10 Working With Electronic Accounting for Mexico (Release 9.1 Update)

This chapter contains the following topics:

-

Section 10.2, "Working With the Chart of Accounts (Catálogo)"

-

Section 10.4, "Working With the General Ledger Report (Pólizas)"

-

Section 10.5, "Working With the Auxiliary Ledger by Account Program (Auxiliar de Cuentas)"

10.1 Understanding Mexico Electronic Accounting

As part of the 2014 Mexican tax reform and its Tax Resolution for 2014 Electronic Media Accounting, companies in Mexico are required to maintain accounting records through electronic systems that can create XML format files with information about their transactions. You then report this information to the fiscal authorities by uploading these files to the Tax Administration Services (SAT) Internet portal, a government system provided by the Mexico Federal Tax Authority.

Taxpayers must be able to generate different types of XML files that include the following information:

- Catálogo (Chart Of Accounts):

-

Companies must report transactions using the company chart of accounts and the corresponding grouping code, according to the catalog published by the SAT. Taxpayers must send the initial chart of accounts to the fiscal authority one initial time before sending in the other XML files. After that, companies send the chart of accounts file only if there are any changes to the information submitted.

Companies are not required to store XML files previously submitted.

- Balanza (Trial Balance):

-

This file includes beginning balances, movements of the period (sum of debits and sum of credits) and ending balances of every one of the accounts of assets, liabilities, capital, results (revenues, costs, expenses), and off-balance sheet accounts.

Taxpayers must send the XML file to the fiscal authority every month.

- Pólizas (General Ledger Report):

-

Companies must be ready to report detailed information on accounting transactions over a specific period, including the documents used and specific information on checks and bank transfers, when applicable.

The regulations specify that certain companies are required to report this information periodically while others must present it only when they receive a direct request from the fiscal authorities.

- Auxiliar de Cuentas (Auxiliary Ledger by Account):

-

Companies must be ready to report detailed information about the balances and modifications of their auxiliary accounts or sub-accounts, when applicable.

The regulations specify that certain companies are required to report this information periodically while others must present it only when they receive a direct request from the fiscal authorities.

|

Note: For additional, detailed information about the content of the XML files that the system generates, you can access My Oracle Support and search for the article with the document ID 1994195.1, or by using this link: |

10.1.1 Understanding XML Files Generation

The system uses Oracle's BI Publisher (Business Intelligence Publisher) to produce all the required XML files. The system has different versions of the extractor process, which relate to different report definition templates to manage the data formatting process of the basic information.

The BI Publisher creates the XML files in a two-phase process:

-

Information extraction, generation, and data formatting

-

XSLT transformation

An Extensible Stylesheet Language Transformation (XSLT) is an .xsl script that maps an XML schema to another XML schema. The XML generation programs extract the required information and produce an XML schema that is mapped to the schema provided by the government fiscal authorities.

To generate the different XML files that comply with the output information and format required by the fiscal authorities, the system uses specific templates and report definitions. Review the relationships in the following table:

| Output | Batch Version Program | Version | Template | BI Publisher Report Definition |

|---|---|---|---|---|

| Chart of Accounts by Level XML File | R7009001 | ZJDE0001 | TP700901TS1 | RD700901A |

| Trial Balance XML File | R7009002 | ZJDE0001 | TP700902TS1 | RD700902A |

| General Ledger Report | R7009003 | ZJDE0001 | TP700903TS1 | RD700903A |

| Auxiliary Ledger by Account | R7009004 | ZJDE0001 | TP700904TS1 | RD700904A |

|

Note: Before you run the XML generation programs, verify that the BI Publisher setup is correct in your system.See Also |

10.1.2 Mexico Electronic Accounting Process

To work with the electronic accounting (e-accounting) process in Mexico you:

-

Set up your system with standard information for your general ledger accounts.

-

Set up a general ledger category code UDC table (09/xx) with the referential chart of accounts that the government publishes. Specify the account nature for each record.

-

Associate the accounts in your system to the codes that the fiscal authority specifies for reporting purposes.

The system collects the information and lists the accounts according to your category code setup.

See Setting Up Single Accounts for Mexico Electronic Accounting

-

Set up the processing options for the Chart of Accounts by Level program (R7009001) to use the category code for the referential chart of accounts.

See Setting Processing Options for the Chart of Accounts by Level Program (R7009001)

-

Generate the Catálogo XML file with the chart of accounts that your company uses.

In most cases, you run the Chart of Accounts by Level program (R7009001) only once. You are required to generate the XML file and submit it to the authorities again every time that the chart of accounts is modified.

See Running the Chart of Accounts by Level Program (R7009001)

-

Submit the chart of accounts XML file generated by the system to the fiscal authorities.

-

Generate the Balanza XML File.

Companies are required to submit this file every month. This report includes a summary of the balances of the accounts for assets, liabilities, capital, and results accounts (revenues, costs, expenses).

-

Submit the trial balance XML file generated by the system to the fiscal authorities.

Companies are required to generate this file and submit it to the fiscal authorities on a monthly basis.

-

(When required) Enter the electronic invoice numbers of your transactions.

Note:

JD Edwards EnterpriseOne for Mexico Localizations does not support electronic invoice generation. You generate the electronic invoices with third-party systems and then import the electronic invoice numbers and associated information into JD Edwards EnterpriseOne. -

(When required) Generate the General Report XML file and the Auxiliary Ledger by Account Report to inform detailed information about your transaction records.

See Working With the General Ledger Report (Pólizas).

See Working With the Auxiliary Ledger by Account Program (Auxiliar de Cuentas).

