Understanding Position Budgeting Setup

Understanding Position Budgeting Setup

This chapter provides an overview of position budgeting setup and discusses how to:

Set up general position budgeting defaults.

Set up job code defaults.

Set up position data defaults.

Review human resource default data.

Understanding Position Budgeting Setup

Understanding Position Budgeting Setup

To use position budgeting activities, you define defaults at the coordinator level that the system uses when you import position and employee job data and add new positions during the budgeting process. As you define the defaults, you can allow override of default information for position budget preparers.

This section lists a prerequisite and discusses compensation and distribution defaults.

Prerequisite

Prerequisite

You need position and employee defaults before you can use position budgeting. Before you can start entering new positions directly into Planning and Budgeting, you may want to import existing data from the PeopleSoft Human Resource Management System or another human resource system into the PeopleSoft EPM interface tables that Planning and Budgeting accesses. Alternatively, you can use data from a prior position activity scenario, or data from the Workforce Rewards (WFR) application in the EPM database.

Compensation and Distribution Defaults

Compensation and Distribution Defaults

When you load position and employee job data from your human resource system into the Planning and Budgeting database, you bring in compensation amounts and distributions that are associated with each job. Positions and jobs are associated with the planning centers in your planning model by assigning your human resource departments to planning centers as part of the human resource data integration process.

See Integrating with PeopleSoft HRMS.

If a position or job in your human resource system does not have compensation or distributions associated with it, the system assigns these values using defaults that the coordinator defines. If a position has salary distributions associated with it, the system generates earnings, benefits, and employer-paid tax distributions using the same dimensions as the salary distribution, with the exception of the account. If a position does not have a salary distribution, the system uses the job code that is associated with the position to determine the salary, earnings, benefits, and tax defaults. If these compensation and distribution defaults are unavailable in the job code definition, the system uses the defaults that you define using the Position Data Defaults page by business unit.

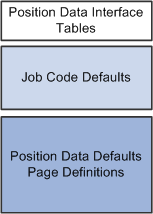

The hierarchy of position data, including compensation and distribution defaults for existing positions and jobs that are loaded into Planning and Budgeting from your human resource system, are position data interface tables, job code defaults, and position data default page definitions, as illustrated as in this diagram:

Hierarchy of position data defaults for existing positions

Your organization may fund a position or job from one or many department budgets. Your organization may also use different budgets for different position compensation costs. Use the distribution pages to distribute position costs across multiple planning centers or dimension values in position budgeting. To distribute costs to the appropriate dimensions, define the dimension distributions for salary, earnings, benefits, and taxes. You can distribute salary and earnings costs to one budget and distribute benefit and tax costs to a different budget. Define position cost distributions according to your organization's business practice regarding the budgeting and tracking of employee costs.

The sources of defaults on the distribution pages depend on the type of position—existing, copied, or added—as listed in the following table:

|

Field |

Default Source for Existing Position and Job |

Default Source for Copied Position |

Default Source for Added Position |

|

Account |

|

Account associated with the copied position. |

|

|

Distributions by Percentage |

|

Distributions associated with the copied position. |

|

|

Position Amounts |

|

Salary, earnings, benefits, and tax amounts associated with the copied position. |

|

See Also

Integrating with Other Applications

Setting up Earning Codes and General Position Budgeting Defaults

Setting up Earning Codes and General Position Budgeting Defaults

You must define general defaults for position activities, including system-generated position numbers and the accounts that are used for position budgeting.

This section discusses how to:

Set up auto numbering for positions.

Set up earning codes for overtime and shift pay.

Identify accounts for position account categories.

