Understanding Cash Sweep Functionality

Understanding Cash Sweep Functionality

This chapter presents an overview of the cash sweep functionality and discusses how to:

Define and approve a cash sweep structure.

Process cash sweep and review the results.

Generate cash sweep reports

Understanding Cash Sweep Functionality

Understanding Cash Sweep Functionality

Cash Sweep enables you to perform a sweep across multiple external bank accounts to manage the liquidity in your organization. Cash Sweep leverages the functionality of these PeopleSoft Treasury features:

External bank accounts.

Cash position.

Fund transfers - Bank account and EFT (electronic fund transfer) requests.

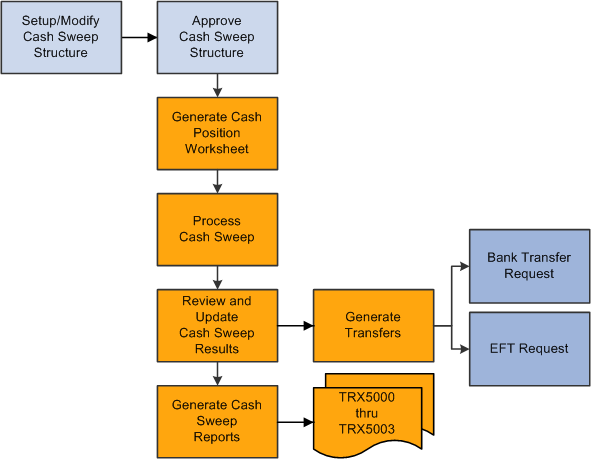

The Cash Sweep process flow includes these steps:

Set up the cash sweep structure.

You set up the cash sweep structure across multiple external bank accounts. The cash sweep structure consists of a master account, overall processing attributes, sub-accounts and sub-account processing attributes.

Approve the cash sweep structure.

You must approve any new or modified cash sweep structure before you can run the Cash Sweep process (TR_CSH_SWEEP).

Generate the Cash Position worksheet.

Run the Cash Sweep process.

Review and update the cash sweep results.

Generate transfers using bank transfer or EFT request.

Generate cash sweep reports.

Cash Sweep Process Flow

Prerequisites

Prerequisites

Complete these prerequisites prior to setting up a cash sweep structure:

Set up external bank accounts.

Set up internal bank accounts.

Set up bank transfer templates.

Set up EFT templates.

Define cash position trees.

Defining and Approving a Cash Sweep Structure

Defining and Approving a Cash Sweep Structure

This section presents an overview of a cash sweep structure and discusses how to:

Define a cash sweep structure.

Set up cash sweep subaccounts.

Approve a cash sweep structure and run the Cash Sweep process.

Overview of a Cash Sweep Structure

Overview of a Cash Sweep Structure

To perform a cash sweep, you must set up an active physical cash sweep structure as of a specified effective date. You can update this structure and change the effective date to keep track of any changes you make.

You set up a physical cash sweep structure across multiple external bank accounts. You identify an external bank account as the master bank account for this cash sweep structure and identify one or more sub-accounts. You can only select one master bank account for each physical cash sweep structure. However, you can select the same external bank account as the master bank account across multiple physical cash sweep structures. When you select a master bank and bank account for a cash sweep structure, the sweep currency and business unit used to set up the bank account display as default values for the cash sweep structure. You cannot change these values unless you select a different bank account.

The activity type that you select for a physical cash sweep structure determines how the funds will be moved. Activity types are:

Funding

This activity type moves funds out of the master bank account to the selected sub bank accounts.

Concentration

This activity type moves funds out of selected sub bank accounts to the master bank account.

Bidirectional

This activity type moves funds into and out of the master bank account depending on the of the calculated transfer amount. If the cash position of the subaccount is negative, Cash Sweep assumes that here is a shortage of funds in the subaccount and moves funds from the master bank account to the subaccount. If the cash position of the subaccount is positive, Cash Sweep assumes that there is a surplus of funds and moves funds from the subaccount to the master bank account. Negative balances in subaccounts are Funded and positive balances in subaccounts are Concentrated.

Example 1: When activity type is bidirectional and the sub bank account cash position is - 12, 000 USD, Cash Sweep understands that the funds need to be moved from the master bank account to the sub bank account.

