Understanding Banking and Recipient Processing

Understanding Banking and Recipient ProcessingThis section provides overviews of banking and recipient processing, the Hong Kong banking process flow, and discusses how to:

Link source banks to pay entities.

Set up additional Mandatory Provident Fund report details.

Manage electronic fund transfers (EFT) to recipients.

Generate recipient payment report files.

Process manual and separate cheques.

Understanding Banking and Recipient Processing

Understanding Banking and Recipient ProcessingGlobal Payroll for Hong Kong supports net payment (employee salary) direct deposits and recipient payments using the electronic file (HSBC) format used by the Hong Kong and Shanghai Corporation Bank. Banking and recipient processing enables you to:

Run an EFT file creation process to generate a file that includes employee salaries (net payments) and recipient payments.

Net amounts and recipient payments are calculated by the core banking process and stored in the GP_PAYMENT result table.

Generate data for delivering deduction details to the recipient.

The process extracts payment information directly from the GP_PAYMENT result table to create the HSBC file.

Decide whether to take the commission out of the recipient payment, as recipients may pay a commission to the pay entity.

Keep track of your banking and recipient processing, and generate the following reports:

Net Payment report: Contains information about amounts transferred to employee accounts.

Recipient report: Contains details about amounts collected from employees on behalf of a recipient.

See Also

Appendix: Global Payroll for Hong Kong Reports

Understanding the Hong Kong Banking Process Flow

Understanding the Hong Kong Banking Process Flow

The Global Payroll banking process brings together payroll data, pay entity source bank data, and payee or recipient bank data. The Hong Kong EFT file creation process extracts data compiled by the banking process according to the type of EFT file that you are creating, merges it with data provided by the Hong Kong country extension, and creates the file for transmission.

Global Payroll handles the banking process as follows:

Runs the payroll process using Global Payroll.

This provides the payment data for the banking process.

Runs the Global Payroll banking process.

Net amounts and recipient payments are calculated by the core prepayment banking process and stored in the GP_PAYMENT result table. The payment status is set to P (prepared). The GP_PAYMENT result table contains one entry for every net pay distribution from every payment included in a calendar run and provides the basis on which an organization pays its payees.

Using Global Payroll for Hong Kong, run the Electronic File For Transfers Application Engine process (GPHK_EFT), which populates the HSBC file used for electronic fund transfer.

In this step, the system selects payees from GP_PAYMENT with the following parameters:

Payment status: P (prepared).

Payment type: 01 (net pay distribution).

Payment method: T (bank transfer).

Currency code: HKD.

The payment status for the selected payees is set to T (transferred) in GP_PAYMENT.

Note. You must run the banking process before the HSBC file generation process.

See Also

Common Elements Used in This Chapter

Common Elements Used in This Chapter|

HSBC |

Hong Kong and Shanghai Banking Corporation. |

|

HSBC file |

Electronic file format, as described by the Hong Kong and Shanghai Corporation Bank (fixed-length file used for electronic fund transfer). |

|

HSBC EFT data |

Single process used to generate the data required for reporting in the EFT format, as defined by HSBC. |

|

Recipient |

Any third-party organization that has dealings with the employer using global payroll software. |

|

Net Payment |

Payment that includes employee salaries. |

|

Source Bank |

Money sources defined at the pay entity level, from which payroll disbursements are drawn. They identify each funding location and the EFT formats used by each institution. |

Viewing Delivered Elements

Viewing Delivered ElementsThe PeopleSoft system delivers a query that you can run to view the names of all delivered elements designed for Hong Kong. Instructions for running the query are provided in the PeopleSoft Global Payroll 9.1 PeopleBook.

See Also

Understanding How to View Delivered Elements

Linking Source Banks To Pay Entities

Linking Source Banks To Pay Entities

To link source banks to pay entities, use the Pay Entity Bank Details HKG (GPHK_PYENT_SBNK) component.

After you identify your banks and branches, source banks are the first entities that you create as part of the banking feature in Global Payroll. Source banks identify each funding location and the EFT formats used by that institution.

This section discusses how to link source banks to pay entities.