Pages

Used to Set Up Earning Codes and General Position Budgeting Defaults

Pages

Used to Set Up Earning Codes and General Position Budgeting Defaults|

Page Name |

Definition Name |

Navigation |

Usage |

|

BP_HRMS_INSTALL |

Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Position Number Default, Position Number Default |

Set up auto numbering for positions by entering the position prefix and the last assigned position number that is used by all position activities for planning models. |

|

|

BP_POS_BUDG_ACT |

Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Position Budgeting Accounts, Position Salary Account Defaults |

Identify salary accounts related to position budgeting that are used to define the personnel line item budgets. |

|

|

BP_EARNING_TBL |

Planning and Budgeting, Planning and Budgeting Setup, Human Resource Default Inquiry, Earning Codes |

Set up earning codes for overtime and shift pay. |

|

|

BP_POS_BNFT_ACT |

Click the Benefits Account link on the Position Salary Account Defaults page. |

Identify benefits accounts related to position budgeting that are used to define the personnel line item budgets. |

|

|

BP_POS_EARN_ACT |

Click the Earnings Account link on the Position Salary Account Defaults page. |

Identify earnings accounts related to position budgeting that are used to define the personnel line item budgets. |

|

|

BP_POS_TAX_ACT |

Click the Tax Account link on the Position Salary Account Defaults page. |

Identify employer-paid tax accounts related to position budgeting that are used to define the personnel line item budgets. |

Setting Up Auto Numbering for Positions

Setting Up Auto Numbering for PositionsAccess the Position Number Default page (Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Position Number Default, Position Number Default).

|

Position Prefix |

Enter a prefix for the system to attach to each new position number so that new positions are distinguished from positions that are imported from the human resource system. The user cannot override this prefix; it applies to all positions that are created during the budgeting process. |

|

Last Assigned Position Number |

Enter the last assigned position number. The system assigns the next number in sequence, and then adds the position prefix for newly created positions. The user cannot override this default. |

Note. The PeopleSoft Position Management application in the PeopleSoft Human Resource Management System is not a required component of Planning and Budgeting integration. However, because Planning and Budgeting uses a position number to manage data within the planning model and activity, the system also uses the default position prefix and last assigned position number during the Data Staging Application Engine process (BP_STG) to assign a position number when none is present.

Setting up Earning Codes for

Overtime and Shift Pay

Setting up Earning Codes for

Overtime and Shift PayAccess the Earnings Code page (Planning and Budgeting, Planning and Budgeting Setup, Human Resource Default Inquiry, Earning Codes).

Use this page to add earning codes, or update existing earning codes.

|

Add to Gross Pay |

Select to indicate amounts associated with this earning code are added to gross pay. |

|

Multiplication Factor and Flat Amount |

Enter either the multiplication factor or flat amount to apply when using this earnings code. You cannot enter a value in both fields; you can define either one or the other, not both. The entered values are used to calculate salary adjustments such as overtime or shift pay. |

Note. To enable earning codes to be used for overtime or shift pay, you must establish options using the Earning Codes and Plan Types - Earning Codes page.

Identifying Accounts for Position Account Categories

Identifying Accounts for Position Account Categories

Access the Position Salary Account Defaults page (Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Position Budgeting Accounts, Position Salary Account Defaults).

Identify position budgeting accounts to:

Determine the salary, earnings, benefits, and tax accounts that are used for position budget activities by account category.

Determine the account members that are allowed for the position budgeting activity by business unit.

|

From Account and To Account |

Enter one account value or a range of values to define your available salary, benefits, earnings, and employer-paid tax expense accounts by business unit. The system associates the accounts on these pages with the corresponding salary, benefits, earnings, and tax expense categories in position budgeting. |

|

Salary Account |

Click to access the Position Salary Account Defaults page and identify salary accounts that are related to your position budgeting activity that are used to define the personnel expenses. |

|

Benefits Account |

Click to access the Position Benefits Account Defaults page and identify benefits accounts related to your position budgeting activity that are used to define the personnel expenses. |

|

Earnings Account |

Click to access the Position Earnings Account Defaults page and identify earnings accounts related to your position budgeting activity that are used to define the personnel expenses. |

|

Tax Account |

Click to access the Position Tax Account Defaults page and identify employer-paid tax accounts related to your position budgeting activity that are used to define the personnel expenses. |

Note. Because these account default rules represent the dimension members for the position activities in your business unit planning model, make sure that the values all exist on the same level of an account tree that you use in your activity group. You want all the accounts that are used for position budgeting to be consistent with the account tree, dimension leveling, and parent line item activity, within the activity scenario of your business unit's planning model. Users may not be able to add positions or run reports when the accounts that are used are at varying levels of an account tree.