Example 2: When the activity type is bidirectional and the sub bank account cash position is + 12, 000 USD, Cash Sweep understands that the funds need to be moved from the sub bank account to the master bank account.

You identify either your organization or the bank as the initiator of the cash sweep. When an organization initiates the cash sweep the Auto Generate Transfers check box is enabled. You select this check box to enable the system to automatically generate the EFT requests and bank transfers when the Cash Sweep (TR_CSH_SWEEP) process is run. If you select an organization and do not select this check box, then you must access the Request Cash Sweep component and perform the transfers manually. However, frequently an organization does not want to initially generate the EFT requests and bank transfers automatically (deselect the check box) so that it can review the recommended transfer amount for each cash sweep structure and make any necessary changes. Once the organization is satisfied with the recommended transfer amount, it can select the Auto Generate Transfers check box and the system will automatically generate the EFT requests and bank transfers when the Cash Sweep process is run. The Auto Generate Transfers check box is not selected if a bank initiates the cash sweep.

When the bank is the initiator of the cash sweep, the bank moves the funds, but the system only stores the recommended transfer amounts without creating the actual EFT requests or bank transfers.

You select a market index and rate type to assist in identifying the exchange rate to apply to the cash sweep when cash sweep currency is different from cash position currency.

Important! Make sure that the Exchange Rate tables are updated with the appropriate exchange rates.

You can select cash sweep rounding options or choose not to round the physical cash sweep amounts. Rounding will never break below the target balance defined on external bank account definition.

You can select one of the following rounding options:

Nearest

Selecting this value will increase or decrease the physical cash sweep amount to the closest multiple specified. For example, if the physical sweep/concentration amount of 1,234,567.87 USD is rounded to the nearest hundreds, the amount will be calculated as 1,234,600.00 USD. However, if a physical sweep/concentration amount of 1,234,347.87 USD is rounded to the nearest hundreds, the amount will be 1,234,300.00 USD.

None

Rounding will not be performed when you select this value.

Round Down

Selecting this value will decrease the physical cash sweep amount to the nearest multiple specified. For example, if the physical sweep/concentration amount of 1,234,567.87 USD rounded down to hundreds, the amount will be calculated as 1,234,500.00 USD.

Round Up

Round up increases the physical cash sweep amount to the nearest multiple specified. For example, if the physical cash sweep amount of 1,234,567.87 USD is rounded up to hundreds, the amount will be calculated as 1,234,600.00 USD.

If you select Nearest, Round Down, or Round Up as a rounding option, you must select one of these rounding factors:

Units (1)

Tens (10)

Hundreds (100)

Thousands (1,000)

Ten thousands (10,000)

Hundred thousands (100,000)

Millions (1,000,000)

Ten Millions (10,000,000)

You select an active cash position tree name and tree node for each cash sweep structure. The tree nodes can be recursive or nonrecursive.

You can identify one or more external bank accounts as sub bank accounts on a physical cash sweep structure. The system issues a warning message to alert the user that setting an external bank account as sub bank account on multiple physical cash sweep structures could result in a sub bank account that is overdrawn. Duplicate sub bank accounts in the same cash sweep structure are not permitted. You also cannot identify the same external bank account as a master bank account and a sub bank account in the same physical cash sweep structure. However, you can identify an external bank account as a sub bank account in one physical cash sweep structure, and as a master bank account in another physical cash sweep structure. You can pool multiple subaccounts for a cash sweep.

You select a cash position tree node for each subaccount. The master bank account and any sub bank accounts identified for each cash sweep structure must share the same cash position tree.

Important! It is critical that you correctly map the cash position tree nodes to the master bank accounts and subaccounts on the cash sweep structure.

You can select EFT Transfer or Bank Transfer as the Transfer Class for each subaccount. Selecting either transfer class moves funds across bank accounts. However, if you select Organization as the Initiator on the Cash Sweep Structure page, you must select one of these values for each subaccount that you establish.

You can select a Funding or Concentration template to apply to each subaccount. These templates enable you to set up transactions in advance with parties with which you conduct regular, specific transactions. You select a Funding Template for each subaccount if you selected Funding or Bi-Directional as the activity type on the Cash Sweep Structure page. You select the Concentration Template if you selected Concentration or Bi-Directional as the activity type.

Important! It is critical that you define and map the appropriate template with each subaccount. Mapping these templates incorrectly can result in transfer errors when the Cash Sweep process is run.

