3 JD Edwards EnterpriseOne Accounts Receivable Reports

This chapter provides report navigation, overview information and a report sample for the following reports:

-

Section 3.1, "Batch Update for Multitiered A/R Report (R005142)"

-

Section 3.9, "Statistical Calculations by Company Report (R03B1691)"

-

Section 3.10, "Statistical Calculations by Credit Manager Report (R03B1692)"

-

Section 3.11, "Statistical Calculations by Collection Manager Report (R03B1693)"

-

Section 3.12, "A/R Delinquency Notices Print Report (R03B20)"

-

Section 3.14, "Tiered Delinquency Notice Print Report (R03B21)"

-

Section 3.20, "Open A/R Summary with Currency Report (R03B413B)"

-

Section 3.24, "Currency Detail - Foreign and Domestic Report (R03B429A)"

-

Section 3.26, "Currency - Foreign/Domestic with Aging Report (R03B429C)"

-

Section 3.28, "A/P and A/R Netting - Detail Report (R03B466)"

-

Section 3.29, "Receivables/Payables Netting - Summary Report (R03B450)"

-

Section 3.32, "Credit Card Statement Print Report (R03B5003)"

-

Section 3.33, "Statement/Notification Purge Report (R03B5010)"

-

Section 3.39, "Create Automatic Debit Batch Report (R03B571)"

-

Section 3.42, "Convert Unapplied Receipts to Credit Memos Report (R03B620)"

-

Section 3.46, "Draft Collection with Status Update Report (R03B680)"

-

Section 3.48, "A/R to Account Balance by Account ID Report (R03B707)"

-

Section 3.50, "General Ledger Post Report (Invoices) (R09801)"

-

Section 3.51, "General Ledger Post Report (Receipts) (R09801)"

|

Note: This reports guide discusses reports that are commonly used in the JD Edwards EnterpriseOne system. This reports guide does not provide an inclusive list of every report that exists in the system.This guide is intended to provide overview information for each report. You must refer to the appropriate JD Edwards EnterpriseOne implementation guide for complete report information. |

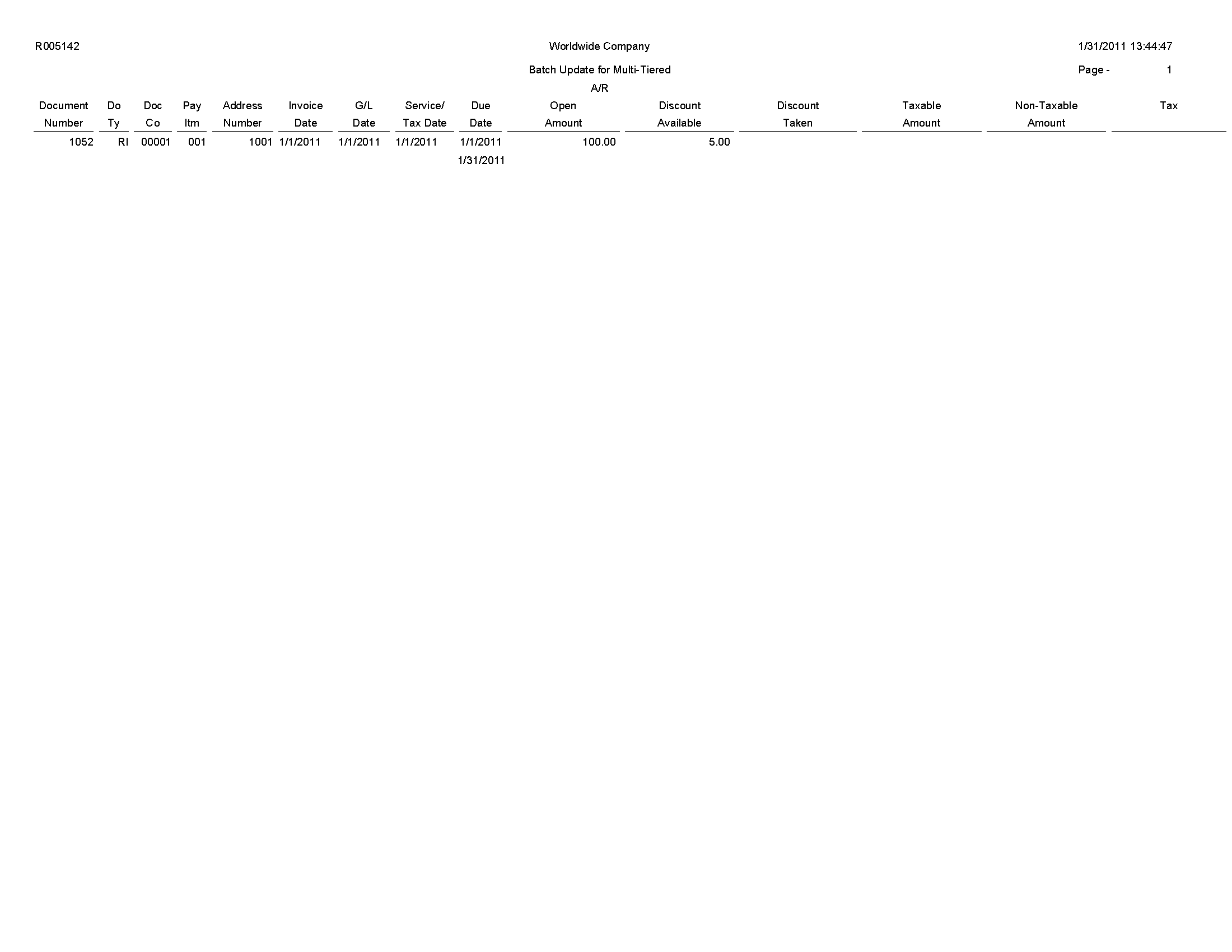

3.1 Batch Update for Multitiered A/R Report (R005142)

On the Payment Terms Revisions menu (G00141), select Update A/R Invoices.

Run this program to update the discount amount and discount due date on your invoices according to the tiers that you set up for the multitiered payment term that you assign to them.

Review the Batch Update for Multitiered A/R report (R005142):

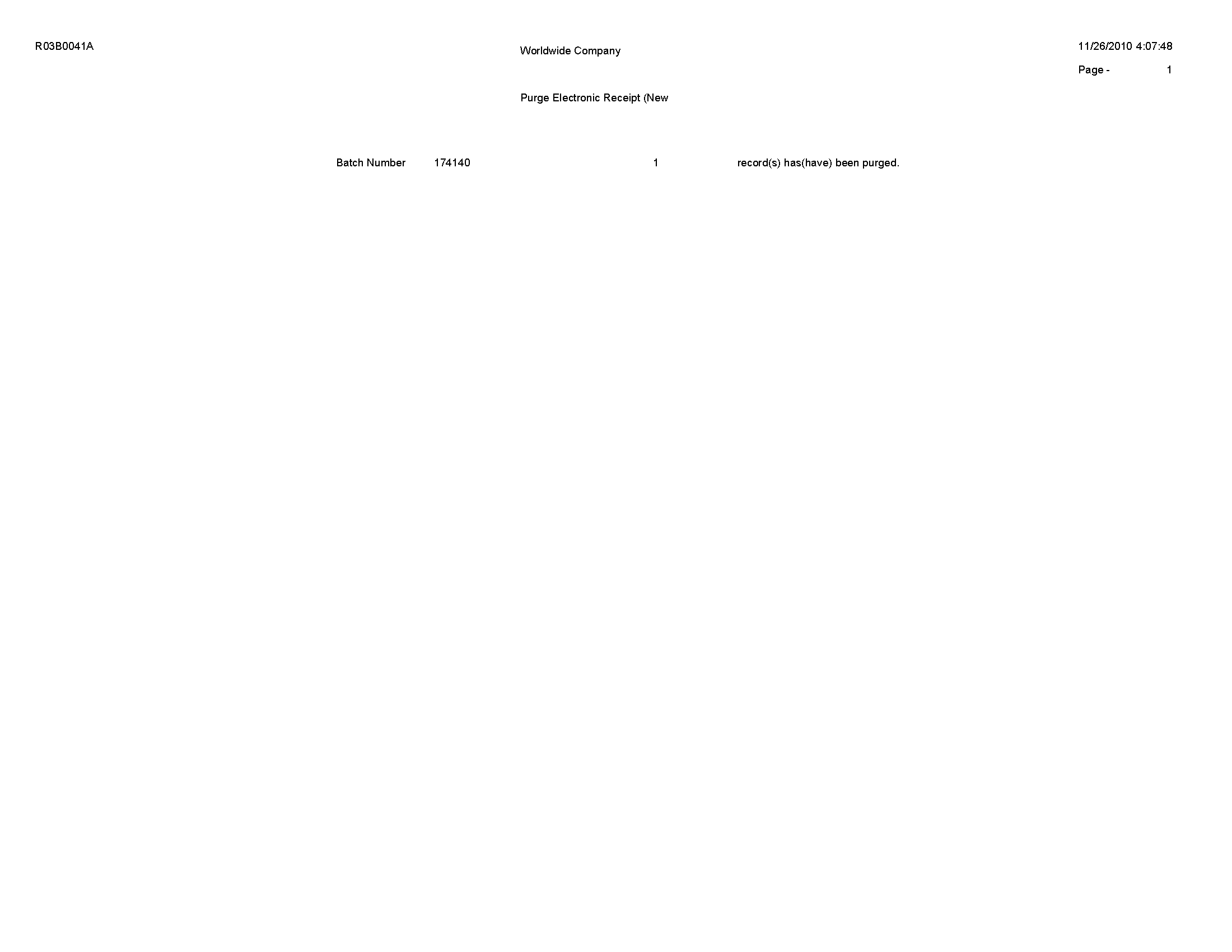

3.2 Purge Electronic Receipts Report (R03B0041A)

On the Automated Receipts Processing menu (G03B13), select Purge Electronic Receipts.

To improve processing time and conserve system disk space, purge the receipts that you transferred from the bank to the JD Edwards EnterpriseOne Accounts Receivable system. Purging electronic receipts removes records from the Electronic Receipts Input table (F03B13Z1) only.

Review the Purge Electronic Receipts report (R03B0041A):

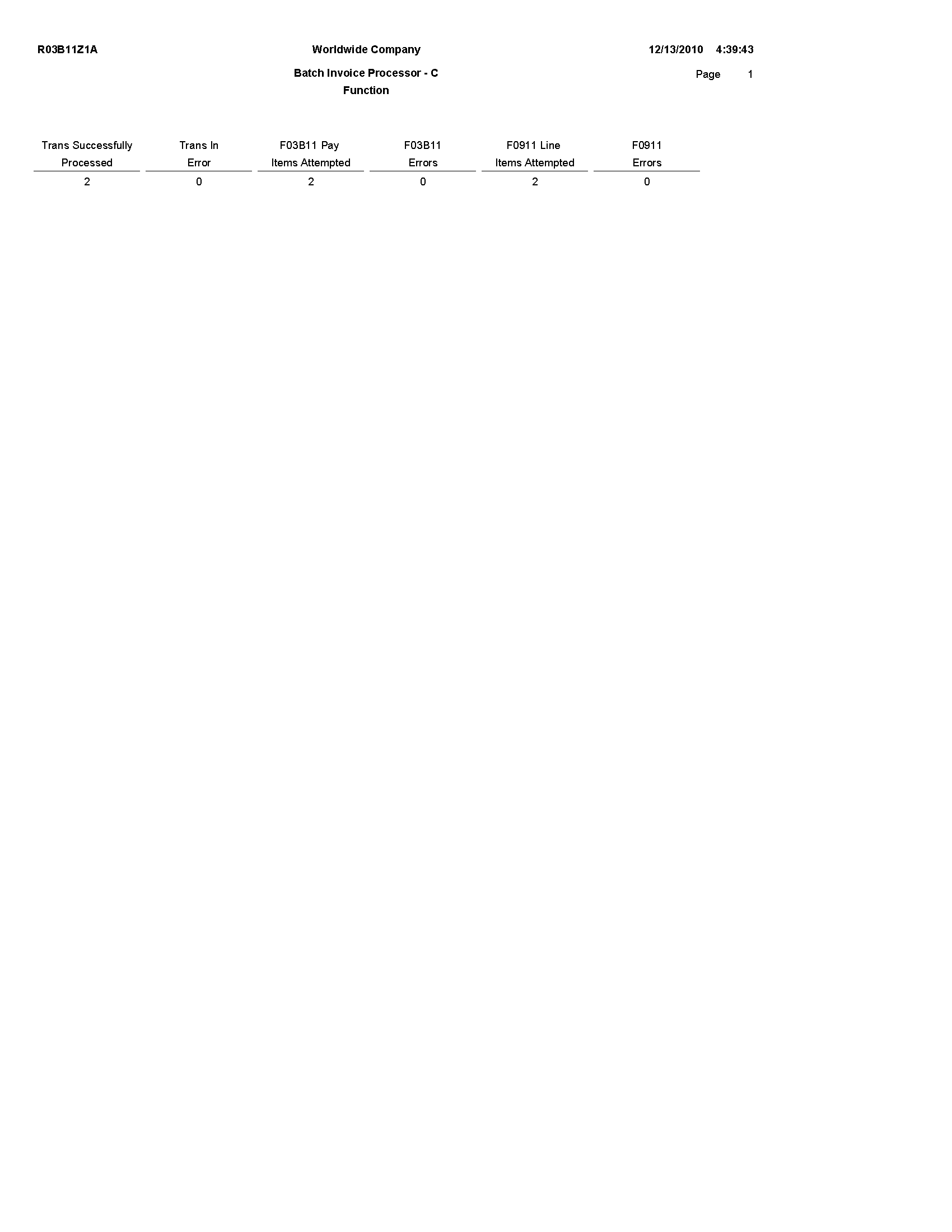

3.3 Batch Invoice Processor Report (R03B11Z1A)

On the Batch Invoice Processing menu (G03B311), select Batch Invoice Processor.

After you convert the external invoices and transfer them to the Batch Invoices (F03B11Z1) and Journal Entry Transactions - Batch (F0911Z1) tables, run this program to process the information from the batch tables and create records in the Customer Ledger (F03B11) and Account Ledger (F0911) tables.

Review the Batch Invoice Processor - C Function report (R03B11Z1A):

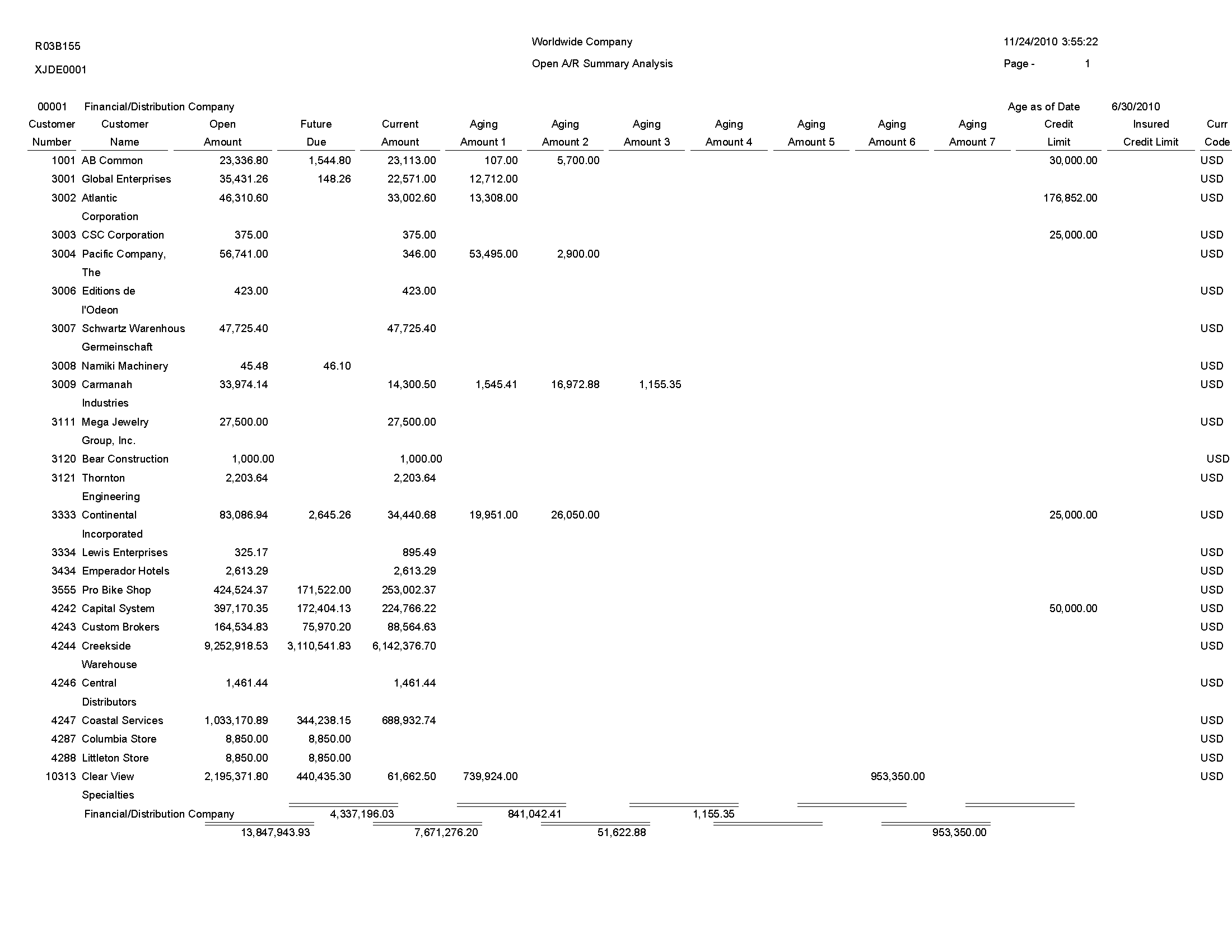

3.4 Open A/R Summary Analysis Report (R03B155)

On the Accounts Receivable Reports menu (G03B14), select Open A/R Summary Analysis.

Use this report to review a list of the status of customer accounts.

Review the Open A/R Summary Analysis report (R03B155):

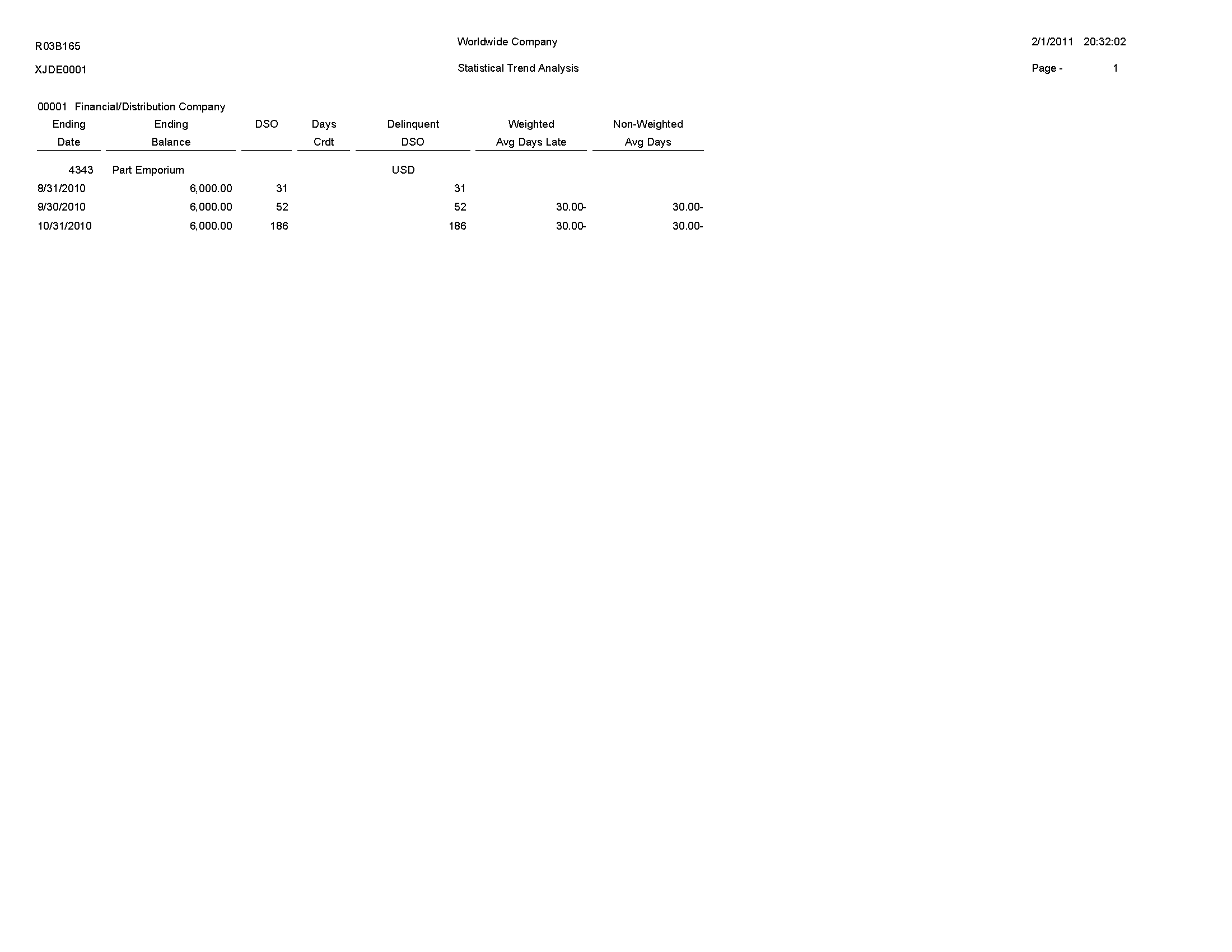

3.5 Statistical Trend Analysis Report (R03B165)

On the Accounts Receivable Reports menu (G03B14), select Statistical Trend Analysis.

Use this report to review customer trends within a specific period.

