5 Generating the Multi-Purpose VAT Communication (Release 9.1 Update)

This chapter includes the following topics:

-

Section 5.1, "Understanding the Multi-Purpose VAT Communications"

-

Section 5.5, "Generating the San Marino Purchases Declaration"

|

Important: The Agenzia delle Entrate (Italian Tax Authorities) occasionally changes the requirements for generating the yearly list and the black list reports. You should verify that you have the most current information about generating these reports before you run the process to generate these reports. If you used the JD Edwards EnterpriseOne software for Italy to process the yearly list and the black list reports prior to December, 2013, you should note:

|

5.1 Understanding the Multi-Purpose VAT Communications

The Agenzia delle Entrate (Italian Tax Authorities) published regulations for the Multi-Purpose VAT Communication relevant transactions, which is also known as Nuovo Spesometro. The regulations require that you periodically report information on sales and purchase transactions to the Italian government.

You include the transaction information that you must report in these declarations, which you submit in an electronic file:

-

Yearly List (Spesometro)

-

Black List Declaration

-

San Marino Purchases Declaration

You use the Multi-Purpose VAT Communications to submit each of the declarations. In the JD Edwards EnterpriseOne software for Italy, you use the Multi-Purpose VAT Communication program (R74Y060) to generate the Multi-Purpose VAT Communication. The program populates different sections for the communication based on which declaration you choose to generate. For example, if you choose to generate the Black List Declaration, the program generates the Multi-Purpose VAT Communication files and populates only the sections of multi-purpose communication that are required for reporting transactions for black list countries.

See Section 5.1.1, "Record Types in the Multi-Purpose Communications of VAT Reports"

The Multi-Purpose VAT Communication program populates two workfiles with detailed and summary information that it then uses to generate audit reports and the specified text file. You then use the Text File Processor program (P007101) to work with the text files and copy the files to the media that you use to submit the electronic files.

5.1.1 Record Types in the Multi-Purpose Communications of VAT Reports

The Multi-Purpose Communications of VAT includes multiple sections of record types. The records types include subsections that are used for different data, and the subsections can also have additional subsections. Because the Multi-Purpose Communications of VAT can be used to report three different declarations, the subsections include different data based on the declaration type. For example, the BL subsection in Record type C includes subsections BL001 through BL008. Depending on the values written to subsection BL002, the system writes data about transactions with subject based in tax haven countries, transactions with non-resident subjects, or transactions for the purchase of goods and services from non-resident subjects in the other subsections of section BL.

The electronic file is composed of the following record types:

| Record Type | Comments |

|---|---|

| A: Header Record | This record type is mandatory and includes:

|

| B: First party and transmission information record | This record type is mandatory and includes:

|

| C: Records containing transactions data transmitted in summary transmission mode | The system populates the Yearly List Summarized Workfile (F74Y060) and then sections and fields in record type C when you set the Process Detailed or Summarized processing option to generate summary records. The system populates different sections in record type C depending on whether you specify to generate records for the Black List Declaration or the Yearly List (Spesometro). See Section 5.1.1.1, "Sections in Record Type C"

Record type C and record type D are mutually exclusive. If you specify summary as the mode, then the system populates the sections in record type C and does not populate the sections in record type D. If you specify detailed as the transmission mode, then the system populates the sections in record type D and does not populate the sections in record type C. If you set the Type of Upload processing option to generate a cancellation, the Multi-Purpose VAT Communication program does not populate record type C. |

| D: Records containing transactions data transmitted in detailed transmission mode | The system populates the Yearly List Detail Workfile (F74Y061) and then sections and fields in record type D when you set the Process Detailed or Summarized processing option to generate detail records. The system populates different sections in record type D depending on whether you specify to generate records for the San Marino residents or the Yearly List (Spesometro). See Section 5.1.1.2, "Sections in Record Type D"

Record type C and record type D are mutually exclusive. If you specify detailed as the mode, then the system populates the sections in record type D and does not populate the sections in record type C. If you specify summary as the transmission mode, then the system populates the sections in record type C and does not populate the sections in record type D If you set the Type of Upload processing option to generate a cancellation, the Multi-Purpose VAT Communication program does not populate record type D. |

| E: Counters record | In addition to header information such as the responsible company's tax ID, this record includes counters for the records in each of the sections in record types C and D. This record is mandatory. |

| Z: Footer record | This record includes the number of records in record type B, C, D, and E. This record is mandatory. |

5.1.1.1 Sections in Record Type C

Record type C includes sections for specific types of transactions in summary mode. The system populates these sections only when the section needs to be populated based on the declaration type and whether you specify to generate the data in summary or detail mode.

Record type C includes these sections:

-

Section FA: Summary of Transactions Documented by an Invoice.

Section FA includes:

-

Third Party VAT Number

-

Rental / Leasing

You use the Additional Information Yearly List program (P74Y3016) to indicate that a transaction involves a rental or lease.

-

Positive and negative transactions

The system includes accounts receivable records (batch type is IB) as positive transactions and accounts payable records (batch type is V or W) as negative transactions.

-

Taxable / Non Taxable/ Exempt Amounts

The system uses the values in the Special Handling Code field of 74Y/DT to determine whether to include transactions in these fields.

