Understanding Multiple Currency Processing in General Ledger

Understanding Multiple Currency Processing in General LedgerThis chapter provides an overview of multiple currency processing in Oracle's PeopleSoft General Ledger and discusses how to:

Prepare to revalue account balances.

Define revaluation steps.

Prepare to translate ledger balances.

Set up translation rules.

Define translation steps.

Prepare for the translate within ledger process.

Combine steps into a multicurrency group.

Initiate multicurrency processing.

Use multicurrency processing.

Produce revaluation and translation reports.

Understanding Multiple Currency Processing in General Ledger

Understanding Multiple Currency Processing in General LedgerPeopleSoft's uniquely flexible structure enables you to manage financial information in multiple currencies. You can use a ChartField to designate different currency codes within a ledger or, as required, store each currency in a different ledger.

PeopleSoft General Ledger provides specific input, processing, and reporting features that satisfy the most demanding requirements of multinational financial management. PeopleSoft GL supports the European common currency (Euro), as well as currency conversions, remeasurement, revaluation, translation and a complete audit trail of all multicurrency processing.

PeopleSoft also includes position accounting, which enables you to identify and track the risks associated with holding financial assets in currencies other than your base currency.

See Also

Setting Up Position Accounting

Preparing to Revalue Account Balances

Preparing to Revalue Account Balances

Periodically, you may need to revalue the base currency of the balance sheet accounts that you maintain in foreign currencies to reflect changes in value due to fluctuations in exchange rates. The General Ledger Revaluation process (FSPCCURR) adjusts the base currency value of the account balances by creating adjusting entries for the accounts being revalued. It creates corresponding entries for any gain or loss that results from the revaluation. Revaluation typically takes place at the end of each accounting period prior to translation.

For example, suppose that a company whose base currency is U.S. dollars (USD) made the following cash deposits in Swiss francs (CHF):

|

Transaction Date |

CHF |

Exchange Rate |

USD |

|

January 10, 2009 |

100 |

0.45 |

45 |

|

January 15, 2009 |

100 |

0.50 |

50 |

|

January 20, 2009 |

100 |

0.55 |

55 |

|

January 31, 2009 Balance |

300 |

150 |

At month end, revaluation takes place at the CHF to USD exchange rate of 0.55. The account is revalued at 165 USD (300 * 0.55 = 165). The following journal entry recognizes the increase in value with a debit of 15 USD to the asset account and a corresponding credit to the revaluation gain account:

|

Description |

Debit |

Credit |

|

Cash in Bank |

15 USD |

|

|

Revaluation Gain |

15 USD |

Note. General Ledger revalues ledger balances for all foreign currencies.

When you want the results of revaluation to go into accounts that are different from the source accounts, use the Target ChartField Entry page, on which you can indicate target unrealized gain and loss accounts.

In General Ledger, the following processing takes place when you revalue accounts:

Revaluation gains and losses are calculated for accounts maintained in foreign currencies.

Balances of affected accounts are adjusted to the new value.

The system generates an adjusting entry to the base currency balance plus a corresponding entry to the revaluation gain/loss account.

You can choose to:

Create journal entries to reverse the revaluation results in the following period.

Create journal entries to provide an audit trail of revaluations automatically.

Report revaluation gains and losses using PS/nVision.

Defining Revaluation Steps

Defining Revaluation Steps

To define revaluation steps, use the Revaluation Step component (REVAL_STEP).

This section discusses how to:

Specify a ledger and TimeSpan for revaluation.

Specify source ChartFields for revaluation.

Specify output and journal options for revaluation.

Specify gain and loss ChartFields for revaluation.

Pages Used to Define Revaluation Steps

Pages Used to Define Revaluation Steps|

Page Name |

Definition Name |

Navigation |

Usage |

|

REVAL_STEP_LED_TM |

General Ledger, Process Multi-Currency, Define and Process, Revaluation Step, Ledger and TimeSpan |

Define a ledger, TimeSpan, and rate type for revaluation. |

|

|

REVAL_STEP_CF |

General Ledger, Process Multi-Currency, Define and Process, Revaluation Step, Source ChartFields |

Identify accounts to revalue. |

|

|

CURR_STEP_OUT_JR |

General Ledger, Process Multi-Currency, Define and Process, Revaluation Step, Output and Journal Options |

Specify output options, journal information, and revaluation reversal options. Also, use the Translation Step - Output and Journal Options version of this page to determine whether General Ledger automatically posts translated amounts to the ledger or generates journal entries for subsequent posting. |

|

|

CURR_STEP_GN_LS |

General Ledger, Process Multi-Currency, Define and Process, Revaluation Step, Gain and Loss ChartFields |

Identify the revaluation gain and loss accounts or specify the specific accounts where you record translation gain or loss. |

Specifying a Ledger and TimeSpan for Revaluation

Specifying a Ledger and TimeSpan for Revaluation

Access the Ledger and TimeSpan page (General Ledger, Process Multi-Currency, Define and Process, Revaluation Step, Ledger and TimeSpan).

