5 JD Edwards EnterpriseOne General Accounting Reports

This chapter provides report navigation, overview information and a report sample for the following reports:

-

Section 5.3, "Fiscal Date Pattern - 52 Per. Print Report (R0008BP)"

-

Section 5.8, "Transactions to Batch Headers Report (R007021)"

-

Section 5.14, "Journal Entries Batch Processor Report (R09110Z)"

-

Section 5.15, "Store and Forward JE Batch Processor Report (R09110ZS)"

-

Section 5.16, "Purge Batch Journal Entries Report (R0911Z1P)"

-

Section 5.17, "Purge F0911 Interoperability Table Report (R0911Z4P)"

-

Section 5.18, "Compute Advanced Variable Numerator Allocations Report (R09123)"

-

Section 5.19, "Print Advanced Variable Numerator Definitions Report (R09123A)"

-

Section 5.21, "Reconciliations Print - Outstanding Items Report (R09132P)"

-

Section 5.25, "Account Master Report Cat. Code 01–23 Report (R09205P)"

-

Section 5.27, "Recurring Journal Entry Compute & Print Report (R09302)"

-

Section 5.28, "Indexed Computations Compute And Print Report (R093021)"

-

Section 5.38, "Account Totals By Supplier/Customer Report (R09451)"

-

Section 5.39, "General Ledger by Category Code Report (R09470)"

-

Section 5.40, "Debit/Credit T/B by Category Code Report (R09472)"

-

Section 5.42, "Match Bank Tape File to Reconciliation File Report (R09150)"

-

Section 5.43, "Process Automatic Bank Statements Flat File Report (R09600)"

-

Section 5.46, "Purge Auto Bank Statement Tables Report (R09615)"

-

Section 5.49, "Intercompany Account Balance Integrity Report (R097011)"

-

Section 5.50, "Transaction w/o Account Master Report (R097021)"

-

Section 5.51, "Account Balance w/o Account Master Report (R097031)"

-

Section 5.52, "Accounts Without Business Units Report (R097041)"

-

Section 5.53, "Compare Account Balances To Transactions Report (R09705)"

-

Section 5.54, "Batch and Company Within Batch Out of Balance Report (R09706)"

-

Section 5.55, "Foreign Currency Account Balance Integrity Report (R09707)"

-

Section 5.58, "Copy Accounts to Business Units Report (R09804)"

-

Section 5.59, "Global Update BU/OBJ/SUB to F0902/F0911 from F0901 Report (R09806)"

-

Section 5.61, "Delete Account Master Records Report (R09814)"

-

Section 5.64, "Calculate Fiscal Year and Period Number Report (R099103)"

-

Section 5.66, "Purge Prior Year Account Balance Report (R09912)"

|

Note: This reports guide discusses reports that are commonly used in the JD Edwards EnterpriseOne system. This reports guide does not provide an inclusive list of every report that exists in the system.This guide is intended to provide overview information for each report. You must refer to the appropriate JD Edwards EnterpriseOne implementation guide for complete report information. |

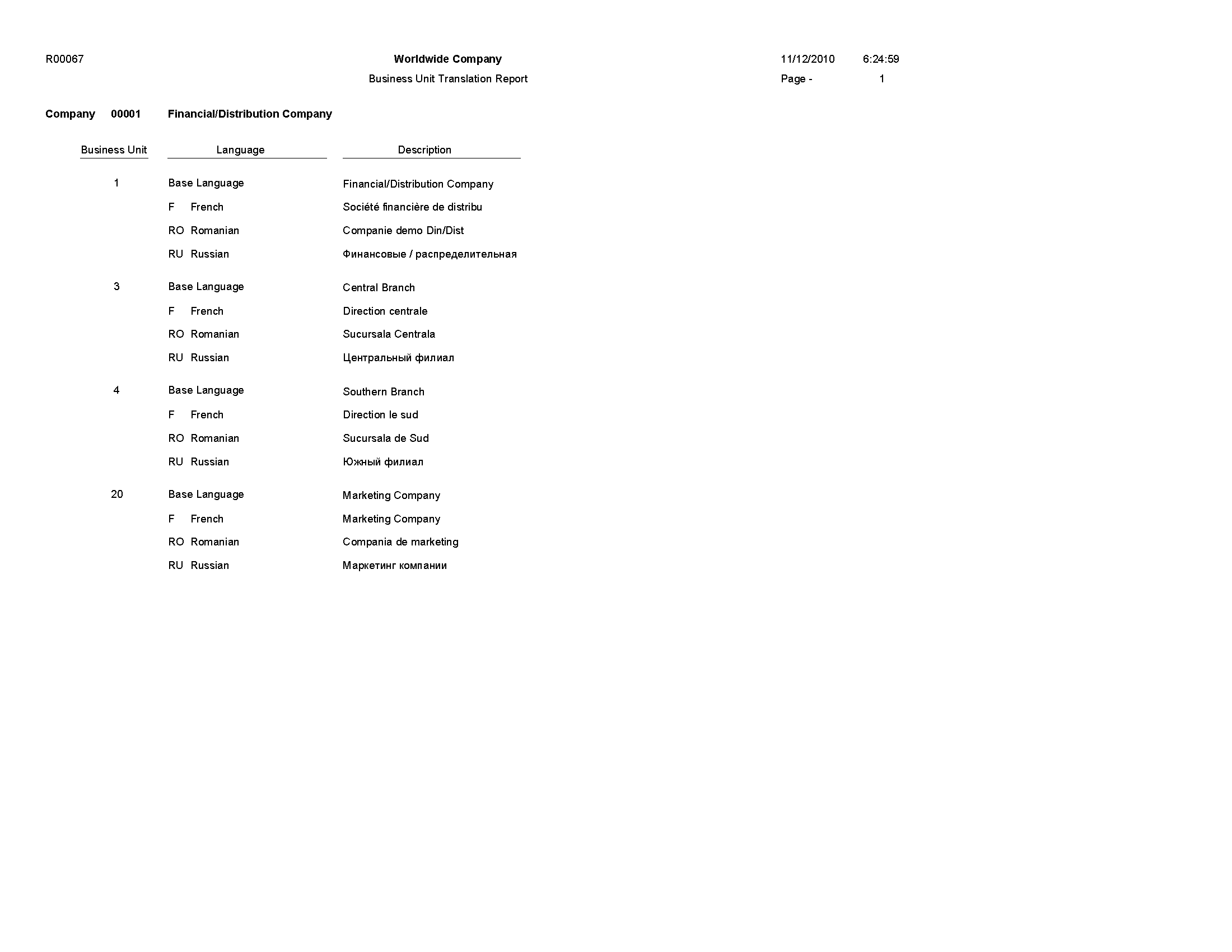

5.1 Business Unit Translation Report (R00067)

On the Organization & Account Setup menu (G09411), select Business Unit Translation Report.

Use this report to review the business units that you translate and verify the translations.

Review the Business Unit Translation report (R00067):

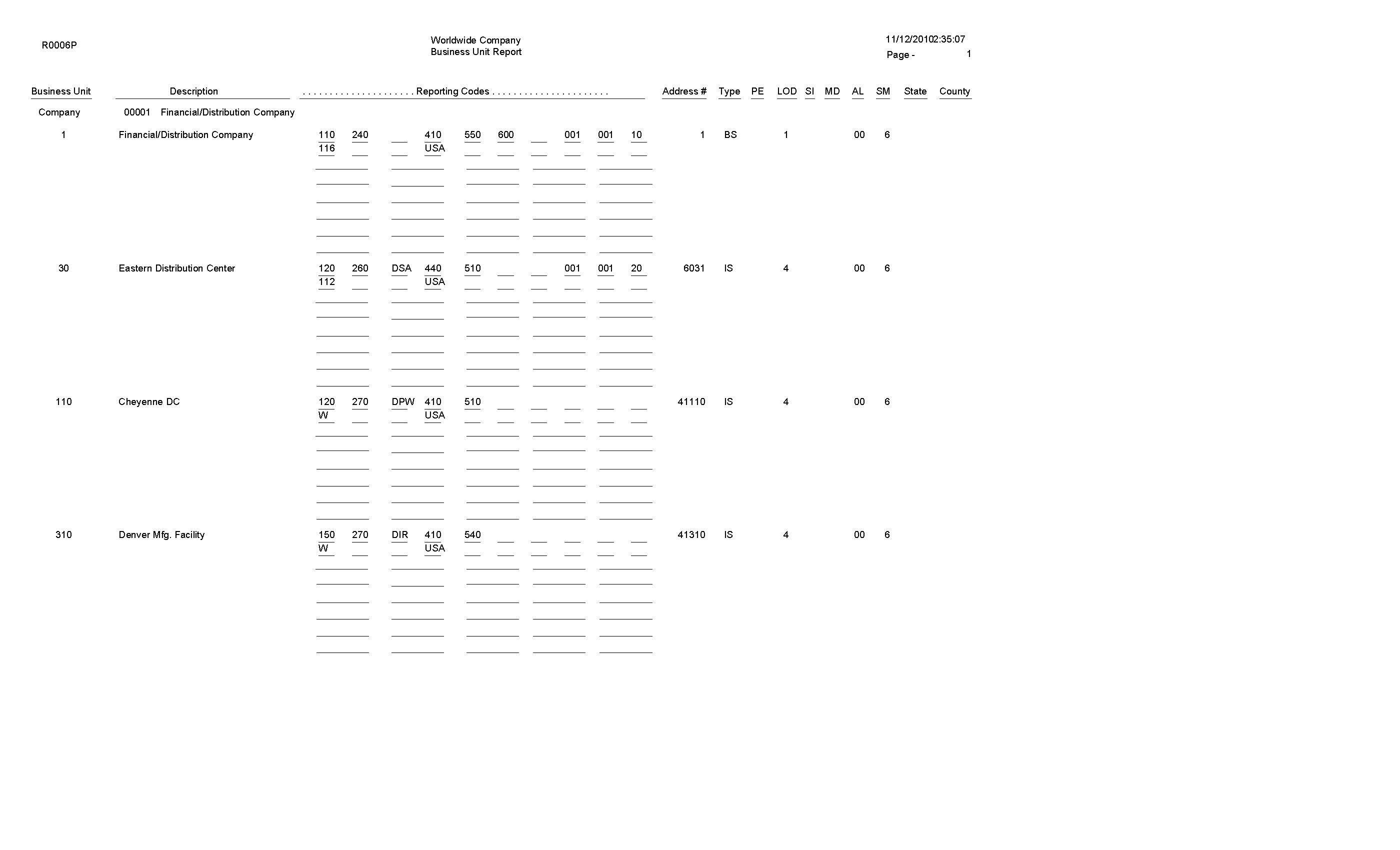

5.2 Business Unit Report (R0006P)

On the Organization & Account Setup menu (G09411), select Review and Revise Business Units. On the Work With Business Units form, select BU Print from the Report menu.

Use this report to print a list of business units.

Review the Business Unit report (R0006P):

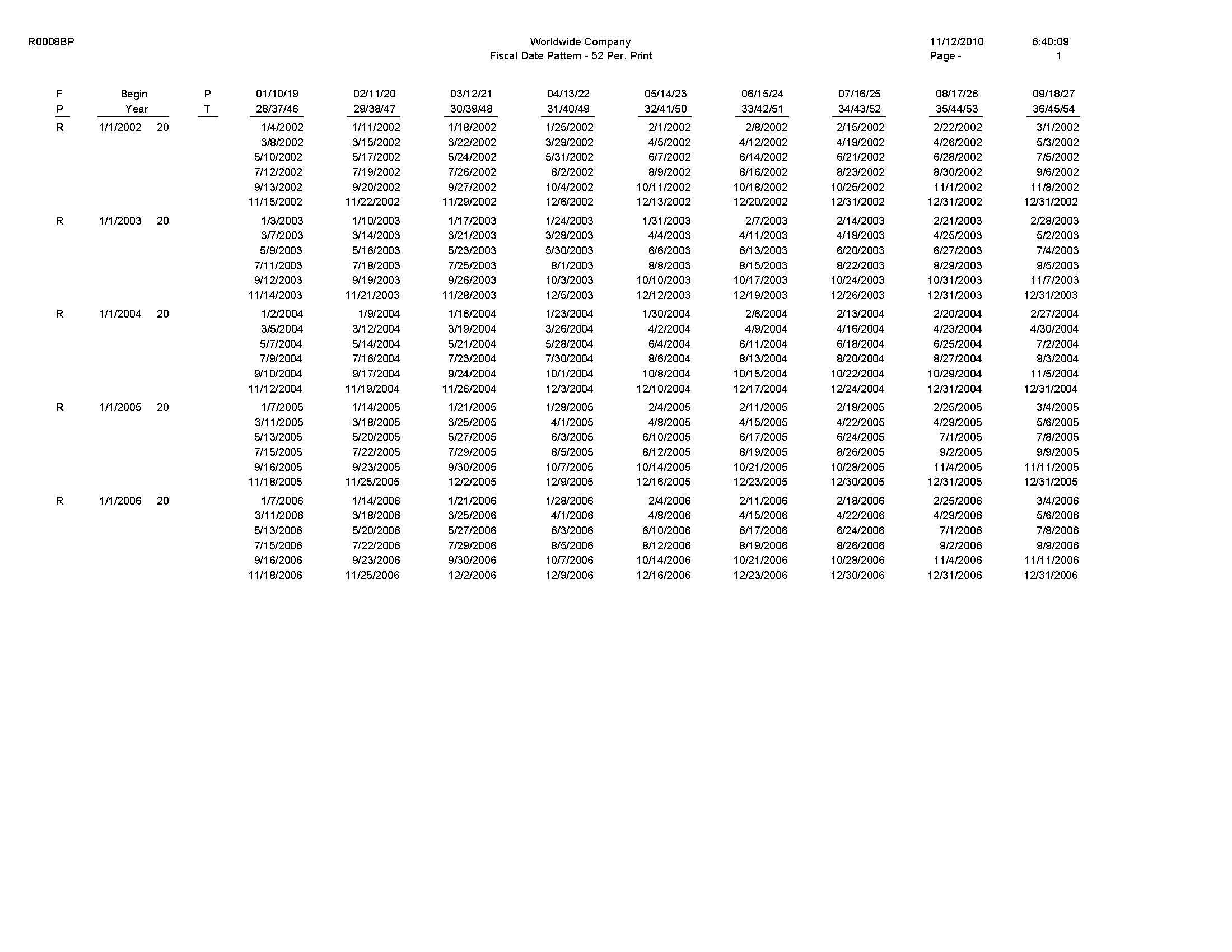

5.3 Fiscal Date Pattern - 52 Per. Print Report (R0008BP)

In the Set period 52 dates program (P0008B), select Print 52 Periods from the Report menu on the Work With 52 Periods form.

Use this report to review date pattern information such as date pattern type, the beginning date of the fiscal year, and the period end dates when using 52 period accounting.

Review the Fiscal Date Pattern - 52 Per. Print report (R0008BP):

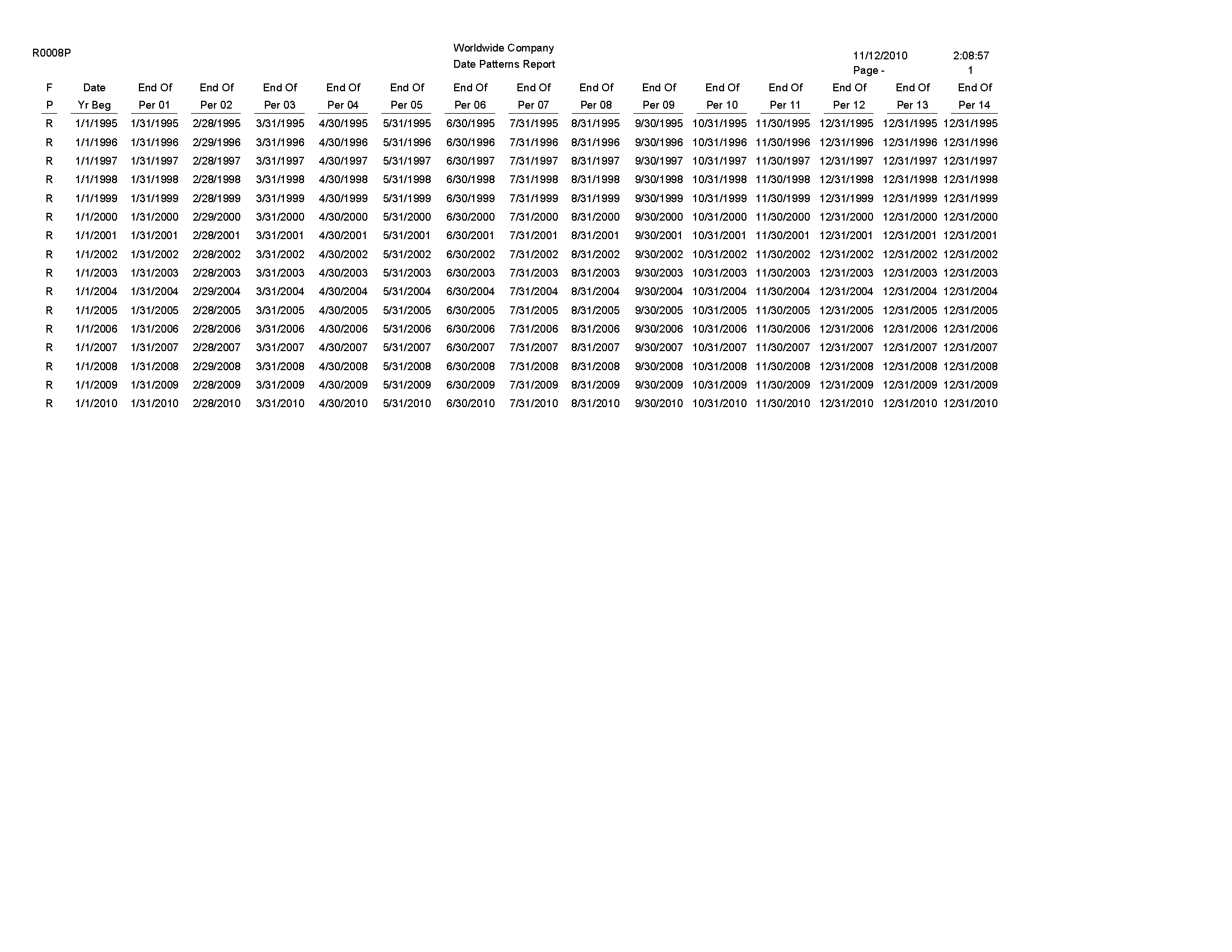

5.4 Date Patterns Report (R0008P)

In the Work with Fiscal Date Patterns program (P0008), select Date Pattern Report from the Report menu on the Work With Fiscal Date Patterns form.

Use this report to review date pattern information such as date pattern type, the beginning date of the fiscal year, and period end dates.

Review the Date Pattern report (R0008P):

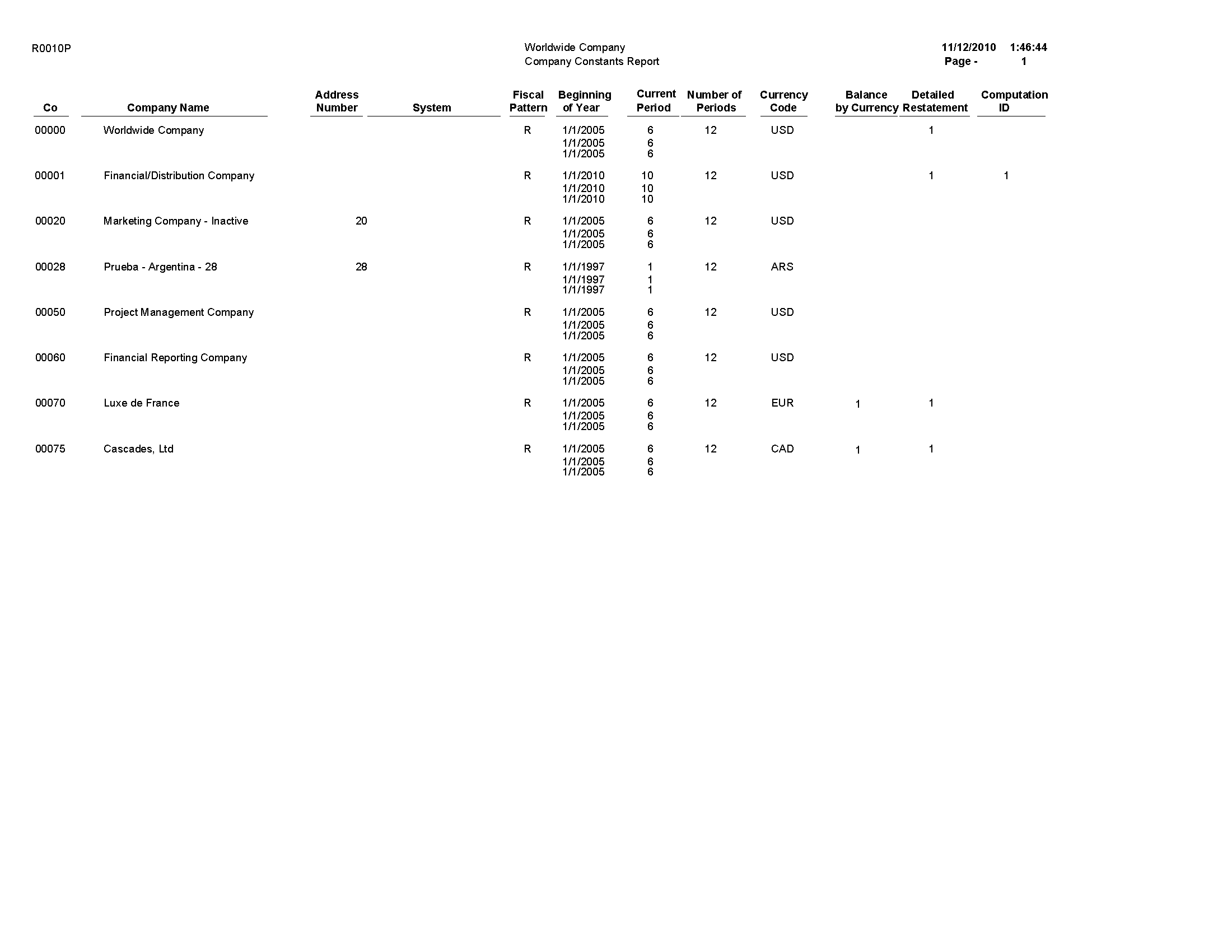

5.5 Company Constants Report (R0010P)

In the Companies Names and Number program (P0010), select Print Companies from the Report menu on the Work With Companies form.

Use this report to review detailed company constants setup information, such as fiscal date pattern, period information, and currency code.

Review the Company Constants report (R0010P):

5.6 Refresh Cash Forecast Data Report (R00522)

On the Cash Forecasting menu (G09319), select Refresh Cash Forecast Data.

When you run this program, specify in the processing options a based-on date and the future number of days in which to create cash forecast data. The system then calculates the ending date. To refresh data from the JD Edwards EnterpriseOne Accounts Receivable, JD Edwards EnterpriseOne Accounts Payable, and JD Edwards EnterpriseOne General Accounting systems in the Cash Forecast Data table (F09522), you specify a version for the Extract A/R Cash Forecast Data (R03B522), Extract A/P Cash Forecast Data (R04522), and Extract G/L Cash Forecast Data (R09522) programs.

The extraction programs perform these tasks:

-

Retrieve active cash type rules for A/R, A/P, and G/L from the Cash Type Rules table (F09521).

-

Extract cash forecast detail from the Customer Ledger (F03B11), Accounts Payable Ledger (F0411), and Account Ledger (F0911) tables.

-

Refresh the Cash Forecast Data table (F09522) with new cash forecast records.

Review the Refresh Cash Forecast Data report (R00522):

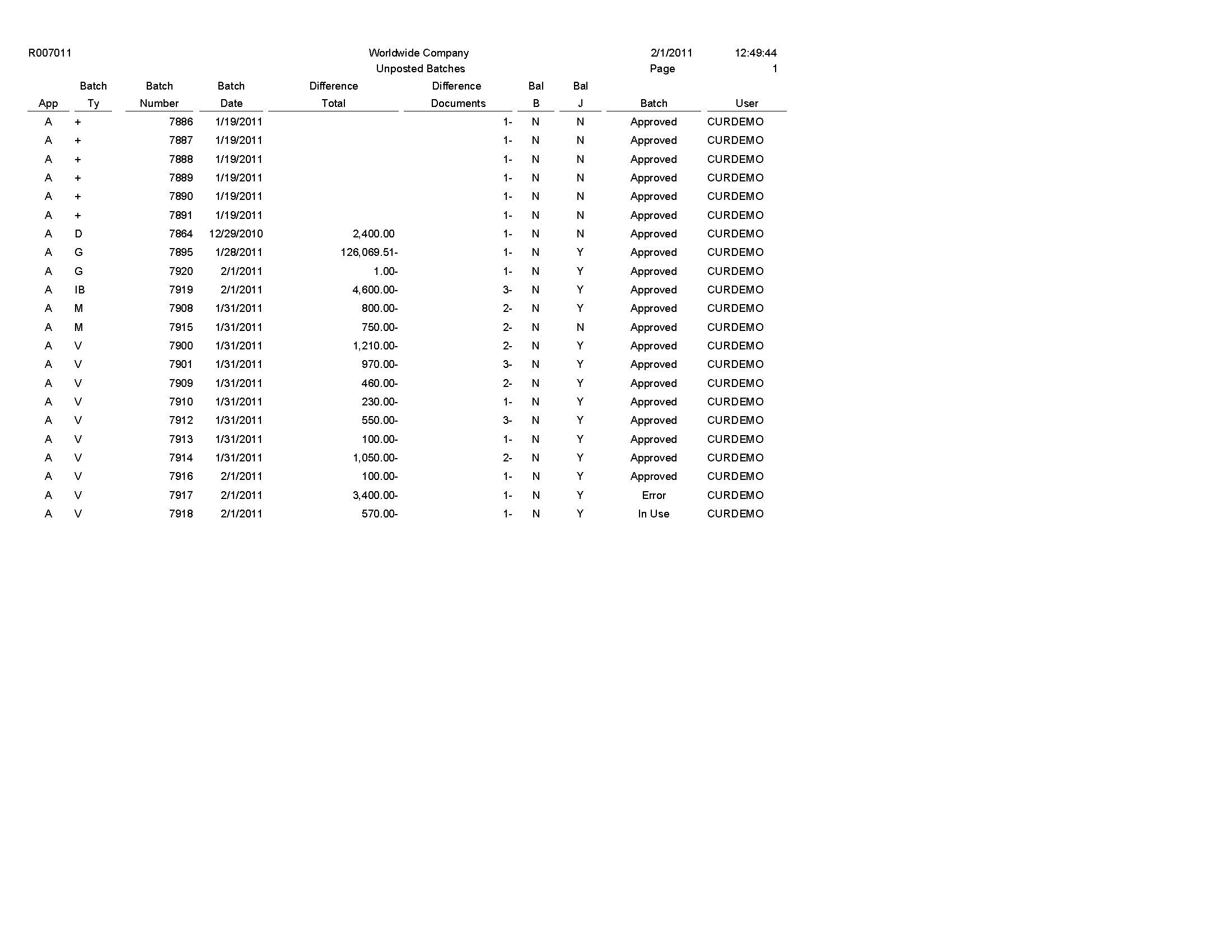

5.7 Unposted Batches Report (R007011)

On the Integrity Reports and Updates menu (G0922), select Unposted Batches.

Use this report to review a list of unposted batches based on the batch control records in the Batch Control Records table (F0011).

Review the Unposted Batches report (R007011):

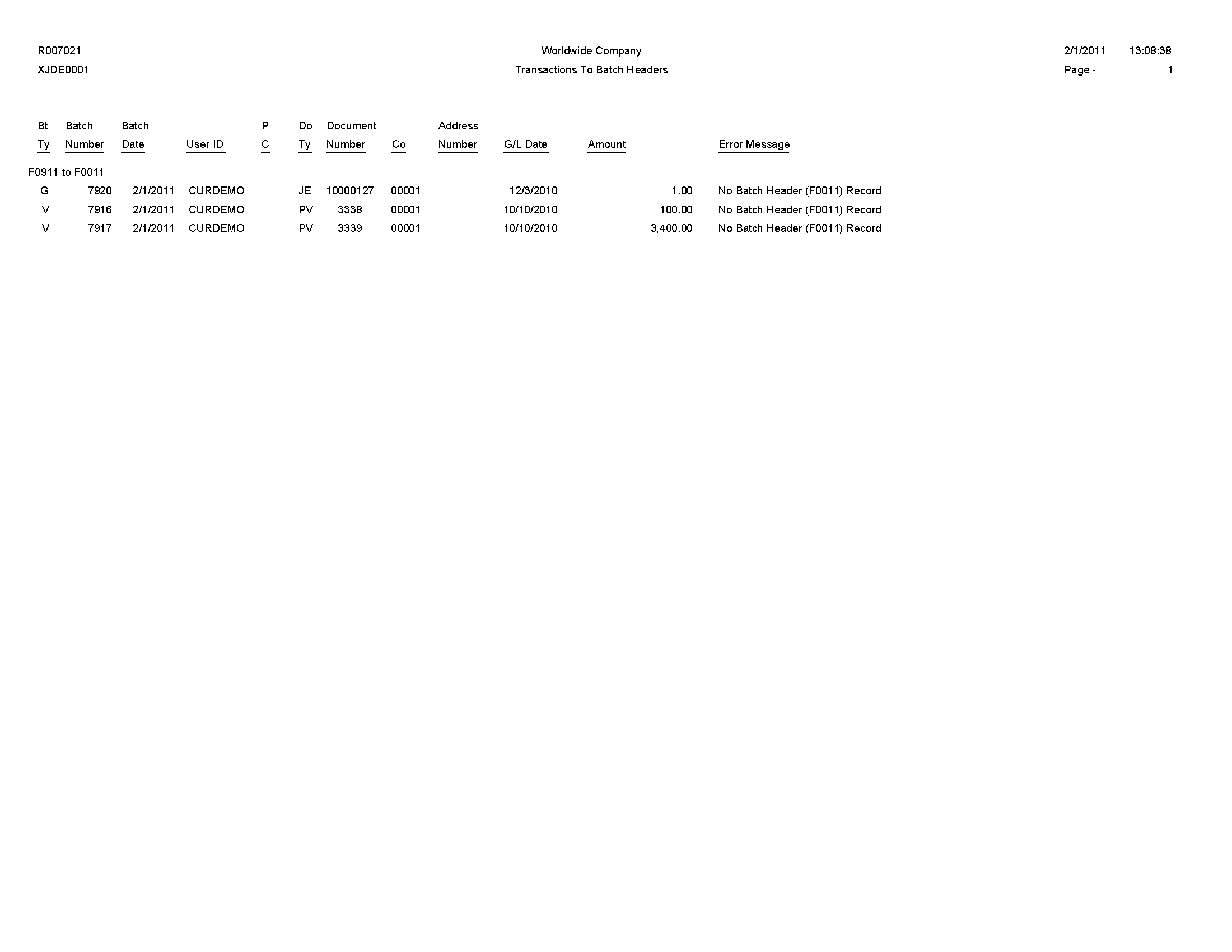

5.8 Transactions to Batch Headers Report (R007021)

On the Integrity Reports and Updates menu (G0922), select Transactions to Batch Headers.

