Understanding This Appendix

Understanding This AppendixThis appendix discusses scenarios for using PeopleSoft Cost Management to:

Calculate transaction costing based on the cost profile.

Determine your cost structure strategy.

Understanding This Appendix

Understanding This AppendixThis appendix presents scenarios of how to use some of the features within PeopleSoft Cost Management. These real-life examples describe some of the intended uses of these features; enabling you to understand how these features might be applied to your own organization.

Note. The real-life scenarios described within this PeopleBook may not conform to the business rules and procedures within your organization. These scenarios should not be construed as consulting or implementation advise for your specific industry or your individual organization. The information here should be adapted or even disregarded based on the needs of your organization. PeopleSoft does not guarantee that the information included here will work as intended within your customized environment.

Example: Calculating Transaction Costing Based on the Cost Profile

Example: Calculating Transaction Costing Based on the Cost Profile

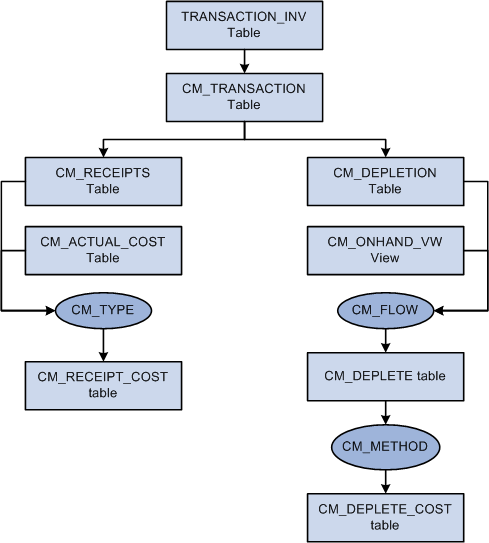

These examples illustrate how the costing structure operates. Transactions for PeopleSoft Inventory and PeopleSoft Manufacturing are inserted into the PeopleSoft Transaction History (TRANSACTION_INV) table. The Transaction Costing process in PeopleSoft Cost Management uses the transaction data along with the costing structure to determine the cost for each transaction.

The Transaction Costing process is discussed in detail in the Costing Transactions and Creating Accounting Entries chapter of this PeopleBook.

These diagrams illustrate how the Transaction Costing process uses the cost profile setup (receipt cost, cost flow, and deplete cost methods) to calculate transactions cost for:

Lot control items.

FIFO and LIFO items.

Average cost items.

Standard cost items.

See Also

Costing Transactions and Creating Accounting Entries

Setting Up the Accounting Rules Structure

Costing Lot Controlled Items

Costing Lot Controlled Items

This example illustrates the records that are used while costing lot controlled items. For this example, this information is used:

|

Inventory Business Unit |

US008 |

|

Item ID |

A |

|

Cost Book |

FIN |

|

From Cost Profile |

|

|

Receipt Cost Method (CM_TYPE) |

Actual |

|

Cost Flow (CM_FLOW) |

Lot ID |

|

Deplete Cost Method (CM_METHOD) |

Actual |

This diagram illustrates the cost flow for a lot controlled item:

Lot-Control Costing Example

The TRANSACTION_INV Table

Transactions for PeopleSoft Inventory and PeopleSoft Manufacturing are inserted into the PeopleSoft Transaction History (TRANSACTION_INV) table. In this example, there are three transactions stocking item A into the US008 inventory business unit (020 Putaway transactions), and two transactions shipping item A out of the US008 business unit (030– Usage and Shipment transactions).

|

Business Unit |

Item |

Date/Time |

Transaction |

Lot ID |

Qty |

|

US008 |

A |

T1 |

020–Putaway |

1 |

10 |

|

US008 |

A |

T3 |

020–Putaway |

2 |

5 |

|

US008 |

A |

T5 |

030–Usages & Shipments |

1 |

6 |

|

US008 |

A |

T7 |

020–Putaway |

3 |

5 |

|

US008 |

A |

T9 |

030–Usages & Shipments |

3 |

5 |

The CM_TRANSACTION Table

The Transaction Costing process expands the transactions in TRANSACTION_INV into the PeopleSoft Cost Management CM_TRANSACTION table, adding a separate row for each business unit and cost book combination.

The CM_RECEIPTS Table

The Transaction Costing process places 020– Putaway transactions into CM_RECEIPTS.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Lot ID |

Qty |

|

US008 |

A |

T1 |

FIN |

1 |

10 |

|

US008 |

A |

T3 |

FIN |

2 |

5 |

|

US008 |

A |

T7 |

FIN |

3 |

5 |

The CM_DEPLETION Table

The Transaction Costing process places 030– Usage & Shipment transactions into CM_DEPLETION.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Lot ID |

Qty |

|

US008 |

A |

T5 |

FIN |

1 |

6 |

|

US008 |

A |

T9 |

FIN |

3 |

5 |

The CM_ACTUAL_COST Table

Item putaway costs are computed and placed in CM_ACTUAL_COST table.

|

Business Unit |

Item |

Date/Time |

Cost Element |

Unit Cost |

|

US008 |

A |

T1 |

100 |

10.00 |

|

US008 |

A |

T1 |

200 |

1.00 |

|

US008 |

A |

T3 |

100 |

20.00 |

|

US008 |

A |

T3 |

200 |

2.00 |

|

US008 |

A |

T7 |

100 |

25.00 |

|

US008 |

A |

T7 |

200 |

5.00 |

The CM_RECEIPT_COST Table

Data from the CM_RECEIPTS table and the CM_ACTUAL_COST table are used to calculate the receipt costs for the CM_RECEIPT_COST table. This is based on the cost type entered for the cost book on the Inventory Definition - Business Unit Books page.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Cost Element |

