Understanding Interunit Transfers

Understanding Interunit Transfers

This chapter provides overviews of interunit transfers and the types of interunit transfers, lists a prerequisite, lists common elements, and discusses how to:

Use transfer pricing definitions.

Populate the Transfer Price table.

Calculate default actual cost and current purchase cost.

View transfer pricing data for an item.

Review interunit accounting examples.

Understanding Interunit Transfers

Understanding Interunit Transfers

A transfer of stock between two inventory business units is known as an interunit transfer. To create an interunit transfer:

Add a material stock request (MSR) with the request type of Interunit Transfer. The MSR includes a destination (receiving) inventory business unit.

Complete the demand fulfillment steps within the source (sending) Inventory business unit to ship the stock.

Run the Deplete On Hand Quantity (Depletion) process in the source unit. In addition to other functions, this process calculates the transfer price (transfer cost) of the stock and any additional transfer costs.

When the items are received in the destination business unit, run the Load Staged Items process (INPSSTGE).

Run the Cost Accounting Creation process page to create the accounting entries for the interunit transfer. These accounting entries record the changes to the inventory stock accounts, intransit accounts, and record any additional transfer expenses or gain/loss on transfers.

While using this chapter, please note the following points:

The terms transfer price and transfer cost both refer to the same value.

The setup of an interunit transfer can be divided into several parts. In this chapter, we discuss the transfer pricing and accounting entries related to a transfer. Before defining your transfer pricing structure, you must set up the overall interunit transfer structure. The PeopleSoft Enterprise Inventory PeopleBook provides detailed instructions for setting up the system for interunit transfers.

PeopleSoft Cost Management does not support interunit pricing for non-cost items.

This chapter discusses transferring stock between two Inventory business units. For information about shipping stock to internal departments or on behalf of another GL unit, see the PeopleSoft Enterprise Cost Management PeopleBook, Setting Up the Accounting Rules Structure chapter. Read the sections "Designing Shipment On Behalf Of" and "Creating and Reversing Interunit Expensed Issues."

Applying Transfer Prices to a Material Stock Request

Applying Transfer Prices to a Material Stock Request

The Deplete On Hand Qty (Depletion) process uses a default hierarchy to determine the transfer price for each line of a interunit material stock request. In the default hierarchy, the more specific information overrides the more general information. Transfer prices can be derived from:

Override values entered on the material stock request line. If you selected the Allow Price/Markup Overrides check box on the Setup Fulfillment page of the source business unit, then you can change the transfer price on the line.

The Transfer Pricing table. This table includes the material portion of the transfer price and the additional transfer costs. The Deplete On Hand Qty process looks for a transfer price specified for the item ID. This transfer price can be broken up into multiple cost elements. The setup and use of the Transfer Pricing table is optional.

The Transfer Pricing Definition component. If the Transfer Pricing table contains no entry for the specific item ID, then the Deplete On Hand Qty process calculates a transfer price using the data in the Transfer Pricing Definition component.

A value based on the cost of the item. If the transfer price cannot be derived from the transfer pricing definition, then the Deplete On Hand Qty process uses a value based on the item cost.

Details of the Transfer Price Default Hierarchy

The Deplete On Hand Qty process uses the following steps to determine the material transfer price and additional transfer costs included in an item's transfer price:

Use the override values (transfer price, markup percentage, or zero cost) entered on the MSR line using:

The Create/Update Stock Request component.

The Express Issue component.

The Maintain Stock Requests component.

The Inventory_Create_Stock_Request, Inventory_Front_End_Shipping, or Inventory_Shipping EIPs.

Find a transfer price for the specific item ID based on the source and destination business unit pair in the Transfer Price table. If no row contains this data, then:

Find a transfer price for the specific item ID in the Transfer Price table for which the source business unit is specified and the destination business unit is blank. If no row contains this data, then:

Use the Transfer Pricing Definition component to calculate the material portion of the transfer price using information defined for the specific source and destination unit pair.

Search for item specific information at the detail level. If no item ID information is found, then:

Search for item group information at the detail level. If no item group information is found and the Price Overrides Only check box has not been selected, then:

Search for header level information (this step is skipped if the Price Overrides Only check box has been selected). If no Transfer Pricing Definition component is defined for the specific source and destination unit, then:

Use the Transfer Pricing Definition component to calculate the material portion of the transfer price using information defined for the specific source unit and a blank destination unit.

Search for item specific information at the detail level. If no item ID information is found, then:

Search for item group information at the detail level. If no item group information is found and the Price Overrides Only check box has not been selected, then:

Search for header level information (this step is skipped if the Price Overrides Only check box has been selected). If no Transfer Pricing Definition component is defined for the specific source unit and a blank destination unit, then:

Use a value based on the item's cost as the transfer price. This value would record just a material portion of the transfer price with no additional transfer costs.

For standard cost items, the transfer price is the current frozen standard cost located in the CM_PRODCOST table.

For actual cost items, the transfer price is the value in the Default Actual Cost field (DFLT_ACTUAL_COST) in the Define Business Unit Item - General page.

For perpetual weighted average items, the transfer price is the current perpetual average cost located in the CM_PERPAVG_COST table. If there is no value in CM_PERPAVG_COST table, then the transfer price is taken from the AVERAGE_COST field in the BU_ITEMS_INV table.

For items using Periodic Weighted Average or Retroactive Weighted Average, the transfer price is the value in the Average Purchase Price field (AVERAGE_COST) in the Define Business Unit Item - General page.

Note. Rounding differences could create a small gain or loss when using the current perpetual average cost (located in the CM_PERPAVG_COST table) as the transfer price.

See Also

Using Transfer Pricing Definitions

Populating the Transfer Price Table

Determining the Calculation Method for Transfer Prices

Determining the Calculation Method for Transfer Prices

The following costs can be included in an interunit transfer price:

Material transfer prices

Landed costs

Additional transfer costs

Determining the Material Transfer Price

The transfer price includes the material cost of the transferred item determined by the transfer price default hierarchy. Create a cost element with the cost category of Material to be used for the transfer price. The item's default material cost element is stored in the Default Cost Element field in the Define Business Unit Item - General page. Additional material cost elements can be established on the transfer pricing definition or in your PeopleSoft Manufacturing setup.

There are four different methods to value the material portion of an transfer price:

The system transfers the item using a fixed transfer price.

At a Percent Markup of Cost or Transfer Price.

The system creates the new transfer price by increasing the cost or transfer price of the inventory stock by a percentage markup.

The system values the intransit stock at zero. The zero cost method records the entire cost of the stock in the source business unit's interunit transfer gain or loss account. You can use this method for the shipment of promotional or sample items. You can change the default value for the zero price option on the material stock request line using the Material Stock Request - Accounting/Interunit Detail page or the Express Issue - Detail Override/Exceptions page. You can also change the zero price option on the Par Location Definition - Line Details page for issues to the par location.

At a value based on the item's cost.

The system transfers the item using a value based on the item's cost in the source inventory business unit.

Note. PeopleSoft Cost Management does not support interunit pricing for non-cost items.

Recording Landed Costs

The cost of obtaining inventory stock includes more than just the material costs of the items. Landed costs include some of the charges that are associated with getting items into a warehouse and available for use or sale. In the destination business unit, landed costs are absorbed into the material cost of the item for actual and weighted average items. For standard items, a variance is recorded. For information on setting up landed costs, see the "Structuring Landed Costs" chapter in this PeopleBook.

Creating Additional Transfer Costs

In addition to the item's material cost and landed costs, you can also record additional transfer fees for an interunit transfer. To define additional transfer costs:

Establish a cost element for additional transfer by using the cost category of Addl Trans.

Define a fixed cost or percentage markup to calculate the additional transfer cost using the Transfer Pricing Definition component. Additional transfer costs can be defined at the header level or detail level (item ID or item group).

Determine if your additional transfer costs should be added to the cost of the item in the destination business unit or written off in an expense account. Select the Expense Transfer Fees check box on the Inventory Definition - Business Unit Definition page to write off the additional transfer costs.

Populate the Transfer Price table (CM_TRAN_PRICE) with the transfer prices (material and additional transfer costs) by running the Calculate Transfer Price (CM_TRANS_PRC) process. Additional transfer costs can only be used from the Transfer Price table. The Deplete On Hand Qty (Depletion) process does not calculate additional transfer costs directly from the Transfer Pricing Definition component.

See Applying Transfer Prices to a Material Stock Request.