Use this report to identify discrepancies between a batch record and its associated transactions. This report compares batches in the Batch Control Records table (F0011) with transactions in these tables:

-

Account Ledger (F0911)

-

Customer Ledger (F03B11)

-

Receipts Header (F03B13)

-

Receipts Detail (F03B14)

-

Accounts Payable Ledger (F0411)

-

Accounts Payable - Matching Document (F0413)

-

Accounts Payable Matching Document Detail (F0414)

Review the Transactions to Batch Headers report (R007021):

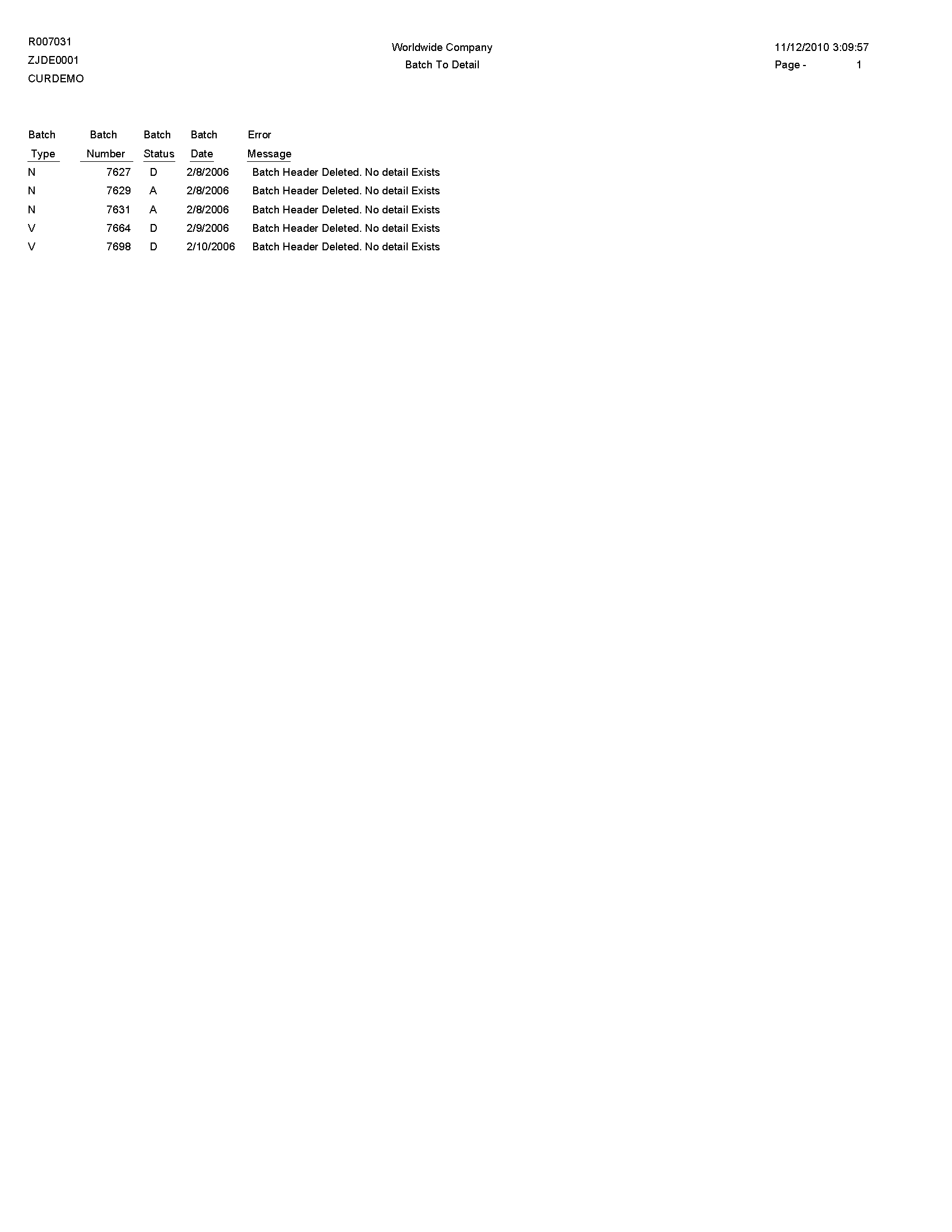

5.9 Batch to Detail Report (R007031)

On the Integrity Reports and Updates menu (G0922), select Batch to Detail

Use this report to compare the status of the batch header records for each batch in the Batch Control Records table (F0011) to the status of the corresponding transactions in these tables:

-

Account Ledger table (F0911)

-

Accounts Payable Ledger (F0411)

-

Accounts Payable - Matching Document (F0413)

-

Accounts Payable Matching Document Detail (F0414)

-

Customer Ledger (F03B11)

-

Receipts Header (F03B13)

-

Receipts Detail (F03B14)

Review the Batch to Detail report (R007031):

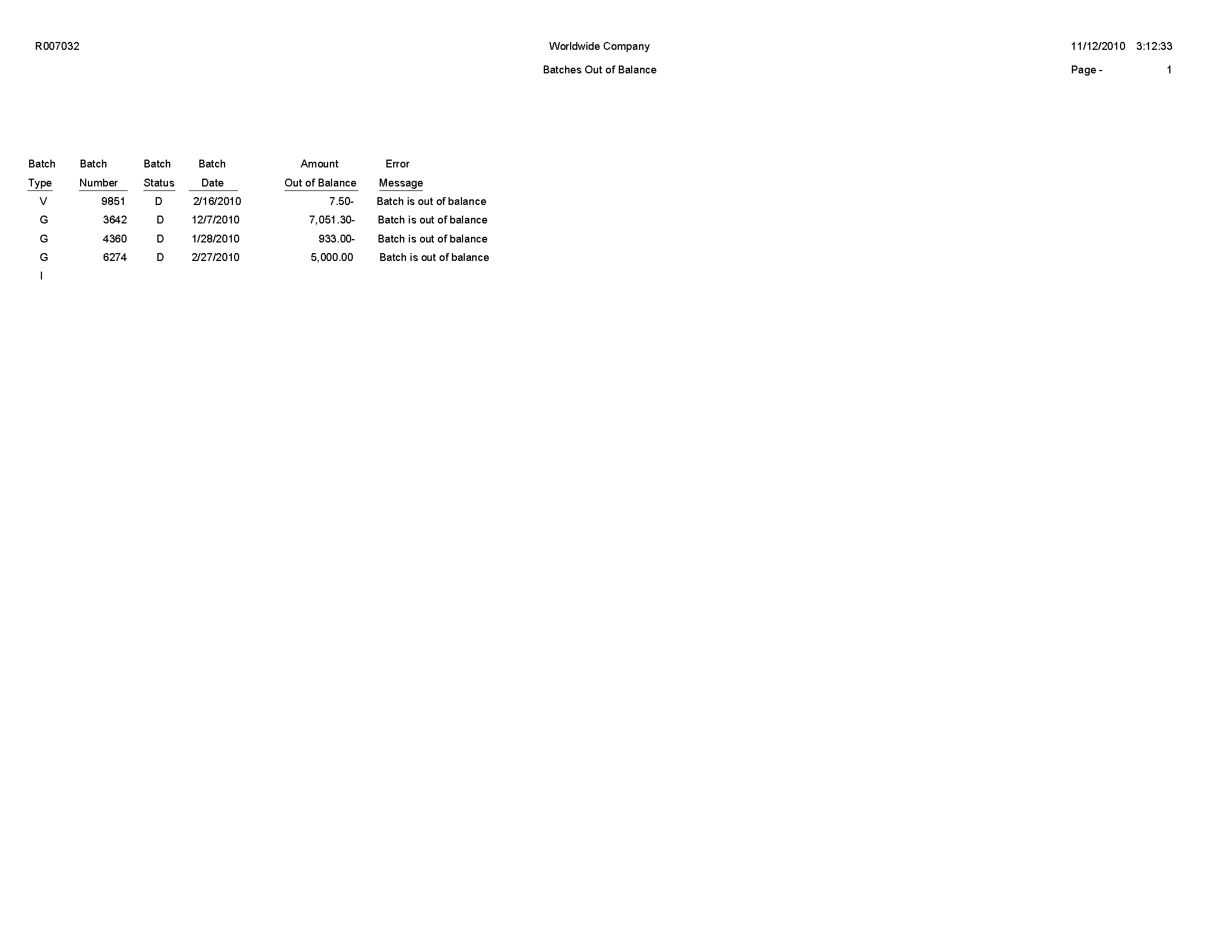

5.10 Batch Out of Balance Report (R007032)

On the Integrity Reports and Updates menu (G0922), select Batches Out of Balance.

Use this report to locate batches in which the net amount of debits and credits does not equal zero.

Review the Batch Out of Balance report (R007032):

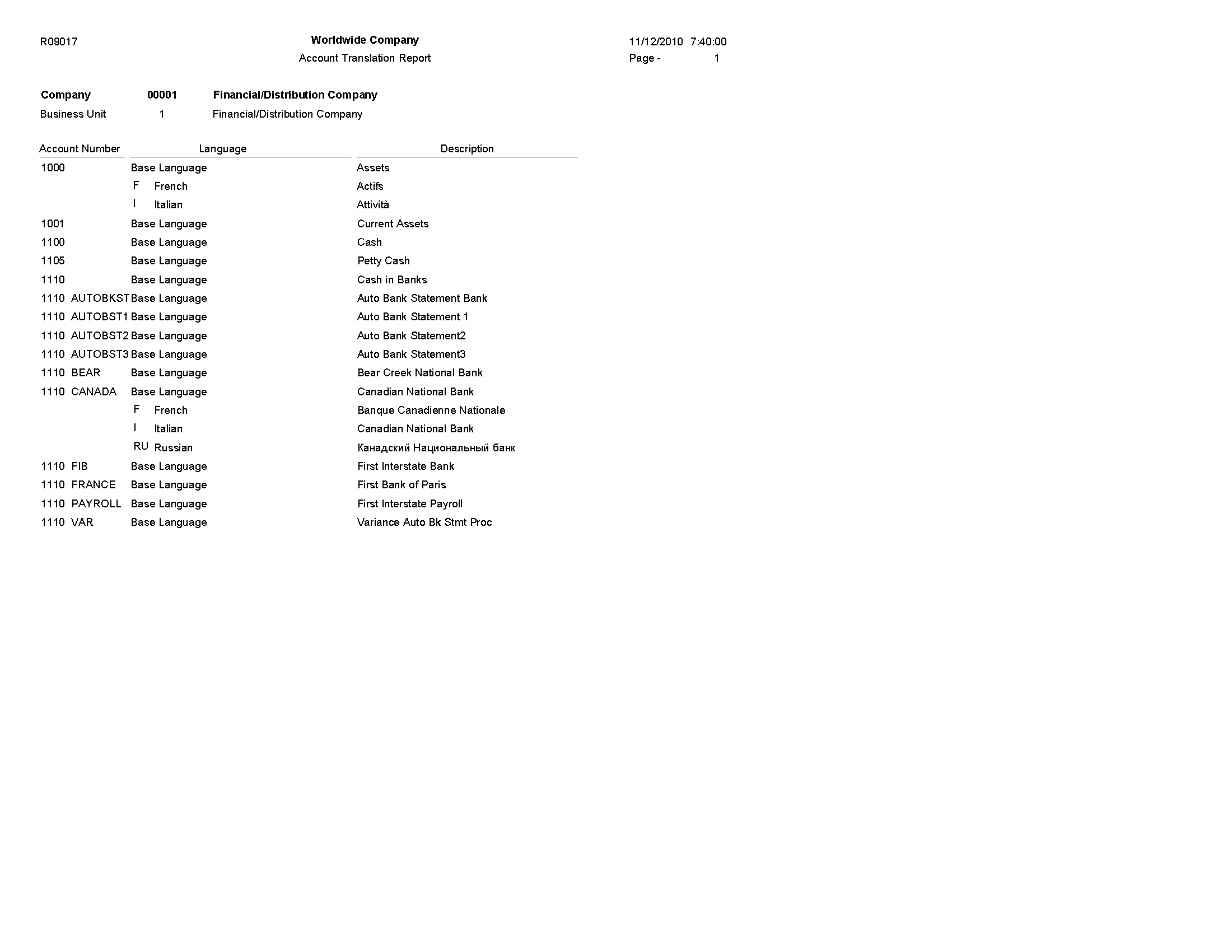

5.11 Account Translation Report (R09017)

On the Organization & Account Setup menu (G09411), select Account Translation Report.

Use this report to review account numbers and translated descriptions from the Account Master - Alternate Description table (F0901D).

Review the Account Translation report (R09017):

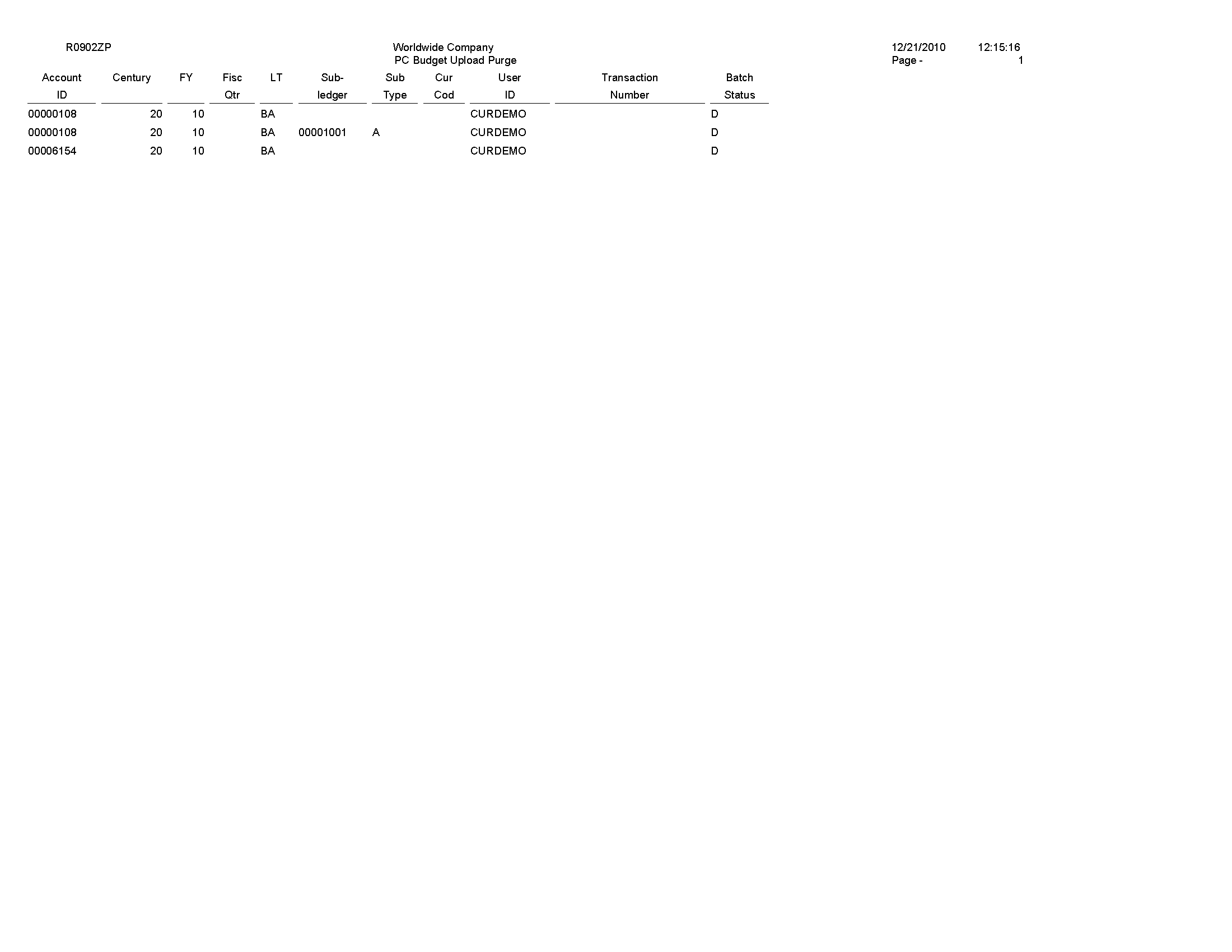

5.12 PC Budget Upload Purge Report (R0902ZP)

On the Other Budgeting Methods menu (G1421), select Processed Upload Purge.

If you upload multiple spreadsheets to the Account Balances - Batch File (F0902Z1), the table might become very large. To manage the size of this table, run this program to purge records that have been processed.

Review the PC Budget Upload Purge report (R0902ZP):

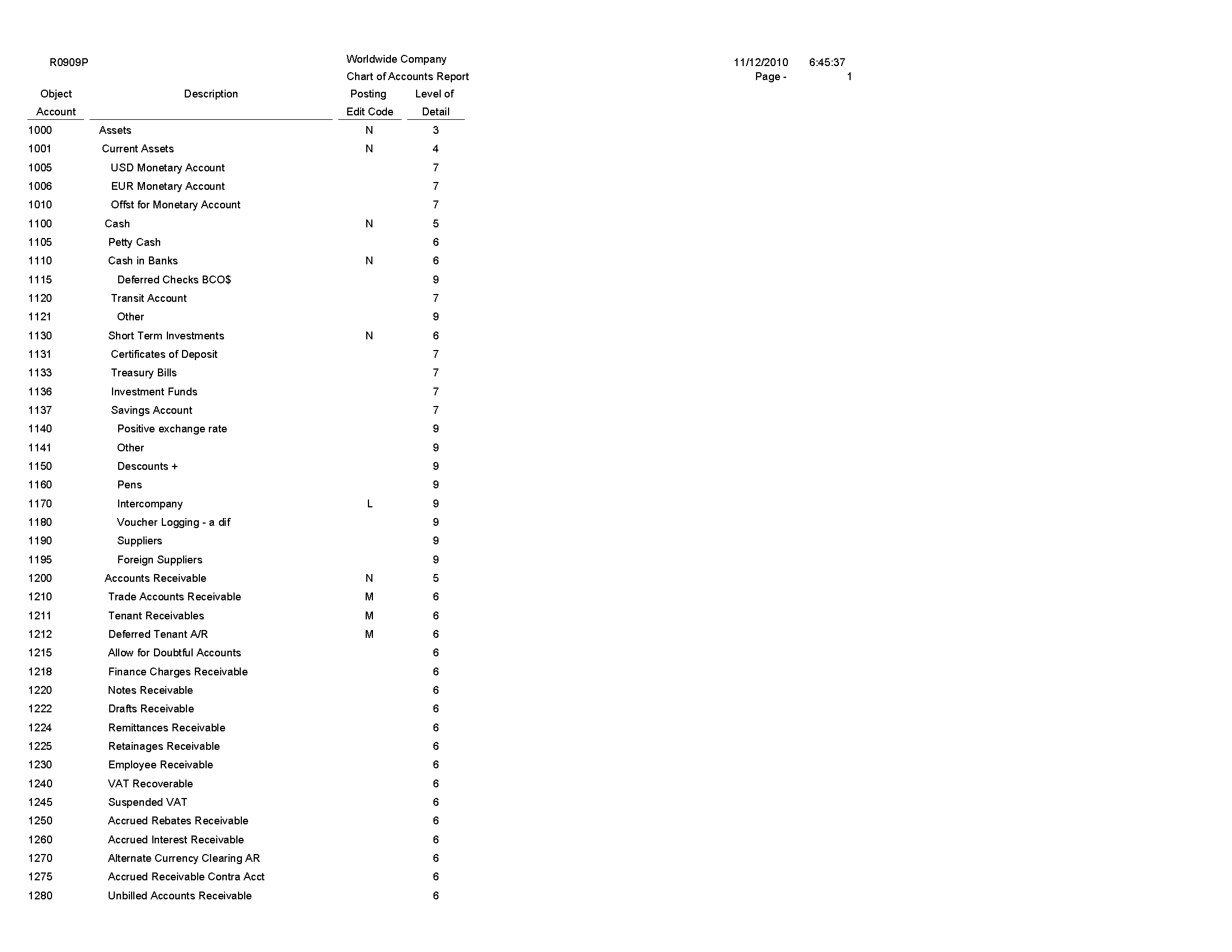

5.13 Chart of Accounts Report (R0909P)

On the Organization & Account Setup menu (G09411), select Review and Revise Accounts. On the Work With Chart of Accounts form, select Refresh Chart of Ac from the Report menu.

Use this report to review the updated chart of accounts.

Review the Chart of Accounts report (R0909P):

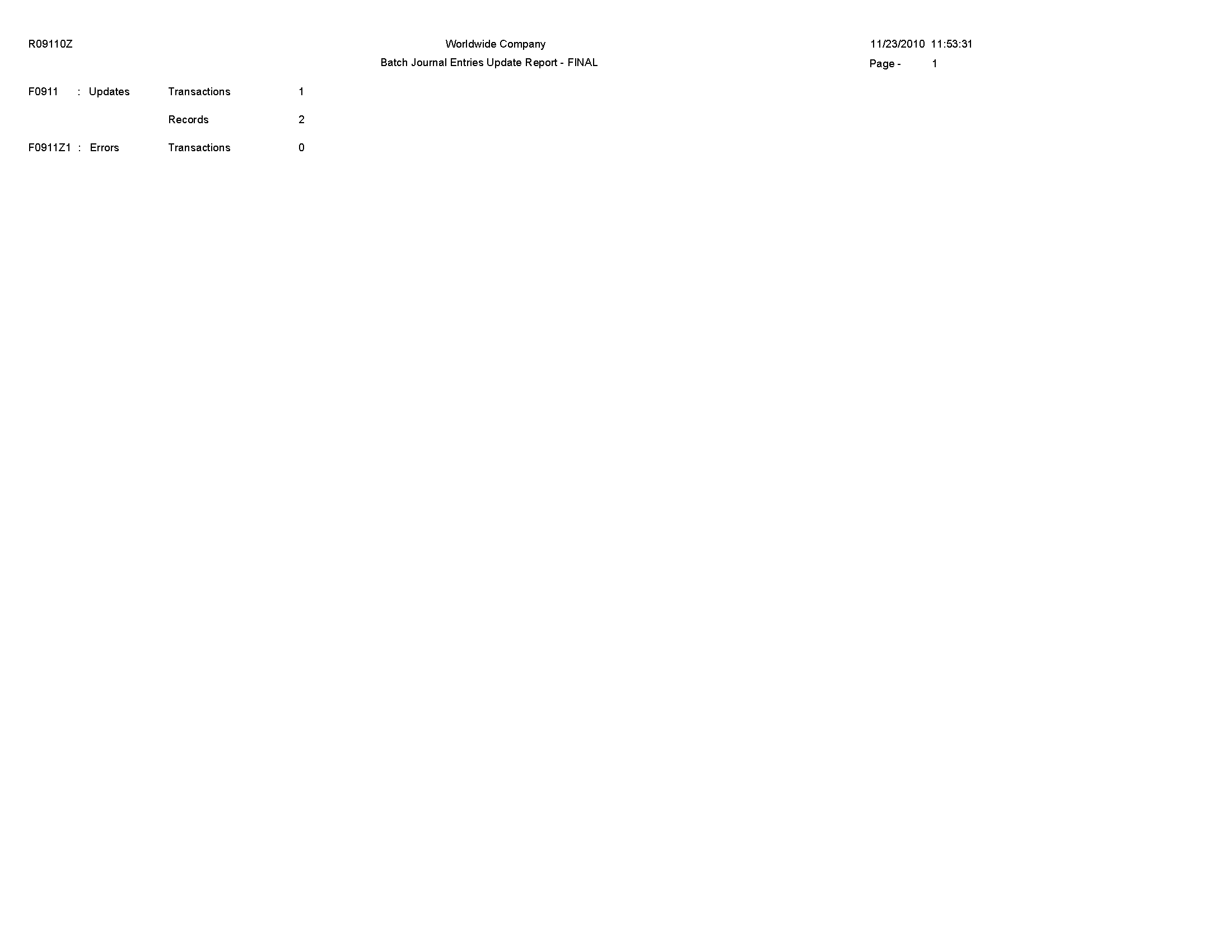

5.14 Journal Entries Batch Processor Report (R09110Z)

On the Batch Journal Entry Processing menu (G09311), select Journal Entries Batch Processor.

After your custom program loads the transaction information into the Journal Entry Transactions - Batch table (F0911Z1), run this report to process the information in the F0911Z1 table and load it to Account Ledger table (F0911).

Review the Journal Entries Batch Processor report (R09110Z):

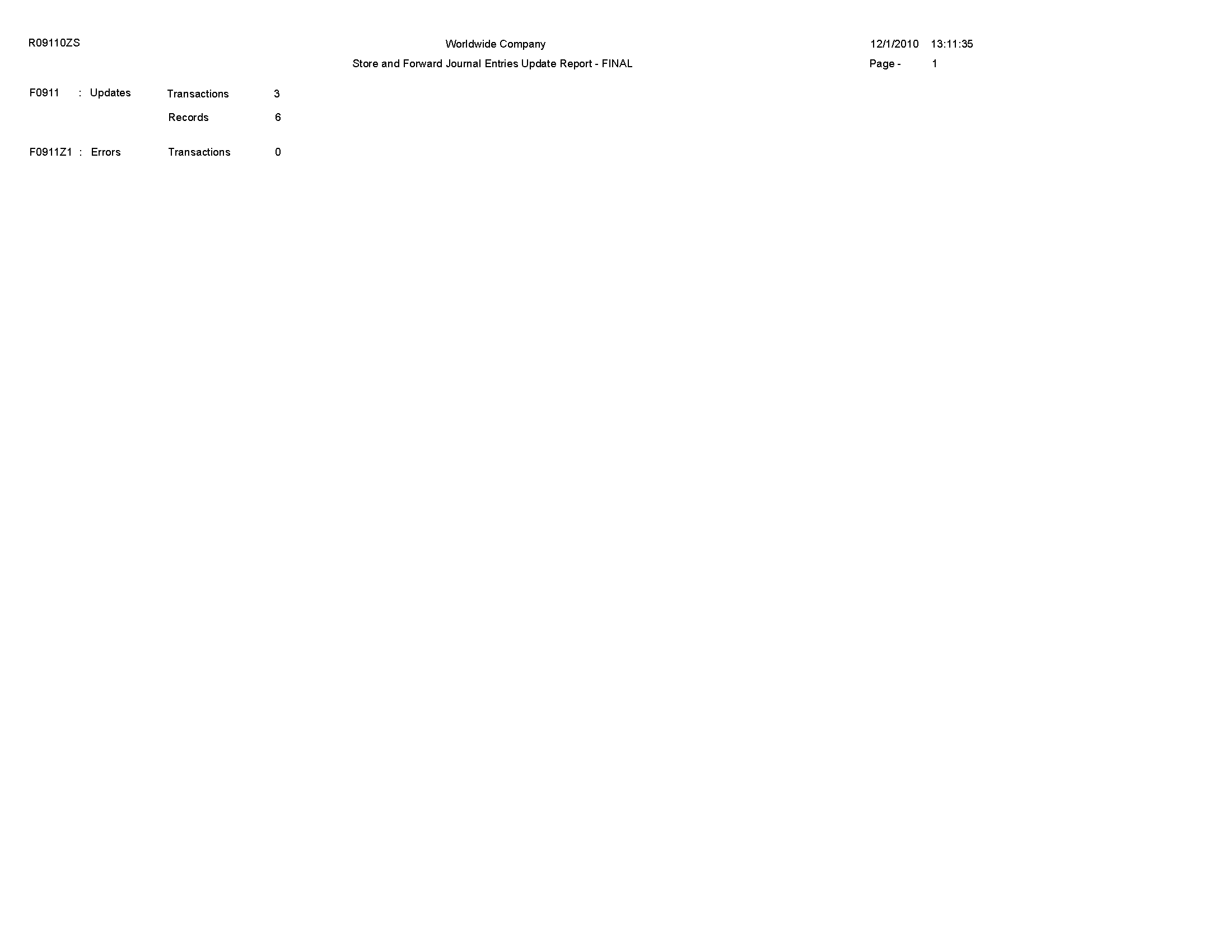

5.15 Store and Forward JE Batch Processor Report (R09110ZS)

On the Store and Forward Journal Entries menu (G09318), select Store & Forward JE Batch Processor.

After your custom program loads the transaction information into the Journal Entry Transactions - Batch table (F0911Z1), run this report to process the information in the F0911Z1 table and load it to Account Ledger table (F0911).

Review the Store and Forward JE Batch Processor report (R09110ZS):

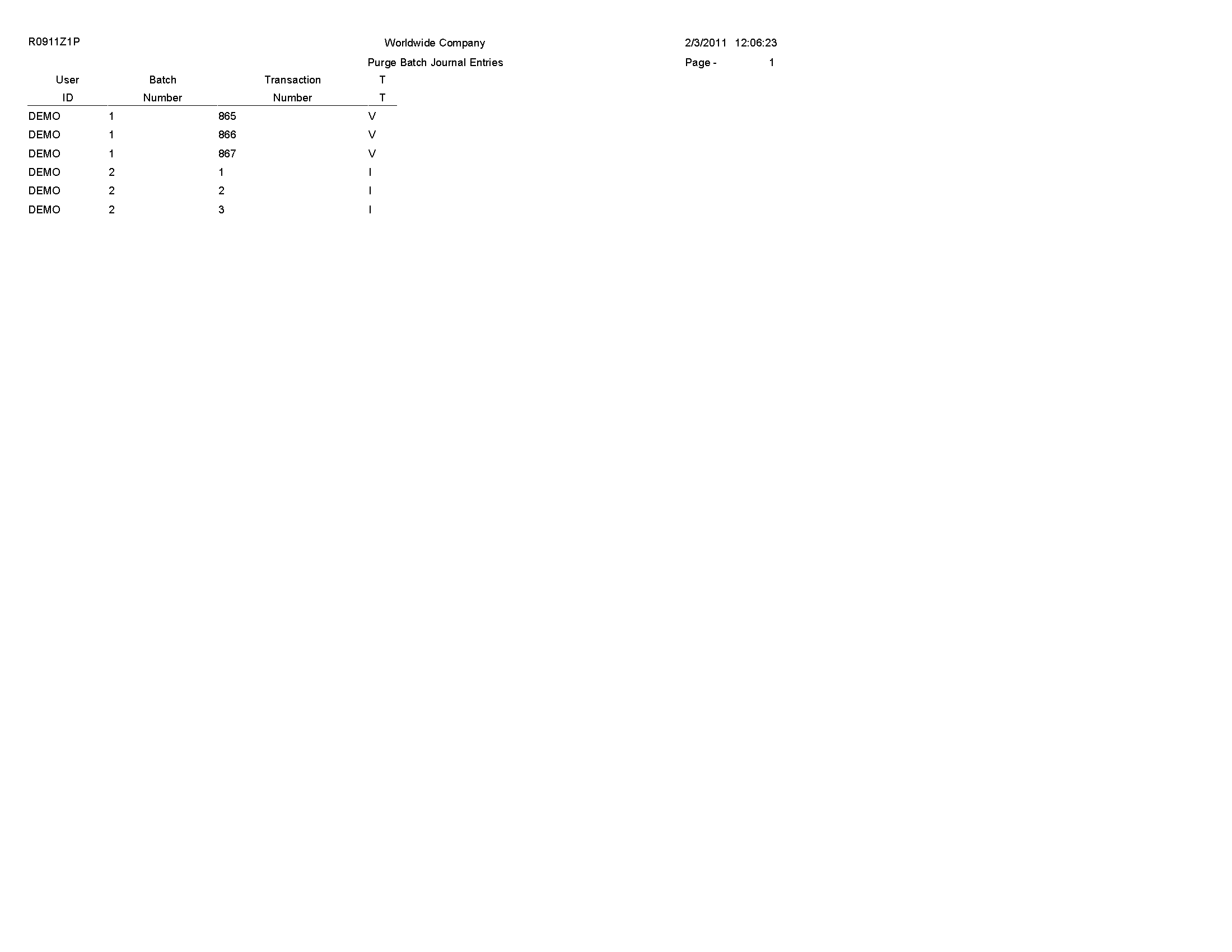

5.16 Purge Batch Journal Entries Report (R0911Z1P)

On the Batch Journal Entry Processing menu (G09311), select Purge Batch Journal Entries.

