Understanding Actual and Average Costing

in Manufacturing

Understanding Actual and Average Costing

in Manufacturing

This chapter provides an overview of actual and average costing in manufacturing, lists common elements, and discusses how to:

Define actual and average costing for makeable items.

Group production schedules for actual or average costing.

Understanding Actual and Average Costing

in Manufacturing

Understanding Actual and Average Costing

in Manufacturing

With PeopleSoft Cost Management, you can manufacture an item by using any of the five cost methods: frozen standard, actual cost, perpetual average, retroactive perpetual average, or periodic average costing. Standard costing is based on the frozen standards that are established for each component plus the conversion costs and overhead conversions costs. The actual and average costing methods are based on the actual cost of the end item as it is placed in finished goods after production is complete. This section discusses how the actual cost of an end item is computed by PeopleSoft Cost Management.

As an item is built in the manufacturing process, the costs from components, conversion costs, and overhead conversion costs are accumulated in Work in Process (WIP). The end item's actual cost is the net cost in WIP for the production ID or production schedule. When the production ID is completed and closed for accounting and the items are put away into inventory, then the WIP costs are moved to finished goods. In other words, the net debit to WIP is the actual cost. For actual or average cost end items, the finished goods account is debited with the entire WIP costs, there is no variance, as there is in standard costing.

Actuals costs for a production ID or production schedule are computed as part of the Transaction Costing process that is within the Cost Accounting Creation run control. After the production ID is closed for accounting, the Transaction Costing process finishes debiting the unposted transactions and calculates the actual cost of the assembly items. Then the process clears WIP to finished goods for all cost books. The Transaction Costing process gathers up the actual costs that are recorded and posts the costs to the work in process costs (CE_ACTUAL_COST) table. Then, the Transaction Costing process posts the manufacturing costs from the CE_ACTUAL_COST table to the CM_ACTUAL_COSTB table. Production IDs that are closed for accounting can be reopened for changes; the actual cost calculations of the Transaction Costing process handles these changes.

It is important to understand what is added (debited) to WIP during the production process. This is based on the definition of the cost profiles for the end item and components.

Material Cost of Components

The material cost of an end item is determined by the cost profiles of the input items or components. Components having different cost profiles may be used in the manufacture of an end item. For example, component A is an actual cost profile item, component B is a perpetual average cost item, component C is a standard cost item, and the end item uses an actual cost profile. Therefore, the final cost is made up of the component costs using each of those different cost assumptions. The actual cost of component A is calculated and applied to the end item. The perpetual average cost of component B is calculated and applied to the end item. The frozen standard cost of component C is applied to the end item. If you want actual cost applied to all levels, define the cost profiles of all significant components as actual cost. For purposes of computing actual costs of production ID's, if any component items (make or buy) use an actual cost profile, then those final lower-level actual costs are necessary for computing a final actual cost at the next level. PeopleSoft provides the actual cost inquiry to display production IDs with unfinalized costs as well as the dependencies that are underneath each level.

Component consumption transactions occur as component items are issued from inventory. These issues are recorded in TRANSACTION_INV in the transaction groups; 021 Receipts from Production, 230 Component Consumption, 221 Route to Production Kit, 222 Waste Completion, and 223 Component/Output Transfers. The production ID and the operation sequence of the consumption are recorded to TRANSACTION_INV. The inventory issue transaction is triggered by recording completions. In general, these component issues credit raw material inventory and debit WIP.

Labor and Machine Conversion Costs

Define on the Cost Profile-Manufacturing page for the make item, how labor and machine costs are calculated. You can use the costing conversion rates that are established on the Conversion Rates page (defined by cost type and cost version used) or the rates can be entered by crew on the Crew Actual Cost page (defined by business unit). For time, choose between the times that are established for the item routing or the actual time per production ID that is entered on the Record Actual Hours page.

Conversion costs occur as operations are completed and are recorded in the SF_EARNCONCOST table. As operation sequences are completed, the transaction group 640–Actual Labor Costs records an accounting entry with a credit to an earned labor account and a debit to WIP. Also, the transaction group 645–Actual Machine Costs records an accounting entry with a credit to an earned machine account and debits to WIP.