Recording the Accounting Entries for Transfer Prices

Recording the Accounting Entries for Transfer Prices

During demand fulfillment, the MSR is located in the IN_DEMAND table. Once the transfer price has been calculated by the Deplete On Hand Qty process, the transfer price is located in a child table, IN_DEMAND_TPRC, where it is broken out into several parts by cost elements. Cost elements can be created for material costs, landed costs, and additional transfer costs. Estimated transfer price details can be viewed using the Transfer Price Inquiry component. While the stock is in the intransit account, the material, landed, and additional transfer costs are all included in the total transfer price. The transfer price details are retained when the stock is received by the destination business unit. During putaway, the additional transfer costs can be included in the material cost of the stock or the additional transfer costs can be expensed.

The following transaction groups can be used for an interunit transfer:

022 IBU Transfer Receipts

025 InterCompany Receipts

031 InterBU Transfer Shipments

035 InterCompany Transfers

042 IBU Transfer Adjustments

300 Gain/Loss on Transfer Price

301 InterCompany Cost of Goods

Transfer prices and additional transfer costs can also be used for Shipment On Behalf Of transactions using the following transaction groups:

034 Shipments on Behalf of Other BU

302 ShipOnBehalf Gain/Loss

See Designing Shipment On Behalf Of.

Transfer prices only can be used with interunit expense issues using the following transaction groups:

036 InterUnit Expensed Issue

026 Expensed Issue Return

Example of the Transfer Pricing Table

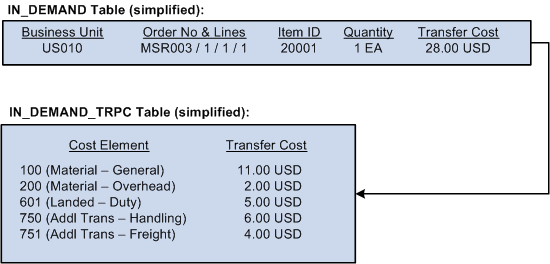

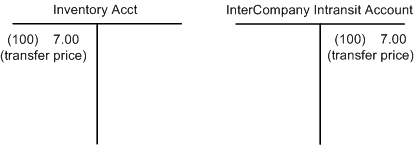

Once the Deplete On Hand Qty process calculates the transfer price for a standard, actual, or average cost item, the total transfer price is stored in the TRANSFER_COST field of the IN_DEMAND table; the transfer price details, broken out by cost element, are stored in the IN_DEMAND_TRPC table. To record the material cost of the transferred items, the system used the cost element in the Default Cost Element field in the Define Business Unit Item - General: Common page. The following diagram illustrates a simplified example of a material stock request with an interunit transfer price (transfer cost):

Example of a material stock request a with transfer price

Note. The terms transfer price and transfer cost both refer to the same value.

The above example displays an item with more than one material cost element, a landed cost element, and two additional transfer cost elements. Your purchased items may only have one material cost element, however, your make (manufactured) items may have multiple material cost elements. The setup for landed cost is located in the "Structuring Landed Costs" chapter of this PeopleBook.

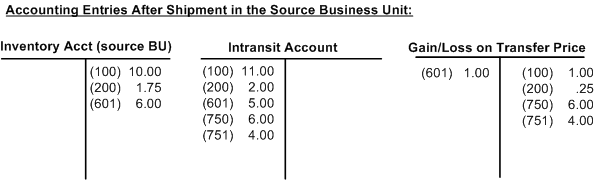

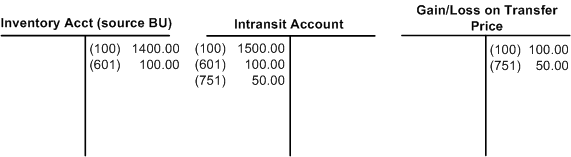

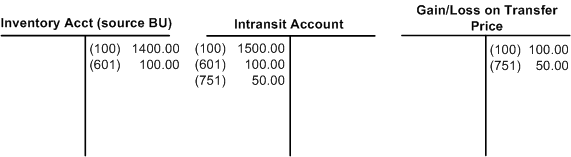

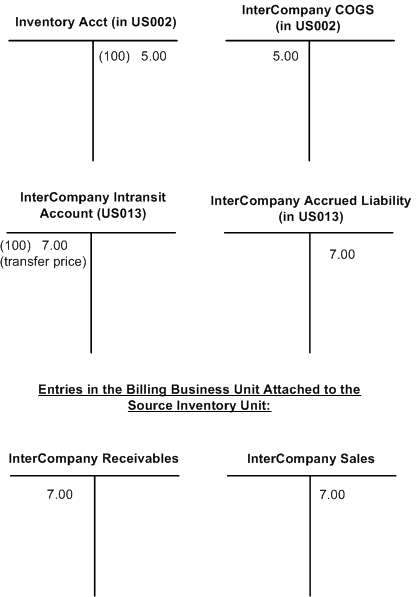

Example of an InterBU Transfer Shipment (Transaction Group 031)

The following diagram illustrates a simplified example of the accounting entries generated in the source business unit after the Deplete On Hand Qty process and the Cost Accounting Creation process are complete. For the transaction group 031 (InterBU Transfer Shipments), the Cost Accounting Creation process determines any difference between the item's cost and the transfer price by comparing cost element to cost element. The typical shipping accounting entry debits the intransit inventory account at the item's transfer price and credits the inventory account at the item's cost. Any difference between the transfer price and cost creates an additional entry associated with the transaction group 300 (gain or loss on transfer price). The following diagram illustrates a gain on transfer price for the source business unit:

Gain or loss on an interunit transfer in the shipping (source) inventory business unit.

In the above example, note that the cost element detail is included in the accounting entry. The Cost Accounting Creation process uses the IN_DEMAND_TRPC table when creating accounting entries for interunit transactions.

Note. The above example does not address an intercompany transfer or an interunit transfer using interunit receivable and payable accounts. More detailed examples are given later in this chapter.

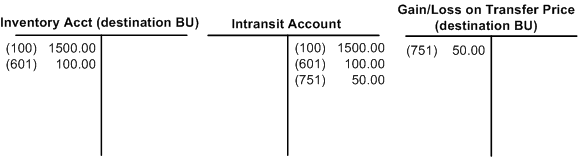

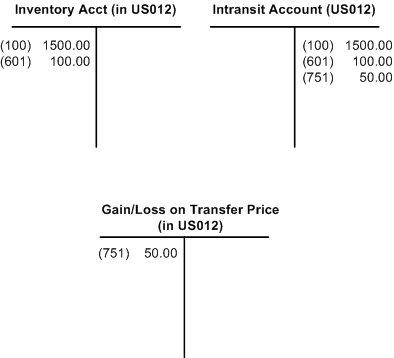

Examples of Inventory Business Unit Transfer Receipts (Transaction Group 022)

The following diagram illustrates a simplified example of the accounting entries generated in the destination business unit after the Load Staged Items process (INPSSTGE) and the Cost Accounting Creation process are complete. The Cost Accounting Creation process uses the transaction groups 022 (IBU Transfer Receipts) and 300 (gain or loss on transfer price).

Gain or loss on an interunit transfer in the receiving (destination) inventory business unit.

In both of these examples:

The source business unit owns the stock while it is in the intransit account.

The destination business unit has elected to write-off the additional transfer costs rather than include them in the inventory stock's cost.

For items using one of the weighted average costing methods, the material and landed cost portions of the transfer price are weighted into the new average cost for the item in the destination business unit. For items using the actual cost method, the material and landed cost portions of the transfer price becomes the actual cost for the receipts at the destination business unit. Note that for both the actual and average cost methods, you can choose to include the additional transfer costs in the cost of the item rather than write off these amounts.

For standard cost items, a gain or loss is calculated for the difference between the transfer price (material and landed cost portions only) and the item's standard cost maintained in the destination business unit. This difference is recorded in a gain/loss on transfer price account. The interunit stock is recorded into the inventory account at the standard cost, and the additional transfer costs are written off to a gain and loss on transfer price account.

Note. The previous example does not address an intercompany transfer or an interunit transfer using interunit receivable and payable accounts. More detailed examples are given later in this chapter.