|

Allow Book Code Override |

Select this check box to enable you to choose different book code and account combinations at the time of revaluation journal entry. You can then associate any of your book codes with the account value to record related amounts in the same ledger. For example, book codes C, L or B can be associated with account 500001. The chief advantage of this method is that fewer account values are required. The book codes that you can associate with an account are available from a drop down list at the time of journal entry. See PeopleSoft Application Fundamentals 9.1 PeopleBook, Defining and Using ChartFields: Adding Book Code Values See PeopleSoft Application Fundamentals 9.1 PeopleBook, Defining and Using ChartFields: Adding Account Values See PeopleSoft Global Options and Reports 9.1 PeopleBook, Managing Multiple GAAPs and Prior Period Adjustments: Book Code See PeopleSoft Application Fundamentals 9.1 PeopleBook, Setting Installation Options for PeopleSoft Applications, Setting Overall Installation Options |

|

From Ledger Group and Ledger |

Specify the from ledger group and specific ledger in which you want to perform the revaluation. You cannot specify a translation ledger for revaluation. If you do not specify a ledger, revaluation revalues the amounts of all the ledgers in the ledger group. To revalue a ledger group with KLS (keep ledgers in sync) selected, you must leave the Ledger field blank.

Note. The effect of a base amount adjustment resulting form

a revaluation of a primary ledger within a ledger group that has keep ledgers

in sync (KLS) selected, is carried down to a translate ledger if it is a

secondary ledger in that KLS ledger group by either a journal edit or by a

revaluation if the edit option is not selected. |

|

TimeSpan |

General Ledger generates journal entries whose amounts represent the period of time indicated by the TimeSpan for the revaluation being processed. The TimeSpan normally used for balance sheet accounts is BAL (year to date). With this TimeSpan, the system totals the account balances in periods 0 through n for balance sheet accounts. |

|

Rate Type |

Enter the exchange rate type for the process. |

Specifying Source ChartFields for Revaluation

Specifying Source ChartFields for Revaluation

Access the Source Chartfields page (General Ledger, Process Multi-Currency, Define and Process, Revaluation Step, Source Chartfields).

|

ChartField |

Select the ChartField (for example, Account or Alternate Account) for which values are to be revalued using the TimeSpan and rate type specified. |

|

How Specified |

List your accounts individually by selecting the Selected Detail Values check box or, more likely, select the Selected Tree Nodes check box. The latter option activates the Tree Information fields for you to specify a tree from which to select nodes. Using trees establishes rollups for the account values so that you can select particular types of accounts according to the structure of your business unit. |

|

Tree |

Use trees to establish rollups for account values. |

|

Level |

(Optional) If the tree has levels, you can limit prompting in this field to selected levels. |

|

ChartField Values/Tree Nodes |

Select particular types of accounts according to the structure of your business unit. We recommend that you use trees whenever possible to reduce future maintenance when your ChartField values change. |

Specifying Output and Journal Options for Revaluation

Specifying Output and Journal Options for Revaluation

Access the Output and Journal Options page (General Ledger, Process Multi-Currency, Define and Process, Revaluation Step, Output and Journal Options).

|

Journal ID Mask |

Identifies the revaluation journal naming convention that you specify. General Ledger identifies journals by a 10-character alphanumeric identifier. The system automatically names journals starting with the mask value that you specify here. For example, if you entered a mask of RVAL1, the system supplies the remaining characters based on the next available journal ID number. If the next available journal ID number is 19, the generated journal ID would be RVAL100019. Alternatively, if you do not use the journal ID mask, the system automatically assigns the next 10-character available journal ID number. If you use a journal ID mask, reserve a unique mask value to ensure that no other process creates the same journal ID. |

|

Description |

Describes this revaluation step. |

|

Source |

Identifies the source of the journals. You can select any valid source on the Source table. |

|

Document Type |

If you enabled PeopleSoft Document Sequencing in your system, select a predefined document type for your revaluation journals. Document sequencing requires that you have a document type for all of the journal entries that you create. |

|

Create Journal Entries |

Creates journal entries with a header status of V = Valid that can be posted automatically as part of revaluation processing or through the normal posting methods. Select the Post Journal(s) check box along with this option to automatically post the journals created. |

|

Edit Journal(s) |

Because values being processed are from previously edited data in existing ledger tables, journal entries are created with a valid status. However, you can submit journal entries created by revaluation to the journal edit process to be validated for such things as changes to combination edits or inactivated ChartFields. You can then review the journals using journal inquiry after you edit them. Note. To restrict further activity for inactive accounts that have balances, you bypass journal edit and post translation journals for these accounts. Deselect the Edit Journals check box to bypass journal edit. The multicurrency process handles the multibook processing features within journal edit for these journals. |

|

Budget Check Journal(s) |

Submits journal entries to the budget processor for the control budget. |

|

Post Journal(s) |

Posts the journals to the target ledger as part of revaluation processing. When you process multiple revaluation steps together, where each step depends on the results of the previous step, you must select this check box for all but the last step to provide updated ledger balances for each subsequent step. In the last step, posting the journals is optional. The journals created by multicurrency processing are not intended or designed to be viewed using the journal entry pages before running journal edit or journal post. |

Note. When you run revaluation on secondary ledgers in a multibook ledger group, the revaluation version of this page produces a journal with a journal header and journal lines for the secondary ledgers only. This action optimizes performance. If you attempt to view these journals using the Journal Entry pages, this type of journal may appear corrupt because no primary ledger lines exist for the ledger group. If you want to view the primary ledger lines from the Journal Entry pages, the recommended procedure is to run the Journal Edit process on all multicurrency journals. The journal editing process creates the missing primary ledger lines needed to view the complete journal.