Page Used to Link Source Banks To Pay Entities

Page Used to Link Source Banks To Pay Entities|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPHK_PYENT_BNK |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Entity Bank Details HKG, Pay Entity Bank Details HKG |

Link a source bank to a pay entity and define the source bank's customer number that identifies the EFT formats used by that organization. |

Linking Source Banks To Pay Entities

Linking Source Banks To Pay EntitiesAccess the Pay Entity Bank Details HKG page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Entity Bank Details HKG, Pay Entity Bank Details HKG).

|

Pay Entity and Source Bank ID |

Link a specific pay entity with the source bank ID that is used to fund all payroll activities for all payees that are part of this pay entity. The system uses these links to:

Define your source banks and account numbers on the Source Bank Accounts page. |

|

Customer Number |

For each source bank ID, identify the appropriate bank or branch customer number (bank reference number). This number identifies the EFT formats used by that institution and is used to generate the name of the electronic file. The HSBC file name is the first 8 digits of the customer number with the APC file extension. Because HSBC has the profile of all customers, they verify the submitted file with the customer information. If the file is valid, they transfer the funds on the appointed date. For example, the HSBC customer number for PeopleSoft Hong Kong is 586 2988 023-233. The autopay file for PeopleSoft Hong Kong is 58629880.APC. |

See Also

Setting Up Additional Mandatory Provident Fund Report Details

Setting Up Additional Mandatory Provident Fund Report Details

To set up additional Mandatory Provident Fund (MPF) report details, use the Deduction Recipients HKG (GPHK_RCP_CMN) component.

This section discusses how to:

Set up recipient commission and MPF scheme details.

Link employees to recipients by membership number.

Pages Used to Set up Additional Mandatory Provident Fund Report Details

Pages Used to Set up Additional Mandatory Provident Fund Report Details|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPHK_RECIPIENT_EXT |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Banking, Deduction Recipients HKG, Deduction Recipients HKG |

Enter additional recipient information including that required for the MPF Remittance Statement. Additional information must be captured for each MPF scheme. Define the commission calculation method for one or more pay entities and associate each recipient with a file layout name. |

|

|

GPHK_MEMBERSHIP_NO |

Global Payroll & Absence Mgmt, Payee Data, Net Pay / Recipient Elections, Add Recipient Mbrship Nbr HKG, Add Recipient Mbrship Nbr HKG |

Link employees to recipients using the employee's membership number. |

Setting up Recipient Commission and MPF Scheme Details

Setting up Recipient Commission and MPF Scheme Details

Access the Deduction Recipients HKG page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Banking, Deduction Recipients HKG, Deduction Recipients HKG).

Note. Multiple views of this page are available on the tabs in the scroll area. We document fields common to all views first.

Common Page Elements

|

File Layout Name |

Select the appropriate file layout from those you have created in Application Designer for the electronic files you submit to your recipients. |

|

Registration Number |

This is the MPF reference number and it appears on the MPF Remittance Statement. |

|

Pay Entity |

Enter the pay entity that is going to receive any commission payable by the recipient. If the commission is to be deducted from the payment due to the recipient, the debit to this pay entity's source bank will be reduced by the commission amount. |

Commission & Scheme Details

You can define the commission calculation method for one or more pay entities and associate each recipient with a file layout name.

Commission Tab

|

Recipient Group Nbr (recipient group number) |

When a transaction takes place between the employer and the recipient, it is common to have a unique identification number representing the organization. Enter the unique identifier which the recipient has supplied to your pay entity. For payment to recipients, the group number is part of the unique lodgment reference that is part of each recipient EFT file. Associate a group number with the pay entity who will remit amounts to the recipient. This unique ID must be captured and maintained for the reports and electronic file supplied to the recipient. |

|

Commission Calc Option (commission calculation option) |

Commission is calculated either for reporting or for deducting the calculated amount (from the total amount transferred). Select the method used to calculate fee processing: Deduct (deduct commission): The system deducts the commission amount from the payment due to the recipient. Select a Commission Calc Method, either flat amount or percentage. Report (report only): The system reports the commission amount in the EFT file but doesn't deduct it from the payment. Once a recipient has been identified for processing and the total amount to be paid is known, the system calculates commission (if you have specified it) and deducts the amount or fee from the total amount. This step is carried out only if the setup at the recipient level (for the pay entity) has been set to "calculate and deduct commission." |

|

Commission Calc Method (commission calculation method) |

Enter the commission as a percent rate (Percentage) or flat amount (Flat Amt). If commission is to be deducted, the appropriate value is calculated and the newly calculated amount is written to the file layout object:

|

|

Commission Value |

The flat amount or percentage of the commission to be calculated. If you select Flat Amt or Percent as the Commission Calc Method, you must enter a value in the Commission Value field. Note. You should enter the value as a decimal (2 percent as 0.02). |

Scheme Tab

The fields in this page are for MPF reporting.

|

Participation Number, Contact ID, and Contact Phone |

Just as recipients identify each employer with a group number, they also identify their employees, as a group, with a unique number that is also known as the participation number. |