-

VAT amount

-

Amount of transactions with VAT not exposed on the invoice.

Transactions that you need to include in this section must be assigned a tax rate/area that is set up in the Multi Purpose VAT Classification by Tax Area/Item (F74Y011) table and has a value of 04 in the SP Class column which classifies the transaction as Vat Not Exposed on Invoice according to the Multi Purpose Classification (74Y/SP) UDC table.

-

Amount of adjustment notes

The program uses the document type to determine which transactions are adjustment notes. Document types set up in the 74Y/DT UDC table that have the value 3 in the Special Handling Code field of UDC 74Y/DT are adjustments.

-

VAT Amount of adjustment notes.

-

-

Section SA: Summary of Transactions Not Documented by an Invoice

Transactions that are not documented by an invoice must have a tax rate/area set up in the Multi Purpose VAT Classification by Tax Area/Item (F74Y011) table and have a value of 04 in the SP Class column which classifies the transaction as Vat Not Exposed on Invoice according to the Multi Purpose Classification (74Y/SP) UDC table. Section SA includes a summary by taxpayer ID of the number of transactions, the total amount, and whether the transaction involved a rental or lease. You use the Additional Information Yearly List program (P74Y3016) to indicate that a transaction involves a rental or lease.

-

Section BL: Transaction with subject based in tax haven countries (countries included in the black list), as well as a summary of transactions with non-resident subjects, and a summary of purchase of services from non-resident subjects. Section BL includes different data based on which declaration you generate.

Section BL includes these subsections:

-

BL001

This section includes information about the taxpayer, including name, date of birth, and country code if the taxpayer is an individual; or, the information about the company, such as the taxpayer ID, the country where the company is located, and the legal address of the company.

-

BL002

This section includes the VAT registration number, and indicates whether the declaration is to report transactions involving black list countries, transactions with non-resident subjects, or purchases of services from non-resident subjects. To include transactions as those involving black list countries, you must use the Additional Information Yearly List program (P74Y3016) to indicate that the transaction involves a black list country.

-

BL003: Taxable, Non-Taxable, and Exempt Amounts

This section is completed for only accounts receivable (positive) transactions when the report includes transactions with black list countries (field BL002002 is completed) or transactions with non- resident subjects (field BL002003 is completed). Section BL003 includes the total amount and the taxable amount of the transactions.

-

BL004: Transactions Non Subject to VAT

This section is completed only for accounts receivable (positive) transactions when the report includes transactions with black list countries (field BL002002 is completed).

The section includes the total amount for the sale of goods, and the total amount for the sale of services.

Only transactions set up in the Multi Purpose VAT Classification by Tax Area/Item (P74Y011) program and classified as Non Subject to VAT (according to the Multi Purpose Classification (74Y/SP) UDC table) are included in the report.

See Section 3.10, "Classifying Transactions by Tax Area and Items for VAT Reports"

-

BL005: Adjustment Notes

This section is completed only for accounts receivable (positive) transactions when the report includes transactions with black list countries (field BL002002 is completed). The section includes the total amount and tax amount of adjustment notes.

-

BL006: Taxable, Non-Taxable, and Exempt Amounts

This section is completed for only accounts payable (negative) transactions when the report includes transactions with black list countries (field BL002002 is completed), transactions with non- resident subjects (field BL002003 is completed), or transactions for purchase of services from non-resident subjects (BL002004 is completed). Section BL006 includes the total amount and the taxable amount of the transactions.

-

BL007: Transactions Non Subject to VAT

This section is completed only for accounts payable (negative) transactions when the report includes transactions with black list countries (field BL002002 is completed). This section includes the total amount of the transactions and the total tax amount.

Only transactions set up in the Multi Purpose VAT Classification by Tax Area/Item (P74Y011) program and classified as Non Subject to VAT (according to the Multi Purpose Classification (74Y/SP) UDC table) are included in the report.

See Section 3.10, "Classifying Transactions by Tax Area and Items for VAT Reports"

-

BL008: Adjustment Notes

This section is completed only for accounts payable (negative) transactions when the report includes transactions with black list countries (field BL002002 is completed). The section includes the total amount and tax amount of adjustment notes.

-

-

Control Digits

This section includes control digits for the file.

5.1.1.2 Sections in Record Type D

Record type D includes sections for specific types of transactions in detail mode. The system populates these sections only when you set the processing options to generate records in detail mode. Record type D includes these sections:

-

Section FE: Issued Invoices and Recap Invoices (Receivables)

This section includes information such as the taxpayer ID, document dates, taxable and tax amounts, and whether the invoice involves a lease or rental. You use the Additional Information Yearly List program (P74Y3016) to indicate that the transaction involves a lease or rental. You specify the recap document type for accounts receivable transactions in a processing option.

-

Section FR: Received Invoices and Recap Invoices (Payables)

This section includes information such as the taxpayer ID, document dates, taxable and tax amounts, and whether the invoice involves a lease or rental. You use the Additional Information Yearly List program (P74Y3016) to indicate that the transaction involves a lease or rental. You specify the recap document type for accounts payable transactions in a processing option.

-

Section NE: Issued Adjusting Notes

This section includes information such as the taxpayer ID and information about the adjustment, such as the amount and date of the adjustment.

