Basic Earnings

Basic Earnings

This chapter discusses:

Basic earnings.

Base salary.

Complements.

Earnings calculation.

Compensation definition.

Viewing delivered basic earnings elements.

Basic Earnings

Basic Earnings

This section discusses:

Basic earnings in Spain.

Processing considerations for basic earnings.

Basic Earnings in Spain

Basic Earnings in SpainIn PeopleSoft Global Payroll for Spain, earnings are classified in two ways: basic and nonbasic. Whether an earning is considered basic or nonbasic depends on its frequency and whether it's a fixed amount or a variable amount.

Basic earnings are:

Paid every month.

Included in the employee's annual income at the beginning of the year.

A fixed amount each period (fixed earnings).

Basic earnings include:

Base salary.

Seniority.

Prorated extra periods established by the labor agreement.

Complements, such as languages, degrees, mejora voluntaria, complemento absorbible, and public transportation.

Any other delivered earning is considered a nonbasic earning in PeopleSoft Global Payroll for Spain.

Note. The basic earnings discussed here are only the ones that PeopleSoft Global Payroll for Spain delivers as sample data. They are the most common basic earnings required in Spain.

You can also create your own earnings and modify the calculation rules to fit your company's needs. To create your own earnings, use the Earnings component (GP_EARNING).

See Also

Defining Earning and Deduction Elements

Understanding Nonbasic Earnings

Processing Considerations for Basic Earnings

Processing Considerations for Basic Earnings

Basic earnings have these processing considerations:

Net to gross and gross to net adjustments.

Seniority calculation.

Extra period calculation.

Termination.

Because of these processing considerations, all basic earnings have the following special characteristics:

Calculation Rule = Unit * Rate

All basic earnings must:

Be defined with the calculation rule of Unit * Rate, where Unit is the formula GEN FM UNIDADES and Rate is a rate code.

Be identified by the category BAS at the earning definition.

Have their own rate code.

Have the formula GEN FM RATE AN/DAN as a post process formula.

Have as generation control XTR GC MEN O PXTRA.

PeopleSoft Global Payroll for Spain calculates the earnings for all employees on a daily basis, regardless of the way they contribute to social security (daily or monthly). Therefore, the rate component is always a daily rate. For employees who contribute monthly, the Unit component is 30 days (when they work the whole month) for regular payments or the extra period time frame for an extra period. For employees who contribute daily, the unit component contains the number of days that the employee worked. The unit is the GEN FM UNIDADES formula.

The rate for basic earnings is always a rate code, which retrieves its values from the Job Data - Compensation page. Note that you can enter rate codes with whatever frequency you need. In the case of daily employees, normally you provide daily rates or annual rates. All rate codes are annualized or deannualized to days. So you can think of the unit as the actual number of days worked in a month and the rate as the theoretical amount that an employee is supposed to earn per day.

For employees who are paid based on real worked days and contribute to social security on a daily basis, if they work the entire month, the unit equals 30 for months with 30 days, 31 for months with 31 days, and 28 or 29 in February. The unit equals the number of days worked for employees who don't work the entire month.

For employees whose earnings are calculated monthly (whose social security contribution group is Monthly ) and who work the entire month, the unit equals 30 regardless of the number of days that month has. If an employee is sick 10 days, the unit equals 20.

Generation Control = GEN GC MEN O PXTRA

The GEN GC MEN O PXTRA generation control determines whether an earning must be calculated at an extra period an extra period payroll is processed.

See Also

Base Salary

Base Salary

This section discusses:

Base salary in Spain.

Adjustments to salary.

Complemento Absorbible.

Seniority.

Base Salary in Spain

Base Salary in SpainTypically in Spain, an employee's base salary is defined by the labor agreement. However, with HR and PeopleSoft Global Payroll for Spain you can set up employee compensation in different ways to suit your company needs.

The base salary is a basic earning. It is typically calculated as Unit * Rate, where the rate code is established by the labor agreement or in other ways, depending on the setup of your company's compensation. The unit is calculated with the formula GEN FM UNIDADES. The calculated value depends on the type of employee (daily or monthly).

Note. PeopleSoft Global Payroll for Spain uses the GEN RC SAL BASE rate code to specify the base salary. This rate code is linked to the SALBSE rate code defined in HR.