Setting Up Job Code Defaults

Setting Up Job Code Defaults

This section provides an overview of job code defaults and discusses how to:

Define distribution profiles.

Define salary defaults.

Define benefit plan defaults.

Define earnings defaults.

Define employer-paid tax defaults.

Assign defaults to job codes.

Understanding Job Code Defaults

Understanding Job Code Defaults

Job code defaults link in Planning and Budgeting compensation, distribution, and union code information. When you attach a job code to a position, you assign the compensation costs and define how the system distributes those costs to specific dimensions. If job code defaults are defined to allow override at the coordinator level, budget preparers can override these defaults at the position-detail level.

Use these defaults for existing positions, loaded from your human resource system, that do not have compensation costs associated with them and for new positions that are created using position budgeting activities.

Pages Used to Set

Up Job Code Defaults

Pages Used to Set

Up Job Code Defaults|

Page Name |

Definition Name |

Navigation |

Usage |

|

BP_DISTR_PRFL |

Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Distribution Profile |

Set up distribution profiles that include default distributions for salary, earnings, benefits, and tax costs. |

|

|

BP_SAL_GRP |

Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Salary Group |

Define salary default groups. |

|

|

WA_SAL_GRADE_D00 |

EPM Foundation, Business Metadata, OW-E Dimension Maintenance, HRMS, Salary, Grade, Salary Grade Data |

Inquire and update existing grades that are associated with a salary administration plan. |

|

|

WA_SAL_STEP_D00 |

EPM Foundation, Business Metadata, OW-E Dimension Maintenance, HRMS, Salary, Grade, Salary Step Data |

Inquire and update existing steps that are associated with a salary administration plan. |

|

|

BP_BNFT_GRP |

Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Benefit Group |

Define benefit default groups. |

|

|

BP_EARN_GRP |

Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Earnings Group |

Define earnings default groups. |

|

|

BP_TAX_GRP |

Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Employer Tax Group |

Define employer-paid tax default groups. |

|

|

BP_ASSIGN_JOBCD |

Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Job Code Defaults |

Assign the salary, benefits, earnings, and tax default groups to job codes, and associate distribution profile and union code defaults. |

|

|

JOBCODE_D00 |

EPM Foundation, Business Metadata, OW-E Dimension Maintenance, HRMS, Employee and Job, Job Code, Maintain Dimension |

Inquire, update, or add a job code. |

Defining Distribution Profiles

Defining Distribution ProfilesAccess the Distribution Profile page (Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Distribution Profile).

Distribution Options

|

Salary Distribution, Benefit Distribution, Earning Distribution, and Tax Distribution |

Select to apply the default dimension distributions for salary, benefits, earnings, and tax costs respectively. You can select any combination of distribution options to specify the distribution type. Each selected distribution option uses the same default distribution. If you deselect the check box for a distribution option, the system uses the planning center that is associated with the position to populate the dimensions for the distribution lines. |

Default Distribution

Enter percentage values for the dimensions to define a dimension distribution.

Enter these values on each distribution row to define the portion of the compensation costs that use the defined dimension distributions. The distribution profile can contain one or multiple distribution lines. This enables you to distribute the cost of a position to multiple budgets. You can have an unlimited number of distribution lines for a distribution profile. The dimensions that appear depend on the dimensions that you use for budgeting purposes, as defined on the Dimension Configuration page.

If you leave a dimension value blank for your planning center, the system populates the dimension with the planning center value when you add a new position. In this situation, the distribution default percentage is 100 percent.

If you enter dimensions, the system uses the dimension values from the distribution profile. The coordinator can assign the distribution profile to a job code that is associated with the position to which you want to assign the default dimension values. A distribution default that is associated with a job code is global for all positions that are added by all planning centers for a job code. Leave the distribution profile default option blank on the Job Code Defaults page when your distributions are not global across job codes and planning centers.

