32 Additional Information File Generation

This chapter contains these topics:

32.1 Generate the Additional Information File

At the end of each period, the user will need to run the File Data Generation program for the Declaring Company.

This program selects all intra-community service transactions posted for the period and searches each transaction for the required data for Intrastat Declaration, called Additional Information.

It is a Batch program that takes transactions from the Sales/Use/V.A.T. Tax File (F0018) and generates the "Intrastat Declaration for Service - Additional Information" file (F74Y0018).

When the program is executed and there is not an active declaration for the Declaring Company and Period defined in the Processing Options, it creates a new Internal Declaration Number to identify the current Declaration in progress and it also creates the Declaration entry in the Intrastat for Declaration - Header file (F74Y0020).

Additional Information is composed of:

-

Service Explanation Code

-

Supply Method

-

Collection Method

-

Payment Country

From Italian Localizations (G74Y), choose EU VAT Package INTRASTAT

From EU VAT Package INTRASTAT (G74Y001), choose Intrastat Declaration Steps

From Intrastat Declaration Steps (G74Y0011), choose File Data Generation

When the Additional Information file is generated successfully, the declaration status is moved to '1'(Pending - Ready to Validate Data).

Those transactions that correspond to a document voided or reversed in the period will be ignored.

Note:

Only declarations with status '0','1','2' or '3' will be processed.32.2 Additional Information Recovery

32.2.1 Service Explanation Code:

This value will be retrieved from the Tax Area Legal Report Set Up for Legal Identification (REPI) = 'IT_INTRA_S' and Tax Area (TXA1) = transaction Tax Area. If it isn't defined, the value is retrieved from A/B Additional Information - Italy defined for the supplier or customer.

32.2.2 Supply Method:

This value will be retrieved from the Tax Area Legal Report Set Up for Legal Identification (REPI)='IT_INTRA_S' and Tax Area (TXA1) = transaction Tax Area. If it isn't defined, the value is retrieved from A/B Additional Information Italy defined for the supplier or customer.

32.2.3 Collection Method:

This value will be retrieved from the Payment instrument associated with the transaction. The Special Handling Code from UDC 00/PY or 00/RY, according to the transaction module, will define the Collection Method. The allowed values are 'A', 'B' or 'X'. If the field is blank, the default value is 'X'.

32.2.4 Payment Country:

It will retrieve the Country Code of the Supplier for Accounts Payable documents, or the Country Code of the Address Number of Company. The ISO Code will be used. The ISO Code of the EU Member Country is in UDC 70/TI Description 2.

It can also be accessed with the Country Code. If this value is not defined in the UDC, the Country Code will be used by default.

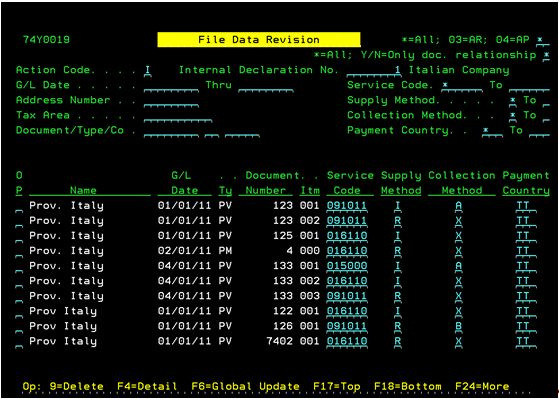

32.3 Additional Information Data Revision

From Italian Localizations (G74Y), choose EU VAT Package INTRASTAT

From EU VAT Package INTRASTAT (G74Y001), choose Intrastat Declaration Steps

From Intrastat Declaration Steps (G74Y0011), choose File Data Revision

This program allows users to review and update the Intrastat Additional Information for Services previously generated through the Additional Information Generation program for the current declaration.

Additional Information is composed of:

-

Service Explanation Code

-

Supply Method

-

Collection Method

-

Payment Country

It allows users to review the information for each document line, using various selection criteria, update the information for a document line (record-by-record) or for a group (global), and delete a document from the declaration file.

This application will only allow modification of those documents not included in a declaration at status: '4 - Closed'. Also, the program will allow users to delete specific records from the file. In this case, when the user deletes one line of the document, the program displays a message to inform the user that the whole document will be deleted.

There is a global update function for these additional fields. The system allows the users to select multiple records (document lines) and then, select this function in order to populate the additional field's values that will be updated on the previously selected records.

Once the changes are finished, the program will change the status of the declaration to:

'1: Pending - Ready to Valid. Data'

32.3.1 Record by Record Update

Updates may be performed on a record-by-record basis for:

-

Service Code

-

Supply Method

-

Collection Method

-

Payment Country

Users may pick and choose individual document lines.

32.3.2 Global Update

Global updates may be performed with F6 and Action Code 'C' to:

-

Service Code

-

Supply Method

-

Collection Method

-

Country Payment

Note:

This feature should be used with great caution. It will update all records selected. It will not update these records if you have not rolled through all pages of your subfile or skipped to the end with F18.32.3.3 Screen Message Text

If there is a document with a relationship defined in the subfile, the document will be displayed in yellow and the message "There is a document relationship." will appear at the top of the screen.

