Understanding Transaction Costing and Accounting

Entry Creation

Understanding Transaction Costing and Accounting

Entry Creation

This chapter provides an overview of transaction costing and entry creation and discusses how to:

Generate costs for transaction records.

Create accounting entries.

Create transaction costs and accounting entries processes.

Review and change item costing and accounting entries.

Cost and account for consigned inventory.

Cost and account for the repair and maintenance of assets.

Returning perpetual weighted average items to inventory.

Cost and account for vendor managed inventory.

Calculate and apply purchase price variance and exchange rate variance.

Generate a PeopleSoft Enterprise Performance Management (PeopleSoft EPM) extract.

Understanding Transaction Costing and Accounting

Entry Creation

Understanding Transaction Costing and Accounting

Entry Creation

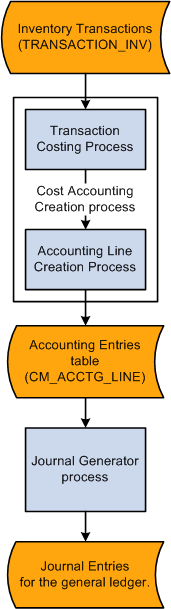

The inventory system posts inventory transactions into the TRANSACTION_INV table, then PeopleSoft Cost Management can assign costs to the transactions and create accounting entries. The Cost Accounting Creation process (CM_CSTACCTG) is an application engine process that completes these tasks by launching the:

Transaction Costing process (CM_COSTING). This application engine process picks up these inventory transactions and attaches costs to each transaction based on the item's cost profile.

Accounting Line Creation process (CM_ALC). This application engine process picks up the calculated costs, creates the accounting entries, and stores the entries in the CM_ACCTG_LINE table.

The Cost Accounting Creation process page launched both of these process using one run control page. This enables you to:

Streamline the maintenance of run control definitions.

Run both processes in a continuous stream without a break between steps.

Run just the Transaction Costing process or just the Accounting Line Creation process based on your current processing needs.

PeopleSoft Cost Management provides inquiries and reports to view the accounting entries. Use the Edit Unposted Accounting Lines page to change the accounting entries before they are posted to the general ledger. Once, you are satisfied with the entries, use the Journal Generator process (JRNL_GEN_REQUEST) to summarize the accounting entries into journal entries. PeopleSoft General Ledger can then post the journal entries to the correct ledgers.

This diagram illustrates the cost flow of inventory transactions from the TRANSACTION_INV record using the Transaction Costing process and the Accounting Line Creation process to produce accounting entries to be picked up and summarized by the Journal Generator process:

Transaction Costing and Accounting Line Creation process flow

See Also

Understanding PeopleSoft Enterprise ChartFields

Common Elements Used in This Chapter

Common Elements Used in This Chapter

|

Search |

Click the Search button to display the results of the search. |

|

Transaction Group |

Predefined codes attached to different types of transactions, such as, stocking, issues, adjustments, and so on. |

|

Distribution Type |

User-defined codes that are a subset of transaction groups. Enables you to break down a transaction group into customized categories. |

|

FERC Code (Federal Energy Regulatory Commission code) |

Federal Energy Regulatory Commission identification codes. Appears only if you select FERC reporting on the PeopleSoft Inventory Options page. |

|

ChartFields |

Chart of accounts used to record accounting entries and journal entries in PeopleSoft. |

|

Cost Element |

A code used to categorize the different components of an item's cost and also define the debit and credit ChartFields for accounting entries. |

|

Item Group |

A grouping of items that enable you to design the accounting structure for a group of similar items, such as, sporting equipment or dress shoes. The item group is attached to an item using the Item Definition - General page. |

|

Book Name |

The cost book used to record the accounting entry. |

|

As of Date |

The process extracts any line with a transaction date less than or equal to this date. |

|

Foreign Amount |

The amount in the entry currency. |

|

Monetary Amount |

The amount in the base currency. |

Generating Costs for Transaction Records

Generating Costs for Transaction Records

The Transaction Costing process picks up inventory transactions from the TRANSACTION_INV record and calculates the costs of each transaction, including, material, conversion, conversion overhead, landed, inbound, outbound, and other costs. The parameters for the Transaction Costing process are defined on the Cost Accounting Creation process page.

The Transaction Costing process:

Calculates the cost of receipts.

Calculates the cost of depletions. If chosen in setup, this could include costing negative inventory depletions before a corresponding receipt is available.

Calculates and updates the weighted average costs and actual costs of items having cost profiles that use actual, periodic average, or perpetual average cost methods.

Note. For standard cost items, the system does not automatically set frozen standard costs when you use the Transaction Costing process. To update standard costs, you must use the Cost Rollup process (CEPCROLL) and Update Production Costs process (CEREVAL, SFPREVAL, CES5001).

Calculates purchase price variances and exchange rate variances.

Calculates landed costs.

Calculates the cost of make items produced in PeopleSoft Manufacturing.

(optional) Launches the Negative Inventory Resolver process to check for new receipts (putaway and adjustment transactions) and adjust the quantities and costs of previously recorded negative inventory depletion transactions.

Working With Non Cost Items

Transactions involving a non-cost item (that is, items with a cost profile defined as non-cost) are not placed in the costing records by the Transaction Costing process. For example, putaway transactions are not moved to the CM_RECEIPTS record. Use caution if you later decide to change a non-cost item to an actual, standard, or average cost profile. After transactions have been generated in the system, changing a non-cost item can result in discrepancies between the costing and inventory records. A warning message displays online if you change the non-cost cost profile for an item with inventory transactions on the Define Business Unit Item - General: Costing page. If you decide to change a non-cost item please make sure you have no on hand quantity in the inventory business unit by running the Inventory Balance report (INS9090) and the Cost Management On hand Balance Validation report (CMS9010). Any inventory balance created while the business unit item used a non-cost profile will no longer be available when changing to another cost profile. In addition, PeopleSoft Cost Management does not support interunit pricing for non-cost items.

See Also

Additional Information for the Costing Structure

Using the Cost Rollup Process to Calculate Product Costs

Understanding Standard Costing for Purchased Items

Costing Negative Inventory

Costing Negative InventoryA negative inventory depletion transaction is a depletion transaction that drives the item quantity to a negative balance in the system even though physically the quantities did exist. The negative inventory feature is activated by selecting the Allow Negative Inventory check box on the Inventory Definition-Business Unit Options page.

Once PeopleSoft Inventory has shipped a negative inventory depletion transaction, you have options in PeopleSoft Cost Management on how to cost the transaction. There is no corresponding receipt or receipt cost to apply to the negative inventory depletion transaction. The Insufficient Qty Cost Option on the Cost Profiles page determines how the Transaction Costing process applies costing to negative inventory transactions:

|

Always cost insufficient qty |

Enables the Transaction Costing process to cost negative inventory depletion transactions before sufficient quantity is entered into the business unit. For actual cost items, these costs can later be adjusted when sufficient quantity is placed in the Inventory business unit by putaway or adjustment transactions. For example, if there are 10 units of an item available in the business unit and an order is shipped and depleted for 15 units, then the entire depletion transaction of 15 units is costed the next time the Transaction Costing process is run, even if this is before sufficient stock is placed in the business unit. Of the 15 units, 10 are costed using the existing stock on hand and 5 are costed using the current average, current standard, or last actual cost depending on the cost method employed. |

|

Cost in Regular Mode Only |

Enables the Transaction Costing process, run in Regular mode only, to cost negative inventory depletion transactions before sufficient quantity is entered into the business unit. These costs can later be adjusted when sufficient quantity is placed in the Inventory business unit by putaway or adjustment transactions. If Transaction Costing is run in Mid Period mode, then the depletion transaction is costed up to the currently available quantity and the remainder is held. For example, if there are 10 units of an item available in the business unit and an order is shipped and depleted for 15 units and:

|

|

Cost to point of zero quantity |

Enables the Transaction Costing process to split a negative inventory depletion transaction and cost part of the depletion transaction up to the currently available stock quantity. The remaining depletion transaction is held until sufficient stock is received. For example, if there are 10 units of an item available in the business unit and an order is shipped and depleted for 15 units, then the depletion transaction is split by the Transaction Costing process. 10 units are costed and 5 units are put on hold until sufficient stock is placed in the business unit. |

|

Don't cost if insufficient qty |

Enables the Transaction Costing process to delay costing the entire negative inventory depletion transaction until sufficient stock is received to cover the depletion transaction. This is the default setting. For example, if there are 10 units of an item available in the business unit and an order is shipped and depleted for 15 units, then the entire depletion transaction of 15 units is put on hold by the Transaction Costing process until sufficient stock is placed in the business unit. |