Distributions do not include the account dimension. Assign the account defaults for salary, earnings, benefits, and tax costs for these compensation components using the salary, earnings, benefits, and employer tax group pages respectively. The preparer can override the account default at the position level if override capability is enabled in the salary, earnings, benefits, and employer tax group definitions. The account dimension values that are used are determined by the values that are assigned to salaries, benefits, earnings, or taxes at the time that the distributions are created.

Note. If your organization's labor distribution program does not support or use multiple dimension distributions for a position, define at least one distribution line with a percentage of 100.00. Assign this single distribution profile on the Position Data Defaults page for the business unit because you do not need to associate a distribution default with each job code.

Defining Salary Defaults

Defining Salary DefaultsAccess the Salary Group page (Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Salary Group).

|

Currency Code |

Enter the same currency code as the one that is used for the job code defined in the planning model. You cannot modify or convert currency code defaults for the job code record during the position budgeting process. Additionally, when you are staging data or creating new positions, if the job code's default currency is not an entry currency of the planning model, it will be converted to the business unit's base currency. |

|

Salary Plan, Grade, and Step |

Enter values to establish and further define the starting salary for positions by job code and the overall salary plan. Available selections depend on the salary plans, salary grades, and salary steps that are imported from your human resource system. |

|

Account |

Enter the desired account to be used as the default for salary cost distributions. The system uses only one account for salary distributions for a single position. |

|

Survey Salary |

Enter or modify the desired survey salary. When you define the salary plan, grade, and step to add a new position, the system displays a Survey Salary value if one is available for the selected job code. You can modify this value. Note. You can use the salary plan, grade, or step value, if available, to define the survey salary on the Salary Group page. If none are available, you can manually enter a survey salary value. When you decide not to use the optional Salary Group page, or indicate a survey salary, then the position's salary may result in 0 (zero) if a survey salary is not defined on the job code maintenance page. The survey salary on the Job Code - Maintain Dimension page in EPM Warehouse is used when none is available through Planning and Budgeting defaults. Therefore, you should consider entering an amount in the Survey Salary field for Salary Group when there is none available on the job code maintenance page, or you may update your job code defaults from your human resource management system. |

|

Account Override Allowed |

Select to enable override capability of the salary account at the position default and employee job levels. If this check box is selected, a preparer can override the account that is used to distribute a position and employee's salary costs. |

|

Amount Override Allowed |

Select to enable override capability of the salary amount at the position and employee job levels. If you select this option, you can override the salary amount that is defined for the position and employee. |

Note. Access the Salary Grade Data and Salary Step Data pages under EPM Foundation to review and update existing grades and steps that are associated with a salary plan that is imported from your human resource system.

Defining Benefit Plan Defaults

Defining Benefit Plan DefaultsAccess the Benefit Group page (Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Benefit Group).

|

Currency Code |

Enter the same currency code as the one that is used for the job code defined in the planning model. |

|

Plan Type |

Enter a benefits plan type default defined as translate values similar to those in PeopleSoft Human Resource Management System. |

|

Account |

Enter the default account for benefits cost distributions. |

|

Account Override Allowed |

Select to enable override capability of the benefits account at the position default and employee job levels. If this check box is selected, a preparer can override the account that is used to distribute a position and employee's benefits costs. |

|

Amount |

Enter a flat amount to define the lump sum cost of benefits for positions and employees. |

|

% of Salary (percentage of salary) |

Enter a percentage of salary to have the system calculate the benefits costs by applying the percentage against a position or employee's gross pay. Enter an amount or percentage, but not both. Note. Gross pay is defined as the salary amount plus any earnings marked as added to gross pay. The Add Gross field in the earnings table is visible to an end user in position budgeting on the Earnings/Allowance page. |

|

Amount Override Allowed |

Select to enable override capability of the benefit plan amount at the position default and employee levels. If this check box is selected, a preparer can override the amount that is used to distribute a position or employee's benefits costs. |

Defining Earnings Defaults

Defining Earnings DefaultsAccess the Earnings Group page (Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Earnings Group).

