| Previous Contents Index Next |

| iPlanet Market Maker 4.5 Exchange Customization Guide |

Chapter 1 Introduction to Exchange

The iPlanet Market Maker Exchange module is a customizable framework that allows companies to create electronic trades.This chapter contains the following sections:

Functionality

Functionality

An exchange is a mechanism by which traders (both buyers and sellers) asynchronously trade [the symbols of] homogenous commodities using a bid/ask methodology. This is similar to the way symbols are traded in a stock exchange. Symbols best suited to trade as exchanges represent near-commodity items that have a small number of similar attributes. Standard goods and services are also well suited for exchange trading. Exchanges are especially effective in markets where items are affected by volatile supply and demand. By managing excess supply and peak load demand, exchanges can facilitate quick liquidity.The methodology for setting up an exchange depends on:

Unlike a stock exchange, where price and quantity are usually the basis for defining a trade, an iPlanet MarketMaker exchange might have additional factors to consider before a trade can take place. Price may or may not be a factor in defining a trade.

A common example is a transport exchange, which is a type of exchange that involves a means/method of transport from one place to another. This could be any type of transportation or container, such as cargo space on an airline. In addition to price and quantity factors, the following factors might also be part of the trade specification:

Features

The iPlanet MarketMaker Exchange module features include:

Real-time or batch mode matching of buy orders and sell orders.

Real-time, market-wide quoting (and price determination, if price is an exchange attribute).

Order splitting and aggregation.Support for market-wide member black lists, exclusive lists, and preferred lists.

Built-in transaction audit trail.

Comprehensive exchange management, including membership, administrative order manipulation, scheduled market open and close, symbol suspension, and so on.

Manual matching, also known as lifting (with or without reference).

Users

There are three users involved in exchanges:

Trader

A trader is the person or company doing either the buying or selling in an exchange. The basic tasks performed by a trader are:

Placing orders

Performing extended (fuzzy) searches

Company Administrator

The company administrator is the person assigned by the iPlanet Market Maker administrator to perform the following Exchange module tasks:

iPlanet Market Maker Administrator

The iPlanet Market Maker administrator (also known as immhost) owns the iPlanet Market Maker software and sets up the digital marketplace. This user has the authority to create and approve member companies, edit company profiles, and manage users for companies. The specific tasks that relate to the Exchange module are:

Customization

Because the requirements of a trade in an iPlanet Market Maker exchange can have so many variables, the Exchange module provides very little out-of-box business functionality. Instead, it provides a framework of services that you can extend or customize to create your own exchanges. You can specify the matching and trading rules that determine how to match orders and settle trades. You can also specify whether to create buy orders and sell orders interactively or in batch mode.Two sample exchange implementations are provided with the iPlanet Market Maker software. For more information about these sample exchanges, refer to Chapter 2 "Defining the Exchange Attributes."

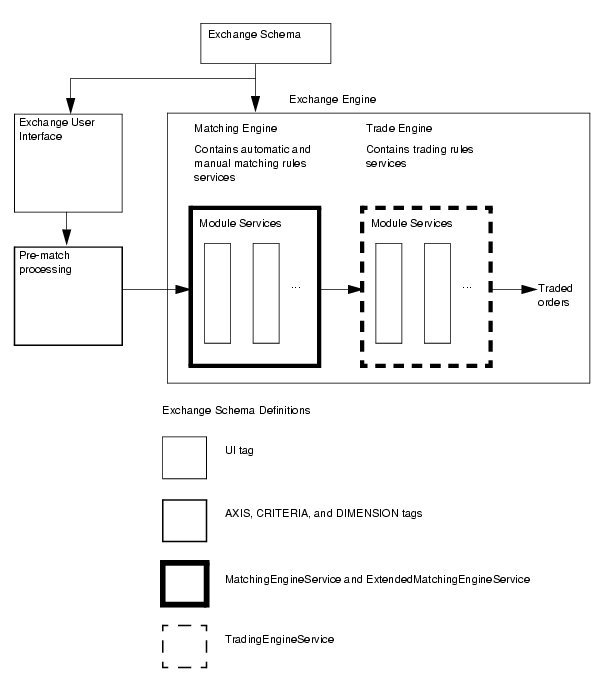

Exchange Schema

Each exchange has a schema that defines its particular characteristics. By identifying exactly what behavior you want the exchange to implement, you can tailor the exchange to your precise needs. Each exchange uses a separate schema, which allows you to create and host multiple exchanges in a single installation.

Schema Processes

To set up the schema for an exchange, you will define attributes associated with the following processes:

Pre-match Processing

Pre-match processing is determined by setting the exchange rules that define the following:

Life span of orders (for example, Good Until Cancelled, or Expiration Date)

Details about the user interface and pre-match processing are contained in Chapter 2 "Defining the Exchange Attributes."Sequence in which to process orders

Flatten function—Mechanism to convert the values defined in the user interface to a set of values that the Exchange module can process

Match Processing

Match processing is determined by setting the exchange rules that define how you want to match buy orders and sell orders. Details about match processing are contained in Chapter 3 "Defining the Matching and Trading Rules."

Post-match Processing

Post-match processing is determined by setting the exchange rules that define how to convert matched orders into traded orders. Details about post-match processing are contained in Chapter 3 "Defining the Matching and Trading Rules."

Schema Services

Within each exchange schema, there are two types of services:System services provide basic Exchange module functionality and usually do not need to be customized. Module services are typically meant to be customized to implement your requirements for a particular exchange.

Figure 1-1 illustrates the exchange flow.

Previous Contents Index Next

Copyright © 2001 Sun Microsystems, Inc. All rights reserved.

Last Updated April 03, 2002