Unit Cost |

|

US008 |

A |

T1 |

FIN |

100 |

10.00 |

|

US008 |

A |

T1 |

FIN |

200 |

1.00 |

|

US008 |

A |

T3 |

FIN |

100 |

20.00 |

|

US008 |

A |

T3 |

FIN |

200 |

2.00 |

|

US008 |

A |

T7 |

FIN |

100 |

25.00 |

|

US008 |

A |

T7 |

FIN |

200 |

5.00 |

The CM_ONHAND_VW Table

The CM_ONHAND_VW table matches receipts (putaways) with depletions (usage and shipments) based on the Cost Flow field on the Cost Profiles page.

|

Bus Unit |

Item |

Date/Time |

Cost Book |

T0 QTY |

T2 QTY |

T4 QTY |

T6 QTY |

T8 QTY |

T10 QTY |

|

US008 |

A |

T1 |

FIN |

0 |

10 |

10 |

4 |

4 |

4 |

|

US008 |

A |

T3 |

FIN |

0 |

0 |

5 |

5 |

5 |

5 |

|

US008 |

A |

T7 |

FIN |

0 |

0 |

0 |

0 |

5 |

0 |

The CM_DEPLETE Table

The process matches up each depletion transaction in CM_DEPLETION with a qualifying putaway from CM_ONHAND_VW. These depleted depletions are inserted into the CM_DEPLETE table. The Cost Flow field on the Cost Profiles page determines how receipts are matched with depletions. For lot-controlled items, the cost of the specific lot is used. This offers you a specific method of tracking quantities and costs by lot.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Rec Date/Time |

Qty |

|

US008 |

A |

T5 |

FIN |

T1 |

6 |

|

US008 |

A |

T9 |

FIN |

T7 |

5 |

The CM_DEPLETE_COST Table

The process calculates the cost of depletions in the CM_DEPLETE table and placed them in the CM_DEPLETE_COST table. This is based on the Deplete Cost Method defined on the Cost Profiles page.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Rec Date/Time |

Cost Element |

Unit Cost |

|

US008 |

A |

T5 |

FIN |

T1 |

100 |

10.00 |

|

US008 |

A |

T5 |

FIN |

T1 |

200 |

1.00 |

|

US008 |

A |

T9 |

FIN |

T7 |

100 |

25.00 |

|

US008 |

A |

T9 |

FIN |

T7 |

200 |

5.00 |

Costing FIFO/LIFO Items

Costing FIFO/LIFO Items

This example illustrates costing using the FIFO/LIFO methods. For this example, this information is used:

|

Inventory Business Unit |

US010 |

US010 |

|

Item ID |

A |

A |

|

Cost Book |

FIN |

TAX |

|

From Cost Profile |

|

|

|

Receipt Cost Method (CM_TYPE) |

Actual |

Actual |

|

Cost Flow (CM_FLOW) |

FIFO |

LIFO |

|

Deplete Cost Method (CM_METHOD) |

Actual |

Actual |

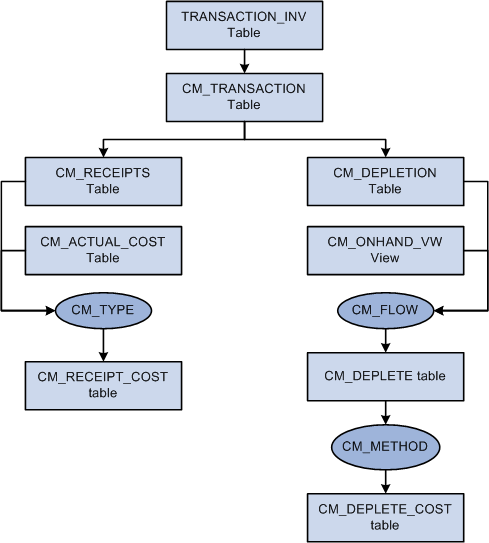

This diagram illustrates the cost flow for a FIFO or LIFO item:

FIFO and LIFO Costing Example

The TRANSACTION_INV Table

Transactions for PeopleSoft Inventory and PeopleSoft Manufacturing are inserted into the PeopleSoft Transaction History (TRANSACTION_INV) table. In this example, there are three transactions stocking item A into the US010 inventory business unit (020 Putaway transactions), and two transactions shipping item A out of the US010 business unit (030– Usage and Shipment transactions).

|

Business Unit |

Item |

Date/Time |

Transaction |

Qty |

|

US010 |

A |

T1 |

020–Putaway |

10 |

|

US010 |

A |

T3 |

020–Putaway |

5 |

|

US010 |

A |

T5 |

030–Usages & Shipments |

6 |

|

US010 |

A |

T7 |

020–Putaway |

5 |

|

US010 |

A |

T9 |

030–Usages & Shipments |

5 |

The CM_TRANSACTION Table

The Transaction Costing process expands the transactions in TRANSACTION_INV into the PeopleSoft Cost Management CM_TRANSACTION table, adding a separate row for each business unit and cost book combination.

