Understanding Section 415 Limits

Understanding Section 415 Limits

This chapter provides overviews of 415 limits and 415 limits processing and discusses how to create a 415 limits definition.

Understanding Section 415 Limits

Understanding Section 415 Limits

This section provides an overview of 415 limits and discusses:

Use of 415 limits results.

Incorporation of 415 limits into a jobstream.

Development of strategies for implementing 415 limits.

Overview of 415 Limits

Overview of 415 LimitsThere are limits placed on the amount of annual contributions that can be made on behalf of a defined contribution plan participant or the amount of benefits that can be paid to a participant in a defined benefit plan. These limits are determined under Section 415 of the Internal Revenue Code. This PeopleBook generally refers to Section 415 limits as "415 limits."

Pension Administration deals with Section 415(b) limits on the total benefit from all defined benefit plans. For historical calculations effective prior to the implementation of the Small Business Job Protection Act of 1996 (SBJPA), the system can also apply Section 415(e) limits on the amount employees can receive from defined benefit plans relative to benefits received from their defined contribution plans.

Because 415 limits apply to multiple plans, the calculation handles this function somewhat differently from any other. You create a single 415 limits function result for all plans.

Use of 415 Limits Results

Use of 415 Limits Results

The 415 limits function produces a second set of optional forms results for every optional formset subject to these limits. If a limited result is present, the system uses this amount when you pay your retirees.

To see whether 415 limits were applied, compare the limited and unlimited optional forms results. Both sets of results are shown on the Review Calculation Results - Optional Forms page.

To see the actual limit, a list of the benefits subject to the limit, and the unlimited and limited amount single life annuity value of each of those benefits, go to the Review Main Results - 415 Limits page.

See Also

Creating the Plan Implementation and Plan Aliases

Incorporation of 415 Limits into a Jobstream

Incorporation of 415 Limits into a Jobstream

Section 415 limits apply to multiple plans. Because the 415 limits function must process all plans together, you create a single 415 limits function result for all plans. Do not create one per plan. Create only one for the entire application.

Normally the calculation processes each plan in the order you specify on the Plan Order page. Within each plan, the calculation processes function results in the order that you specify on the Plan Implementation page. Your 415 limits function result is an important exception to this rule.

When the calculation encounters a 415 limits function result in a plan, processing for that function result is delayed. The calculation continues with any remaining processing for that plan and with any subsequent plans until it encounters a nonqualified plan (or finishes processing all plans, if all plans are qualified). At this point, the system processes the 415 limits. Nonqualified plans are processed after the 415 limits.

Note. To ensure proper 415 limits processing, order your plans so that all qualified plans run before all nonqualified plans.

When 415 limits are processed, the optional forms reflect both the limited and unlimited amounts. However, benefit formula results are not adjusted to show the limits. Because the benefit formula is not adjusted, you cannot reference the unlimited amount if you want to find the difference between the limited and unlimited benefit—for example, if you have a nonqualified plan that makes up the difference.

Because the 415 limits function always runs at a specific point in the calculation, you have some flexibility as to which plan houses your 415 limits function result. You do need to put it in one of the plans before the 415 limits processing point—that is, into one of your qualified plans.

See Also

Creating the Plan Implementation and Plan Aliases

Development of Strategies for Implementing 415 Limits

Development of Strategies for Implementing 415 Limits

As you set up your 415 limits, a key issue is where the 415 definition gets some of the data it needs—for example, how much participation service an employee has and what are the average earnings for the high three years.

In order to set up the 415 definition, you identify function results that provide this data. Some function results, such as the participation service, may already be part of your plan implementation. Other function results, such as the average earnings, probably have to be set up especially for 415 limits processing.

When you set up your 415 limits processing, make sure you put the 415 limits function result and all of its component function results into the same plan. There are two approaches:

Incorporate the function results into an existing qualified plan.

Set up a dummy plan for 415 and put all the function results there.