See Setting Up Multicurrency Processing.

Adjustment Period

|

Target to Adjustment Period |

Click to specify an adjustment period as the accounting period for the revaluation journals and to enter a period in the Target Adjusting Period field. An adjustment period revaluation journal can only be reversed to an adjustment period. If you want to reverse the journal, click the Reversal link and select the Adjustment Period check box to enter an adjustment period in the Specify field on the MultiCurrency Process Journal Reversal page. |

Reversal

|

Reversal |

Click the link to access the options. To facilitate period based reporting, the system generates a reversal for the period that follows the revaluation process period. The net amount that results on the target ledger represents the current period year-to-date (YTD) amount, less the reversal amount generated by the prior period process run. (The reversal journal date is calculated using the as-of date of the process request, the reversal option, and business unit calendar.) Select a reversal code:

|

Target ChartFields

|

ChartField |

Select the ChartFields to be included in the revaluation journal entries. The ChartFields defined here relate to the ChartFields that you specified on the Specifying Gain and Loss ChartFields for the Revaluation page. If you are balancing by ChartFields, include all balancing ChartFields as your target ChartFields. |

|

Retain Value (retain ChartField value) |

You can either select this check box or enter a ChartField value in the Chartfield Value column. If you select this check box, the ChartField values are carried over from the source transaction entries to the system-generated position accounts. For the ledger defined on the Ledger and TimeSpan page and for a balancing ChartField as defined in the ledger group, if Retain Value is selected for the gain and loss ChartFields, it must also be selected here for the Target ChartField. If Retain Value is not selected for gain and loss ChartFields, then it is clear for the Target ChartField. All three fields must have the same ChartField value if retain value is not selected. |

|

ChartField Value |

If you did not select the Retain Value check box, use this field to specify the ChartField value to be used for the system-generated target account. If you enter a ChartField value here, the system ignores the ChartField value on the source transaction entry. When a ChartField value is not included in target ChartFields, it is blank for the target journals. Extra gain or loss entries can be created from multiple runs of revaluation, if the gain ChartField value is different from the corresponding loss ChartField value. |

Specifying Gain and Loss ChartFields for Revaluation

Specifying Gain and Loss ChartFields for Revaluation

Access the Gain and Loss Chartfields page (General Ledger, Process Multi-Currency, Define and Process, Revaluation Step, Gain and Loss Chartfields).

General ledger posts the offsetting entries that correspond to the adjusting entries created during revaluation to the accounts specified as follows—credits to the gain ChartFields, debits to the loss ChartFields.

|

Gain ChartKeys |

Enter the ChartField and either select the Retain Value check box or enter a value in the ChartField Value field. |

|

ChartField |

Indicate the ChartFields to be included in the revaluation gain and loss journal entries. If you are balancing by ChartFields, include all balancing ChartFields (do not include business unit and currency) as your target ChartFields. |

|

Retain Value (retain ChartField value) |

You can either select this check box or enter a ChartField value in the Chartfield Value field. If you select this check box, the ChartField values are carried over from the source transaction entries to the system-generated position accounts. Select Retain Value for a ChartField for both gain and loss, or for neither. So, for the same ChartField, either select both check boxes, or deselect both. For the ledger defined on the Ledger and TimeSpan page, for a balancing ChartField as defined in the ledger group, if Retain Value is selected for the gain and loss ChartFields, it must also be selected for the Target ChartField. If the Retain Value check box is deselected for gain and loss ChartFields, then it is clear for the Target ChartField. All three fields must have the same ChartField value if Retain Value is clear (not selected). Extra gain or loss entries may be created from multiple runs of revaluation if a ChartField is set to retain value in gain or loss but not in target. If some ChartFields are not included as target ChartFields, they will be blank. |

|

ChartField Value |

If you did not select the Retain Value check box, use this field to specify the ChartField values that are to be used for the system-generated target account. If you enter a ChartField value here, the system ignores the ChartField value on the source transaction entry. When a ChartField value is not included in target ChartFields, it will be blank for the target journals. |

|

Loss ChartKeys |

Enter the loss ChartField and either select the Retain Value check box or enter a ChartField value. The field definitions for the loss ChartFields are the same as for gain ChartFields. If a ChartField retains value for gains, it must retain value for loss, and conversely. |

Note. When you balance by ChartFields, if a balancing ChartField is designated as a gain or loss ChartField, then the balancing ChartField overrides the value specified on this page.

Preparing to Translate Ledger Balances

Preparing to Translate Ledger Balances

General Ledger translates posted balances into different currencies according to the rules you define, and calculates gains or losses due to restatement. You can run translation at any time because it is a background process. General Ledger can perform regular translation on any type of ledger.

