20 Process Accounts Receivable Drafts (RiBA)

This chapter contains these topics:

Drafts are payment instruments that involve direct communication between the bank of the payor and the bank of the payee. A draft must be classified, tracked, and reported separately from other types of obligations such as checks and transfers. Clients might require both manual and automatic draft processing. These processes consist of three to five steps, depending on the country or client requirements.

In Italy, accounts receivable drafts are referred to as RiBa. RiBa can be remitted to the bank on paper or electronically.

The Accounts Receivable system provides an effective way to process accounts receivable drafts (RiBa). The following information pertains only to accounts receivable draft processing.

20.1 Creating Invoices

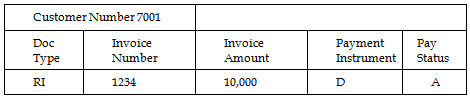

The process begins when a customer purchases goods or services from you for which you must create an invoice. Use the Standard or Speed Invoice Entry screen to create and then post an invoice. When you post the invoice, the system debits accounts receivable and credits sales.

At this point in the process, the invoice is open. No draft exists.

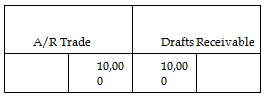

The account postings and the balances in the general ledger for the journals are as follows:

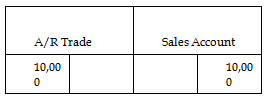

20.2 Printing the Draft (optional)

Either you or your customer can originate the draft. The draft shows the amount to be paid, the due date, banking information, and, possibly, information about the invoices.

If you originate the draft, you can include invoices or statements. Some customers expect one draft per invoice. Other customers expect one draft for a statement of invoices. You can send either invoices or statements with drafts attached. Printing the draft has no effect on the general ledger.

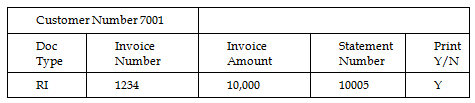

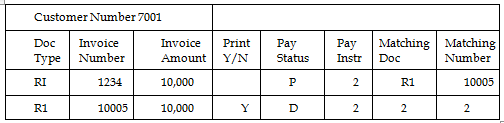

20.3 Accepting the Draft

The draft cannot be legally enforced until your customer accepts it. After your customer accepts the draft, you enter and post the draft, whether it is manual or automatic.

Your customer can accept a manual draft by:

-

Signing the draft that you originated and returning it to you

-

Changing the draft that you originated (date, amount, bank, and so on), and then signing and returning it to you

-

Originating, printing, signing, and sending the draft to you

For automatic (preauthorized) drafts, the draft is considered accepted by prior agreement without a response from your customer.

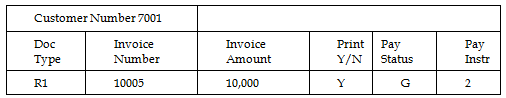

At this point in the process, the system closes the invoice. The draft has been created and accepted.

The system creates a journal entry to debit drafts receivable and credit an A/R trade account. You post the journal entry.

The account postings and the balances in the general ledger for the journals are as follows:

20.4 Remitting the Draft (optional)

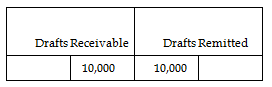

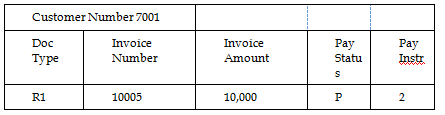

You remit (deposit) the draft to your bank so that it can collect the funds from your customer's bank. You can remit the draft on either magnetic tape or by printing a register. When you remit the draft, the system creates a journal entry to credit drafts receivable and debit drafts remitted. You post the journal entry.

You arrange to collect funds from the draft in one the following ways:

-

Wait until the funds are available on the due date of the draft

-

Request an advance from your bank before the due date of the draft (discounting). Typically, banks charge interest when they advance funds for a draft before its due date.

The account postings and the balances in the general ledger for the journals are as follows:

When you remit the draft, the system automatically prints the Stamp Tax Report. The Stamp Tax Report is no longer required in Italy.

20.5 Collecting the Draft

Your bank collects the funds for the draft from the customer's bank on the due date. Your bank informs you if it cannot collect the funds. On or after the due date, both the supplier and the customer recognize the transfer of cash.

You run the Draft Collection program (P03576) to update the status of the draft to indicate that it was collected. When you run the program, the system creates a journal entry to credit the drafts remitted and debit a cash account. You post the journal entry.

The account postings and the balances in the general ledger for the journals are as follows:

Note:

In Italy, companies typically do not consider a draft paid until the bank sends verification of the actual payment. In this case, the preferred practice for collecting a draft is to set the processing options for the Draft Collection program (P03576) so that the program does not automatically create journal entries. Instead, it updates the payment instrument for the draft to an intermediate status. The intermediate status indicates that payment for the draft has been requested from the bank, but not actually received. When the bank verifies the payment of the draft, you can create and post a manual journal entry for the payment. Then, you run the Draft Collection program for the draft again to update the payment instrument for the draft to a "paid" status.20.6 Processing Unpaid Drafts

There are times, after the draft has already been accounted for as collected, that the bank rejects the draft (usually because the client's account is overdrawn).

You can account for unpaid drafts by choosing Automatic Reversing Entries or Automatic NSF Entries on the draft entry screen.

When you account for unpaid drafts, the system creates a matching document type to close the original document. The original invoice is reopened. When you post the batch, the system creates the following journal entry:

-

Cash Bank Account (CR)

-

A/R Trade (DR)

You can also account for unpaid drafts at the remittance phase by choosing Automatic Reversing Entries or Automatic NSF Entries on the receipts entry screen. In this case, the system creates the following journal entry when you post the batch:

-

Drafts Remitted (CR)

-

A/R Trade (DR)

20.6.1 Maximum Amounts

You can use a processing option to specify a maximum amount for accounts receivable draft (RiBa) processing. When you use the processing option, the system excludes customer invoices with amounts exceeding the maximum. You can review a report of the invoices that were not included in the RiBa generation based on the maximum amount that you specify.

See Also:

-

JD Edwards World Accounts Receivable Guide for more information about the tasks involved in accounts receivable draft processing

-

Appendix F, "Alternate Solution for NSF RiBa" to review the custom module provided by JD Edwards Italy