7 JD Edwards EnterpriseOne Financial Reports

This chapter discusses the report navigation, overview information and a report sample for the following reports:

-

Section 7.6, "Consolidated Income Statement Report (R10250)"

-

Section 7.8, "Consolidated Income-7 Column Report (R103121A)"

-

Section 7.9, "Variance Analysis With 5 Months Actual Report (R10411A)"

-

Section 7.13, "Business Unit Structure Build Report (R10450)"

-

Section 7.14, "Journalize Consolidation Balances Report (R10480)"

-

Section 7.16, "Multi-Site Consolidations - Periods 1 - 6 Report (R105501)"

-

Section 7.17, "Multi-Site Consolidations - Periods 7 - 14 Report (R105502)"

-

Section 7.19, "Prior Period Balance Integrity Report (R10700)"

-

Section 7.20, "Business Units/Accounts Monthly Comparison Report (R10701)"

-

Section 7.21, "UDC Value Control Exceptions Report (R107011)"

-

Section 7.22, "Object/Subsidiary Value Control Exceptions Report (R107021)"

|

Note: This reports guide discusses reports that are commonly used in the JD Edwards EnterpriseOne system. This reports guide does not provide an inclusive list of every report that exists in the system.This guide is intended to provide overview information for each report. You must refer to the appropriate JD Edwards EnterpriseOne implementation guide for complete report information. |

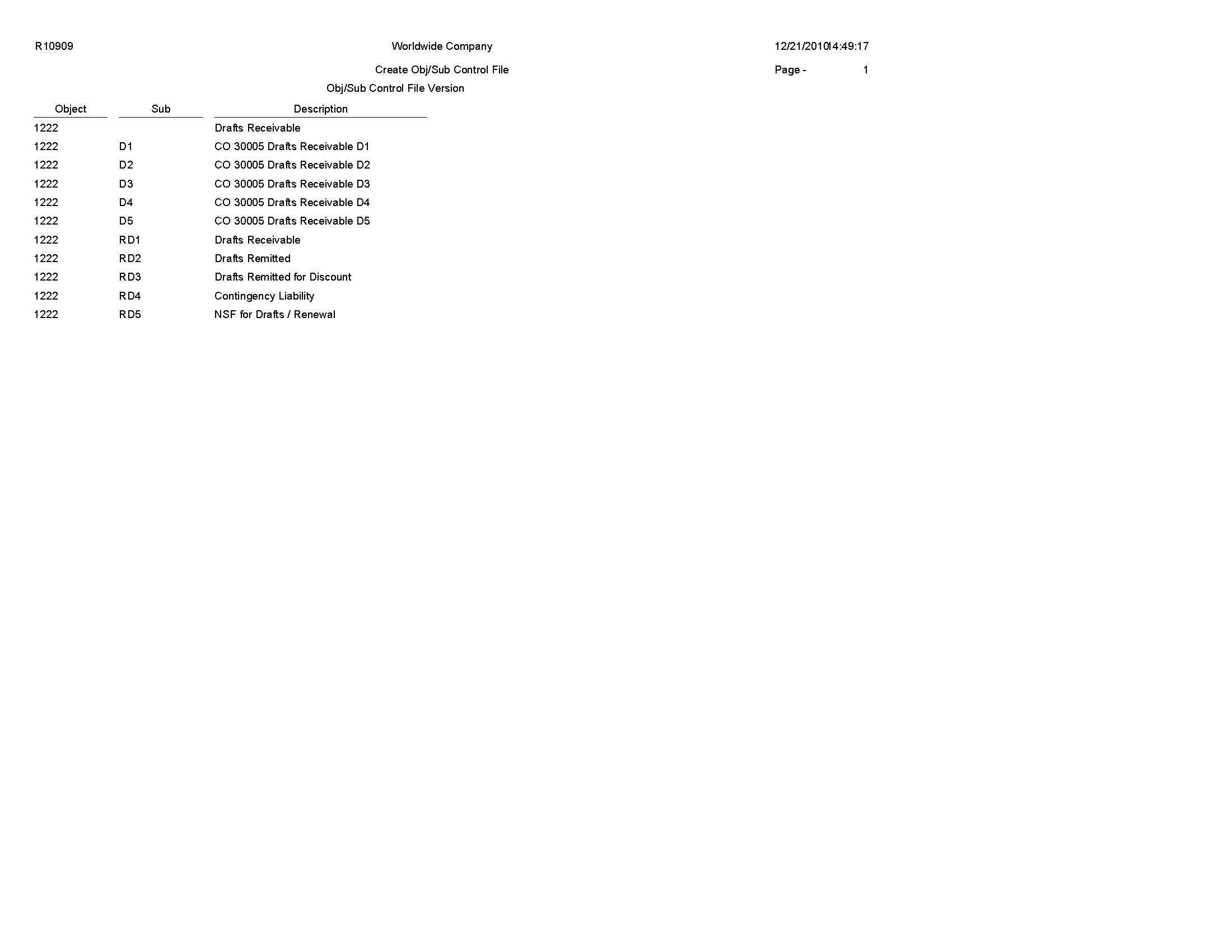

7.1 Create UDC Control File Report (R10005)

On the Integrity Reports menu (G1022), select Create UDC Control File.

Use this report to identify the user-defined codes that the source can use when consolidating multisite information. The source can use only category codes from this report to define its organizational structure and its account structure. Usually, the target company defines valid user-defined codes and their values.

Review the Create UDC Control File report (R10005):

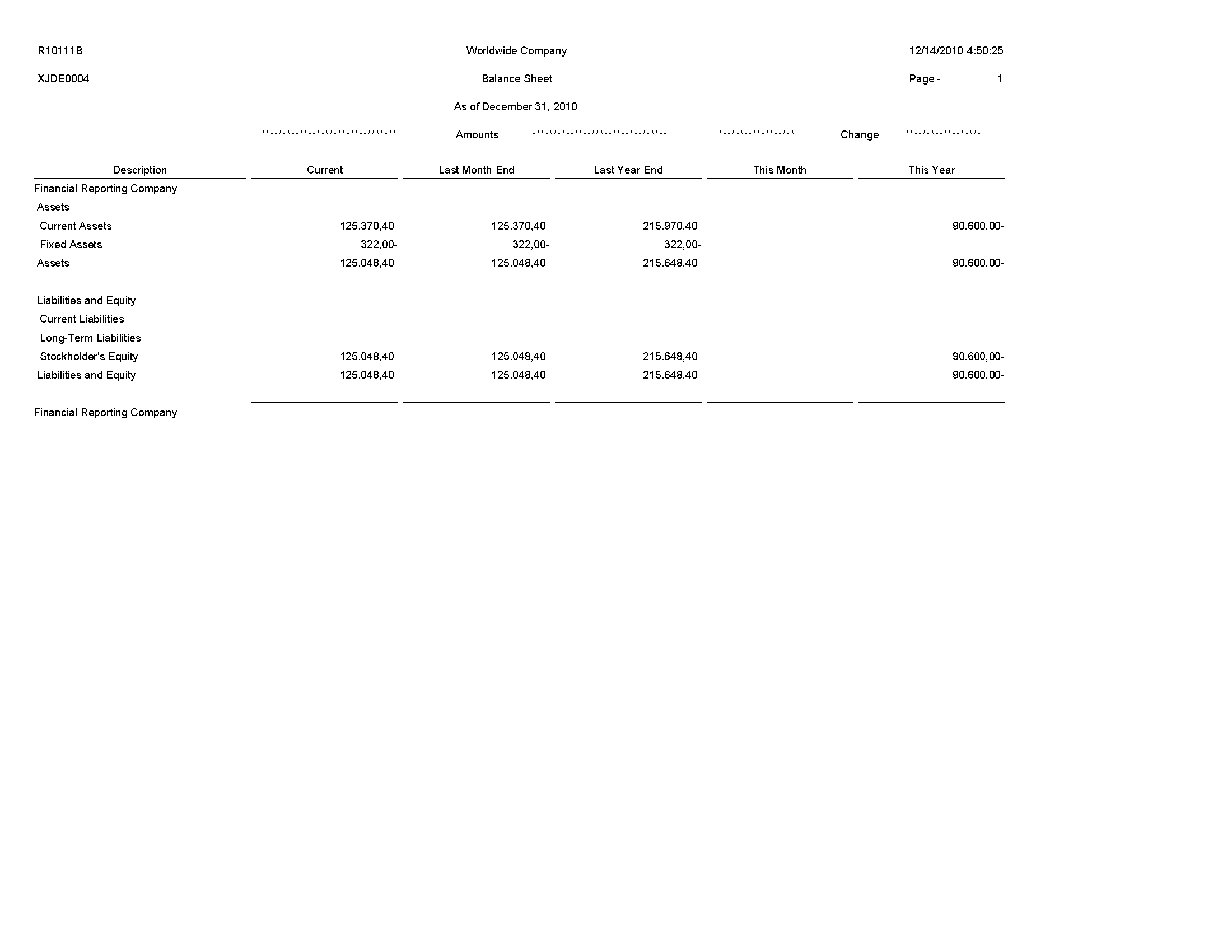

7.2 Balance Sheet Report (R10111B)

On the Financial Reports menu (G10), select Simple Balance Sheet.

Use the program to track assets, liabilities, and equity by business unit or company. To print a simple balance sheet, all of your balance sheet accounts must be grouped in your chart of accounts, and cannot be interrupted by any profit and loss accounts.

Review the Simple Balance Sheet report (R10111B):

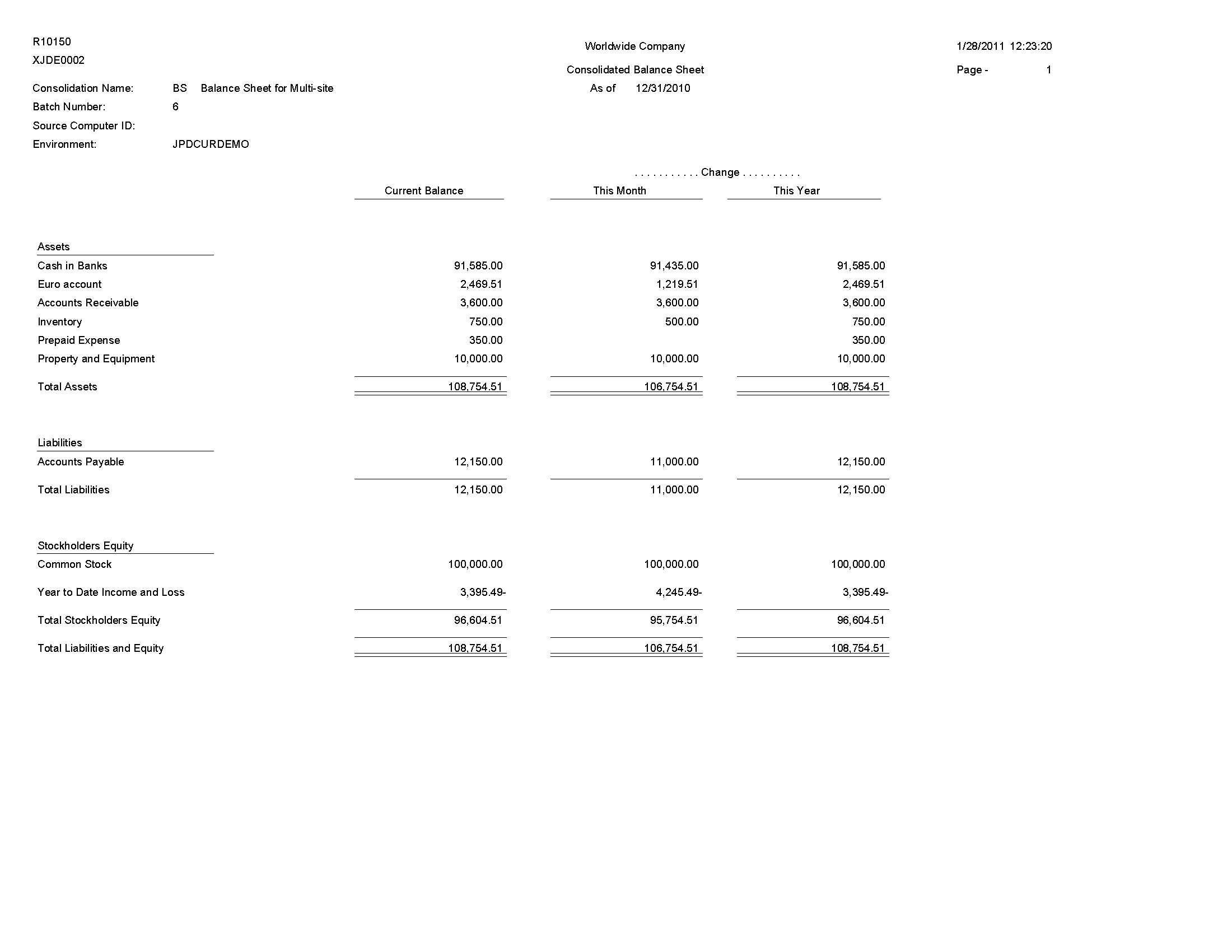

7.3 Consolidated Balance Sheet Report (R10150)

On the Integrity Reports menu (G1022), select Consolidated Balance Sheet.