Review the Statistical Trend Analysis report (R03B165):

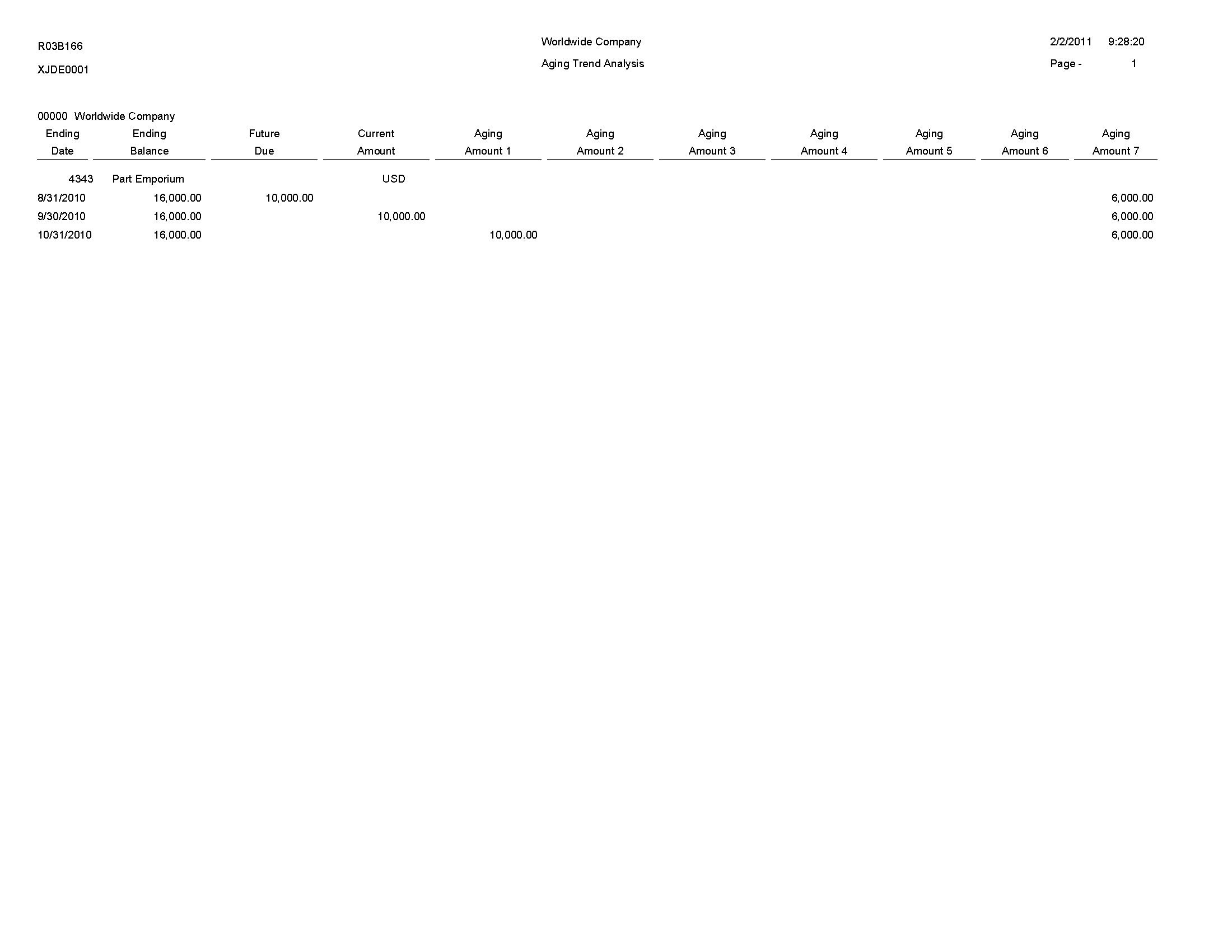

3.6 Aging Trend Analysis Report (R03B166)

On the Accounts Receivable Reports menu (G03B14), select Aging Trend Analysis.

Use this report to review customer payment trends over periods.

Review the Aging Trend Analysis report (R03B166):

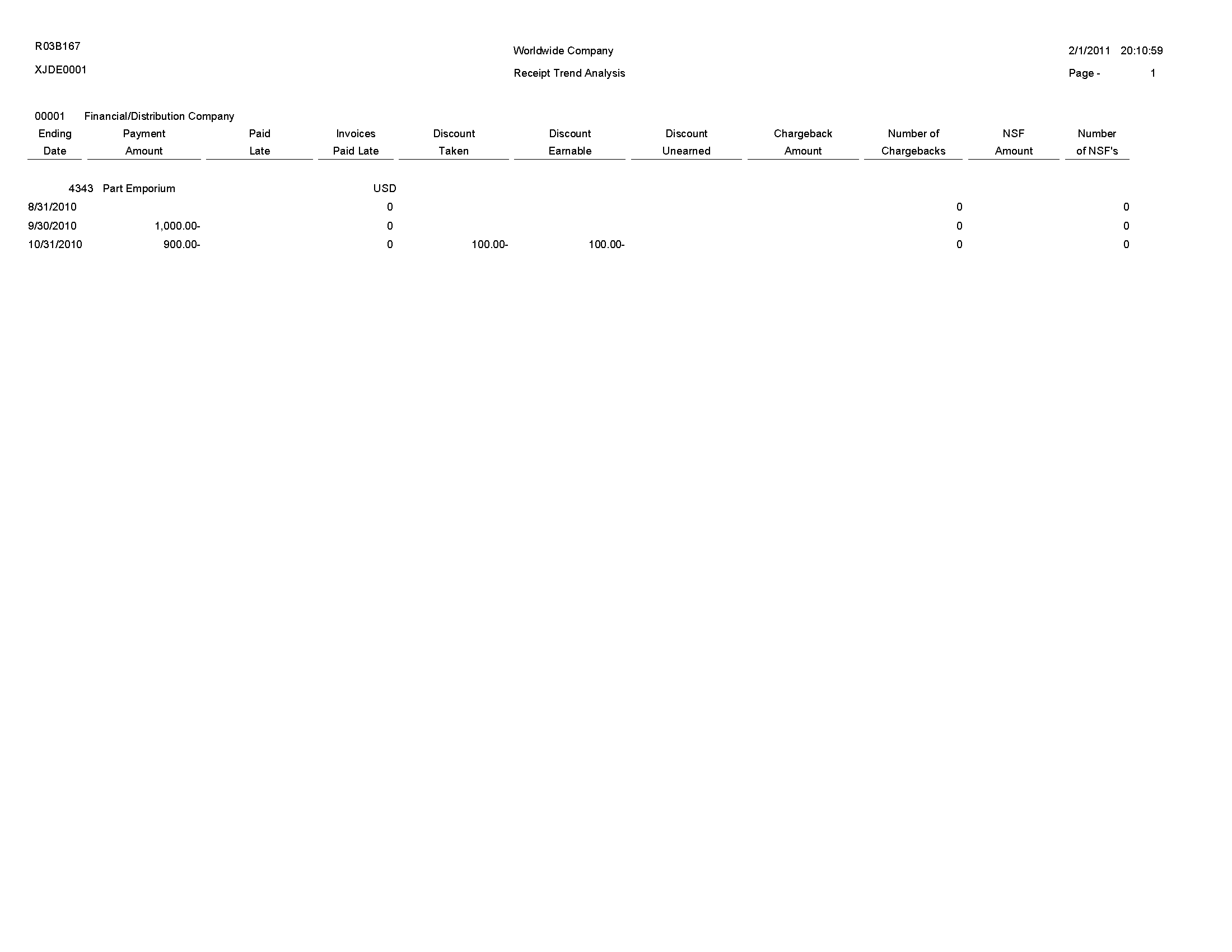

3.7 Receipt Trend Analysis Report (R03B167)

On the Accounts Receivable Reports menu (G03B14), select Receipt Trend Analysis.

Use this report to review the payment history of a customer within a specific period.

Review the Receipt Trend Analysis report (R03B167):

3.8 Invoice Trend Analysis Report (R03B168)

On the Accounts Receivable Reports menu (G03B14), select Invoice Trend Analysis.

Use this report to review the invoice history of a customer within a specific period.

Review the Invoice Trend Analysis report (R03B168):

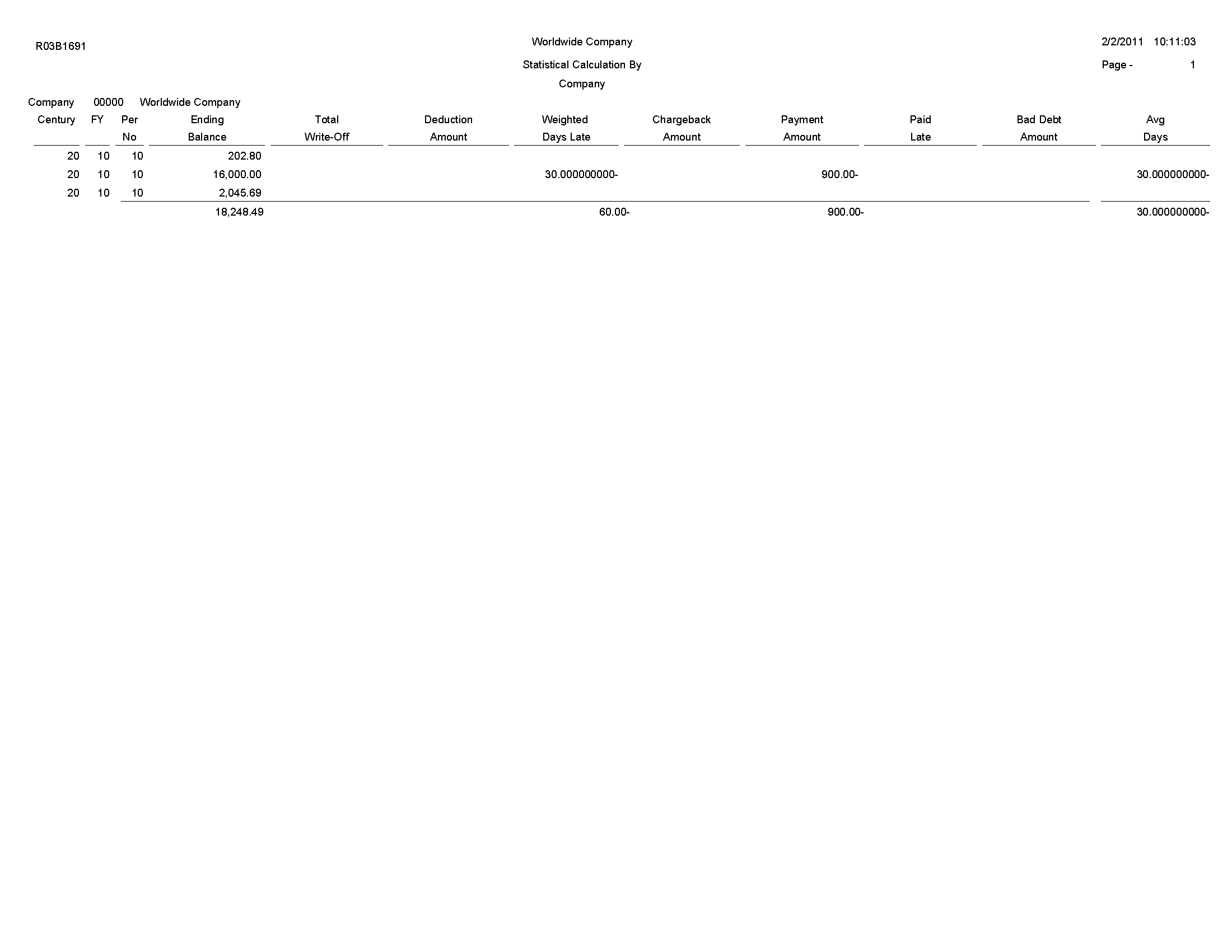

3.9 Statistical Calculations by Company Report (R03B1691)

On the Accounts Receivable Reports menu (G03B14), select Statistical Calculations by Company.

Use this report to review summarized period information by company from the A/R Statistical History table (F03B16).

Review the Statistical Calculations by Company report (R03B1691):

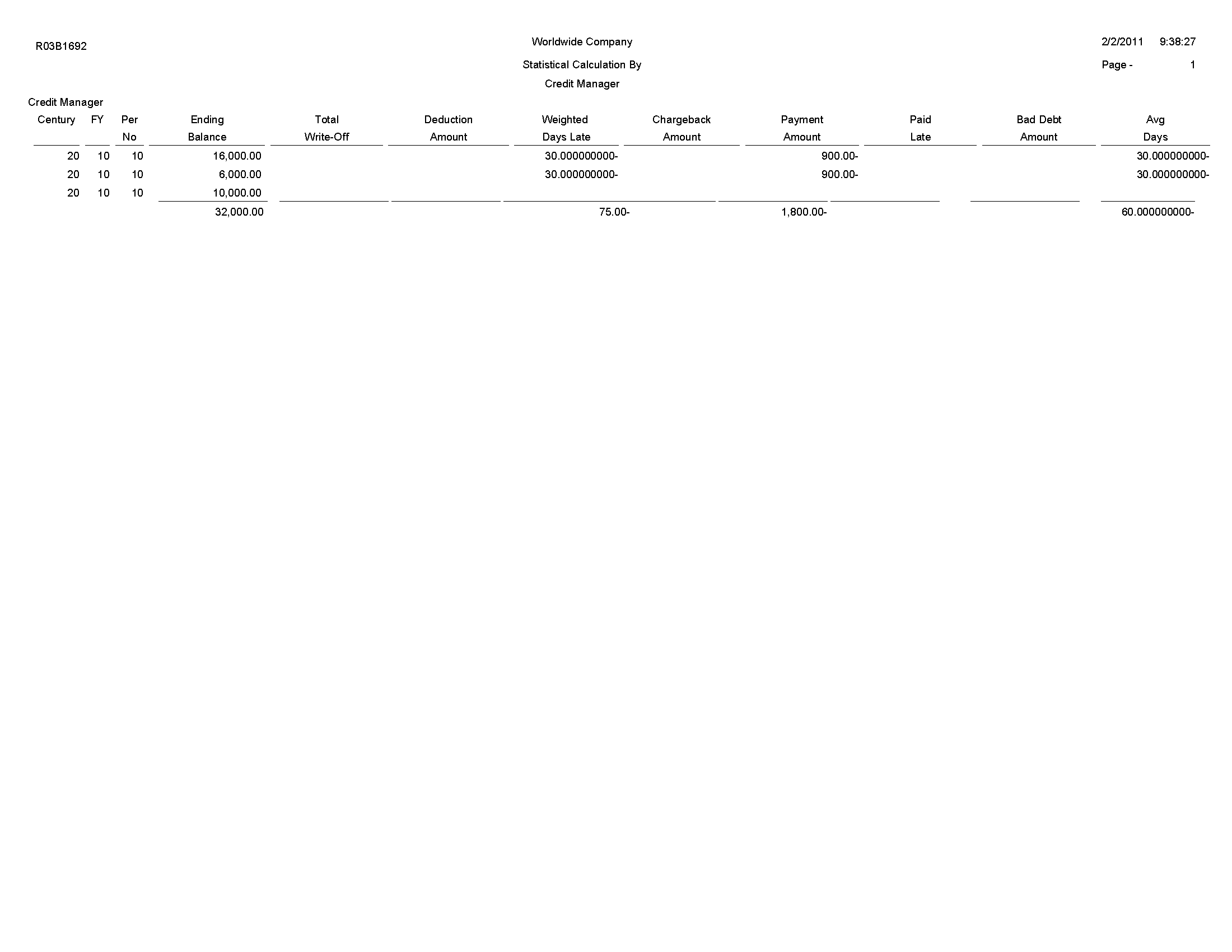

3.10 Statistical Calculations by Credit Manager Report (R03B1692)

On the Accounts Receivable Reports menu (G03B14), select Statistical Calculations by Credit Mgr.

Use this report to review summarized period information by credit manager from the A/R Statistical History table (F03B16).

Review the Statistical Calculations by Credit Manager report (R03B1692):

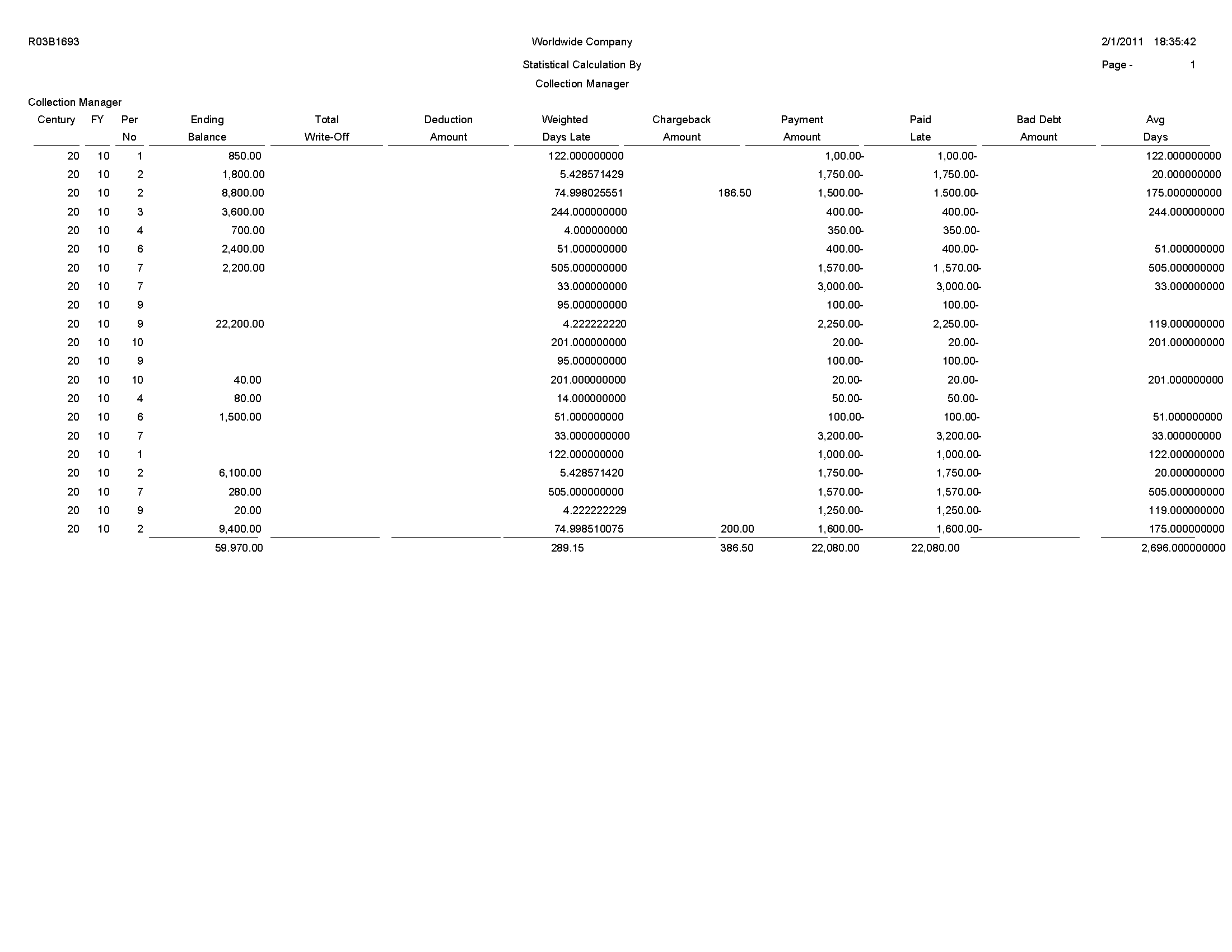

3.11 Statistical Calculations by Collection Manager Report (R03B1693)

On the Accounts Receivable Reports menu (G03B14), select Statistical Calculations by Collect Mgr.

Use this report to review summarized period information from the A/R Statistical History table (F03B16).