Incorporation of 415 Limits Processing into Existing Plans

Incorporating 415 limits processing into existing plans works best if you have a single qualified plan because elements such as "participation service" are unambiguous for a single plan, and you can reuse the plan's existing function results. One aspect of this strategy is that you now have an extra final average earnings function result in the plan (unless the plan uses the same rules as the 415 limits), and the results from this function result appear on the calculation worksheet and in the calculation results pages. You can modify the worksheet and results pages so that they do not show this result.

Setup of Dummy Plan for 415 Limits Processing

Implementing 415 limits processing in a dummy plan is the better strategy if the component function results are all 415-specific and cannot be borrowed from your existing plans. When you know that employees will not exceed the limits, setting up a dummy plan enables you to avoid 415 limits processing and to run 415 limits processing only for your highly compensated employees. This approach also neatly separates all the 415-specific function results from those with direct impact on the benefit.

A 415 dummy plan requires its own plan eligibility processing. One approach to setting up eligibility for the dummy plan is to blend the requirements from all other qualified plans to create a single timeline showing when an employee was eligible and ineligible for any plan. You can thus accrue participation service based on eligibility for the dummy plan.

Another approach is to reference the eligibility results from other plans. In this case, the dummy plan has to be the last qualified plan on the Plan Order page. Remember that the eligibility results from the other plans can be Y (yes), N (no), or P (previously eligible). Your dummy plan eligibility should pick up Y and Pvalues. In this scenario, the dummy plan eligibility cannot build an eligibility timeline. This is because the Y, N, and P values are not effective-dated. Therefore, all employees would appear to have always been eligible for the dummy plan. This means that you cannot set up accruals based on eligible and ineligible periods of time. You have to calculate 415 participation service using another method.

Application of 415 Limits to Contributory Plans

Section 415 limits only apply to the employer-paid portion of a benefit. Because the 415 limits function obtains the unlimited amount from optional forms, you need optional forms for the employer-paid benefit.

When 415 limits are applied to the employer-paid benefit, only optional forms based on that benefit reflect the limits. A subsequent benefit formula that recombines the employee-paid and employer-paid benefits is not recalculated after 415 limits are applied, nor are any optional forms based on the total benefit amount.

Warning! The system does not support recombining employee-paid and employer-paid benefits for highly compensated employees.

You can work around the limitation by running an initial calculation to find the limited employer-paid portion, then running a second calculation where you override the employer-paid benefit with that limited amount in order to provide the appropriate amount to the combined benefit formula and optional forms.

See Managing Employee-Paid and Employer-Paid Benefits.

Understanding 415 Limits Processing

Understanding 415 Limits Processing

This section provides an overview of 415 Limits Processing and discusses:

Finding the amounts subject to limits.

Determining the limits.

Applying the limits.

Overview of 415 Limits Processing

Overview of 415 Limits ProcessingPeopleSoft's 415 limits processing can be broken into three parts:

Finding the amounts subject to the limits.

Finding the limits themselves.

Applying the limits.

The first part happened during optional forms processing: your optional forms definitions have a flag where you mark whether the benefit is subject to the limits. The 415 definition controls the other two parts.

When benefits are reduced for 415 limits, you see the reduced amounts in the associated optional forms function result. These are the only results that change due to 415 limits processing.

Note. The benefit amount—that is, the benefit formula function result—is not updated. It still shows the pre-415 limits amount.

Find the Amount Subject to Limits

Find the Amount Subject to Limits

You indicate that benefits are subject to 415 limits by selecting the Use Formset in 415 Processing check box on the Optional Forms pages.

If you have multiple benefit formulas and optional formsets representing the same benefit (for example, an early retirement benefit and a normal retirement benefit), include only one.

In a contributory plan, only the employer-paid portion of a benefit is subject to 415 limits.

Section 415 limits are always applied to the single life annuity value of a benefit. If the normal form of a benefit is not a single life annuity, be sure to include single life annuity in the optional formset. If the single life annuity is only for 415 purposes and is not an actual option for your employees, you can select the For 415 Only check box in the optional forms definition. This prevents the option from appearing in the calculation results.