-

(When required) Submit the General Ledger report and the Auxiliary Ledger y Accounts report XML files generated by the system to the fiscal authorities.

|

Note: Before you submit any of the Electronic Accounting for Mexico reports to the fiscal authorities, verify that there are no errors in the XML output file.For your convenience, JD Edwards EnterpriseOne for Mexico Localizations lists, at the end of the report, all the errors found during the XML generation and verification process. The information that appears in the XML output file describe the errors found in greater detail in comparison to the error codes that the messages in WorkCenter show. |

|

Important: Submitting the XML files to the fiscal authorities is a step of the process that takes place outside of the JD Edwards EnterpriseOne for Mexico Localizations system and processes. |

10.2 Working With the Chart of Accounts (Catálogo)

This section provides an overview of the setup for general ledger (GL) accounts for Mexico e-accounting; an overview of parent/child relationships and account group codes; and discusses how to:

-

Set up the referential chart of accounts in a general ledger UDC table.

-

Manually add an association between a GL account and a referential account entering the appropriate grouping code as a category code.

-

Set the processing options for the Chart of Accounts by Level Program (R7009001).

-

Run the Chart of Accounts by Level Program (R7009001).

10.2.1 Understanding the Setup to Work with the Chart of Accounts

The Mexican fiscal authorities publish the official chart of accounts that all companies must use when reporting accounting information. This referential chart of accounts assigns a code to each account and its level identifying parent/child relationships for reporting purposes. The format for the code uses numbers and periods.

You must set up the concepts and codes included in the official chart of accounts provided by the government in a user-defined code table. You use this UDC table to load the accounts and codes, and to identify the account nature of each record as A (Credit) or D (Debit).

Determine the best match in the referential grouping accounts for each of your existing general ledger accounts and create associations using the Review and Revise Accounts program (P0901). To create these associations you manually set up the single accounts entering the grouping code into the category code field for the UDC table created.

When you run the Chart of Accounts by Level program (R7009001) to generate the XML file, the system extracts the information from your general ledger records in the Account Master table (F0901) and generates an XML source file that can be transformed to the XML format specifications set by the fiscal authorities. This chart contains the details of each account, the level of the account in the chart and the parent account related.

The program also generates an output table for the Chart of Accounts by Level (F7009001). This table is required to generate all the electronic accounting XML reports.

10.2.1.1 Level of Detail

You determine the level of detail of your chart of accounts for electronic accounting reporting when you associate them to the referential chart of accounts using grouping codes. You can use many levels defining parent-child relationships between the accounts.

Despite the amount of levels that you define using grouping codes, you can use processing options to determine how many levels of detail the system includes in the output XML file that the Chart of Accounts by Level report generates.

For example, you can define a chart of accounts that includes 6 levels of accounts. If you set the Level of Detail processing option to use only two levels, then the output XML file that the Chart of Accounts by Level program generates only includes the level 1 title accounts and the level 2 accounts.

If you work with several business units, ensure that every account (Object.sub) is at the same level across all business units.

When you run the report, if the system finds posting accounts that are not associated directly to its parent title account within a business unit, then the output file lists the accounts found under the corresponding title account in the previous business unit (Business Unit.Object.Sub) listed.

|

Important: The Chart of Accounts by Level program generates table records that the system uses when you run the Trial Balance program. The level of detail that you define for the Chart of Accounts by Level report must be equal or greater than the level of detail that you set for the Trial Balance report. |

10.2.2 Forms Used to Work with the Chart Of Accounts (Catálogo)

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With Accounts | W0901H | Organization & Account Setup (G09411), Review and Revise Accounts. | Review and select object accounts by company. |

| Revise Single Account | W0901A | On the Work With Accounts form, select an account and click Select. | Use category codes to associate the government required grouping codes to the accounts in your company chart of accounts. |

| Account Translations | W0901K | Select a record on the Work With Accounts form, and then select Account Translations from the Row menu. | Add translated descriptions of the accounts into languages other than the base language. The output XML file of the Chart of Accounts by Level report shows the translated descriptions. |

10.2.3 Setting Up UDCs to Work With the Chart of Accounts

Set up this UDC before working with the chart of accounts for Mexico e-accounting.

10.2.3.1 Account Ledger Category Codes (09/xx)

Set up an account ledger category code with the grouping accounts in the referential chart that your company must report. Set up a system 09 category code UDC table record for every referential grouping code and account.

|

Note: Select a category code 21–43 in System 09, which allows you to enter up to 10 characters. |

The code must be identical to the grouping code specified by the fiscal authorities. Use the Special Handling Code field to specify the account nature for reporting purposes. Enter D for debit accounts and A for credit accounts.

Review the following example of records that you can set up:

| Code | Description | Special Handling Code |

|---|---|---|

| 102 | Banks | D |

| 102.01 | National Banks | D |

| 102.02 | Foreign Banks | D |

| 201 | Suppliers | A |

| 201.01 | National Suppliers | A |

| 201.02 | Foreign Suppliers | A |

You could set up this information in the 09/22 UDC table. In this example, the account Banks (Grouping Code 2) is a parent account to National Banks and Foreign Banks. It is the title account and is a non-posting account.

Ensure that you use the appropriate posting edit code and that you associate your posting accounts to referential posting accounts and title accounts to non-posting accounts.

10.2.3.2 Replaced Character - W3C Std (70/RC)

When you work with the electronic accounting reports in Mexico, any special characters in the XML files that you must submit to the fiscal authorities must be replaced according to the World Wide Web Consortium (W3C) Standards.Set up this UDC table to establish relationships between the special characters that you use in your accounts and that should be replaced (enter it in the Description 01 field), and the appropriate values assigned to those special characters in the W3C Standards list (enter that in the Description 02 field), which you can find in the W3 website.