Use this report to review the assets, liabilities, and stockholders' equity of the consolidation that you are sending to the target company.

Review the Consolidated Balance Sheet report (R10150):

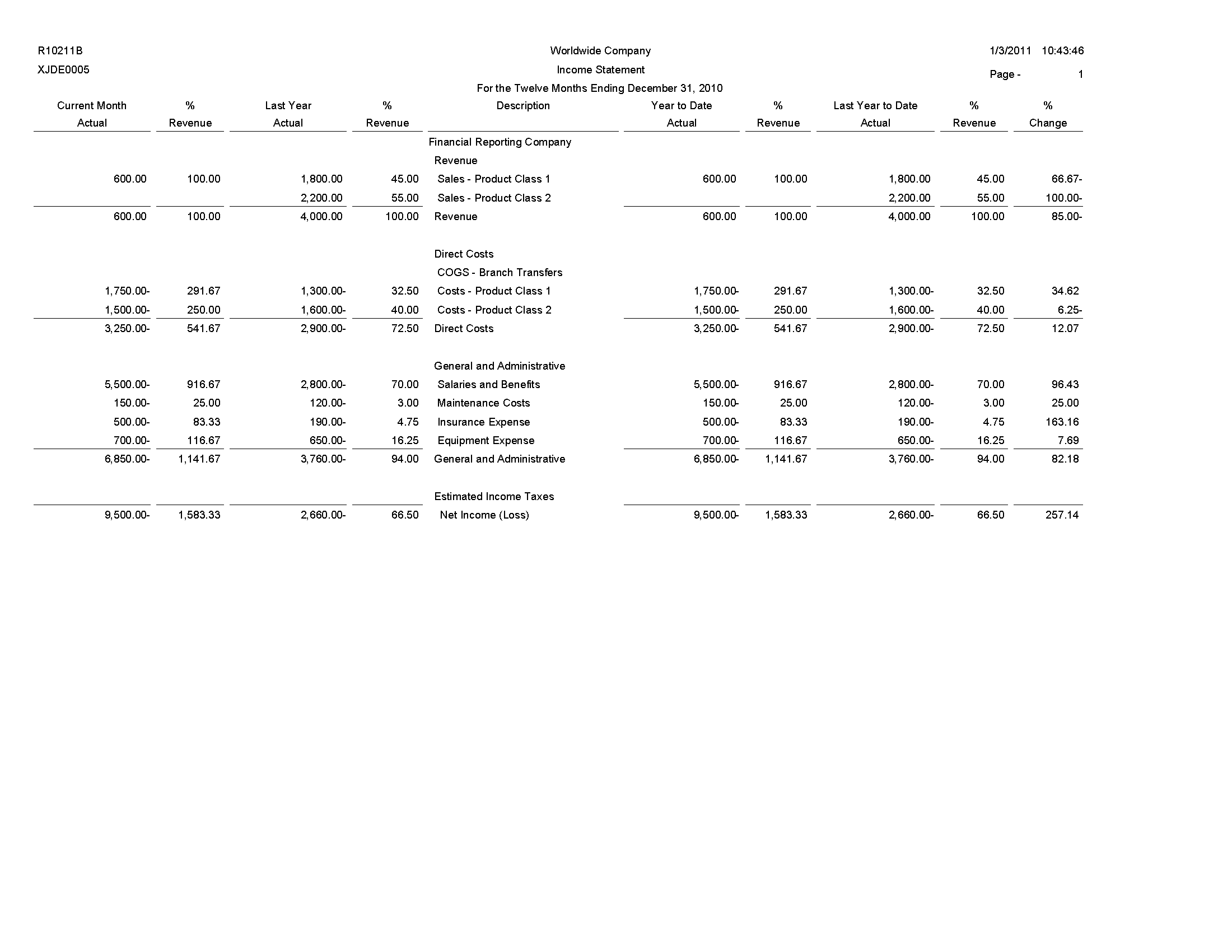

7.4 Simple Income Statement Report (R10211B)

On the Financial Reports menu (G10), select Simple Income Statement.

Use the report to track revenues and expenses and the net income or loss for a specific period. To print a simple income statement, all of your profit and loss accounts must be grouped together in your chart of accounts and cannot be interrupted by any balance sheet accounts.

Review the Simple Income Statement report (R10211B):

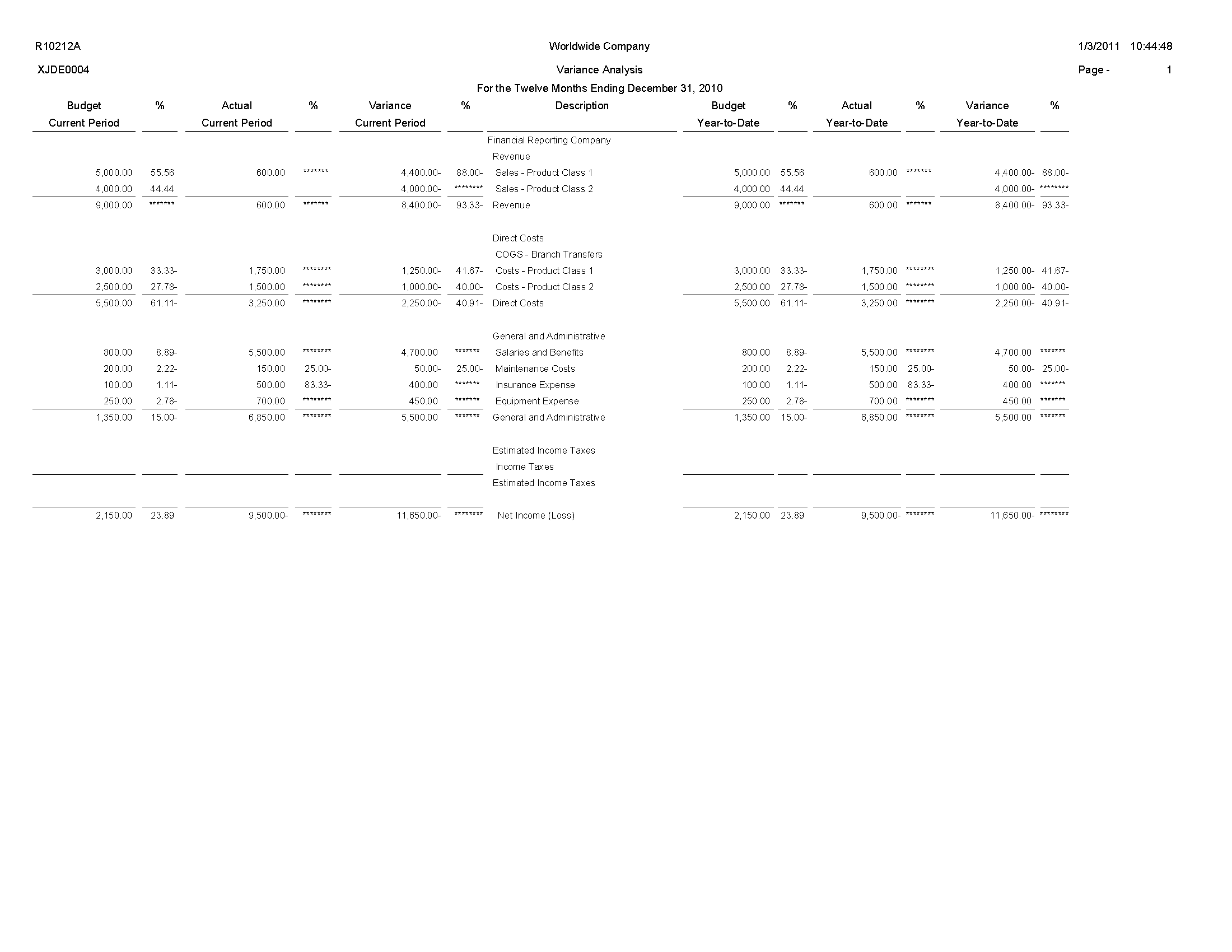

7.5 Variance Analysis Report (R10212A)

On the Financial Reports menu (G10), select Variance Analysis.

Use this report to review budget and actual amounts and check the difference (variance) between the two amounts. In addition, the percentage that is associated with each line item reflects the percentage of revenues. The percentage of budget that is associated with each line item is equal to the variance divided by the budget for the current period or year-to-date.

Review the Variance Analysis report (R10212A):

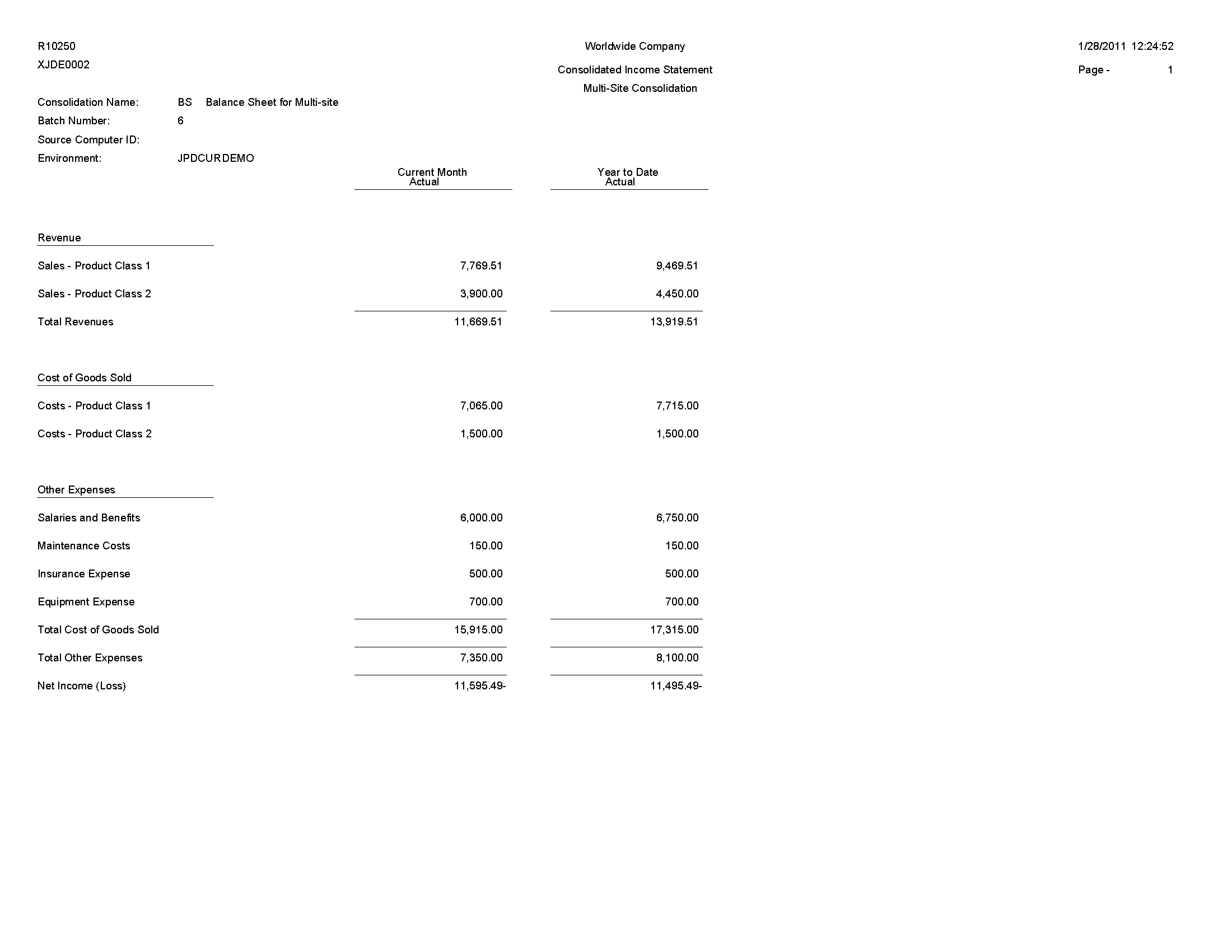

7.6 Consolidated Income Statement Report (R10250)

On the Integrity Reports menu (G1022), select Consolidated Income Statement.