After you successfully process and post batch journal entries, you should purge them from the Journal Entry Transactions - Batch File table (F0911Z1). When you run this program, the system purges successfully processed journal entries from the F0911Z1 table, but only from the environment in which you run the program.

Review the Purge Batch Journal Entries report (R0911Z1P):

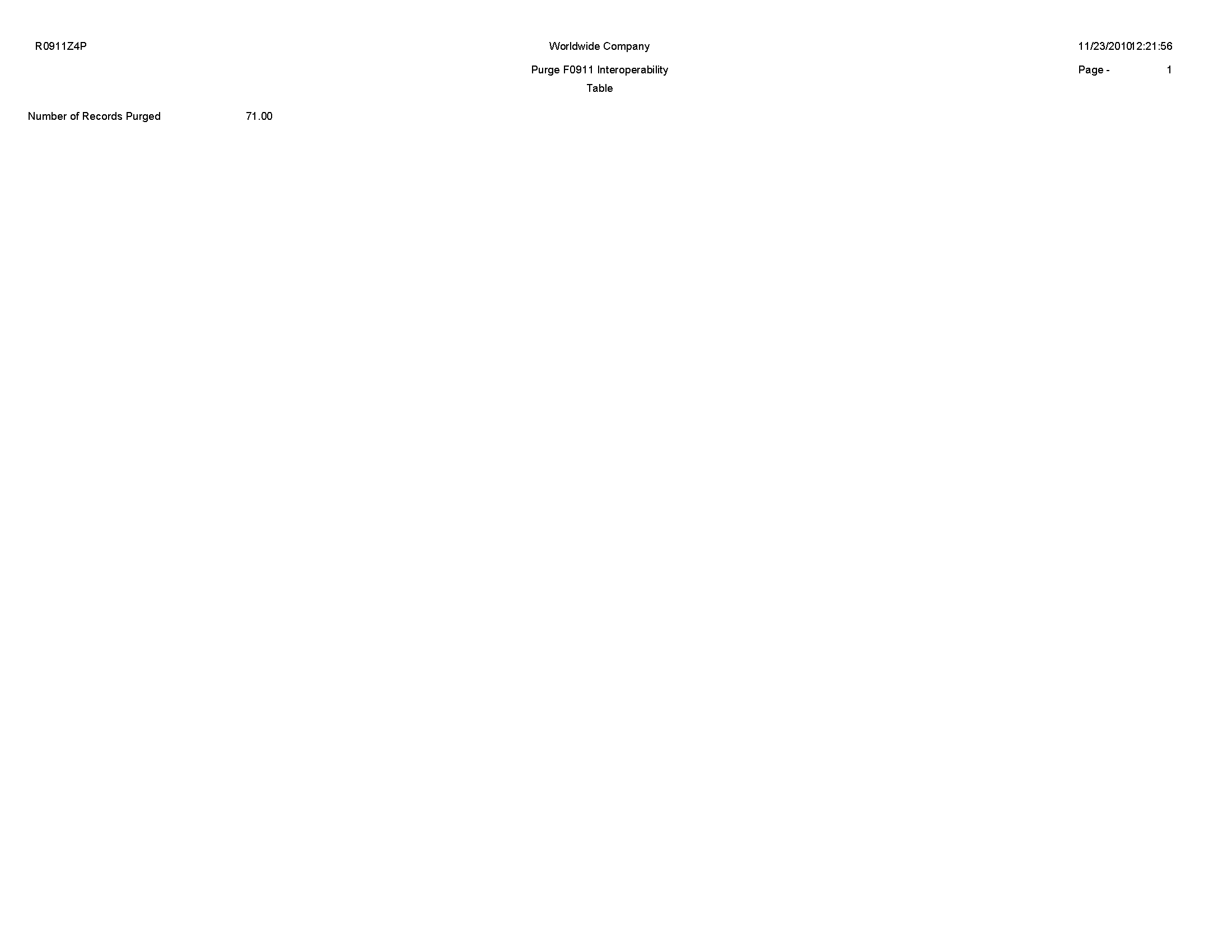

5.17 Purge F0911 Interoperability Table Report (R0911Z4P)

On the Financials Interoperability Processing menu (G00313), select Purge F0911 Interoperability Table.

Use this report to purge general ledger records from the F0911 Interoperability table (F0911Z4).

Review the Purge F0911 Interoperability Table report (R0911Z4P):

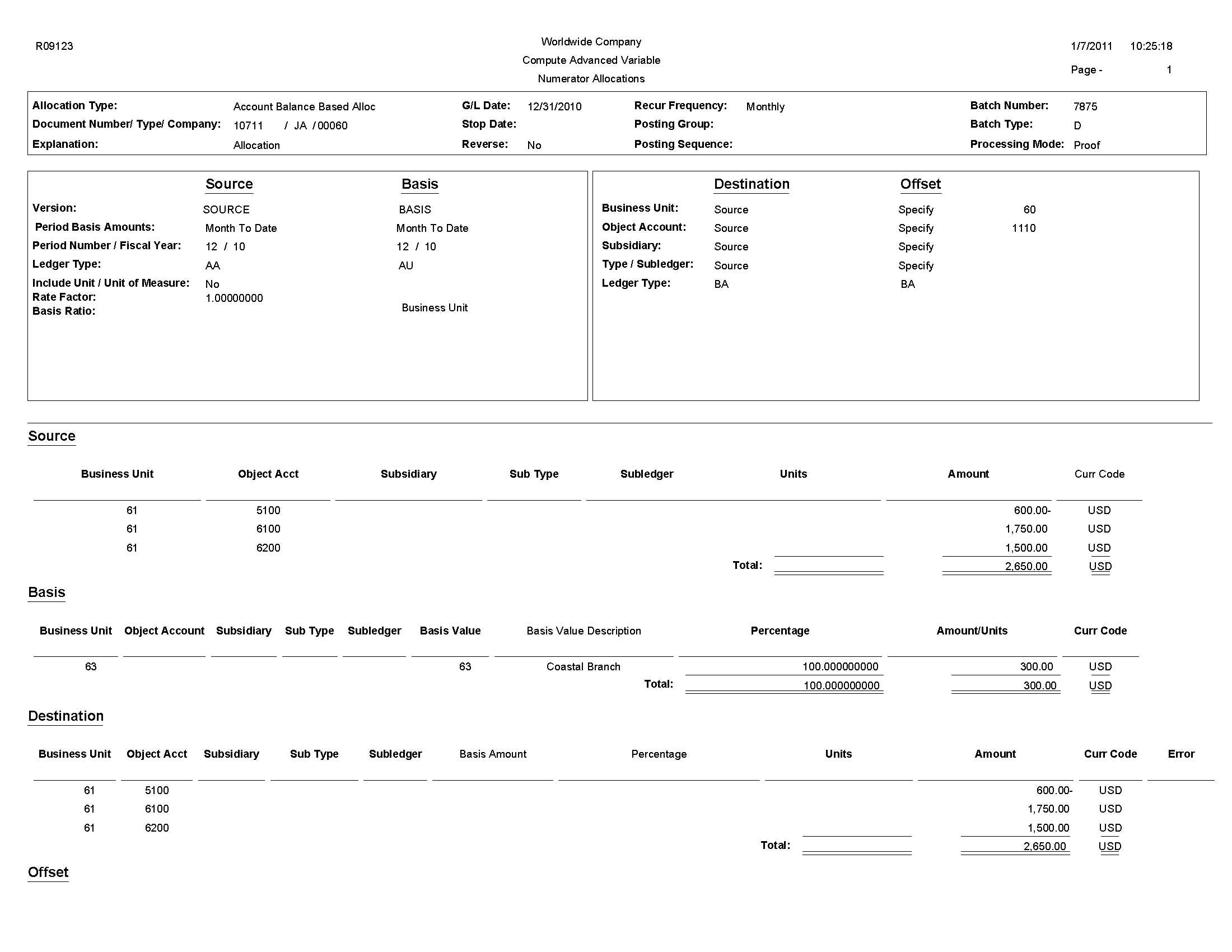

5.18 Compute Advanced Variable Numerator Allocations Report (R09123)

On the Advanced Variable Numerator menu (24/G0923), select Compute Advanced Variable Numerator Allocations.

Use this report to calculate the source, basis, destination, and offset amounts.

Review the Compute Advanced Variable Numerator Allocations report (R09123):

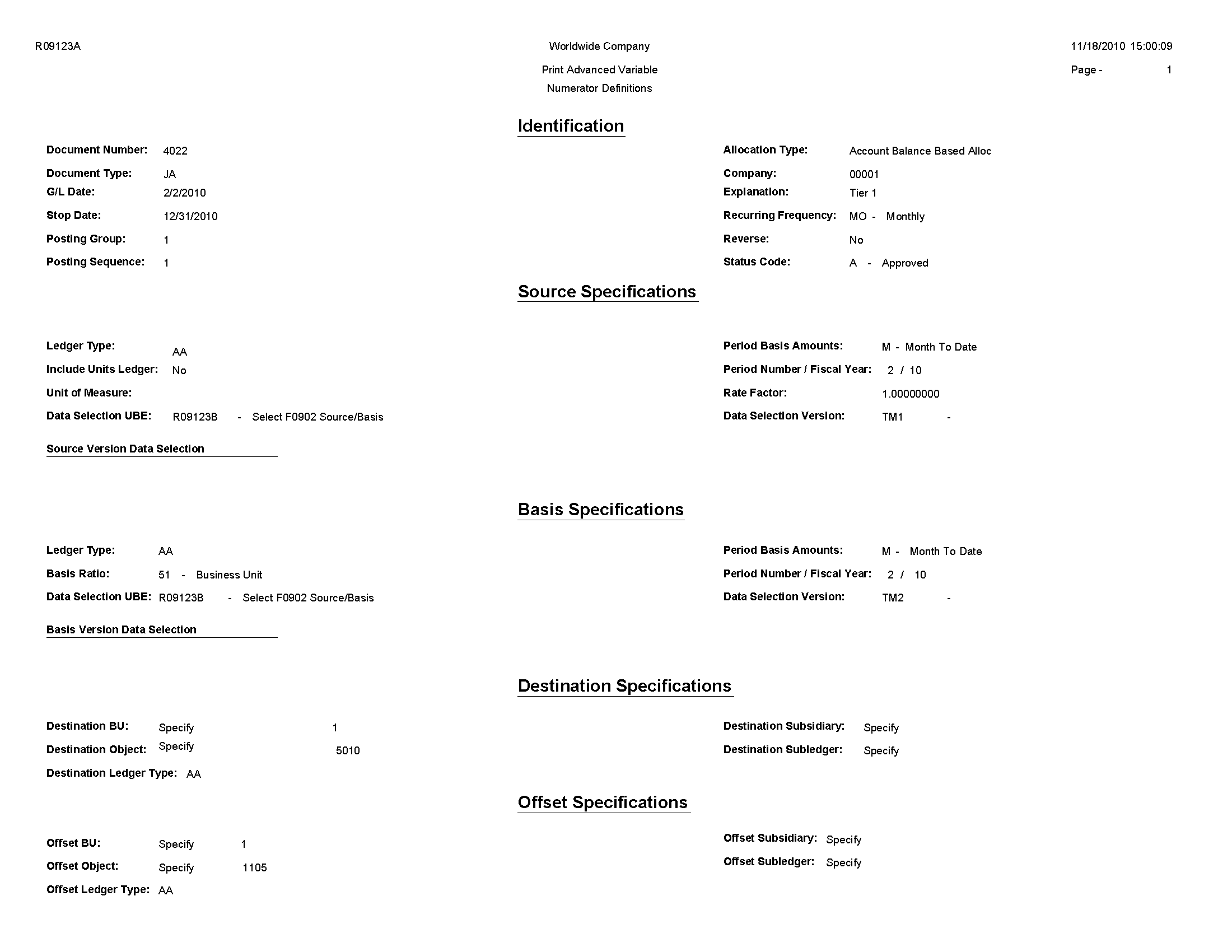

5.19 Print Advanced Variable Numerator Definitions Report (R09123A)

On the Advanced Variable Numerator menu (24/G0923), select Print Advanced Variable Numerator Definitions. You can also set a processing option in the Compute Advanced Variable Numerator Allocations report (R09123) to specify whether the system runs the Print Advanced Variable Numerator Definitions report.

Use this report to print the source, basis, destination, and offset amounts.

Review the Print Advanced Variable Numerator Definitions report (R09123A):

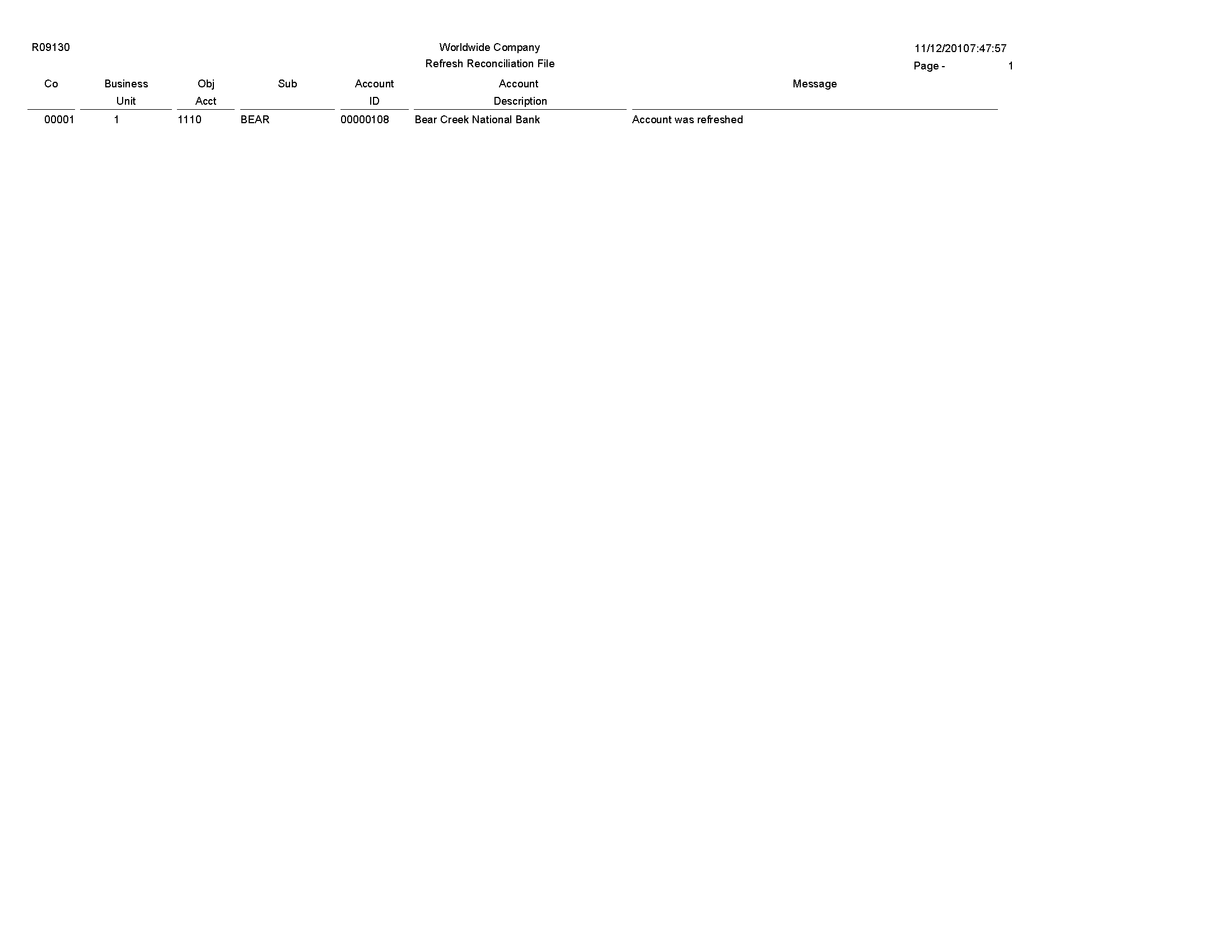

5.20 Refresh Reconciliation File Report (R09130)

On the Manual Reconciliation menu (G09209), select Refresh Reconciliation File.

Run this program at the end of each period to reconcile transactions for the period. The report copies the unreconciled transaction detail for all reconcilable accounts from the Account Ledger table (F0911) into the WF - Account Ledger Reconciliation table (F0911R).

Review the Refresh Reconciliation File report (R09130):

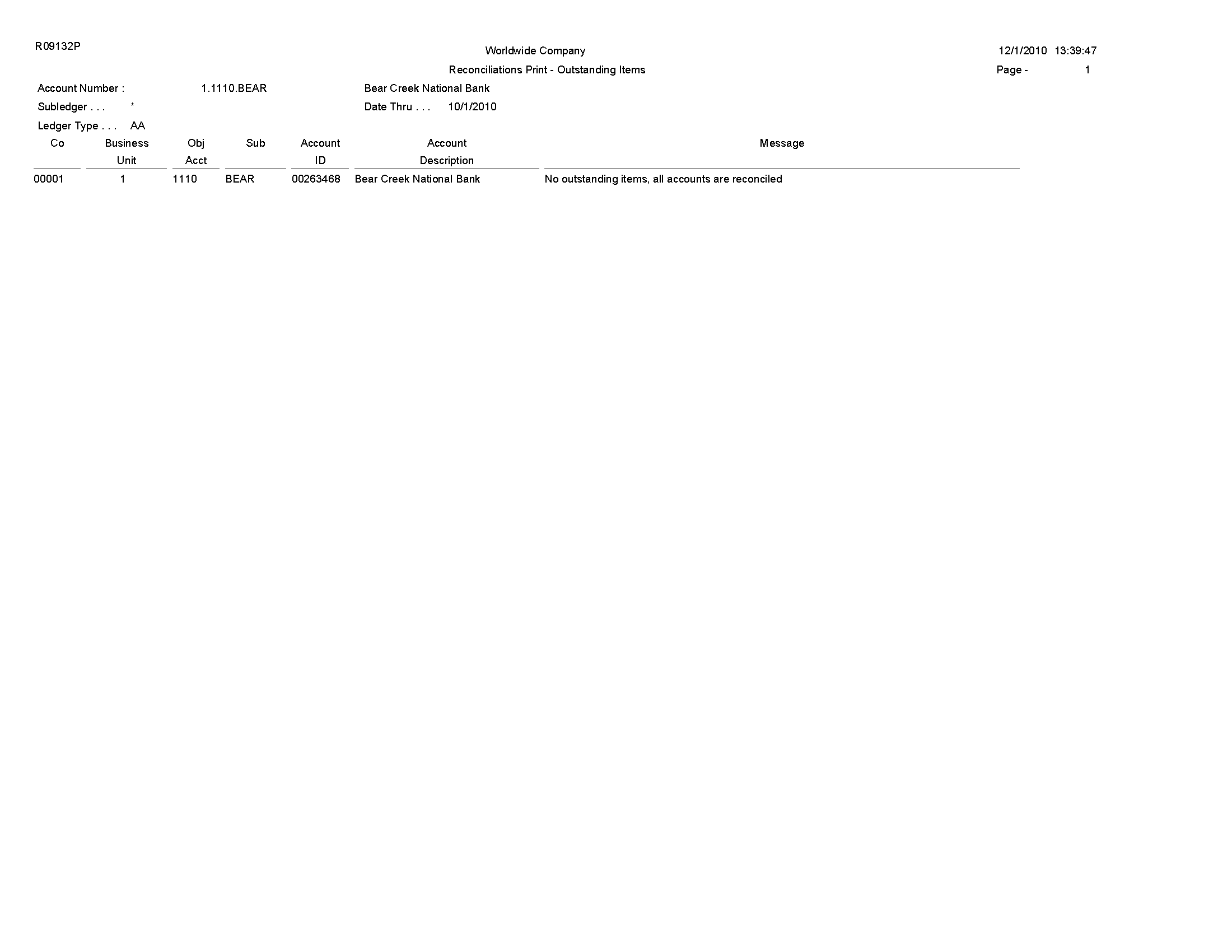

5.21 Reconciliations Print - Outstanding Items Report (R09132P)

On the Manual Reconciliation menu (G09209), select Manual Reconciliation On the Reconciliations form, select Bank Account Reconciliation.

After you reconcile your bank account transactions, run this report for a list of any outstanding items that are unreconciled.

Review the Reconciliations Print - Outstanding Items report (R09132P):

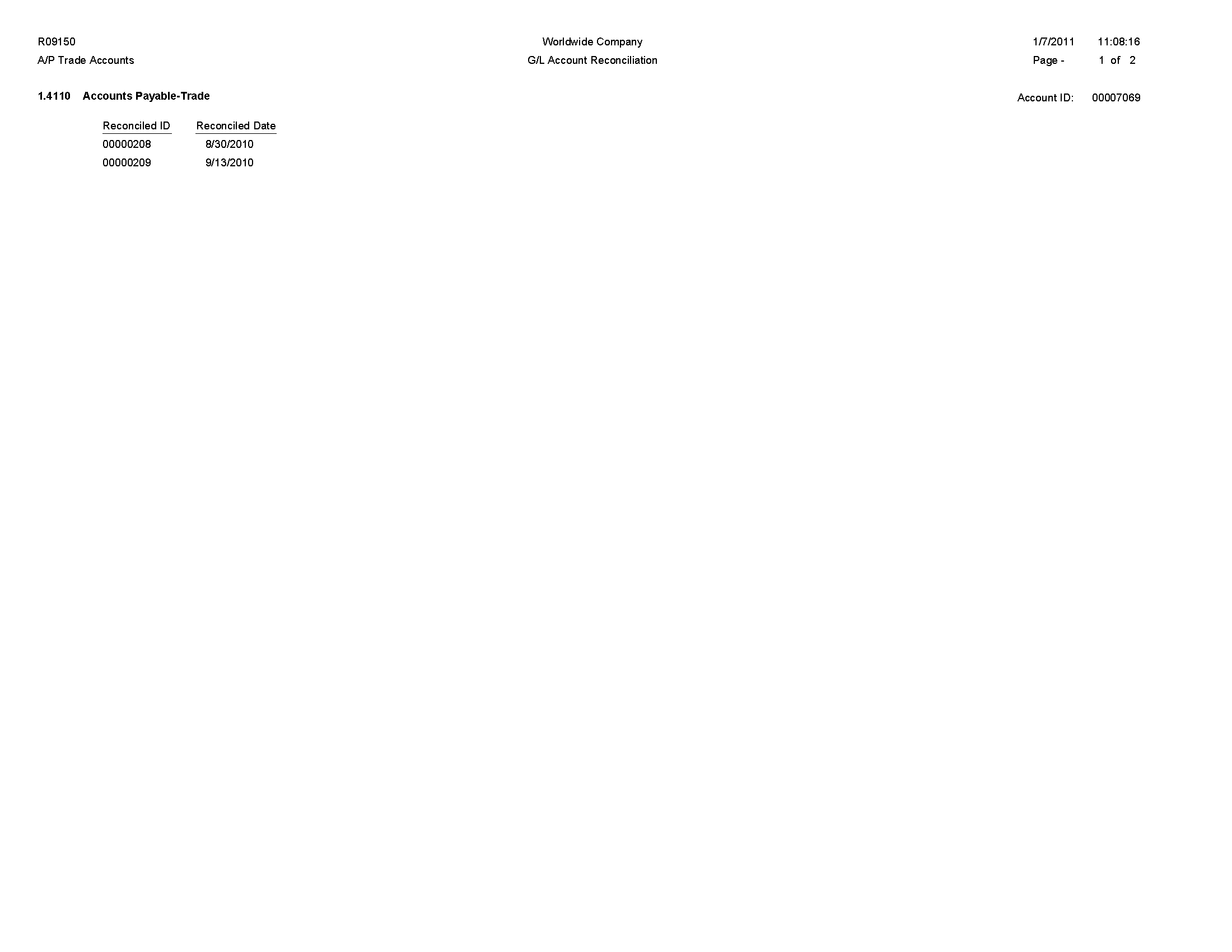

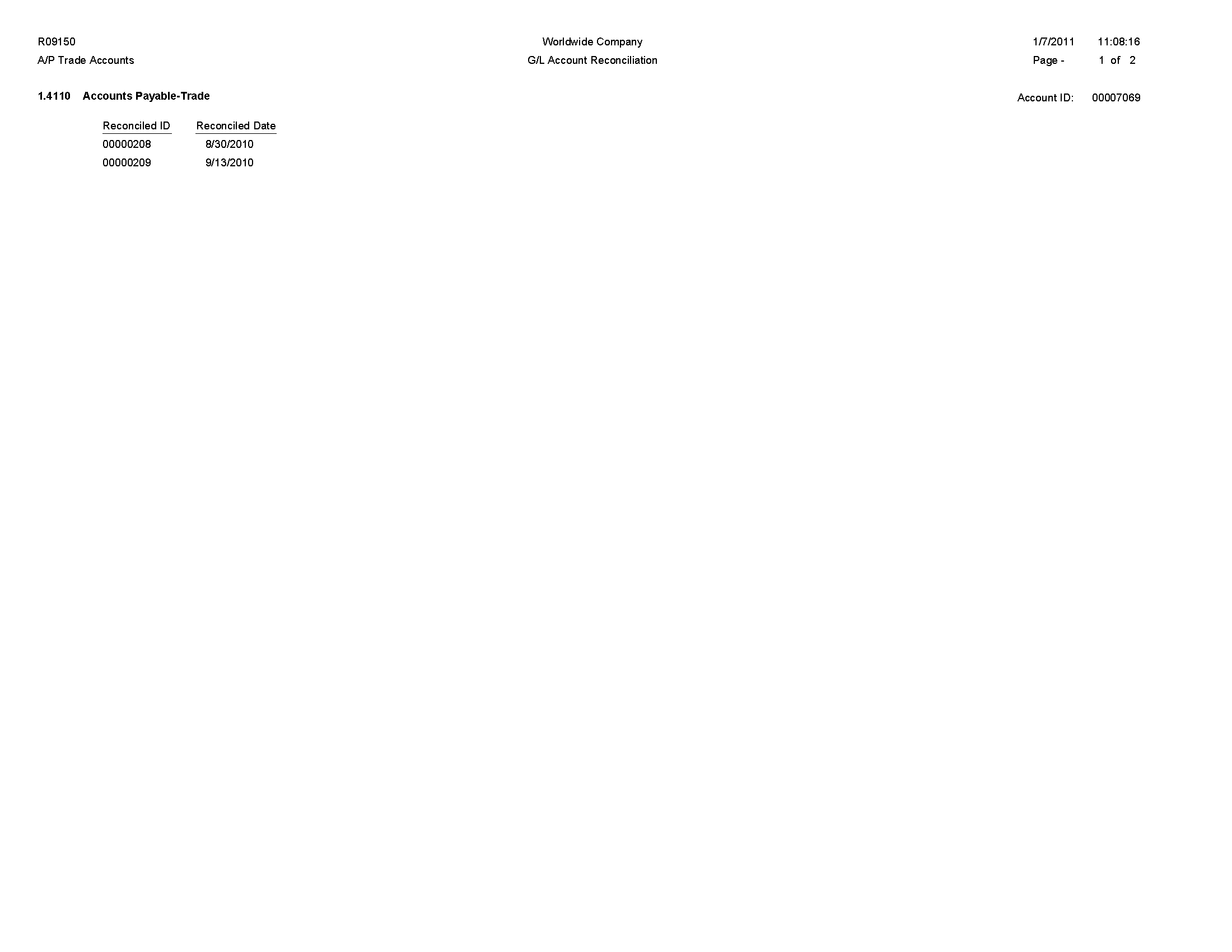

5.22 G/L Account Reconciliation Report (R09150)

On the Automated Reconciliation menu (G09205), select Automated Account Reconciliation.

Use this report to review the ID and date of the reconciled accounts

Review the G/L Account Reconciliation report (R09150):

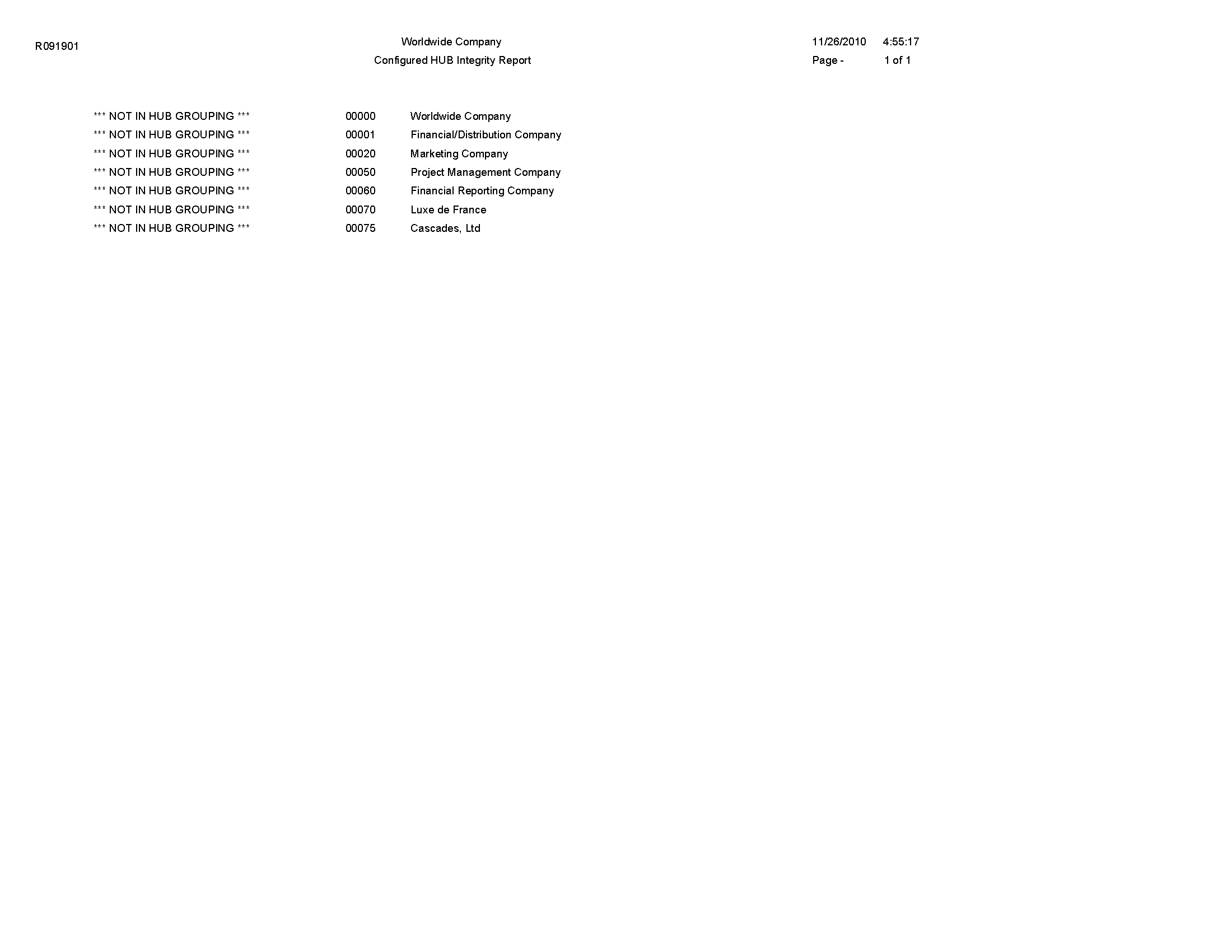

5.23 Configured HUB Integrity Report (R091901)

On the Configured Hub Intercompany Setup menu (G094115), select Configured Hub Integrity Report.

