(USA) Setting Up the Company State Tax Table

(USA) Setting Up the Company State Tax Table

This chapter discusses how to:

(USA) Set up the Company State Tax table.

(USA) Set up the Company Local Tax table.

(CAN) Set Up the Canadian Company Tax table.

Define tax locations.

Note. The tax tables discussed in this chapter are required for both the Payroll for North America and Payroll Interface applications. The PeopleBook for each of these applications discusses additional tax data setup that is specific to the application.

See Also

(CAN) Canadian Tax Method Calculations

(USA) U.S. Tax Methods and Calculations

(USA) Setting Up the Company State Tax Table

(USA) Setting Up the Company State Tax Table

To set up the Company State Tax table, use the Company State Tax Table component (CO_STATE_TAX_TBL) or Agency State Tax Table USF component (CO_STATE_TAX_TBL) and Tax Collector Table component (TAX_COLLECTOR_TBL).

This section discusses how to:

Define states where you collect or pay taxes.

Identify the voluntary disability plans.

Enter general ledger account numbers for state taxes.

Pages Used to Set Up the Company State Tax Table

Pages Used to Set Up the Company State Tax Table|

Page Name |

Definition Name |

Navigation |

Usage |

|

CO_STATE_TAX_TBL |

|

Set up an entry in the Company State Tax Table for each state where your organization collects or pays taxes. |

|

|

CO_STATE_TAX_TBL2 |

|

Identify the voluntary disability plans associated with the company. |

|

|

CO_STATE_TAX_TBL3 |

|

Enter your general ledger account numbers for state taxes. |

|

|

PRCSRUNCNTRL |

|

Run TAX704 to print information from the Company State Tax Table, which identifies the states in which your company collects and pays taxes. |

Specifying States Where You Collect or Pay Taxes

Specifying States Where You Collect or Pay Taxes

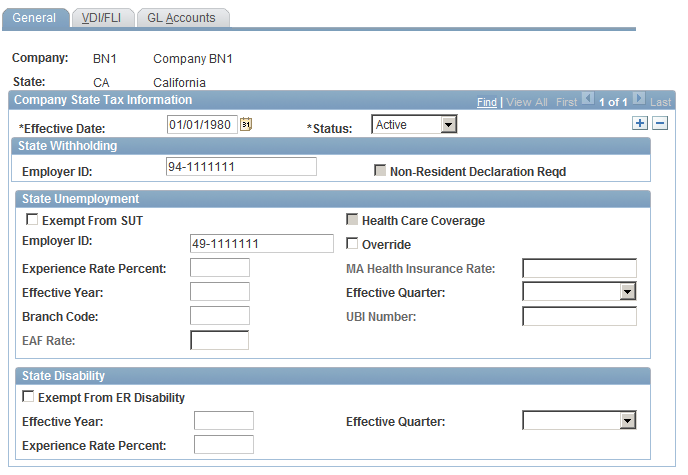

Access the Company State Tax Table - General page (Set Up HRMS, Product Related, Payroll for North America, Federal/State Taxes, Company State Tax Table, General).

Company State Tax Table - General page

The State field in State Tax Data 1 and Local Tax Data is edited against this table. You must create entries in this table before entering any state and local tax information for your employees.

State Withholding

|

Employer ID |

Enter your state employer ID for state withholding. |

|

Non-Resident Declaration Reqd |

This check box is selected or deselected by default according to the Federal/State Tax Table 1 record for the state. Indicates whether the state requires a Non-Resident Declaration for non-resident employees. |

|

Exempt From SUT |

Select this check box if the company is not required to pay SUT for this state. Use this option if you've specified, on the Company table, that the company as a whole is not exempt from SUT. If you select it here, Exempt from SUT becomes the default at the employee level; employees hired in this state have this check box selected on the State Tax Data page. See Setting Up SUT Exemptions To Generate Data for the TAX002, TAX810 and TAX860 Reports. |

|

Employer ID |

Enter your state employer ID for state unemployment. |

|

Override |

(MA only.) The Massachusetts standard Health Ins Rate is set by default from the State Tax table. For Massachusetts, the Health Insurance Rate differs for newer employers. If you're a Massachusetts employer to whom a lower rate applies, select this check box and enter the correct Massachusetts Health Ins Rate. |

|

Experience Rate Percent |

The experience rate you enter in the State Unemployment group box should reflect the rate you receive from your state unemployment agency. Enter the year and quarter when the rate becomes effective in the Effective Yr/Qtr field. This enables you to have different rates within a single calendar year. |