You specify the minimum amount and a maximum amount to transfer during the Cash Sweep process between a master bank account. A zero amount indicates that there is no minimum amount limit. Specific rules dictate how the minimum and maximum transfer amounts either do or do not affect the calculated amount that the cash sweep process generates:

Minimum Transfer Amount

The minimum amount to be transferred during a cash sweep process between Master Bank Account and Sub Bank Account. A zero amount indicates that there is no minimum amount limit.

When the activity type is Funding and calculated transfer amount is less than the minimum transfer amount, cash sweep process sets the calculated transfer amount to the minimum transfer amount.

When the activity type is Concentration and the calculated transfer amount is less than the minimum transfer amount, cash sweep process sets the calculated transfer amount to zero. There are not enough funds in the sub-account to meet the minimum transfer amount and still maintain its target balance, so no amount is set to transfer.

Maximum Transfer Amount

The maximum amount to be transferred during a cash sweep process between Master Bank Account and Sub Bank Account. A zero amount indicates that there is no maximum amount limit.

The maximum transfer amount rule is the same for both Funding and Concentration activity types. During the cash sweep process if the calculated transfer amount is greater than the maximum transfer amount, then the calculated transfer amount is set to the maximum transfer amount.

You can select an Exclude check box on the Cash Sweep Structure page to temporarily prevent a subaccount row from being included in the Cash Sweep Process. Once you remove the check mark, the row will be included the next time the Cash Sweep Process is run.

Once you have set up and saved a cash sweep structure, a designated approver must approve the cash sweep structure using the Cash Sweep Structure Approval component before running the Cash Sweep process. The status of a cash sweep structure can be pending, approved, or denied. If the approver either approves or denies approval of the cash sweep structure, you can modify the cash sweep structure without having to leave the Approve Cash Sweep Structure page . When you modify an approved or denied cash sweep structure and save it, the status of the cash sweep structure changes to pending until the designated approver approves or denies it again. If the structure is approved, it is ready for the Cash Sweep Calculations process to be run. When a designated approver approves or denies a cash sweep structure, the user ID of the approver and the date that the structure was approved or denied appears on the Approve Cash Sweep Structure page. An assigned user other than the user who entered the Cash Sweep Structure must approve all changes before you can run the Cash Sweep Calculations process.

Important! The user who is assigned to approve a cash sweep structure must be someone other than the user who enters or modifies the cash sweep structure.

See Setting Up Trees and Positions.

Pages Used to Define and Approve a Cash Sweep Structure

Pages Used to Define and Approve a Cash Sweep Structure|

Page Name |

Definition Name |

Navigation |

Usage |

|

CSH_SWEEP_DEFN |

Cash Management, Cash Sweep, Define Cash Sweep Structure, Cash Sweep Structure |

Define the master bank account, currency, and cash position tree and node for a physical cash sweep. Set up cash sweep subaccounts. |

|

|

CSH_SWEEP_APPR |

Cash Management, Cash Sweep, Approve Cash Sweep Structure |

Approve or deny selected cash sweep structures. |

Defining a Cash Sweep Structure

Defining a Cash Sweep Structure

Access the Cash Sweep Structure page (Cash Management, Cash Sweep, Define Cash Sweep Structure, Cash Sweep Structure).

|

Sweep ID |

Select the appropriate setID and enter a value to identify the cash sweep structure that you are creating on the Cash Sweep Structure – Add a New Value page. |

|

Sweep Type |

Accept the system-defined default value, Physical on the Cash Sweep Structure – Add a New Value page. A physical cash sweep indicates movement between external bank accounts selected for this cash sweep structure. |

|

Master Bank Code |

Select the bank that has the master bank account that you want to assign to this cash sweep structure. The Bank ID field is updated based on the code you select. |

|

Master Bank Account |

Select the bank account that you want to use to transfer funds to subaccounts or to concentrate funds from subaccounts. The Bank Account # (number), Sweep Currency, and Business Unit values associated with the selected bank account appear as defaults on the page and are derived from the account selected as the master bank account. This business unit is used as the anchor business unit when the cash sweep transfers are performed. |

|

Activity Type |

Select one of these activity types to move funds for this cash sweep structure. This field is required for both organization and bank initiated cash sweeps.