Conversion Overhead Costs

Overhead costs for production, such as depreciation, electricity, rent, and insurance, are calculated and applied to a manufactured item based on the production overhead codes that are applied to the item routing and the applicable conversion overhead rates (defined by cost type and cost version that is used). Overhead costs are applied the same way for standard, actual, and average costing methods.

Conversion costs occur as operations are completed and are recorded in CE_ACTUAL_COST and SF_EARNCONCOST tables. The transaction group 630 (Overhead) records an accounting entry to debit WIP and credit a manufacturing overhead cost absorption account.

Subcontracted Costs

Costs for subcontract services are quoted as standard costs on the routing, as quoted costs on the purchase order, and finally as vouchered costs from PeopleSoft Payables. The transaction group 664 (Subcontracted Costs) records the variance between the subcontracted costs on the purchase order and the actual subcontracted costs on the voucher. The accounting entry debits WIP and credits an accrued liability account. This transaction group is used only for actual or average cost items.

If a single manufacturing process generates multiple items, you can allocate the batch cost across the primary and co-products to determine the per unit cost of each end item. Primary and co-products can have different costing methods; for example, the primary product could use the actual cost method while one co-product uses the standard cost method and another co-product uses actual cost. When the primary product uses the actual cost method, then the Cost Accounting Creation process, with the Calculate Actual Prdn Costs check box selected, computes the actual cost of the entire manufacturing process based on the primary product. The choices made for the primary product on the Cost Profiles-Manufacturing page for calculation of labor and machine costs are used. When the cost of the production order is completed, the cost is allocated to the co-products. If all products are using actual or average costing, then the system calculates a co-product's cost by multiplying the total cost of the batch (including the recycle and waste by-product costs) by the cost percentage for the co-product (as specified on the BOM Maintenance - Outputs page), then dividing by the expected output quantity of the co-product.

However, if one or more of the co-products uses the standard cost method, then their cost is derived from the Cost Rollup and Cost Update/Revalue processes for that co-product's item ID. Based on the cost percentages on the BOM Maintenance - Outputs page, the Cost Accounting Creation process re-weights the output cost percentages and divides the costs from the primary product among the primary and co-products that are not using standard costing. For example, assume a production ID has this breakdown:

|

Item ID |

Output Type |

Output Cost Percentage |

Cost Method |

|

10001 |

primary product |

60 |

actual |

|

10002 |

co-product |

20 |

actual |

|

10003 |

co-product |

20 |

standard |

The Production ID costs from the Cost Accounting Creation process are allocated:

|

Item ID |

Applied Output Cost Percentage |

|

10001 |

75 percent (60/80) |

|

10002 |

25 percent (20/80) |

|

10003 |

None, cost derived from standard cost for this item. |

If the total cost of production is 100.00 EUR and 2 units of each item are produced, then:

|

Item ID |

Applied Cost |

|

10001 |

60.00 (total cost of production less standard costs, multiplied by the applied output cost percentage: ) 100.00–20.00=80.00 x 75% |

|

10002 |

20.00 (total cost of production less standard costs, multiplied by the applied output cost percentage: ) 100.00–20.00=80.00 x 25% |

|

10003 |

20.00 (the standard cost of item 10003 is 10/unit and 2 units were produced). |

By-products can be of two types, recycle and waste.

|

Recycled By-Products |

The system calculates cost relief for recycled by-products by multiplying the quantity and the cost of the by-product. This cost relief is subtracted from the lower level costs; the system treats recycled by-products as a negative cost because they can be used as an input to another process. The cost that is used is determined by the purchase cost as specified for the cost type that is defined on the Inventory Definition-Business Unit Books page for the item's business unit. If the make (end) item is actual or average costed and a recycled by-product is produced, then the Cost Accounting Creation process uses the transaction group 021–Receipts from Production when the production is closed to accounting to credit WIP and debit the finished goods inventory account. |