|

MA Health Insurance Rate |

(MA only.) If you select Override, enter the correct health insurance rate. |

|

Branch Code |

This field is informational for Arizona. TAX860AZ.SQR appends the branch code to the end of the state EIN. |

|

UBI Number (unified business ID number) |

If the company you're adding is in Washington State, enter the UBI number assigned. Used for quarterly reporting for companies in the State of Washington only. |

|

EAF Rate (employment administration fund rate) |

If the company you're adding is in Washington State, enter the EAF rate used to calculate an additional tax for the Employment Administration Fund, which finances work search assistance and training for the unemployed. Used for quarterly reporting for companies in the State of Washington only. |

|

Exempt From ER Disability |

Select this check box if employees in this state are exempt from employer-paid state disability tax. This field is for informational purposes only and is not used by the system. |

|

Experience Rate Percent |

The experience rate you enter in the State Disability group box should reflect the rate you receive from your state disability agency. Enter the year and quarter when the rate becomes effective in Effective Tax Yr/Qtr. This enables you to have different rates within a single calendar year. Note. You must set up a record for Quarter 1, because the system assumes a Quarter 1 record exists. A record for a subsequent quarter is required only if the rate changes mid-year. If you set up a Quarter 2 record, and you don't have a Quarter 1 record, you receive the error "SUT rate not found on Company/State Tax table" during Pay Calculation. This error occurs regardless of the pay end date you are processing. |

|

Employer ID |

(E&G) Enter the appropriate employer ID for state disability grouping in California, Michigan, and Minnesota. The T002CAHP, T002MIHP, and T002MNHP reports are grouped by employer ID if you enter the employer ID here and select the Separate Tax Report check box on the run control page. The report lists state withholding, state unemployment, and state disability. |

Setting Up SUT Exemptions To Generate Data for the TAX002, TAX810 and TAX860 Reports

The TAX002, TAX810, and TAX860 reports are generated based on SUT wages. When you select the Exempt From SUT field on this page, the system does not generate taxable wages, and the TAX002, TAX810, and TAX860 reports will contain no data.

Perform the following to generate taxable earnings, enabling the TAX002, TAX810, and TAX860 reports to produce the required wage detail reporting data, while still remaining exempt from State Unemployment Taxes:

Ensure that the Company Exempt from SUT field on the Company Table-FICA/Tax Details page is deselected.

Leave the Exempt From SUT field on the Company State Tax Table - General page deselected.

These steps should ensure that the Exempt From SUT field on the State Tax Data page remains clear for each employee. Verify that the Exempt From SUT field is clear on all three pages.

Enter a dummy number in the State Unemployment Employer ID field on the Company State Tax Table – General page.

Enter a value of 0 (zero) in the State Unemployment Experience Rate.

After you do these steps, the system can track taxable wages without calculating SUT tax dollars. The TAX002, TAX810, or TAX860 report can report the SUT subject wages.

Identifying Voluntary Disability Plans

Identifying Voluntary Disability Plans

Access the Company State Tax Table - VDI/FLI page (Set Up HRMS, Product Related, Payroll for North America, Federal/State Taxes, Company State Tax Table, VDI/FLI).

This page includes nearly identical sections for setting up information for your VDI (voluntary disability insurance) plan and your voluntary state family leave insurance plan.

Voluntary Disability Plan

|

Voluntary Disability Plan |

Select this check box to indicate that the plan you're defining is a voluntary disability plan allowed by the state. |

|

Plan Number |

Enter the plan number of the voluntary disability plan. For New Jersey, this number appears on Form W-2. |

|

VDI Administrator Code |

Select the code that identifies the administrator of the plan. You maintain administrator codes on the VDI/FLI Administrator Table page. |

|

Employee Rate Percent |

Enter the employee-paid rate. |

|

Employer Rate Percent |

Enter the employer-paid rate. |

To set up VDI with a rate of zero so that you can track the VDI wages, enter 99.99999 as the Employee Rate Percent and Employer Rate Percent on this page.

State Family Leave Insurance

|

Voluntary Family Leave Plan |

Select this check box to indicate that the plan you're defining is a voluntary family leave plan allowed by the state. |

|

FLI Plan Number |

Enter the plan number of the voluntary family leave insurance plan. |

|

FLI Administrator Code |

Select the code that identifies the administrator of the plan. You maintain administrator codes on the VDI/FLI Administrator Table page. |

|

Employee Rate Percent |

Enter the employee-paid rate. |

|

Employer Rate Percent |

Enter the employer-paid rate. |

To set up FLI with a rate of zero so that you can track the FLI wages, enter 99.99999 as the Employee Rate Percent and Employer Rate Percent on this page.