See Also

Defining Optional Forms of Payment

Defining Employee-Paid Benefits

Determine the Limits

Determine the Limits

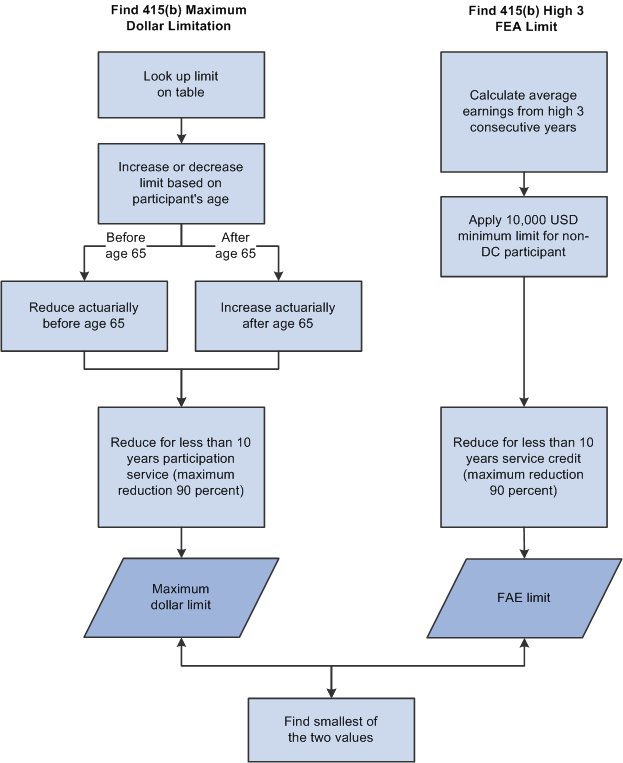

This is the most complex part of the process. You can look at the 415 pages to go through all the parameters used during this stage. The following diagram summarizes the process for determining limits. It includes steps for increasing or decreasing limits based on age, calculating average earnings, and reducing limits for service length:

Illustration showing how system calculates 415 limits, including how the system increases or decreases limits based on age, calculates average earnings, and reduce limits for service length

This calculation reflects amendments to IRC section 415 by the Small Business Job Protection Act of 1996 (SBJPA) and the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA).

Note. The acronym GUST refers to several legislative acts, including SBJPA.

Pre-amendment methodology will be applied, however, when a calculation involves a benefit commencement date occurring in a plan year that ended before January 1, 2002. For subsequent dates, ages used for actuarial increases and decreases to the 415(b) maximum dollar limit were changed by EGTRRA.

Also, SBJPA removed the 415(e) test for defined benefit plans that are secondary to defined contribution plans. Pension Administration still performs this historical calculation if both of the following are true:

The benefit commencement date occurs in a plan year that ended before December 31, 2000, the effective date of the SBJPA change.

You provide historical 415(e) information for the plan and the employee.

In this case, the final 415 limit is the smallest of the historical 415(e) limit, the 415(b) maximum dollar limit, and the 415(b) high 3 FAE limit.

Apply the Limits

Apply the Limits

If the benefit (still expressed as a single life annuity) is over the limit, the system subtracts the benefit from the limit to find how much the benefit needs to be reduced. If there are multiple plans providing the benefit, you have two options for distributing the reduction: proportionately or by precedence order.

After benefits are reduced, the system converts each plan's limited benefit back to its normal form using the same optional forms rules used to convert to the single life annuity.

Limited optional forms are calculated using the same factors used by the unlimited benefit with one exception: To convert to any forms flagged "QJSA" (qualified joint and survivor annuity), the system puts the regular conversion rules aside and applies the final 415 limit directly to the unreduced QJSA amounts. If the original QJSA value is less than the 415 limit, it is retained.

Creating a 415 Limits Definition

Creating a 415 Limits Definition

To define a 415 limits definition, use the 415 Limits Parameters (415_LIMITS) component.

This section lists the pages used create a 415 limits definition and discusses how to:

Set the 415 limits parameters - 1 of 3.

Set the 415 limits parameters - 2 of 3.

Set the 415 limits parameters - 3 of 3.