Use this report to review the revenues and expenses of the consolidation that you are sending to the target company.

Review the Consolidated Income Statement report (R10250):

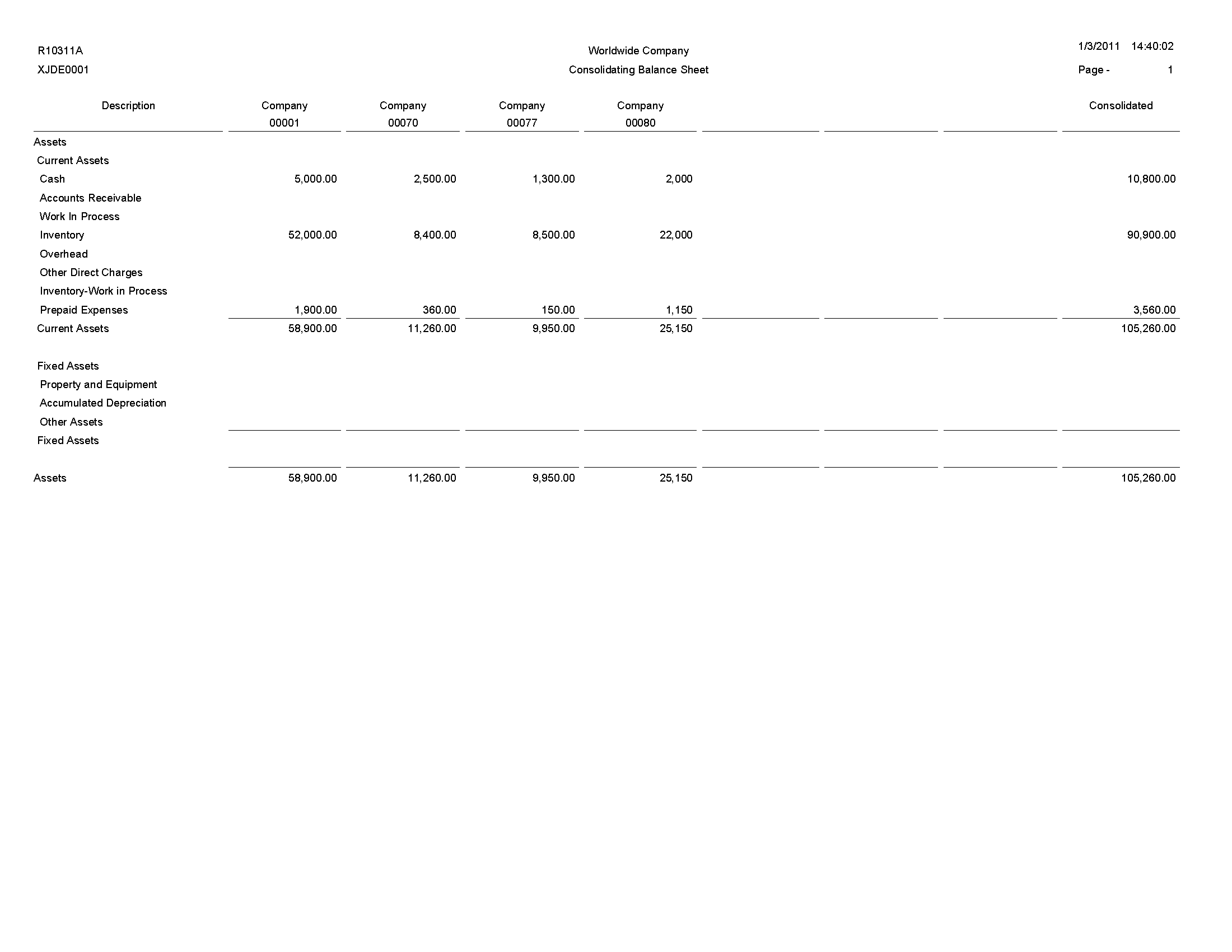

7.7 Consolidating Balance Sheet Report (R10311A)

On the Financial Reports menu (G10), select Consolidated Balance Sheet.

Use this report to print balance sheet comparisons using combined totals for companies or business units for the current period or the year to date. You can consolidate up to seven different reporting entities on the consolidated balance sheet.

The XJDE versions of the Consolidated Balance Sheet have predefined columns for specific companies. To create a report for companies other than those that are defined in the XJDE versions, you must use the Report Design Aid tool to set up data selection and column titles.

Review the Consolidated Balance Sheet report (R10311A):

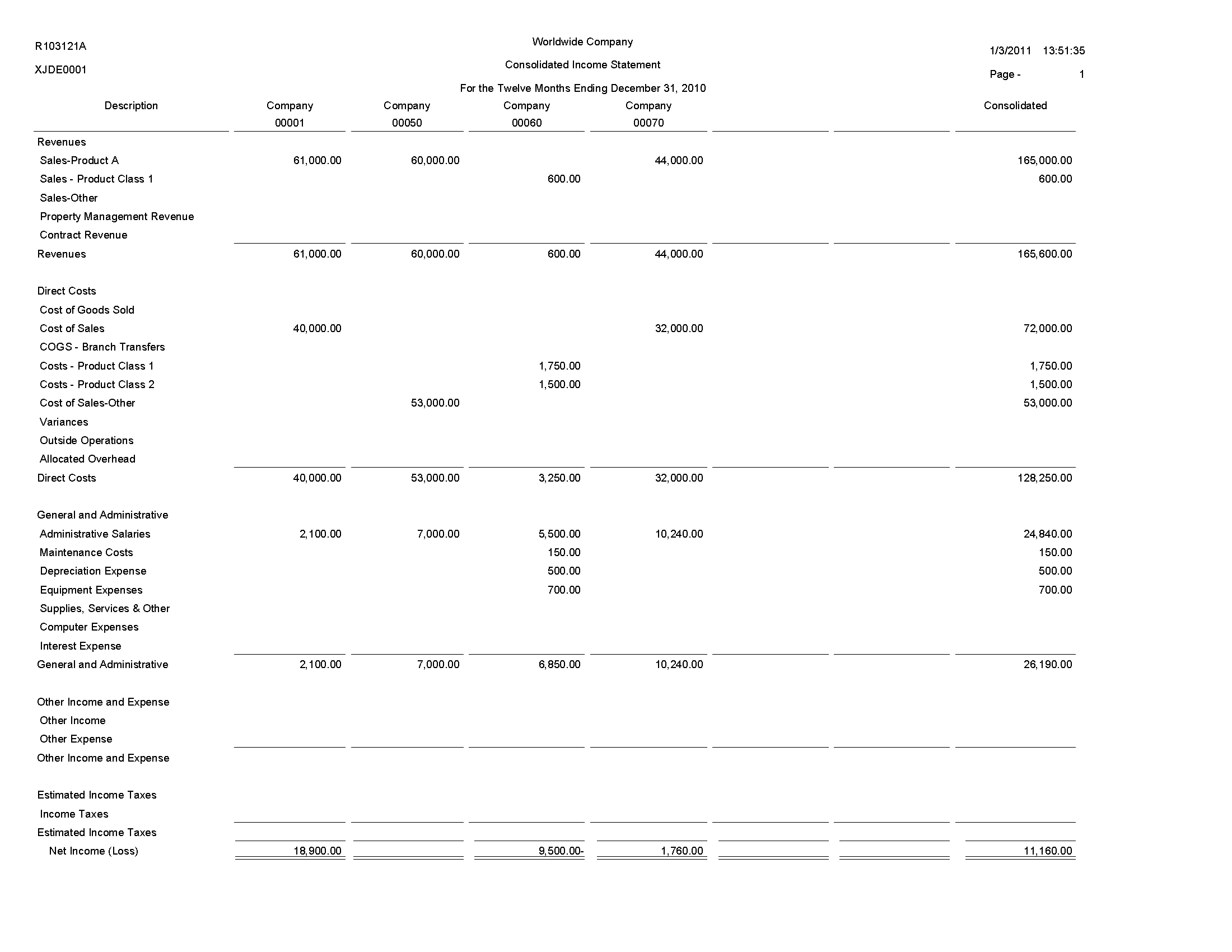

7.8 Consolidated Income-7 Column Report (R103121A)

On the Financial Reports menu (G10), select Consolidated Income-7 column.

Use this report to print income (profit and loss) information that is combined for companies or business units. Amounts on consolidated income statements include a maximum of 999 million with separators and 999 billion without separators. You can include information for the current period or year to date.

The XJDE versions for the report have predefined columns for specific companies. To create a report for companies other than those that are defined in the XJDE versions, you must use the Report Design Aid tool to set up data selection and column titles.

Review the Consolidated Income-7 report (R103121A):

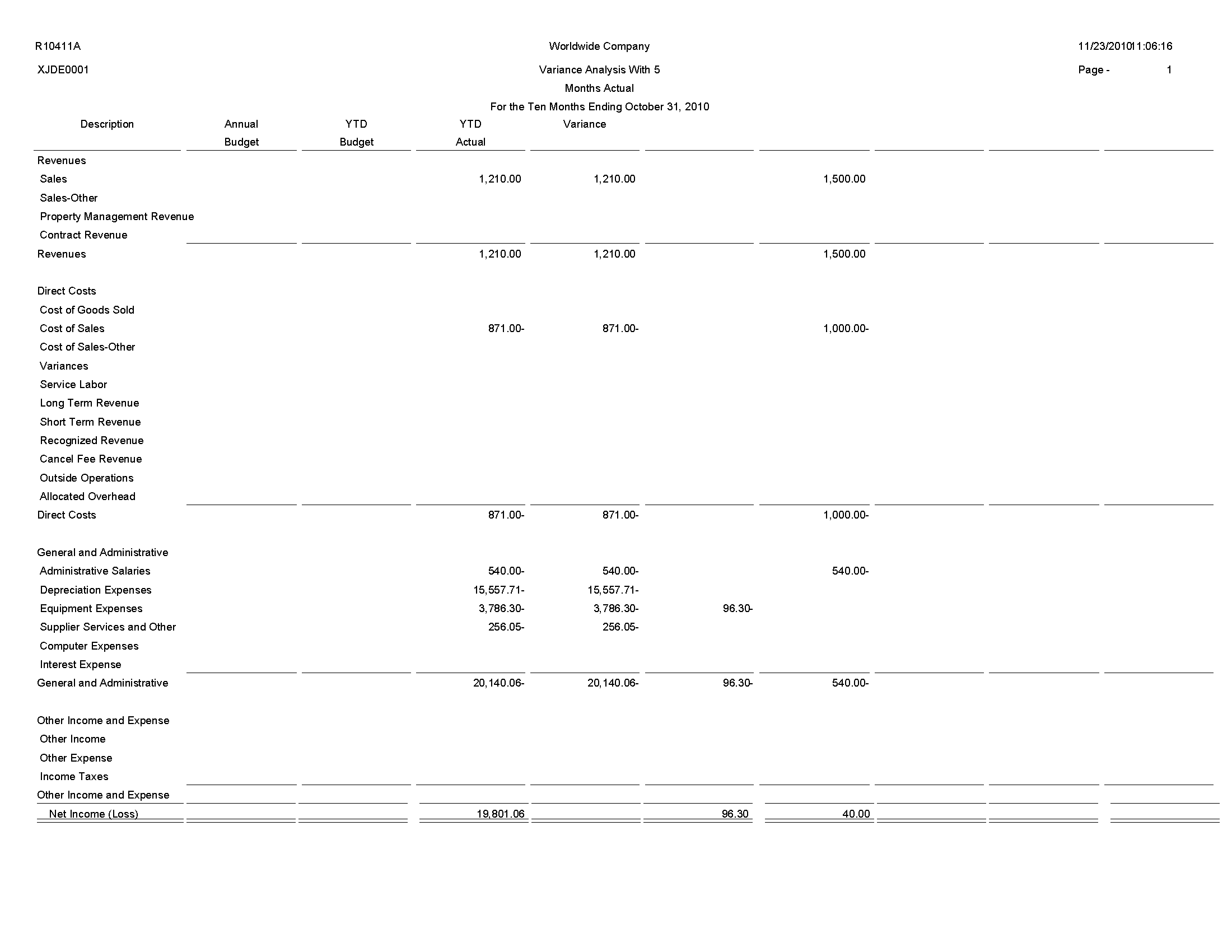

7.9 Variance Analysis With 5 Months Actual Report (R10411A)

On the Financial Reports menu (G10), select Variance Analysis w/5 Months.