Review the Statistical Calculations by Credit Manager report (R03B1693):

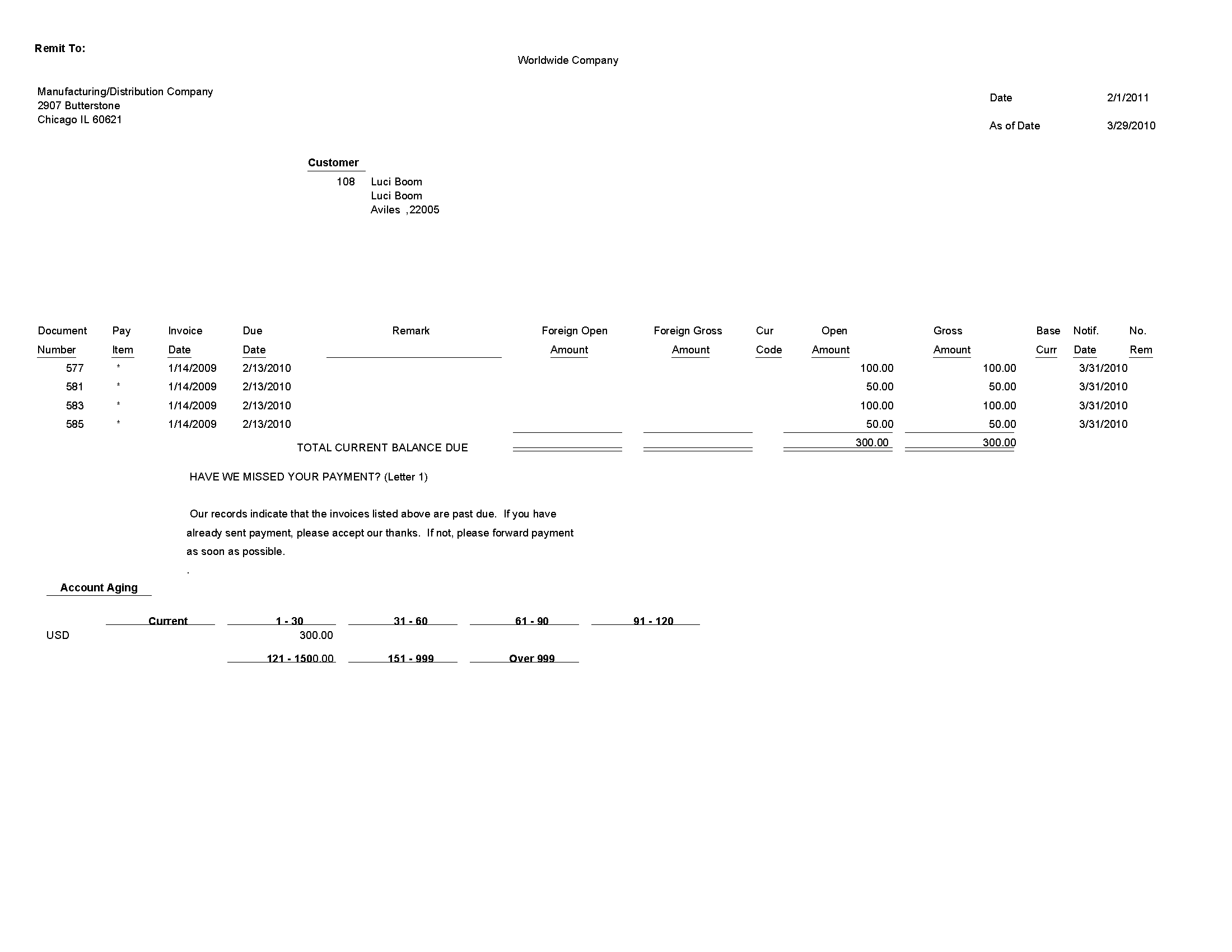

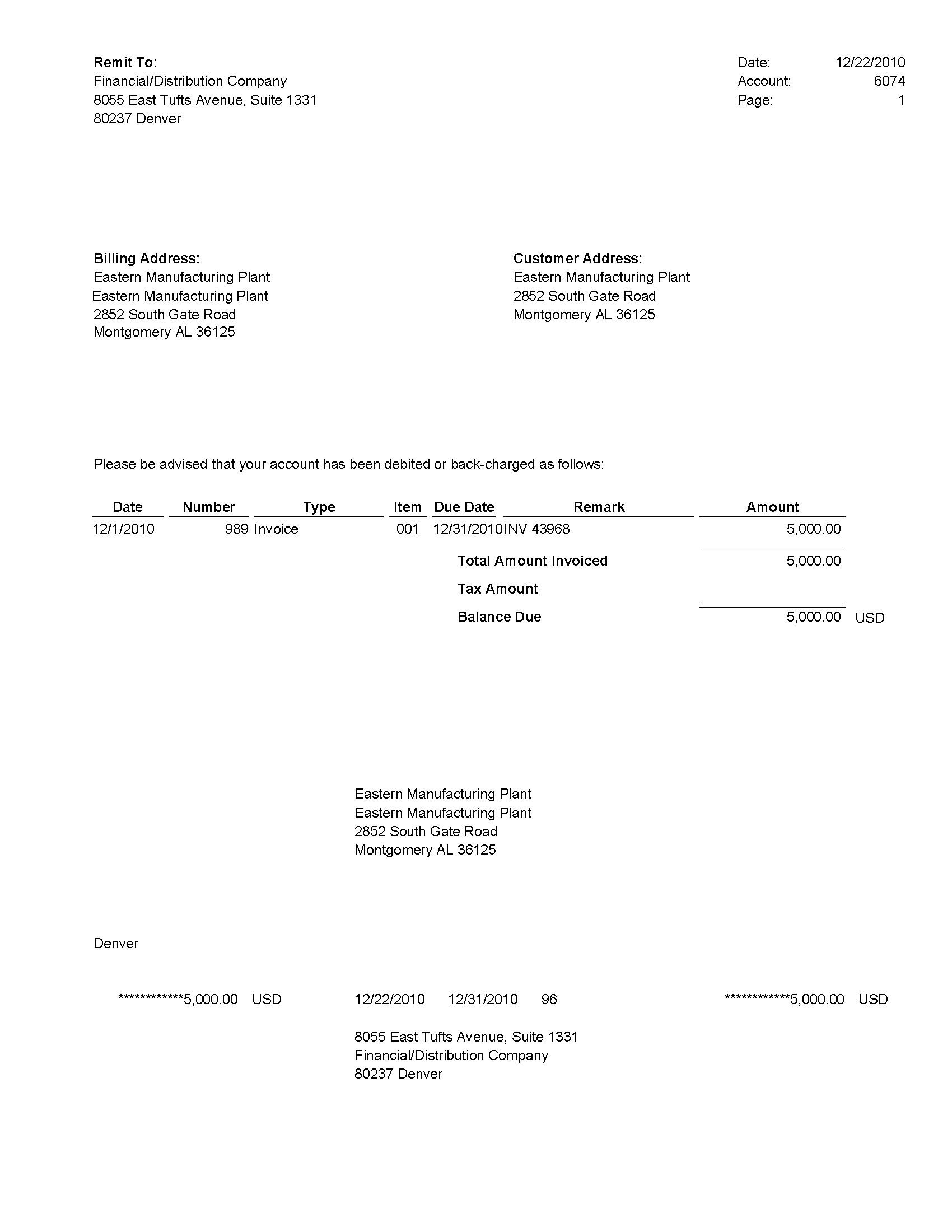

3.12 A/R Delinquency Notices Print Report (R03B20)

On the Statement Reminder Processing menu (G03B22), select Print Delinquency Notices. You can also use the Notice Print Program processing option in the Credit Analysis Refresh program (R03B525) to specify that the system runs this program.

Use this program to print delinquency notices. You can run this program in proof or final mode:

-

In proof mode, the system prints notices and designates them as proof. The system deletes the records that it temporarily generated to print the notices from the A/R Notification History (F03B20) and A/R Notification History Detail (F03B21) tables.

-

In final mode, the system prints notices and creates records in the F03B20 and F03B21 tables and updates fields on the invoice records in the Customer Ledger table (F03B11).

Review the output from the A/R Delinquency Notices Print report (R03B20):

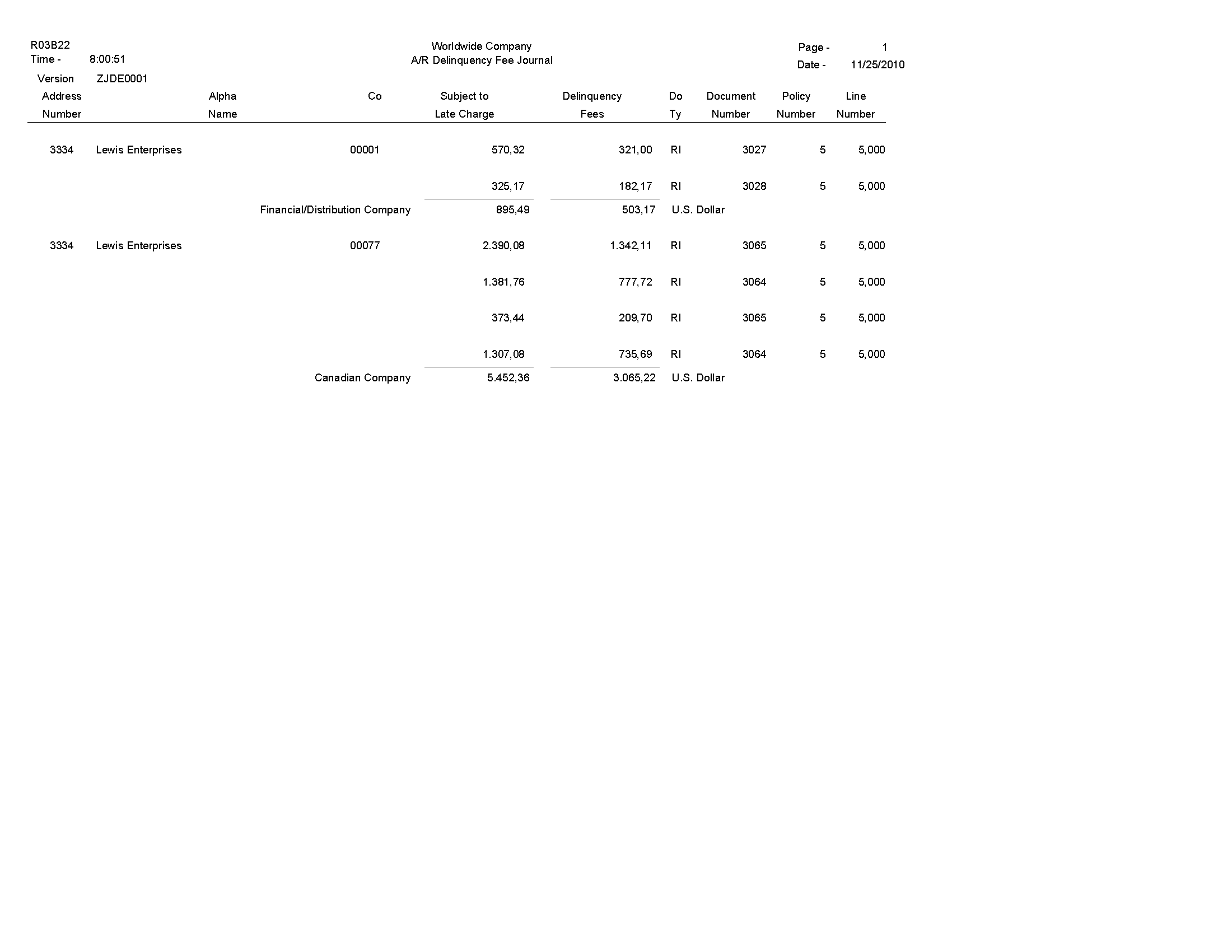

3.13 A/R Delinquency Fee Journal Report (R03B22)

On the Statement Reminder Processing menu (G03B22), select Generate Delinquency Fees.

You can also set the Version For Fee Processing processing option in the Late Payment Delinquency Fees program (R03B221) to specify that the system runs this program.

Use this program to specify how the system processes tax information on delinquency fees.

Review the A/R Delinquency Fee Journal report (R03B22):

3.14 Tiered Delinquency Notice Print Report (R03B21)

On the Statement Reminder Processing menu (G03B22), select Print Delinquency Notices.

You can also use the Notice Print Program processing option in the Credit Analysis Refresh program (R03B525) to specify that the system runs this program.

Use this program to print delinquency notices. You can run this program in proof or final mode:

-

In proof mode, the system prints notices and designates them as PROOF. The system deletes the records that it temporarily generates to print the notices from the A/R Notification History (F03B20) and A/R Notification History Detail (F03B21) tables.

-

In final mode, the system prints notices and creates records in the F03B20 and F03B21 tables and updates fields on the invoice records in the Customer Ledger table (F03B11).

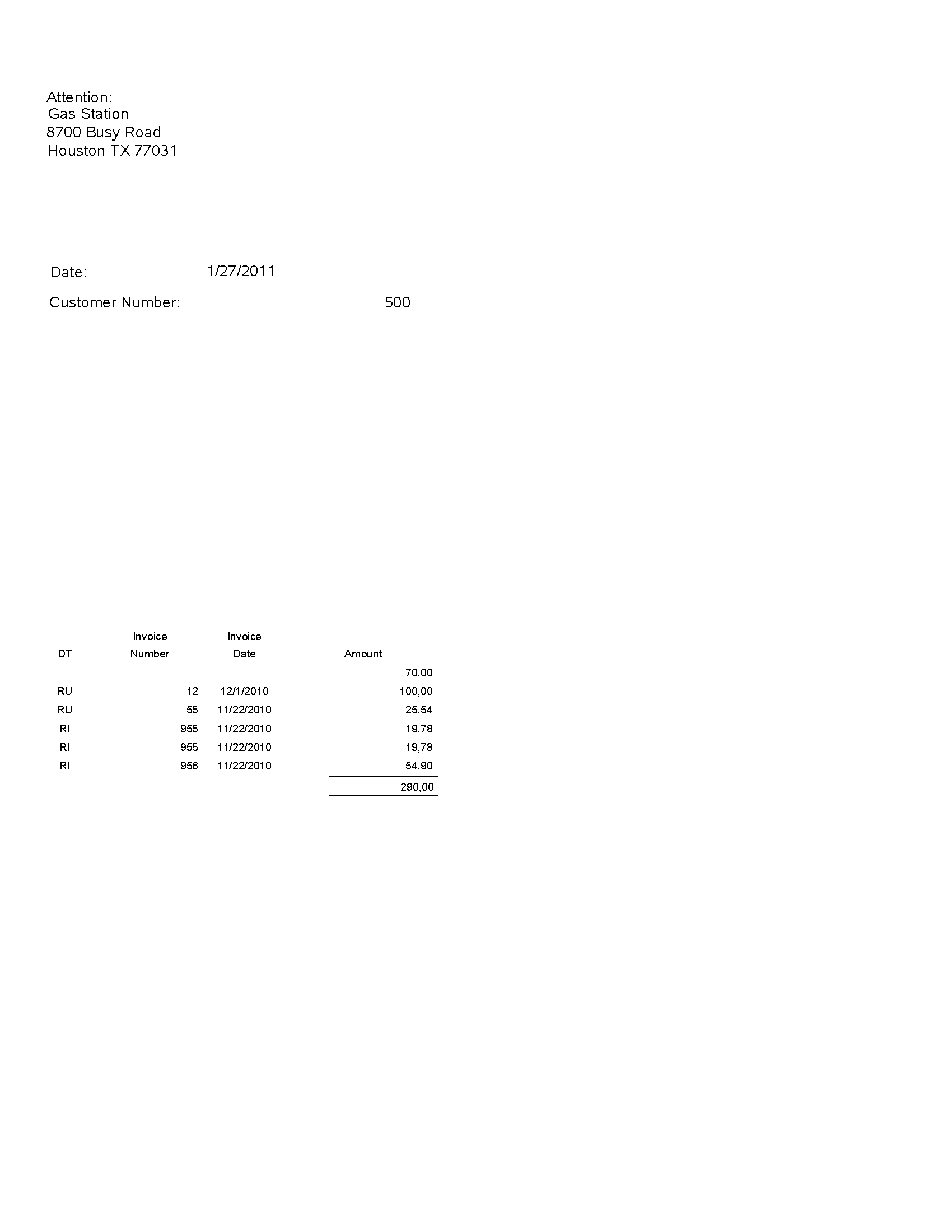

Review the output from the Tiered Delinquency Notice Print report (R03B21):

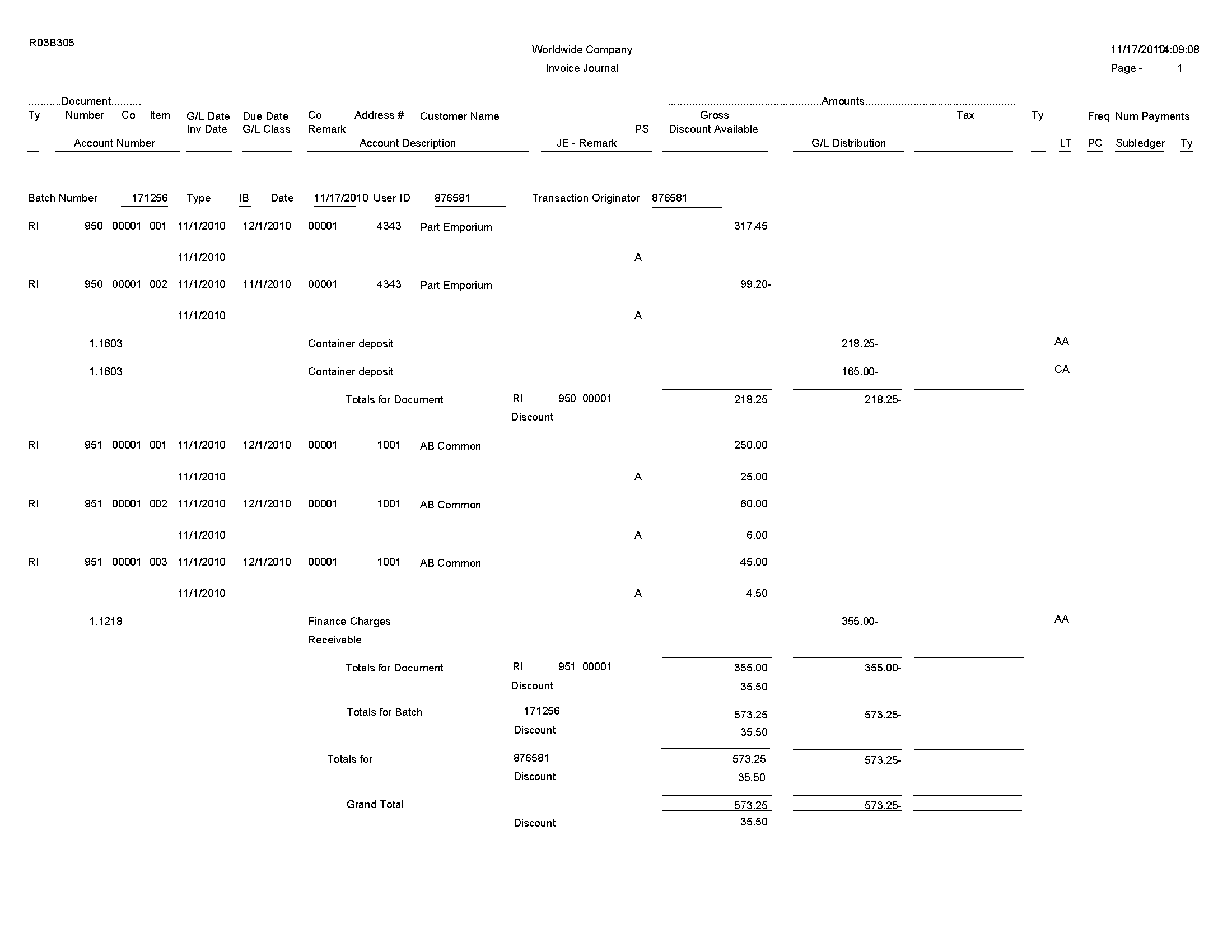

3.15 Invoice Journal Report (R03B305)

On the Other Invoice Entry Methods menu (G03B111), select Recurring Invoice Report.

Use this program to print invoice journal information. The system selects transactions from the Customer Ledger (F03B11) and Account Ledger (F0911) tables.

Review the Invoice Journal report (R03B305):

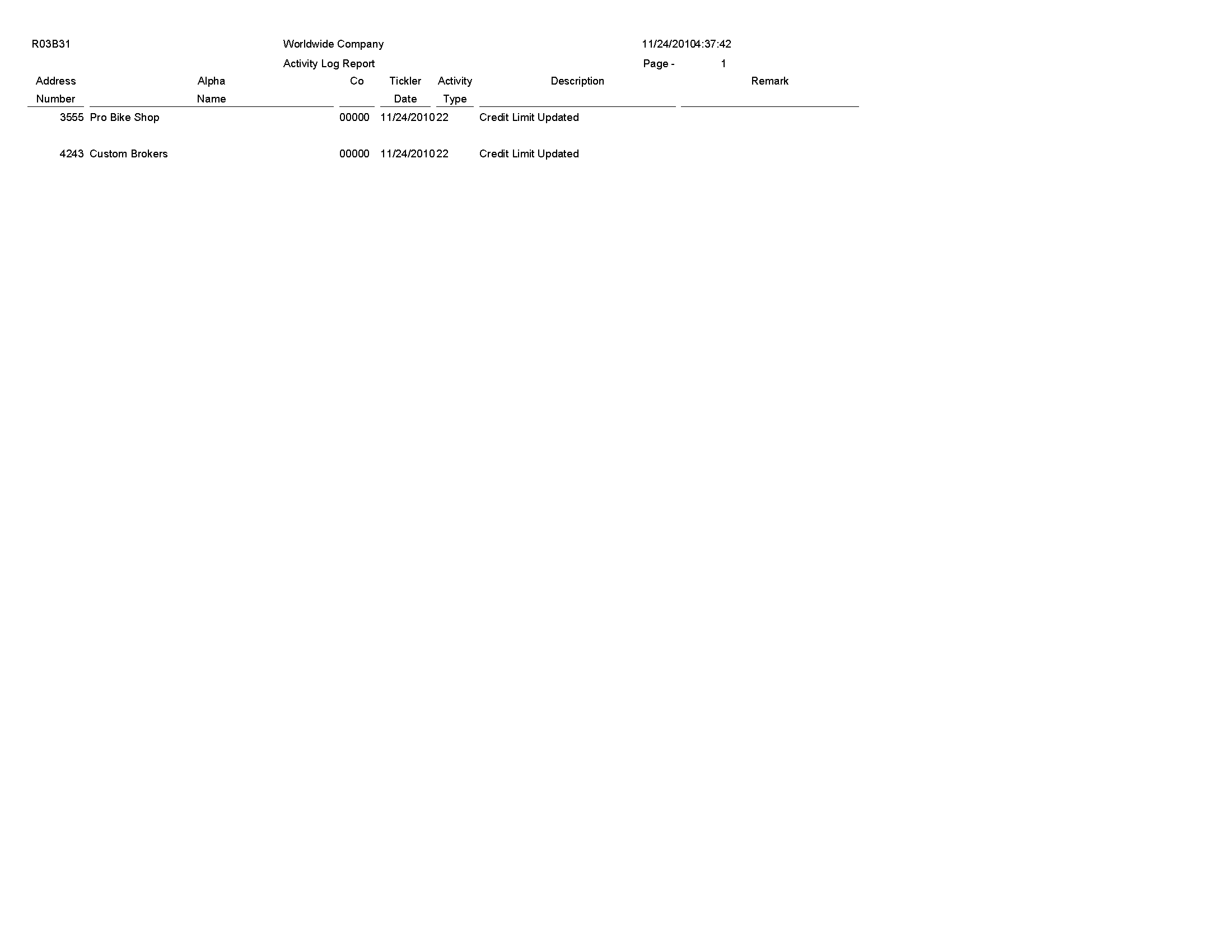

3.16 Activity Log Report (R03B31)

On the Credit/Collections Management menu (G03B15), select Print Activity Log.

Use this report to review and manage account activities from a printed copy.