Pages Used to Create a 415 Limits Definition

Pages Used to Create a 415 Limits Definition

|

Page Name |

Definition Name |

Navigation |

Usage |

|

PA_415_PNL |

Set Up HRMS, Product Related, Pension, Components, 415 Limits Parameters, 415 Limits 1 of 3 |

|

|

|

PA_415_PNL2 |

Set Up HRMS, Product Related, Pension, Components, 415 Limits Parameters, 415 Limits 2 of 3 |

|

|

|

PA_415_PNL3 |

Set Up HRMS, Product Related, Pension, Components, 415 Limits Parameters, 415 Limits 3 of 3 |

Establish the method for reducing the total benefit. |

Setting the 415 Limits Parameters - 1 of 3

Setting the 415 Limits Parameters - 1 of 3

Access the 415 Limits 1 of 3 page (Set Up HRMS, Product Related, Pension, Components, 415 Limits Parameters, 415 Limits 1 of 3).

Processing Parameters

The system uses the table lookup utility to find the 415(b) dollar limit for the event year.

|

415 Limit Table Lookup |

Enter the table lookup for the 415 Limit table. The table lookup you create should:

|

See Creating Table Lookup Aliases.

See Maintaining Internal Revenue Code Limit Tables.

Actuarial Decrease Prior to Age 62

When an employee begins receiving benefits before age 62, there is an actuarial reduction.

Note. Even if you sponsor multiple qualified plans, you can only enter a single plan reduction factor. This is the same for the plan increase factor and the participation service function result.

|

Plan Reduction Factor and GATT Reduction Factor |

Specify both factors. The system uses the lesser of the two, thus providing the greater reduction. The factors are results from the early and late retirement factors function. Remember that early and late adjustments can produce actuarial factors, in addition to the arithmetic factors typically used for early retirement reductions. You may need to create early and late retirement factors function results specifically for 415, or you may be able to reuse one from one of your plans. To set up the GATT or GAR94 adjustments, create an early and late retirement factors function result that uses GATT-compliant or GAR94 actuarial assumptions. |

Actuarial Increase After Age 65

|

Plan Increase Factor and GATT Increase Factor |

Specify both factors. The system uses the lesser of the two, thus providing the smaller increase. You may need to create one specifically for 415, or you may be able to reuse one from one of your plans. To set up the GATT adjustment, create an early and late retirement factors function result that uses GATT-compliant actuarial assumptions. Note. The same fields are used for late retirement limit increase calculations that use pre-EGTRRA methodology. |

Decrease for Less Than 10 Years Participation

You may further reduce the 415 dollar limit when an employee has less than 10 years of participation service across all plans.

|

Participation Service |

Enter a service function result representing the accrued participation service (you may need to create one just for your 415 calculations), or enter a user code. |

When participation is less than 10 years, the system reduces the limit using a factor found by dividing the years of participation service by 10. For example, an employee with 6.5 years of participation service is subject to a limit reduction of 65 percent.

Setting the 415 Limits Parameters - 2 of 3

Setting the 415 Limits Parameters - 2 of 3

Access the 415 Limits 2 of 3 page (Set Up HRMS, Product Related, Pension, Components, 415 Limits Parameters, 415 Limits 2 of 3).

FAE Limit (final average earnings limit)

Use this group box to find the 415 average earnings limit.

|

Result Name |

Enter a final average earnings function result to find the 415 average earnings limit. Do not be misled by the word final. Set up the definition to meet the "high three" criteria required by section 415, or you can enter a user code. |

See Defining Final Average Earnings.

The 415 limits are subject to a minimum of 10,000 USD for employees who have never participated in a defined contribution (DC) plan. The 415 limits function automatically applies this rule. If this minimum should not be applied for an employee, enter historical 415(e) information on this page, and enter historical 415(e) data for the employee on the 415(e) Limit page. 415(e) limits are processed only where historically appropriate.