Understanding the Types of Interunit Transfers

Understanding the Types of Interunit Transfers

When you maintain warehouses and plants all over the world, you must be able to transfer goods among these locations and account for transfer prices, costs, currency changes, taxes, and invoicing for business units involved in the transfer. In PeopleSoft Inventory, a transfer of stock between two inventory business units is known as an interunit transfer. There are three approaches to interunit transfers:

|

Interunit transfer using an intransit account only |

The transfer price of the inventory stock is entered into an intransit account while it is moved from one inventory business unit to another. This approach can be used when both inventory business units post to the same general ledger (GL). |

|

Interunit transfer with interunit receivables and interunit payables accounts |

An intransit account is used along with interunit accounts receivable (AR) and interunit accounts payable (AP) accounts recorded for each inventory business unit. Both inventory business units post to different GL business units. This approach can be used when transferring stock between separate legal entities or within the same legal entity. |

|

Interunit sales approach (intercompany) |

An intercompany sale is recorded with the source inventory business unit recording a sale and the linked billing business unit issuing an invoice for the stock transfer to the receiving business unit's payable unit. This approach can be used when transferring stock between separate legal entities or within the same legal entity. Intercompany is required if the (GL) business units are using different currencies. |

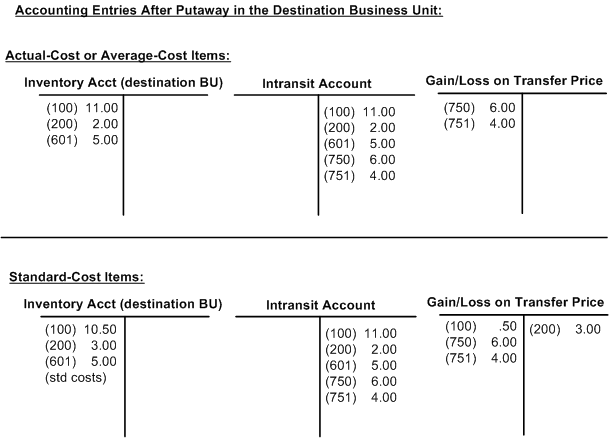

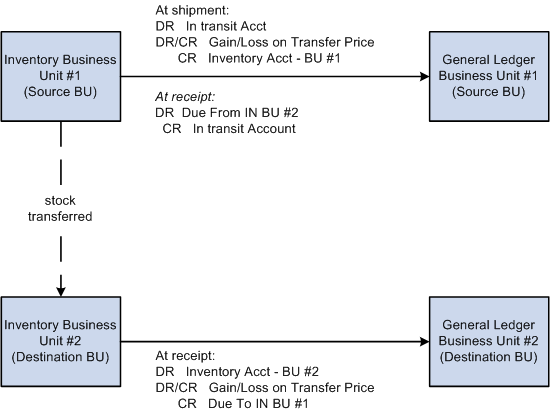

This diagram illustrates the flow of an interunit transfer using only an intransit account:

Interunit transfers using only an intransit account

If the inventory business units transferring stock are linked to the same GL business unit, the system does not generate any affiliate interunit transactions. The intransit account must be defined as belonging to the source or destination business unit.

This diagram illustrates the flow of an interunit transfer with interunit receivables and interunit payables accounts when the source unit owns the intransit stock:

Interunit transfers with interunit receivables and interunit payables accounts when the source unit owns the intransit stock

In a transfer for which the inventory business units are linked to two GL business units that may be part of the same legal entity, entries are recorded in the interunit receivables and payables accounts. Affiliate accounting is used, and the interunit receivables affiliate and interunit payables affiliate entries should equal each other.

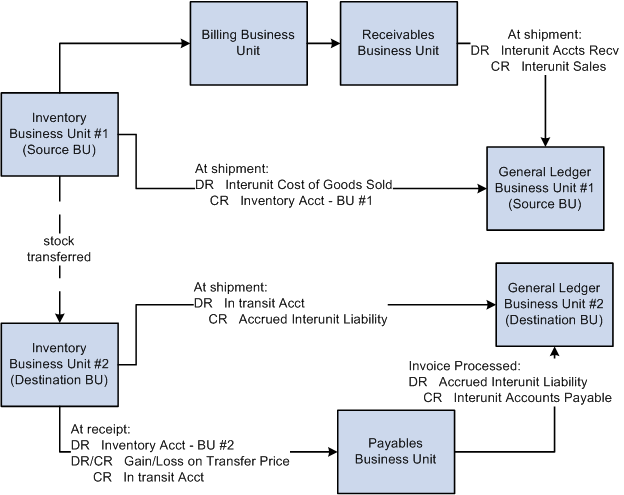

This diagram illustrates the cost flow of an intercompany sales transaction:

Intercompany sales approach

In an intercompany transfer, the inventory business units transferring stock want to transfer inventory in an "arm's length" manner. In this case, an intercompany sale is recorded. The destination inventory business unit must be defined as a customer and the source GL business unit must be defined as a vendor. The billing business unit linked to the source inventory business unit performs the additional tasks of calculating value-added taxes (VAT), invoice generation, legal shipping documentation, accounting line creation, and voucher initiation. The AP voucher is recorded in the interface tables of the destination payables business unit, where it can be processed and paid.

See Also

Transferring Stock Between Business Units

Defining Default Storage Location Structures and Attributes

Establishing InterUnit and IntraUnit Billing

Defining Additional Common Information

Understanding PeopleSoft Enterprise ChartFields

Prerequisite

Prerequisite

Before defining your transfer pricing structure, you must setup the overall interunit transfer structure. The PeopleSoft Enterprise Inventory PeopleBook provides detailed instructions for setting up the system for interunit transfers.

See Transferring Stock Between Business Units.

Common Elements Used in This Chapter

Common Elements Used in This Chapter

|

FERC Code (Federal Energy Regulatory Commission code) |

Appears only if you select FERC reporting on the PeopleSoft Inventory Options page. |

|

ChartFields |

Chart of accounts used to record accounting entries and journal entries in PeopleSoft applications. |

|

Cost Element |

Use this code to categorize the different components of an item's cost and define the debit and credit ChartFields for accounting entries. |

|

Transaction Group |

Predefined codes attached to different types of transactions, such as, stocking, issues, adjustments, and so on. |

|

Distribution Type |

User-defined codes that are a subset of transaction groups. This enables you to break down a transaction group into customized categories. |

|

Item Group |

A grouping of items that enable you to design the accounting structure for a group of similar items, such as, sporting equipment or dress shoes. The item group is attached to an item using the Item Definition - General page. |

|

Affiliate |

A ChartField used in interunit transactions or consolidation reporting to identify the other business unit in the transaction. Provides a way to map transactions between business units while using a single intercompany account. The use of an Affiliate ChartField is optional. |

Using Transfer Pricing Definitions

Using Transfer Pricing Definitions

This section provides an overview of transfer pricing definitions and discusses how to:

Use the Transfer Pricing Definition page.

Copy transfer pricing defaults between business units.

Use the Additional Transfer Price page at the header level.

Use the Additional Transfer Price page at the detail level.

Review examples of transfer pricing.

Understanding Transfer Pricing Definitions

Understanding Transfer Pricing DefinitionsTo define transfer prices, use the Transfer Pricing Definition component (CM_TRAN_PRICE_DEFN). Use the Transfer Pricing Definition component interface (CM_TRAN_PRICE_CI) to load data into the tables for this component.

The key to establishing your transfer price is the Transfer Pricing Definition component, where you can establish transfer prices by:

Inventory Business Unit Pairs: A combination of the source business unit, destination business unit, and pricing effective date.

Source Business Unit Only: A combination of the source business unit and pricing effective date. By leaving the destination business unit blank, you can create transfer prices for all items in the source unit that transfer to any destination business unit that is not already defined in a business unit pair.

The Transfer Pricing Definition component defines the transfer prices for all items within a source business unit or an inventory business unit pair. When a transfer pricing definition has not been setup for certain business units, the system transfers the items at the cost in the source inventory business unit. When a transfer pricing definition is created, setting all transfer prices at the business unit level (header level) may be too broad; therefore, the Transfer Pricing Definition component allow you to override the header level settings with transfer prices specific to the item group or item ID itself. The specific information is used instead of the more general information.

Once you define your transfer pricing definitions, you can:

Populate the Transfer Pricing table with your transfer prices and additional transfer costs by running the Calculate Transfer Price process. The Deplete On Hand Qty process looks to this table first to find a match and to retrieve transfer data.

Leave the Transfer Pricing table blank for some or all items. If the Deplete On Hand Qty process cannot find a match in the Transfer Pricing table, then it looks to the setup in the Transfer Pricing Definition components. The detail level overrides are used instead of the header level information. Header level information is used when no detail level overrides exist and the Price Overrides Only check box is not selected.

The Transfer Pricing Definition component can be used by both:

The Calculate Transfer Price process to populate the Transfer Price table.

The Deplete On Hand Qty process to calculate a transfer price for an MSR line directly using the data in the Transfer Pricing Definition component. Use this option if the Transfer Price table does not contain a transfer price for the MSR line.

Not all options on the Transfer Pricing Definition component are available when the Deplete On Hand Qty process is calculating a transfer price directly from the component. Look carefully at the field definitions for information about the Calculate Transfer Price process and the Deplete On Hand Qty process.

Note. PeopleSoft Cost Management does not support interunit pricing for non-cost items.

For additional details about applying transfer prices to an MSR, see the Understanding Interunit Transfers topic of this chapter.