The current cost used to cost negative inventory depletion transactions depends on the Deplete Cost Method on the item's Cost Profile. The options are:

|

Actual Cost |

The last actual cost received for this item. |

|

Periodic Weighted Average |

Not applicable. This deplete cost method cannot be used to cost negative inventory depletion transactions before sufficient quantity is entered in the business unit. The transaction is held. |

|

Perpetual Weighted Average |

The current average |

|

Retroactive Perpetual Weighted Average |

The current average. |

|

Value at Current Standard |

The current standard cost for the item. |

If a current cost is not available for actual or average cost items, then the system uses the value entered in the Default Actual Cost field of the Define Business Unit Item - General: Common page.

The Accounting Line Creation process can process the costed depletion transactions and create accounting entries for the general ledger. This enables negative inventory depletion transactions to be reflected in the period end account balances rather then held up for receipt costs.

A negative inventory depletion transaction is costed by creating a dummy receipt row with a zero quantity. The depletion transaction is matched to this dummy receipt, which uses the new transaction group 001 (negative inventory) and is inserted into the costing tables. Once sufficient stock is received into the business unit, the negative state of the depletion can be cleared by using the Negative Inventory Resolver process.

Using the Negative Inventory Resolver

The Negative Inventory Resolver process has been added to the Transaction Costing process to check for new putaway and adjustment transactions, and if sufficient quantities have been received into the business unit, the resolver process:

Applies the new receipt quantities to the previously recorded negative inventory depletion transactions. The resolver matches the negative inventory depletion transactions to actual stock received.

Creates adjusting accounting entries for items using the Deplete Cost Method of Actual Cost. The resolver creates an entry to reverse the cost previously recorded for the negative inventory depletion transaction and to record a new transaction at actual receipt cost. These changes flow to the Accounting Line Creation process where two accounting entries are created:

A reversing entry to remove the depletion based on the last actual cost received before the negative state.

An entry to record the depletion based on the actual receipt costs.

For items using the Deplete Cost Method of Value at Current Standard, Perpetual Weighted Average, or Retroactive Perpetual Weighted Average, the resolver does not change the previously recorded cost for the negative inventory depletion transaction. The standard or average cost on record at the time of the depletion was used on the original depletion and is not changed when the resolver corrects the negative state by matching the negative inventory depletion transactions to actual stock received.

Inserts resolved negative inventory depletion transactions into a history table called CM_RESOLVE_HIST.

To resolve negative inventory, select the Resolve Negative Inventory check box on the Cost Accounting Creation process page. The process is launched within the Transaction Costing process after receipts have been processed, but before depletions.

Note. The Negative Inventory Resolver process is optional. It is highly recommended that you use this process to resolve all negative depletion transactions so that reports and queries do not reflect negative states that have been resolved. The resolver does not impact the total on hand quantity. For costs, it only impacts the total inventory value for actual cost items.

Inquiries for Negative Inventory

Two inquiries are available to monitor the costing of negative inventory depletion transactions and the recalculations of the quantities and costs performed by the Negative Inventory Resolver process. These queries are CM_PENDING_RESOLVER and CM_RESOLVED_NEG_HIST and can be viewed using the Query Viewer.

The CM_PENDING_RESOLVER query returns negative inventory depletion transactions that have not been resolved.

The CM_RESOLVED_NEG_HIST query returns negative inventory depletion transactions that have been resolved and recorded in a history table CM_RESOLVE_HIST.

See Also

Determining Your Negative Inventory Strategy

Calculating Cost for Actual or Average Makeable Items

Calculating Cost for Actual or Average Makeable ItemsFor makeable items using actual or average cost profiles, the Transaction Costing process processes according to the production ID. After the production ID has been closed for accounting, the Transaction Costing process finishes debiting the unposted transactions and calculates the actual cost of the assembly items. Then, the process clears WIP to finished goods for all cost books. Finished goods receives the completed items. They are posted to the TRANSACTION_INV record or directed to another production ID. The Transaction Costing process gathers the actual costs that have been recorded and posts the costs to the CE_ACTUAL_COST table. Then, the Transaction Costing process posts the manufacturing costs from the CE_ACTUAL_COST table to the CM_ACTUAL_COST table.

If the production ID is not costed by the Transaction Costing process, the transaction displays on the Pending Transactions page under the Pending Calculation Prdn Cost. If an item is not costed, simply enter the necessary corrections to the production data and the item will be costed on the next run of the process. There are a number or reasons that the Transaction Costing process may not pick up a production ID that has been closed for accounting, including:

The Transaction Costing process was not run for the business unit and cost book with the Calculate Actual Prdn Costs check box selected.

For direct labor costs, no actual labor rates are set up for the business unit when the make item's Cost Profile has a labor cost method of Actual Time-Crew Rate.

For direct labor costs, no conversion rates exist for the business unit when the make item's Cost Profile has a labor cost method of Actual Time-Conversion Rate.

For direct labor costs, either no routing times or no conversion rates are defined for the business unit when the make item's Cost Profile has a labor cost method of Standard Time-Conversion Rate.

For direct labor costs, no default cost version is active for the business unit when the make item's Cost Profile has a labor cost method of Standard Time-Conversion Rate.

For direct machine costs, no conversion rates exist for the business unit when the make item's Cost Profile has a machine cost method of Actual Time-Conversion Rate.

For direct machine costs, either no routing times or no conversion rates are defined for the business unit when the make item's Cost Profile has a machine cost method of Standard Time-Conversion Rate.

For direct machine costs, no default cost version is active for the business unit when the make item's Cost Profile has a labor cost method of Standard Time-Conversion Rate.

For overhead costs, no production overhead codes were defined.

For overhead costs or direct materials, no default cost version is active for the business unit.

For direct materials, the production ID has rows stuck in CM_DEPLETION or CM_DEPLETE.

For direct materials, insufficient quantity exists to satisfy the depletion.

For direct materials, an adjustment has been posted since the last time the Transaction Costing process has been run and the process must be run again for this production ID.

The production ID has uncosted rows in CE_ACTUAL_COST, due to:

A lower level production ID with unfinished costing. The lower level production ID has the Hold for Final Cost check box selected the cost profile and the Transaction Costing process was run in mid-period mode.

A current level open production ID that has the Hold for Final Cost check box selected the cost profile and the Transaction Costing process was run in mid-period mode.

The production ID has rows stuck in CM_DEPLETION or CM_DEPLETE.

The production ID is not defined for actual or average costing.