-

Section NR: Received Adjustment Notes

This section includes information such as the taxpayer ID and information about the adjustment, such as the amount and date of the adjustment.

-

Section DF: Transactions Not Documented by an Invoice

This section includes information such as the taxpayer ID, the transaction date and document amount, and whether the transaction involves a lease or rental.

-

Section FN: Transactions with Non-Resident Subjects (Receivables)

This section includes information about the taxpayer, including name, date of birth, and country code if the taxpayer is an individual; or, the information about the company, such as the taxpayer ID, the country where the company is located, and the legal address of the company. It also includes details of the transactions, such as the taxable and tax amounts, invoice date, and whether the transaction involves a lease or rental.

To include transactions as those involving non-resident subjects, you must use the Additional Information Yearly List program (P74Y3016) to indicate that the transaction involves a non-resident subject.

-

SECTION SE - Purchases of Services from Non-Resident Subjects and Purchases from Subjects Resident in San Marino

This section includes information about the taxpayer, including name, date of birth, and country code if the taxpayer is an individual; or, the information about the company, such as the taxpayer ID, the country where the company is located, and the legal address of the company. It also includes details of the transactions, such as the taxable and tax amounts, invoice date, and whether the transaction involves a lease or rental.

The system uses the country code associated with the supplier address book records to determine if the supplier is a resident of San Marino.

-

Section TU - Tourism Related Transactions

The JD Edwards EnterpriseOne system does not support the completion of section TU in record type D.

-

Control Digits

This section includes control digits for the file.

|

Note: The values for sections FN, SE, and BL that you define in the F74Y3016 table using the Additional Information Yearly List program supercede the values stored in the F74Y011 and F74Y010 tables that you define using the Multi Purpose VAT Classification by Tax Area/Item program (P74Y011) and Work With Black List Setup (P74Y010) programs. |

5.1.2 Process Flow to Generate the Multi-Purpose VAT Communication

Complete these steps to generate these declarations:

-

Yearly List (Spesometro)

-

Black List Declaration

-

San Marino Purchases Declaration

-

Complete the required setup.

-

Enter and post vouchers and invoices.

-

Classify transactions for declarations.

See Section 5.2, "Classifying Transactions for Declarations"

-

Set the processing options for the Multi-Purpose VAT Communication program (R74Y060).

Specify whether to generate the Yearly List (Spesometro), the Black List Declaration, or the San Marino Purchases Declaration.

See these sections:

Section 5.3.3, "Setting Processing Options for Multi-Purpose VAT Communication (R74Y060)"

Section 5.4.2, "Setting Processing Options to Generate the Black List Declaration"

Section 5.5.2, "Setting Processing Options to Generate the San Marino Purchases Declaration"

-

Run the Multi-Purpose VAT Communication program to generate the Multi-Purpose VAT Communication for one of these declarations:

-

Yearly List (Spesometro)

-

Black List Declaration

-

San Marino Purchases Declaration.

See Section 5.5, "Generating the San Marino Purchases Declaration"

You can run the program to generate an audit report with summary or detail lines. You can also specify whether to generate the text files.

-

-

Process the text files.

Note that the Multi-Purpose VAT Communication program writes records to the Text Processor Header table (F007101) and Text Processor Detail Table - 70 (F707111) instead of to the standard text file detail table (F007111) because the government regulations limit the size of the file. If the file is larger than 40,000 records, the program creates multiple files. You specify the maximum file size in a processing option.

5.1.3 Prerequisites

Before you generate the Multi-Purpose VAT Communication to include data for the Yearly List (Spesometro), the San Marino Purchases Declaration, or the Black List Declaration, you must:

-

Set up your system to process the Multi-Purpose VAT Communication:

-

Set up UDC values.

See Setting Up UDCs for the Multi-Purpose VAT Communications (Release 9.1 Update)

-

Set up additional company address book information.

See Entering Address Book Information for a Tax Reporting Entity

-

Set up additional customer and supplier address book information.

See Entering Address Book Information for Customers and Suppliers in Italy

-

Set up black list information in the Black List Setup program (P74Y010).

See Associating Countries with Tax Rate Areas for VAT Reports

-

-

Post all vouchers.

-

Post all invoices.

-

Classify transactions for declarations.

See Section 5.2, "Classifying Transactions for Declarations"

5.2 Classifying Transactions for Declarations

This section provides an overview of transaction classifications and discusses how to classify transactions for declarations.

5.2.1 Understanding Transaction Classifications

After you post vouchers and invoices and before you generate the Multi-Purpose VAT Communication, which includes sections for the Yearly List, the Black List Declaration, and the San Marino Purchases Declaration, you must indicate for each transaction whether the transaction:

-

Is a rental or leasing transaction.

-

Is a reverse charge (adjustment) to include in section FR (Received Invoices and Recap Invoices (Payables)).

The Reverse Charge check box must be populated when the invoices received refers to purchases of gold or silver materials, to services in the construction industry performed by sub-contractors, and purchases of non-ferrous scraps or materials.

-

Needs to be included in one of these sections for non-residents:

-

Section C, subsection BL for transactions with non-residents subjects.

-

Section D, subsection FN for transactions for non-resident subjects (receivables).

-

Section D, subsection SE for transactions that are purchases of services from non-resident subjects, or purchases from subjects resident in San Marino.

