Interface Definitions

Interface Definitions

This chapter discusses:

Interface definitions.

Data exchanges.

Sample data definitions.

Implementation steps.

Implementation tasks.

Interface Definitions

Interface Definitions

Payroll Interface is a table-driven export and import engine that enables you to exchange data between PeopleSoft HCM and a third-party payroll system. Data exchanges are set up through the export and import interface definitions, which enable you to download data from or upload data to database tables:

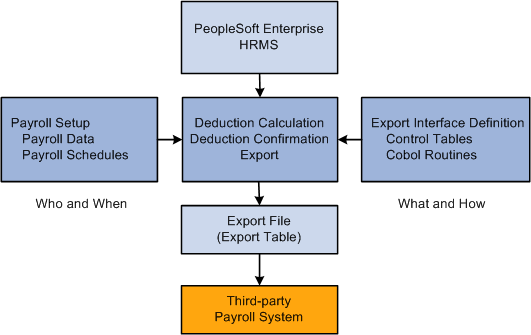

The export interface definition retrieves, formats, and downloads payroll-related data from various PeopleSoft HCM tables. The Export process writes the data to either a flat file or a database table.

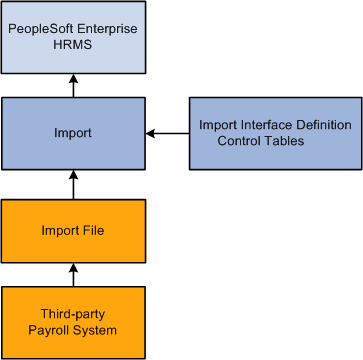

The import interface definition uploads the processed payroll results into seven Payroll Interface import tables located in PeopleSoft HCM. The Import process reads data only from ASCII files.

The export interface definition includes the payroll setup and the interface definition. The payroll setup identifies the payroll-related data (earnings, deductions, taxes, and so forth) and determines the pay schedules (the pay groups and pay calendars that determine which employees are processed during the export run). The interface definition determines the data mapping between the PeopleSoft HCM system and the third-party payroll system, defines the SQL retrievals and any additional COBOL processing, and specifies the export file format.

This diagram illustrates the export framework:

Payroll Interface export framework

The import interface definition is simpler—and more limited—than the export interface definition. The interface definition is set up such that the Import process can locate the import file and then load the processed payroll data into the seven Payroll Interface import tables. You do not need to set up any type of scheduling; the Import process can be run as soon as the import file is made available.

Note. The Import process does not perform data auditing or reverse translations. Depending on your implementation, you may want to write a custom Structured Query Report (SQR) program that performs these functions as well as loads the data into the seven import tables.

This diagram illustrates the import framework:

Payroll Interface import framework

Data Exchanges

Data Exchanges

Payroll Interface enables you to maintain employee data in PeopleSoft HCM while using the third-party payroll system to perform the payroll processing functions. With Payroll Interface, data exchanges between the two systems are performed in four phases:

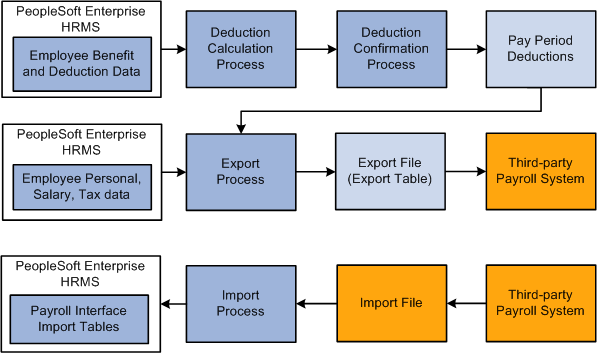

(optional) Run the Calculate Deductions and Deduction Confirmation processes to calculate and confirm pay period deductions.

Run the Export process to retrieve and write the pay (and deduction) data from PeopleSoft HCM to an export file or table.

Make the export file or table available to the third-party payroll vendor. The third-party vendor uses the appropriate software solution to load the data into the third-party payroll system, to perform the payroll processing functions, and to write the processed payroll results to one or more import files.

(optional) Run the Import process to read the import file and load the processed payroll data back into PeopleSoft HCM.

This diagram illustrates the Payroll Interface Deduction, Export, and Import processes:

Payroll Interface Deduction, Export, and Import processes

You have the option of maintaining employee deduction information in PeopleSoft HCM using the PeopleSoft HR Manage Base Benefits business process. If you maintain deductions, you must run the Calculate Deductions and Deduction Confirmation processes before you run the Export process. The deduction processes calculate and confirm per pay period benefit and general deduction amounts.

Note. If you do not maintain deductions (that is, if the third-party payroll system manages all deduction information) then you do not need to run the Calculate Deductions or Deduction Confirmation processes.

The Export process exports employee-level personal, job, salary, deduction, and tax information that the third-party payroll system needs to produce paychecks each pay period. Payroll Interface can export data from any PeopleSoft HCM table that includes the PeopleSoft EMPLID field as a key field. Data is exported to either a flat file or a database table.