JD Edwards EnterpriseOne software provides some hard-coded values for this UDC table that you can use as examples to set up the relationship records that meet the requirements of your company. Examples of these code values include:

| Code | Description 01 | Description 02 |

|---|---|---|

| 1 | & | & |

| 2 | " | " |

| 3 | < | < |

10.2.4 Setting Up Single Accounts for Mexico Electronic Accounting

You use the Accounts by Business Unit (P0901) program to associate the accounts in the chart of accounts of your company to the referential chart provided by the government set up in the previous step.

Select the record for the account that you want to associate to the referential account.

In the tab Cat. Codes 21-30, Cat. Codes 31-40, or Cat. Codes 41-50, use the category code field (from 21 to 43) that relates to the UDC table created in the previous step. Enter the grouping code that identifies the referential grouping account for your GL account.

|

Important: The category code field number that you use to specify the grouping code for the accounts in the chart of accounts XML file, must match the one specified in the processing options for the Chart of Accounts by Level program (R7009001). |

For example, if you work with an account for the Bank of Mexico, select the record for the account in the Work With Accounts form and then enter the code 2.1 (for National Banks) in the category code field 22 (if you used the 09/22 UDC table to load the referential chart of accounts). Ensure that the processing option Account Category Code in the Accounts by Level program (R7009001) is set to 22.

Perform this task for each account that you want to report. The program includes only the accounts associated to a valid grouping code.

|

Note: If your company works with different charts of accounts for different business units, you must perform this association in all of the charts of accounts that the system should include in the final file that you submit to the government authorities. |

10.2.5 Setting Up Account Translation

You can set up your system to use translated account names in the reports you generate when you work with electronic accounting in Mexico.

Access the Account Translations form and select a code from the Language Preference Codes (01/LP) UDC table. In the Description field, enter the translated term that the system uses when working with electronic accounting reports for Mexico.

Before any translations become effective, a language code must exist at either the system level or in your user preferences.

See Setting Up User Display Preferences

The language preference codes work in conjunction with vocabulary overrides to select the correct language translation.

10.2.6 Setting Processing Options for the Chart of Accounts by Level Program (R7009001)

Processing options enable you to specify default processing values.

10.2.6.1 Default

- 1. Chart of Accounts Version Format

-

Specify the layout version that the system uses to generate the XML File. If you do not complete this processing option, the system uses 1.3

- 2. Contributor's Address Number

-

Specify the Address Book Number from which the system retrieves the Contributor's TAX ID of the company for which you are generating the report. This processing option is required and the address book record entered must be associated to a valid Tax ID.

10.2.6.2 Process

- 1. Start Period

-

Enter the "valid from" period for the Chart of Accounts that you are generating.

Values are:

01: January

02: February

03: March

04: April

05: May

06: June

07: July

08: August

09: September

10: October

11: November

12: December

13: Adjustments for final year-end balance

- 2. Start Year

-

Enter the "valid from" year for the Chart of Accounts that you are generating. The four-digit number must be a value higher than 2014.

- 3. Account Category Code (21-43)

-

Specify the Category Code that the system uses when reporting the Grouping Code. The system uses this code to reclassify the Chart of Accounts records.

- 4. Account Reporting Level (1...7)

-

Enter the number of account grouping levels that the system displays for reporting purposes. Valid values are 1 through 7; 1 being the highest summarization possible and 7 is the lowest.

- 5. Replace Pre-Defined Characters Using UDC 70/RC

-

Specify if the system automatically replaces the special characters listed in the W3C Std Replaced Character UDC table (70/RC) according to World Wide Web Consortium (W3C) Standards.

Blank: The system replaces the special characters.

1: The system does not replace special characters.

10.2.7 Running the Chart of Accounts by Level Program (R7009001)

Select General Accounting (G76M09), Electronic Accounting, Chart of Account by Level.

The program extracts the information for the accounts associated to a category code and includes the information in an XML file according to the format that the fiscal authorities require.

10.2.7.1 Naming Conventions for the Chart of Accounts XML File

You must manually rename the XML file that the system generates to meet the naming conventions requirements that the fiscal authority sets, before you submit it. For the Chart of Accounts XML file, the name contains:

-

The 12 or 13 characters for the Taxpayers Federal Register (RFC - Registro Federal de Contribuyentes) number of your company

-

The year (four digits) and the month (two digits) when you submit the file

-

XML type identification: Use CT for the Catalogo

-

Extension XML (.xml)

For example, if the RFC number of your company is 888888888888 and you are submitting a Chart of Accounts XML file for July of 2015, the name of the file should be 888888888888201507CT.XML.

Ensure that both the XML file generated and the compressed ZIP file that you submit, comply with the naming convention requirements.

10.3 Working With the Trial Balance (Balanza)

This section provides an overview of the trial balance XML file, lists prerequisites, and discusses how to generate the trial balance XML file.

10.3.1 Understanding the Trial Balance XML File Generation

The trial balance report is an XML file that companies must submit to the fiscal authorities every month. It includes a summary of the initial balances, the sum of total transactions for the period, and the final balances for each of the accounts that the taxpayer reports in the chart of accounts XML file. The accounts related to assets, liabilities, equity, and results of operations (revenues, costs and expenses) must be included.

The heading information of the output XML file includes the layout version, the taxpayer RFC number, and the period and year when the file is generated.