See Also

Applying Transfer Prices to a Material Stock Request

Defining Basic Fulfillment Defaults

Pages Used to Define Transfer Prices

Pages Used to Define Transfer Prices

|

Page Name |

Definition Name |

Navigation |

Usage |

|

CM_TRAN_PRICE_DEFN |

Cost Accounting, Item Costs, Define Rates and Costs, Transfer Pricing Definition |

Define the transfer prices, markup percentages, and additional transfer costs to be used for a source business unit or a source and destination unit pair. |

|

|

CM_TRAN_PRC_COPY |

Click the Copy Pricing Definition link on the Transfer Pricing Definition page. |

Enter a source inventory business unit and a destination business unit (optional) to copy an existing transfer pricing definition to another inventory business unit. |

|

|

CM_TRAN_PRICE_CE |

On the Transfer Pricing Definition page, click the Additional Costs link in the BU Level Defaults group box. |

Add or change additional costs at the header level of the transfer pricing definition. |

|

|

CM_TRAN_PRICE_CEDT |

On the Transfer Pricing Definition page, click the Addl Costs icon in the Item / Item Group Definitions group box. |

Add or change additional costs to a item group or item ID (detail level). |

Using the Transfer Pricing Definition Page

Using the Transfer Pricing Definition Page

Access the Transfer Pricing Definition page (Cost Accounting, Item Costs, Define Rates and Costs, Transfer Pricing Definition).

New Transfer Pricing Definitions

In add mode, you enter the source inventory business unit in the Business Unit field and the destination inventory business units in the Destination Unit field. The Pricing Effective Date field defaults to today's date if there is no entry. The Destination Unit field is not required. If you leave the Destination Unit field blank, then the parameters set up on this component apply to the source business unit, regardless of the inventory business unit receiving the stock. The transfer pricing definition with the source business unit and no destination unit is used as the default for all business unit pairs that are not defined. The source business unit must be valid and an open inventory unit.

|

Copy Pricing Definition |

Click this link to access the Copy Pricing Definition page, where you can copy an existing transfer pricing definition to this source inventory business unit, destination unit, and price effective date combination. This link is only available if you creating a new transfer pricing definition by entering this page in the add mode. |

Header Levels and Detail Levels

On the Transfer Pricing Definition page, overrides and default values can be entered at both the header level or the detail level.

Overrides and default values defined at the header level apply to the entire transfer pricing definition. The header level includes the Default Overrides group box and the BU Level Defaults group box. These values are used with transfers from this source inventory business unit (or source unit and destination unit combination) and for this price effective date. Information added at the header level is used to determine the transfer price for all items that are not overridden at the detail level as long as the Price Overrides Only check box has not been selected.

Overrides and default values defined at the detail level apply to an item group or item ID within the transfer pricing definition. The detail level includes the Item / Item Group Definitions group box. These values can be added to override the values defined at the header level.

|

Price Overrides Only |

Select this check box to have the system use only the data in the Item / Item Group Definitions group box. The overrides and default values defined at the header level are not used unless the detail level selects the default option for a specific item ID or item group. |

Default Overrides Group Box

The values defined in this group box apply to the header level of this transfer pricing definition. The following zero check boxes prevent the system from performing a particular calculation. These check boxes are not mutually exclusive with their associated value. For example, both a Zero Markup Percent can be entered and the Zero Markup Percent flag checked, though once the Transfer at Zero Price field is selected, selecting the Zero Markup Percent has no additional effect. These check boxes control what is done for any items not overridden at the detail level. Keep in mind that these check boxes are never used for items defined in the detail level of this component. In addition, if the Price Overrides Only check box is selected, then this group box is not used.

|

Transfer at Zero Price |

Select this check box if all items in this transfer pricing definition are to be transferred at no cost; unless overridden at the detail level. If you select this check box, the transfer price row (in IN_DEMAND_TPRC) for each transferred item is created using the item's default cost element with a cost of 0.00. |

|

Zero Markup |

Select this check box if all items in this transfer pricing definition are to be transferred at with no markup percentage; unless overridden at the detail level. |

|

Zero Additional Costs |

Select this check box if all items in this transfer pricing definition are to be transferred at with no additional transfer costs added to the base transfer price; unless overridden at the detail level. |

The check boxes in this group box are used by both:

The Calculate Transfer Price process to populate the Transfer Price table (CM_TRAN_PRICE).

The Deplete On Hand Qty process to calculate a transfer price for an MSR line using the data in the Transfer Pricing Definition component. This option is used if the Transfer Price table does not contain a transfer price for the MSR line.

BU Level Defaults Group Box

The default values defined in this group box apply to the entire transfer pricing definition (that is, the header level). These default values are used with transfers from this source inventory business unit (or source unit and destination unit combination) and for this price effective date. When setting up a Transfer Pricing Definition component, keep in mind that your entry in the Price Overrides Only check box changes the use of this group box.

|

Actual Cost |

Select the method for calculating the transfer price for items using the actual cost method on the Cost Profiles page. If this field is left blank, then the system uses the Default Actual Cost value. The options are:

PeopleSoft Cost Management does not support interunit pricing for non-cost items. |

|

Average Cost |

Select the method for calculating the transfer price for items using an average cost methods on the Cost Profiles page. If this field is left blank, then the system uses the Average Purchase Price value. The options are:

This option is the default value when creating a new transfer pricing definition. If the Deplete On Hand Qty process is calculating a transfer price for an MSR line by directly using the data in the Transfer Pricing Definition component, then this option is the only available choice. PeopleSoft Cost Management does not support interunit pricing for non-cost items. |

|

Number of Days |

Enter the past number of days' worth of receipts to be used to calculate the weight average for the transfer price. This field is required when the Average Day's Receipts value is selected for the Actual Cost field or the Average Cost field. |

|

Price Markup % (price markup percentage) |

Define the percentage increase to the initial transfer price of the item. The markup percentage is applied to all cost elements. For example, if you enter a value of 25 in this field and the item includes 75 USD in the cost element 100 (material) and 25 USD in the cost element 601 (landed costs), then the markup is applied to 100 USD for a total markup of 25 USD (100 USD × 25% = 25 USD). The markup amount can be applied to the material cost element or to an additional transfer cost element, depending on your entry in the next field (the Cost Element Option field). Be sure to enter a 25% markup as 25, not .25. In addition, you can enter a percentage greater than 100. For the source inventory business unit, a gain is recorded for the difference between the marked up transfer price and the cost of the item. The destination business unit can include the markup in the cost of the item or expense it to another account. This field is used by both the Calculate Transfer Price process (to populate the Transfer Price table) and the Deplete On Hand Qty process (to calculate a transfer price directly from this component). |

|

Cost Element Option |

Select the type of cost element to which the markup percentage should be applied. This is the Cost Category defined for the cost element. The options are:

This field is used by both the Calculate Transfer Price process (to populate the Transfer Price table) and the Deplete On Hand Qty process (to calculate a transfer price directly from this component). |

|

Markup Cost Element |

If you have entered the value of Addl Cost in the Cost Element Option field, enter a cost element with the cost category of Addl Trans (Additional Transfer Costs). When the price markup is calculated, it is applied to this cost element. If this field is blank, then the system retrieves the material cost element for the item from the Default Cost Element field defined on the Define Business Unit Item - General: Common page. This field is used by both the Calculate Transfer Price process (to populate the Transfer Price table) and the Deplete On Hand Qty process (to calculate a transfer price directly from this component). |

|

Additional Costs |

Click the Additional Costs link (in the BU Level Defaults group box) to access the Additional Transfer Price (Header Level) page, where you can define or change additional transfer costs at the header level of this transfer pricing definition. These costs use a cost element with the cost category of Addl Trans (Additional Transfer Costs). This link and the underlying Additional Transfer Price (Header Level) page can only be used by the Calculate Transfer Price process to populate the Transfer Price table. |

Select Lines Group Box

Use the Select Lines group box to enter search criteria for displaying existing items and item group definition in the Item / Item Group Definitions group box.

|

Select Lines By |

Select to search for rows by Item Group, Item ID, or All. |

|

Item / Group |

Enter the item ID or item group ID to be used when selecting data for the Item / Item Group Definitions group box. The search returns rows with a value equal to or greater than the item ID or item group defined. If this field is left blank, the search returns both item IDs and item groups. |

|

Number of Lines |

Enter the number of rows to be displayed in the Item / Item Group Definitions group box. If this field is blank, then the search uses a default of 100 rows. This field is populated by a default value from the Transfer Price Lines Displayed field on the Installation Options - Inventory page. |

|

Select Lines |

Click this button to search for rows previously created for items and item groups in the Item / Item Group Definition group box. The rows that appear are limited by your search criteria (Select Lines By field, Item / Group field, and Number of Lines field). To display other rows, change your search criteria and then click this button to initiate a new search; a warning message is displayed asking if you want to save changes to the existing date. |