Use this report to review a list of annual and year-to-date budget amounts, year-to-date actual amounts, and the year-to-date variance. The report also lists actual amounts for the period that is specified in the processing option and the four preceding periods.

Review the Variance Analysis with 5 Months Actual report (R10411A):

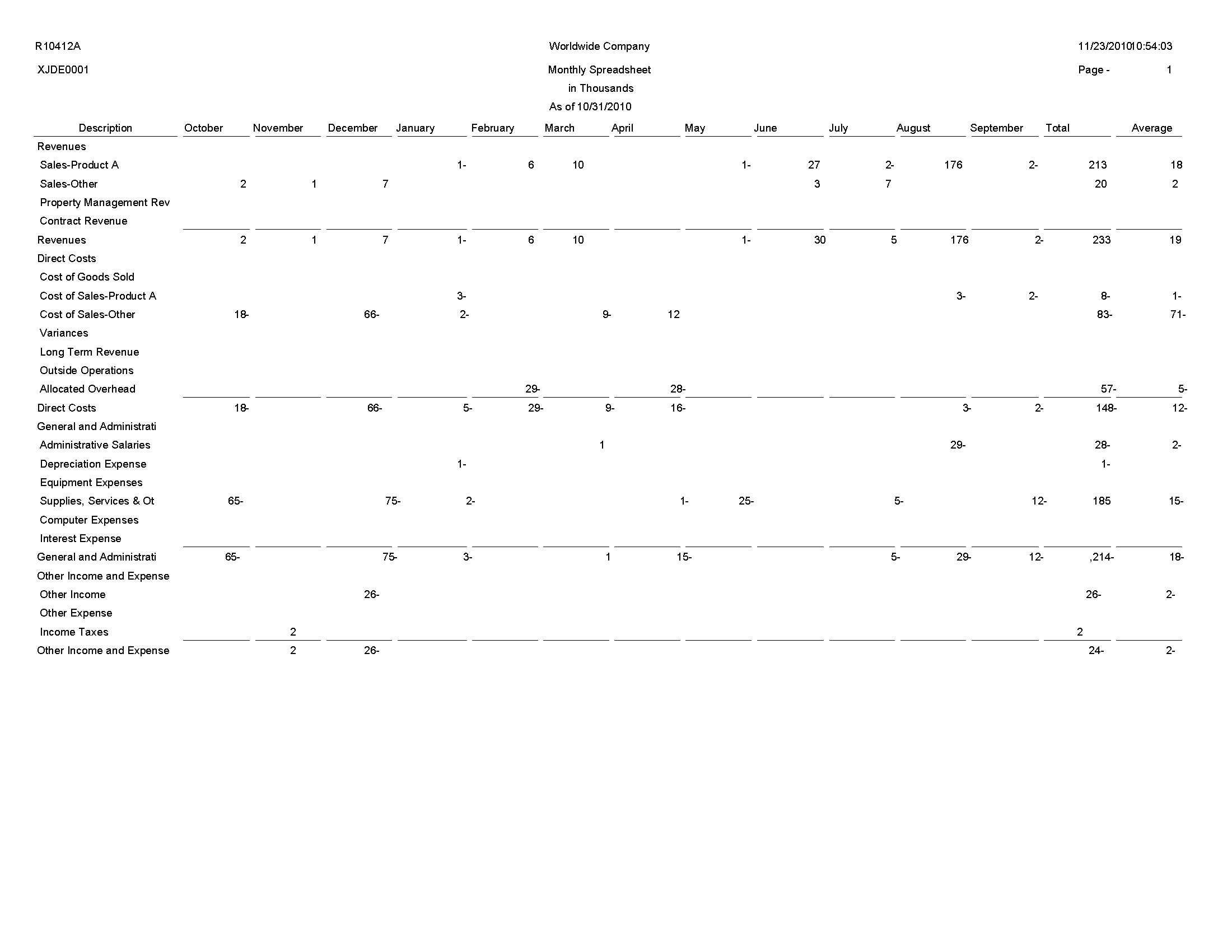

7.10 Monthly Spreadsheet Report (R10412A)

On the Financial Reports menu (G10), select Monthly Spreadsheet.

Use this report to examine trends in your company's financial activity. You can analyze actual and budget amounts for period-to-date and year-to-date. You can also show current period amounts with budget amounts for future periods.

The monthly spreadsheet rounds to the thousands. For example, if the amount is 2700, it rounds to 3000 and prints as 3. If you want a spreadsheet with different specifications, you can design your own by using the Report Design Aid tool.

The system uses information stored in the Account Balances table (F0902) for the monthly spreadsheet.

Review the Monthly Spreadsheet report (R10412A):

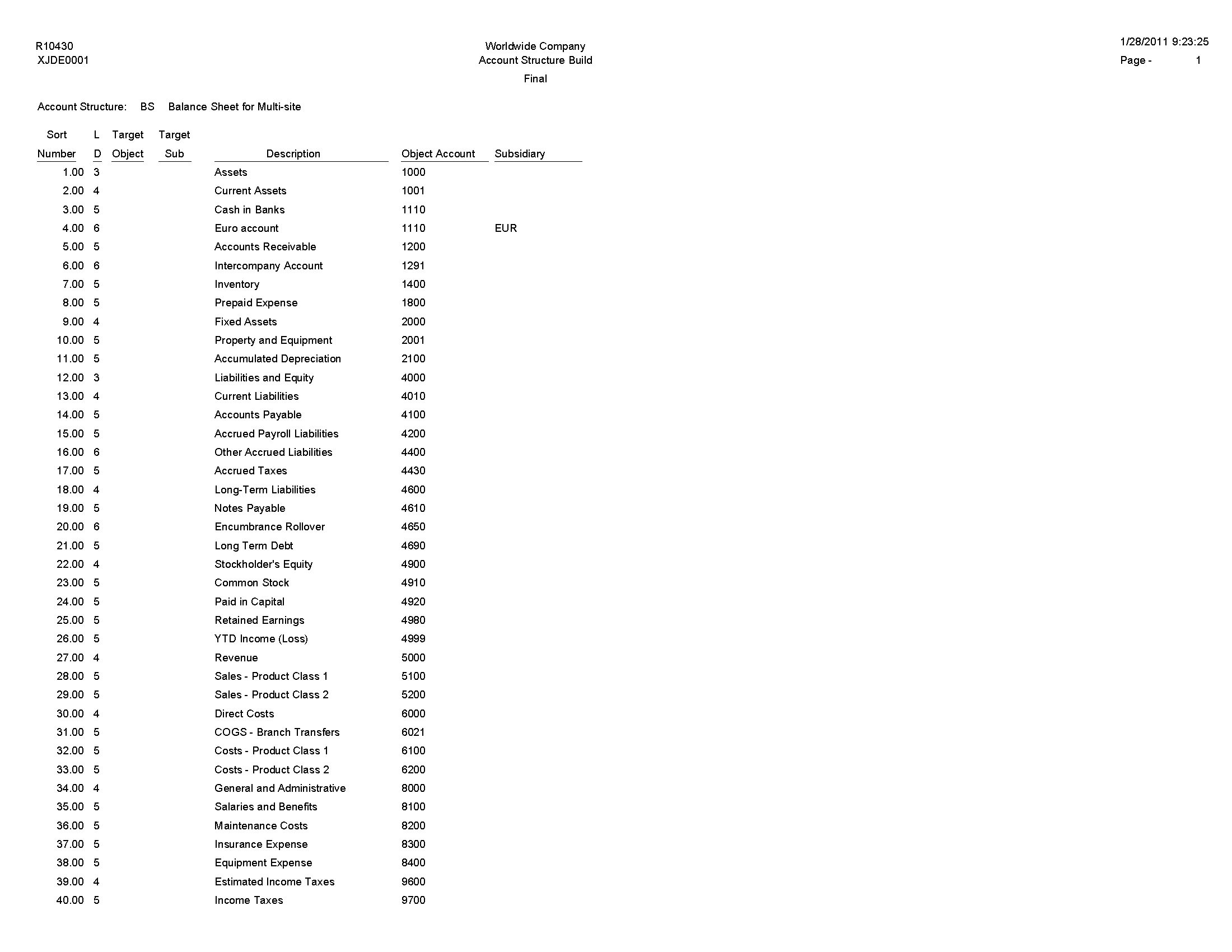

7.11 Account Structure Build Report (R10430)

On the Multi-Site Consolidation Setup menu (G1042), select Account Structure Build.

Before you can consolidate account balances, you must build the account structure that the system uses for the consolidation. This program reads the Account Master table (F0901) and creates the account structure that is based on the sequence that you define in the account structure. The system creates one record in the structure for each unique object and subsidiary combination.

The program can add records to an existing account structure, or it can create a new account structure. The system deletes the existing structure if you set the corresponding processing option to create a new account structure that has an existing structure name.

If you entered target object and subsidiary information in category codes, you can specify the codes in the corresponding processing option. The system uses the values to create the target object and subsidiary account information.

If you entered level of detail information in a category code, you can specify the code in the corresponding processing option. The system uses the value for the level of detail of the account structure.

Review the Account Structure Build report (R10430):

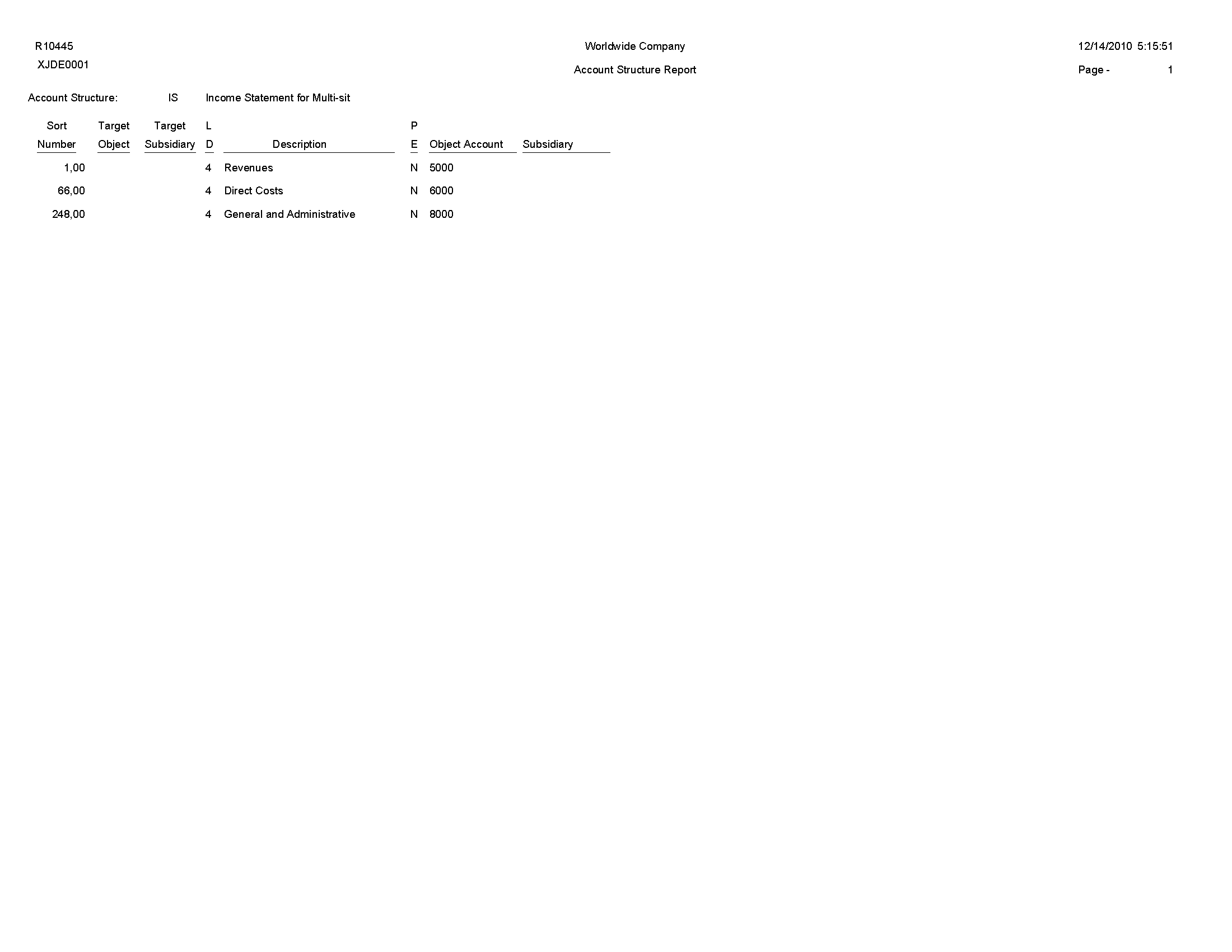

7.12 Account Structure Report (R10445)

On the Multi-Site Consolidation Setup menu (G1042), select Account Structure Report.