The system uses the country associated with the supplier's address book record to determine if a supplier is a resident of San Marino.

-

You use the Additional Information Yearly List program (P74Y3016) to enter additional information required for the declarations. When you access the program, the system displays records from the Taxes table (F0018). You can use the fields in the header area to search for and display only the records that you want to work with. For example, you can specify the supplier or customer number, the order type, and the batch type to work with only the records that meet the search criteria.

You can enter the additional information for single record or select multiple records and complete a global update to enter the additional information. The system saves the information that you enter to the Additional Information Yearly table (F74Y3016). When you run the Multi-Purpose VAT Communication program to generate one of the declarations, the system reads the values in the F74Y3016 to determine whether to include the transaction in the declaration subsections.

5.2.2 Forms Used to Classify Transactions for Declarations

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

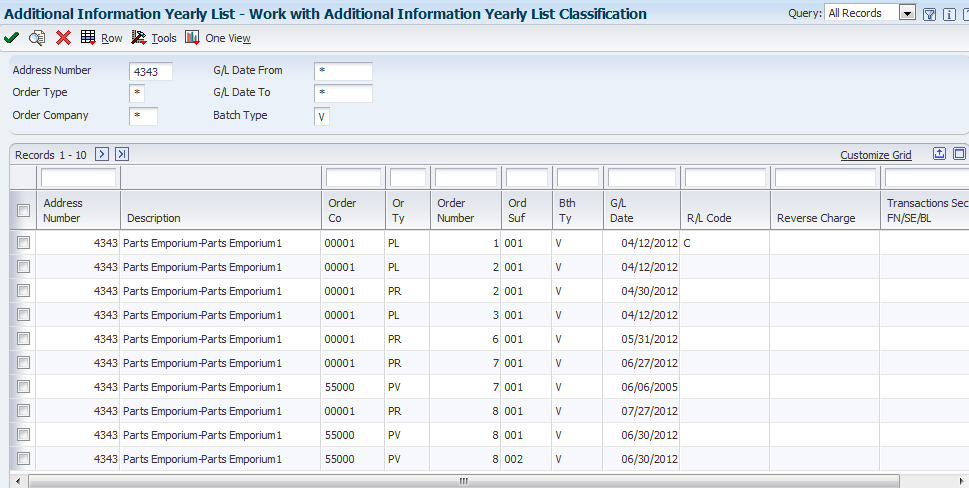

| Work with Additional Information Yearly List Classification | W74Y3016A | Italy Multi-Purpose VAT Communication (G74IYL), Additional Information Yearly List | Search for and select records from the Taxes (F0018) table. |

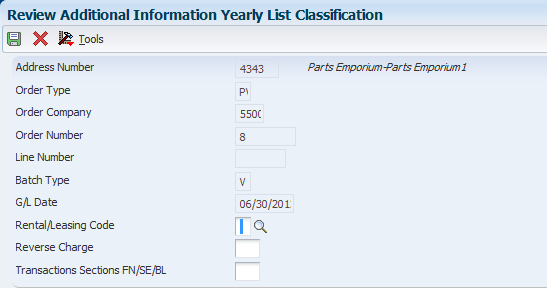

| Review Additional Information Yearly List Classification | W74Y3016C | On the Work with Additional Information Yearly List Classification form, select a record and then click Select. | Classify a single transaction. |

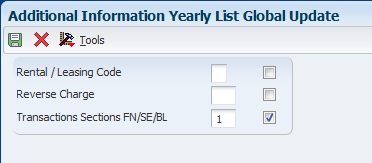

| Additional Information Yearly List Global Update | W74Y3016D | On the Work with Additional Information Yearly List Classification form, select multiple records and then select Global Update from the Row menu. | Classify multiple transactions. |

5.2.3 Classifying a Single Transaction for Declarations

Access the Review Additional Information Yearly List Classification form.

Figure 5-1 Review Additional Information Yearly List Classification

Description of ''Figure 5-1 Review Additional Information Yearly List Classification''

- Rental/Leasing Code

-

Enter a code from the Rental/Leasing Code (74Y/RL) UDC table to specify the type of lease or rental for the transaction. The system writes the code that you enter to the FA and SA sections of record type C, and to the FE, DN, and FN sections of record type D.

If the transaction is not for a rental or lease, leave this field blank.

Values are:

Blank: Transaction does not involve a lease or rental.

A: Car

B: Caravan

C: Other vehicles

D: Boats

E: Planes

- Reverse Charge

-

Enter 1 in this field to indicate that the invoices received are for purchases of gold or silver materials, for services in the construction industry performed by sub-contractors, and for purchases of non-ferrous scraps or materials.

- Transactions Sections FN/SE/BL

-

Specify whether to include the transaction in the included in the FN, SE or BL sections of the text file. Values are:

0 or blank: Do not include in sections FN, SE or BL.

1: Transactions with Non-Residents Subjects. The system includes the transaction in section BL if you generate a summarized report and includes the transaction ins section FN if you generate a detailed report.

2: Purchases of Services with Non-Resident Subjects. The system includes the transactions in section BL if you generate a summarized report and includes the transactions in section SE if you generate a detailed report.

5.2.4 Classifying Multiple Transactions for Declarations

Access the Work with Additional Information Yearly List Classification form.