Note:

Document Relationship is established when a user links one or more A/R Invoices or A/P Vouchers to an A/R or A/P Credit/Debit Note.32.3.4 Delete Action

When a document doesn't have a Document Relationship:

-

Document can be deleted by entering '9' in the option field for all and each line of document.

When a document has a Document Relationship:

-

Document cannot be deleted. An error will be displayed.

32.3.5 Change Action

When a document has a Document Relationship:

-

If the Service Code is not changed:

-

Document can be changed. If

-

-

If the Service Code is changed:

-

Document can be changed if the user consistently changes all documents involved in the relationship. It means that the same Service Code must be defined in matching lines.

-

When document does not have a Document Relationship:

-

Document can be changed

32.3.6 Declaration Status

When a change is done, the program automatically updates the declaration status to '1 - Pending - Ready to Valid. Data'

32.4 File Data Validation

From Italian Localizations (G74Y), choose EU VAT Package INTRASTAT

From EU VAT Package INTRASTAT (G74Y001), choose Intrastat Declaration Steps

From Intrastat Declaration Steps (G74Y0011), choose File Data Validation

The main purpose of this program is to identify and print on an exceptions report, any Intrastat Declaration for Services Additional Information record(s) lacking any Additional Information item(s).

The Additional Information data items are the following:

-

Service Explanation Code

-

Supply Method

-

Collection Method

-

Payment Country

If any of these data items are blank, an exceptions report line is printed, identifying the Declaration Additional Information record lacking the required information.

If the data is correct, the program will change the status of the Declaration from '1: Pending - Ready to Valid. Data' to '2: Pending - Ready to Generate Declaration'

32.5 Declaration File Generation

From Italian Localizations (G74Y), choose EU VAT Package INTRASTAT

From EU VAT Package INTRASTAT (G74Y001), choose Intrastat Declaration Steps

From Intrastat Declaration Steps (G74Y0011), choose Declaration Files Generation

This program generates the Intrastat Declaration for Services files for the declaration in progress. These files are:

-

(F74Y0020) Intrastat Declaration for Services - Header.

-

(F74Y0021) Intrastat Declaration for Services - Detail.

-

(F74Y0022) Intrastat Declaration for Services - Amendments

During this process, the system will execute the following steps:

-

The program processes the F74Y0018 transactions in this order:

Invoices & Vouchers: It stores the document information required in the F74Y0021 file for Section 3 and Reporting System.

Credit & Debit Notes: It stores the document information required of adjusted documents. They will be generated in the Section 3 or 4:

-

If the adjusted document belongs to a previous declaration period then it will be stored in Section 4.

-

If the adjusted document belongs to a current declaration period then it will be stored in Section 3.

In both cases, the adjusted documents will be stored with the amount amended.

-

-

The program processes the F74Y0023 transactions:

Invoices & Vouchers modified: It stores the document information required in the F74Y0021 file for Section 4 and Reporting System with the Additional Information adjusted.

Note:

The F74Y0022 file will be filled for each document stored in Section 4. It stores the required information of the previous closed declaration where the document was included.The amounts are accumulated by Order Company, Order Type, Order Document, Service Explanation Code, Supply Method, Collection Method and Payment Country.

If there are no errors, the status of the declaration will be moved to '3 - Done - Ready to Close Declaration.

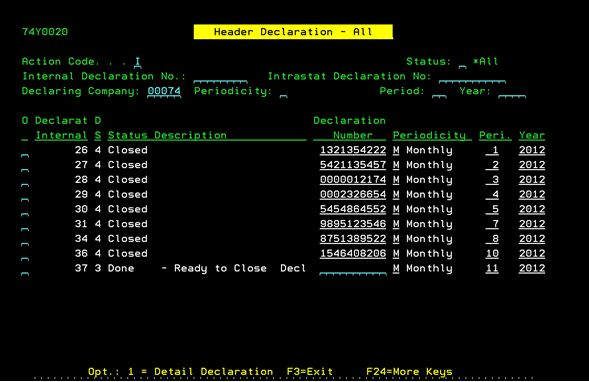

32.6 Intrastat Declaration Review

From Italian Localizations (G74Y), choose EU VAT Package INTRASTAT

From EU VAT Package INTRASTAT (G74Y001), choose Intrastat Declaration Review

This application is used to review the declarations in their different statuses. You can also inquire on the details of each declaration.

You can use the filter fields to select the declarations to review.

Figure 32-2 Header Declaration - All screen

Description of "Figure 32-2 Header Declaration - All screen"

Only some of the fields of the declaration header will be available to modify based on the declaration status:

-

Status "0-Pending - Ready to Gener. Data" - You can modify Periodicity, Period and Year.

-

Status "3-Done ready to Closed Decl" - You can complete the Declar. Number. With this action the program changes the declaration status from "3" to "4- Closed".

With Option '1' you can view the declaration in detail.