Item / Item Group Definitions Group Box

The detail level overrides and default values defined in this group box apply to the specific item ID or item group in the row. The values entered here override the same values entered at the header level. To create a new row to override header level attributes for a specific item ID or item group, add a new row to the grid.

|

Select Type |

When adding a new row, select to add an Item or Group to specify what type of value will be entered in the Item ID / Item Group field. |

|

Item ID / Item Group |

Enter either an item ID or an item group depending on your entry in the Select Type field. An row in this grid overrides the header level parameters used to calculate the transfer price. If a destination business unit has been specified, the item ID must be valid in both business units. |

|

Description |

Displays the description of the item ID or item group. |

|

Price Override Action |

Enter a value to determine the origin of the transfer price. The options are:

|

|

Transfer Price |

Enter a transfer price to override the calculation at the header level of this transfer pricing definition. To use this field, you must select the value of Specify for the Price Override Action field in this row. If the field is blank, then the system uses a zero price for the transfer. This field is used by both the Calculate Transfer Price process (to populate the Transfer Price table) and the Deplete On Hand Qty process (to calculate a transfer price directly from this component). |

|

Markup Override Action |

Enter a value to determine the origin of the markup percentage applied to the transfer price. The options are:

|

|

Price Markup % |

Enter a markup percentage to be applied to the transfer price. This field overrides the markup percentage at the header level of this transfer pricing definition. To use this field, you must select the value of Specify for the Markup Override Action field in this row. If the field is blank, then the system does not use a markup percentage on the transfer price. This field is used by both the Calculate Transfer Price process (to populate the Transfer Price table) and the Deplete On Hand Qty process (to calculate a transfer price directly from this component). |

|

Cost Element Override Action |

Select the type of cost element to which the markup percentage should be applied. The options are:

|

|

Cost Element |

Enter a cost element with a cost category of Addl Trans (additional transfer costs). The markup percentage is applied to this cost element if you have selected the value of Specify for the Cost Element Override Action field on this row. This field is used by both the Calculate Transfer Price process (to populate the Transfer Price table) and the Deplete On Hand Qty process (to calculate a transfer price directly from this component). |

|

Add'l Cost Override Action (additional cost override action) |

Enter a value to determine the origin of the Addl Trans cost elements applied to the transfer price. The options are:

This field can only be used by the Calculate Transfer Price process to populate the Transfer Price table. |

|

|

Click the Additional Costs icon to access the Additional Transfer Price (Detail Level) page, where you can add or change additional costs to a item group or item ID (detail level). This link and the underlying Additional Transfer Price (Detail Level) page can only be used by the Calculate Transfer Price process to populate the Transfer Price table. |

Copying Transfer Pricing Defaults Between Business Units

Copying Transfer Pricing Defaults Between Business Units

Access the Copy Pricing Definition page (click the Copy Pricing Definition link on the Transfer Pricing Definition page).

When setting up the transfer pricing definitions for each of your source unit, destination unit, and price effective date combinations, you can reduce data entry time by using the copy feature on the Copy Pricing Definition page. Enter a source inventory business unit and a destination business unit (optional) Use this page to copy an existing transfer pricing definition to your new combination of source business unit, destination unit, and price effective date. This page is only available if you are adding a new transfer pricing definitions.

|

Business Unit |

Enter the source business unit for an existing transfer pricing definition that you wish to copy. The default value for this field is the source business unit defined on the new Transfer Pricing Definition page. |

|

Destination Unit |

(Optional) Enter the destination business unit for an existing transfer pricing definition that you want to copy. The default value for this field is the destination unit defined on the new Transfer Pricing Definition page. |

|

Price Effective Date |

Enter the effective date for the existing transfer pricing definition that you want to copy. The Look Up icon displays existing price effective dates based your entries in the Business Unit and Destination Unit fields. |

|

Copy Detail |

Select this check box to copy the item and item group overrides (the Item / Item Group Definitions group box) from the existing transfer pricing definition to your new definition. The Additional Transfer Price (Detail Level) page is also copied. Note. In order to copy item and item group details, the business units must share the same available items. Item groups are not edited. |

The copy action immediately saves the new data and overrides any existing information that you may have entered on the new transfer pricing definition.

Using the Additional Transfer Price Page at the Header Level

Using the Additional Transfer Price Page at the Header Level

Access the Additional Transfer Price (Header Level) page (on the Transfer Pricing Definition page, click the Additional Costs link in the BU Level Defaults group box).

This page displays the cost element detail for the header level of the transfer pricing definition and allows you to enter additional transfer costs using cost elements with a cost category of Addl Trans. This page can only be used by the Calculate Transfer Price process to populate the Transfer Price table.

|

Cost Element Option |

Select the cost category of the cost element for this row. The options are Material or Add'l Cost. If you select the Material option, the Cost Element field must remain blank. |

|

Cost Element |

Select a Addl Trans cost element for this row. The cost element does not have to be unique. If the cost element field is blank, then the system retrieves the material cost element for the item from the Default Cost Element field defined on the Define Business Unit Item - General: Common page. |

|

Description |

Displays the description of the cost element. |

|

Comment |

(Optional) Enter a comment about this additional charge. |

|

Additional Fee |

Enter a amount to be applied to transfers using the cost element specified on this row. |

|

Markup %(markup percentage) |

Define the percentage increase to the initial transfer price of the item. The markup percentage is applied to all cost elements. For example if you enter a value of 25 in this field and the item includes 75 USD in the cost element 100 (material) and 25 USD in the cost element 601 (landed costs) then the markup is applied to 100 USD for a total markup of 25 USD (100 USD x 25%= 25 USD). The markup amount can be applied to the material cost element or to an additional transfer cost element depending on your entry in the Cost Element Option field of this row. Be sure to enter a 25% markup as 25, not .25. In addition, you can enter a percentage greater than 100. |

Using the Additional Transfer Price Page at the Detail Level

Using the Additional Transfer Price Page at the Detail Level

Access the Additional Transfer Price (Detail Level) page (on the Transfer Pricing Definition page, click the Addl Costs icon within the Item / Item Group Definitions group box).

This page displays the cost element detail for the detail level of the transfer pricing definition and allows you to enter additional transfer costs using cost elements with a cost category of Addl Trans. The top section of this page displays the item ID or item group for these additional prices. The field definitions are the same as the Additional Transfer Price (Header Level) page defined above. This page can only be used by the Calculate Transfer Price process to populate the Transfer Price table.

See Also

Using the Additional Transfer Price Page at the Header Level

Reviewing Examples of Transfer Pricing

Reviewing Examples of Transfer Pricing

The following examples show how the transfer price default hierarchy uses the Transfer Pricing Definition component. In the examples below, the fields used on the Transfer Pricing Definition component can be used by the Calculate Transfer Price process to build the Transfer Pricing table and by the Deplete On Hand Qty process to directly calculate the MSR line transfer price.

Transfer Pricing Definition 1: Source business unit: US001, Destination business unit: (blank), and Price Effective Date: 10/15/2009

Header Level:

|

Price Overrides Only check box |

Price Markup % |

Cost Element Option |

Markup Cost Element |

|

Not selected |

20% |

Add'l Cost |

751 |

Detail Level:

|

Item ID |

Transfer Price |

Price Markup % |

Cost Element |

|

80200 |

Specify: 4.00 |

Specify: 4% |

Specify: 750 |

Transfer Pricing Definition 2: Source business unit: US001, Destination business unit: US014, and Price Effective Date: 10/15/2009

Header Level:

|

Price Overrides Only check box |

Price Markup % |

Cost Element Option |

Markup Cost Element |

|

Not selected |

15% |

Add'l Cost |

750 |

Detail Level:

|

Item ID |

Transfer Price |

Price Markup % |

Cost Element |

|

80400 |

Specify: 18.18 |

Specify: 10% |

Default |

|

80500 |

Specify: 7.00 |

Specify: 5% |

Specify: 751 |

The following item and cost information are used in these examples:

|

Item ID |

Cost Method |

Cost Element |

Cost |

|

80100 |

Perpetual Average |

Material: 100 |

11.00 (current perpetual average) |

|

80200 |

Perpetual Average |

Material: 100 |

10.00 (current perpetual average) |

|

|

|

Landed Cost- Duty: 601 |

1.00 |

|

80300 |

Actual |

Material: 100 |

10.10 (default actual cost) |

|

80400 |

Perpetual Average |

Material: 100 |

10.00 (current perpetual average) |

|

|

|

Landed Cost- Duty: 601 |

1.00 |

|

80500 |

Perpetual Average |

Material: 100 |

5.00 (current perpetual average) |

|

|

|

Landed Cost- Duty: 601 |

.25 |

|

80600 |

Standard cost |

Material: 100 |

10.00 (current standard) |

Example 1

In this example, the following results will occur (for the US001/US014 combination only) when the Calculate Transfer Price process populates the Transfer Pricing table or when the Deplete On Hand Qty process calculates the transfer prices directly for MSR lines. In both cases, to populate transfer prices and cost elements for the source business unit US001 and the destination business unit US014, the processes (using the transfer price default hierarchy) look first to the transfer pricing definition 2; if data cannot be found then the processes look to the transfer pricing definition 1.