Figure 5-2 Work with Additional Information Yearly List Classification form

Description of ''Figure 5-2 Work with Additional Information Yearly List Classification form''

-

On the Work with Additional Information Yearly List Classification form, select one or more transactions.

You can select multiple check boxes, or you can select the check box in the header row of the grid to select all records.

-

Select Global Update from the Row menu.

Figure 5-3 Additional Information Yearly List Global Update form

Description of ''Figure 5-3 Additional Information Yearly List Global Update form''

-

On the Additional Information Yearly List Global Update form, complete the Rental / Leasing Code, Reverse Charge, and Transactions Sections FN/SE/BL fields as necessary.

-

Select the check box for each field that you want to apply to all selected records.

-

Click OK.

5.3 Generating the Yearly List (Spesometro)

This section provides an overview of the Yearly List (Spesometro) and discusses how to:

-

Run the Multi-Purpose VAT Communication program.

-

Set processing options for Multi-Purpose VAT Communication (R74Y060).

5.3.1 Understanding the Yearly List (Spesometro) Declaration

|

Note: The JD Edwards EnterpriseOne software for Italy supports the completion of the fields required for tax payers that are companies. The software does not complete the fields in the text file when the tax payer is an individual. |

You must report these transactions annually in the Yearly List (Spesometro):

-

Sales and purchases of goods and services documented by an invoice.

-

Sales and purchases of goods and services for which the invoice is not required if the total gross amount of each transaction is over a threshold amount and if they are not paid by credit card, debit card, prepaid cards or checks.

You set processing options to specify the threshold amounts for business to consumer (B2C) transactions with and without invoices.

-

Purchases from subjects resident in the Republic of San Marino.

-

Transactions with subjects resident in tax haven countries listed in a Black List maintained by the Italian Tax Authorities.

You must include in the Multi-Purpose VAT Communication this information about your customers and suppliers:

-

Company tax ID.

-

Company additional tax ID.

-

Supplier and customer tax ID information.

-

Intermediary information, if applicable.

-

Total taxable amount of the transactions in the period.

-

Total tax amount, based on the total taxable amount.

-

Adjustments to vouchers and invoices, including the date, taxable amount, and tax amount of the adjustment.

When you generate the Multi-Purpose VAT Communication, the system:

-

Generates an audit report in summary or detail mode.

-

Creates batches in the text file processor tables that you can transfer to the media that you use to submit the Multi-Purpose VAT Communication.

5.3.1.1 Threshold Amounts

You use processing options in the Multi-Purpose VAT Communication program to specify threshold amounts for business-to-consumer transactions (B2C) with and without invoices. Business-to-consumer transactions are considered non-invoice transactions, and typically do not have a standard invoice.

The system uses the threshold amount that you specify in two processing options to determine whether to include the transaction in the Multi-Purpose VAT Communication. In one processing option, you specify the threshold for B2C transactions with an invoice; in the other, you specify the threshold for B2C transactions without an invoice.

The system uses tax IDs and the value in the Special Handling Code field of UDC 74Y/DT to determine which threshold to compare to the transactions. If a transaction is for a customer that has a Fiscal ID (Codice Fiscale) but not a Tax ID (Partita IVA) in the address book record, and the Special Handling Code for the assigned document type is 1 in UDC 74Y/DT, then the system compares the transaction to the threshold for B2C transactions with an invoice. If the Special Handling Code for the assigned document type is 4 in UDC 74Y/DT, the transaction is compared to the threshold for B2C transactions without an invoice.

5.3.1.2 Exclusions

The system excludes these transactions when you generate the Multi-Purpose VAT Communication for the Yearly List (Spesometro):

-

Vouchers and invoices for imports and exports to non-European Union (EU) countries.

-

Transactions for EU countries that are included on the Black List Declaration or San Marino Purchases Declaration.

-

Intra-EU transactions.

-

Business-to-consumer transactions paid with a credit card, electronic debit card, prepaid electronic cards when these cards are issued by a financial institution that is resident in Italy or that has a stable organization in Italy.

-

Transaction assigned a payment instrument that is listed in the 74Y/PY UDC table.

-

Transactions assigned a document type for which the value in the Special Handling Code field of the 74Y/DT UDC table is 2.

5.3.1.3 Record Processing

The Multi-Purpose VAT Communication program selects records to process from the Taxes table (F0018). These factors determine the records that the system selects:

-

The batch type must be V, W or IB.

Records with batch type G are excluded.

-

The setup for the alternate tax rate/area functionality if you set the Report By Country processing option to enable country processing.

-

The G/L date of the transaction, as recorded in the F0018 table, must be within the declaration year defined in the processing options.

-

The document type must be listed in the 74Y/DT (Document Type - Annual Report) UDC table, and the value in the Special Handling Code field is not 2 (exclude).

-

The payment type must not exist in the 74Y/PY (Payment Instrument Excluded) UDC table.

After the system selects records from the F0018 table, the system validates the selected records against values in these tables:

-

F740018A (Taxes Areas)

-

F74Y3016 (Additional Information Yearly)

-

F74Y010 (Black List Setup)

-

F0101 (Address Book Master)

-

Address Book Italian Tag File - ITA table (F74Y0101)

-

W/T Additional A/B Information table (F74401)

|

Note: The system does not use the value that you enter in the Company processing option for the Multi-Purpose VAT Communication program for data selection. |

5.3.2 Running the Multi-Purpose VAT Communication Program (R74Y060)

Select Italy Multi-Purpose VAT Communication (G74IYL), Multi-Purpose VAT Communication.