If you perform multiple translations for each business unit—such as a remeasurement followed by translation— General Ledger enables you to define a separate set of processing rules for each translation. It considers each translation as a translation step.You can process as many translation steps as you require at one time.

Note. Although remeasurement is considered a separate process to precede translation under FASB 52, it is defined in General Ledger as a translation step with different exchange rates. To perform a remeasurement, set up a translation step as described in this section to translate your base currency balances to functional currency balances. You can also use the multibook feature to maintain a secondary ledger in your functional currency.

See Also

Setting Up Translation Rules

Setting Up Translation Rules

Because different accounts are translated according to different exchange rate rules, you can use the Translation Rule pages to define which accounts are processed with which conversion rate types. This information defines your approach to translating types of accounts. For example, you can translate your asset and liability accounts at the current rate, but use historical rates to translate equity accounts. You refer to these rules when you define your translation steps.

To set up translation rules, use the Translation Rule component (TRANS_RULE).

This section discusses how to:

Define TimeSpans and rates for a translation rule.

Define ChartFields for a translation rule.

Pages Used to Set Up Translation Rules

Pages Used to Set Up Translation Rules|

Page Name |

Definition Name |

Navigation |

Usage |

|

TRANS_RULE_TIME_RT |

General Ledger, Process Multi-Currency, Define and Process, Translation Rules, TimeSpan and Rate |

Define TimeSpans and rates for a translation rule. |

|

|

TRANS_RULE_CF |

General Ledger, Process Multi-Currency, Define and Process, Translation Rules, Chartfields |

Specify the ChartFields for the translation rule. |

Defining TimeSpans and Rates for a Translation Rule

Defining TimeSpans and Rates for a Translation Rule

Access the Translation Rules - TimeSpan and Rate page (General Ledger, Process Multi-Currency, Define and Process, Translation Rules, TimeSpan and Rate).

|

TimeSpan |

General Ledger generates journal entries for amounts that represent the period of time indicated by the TimeSpan for the translation rules being processed. The TimeSpan commonly used is ITD (inception-to-date profit and loss accounts) or BAL (balance sheet accounts). Using these TimeSpans, the system sums the account balances in periods 1 through n for profit and loss accounts and in periods 0 through n for balance sheet accounts. |

|

Rate Type |

Select the applicable exchange rate type. |

Defining ChartFields for a Translation Rule

Defining ChartFields for a Translation Rule

Access the Chartfields page (General Ledger, Process Multi-Currency, Define and Process, Translation Rules, Chartfields).

|

ChartField |

Select the ChartField to be translated using the TimeSpan and rate type specified. For example, assets and liabilities are typically translated as balances (BAL) at the current exchange rate (CRRNT), while retained earnings are translated at a historical exchange rate (HSTRE). |

|

How Specified |

Select the Selected Detail Values option to list asset accounts individually or, more likely, select the Selected Tree Nodes option to activate the Tree Information fields, where you can specify a tree from which to select nodes. |

|

Tree Information |

Enter each tree node in the Tree field. The Level field is optional. If the tree has levels, you can limit prompting to selected levels. Using trees establishes rollups for the account values so that you can select particular types of accounts according to the structure of your business unit. We recommend that you use trees whenever possible to reduce future maintenance when your ChartField values change. |

Defining Translation Steps

Defining Translation Steps

Use the Translation Step pages to define how a specific translation is to be processed.

To define translation steps, use the Translation Step component (TRANS_STEP).

This section discusses how to:

Specify ledgers for translation.

Specify rules for translation.

Specify output and journal options for translation.

Specify gain and loss ChartFields for translation.

Pages Used to Define Translation Steps

Pages Used to Define Translation Steps|

Page Name |

Definition Name |

Navigation |

Usage |

|

TRANS_STEP_LED |

General Ledger, Process Multi-Currency, Define and Process, Translation Steps, Ledger |

Specify the source and target ledger group and ledgers for a translation step. |

|

|

TRANS_STEP_RULE |

General Ledger, Process Multi-Currency, Define and Process, Translation Steps, Rule |

Specify which translation rules to use in this step. |

|

|

CURR_STEP_OUT_JR |

General Ledger, Process Multi-Currency, Define and Process, Translation Steps, Output and Journal Options |

Use the Specifying Output and Journal Options for Revaluation page to determine whether General Ledger automatically posts translated amounts to the ledger or generates journal entries for subsequent posting. |

|

|

CURR_STEP_GN_LS |

General Ledger, Process Multi-Currency, Define and Process, Translation Steps, Gain and Loss Chartfields |

Specify the specific accounts where you record translation gain or loss. |

|

|

TRANS_PROCESS_INQ |

General Ledger, Process Multi-Currency, Review Results Online, Translation Process Log |

Review the results of your translation process online using the Translation Process Log. |

Specifying Ledgers for Translation

Specifying Ledgers for TranslationAccess the Ledger page (General Ledger, Process Multi-Currency, Define and Process, Translation Steps, Ledger).

