10 Set Up Transaction Nature Codes

This chapter contains these topics:

10.1 Setting up Transaction Nature Codes

From Localizations - Brazil (G76B), enter 29

From Localization Setup - Brazil (G76B41B), choose Transaction Nature

The transaction nature code (natureza da operação) is a legal code established by the Brazilian government. The code indicates for what the product is used, for example, raw material used in manufacturing or materials used for internal consumption. This code determines the incidence of tax for the product use.

In Brazil, the government requires companies to assign each business transaction a transaction nature code for tax purposes. This tax identification is the primary purpose of the code. The transaction nature code is a four-character code and has a two-character suffix.

The first digit of the code changes depending on the geographical location of the transaction, as well as whether the transaction indicates that something was received from a supplier or something was delivered to a customer. Digits 2-4 represent the product.

The two digits of the suffix identify additional features of the transaction. For example, the suffix for returned merchandise is 04, while the suffix for back orders is 05.

10.1.1 Understanding Transaction Nature Code Defaults

During Purchase Order and Sales Order entry, the system will attempt to default a transaction nature code, based on your Purchase Order Entry - Detail (P4311BR) and Sales Order Entry - Detail (P4211BR) setup. The 4th Digit of the Transaction Nature code can be retrieved from Item Category Codes.

If you enter different types of sales/purchase orders/nota fiscal, you may need to set up multiple versions of Sales Order Entry - Detail (P4211BR) and Purchase Order Entry - Detail (P4311BR).

The Calculate Transaction Nature server (X7615B) calls the Sales Order Entry - Detail (P4211BR) and Purchase Order Entry - Detail (P4311BR) versions according to:

-

The SO Entry (P4211), PO Entry (P4311) and Batch/EDI Order Edit/Creation (P40211Z) version names

-

Sales Transfers (P4242): P4211BR version name comes from P4242/ SO Entry processing option. P4311BR version name comes from P4242/PO Entry processing option.

-

PO Generator (P43011), SO Entry and/or PO Entry version processing options

If the version does not exist, ZJDE0001 version is used.

The code is validated against the Transaction Nature Code file (F7615B).

The table below explains how the system determines each of the 4 digits of the code. Always check to be certain that the default is correct for your order.

| 1st Digit | 2nd and 3rd Digits | 4th Digit |

|---|---|---|

| The system compares the ship-from and ship-to locations and defaults according to the list below.

1 Inbound, inside the state 2 Inbound, other states 3 Inbound, import 5 Outbound, inside state 6 Outbound, other states 7 Outbound, export |

Controlled by a processing option of P4211BR and P4311BR. If the processing option is blank, then the 2nd digit defaults to '1' and the 3rd digit defaults to '0'

If the processing option has a value, then the 2nd and 3rd digits default from it. |

Classifies the purpose of the goods. Is controlled by a processing option of P4211BR and P4311BR. If the processing option has a value, the 4th digit of the processing option becomes the default.

For Sales Order and Purchase Order entry: If the processing option is blank, or if the 4th position is an asterisk ( * ), the system defaults a 0 into the 4th digit of the Transaction Nature code at the header level. Only the first 3 digits are validated on the header, so it is not necessary to set up codes that end in 0 in the Transaction Nature file F7615B. On detail lines, the system obtains the value for the 4th digit from an item master category code. For example: If the processing option contains 523*, the header could default to 5230. But, the detail line will default from an item master category code. If that category code value = 1, the code on the detail line will be 5231. Any category codes in the range of SRP0 through SRP9 or PRP0 through PRP9 may be assigned. See user defined code 76/CN to enter the category code you prefer for the code NATUR, such as SRP6. The values for the 4th digit are then identified in the corresponding UDC table. For example, if you chose SRP6, you might set up these values in UDC 41/06: 1 Industrial product 2 Transferred product Note: UDCs 76/CN and 41/06 must have the same value for Portuguese language as the value in the base language. |

10.1.2 Before You Begin

-

Verify that the user defined codes tables for IPI Code - Fiscal Value (system 76, type IP) and ICMS Code - Fiscal Value (system 76, type II) are set up. See Section 3.2, "Setting Up User Defined Codes for Brazil"