|

Currency Code |

Enter the same currency code as the one that is used for the job code defined in the planning model. |

|

Earnings Code |

Enter the default earnings code. |

|

Account |

Enter the default account for earnings cost distributions. |

|

Account Override Allowed |

Select to enable override capability of the earnings account at the position default and employee job levels. If this check box is selected, a preparer can override the account that is used to distribute a position or employee's earnings costs. |

|

Amount |

Enter a flat amount to define the lump sum cost of earnings for positions and employees. |

|

% of Salary (percentage of salary) |

Enter a percentage of salary to have the system calculate the earnings costs by applying the percentage against a position or employee's base pay. Enter an amount or percentage, but not both. Note. Base pay is the default position or employee's salary amount. |

The Amount and % of Salary fields are not required for earning codes that have the Include in OT Calculation or Calculate by Hours or Shifts option selected on the Earning Codes and Plan Types - Earning Codes page.

|

Amount Override Allowed |

Select to enable override capability of the earnings amount at the position default and employee job levels. If this check box is selected, a preparer can override the amount that is used to distribute a position or employee's earnings costs. |

Defining Employer-Paid Tax Defaults

Defining Employer-Paid Tax DefaultsAccess the Employer Tax Group page (Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Employer Tax Group).

|

Currency Code |

Enter the same currency code as the one that is used for the job code defined in the planning model. |

|

Tax Class |

Select the default employer-paid tax. The available options are those that are defined as translate values similar to those in the PeopleSoft Human Resource Management System. |

|

Account |

Enter the default account for employer-paid tax distributions. |

|

Account Override Allowed |

Select to enable override capability of the tax account at the position default and employee job levels. If this check box is selected, a preparer can override the account that is used to distribute a position or employee's employer-paid tax costs. |

|

Amount |

Enter a tax amount to define the lump sum cost for positions and employees. Enter an amount or percentage, but not both. |

|

Maximum Gross |

Enter the amount that the system uses to control the maximum gross pay amount against which employer-paid taxes are applied. For example, suppose that you define maximum gross as 56,000 USD and taxes as 5 percent of salary. The system calculates taxes for positions up to 56,000 USD in gross salary costs. Thus, the maximum amount that is applied to employer-paid taxes is 2,800 USD, or 5 percent of 56,000 USD. The system does not apply taxes for salary costs that are above 56,000 USD. |

|

% of Salary (percentage of salary) |

Enter a percentage of salary to have the system calculate the tax by applying this value against a position or employee's gross pay. Note. Gross pay is defined as the salary amount plus any earnings marked as added to gross pay. The Add Gross field in the earnings table is visible to an end user in position budgeting on the Earnings/Allowance page. |

|

Amount Override Allowed |

Select to enable override capability of the tax default at the position default and employee job levels. If this check box is selected, a preparer can override the employer-paid tax amount defined to distribute a position or employee's costs. |

Assigning Defaults to Job Codes

Assigning Defaults to Job Codes

Access the Job Code Defaults page (Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Job Code Defaults, Job Code Defaults).

|

Salary Group ID, Benefit Group ID,Earnings Group ID, and Tax Group ID |

Enter optional group ID information for each job code. The available options for these fields are effective-dated and depend on the data that you enter using the Salary Group, Benefit Group, Earnings Group, and Employer Tax Group pages, respectively, and the currency code that is associated with the job code. The currency code for salary, benefit, earnings, and tax groups must match the currency code that is assigned to the job code. If you do not enter a value for one of the fields, the system searches for any corresponding defaults that are established at the next level within the hierarchy, which is on the Position Data Defaults page by business unit. If the system does not find appropriate defaults, it does not supply the information. You can manually enter the data at the position level. Note. You cannot modify or convert currency code defaults for the job code default record during the position budgeting process. Currencies are converted only during staging and the creation of new positions when the job code's default currency is not an entry currency of the planning model. |

|

Union Code |

Enter union code information for each job code as appropriate. The available union code options depend on those in the union code interface table (UNION_TBL) when loaded into EPM Warehouse for Planning and Budgeting. |

|

Distribution Profile |

Enter distribution profile information for each job code as appropriate. The available options for the distribution profile depend on the data that you enter using the Distribution Profile page. |

Note. Even if you do not want to assign any defaults at

the job codes level, you must select at least one effective date to display

available job codes, and then save the page to populate the record that is

used for position budgeting activity. All defaults will then be extracted

from the Position Data Defaults page by business unit.