Entering General Ledger Account Numbers for State Taxes

Entering General Ledger Account Numbers for State Taxes

Access the Company State Tax Table - GL Accounts page (Set Up HRMS, Product Related, Payroll for North America, Federal/State Taxes, Company State Tax Table, GL Accounts).

Enter the general ledger account numbers, if applicable, for the following company liabilities:

|

SWT |

State Withholding liabilities. |

|

SUT (Employee) |

State Unemployment employee liabilities. |

|

SUT (Employer) |

State Unemployment employer liabilities. |

|

SDI (Employee) |

State Disability employee liabilities. |

|

SDI (Employer) |

State Disability employer liabilities. |

|

VDI (Employee) |

Voluntary Disability employee liabilities. |

|

VDI (Employer) |

Voluntary Disability employer liabilities. |

|

FLI (Employer) |

State family leave insurance employee liabilities. |

|

VFLI (Employee) |

Voluntary family leave insurance employee liabilities. |

|

VFLI (Employer) |

Voluntary family leave insurance employer liabilities. |

(USA) Setting Up the Company Local Tax Table

(USA) Setting Up the Company Local Tax Table

To set up the company local tax table, use the Company Local Tax Table component (COMP_LOCAL_TAX_TBL).

This section discusses how to set up company local tax table entries.

Note. You must complete the Company Local Tax table before local tax data for employees is entered because the locality field on the Local Tax Data page is edited against this table.

Pages Used to Define an Entry for the Company Local Tax Table

Pages Used to Define an Entry for the Company Local Tax Table|

Page Name |

Definition Name |

Navigation |

Usage |

|

COMP_LOCAL_TAX_TBL |

|

Set up an entry in the Company Local Tax Table page for each locality where the organization withholds or pays taxes. |

|

|

PRCSRUNCNTRL |

|

Run TAX705 to print information from the Company Local Tax Table, which identifies the localities for which your organization collects and pays taxes. |

Setting Up Company Local Tax Table Entries

Setting Up Company Local Tax Table Entries

Access the Company Local Tax Table page (Set Up HRMS, Product Related, Payroll for North America, Local Taxes, Company Local Tax Table, Company Local Tax Table).

|

Employer ID |

This field is used for local withholding tax for this locality. It is set by default to the Employer ID for state withholding taxes on the Company State Tax table. |

GL Account Number - Local Withholding Tax for Non Commitment Accounting

These accounts are General Ledger accounts for use with local withholding tax; they are only used by the PayGL01 process. Only GL information not subject to Commitment Accounting would use these accounts.

|

Employee and Employer |

If you have general ledger account numbers to which you post liability for local withholding tax for this locality, enter the employee and employer account numbers here. |

(CAN) Setting Up the Canadian

Company Tax Table

(CAN) Setting Up the Canadian

Company Tax Table

To set up Canadian company tax information, use the Company Tax Table component (CO_CAN_TAX_TABLE) and the Wage Loss Plan Table component (WAGELS_PLN_TBL).

This section discusses how to:

Set up the Canadian Company Tax Table.

Define wage loss plans.

Pages Used to Set Up the Canadian Company Tax Table

Pages Used to Set Up the Canadian Company Tax Table|

Page Name |

Definition Name |

Navigation |

Usage |

|

CAN_USR_TAX_TABLE1 |

|

Identify the Prescribed Interest Percent, Province, Provincial Premium Tax Percent, and Health Insurance Rate Override for each company you set up. |

Setting Up the Canadian Company Tax Table

Setting Up the Canadian Company Tax Table

Access the Company Tax Table page (Set Up HRMS, Product Related, Payroll for North America, Canadian Taxes, Company Tax Table, Company Tax Table).

Note. It is your responsibility to update all rates on the Company Tax Table.

Company Tax Information

|

Prescribed Interest Percent |

If your company processes low interest loans, enter the current prescribed interest percent. This rate is updated quarterly by the Canadian federal government. Warning! It is your responsibility to update the Prescribed Interest Percent field according to the rate set each quarter by the Canadian federal government. PeopleSoft does not update this field in its tax updates; PeopleSoft leaves the field blank. |

Company Tax Rates

Use these fields to enter company-specific overrides to provincial tax rates.