|

|

Initiated By |

Select one of these values as the initiator of the cash sweep.

|

|

Auto-Generate Transfers |

Select this check box to enable the system to automatically generate EFT (electronic file transfer) requests and bank transfers for the recommended transfer amount when you run the Cash Sweep process. If you leave this check box blank, then you must access the Cash Sweep Results page to initiate the creation of EFT requests and bank transfers. |

|

Index |

The default value is derived from the selected master bank account . Selecting a market rate from the market rate index assists in identifying the exchange rate to apply to the cash sweep when the cash sweep currency is different from the cash position currency. |

|

Rate Type |

The default value is derived from the selected master bank account. Selecting a rate type assists in identifying the exchange rate to apply to the cash sweep when cash sweep currency is different from the cash position currency. |

|

Round Option |

Select one of these options to determine how you want to round the transfer amount:

|

|

Round Factor |

Select one of these options to determine how the amount will be rounded.

Note. The Round Factor is required unless the value selected for the Round Option is None. |

|

Tree Name |

You must select a Cash Position Tree to apply to this cash sweep. |

|

Tree Node |

You must select a Cash Position Tree Node to apply to this cash sweep. The master bank account and each of the sub bank accounts identified in each physical cash sweep structure should share the same cash position tree. Important! When selecting a cash position tree node, take note of the associated position sources and the resulting position calculation amount. |

Audit Information

The system tracks and displays this information about a selected cash structure:

Date Created

Identifies when the cash sweep structure was created.

Created By

Identifies the user who created the cash sweep structure.

Date Modified

Identifies the last date that the cash sweep structure was modified.

Modified By

Identifies the last person who modified the cash sweep structure

Date Approved

Identifies the date that the cash sweep structure was approved.

Approved By

Identifies the user who approved the cash sweep structure.

Approval Status

Identifies the cash sweep structure as Pending, Approved, or Denied.

Cash Sweep Details – Subaccounts Information

Select the Cash Sweep Details – Sub Accounts tab.

|

Bank SetID, Bank Code and Bank Account |

Select a bank setID, bank code, and bank account for each subaccount that you set up for this physical cash sweep structure. |

|

Tree Node |

Select a cash position tree node for each subaccount that you set up. The cash position tree node that you select for each subaccount must share the same cash position tree as the master account selected for this physical cash sweep structure. |

|

Transfer Class |

Select one of these values to transfer the physical cash sweep amount.

Note. You must select one of these values if you selected Organization as the Initiator of the physical cash sweep on the Cash Sweep Definition page. |

|

Funding Template |

Select a funding template if you selected either Funding or Bi-Directional as the Activity Type on the Cash Sweep Definition page. If you selected Bank Transfer as the Transfer Class, the system only displays a list of external bank account funding transfer templates. |

|

Concentration Template |

Select a concentration template if you selected either Concentration or Bi-Directional as the Activity Type on the Cash Sweep Definition page. If you selected Bank Transfer as the Transfer Class, the system only displays a list of external bank account transfer templates. Important! You must select the funding and concentration templates that are set up for the purpose of performing a cash sweep and are appropriate for the cash sweep structure that is being defined, otherwise the system may generate incorrect transfers. |

|

Exclude |

Select this check box to exclude the subaccount row for which it is selected from being included in the cash sweep process. |

Cash Sweep Details – Amount Information

Select the Cash Sweep Details – Amount tab.

|

Minimum Transfer Amount |

Enter the minimum amount to be transferred during a cash sweep process between the master bank account and a subaccount. A zero minimum amount indicates that there is no limit to the minimum transfer amount regardless of the activity type selected on the Cash Sweep Definition page. However if the calculated transfer amount is less than the minimum transfer amount, these rules apply:

|

|

Maximum Transfer Amount |

Enter the maximum amount to be transferred during a cash sweep process between the master bank account and the subaccount. A zero amount indicates that there is no maximum amount limit. The maximum transfer amount rule is when you select either Funding or Concentration as the activity type on the Cash Sweep Definition page. When you run the Cash Sweep process, if the calculated transfer amount is greater than the maximum transfer amount, then the calculated transfer amount is set to the maximum transfer amount for both activity types. |

|

Sweep Currency |

The default currency that appears in this field is derived from the Master Bank Account. |

Cash Sweep Details – Account Information

Select the Cash Sweep Details – Account Information tab.