If you have more than one set of accounts (more than one setID for account

dimensions) for multiple models that use a single set of job code data (one

setID), define any account-related defaults at the business unit level using

the Position Data Defaults page.

Note. Access the Job Code - Maintain Dimension page in EPM Warehouse to inquire, update, or add job codes.

Setting Up Position Data Defaults

Setting Up Position Data Defaults

The distributions associated with each job or position that is imported from your human resource system are the primary defaults that are used in Planning and Budgeting. If a position and employee job in your human resource system does not have compensation or distributions associated with it, the system uses other defaults that you define. The system first looks to the job code definition, and then to the defaults by business unit on the Position Data Defaults page.

This section discusses how to define position data defaults.

Page Used to Set Up Position Data Defaults

Page Used to Set Up Position Data Defaults|

Page Name |

Definition Name |

Navigation |

Usage |

|

BP_HRMS_DEFAULT |

Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Position Data Default |

Establish defaults for importing position and employee job data and performing position budgeting activities. The system applies these defaults when they are unavailable from your human resource system or job code default definitions. |

Defining Position Data Defaults

Defining Position Data DefaultsAccess the Position Data Defaults page (Planning and Budgeting, Planning and Budgeting Setup, Position Budgeting Defaults, Position Data Default).

|

Distribution Profile |

Enter the distribution profile default that is used to assign dimension distributions for compensation costs for newly added positions or those associated with existing positions that are imported from your human resource system that do not have complete distribution information. The options depend on the distribution profiles that you set up. Override the distributions at the position level. |

|

Salary Account |

Enter the salary account default. The option includes those accounts that you define as your default salary accounts using the Position Salary Account Defaults page. Override this default at the position level. |

|

Benefit Account |

Enter the benefits account default. The option includes those accounts that you define as your default benefit accounts using the Position Benefits Account Defaults page. Override this default at the position level. |

|

Earning Account |

Enter the earnings account default. The option includes those accounts that you define as your default earning accounts using the Position Earnings Account Defaults page. Override this default at the position level. |

|

Tax Account |

Enter the tax account default. The option includes those accounts that you define as your default tax accounts using the Position Tax Account Defaults page. Override this default at the position level. |

|

Standard Hours |

Enter the default value for positions that do not have standard hours associated with them. Use this field for unfilled and new positions. Override this default at the position level. |

|

Budget Factor |

Enter the budget factor that you want to calculate position costs for unfilled and new positions. If the budget factor is 1.00, the system budgets 100 percent of the position costs. To prorate the position costs, enter a fraction of the position cost. For example, for a new position effective-dated at the first of the budget year that goes unfilled for 3 out of 12 months into the budget year, enter a budget factor of 0.75. The system calculates 75 percent (9 months of expense) of the position costs as expense to spread across the budget year. Override this default at the position level. Note. Budget factor is treated as a percent applied to the overall position costs. As an alternative, use effective dating instead and add the position on the anticipated fill date. For the same example with a 1.00 budget factor and an effective date starting after the third month, the budget expense is the same for the position. With an effective date, the expense is recognized in the last 9 months; using the budget factor spreads the expense across all 12 months. |

|

Using HR Position Numbers (using human resource position numbers) |

Select if the customer populated the POSITION_DATA table either from PeopleSoft Position Management or a third-party system. Enabling this option is an indication that you use position numbers in conjunction with employee job records in your human resource system. Note. Using position numbers (or PeopleSoft Position Management) is optional. The option used in conjunction with Use Position Delete Rules will prevent your end users from deleting positions in their position budgeting activity when the position still exists in the POSITION_DATA table. |

|

Use Position Delete Rules |

Select to enable the user to delete positions. From the Position Overview page in the activity, the user can select Delete a Position. The Delete a Position dropdown list item is available only if you select Use Position Delete Rules for this business unit. |