The system generates a record for every account. The record includes the account number, the initial balance at the beginning of the period, the total amount of debits, the total of the credits, and the resulting final balance, that is calculated by the program. The report displays information that includes the relationship between parent accounts or title accounts, and the single accounts that are grouped under each parent or title account. The system calculates the initial balance, credits, debits, and final balance for the grouping accounts too, summarizing the information of all the accounts included in the group.

The report identifies the tax accounts, when applicable, with the appropriated rates, quotas, exempt activities, and also transferred taxes and creditable taxes. For final year-end balances, companies must also include information on recorded tax adjustments.

If you need to add or modify information for a period that was submitted, you can use processing options to generate a complementary declaration report by running the Trial Balance program again. The new XML file identifies the declaration as complementary and includes the date of the last modification.

10.3.1.1 Level of Detail

Regardless of the amount of levels that you define for the Chart of Accounts by Level program, you can use processing options to determine how many levels of detail the system includes in the output XML file that the Trial Balance report generates.

The report processes all the account levels but only displays the levels selected. The system summarizes the data for the levels that are not displayed and includes the balances into the information for the accounts in the levels shown.

For example, you can define a chart of accounts that includes 6 levels of accounts. If you set the Account Reporting Level processing option to use only two levels, then the output XML file that the Trial Balance program generates includes only the level 1 title accounts and the level 2 accounts. Every level 2 account displayed sums up the totals of the child accounts related to the level 2 account.

|

Important: The Chart of Accounts by Level program generates table records that the system uses when you run the Trial Balance program. The level of detail that you define for the Chart of Accounts by Level report must be equal or greater than the level of detail that you set for the Trial Balance report. |

10.3.2 Prerequisites

Before you complete the task in this section:

-

Verify that the value in the Localization Country Code field in the User Profile Revisions program (P0092) is set to MX (Mexico).

-

Verify that a current version of the chart of accounts (Catálogo XML) has been submitted to the fiscal authorities.

10.3.3 Setting Processing Options for the Trial Balance Program (R7009002)

Processing options enable you to specify default processing values.

10.3.3.1 Default

- 1. Trial Balance Version Format

-

Specify the layout version that the system uses to generate the XML File. If you do not complete this processing option, the system uses 1.3

- 2. Contributor's Address Number

-

Specify the Address Book Number from which the system retrieves the Contributor's TAX ID of the company for which you are generating the report. This processing option is required and the address book record entered must be associated to a valid Tax ID.

10.3.3.2 Process

|

Note: (Release 9.1 Update) When you enter the amount value, the JD Edwards EnterpriseOne system allows a maximum of 15 digits and 2 decimals only. |

- 1. Electronic Accounting Presentation Period

-

Select a value for the Period Number UDC (70/PN) table to specify the period for the electronic accounting reports that you are generating.

Values are:

01: January

02: February

03: March

04: April

05: May

06: June

07: July

08: August

09: September

10: October

11: November

12: December

13: Adjustments for final year-end balance

- 2. Electronic Accounting Presentation Year

-

Enter the year for the electronic accounting reports that you are generating. The four-digit number must be a value higher than 2014.

- 3. Account Reporting Level

-

Enter the number of account grouping levels that the system uses for reporting purposes. Valid values are 1 through 7; 1 being the highest summarization possible and 7 is the lowest.

If you leave this processing option blank, the system uses 7.

See Level of Detail.

- 4. Declaration Type

-

Select a value from the Balance Declaration Type UDC table (70/DE) to identify the type of declaration that you are generating. Valid values are:

N: Normal

C: Complementary

If you leave this processing option blank, the system generates the declaration using the N (Normal) declaration type.

- 5. Last Modified On

-

Enter the date of the last modification of the balance sheet. You use this processing option when you generate a complementary trial balance declaration

If you leave this processing option blank, the report uses the system date.

10.3.4 Running the Trial Balance Program (R7009002)

Select General Accounting (G76M09), Electronic Accounting, Trial Balance.

10.3.4.1 Data Selection

You can run this program using one or several ledger types. If you select different ledger types, the system creates and displays records for the accounts in all the ledger types selected and sums up the amounts into a single record.

If you run the program to generate the report for a specific business unit (MCU), you must choose the selection criteria Business Unit (F0901) (MCU) and not the Business Unit (F0902) (MCU) option. The process uses both tables when it processes the information for the report but to filter by a specific business unit, it uses the table F0901.

10.3.4.2 Naming Conventions for the Trial Balance XML File

You must manually rename the XML file that the system generates to meet the naming conventions requirements that the fiscal authority sets, before you submit it. For the General Ledger Report XML file, the name contains: For the Trial Balance XML file, the name contains:

-

The 12 or 13 characters for the RFC number

-

The year (four digits) and the month (two digits)

-

XML type identification: Use BN for the Trial Balance (Balanza) file. Use BC for an amendment version of the Trial Balance file (Balanza Complementaria).

-

Extension XML (.xml)

For example, if the RFC number of your company is 888888888888 and you are submitting a Balanza XML file for July of 2015, the name of the file should be 888888888888201507BN.XML.

Ensure that both the XML file generated and the compressed ZIP file that you submit, comply with the naming convention requirements.

10.4 Working With the General Ledger Report (Pólizas)

This section provides an overview of the general ledger report and the required setup, list prerequisites, and discusses how to:

-

Set up required user defined codes (UDC) tables.

-

Set up origin and destination bank accounts information.

-

Set the processing options for the General Ledger Report program (R7009003).

-

Run the General Ledger Report program (R7009003).