Important! The system ignores override values of zero. If the override value is 0.00, the system calculates taxes using the rates on the provincial tax tables.

|

Province |

Enter all applicable provinces in which the company operates and needs to process PPT tax or override a Health Insurance Rate. |

|

Provincial Premium Tax Percent |

Enter the provincial premium tax percent applicable to group life and health insurance benefit plan premiums, if your company is responsible for withholding and submitting the tax. |

|

Health Insurance Rate Override |

Enter the health insurance rate override to specify the premium rate that applies to your company, if that rate is different from the rate defined on the Canadian Tax Table Provincial Rates page. This field applies to companies operating in provinces, such as Ontario and Manitoba, where variable rates apply based upon total gross payroll figures. |

Defining Tax Locations

Defining Tax Locations

To define tax locations, use the Tax Location Table component (TAX_LOCATION_TBL). Use the TAX_LOCATION_TBL component interface to load data into the tables for this component.

This section provides an overview of tax locations and discusses how to:

Establish the locations for which you process payroll and taxes.

Associate provinces, states, and localities with the tax location code.

Understanding Tax Locations

Understanding Tax Locations The system sets up federal, state, and local employee tax data and tax distribution data according to the information you specify in the Tax Location table. In this table, you establish each of your locations with a Tax Location ID and identify the work states, provinces, and localities associated with each tax location.

Note. If you've selected Automatic Employee Tax Data on the Installation table, the system automatically sets up tax data for each work and resident state and locality of each of your employees. Tax distribution records are created for the work state/locality if the tax location represents a single state/locality.

Pages Used to Define Tax Locations

Pages Used to Define Tax Locations|

Page Name |

Definition Name |

Navigation |

Usage |

|

TAX_LOCATION_TBL1 |

|

Establish the locations for which you process payroll and taxes. |

|

|

TAX_LOCATION_TBL2 |

|

Associate a province or any number of states, localities, and linked localities with the tax location code. |

|

|

PRCSRUNCNTL |

Set Up HRMS, Product Related, Payroll for North America, Tax Table Reports, Tax Location, Tax Location Report |

Generate PAY718 that lists information from the Tax Location table. |

Establishing the Locations for Which You Process Payroll and Taxes

Establishing the Locations for Which You Process Payroll and Taxes

Access the Tax Location Table - Address page (Set Up HRMS, Product Related, Payroll for North America, Federal/State Taxes, Tax Location Table, Address or Set Up HRMS, Product Related, Payroll for North America, Canadian Taxes, Tax Location Table, Address).

|

Tax Location Code |

Establish a tax location code for each location for which you process payroll and tax data. You can associate any number of states and localities with each code. |

|

Alaska Area Code |

If applicable, select an Alaskan area code. |

Note. If you select Automatic Employee Tax Data on the Installation table and assign a Tax Location ID to each employee in the Job data, each employee's tax data is set by default on the Employee Tax Data page and the Employee Tax Distribution page.

Associating Provinces, States, and Localities with the Tax Location

Code

Associating Provinces, States, and Localities with the Tax Location

Code

Access the Tax Location Table − State/Province/Locality page (Set Up HRMS, Product Related, Payroll for North America, Federal/State Taxes, Tax Location Table, State/Province/Locality or Set Up HRMS, Product Related, Payroll for North America, Canadian Taxes, Tax Location Table, State/Province/Locality).

|

State / Province |

Use to identify each state that is associated with the tax location code. You can associate any number of states with a single tax location. For each state, identify each taxing locality, if any. The states you associate with this tax location code must be defined on the Company State Tax table and the Company Local Tax table. This value is set by default to the Employee Tax Data pages and the Employee Tax Distribution page for employees you assign to this tax location. |

|

Locality |

The localities you associate with this tax location code must be defined on the Company State Tax table and the Company Local Tax table. This value is set by default to the Employee Tax Data pages and the Employee Tax Distribution page for employees you assign to this tax location. |

|

Other Work Locality |

Use this field only where multiple local taxes apply in one location, such as:

Note. You should never attempt to enter multiple Indiana localities. Regardless of the number of Indiana locations in which an employee may work, either simultaneously or over the course of the year, the employee is liable for Indiana county tax for only one Indiana county per calendar year. This is the Indiana county of residence as of January 1, if that county imposes a tax, or the Indiana county of principal work activity as of January 1, if the residence county does not impose a tax. |

Note. Locality and Other Work Locality are not required in Canada, because a Canadian employee can be taxed in only one province at a time, and there are no locality taxes in Canada.

See Also

Setting Up Organization Foundation Tables

Understanding Split Local Tax Distribution for KY, AL, and OR