|

Waste By-Products |

The system treats waste by-products as positive or zero cost: they either add to the cost of the product, such as the cost of disposing it, or have no associated cost. The system determines the cost that is used for waste by-products by multiplying the quantity and the cost of the waste by-product. This cost is added to the material costs. If the make (end) item is actual or average costed and a waste by-product is produced, then the Cost Accounting Creation process uses the transaction group 622–Actual Waste Cost when the production is closed to accounting to credit an expense account, such as waste disposal liability, and debit the finished goods inventory account. Note. A recycled by-product must have the same cost element (with a cost category of material) as another component or waste by-product, or the item is not costed. This reduces the chance of a material element producing a negative value. If the cost element becomes negative, because of a recycle by-product cost relief, the system does not cost the item and an error message is generated. Errors can be viewed through the Pending Transactions inquiry page or the Message Log page. |

By-products are valued by using net realizable value, therefore a frozen standard cost must exist for each by-product. Create the frozen standard cost by cost type and cost version by using the Cost Rollup process.

Scrap and Rejected Costs

If the make (end) item is actual or average costed and scrap is produced, then scrap costs are included in the cost of the successfully produced end items.

Costing Partial Receipts From Manufacturing

Partial receipts occur when part of a production run is completed and put away into inventory but the production ID is not yet completed and closed for accounting. All production costs are not yet recorded and are not available for actual cost computation. Therefore, any depletions from inventory that ship these partial receipts do not have an actual final receipt cost to use.

If the Cost Accounting Creation process is set for midperiod mode and the item's cost profile selects the wait for final costs option, then the partial receipts and partial depletions wait to be costed. The system simply waits for the production ID to be completed and closed for accounting to cost. If both midperiod mode and wait for final cost are not selected, then the partial receipts and partial depletions are costed using estimates based on the partial putaway cost option on the Cost Profile-Manufacturing page. Once production is complete for this production ID and lower level production IDs and the proper actual costs can be computed into CE_ACTUAL_COST and CE_ACTUAL_COST, an adjustment is made to CM_ACTUAL_COSTB to reflect the actual cost and inactivate the previously estimated cost.

The transaction group 651 is used when a user enters a cost adjustment manually. Cost adjustments made by the user will override adjustments from system calculations and any system generated transactions. The transaction group records a credit or debit to clear WIP with a credit or debit to an actual cost writeoff account.

Manufacturing Average Cost Updates

Average costs are calculated for putaways. As new cost information on putaways becomes known, the average cost is updated to the extent the new costs are different than the previous costs used in the average cost calculations. Transaction group 601 (Weighted Average Update Production Variance) accounts for average cost updates due to new cost information on receipts from manufacturing, usually when the estimated manufacturing cost from partial receipts from WIP are updated to a finalized manufacturing cost once the production order or production schedule is complete. For example, if there are three putaways with 1 unit each at an original estimated cost of 1 each and the new cost information revises the cost to 1.25 each on the first, .75 on the second, and 1.25 on the third, then for the three units the average cost needs to be increased by a net .25 per unit. The average cost is updated and transaction group 601 is designed to account for that change in the average by debiting finished goods inventory and crediting WIP for .75 (3 x 0.25).

Manufacturing Average Cost Writeoffs

When the average cost of the item needs to be updated, due to new cost information on receipts from manufacturing, but there is not enough quantity currently in stock to absorb the updated costs, then the excess is written off using transaction group 605 (Weighted Average Update Production Writeoffs). Using the example above in the transaction group 601 description, if at the time of the adjustment, there are only 2 units still on hand (1 unit was shipped already), the average cost adjustment is only done to the extent of the 2 units: 601 debiting finished goods inventory and crediting WIP for .50 (2 x 0.25). Then the transaction group 605 is used to debit an average cost writeoff account and credit WIP for the remaining cost of 0.25 (1 x 0.25). The 605 transaction does not attempt to match individual putaways; if 1 unit had shipped but another unit had been received from another production order then the 601 adjustment applies to the 3 that are on-hand inventory and there is no 605 transaction. The objective of both 601 and 605 is to always clear work in process such that all the input costs are relieved to a net of zero once the production is complete.

