define Rates and Costs, Copy Cost Types/Versions).

Copy costs and rates from one business unit to another. If another business unit has the rates and item costs that you want to use, or if you want to use one set of cost type and version information as the basis for other cost types or versions, you can use this page to copy those costs and rates.

Updating Conversion Rates

Updating Conversion Rates

Access the Update Conversion Rates page (Cost Accounting, Item Costs, Update Costs, Update Conversion Rates).

Use this page to update the set of production conversion rates and conversion overhead rates. For standard cost items, run the Cost Update/Revalue process (RUN_CES5001) to copy these conversion rates and conversion overhead rates into production. It then uses these rates to calculate earned labor and machine costs, as well as applied overhead for the assembly completions and scrapped assemblies. If you are introducing a new conversion rate or conversion overhead rate for a single item whose cost you are updating, you must also update the set of production conversion rates and conversion overhead rates that are used to calculate the item's cost. The lower portion of the page displays the conversion rates and conversion overhead rates to copy to the frozen rates records. Save the page to update the rates.

Calculating the Cost of Purchased Components

Calculating the Cost of Purchased Components

This section provides an overview of component costs and discusses how to forecast purchase costs.

Understanding Component Costs

Understanding Component CostsThe standard cost of all purchased components must be accurate when rolling up the cost of a manufactured item. For standard cost items, the cost type that is entered in the Cost Rollup page determines how these costs are calculated. For actual and average cost items, the cost type is applied through the cost book that is defined at the inventory business unit definition. Select the method of calculating the purchased component's cost on the Purchased Cost Used field of the Cost Types page. Component costs include:

|

Average Purchase Price |

A weighted average of all purchases of this item that are calculated by the system. |

|

Current Purchase Cost |

Cost manually entered on the Define Business Unit Item - General: Common page. |

|

Forecasted Purchase Cost |

Cost manually entered on the Forecasted Purchase Costs page. |

|

Last Price Paid |

The purchase price recorded with the last receipt of this item. This price appears on the Define Business Unit Item - General: Common page. |

It is possible that the system might not find a purchase cost for a component. For example, if you select the average or last price methods and the purchased item is new with no receipts, then the cost is zero. For items using standard costing, use the Cost Rollup page to select the Use Current Cost When No Price check box to use the current purchase cost whenever the calculated purchase cost is zero. If you select this check box, be sure to enter a value in the Current Purchase Cost field on the Define Business Unit Item - General: Common page.

See Also

Using the Cost Rollup Process to Calculate Product Costs

Defining Basic Business Unit Item Attributes

Pages Used to Calculate the Cost of Purchased

Components

Pages Used to Calculate the Cost of Purchased

Components

|

Page Name |

Definition Name |

Navigation |

Usage |

|

CE_TYPE |

Set Up Financials/Supply Chain, Product Related, Cost Accounting, Cost Types |

Define the method that is used to calculate the cost of purchased components. |

|

|

GEN_ATTRIB_INV |

Items, Define Items and Attributes, Define Business Unit Item, General |

Enter the current purchase cost. This page displays the item's average purchase price and last price paid. |

|

|

CE_FCST |

Cost Accounting, Item Costs, Define Rates and Costs, Forecasted Purchase Costs, Forecasted Purchase Cost |

Enter forecasted purchase costs. |

Forecasting Purchase Costs

Forecasting Purchase Costs

To define forecasted purchased costs, use the Forecasted Purchase Cost (CE_FCST) component. Use the Forecasted Purchase Rates component interface to load data into the tables for this component.

Access the Forecasted Purchase Costs page (Cost Accounting, Item Costs, Define Rates and Costs, Forecasted Purchase Costs, Forecasted Purchase Cost).