Linking Employees to Recipients by Membership Number

Linking Employees to Recipients by Membership Number

Access the Add Recipient Mbrship Nbr HKG page (Global Payroll & Absence Mgmt, Payee Data, Net Pay / Recipient Elections, Add Recipient Mbrship Nbr HKG, Add Recipient Mbrship Nbr HKG).

|

Recipient ID |

When a transaction takes place between the employer and the recipient, it is common to have a unique identification number representing the organization. Enter the unique identifier that the recipient has supplied to your pay entity. |

|

Membership Number |

For reporting, employers must enter their MPF membership details for each of their employees. Just as recipients identify each employer with a group number, they also identify their employees (associated with the employer) with a unique number that is also known as the participation number. The membership number is used on the reports and electronic file supplied to the recipient. |

Managing Electronic Fund Transfers to Recipients

Managing Electronic Fund Transfers to Recipients

This section provides an overview of the EFT HSBC file and discusses how to manage electronic fund transfers to recipients.

Understanding the EFT HSBC File

Understanding the EFT HSBC File

The Hong Kong-standard HSBC file for EFT is created by a process that provides multiple options that control what each file contains. You can create an EFT file that contains:

Net pay data only.

Recipient data only.

Net pay and recipient data.

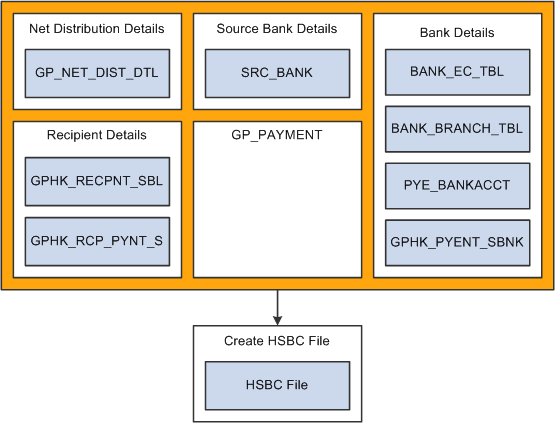

The following diagram shows the tables that contribute data to the HSBC file that is part of the EFT file:

Tables contributing data to the HSBC file

Note. You must finalize your banking process (GP_PMT_PREPARE) before you can create the HSBC file. After the HSBC file has been created, the system changes PMT_STATUS on GP_PAYMENT from P (prepared) to T (transferred).

Pages Used to Manage Electronic Fund Transfers to Recipients

Pages Used to Manage Electronic Fund Transfers to Recipients

Creating the EFT HSBC File

Creating the EFT HSBC File

Access the Create EFT Payment File HKG page (Global Payroll & Absence Mgmt, Payment Processing, Create EFT Payment File HKG, Create EFT Payment File HKG).

|

Payment Type |

The EFT file that the system creates contains only payments of the type that you specify. The value that you select here enables you to identify which details are written to the EFT file and determines the other fields that you must complete on this page. Net Pay Distribution: Enter a calendar group ID and payment date. You don't need to enter a debit date or recipient ID. Only employee salary details (net payments) are processed. The system selects employees with a payment method of bank transfer for the specified calendar group. When processing net payments, multiple pay entities are associated with a single calendar group ID, and there is a distinct EFT file for each pay entity, regardless of whether they use HSBC or some other format. Recipient Payment: Enter a debit date. You don't need to enter a calendar group ID. Recipient payments are selected. You might be processing payroll weekly but paying the recipient only once per month or quarter. Therefore, if you processed by calendar group ID, you produce only one period of payments for the recipient. This problem is overcome by using the Debit Date field. You can enter the date on which recipients must be paid. The date that you enter is compared to the Debit Date field in the GP_PAYMENT result table. All matching rows for the selected recipient in which the payment type is Recipient Payment or Net Pay and Recipient are retrieved for processing. Net Pay and Recipient: Enter a calendar group ID, debit date, and recipient ID. To process recipients, the payment type can be either Recipient Payment or Net Pay and Recipient—both are included. Both payments are processed if you select both payment types. |

|

Calendar Group ID |

Enter the calendar group ID for which you want the file to be created. This enables you to select a separate pay calendar to pay a smaller group of employees on a different date. Note. There is a possibility of using multiple EFT formats to generate the electronic file. There might be multiple pay entities in a single calendar group ID, which means that the process can create separate flat files for each pay entity. |

|

Payment Date |

Enter the date passed to the EFT file header on which the fund amount is transferred between accounts by the bank. Enter a date regardless of the payment type that you select. |

|

Debit Date |

Identifies the recipient transactions that should be selected for processing. The system extracts recipient payments for which the deposit schedule date equals the deposit date. |

Recipients List

|

Recipient ID |

Select recipients to be paid by bank transfer. A recipient is paid only if the payment method in the GP_PAYMENT result table has been identified as T (bank transfer). A recipient identified with a payment method other than bank transfer is not processed, even if selected here. Note. Leaving this field blank indicates that a file must be created for all recipients. |

Generating Recipient Payment Report Files

Generating Recipient Payment Report Files

This section provides an overview of recipient payment files and discusses how to create the recipient payment file.