This grid defines the bank account details for each subaccount including the Bank ID, the Bank Account # (bank account number) as well as the bank account's currency, associated business unit, and description.

Approving a Cash Sweep Structure

Approving a Cash Sweep Structure

Access the Approve Cash Sweep Structure page. (Cash Management, Cash Sweep, Approve Cash Sweep Structure, Approve Cash Sweep Structure)

Search Criteria

Select values for the search criteria fields as needed. If you only select a setID and leave all other fields blank, the system will list all of the Cash Sweep Structures that have a status of Pending, Approved, and Denied when you click the Search button. You can also select an approval status of Pending, Approved, or Denied and only cash sweep structures with the selected approval status appear on the list when you click the Search button.

Cash Sweep Structure

A list of cash sweep structures appears in the Cash Sweep Structure group box based on you selected search criteria. You can select all of the structures in the list or select individual structure check boxes and click the Approve or Deny button to approve or deny the selected cash sweep structures.

|

Cash Sweep ID |

Click the link of an individual cash sweep structure and access the actual cash sweep structure. |

|

Approval Status |

These values can appear in this field:

|

|

Approved By and Date Approved |

Displays the User ID of the individual who approved or denied the cash sweep structure along with the date that the structure was approved or denied. |

Processing Cash Sweep and Reviewing the Results

Processing Cash Sweep and Reviewing the Results

This section presents and overview of cash sweep processing and review and discusses how to:

Run the Cash Sweep process.

Review and update the results of a cash sweep.

Overview of the Cash Sweep Processing and Results

Overview of the Cash Sweep Processing and Results

The Cash Sweep process (TR_CSH_SWEEP) drives the data extraction, funds transfer calculation and funds transfer execution for a cash sweep structure. This process performs these functions for each sub-account:

Retrieves the cash position balance.

Retrieves the target balance.

Calculates the amount of funds in short or excess of the target balance.

Determines from the cash sweep structure whether funding or concentrating funds apply.

Applies rounding rules set in the cash sweep structure to the transfer amount.

Compares the transfer amount to the minimum and maximum transfer limits in the cash sweep structure and adjusts as needed.

Sets the final recommended transfer amount.

If auto-generate check box is selected for a cash sweep structure, then it generates any bank transfers or EFT transfers.

Populates the header and details on the Cash Sweep Results tables.

You can process cash sweep for each cash sweep structure and for a specific date. You can run the Cash Sweep process multiple times during a specified date. You can also select or not select sub-accounts for cash sweep processing.

Important! You can run Cash Sweep process for a cash sweep

structure multiple times during the day. You should exercise caution and ensure

that the system is set up to handle such a scenario. Make sure that the Cash

Position Sources include the cash sweep amount and that a cash position has

been recalculated after generating cash sweep transfers. If system is setup

incorrectly it could result in inappropriate transfers.

See Also

Cash Management Reports: A to Z

Pages Used to Run the Cash Sweep Process and Review the Results

Pages Used to Run the Cash Sweep Process and Review the Results|

Page Name |

Definition Name |

Navigation |

Usage |

|

CSH_SWEEP_REQ |

Cash Management, Cash Sweep, Request Cash Sweep, Cash Sweep Request |

Run the Cash Sweep Calculations process. |

|

|

CSH_SWEEP_RESULTS |

Cash Management, Cash Sweep, Cash Sweep Results, Cash Sweep Results |

Review and update cash sweep results. |

Running the Cash Sweep Process

Running the Cash Sweep Process

Access the Cash Sweep Request page (Cash Management, Cash Sweep, Request Cash Sweep, Cash Sweep Request).

|

Value Date Option |

Select one of these options to set the date for the value date. The value date is the date that is used to retrieve the cash position amounts.