See Also

Adjustments to Salary

Adjustments to Salary

To calculate an employee's total salary, you may have to consider some adjustments to the basic compensation that are specified in the labor agreement, or that result from an employee's personal agreement.

If the salary in the employee's personal agreement is the same as the amount reflected in the labor agreement, no adjustment is necessary. This salary includes both base salary and complements.

Adjustments may include:

Gross to net: Make this adjustment if the employee's gross salary defined by the labor agreement for his professional category is different from the gross salary in his personal agreement.

Net to gross: Make this adjustment if you need to calculate an employee's annual gross salary from an agreed net amount.

See Also

Understanding Gross and Net Guarantee

Complemento Absorbible

Complemento Absorbible

The difference between the real gross defined in employees' personal agreements and the total earnings that they should receive in their professional category must be reflected in an earning element called complemento absorbible. In the case of net guarantee, the complemento absorbible is the difference between the calculated gross (calculated from the net) and the total earnings based on the professional category of the employee.

The calculation rule for complemento absorbible is defined as Unit * Rate, where Unit is the number of days worked in a month and Rate is the rate code GEN RC COM ABS EST. The earning is identified in the Customer Fields area with a value equal to 9-COMPABS.

To calculate the complemento absorbible, you must override the variable GEN VR TIPO AJ SAL for that employee using the value BRUTO for gross to net adjustment or the value NETO for net to gross adjustment. Use the Supporting Elements Overrides page to enter this override.

See Also

Seniority

Seniority

Companies often calculate seniority by subtracting the seniority date from the payroll period end date. This is the PeopleSoft-delivered calculation method, but you can change it to fit your company's needs. If you want to change the calculation method, specify a custom duration or formula to calculate seniority years for a labor agreement on the Labor Agreement - Seniority page or modify the code of formula CLI FM ANTIG DESDE.

Note. Absences can decrease seniority years based on the number of months absent.

You can measure seniority pay in different ways. Typically, you measure seniority in multiples of three years (trienniums) or four years (cuatrenniums). You can also measure seniority as a mixture of years.

PeopleSoft Global Payroll for Spain delivers trienniums and cuatrenniums, but you can create a different seniority measurement by adding a new earning using one of the existing earnings as a template. If you define a new seniority measurement, add it on the Seniority Earnings page and identify those new seniority earnings with value 5–ANTIGDAD in the Custom Field5.

The most common way to determine seniority is to associate an amount with a triennium or cuatrennium. For example, an employee could get 18 EUR per month for the first triennium and 21 EUR per month for the second triennium. So if an employee has six years of seniority, he would get 39 EUR per month in seniority earnings.

Another typical seniority calculation method is a percentage over the base salary or base salary plus a complement.

Here's an example:

Assume that you have a programmer who is at Salary Level 4, earning 700 EUR per month. The labor agreement defines seniority as a cuatrennium that is 4 percent of the base salary. The programmer has eight years of seniority, which is equal to two cuatrenniums. His seniority earnings per month is calculated as:

Number of cuatrenniums x (Percentage x Base) = Seniority earnings.

2 (cuatrenniums) x (0.04 x 700 EUR) = 56 EUR per month.

Consolidated Seniority (Antigüedad consolidada)

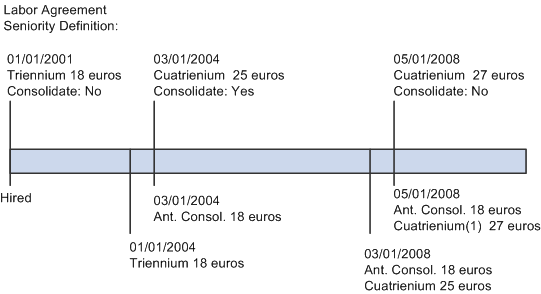

Sometimes, the labor agreement establishes a change in the measurement of seniority, for example, from trienniums to cuatrenniums. When this happens, part of the seniority amount can appear as another earnings element called consolidated seniority (antigüedad consolidada). The consolidated seniority element must reflect the total amount that the employee was receiving until the date of the change. This occurs if you select the Consolidation check box when adding a new effective-dated row on the Labor Agreement - Seniority page. If you don't select this check box, the seniority calculation considers only the new values or percentages when calculating the total amount to be paid for seniority.