10.4.1 Understanding the General Ledger Report

Whenever the fiscal authorities require that your company presents detailed accounting records, you can use JD Edwards EnterpriseOne for Mexico Localizations to generate a report that includes the information required.

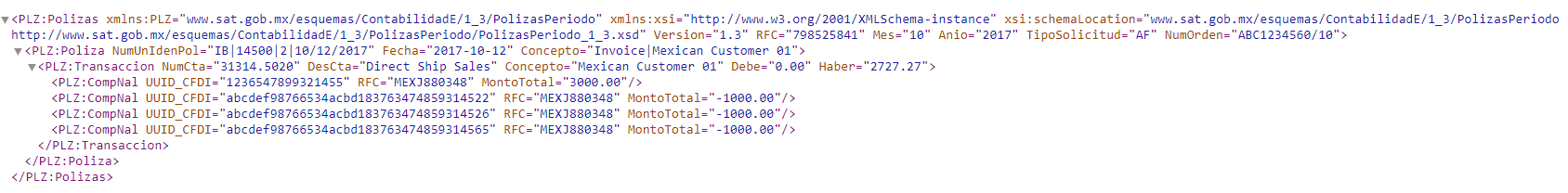

The file that you must present to the government is called Pólizas. A Póliza is a record or cluster of records that reflects posted operations where debits and credits are balanced out, and that relates to a document.

When you run the General Ledger Report program (R7009003), the system extracts detailed transaction information from the General Ledger table (F0911) for the period and year defined in the processing options.

The output XML file includes in its heading the layout version, the taxpayer RFC number, and the month and year when the file is generated. In the details, the system sums up the accounting information in journal entries. The program groups records in journal entries depending on how you set up the constants for Accounts Payable and Accounts Receivable: If the offset method for either is summarized by batch, the system identifies the journal entry by batch type and batch number; and if the offset method is detailed, the system identifies the journal entry by batch type, batch number, G/L date and document number.

The report also includes specifications on electronic invoice number and bank information details for the records that must report this data.

10.4.1.1 Bank Information

When reporting your accounting information in detail to the fiscal authorities, the regulations require that you follow specific instructions for the journal entries that involve bank operations.

The information that you provide about the banks involved in your transactions must be complete according to the standards set by the regulation.

To set up your system to report the required bank and bank account information, complete these tasks:

-

The Mexican fiscal authorities publish the official list of legal bank codes that all companies must use when reporting detailed accounting information for transactions that involve banks. This referential bank code list assigns a three-digits code to each bank.

You must set up the codes included in the official list provided by the government in a user-defined code table. Use Address Book Category Codes to enter the referential bank codes list.

-

After you load the code list, associate each of your address book entries for banks to the appropriate code.

See Associating Legal Bank Codes to Address Book Records for Banks.

-

Create associations for the bank account records that your company uses and the address book records linked to the legal bank codes with the G/L Bank Accounts program (P0030G).

-

Create associations for the third-party bank account records and the address book records linked to the legal bank codes using the Bank Accounts by Address program (P0030A).

10.4.1.2 Checks and Bank Transfers Information

Fiscal regulations in Mexico establish that when you report your accounting information, you must identify the payment method of your transactions.

When the payment method is a check or bank transfer, the system includes additional information that identifies that payment method:

-

For transactions associated to checks, the system includes the check number.

-

For transactions associated to bank transfers, the system includes the bank account number in the accounting record listed in the report.

You can set up your system to identify these transactions automatically according to the payment instrument used in your transactions.

10.4.1.3 Currency Information

When reporting your accounting information, you must identify the currency used in the transaction according to specific codes listed in the fiscal regulations.

You can set up your system to associate the internal currency codes that your company uses to the legal currency codes listed by the government.

10.4.2 Prerequisites

Before you complete the tasks in this section:

-

Verify that the value in the Localization Country Code field in the User Profile Revisions program (P0092) is set to MX (Mexico).

-

Verify that a current version of the chart of accounts (Catálogo XML) has been submitted to the fiscal authorities.

-

Post all the transactions for the period to the general ledger.

-

Enter the invoice number for all the transactions of the period.

-

Set up the UDCs required to work with the General Ledger report.

-

Complete the records for the banks and accounts that your company uses.

10.4.3 Setting Up UDCs to Work With the General Ledger Report

Set up these UDCs before working with Mexico e-accounting journals.

10.4.3.1 Address Book Category Codes (01/xx)

Set up an address book (system 01) category code UDC table by entering one record for every bank and its legal code listed by the government in the referential bank code list. The code must be identical to the bank code specified by the fiscal authorities.

|

Note: Select an unused category code from 01 to 30 in System 01. |

You must report if the bank involved in an operation is a national institution or if it is foreign. Use the Special Handling Code (SHC) field to specify it. Enter a 1 in the SHC field of every foreign bank record.

Review the following example of records that you can set up in the selected address book category code UDC table:

| Codes | Description 01 | Special Handling Code |

|---|---|---|

| 002 | BANAMEX | |

| 006 | BANCOMEXT | |

| 014 | Santander | |

| 044 | Scotia Bank | |

| 058 | BANREGIO |

10.4.3.2 Payment Instrument (70/PY)

Set up this UDC table to establish relationships between the codes that your company uses in the Payment Instrument UDC (00/PY) table and the values in the payment instrument catalog that the regulation assigns and publishes.

The code is the value assigned in the Payment Instrument UDC (00/PY) to a specific payment instrument. You can use the Description 01 field to enter a description of the code (the system does not use the information in this field). The data in the Description 02 field is the code listed in the catalog published by the government.