Actual or Average Cost Components With Standard Cost End Items

When the output(s) are all standard cost items, the standard cost of the inputs are used to compute the standard cost of the outputs. However, although the inputs to standard cost end items will have standard costs themselves, the input items can still use any cost profile for accounting purposes. As components are depleted, the cost on the depletion becomes part of the actual cost of the output items. When the output item is standard, the transaction group 661 (Actual Cost Variance) relieves WIP for the difference between the actual cost of the component consumption transaction and the standard cost of the component(s) which were used to build up the standard cost of the end item. This transaction group is used to credit or debit WIP to clear it out and the offset is posted to a period variances account.

Working with Cost Types and Cost Versions

The Transaction Costing process within the Cost Accounting Creation process determines which conversion rates, overhead conversion rates, and additional costs to use based on the cost type and cost version of the production ID. The cost type is applied to the production ID because the cost book in the Inventory business unit definition has a cost type and appears by default on the Business Unit Item Definition page for the manufactured item. The cost version is defined by the inventory business unit and cost book by using the Set Default Versions page. By defining the cost type and cost version by a combination of inventory business unit and cost book, the system enables you to vary the rates used by various cost books. Cost books can have different cost conversion rates, calculation approaches, and update cycles for planning, budgeting, and actual books.

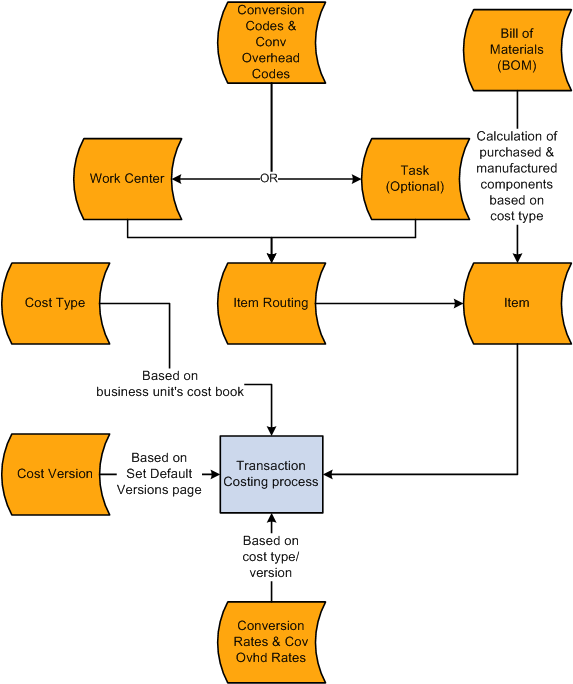

This diagram illustrates how actual costs from production are gathered by the Transaction Costing process. The process uses the BOM and routing of the item along with the rates determined by the cost type and cost version:

The actual cost for make items calculated by the Transaction Costing process within the Cost Accounting Creation process

Common Elements Used in This Chapter

Common Elements Used in This Chapter

Defining Actual and Average Costing for

Makeable Items

Defining Actual and Average Costing for

Makeable Items

Within an actual or average cost environment, you can calculate the cost of makeable items by running the Transaction Costing process within the Cost Accounting Creation process. To set up product costs:

Verify that the cost structure is defined for the make and buy items. See "Structuring Your Cost Management System."

Verify that you defined cost foundation for manufacturing. See "Defining the Cost Foundation for Makeable Items."

Define the default cost version by cost book.

Establish actual costs for crews.

Check the item default values, including: source code and cost element on the Define Business Unit Item component.

Confirm that items have a bill of material (BOM). If you roll up the costs to a configured item, verify that you have a component list on the production ID.

(Optional) Confirm that the items have an item routing. If you roll up the costs to a configured item, verify that you have an operation list on the production ID.

Once the production ID is closed for accounting, use the Transaction Costing process to calculate the cost for the items.