Returning Components to Inventory

Returning Components to Inventory

The Transaction Costing process also records the cost for components or kits returned to inventory. When components are returned to inventory stock, the transaction groups, 220 (Component Kit) and 230 (Component Consumption), are inserted in the TRANSACTION_INV table with a negative quantity. The Transaction Costing process must find the correct cost and process the receipt to the CM_RECEIPTS record.

In a standard costed environment, the returned stock is received and put away at the standard cost.

For items using a deplete cost method of actual or periodic weighted average, the original receipt cost must be located by back tracking from the depletion record (for the production ID that consumed the component) to the original receipt. The process uses the last component consumed for the unit, item, production ID, and operation sequence. If the item is lot or serial-controlled, then the specific lot or serial must be found on the depletion record. FIFO and LIFO items also use the last consumed on the depletion record. For items using a deplete cost method of perpetual weighted average, the return transactions is costed using the weighted average of the items issued. For more information, see the "Returning Perpetual Weighted Average Items to Inventory" section of this chapter.

Creating Accounting Entries

Creating Accounting Entries

The parameters for the Accounting Line Creation process are defined on the Cost Accounting Creation process page. The Accounting Line Creation job performs up to three processes in this order:

|

This PeopleSoft Application Engine process retrieves costed transactions and finds the correct ChartField combinations to use for the debit and credit lines of each accounting entry. Results are stored in the CM_ACCTG_LINE table. |

|

|

This process performs budget checking against the rows in CM_ACCTG_LINE table. Results are stored in the CM_ACCTG_LINE table. The BUDGET_HDR_STATUS and BUDGET_LINE_STATUS fields display the current budget checking state of the accounting entry. Budget checking does not apply to manufacturing transactions. |

|

|

This PeopleSoft Application Engine process calls the IU_PROCESSOR process which in turn creates balancing entries for intraunit transactions in the CM_ACCTG_LINE table. If commitment control is turned on for PeopleSoft Inventory, then the accounting entry must pass budget checking successfully before ChartField balancing is done. This process picks up any row with a status of N (not balanced) or E (error) in the CM_IU_STATUS field and attempts to create the balancing entries. The results are stored back in the CM_ACCTG_LINE table with a status of B (balanced), X (balancing not required), or E (error). |

Once the Accounting Line Creation process completes the preceding steps, the process verifies that the accounting entries were created for the debit and credit sets without error and the budget checking and ChartField balancing have been successfully completed or not required. The process then changes the GL_DISTRIB_STATUS of the transaction to N (none). With an N status, the transaction can now be picked up from the CM_ACCTG_LINE table by the Journal Generator process and sent to the general ledger system.

Numbering Sequence of the Accounting Lines

Within the Accounting Line Creation process, a substantial reduction in processing time can be achieved by using set-based processing to number the lines of the newly-created accounting entries. As delivered, the system uses row-by-row processing to create the sequential accounting line numbers. By performing additional set up steps you can switch from row-based processing to set-based processing to generate the line numbers. The set-based approach is optional. The delivered default option is the row-by-row approach.

Using the set-based processing method to generate the sequential accounting line number is significantly faster than row-based processing. However, set-based processing can produce gaps in numbering. For example, within one accounting entry with four lines, the lines can be numbered 1, 5, 6, and 11, rather than 1, 2, 3, and 4.

See Also

Selecting the Method to Number Accounting Lines

Creating Accounting Lines

Creating Accounting Lines

The Accounting Line Creation process retrieves costed transactions and finds the ChartFields to use for the debit and credit lines of each accounting entry. The results are stored in the CM_ACCTG_LINE table. The process always uses the date and time of the transaction and not the transaction date that was entered. Accounting entries can be manually back dated using the Edit Unposted Accounting Lines page.

The Accounting Line Creation process searches for the correct ChartField information to build the accounting entry lines. The system searches for the ChartFields based on this logic starting with the first step and continuing until a match is found:

If the transaction is an interunit transfer of inventory stock, then the ChartFields to define the intransit account, interunit receivables, and interunit payables balancing entries are derived from the method that you selected for interunit accounting.

The other parts of the accounting entries are derived from these pages.

If location accounting is used for the storage areas or production areas, the system first searches for the correct Storage Area Accounting page or Production Area Accounts page.

When the entries on these pages match the same key fields on the transaction, then the correct ChartFields are found to build the accounting entry. Often, these pages define just one side of the accounting entry and the other side is derived from the Accounting Rules page or the interunit transfer method. The system searches for the page by starting with the first rule and continuing until a match is found:

|

Rule |

Unit |

Area |

Cost Element |

|

1 |

Business Unit |

Storage Area or Production Area |

Cost Element |

|

2 |

Business Unit |

Storage Area or Production Area |

Blank |

The Accounting Line Creation process uses the Accounting Rules page (Account Distribution page) with the most specific information matching the transaction. There are some situations where more than one Accounting Rules page can match the transaction. In this case, the search for the correct Accounting Rules page uses the logic in this table starting with the first rule and going through all twelve rules. The system uses the first rule encountered that matches the transaction.

|

Rule |

Unit |

Trans Group |

Item ID |

Item Group |

Distrib Type |

Cost Element |

|

1 |

Business Unit |

Transaction Group |

Item ID |

Blank |

Distribution Type |

Cost Element |

|

2 |

Business Unit |

Transaction Group |

Item ID |

Blank |

Distribution Type |

Blank |

|

3 |

Business Unit |

Transaction Group |

Item ID |

Blank |

Blank |

Cost Element |

|

4 |

Business Unit |

Transaction Group |

Item ID |

Blank |

Blank |

Blank |

|

5 |

Business Unit |

Transaction Group |

Blank |

Item Group |

Distribution Type |

Cost Element |

|

6 |

Business Unit |

Transaction Group |

Blank |

Item Group |

Distribution Type |

Blank |

|

7 |

Business Unit |

Transaction Group |

Blank |

Item Group |

Blank |

Cost Element |

|

8 |

Business Unit |

Transaction Group |

Blank |

Item Group |

Blank |

Blank |

|

9 |

Business Unit |

Transaction Group |

Blank |

Blank |

Distribution Type |

Cost Element |

|

10 |

Business Unit |

Transaction Group |

Blank |

Blank |

Distribution Type |

Blank |

|

11 |

Business Unit |

Transaction Group |

Blank |

Blank |

Blank |

Cost Element |

|

12 |

Business Unit |

Transaction Group |

Blank |

Blank |

Blank |

Blank |

ChartFields entered directly on the transaction override these rules. Often, this is just one side of the accounting entry.

Note. If the accounting pages have not been defined correctly, then the effected transactions are written to the error table. To view any errors occurring in the CM_ACCTG process, use the Accounting Line Errors page.

See Also

Understanding the Types of Interunit Transfers

Setting Up the Accounting Rules Structure

Understanding Stock Transfers Between Business Units

Using Commitment Control

Using Commitment Control

Commitment control enables you to check expenditures against a predefined budget. In PeopleSoft Cost Management, these expenditures typically occur when you expense inventory material to a department or expense account. Commitment control considers actual expenditures and imminent future obligations (encumbrances and pre-encumbrances). The option to use commitment control must be selected at both the installation and ledger group level. In multibook environments, only the primary ledger transactions should be checked against control budgets.

Note. Commitment control does not apply budget checking to manufacturing transactions.

If you are using commitment control, the accounting entries must pass budget checking before you can pass them to the general ledger system using the Journal Generator process. If you select the Budget Check Accounting Lines check box on the Accounting Line Creation process page, then the Commitment Control Processor process runs on the accounting lines in the CM_ACCTG_LINE table with a BUDGET_LINE_STATUS of N (not budget checked) or E (error in budget check). Once the line passes budget checking, the status changes to V (valid budget check). Entries that do not pass budget checking appear on the CM Transaction Exceptions - Header Exceptions page, where you can resolve the error status by adjusting or redirecting charges to alternate accounts or changing budget periods for the transactions if authorized to do so.