Example

This example shows how consolidated seniority can affect an employee's seniority earnings:

Labor agreement seniority example

See Also

Complements

Complements

This section discusses:

Complements in Spain.

Language complement.

Degrees or special skills complement.

Mejora Voluntaria.

Public transportation and distance complement.

Extra periods.

Complements in Spain

Complements in SpainComplements complete the final gross pay for each employee or group of employees. Complements understood as basic earnings are always calculated as Unit * Rate, where the worked days is in the Unit component of the calculation rule.

Three types of complement earnings exist:

Personal conditions.

Work completed.

The company's situation and results.

Note. The payroll calculation process treats all these complements in the same way.

In this section, detailed information is provided about personal condition complements, which include language skills, degrees or special skills, mejora voluntaria, and transportation. Complements for work completed and company situation are discussed in another chapter in this PeopleBook.

See Also

Understanding Nonbasic Earnings

Language Complement

Language Complement

Generally, employees receive a language complement only if they were hired specifically for their language skills and if using those language skills are a tool in their job.

The calculation rule for the language complement element is defined as Unit * Rate, where Unit is the days worked in a month and Rate is a rate code.

Because the language complement is an employee-specific earnings, it must be assigned individually for each employee who qualifies.

The language complement is defined on the Earnings component (GP_EARNING). Accumulators for the language component are discussed in this chapter.

See Defining Earning and Deduction Elements.

See Earnings and Accumulators.

Degrees or Special Skills Complement

Degrees or Special Skills Complement

The degrees or special skills complement is used to compensate employees for their knowledge of a subject or for their skills.

Note. The calculation rule, page setup, and accumulators for the degrees or special skills complement are the same as those for the language complement.

Mejora Voluntaria

Mejora Voluntaria

Mejora voluntaria is the substitute for the complemento absorbible. It is a complement that you manually calculate to pay an employee the difference between the market price and the specific salary reflected in the labor agreement for his category if you have defined compensation at the labor agreement level.

Note. The calculation rule, page setup, and accumulators for the mejora voluntaria complement are the same as those for the language complement.

Public Transportation and Distance Complement

Public Transportation and Distance Complement

The public transportation and distance complement is paid to employees to compensate for the distance between their residence and the company location. The maximum social security exempted is 20 percent of PRIM (Indicador Público de Renta de Efectos Multiples). Depending on whether the employee contributes to social security on a monthly or daily basis, the PRIM amount is calculated either monthly or daily.

Note. Indicador Público de Renta de Efectos Multiples is the a monthly or daily value established annually. A maximum of 20 percent of PRIM is exempt from social security contributions.

Only earnings that are paid in excess of the 20 percent of PRIM must be included in the Social Security base, but the whole amount is taxable. Since July 2004, this ceiling has been established as:

20% x 479.19 EUR (SMI) = 95.826 EUR/month

Because the public transportation and distance complement is an employee-specific earning, you must assign it individually for each employee who qualifies.

Note. One exception exists that is related to daily employees and the transportation complement. Sometimes, the transportation complement is paid monthly regardless of whether an employee contributes to Social Security on a monthly or daily basis. You can specify how the earning is calculated by assigning a daily or nondaily frequency on the Job Data - Compensation page. Frequencies other than daily generate monthly transportation complements. The TRANSPORTE earning is identified in the Custom Fields area with the value equal to 1-TRNSPRTE.

See Also

Extra Periods

Extra Periods

In addition to 12 pay periods per year, employees are also eligible for two or more extra period payments, as defined by their labor agreements. Two extra period payments are the statutory minimum; however, a labor agreement may set a higher number. Extra periods are either paid as a lump sum or prorated over the year.

Note. Extra periods are discussed in detail in another chapter in this PeopleBook.

See Also

Earnings Calculation

Earnings Calculation

This section discusses:

Daily calculation.

Earnings and accumulators.

Daily Calculation

Daily Calculation

PeopleSoft Global Payroll for Spain calculates earnings, getting a daily rate. Depending on the way that the employee contributes to social security, the rate is multiplied by 30 for monthly employees or by the number of days in the month for daily employees.

Note. Regardless of how an employee's earnings are calculated, all employees are paid every month.