Payroll Interface does not perform any payroll calculations. The third-party payroll system performs the tax calculations, earnings calculations, gross-to-net calculations, and year-end processing. You use Payroll Interface to track and export changes that occur, during a pay period, to static employee payroll-related data. The data is considered static because it rarely changes, for example, a person's job code, pay rate, marital status, number of dependents, or benefit plan (which can be changed only during an open enrollment period).

Warning! Payroll Interface is designed to export changes to static employee payroll-related data; for example, job codes, benefit deductions, or wages - information that does not change that often during the course of a year. Dynamic or transactional pay data, such as monthly commission payments or time and labor calculations, must be set up and maintained by the third-party payroll system.

You have the option of importing the payroll results produced by the third-party payroll system back into PeopleSoft HCM. The Import process loads payroll check, earnings, deduction, and tax data into seven Payroll Interface import tables. Once loaded, the data can be viewed online or by running reports. Data is imported only from ASCII files.

Note. Further processing or technical configuration may be required to check the validity of the imported data or to ensure that the data can be accessed in a secure manner.

See Also

Understanding PeopleSoft Payroll Interface Processing

Sample Data Definitions

Sample Data Definitions

PeopleSoft delivers sample data definitions for use with Payroll Interface. You can often more easily begin an implementation by cloning (copying) one of the sample data definitions.

The export sample data definitions are logical (LOG), physical (PHY), comma-separated value (CSV), and National Finance Center (NFC) for the federal government. The import sample data definitions are check detail (DETI) and check balance (BALI). ADP Connection includes sample data definitions for enterprise configurations (ENTP) and PC configurations (PCPW). Corresponding system IDs, configuration IDs, and file IDs are set up for most of these definitions.

Warning! Do not assume that the sample data is complete or that it will function in a production environment without further modification.

See Also

Cloning a Payroll Interface Definition

Working with Interface Definitions

Implementation Steps

Implementation Steps

To set up, test, and install a payroll interface, follow these steps. As you perform the tasks outlined here, document everything; this will help you to troubleshoot any problems that arise.

|

Step |

Tasks |

|

1. Assemble an implementation team and perform the gap/fit analysis. |

See Implementation Tasks. |

|

2. Set up the PeopleSoft HCM core and foundation table components. |

See PeopleSoft HCM Application Fundamentals PeopleBook |

|

3. (optional) Set up PeopleSoft HR Manage Base Benefits. Note. Perform this step only if you maintain benefit deductions. |

|

|

4. Set up export (or import) interface. Note. The import interface is usually set up and tested after you have set up and tested the export interface. |

Perform these tasks:

|

|

5. Test the export (or import) interface. |

Using the sample data or a copy of the live system, perform these tasks:

|

|

6. Install the export (or import) interface. |

Using the live system:

|

Implementation Tasks

Implementation Tasks

This section discusses:

Preliminary tasks.

Implementation team.

Gap/fit analysis.

Preliminary Tasks

Preliminary TasksImplementing a payroll interface requires a thorough understanding of PeopleSoft HCM and the requirements of the third-party payroll system. To ensure a smooth implementation, you should:

Secure full executive sponsorship.

You need cooperation from multiple departments, such as payroll, human resources, finance, and information services.

Set aside sufficient time and resources.

Implementing a payroll interface requires design, planning, development, implementation, and testing. While strong project management is especially critical for global implementations with multiple companies, all implementations require a firm hand with scheduling and details.

Attend Payroll Interface training.

Implementing a payroll interface requires both functional and technical expertise. Practice first by using the delivered sample data to understand how Payroll Interface works. Then, create your own definitions and output file using the delivered demo data as the model. Finally, copy a "live" database—don't use the actual live database—from your organization. Configure it and test run the Payroll Interface Calculate Deductions and Confirmation processes and the Export and Import processes using your organization's actual data.

Apply any software updates or fixes.

Contact My Oracle Support for any applicable patches that have been posted since the general release.

Obtain the vendor documentation.

Obtain a complete set of documentation from the third-party payroll vendor. The payroll interface that you set up is based on the data, formatting, and processing requirements of the third-party payroll system.

Implementation Team

Implementation Team

Recommended team members for a payroll interface implementation include:

Payroll interface lead.

The lead is responsible for the payroll interface setup and configuration, and for the initial export/import of data. The lead must understand Payroll Interface as well as the third-party payroll system. Keep the backup lead informed during the entire implementation process.

Payroll functional lead.

The lead is the recipient of the exported payroll data file. The lead should know about payroll codes, employee payroll data, and the steps involved in processing payroll. The lead needs to understand the third-party payroll system capabilities, if not its technical details.

Database administrator (DBA) technical lead.

The lead manages PeopleSoft table maintenance, technical configurations, SQL, PeopleTools, the Application Engine, COBOL, and PeopleCode.

HCM functional lead.

The lead must understand PeopleSoft HCM data and the transactions and business processes involving a payroll interface, including benefits and deduction calculations.

HCM project lead.

The lead manages a payroll interface implementation and ongoing maintenance. Sometimes another team member takes on these duties.