Service Credit < 10 Years

The system further reduces the 415 average earnings limit (after applying the 10,000 USD minimum) when an employee has less than 10 years of credited service across plans This service may or may not be measured the same way as the participation service used to adjust the dollar limit.

|

Result Name |

Enter a service function result representing the accrued service. Note that the service credit is not necessarily the same as the participation service used to adjust the maximum dollar limit. Even if you sponsor multiple qualified plans, you can only enter a single service result name, so you may need to create one just for your 415 calculations. You can also enter a user code to determine service credit. |

When service credit is less than 10 years, the system then reduces the limit using a factor found by dividing the years of service by 10. For example, an employee with 6.5 years of participation service is subject to a limit reduction of 65 percent.

Understanding the Historical 415(e) Calculation

Prior to its elimination by SBJPA, Section 415(e) limited the combined benefit from defined benefit (DB) and defined contribution (DC) plans. Pension Administration can calculate this historical pre-SBJPA limit when the benefit commencement date of a calculation occurs in a plan year that ends before December 31, 2000. This calculation applies only when the DC plan is primary so that benefits in excess of the limit result in a reduction to the DB plan.

The reduction is determined either by a dollar limit on the total benefit (DC + DB) or by using a "DC fraction" to calculate the upper limit on the DB benefit. The DC fraction represents the portion of the total limited benefit expected to consist of the DC benefit. Since SBJPA removed the 415(e) limit, the dollar limit and fraction are referred to here as "historical."

Because the system does not have access to DC information, your plan administrator will have to provide it. On the 415(e) Limit page, the administrator can enter either the historical DC fraction or an already-calculated historical 415(e) limit for an individual employee.

See Maintaining Employee Pension Data.

Historical 415(e) Information

Use these parameters to tell the system where to find the historical DC fraction.

|

No 415e information |

Select this option if you do not want the system to calculate historical 415(e) limits. |

|

DC Fraction |

Select this option if you store the historical DC fraction in the system. In the 415(e) Amount field, enter an alias to the field where the historical DC fraction is stored. If you use the 415(e) Limit page PeopleSoft provides, use the delivered alias DC_FRACTN. |

|

DB Limit |

Select this option if you store the precalculated limits, that is, the dollar amount of the historical 415(e) limit. In the Historical 415(e) Amount field, enter an alias to the field where this limit is stored. If you use the 415(e) Limit page that PeopleSoft provides, you use the delivered alias DB_LIMIT. |

Note. You select to always use the historical fraction or to always use the historical limit. Therefore, you should remove the unused field from the 415(e) Limit page to ensure that your users do not enter information that the 415 limits function does not recognize.

|

Warn if DB Fraction Is Over |

Enter a threshold. Pension Administration calculates the DB fraction using the final, limited benefit. You can configure the system to notify you if the DB fraction exceeds a specified threshold. The warning appears in the calculation messages and on the calculation worksheet. |

Setting the 415 Limits Parameters - 3 of 3

Setting the 415 Limits Parameters - 3 of 3

Access the 415 Limits 3 of 3 page (Set Up HRMS, Product Related, Pension, Components, 415 Limits Parameters, 415 Limits 3 of 3).

When a benefit exceeds the 415 limit, you have to reduce the total benefit by reducing some or all of the component benefits.

Reduction Options

|

Prorate |

Each benefit is reduced according to what portion of the unreduced benefit comes from that plan. For example, if a benefit has to be reduced by 10,000 USD, and Plan A supplied 50 percent of the unreduced benefit while Plans B and C each provided 25 percent of the unreduced benefit, then the Plan A benefit is reduced by 5,000 USD (50 percent of the 10,000 USD reduction) and the Plan B and C benefits are each reduced by 2,500 USD (25 percent of the 10,000 USD reduction). |

|

Precedence Order |

Select this option to assign a priority to each benefit. The first benefit is reduced first, any remaining reduction is subtracted from the second benefit, and so on until the entire reduction amount is applied. To assign a precedence order, you first list the benefits that might be reduced. You identify a benefit by plan and formset, the optional forms function result. |

|

User Code |

Select this option to use customized code. |

Formset Details

|

Order Nbr (order number) |

The benefit with the first precedence number is reduced first. That is, a plan with precedence 1 is reduced before a plan with precedence 10. |