Note. The Budget Processor process (FSBKBDP3) considers all of the accounting lines in a transaction set together. If one accounting line fails the budget check, the Budget Processor process rejects the entire transaction set.

The header of the transaction can have these statuses in the BUDGET_HDR_STATUS field:

|

Status |

Description |

|

N |

Not budget-checked. |

|

E |

Error: The transaction fails budget checking and does not update the control budget. |

|

V |

Valid: The transaction passes budget checking with no errors or warnings and updates the control budget. If commitment control is turned off, all transaction lines are set to V. |

The transaction line can have these statuses in the BUDGET_LINE_STATUS field:

|

Status |

Description |

|

N |

Not budget checked. |

|

E |

Error: The transaction line fails budget checking and does not update the control budget. |

|

W |

Warning: The transaction line completes budget checking successfully, but the transactions have warning exceptions. The transaction updates the control budget. The warnings can range from an overridden error to mismatched budget and accounting dates. It issues a warning if the transaction is over the budget amount but less than the tolerance amount. |

|

V |

Valid: The transaction line passes budget checking with no errors or warnings and the process creates the journal line for the control budget ledger. If commitment control is turned off, all transaction lines are set to V. |

The statuses in the CM_IU_INDICATOR field tell the Commitment Control Processor process whether to pick up the line. If you use the centralized interunit and intraunit processor to create intraunit ChartField balancing entries, then these accounting lines do not need to be budget checked.

|

Status |

Description |

|

N |

Not created by the central processor. This transaction is picked up by the Commitment Control Budget Processor process. |

|

Y |

Created by the central processor. The Commitment Control Budget Processor process is skipped. The budget statuses are set to V. |

See Also

Setting Up Basic Commitment Control Options

Understanding the Budget Checking of Source Transactions

Acquiring Intraunit Entries

Acquiring Intraunit Entries

Intraunit processing, or fund balancing, creates balancing entries for transfers between ChartFields (such as Fund) within the same business unit. Intraunit balancing can be performed on any ChartField within the business unit except Account. The ChartField Balancing process (CM_IU_ACCTG) compares debit and credit ChartFields (except Account) for the same item and cost element. If the ChartFields are not the same, the interunit receivable and interunit payable accounting entry is created. For example, suppose that these transactions are entered for the same item and cost element. The system is set up for intraunit balancing on the fund ChartField. The interunit receivable account is 4003 and the interunit payable account is 4002 for this transaction:

|

|

Account |

Fund |

Dept ID |

Program |

Class |

Bdgt Pd |

|

Expense |

5002 |

100 |

20 |

88 |

10 |

2000 |

|

Inventory |

1001 |

200 |

30 |

99 |

20 |

2000 |

The Accounting Line Creation process creates this interunit receivable and interunit payable transaction:

|

|

Account |

Fund |

DeptID |

Program |

Class |

Bdgt Pd |

|

Offsetting Inventory |

4003 |

200 |

30 |

99 |

20 |

2000 |

|

Offsetting Expense |

4002 |

100 |

20 |

88 |

10 |

2000 |

Set up the PeopleSoft system to use intraunit accounting. If you are using intraunit ChartField balancing, you must balance the intraunit accounting entries before you can pass them to the general ledger system using the Journal Generator process. If you are also using commitment control, the accounting entries must pass budget checking before they are available to perform ChartField balancing.

To perform ChartField balancing using the Accounting Line Creation process, select the Acquire IntraUnit Entries check box on the Accounting Line Creation process page. This check box is selected by default. The Intraunit Balancing process runs on the accounting lines in the CM_ACCTG_LINE table with a BUDGET_LINE_STATUS of Vand a CM_IU_STATUS of N (not balanced), or E (error). Once the intraunit transaction has been balanced successfully, the CM_IU_STATUS changes to B (balanced) or to X (balancing not required). Entries that could not be balanced are given the status of E (error) and appear on the Edit Unposted Accounting Lines page where you can resolve the error status.

Note. On the intraunit transaction, if the ChartField that you are balancing on changes after the ChartField Balancing process, then the system resets the CM_IU_STATUS to N (not balanced) and the transaction must be rerun by the ChartField Balancing process.

Intraunit ChartField Balancing Statuses

The transaction can have these statuses in the CM_IU_STATUS field:

|

Status |

Description |

|

N |

Not balanced |

|

B |

Balanced |

|

P |

In process |

|

E |

Error |

|

I |

Ignore. The line is not an intraunit transaction. |

|

X |

Balancing not required. |

|

S |

Staged |

|

H |

Hold for other business unit affiliates. |

See Also

Using Interunit and Intraunit Accounting and ChartField Inheritance

Setting the General Ledger Distribution

Status

Setting the General Ledger Distribution

Status

The Set GL Distrib Status (general ledger distribution status) process in the Accounting Line Creation job insures that the accounting entries are not passed to the general ledger system until they are complete. The process also updates the status of accounting entries as they are picked up and used by the Journal Generator process. All rows that have a budget check status of V (valid) and an intraunit ChartField balancing status of B, I, or X will have their GL Distrib Status (general ledger distribution) set to N (ready).

GL Distribution Statuses

The transactions can have these statuses in the GL_DISTRIB_STATUS field:

|

Status |

Description |

|

D |

Distributed. The entries are posted to the general ledger system. They no longer appear on the Edit Unposted Accounting Lines page. |

|

H |

Hold. These lines are not yet ready to be picked up by the Journal Generator. |

|

N |

None; not yet processed. The accounting entries are created without error and (if applicable) the budget checking and ChartField balancing complete successfully. The Journal Generator process can now pick up the entries. |

Creating Transaction Costs and Accounting Entries Processes

Creating Transaction Costs and Accounting Entries ProcessesThe Cost Accounting Creation process is an application engine process that can launch both the Transaction Costing process and the Accounting Line Creation process.

Page Used to Create Transaction Costs and

Accounting Entries

Page Used to Create Transaction Costs and

Accounting Entries

|

Page Name |

Definition Name |

Navigation |

Usage |

|

CM_ACCTG_REQ |

Cost Accounting, Inventory and Mfg Accounting, Create Accounting Entries, Cost Accounting Creation |

Calculates the cost of transactions that have not yet been costed and then creates accounting entry lines for these costed transactions. |

Running the Cost Accounting Creation Process

Running the Cost Accounting Creation Process

Access the Cost Accounting Creation page (Cost Accounting, Inventory and Mfg Accounting, Create Accounting Entries, Cost Accounting Creation).

|

Generate Table Statistics |

(Database administration) This check box enables database administrators to control whether or not this process should issue basic table statistics update commands to the database for the tables accessed by this process. The Cost Accounting Creation process is structured to delete temporary working data at the beginning of the process, before that deletion step, accurate table statistics can be generated. Database platforms keep statistics about the distribution of the key values in each index and use these statistics to determine which indexes to use in query processing. Cost-based query optimization depends on the accuracy of the distribution statistics. Table statistics should be updated whenever a large amount of data in an indexed column has been added, changed, or removed (that is, if the distribution of key values has changed). The update table statistics option gives database administrators an added tool for maintaining table statistics for query optimization; however, sites that already have database administration procedures in place for periodically updating table statistics might want to deselect this option. |

|

Generate Temp Table Statistics |

The Cost Accounting Creation process stores some of its temporary working data in dedicated temporary tables. This check box is defaulted to make it easier for database administrators to generate accurate table statistics for these types of tables. |

|

As of Date |

The process selects all unprocessed lines with a transaction date less than or equal to this date. |