Review the Activity Log report (R03B31):

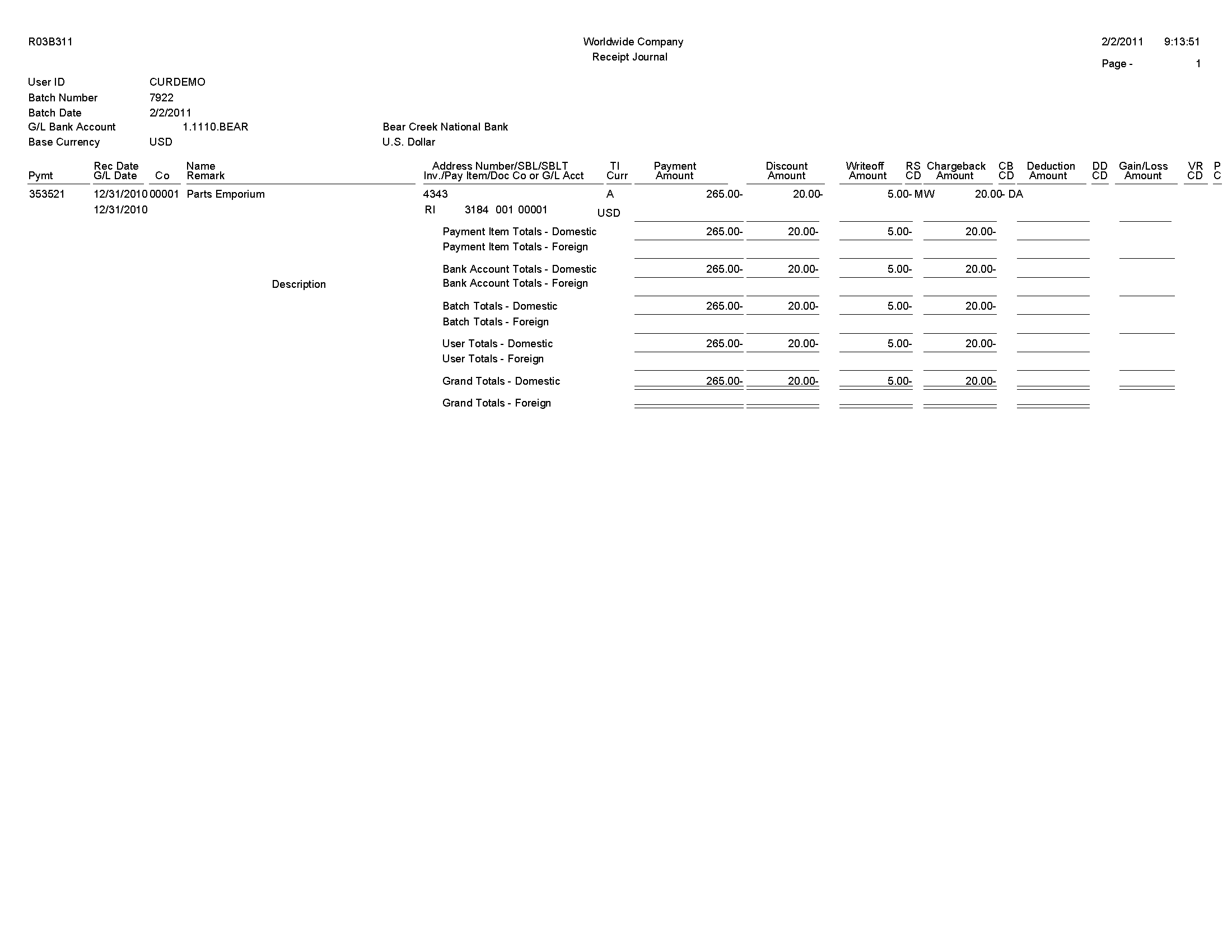

3.17 Receipt Journal Report (R03B311)

On the Manual Receipts menu (G03B12), select Receipts Journal Report.

On the Automated Receipts Processing menu (G03B13), select Receipts Journal Report.

Use this program to print receipt batch information, as an alternative to reviewing receipts online.

Review the Receipt Journal report (R03B311):

3.18 Bank Deposit Journal Report (R03B408)

On the Manual Receipts Processing menu (G03B12), select Receipts Deposit Journal.

Use this report to review all payments received and processed as of a specific batch date or range of batch dates by bank account. This report also shows any receipts that are voided or designated as NSF.

Review the Bank Deposit Journal report (R03B408):

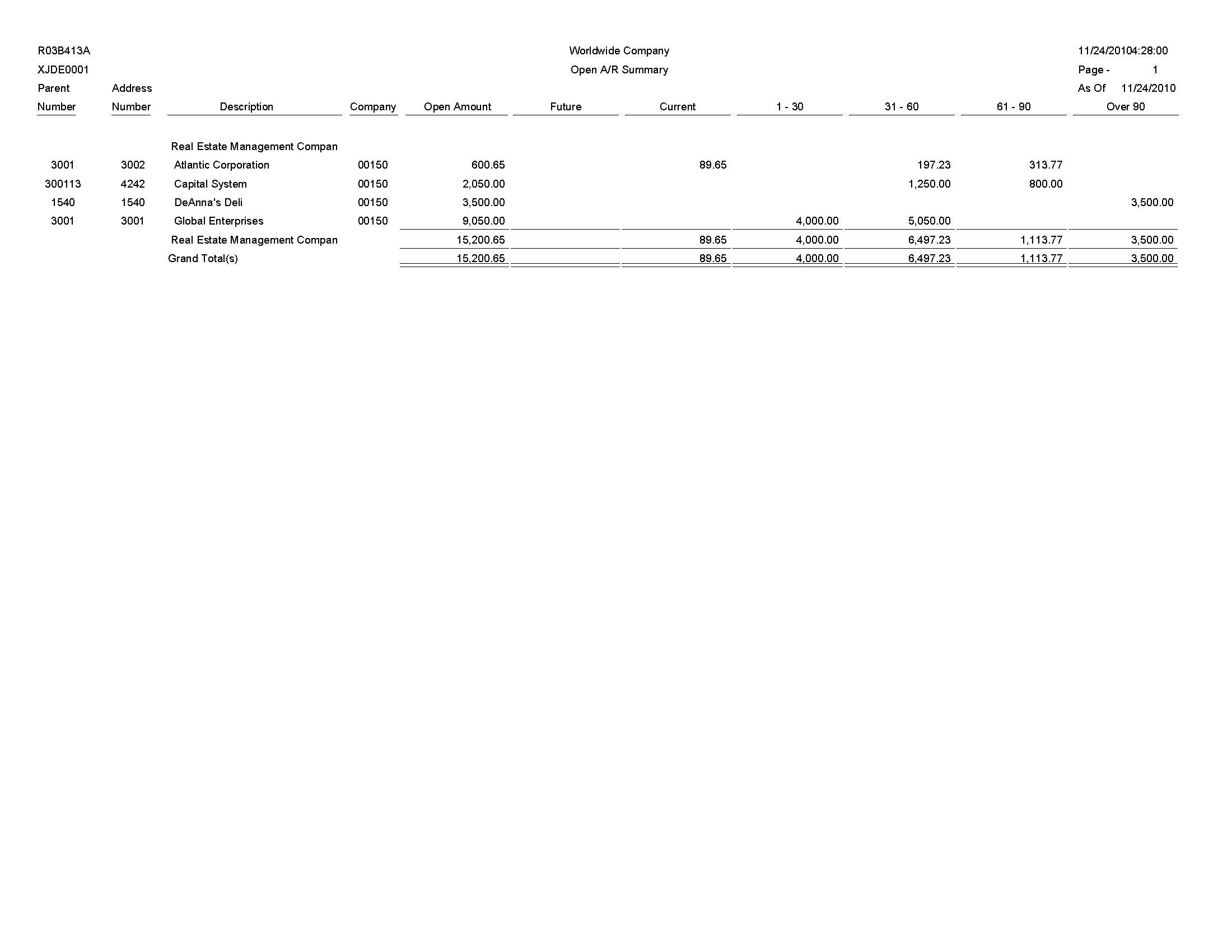

3.19 Open A/R Summary Report (R03B413A)

On the Accounts Receivable Reports menu (G03B14), select Open A/R Detail - Summarized.

Use this report to print current summary information about customer accounts.

Review the Open A/R Summary report (R03B413A):

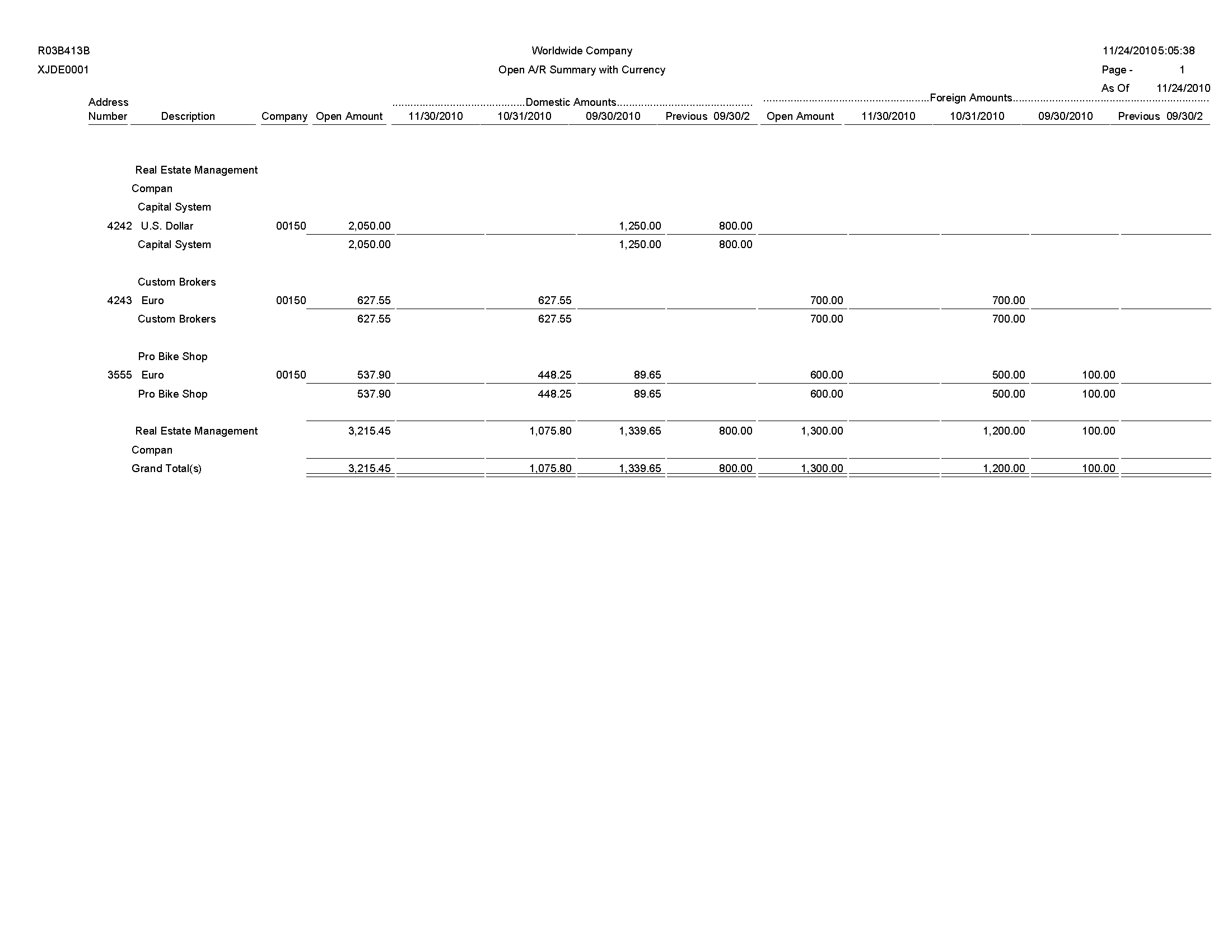

3.20 Open A/R Summary with Currency Report (R03B413B)

On the Accounts Receivable Reports menu (G03B14), select Open A/R Detail - Summarized w/ Currency.

Use this report to review current summary information about your customer accounts and the associated currency information.

Review the Open A/R Summary with Currency report (R03B413B):

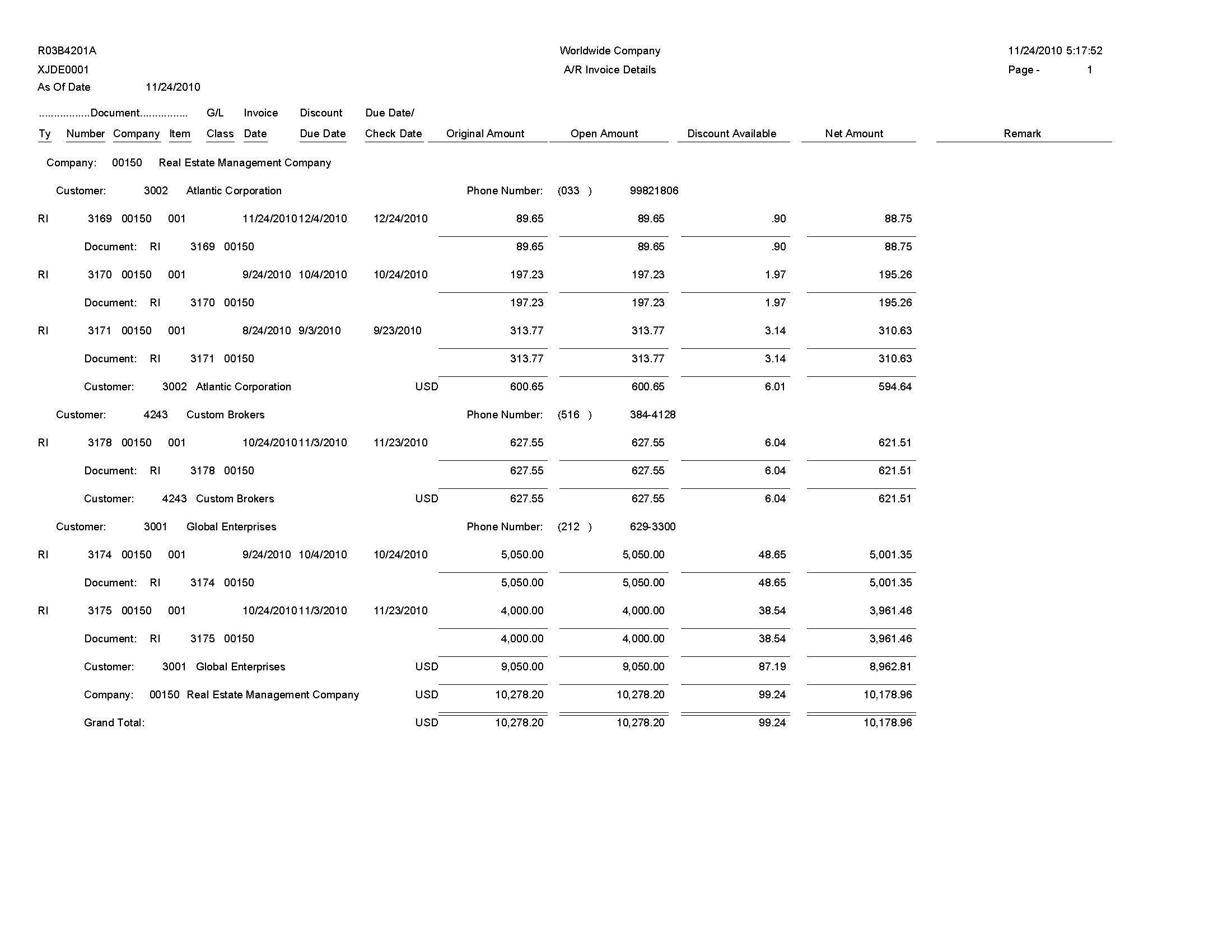

3.21 A/R Invoice Details Report (R03B4201A)

On the Accounts Receivable Reports menu (G03B14), select Open A/R Detail with Remarks.

Use this report to review a list of open items such as invoices, credit memos, and unapplied receipts for every customer.

Review the A/R Invoice Details report (R03B4201A):

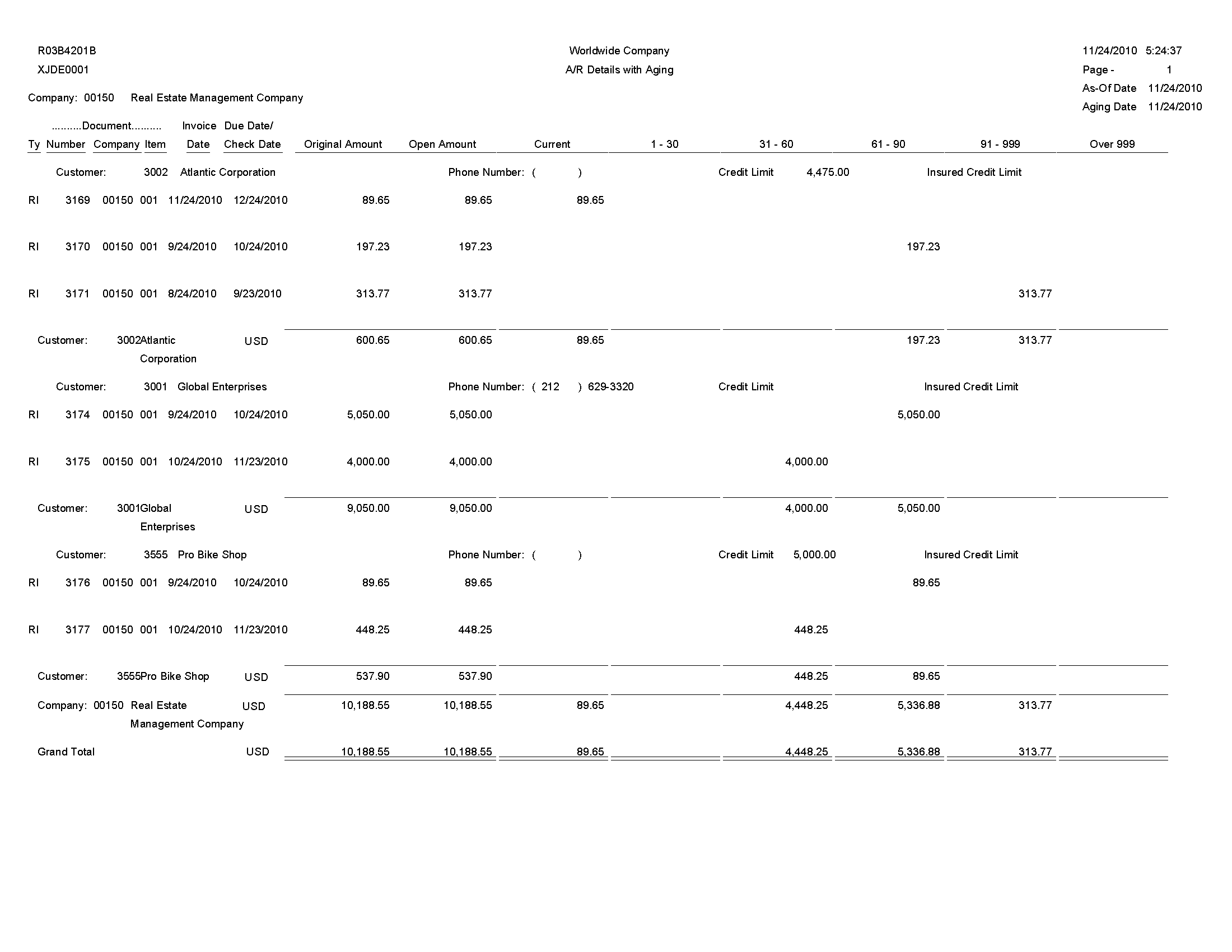

3.22 A/R Details with Aging Report (R03B4201B)

On the Accounts Receivable Reports menu (G03B14), select Open A/R Detail with Aging.

Use this report to review open A/R items for specific aging categories. This report lists totals for each company and a grand total for all companies.

Review the A/R Invoice Details report (R03B4201B):

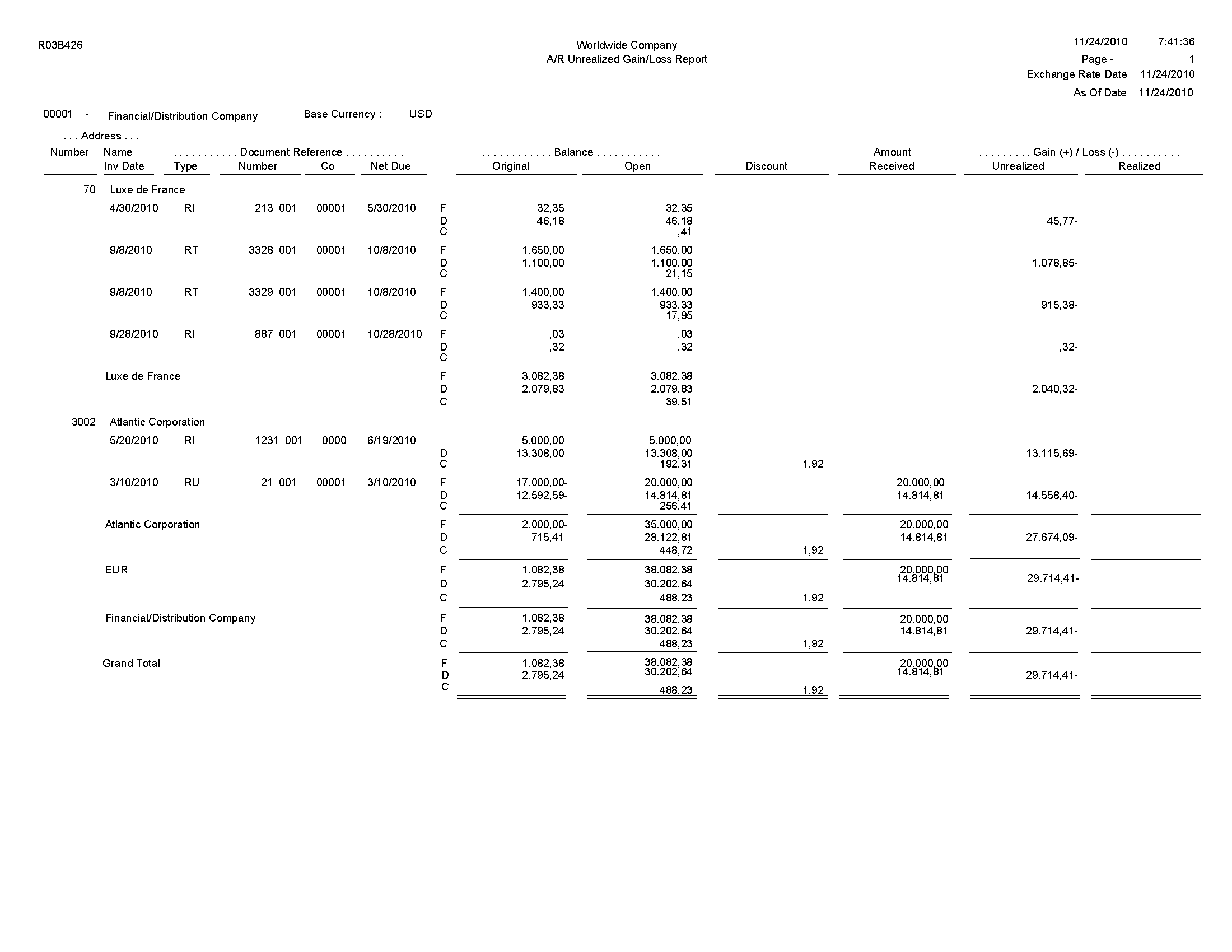

3.23 A/R Unrealized Gain/Loss Report (R03B426)

On the Monthly Valuation menu (G1121), select A/R Unrealized Gain/Loss Report.

