30 Set Up Exchange Rate Differences

This chapter contains these topics:

-

Section 30.2, "Setting Up Exchange Rate Differences for Accounts Receivable,"

-

Section 30.3, "Setting Up Exchange Rate Differences for Accounts Payable."

30.1 Setting Up Exchange Rate Differences

You need to perform the following steps to enable exchange rate differences:

-

For Accounts Receivable:

-

Specify the exchange rate differences processing:

-

Blank = No exchange rate differences processing.

-

1 = Exchange rate differences processing is active for all invoices.

-

2 = Exchange rate differences processing at the company level.

-

-

-

For Accounts Payable:

-

Specify the exchange rate differences processing:

-

Blank = No exchange rate differences processing.

-

1 = Exchange rate differences processing is active for all vouchers.

-

2 = Exchange rate differences processing at the company level.

-

-

-

At the company level, one for A/R and one for A/P:

-

Specify the exchange rate differences processing:

-

Blank = No exchange rate differences processing for the company.

-

1 = Exchange rate differences processing for all invoices and vouchers in the company.

-

-

30.1.1 Programs Used to Set Up Exchange Rate Differences

| Program Name | Navigation | Usage |

|---|---|---|

| Menu: Advanced International Processing (G09319) | From Russian Localization (G74R), select 1, Suspended Tax | Select an option for suspended tax. |

| Accounts Receivable Constants | From Advanced International Processing (G09319), select 2, Accounts Receivable Constants, and then 2, Accounts Receivable Constants. | Enter accounts receivable information, including Suspended Tax Processing. |

| Accounts Payable Constants | From Advanced International Processing (G09319), select 3, Accounts Payable Constants, and then 2, Accounts Payable Constants. | Enter accounts payable information, including Suspended Tax Processing. |

| Company Numbers & Names | From Advanced International Processing (G09319), select 4, Company Numbers and Names, and then select 2, Company Numbers & Names | Set up company information. |

30.2 Setting Up Exchange Rate Differences for Accounts Receivable

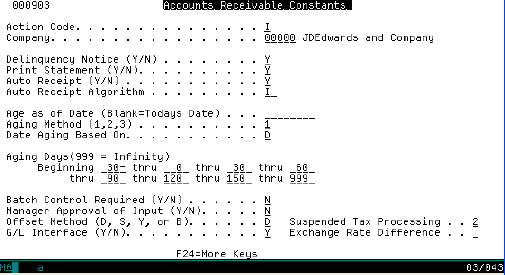

Figure 30-1 Accounts Receivable Constants screen

Description of "Figure 30-1 Accounts Receivable Constants screen"

To set up exchange rate differences for accounts receivable

On Accounts Receivable Constants

-

In the Action Code field, enter C.

-

In the Suspended Tax Processing field, enter blank for no suspended tax processing, 1 for suspended tax processing for all invoices and vouchers, or 2 for suspended tax processing at the company level.

-

In the Exchange Rate Difference field, enter blank for no exchange rate differences processing, 1 for exchange rate differences processing for all invoices, or 2 for exchange rate differences processing at the company level.

-

Press Enter to save the changes.

-

Press F3 to return to the Accounts Receivable Setup menu.

-

Enter G09319 and press Enter to return to the Advanced International Processing menu.

30.3 Setting Up Exchange Rate Differences for Accounts Payable

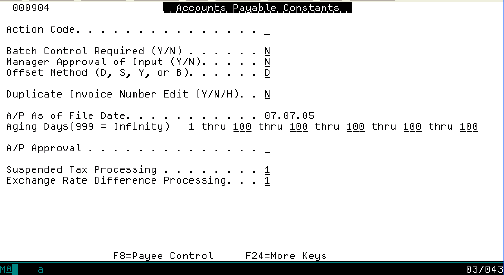

Figure 30-2 Accounts Payable Constants screen

Description of "Figure 30-2 Accounts Payable Constants screen"

To set up exchange rate differences for accounts payable

On the Accounts Payable Constants screen

-

In the Action Code field, enter C.

-

In the Suspended Tax Processing field, enter blank for no suspended tax processing, 1 for suspended tax processing for all invoices and vouchers, or 2 for suspended tax processing at the company level.

-

In the Exchange Rate Difference Processing field, enter blank for no exchange rate differences processing, 1 for exchange rate differences processing for all vouchers, or 2 for exchange rate differences processing at the company level.

-

Press Enter to save the changes.

-

Press F3 to return to the Accounts Payable Setup menu.

-

Enter G09319 and press Enter to return to the Advanced International Processing menu.