Cost Inventory Transactions group box

This section contains the parameters used by the Transaction Costing process.

|

Cost Inventory Transactions |

Select to have the cost calculated for all uncosted inventory transactions using the Transaction Costing process. |

|

Cost Mode |

Values are: Regular: Costing is for uncosted transactions occurring in the period ending up to the As of Date. Regular mode can be used at anytime during the period and at period end. When you run this process in regular mode, all transactions are costed, regardless of the Hold for Final Cost check box for the cost book. Mid-Period: Costing is for uncosted transactions occurring in the partial period ending on the as of date. The Mid-Period value postpones certain types of calculations if final costs are not yet available, for example, purchased items when the invoice has not yet been received or production that are not yet completed. If the profile for the book is marked as Hold for Final Cost, receipt and depletion records are not costed unless the invoice price is available (for purchased items) or the production ID or production schedule is complete (for makeable items). Periodic averages and retroactive perpetual averages are not calculated in this mode. |

|

Calculate Actual Prdn Costs |

Select to calculate the actual production costs of an item. |

|

Apply Perpetual Average Adjs |

Select to update the perpetual average costs to include the difference between the purchase price and the voucher, including exchange rate differences. This applies to the perpetual average costing method as defined on the cost profile. Select this check box to create adjustments to the perpetual weighted average costs in both the Mid-Period and Regular cost modes. For period end processing, select this check box if you want the perpetual average cost items to reflect the invoice price. Actual cost items are always updated once the invoice price is available. Periodic average items are not updated for cost adjustments. Note. The Apply Perpetual Average Adjs check box is only applicable if you have perpetual average cost items. It does not apply to the retroactive perpetual average method. |

|

Resolve Negative Inventory |

Select to run the Negative Inventory Resolver process to check for new receipts (putaway and adjustment transactions) and adjust the quantities and costs of previously costed negative inventory depletion transactions. The process is launched within the Transaction Costing process after receipts have been processed, but before depletions. |

|

Commit Limit |

(Optional) To manage the database resources, enter the number of rows to be processed before committing costed depletion records to the database. If this field is left blank, the system issues a commit to the database after all depletions rows have been processed. |

Create Accounting Lines group box

This section contains the parameters for the Accounting Line Creation process.

|

Create Accounting Lines |

Select to have accounting entries generated for all costed transactions using the Create Accounting Lines process (CM_ACCTGLINE). |

|

All Transaction Groups |

Select to run this process for all transaction groups or enter specific transaction groups in the Transaction Group section. Selecting this check box erases any entries that you have made in the Transaction Group section. |

|

Budget Check Accounting Lines |

Select to run the Commitment Control Budget Processor process. If you have not turned on commitment control for the PeopleSoft system, this check box is unavailable. |

|

Acquire IntraUnit Entries |

Select to run the Acquire IntraUnit Entries process (CM_IU_ACCTG) which launches the IU_PROCESSOR process. This check box is unavailable if intraunit processing is not enabled for the PeopleSoft system. The IU_PROCESSOR process creates intraunit balancing entries for all applicable transactions in the specified business unit and book. All transaction groups are processed regardless of the entries on this page. Note. If the Budget Check Accounting Lines check box is available, you should not select the Create Accounting Lines check box and the Acquire IntraUnit Entries check box only, because budget checking is required before intraunit ChartField balancing can be performed. By default, all three check boxes are selected when available. |

|

Transaction Group |

Enter specific transaction groups to be processed. Use the Insert Row button to add additional transaction groups. |

|

Accounting Line Errors |

Click to access the Accounting Line Errors page, where you can view any errors generated by the Accounting Line Creation process. This page displays accounting lines that could not be processed because of missing accounting line creation rules. |

See Creating Accounting Entries.

Coalesced Selection group box

Specify one or many business unit and cost book combinations on each request in the Coalesced Selection group box. All the business units in one request are processed together as one set to take advantage of set-based relational database performance on sets of data. Define the same parameters for all business units within one request or add multiple requests to define different parameters for each request.

Use the Insert Row button within the Coalesced Selection group box to add as many business units and cost books as needed to one request.

To create multiple sets that process one at a time, create multiple process requests on the same process page by using the Insert Row button just below the Process Request Parameters bar (far upper right of page). Depending on your environment, multiple sets could take longer to process than one set. Each request will be run sequentially.

The system displays the business unit setting for Location Accounting.

Note. Within one process request, all the business units must have the same setting for location accounting. A warning message displays if there is a mismatch.

See Also

Reviewing and Changing Item Costing and

Accounting Entries

Reviewing and Changing Item Costing and

Accounting Entries

PeopleSoft Cost Management provides several interactive pages to help you analyze, compare, and review the item costs generated in a manufacturing or distribution environment. You can monitor the transactions as they are processed through the Transaction Costing, Accounting Line Creation, and Journal Generator processes. In a manufacturing environment, you can analyze the production costs at every stage of the production ID, enabling you to identify cost fluctuations early in the process.

This section discusses how to review the inventory transactions as they flow through the accounting system.

Reviewing Item Setup

PeopleSoft provides you with inquiry pages to help you review the costing status of an item. Use the:

Item Cost Inquiry component to review every part of an item's costing definition.

This ten page component provides information about how the item is set up for costing within the business unit.

Inventory On Hand page to identify the basic costing setup for an item and the current quantity on hand.

Monitoring the Costing Flow

PeopleSoft provides inquiry pages to enable you to monitor the transactions at each stage as they flow through the accounting processes of the Transaction Costing, Accounting Line Creation, and Journal Generator processes.

The Message Log inquiry page checks for the successful completion of all processes, including the Transaction Costing, Accounting Line Creation, and Journal Generator processes.

The Cost Tolerance Control page identifies possible cost errors for all transactions that have completed the Transaction Costing process.

The Pending Transactions page identifies the number of transactions at each stage of the costing flow.

Predefined queries give detailed transaction information about each area.

The Insufficient Qty Tool (insufficient quantity tool) page identifies depletion transactions (in environments using the negative inventory feature) where accounting entries are not created due to insufficient quantity.

Comparing and Analyzing Manufacturing Costs

PeopleSoft Cost Management enables you to monitor the costing of items produced in PeopleSoft Manufacturing for all types of costing (frozen standard, actual, and average costing methods). Use the:

Actual Cost Inquiry page to review the actual costs of production for a manufactured item.

Costs are broken down by business unit, item ID, operation sequence, cost category, production conversion codes, and other criteria.

Proactive Production Cost - PID Cost to take a snapshot of the production costs at any stage in the production process.

Then, these captured costs can be compared and analyzed using the Compare Cost Measures component.

Compare Cost Measures component to identify costing flow issues by comparing the production costs at various stages for production for a single production ID or production schedule.

Pending Transactions page to identify the number of production completions that have been putaway in inventory, partially or completely, and the number of production completions that have not been costed by Transaction Costing process.

Predefined queries give detailed transaction information about each area.

Verifying the Creation of Accounting Entries

Once you generate accounting entries using the Accounting Line Creation process, you can review or change the entries before they are picked up by the Journal Generator process for posting in the general ledger.

Use the:

Accounting Line Errors page, the Edit Unposted Accounting Lines page, and the Detail Accounting page to review and change accounting entries.

From the Edit Unposted Accounting Lines page, you can link to the Change Accounting Date page to redirect the accounting entry to an earlier accounting period by changing the accounting date of the transaction before it is sent to the general ledger.