|

Item ID |

Cost Element |

Transfer Price |

Comments |

|

80100 |

100 |

11.00 |

On the transfer pricing definition 2 no detail information for this item is found, so the header information is used. A 15% markup is applied to the current perpetual average cost and added to the 750 cost element. |

|

|

750 |

1.65 |

|

|

80200 |

100 |

10.00 |

On the transfer pricing definition 2 no detail information for this item is found, so the header information is used. A 15% markup is applied to the current perpetual average cost and added to the 750 cost element. In addition, the landed costs in the cost element 601 is added to the transfer price. |

|

|

601 |

1.00 |

|

|

|

750 |

1.50 |

|

|

80300 |

100 |

10.10 |

On the transfer pricing definition 2 no detail information for this item is found, so the header information is used. A 15% markup is applied to the default actual cost and added to the 750 cost element. |

|

|

750 |

1.515 |

|

|

80400 |

100 |

18.18 |

Detail information for this item is found on the transfer pricing definition 2. A transfer price of 18.18 is applied to the material cost element and a 10% markup of the transfer price is applied to the 750 cost element. |

|

|

750 |

1.81 |

|

|

80500 |

100 |

7.00 |

Detail information for this item is found on the transfer pricing definition 2. A transfer price of 7.00 is applied to the material cost element and a 5% markup of the transfer price is applied to the 751 cost element. |

|

|

751 |

.35 |

|

|

80600 |

100 |

10.00 |

On the transfer pricing definition 2 no detail information for this item is found, so the header information is used. A 15% markup is applied to the current frozen standard cost and added to the 750 cost element. |

|

|

750 |

1.50 |

|

Example 2

In this example, all information is the same as example 1 except the Price Overrides Only check box is selected on the transfer pricing definition 2. The following results will occur (for the US001/US014 combination only) when the Calculate Transfer Price process populates the Transfer Pricing table or when the Deplete On Hand Qty process calculates the transfer prices directly for MSR lines. Since the transfer pricing definition 2 is more specific, the processes (using the transfer price default hierarchy) look first to it. If data cannot be found then the processes look to the transfer pricing definition 1.

|

Item ID |

Cost Element |

Transfer Price |

Comments |

|

80100 |

100 |

11.00 |

No detail information for this item is found on the transfer pricing definition 2, so the header information is used from the transfer pricing definition 1. A 20% markup is applied to the current perpetual average cost and added to the 751 cost element. |

|

|

751 |

2.20 |

|

|

80200 |

100 |

4.00 |

No detail information for this item is found on the transfer pricing definition 2, so the detail information is used from the transfer pricing definition 1. A transfer price of 4.00 is applied to the material cost element and a 4% markup of the transfer price is applied to the 750 cost element. |

|

|

750 |

.16 |

|

|

80300 |

100 |

10.10 |

No detail information for this item is found on the transfer pricing definition 2, so the header information is used from the transfer pricing definition 1. A 20% markup is applied to the default actual cost and added to the 751 cost element. |

|

|

751 |

2.02 |

|

|

80400 |

100 |

18.18 |

Detail information for this item is found on the transfer pricing definition 2. A transfer price of 18.18 is applied to the material cost element and a 10% markup of the transfer price is applied to the 750 cost element. Note that the detail level of the transfer pricing definition 2 instructs the system to use the header level default for the cost element even though the Price Overrides Only check box has been selected. |

|

|

750 |

1.81 |

|

|

80500 |

100 |

7.00 |

Detail information for this item is found on the transfer pricing definition 2. A transfer price of 7.00 is applied to the material cost element and a 5% markup of the transfer price is applied to the 751 cost element. |

|

|

751 |

.35 |

|

|

80600 |

100 |

10.00 |

No detail information for this item is found on the transfer pricing definition 2, so the header information is used from the transfer pricing definition 1. A 20% markup is applied to the current frozen standard cost and added to the 751 cost element. |

|

|

751 |

2.00 |

|

Populating the Transfer Price Table

Populating the Transfer Price Table

This section provides an overview of the transfer price feature and discusses how to populate the Transfer Price table.

Understanding the Transfer Price Feature

Understanding the Transfer Price FeatureThe transfer price feature enables you to populate the Transfer Price table (CM_TRAN_PRICE) with the transfer prices (material and additional transfer costs) that are used by the system when an MSR transfers stock. The Calculate Transfer Price process (CM_TRANS_PRC) populates this table based on your setup in the Transfer Pricing Definition component. Populating the Transfer Price table is optional, you can choose to have the system create the transfer price based on the currently available data and setup rather than using the values in this table.

Note. The performance of the Deplete On Hand Qty process can be affected if the Transfer Price table contains a large number of rows. Consider the size of the table when you design your transfer price method.

See Applying Transfer Prices to a Material Stock Request.

Page Used to Populate the Transfer Price Table

Page Used to Populate the Transfer Price Table|

Page Name |

Definition Name |

Navigation |

Usage |

|

CM_TRAN_PRICE_REQ |

Cost Accounting, Item Costs, Update Costs, Calculate Transfer Price |

Run the Calculate Transfer Price process to populate the CM_TRAN_PRICE table with the transfer prices to be used. |

Running the Calculate Transfer Price Process

Running the Calculate Transfer Price Process

Access the Calculate Transfer Price page (Cost Accounting, Item Costs, Update Costs, Calculate Transfer Price).

|

As of Date |

Determines the set of parameters to use when calculating the transfer price. This date controls the effective date used to retrieve rows defined on the Transfer Pricing Definition component and to retrieve actual cost rows for pricing calculations. In addition this date is the new Price Effective Date set in the Transfer Price record. |

|

Create Errors for No Receipts |

Select this check box to have the process log error messages when the calculation method is Last Price Paid, First Price Paid, or Average N, and there are no receipts for a source business unit and item ID . Use caution when selecting this check box as the number of log messages could potentially be quite high. |

Source Business Unit Group Box

This process can only select source PeopleSoft Inventory business units that:

Are valid for the user running this process.

Have an open status on the Inventory Definition - Business Unit Definition page.

Have the Generate InterUnit Prices check box selected on the Inventory Definition - Business Unit Definition page.

Have an existing transfer pricing definition record with a status of Active.

|

All Business Units |

Select this check box to have the process include all valid PeopleSoft Inventory business units as the source business units. |

|

Business Unit and To Business Unit |

Enter a range of source Inventory business units. If this run control should process one source business unit, enter the unit in the Business Unit field. If you want to process a range of business units, enter the starting unit in the Business Unit field and the ending business unit in the To Business Unit field. The system processes all Inventory business units, sorted in alphanumerical order, that fall between the starting and ending unit. |

Destination Business Unit Group Box

The Destination Business Unit group box enables you to select destination business unit that are paired with the source unit on a transfer pricing definition. You can select combinations with a blank destination, a specific destination unit, or all valid combinations. This process can only select destination PeopleSoft Inventory business units that have, in combination with the source unit, an existing transfer pricing definition record with an active status.

|

All Business Units |

Select this check box to have the process include all valid PeopleSoft Inventory business units as the destination business units. This check box includes transfer pricing definitions with a combination of source and destination units and transfer pricing definitions with a blank destination unit. |

|

Default Destination BU |

Select this check box to have the process calculate transfer prices for the source business unit for which the destination unit is always blank. This check box cannot be used in combination with the All Business Units check box mentioned previously. |

|

Destination BU |

Enter a specific destination Inventory business unit. The process only uses transfer pricing definitions with a source/destination unit pair that specify this destination unit. |

|

Show Results |

Click this button to display the valid source unit, destination unit, and price effective date combinations that can be processed based on your parameters. The search results appear in the Selected Business Units group box. You can keep current search results and change parameters to add additional combinations to the Selected Business Units group box. |

Selected Business Units Group Box

This group box displays the results of the search initiated by the Show Results button on this page. Clicking this button displays the valid source unit, destination unit, and price effective date combinations that can be processed based on your parameters. In order for a combination to be selected, the following rules apply:

The source and destination unit combinations must have a transfer pricing definition with a price effective date matching the As of Date field on this page.

The transfer pricing definition must have a status of Active.