Use this report to calculate unrealized gains and losses. The system uses information from the Customer Ledger (F03B11 and the Receipts Detail (F03B14) tables.

Review the A/R Unrealized Gain/Loss report (R03B426):

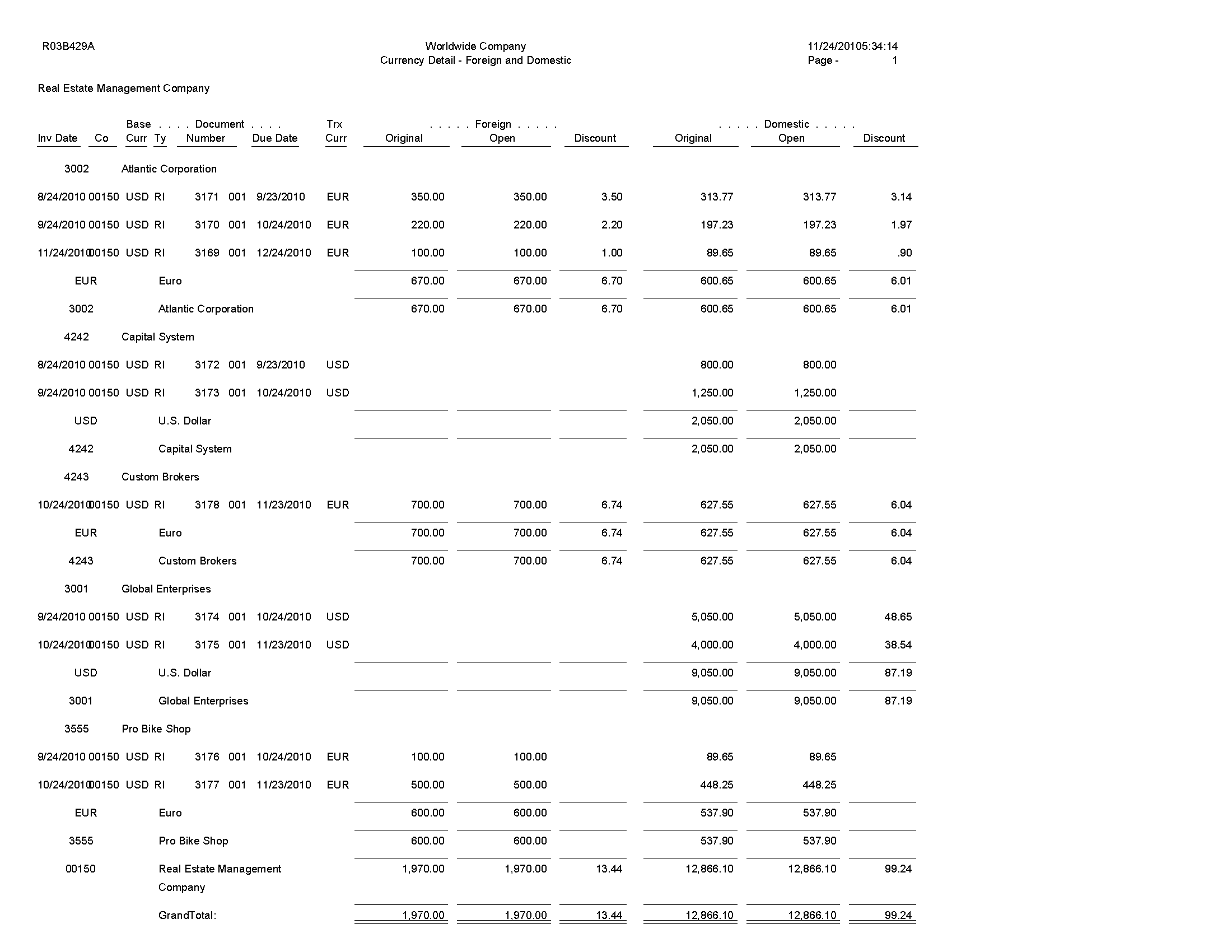

3.24 Currency Detail - Foreign and Domestic Report (R03B429A)

In the Open A/R Foreign Amounts program (P03B4291), select Foreign and Domestic on the Open A/R Foreign Amounts - A/R Currency Detail Reports form.

Use this report to review a list of open accounts receivable items with both foreign and domestic currency amounts.

Review the Currency Detail - Foreign and Domestic report (R03B429A):

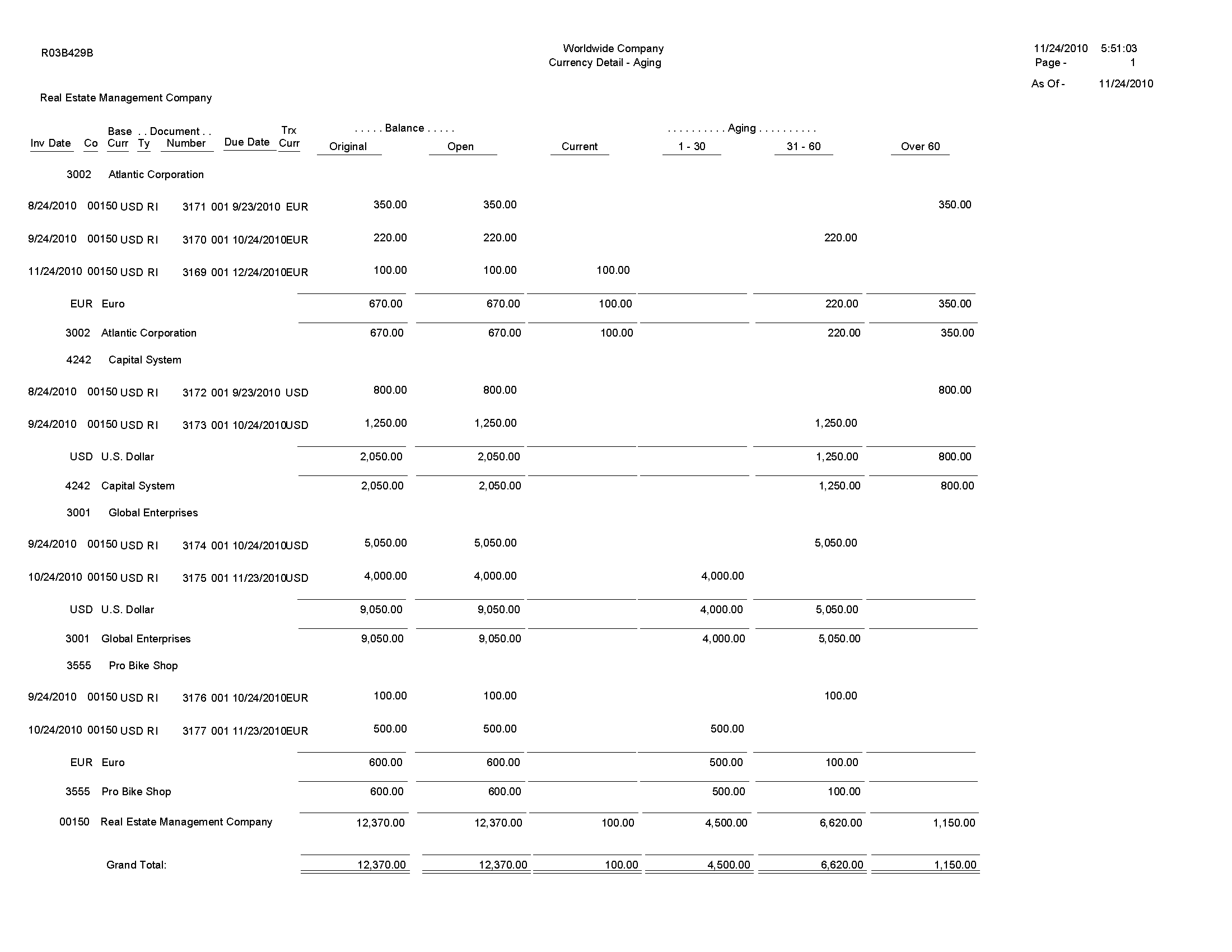

3.25 Currency Detail - Aging Report (R03B429B)

In the Open A/R Foreign Amounts program (P03B4291), select Currency Detail with Aging on the Open A/R Foreign Amounts - A/R Currency Detail Reports form.

Use this report to review a list of open account receivable items in the currency in which the system ages the transactions.

Review the Currency Detail - Aging report (R03B429B):

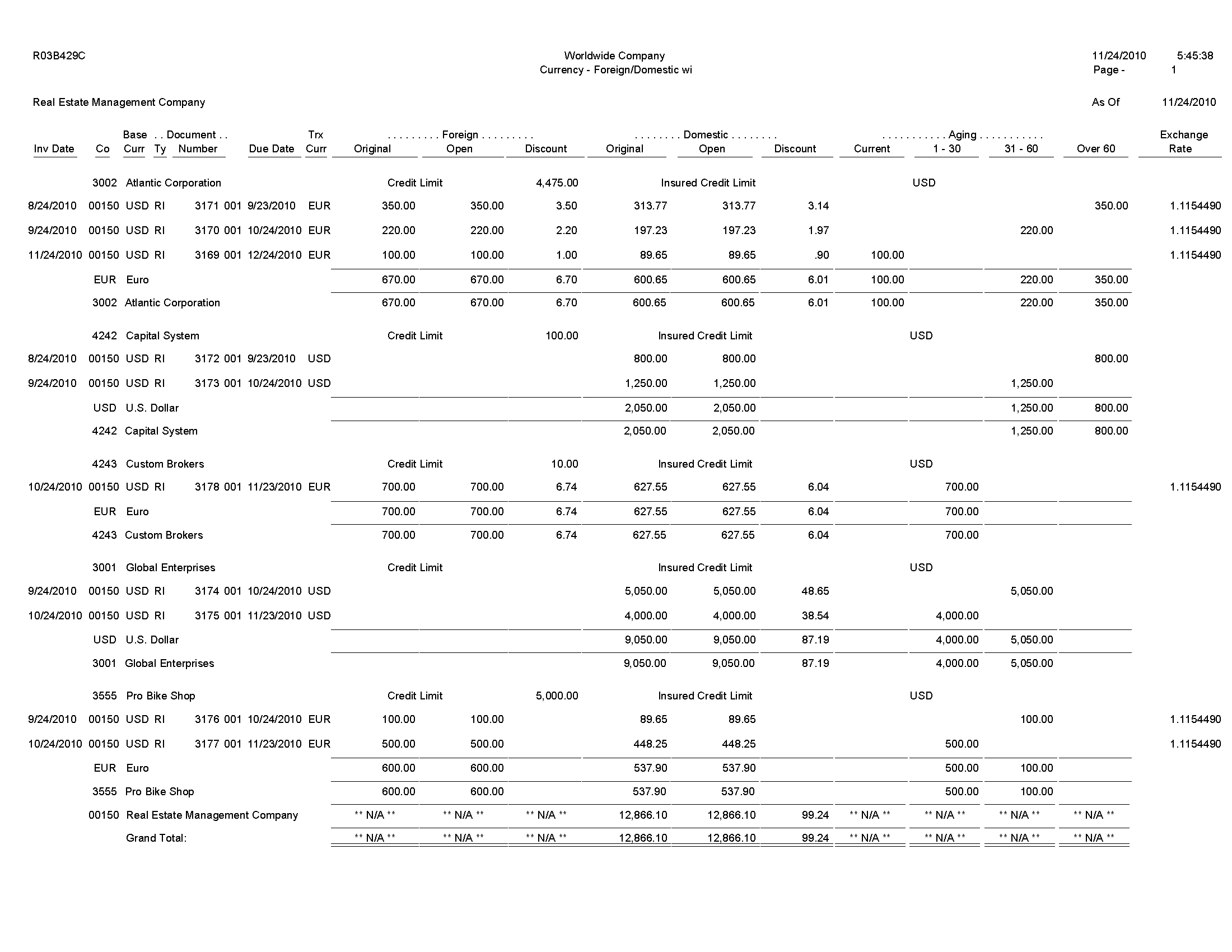

3.26 Currency - Foreign/Domestic with Aging Report (R03B429C)

In the Open A/R Foreign Amounts program (P03B4291), select Foreign and Domestic with Aging on the Open A/R Foreign Amounts - A/R Currency Detail Reports form.

Use this report to review a list of open accounts receivable items with foreign and domestic currency amounts for specific aging categories.

Review the Currency - Foreign/Domestic with Aging report (R03B429C):

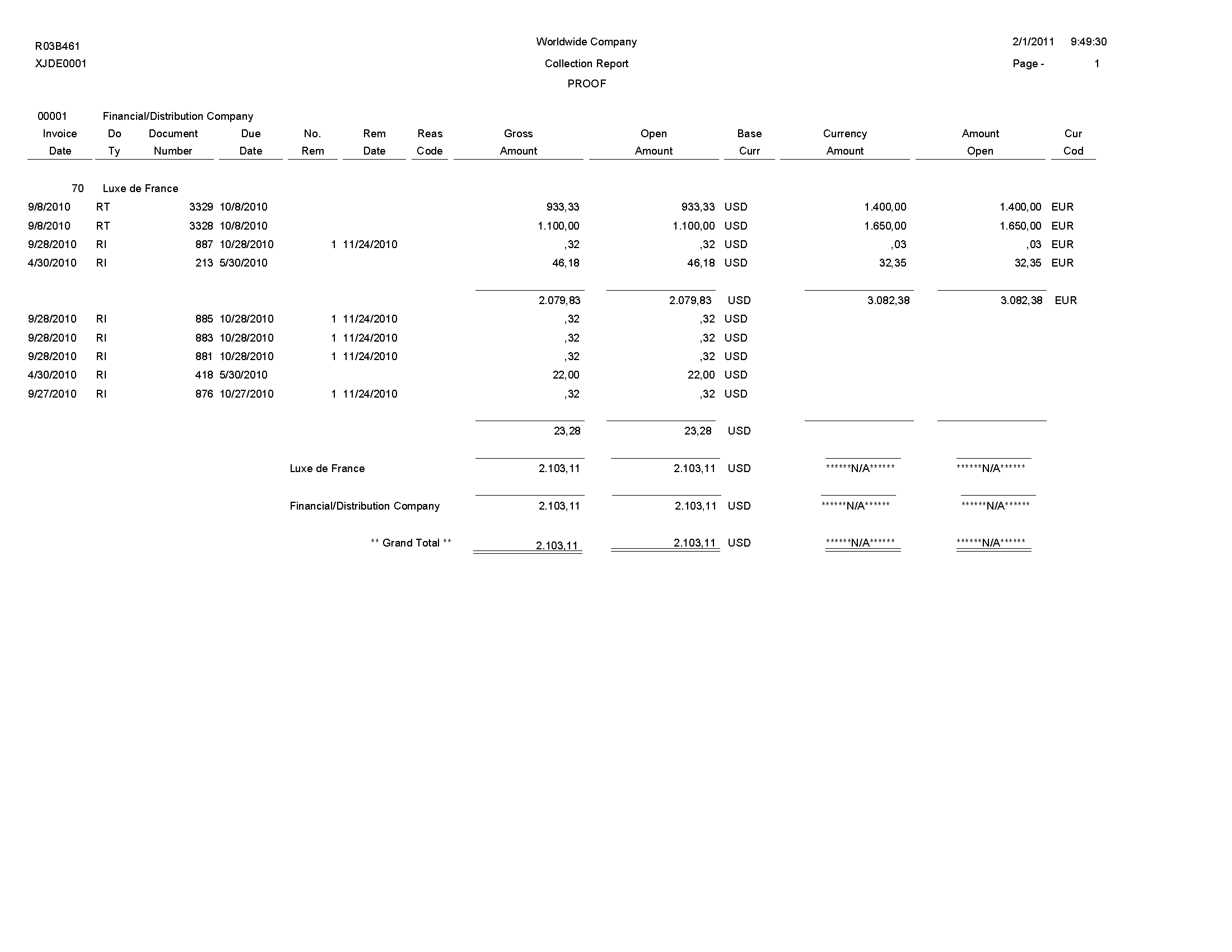

3.27 Collection Report (R03B461)

On the Accounts Receivable Reports menu (G03B14), select Collection Report.

Use this report to review a list of outstanding items for customers with past-due accounts. You can also use this report to determine whether to consign specific invoices or customers to an external collection agency.

Review the Collection report (R03B461):

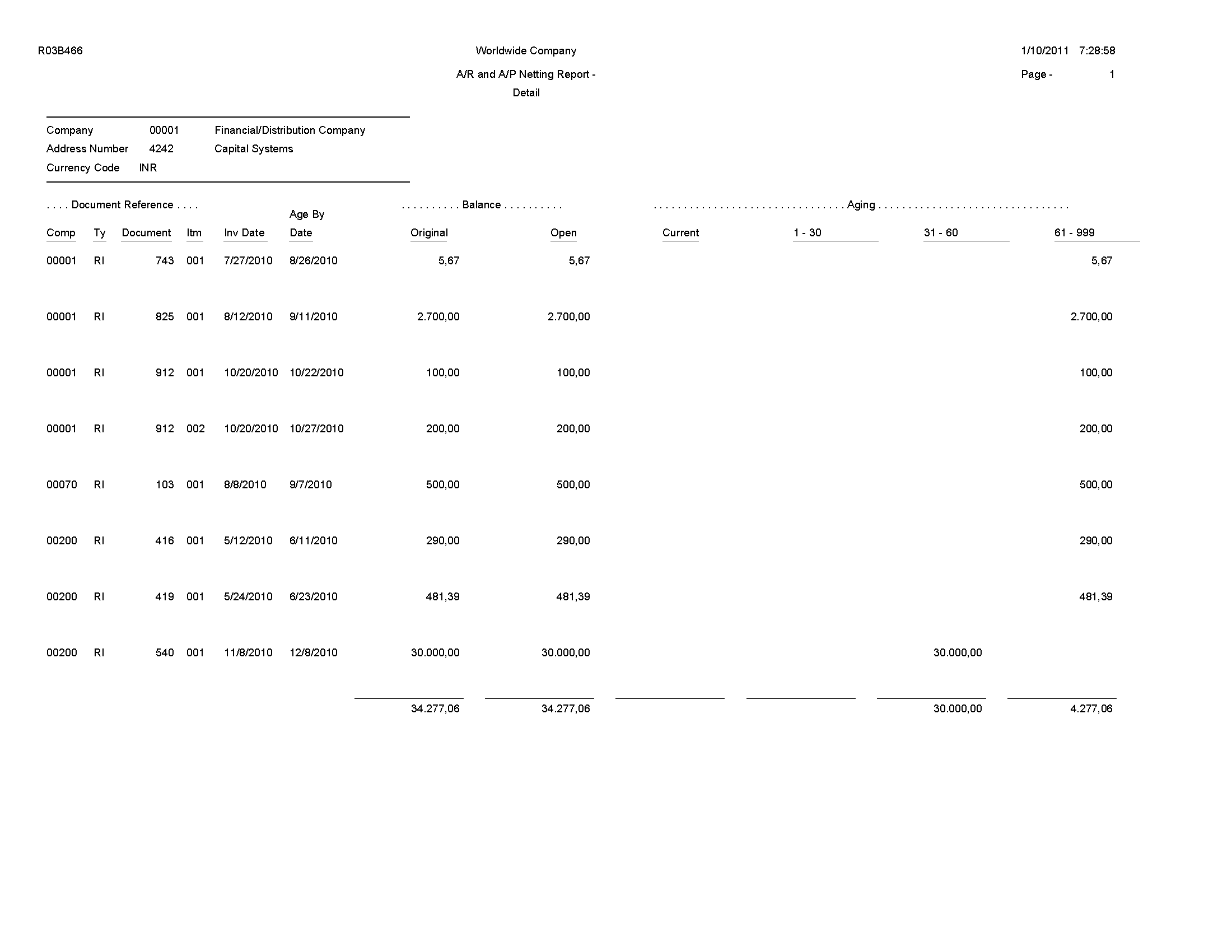

3.28 A/P and A/R Netting - Detail Report (R03B466)

On the Accounts Receivable Reports menu (G03B14), select Netting - Aging Report.

Use this report to review transactions by customer and supplier, aged by currency type.