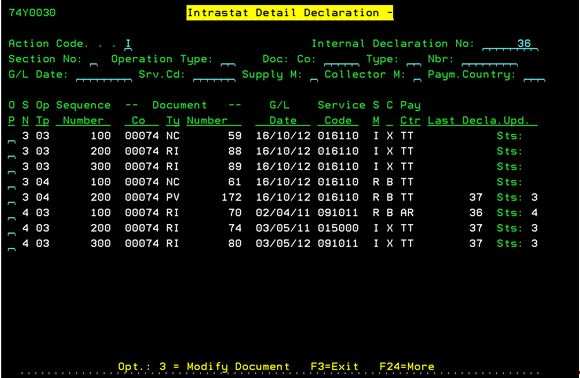

Figure 32-3 Intrastat Detail Declaration screen

Description of "Figure 32-3 Intrastat Detail Declaration screen"

With Option '3' you can modify documents from a closed declaration or from a declaration with status = '3-Done - Ready to Close Declaration' if the document is in Section 4.

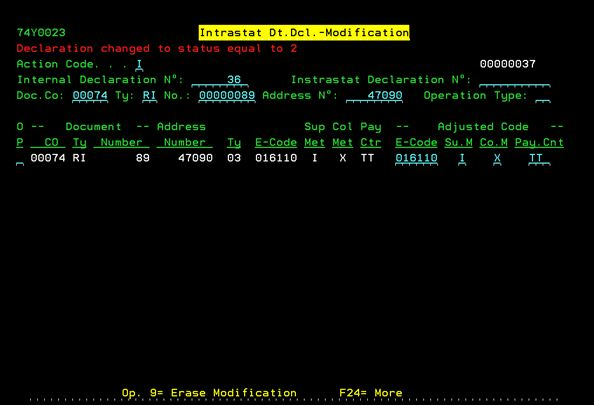

Figure 32-4 Intrastat Detail Declaration - Modification screen

Description of "Figure 32-4 Intrastat Detail Declaration - Modification screen"

Only the additional information fields (Service Explanation Code, Supplier Method, Collection Method and Payment Country) will be available to modify.

When a document is modified and there is not an active declaration for the company, the program will create a new Declaration with the following information:

-

New internal declaration number

-

Period and Year fields (will be advanced to the next period / year according to the latest closed declaration for that company).

-

Company information (will be based on the last declaration stored for that company).

If there is an active declaration for the company, the document will be added to that declaration and the information updated will be written to the Intrastat Declaration for Services-Modification file (F74Y0023).

If the document modified belongs to a declaration that is in status '3 - Ready to Close Declaration' the status will be modified to '2 - Pending - Ready to Generate Declaration' and the declaration files will be deleted. Also, a message will be displayed on the screen: "Declaration changed to status equal to .2".

32.7 Declaration Flat Files Generation

From Italian Localizations (G74Y), choose EU VAT Package INTRASTAT

From EU VAT Package INTRASTAT (G74Y001), choose Intrastat Declaration Steps

From Intrastat Declaration Steps (G74Y0011), use Declaration Flat Files section

There are four World Writer reports that allow the users to create the 4 sections that are required.

Each World Write will create a flat file with the information formatted as required:

| World Writer Report name | Description |

|---|---|

| INTRA_3_RS | Section 3 Received Services |

| INTRA_4_RS | Section 4 Received Services |

| INTRA_3_PS | Section 3 Performed Services |

| INTRA_4_PS | Section 4 Performed Services |

32.7.1 Export of the file to the IFS area

An IFS area must be set up on the iSeries for the XML files. See the A9.1 Online Documentation for instructions.

You must set up 'Batch Export Parameters' for each version. On the World Writer list, choose to change your version. On the Additional Parameters screen, select F6, "Spooled File Export Parms." Enter your IFS path in the field provided for it.

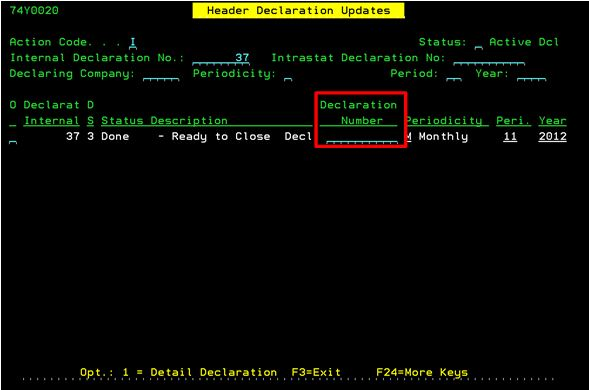

32.8 Closing Intrastat Declaration

From Italian Localizations (G74Y), choose EU VAT Package INTRASTAT

From EU VAT Package INTRASTAT (G74Y001), choose Intrastat Declaration Steps

From Intrastat Declaration Steps (G74Y0011), choose Header Declaration Updates

Once the declaration's files are sent through Intr@web, the declaration must to be closed.

To do this, the user must update the Intrastat Declaration Number field with the number provided by the Italian Tax Authority.

To update this field the user must access the Header Declaration Updates program and enter the number in the Declaration Number field.

Once this process is completed the declaration status will be updated to '4 - Closed' and no changes can be done to the declaration.