Set up the relationship records that meet the requirements of your company. For example, you can set up these record types:

| Codes | Description 01 | Description 02 |

|---|---|---|

| C | Checks | 2 |

| P | Printed Checks | 2 |

| T | Transfers of E-funds | 3 |

| E | Cash | 1 |

In this example, the first two lines associate the records that use a payment instrument C (for Checks) and a payment instrument P (for Printed Checks) according to the Payment Instrument UDC table (00/PY), to the value 2 (for Checks) in the Check/Bank Transfers Classification by Payment Instrument (70/PY) table. The third record associates the payment instrument T (for Transfer of Electronic Funds) in UDC 00/PY to the value 3 (for Bank Transfers) in the 70/PY UDC table. The last record associates the transactions that use a payment instrument of E (for Cash) to the catalog value 1 (for Cash).

Depending on the value used in the Description 02 field, the system classifies the payment into the following categories, that generate different nodes that extract and display different pieces of information:

-

Code 2: Checks

-

Code 3: Bank transfers

-

All other codes: Other method.

If the system does not find an association in this UDC table for the payment instrument used in a transaction, then the report assigns the code 98 (for Not Applicable) and reports the information for the record using the Other Method node.

10.4.3.3 Currency Code Reference (70/CC)

Set up this UDC table to establish relationships between the currency codes that your company assigns in the Work With Currency Codes and Rates program (P0013) and the currency codes published by Mexico fiscal authorities.

The code is the value assigned in the Payment Instrument UDC (00/PY) to a specific payment instrument. The information in the Description 01 field is the code that classifies that method as a check (C) or bank transfer (T).

Set up the relationship records that meet the requirements of your company. For example, you might set up these record types:

| Code | Description |

|---|---|

| ARG | ARP |

| DOL | USD |

| MXP | MXN |

In this example, the first record associates the records that use ARG as the currency code (for Argentinian currency) according to the Work With Currency Codes and Rates program (P0013) to the code ARP (for Argentinian pesos) in the Currency Code Reference UDC (70/CC) table. The second record associates the currency DOL (for Dollars) in P0013 to the code USD (for US Dollars) in the Currency Code Reference UDC (70/CC) table. The third record associates the payment instrument MXP (for Mexican Currency) in P0013 to the code MXN (for Mexican Pesos) in the Currency Code Reference UDC (70/CC) table.

|

Note: If the system does not find an association in this UDC table for the currency code used in a transaction, then the report lists the internal currency code defined in the Work With Currency Codes and Rates program (P0013).To prevent inaccuracies in the report, ensure that your unassigned internal currency codes do not match any currency codes published by the government. |

10.4.3.4 Document Type with UUID (70/DV)

Use this UDC table to list the codes that your company uses that must be associated to a legal document number UUID (universally unique identifier). The valid values for this UDC are the document type codes that you use in the Document Type UDC (00/DT) table.

When the system processes the payment information for transactions, it only gets the UUID number information for the document types listed in this UDC.

Set up the records that meet the requirements of your company. For example, you might set up these record types:

| Code | Description |

|---|---|

| PV | Voucher |

| RI | Invoice |

If a document listed is not associated to a UUID code, then the report includes a warning in the output file where the UUID number should appear.

10.4.4 Forms Used to Set Up the General Ledger Report

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With Addresses | W01012B | Daily Processing (G0110), Address Book Revisions. | Review and select existing address book records for banks. |

| Address Book Revisions | W01012A | On the Work With Addresses form, click Add, or select a record. | Complete the Bank Code category code field for all banks. |

| Work With G/L Bank Accounts | W0030GA | Automatic Payment Setup (G04411), Bank Account Information. | Review and select existing bank account records for your company. |

| Revise Bank Account Information | W0030GC | On Work With G/L Bank Accounts, select Bank Info from the Row menu. | Associate the account to the Address Book record identified with the legal bank code.

Specify the account number that the system uses when reporting accounting information. |

| Work With Bank Accounts By Address | W0030AD | Automatic Payment Setup (G04411), Bank Account Cross-Reference. | Review and select existing bank account records for third parties (customers, suppliers, and so on). |

| Set Up Bank Accounts By Address | W0030AA | On Work With Bank Accounts by Address, click Add.

To revise an existing bank account, select Revise from the Row menu. |

Associate the account to the Address Book record identified with the legal bank code.

Specify the account number that the system uses when reporting accounting information. |

10.4.5 Setting Up Bank Account Information

This section provides an overview of the origin and destination bank accounts setup, lists a prerequisite, and discusses how to:

-

Associate legal bank codes to internal Address Book records for banks.

-

Complete G/L bank accounts information.

-

Complete bank account information for third parties.

10.4.5.1 Prerequisite

Before you complete the tasks in this section:

-

Set up the Address Book category code UDC table with the referential legal bank code list.

10.4.5.2 Associating Legal Bank Codes to Address Book Records for Banks

You use the Address Book Revisions (P01012) program to associate the address book records for banks that your company uses, to the referential code list provided by the government set up in the previous section.

Select the record for the bank that you want to associate to the referential bank code list.

In the tabs for Category Codes, use the category code field (from 01 to 30) that relates to the UDC table created in the previous step. Enter the three-digit value that identifies legal bank code for your address book record.

|

Important: The category code field number that you use to specify the legal bank code must match the category code specified in the processing options for the General Ledger Report program (R7009003). |

For example, if you work with a record for the BANAMEX bank, select the record for that bank in the Address Book Revision form and then enter the code 002 (for BANAMEX) in the category code field 22 (if you used the 09/22 UDC table to load the referential legal bank code list). Ensure that the processing option Address Book Category Code in the General Ledger Report program (R7009003) is set to 22.