Review the A/P and A/R Netting - Detail report (R03B466):

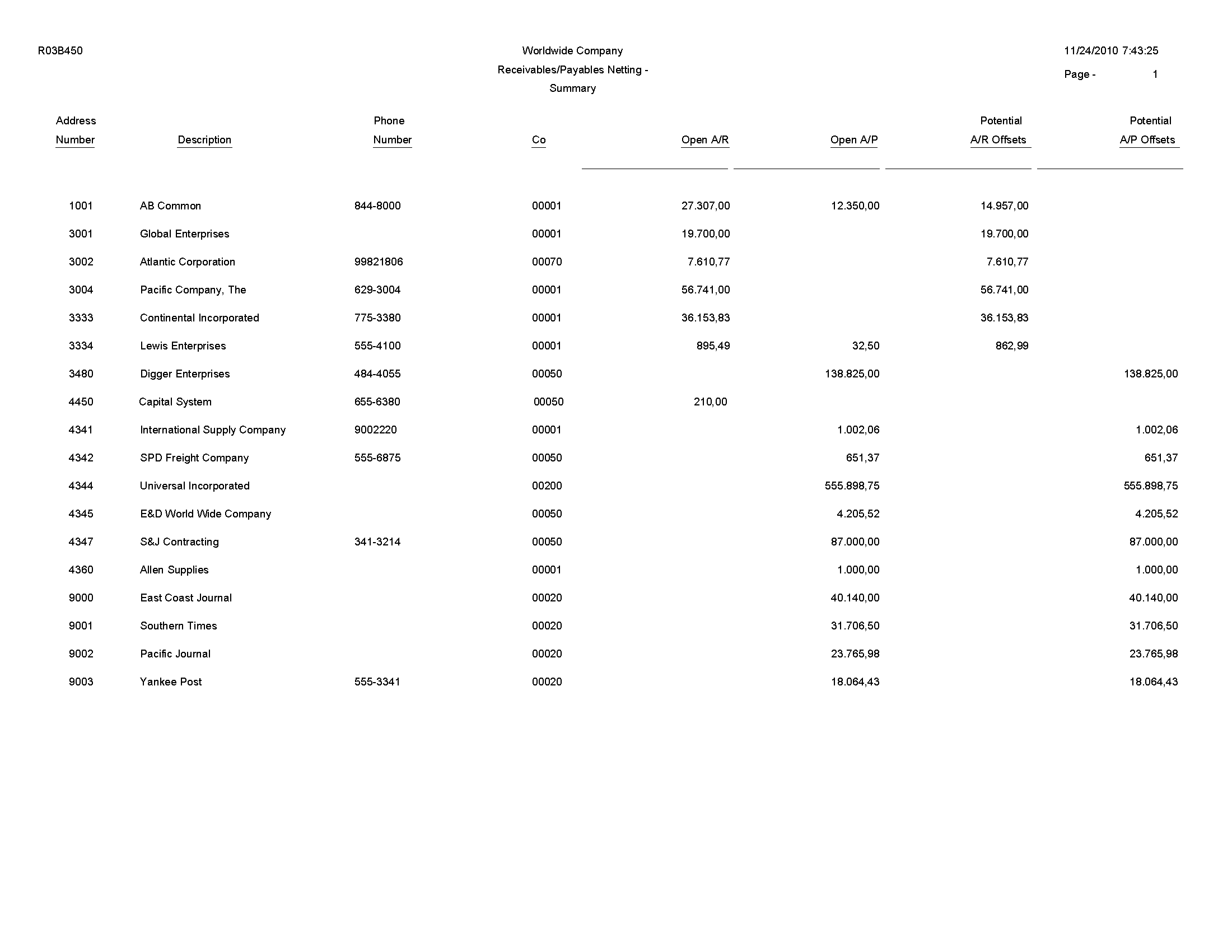

3.29 Receivables/Payables Netting - Summary Report (R03B450)

On the Accounts Receivable Reports menu (G03B14), select Receivables/Payables Netting.

Use this report to review the potential offsets between open accounts payable balances and open accounts receivable balances.

Review the Receivables/Payables Netting Summary report (R03B450):

3.30 Apply Receipts to Invoices Report (R03B50)

On the Automatic Receipts Processing menu (G03B13), select Apply Receipts to Invoices.

After creating unapplied receipts or drafts or logged receipts, you must apply the receipts to invoices by running this program. This program determines the information that is necessary for the system to match a receipt to an invoice or a group of invoices based on the algorithms that are set up on the execution list and the information that is provided in the receipt records.

Review the Apply Receipts to Invoices report (R03B50):

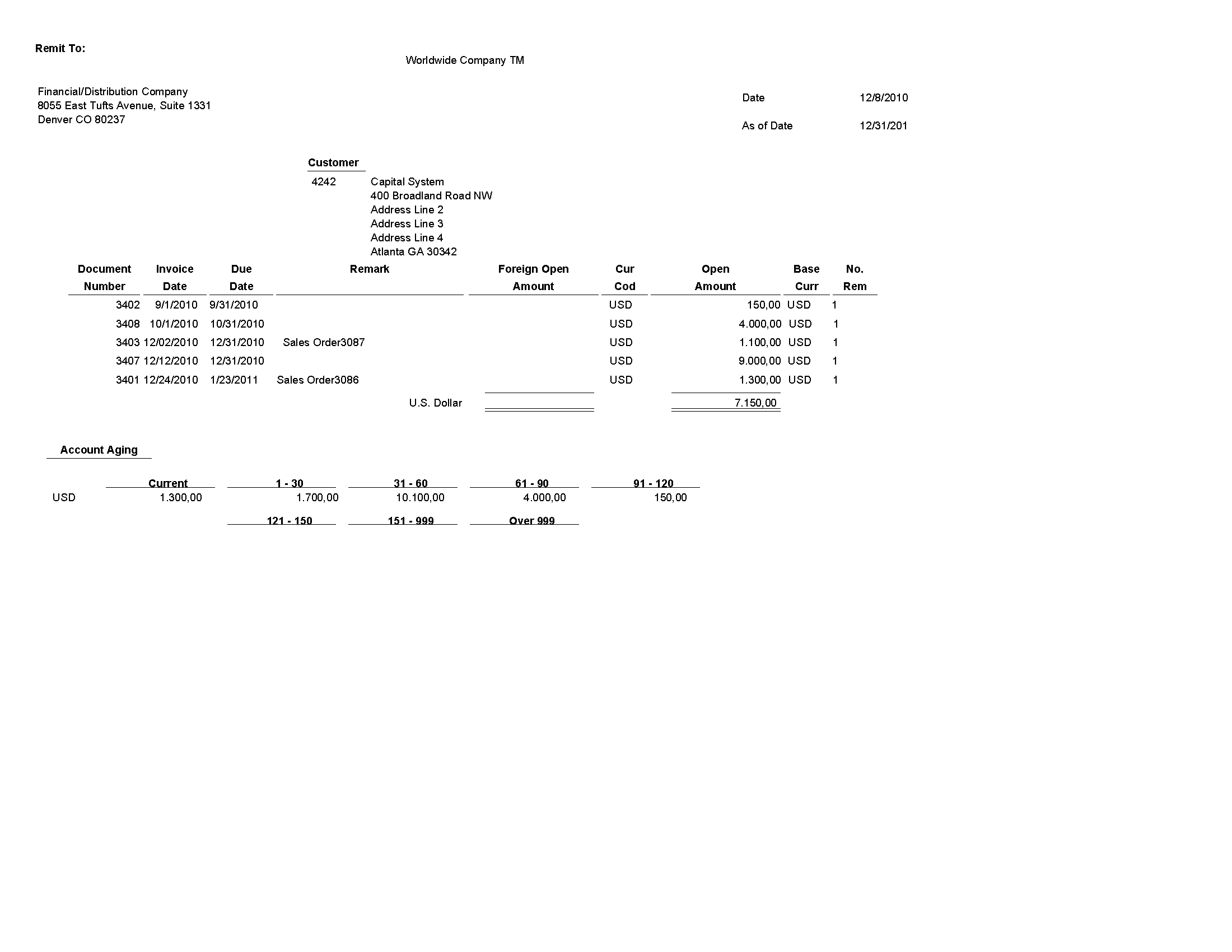

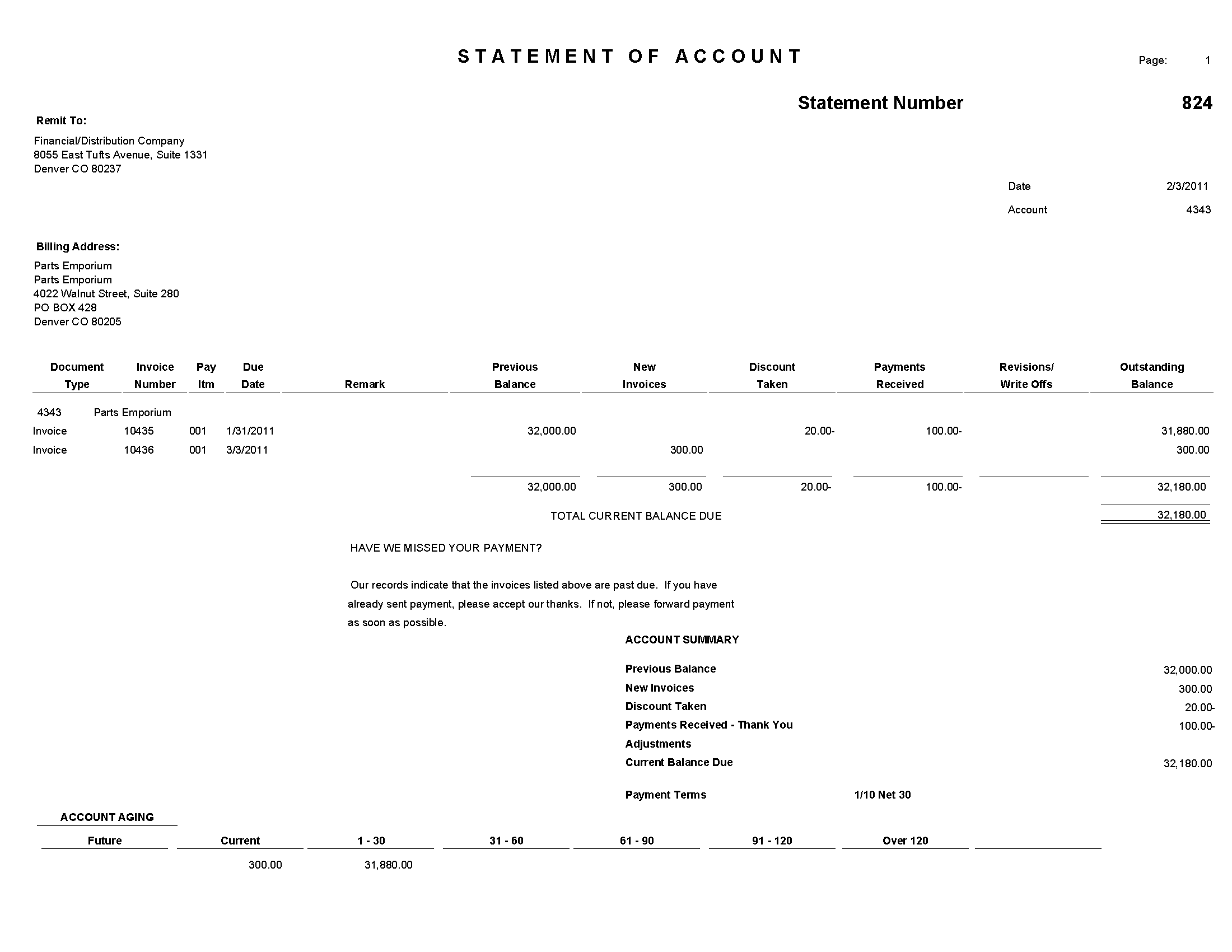

3.31 Statement Print Report (R03B5001)

When you run the Statement Notification Refresh report (R03B500X), the A/R Statement Print Driver (R03B5005) generates the Statement Print report (R03B5001).

Use this program to print standard statements. Use processing options to customize statements for the organization. This enables you to specify whether to print aging or account summary information on the statement, whether to print each invoice pay item or summarize the pay items for each invoice, and the date to print on the statement.

Review the output from the Statement Print report (R03B5001):

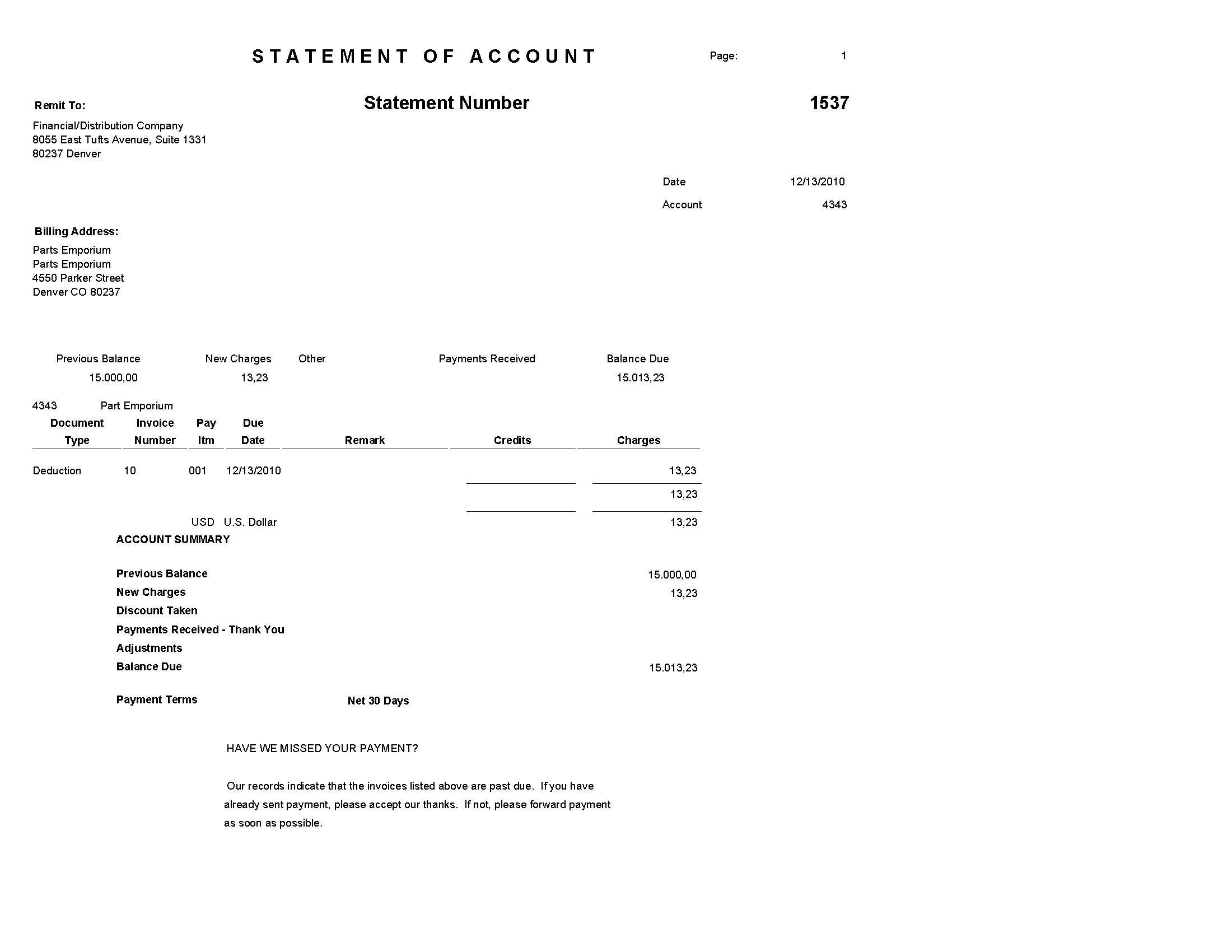

3.32 Credit Card Statement Print Report (R03B5003)

On the Statement Reminder Processing menu (G03B22), select Statement Notification Refresh. You can also use the Print Program processing option to in the Statement Notification Refresh (R03B500X) to specify that the system runs this program.

Use this program to print statements in a credit card format. The system prints only new invoices and summarizes invoices previously printed into a balance forward amount.

Review the output from the Credit Card Statement Print report (R03B5003):

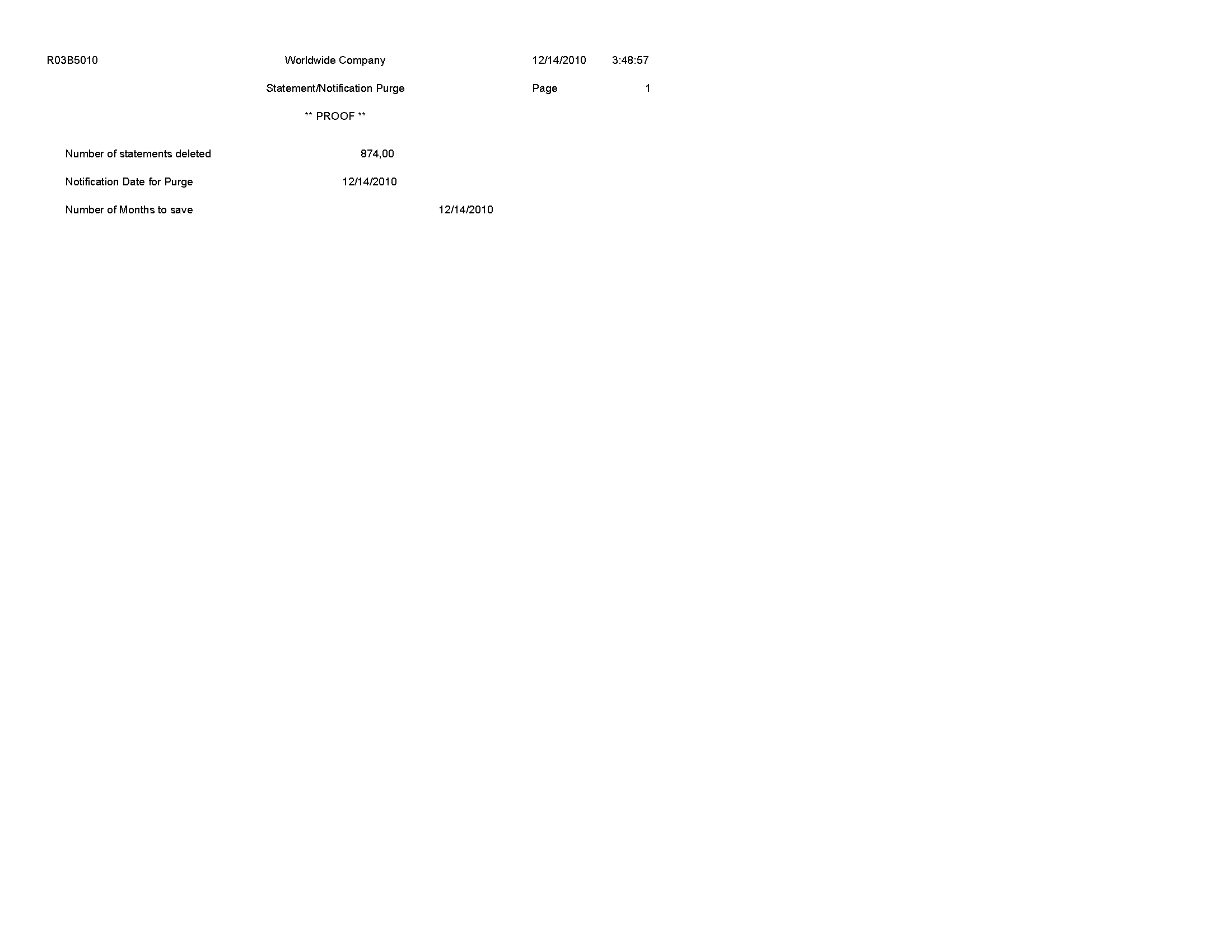

3.33 Statement/Notification Purge Report (R03B5010)

On the Statement Reminder Processing menu (G03B22), select Statement/Notification Purge.

When you consider statement or delinquency notice information to be obsolete, you can purge it. Use this program to remove statement and delinquency notice records from the A/R Notification History (F03B20) and A/R Notification History Detail (F03B21) tables. The system does not write purged information to another table for archiving. If you want to retain purged information, keep a backup of the tables before purging them.

Review the Statement/Notification Purge report (R03B5010):

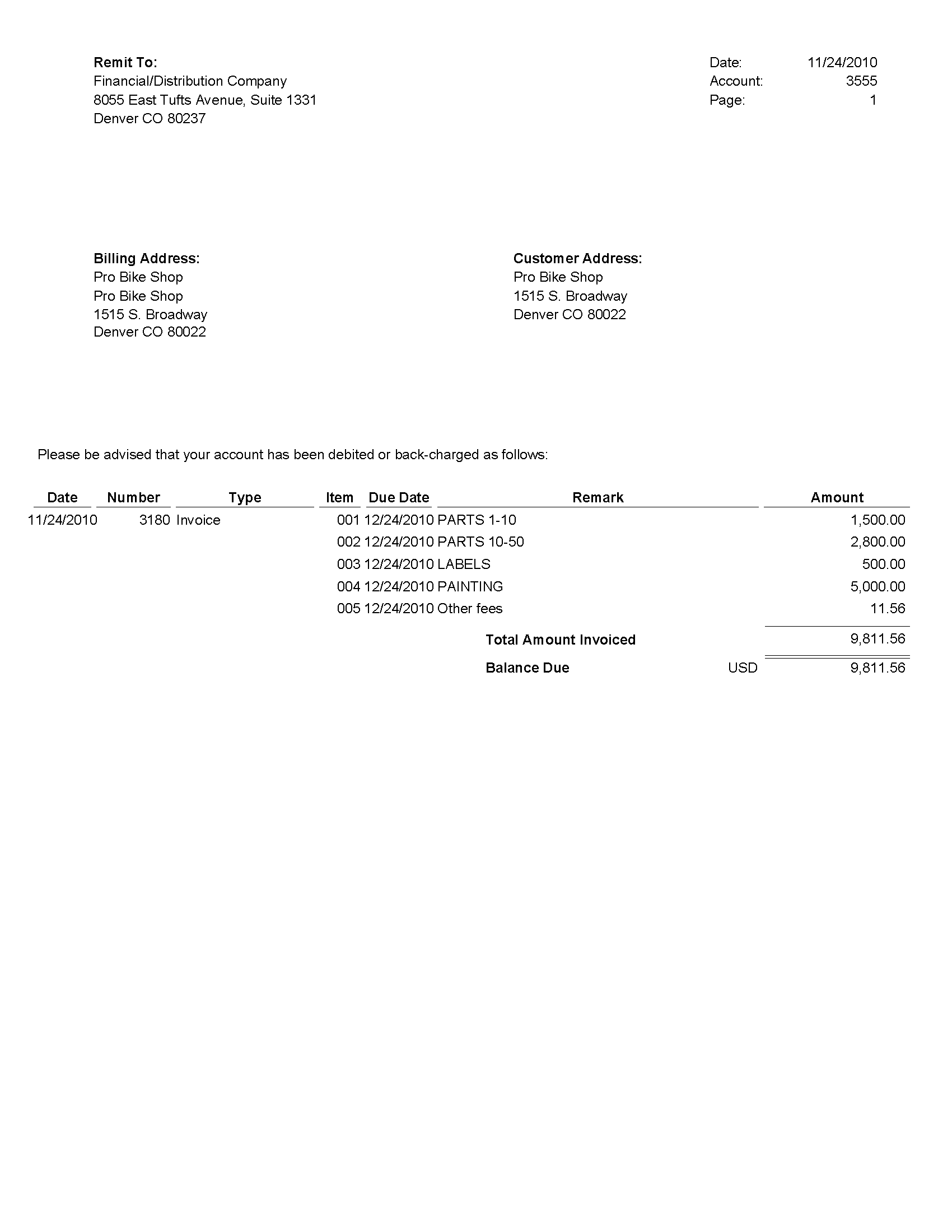

3.34 Invoice Print Report (R03B505)

On the Statement Reminder Processing menu (G03B22), select Invoice Print.