The CM_RECEIPTS Table

The Transaction Costing process places 020– Putaway transactions into CM_RECEIPTS.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Qty |

|

US010 |

A |

T1 |

FIN |

10 |

|

US010 |

A |

T1 |

TAX |

10 |

|

US010 |

A |

T3 |

FIN |

5 |

|

US010 |

A |

T3 |

TAX |

5 |

|

US010 |

A |

T7 |

FIN |

5 |

|

US010 |

A |

T7 |

TAX |

5 |

The CM_DEPLETION Table

The Transaction Costing process places 030– Usage & Shipment transactions into CM_DEPLETION.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Qty |

|

US010 |

A |

T5 |

FIN |

6 |

|

US010 |

A |

T5 |

TAX |

6 |

|

US010 |

A |

T9 |

FIN |

5 |

|

US010 |

A |

T9 |

TAX |

5 |

The CM_ACTUAL_COST Table

Item putaway costs are computed and placed in CM_ACTUAL_COST table.

|

Business Unit |

Item |

Date/Time |

Cost Element |

Unit Cost |

|

US010 |

A |

T1 |

100 |

10.00 |

|

US010 |

A |

T1 |

200 |

1.00 |

|

US010 |

A |

T3 |

100 |

20.00 |

|

US010 |

A |

T3 |

200 |

2.00 |

|

US010 |

A |

T7 |

100 |

25.00 |

|

US010 |

A |

T7 |

200 |

5.00 |

The CM_RECEIPT_COST Table

Data from the CM_RECEIPTS table and the CM_ACTUAL_COST table are used to calculate the receipt costs for the CM_RECEIPT_COST table. This is based on the cost type entered for the cost book on the Inventory Definition - Business Unit Books page.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Cost Element |

Unit Cost |

|

US010 |

A |

T1 |

FIN |

100 |

10.00 |

|

US010 |

A |

T1 |

FIN |

200 |

1.00 |

|

US010 |

A |

T1 |

TAX |

100 |

10.00 |

|

US010 |

A |

T1 |

TAX |

200 |

1.00 |

|

US010 |

A |

T3 |

FIN |

100 |

20.00 |

|

US010 |

A |

T3 |

FIN |

200 |

2.00 |

|

US010 |

A |

T3 |

TAX |

100 |

20.00 |

|

US010 |

A |

T3 |

TAX |

200 |

2.00 |

|

US010 |

A |

T7 |

FIN |

100 |

25.00 |

|

US010 |

A |

T7 |

FIN |

200 |

5.00 |

|

US010 |

A |

T7 |

TAX |

100 |

25.00 |

|

US010 |

A |

T7 |

TAX |

200 |

5.00 |

The CM_ONHAND_VW Table

The CM_ONHAND_VW table matches receipts (putaways) with depletions (usage and shipments) based on the Cost Flow field on the Cost Profiles page.

|

Bus Unit |

Item |

Date/Time |

Cost Book |

T0 QTY |

T2 QTY |

T4 QTY |

T6 QTY |

T8 QTY |

T10 QTY |

|

US010 |

A |

T1 |

FIN |

0 |

10 |

10 |

4 |

4 |

0 |

|

US010 |

A |

T1 |

TAX |

0 |

10 |

10 |

9 |

9 |

9 |

|

US010 |

A |

T3 |

FIN |

0 |

0 |

5 |

5 |

5 |

4 |

|

US010 |

A |

T3 |

TAX |

0 |

0 |

5 |

0 |

0 |

0 |

|

US010 |

A |

T7 |

FIN |

0 |

0 |

0 |

0 |

5 |

5 |

|

US010 |

A |

T7 |

TAX |

0 |

0 |

0 |

0 |

5 |

0 |

The CM_DEPLETE Table

The process matches up each depletion transaction in CM_DEPLETION with a qualifying putaway from CM_ONHAND_VW. These depleted depletions are inserted into the CM_DEPLETE table. The Cost Flow field on the Cost Profiles page determines how receipts are matched with depletions.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Rec Date/Time |

Qty |

|

US010 |

A |

T5 |

FIN |

T1 |

6 |

|

US010 |

A |

T5 |

TAX |

T3 |

5 |

|

US010 |

A |

T5 |

TAX |

T1 |

1 |

|

US010 |

A |

T9 |

FIN |

T1 |

4 |

|

US010 |

A |

T9 |

FIN |

T3 |

1 |

|

US010 |

A |

T9 |

TAX |

T7 |

5 |

The CM_DEPLETE_COST Table

The process calculates the cost of depletions in the CM_DEPLETE table and placed them in the CM_DEPLETE_COST table. This is based on the Deplete Cost Method defined on the Cost Profiles page.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Rec Date/Time |