Run this report to verify that you have assigned every company to a hub. The system compares the hub information in the Inter/Intra Company Account Relationships table (F09190) with the company information in the Company Constants table (F0010).

Review the Configured HUB Integrity report (R091901):

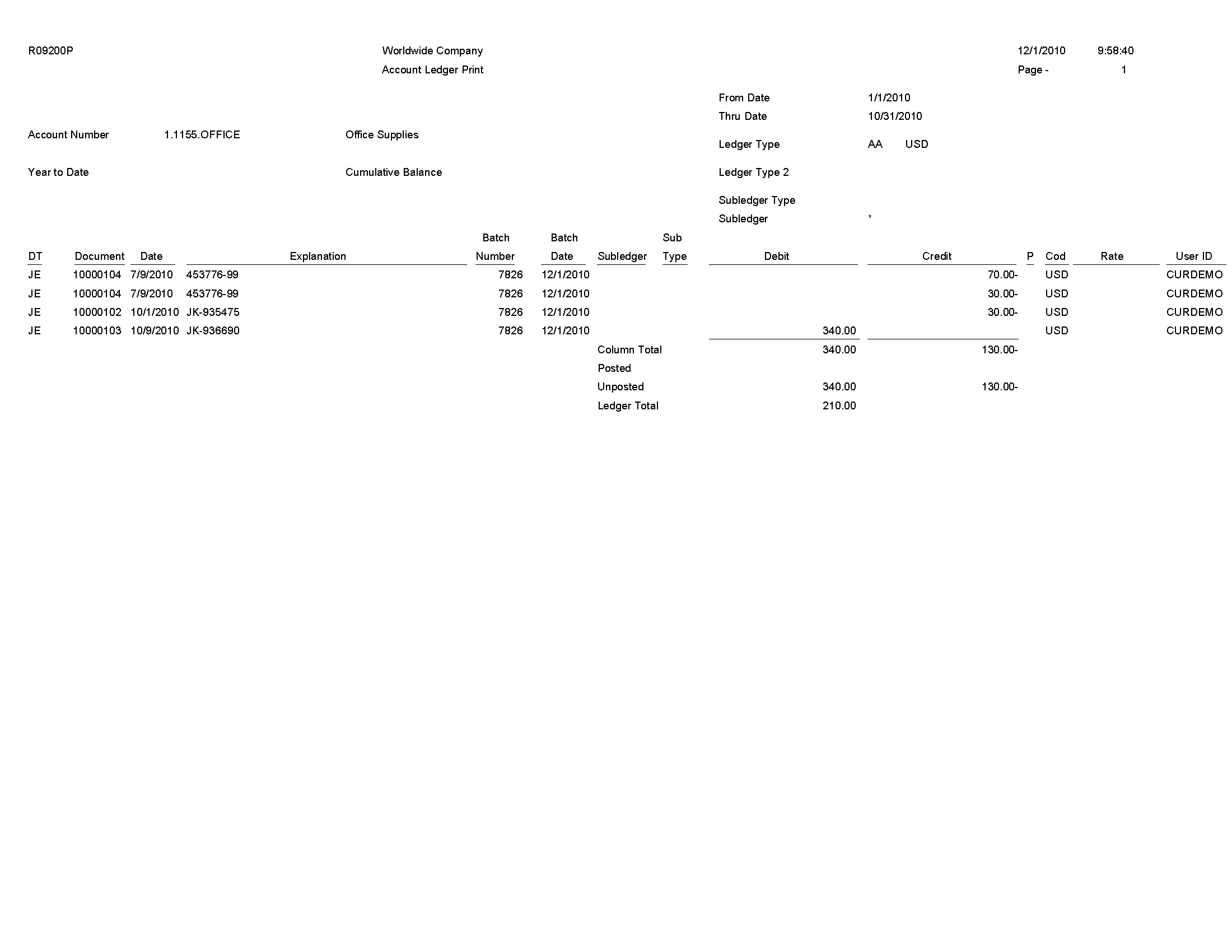

5.24 Account Ledger Print Report (R09200P)

In the Account Ledger Inquire program (P09200), select Print Ledger from the Report menu.

Use this report to review general ledger information in printed format instead of viewing the information online.

Review the Account Ledger Print report (R09200P):

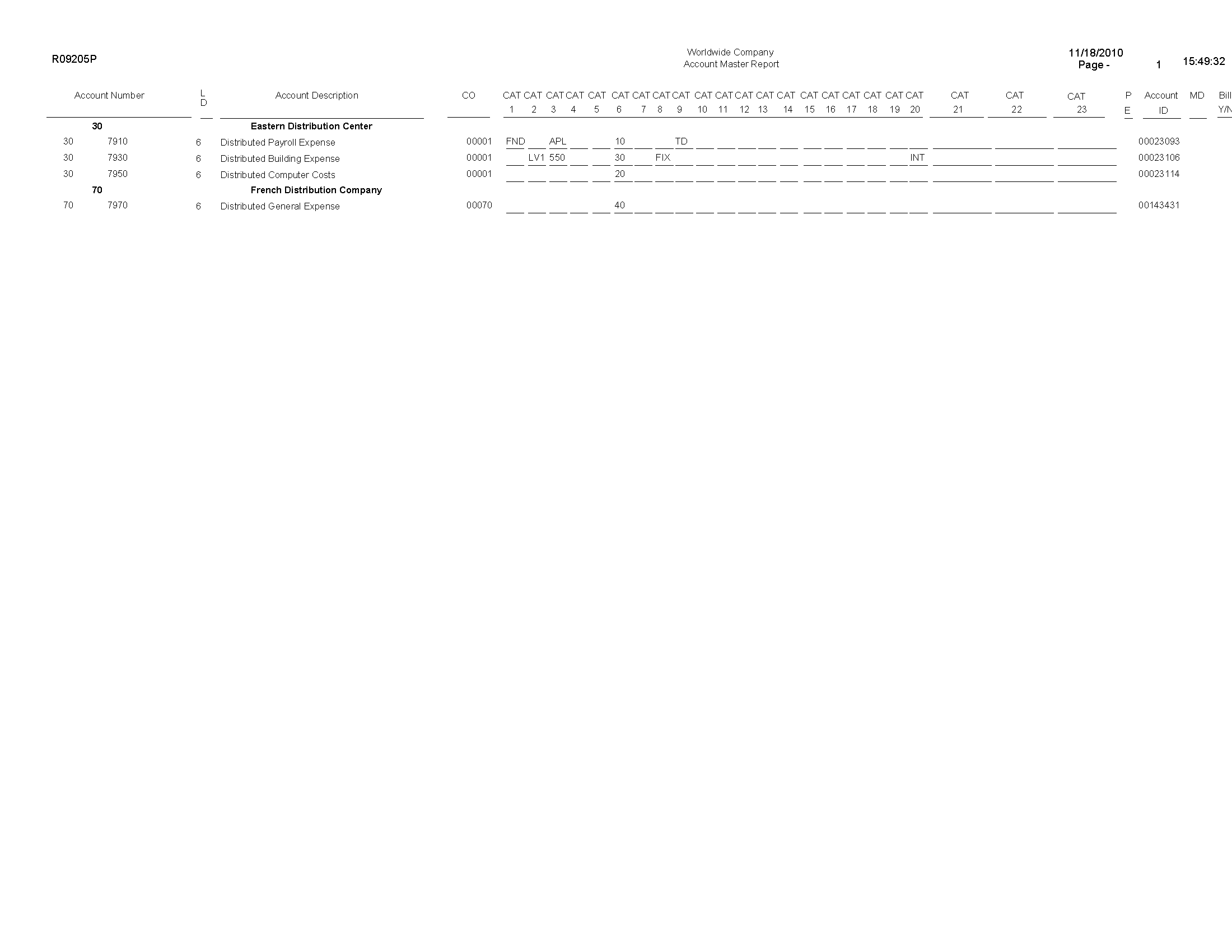

5.25 Account Master Report Cat. Code 01–23 Report (R09205P)

On the Organization & Account Setup menu (G09411), select Account Master Report Cat. Code 01 - 23.

Use this report to review the accounts in your chart of accounts that are associated with category codes 01–23.

Review the Account Master Report Cat Code 01-23 report (R09205P):

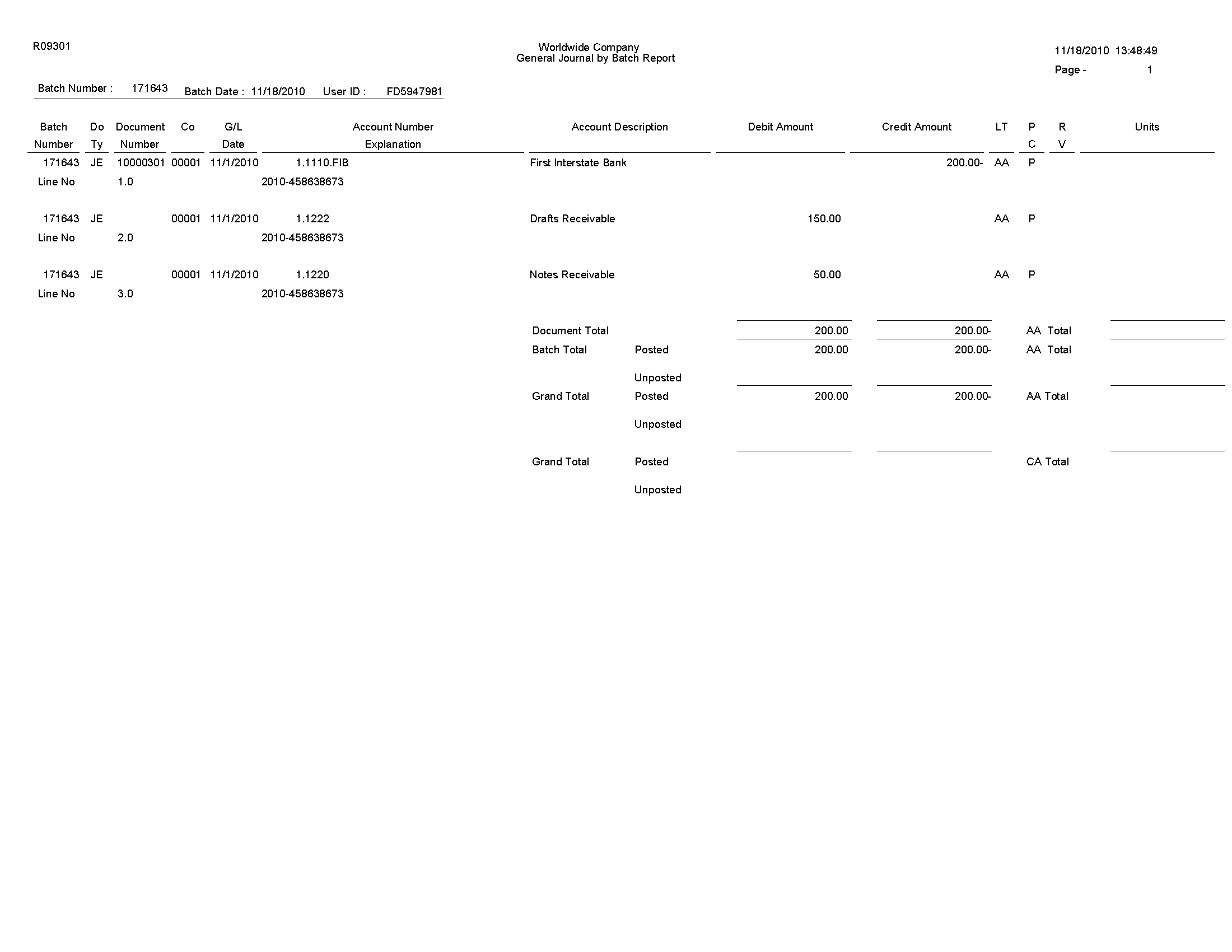

5.26 General Journal by Batch Report (R09301)

On the Journal Entry, Reports, & Inquiries menu (G0911), select General Journal by Batch.

Use this report to review posted and unposted journal entries in batch number sequence.

Review the General Journal Review by Batch report (R09301):

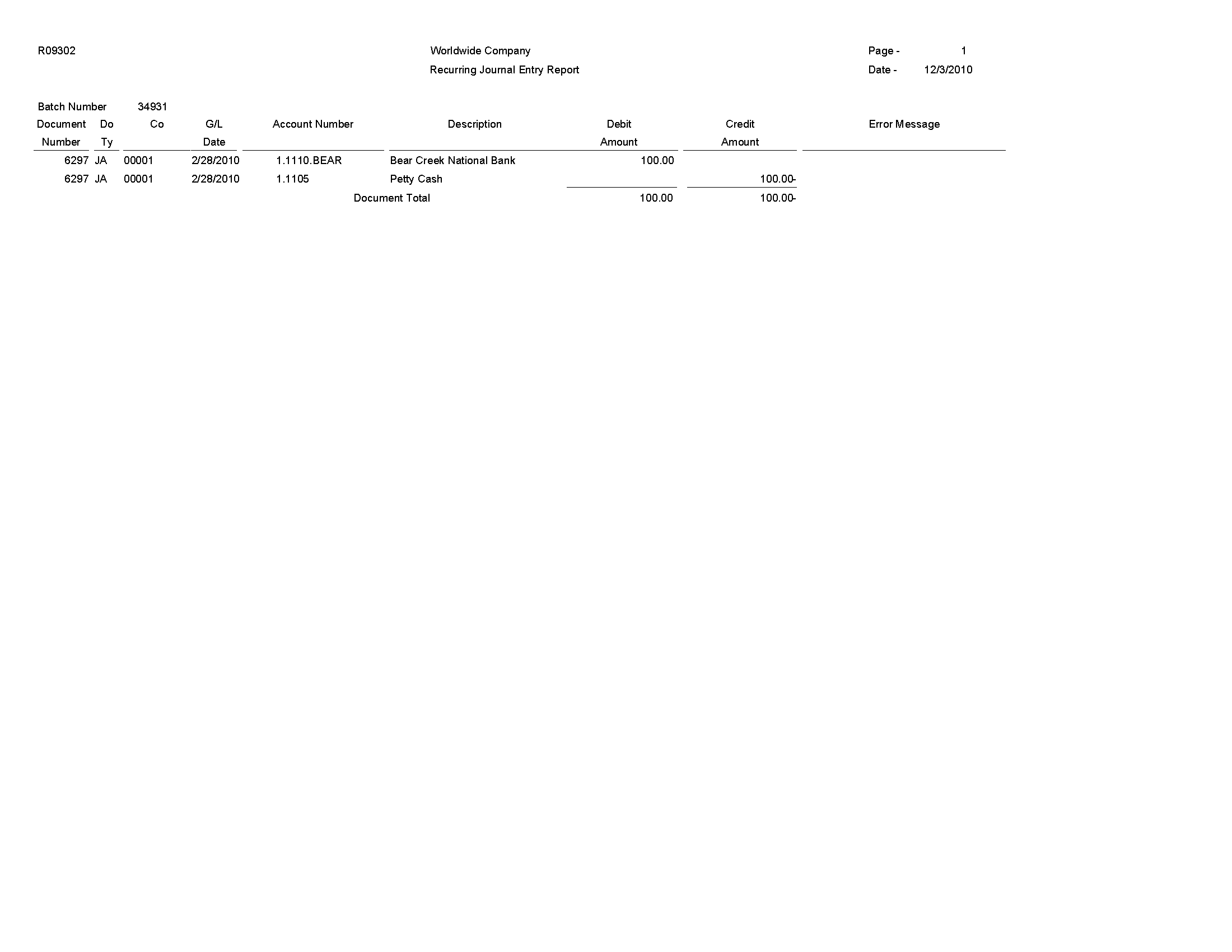

5.27 Recurring Journal Entry Compute & Print Report (R09302)

On the Allocations menu (G0923), select Recurring JE Compute & Print.

When you run the program in proof mode, the system generates a report but does not create journal entries.

In final mode, the system creates journal entries in the Account Ledger table (F0911) and advances the general ledger date according to the recurring frequency and stop date.

Review the Recurring Journal Entry Compute & Print report (R09302):

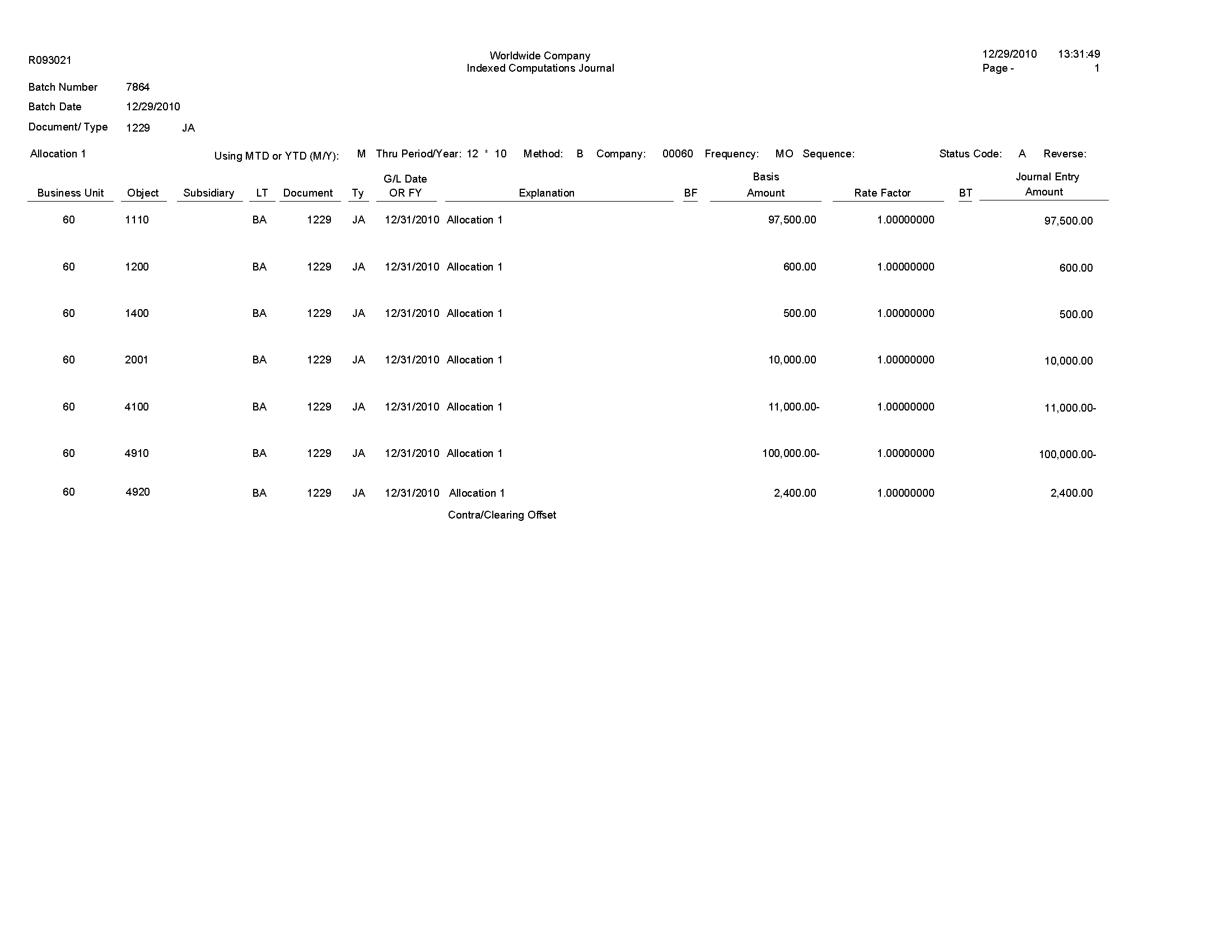

5.28 Indexed Computations Compute And Print Report (R093021)

On the Allocations menu (G0923), select Indexed Computations Compute & Print.

After you review the indexed allocations and determine that they are correct, run this program.

In proof mode, the system prints a report that shows the entries that are created in final mode. Review the report to determine whether you need to make any changes to the allocation before running the program in final mode.

In final mode, the system:

-

Reads balances or transactions, based on the allocation method, from one or more accounts.

-

Multiplies each balance or transaction by the specified rate index.

-

Creates journal entries with batch type D in the Account Ledger table (F0911).

For the balance allocation method, the system creates journal entries based on the balance of an account or a range of accounts. For the transaction allocation method, the system creates journal entries in a one-to-one ratio with the transactions that it reads.

-

Calculates an offset to balance the resulting journal entries, if needed, and distributes the offset to a contra/clearing account.

-

Increases the general ledger date incrementally according to the recurring frequency for the allocation, which ensures that the allocation is ready for future processing.

For the update allocation method, updates balances only in the Account Balances table (F0902) for ledger types other than AA.

-

Prints the Indexed Computations Journal report.

This report lists detailed allocation information and errors, such as invalid accounts and entries posted before cutoff (PBCO). Invalid accounts appear with *** on the report.

Review the Indexed Computations Journal report (R093021):

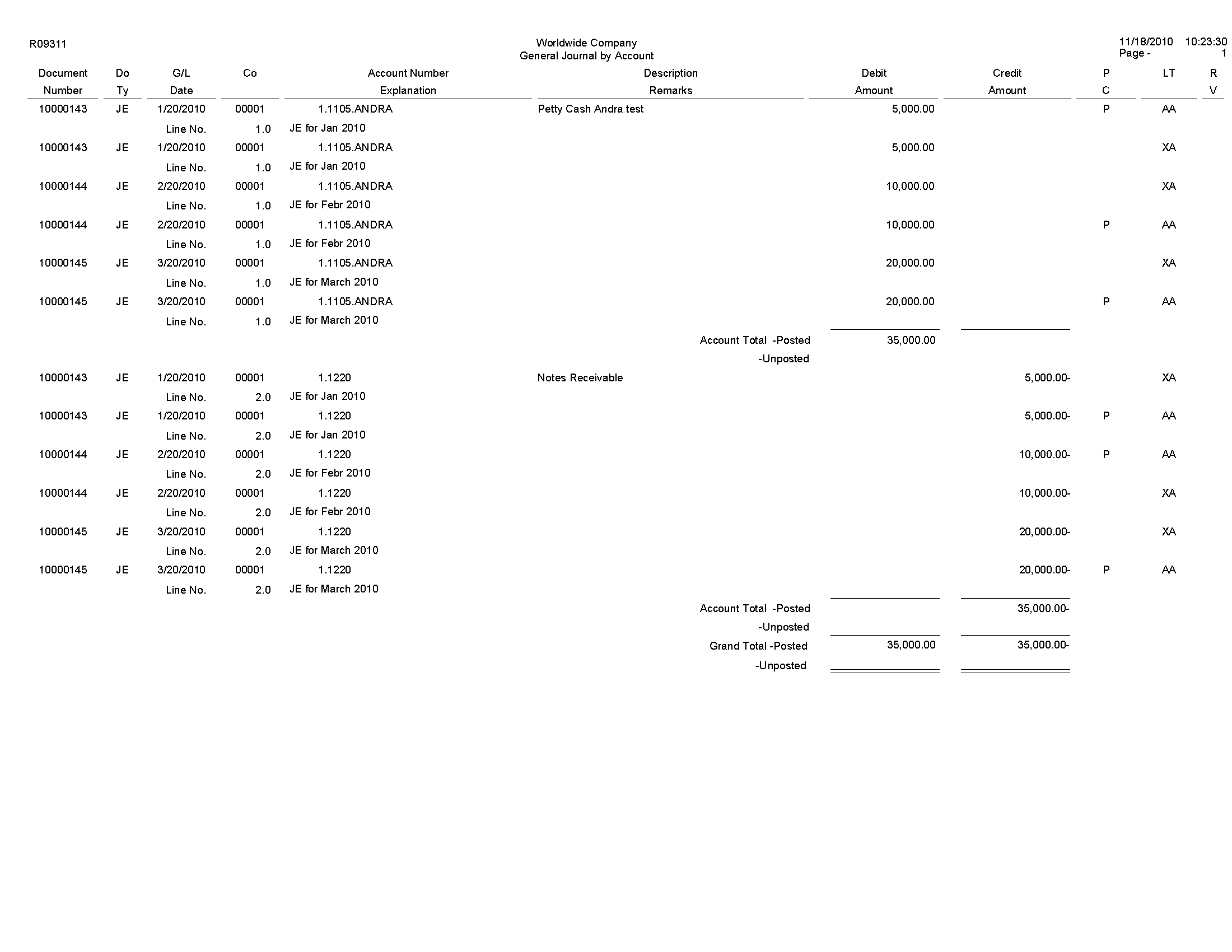

5.29 General Journal by Account Report (R09311)

On the Journal Entry, Reports, & Inquiries menu (G0911), select General Journal by Account.

Use this report to review posted and unposted transactions by account. The report provides totals by account number.

Review the General Journal by Account report (R09311):

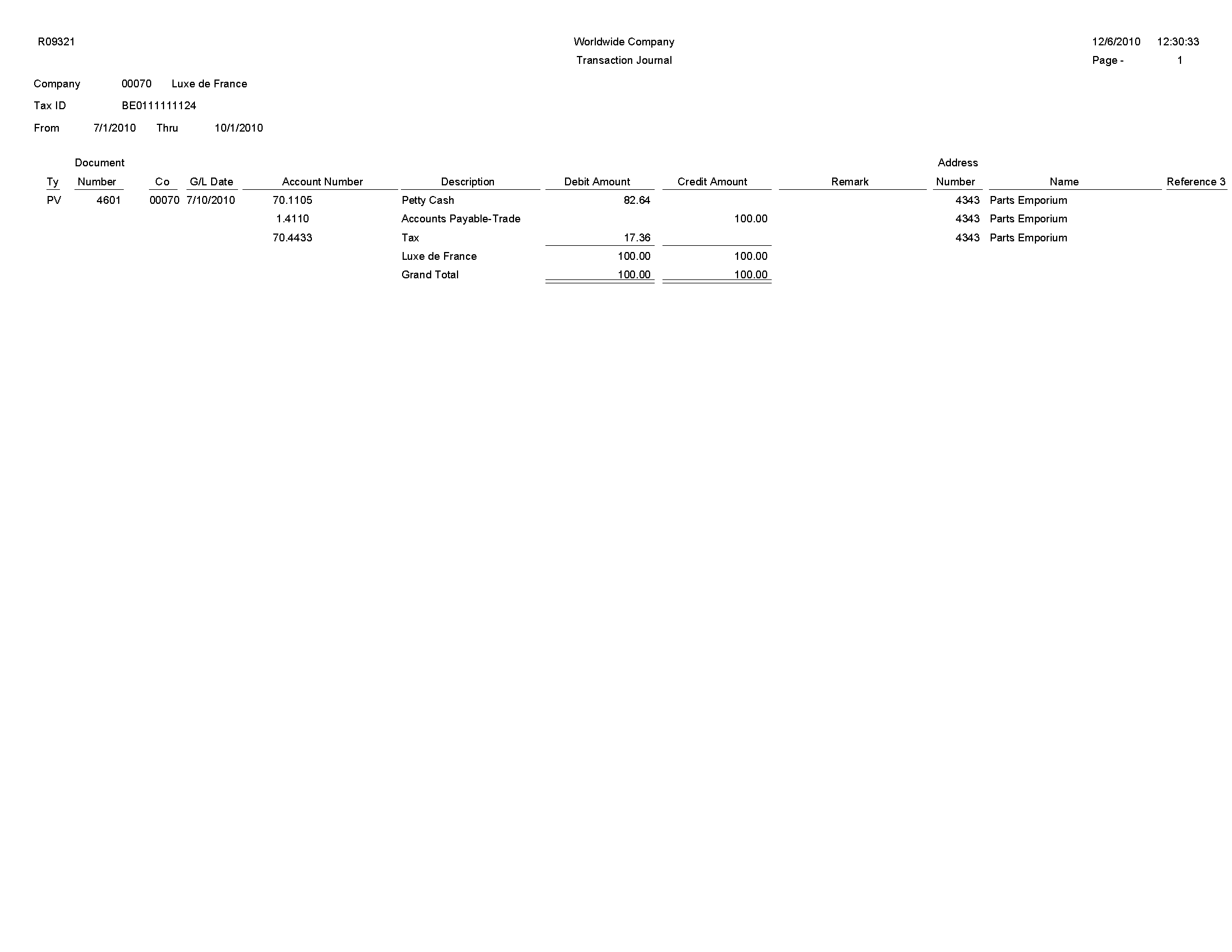

5.30 Transaction Journal Report (R09321)

On the Accounting Reports & Inquiries menu (G0912), select Transaction Journal.

Use this report to review transactions within a general ledger date range. This report prints the debit and credit amounts that comprise balanced entries for invoices and vouchers.