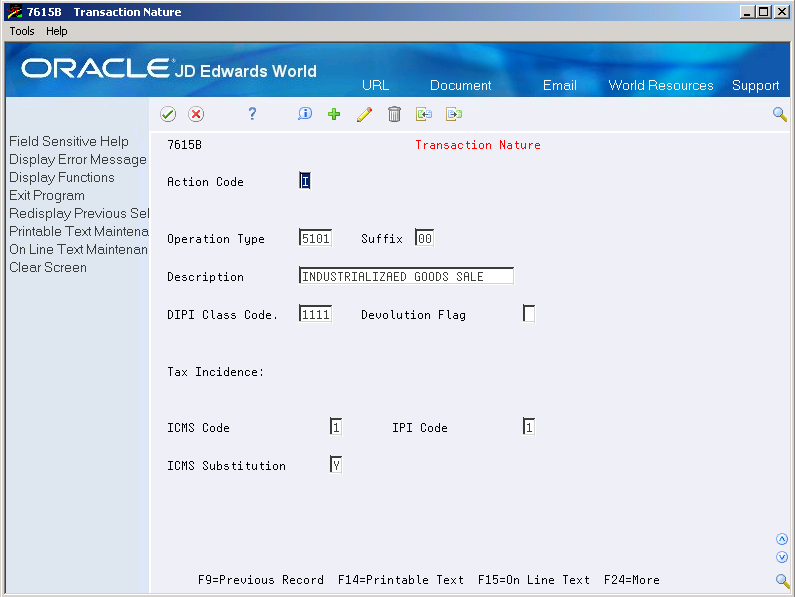

To set up transaction nature codes

-

To define a code for a specific type of transaction, complete the following fields:

-

Transaction Nature

-

Suffix

-

Description

-

DIPI Class Code

-

Devolution Flag

-

To specify the taxes for which the transaction type is eligible or exempt, complete the following fields:

-

ICMS Code

-

IPI Code

-

ICMS Substitution Flag

-

| Field | Explanation |

|---|---|

| Trans Nature | Use this four-character code to indicate different types of transactions for tax purposes.

To enter valid values for the Transaction Nature code, use the following convention: XYYY A value for X will default to define the origin of the transaction (inbound or outbound). Valid values for X are: 1 - Inbound, inside the state 2 - Inbound, other states 3 - Inbound, import 5 - Outbound, inside state 6 - Outbound, other states 7 - Outbound, export The values for YYY are defined by the fiscal authority to identify products. |

| Suffix Transaction Nature | Complete this two-character field in conjunction with the Transaction Nature code to identify the complementary implications of a type of transaction. For example, the suffix might indicate that a certain type of transaction represents a inventory change, or that a transaction is eligible for a certain type of tax.

Valid values might include: 01 - Bonus 02 - Demo 03 - Sample 04 - Return merchandise 05 - Back order 06 - Donation Examples of Transaction Nature codes with suffixes: 5111 01 - In state sale, bonus 5111 05 - In state sale, back order |

| DIPI Class Code | The DIPI Classification code is a four-character, alphanumeric field that you can use for tax reporting. Use this code to link the product with the Transaction Nature. |

| Devolution Flag | This flag applies to Sales Orders. Enter '1' to indicate devolution. |

| ICMS Code

(UDC 76 / II) |

Use this code to indicate how ICMS tax is assessed.

For example, you might set up your codes as follows: 1 - Taxable 2 - Exempt or Not Taxable 3 - Other This information indicates in which column of the Inbound/Outbound Fiscal Book the system prints the ICMS tax amount. |

| IPI Code

(UDC 76 / IP) |

Use this code to indicate how IPI is assessed.

Valid values are: 1 - Taxed 2 - Exempt 3 - Other or not taxed This information indicates in which column of the Inbound/Outbound Fiscal Book the system prints the IPI tax amount. |

| ICMS Substitution | Use this code to indicate whether a client or product is subject to tax substitution.

Valid values are: Y = Yes, use List Price Z = Yes, use Net Price N = No |