|

From Ledger Group |

Specify the ledger group to be translated. |

|

From Ledger |

Required for translation. You can translate any type of ledger in a group, including secondary, primary, and translation ledgers. |

|

Target Ledger Group |

Select the target ledger group that is to receive the results. Translation only creates journals to a ledger group that is defined as a translation ledger in the Ledger Group Type field on the Detail Ledger Group page. Translation creates balances for the primary ledger of the target ledger group. Other adjustment journals are allowed to this ledger. |

|

From Currency Type |

Select one of the following values:

The system translates a currency to the base currency of the target ledger, and it populates both the foreign amount and the monetary amount in the journal. In turn, the system populates the POSTED_TOTAL_AMT and POSTED_BASE_AMT fields in the translation ledger. These two fields are always the same in the ledger. The foreign currency and the base currency will always be the same for the journals posting to this ledger. |

|

From Currency |

If you selected S (specify) in the From Currency Type field, then select the currency code in the From Currency drop-down list. |

Specifying Rules for Translation

Specifying Rules for Translation

Access the Rule page (General Ledger, Process Multi-Currency, Define and Process, Translation Steps, Rule).

|

Translation Rule |

Select the translation rules. Remember that any translation rules that you select here must already be defined in the Translation Rules table. |

Specifying Output and Journal Options for Translation

Specifying Output and Journal Options for Translation

Access the Output and Journal Options page (General Ledger, Process Multi-Currency, Define and Process, Translation Steps, Output and Journal Options).

Refer to the Specifying Output and Journal Options for Revaluation topic to complete this page. General Ledger can generate journal entries for subsequent posting.

|

Undo Previous Process |

Select the Undo Previous Process check box when you need to rerun the translation process for a period that has already been processed. Selection of this check box clears the entries that were created by the previous process for the requested processing periods. If the translation journals are not yet posted to General Ledger, the process deletes them. If they have been posted, the process removes the amounts from the ledger before it deletes the journals. If you select this check box and the translation process has not yet been run for the given period, you will receive an error in the message log. In this case, merely deselect the Undo Previous Process check box and run the process. |

|

Undo - Do Not Delete Journals |

Select this option to undo the previous translation process without deleting the previously-generated journals. This option is primarily useful to countries where document sequencing is required or in companies that use data warehousing or a metadata storage process. If the previous journals were deleted, as in the Undo Previous Process option, the sequencing of documents and metadata would no longer agree with the data. Be careful if you select this option and have journals from the Translation process that have not been posted, you can accidentally post those journals and cause them to be double-booked. |

You can use the Translation Process Log page to review the results of the translation process (General Ledger, Process Multi-Currency, Review Results Online, Translation Process Log).

Note. If the process ends prematurely during an Undo process, unlock the journals for the process instance before rerunning the Undo process.

See Also

Specifying Output and Journal Options for Translation Within Ledger

Specifying Gain and Loss ChartFields for Translation

Specifying Gain and Loss ChartFields for Translation

Access the Gain and Loss Chartfields page (General Ledger, Process Multi-Currency, Define and Process, Translation Steps, Gain and Loss Chartfields).

Refer to the Specifying Gain and Loss Chartfields for Translation Within Ledger topic to complete this page. On this page, you specify the accounts for which you will record translation gain or loss.

The following check boxes appear only on the translation step version of this page:

|

Check Balance of Step |

Select this check box to have the system check the balances of your step entries to ensure that they are balanced. Checking the balance on your translation step definition entries protects the integrity of your target ledger. If you specify your target ledger as a balanced ledger and you deselect this check box, you must select the Generate Adjustment check box so that your target ledger stays balanced. |

|

Generate Adjustment |

Select this check box to have the system calculate a currency adjustment. If you do a partial translation, your gain or loss includes an offset required to bring your step into balance in addition to the actual currency adjustment. If you deselect this check box, the gain ChartFields and loss ChartFields are unavailable. |

See Also

Specifying Gain and Loss ChartFields for Translation Within Ledger

Preparing for the Translate Within Ledger Process

Preparing for the Translate Within Ledger Process

To prepare for the Translate Within Ledger process, use the Translation Within Ledger component (MBXLAT).

This section provides an overview of the Translate Within Ledger translation process and discusses how to:

Specify a ledger and TimeSpan for translation within ledger.

Specify ChartFields for translation within ledger.

Specify output and journal options for translation within ledger.

Specify gain and loss ChartFields for translation within ledger.

Understanding the Translate Within Ledger Translation Process

Understanding the Translate Within Ledger Translation ProcessAt the end of the accounting period, you can run the Translate Within Ledger translation process against the translation ledger to produce the appropriate gain or loss adjustment. This process handles the translation ledger in the same manner as revaluation processing. The Translate Within Ledger process only processes translation ledgers.

Prepare for this process on the Detail Ledger Group - Definition page by establishing a particular ledger as a translation ledger.

When journal lines are generated online for the secondary ledgers of a multibook ledger group, the base currency is calculated differently for currency (multibook) translation ledgers than for normal secondary ledgers. Normal secondary ledger lines contain a foreign currency and foreign amount equal to the transaction currency and transaction amount of the primary ledger. For multibook translation ledgers, lines are generated with the foreign currency and foreign amount equal to that of the base currency and base amount of the primary ledger. As a result, multibook translation ledgers have no more than one foreign currency at any time. This foreign currency will always be the base currency of the primary ledger of the ledger group.