Understanding Recipient Payment Files

Understanding Recipient Payment FilesIt is common for organizations to transmit a file to a recipient so that they can update their records. For example an organization might pay a recipient weekly and, at the end of the month, deliver a file with all of the payment details. Recipients generally specify the information that they want and the report file layout. After you create the file layout, link it to the recipient on the Deduction Recipients HKG page.

You can select the appropriate file layout from those that you created in PeopleSoft Application Designer for the electronic data (report) files that you submit to your recipients. When you run the creation process, the system creates the file in the layout that you specify here.

PeopleSoft supplies a sample file layout for the recipient file template, GPHK_RCPNT_FILE.

Important! The Application Engine program GPHK_RCPFILE is written to process only the GPHK_RCPNT_FILE recipient schedule file. You can make minor changes to that file, for example field order, but if you make major file layout changes you will need to create additional Application Engine programs to process them.

Pages Used to Generate Recipient Payment Files

Pages Used to Generate Recipient Payment Files

Creating the Recipient Payment File

Creating the Recipient Payment FileAccess the Create Recipient File HKG page (Global Payroll & Absence Mgmt, Payment Processing, Create Recipient File HKG, Create Recipient File HKG).

|

Debit Date |

Enter a date to initiate the process. The process retrieves all recipient payments for which the debit date in the GP_PAYMENT result table equals the debit date that you entered on the Create EFT Payment File HKG page. The system extracts payment data for which the deposit date equals the date that you enter here. |

Recipients List

|

Recipient ID |

Enter one or more recipient IDs to restrict the number of recipients being processed and reported. |

Note. This page should contain the same values that you entered for the generation of the file for bank transfer. A different set of values can lead to generating a file with a totally different set of information. For example, if you ran the bank transfer with a payment date of March 31, 2007 and the recipient payment file is generated for February 28, 2007, the results are not the same. You should use the same run time parameters.

See Also

Managing Electronic Fund Transfers to Recipients

Processing Manual and Separate Cheques

Processing Manual and Separate Cheques

This section discusses how to:

Process manual cheques using calendars.

Process separate cheques.

Processing Manual Cheques Using Calendars

Processing Manual Cheques Using CalendarsOrganizations are often required to produce manual cheques for their employees. When required, all values are calculated and paid outside of the payroll system. PeopleSoft enables you to enter these values in the system to keep the employee's earning history current.

If a payment to a payee is missed in Global Payroll, enter the values into the pay calendar in which the payment should have occurred. The system recognizes that the pay calendar has been finalized and considers changes made to that calendar during retroactive processing.

To use calendars for manual cheques:

Create a new calendar ID and calendar group ID.

If you incorporate into the naming convention of the calendar group ID a notation that the run was specifically for manual cheques, you can identify at the employee level that the payment was not banked.

Add or correct the data (through positive input) in the calendar in which the payment should have occurred.

If the amounts have already been calculated and paid, enter these values here and retro process the entered amounts.

Run the pay calculation process for the new calendar.

Finalize the pay run when you are satisfied that the results are correct.

Use the results of the calculation to create and issue the cheque.

Warning! Don't run the banking process. This prevents the payment from being sent to the bank.

Processing Separate Cheques

Processing Separate ChequesIt is also common for employers to have local agreements that require certain payments to be assigned to a separate cheque number. PeopleSoft enables you to assign additional earnings to a separate cheque number, either on a one-time basis through positive input or on a more permanent basis through additional earnings. When you run the pay calculation process, a separate gross-to-net calculation is performed.

You typically use separate cheque functionality for bonus payments and retro payments, and the result in the pay calculation is a separate gross-to-net calculation.

To process separate cheques in Global Payroll, set up a new calendar, enter positive input, and process the pay run as usual. (Retro payments can be made in separate calendars, but most earnings need a generation control so that they are not processed in the retro run.)

Employees might also request that their net pay, as the result of this separate calculation, be deposited to a different bank account than that of their regular pay. Global Payroll enables employees to have multiple net distribution details, but they are defined by run type. If you defined a run type for regular run type and another for bonus run type, then the employee can nominate a different bank account for each run.

Note. If this method is used to pay into a different bank account, then retro mismatches occur. When retro triggers are processed, you must manually forward the deltas to a target calendar on the Unprocessed Retro Deltas page.