Pending Transactions page, Unposted Accounting Lines page, Posted Accounting Line page, and the Accounting Entries page to inquire about the accounting entries.

Verifying Your Entries Passed Budget Checking

If you are using commitment control, the accounting entries must pass budget checking before you can pass them to the general ledger system using the Journal Generator process. Entries that do not pass budget checking appear on the CM Transaction Exceptions component, where you can determine the action necessary to resolve the error. The Pending Transactions page also has a query for transactions not posted to the general ledger that identifies the transaction's budget checking status. If you change a line that has already been budget checked, the budget status is set to N, and the line must run through budget checking again.

Verifying Your Entries Passed ChartField Balancing

If you are using intraunit ChartField balancing, the intraunit accounting entries must be balanced before passing them to the general ledger system using the Journal Generator process. Also, if you are using commitment control, the accounting entries must pass budget checking before they are available to perform ChartField balancing. The system assigns an error status to entries that cannot be balanced. They appear on the Edit Unposted Accounting Lines page, where you can resolve the problem. The Pending Transactions page also has a query for transactions not posted to the general ledger that identifies the transaction's status. When the accounting entries have successfully passed the Intraunit ChartField Balancing process, you can no longer change the interunit receivables and payables accounting lines.

Note. If you use commitment control and intraunit accounting (fund accounting), budget checking and intraunit ChartField balancing must be completed successfully before the accounting entries can be passed to the general ledger system. Once the accounting entries have been processed by the Journal Generator, you can no longer change any information on the accounting entries.

Use the Accounting Register report and the Transaction Register report to review both transaction costing and accounting entries.

See Also

PeopleSoft Enterprise Cost Management Reports

Pages Used to Review and Change Item Costing

and Accounting Entries

Pages Used to Review and Change Item Costing

and Accounting Entries

|

Page Name |

Definition Name |

Navigation |

Usage |

|

CM_INQ_GEN |

Cost Accounting, Item Costs, Review Costs, Item Cost, Item Cost Inquiry, General |

View general cost information about any item within the business unit, including default cost element, standard cost group, book names, cost profiles, default actual cost, current purchase cost, last price paid, and quantity on hand. |

|

|

CM_INQ_XFER |

Click the Transfer Costs link on the Item Cost Inquiry - General page. |

Displays transfer information about the item within the business unit. Also displays the item's transfer price or markup percentage. Information for the item appears by default in the Default Unit Transfer Attributes section. Planning attributes appear as defined at the business unit and item level. |

|

|

CM_INQ_VNDR |

Click the Vendor Costs link on the Item Cost Inquiry - General page. |

Displays the vendors defined for this item on the Purchasing Attributes - Item Vendor component, including vendor ID, vendor location, unit of measure (UOM), currency, minimum order quantity, vendor price and effective date of the price. |

|

|

CM_INQ_ADD |

Click the Additional Costs link on the Item Cost Inquiry - General page. |

Displays any additional costs added to the item using the Additional Item Costs page. Also displays the cost type, cost version, cost element, application method, and expense rate or percentage defined for the item and business unit. |

|

|

CM_INQ_PRC |

Click the Pricing Info link on the Item Cost Inquiry - General page. |

Displays pricing information for this item as defined in PeopleSoft Order Management, including product ID, list price, and any price lists for this item. |

|

|

CM_INQ_STD |

Cost Accounting, Item Costs, Review Costs, Item Cost Inquiry, Item Cost Inquiry, Standard |

Displays the current frozen standard costs for this item in this business unit. These standard costs are broken down by cost element and level. The standard costs are determined by the Cost Rollup process and applied to the production environment using the Update Production process. |

|

|

CM_PRODCOST_DET |

Click the Cost Element link on the Item Cost Inquiry - Standard page. |

Displays the detailed costs maintained by component ID and operation sequence. |

|

|

CM_INQ_ACT |

Cost Accounting, Item Costs, Review Costs, Item Cost Inquiry, Item Cost Inquiry, Actual |

Displays information about the item's actual costs with this business unit. The deplete cost method (from the cost profile) is identified for each book set up for this item. The item's cost history appears along with every receipt number with unit cost, vendor, the source of the receipt, and the storage area where the item was received. |

|

|

CM_INQ_PERP |

Cost Accounting, Item Costs, Review Costs, Item Cost Inquiry, Item Cost Inquiry, Perpetual Avg |

Displays the computed perpetual weighted average for this item within this business unit. The date and time of the computation also appears. Perpetual averages are calculated with each putaway of the item. |

|

|

CM_INQ_PERR |

Cost Accounting, Item Costs, Review Costs, Item Cost Inquiry, Item Cost Inquiry, Retroactive Avg |

If retroactive perpetual averaging is used for this item within this business unit, then this inquiry page displays the item's perpetual weighted average and the date and time to which it is applied. Retroactive perpetual averages are applied when you run the Transaction Costing process in the regular Cost Mode. Multiple averages are computed and applied for each putaway. |

|

|

CM_INQ_PERD |

Cost Accounting, Item Costs, Review Costs, Item Cost Inquiry, Item Cost Inquiry, Periodic Avg |

Displays the periodic weighted averages for this item within this business unit and the date and time it was applied. Periodic weighted averages are applied when you run the Transaction Costing process in the regular Cost Mode and are applied to all putaways in the period. |

|

|

CM_OH_INQUIRY |

Cost Accounting, Inventory and Mfg Accounting, Analyze Inventory Accounting, Inventory On Hand Value |

View the accounting profile and current on-hand quantity for any item within a business unit. Also displays the item's book names, costing methods, on-hand quantity, and the value of the on-hand quantity. |

|

|

CM_RCPT_LINEDET_SP |

Click the link for the book name on the Inventory On Hand page. |

View the quantity available and its value according to the storage location for the business unit, item ID, and book name. This inquiry page also displays the receipt and deplete quantities. Click the column heading to sort the data in ascending order based on the column. |

|

|

Cost Tolerance Control |

CM_CTC_INQ |

Cost Accounting, Item Costs, Review Costs, Cost Tolerance Control |

Review costed inventory transactions for possible costing errors based on user-defined tolerance levels. To be viewed on this inquiry, the transactions must have successfully completed the Transaction Costing process of the Cost Accounting Creation process. |

|

MESSAGE_LOG |

Background Processes, Review Message Log, Message Log - Search |

Find any messages created during the Transaction Costing, Accounting Line Creation and Journal Generator processes. |

|

|

CM_NPOSTED |

Cost Accounting, Inventory and Mfg Accounting, Analyze Inventory Accounting, Pending Transactions |

View inventory accounting transactions that have not yet been posted to PeopleSoft General Ledger. This inquiry page enables you to monitor transactions before and after the Transaction Costing and Accounting Line Creation processes. Click the Details links to view current transaction information generated by predefined queries. This page also provides links to the Accounting Line Errors page and the Query Viewer. |

|

|

RUN_CM_NEG_INV |

Cost Accounting, Inventory and Mfg Accounting, Analyze Inventory Accounting, Insufficient Quantity Tool |

This PeopleSoft Application Engine program, (CM_NEG_INV), provides you with a query of the accounting line entries that would be generated for those transactions held back in CM_DEPLETIONS due to insufficient quantities. |

|

|

CM_ACTUALCOST_INQ |

Cost Accounting, Item Costs, Review Costs, Actual Production Costs, Production Selection |

