4 Working With Localizations for South Korea

This chapter contains the following topics:

4.1 Understanding VAT Reports for South Korea

Value-added tax (VAT) is a noncumulative tax that is imposed at each stage of the production and distribution cycle. Businesses in South Korea are required to submit reports that list transactions involving VAT.

You run the Generic VAT Processing program (R700001) to generate these VAT reports for South Korea:

-

Tax Invoice Summary by Customer

-

Tax Invoice Summary by Supplier

-

Error List

The system generates all three reports when you run version XJDE0001 of the Generic VAT Processing program.

When you run version XJDE0001 of the Generic VAT Processing program, the system generates all three reports in a PDF format. The system also populates the Informed Taxes by Report table (F700018) if you have enabled the process and run the process in final mode. You can use the Informed Taxes by Report program (P700018) to remove transactions that are in error. After you correct records that were in error, you run the process in final mode to generate the final PDF report for the Tax Invoice Summary by Customer and Tax Invoice Summary by Supplier reports. You submit the final PDFs to the tax authority to report your VAT transactions.

4.1.1 Credit and Debit Notes

Credit notes, also called credit memos, are adjustments to voucher amounts. Debit notes, also called debit memos, are adjustments to invoices. You use credit and debit notes to adjust amounts due or amounts payable.

See "Entering Debit Memos" in the JD Edwards EnterpriseOne Applications Accounts Payable Implementation Guide and "Understanding Credit Memos" in the JD Edwards EnterpriseOne Applications Accounts Receivable Implementation Guide.

You might need to make adjustments to voucher or invoice amounts after the initial transaction. If you void a transaction in the same reporting period as the original transaction, then the system will include the original and the void transactions in the VAT reports. However, if you need to make an adjustment to an invoice or voucher in a reporting period other than the reporting period of the original transaction, you must enter a debit or credit note to make the adjustment. The system does not include transactions to void an invoice or voucher when the original transaction was reported in a previous period. The system does, however, include the credit or debit memo that adjusts the original transaction.

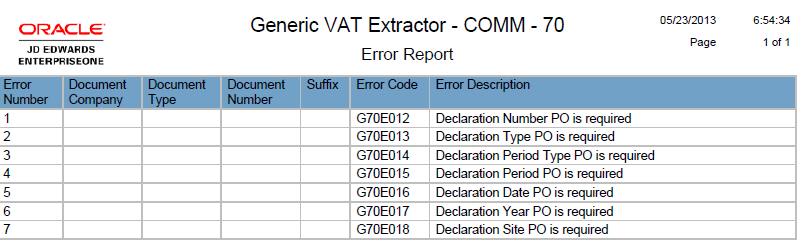

4.1.2 Understanding the Tax Invoice Summary by Customer Report

The objective of the Tax Invoice Summary by Customer report is to show all the invoice information summarized by customer. The system generates this report when you run the XJDE0001 version of the Generic VAT Processing (R700001) program.

The system reads records in the Taxes table (F0018) to obtain the data for the report.

The Tax Invoice Summary by Customer report layout is in the format required by South Korean legal reporting requirements.

This image is an example of the Tax Invoice Summary by Customer report:

Figure 4-1 Tax Invoice Summary by Customer Report

Description of "Figure 4-1 Tax Invoice Summary by Customer Report"

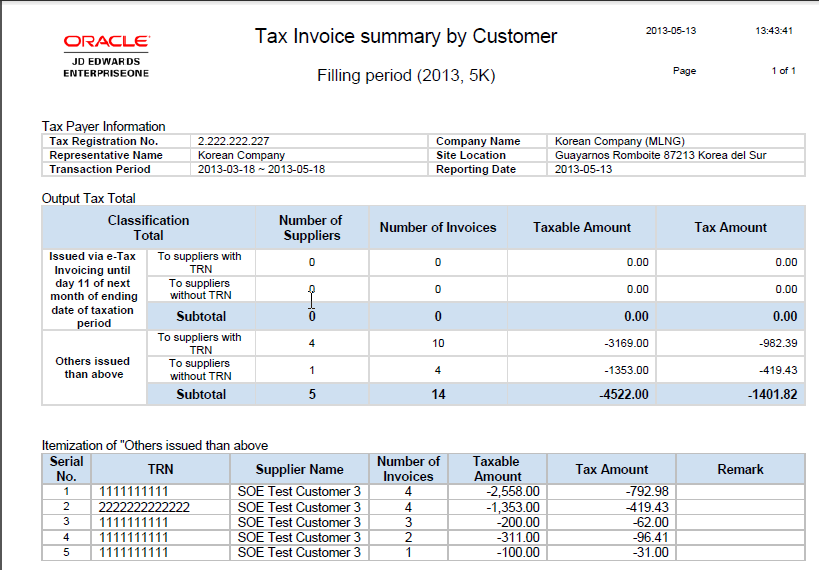

4.1.3 Understanding the Tax Invoice Summary by Supplier Report

The objective of the Tax Invoice Summary by Supplier report is to show all the invoice information summarized by supplier. The system generates this report when you run the XJDE0001 version of the Generic VAT Processing (R700001) program.