Review the Transaction Journal report (R09321):

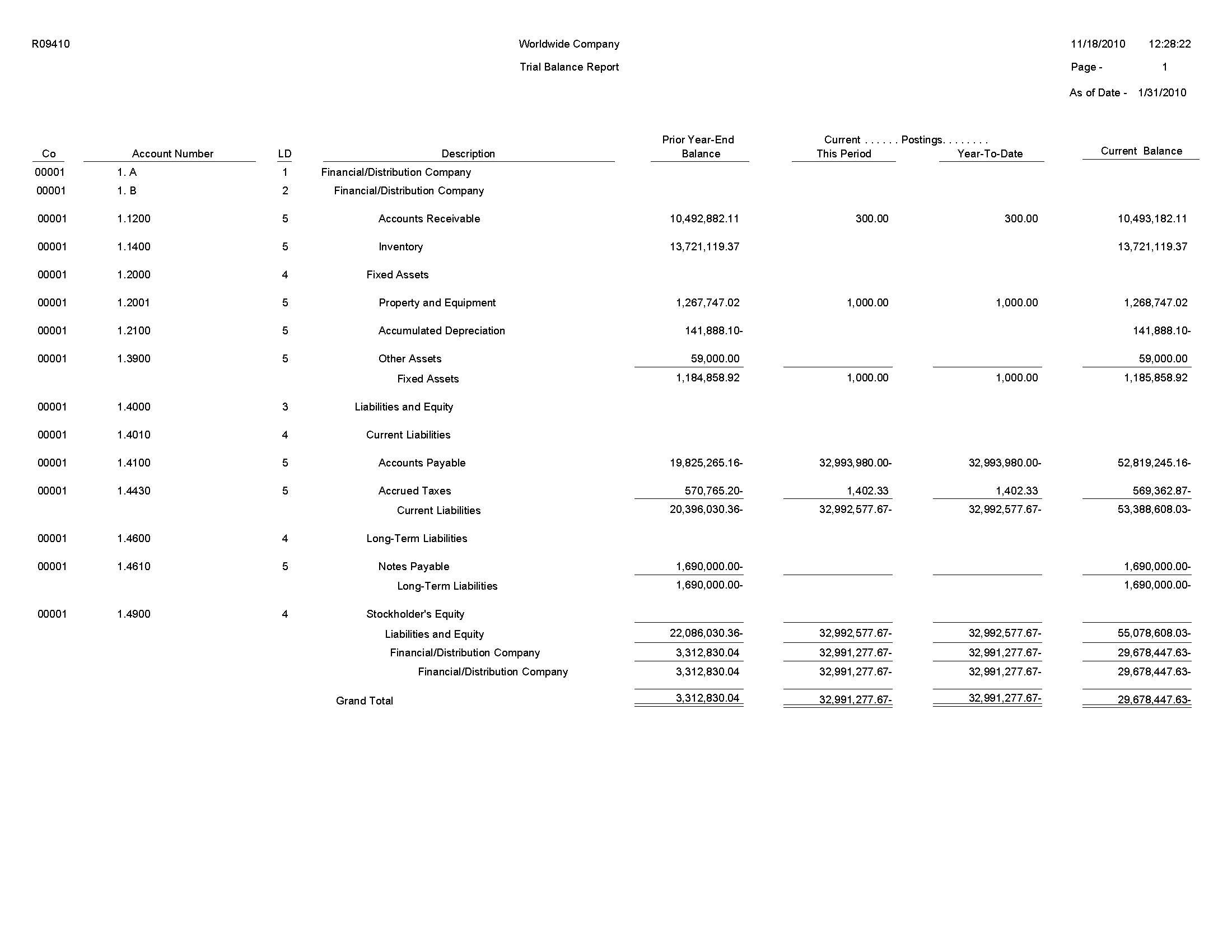

5.31 Trial Balance Report (R09410)

On the Accounting Reports & Inquiries menu (G0912), select Trial Balance Report.

Use this report to review account balances by business unit. Use this report to analyze account balances by business unit and to obtain business unit totals. This report includes a processing option for level-of-detail summarization.

Review the Trial Balance report (R09410):

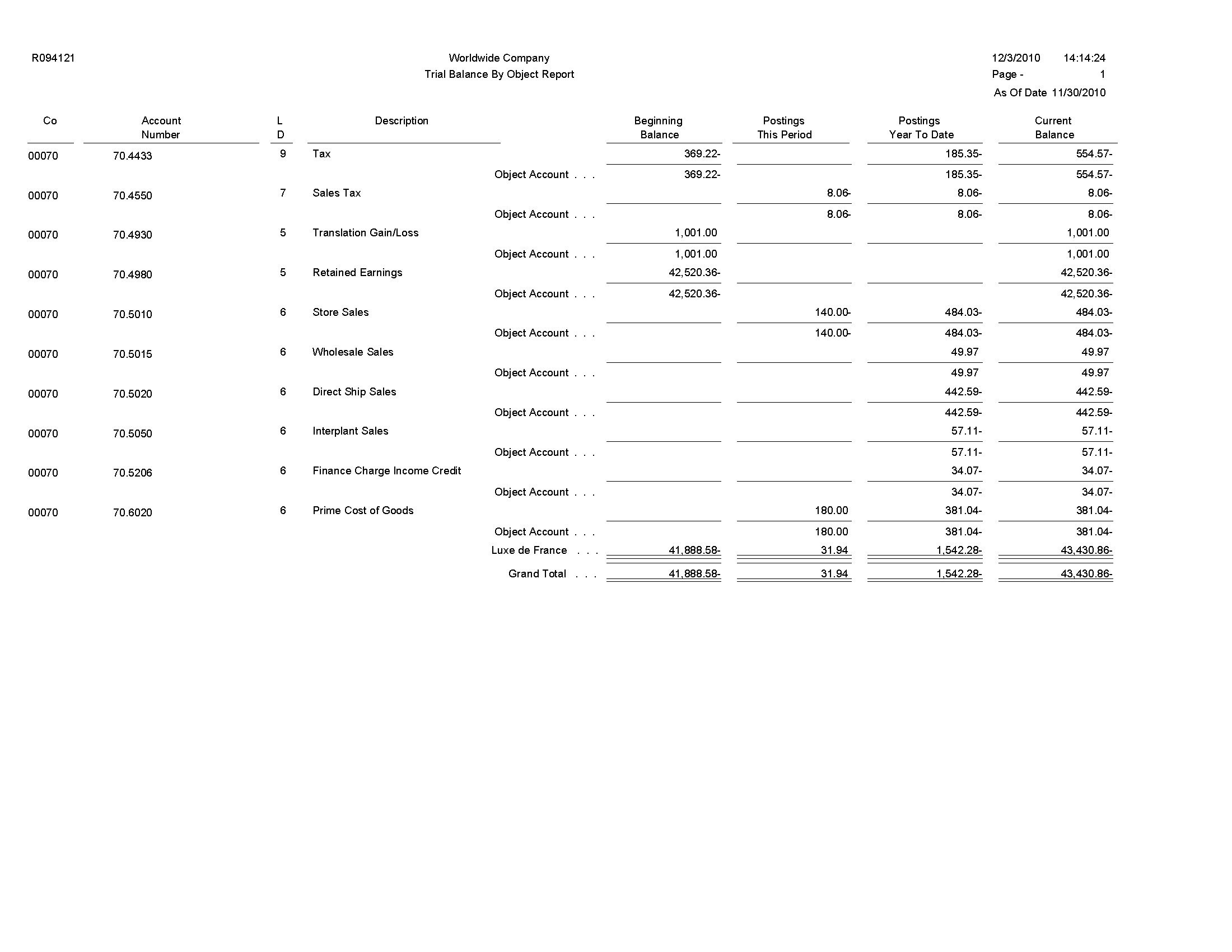

5.32 Trial Balance By Object Report (R094121)

On the Accounting Reports & Inquiries menu (G0912), select Trial Balance By Object Report.

Use this report to review account balances across all business units. You can review similar object accounts, such as all cash accounts, and to obtain account totals for each group of accounts.

Review the Trial Balance by Object report (R094121):

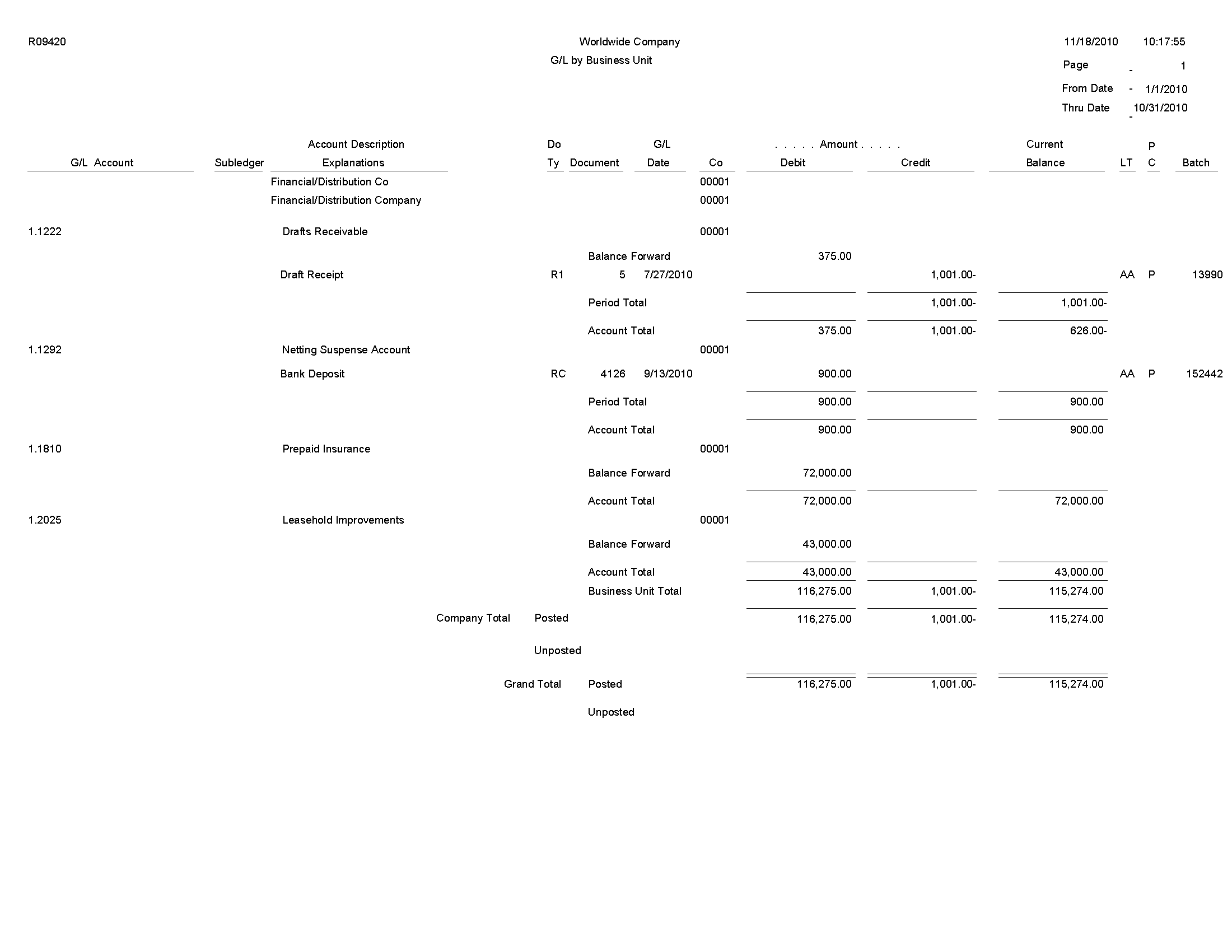

5.33 G/L by Business Unit Report (R09420)

On the Accounting Reports & Inquiries menu (G0912), select G/L by Business Unit.

Use this report to review transactions by object account within a specific business unit.

Review the G/L by Business Unit report (R09420):

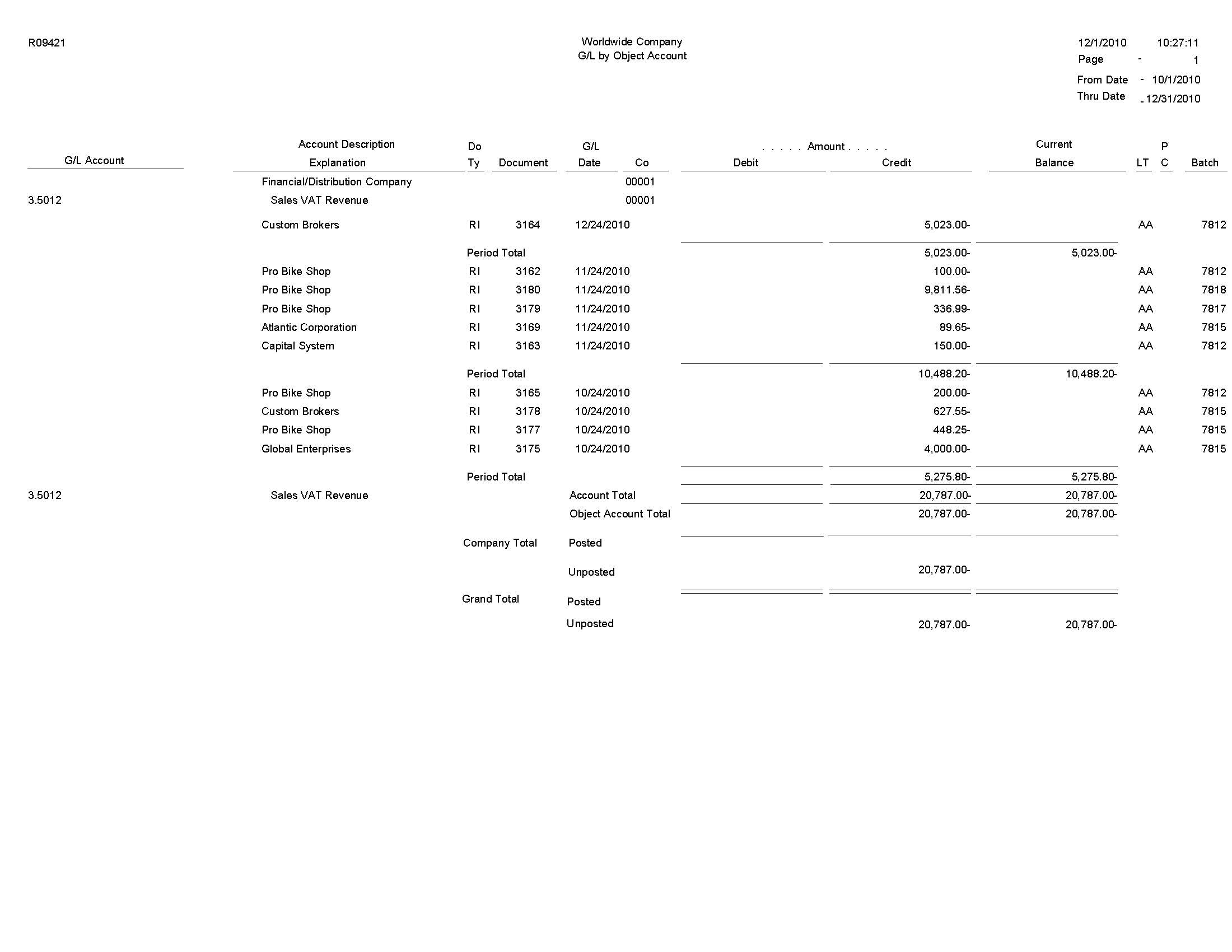

5.34 G/L by Object Account Report (R09421)

On the Accounting Reports & Inquiries menu (G0912), select G/L by Object Account.

Use this report to review transactions across all or several business units. This report lists transactions by account. Use this report to review specific accounts across all or several business units, and to obtain account totals for each group.

Review the G/L by Object Account report (R09421):

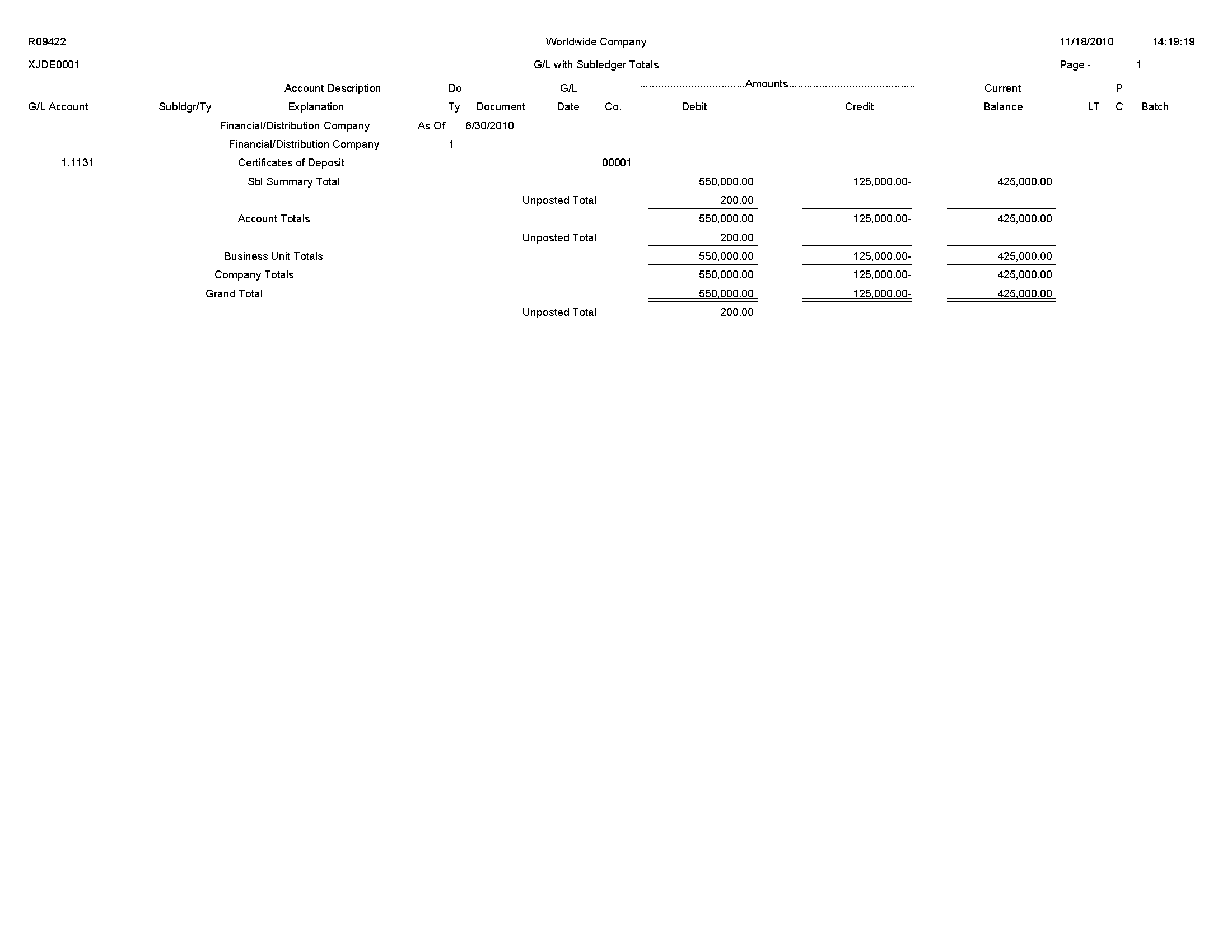

5.35 G/L with Subledger Total Report (R09422)

On the Accounting Reports & Inquiries menu (G0912), select G/L with Subledger Totals.

Use this report to review transaction totals by subledger. This report includes the same information that you can view online with the T/B by Subledger program.

Review the G/L with Subledger Totals report (R09422):

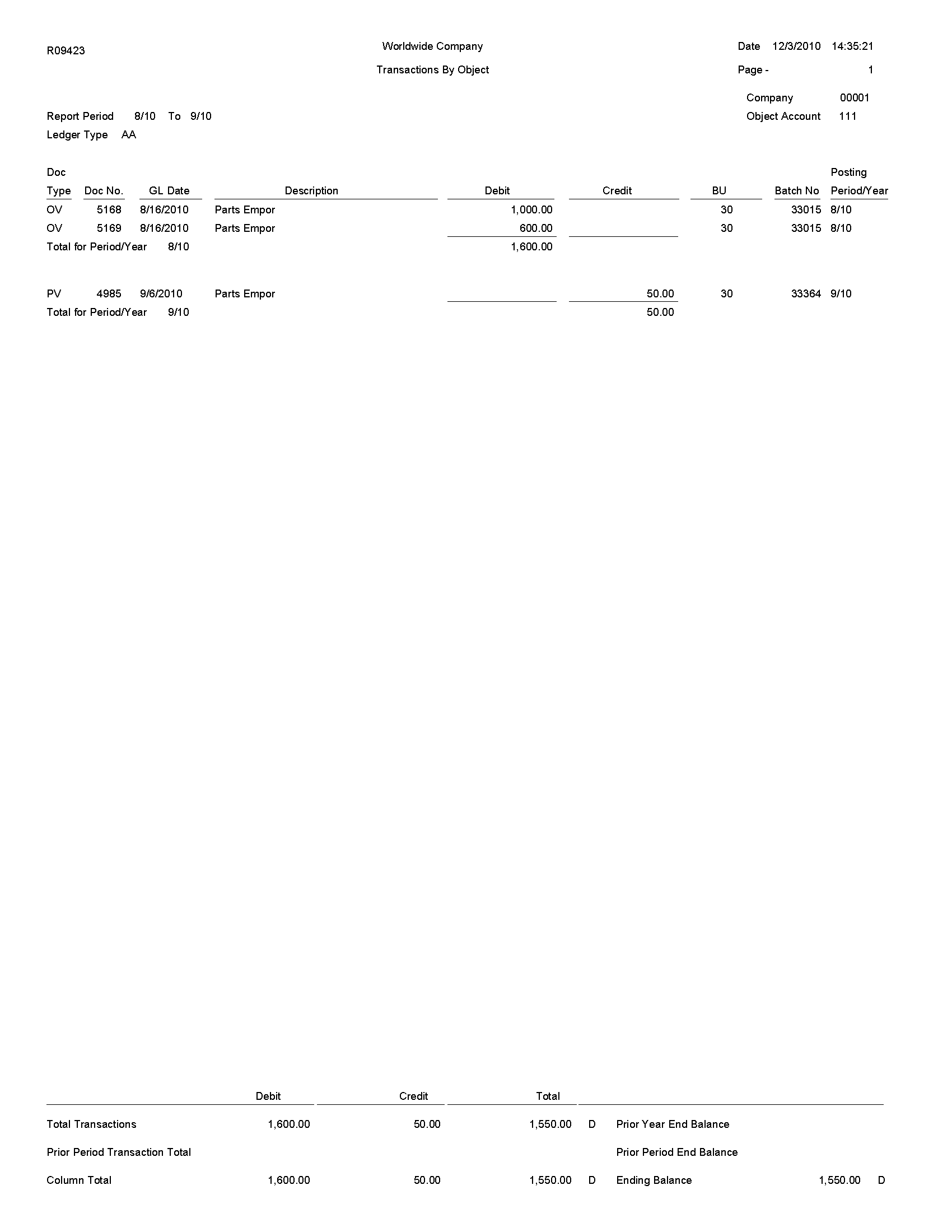

5.36 Transactions By Object Report (R09423)

On the Accounting Reports & Inquiries menu (G0912), select Transactions by Object.

Use this report to review the account balances and posted transactions for each object account of a specified company over the period selected.

Review the Transactions by Object report (R09423):

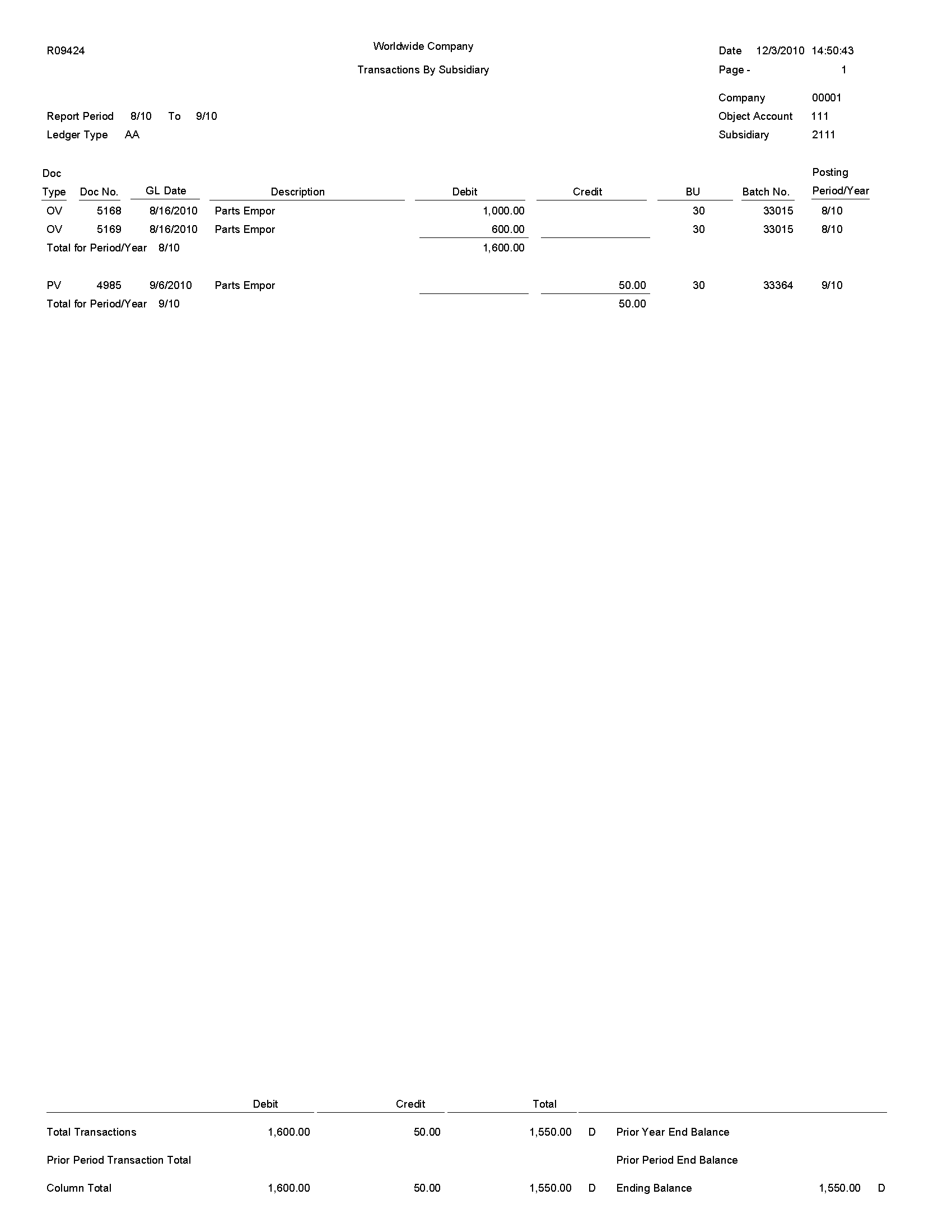

5.37 Transactions By Subsidiary Report (R09424)

On the Accounting Reports & Inquiries menu (G0912), Transactions by Subsidiary.

Use this report to review the account balances and posted transactions for every object account and subsidiary over the period that you select.

Review the Transactions by Subsidiary report (R09424):

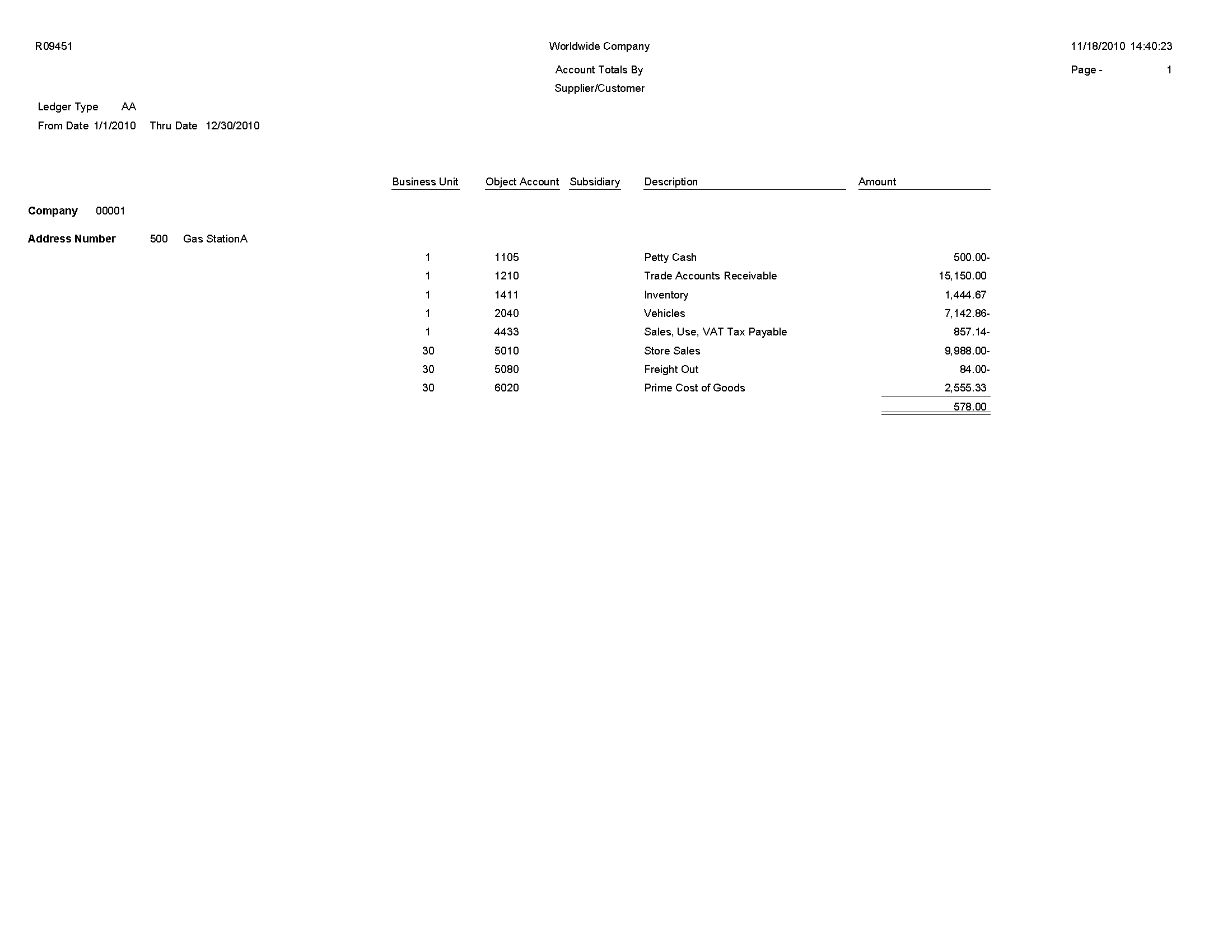

5.38 Account Totals By Supplier/Customer Report (R09451)

On the Accounting Reports & Inquiries menu (G0912), select Account Totals by Supplier/Customer.

Use this report to review the balance for each customer and supplier by object account.