10.4.5.3 Completing G/L Bank Accounts Information

Access the Revise Account Information form.

Enter the address book number for the bank linked to the referential legal bank code in the Bank Address Number field. If the field is unavailable, clear the Bank Country Code field since the form only allows one of these two specifications per record.

Specify the bank account number that the system uses for reporting purposes. If the bank account number is left blank, the system uses the type of data that you specify in the processing options for the program.

You must perform this setup for all the bank account records that your company uses.

10.4.5.4 Completing Bank Account by Address Information

Access the Set Up Bank Account by Address form.

Enter the address book number for the Bank linked to the referential legal bank code in the Bank Address Number field. If the field is unavailable, clear the Bank Country Code field since the form only allows one of these two specifications per record.

Specify the bank account number that the system uses for reporting purposes. If the bank account number is left blank, the system uses the type of data that you specify in the processing options for the program.

You must perform this setup for all the bank account records that your company uses.

10.4.6 Setting Processing Options for the General Ledger Report Program (R7009003)

Processing options enable you to specify default processing values.

10.4.6.1 Default

- Accounting Report Version Format

-

Specify the layout version that the system uses to generate the XML File. If you do not complete this processing option, the system uses 1.3.

- Contributor's Address Number

-

Specify the address book number from which the system retrieves the Contributor's Tax ID of the company for which you are generating the report. This processing option is required and the address book record entered must be associated to a valid Tax ID.

- Declaration Type

-

Select a value from the Declaration Type UDC (70/DY) table to specify the reason for the declaration or the declaration type.

Examples of valid values are:

DE: Refund

FC: Mandatory Audit

- Order Number (Release 9.1 Update)

-

Specify the Order Number associated to the declaration when the declaration type is Audit Act (AF) or Mandatory Audit (FC). Enter the Order Number as follows:

[A - Z] - Enter the first 3 characters

[0 - 9] - Enter the next 7 digits

[0 - 9] - Enter the last 2 digits

- Request Number (Release 9.1 Update)

-

Specify the request number associated to the declaration when the declaration type is Refund (DE) or Compensation (CO). Enter the Request Number as follows:

[A - Z] - Enter the first 2 characters

[0 - 9] - Enter the next 12 digits

10.4.6.2 Process

|

Note: (Release 9.1 Update) When you enter the amount value, the JD Edwards EnterpriseOne system allows a maximum of 15 digits and 2 decimals only. |

- 1. Electronic Accounting Presentation Period

-

Select a value for the Period Number UDC (70/PN) table to specify the period for the electronic accounting reports that you are generating.

Values are:

01: January

02: February

03: March

04: April

05: May

06: June

07: July

08: August

09: September

10: October

11: November

12: December

13: Adjustments for final year-end reporting

- 2. Electronic Accounting Presentation Year

-

Enter the year for the electronic accounting reports that you are generating. The four-digit number must be a value higher than 2014.

- 3. Adjustments for Final Year-End Balance

-

Specify if the system includes the adjustments for final year-end balance or not.

Values are:

1: The system includes the adjustments (any records listed under accounting period 13 or 14) in the XML file.

Blank: The system does not include the adjustments.

Note:

The system only includes the adjustments in the XML file generated if this processing option is set to 1 and the Electronic Accounting Presentation Month is set to 12. - 4. Selection by Range Date

-

Specify the date range from which you want to select transactions.

From Date: Specify the beginning of the range of dates from which you want to select transactions.

Thru Date: Specify the end of the range of dates from which you want to select transactions.

- 5. Replace Pre-Defined Characters Using UDC 70/RC

-

Specify if the system automatically replaces the special characters listed in the W3C Std Replaced Character UDC table (70/RC) according to World Wide Web Consortium (W3C) Standards.

Blank: The system replaces the special characters.

1: The system does not replace special characters.

10.4.6.3 Bank Information

- 1. Address Book Category Code for Bank Code

-

Specify the Address Book Category Code that identifies the bank code. The system uses this code to associate bank address book records to the referential legal bank code list.

Valid values are 01 through 30.

- 2. Bank Account Number Type

-

Specify the method that the system uses when completing the bank account number used. Values are:

1: Bank account number or IBAN.

Blank: Bank transit number.

10.4.7 Running the General Ledger Report Program (R7009003)

Select Electronic Accounting (G76M09), Electronic Accounting, General Ledger Report.

10.4.7.1 Data Selection

You can run this program using one or several ledger types. If you select different ledger types, the system creates and displays records for the transactions recorded.

10.4.7.2 Naming Conventions for the Polizas XML File

You must manually rename the XML file that the system generates to meet the naming conventions requirements that the fiscal authority sets, before you submit it. For the General Ledger Report XML file, the name contains:

-

The 12 or 13 characters of the RFC number

-

The year (four digits) and the month (two digits)

-

XML type identification: Use PL for the General Ledger Report (Pólizas) file

-

Extension XML (.xml)

For example, if the RFC number of your company is 888888888888 and you are submitting a Pólizas XML file for July of 2015, the name of the file should be 888888888888201507PL.XML.

Ensure that both the XML file generated and the compressed ZIP file that you submit, comply with the naming convention requirements.

10.5 Working With the Auxiliary Ledger by Account Program (Auxiliar de Cuentas)

This section provides an overview of the auxiliary ledger by account report and the required setup, list prerequisites, and discusses how to:

-

Set the processing options for the Auxiliary Ledger by Account program (R7009004).