(Manufacturing environment only) For makeable items, you can view the actual cost of production based on the production ID or the combination of production area and item ID. Also displays the actual costs of production broken down by operation sequence, cost category, and conversion code. The production status, item ID, book name, and completed quantity also appear. The actual costs are calculated by the Transaction Costing process. |

|

|

CE_PRDNID_COSTING |

|

For makeable items, this page provides advanced proactive visibility into the costing of a production ID during each phase of production. You can save the current costs under a cost measure type for reviewing and comparing on the Compare Cost Measure component. |

|

|

CE_OUTPUT_COST_SEC |

Select the Primary Product & Co-Product link on the Proactive Production Cost - PID Cost. |

View the projected costs for the primary product and co-products of this production ID. |

|

|

CE_COST_ANALYTICS |

Cost Accounting, Item Costs, Review Costs, Compare Cost Measures, Output Analysis |

Review and compare the cost calculations for the output from a production ID (products, co-products, and so on) at various stages of production. Cost comparisons can include the production ID as planned, as produced, the frozen standard costs, the actual production costs, or other stages of production. |

|

|

CE_COST_ANALYTICS2 |

Cost Accounting, Item Costs, Review Costs, Compare Cost Measures, Input Analysis |

Review and compare the cost calculations for the input into a production ID (components, direct, and indirect costs) at various stages of production. Cost comparisons can include the production ID as planned, as produced, the frozen standard costs, the actual production costs, or other stages of production. |

|

|

CE_COST_MEASUR_SEC |

Enter a value in the Cost Measure 1 or Cost Measure 2 fields of the Compare Cost Measures component. If more than one sequence has been created for this cost measure, the system takes you to this page. |

Select the sequence number for viewing costs for this business unit, production ID, and item ID combination. |

|

|

CM_ACCTG_LN_ERR |

Cost Accounting, Inventory and Mfg Accounting, Create Accounting Entries, Accounting Line Errors |

Find any accounting lines that could not be created because of missing accounting rules. |

|

|

CM_ACCTG_LN_UNPOST |

Cost Accounting, Inventory and Mfg Accounting, Create Accounting Entries, Edit Unposted Accounting Lines |

After you run the Accounting Line Creation process, use this page to review and make changes to the accounting entry line information for a transaction prior to generating journal entries. For any transaction, you can correct the ChartFields and also change the accounting date. For example, you can adjust or redirect charges to other accounts, change the budget period for the transaction, or redirect the entry to a prior accounting period. |

|

|

CM_ACCTG_UNPST_TRX |

Click the Change Accounting DT button on the Edit Unposted Accounting Lines page. |

Enables you to redirect an accounting entry to an earlier accounting period by changing the accounting date of the transaction before it is sent to the general ledger system. The system displays all the debit and credit lines for the selected accounting entry. Enter the new date in the Accounting Date field and click the OK button to change the accounting date for this transaction. If commitment control is enabled, you cannot change the transaction if any line has passed budget checking. |

|

|

CM_DRILL_UNPST_DET |

Cost Accounting, Inventory and Mfg Accounting, Review Accounting Lines, Unposted to GL, Unposted Accounting Lines |

View accounting entries that have not yet been picked up by the Journal Generator process for posting to the general ledger system. ChartField security can be applied to this page. |

|

|

CM_DRILL_JRNL_DET |

Cost Accounting, Inventory and Mfg Accounting, Review Accounting Lines, Posted to GL, Posted Accounting Lines |

View accounting entries that have already been picked up by the Journal Generator process for posting to the general ledger system. ChartField security can be applied to this page. |

|

|

CM_ACCTG_LINE |

Cost Accounting, Inventory and Mfg Accounting, Review Accounting Lines, Accounting Entries |

View accounting entries, by entering the search criteria and click the Refresh button. Displays the both the debit and credit sides of the accounting entry and the complete ChartField combinations. ChartField security can be applied to this page. |

|

|

KK_XCP_HDR_CM1 |

Commitment Control, Review Budget Check Exceptions, CM Transaction, Cost Management Exceptions |

View budget checking errors or warning messages for PeopleSoft Cost Management transactions. Users who have authority can override the budget exceptions on this page. |

|

|

KK_DRL_CM1_SEC |

Click the Drill Down to Transaction Line button on the CM Transaction Exceptions - Header Exceptions page. |

View line details for PeopleSoft Cost Management transactions with budget exceptions. |

|

|

KK_XCP_LN_CM1 |

Commitment Control, Review Budget Check Exceptions, CM Transaction, Line Exceptions |

View individual lines in transactions with budget checking errors or warning messages. |

Using Cost Tolerance Control

Using Cost Tolerance Control

Access the Cost Tolerance Control page (Cost Accounting, Item Costs, Review Costs, Cost Tolerance Control).

PeopleSoft Cost Management receives transactions from a variety of sources. The Cost Tolerance Control page helps you to monitor transactions flowing into your cost management system and identifies possible cost errors from any of the sources of incoming inventory. Use the inquiry page to view costed inventory transactions that exceed your cost tolerance parameters. The inquiry results can be viewed on screen or downloaded into a spreadsheet such as Microsoft Excel for further analysis.

In order to be evaluated by this inquiry, an inventory transaction must have successfully completed the Transaction Costing process of the Cost Accounting Creation process.

Search Criteria

Enter your search criteria to select the inventory transactions to be examined for cost tolerance exceptions. Your search criteria determine the sample population to be used.

|

Business Unit |

(Required) Enter the PeopleSoft Inventory business unit. |

|

Book Name |

(Required) Enter the name of the cost book used. |

|

From Date and To Date |

(Required) Enter a date range for the transaction date. The default range is from 01/01/1900 to the current system date. |

|

All Items |

Select to include all items within the business unit and cost book. |

|

Single Item |

Select to run this inquiry only for transactions with the item identified in the Item ID field. |

|

Standard Cost Group |

Select to run this inquiry only for a specific standard cost group defined in the Std Cost Group field. Standard cost groups, or cost groups, enable you to group together a set of items using the Define Business Unit Item -General: Common page. Inventory transactions with items included in the defined cost group are included in this search. |

Cost Tolerances and Searching

To qualify as an exception, a transaction must exceed either the % Under or % Over tolerance and also exceed the Threshold tolerance. Cost tolerances are:

|

% Under |

Enter a percentage of the average cost. If an individual transaction is less than this percentage of the average cost of the sample then it is tagged as a possible exception. For example, if the average cost in the sample for business unit US008/cost book FIN/item ID 10001 is 100 USD and the % Under value is 10 percent, then any transaction with an item cost of less than 90 USD is a possible exception. This field must be less than 100 percent. The default value is zero percent. |

|

% Over |

Enter a percentage of the average cost. If an individual transaction is greater than this percentage of the average cost of the sample then it is tagged as a possible exception. For example, if the average cost in the sample for business unit US008/cost book FIN/item ID 10001 is 100 USD and the % Over value is 15 percent, then any transaction with an item cost of greater than 115 USD is a possible exception. The default value is 100 percent. |

|

Threshold |

Enter the amount that the costed inventory transaction must fluctuate from the average cost. If any individual transaction differs from the average cost of the sample by more or less than this amount, then the transaction is a possible exception. For example, if the average cost in the sample for business unit US008/cost book FIN/item ID 10001 is 100 USD and the Threshold value is 25 USD, then any transaction with an item cost of greater than 125 USD or less than 75 USD is a possible exception. This cost tolerance is useful if you wish to prevent small value items from appearing as exceptions. The default value for this field is zero. |

Click the Search button to identify transactions that exceed your cost tolerance parameters. The exception transactions are based on the following calculation:

Based on the business unit, book, date range, and item selection entered on this page, the system finds all costed inventory transactions that meet these parameters and creates a sample population.

An average cost is calculated for each business unit/cost book/item ID combination based on the sample population.

Note. This average cost could differ from the average cost used in PeopleSoft Cost Management transactions since the search criteria on this page could limit the number of transactions used.