The Translation Within Ledger process generates a translation adjustment with the multibook translation ledger for specified accounts in order to maintain a real-time balance for the accounts. Use the Translate Within Ledger Group pages to define the criteria for running this process.

To prepare for the Translate Within Ledger process, use the Translation Within Ledger component (MBXLAT).

See Also

Linking Ledgers to a Ledger Group

Pages Used for the Translate Within Ledger Process

Pages Used for the Translate Within Ledger Process|

Page Name |

Definition Name |

Navigation |

Usage |

|

MBXLAT_STEP_LED_TM |

General Ledger, Process Multi-Currency, Define and Process, Translation Within Ledger, Ledger and TimeSpan |

Define a ledger and TimeSpan for the Translate Within Ledger process. |

|

|

MBXLAT_STEP_CF |

General Ledger, Process Multi-Currency, Define and Process, Translation Within Ledger, Chartfields |

Identify the accounts that you want to include in your step. |

|

|

CURR_STEP_OUT_JR |

General Ledger, Process Multi-Currency, Define and Process, Translation Within Ledger, Output and Journal Options |

Determine whether General Ledger automatically posts translated amounts to the ledger or generates journal entries for subsequent posting. |

|

|

CURR_STEP_GN_LS |

General Ledger, Process Multi-Currency, Define and Process, Translation Within Ledger, Gain and Loss Chartfields |

Specify the specific accounts where you record translation gain or loss. |

Specifying a Ledger and TimeSpan for Translation Within Ledger

Specifying a Ledger and TimeSpan for Translation Within Ledger

Access the Ledger and Timespan page (General Ledger, Process Multi-Currency, Define and Process, Translation Within Ledger, Ledger and TimeSpan).

Although the Translation Within Ledger - Ledger and TimeSpan page is a different object than the Revaluation - Ledger and TimeSpan page, the fields are common to both pages.

|

From Ledger Group and Ledger |

Specify the from ledger group and specific ledger in which you want to perform the Translate Within Ledger process. You must specify a translation ledger for this process. If you do not specify a ledger, the Translate Within Ledger process is run by the system against all the translation ledgers in the ledger group. |

|

TimeSpan |

General Ledger generates journal entries for which the amounts represent the period of time indicated by the TimeSpan for the step definition being processed. The TimeSpan typically used is BAL (balance sheet accounts). With this TimeSpan, the system totals the account balances in periods 0 through n for balance sheet accounts. |

|

Rate Type |

Enter the applicable rate type for the process. |

See Also

Specifying a Ledger and TimeSpan for Translation Within Ledger

Specifying ChartFields for Translation Within Ledger

Specifying ChartFields for Translation Within Ledger

Access the Chartfields page (General Ledger, Process Multi-Currency, Define and Process, Translation Within Ledger, Chartfields).

Although this ChartField page has a different object name than the Revaluation - Source Chartfields page, the fields are common to both pages. See the Specifying Source ChartFields for Revaluation topic.

|

Chartfields |

Select the accounts to be processed in the Chartfields group box. For example, you can list your balance sheet accounts individually as detail values or, more typically, you can define tree nodes. Using trees establishes rollups for the account values so that you can select particular types of accounts according to the structure of your business unit. |

See Also

Specifying Source ChartFields for Revaluation

Specifying Output and Journal Options for Translation Within Ledger

Specifying Output and Journal Options for Translation Within Ledger

Access the Output and Journal Options page (General Ledger, Process Multi-Currency, Define and Process, Translation Within Ledger, Output and Journal Options).

Refer to the Specifying Output and Journal Options for Revaluation topic for information about specifying output options, journal information, and revaluation reversal options for the Translation Within Ledger process.

See Also

Specifying Output and Journal Options for Revaluation

Specifying Gain and Loss ChartFields for Translation Within Ledger

Specifying Gain and Loss ChartFields for Translation Within Ledger

Access the Gain and Loss Chartfields page (General Ledger, Process Multi-Currency, Define and Process, Translation Within Ledger, Gain and Loss Chartfields).

Refer to the Specifying Gain and Loss Chartfields for Revaluation topic when specifying Translate Within Ledger gain and loss accounts.

See Also

Specifying Gain and Loss ChartFields for Revaluation

Combining Steps into a Multicurrency Group

Combining Steps into a Multicurrency Group

Once you have defined the steps necessary to accomplish your desired revaluation, translation, or Translate Within Ledger process, you define a multicurrency group that specifies the processing sequence for these steps.

To combine steps into a multicurrency group, use the Currency Group component (CURR_GROUP).

This section discusses how to combine steps in a multicurrency group.