If you calculate daily employees, you must know the daily values for each earning, as well as the total number of days worked. An employee with a daily calculation type doesn't receive the same gross and net amount every month because different months have different numbers of days. For example, an employee will receive less money in February than in June.

Cases occur in which you might want to manage daily employees as though they were monthly employees. Although an employee is assigned to a daily social security work group, you might want to pay the employee's Social Security contribution on the basic 30-day month. In such a case, you must override the value of variable SS VR TRATA MNSUAL with a value other than No for the specific employee.

Conversely, you might want to manage monthly employees as though they were daily employees. In such a case, you must override the value of variable SS VR TRATA DIARIO with a value other than No. In addition, you must specify the range of dates for which this override is effective.

PeopleSoft Global Payroll for Spain also calculates earnings for part-time employees. Part-time employees for Spanish payroll are ones who are normally paid based on their hours worked and have their Social Security contribution calculation based on their hours worked. You identify whether an employee is part-time through the Full/Part field on the Job Information page of the Job Data component (JOB_DATA). You can also use the FTE field to identify the employee's full-time equivalent. You can then apply the FTE value to compensation rate codes to determine reduced proportionality.

PeopleSoft Global Payroll for Spain differentiates between two types of part-time employees:

Regular part-time employees:

These are employees who have a reduction in the working hours per day and whose contribution to social security is based on hours. An example is an employee working from Monday through Friday for four hours per day. These employees are always paid for 30 days if they are monthly or paid by the number of days in the month if they are daily.

Irregular part-time employees:

These are employees who have an irregular work schedule where they can work a different number of days each month. Examples include employees who work weekends or weekends and bank holidays only, employees who work just three days per week, and employees who work a different number of days and hours each week. PeopleSoft Global Payroll for Spain uses the work schedule definition assigned to the employee to calculate the actual worked and contributed days for irregular part-time employees.

For regular part-time employees, you must use the supporting element override functionality to specify through the CLI VR RED JORNADA variable the number of working hours per day for the employees. This step is required for regular part-time employees.

Here is an example of how the system calculates earnings for part-time employees. Assume that the monthly gross salary for a full-time employee working eight hours a day is 2000 EUR. For a part-time employee who is in the same professional category as the full-time employee, working six hours a day, the system automatically multiplies the rate by a factor of 6/8 to calculate a monthly gross salary of 1500 EUR for the part-time employee.

Earnings and Accumulators

Earnings and Accumulators

Each earnings element can accumulate its value over other elements. The following is a list of the accumulators that are used with earnings elements included in the standard solution. Before defining a new element, it's a good idea to understand what each accumulator does.

Basic earnings (GEN AC DEV BAS S):

The sum of all basic earnings for an employee. Use this base to determine the amount of an extra period or as the base for calculating an hourly rate.

Nonbasic earnings (TAX AC DIN VAR S):

The sum of all nonbasic or variable earnings for an employee.

Total earnings (GEN AC SAL BRUTO S):

The sum of all elements considered as earnings for an employee.

In kind earnings (TAX AC SPC):

The sum of all in kind earnings for tax reasons.

Salary taxable base (TAX AC BASE S):

The sum of all the taxable salary earnings.

Note. Not all salary earnings are added to the taxable base. For example, dietas don't contribute to taxes until an employee reaches a statutory rate that is established each year. So only the dietas earnings that are in excess of the statutory rate contribute to the taxable base.

In kind taxable base (TAX AC SPC ): The sum of all the taxable in kind earnings.

Employee's Social Security common contribution base (SS AC BSE D S and SS AC BSE M S): The sum of all the contribution earnings in common contributions.

When you create a new element, you should define the accumulators to which the element contributes.