The business units must:

Have the Generate InterUnit Prices check box selected on the Inventory Definition - Business Unit Definition page.

Be valid for the user running this process.

Have an open status on the Inventory Definition - Business Unit Definition page.

|

Choose One (Optional) |

Select a row in the Selected Business Units group box to choose just one combination for processing. The system populates the source and destination business unit values above and collapses the grid area. |

Item Options Group Box

Use the Item Options group box to calculate transfer prices based on item ID or item group.

|

All Items |

Select to include all items within the source business unit. This value is the default. |

|

Single Item |

Select to limit this process run to one specific item within the source business unit. Enter the item in the Item ID field in this group box. |

|

Item Group |

Select to limit this process run to one specific item group within the source business unit. Enter the item group in the Item Group field in this group box. |

Note. When you save this run control, the system performs a check of existing transfer prices in the Transfer Pricing table. Based on your parameters, if this process run could overwrite existing transfer prices, then a warning message will appear.

Calculating Default Actual Cost and Current Purchase Cost

Calculating Default Actual Cost and Current Purchase Cost

This section provides an overview of costs and discusses how to use the Update Default Actual Cost process.

Understanding Costs

Understanding CostsThe values in the Default Actual Cost field and the Current Purchase Cost field are used by both processes and reports when a item value is needed. These fields are located on the Define Business Unit Item - General: Common page. The value in these fields can be manually updated or you can use the Update Default Actual Cost (CM_BUCST_UPD) process to automatically update these field.

Understanding Default Actual Cost and Current Purchase Cost

The Default Actual Cost field is used as the actual or average cost if the item does not yet have an actual cost generated from the receipt and putaway processes. This value is stored in the DFLT_ACTUAL_COST field of the BU_ITEMS_INV record. The Default Actual Cost is used in these processes and reports:

The Deplete On Hand Quantity process (IN_FUL_DPL). This field value is used to determine the transfer cost of an interunit transfer when the Transfer Pricing Definition component uses the default actual cost option.

The Reconciliation Report (INS5050) and the Stock Quantity Update process (INPOPOST) for a inventory stock count (physical count or cycle count). This field value is used to record a positive inventory adjustment when a receipt cost is not found.

The Adjustments page (ADJUSTMENT2_INV). The field value is used if the item requires a positive inventory adjustment prior to an actual cost being generated from receipt of the item.

The Cost Rollup process in PeopleSoft Manufacturing uses this field value as a preliminary cost if a receipt cost is not found.

The Interunit and RMA Receiving component uses the value in the Default Actual Cost field to cost the receipt of items using actual cost.

The Utilization Type Calculation Summary report (INS5100)

The Slow Moving Inventory report (INS5200) uses this field value if a receipt cost is not found.

The Current Purchase Cost field is used in PeopleSoft Manufacturing. This value is stored in the CURRENT_COST field of the BU_ITEMS_INV record. The Cost Rollup process in PeopleSoft Manufacturing uses this field value as an optional source to calculate the value of a standard-cost item. The Current Purchase Cost field is used to determine the material cost of purchased items and the lower-level material cost of a manufactured item when the cost type that you are rolling uses current costs.

Understanding the Update Default Actual Cost Process

The Update Default Actual Cost (CM_BUCST_UPD) process is a PeopleSoft Application Engine program that can update the Default Actual Cost field and the Current Purchase Cost field for all the items regardless of the item's cost profile. Before running this process, be sure to run the Cost Accounting Creation process to update the PeopleSoft Cost Management tables for any new receipts, cost adjustments, PeopleSoft Payable cost adjustments, or PeopleSoft Manufacturing finalized cost adjustment transactions. Based on your search criteria, the process:

Includes all the zero cost receipts, as they are originally part of average cost calculation during putaway.

Excludes cancelled receipts.

For consigned inventory items, includes all receipts irrespective of the consumption for consigned inventory items.

Rolls up all the cost elements into one default actual cost for each item, receiver ID, receiver line, distribution line before calculating the new cost.

Excludes manufacturing transactions with a cost source of 8 (Preliminary Production Cost).

Note. After the Update Default Actual Cost process is completed, you can query the PS_CM_ACT_COST_TMP and PS_CM_AVG_RCST_TMP tables to see what receipts were used during the cost calculation. These tables are cleared during the next run.

Page Used to Calculate Default Actual Cost and Current Purchase Cost

Page Used to Calculate Default Actual Cost and Current Purchase Cost|

Page Name |

Definition Name |

Navigation |

Usage |

|

RUN_CM_DFLTCOST |

Cost Accounting, Item Costs, Update Costs, Update Default Actual Cost |

Calculate the value to be stored in the Default Actual Cost field or the Current Purchase Cost field on the Define Business Unit Item - General: Common page. |

Using the Update Default Actual Cost Process

Using the Update Default Actual Cost ProcessAccess the Update Default Actual Cost page (Cost Accounting, Item Costs, Update Costs, Update Default Actual Cost).

Use the Update Default Actual Cost process to update the cost fields Default Actual Cost (DFLT_ACTUAL_COST) and Current Purchasing Cost (CURRENT_COST) in the Define Business Unit Item - General: Common page (BU_ITEMS_INV).

|

Business Unit |

Enter the PeopleSoft Inventory business unit in which the process updates the cost fields for item IDs in that business unit. All items meeting the search criteria on this page are updated, regardless of the cost profile used. |

|

All Business Units |

Select all Inventory business units. The process updates the cost fields for the specified item IDs in all of the business units. If row-level security is enabled, then the user must have security access to all of the Inventory business units for the process to run the cost calculations. |

|

All Items |

Select this option to include all items in the business units that meet the search criteria of this page. |

|

Item Range |

Select this option to define a range of item IDs to be processed. |

|

Item Group |

Select this option to define an item group ID to be processed. |

|

From Item ID and To Item ID |

Enter a range of item IDs to be processed. The system includes all items in the alphanumeric sequence. The Item Range option must be selected to enter values in these fields. |

|

Item Group |

Enter an item group ID to be processed. The Item Group option must be selected to enter a value in this field. If the Item Group option is selected and the Item Group field is left blank, then the process includes only the items that do not have an item group assigned on the Define Item - General: Common page (MASTER_ITEM_TBL table). |

|

Cost Update Selection |

Select the cost fields to be updated by this process. The options are:

|

|

Cost Update Options |

Choose the method to update the cost fields. The options are:

|

|

Number of Days |

Enter the past number of days' worth of receipts to be used to calculate the weight average for the transfer price. The field is required when the option Use Average of Receipt Costs is selected. |

Viewing Transfer Pricing Data for an Item

Viewing Transfer Pricing Data for an Item

This section discusses how to use the transfer price inquiry, which is an online inquiry page that enables you to view the transfer pricing setup for an item.

Pages Used to View Transfer Pricing Data for an Item

Pages Used to View Transfer Pricing Data for an Item|

Page Name |

Definition Name |

Navigation |

Usage |

|

CM_TRAN_PRICE_INQ |

Cost Accounting, Item Costs, Review Costs, Transfer Price Inquiry |

View the transfer pricing data for a specific item ID. |

|

|

CM_IU_PAIR_LOOKUP |

Click the Source / Dest BU Lookup link on the Transfer Price Inquiry page. |

View the source and destination business unit pairs created for the item. |

Using the Transfer Price Inquiry

Using the Transfer Price InquiryAccess the Transfer Price Inquiry page (Cost Accounting, Item Costs, Review Costs, Transfer Price Inquiry).

The Transfer Price Inquiry page displays the transfer pricing details for the combination of a specific item ID, source business unit, destination unit, and price effective date.

|

Search |

Click this button to search for transfer pricing data based on your entries in the Item ID, Source BU, Destination BU, and Price Effective Date fields. |

|

Source / Dest BU Lookup |

Click this link to access the Source / Dest BU Lookup page, where you can view the source and destination business unit pairs that were created for the item. |

|

Cost Method |

Displays the Deplete Cost Method from the Cost Profile used for this item ID in the source Inventory business unit. |

|

Transfer Price |

Displays the transfer price that would be used for this item. In some cases, the most current transfer price is determined by the Deplete On Hand Qty process; therefore, this price may be just an estimate. The field is calculated at the time of display using the transfer pricing hierarchy defined in this chapter. |

Transfer Pricing Definition Group Box

This group box displays the values from the Transfer Pricing Definition component that apply to this item ID based on source unit, destination unit, and price effective date. The data displays any override values entered at the item ID or item group level as well as any additional cost data from the Additional Transfer Price page.

Transfer Prices Group Box

This group box displays values from the Transfer Pricing table. This table is optional and is populated by the Calculate Transfer Price process.

