33 Suspending IVA for Accounts Payable

This chapter contains these topics:

-

Section 33.3, "Generating Suspended IVA for Accounts Payable"

-

Section 33.4, "Printing Voucher List Control Report (option 12)"

33.1 Overview

Italian law requires that you defer entry of Imposta sul Valore Aggiunto (IVA) for certain accounts payable operations until you generate a complete or partial payment of the voucher. Instead of entering IVA in the IVA account at the time of purchase, your business must enter the IVA in a suspense account until you issue the payment.

JD Edwards World enhanced the suspended IVA in the Accounts Payable system using the existing functionality for suspended IVA in the Accounts Receivable system in order to maintain the logic of information in both systems.

Suspending IVA for Accounts Payable includes the following tasks:

-

Set up for suspended IVA

-

Process suspended IVA

33.2 Setting Up for Suspended IVA

Prior to processing any vouchers with suspended IVA, you must complete the following set up tasks:

-

Set up User Defined Codes (UDCs)

-

Set up Automatic Accounting Instructions (AAIs)

-

Set up Accounts Payable Constants

-

Set up Company Numbers and Names

Prior to processing any vouchers with suspended IVA, you must complete the following set up tasks:

-

Set up User Defined Codes (UDCs)

-

Set up Automatic Accounting Instructions (AAIs)

-

Set up Accounts Payable Constants

-

Set up Company Numbers and Names

33.2.1 Setting Up UDCs

You must set up the following UDCs:

74/DT - Suspended VAT Document Types

Use this UDC to create a relationship between the voucher you pay, which is subject to suspended IVA and the document the system generates when it releases the IVA amount from the IVA suspense account to the IVA account. You enter 2 characters for the Document Types. You enter the originating voucher document type in the Code field and the releasing document type in the Description field. You also enter the opposite values which the system uses for reversing payment entries. For example, you enter the original voucher document type PV in the Code field and the corresponding user-defined document type, U1, in the Description field. On another line, you then enter U1 in the Code field and PV in the Description field.

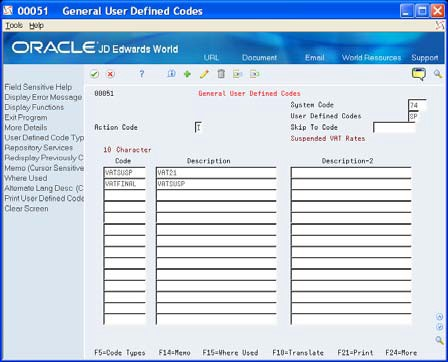

Figure 33-1 74/DT - Suspended VAT Document Types

Description of "Figure 33-1 74/DT - Suspended VAT Document Types"

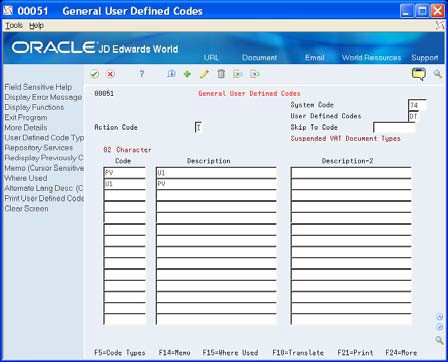

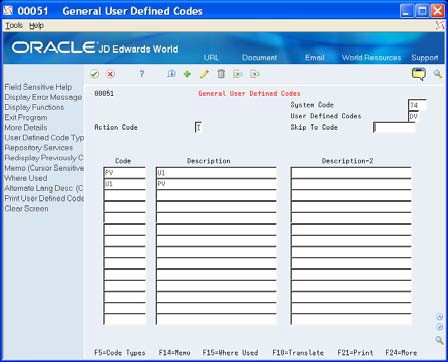

74/DV - AP Suspended VAT Document types

Set this UDC to specify only voucher document types for Accounts Payable. Use the same values that you set up in UDC 74/DT.

Figure 33-2 74/DV - AP Suspended VAT Document Types

Description of "Figure 33-2 74/DV - AP Suspended VAT Document Types"

Use this UDC to create a relationship between the tax area of the voucher you pay, which is subject to suspended IVA and the tax area defines the IVA account., in the 10 Character Code field, and the Tax Area that the system assigns for the IVA amount in the IVA account, in the Description field. You can enter up to 10 characters for the tax rate name. You enter the first tax area in the Code field and then enter the corresponding tax area, not a description, in the Description field. You also enter the opposite values which the system uses when you void payments. For example, the suspense tax area is VATSUSP and the corresponding item is VAT21 (the normal tax area). In the Code field, you enter VATSUSP and VAT21 in the Description field. On another line, you then enter the opposite values of VATFINAL in the Code field and VATSUSP in the Description field.

33.2.2 Setting Up AAIs

You must set up AAI PTxxxx where xxxx is the associated G/L offset account in the first G/L Offset field (TAGL01) in the Tax Area file (F4008) for the tax areas you set in UDC 74/SP.

33.2.3 Set Up Accounts Payable Constants

In releases A9.1 and A9.2, ensure that the Suspended Tax Processing field contains a zero or is blank. Italian processing does not use this.

33.3 Generating Suspended IVA for Accounts Payable

From Additional Italian Tax Processing (G002131), choose Suspended IVA Generation AP

You run the Suspended VAT - Voucher/Payment Control Report program (P74080) to identify and account for vendor payments that are subject to suspended IVA. When you run this program, the system:

-

Selects only the records in the Accounts Payable - Matching Document (F0413) and Accounts Payable Matching Document Detail (F0414) tables that are subject to suspended IVA and do not have matching records in the Suspended VAT Detail table (F74800). The documents subject to suspended IVA include a specific user-defined Document Type.

-

Creates an internal document in the Sales/Use/V.A.T. Tax (F0018) and Suspended VAT Detail file (F74800) tables. This document uses the normal tax code, based on the tax rates and areas you set up in your system. The system uses the values in UDC 74/SP to determine the correspondence between the IVA suspense code and the actual IVA code.

-

Creates journal entries in the Account Ledger table (F0911). These journal entries credit the IVA suspense account and debit the IVA payable account.

33.3.1 Processing Options

See Section 44.4, "Processing Options for Generate Suspended VAT Amounts (P74080)."

33.4 Printing Voucher List Control Report (option 12)

From Additional Italian Tax Processing (G002131), choose Voucher List Control Report

You can use the Voucher List Control report (P74082) to print a list of suspended IVA vouchers that you need to pay. When you print the report, the system verifies that the vouchers have not been paid on the "As Of Date" you specify in the report, and calculates the open amount.

For each voucher, the report includes the following information:

-

Identifying Data (date, number, pay item)

-

IVA Rate

-

Original Amounts (taxable, tax, and total)

33.4.1 Processing Options

See for Section 44.5, "Processing Options for Generate Suspended VAT Amounts (P74082)."