5.3.3 Setting Processing Options for Multi-Purpose VAT Communication (R74Y060)

Processing options enable you to set default processing values.

5.3.3.1 General

- 1. Company

-

Specify the company for which you generate the report. The value that you enter must exist in the Company Constants table (F0010).

Note:

The system uses the company that you specify to obtain information about the company to include in the Multi-Purpose VAT Communication. The system does not use the value that you enter here for data selection. - 2. Declaration Year

-

Enter the 4-character declaration year.

- 3. Declaration Periodicity

-

Specify the period of the declaration. Values are:

Blank: Annual

M: Month

T: Quarter

- 4. Declaration Period Number

-

Specify the quarter or month of the declaration. You complete this processing option only when you specify M (Month) or T (Quarter) in the Declaration Periodicity processing option. If you entered M in the Declaration Periodicity processing option, enter the number that corresponds with the month. For example, enter 1 for January, 2 for February, and so on.

If you entered T in the Declaration Periodicity processing option, enter the number that corresponds with the quarter. Values for quarters are:

1: January - March

2: April - June

3: July - September

4: October - December

- 5. Black List or San Marino

-

Enter 1 to generate the Multi-Purpose VAT Communication for the Black List Declaration, 2 to generate the Multi-Purpose VAT Communication for the San Marino Purchases Declaration, or leave this processing option blank to generate the Yearly List (Spesometro).

- 6. Company Activity Code

-

Specify an activity code from the ATECO 2007 activity codes list. You set up the activity codes in the Service Explanation Code (74Y/SX) UDC table.

- 7. Recap Document Type for Account Receivable

-

Specify the document type that you use for recap invoices.

- 8. Recap Document Type for Account Payable

-

Specify the document type that you use for recap vouchers.

- 9. Type of Supplier of the Declaration

-

Enter a value from the Type of Supplier (74Y/TS) UDC table to specify whether the report is submitted by the reporting company or by someone else. If you do not complete this processing option, the system uses a value of 0 (company). Values are:

0: Company

1: Intermediary - Declaration created by the company. If you use this value, you must also provide the intermediary information in the address book records so that the system can include required information in the file.

2: Intermediary -Declaration created by the intermediary. If you use this value, you must also provide the intermediary information in the address book records so that the system can include required information in the file.

5.3.3.2 Process

- 1. Threshold Amount to B2C Transactions without Invoice

-

Specify the threshold to which the system compares the amount of a business-to-consumer (B2C) transaction for a customer or supplier when no invoice exists for the transaction. The system compares the document gross amount to the threshold amount. The system applies this threshold to transactions assigned a document type that has a value of 4 in the Special Handling Code field of UDC 74Y/DT.

- 2. Threshold Amount to B2C Transactions with Invoice (Only Year 2012 and 2013)

-

Specify the threshold to which the system compares the amount of a business-to-consumer (B2C) transaction for a customer or supplier when an invoice exists for the transaction. The system compares the document gross amount to the threshold amount. The system applies this threshold to transactions assigned a document type that has a value of 1 in the Special Handling Code field of UDC 74Y/DT.

- 3. Process Detailed or Summarized

-

Enter 1 to process records in summary mode. Enter 0 in this processing option to process records in detailed mode. You must process in detailed mode to be able to print the audit report in detail. The San Marino Purchases Declaration must be processed and submitted in detailed mode.

- 4. Print Report in Detail or Summary

-

Enter 1 to print the audit report summary mode. Enter 0 in this processing option to print the audit report in detailed mode. You can print in detailed mode only when you leave the Process Detailed or Summarized processing option blank to process records in detailed mode.

- 5. Generate Text File (Y/N)

-

Enter Y (yes) to have the system run the Generate Text File program (R74Y062) to generate the text files for the declaration. When the system generates the text files, it populates the Text Processor Header table (F007101) and Text Processor Detail Table - 70 (F707111) with the record types that you must report.

Enter N (no) to suppress the creation of the text files.

- 6. Lines Quantity BY FILE

-

Enter the maximum number of lines permitted in a file. If the file size generated by the system exceeds the number you enter, then the system splits the file into multiple files.

- 7. Purge (Y/N) - Default N

-

Enter Y (yes) to purge the workfiles used by the Multi-Purpose VAT Communication program (R74Y060).

- 8. Max. Amount to check box control

-

Specify the amount that will cause the system to indicate in record type D that the amount reported in the declaration exceeds the amount entered here.

- 9. Type of Upload

-

Enter a value from the Type of Upload (74Y/TU) UDC table to specify the type of declaration. If you do not complete this processing option, the system uses a value of 0 (standard declaration). Values are:

0: Standard declaration

1: In Substitution

2: Cancellation - 10. Electronic Code

-

If you filed a previous declaration for the period, enter the electronic code that the government assigned to the previous declaration that you filed for the same reporting company. You complete this processing option only when you enter 1 or 2 in the Type of Upload processing option.