Cost Element |

Unit Cost |

|

US010 |

A |

T5 |

FIN |

T1 |

100 |

10.00 |

|

US010 |

A |

T5 |

FIN |

T1 |

200 |

1.00 |

|

US010 |

A |

T5 |

TAX |

T3 |

100 |

20.00 |

|

US010 |

A |

T5 |

TAX |

T3 |

200 |

2.00 |

|

US010 |

A |

T5 |

TAX |

T1 |

100 |

10.00 |

|

US010 |

A |

T5 |

TAX |

T1 |

200 |

1.00 |

|

US010 |

A |

T9 |

FIN |

T1 |

100 |

10.00 |

|

US010 |

A |

T9 |

FIN |

T1 |

200 |

1.00 |

|

US010 |

A |

T9 |

FIN |

T3 |

100 |

20.00 |

|

US010 |

A |

T9 |

FIN |

T3 |

200 |

2.00 |

|

US010 |

A |

T9 |

TAX |

T7 |

100 |

25.00 |

|

US010 |

A |

T9 |

TAX |

T7 |

200 |

5.00 |

Costing Average Cost Items

Costing Average Cost Items

This example details the perpetual and periodic average cost methods that are used in PeopleSoft Cost Management. For this example, this information is used:

|

Inventory Business Unit |

US011 |

US011 |

|

Item ID |

A |

A |

|

Cost Book |

FIN |

TAX |

|

From Cost Profile |

|

|

|

Receipt Cost Method (CM_TYPE) |

Actual |

Actual |

|

Cost Flow (CM_FLOW) |

FIFO |

FIFO |

|

Deplete Cost Method (CM_METHOD) |

Perpetual Average |

Periodic Average |

|

Cost Element Option |

Production |

N/A |

For the TAX cost book, assume that the average is calculated only once, at the end of the period (periodic).

For the FIN cost book, assume that the average is calculated after each putaway.

Perpetual Average Is Calculated:

|

Date/Time |

Cost Element |

Existing Onhand Stock |

Shipments |

Actual Cost of New Receipt |

New Average Cost per Unit |

|

T1 |

100 |

None |

|

10 units @ 10/unit |

10.00/unit |

|

T1 |

200 |

None |

|

10 units @ 1/unit |

1.00/unit |

|

T3 |

100 |

10 units @ 10/unit |

|

5 units @ 20/unit |

13.33/unit |

|

T3 |

200 |

10 units @ 1/unit |

|

5 units @ 2/unit |

1.33/unit |

|

T5 |

100 |

|

6 units shipped |

|

|

|

T5 |

200 |

|

6 units shipped |

|

|

|

T7 |

100 |

9 units @ 13.3/unit |

|

5/units @ 25/unit |

17.50/unit |

|

T7 |

200 |

9 units @ 1.33/unit |

|

5/units @ 5/unit |

2.64/unit |

Periodic Average is Calculated:

|

Date/Time |

Cost Element |

Actual Cost of New Receipt |

Total Average Cost |

Avg Cost/Unit to Cost all Shipments within Period |

|

T1 |

100 |

10 units @ 10/unit |

100.00 |

|

|

T1 |

200 |

10 units @ 1/unit |

10.00 |

|

|

T3 |

100 |

5 units @ 20/unit |

100.00 |

|

|

T3 |

200 |

5 units @ 2/unit |

10.00 |

|

|

T5 |

100 |

5 units @ 25/unit |

125.00 |

|

|

T5 |

200 |

5 units @ 5/unit |

25.00 |

|

|

Totals |

|

20 units |

325.00 for cost element 100 45.00 for cost element 200 |

16.25/unit for cost element 100 2.25/unit for cost element 200 |

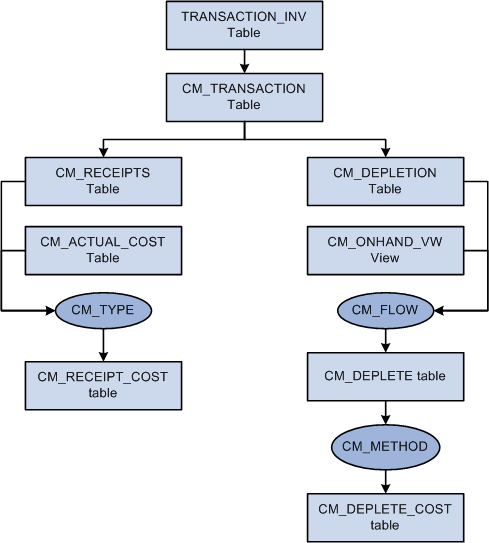

This diagram illustrates the cost flow for a perpetual and periodic average cost item:

Perpetual and Periodic Average Costing Example

The TRANSACTION_INV Table

Transactions for PeopleSoft Inventory and PeopleSoft Manufacturing are inserted into the PeopleSoft Transaction History (TRANSACTION_INV) table. In this example, there are three transactions stocking item A into the US011 inventory business unit (020 Putaway transactions), and two transactions shipping item A out of the US011 business unit (030– Usage and Shipment transactions).

|

Business Unit |

Item |

Date/Time |

Transaction |

Qty |

|

US011 |

A |

T1 |

020–Putaway |

10 |

|

US011 |

A |

T3 |

020–Putaway |

5 |

|

US011 |

A |

T5 |

030–Usages & Shipments |

6 |

|

US011 |

A |

T7 |

020–Putaway |

5 |

|

US011 |

A |

T9 |

030–Usages & Shipments |

5 |

The CM_TRANSACTION Table

The Transaction Costing process expands the transactions in TRANSACTION_INV into the PeopleSoft Cost Management CM_TRANSACTION table, adding a separate row for each business unit and cost book combination.