Use the Forecasted Purchase Costs page to use negotiated prices for the purchased components in the calculation of makeable items. This enables you to perform what-if scenarios or simulations by changing the material cost assumptions for each cost type and version combination. The amount that is entered should be the cost of the item only, exclusive of any freight, duty, or procurement expenses. The cost element that is selected must have a cost category of Material assign on the Cost Elements page.

|

Amount |

Enter the cost of the item only, exclusive of any freight, duty, or procurement expenses. |

|

Cost Element |

Enter a cost element with a cost category of material assign on the Cost Elements page. |

Note. Be sure that the cost type that you enter designates forecasted purchase costs as the purchase cost that is used. If you use forecasted purchase costs, you must define a cost for every purchased item.

See Also

Adding Additional Costs

Adding Additional Costs

To define additional costs for a make item, use the Additional Costs by Item component. Use the Additional Costs by Item component interface to load data into the tables for this component.

This section discusses how to enter additional costs by item.

Page Used to Add Additional Costs

Page Used to Add Additional Costs

|

Page Name |

Definition Name |

Navigation |

Usage |

|

CE_ITEMEXP |

Cost Accounting, Item Costs, Define Rates and Costs, Additional Item Costs, Additional Costs by Item |

Add additional costs to purchased or makeable items. |

Entering Additional Costs by Item

Entering Additional Costs by Item

To define additional costs, use the Additional Costs by Item component (CE_ITEMEXP).

Access the Additional Item Costs page (Cost Accounting, Item Costs, Define Rates and Costs, Additional Item Costs, Additional Costs by Item).

You can add additional costs to the cost of a manufactured or purchased item by using the Additional Item Costs page. This enables the system to calculate and track the fully burdened cost of the item. Examples of additional costs are duty, freight, inspection, procurement expenses, and material handling. Based on the cost type and cost version combination that is defined for the business unit and item and entered on the Cost Rollup page, the system adds these additional costs, one cost at a time. These costs are applied after all labor, machine, material, and overhead costs are added.

When you use this page to add landed cost components to an item, you can track and analyze the total landed cost for that item. You can set up consigned items as landed cost items; if you do, the system transacts all accrued landed cost charges when the consigned item is consumed.

The Exp Sequence No (expense sequence number) determines the order in which the system applies costs; it is especially critical when it applies the rate to the total cost. The total cost base includes material, labor, machine, subcontracting, overhead costs, and any additional cost that was previously applied to that point.

You must define how the system calculates the additional cost. Application Method values include:

|

% of Material Cost (percentage of material cost) |

Select to multiply the percentage that is specified by the sum of all costs whose cost category you set to Material on the Cost Elements page. |

|

% of Total Costs (percentage of total costs) |

Select to include all material, labor, machine, subcontracting, and conversion overhead costs, plus any previously calculated additional costs as the total cost basis. For example, suppose that the item material cost is 1.00 and you define an additional cost for sequence 10 as 50 percent of material cost and sequence 20 as 100 percent of total cost. The basis for applying additional costs for sequence 20 is 1.50 (1.00 of material cost plus 50 percent of 1). |

|

Amount Per Unit |

Select to add this amount to the cost of the item. You can use this method if you determine activity costs and apply those costs to items that consume the activity. |

The Transaction Group field defines the point at which you apply the additional costs into inventory:

|

020 Putaway |

Select to receive the item into inspection or stock using the transaction group 020 Putaway. For purchased items, this takes place following receiving and inspection, whereas for makeable items this takes place following the completion from a production area and receipt into stock or to another production area. All landed costs use the Putaway transaction group. |

|

030 Usages & Shipments |

Select to issue the item out of inventory to a customer or to another business unit using the transaction group 030 Usages & Shipments. Costs that are applied at the time of issue are never included in the item's inventory value. |

Note. For standard cost items, if you run the Cost Update/Revalue process for the item that is specified, then you cannot change the transaction group selection.

Assign a Cost Element for each additional cost. The cost element selected must have a cost category of Inbound, Outbound, Landed, or Other entered on the Cost Elements page.

See Also