Use this report to print the invoices that you created during invoice entry or receipts entry. This program prints standard invoices, chargeback invoices (document type RB), credit memos (document type RM), and delinquency fees (document type RF).

Review the output from the Invoice Print report (R03B505):

3.35 Invoice Print with Draft Report (R03B5051)

On the Draft Daily Operations menu (G03B161), select Invoice Print with Draft.

Use this program to print an invoice or credit memo with an attached draft. You can select different versions of this report to print delinquency fees or chargebacks only.

Review the output from the Invoice Print with Draft report (R03B5051):

3.36 Statement Print with Draft Report (R03B506)

When you run the Statement Notification Refresh report (R03B500X), the A/R Statement Print Driver (R03B5005) generates the Statement Print with Draft report (R03B506).

Use this program to print statements that include draft information. Use processing options to customize statements for the organization. This enables you to specify whether to print aging or account summary information on the statement, whether to print each invoice pay item or summarize the pay items for each invoice, and the date to print on the statement.

Review the output from the Statement Print with Draft report (R03B506):

3.37 Update Receipts Header Report (R03B551)

On the Automated Receipts Processing menu (G03B13), select Update Receipts Header.

When you run this program, the system creates either unapplied receipts or drafts, or it creates logged receipt records. The system creates logged receipts when it cannot locate a payor or customer; otherwise, it creates unapplied receipts.

Review the Update Receipts Header report (R03B551):

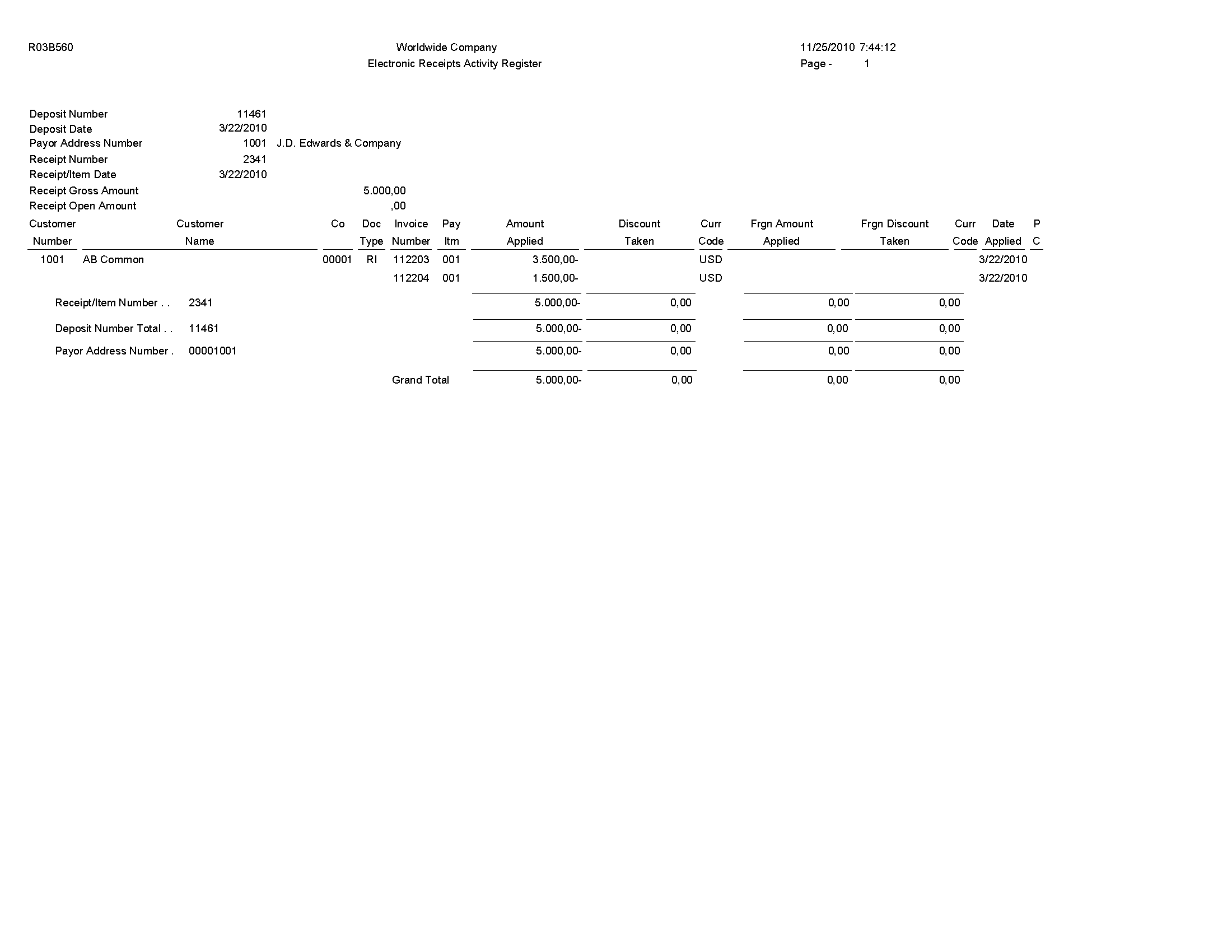

3.38 Receipts Activity Register Report (R03B560)

Select Automated Receipts Processing (G03B13), Receipts Activity Register.

Use this report to print a list of all processed items.

Review the Receipts Activity Register report (R03B560):

3.39 Create Automatic Debit Batch Report (R03B571)

Use the Process Auto Debits program (P03B571) to run this program.

Use this program to create a batch of automatic debits.

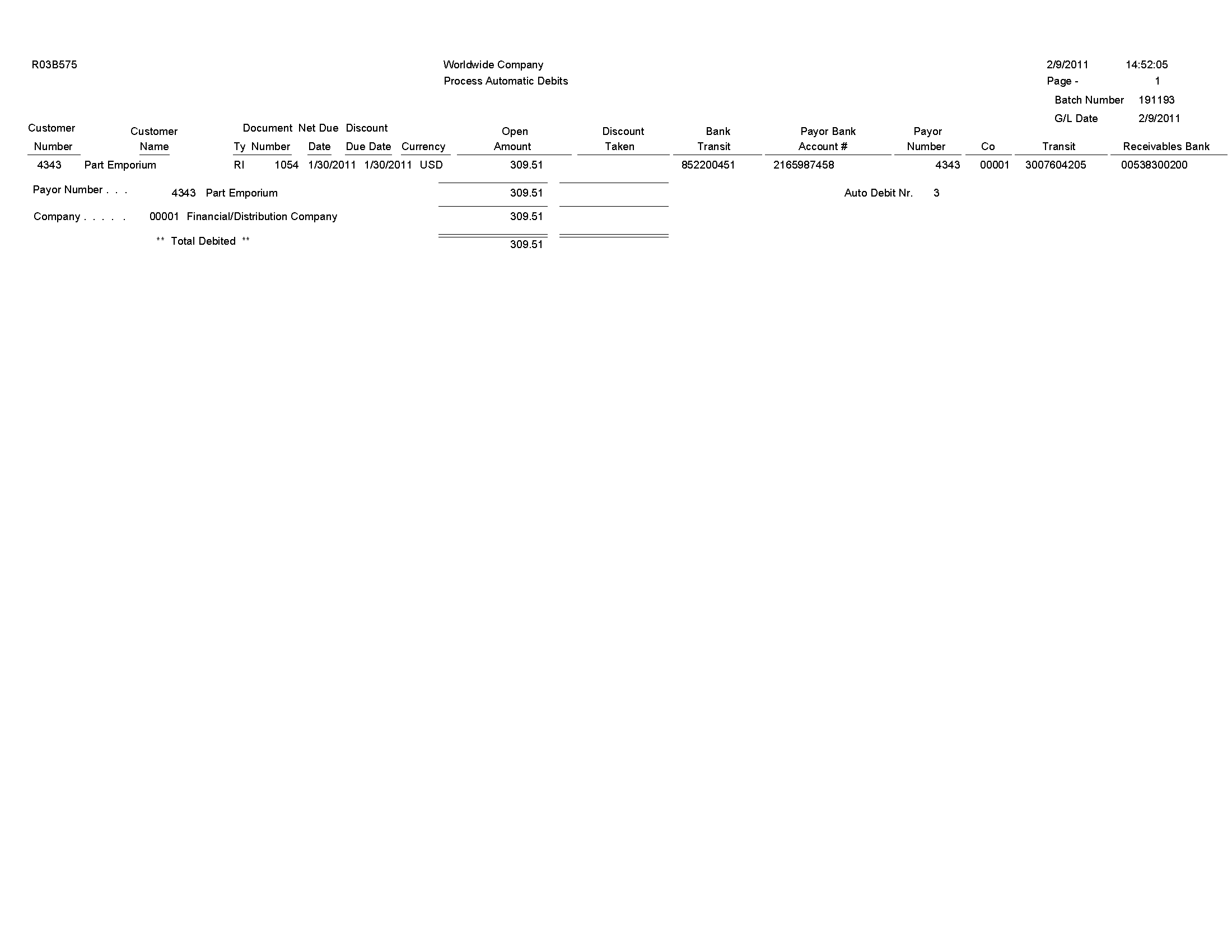

Review the Create Automatic Debit Batch report (R03B571):

3.40 NSF Drafts Notification Report (R03B574)

On the Draft Remittance and Collection menu (G03B162), select NSF Drafts Notification.

Use this report to review the total amount of drafts that have been returned for insufficient funds.

Review the output from the NSF Drafts Notification report (R03B574):

3.41 Process Automatic Debits Report (R03B575)

On the Automatic Debiting menu (G03B131), select Process Auto Debits. On the Work With Auto Debit Batches form, click Add to run this program.

Use the program to create the invoices that constitute the automatic debit batch.

Review the Process Automatic Debits report (R03B575):

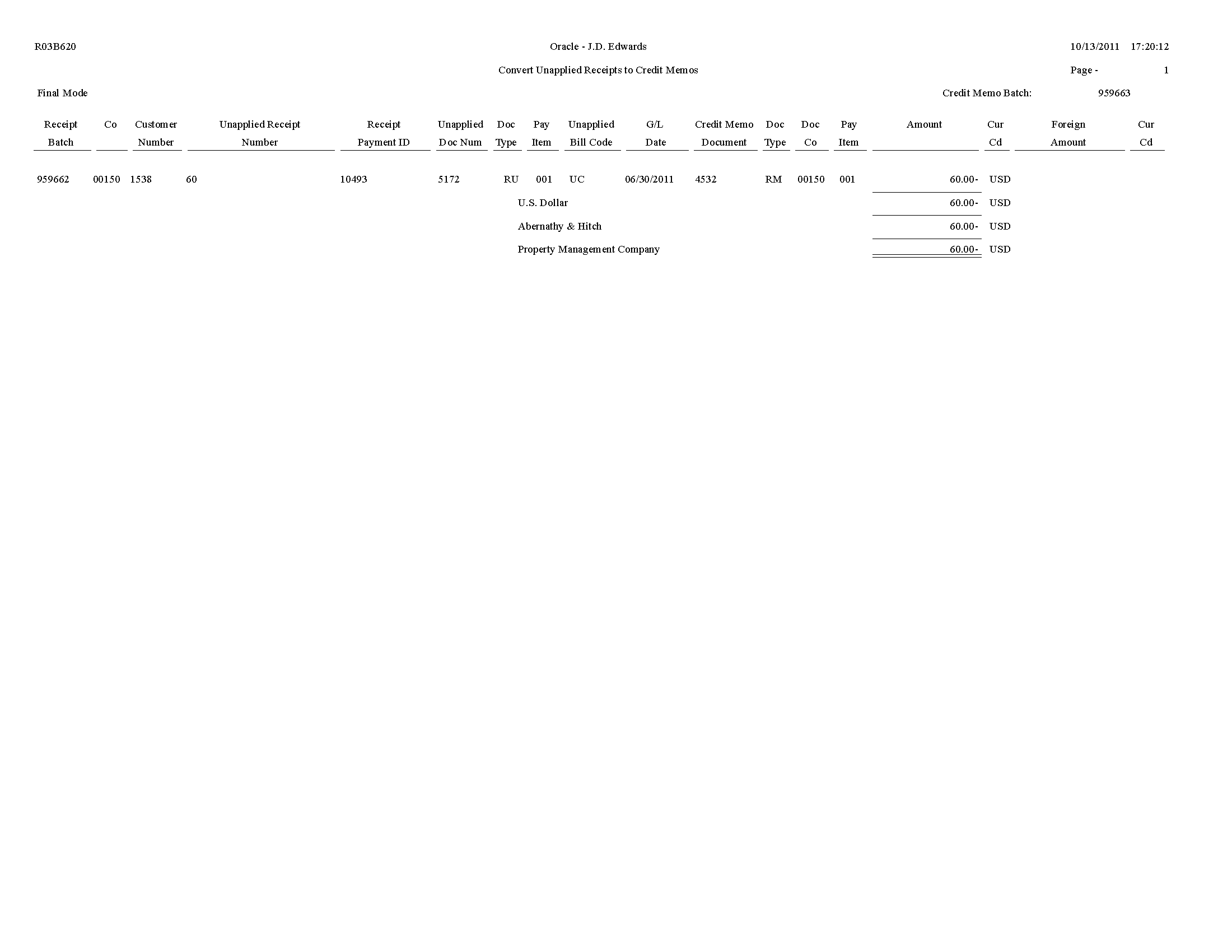

3.42 Convert Unapplied Receipts to Credit Memos Report (R03B620)

From the Period End Processing menu (G03B21), select Convert Unapplied Receipts to Credit Memos.

You may need to convert unapplied receipts to credit memos in order to issue refund checks to customers. For example, you may need to create a refund check if a customer overpays.

Although unapplied receipts represent a credit to the customer, the system does not allow you to process unapplied receipts (RU document type) in the Credit Reimbursements program (R03B610). The system does not process the RU document type because unapplied receipts are generated from a receipts program which creates additional records in the Receipts Header (F03B13) and Receipts Detail (F03B14) tables. Therefore, to reimburse a customer for an unapplied receipt, you must close the unapplied receipt and create a credit invoice to replace the unapplied receipt.

Follow these steps in sequential order:

-

Run the Convert Unapplied Receipts to Credit Memos program (R03B620). Use data selection to specify one or multiple unapplied receipts.

When you run the Convert Unapplied Receipts to Credit Memos program, the system converts unapplied receipt records in the F03B13 and F03B14 tables to credit memos in the Customer Ledger table (F03B11).

-

Run Credit Reimbursements program. You can run this program manually or use the processing options in the Convert Unapplied Receipts to Credit Memos program to run the program automatically.

When you run the Credit Reimbursements program, the system pays open credit memos and generates vouchers to reimburse to the customer.

You can reimburse unapplied receipts whether the receipt is posted or not posted.

|

Note: The system does not pass the data selection from the Convert Unapplied Receipts to Credit Memos program to the Credit Reimbursements program. Therefore, if you set the processing option in the Convert Unapplied Receipts to Credit Memos program to run the Credit Reimbursements program automatically, you must set the data selection in the Credit Reimbursements program prior to running the Convert Unapplied Receipts to Credit Memos program. |

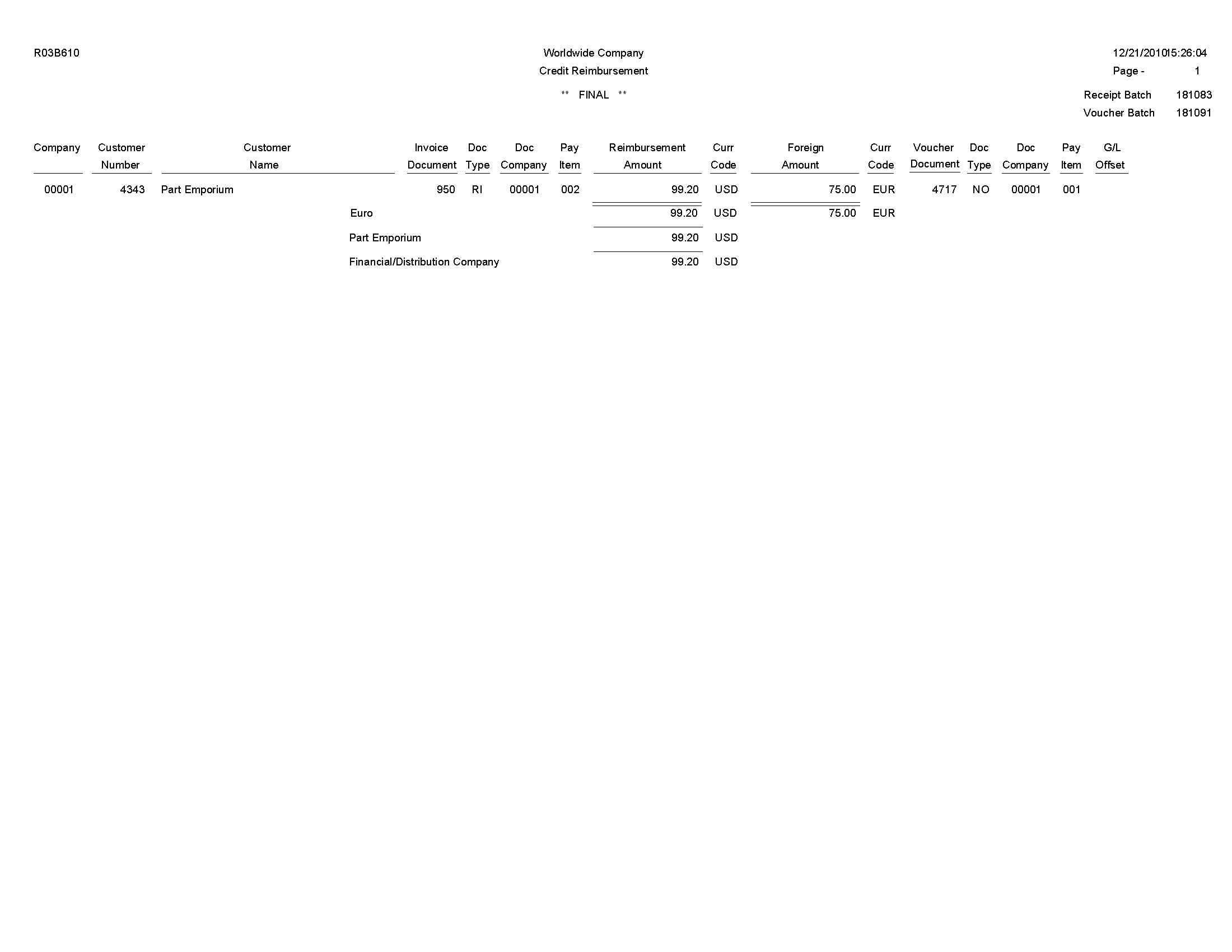

3.43 Credit Reimbursement Report (R03B610)

On the Period End Processing menu (G03B21), select Generate Reimbursements.

In proof mode, use this program to print a list of eligible documents. The system generates a separate reimbursement record for each customer, company, and currency combination, and prints it on the report.

In final mode, use this program to process credit reimbursements by selecting documents from the list of eligible documents. The system:

-

Creates a receipt in the Receipts Header (F03B13) and Receipts Detail (F03B14) tables to close the selected invoices.

-

Creates a batch of receipts (batch type RB), which you must post.

When you post the receipt batch, the system debits the A/R trade account and credits the suspense account specified by the AAI item NC.

-

Changes the pay status on the invoices to P (paid).

-

Creates a voucher in the Accounts Payable Ledger table (F0411) with a document type NO.

The system does not create vouchers with tax information from the credit memo.

-

Creates a batch of vouchers (batch type V), which you must post.

When you post the voucher batch, the system credits the A/P trade account and debits the suspense account specified by the AAI item NC.

Review the Credit Reimbursement report (R03B610):

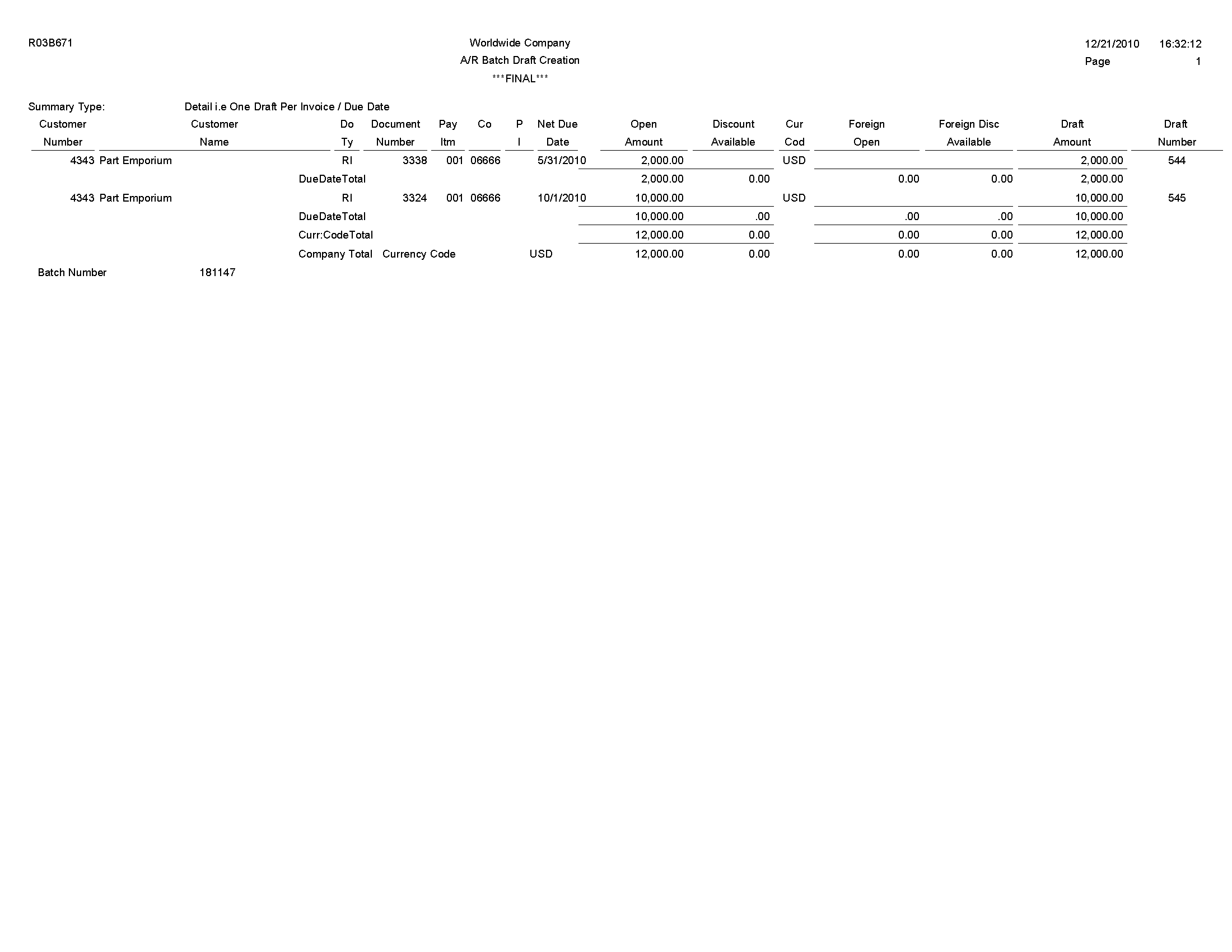

3.44 A/R Batch Draft Creation Report (R03B671)

On the Draft Daily Operations menu (G03B161), select Pre-Authorized Drafts.