Review the Account Totals by Supplier/Customer report (R09451):

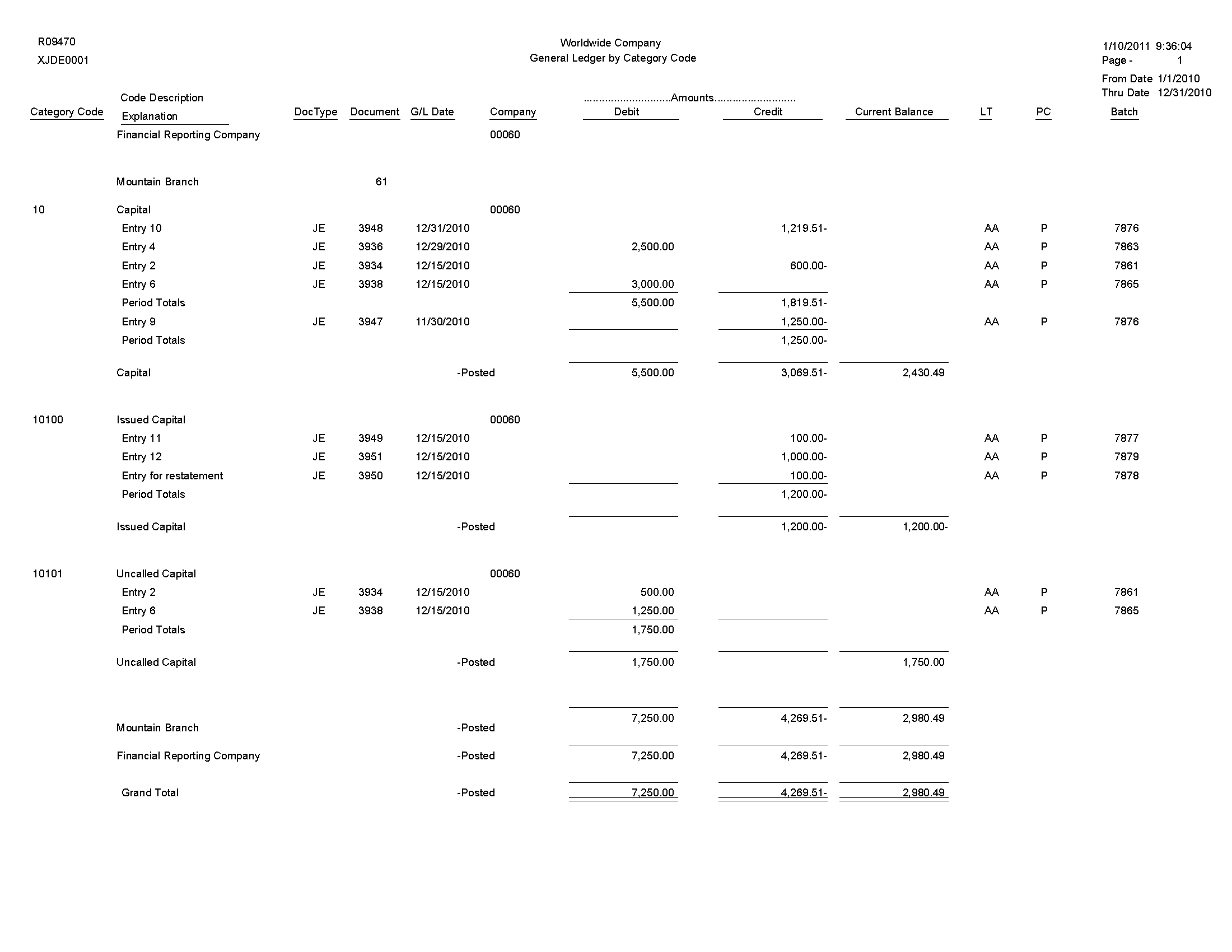

5.39 General Ledger by Category Code Report (R09470)

On the Accounting Reports & Inquiries menu (G0912), select G/L by Category Code.

Use this report to review the account balances for accounts assigned to category codes 21–43.

Review the General Ledger by Category Code report (R09470):

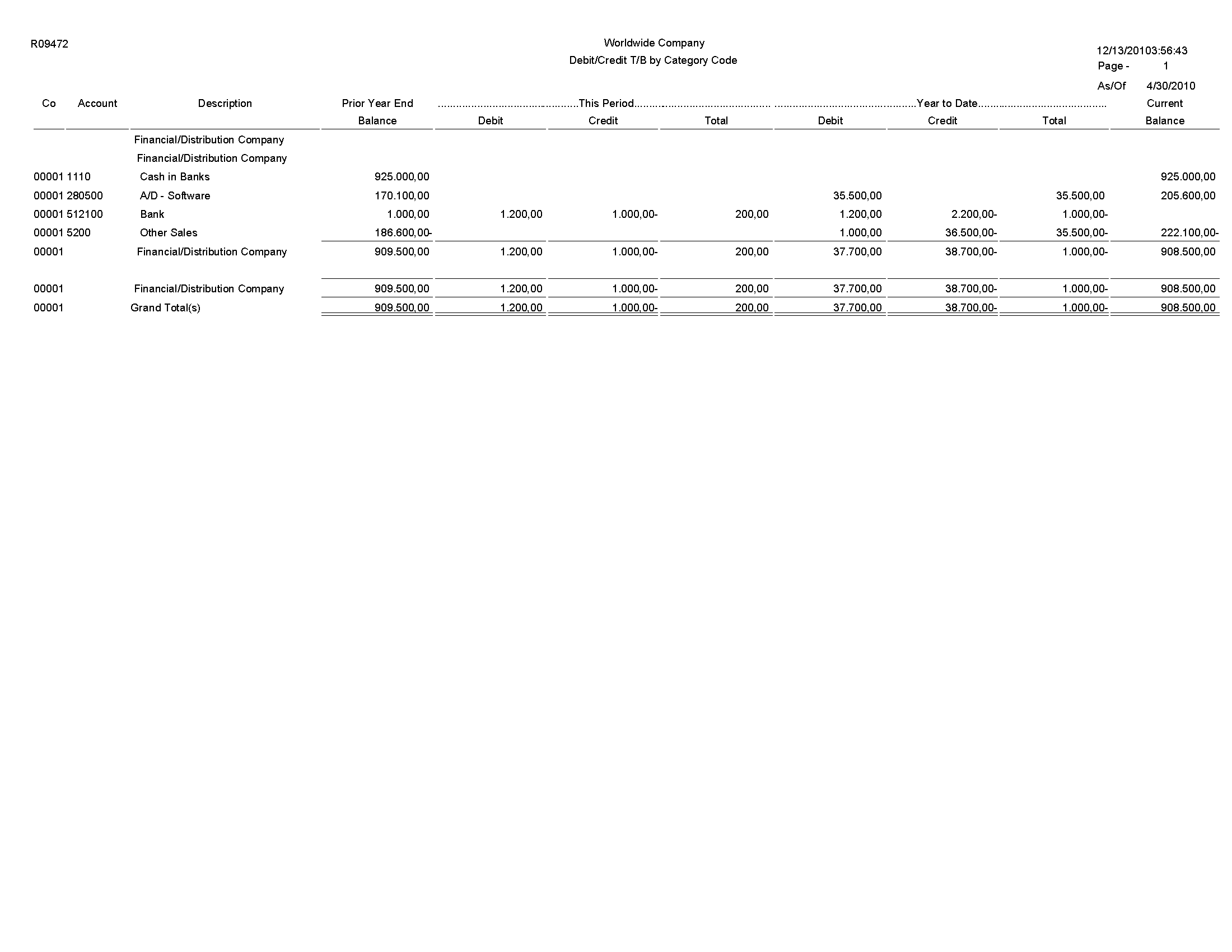

5.40 Debit/Credit T/B by Category Code Report (R09472)

On the Accounting Reports & Inquiries menu (G0912), select Debit/Credit T/B by Category Code.

Use this report to review a trial balance that includes the account balances for accounts assigned to category codes 21–43. Use this report to obtain debit and credit totals, and to supplement your chart of accounts reporting for multinational companies and for statutory accounting.

Review the Debit/Credit T/B by Category Code report (R09472):

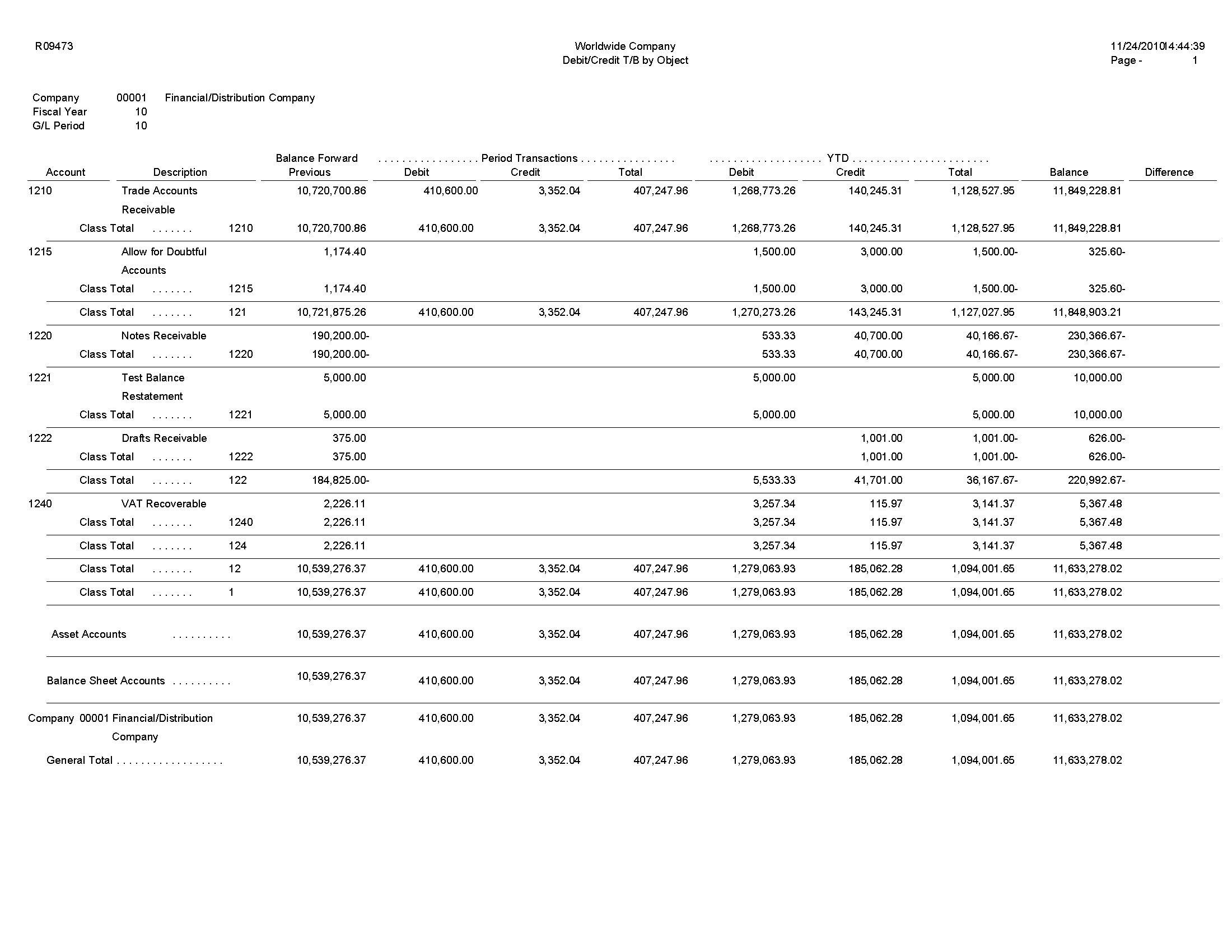

5.41 Debit/Credit T/B by Object Report (R09473)

On the Accounting Reports & Inquiries menu (G0912), select Debit/Credit T/B by Object.

Use this report to review the total debit and credit amounts for each account in any given ledger. Current balances for income statement accounts do not include the prior-year balance. To calculate an inception-to-date total for income statement accounts, add the year-end balances for all prior years to the current balance.

Review the Debit/Credit T/B by Object report (R09473):

5.42 Match Bank Tape File to Reconciliation File Report (R09150)

On the Bank Tape Reconciliation menu (G09213), select Match Tape File To Recon File.

After you run the Custom Reformat UBE program to convert the bank tape data from the Bank File OF Cleared Checks - Flat File (F095051) to the WF - Bank File of Cleared Checks table (F09505), run this program to reconcile the transactions that have cleared your bank account.

Review the Match Bank Tape File to Reconciliation File report (R09150):

5.43 Process Automatic Bank Statements Flat File Report (R09600)

On the Automatic Bank Statement Processing menu (G09212), select Process Electronic Bank Statements.

Use this program to convert the data that you receive from the bank into a format that can be read and used by the JD Edwards EnterpriseOne General Accounting system.

Review the Process Automatic Bank Statements Flat File report (R09600):

5.44 Purge Staging Tables Report (R09610)

On the Purges menu (G09215), select Purge Staging Tables.

Use this program to purge data in the Electronic Bank Statement Staging Header (F09160) and Electronic Bank Statement Staging Detail (F09611) staging tables.

Review Purge Staging Table report (R09610):

5.45 Load Bank Statement Report (R09612)

On the Automatic Bank Statement Processing menu (G09212), select Load Bank Statement.

Use this program to load data from the Electronic Bank Statement Staging Header (F09610) and Electronic Bank Statement Staging Detail (F09611) staging tables to the Bank Statement Header (F0916) and Bank Statement Detail (F0917) bank statement tables in the JD Edwards EnterpriseOne General Accounting system. The report displays the number of records loaded and, if applicable, not loaded.

Review the Load Bank Statement report (R09612):

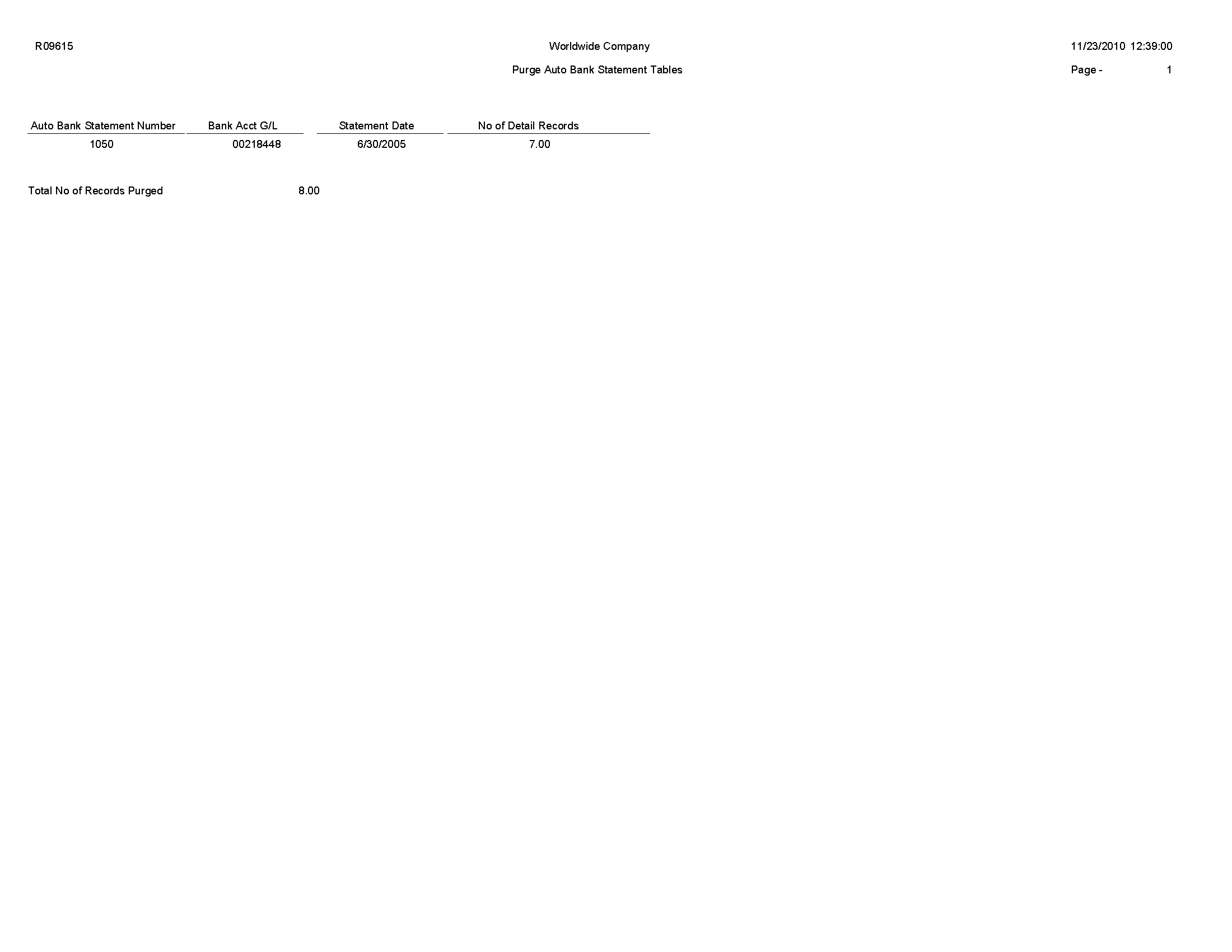

5.46 Purge Auto Bank Statement Tables Report (R09615)

On the Purges menu (G09215), select Purge Automatic Bank Statement Tables.

Use this program to purge data in the Auto Bank Statement Header (F09616) and Auto Bank Statement Detail (F09617) bank statement tables.

Review the Purge Auto Bank Statement Tables report (R09615):

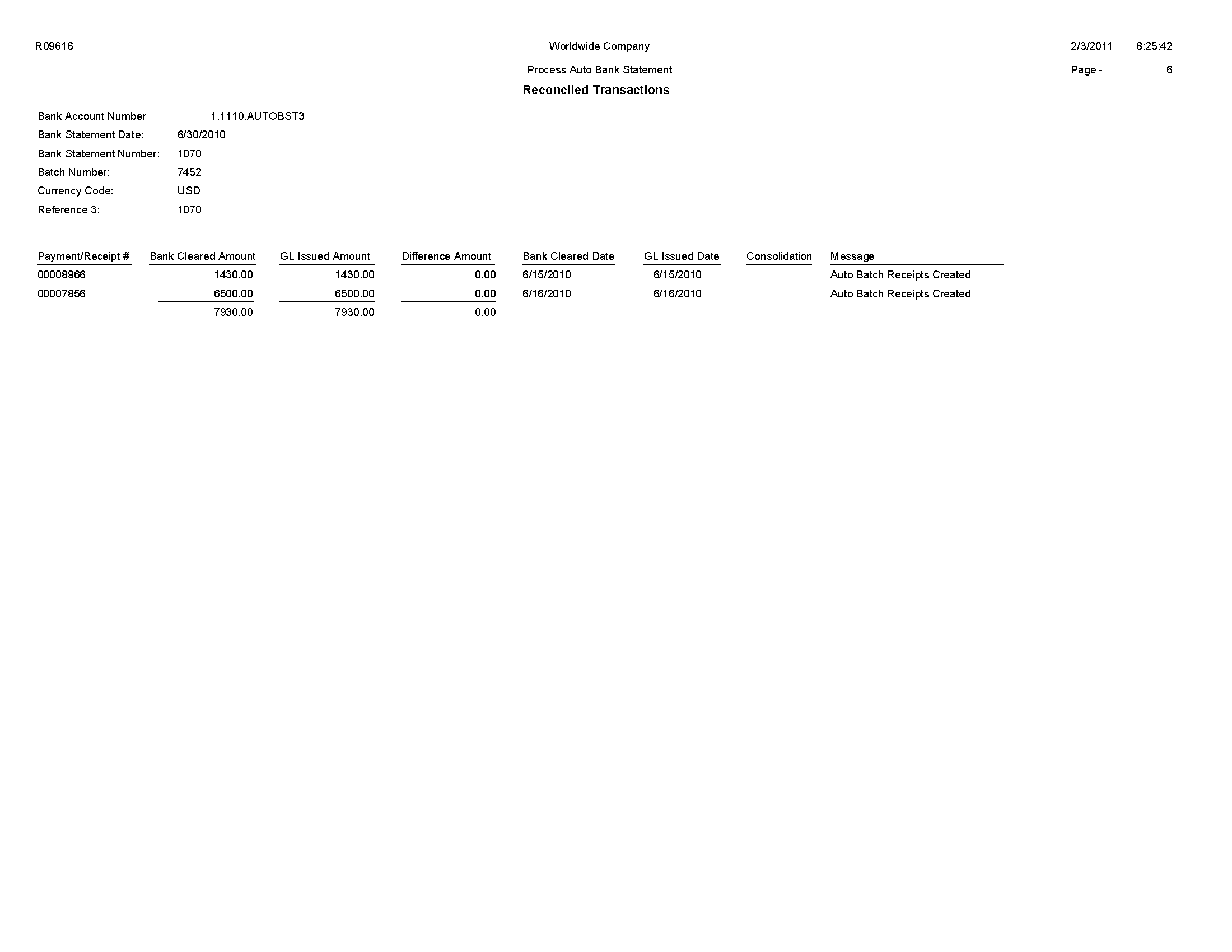

5.47 Process Auto Bank Statement Report (R09616)

On the Automatic Bank Statement Processing menu (G09212), select Process Automatic Bank Statement.

Based on processing option settings, the Process Automatic Bank Statement program produces an Auto Bank Statement Processing report (R09616) that includes these reports:

-

Summary report.

A summary report shows the number of reconciled and unreconciled transactions and summary information about any new batches created.

-

Reconciled Transactions report.

A Reconciled Transactions report is a detailed report that shows the total amount of reconciled transactions and each reconciled transaction.

-

Unreconciled Transactions report.

An Unreconciled Transactions report is a detailed report that shows the total amount of unreconciled transactions and each unreconciled transaction.

Review the Process Auto Bank Statement report (R09616):

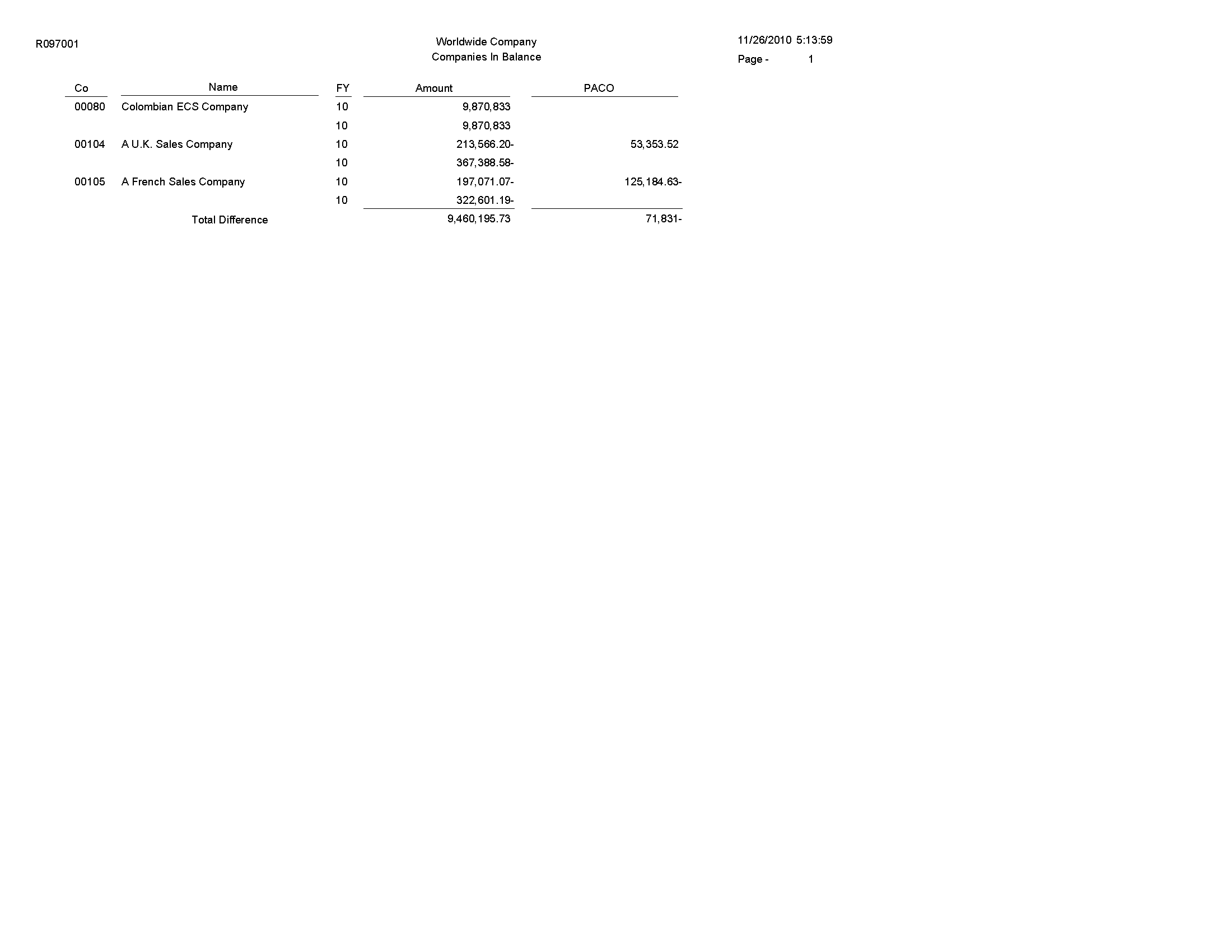

5.48 Companies in Balance Report (R097001)

On the Integrity Reports and Updates menu (G0922), select Companies in Balance.

Use this report to review the net differences by company and fiscal year. The report also identifies:

-

Adjustments posted to a prior year that are not included in the balance forward amounts for an account.

-

Amounts posted after the period cutoff.

-

Missing intercompany settlements.

Review the Companies in Balance report (R097001):

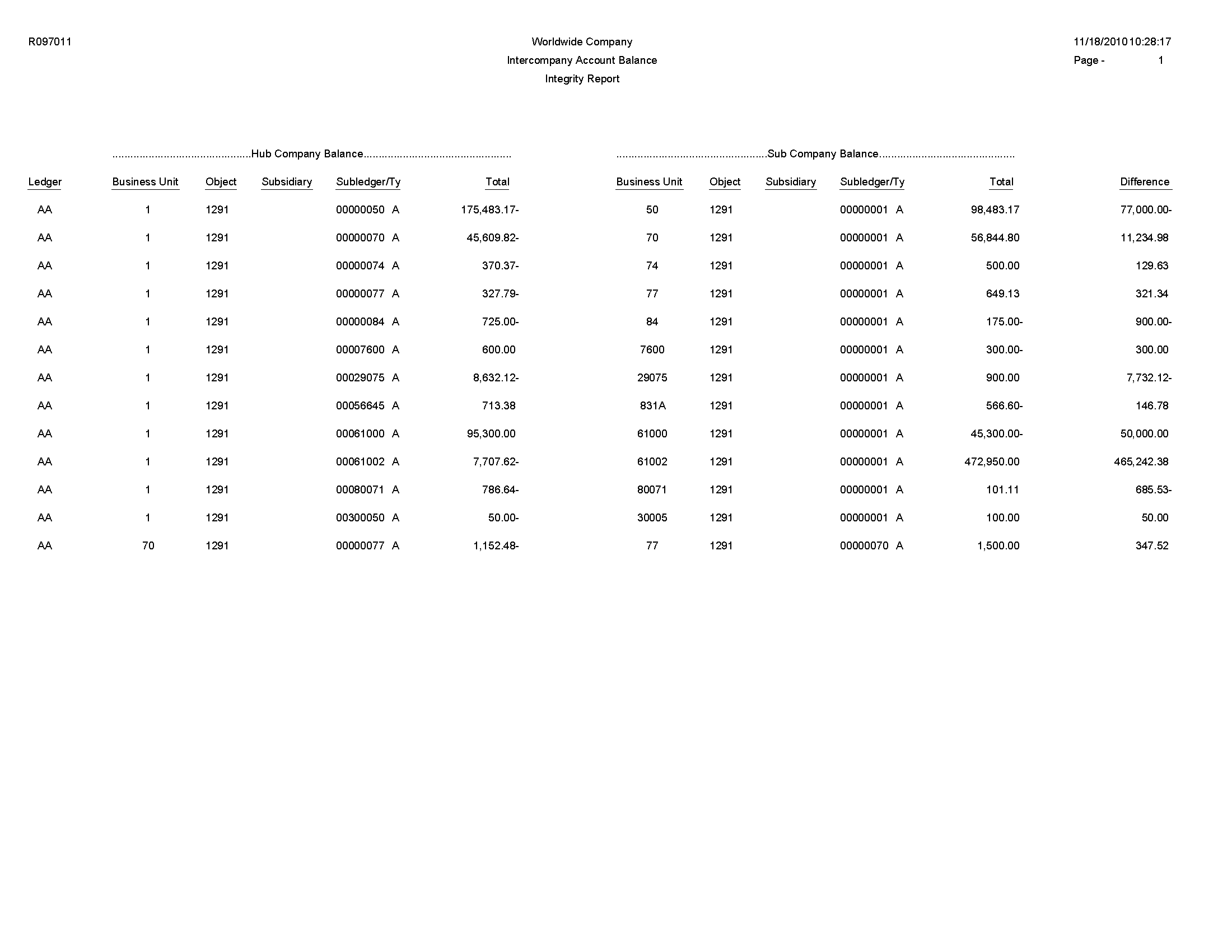

5.49 Intercompany Account Balance Integrity Report (R097011)

On the Integrity Reports and Updates report (G0922), select Intercompany Accts in Balance.

If you have multiple companies that are set up for hub or detail intercompany settlements, use this report to verify that all intercompany accounts are in balance. The report:

-

Uses information from the Account Balances table (F0902) to compare the balances among the company's various intercompany settlement accounts.

-

Determines whether AAI items and the associated intercompany accounts are set up correctly.

-

Includes all of the periods in the current year, previous year, and next year.

The report is not based on any specific financial period.

Review the Intercompany Account Balance Integrity report (R097011):

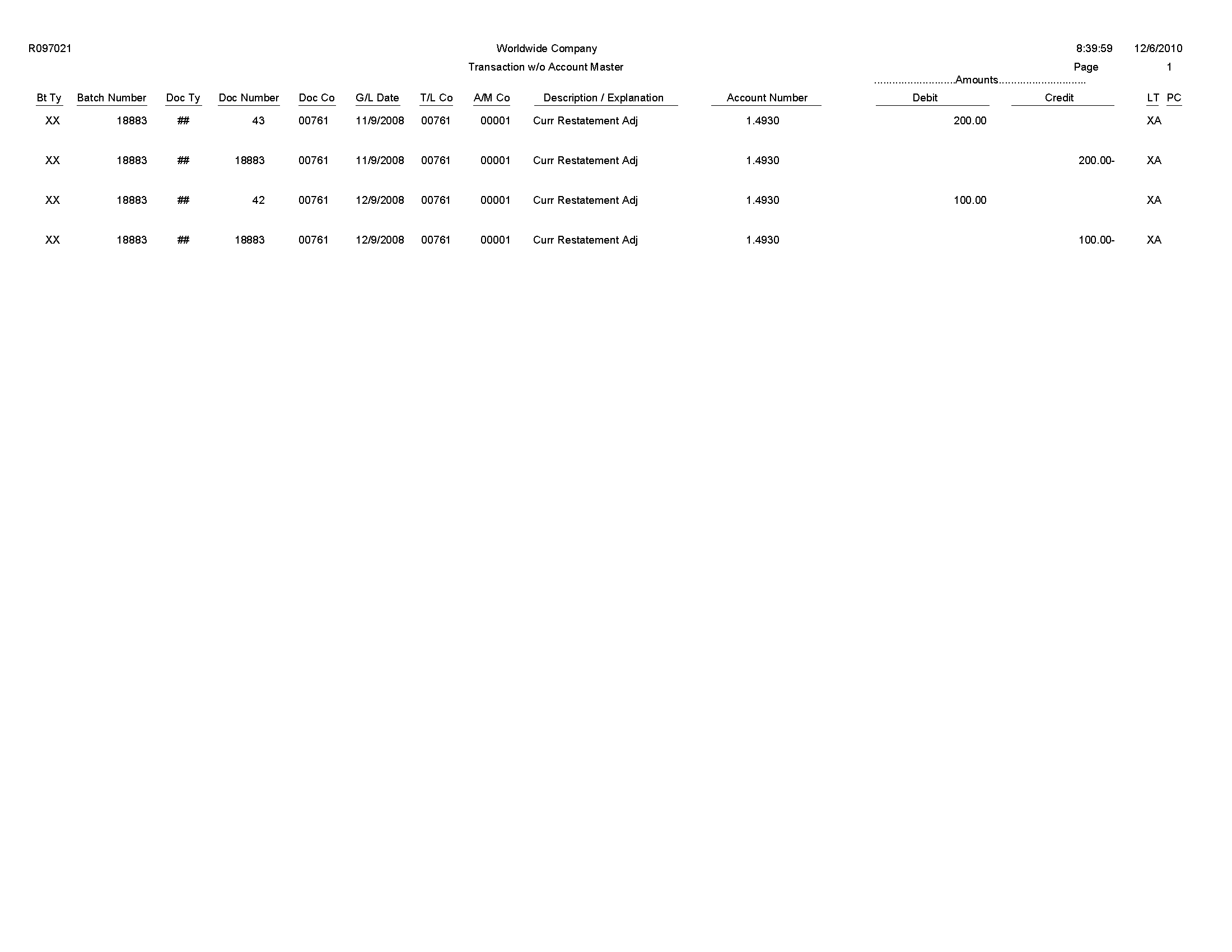

5.50 Transaction w/o Account Master Report (R097021)

On the Integrity Reports and Updates menu (G0922), select Transactions w/o Acct Master.

