34 Working with Intracommunity Non-Recoverable VAT

This chapter contains these topics:

-

Section 34.2, "Understanding Changes to the Existing Software"

-

Section 34.3, "Setting Up Intracommunity Non-Recoverable VAT"

This chapter provides an overview of the changes to the existing software regarding Intracommunity VAT (value-added tax), Non-Recoverable Intracommunity VAT, and how to set up Intracommunity Non-Recoverable VAT for Italy.

34.1 Understanding Intracommunity VAT

In Europe, companies who do business with companies from other European Union countries do not need to pay VAT on the goods they purchase. However, European Union countries must show to the fiscal authorities the amount the VAT would have been. This concept is called intracommunity VAT.

34.1.1 Intracommunity Non-Recoverable VAT

In Italy, in some cases, there is a Non-Recoverable portion for the Output VAT account, which needs to be included as part of the G/L amount to distribute (Expense Account). For example:

Amount to Distribute = Taxable Amount + Non-Recoverable amount

When you post a transaction following this VAT requirement, the Expense Account is debited with Amount to Distribute (Taxable + Non Recoverable VAT).

34.2 Understanding Changes to the Existing Software

Currently, to define an intracommunity VAT tax rate/area, you have to set up a tax rate/area with two tax rates.

-

The first tax rate (output VAT)

-

The second tax rate (input VAT)

Changes to the JD Edwards World software:

-

Indicate the Non-Recoverable portion of the intracommunity VAT

-

Requires a special Tax/Rate Area set up

-

Allows the voucher entry programs to record the Non-Recoverable VAT

-

Allows the posting process to create the journal entry with the Non-Recoverable VAT and to post it to the correct General Ledger accounts

-

Reports R004051 (AR - AP IVA Tax Report - Italy) and R74093 (VAT Summary Report) were modified to include the Non-Recoverable VAT

34.3 Setting Up Intracommunity Non-Recoverable VAT

This section describes how to set up intracommunity Non-Recoverable VAT. It contains the following topics:

-

"Set up Intracommunity Non-Recoverable VAT Tax/Rate Area

-

"Set up Generic Report with the Tax Rate/Area created

-

"Set up Register Type and Class for the Document Type and Tax Rate/Area

-

"Run an IVA Summary Report

-

"Run a Monthly Suspended IVA Report

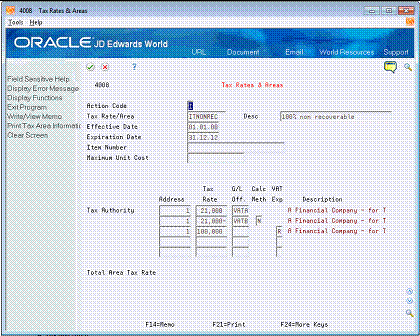

34.3.1 Set up Intracommunity Non-Recoverable VAT Tax/Rate Area (P4008)

From the Master Directory menu (G), type 29

From the General Systems menu (G00), select Tax Processing & Reporting

From the Tax Processing & Reporting menu (G0021), select Tax Rates & Areas.

You can use this program to inquire on, add, change, and delete tax rate/areas.

To set up Intracommunity Non-Recoverable VAT Tax/Rate Area

On Tax Rates & Areas

-

Complete the following fields:

-

Tax Rate/Area

-

Description

-

Effective Date

-

Expiration Date

You may set up a default Expiration Date to be used in the processing options for P4008.

-

Tax Authority Address

-

Tax Rate

-

The first tax rate must be positive.

-

The second tax rate must be the negative equivalent to the first tax rate.

-

The third tax rate is the Non-Recoverable portion of the tax rate and must have an R in the VAT Exp field.

-

For each type of Tax Rate/Area code, you can set up specific GL offsets. The system uses the GL offset, which is defined in the PTxxxx Automatic Accounting Instructions, to post the journal entries to different VAT accounts.

-

-

Complete the following fields, as needed.

-

Item Number

-

Maximum Unit Cost

-

G/L Offset

-

Calculation Method (only used in Canada)

-

VAT Expense - set to R

When you add a tax rate/area with multiple tax rates, the program displays the total tax rate to be applied to goods and services.

-

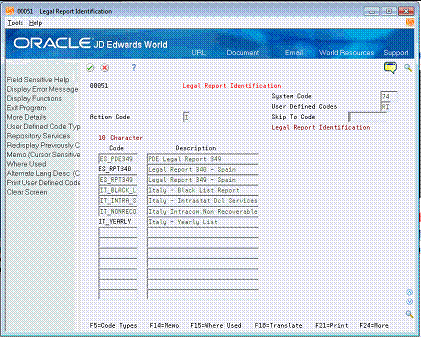

34.3.2 Set up Generic Report with the Tax Rate/Area created

From the Master Directory menu (G), type G740001

From the Generic Report menu (G740001), select Legal Report Identification

To set up Generic Report with Tax Rate/Area created

On Legal Report Identification

Figure 34-2 Legal Report Identification screen

Description of "Figure 34-2 Legal Report Identification screen"

-

For the system to identify the Tax Rate/Area for Intracommunity Non-Recoverable VAT, you must set up a new Legal Report Identification with the following values:

-

System Code: 74

-

User Defined Codes: RI

-

10 Character Code: IT_NONRECO

-

-

Save the new Legal Report Identification.