The CM_RECEIPTS Table

The Transaction Costing process places 020– Putaway transactions into CM_RECEIPTS.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Qty |

|

US011 |

A |

T1 |

FIN |

10 |

|

US011 |

A |

T1 |

TAX |

10 |

|

US011 |

A |

T3 |

FIN |

5 |

|

US011 |

A |

T3 |

TAX |

5 |

|

US011 |

A |

T7 |

FIN |

5 |

|

US011 |

A |

T7 |

TAX |

5 |

The CM_DEPLETION Table

The Transaction Costing process places 030– Usage & Shipment transactions into CM_DEPLETION.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Qty |

|

US011 |

A |

T5 |

FIN |

6 |

|

US011 |

A |

T5 |

TAX |

6 |

|

US011 |

A |

T9 |

FIN |

5 |

|

US011 |

A |

T9 |

TAX |

5 |

The CM_ACTUAL_COST Table

Item putaway costs are computed and placed in CM_ACTUAL_COST table.

|

Business Unit |

Item |

Date/Time |

Cost Element |

Unit Cost |

|

US011 |

A |

T1 |

100 |

10.00 |

|

US011 |

A |

T1 |

200 |

1.00 |

|

US011 |

A |

T3 |

100 |

20.00 |

|

US011 |

A |

T3 |

200 |

2.00 |

|

US011 |

A |

T7 |

100 |

25.00 |

|

US011 |

A |

T7 |

200 |

5.00 |

The CM_RECEIPT_COST Table

Data from the CM_RECEIPTS table and the CM_ACTUAL_COST table are used to calculate the receipt costs for the CM_RECEIPT_COST table. This is based on the cost type entered for the cost book on the Inventory Definition - Business Unit Books page.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Cost Element |

Unit Cost |

|

US011 |

A |

T1 |

FIN |

100 |

10.00 |

|

US011 |

A |

T1 |

FIN |

200 |

1.00 |

|

US011 |

A |

T1 |

TAX |

100 |

10.00 |

|

US011 |

A |

T1 |

TAX |

200 |

1.00 |

|

US011 |

A |

T3 |

FIN |

100 |

20.00 |

|

US011 |

A |

T3 |

FIN |

200 |

2.00 |

|

US011 |

A |

T3 |

TAX |

100 |

20.00 |

|

US011 |

A |

T3 |

TAX |

200 |

2.00 |

|

US011 |

A |

T7 |

FIN |

100 |

25.00 |

|

US011 |

A |

T7 |

FIN |

200 |

5.00 |

|

US011 |

A |

T7 |

TAX |

100 |

25.00 |

|

US011 |

A |

T7 |

TAX |

200 |

5.00 |

The CM_ONHAND_VW Table

The CM_ONHAND_VW table matches receipts (putaways) with depletions (usage and shipments) based on the Cost Flow field on the Cost Profiles page.

|

Bus Unit |

Item |

Date/Time |

Cost Book |

T0 QTY |

T2 QTY |

T4 QTY |

T6 QTY |

T8 QTY |

T10 QTY |

|

US011 |

A |

T1 |

FIN |

0 |

10 |

10 |

4 |

4 |

0 |

|

US011 |

A |

T1 |

TAX |

0 |

10 |

10 |

4 |

4 |

0 |

|

US011 |

A |

T3 |

FIN |

0 |

0 |

5 |

5 |

5 |

4 |

|

US011 |

A |

T3 |

TAX |

0 |

0 |

5 |

5 |

5 |

4 |

|

US011 |

A |

T7 |

FIN |

0 |

0 |

0 |

0 |

5 |

5 |

|

US011 |

A |

T7 |

TAX |

0 |

0 |

0 |

0 |

5 |

5 |

The CM_DEPLETE Table

The process matches up each depletion transaction in CM_DEPLETION with a qualifying putaway from CM_ONHAND_VW. These depleted depletions are inserted into the CM_DEPLETE table. The Cost Flow field on the Cost Profiles page determines how receipts are matched with depletions.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Rec Date/Time |

Qty |

|

US011 |

A |

T5 |

FIN |

T1 |

6 |

|

US011 |

A |

T5 |

TAX |

T1 |

6 |

|

US011 |

A |

T9 |

FIN |

T1 |

4 |

|

US011 |

A |

T9 |

FIN |

T3 |

1 |

|

US011 |

A |

T9 |

TAX |

T1 |

4 |

|

US011 |

A |

T9 |

TAX |

T3 |

1 |

The CM_DEPLETE_COST Table

The process calculates the cost of depletions in the CM_DEPLETE table and placed them in the CM_DEPLETE_COST table. This is based on the Deplete Cost Method defined on the Cost Profiles page.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Rec Date/Time |

Cost Element |

Unit Cost |

|

US011 |

A |

T5 |

FIN |

T1 |

100 |

13.3333 |

|

US011 |

A |

T5 |

FIN |

T1 |

200 |

1.3333 |

|

US011 |

A |

T5 |

TAX |

T1 |

100 |

16.2500 |

|

US011 |

A |

T5 |

TAX |

T1 |

200 |

2.2500 |

|

US011 |

A |

T9 |

FIN |

T1 |

100 |

17.5000 |

|

US011 |

A |

T9 |

FIN |

T1 |

200 |

2.6428 |

|

US011 |

A |

T9 |

FIN |

T3 |

100 |

17.5000 |

|

US011 |

A |

T9 |

FIN |

T3 |

200 |

2.6428 |

|

US011 |

A |

T9 |

TAX |

T1 |

100 |

16.2500 |

|

US011 |

A |

T9 |

TAX |

T1 |

200 |

2.2500 |

|

US011 |

A |

T9 |

TAX |

T3 |

100 |

16.2500 |

|

US011 |

A |

T9 |

TAX |

T3 |

200 |

2.2500 |

Costing Standard Cost Items

Costing Standard Cost Items

This diagram details the standard cost method used in PeopleSoft Cost Management. For this example, this information is used:

|

Inventory Business Unit |

US009 |

US009 |

|

Item ID |

A |

A |

|

Cost Book |

FIN |

TAX |

|

From Cost Profile |

|

|

|

Receipt Cost Method (CM_TYPE) |

Standard |

Actual |

|

Cost Flow (CM_FLOW) |

FIFO |

LIFO |

|

Deplete Cost Method (CM_METHOD) |

Standard |

Actual |

Standard costs used for item A:

|

Inventory Business Unit |

US009 |

US009 |

|

Item ID |

A |

A |

|

Cost Element |

100 |

200 |

|

Unit Cost |

18.00 |

3.00 |

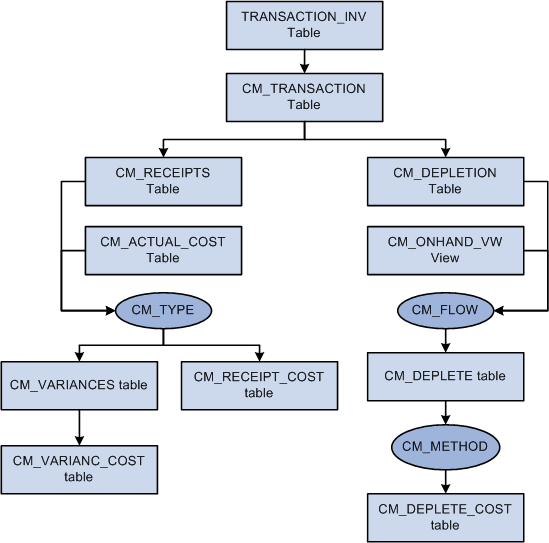

This diagram illustrates the cost flow for a standard cost item:

Standard Costing Example

The TRANSACTION_INV Table

Transactions for PeopleSoft Inventory and PeopleSoft Manufacturing are inserted into the PeopleSoft Transaction History (TRANSACTION_INV) table. In this example, there are three transactions stocking item A into the US009 inventory business unit (020 Putaway transactions), and two transactions shipping item A out of the US009 business unit (030– Usage and Shipment transactions).

|

Business Unit |

Item |

Date/Time |

Transaction |

Qty |

|

US009 |

A |

T1 |

020–Putaway |

10 |

|

US009 |

A |

T3 |

020–Putaway |

5 |

|

US009 |

A |

T5 |

030–Usages & Shipments |

6 |

|

US009 |

A |

T7 |

020–Putaway |

5 |

|

US009 |

A |

T9 |

030–Usages & Shipments |

5 |

The CM_TRANSACTION Table

The Transaction Costing process expands the transactions in TRANSACTION_INV into the PeopleSoft Cost Management CM_TRANSACTION table, adding a separate row for each business unit and cost book combination.

The CM_RECEIPTS Table

The Transaction Costing process places 020– Putaway transactions into CM_RECEIPTS.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Qty |

|

US009 |

A |

T1 |

FIN |

10 |

|

US009 |

A |

T1 |

TAX |

10 |

|

US009 |

A |

T3 |

FIN |

5 |

|

US009 |

A |

T3 |

TAX |

5 |

|

US009 |

A |

T7 |

FIN |

5 |

|

US009 |

A |

T7 |

TAX |

5 |

The CM_DEPLETION Table

The Transaction Costing process places 030– Usage & Shipment transactions into CM_DEPLETION.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Qty |

|

US009 |

A |

T5 |

FIN |

6 |

|

US009 |

A |

T5 |

TAX |

6 |

|

US009 |

A |

T9 |

FIN |

5 |

|

US009 |

A |

T9 |

TAX |

5 |

The CM_ACTUAL_COST Table

Item putaway costs are computed and placed in CM_ACTUAL_COST table.

|

Business Unit |

Item |

Date/Time |

Cost Element |

Unit Cost |

|

US009 |

A |

T1 |

100 |

10.00 |

|

US009 |

A |

T1 |

200 |

1.00 |

|

US009 |

A |

T3 |

100 |

20.00 |

|

US009 |

A |

T3 |

200 |

2.00 |

|

US009 |

A |

T7 |

100 |

25.00 |

|

US009 |

A |

T7 |

200 |

5.00 |

The CM_RECEIPT_COST Table

Data from the CM_RECEIPTS table and the CM_ACTUAL_COST table are used to calculate the receipt costs for the CM_RECEIPT_COST table. This is based on the cost type entered for the cost book on the Inventory Definition - Business Unit Books page.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Cost Element |