After you create or revise the account structure, use this report to show the complete hierarchy of the structure.

Review the Account Structure report (R10445):

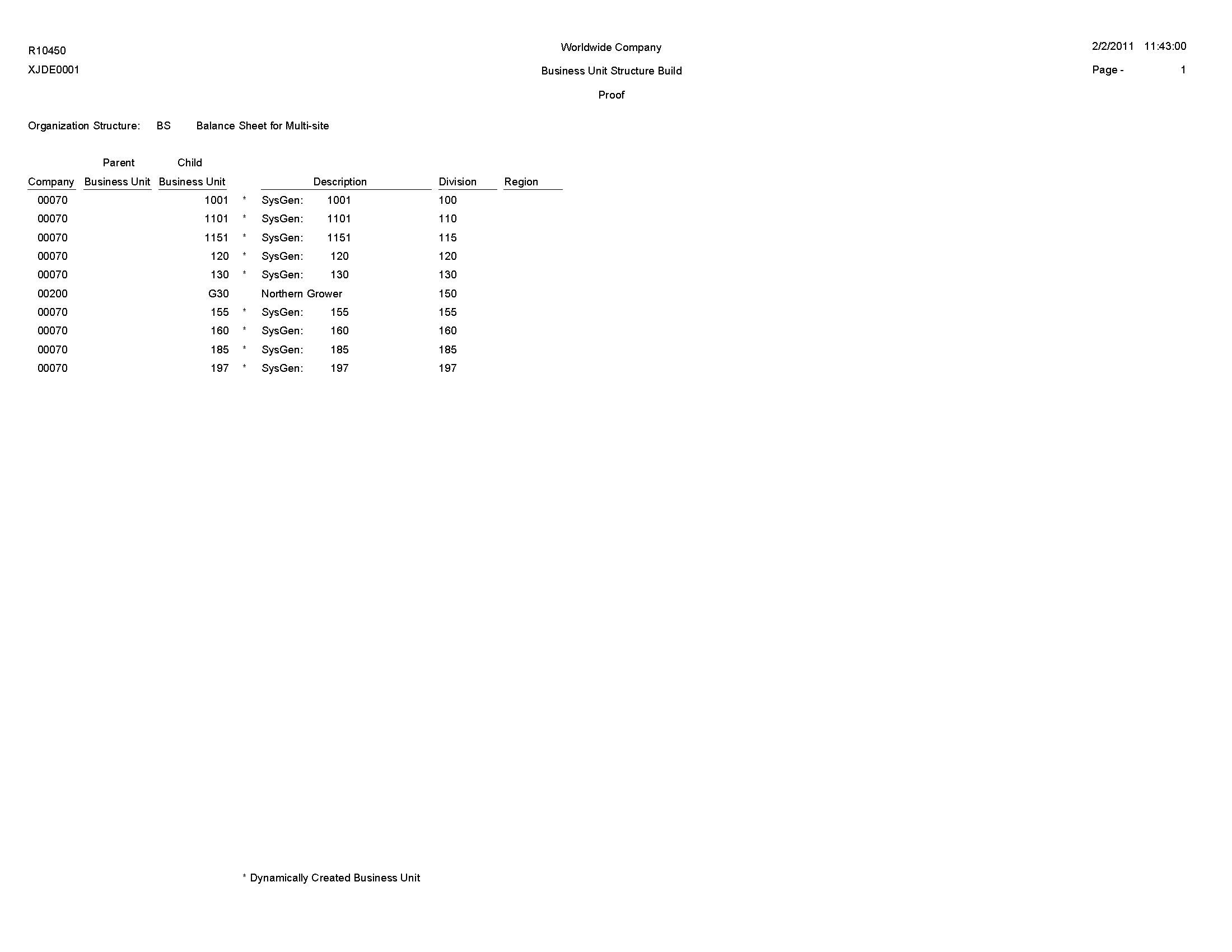

7.13 Business Unit Structure Build Report (R10450)

On the Advanced Organization Setup menu (G094111), select Organization Structure Build.

After you define your organization report structure in the Organization Structure Definition program (P0050B), run this program to build it.

You can run this program in proof or final mode. In proof mode, the system prints a report that shows the changes that occur when you run the report in final mode. In proof mode, any business units that are dynamically created appear on the report as a concatenation of category codes, regardless of the setting of the BU Creation processing options.

In final mode, the system dynamically creates business units either by using next numbers or by concatenating category codes, depending on the setting of the BU Creation processing options. In final mode, the system updates the Organization Structure Master File table (F0050).

Review the Business Unit Structure Build report (R10450):

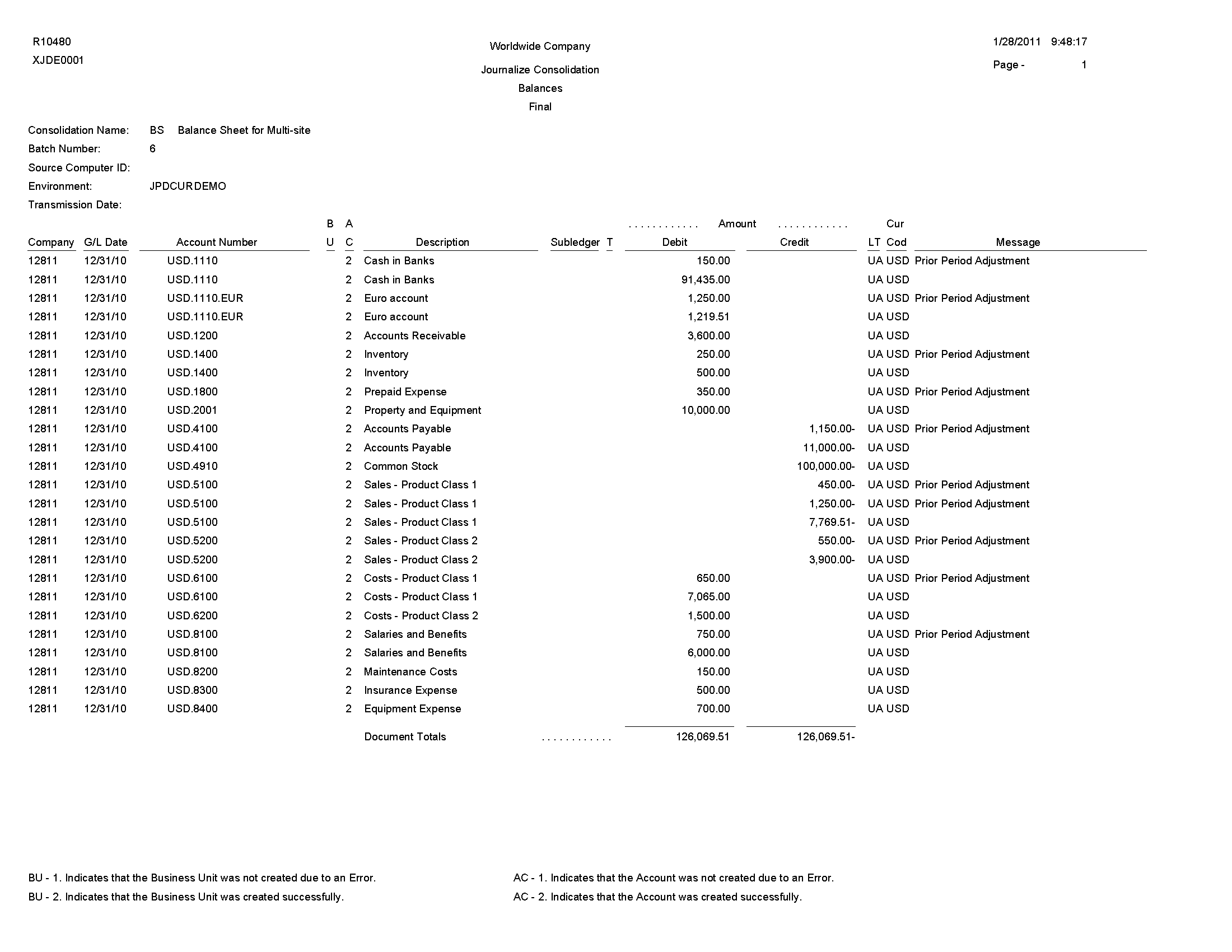

7.14 Journalize Consolidation Balances Report (R10480)

On the Multi-Site Consolidation menu (G1021), select Journalize Consol. Balances.

After you receive the multisite consolidations at the target company, you should run integrity reports to ensure that the data that you received is accurate. Use this program to create journal entries for the summarized account balances that were received from the source company. These journal entries are based on the difference from one consolidation batch to another.

When you run this program, the system reads the Multi-Site Consolidation Transfer File Header (F1001), Multi-Site Consolidation Transfer File (F1002), and Multi-Site Consolidation Transfer File - Category Codes (F1003) tables and creates journal entries in the Journal Entry Transactions - Batch File table (F0911Z1).

You can run this batch program in proof or final mode. In proof mode, the system prints a report of the journal entries, but does not update the F0911Z1 table. In final mode, the system creates the journal entries in the F0911Z1 table and, based on a processing option, prints a report of the journal entries.

The report shows the journal entries that were created for the summarized balances from the source company by source system ID and batch number. It also shows batch totals.

Review the Journalize Consolidate Balance report (R10480):

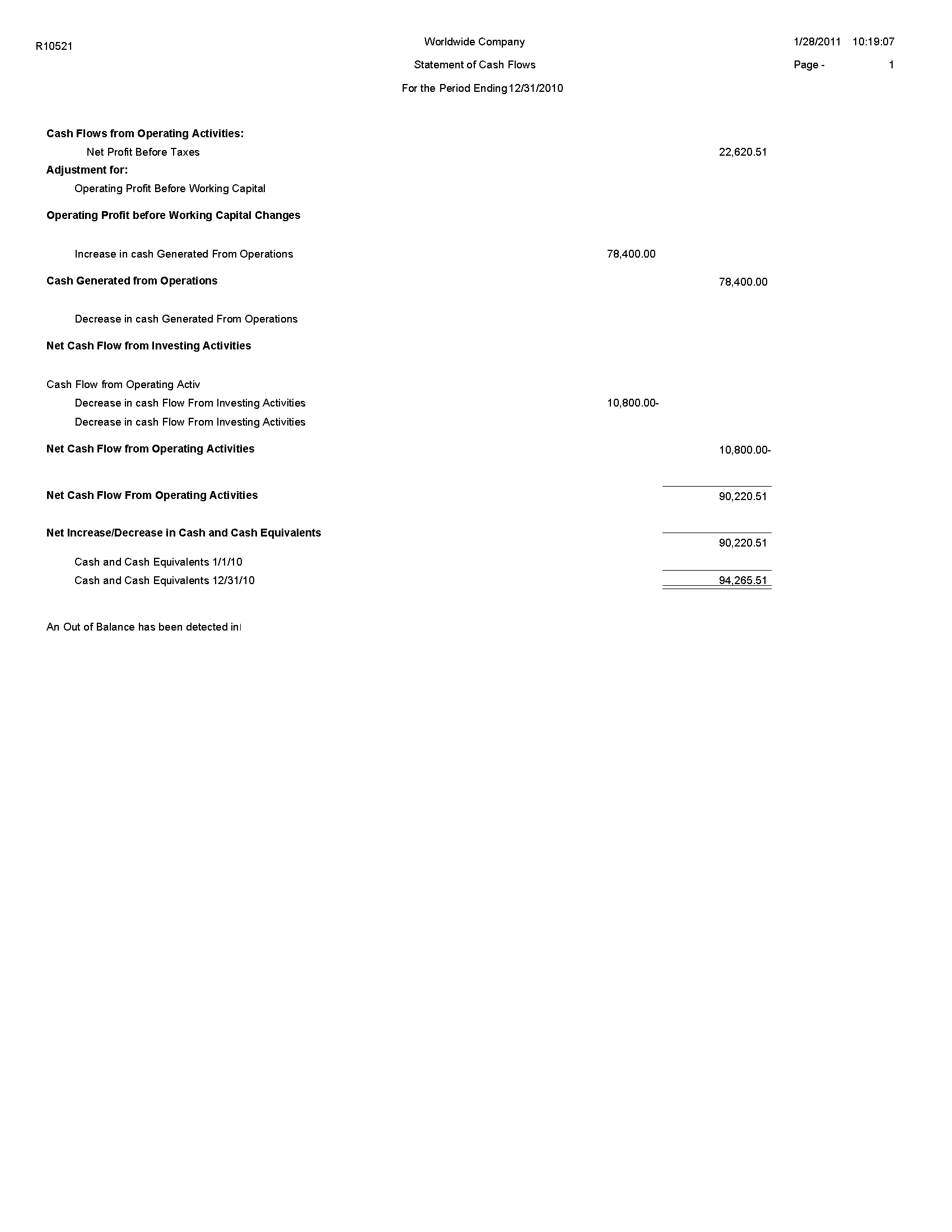

7.15 Statement of Cash Flows Report (R10521)

On the Statement of Cash Flow menu (G1031), select Statement of Cash Flows Report.