-

Run the Auxiliary Ledger by Account program (R7009004).

10.5.1 Understanding the Auxiliary Ledger by Account Program

Whenever the fiscal authorities require that your company presents detailed records about your accounts, you can use JD Edwards EnterpriseOne for Mexico Localizations to generate a report that includes the information required.

The name of the report that you must submit to the government is Auxiliar de Cuentas y Subcuentas or Auxiliary Ledger by Account.

When you run the Auxiliary Ledger by Account program (R7009004), the system extracts detailed account information from the Account Master (F0901), Account Balances (F0902), Account Ledger (F0911) and the Chart of Accounts by Level (F7009001) tables, for the period and year defined in the processing options, and groups it up by account.

The output XML file includes in its heading the layout version, the taxpayer RFC number, and the month and year when the file is generated, the declaration type, and the order or request number.

In the body of the report, the system generates one record per account. The node consists of an overview section and a detailed section. In the account overview, the system displays the account number and description (as it appears in the Chart of Accounts by Level report) and the initial and ending balances for the selected period. In the account details section, the system lists the posted transactions that affect the account during the selected period. Every line describes a specific transaction, including the transaction date, the identification code of the accounting record, a description of the accounting record and the applicable debit and/or credit amounts.

10.5.2 Prerequisites

Before you complete the tasks in this section:

-

Verify that the value in the Localization Country Code field in the User Profile Revisions program (P0092) is set to MX (Mexico).

-

Verify that a current version of the chart of accounts (Catálogo XML) has been submitted to the fiscal authorities.

-

Post all the transactions for the period to the general ledger.

10.5.3 Setting Processing Options for the Auxiliary Ledger By Account Program (R7009004)

Processing options enable you to specify default processing values.

10.5.3.1 Default

- Auxiliary Reports Version Format

-

Specify the layout version that the system uses to generate the XML File. If you do not complete this processing option, the system uses 1.3.

- Contributor's Address Number

-

Specify the address book number from which the system retrieves the Contributor's Tax ID of the company for which you are generating the report. This processing option is required and the address book record entered must be associated to a valid Tax ID.

- Declaration Type

-

Select a value from the Declaration Type UDC (70/DY) table to specify the reason for the declaration or the declaration type.

Examples of valid values are:

DE: Refund

FC: Mandatory Audit

- Order Number (Release 9.1 Update)

-

Specify the Order Number associated to the declaration when the declaration type is Audit Act (AF) or Mandatory Audit (FC). Enter the Order Number as follows:

[A - Z] - Enter the first 3 characters

[0 - 9] - Enter the next 7 digits

[0 - 9] - Enter the last 2 digits

- Request Number (Release 9.1 Update)

-

Specify the request number associated to the declaration when the declaration type is Refund (DE) or Compensation (CO). Enter the Request Number as follows:

[A - Z] - Enter the first 2 characters

[0 - 9] - Enter the next 12 digits

10.5.3.2 Process

|

Note: (Release 9.1 Update) When you enter the amount value, the JD Edwards EnterpriseOne system allows a maximum of 15 digits and 2 decimals only. |

- 1. Electronic Accounting Presentation Period

-

Select a value for the Period Number Auxiliary UDC (70/PA) table to specify the period for the electronic accounting reports that you are generating.

Values are:

01: January

02: February

03: March

04: April

05: May

06: June

07: July

08: August

09: September

10: October

11: November

12: December

- 2. Electronic Accounting Presentation Year

-

Enter the year for the electronic accounting reports that you are generating. The four-digit number must be a value higher than 2014.

- 3. Replace Pre-Defined Characters Using UDC 70/RC

-

Specify if the system automatically replaces the special characters listed in the W3C Std Replaced Character UDC table (70/RC) according to World Wide Web Consortium (W3C) Standards.

Blank: The system replaces the special characters.

1: The system does not replace special characters.

- 4. Adjustments for Final Year-End Balance

-

Specify if the system includes the adjustments for the year-end balance or not.

Values are:

1: The system includes the adjustments in the XML file.

Blank: The system does not include the adjustments.

Note:

The XML file that the system generates only includes the year-end adjustments if this processing option is set to 1 and if the Electronic Accounting Presentation Period field is set to 12 (December).

10.5.4 Running the Auxiliary Ledger by Account Program

Select Electronic Accounting (G76M0901), Auxiliary Ledger by Account.

10.5.4.1 Data Selection

You can run this program using one or several ledger types. If you select different ledger types, the system creates and displays records for the posted transactions in the selected ledger types.

If you run the program to generate the report for a specific business unit (MCU), you must choose the selection criteria Business Unit (F0901) (MCU) and not the Business Unit (F0902) (MCU) option. The process uses both tables when it processes the information for the report but to filter by a specific business unit, it uses the table F0901.

10.5.4.2 Naming Conventions for the Auxiliar de Cuentas XML File

You must manually rename the XML file that the system generates to meet the naming conventions requirements that the fiscal authority sets, before you submit it. For the Auxiliary XML file, the name contains:

-

The 12 or 13 characters of the RFC number

-

The year (four digits) and the month (two digits)

-

XML type identification: Use XC for the Auxiliary Ledger by Account (Auxiliar de Cuentas) file

-

Extension XML (.xml)

For example, if the RFC number of your company is 888888888888 and you are submitting an Auxiliary Ledger by Accounts XML file for July of 2015, the name of the file should be 888888888888201507XC.XML.

Ensure that both the XML file generated and the compressed ZIP file that you submit, comply with the naming convention requirements.