This table lists the basic earnings and the accumulators to which each basic earnings type contributes:

|

Type of Basic Earning |

Accumulators |

|

Base Salary |

Basic Earnings, Total Earnings, Taxable Base, Social Security Common Contribution Base |

|

Seniority |

Basic Earnings, Total Earnings, Taxable Base, Social Security Common Contribution Base |

|

Mejora voluntaria |

Basic Earnings, Total Earnings, Taxable Base, Social Security Common Contribution Base |

|

Complemento absorbible |

Basic Earnings, Total Earnings, Taxable Base, Social Security Common Contribution Base |

|

Idioma |

Basic Earnings, Total Earnings, Taxable Base, Social Security Common Contribution Base |

|

Cualificacion |

Basic Earnings, Total Earnings, Taxable Base, Social Security Common Contribution Base |

|

Transport |

Basic Earnings, Total Earnings, Taxable Base, Social Security Common Contribution Base (only the excess TRNSPRTE EX) |

|

Prorated extra periods |

Basic Earnings, Total Earnings, Taxable Base |

PeopleSoft Global Payroll for Spain also provides accumulators that are PS Delivered/Not Maintained. These accumulators make defining new basic earnings easier.

Important! For maintenance reasons, do not update these accumulators. When creating your own accumulators, use these accumulators as models only; use the set of delivered parallel accumulators to customize accumulators.

This table lists the accumulators that are PS Delivered/Not Maintained:

|

Functional Area |

Accumulator Name |

Description |

|

Compensation |

CLI AC SAL BRUTO |

Custom gross salary. Add elements here that correspond to the employee's compensation. |

|

Compensation |

CLI AC DEV ABSRBLE |

Custom absorbable earnings. Add elements here that are going to be absorbed by the net-to-gross process. Note. An element that contributes to both gross salary and to absorbable earnings needs to be added to both the CLI AC SAL BRUTO and CLI AC DEV ABSRBLE accumulators. |

|

Taxes |

CLI AC ING DIN FJO |

Custom-fixed taxable base. Depending on the nature of the earning, you need to include it in one of the following accumulators for tax purposes:

|

|

Social Security |

CLI AC BASE SS D |

Social Security daily base. |

Compensation Definition

Compensation Definition

In PeopleSoft Global Payroll for Spain, you can define compensation at these levels:

The labor agreement.

In this case, you define a specific salary plan for the labor agreement. You can associate the salary grades of the salary plan with every category or subcategory of the labor agreement.

Your company's own salary plan.

This may have salary steps and grades that are different from the ones in the labor agreement. If you have employees with guaranteed gross or guaranteed net pay, you need to set up the automatically calculated premium section that is part of multiple components of pay.

Job code.

Individual employee.

You can specify a different amount from what is stated in the labor agreement directly on the individual employee's job data.

With a specific rule defined using the functionality of rate code defaulting rules.

See Also

PeopleSoft HR 9.1 PeopleBook: Administer Compensation

Viewing Delivered Basic Earnings Elements

Viewing Delivered Basic Earnings Elements

This section discusses:

Delivered basic earnings.

Delivered process list for basic earnings.

Delivered Basic Earnings

Delivered Basic Earnings

This table lists the delivered basic earnings:

|

Basic Earning |

Description |

|

ANT CONSOLDA |

Consolidated seniority |

|

BECA INVESTN |

Scholarship Holder |

|

COMP ABSRBLE |

Absorbable complement |

|

CUALIFCN |

Degrees or special skills complement |

|

CUATRIENIOS |

Seniority cuatrienniums |

|

DEV SS EXPTR |

Social Security Contributed by Expatriate |

|

DEV SS PREJ |

Social Security Paid by Employee |

|

DEV SS PRJ I |

Social Security Paid by Employee – Irregular |

|

IDIOMAS |

Languages complement |

|

MEJORA VOLUN |

Voluntary income |

|

PREJBILACN I |

Pre-retired Income - Irregular |

|

PREJUBILACN |

Pre-retired Income |

|

PXTRA PRTDA |

Prorated extra period |

|

SALARIO BASE |

Base salary |

|

TRANSPORTE |

Transportation complement |

|

TRNSPRTE EX |

Transportation taxable excess |

|

TRIENIOS |

Seniority trienniums |

Delivered Process List for Basic Earnings

Delivered Process List for Basic Earnings

This table lists the process list for basic earnings:

|

Process List |

Description |

|

GEN PR CALC NOM |

Regular payroll process. The standard sections of this process list that include the calculation of basic earnings are:

|

Note. The system also calculates basic earnings that are part of the extra period processing.

Note. The PeopleSoft system delivers a query that you can run to view the names of all delivered elements that are designed for Spain. Instructions for running the query are provided in the PeopleSoft Global Payroll 9.1 PeopleBook.

See Also

Understanding How to View Delivered Elements