Unit Cost |

|

US009 |

A |

T1 |

FIN |

100 |

18.00 |

|

US009 |

A |

T1 |

FIN |

200 |

3.00 |

|

US009 |

A |

T1 |

TAX |

100 |

10.00 |

|

US009 |

A |

T1 |

TAX |

200 |

1.00 |

|

US009 |

A |

T3 |

FIN |

100 |

18.00 |

|

US009 |

A |

T3 |

FIN |

200 |

3.00 |

|

US009 |

A |

T3 |

TAX |

100 |

20.00 |

|

US009 |

A |

T3 |

TAX |

200 |

2.00 |

|

US009 |

A |

T7 |

FIN |

100 |

18.00 |

|

US009 |

A |

T7 |

FIN |

200 |

3.00 |

|

US009 |

A |

T7 |

TAX |

100 |

25.00 |

|

US009 |

A |

T7 |

TAX |

200 |

5.00 |

The CM_VARIANCES Table

Data from the CM_RECEIPTS table and the CM_ACTUAL_COST table are used to complete the CM_VARIANCES table. This is based on the cost type entered for the cost book on the Inventory Definition - Business Unit Books page.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Qty |

|

US009 |

A |

T1 |

FIN |

10 |

|

US009 |

A |

T3 |

FIN |

5 |

|

US009 |

A |

T7 |

FIN |

5 |

The CM_VARIANC_COST Table

Data from the CM_VARIANCES table is used to complete the CM_VARIANC_COST table.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Cost Element |

Unfav (fav) Unit Variance |

|

US009 |

A |

T1 |

FIN |

100 |

(8.00) |

|

US009 |

A |

T1 |

FIN |

200 |

(2.00) |

|

US009 |

A |

T3 |

FIN |

100 |

2.00 |

|

US009 |

A |

T3 |

FIN |

200 |

(1.00) |

|

US009 |

A |

T7 |

FIN |

100 |

7.00 |

|

US009 |

A |

T7 |

FIN |

200 |

2.00 |

The CM_ONHAND_VW Table

The CM_ONHAND_VW table matches receipts (putaways) with depletions (usage and shipments) based on the Cost Flow field on the Cost Profiles page.

|

Bus Unit |

Item |

Date/Time |

Cost Book |

T0 QTY |

T2 QTY |

T4 QTY |

T6 QTY |

T8 QTY |

T10 QTY |

|

US009 |

A |

T1 |

FIN |

0 |

10 |

10 |

4 |

4 |

0 |

|

US009 |

A |

T1 |

TAX |

0 |

10 |

10 |

9 |

9 |

9 |

|

US009 |

A |

T3 |

FIN |

0 |

0 |

5 |

5 |

5 |

4 |

|

US009 |

A |

T3 |

TAX |

0 |

0 |

5 |

0 |

0 |

0 |

|

US009 |

A |

T7 |

FIN |

0 |

0 |

0 |

0 |

5 |

5 |

|

US009 |

A |

T7 |

TAX |

0 |

0 |

0 |

0 |

5 |

0 |

The CM_DEPLETE Table

The process matches up each depletion transaction in CM_DEPLETION with a qualifying putaway from CM_ONHAND_VW. These depleted depletions are inserted into the CM_DEPLETE table. The Cost Flow field on the Cost Profiles page determines how receipts are matched with depletions.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Rec Date/Time |

Qty |

|

US009 |

A |

T5 |

FIN |

T1 |

6 |

|

US009 |

A |

T5 |

TAX |

T3 |

5 |

|

US009 |

A |

T5 |

TAX |

T1 |

1 |

|

US009 |

A |

T9 |

FIN |

T1 |

4 |

|

US009 |

A |

T9 |

FIN |

T3 |

1 |

|

US009 |

A |

T9 |

TAX |

T7 |

5 |

The CM_DEPLETE_COST Table

The process calculates the cost of depletions in the CM_DEPLETE table and placed them in the CM_DEPLETE_COST table. This is based on the Deplete Cost Method defined on the Cost Profiles page.

|

Business Unit |

Item |

Date/Time |

Cost Book |

Rec Date/Time |

Cost Element |

Unit Cost |

|

US009 |

A |

T5 |

FIN |

T1 |

100 |

18.00 |

|

US009 |

A |

T5 |

FIN |

T1 |

200 |

3.00 |

|

US009 |

A |

T5 |

TAX |

T3 |

100 |

20.00 |

|

US009 |

A |

T5 |

TAX |

T3 |

200 |

2.00 |

|

US009 |

A |

T5 |

TAX |

T1 |

100 |

10.00 |

|

US009 |

A |

T5 |

TAX |

T1 |

200 |

1.00 |

|

US009 |

A |

T9 |

FIN |

T1 |

100 |

18.00 |

|

US009 |

A |

T9 |

FIN |

T1 |

200 |

3.00 |

|

US009 |

A |

T9 |

FIN |

T3 |

100 |

18.00 |

|

US009 |

A |

T9 |

FIN |

T3 |

200 |

3.00 |

|

US009 |

A |

T9 |

TAX |

T7 |

100 |

25.00 |

|

US009 |

A |

T9 |

TAX |

T7 |

200 |

5.00 |

Example: Determining Your Cost Structure Strategy

Example: Determining Your Cost Structure Strategy

These examples illustrate the different strategies for setting up the books and profiles, along with the steps that are necessary for each option. When deciding on an approach, be sure to consider future as well as current accounting and management requirements. The scenarios for cost structure strategies include:

Using one cost profile and one book.

Using different cost profiles in a business unit.

Using different cost profiles in different business units.

Using multiple simultaneous costing methods in one business unit.

Using One Cost Profile and One Book

Using One Cost Profile and One Book

This method is employed for environments where all items use the same cost method. Additionally, if the financial reporting requirements are simple, you can utilize the single book/single profile setup. For example, if all the items use the same costing method for all business units and you want to use one cost book, the steps to set up PeopleSoft Cost Management are simple and straightforward:

Define a single cost book.

Define a single cost profile.

Define a single standard cost group and assign the book and cost profile to that cost group.