See Also

Generating Costs for Transaction Records

Pages Used to Set Up Actual Costing in Makeable

Items

Pages Used to Set Up Actual Costing in Makeable

Items

|

Page Name |

Definition Name |

Navigation |

Usage |

|

CE_SET_BU_DFLT_VER |

Cost Accounting, Item Costs, Define Rates and Costs, Set Default Versions |

Identifies the default cost version that is to be used for each cost book when creating a production ID. Cost versions are defined for the various books for actual costing in manufacturing. Different versions may have different cost rates for different as of dates. |

|

|

CE_CREW_RATE |

Cost Accounting, Item Costs, Define Rates and Costs, Crew Actual Cost |

Enter the actual labor rate by crew that is to be used by the Transaction Costing process (within the Cost Accounting Creation process) to calculate the actual cost of production IDs by using this labor crew. This page is used if the item's cost profile uses the Actual Time-Crew Rate option for the Labor Cost Method field. |

|

|

MFG_ATTRIB |

Items, Define Items and Attributes, Define Business Unit Item, Manufacturing |

Select the source code for each item. |

|

|

GEN_ATTRIB_INV |

Items, Define Items and Attributes, Define Business Unit Item, General |

Enter the cost element for each item. Cost elements are used to categorize the components of an item's cost. For purchased items that are components of a manufactured item, enter a value in the Current Purchase Cost field to ensure that a default price is available for the calculation of the end item. |

|

|

EN_BOM_MAINT |

Manufacturing Definitions, BOMs and Revisions, Maintain BOMs and Revisions, Manufacturing BOMs, Summary |

Verify that a BOM exists for the makeable items. |

|

|

EN_RTG_SUMMARY |

Engineering, Routings, Define Engineering Routings, Summary Manufacturing Definitions, Resources and Routings, Routings, Define Routings, Summary |

Verify that a routing exists for the makeable items. |

Defining the Default Cost Version by Cost

Book

Defining the Default Cost Version by Cost

Book

To use default versions for processing actual costing data, use the Set Default Versions component (CE_SET_BUBOOK_VER2).

Access the Set Default Versions page (Cost Accounting, Item Costs, Define Rates and Costs, Set Default Versions).

Identifies the default cost version that is to be used for each cost book when creating a production ID. As production IDs are created, the costing process needs to know which cost version to use for the various books for actual and average cost purposes. The Transaction Costing process (within the Cost Accounting Creation process) uses the most current cost version based on the effective date that is entered here compared to the transaction date. Cost versions must be set for all cost books. The cost versions are used for calculating labor, machine, overhead, and by-products. Since each cost book could be on a different planning or budget cycle, the system enables you to have different cost versions (and cost rates) for each book. Cost rates, such as costing conversion rates and costing conversion overhead rates, are defined by a combination of cost type and cost version.

This page is not required for cost books using a frozen standard cost profile because the standard costs do not vary across cost books. The frozen standard costs are calculated and applied to production at the business unit level for all standard cost books that are within the business unit.

Establishing Actual Costs for Crew

Establishing Actual Costs for Crew

To assign actual cost rates to a business unit crew, use the Assign Crew Actual Costs (CE_CREW_ACTCOST) component. Use the Assign Crew Actual Costs component interface to load data into the tables for this component.

Access the Crew Actual Cost page (Cost Accounting, Item Costs, Define Rates and Costs, Crew Actual Cost).

Enter the actual labor rate by crew that is to be used by the Transaction Costing process (within the Cost Accounting Creation process) to calculate the actual cost of production IDs by using this labor crew. This page is used if the item's cost profile uses the Actual Time-Crew Rate option for the Labor Cost Method field.

Defining Item Default Values

Defining Item Default Values

These default values are defined for the item and influence the Transaction Costing process within the Cost Accounting Creation process.

The item's source code determines how the item is used for by the Transaction Costing process. You define each item's source code on the Define Business Unit Item - Manufacturing page. Options are:

On the Define Business Unit Item - Manufacturing page you specify which production routing the item uses when the system determines the assembly item's this level labor, material, and overhead costs.