Each individual transaction in the sample population is then compared to the average cost of the sample for the business unit/cost book/item combination using the cost tolerances to find exceptions. Remember, to qualify as an exception, a transaction must exceed either the % Under or % Over tolerance and also exceed the Threshold tolerance.

Viewing Search Results

|

Receipts that exceed Cost Tol |

Identifies the number of rows found by the search that exceed the defined cost tolerances. If too many or too few inventory transactions are found, the user can change the search criteria and cost tolerances then launch another search. |

|

Details |

Select this link to access the results of the query. This link becomes available only when search results are found. |

|

Query Viewer |

Use this link to access the Query Viewer where you can run queries or schedule them to run at a later time. |

Click the Details link to access the query results:

Values displayed include:

|

Unit Cost |

The unit cost of the individual transaction that has exceeded the cost tolerance parameters. |

|

Avg Unit Cost |

The average unit cost of the sample population. |

|

Cost Difference |

"Unit Cost" – "Avg Unit Cost" |

|

% Difference |

("Unit Cost" - "Avg Unit Cost") / "Avg Unit Cost" * 100 |

|

Extended Cost |

"Unit Cost" * "Qty Rcvd" |

|

Extended Avg Cost |

"Avg Unit Cost" * "Qty Rcvd" |

Costs are viewed with four decimal places; however, the intermediate calculations and comparisons utilize the full precision values available.

Using the Pending Transactions Inquiry

Using the Pending Transactions Inquiry

Access the Pending Transactions page (Cost Accounting, Inventory and Mfg Accounting, Analyze Inventory Accounting, Pending Transactions).

Use this inquiry page to review inventory accounting transactions that have not yet been posted to the PeopleSoft General Ledger. This inquiry enables you to monitor pending transactions in these stages of the costing flow:

Before production completions from PeopleSoft Manufacturing have been putaway into PeopleSoft Inventory.

Before production completions from PeopleSoft Manufacturing have been costed.

Before the Transaction Costing process.

Before the Accounting Line Creation process.

Before the Journal Generator process.

Click the Details links to view current transaction information generated by predefined queries for each of these three stages: (TRANSACTION_INV, CM_PENDING_COSTING, CM_PENDING_ACCTG_LINE, and CM_PENDING_GL_DISTRIB). This page also provides a link to the Query Viewer, where you can run queries or schedule them to run at a later time.

|

Search |

Select after entering the business unit, book name, and as of date for the inventory transactions that you want to review. The system displays the number of transactions at each stage of the accounting flow. |

|

Completions Pending Putaway |

Displays the number of WIP completions and scrap from PeopleSoft Manufacturing that have been partially putaway or not yet been putaway into an inventory storage location˙. This query is especially useful when using actual or average costing for make items. |

|

Pending Calculation Prdn Cost |

Displays the number of production completions from PeopleSoft Manufacturing that have been putaway into inventory but not yet costed by the Transaction Costing process. There are a number of reasons why the Transaction Costing process would not have costed these transactions; for a complete list, see the Generating Costs for Transaction Records section of this chapter. |

|

Transactions Not Costed |

Displays the number of inventory transactions, other than production completions, that have not been processed by the Transaction Costing process. This number is further broken down into three sections in the Transactions by Type group box. |

|

Transaction Costing Not Run |

Displays the number of inventory transactions that have not been costed, because the Transaction Costing process has not been run to include them. |

|

Insufficient Qty for Depletion (insufficient quantity for depletion) |

Displays the number of inventory transactions that did not complete the Transaction Costing process successfully, because the inventory business unit did not have a sufficient on-hand quantity to satisfy the depletion. The stock quantity of an item may physically exist in inventory however the quantity is not yet recorded in PeopleSoft Inventory due to timing issues or entry errors. The negative inventory feature enables you to move or ship the stock that sends the item's quantity balance into negative numbers within the PeopleSoft system. You can record a negative quantity within PeopleSoft Inventory, however, you could choose not to cost a transaction based on a negative quantity. If you choose not to cost negative inventory transactions, then the Transaction Costing process holds costing the depletion transaction. Each time the Transaction Costing process is run, the depletion transactions on hold are examined to determine if there is sufficient quantity available to satisfy the depletion. Once sufficient quantity exists, the transaction is costed. Note. The negative inventory feature is activated by selecting the Allow Negative Inventory check box on the Inventory Definition-Business Unit Options page. The Insufficient Qty Cost Option on the Cost Profiles page determines how the Transaction Costing process applies costing to negative inventory transactions. |

|

Other Issues |

Displays the number of inventory transactions that did not successfully complete the Transaction Costing process due to other issues besides insufficient depletion quantity. Other issues include:

|

|

Accounting Lines Not Created |

Displays the number of inventory transactions that have completed the Transaction Costing process successfully, but have not yet been processed by the Accounting Line Creation job. The costed transactions may not have completed the Accounting Line Creation job simply because you have not run the process for the business unit, book name, and as of date combination. Also, these costed transactions may not have completed the Accounting Line Creation process successfully, because the transactions are missing an accounting rule. Click the Accounting Line Errors link at the bottom of this page to view costed transactions without accounting rules. Accounting rules must be added before you can create accounting entries for costed transactions. |

|

Not Posted to General Ledger |

Displays the number of inventory transactions that have completed both the Transaction Costing process and the Accounting Line Creation job successfully, but have not yet been picked up by the Journal Generator process and posted to the general ledger. There are several reasons why the accounting entries may not have been picked up and posted as journal entries:

|

Using the Insufficient Quantity Tool

Using the Insufficient Quantity Tool

Access the Insufficient Quantity Tool page (Cost Accounting, Inventory and Mfg Accounting, Analyze Inventory Accounting, Insufficient Quantity Tool).

This PeopleSoft Application Engine program (CM_NEG_INV) provides you with a query of the accounting line entries that would be generated for those transactions held in CM_DEPLETIONS_VW due to insufficient quantities.

The negative inventory feature is activated by selecting the Allow Negative Inventory check box on the Inventory Definition-Business Unit Options page. Use the Insufficient Qty Cost Option on the Cost Profile page to specify how the negative inventory feature should be applied; select Hold to delay costing the entire depletion transaction that drives the item quantity to a negative balance until sufficient stock is putaway to cover the depletion transaction, or select Partial to split the depletion transaction that drives the item quantity to a negative balance and costs part of the depletion transaction up to the currently available stock quantity. The remaining depletion transaction is held until sufficient stock is putaway.

By Business Unit, Book, and As of Date this process collects the rows in CM_DEPLETIONS that are held back due to insufficient quantities and creates a query displaying the accounting entries that would be generated. The system saves the information into CM_NEG_SNP2_TBL where it is keyed by process instance, business unit, transaction group, accounting date, and line number. It includes the field, CM_ERROR_CODE, to identify rows where an accounting entry could not be determined, because a transaction accounting rule was not found.

After you run this process click the Query Results link to view the results. Using the query, the results can be exported to a Microsoft Excel spreadsheet or a CSV text file.

|

Run insufficient qty process |

Select to run the CM_NEG_INV PeopleSoft Application Engine process to populate the CM_NEG_SNP2_TBL record with entries based on the business unit, cost book, and as of date entered on this page. |

|

Purge previous data |

Select to purge rows from the CM_NEG_SNP2_TBL record based on the business unit, cost book, and as of date entered on this page. |

Editing Unposted Accounting Lines

Editing Unposted Accounting Lines

Access the Edit Unposted Accounting Lines page (Cost Accounting, Inventory and Mfg Accounting, Create Accounting Entries, Edit Unposted Accounting Lines).