Use this report to review a list of customers with missing or invalid bank information. You can review the list to correct or update the bank information before you generate the drafts.

Review the A/R Batch Draft Creation report (R03B671):

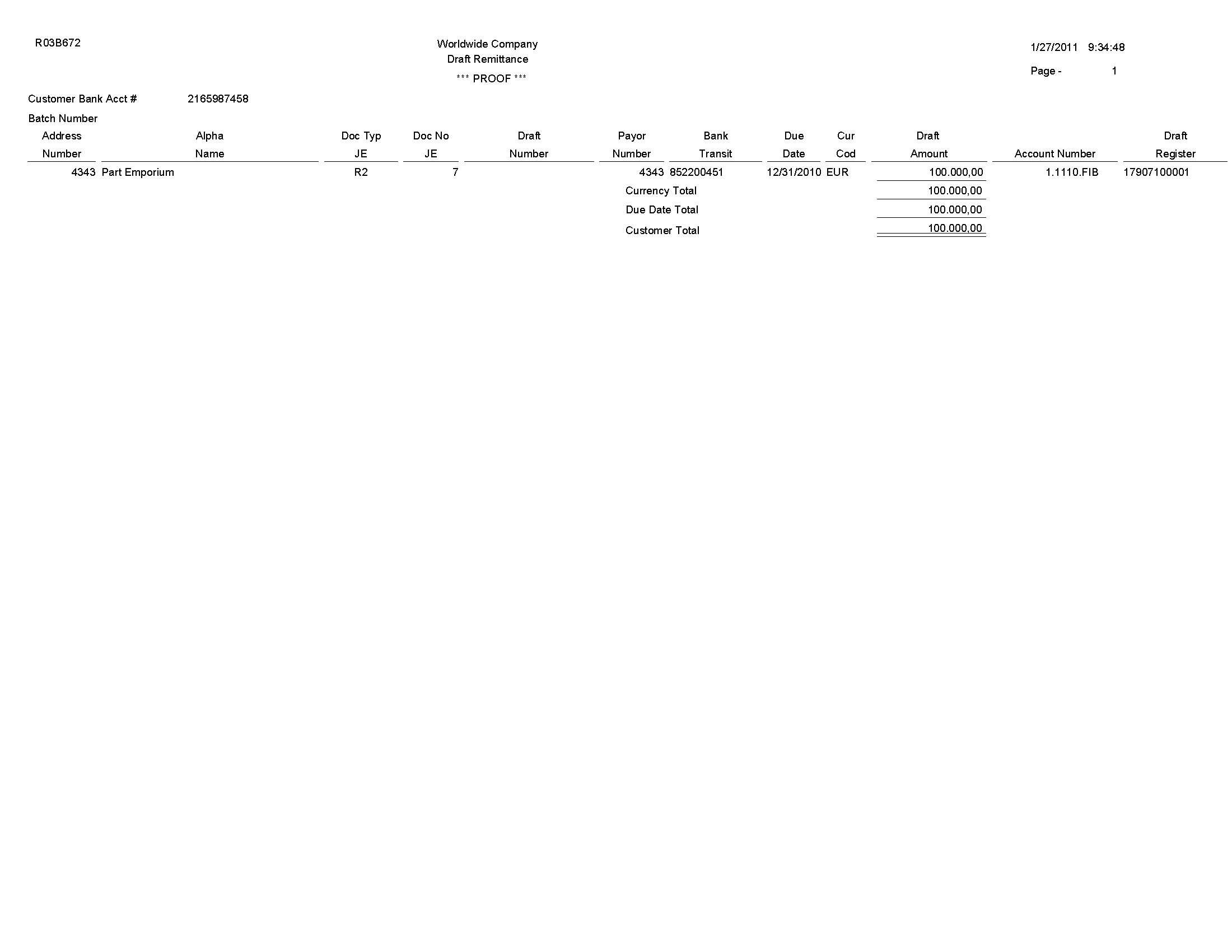

3.45 Draft Remittance Report (R03B672)

On the Draft Remittance and Collection menu (G03B162), select Draft Remittance.

When you create an online register, you select the drafts to remit to the bank for collection. Use this program to remit those drafts to the bank before you can create another register for the same bank account; however, you can add and remove drafts from an existing register before you remit them.

Review the Draft Remittance report (R03B672):

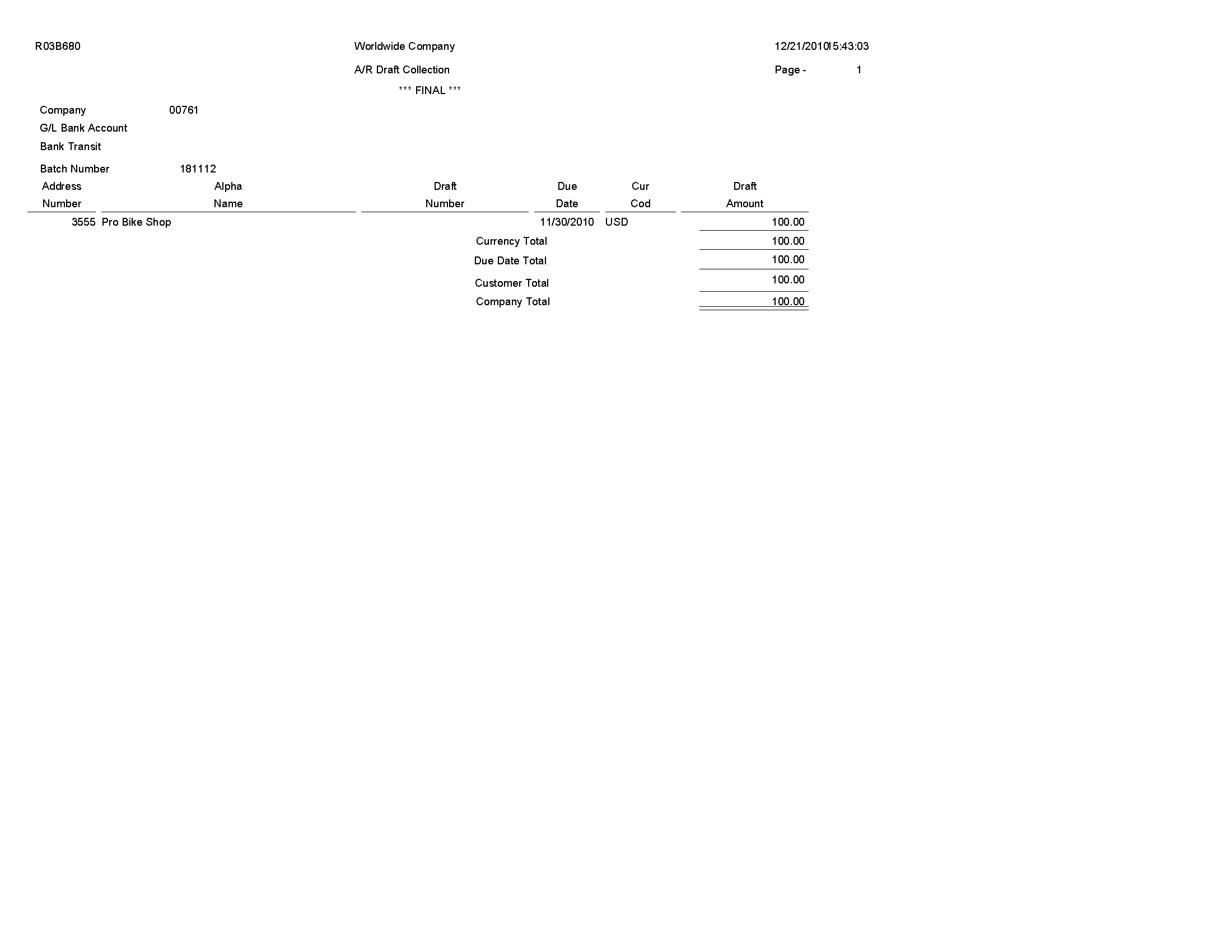

3.46 Draft Collection with Status Update Report (R03B680)

On the Draft Remittance and Collection menu (G03B162), select Draft Collection with Status Update.

Some companies prefer to close the draft on the draft due date, while others wait until the payment appears on their bank statement. If you select to leave the draft records open, you must run this program to select and update the draft records and to create matching records in the Receipts Detail table (F03B14). After you collect the draft and close it, you must post the draft batch to create the appropriate journal entries.

Review the Draft Collection with Status Update report (R03B680):

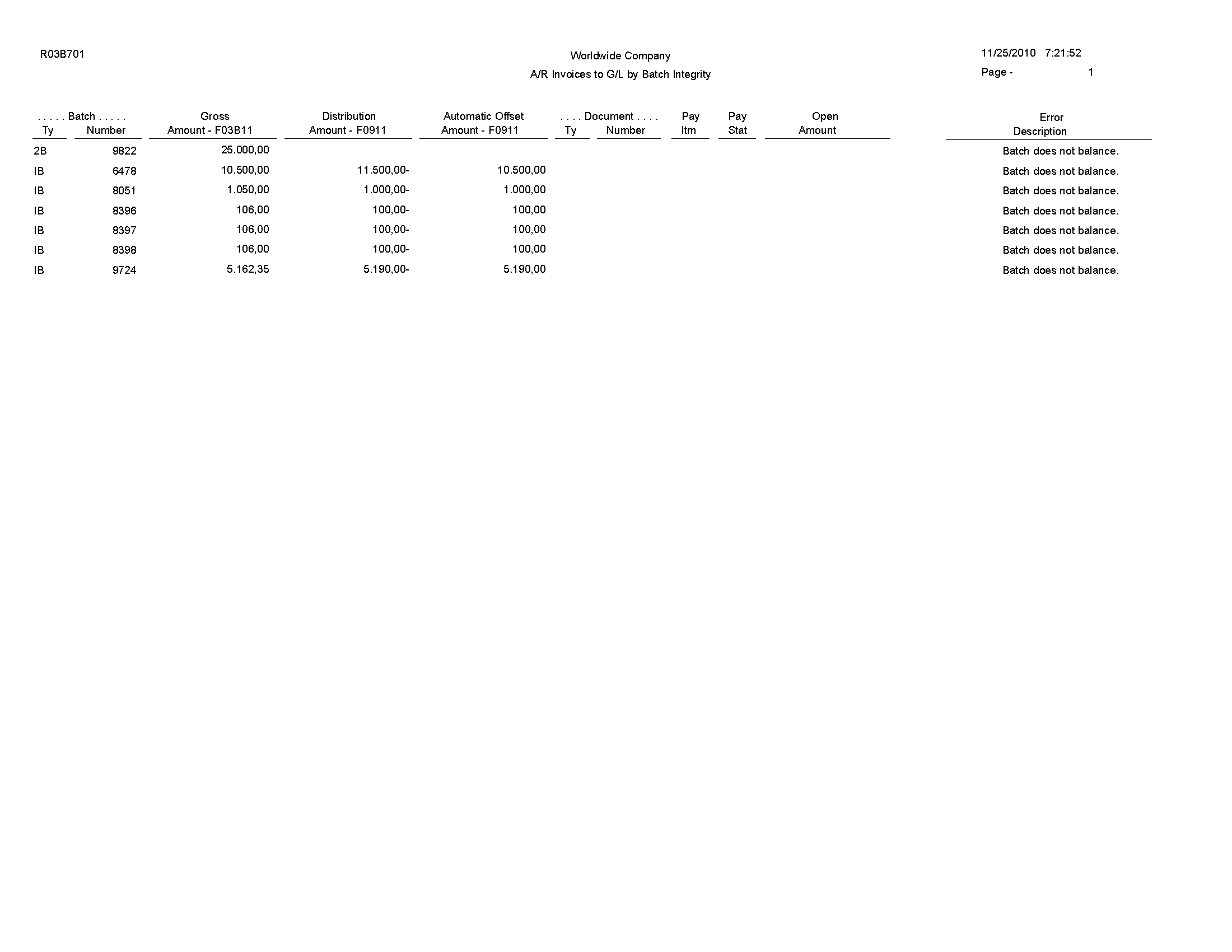

3.47 A/R to G/L by Batch Report (R03B701)

On the Period End Processing menu (G03B21), select A/R to G/L by Batch.

Use this report to compare the batch amount of the transactions in the Customer Ledger table (F03B11) with the batch amount of the corresponding records in the Account Ledger (F0911).

Review the A/R to G/L by Batch report (R03B701):

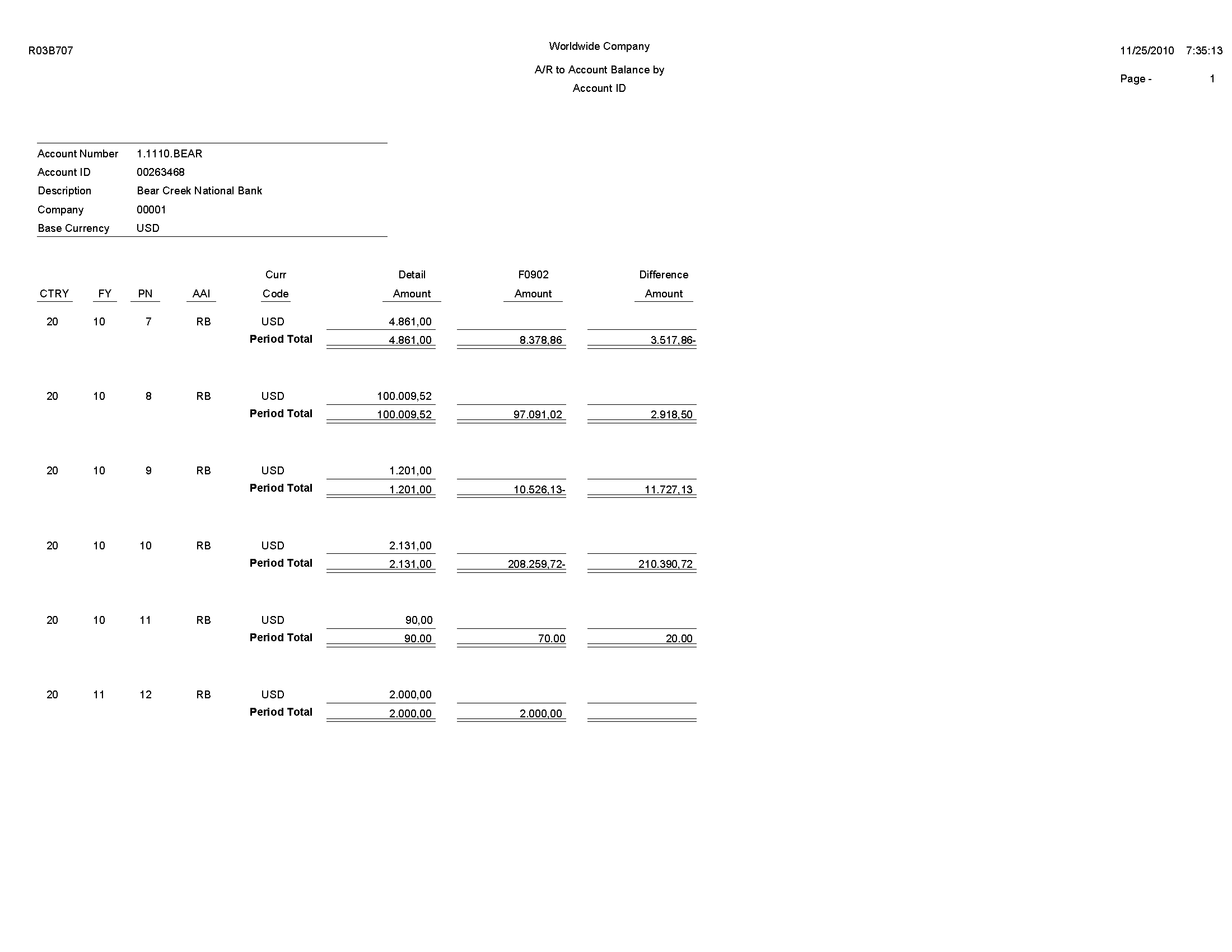

3.48 A/R to Account Balance by Account ID Report (R03B707)

On the Period End Processing menu (G03B21), select A/R to Account Balance by Account ID.

Use this report to compare amounts updated in the Account Balances table (F0902) with posted amounts in the following transaction tables for each offset account by account ID:

-

Customer Ledger (F03B11)

-

Invoice Revisions (F03B112)

-

Receipts Header (F03B13)

-

Receipts Detail (F03B14)

Review the A/R to Account Balance by Account ID report (R03B707):

3.49 Recycle Recurring Invoice Report (R03B8101)

On the Other Invoice Entry Methods menu (G03B111), select Recycle Recurring Invoices.

After you enter, review, and revise recurring invoices, you recycle them to create a new batch of transactions for the next month, quarter, or year. Use this program to generate a new transaction based on the number of payments and the recurring frequency that you specified when you created the original recurring transaction. When you recycle an invoice, the system makes a copy of the previous transaction and updates the appropriate fields.

Review the Recycle Recurring Invoice report (R03B8101):

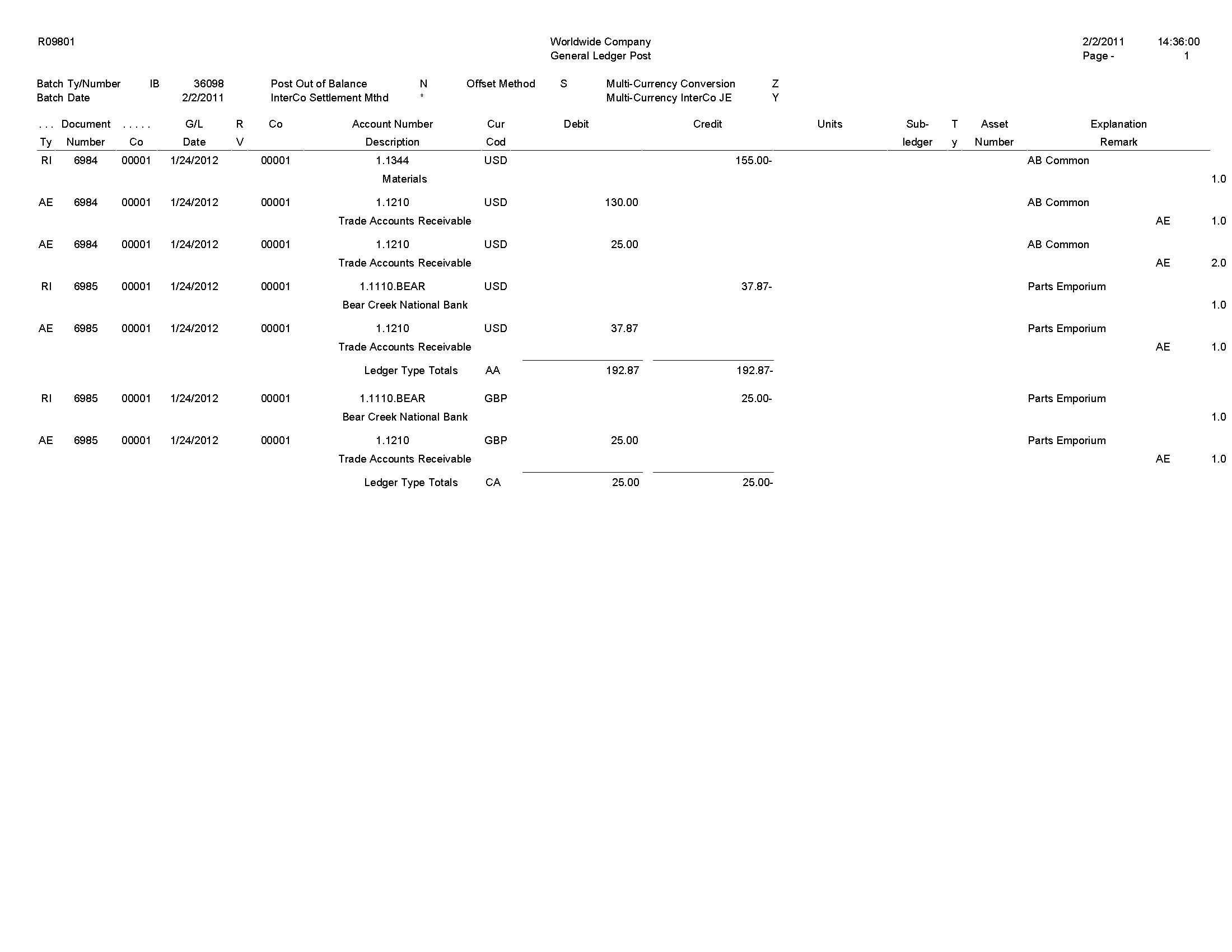

3.50 General Ledger Post Report (Invoices) (R09801)

On the Customer Invoice Entry menu (G03B11), select Post Invoices to G/L.

Run this version of the report to post invoices to the general ledger.

Review the General Ledger Post report (invoices) (R09801):

3.51 General Ledger Post Report (Receipts) (R09801)

On the Automated Receipts Processing menu (G03B13), select Post Receipts to G/L.

On the Manual Receipts Processing menu (G03B12), select Post Receipts to G/L.

Run this version of the report to post receipts to the general ledger.

Review the General Ledger Post report (receipts) (R09801):