The item's average order quantity indicates the typical batch or lot size that is used to produce this item. You define each item's average order quantity on the Define Business Unit Item - Manufacturing page. This is the quantity that is expected to be produced in one production ID or production schedule based on the BOM.

If a BOM quantity on a bill is greater than one, the component's per assembly quantity is spread over the BOM quantity. For example, Assembly A has a BOM quantity of 100; Component B used on A has a per assembly quantity (QPA, or quantity per assembly) of 1500. Therefore, the use of B for a single A is 15 (1500/100). When entering the QPA, BOM maintenance supports a precision of four places to the right of the decimal. You have the option to define the calculated QPA precision the system maintains when it determines the item's cost. On the Installation Options - Manufacturing page, you select a precision anywhere from 4 to 10 places to the right of the decimal. If the BOM and associated process results in multiple outputs (primary, co-products, and by-products), the BOM quantity must be set to the item's average order quantity.

If you use economic order quantities or average order quantities with setup, fixed run, and postproduction times, the system must prorate the cost of these processes over the order quantity to determine a per unit cost. The system determines per unit setup, fixed run, and postproduction cost by dividing the cost of each process by the average order quantity. Typically, the system calculates this at the operation level, then sums it to provide the total cost.

The Transaction Costing process within the Cost Accounting Creation process uses cost elements to categorize the components of an item's cost. Cost elements are also used when costing a transaction. Enter the cost element for the item's material costs on the Define Business Unit Item - General page. For both purchased and makeable items, you must enter a cost element in the material cost category.

Used in Manufacturing Check Box

Any item that can have a BOM or routing, or that can be a component on a BOM or component list, or is associated with a production area, or is used on a production ID or production schedule, must be marked as used in Manufacturing. Select this check box on the Item Business Unit Definition - General: Costing page.

See Also

Defining Basic Business Unit Item Attributes

Using the Bill of Materials

Using the Bill of Materials

The manufacturing bill, engineering bill, or component list determines the structure of the item and therefore the associated lower-level costs.

PeopleSoft Cost Management uses BOM yield or component yield loss to account for the loss of components during the manufacturing process. For costing purposes, the cost of the assembly item can therefore take into account the expected loss of components in production. In this instance, the system inflates the cost of the component by the component's yield.

Transaction costing does not include the cost of floor stock, expensed, subcontract supplied, or nonowned items. Consigned items are included in the item's cost as they are considered owned upon consumption.

If you roll up an assembly item that has no owned components, only nonowned and parts that are supplied by a subcontractor (Subsupply flag is set to Yes), the Transaction Costing process (within the Cost Accounting Creation process) does not calculate any lower-level material costs but still rolls up labor costs for that item.

Note. Subcontractor-supplied or other nonowned items must be designated as consigned to be included in an end item's final cost.

See Also

Using Item Routings

Using Item Routings

The production routing, engineering routing, or operation list documents the operations that are necessary to assemble the item. In the Transaction Costing process (within the Cost Accounting Creation process), the system considers only the routings or operation lists of those items whose source code you define as make.

When calculating conversion costs for an operation, you must consider the crew size of the operation. For example, if the crew that is assigned to a work center consists of three people, you multiply the labor run cost by three.

As it does with crew size, the system multiplies the machine cost of an operation by the number of machines that are assigned to the work center in which the operation takes place.

When the conversion rate that is associated with the code that is assigned to the operation is expressed in terms of a cost per unit, as opposed to a labor or machine rate per hour, you must specify the corresponding costing time type on the routing or operation list in order for the system to include the cost. For example, if in the conversion code that is associated with the operation, you specify a labor run cost of 1 per unit, there must be a costing labor run time in the routing or operation list in order for the system to include that 1 in the item's cost.

When you specify an operation's costing times and run rates in terms of days, the system factors the rate by the work center's average daily capacity to determine the total number of hours that it requires to complete the operation.

See Also

Grouping Production Schedules for Actual

or Average Costing

Grouping Production Schedules for Actual

or Average Costing

Production schedules must be included in a schedule group in order to be costed for actual or average costing by the Transaction Costing process. This section discusses how to group production schedules.