Use this report to review information on the cash flows of a reporting entity and meets International Accounting Standards (IAS) requirements for financial reporting. The statement of cash flow consists of accounts that are part of a company's operating, investing, and financing activities and provides information about how cash and cash equivalents are generated and used by a company. The system retrieves information for cash flow statements from the Statement of Cash Flow Rules (F10520) and Account Balances (F0902) tables.

Review the Statement of Cash Flows report (R10521):

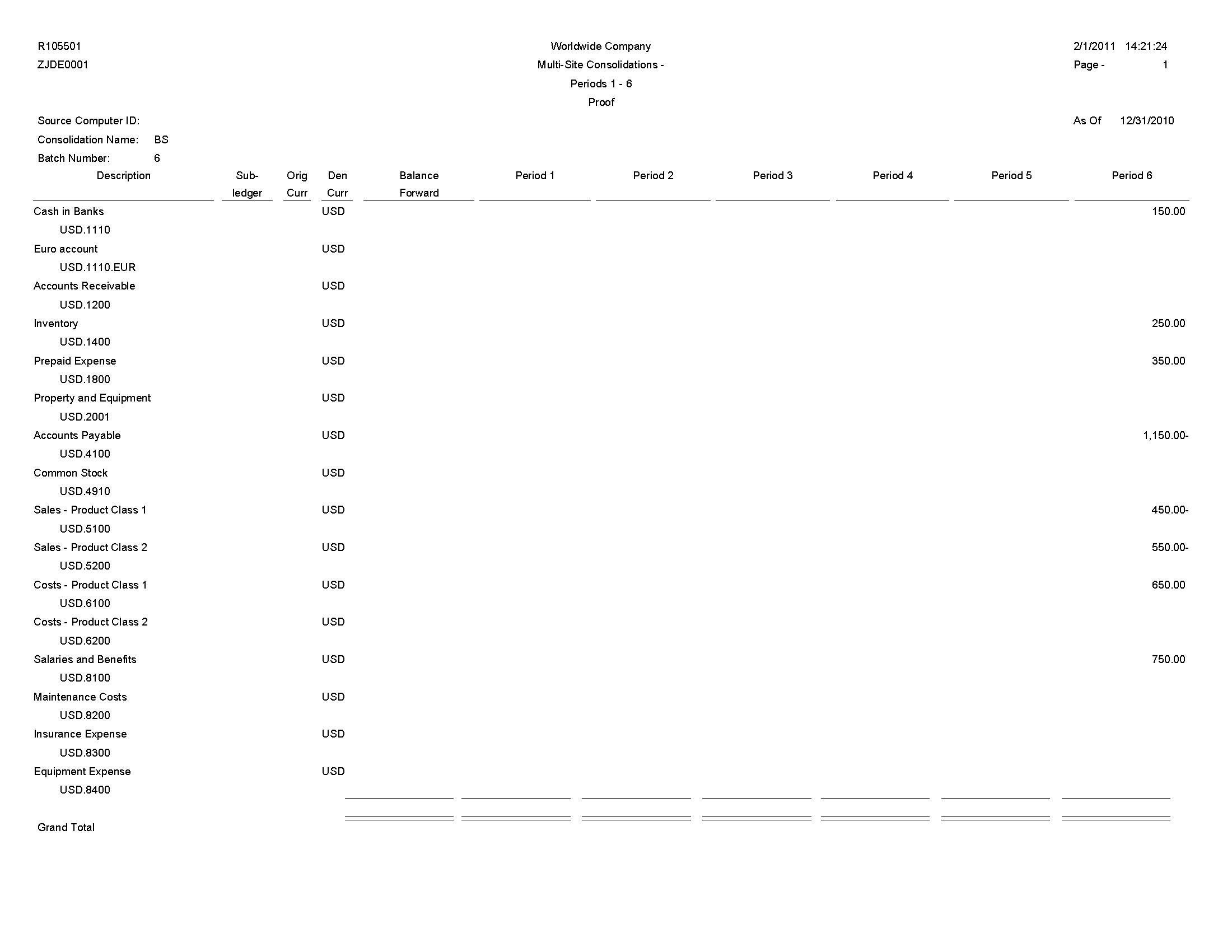

7.16 Multi-Site Consolidations - Periods 1 - 6 Report (R105501)

When you run the Process Consolidations report (R10550), the system also generates the Multi-Site Consolidations - Periods 1 - 6 report.

When you run the Process Consolidations report (R10550) to create consolidated balances, the system reads the account and organizational structures and processes them based on the rules that you defined for multisite consolidations and eliminations. The system also runs the Multi-Site Consolidations - Periods 1-6 report and shows the summarized account balances that the system updates to the Multi-Site Transfer tables for periods 1–6.

Review the Multi-Site Consolidations Period 1-6 report (R105501):

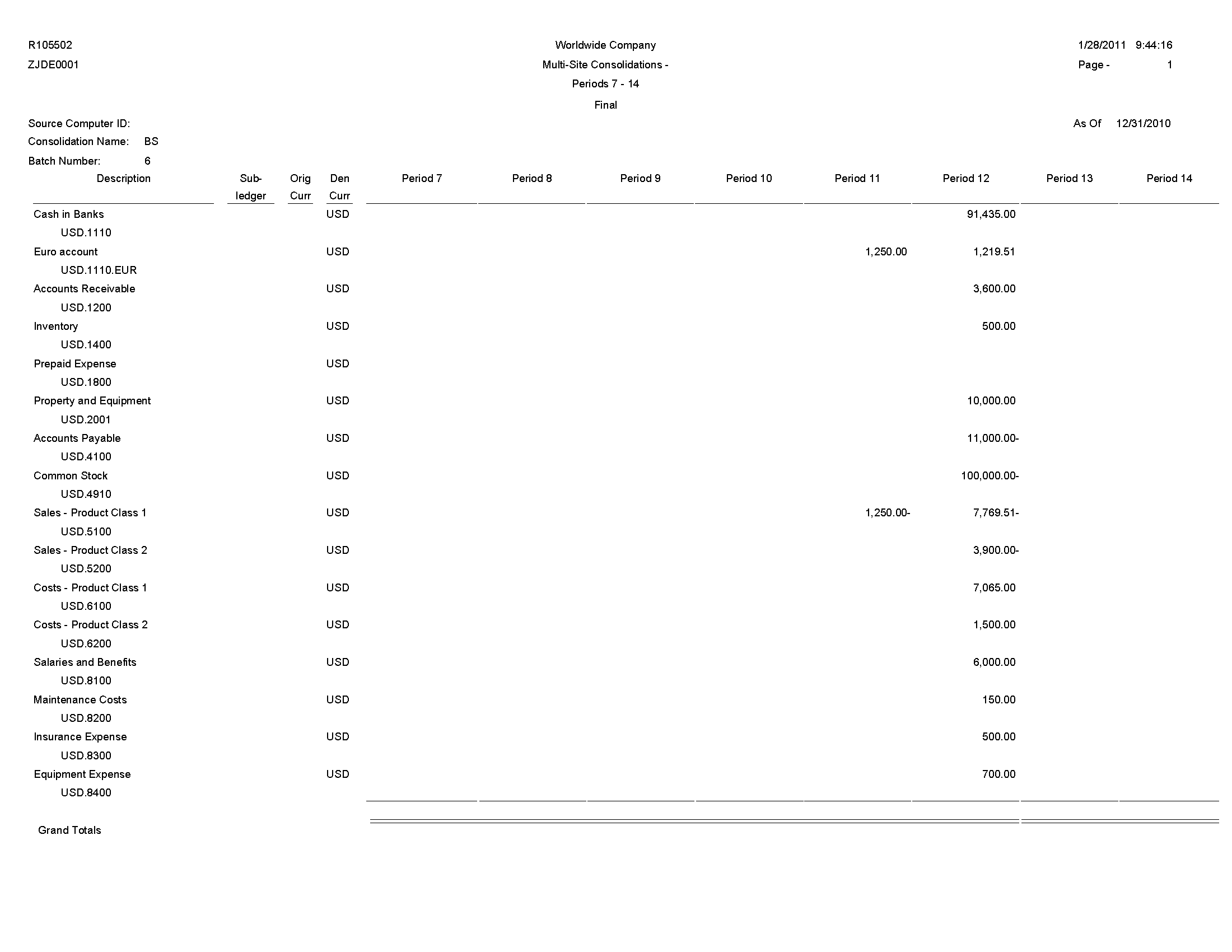

7.17 Multi-Site Consolidations - Periods 7 - 14 Report (R105502)

When you run the Process Consolidations report (R10550), the system also generates the Multi-Site Consolidations - Periods 7 - 14 report.

When you run the Process Consolidations report (R10550) to create consolidated balances, the system reads the account and organizational structures and processes them based on the rules that you defined for multisite consolidations and eliminations. The system also runs the Multi-Site Consolidations - Periods 1-6 report and shows the summarized account balances that the system updates to the Multi-Site Transfer tables for periods 7–14.

Review the Multi-Site Consolidations Period 7-14 report (R105502):

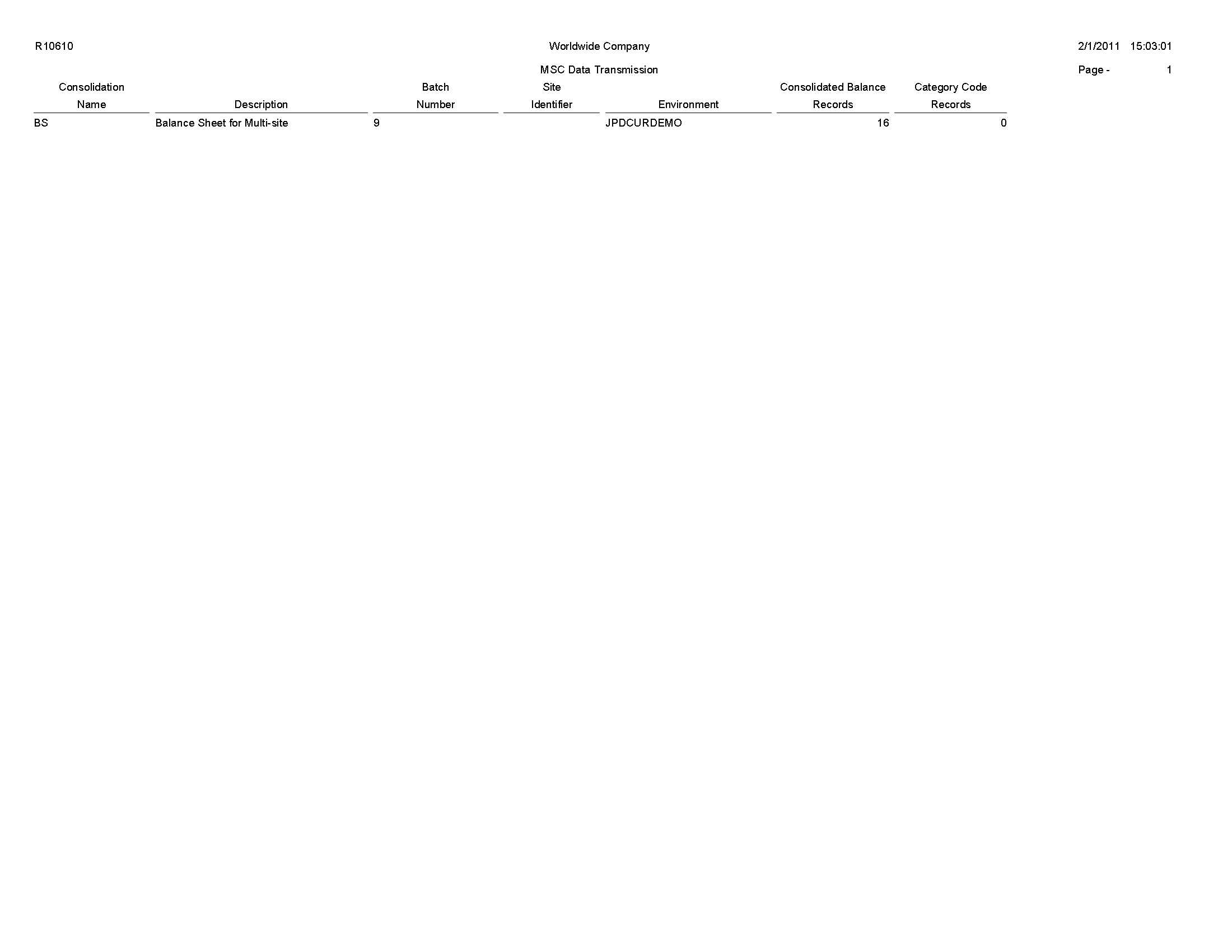

7.18 MSC Data Transmission Report (R10610)

On the Multi-Site Consolidation menu (G1021), select MSC Data Transmission.