Use this report to verify that for each record in the Account Ledger table (F0911), an account master number or valid company number exists in the Account Master table (F0901). If the account master information or company number does not exist in the F0901 table, the report prints every account transaction from the F0911 table.

If you run the report in update mode, the system updates the company number in the F0911 table with the company number in the F0901 table.

Review the Transactions w/o Acct Master report (R097021):

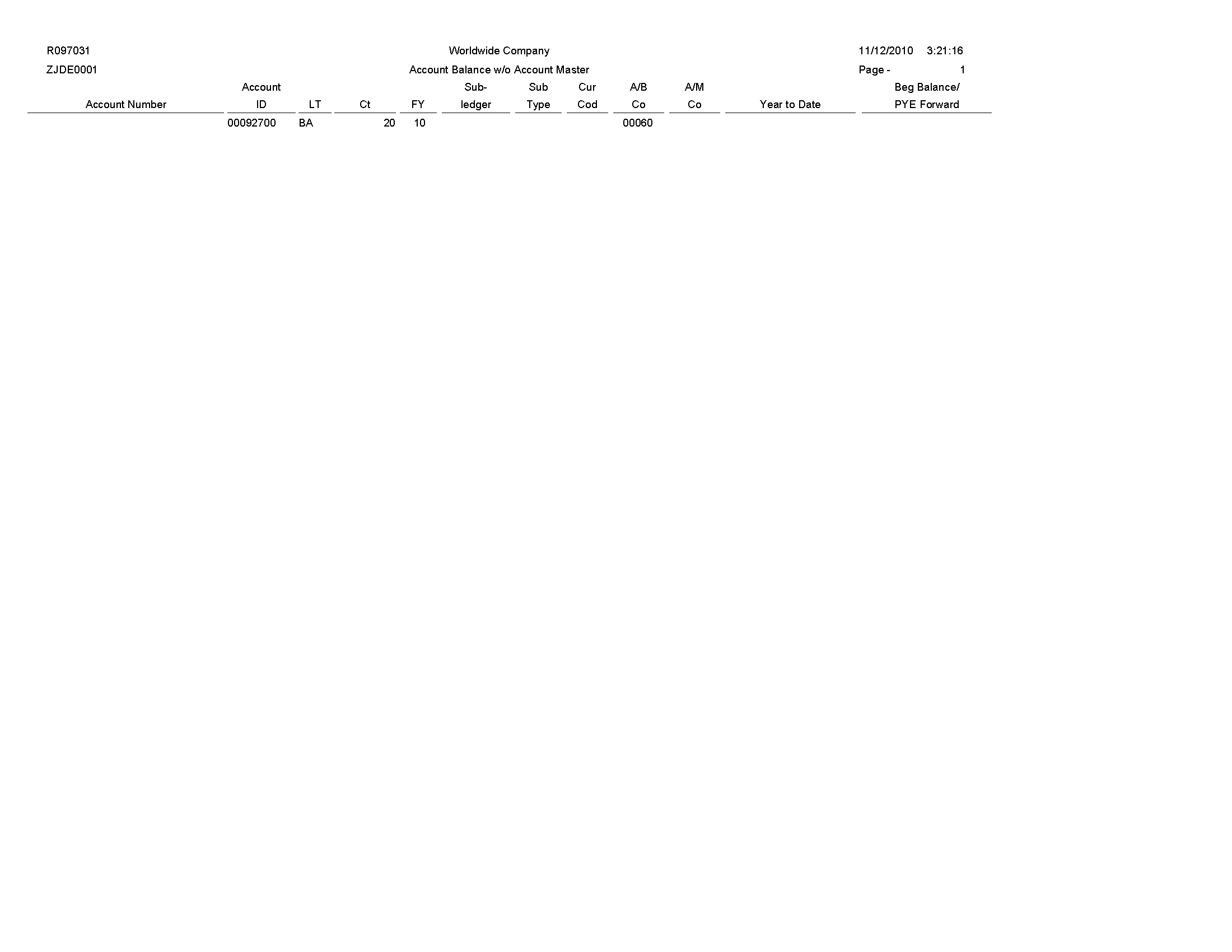

5.51 Account Balance w/o Account Master Report (R097031)

On the Integrity Reports and Updates (G0922) menu, select Account Balance w/o Account Master.

Use this report to verify that an account master number or a valid company number exists for each transaction in the Account Balances table (F0902). If the account master or company number does not exist, the report prints the account balance information.

If you run the report in update mode, the system updates the company number in the F0902 table with the company number in the Account Master table (F0901).

Review the Account Balance w/o Account Master report (R097031):

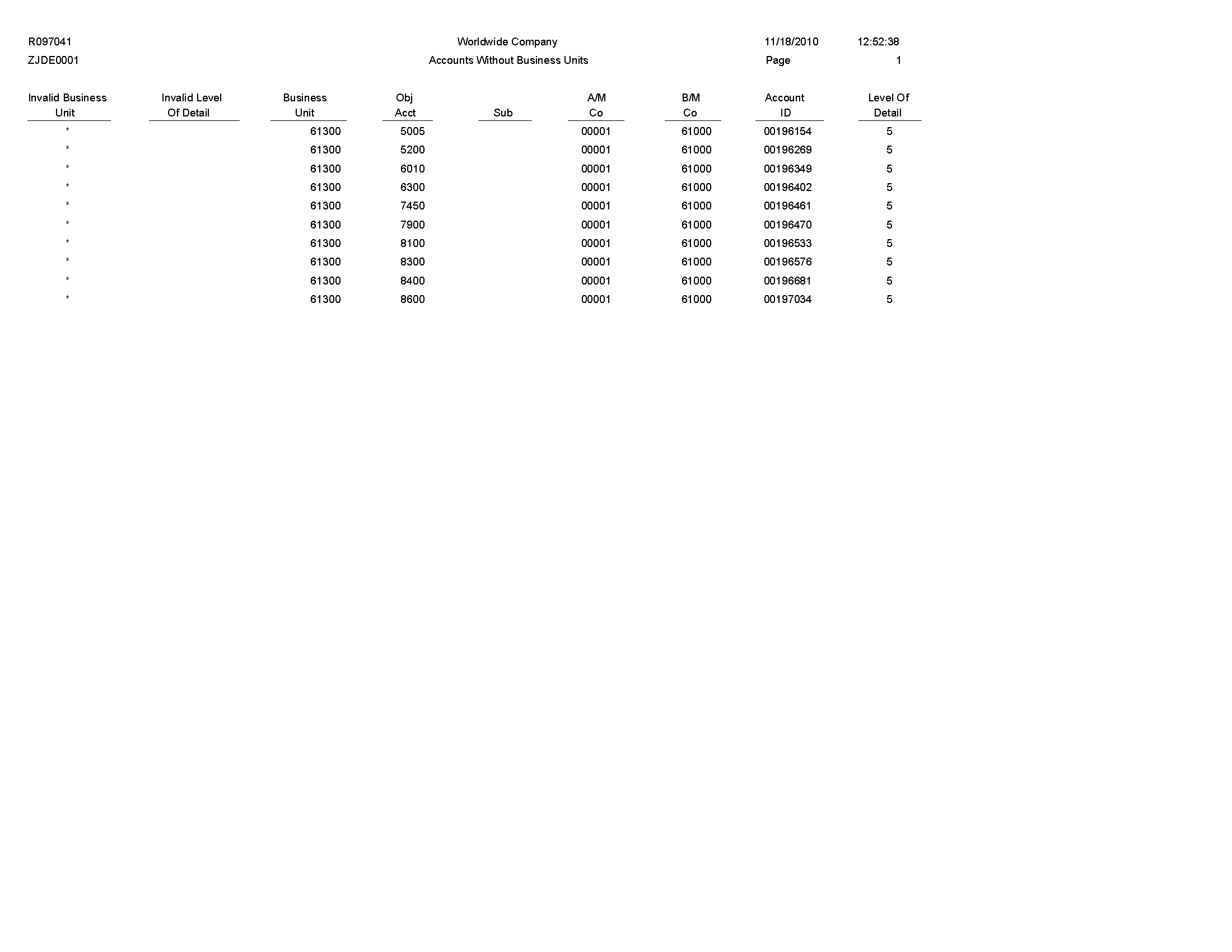

5.52 Accounts Without Business Units Report (R097041)

On the Integrity Reports and Updates menu (G0922), select Accounts w/o Business Units.

Use this report to verify that a business unit and valid company number exist for each record in the Account Master table (F0901). The report compares the F0901 table to the Business Unit Master table (F0006) and lists any discrepancies in which the account master records in the F0901 table do not have corresponding business units in the F0006 table.

Review the Accounts Without Business Units review (R097041):

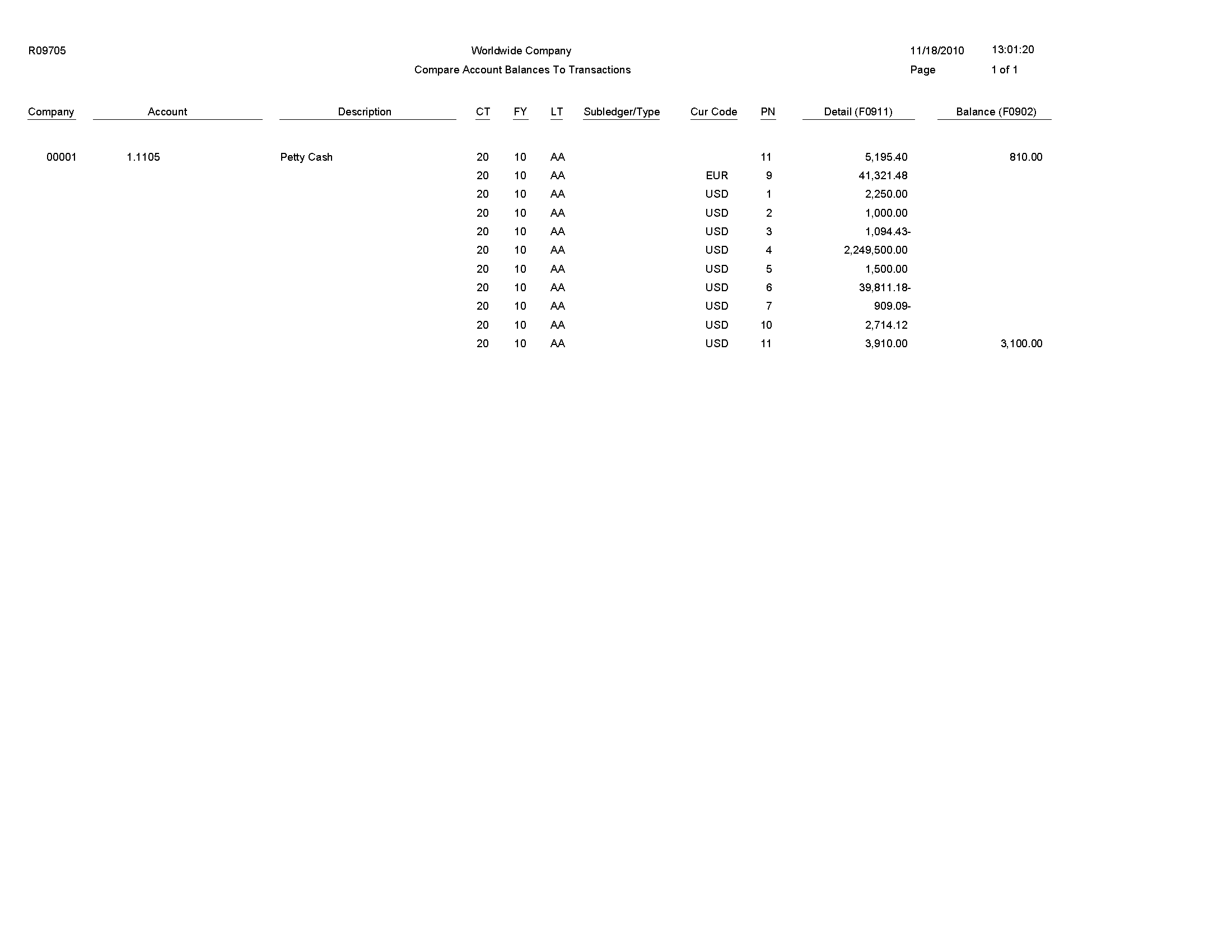

5.53 Compare Account Balances To Transactions Report (R09705)

On the Integrity Reports and Updates menu (G0922), select Acct Balance to Transactions.

Use this report to review balances in the Account Balances table (F0902), verify the amounts against the posted transactions in the Account Ledger table (F0911), and print any out-of-balance conditions by period.

Review the Compare Account Balances to Transactions report (R09705):

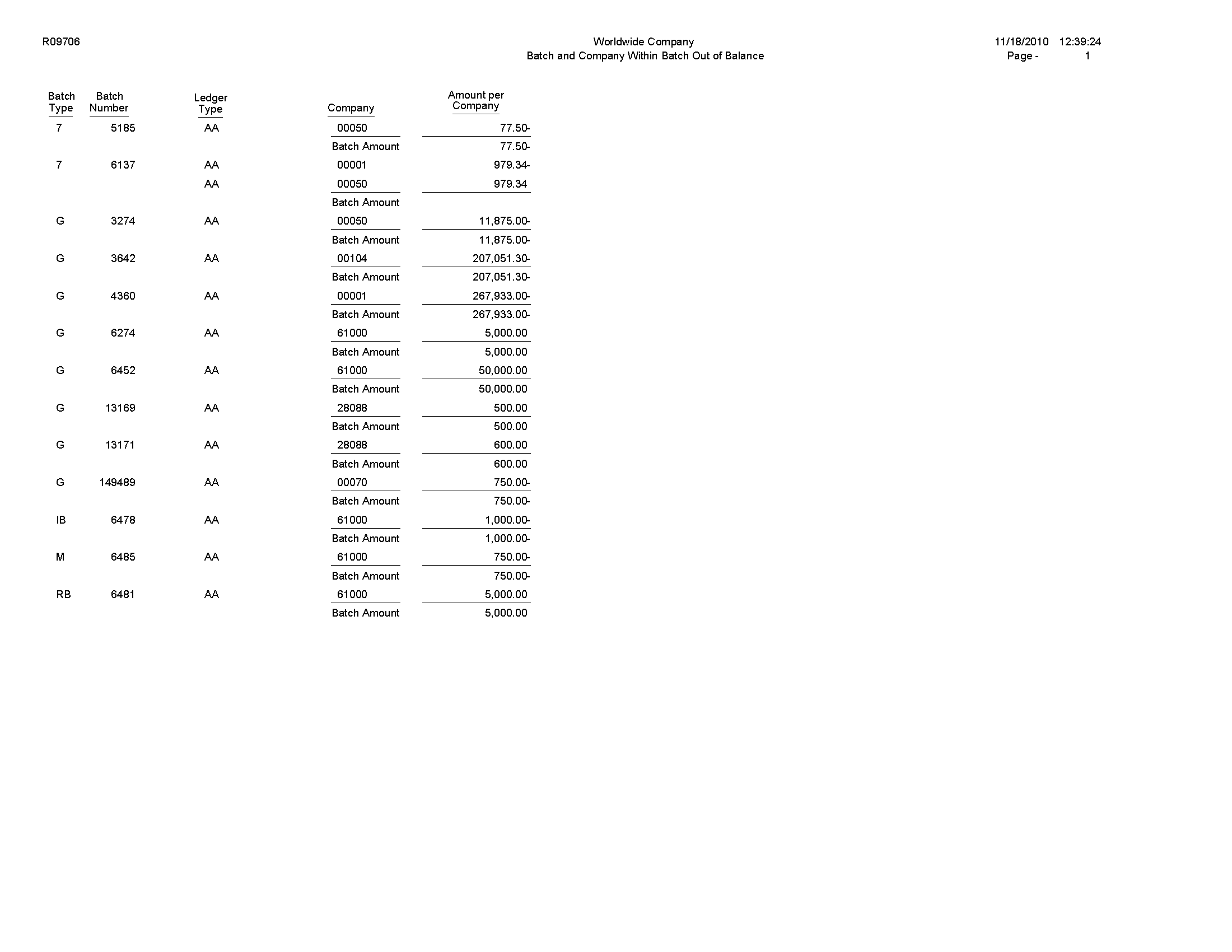

5.54 Batch and Company Within Batch Out of Balance Report (R09706)

On the Integrity Reports and Updates menu (G0922), select Company by Batch Out of Bal.

Use this report to review only the posted transactions in the Account Ledger (F0911). This report totals all posted transactions in the F0911 table by batch and compares each batch total to the batch header record in the Batch Control Records table (F0011).

Review the Batch and Company Within Batch Out of Balance report (R09706):

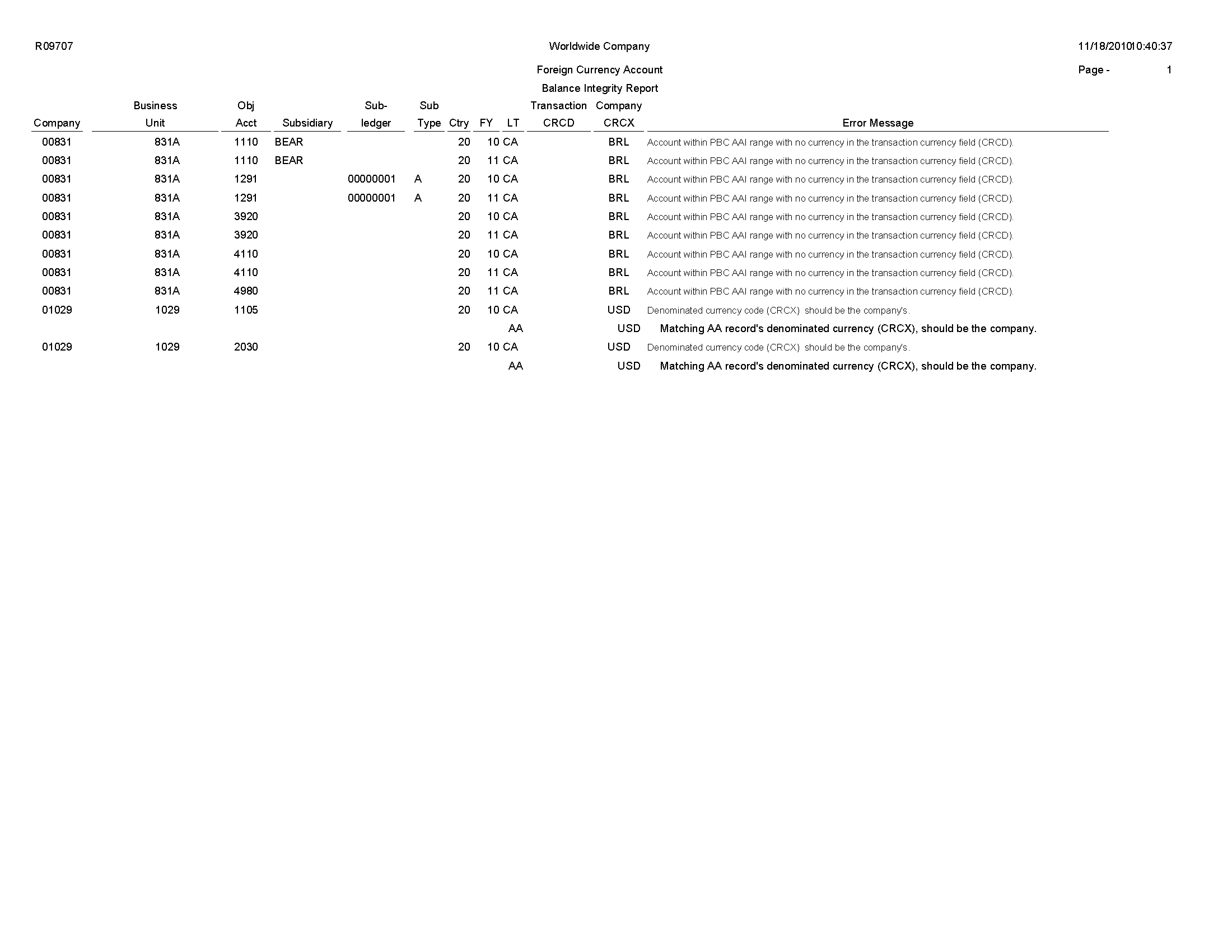

5.55 Foreign Currency Account Balance Integrity Report (R09707)

On the Integrity Reports and Updates menu (G0922), select Foreign Account Balances.

Use this integrity report to review foreign account balances in the Account Balances table (F0902).

Review the Foreign Currency Account Balance Integrity report (R09707):

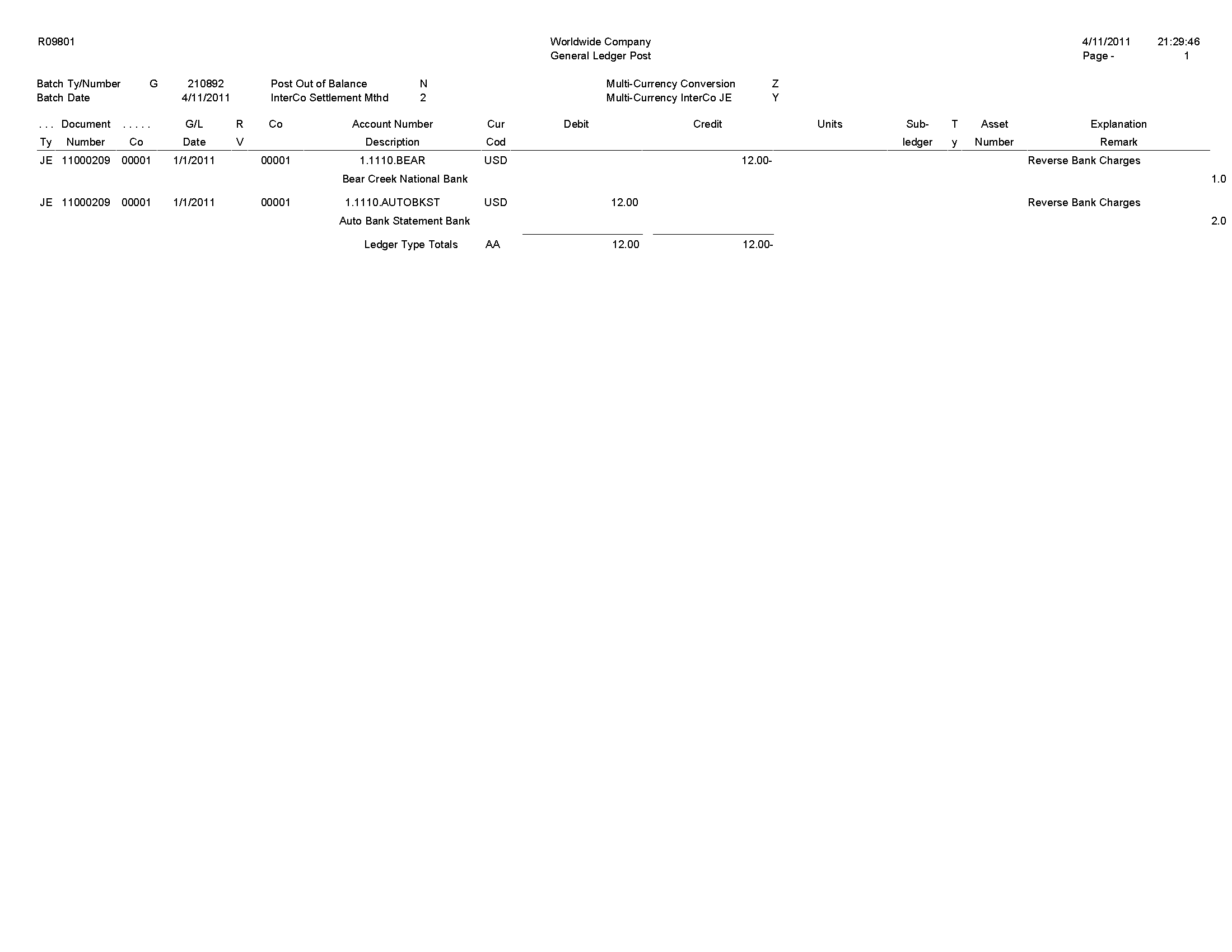

5.56 General Ledger Post Report (R09801)

On the Journal Entry, Inquiries, & Reports menu (G0911), select General Ledger Post.

After you review and approve journal entries, you post them to the Account Balances table (F0902). When you run the General Ledger Post program (R09801), the system:

-

Selects unposted, approved batches of journal entries in the Account Ledger table (F0911) and validates each transaction.

-

Posts accepted transactions to the F0902 table.

-

Changes the status of the journal entry batch to posted.

-

Marks the detail lines of the journal entry as posted in the F0911 table.

-

Sends electronic mail messages for transactions that are in error.

-

Produces a General Ledger Post report, which lists details about successfully posted batches.

Review the General Ledger Post report (R09801):

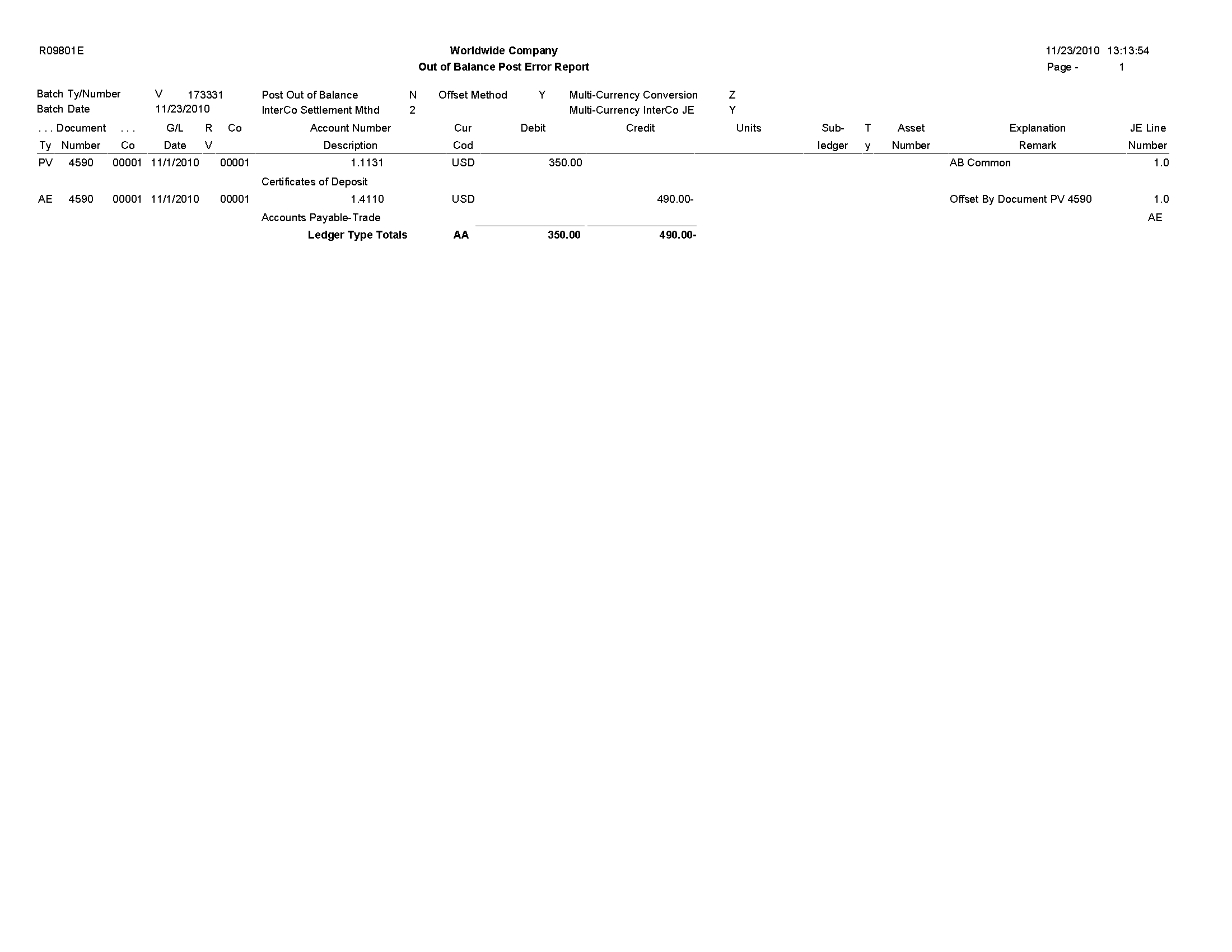

5.57 Out of Balance Post Error Report (R09801E)

The system automatically generates the Out of Balance Post Error report (R09801E) when the General Ledger Post report (R09801) encounters an error during processing.

The system prints this report if a batch for a ledger type that is required to balance does not balance.

Review the Out of Balance Post Error report (R09801E):

5.58 Copy Accounts to Business Units Report (R09804)

On the Organization & Account Setup menu (G09411), select Copy Accts to Business Units. The system submits the report when you click OK on the Copy Accounts to Business Units form.