|

Benefit Group ID |

Select a benefit group ID for each unique currency code that is required for position budgeting within the planning model for a business unit. Valid benefit groups include those that you define using the Benefit Group page. The system uses the benefit plan defaults that you define to calculate budget amounts for newly added or unfilled positions if no benefit data is associated with them. Optionally, you can have the benefit plan defaults inserted for existing employee data when this information is not sourced from your human resource system. Define default benefit plan types as part of the job code definition, or you can use this page for a more global default. End users can override the benefit plan defaults, when allowed, at the position level. |

|

Earnings Group ID |

Select an earnings group ID for each unique currency code that is required for position budgeting within the planning model for a business unit. Valid earnings groups include those that you define using the Earnings Group page. The system uses the earnings type defaults that you define to calculate budget amounts for newly added or unfilled positions if no earnings codes are associated with them. Optionally, you can have the earnings type defaults inserted for existing employee data when this information is not sourced from your human resource system. Define default earnings as part of the job code definition, or you can use this page for a more global default. End users can override the earnings code defaults, when allowed, at the position level. |

|

Tax Group ID |

Select a tax group ID for each unique currency code that is required for position budgeting within the planning model for a business unit. Valid tax groups include those that you define using the Employer Tax Group page. The system uses the tax defaults that you define to calculate budget amounts for newly added or unfilled positions if no taxes are associated with them. You can also assign employer tax information to existing employee job data. Define default taxes as part of the job code definition, or you can use this page for more global default. End users can override the tax defaults, when allowed, at the position level. See Defining Employer-Paid Tax Defaults. Note. Calculated tax information is not sourced from the PeopleSoft Human Resource Management System; therefore, you can choose to apply employer-paid tax defaults to both unfilled position defaults and existing employee job data. |

|

|

Click to access the Benefit Group page, the Earnings Group page, or the Employer Tax Group page. |

Reviewing Human Resource Default Data

Reviewing Human Resource Default Data

Budget coordinators can use inquiry pages to verify that human resource data (such as job codes and benefit plan types) that are needed for position budgeting setup and user defaults exist in the PeopleSoft Enterprise Performance Management database. If the information does not exist, import it from your human resource database.

This section discusses how to review human resource default data.

Pages Used to Review Human Resource Default Data

Pages Used to Review Human Resource Default Data|

Page Name |

Definition Name |

Navigation |

Usage |

|

BP_JOBCODES |

Planning and Budgeting, Planning and Budgeting Setup, Human Resource Default Inquiry, Job Codes |

Inquire about existing job codes and defaults imported from your human resource system and assigned by the coordinator. |

|

|

BP_PLAN_TYPE |

Planning and Budgeting, Planning and Budgeting Setup, Human Resource Default Inquiry, Benefits Plan Type |

Inquire about existing benefit plan types from the human resource system. The system stores benefits as translate values. |

|

|

BP_EARNING_TBL |

Planning and Budgeting, Planning and Budgeting Setup, Human Resource Default Inquiry, Earning Codes |

Maintain earning codes. |

|

|

BP_TAX_CLASS |

Planning and Budgeting, Planning and Budgeting Setup, Human Resource Default Inquiry, Tax Class |

Inquire about existing tax codes from the human resource system. The system stores tax codes as translate values. |

|

|

BP_UNION_CD |

Planning and Budgeting, Planning and Budgeting Setup, Human Resource Default Inquiry, Union Codes |

Inquire about existing union codes imported from your human resource system. |

|

|

BP_ACTION_REASON |

Planning and Budgeting, Planning and Budgeting Setup, Human Resource Default Inquiry, Action Reason |

Inquire about existing codes imported from your human resource system that are used to track actions that are performed on position budgets. |

Reviewing Human Resource Default Data

Reviewing Human Resource Default DataAccess any human resource default inquiry page.

All of the pages are view-only and display similar information.

Note. Because you can define job code defaults for position budgeting at business unit and setID levels, all defaults may not be visible on the Job Code page.