Use the program to send the consolidated balances in the Transmission File Status field in the Multi-Site Consolidation Transfer File Header (F1001), Multi-Site Consolidation Transfer File (F1002), and Multi-Site Consolidation Transfer File - Category Codes (F1003) tables to the target company. You can select and send multiple consolidations at one time.

Review the MSC Data Transmission report (R10610):

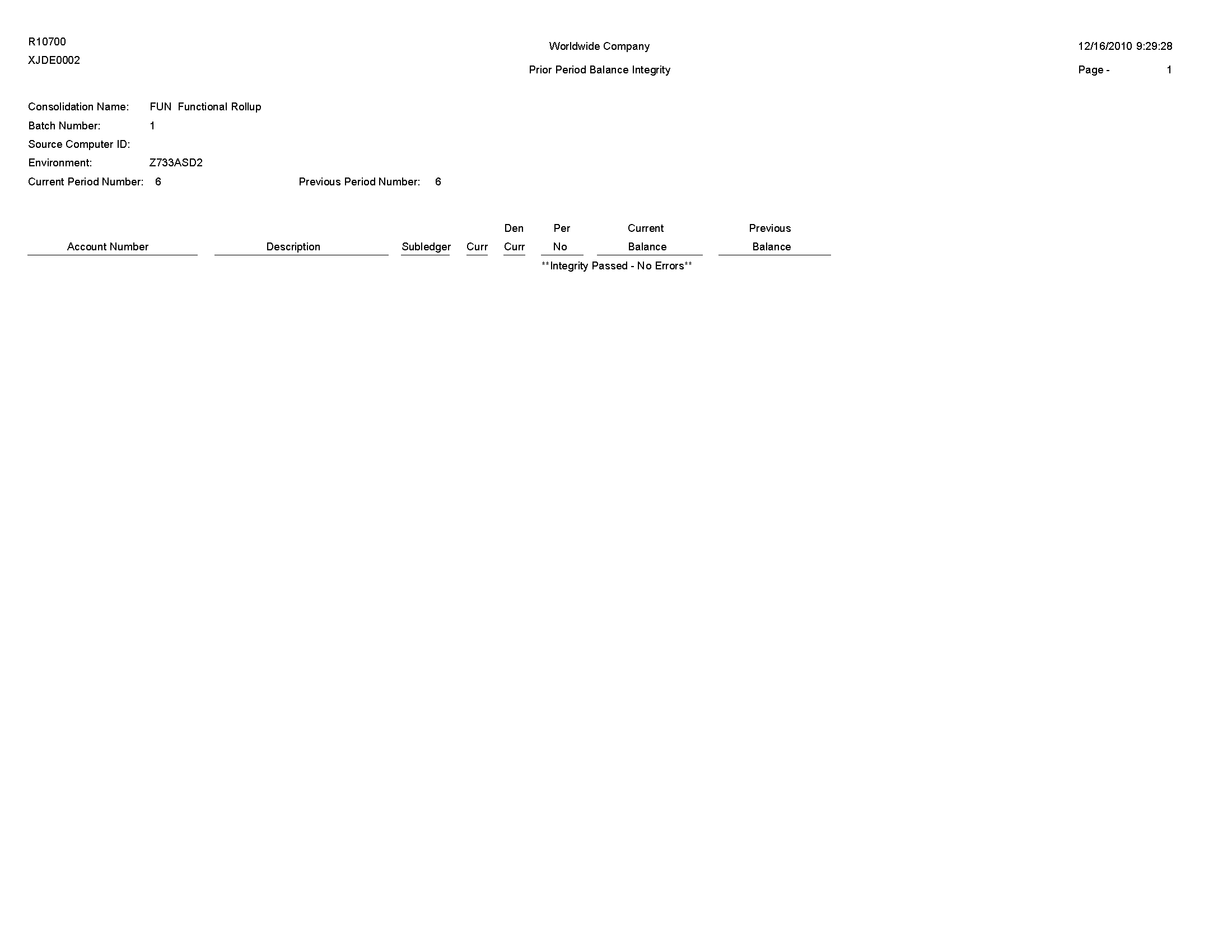

7.19 Prior Period Balance Integrity Report (R10700)

On the Integrity Reports menu (G1022), select Prior Period Balance Integrity.

Use this report to identify any consolidated balances from the prior period that have changed since the previous consolidation.

Review the Prior Period Integrity report (R10700):

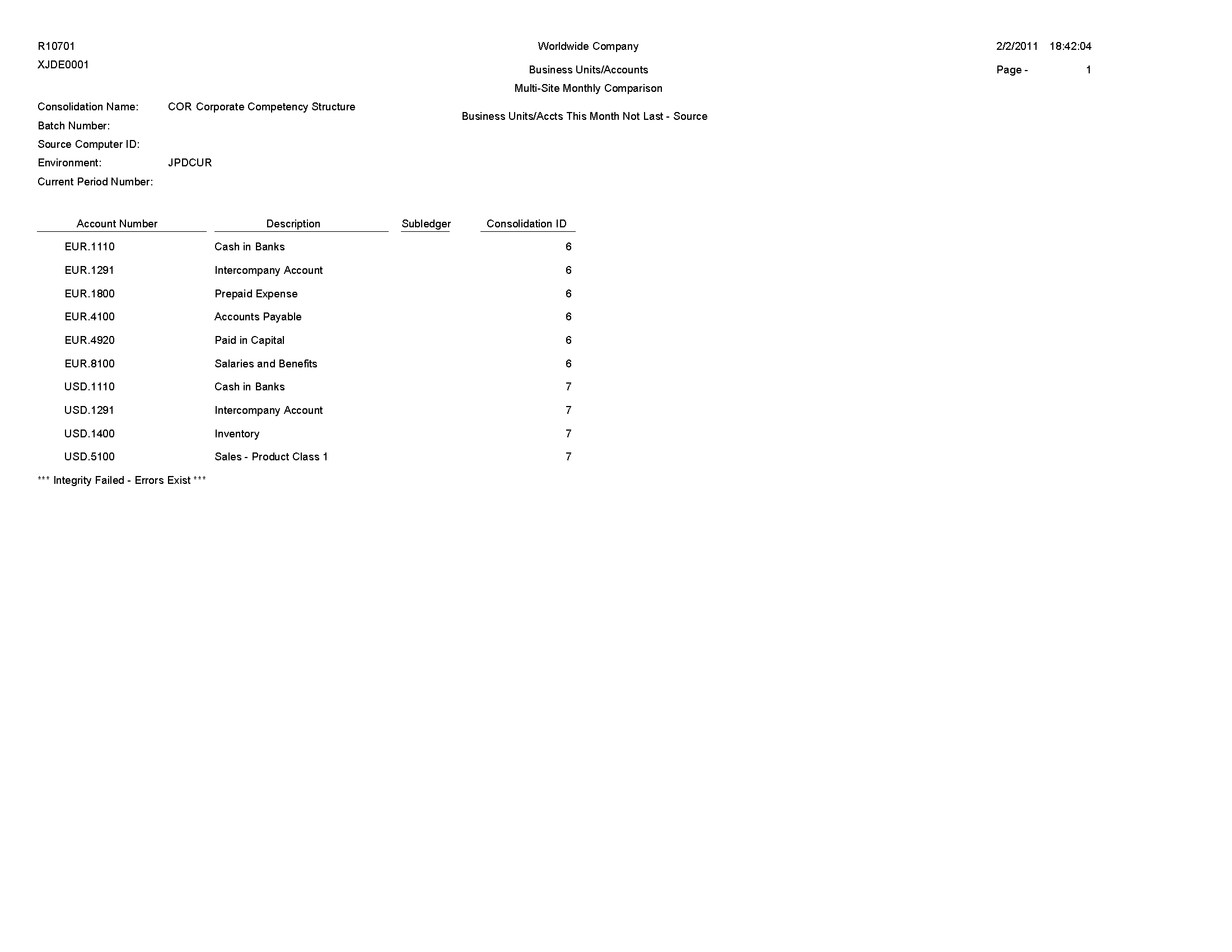

7.20 Business Units/Accounts Monthly Comparison Report (R10701)

On the Integrity Reports menu (G1022), select BU/Accounts Monthly Comparison.

Use this report to compare the business units and accounts in the source to those in the target. Run this report either at the source site prior to sending a consolidation or at the target site after you receive a consolidation.

Review the Business Units/Accounts Monthly Comparison report (R10701):

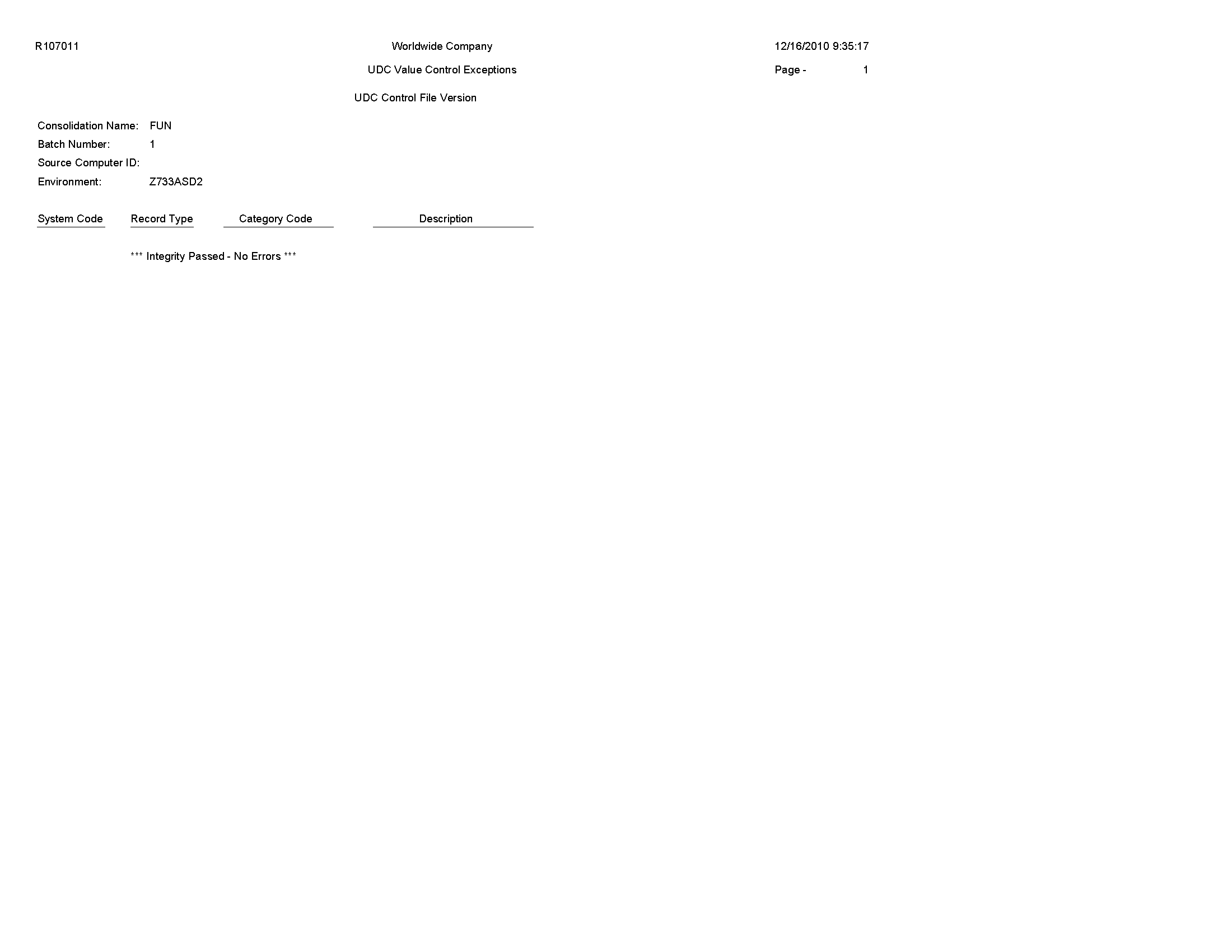

7.21 UDC Value Control Exceptions Report (R107011)

On the Integrity Reports menu (G1022), select UDC Value Control.