- 11. Internal Declaration Number

-

If you filed a previous declaration for the period, enter the document number that the government assigned to the previous declaration that you filed for the same reporting company.

- 10. Report By Country - Country Company Information

-

Specify the country that the system uses to retrieve the company address number from the Address Number for Tax Reports program (P00101). Leave this processing option blank to prevent country processing.

- 10. Report By Country - Tax Rate/ Area Processing

-

Enter1 to enable an additional filter to exclude the tax rate/areas which were not identified for the country in the Alternate Tax Rate/Area by Country program (P40082). You complete this processing option only when you enter a value in the Country Company Information processing option. Leave this processing option blank to prevent the additional filtering.

5.3.3.3 Phone Types

- 1. Phone Type

-

Enter a code from the Phone Type (01/PH) UDC table to specify the phone type.

- 2. Fax Type

-

Enter a code from the Phone Type (01/PH) UDC table to specify the phone type.

5.3.3.4 Third Party

- 1. Third party foreign taxpayer ID

-

Enter 1 or leave this processing option blank to use the Partita IVA tax ID (F0101.TAX), or enter 2 to use the Codice Fiscale tax ID (F0101.TX2).

- 2. Third party foreign VAT Reg Number

-

Enter 1 or leave this processing option blank to use the Partita IVA tax ID (F0101.TAX), or enter 2 to use the Codice Fiscale tax ID (F0101.TX2).

5.4 Generating the Black List Declaration

This section provides an overview of the Black List Declaration and discusses how to set processing options to generate the Black List Declaration.

5.4.1 Understanding the Black List Declaration

The Ministry of Economy and Finance requires that companies doing business with customers or suppliers that are residents of or have a permanent address in the Italian black list countries report the VAT (value-added tax) transactions that they generate. You must report these transactions monthly or quarterly.

The Multi-Purpose VAT Communication must report these types of payables and receivables transactions for the Black List Declaration:

-

Taxable.

-

Non-taxable.

-

Exempt.

-

Transaction not subject to VAT.

-

Adjustment notes.

5.4.1.1 Record Selection

|

Note: The JD Edwards EnterpriseOne software for Italy supports the completion of the fields required for tax payers that are companies. The software does not complete the fields in the text file when the tax payer is an individual. |

You run the Multi-Purpose VAT Communication program (R74Y060) to generate Multi-Purpose VAT Communication for the Black List Declaration. The program uses these processing options to determine the records to select for processing:

-

Declaration Year

-

Declaration Periodicity

-

Declaration Period Number

For transactions included in the data selection, the program refines the dataset using these factors:

-

The country or country/tax rate area of the transaction record is set up in the Black List Setup by Country Tax Area table (F74Y010).

If you set the Report By Country processing option to enable country processing, the system uses the alternate tax rate/area as set up in the Alternate Tax Rate/Area Assignment Constant program (P001001) and the Alternate Tax Rate/Area Definition program (P40081).

-

The invoice or voucher is posted and has a batch type of IB, V, or W.

-

A record for the transaction exists in the Taxes table (F0018).

-

The transaction is defined in the Additional Information Yearly table (F74Y3016) as one to be included in the Black List Declaration.

-

The invoice or voucher date is within the time period you specify in the processing options.

-

The customer or supplier is a legal entity located in a black list country.

5.4.1.2 Additional Validations

The program performs additional validations. If an error occurs, the system prints a message on the audit report, sends a message to the Work Center, and does not continue processing records.

The additional validations are:

-

Company address book number exists and is located.

-

Company tax ID exists and is located.

-

Software house tax ID exists and is located.

-

Address book information is valid.

-

Intermediary information exists and is located.

5.4.1.3 Text File

You set a processing option to specify whether to generate the text files. Oracle recommends that you run a version of the Multi-Purpose VAT Communication program (R74Y060) without setting the processing option to generate the text file so that you can review records in the audit report before you run a version of the program that generates the text files. You set a processing option in the Multi-Purpose VAT Communication program to generate the Multi-Purpose VAT Communication for the Black List Declaration.

5.4.1.4 Purge Records

The Multi-Purpose VAT Communication program includes a processing option that you can set to purge the records in the Yearly List Summarized Workfile (F74Y060) and Yearly List Detail Workfile (F74Y061).

5.4.1.5 Process to Generate the Black List Declaration

Follow these steps to generate the Black List Declaration:

-

Complete the setup:

-

Set up UDCs.

See Section 3.4.4, "Setting Up UDCs for the Multi-Purpose VAT Communications (Release 9.1 Update)"

-

Associate tax rate/areas with countries.

See Section 3.9, "Associating Countries with Tax Rate Areas for VAT Reports"

-

Set up company information.

See Section 3.12, "Entering Address Book Information for a Tax Reporting Entity"

-

Set up supplier and customer information.

See Section 3.13, "Entering Address Book Information for Customers and Suppliers in Italy"

-

-

Enter and post invoices, vouchers, and corrections to invoices and vouchers.

-

Add classifying information to transactions.

See Section 5.2, "Classifying Transactions for Declarations"

-

Generate an audit report to review the transactions to include in the electronic file.

You can generate the audit report in a detailed or summary mode. Oracle recommends that you use the audit report to review the transactions before you generate the text file.

-

Generate the text file.