A schedule group for costing can include one or more production schedules. In the organization, one job could include several production schedules across shifts and days. You can collect all the production schedules for one job together into one schedule group ID. When the schedule group ID is costed by the Transaction Costing process, the final costs are divided by the outputs across all the production schedules in the group.

See Also

Pages Used to Group Schedules for Actual

Costing

Pages Used to Group Schedules for Actual

Costing

|

Page Name |

Definition Name |

Navigation |

Usage |

|

AUTO_NUM_PNL |

Set Up Financials/Supply Chain, Common Definitions, Codes and Auto Numbering, Auto Numbering, Automatic Numbering |

Define a numbering scheme to create group schedule IDs. The numbering scheme is defined by setID and the number type Schedule Group ID. You cannot create groups until you establish a numbering sequence. |

|

|

CE_GROUP_PID |

Cost Accounting, Item Costs, Update Costs, Group Schedules, Group Schedules |

Group one or more production schedules into a schedule group for costing actual and average costs make items. |

|

|

CE_AUTOGRP_PID |

Cost Accounting, Item Costs, Update Cost, Auto Group Schedules |

Group one production schedule into one schedule group for costing actual and average cost make items. |

|

|

CE_UNGROUP_PID |

Cost Accounting, Item Costs, Update Cost, Ungroup Schedules |

Remove production schedules from a schedule group. Production schedules cannot be removed after the Transaction Costing process (within the Cost Accounting Creation process) is run. |

Establishing Automatic Numbering for the

Group Schedule ID

Establishing Automatic Numbering for the

Group Schedule ID

Access the Auto Numbering page (Set Up Financials/Supply Chain, Common Definitions, Codes and Auto Numbering, Auto Numbering, Automatic Numbering).

|

Number Type |

Enter Schedule Group ID to set up automatic numbering for schedule groups. |

|

Field Name |

Select the value CE_GRP_PID_ID for automatic numbering. This automatic numbering field is 10 characters long. |

|

Start Seq (start sequence) |

Enter a prefix using three characters. One or more prefixes can help identify the type of schedule group. For example, you may want to use a unique prefix of ALT for production schedules in the Atlanta plant and LDN for production schedules in the London plant. |

|

Max Length (maximum length) |

Enter maximum length of the schedule group ID. 10 or less characters can be entered. |

|

Last Number Issued |

Enter a numeric value to start the automatic numbering. The system starts by increasing in increments of one the last number that is issued. Note. This field cannot be zero or blank. You must enter a value. |

|

Default |

If you create more than one numbering sequence for this number type, indicate the default sequence. |

See Also

Setting Up Automatic Numbering

Grouping Schedules

Grouping Schedules

Access the Group Schedules page (Cost Accounting, Item Costs, Update Costs, Group Schedules, Group Schedules).

To cost make items using actual or average costing, you must place production schedules in a group. Use this page to add one or more production schedules to a new or existing schedule group ID. When you enter this page, the system displays all available production schedules based on the business unit, item ID, and production area. You can refine the search to include the due dates from and to production. The search results only display production schedules that are not currently attached to a group. Select the production schedules to add to the schedule group ID, enter a Description (required), and save the page.

Auto Grouping Schedules

Auto Grouping Schedules

Access the Auto Group Schedules page (Cost Accounting, Item Costs, Update Cost, Auto Group Schedules).

To cost make items using actual or average costing, you must place production schedules in a group. Use this page to add one production schedule to one schedule group ID. You can create multiple schedule groups at one time by selecting one or more production schedules. The system creates one group ID for each separate production schedule when you save this page.

Ungrouping Schedules

Ungrouping Schedules

Access the Ungroup Schedules page (Cost Accounting, Item Costs, Update Cost, Ungroup Schedules).

Use this page to remove production schedules from a schedule group ID. This can only be done before the Transaction Costing process (within the Cost Accounting Creation process) is run for this schedule group ID or any transaction included in this group.

Note. If a schedule group ID is created with certain production schedules and then later you remove all the production schedules from the group, then the schedule group ID cannot be used again for a different set of production schedules.