Use this report to identify user-defined code values in the consolidation that are not recognized by the target company. You can run the UDC Value Control report to review a list of valid user-defined code values.

Review the UDC Value Control Exceptions report (R107011):

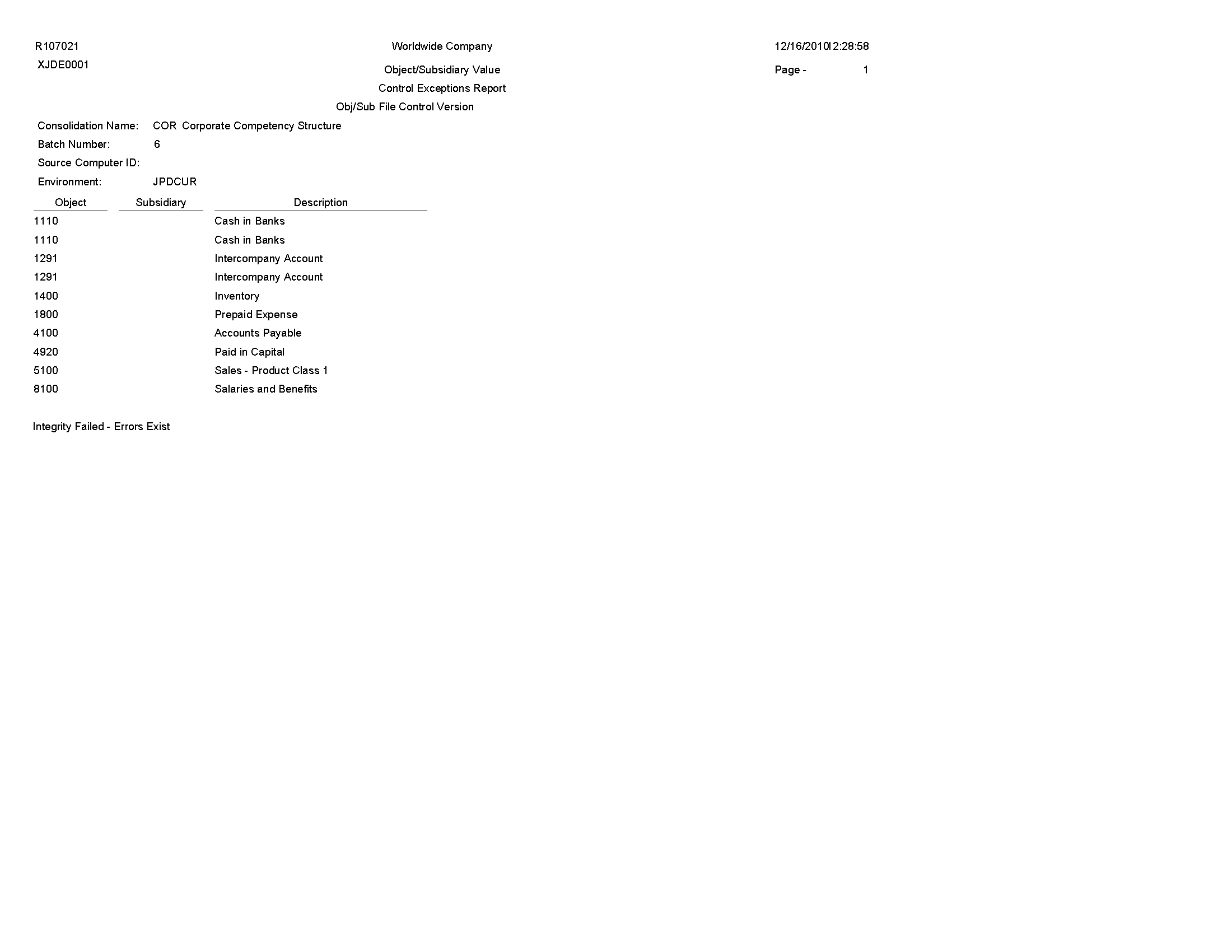

7.22 Object/Subsidiary Value Control Exceptions Report (R107021)

On the Integrity Reports menu (G1022), select Obj/Sub Value Control.

Use this report to identify objects and subsidiaries in the consolidation that are not recognized by the target company.

Review the Object Subsidiary Value Control Exceptions report (R107021):

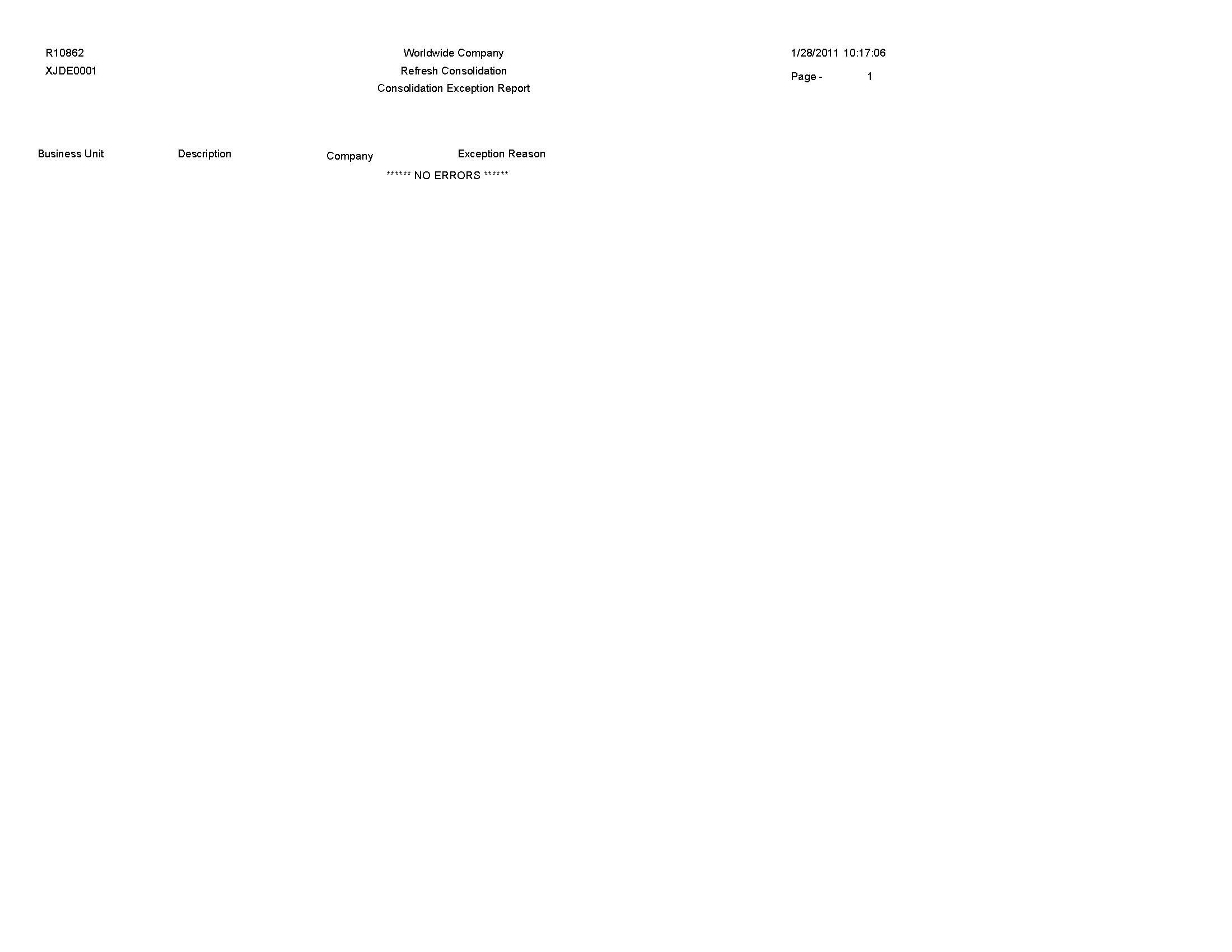

7.23 Refresh Consolidation Report (R10862)

On the Consolidations menu (G1011), select Refresh Consolidation.

Use this report to refresh consolidations, which creates records that are based on your setup. The records include this information:

-

Prior year-end net (APYN), prior year-end cumulative (APYC), and monthly posting information.

-

All accounts with consolidated balances.

-

Header and nonposting title accounts for reports, such as Assets.

Review the Refresh Consolidation report (R10862):

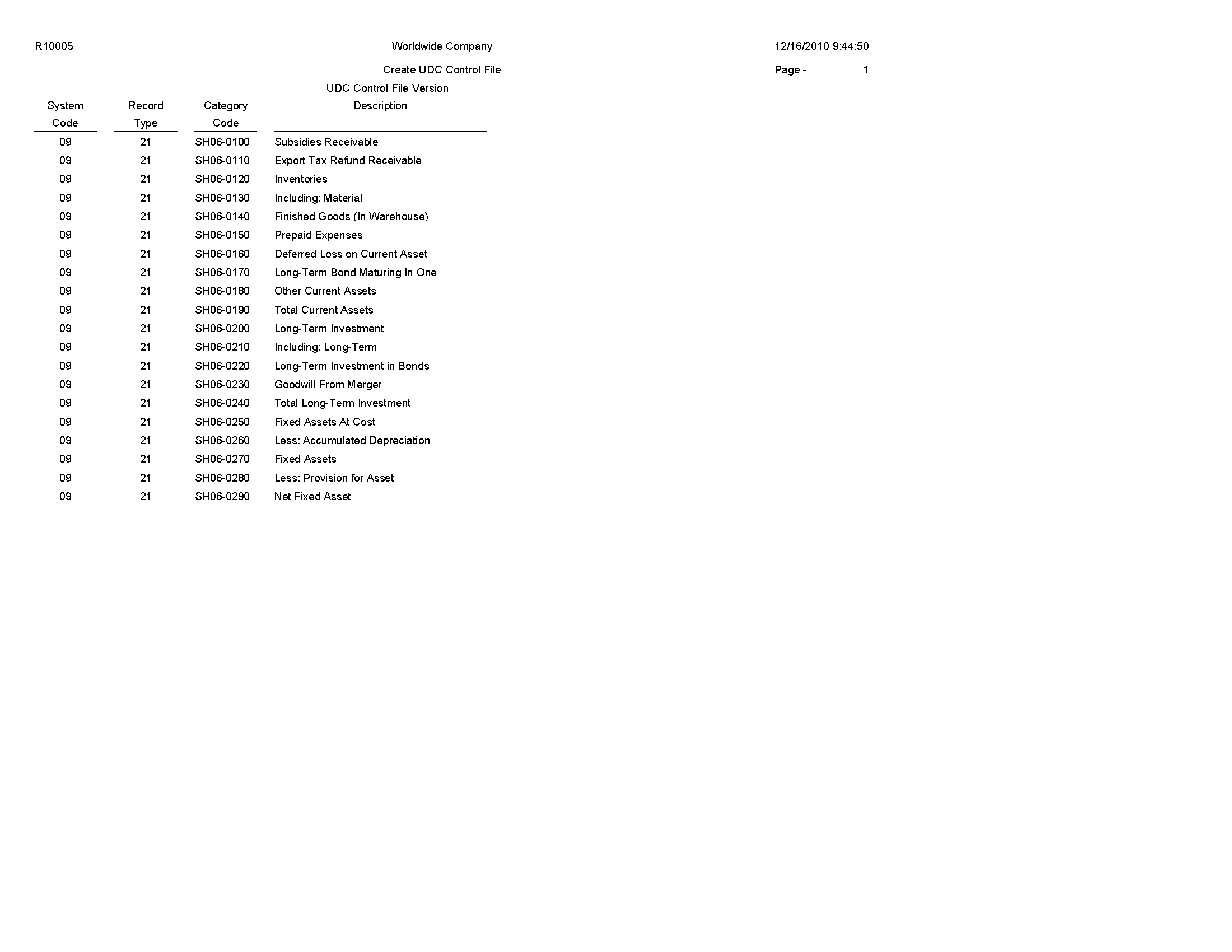

7.24 Create Obj/Sub Control File Report (R10909)

On the Integrity Reports menu (G1022), select Create Obj/Sub Control File.

Use this report to identify each of the objects and subsidiaries that the source can use when consolidating multisite information. Usually, the target company defines these objects and subsidiaries.

Review the Create Obj/Sub Control File report (R10909):