-

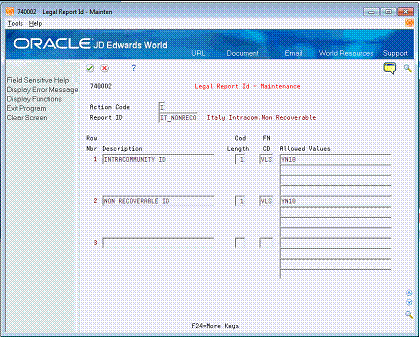

From the Generic Report menu (G740001), select Legal Report Id - Maintenance.

-

Access the Report ID: IT_NONRECO and change the values to identify the Intracommunity and Non-Recoverable IDs data.

Figure 34-3 Legal Report ID - Maintenance screen

Description of "Figure 34-3 Legal Report ID - Maintenance screen"

-

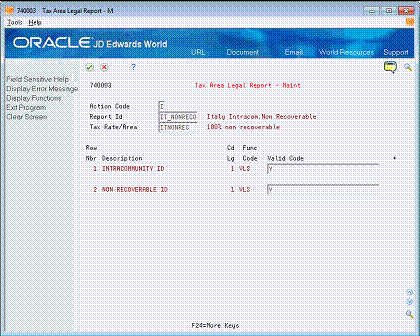

From the Generic Report menu (G740001), select Tax Area Legal Report - Maint.

Figure 34-4 Tax Area Legal Report - Maintenance screen

Description of "Figure 34-4 Tax Area Legal Report - Maintenance screen"

-

Access the Report ID: IT_NONRECO and enter the Intracommunity Non-Recoverable Tax Rate/Area with the correct values for Intracommunity and Non-Recoverable IDs to be able to select them for the reports.

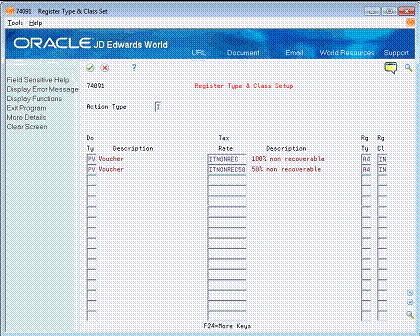

34.3.3 Set up Register Type and Class for the Document Type and Tax Rate/Area

From the Master Directory menu (G), type G74Y002131

From the Additional Italian Tax Processing menu (G74Y002131), select Register Type & Class Setup

In Italy, the government requires businesses to report IVA taxes on Accounts Receivable and Accounts Payable transactions. To meet this reporting requirement, you need to assign a Register Type and Class to each transaction.

To set up Register Type and Class for the Document Type & Tax Rate/Area

On Register Type & Class Setup

Figure 34-5 Register Type & Class Setup screen

Description of "Figure 34-5 Register Type & Class Setup screen"

-

You specify different register types for sales and purchases. Register classes are subsets of register types. For example, the register classes for a sales register type might include Sales within Italy, Sales within the European Union, or Sales outside the European Union.

-

Set up register types and classes to track and report IVA tax in a summarized format. Then, create a link between the register types and classes and the appropriate type of transaction (document type).

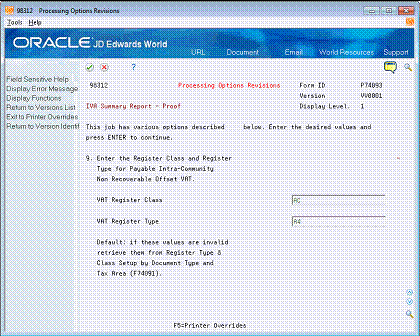

34.3.4 Run an IVA Summary Report

From the Master Directory menu (G), type G74Y002131

From the Additional Italian Tax Processing menu (G74Y002131), select Print IVA Summary Reports

The IVA Summary Report has a new Processing Option, 9, to indicate the VAT Register Class and the VAT Register Type for transactions with Intracommunity Non-Recoverable VAT.

On Print IVA Summary Reports

-

Change Processing Option 9 of the Summary Report - Proof (P74093) to set up the Register Class and Type for Non-Recoverable VAT transactions.

This processing option is linked with the following UDCs (User Defined Code Tables):

-

74/01 VAT Register Class

-

74/02 VAT Register Type

If you leave Processing Option 9 blank, the program selects the Register Class and Type set up in G74Y002131/2 as usual.

Figure 34-6 Processing Options Revisions screen

Description of "Figure 34-6 Processing Options Revisions screen"

-

-

The following is an example IVA Summary Report with a previously entered voucher.

34.3.5 Run a Monthly Suspended IVA Report

From the Master Directory menu (G), type G74Y002131

From the Additional Italian Tax Reporting menu (G74Y002131), select Monthly Suspended IVA Report

The Monthly Suspended IVA Report provides a report of AR and AP VAT taxes and is printed on a legal form, which is pre-numbered and approved by Tax Authorities in Italy.

To run a Monthly Suspended IVA report

On Monthly Suspended IVA Report

-

Select and run the Version of the report you need.

The following is an example of the Monthly Suspended IVA Report with a previously entered voucher. This report displays the Taxable Amount with a Non-Recoverable VAT.

Figure 34-8 Monthly Suspended IVA Report example

Description of "Figure 34-8 Monthly Suspended IVA Report example"