Reviewing Interunit Accounting Examples

Reviewing Interunit Accounting Examples

This section provides an overview of interunit accounting examples and reviews examples of:

Transferring interunit stock using only an intransit account.

Transferring interunit stock using interunit receivables and payables.

Transferring interunit stock using the interunit sales approach (intercompany).

Understanding Interunit Accounting Examples

Understanding Interunit Accounting ExamplesThis table describes the accounting entries that you can create using the three different types of interunit stock transfers:

|

Type of Transfer |

Description |

Examples |

|

Interunit transfer using only an intransit account |

The cost of the inventory stock is entered into an intransit account while being moved from one inventory business unit to another. Use this approach when both inventory business units post to the same general ledger. |

Example 1 |

|

Interunit transfer using interunit receivables and interunit payables accounts |

An intransit account is used along with interunit receivables and payables accounts recorded for each inventory business unit. Both inventory business units post to different general ledger business units. Use this approach when transferring stock between separate legal entities or within the same legal entity. |

Examples 2.1 to 2.3 |

|

Interunit sales approach (intercompany) |

An intercompany sale is recorded with the source inventory business unit recording a sale and the linked billing business unit issuing a voucher (invoice) for the stock transfer to the payable unit of the receiving business unit. Use this approach when transferring stock between separate legal entities or within the same legal entity. The Intercompany method is required if the GL business units use different currencies. |

Examples 3.1 to 3.4 |

All of the examples use the following cost elements:

100 (Material- General)

601 (Landed- Duty)

751 (Addl Trans- Freight)

Determining the Inventory Account

For all the examples below, the location accounting feature determines how the system selects the ChartField combination used for the inventory stock account. The inventory account is debited for receipt of stock and credited for shipment of stock. The location accounting feature is turned on at the business unit level by selecting the Location Accounting Required check box on the Inventory Options page (Set Up Financials/Supply Chain, Business Unit Related, Inventory, Inventory Options).

If the Location Accounting Required check box is not selected, the inventory account is derived from the Accounting Rules page (Account Distribution page) for the applicable transaction group.

If the Location Accounting Required check box is selected, the inventory account is derived from the storage area from which the inventory is shipped.

Determining the Intransit Account

For all the examples below, the intransit inventory account defined using the inventory business unit combinations on the InterUnit Ownership page or from the intransit account defined in the centralized interunit and intraunit processor.

Transferring Interunit Stock Using Only

an Intransit Account

Transferring Interunit Stock Using Only

an Intransit Account

This example illustrates a stock transfer from inventory business unit US012 to inventory business unit US013. Both of these business units post to the same general ledge (US003); in this case, US012 owns the intransit inventory until it is received at the requesting business unit. The item uses the actual-cost method. In this example, the item cost and the transfer price for the item differ.

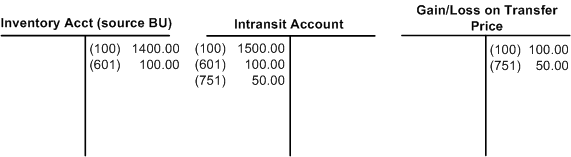

Example 1

The following diagram illustrates the accounting entry for the shipping transaction in the source business unit US012 (transaction group 031- InterBU Transfer Shipments). The inventory account is credited at item cost for the material and landed costs. The intransit account contains the transfer price of material, landed cost, and additional transfer costs. The gain and loss on transfer price account contains the additional transfer cost plus any difference between the transfer price and the cost of the item.

Example of shipping interunit stock from a source business unit

The following diagram illustrates the accounting entry for the putaway transaction in the destination business unit US013 (transaction group 022 - IBU Transfer Receipts). The entire shipment arrives intact, and the intransit account is credited for the transfer price (material, landed, and additional transfer costs). Since the item uses the actual-cost method, the inventory account in US013 is debited for transfer price of the material and landed costs portions. Since the Expense Transfer Fees check box for US013 is selected on Inventory Definition - Business Unit Definition page, the additional transfer costs are written off to the gain and loss on transfer price account rather than added to the cost of the item.

Example of putting away interunit stock in the destination business unit

Transferring Interunit Stock Using Interunit

Receivables and Payables

Transferring Interunit Stock Using Interunit

Receivables and Payables

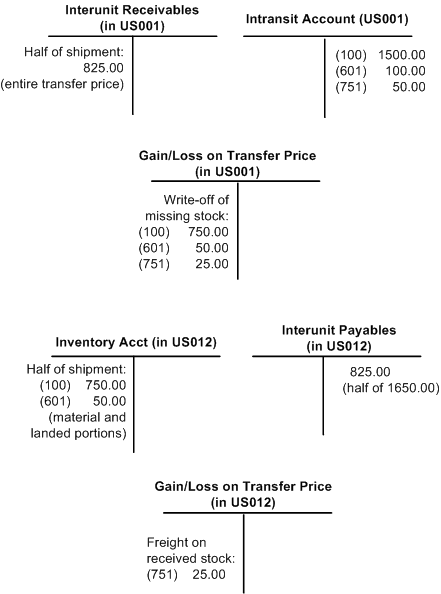

These examples illustrate stock transfers for inventory business units that post to different PeopleSoft General Ledgers.

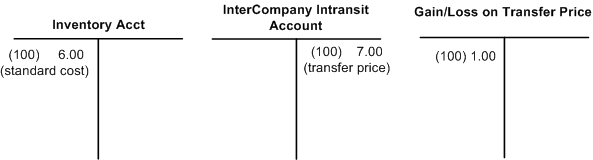

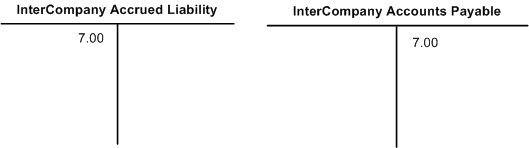

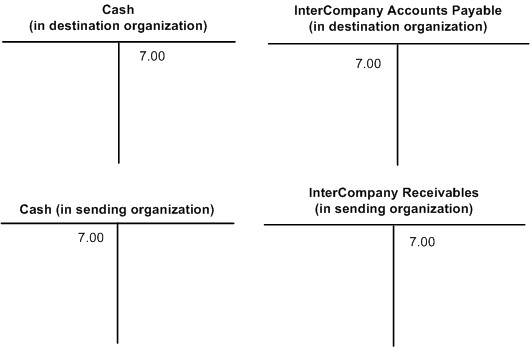

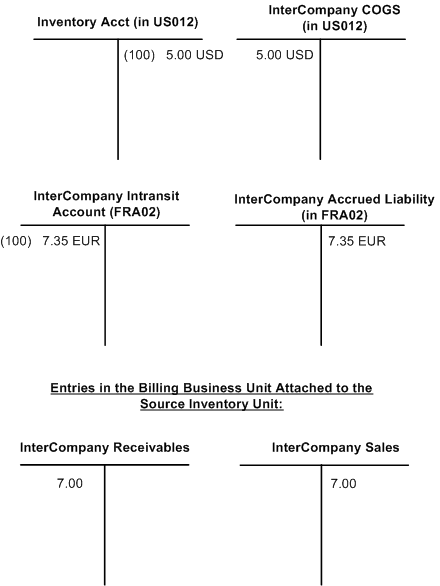

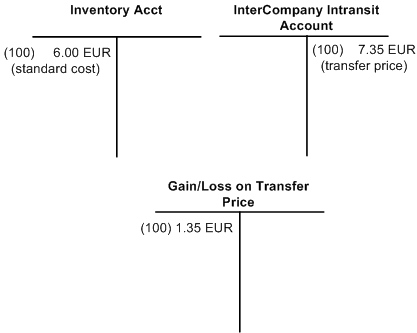

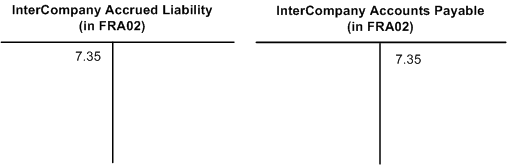

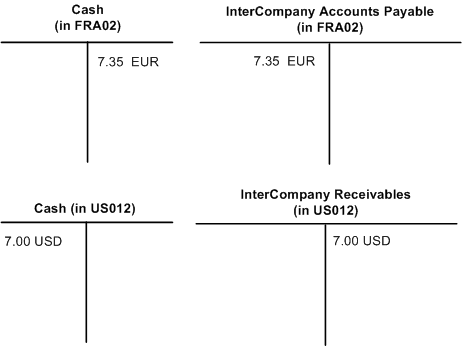

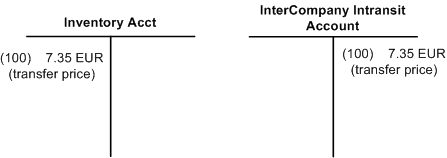

Example 2.1