As items are created at the setID level, assign them the standard cost group.

Define the PeopleSoft Inventory business units, and point to a corresponding PeopleSoft General Ledger business unit. Add the book to the PeopleSoft Inventory business units and point it to the primary ledgers that are in the default ledger groups for the PeopleSoft General Ledger business unit. If you manufacture items by using actual or average costing, also enter a cost type on the inventory business unit.

Now you are ready to add items to the PeopleSoft Inventory business unit. As you add items, the cost profile appears as the default value. No further set up is necessary.

Using Different Cost Profiles in a Business

Unit

Using Different Cost Profiles in a Business

Unit

This option allows you to select a costing method on an item-by-item basis. This method may be utilized in environments where you might want to track the cost of selected items by lot or serial ID and others by FIFO or LIFO actual costs and still others by using a weighted average. In this instance, you need to create cost profiles for all the costing methods you want to employ and standard cost groups to categorize the items according to the various costing methods. To do this, perform these steps:

Define a single cost book.

Define the cost profiles.

Define standard cost groups to categorize items according to the costing methods that are employed. Assign the book to each cost group. Select the appropriate cost profile for the cost group.

As items are created at the setID level, assign them to the appropriate standard cost group.

Define the PeopleSoft Inventory business units, and point to a corresponding PeopleSoft General Ledger business unit. Add the book to the PeopleSoft Inventory business units and point it to the primary ledgers in the Default Ledger Groups for the PeopleSoft General Ledger business unit. If you manufacture items by using actual or average costing, also enter a cost type on the inventory business unit.

Now you are ready to add items to the PeopleSoft Inventory business unit. As you add items, the cost profile appears as the default value. No further set up is necessary.

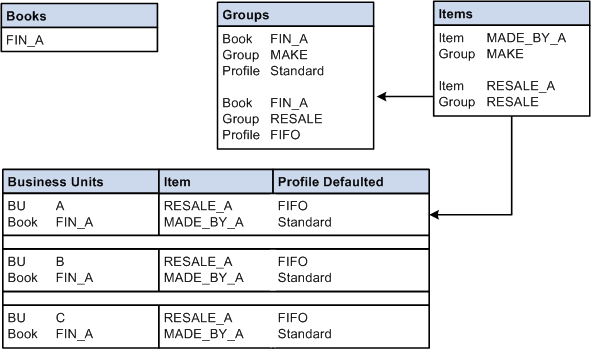

This diagram illustrates how to select a cost method on an item-by-item basis:

Selecting a costing method on an item-by-item basis

Using Different Cost Profiles in Different

Business Units

Using Different Cost Profiles in Different

Business Units

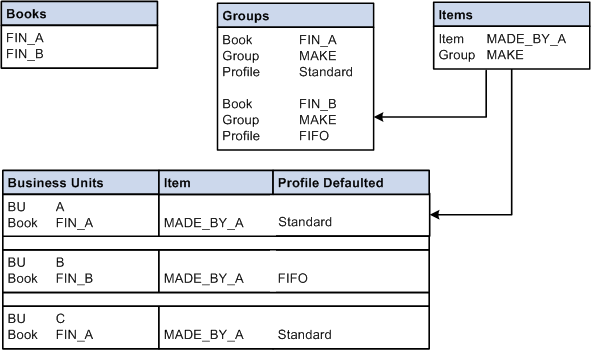

This scenario allows you to cost an item differently in each business unit. You could, for example, use the standard cost method for all of the items that are in one business unit and FIFO actual in another. To set up this scenario:

Define two or more books at the setID level. Each book could represent a costing method. By using the preceding example, you could set up a book called FIN_A and FIN_B.

Define the different costing profiles that are used in each business unit. Examples are STD and FIFO.

Define a standard cost group. You could create a single group or multiple groups, depending on whether all items use the same costing method within a business unit.

Assign both books to the standard cost group, and then assign a profile to each book. For example, cost group MAKE is assigned Book FIN_A and FIN_B. FIN_A uses the STD profile and FIN_B uses the FIFO profile.

Define the items at the setID. Assign the items to a standard cost group (MAKE in this example).

Assign a book to a PeopleSoft Inventory business unit depending on the costing method that is used in the business unit. For this example, FIN_A is assigned to BU A; FIN_B is assigned to BU B.

Add items to each business unit. As items are added to BU A, they are assigned a costing profile of STD. As items are added to BU B, they are assigned a costing profile of FIFO.

This diagram illustrates how to cost an item differently in different business units:

Costing an item differently in different business units

Using Multiple Simultaneous Costing Methods

in One Business Unit

Using Multiple Simultaneous Costing Methods

in One Business Unit

To support varying requirements for financial, government, and management reporting, you can maintain multiple books within a PeopleSoft Inventory business unit, with each book based on different costing methods. You can cost an item differently in the business unit's financial reporting book than you do in the tax or management reporting books. For example, you could use the actual LIFO method cost for tax reporting, and at the same time use the periodic average cost method for customer profitability analysis. When you use simultaneous costing methods, you generate accounting entries for each book.

The setup for using multiple books within a single business unit is similar to the setup in the preceding example. However, both books are defined in a single PeopleSoft Inventory business unit. As items are added to the business unit, they inherit the profiles for all the books. When transactions for the items are costed and the Accounting Line Creation process (CM_ALC) is run, accounting entries are created for each book using the appropriate costing method.