Note. If the auto generate check box is checked on the cash sweep structure, then the system retrieves the cash position amounts for each cash sweep structure based on each sequence and creates the EFT requests and bank transfers. If the auto generate check box is not checked, the system retrieves the cash position amounts for each cash sweep structure based on each sequence and stores the details in the Cash Sweep Structure tables. |

|

Transaction Date Option |

Select one of these options to set the transaction date for the transfer transactions.

|

Reviewing and Updating the Results of a Cash Sweep

Reviewing and Updating the Results of a Cash Sweep

Access the Cash Sweep Results page (Cash Management, Cash Sweep, Cash Sweep Results, Cash Sweep Results).

|

Select |

This check box will only appear if the funds transfer still need to be generated, which means that the Auto Generate Transfers check box was not selected on the Cash Sweep Structure page of the associated cash sweep structure. |

|

Generate Transfers |

Click this button to generate either a bank transfer or an EFT request for the selected rows. Generating a bank transfer will update the Transfer ID field on the Transaction Detail tab with the Bank Transfer ID, and generating an EFT request will update the Transfer ID field with the EFT Request ID. |

|

Recommended Transfer Amount |

After comparing the minimum and maximum transfer limits, the Cash Sweep Calculations process adjust the transfer amount as necessary, sets this final recommended transfer amount and updates this field. |

|

Actual Transfer Amount |

The default value is the amount that appears in the Recommended Transfer Amount field. You can override the this default amount and perform the transfer. |

|

Activity Type |

Displays either Funding or Concentration at the grid level for a bidirectional cash sweep structure. Note. A bidirectional cash sweep structure enables you to override the activity type on the subaccount grid. This provides you with the flexibility to change the direction in the movement of funds and override the actual transfer amount. |

|

Target Balance |

The Cash Sweep Calculations process retrieves the target balance and updates this field. |

|

Cash Position |

The Cash Sweep Calculations process retrieves the cash position for each subaccount and updates this field. |

This tab displays the sub bank account information that was entered on the Cash Sweep Structure – Accounts page.

|

|

A warning or error icon appears before the Select column on each tab, which indicates there is a message on the Message Log tab. |

|

Message Text |

If the system issues a warning or error message and displays an icon, the text describing the warning or error appears in this field. |

Generating Cash Sweep Reports

Generating Cash Sweep Reports

This section presents an overview of the cash sweep reports and describes the page navigation and usage of each report:

You can generate these cash sweep reports:

The Cash Sweep Structure report (TRX5000).

This report lists detailed information for a cash sweep structure, includes the master bank account, overall cash sweep processing attributes, sub-accounts, sub-account processing attributes and audit information

You must select a SetID and an As of Date for report. You have the option of selecting a specific Sweep ID or leaving the field blank, which will include all cash sweep structures that were created with the specified setID and as of the specified date.

Cash Sweep Bank Accounts (TRX5001)

This report lists all of the cash sweep structures associated with a given bank account and whether the account is the master bank account or subaccount in the structure.

You must select a SetID and an As of Date for this report. You have the option of selecting a Bank Code, the Business Unit associated with the bank, and a Bank Account number, or you can leave one or all of these values blank and the system will list all cash sweep structures created with the specified setID and as of the specified date and any bank values associated with a master bank account or subaccount in the structures.

Cash Sweep Summary (TRX5002)

This report summarizes cash sweep amounts within a cash sweep structure by bank account.

You must select a setID and select From Date and To Date values for this report. You can enter the same date in both fields to run the report as of that date only. You have the option of selecting a specific Sweep ID or leaving the field blank which will display a list of cash sweep amounts for all cash sweep structures that were created with the specified setID within or on the specified dates.

Denied Cash Sweep Payments (TRX5003)

This report lists all denied cash sweep payments.

You must select SetID, From Date, and To Date values for this report. You can enter the same date in both fields to run the report as of that date only. You have the option of selecting a specific Sweep ID or leaving the field blank which will display a list of all cash sweep payments that were denied that fall under the specified setID within or on the specified dates.

Pages Used to Generate Cash Sweep Reports

Pages Used to Generate Cash Sweep Reports|

Page Name |

Definition Name |

Navigation |

Usage |

|

RUN_TRX5000 |

Cash Management, Cash Sweep, Reports, Cash Sweep Structure |

Run the Cash Sweep Structure report. |

|

|

RUN_TRX5001 |

Cash Management, Cash Sweep, Reports, Cash Sweep Bank Accounts |

Run the Cash Sweep Bank Accounts report. |

|

|

RUN_TRX5002 |

Cash Management, Cash Sweep, Reports, Cash Sweep Summary |

Run the Cash Sweep Summary report. |

|

|

RUN_TRX5003 |

Cash Management, Cash Sweep, Reports, Denied Cash Sweep Payments |

Run the Denied Cash Sweep Payments report. |