Gap/Fit Analysis

Gap/Fit Analysis

The gap/fit analysis is the most important step in the implementation process. This is where you identify exactly what needs to be set up in the export interface definition (and to a lesser extent, the import interface definition).

Conduct a Functional Analysis

Analyze your functional requirements:

Establish data ownership.

Establish who owns the data, typically either the human resources or the payroll department.

Identify business processes, transactions, and data flow.

Create a flow chart that shows data movement in different situations, such as for new hires, transfers, and pay rate changes.

Determine common data elements.

Determine common elements and relationships between the existing employee data and the requirements of the third-party application. Identify field mapping and translation requirements.

Conduct a Technical Analysis

Analyze your technical requirements:

Identify the PeopleSoft tables and fields.

Identify the tables and fields containing employee-level payroll-related data to be exported. Depending on the data requirements of the third-party payroll system, you may need to create additional views.

Identify the third-party payroll system fields.

Identify the third-party payroll system fields that will receive the data that is exported from PeopleSoft HCM. Understand the third-party payroll system import specifications. Refer to the vendor documentation or use the third-party payroll system's technical support for assistance.

Identify data gaps.

Identify and isolate any gaps between PeopleSoft HCM and the third-party payroll system. Isolate requirements as early as possible. Any gaps will have to be bridged using special processes, routines, calculations, or conditional logic.

Obtain the Vendor Documentation

It is critical that you obtain the vendor documentation for the third-party payroll system. The vendor documentation contains the requirements for the third-party payroll system and will guide you in setting up the export or import interface definition.

Work with the third-party vendor to answer the following types of questions:

What file format is required for import (for example, comma-delimited or a physical sequence)? Is there a choice on the type of fields exported? Which type of file is recommended for personal data?

What's the required file layout? For example, should there be a header record using field names or field name codes followed by the value? Also, should there be a trailer record?

Can you accept a flat file of employee data each pay period? (That is, a full export instead of just changes.)

What are file naming conventions? Where should export files be placed?

Do earnings and personal data need to be in separate files?

Are any fields effective-dated?

What is the unique key field or combination of fields that identifies an employee? For example, payroll ID or national ID (SSN).

What fields are mandatory? Are fields different for new hires or changes to existing data? Do any fields need to be paired or grouped together?

What is the maximum number of fields per output record?

Can new hires and changes be in the same file?

Are there user-defined lists, such as cost center lists, that have to be pre-loaded with PeopleSoft HCM values? (For each user-defined list, you need the third-party payroll provider's values to set up correct data mappings.)

Are there reports that validate the payroll interface export file, for example, a report that identifies changes to the system?

Who prepares the export file from the third-party payroll system?

How do you set up a test database with the third-party payroll software? (You should run test imports into the third-party system, but you do not want to touch the production database.)

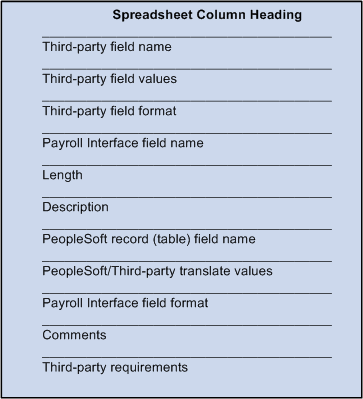

Data mapping between PeopleSoft HCM and the third-party payroll system is a vital implementation step. Base your data mapping on the information gathered during the functional and technical analyses. Data mapping requires two considerations:

PeopleSoft field locations must match up with third-party payroll system field locations.

For example, if your third-party payroll system receives data for hire status in the 30th position of a physical export file, then you must configure Payroll Interface to place this data in the 30th position of your export file.

Data values must be translated accurately.

For example, the hire-status value for active employees is maintained in PeopleSoft HCM as Active. In the third-party payroll system, the same data might be maintained using the value A. To map the PeopleSoft data to the third-party payroll system, you would need to construct your file export process to write a value of A to the export file every time it sees a value of Active in the PeopleSoft data (because the value of Active means nothing to the third-party payroll system).

To map values between PeopleSoft HCM and the third-party payroll system, use translate values.

See Setting Up the Field Definition Table.

Note. (USF) Every effort is made to ensue that the National Finance Center (NFC) sample data that is delivered with Payroll Interface conforms to NFC requirements. However, you should always check the data mapping in the delivered export configuration for accuracy.

This graphic shows a spreadsheet you can use as a starting point to facilitate data mapping:

Spreadsheet to facilitate data mapping

Note. Use the Payroll Interface field name to set up the interface file definition when you define the export/import file layouts.

Assess Employee Actions

Payroll Interface uses the PeopleSoft employee ID (EMPLID) to track and export changes that occur to employee payroll-related data. The PeopleSoft employee ID must be mapped to the third-party payroll system employee ID. Analyze your human resources, benefits, and payroll transactions; make sure you understand the relationships between these transactions and the requirements of the third-party payroll system.

This table lists the types of questions you should ask during the analysis:

|

Action |

Questions |

|

Hires |

|

|

Rehires |

|

|

Terminations |

|

|

Employee ID Changes |

Do you need a procedure to translate the third-party payroll system employee ID to the PeopleSoft EMPLID? |