Page Used to Combine Steps in a Multicurrency Group

Page Used to Combine Steps in a Multicurrency Group|

Page Name |

Definition Name |

Navigation |

Usage |

|

CURR_GROUP |

General Ledger, Process Multi-Currency, Define and Process, Define Process Group, MultiCurrency Process Group |

Define a multicurrency group. |

Combining Steps in a Multicurrency Group

Combining Steps in a Multicurrency GroupAccess the MultiCurrency Process Group page (General Ledger, Process Multi-Currency, Define and Process, Define Process Group, MultiCurrency Process Group).

|

Sequence |

Determines the order in which the system performs the steps. Because the ledger may be updated with each step, the steps must be performed in the appropriate sequence. |

|

Process Step |

Enter the revaluation, translation, or Translate Within Ledger Process step. The system displays the description for the process step. After defining a step, you can select it for the multicurrency group sequence. You can also reuse steps from other multicurrency groups. |

|

Continue |

Click this link to indicate that even if this step fails, processing should continue to the next step. |

Initiating Multicurrency Processing

Initiating Multicurrency Processing

This section discusses how to request multicurrency processing.

Page Used to Initiate Multicurrency Processing

Page Used to Initiate Multicurrency Processing|

Page Name |

Definition Name |

Navigation |

Usage |

|

CURR_REQUEST |

General Ledger, Process Multi-Currency, Define and Process, Request Process, Multi-Currency Process Request |

Once you have specified the multicurrency group, use this page to set up a multicurrency processing request. |

Requesting Multicurrency Processing

Requesting Multicurrency ProcessingAccess the MultiCurrency Process Request page (General Ledger, Process Multi-Currency, Define and Process, Request Process, Multi-Currency Process Request).

|

Group |

Identify the multicurrency group to be processed with this request, for example,REVALBAL for Revaluation processing. When errors occur and processing aborts, you can restart processing at the step that failed by selecting the Start Step check box rather than processing all the steps in a process group. This option becomes available only if errors occur during processing. |

|

Calc Log (calculation log) |

Select this check box if you want the system to create a log of all the calculations performed during processing. |

|

Request Date Option |

You can select As of Date and then specify a date in the As of Date field. You can define steps using relative TimeSpans, such as BAL (current balance). A relative time span causes the process that you are running to retrieve ledger amounts relative to the as of date specified on the MultiCurrency Process Request page. The steps processed by this multicurrency process request must be effective on or before the as of date. You can also select Business Unit Process Date, in which case the process uses the date option on the business unit general ledger definition. The system retrieves the date and uses it as the as of date. |

|

As of Date |

Used to retrieve the following:

If a step definition indicates that a journal should be created, then the system uses the as of date as the journal date. |

Note. The journals created by multicurrency processing were not designed for viewing with the Journal Entry pages. Run the Journal Edit process against these journals before you attempt to view them.

Using Multicurrency Processing

Using Multicurrency Processing

Let us look at two multicurrency processing scenarios. The first scenario shows how you maintain multiple books using all multicurrency processes; the second scenario compares the single book translation to the results of maintaining a translation ledger within a multibook environment.

This section discusses how to:

Use multicurrency processing in a multibook environment.

Compare multibook translation ledger results to translation in a single book environment.

Note. General Ledger must be installed and the Create MultiBook Accounting Entries in Subsystems check box must be selected on the Installed Products page for multibook functionality to be available in subsystems, such as PeopleSoft Accounts Payable.

Using Multicurrency Processing in a Multibook Environment

Using Multicurrency Processing in a Multibook Environment

In the following example, we demonstrate multicurrency processes in a multibook environment. Suppose that your company uses the following ledger structure:

|

Business Unit: |

C007 (CHF) |

|

Ledger Group: |

MULTI-TRAN |

|

Ledgers: |

|

Also assume the following currency transactions:

|

Currency Exchanges |

Exchange Rate - Transaction Date |

Exchange Rate - Reporting Date |

|

MXN to CHF |

0.295 |

0.297 |

|

MXN to EUR |

0.179 |

0.175 |

|

CHF to USD |

0.602 |

0.605 |

The results of using revaluation in a multibook environment is explained in the next section.

Using Revaluation in a Multibook Environment

The following topics discuss various aspects of revaluation processing in a multibook environment.

Beginning Ledger

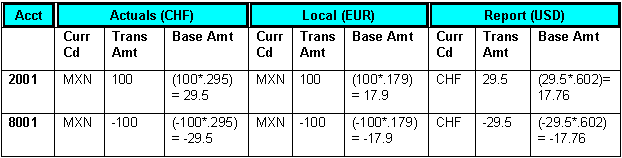

This table shows the results of revaluation in a multibook environment. Assume that the following balances exist in the ledger. Account 2001 is a balance sheet account; 8001 is a profit and loss account. The base amount calculations are shown to exhibit the derivation of the base currency balance:

Example of assumed beginning ledger balances

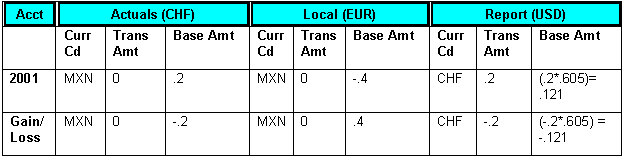

Month End Revaluation Journal (Only Revalue Balance Sheet Accounts)

This journal results from running revaluation on the entire ledger group. The revaluation process skips the report ledger because it is specified as a translation ledger. The actuals and local ledgers are revalued. Running journal edit on this ledger carries the adjustments to the base currency of the actuals ledger down to the report ledger.