The system reads records in the Taxes table (F0018) to obtain the data for the report.

The Tax Invoice Summary by Supplier report layout is in the format required by South Korean legal reporting requirements.

This image shows an example of the Tax Invoice Summary by Supplier report:

Figure 4-2 Tax Invoice Summary by Supplier Report

Description of "Figure 4-2 Tax Invoice Summary by Supplier Report"

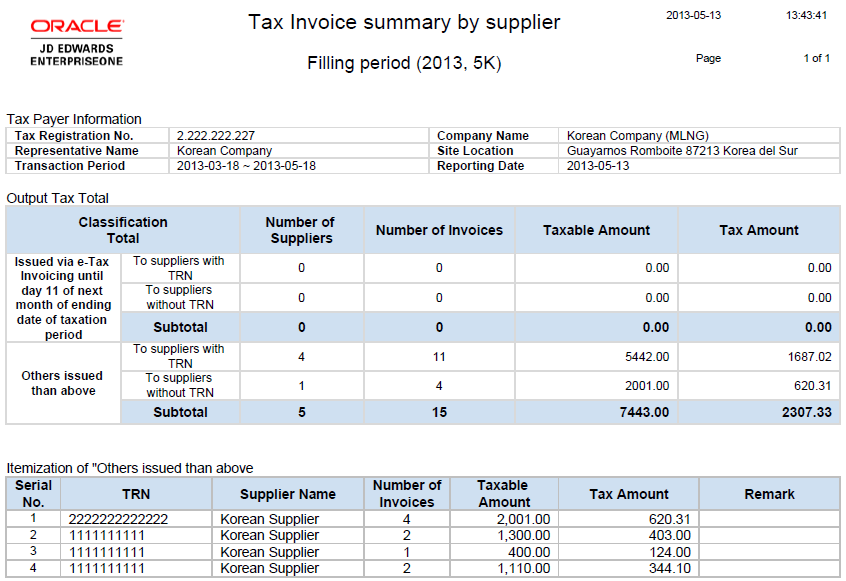

4.1.4 Understanding the Error List Report

The objective of this report is to show the list of errors from the Tax Invoice summary by customer and supplier reports. This report displays records in the Taxes table (F0018) that have errors. Note that this is an additional report, which is not legally required by South Korean authorities. If errors exist in the records that you need to report, then you must correct the errors and reprocess the supplier and customer records to generate the Tax Invoice Summary by Customer and the Tax Invoice Summary by Supplier reports.

This image shows an example of the Error List report:

The Error List report includes an error ID and brief description of the error. The system writes a more detailed description of errors that occurred to the Work Center. You must fix the errors and generate the VAT reports if you receive error messages.

See Appendix A, "Error Messages for South Korean VAT Reports".

4.2 Generating the VAT Reports for South Korea

This section provides an overview of how to generate and review VAT report for South Korea, and discusses how to:

-

Run the Generic VAT Extraction program (R700001).

-

Set processing options for South Korean VAT reports.

4.2.1 Understanding How to Generate and Review VAT Reports for South Korea

When you run version XJDE0001 of the Generic VAT Extraction program in final mode, the system generates PDF reports and populates the Informed Taxes by Report table (F700018). You can use the Informed Taxes by Report program (P700018) to remove records that have errors so that you can regenerate the reports after you have corrected the records.

4.2.2 Running the Generic VAT Extraction Program

To run the program for South Korea, select South Korean Localization (G75K), Tax Processing (G75KTAX), South Korean VAT Reports.

When you run the Generic VAT Extraction program using the South Korean VAT Reports link on the G75KTAX menu, the system runs the XJDE0001 version, which is the version that is set up to process VAT reports according to the requirements for South Korea.

4.2.3 Setting Processing Options for South Korean VAT Reports

You use the processing options in the Generic VAT Extraction program (R700001) to specify parameters to process records for the South Korean VAT reports.

Some of the processing options in the Generic VAT Extraction program are required. If you neglect to enter values for processing options that are required, the system prints error messages on the PDF report and does not complete processing. You must correct the errors and rerun the process to generate the Tax Invoice Summary by Supplier and the Tax Invoice Summary by Customer reports.

These processing options are required for South Korean VAT reports:

-

Processing Mode tab

-

1. Activate Informed taxes register

-

2. Mode

-

-

Data Select tab

-

1. Date From

-

2. Date To

Note:

For South Korea, the system always uses option 3 (Transaction Date) for the Date Selection processing option, so you do not need to complete that processing option. -

-

Fiscal Information tab

-

1. Company

-

2. Legal Representative

-

-

Declaration Information tab

-

4: Declaration Period

-

6: Declaration Year

-

-

Default tab

2. Report Identification