After you create your model chart of accounts, you must review and correct it. Then you can create your actual chart of accounts by copying the object and subsidiary accounts that are assigned to a model business unit to your actual business units. This process saves time and ensures consistency throughout your account structure. You can copy:

-

All or a range of object accounts from one business unit to another

-

Object accounts at a given level of detail

-

All or a range of object accounts from one business unit to multiple business units of the same business unit type

-

All or a range of object accounts to a specific company or across all companies

Review the Copy Accounts to Business Units report (R09804):

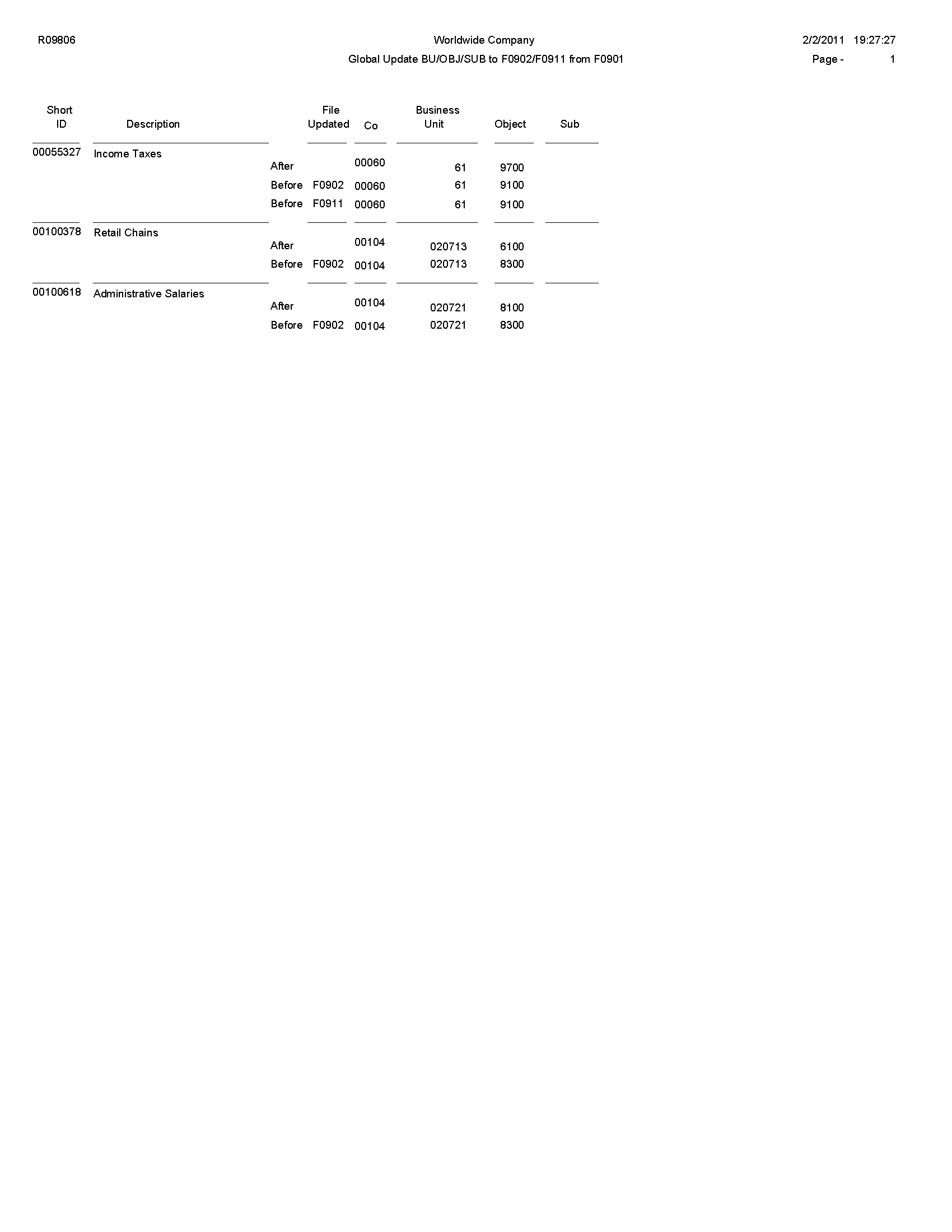

5.59 Global Update BU/OBJ/SUB to F0902/F0911 from F0901 Report (R09806)

On the Global Updates menu (G09316), select Update BU.Obj.Sub to Jrnl Ent.

If you make changes to business units, run the Update BU.Obj.Sub to Jrnl Ent report to update the revised object account numbers, or subsidiaries, in the Account Balances (F0902), Account Ledger (F0911), and Revenue Recognition G/L Information (F03B117) tables. This program compares the business unit, object, and subsidiary for each account ID in the F0902, F0911, and F03B117 tables to the account master records in the Account Master table (F0901) and updates the F0902, F0911, and F03B117 tables based on the F0901 table.

Review the Global Update BU/OBJ/SUB to F0902/F0901 report (R09806):

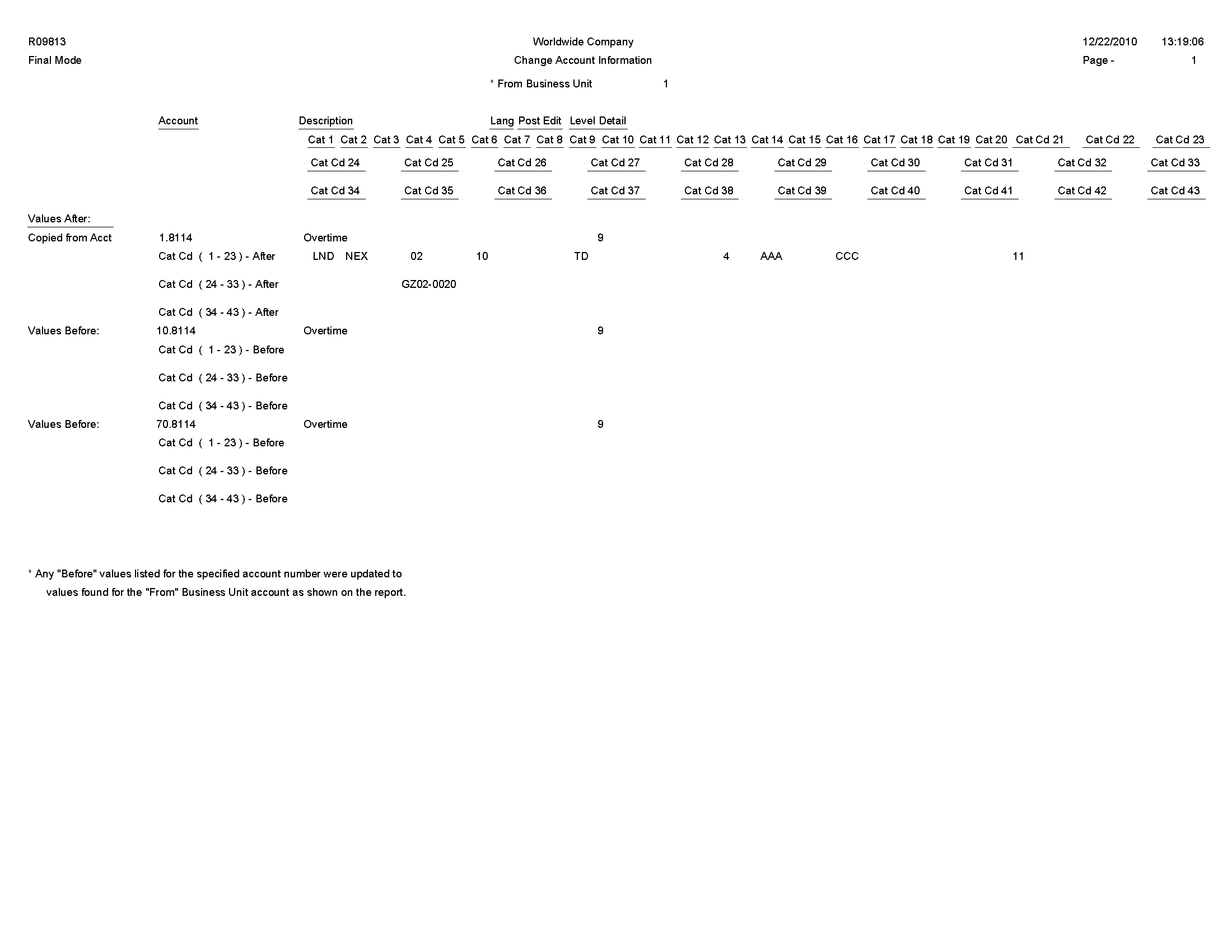

5.60 Change Account Information Report (R09813)

On the Global Updates menu (G09316), select Change Account Information.

In proof mode, the system prints a report and does not update the information. In final mode, the system updates the information in the Account Master table (F0901) and, optionally, prints a report that contains the changes that it made.

Review the Change Account Information report (R09813):

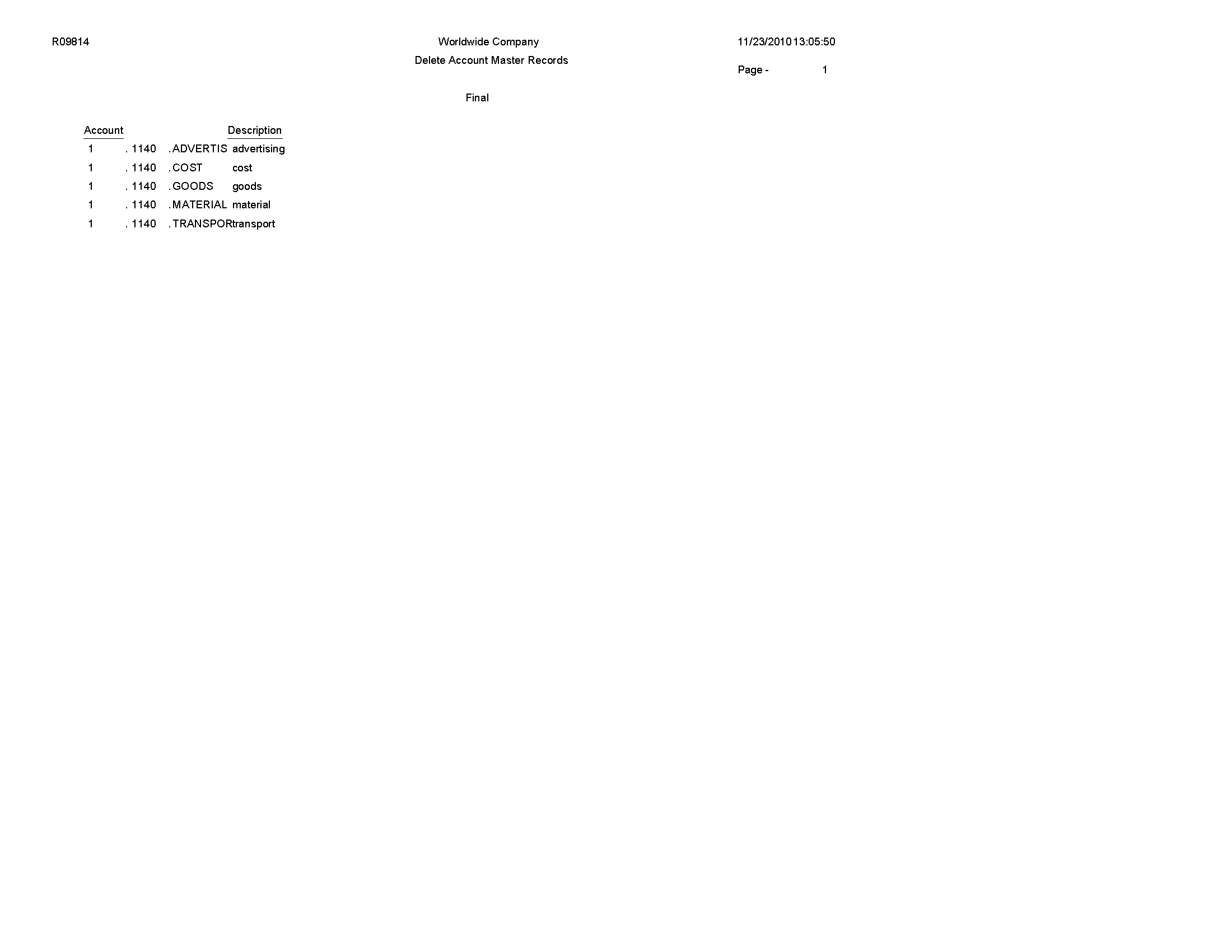

5.61 Delete Account Master Records Report (R09814)

On the Summarize & Purge Data menu (G09317), select Delete Account Master Records.

Use the report to delete accounts that do not contain transactions from the Account Master table (F0901).

Review the Delete Account Master Records report (R09814):

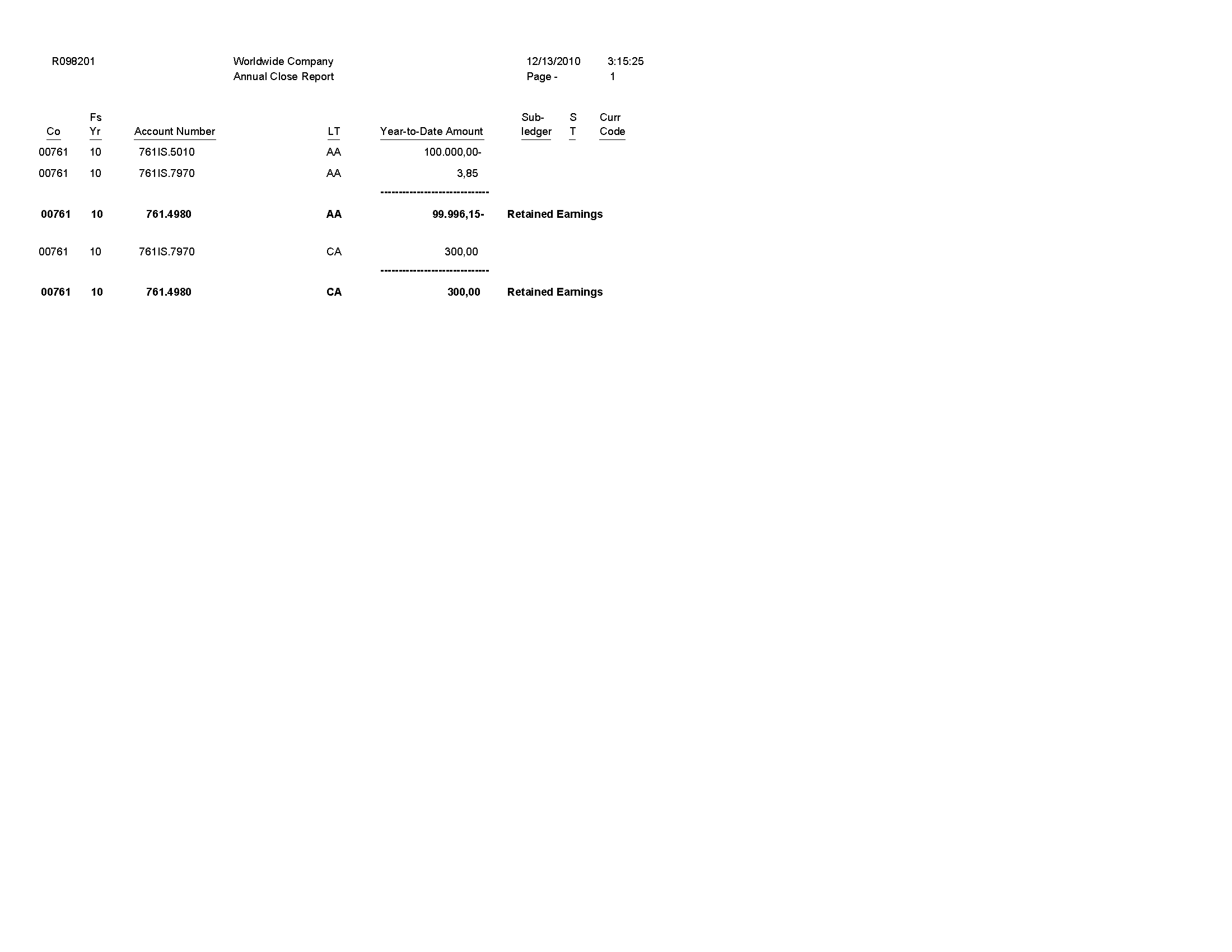

5.62 Annual Close Report (R098201)

On the Periodic and Annual Processes menu (G0924), select Annual Close.

When you run this program to close a fiscal year, the system produces a report that lists the company that was closed, and the retained earnings account and amount. Use this report to verify that a company closed successfully.

Review the Annual Close report (R098201):

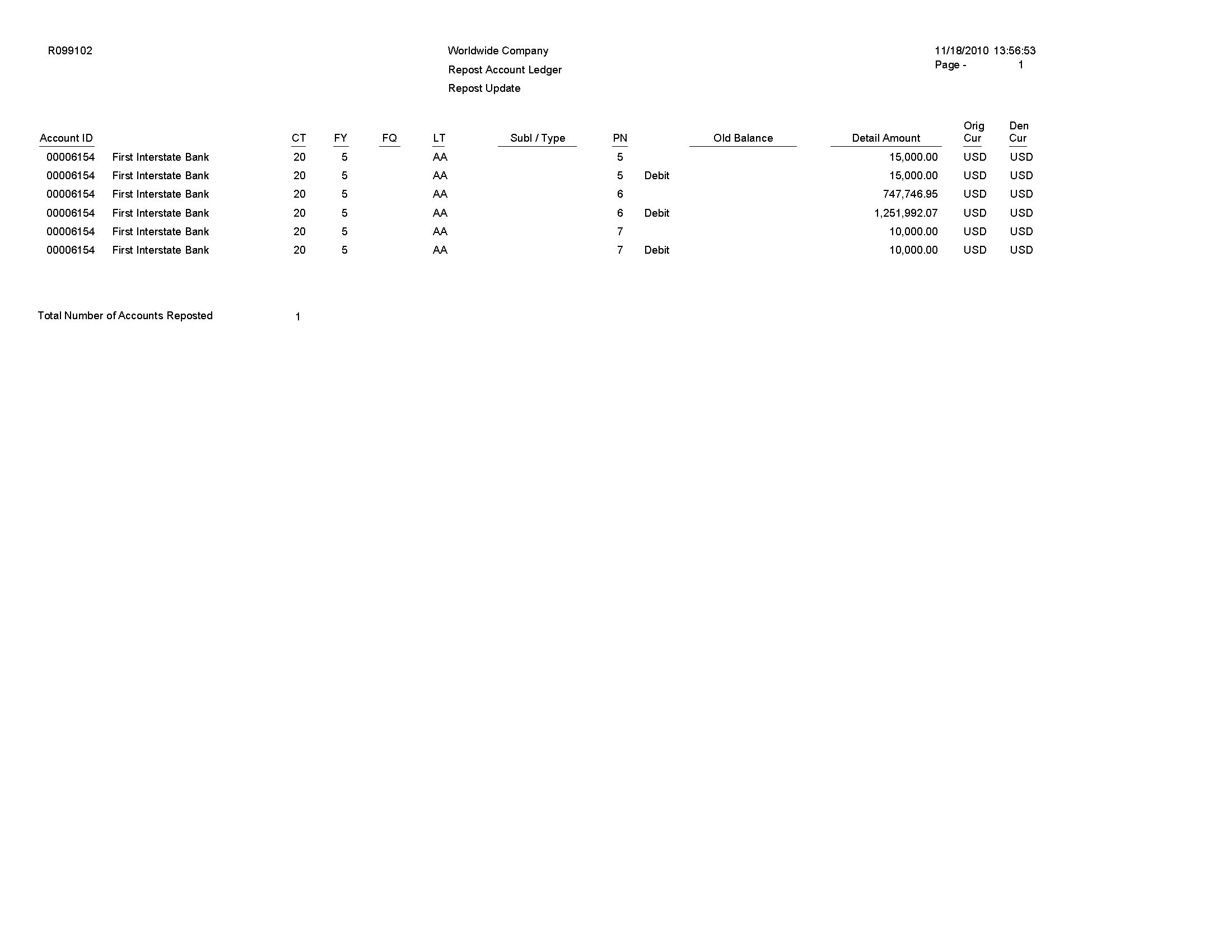

5.63 Repost Account Ledger Report (R099102)

On the Global Updates menu (G09316), select Repost Account Ledger.

You may chose to run this program in the following circumstances:

-

If the Account Ledger (F0911) and Account Balances (F0902) tables are out of balance.

-

If the batch is partially posted.

-

After recalculating fiscal year and period.

Review the Repost Account Ledger report (R099102):

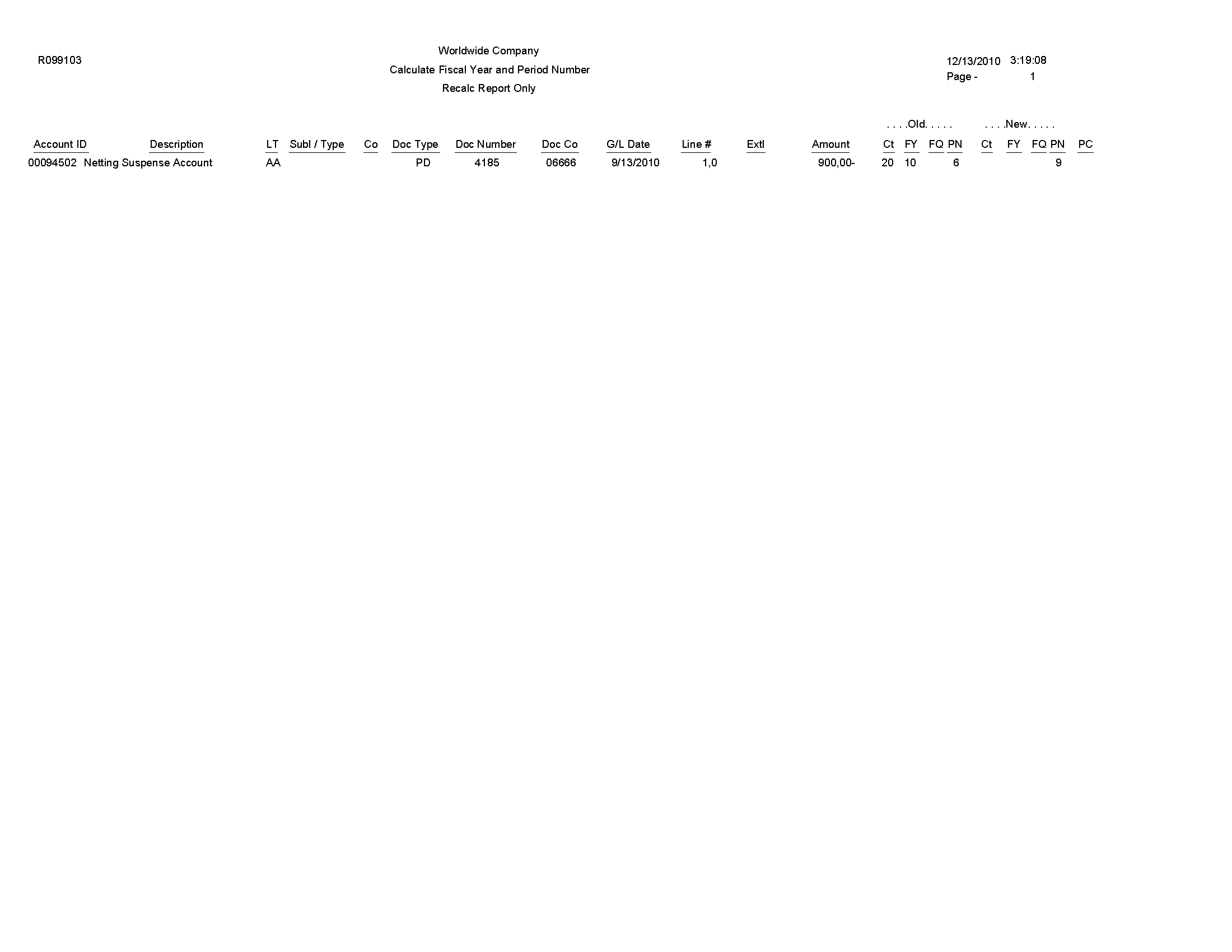

5.64 Calculate Fiscal Year and Period Number Report (R099103)

On the Global Updates menu (G09316), select Calculate Fiscal Year and Period

In update mode, use this program to restate account balances to a new fiscal year or period. Specifically, the system recalculates the fiscal year and period in the Account Ledger table (F0911) and the Revenue Recognition G/L Information table (F03B117), using a revised fiscal pattern in the Date Fiscal Patterns table (F0008).

Review the Calculate Fiscal Year and Period Number report (R099103):

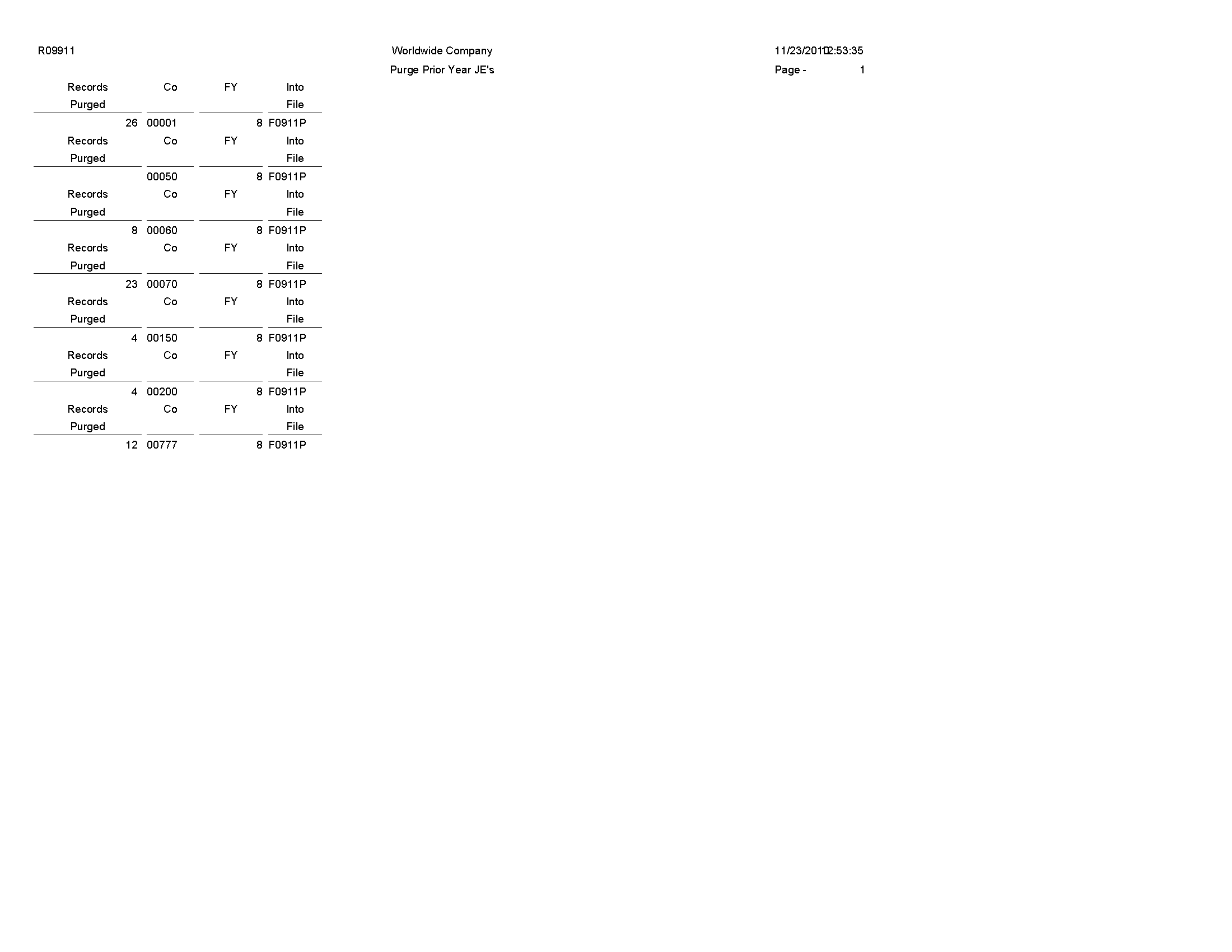

5.65 Purge Prior Year JE's Report (R09911)

On the Summarize & Purge Data menu (G09317), select Purge Prior Year JE's.

Use this program to purge only prior-year transactions, summarized transactions for the current year, and summarized transactions for the prior-year.

Review the Purge Prior Year JE's report (R09911):

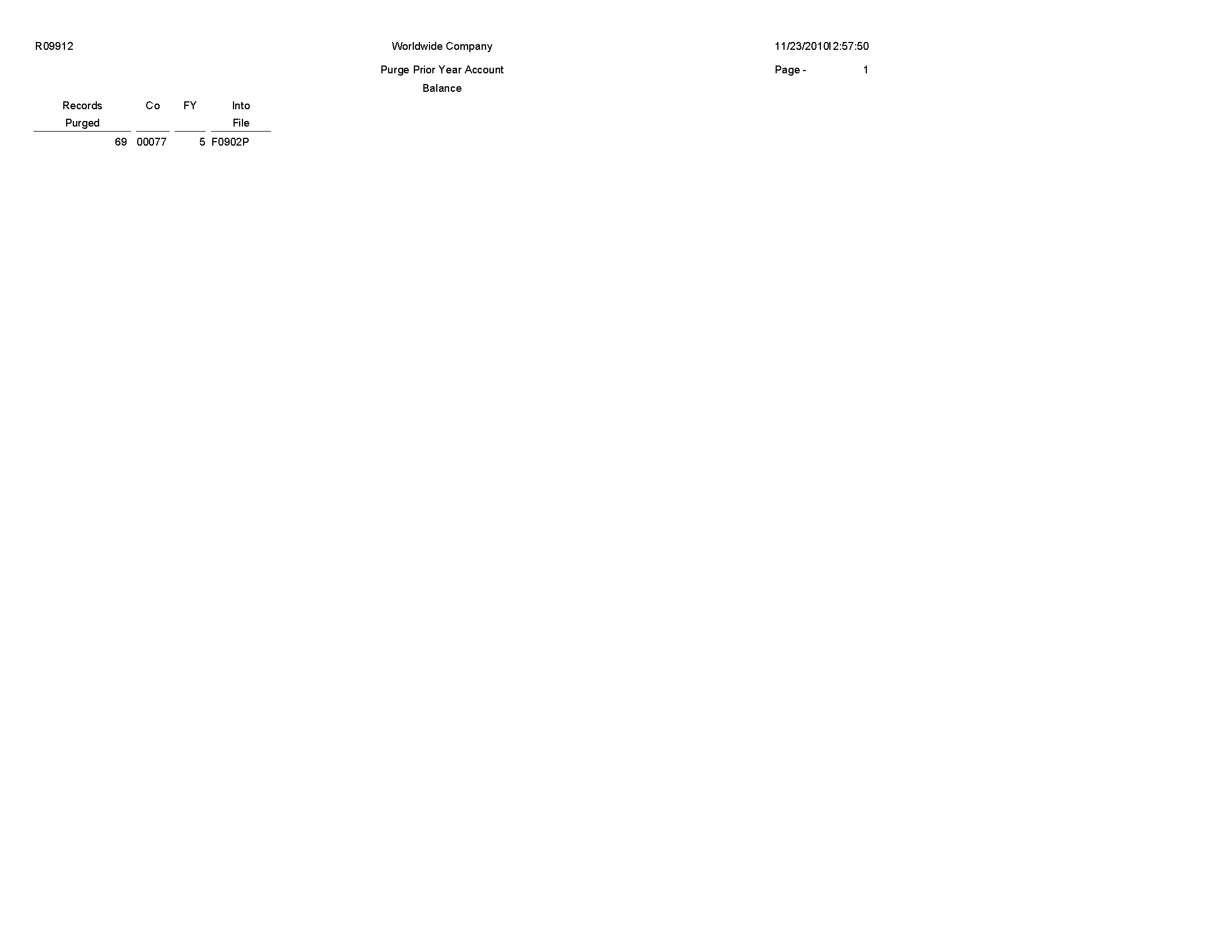

5.66 Purge Prior Year Account Balance Report (R09912)

On the Summarize & Purge Data menu (G09317), select Purge Prior Year Account Balances.

Use this program to purge account balance records with dates prior to the current fiscal year from the Account Balances table (F0902).

Review the Purge Prior Year Account Balance report (R09912):