Example of month end revaluation

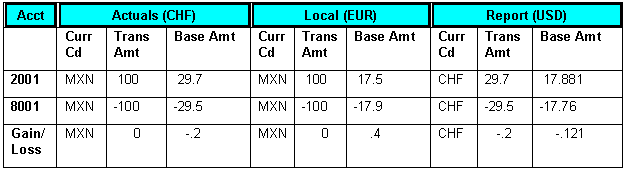

Ending Ledger

The following table contains the ending ledger amounts after the revaluation:

Example of ending ledger amounts

Translate Within Ledger Process

After revaluation, you run the Translate Within Ledger process, which generates the translation adjustment. Only the report translation ledger are processed. Continuing with the previous example, the report ledger balances are shown as follows.

Beginning Ledger (Report Only)

The following table contains the beginning ledger amounts to appear on the translation ledger for reports only:

|

Account |

Foreign Currency |

Foreign Currency Balance |

Report (USD) |

|

2001 |

CHF |

29.7 |

17.881 |

|

8001 |

CHF |

–29.5 |

–17.76 |

|

Gain/Loss |

CHF |

–0.2 |

–0.121 |

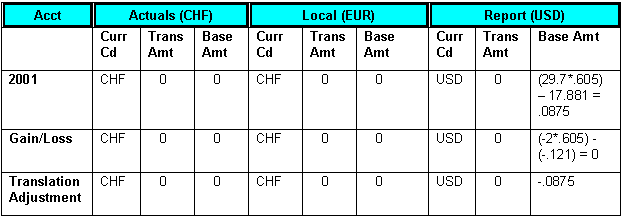

Month End Translation Journal

The output journal that results from the Translate Within Ledger process is shown in this example. This example assumes that the translate within ledger step is defined for balance sheet accounts only, but this need not be the case. You can, for example, define your translate within ledger step definition to include profit and loss, or income statement, accounts to be processed at an average rate.

Example of month end translation journal

Ending Ledger

The following table shows the ending ledger amounts after you run the translate process for reports:

|

Account |

Foreign Currency |

Foreign Currency Balance |

Report (USD) |

|

2001 |

CHF |

29.7 |

17.9685 |

|

8001 |

CHF |

–29.5 |

–17.76 |

|

Gain/Loss |

CHF |

–0.2 |

–0.121 |

|

Translation Adjustment |

CHF |

0 |

0.0875 |

Comparing Multibook Translation Ledger Results to Translation in a

Single Book Environment

Comparing Multibook Translation Ledger Results to Translation in a

Single Book Environment

Maintaining a translation ledger within a multibook ledger group results in the same ledger balances as performing a period-end translation on the actuals ledger. To show this, we start with the ledger balances for actuals from the example above, after revaluation is run on the ledger group. We perform a single book translation: actuals (CHF) to ledger group (USD).

Beginning Ledger

The following table shows the ledger balances for actuals ledger after the revaluation is run on the ledger group:

|

Account |

Currency Code |

Transaction Amount |

Actuals (CHF) |

|

2001 |

MXN |

100 |

29.7 |

|

8001 |

MXN |

–100 |

–29.5 |

|

Gain/Loss |

MXN |

0 |

–0.2 |

Translation Journal

The following table shows the results of running the translation process on the actuals ledger. The translation is simplified for clarity in this example. The balance sheet accounts are translated at the CRRNT exchange rate and the profit and loss, or income statement, accounts are translated at an average rate.

Assume that these are the currency exchange rates:

|

Conversion and Type |

Exchange Rate on Reporting Date |

|

CHF to USD (CRRNT) |

0.605 |

|

CHF to USD (AVG) |

0.604 |

Ending Ledger

The following table shows the resulting balances of this single book ledger:

|

Account |

Currency Code |

SB Reports (USD) |

|

2001 |

USD |

(29.7 * 0.605) = 17.9685 |

|

8001 |

USD |

(–29.5 * 0.604) = –17.818 |

|

Gain/Loss |

USD |

(–0.2 * 0.605) = –0.121 |

|

Translation Adjustment |

USD |

–0.0295 |

Compare the resulting balances of this single book translation to the balances in the report ledger of the ledger group MULTI-TRAN. The difference of .058 between the translation adjustment and the value for account 8001 is because the profit and loss, or income statement, account 8001 was translated at the AVG rate, and its offset is included in the translation adjustment. If we had defined an additional translate within ledger step earlier to process this account at the AVG rate type, the balances would be identical.

Producing Revaluation and Translation Reports

Producing Revaluation and Translation Reports

This section lists the pages used to run standard revaluation and translation reports. To run a report, select it from a menu and enter any necessary parameters. Once you enter the report parameters, use PeopleSoft Process Scheduler to run the report. PeopleSoft Process Scheduler manages the processes, tracks the status, and generates the report in the background while you can continue to work on something else.

For those who want to modify our standard reports, create your own reports, or reformat report output, we offer a variety of reporting tools.

Pages Used to Produce Revaluation and Translation Reports

Pages Used to Produce Revaluation and Translation ReportsSee Also

PeopleTools PeopleBook: PeopleSoft Process Scheduler, "Understanding Process Scheduler"