You set a processing option in the Multi-Purpose VAT Communication to generate the text file.

-

Use Text File Processor program (P007101) to copy the files to the media that you use to submit the electronic file.

-

Purge files.

5.4.2 Setting Processing Options to Generate the Black List Declaration

You run the Multi-Purpose VAT Communication program (R74Y060) to generate the Black List Declaration.

See Section 5.3.2, "Running the Multi-Purpose VAT Communication Program (R74Y060)"

You set the processing option in the Multi-Purpose VAT Communication program to specify values that the system uses as it processes records. You must use specific values in the following processing options to generate the Black List Declaration:

-

General tab

-

3. Declaration Periodicity = M (month) or T (quarter).

-

4. Declaration Period Number = 1-12 for monthly, or 1 - 4for quarterly.

If you entered M in the Declaration Periodicity processing option, enter the number that corresponds with the month. For example, enter 1 for January, 2 for February, and so on.

If you entered T in the Declaration Periodicity processing option, enter the number that corresponds with the quarter. For example, enter 1 for January -March, 2 for April - June, and so on.

-

5. Black List or San Marino = 1

-

-

Process tab

-

3. Process Detailed or Summarized = 1

-

4. Print Report in Detail or Summary = 1

-

5.5 Generating the San Marino Purchases Declaration

This section provides an overview of the San Marino Purchases Declaration and discusses how to set processing options to generate the San Marino Purchases Declaration.

5.5.1 Understanding the San Marino Purchases Declaration

You generate the San Marino Purchases Declaration to report on transactions in which you purchase goods or services from a resident of San Marino. You must report these transactions monthly in a detailed format.

The electronic declaration must report these types of payables and receivables transactions:

-

Taxable.

-

Non-taxable.

-

Adjustment notes.

|

Note: The JD Edwards EnterpriseOne software for Italy supports the completion of the fields required for tax payers that are companies. The software does not complete the fields in the text file when the tax payer is an individual. |

5.5.1.1 Record Selection

The system uses the country code of the supplier to determine whether the supplier is resident in San Marino.

The program uses these processing options to determine the records to select for processing:

-

Declaration Year

-

Declaration Periodicity

-

Declaration Period Number

5.5.1.2 Additional Validations

The program performs additional validations. If an error occurs, the system prints a message on the audit report, sends a message to the Work Center, and does not continue processing records.

The additional validations are:

-

Company tax ID exists and is located.

-

Software house tax ID exists and is located.

-

Address book information is valid.

-

Intermediary information exists and is located.

5.5.1.3 Text File

You set a processing option to specify whether to generate the text files. Oracle recommends that you run a version of the Multi-Purpose VAT Communication program (R74Y060) without setting the processing option to generate the text file so that you can review records in the audit report before you run a version of the program that generates the text files. You set a processing option in the Multi-Purpose VAT Communication program to generate the San Marino Purchases Declaration.

5.5.1.4 Purge Records

The Multi-Purpose VAT Communication program includes a processing option that you can set to purge the records in the Yearly List Summarized Workfile (F74Y060) and Yearly List Detail Workfile (F74Y061).

5.5.1.5 Process to Generate the San Marino Purchases Declaration

Follow these steps to generate the San Marino Purchases Declaration:

-

Complete the setup:

-

Set up UDCs.

See Section 3.4.4, "Setting Up UDCs for the Multi-Purpose VAT Communications (Release 9.1 Update)"

-

Associate tax rate/areas with countries.

See Section 3.9, "Associating Countries with Tax Rate Areas for VAT Reports"

-

Set up company information.

See Section 3.12, "Entering Address Book Information for a Tax Reporting Entity"

-

Set up supplier and customer information.

See Section 3.13, "Entering Address Book Information for Customers and Suppliers in Italy"

-

-

Enter and post invoices, vouchers, and corrections to invoices and vouchers.

-

Add classifying information to transactions.

See Section 5.2, "Classifying Transactions for Declarations"

-

Generate an audit report to review the transactions to include in the electronic file.

You can generate the audit report in a detailed or summary mode. Oracle recommends that you use the audit report to review the transactions before you generate the text file.

You generate the audit report by running the Multi-Purpose VAT Communication program.

-

Generate the text file.

You set a processing option in the Multi-Purpose VAT Communication program to generate the text file.

-

Use Text File Processor program (P007101) to copy the files to the media that you use to submit the electronic file.

-

Purge files.

5.5.2 Setting Processing Options to Generate the San Marino Purchases Declaration

You run the Multi-Purpose VAT Communication program (R74Y060) to generate the Multi-Purpose VAT Communication for the San Marino Purchases Declaration.

See Section 5.3.2, "Running the Multi-Purpose VAT Communication Program (R74Y060)"

You set the processing option in the Multi-Purpose VAT Communication program to specify values that the system uses as it processes records. You must use specific values in the following processing options to generate the San Marino Purchases Declaration:

-

General tab

-

3. Declaration Periodicity = M

-

4. Declaration Period Number = 1-12

Enter the number that corresponds with the month. For example, enter 1 for January, 2 for February, and so on.

-

5. Black List or San Marino = 2

-

-

Process tab

-

3. Process Detailed or Summarized = 0

-

4. Print Report in Detail or Summary = 0

-