11g Release 7 (11.1.7)

Part Number E20376-07

Home

Contents

Book

List

Contact

Us

|

Oracle® Fusion Applications Compensation Management Implementation Guide 11g Release 7 (11.1.7) Part Number E20376-07 |

Home |

Contents |

Book List |

Contact Us |

|

Previous |

Next |

This chapter contains the following:

Define Elements, Balances, and Formulas: Overview

Payroll Relationships: Explained

Manage Organization Payment Methods

The Define Elements, Balances, and Formulas task list contains the tasks required for creating payroll elements for compensation and HR management. You can use this task list if you are recording earnings, deductions, and other payroll data for reporting, compensation and benefits calculations, or transferring data to a third-party payroll provider.

Note

If you are using Oracle Fusion Global Payroll, use the Define Payroll task list instead. The Define Payroll task list includes additional tasks required to set up payroll processing.

The Define Elements, Balances, and Formulas task list is included in the Workforce Deployment and Compensation Management offerings. These offerings contain other tasks that must be completed first. In particular:

Ensure that you have defined the payroll statutory units that you require using the Manage Legal Entities task.

Associate a legislative data group with each payroll statutory unit using the Manage Legal Entity HCM Information task.

Performing these tasks ensures that payroll relationship records are created automatically when you hire employees. Employees must have a payroll relationship so that you can create element entries for them.

The Define Elements, Balances, and Formulas task list includes the following tasks.

Use this task to create rules for legislations not initially provided by Oracle. It guides you through configuring some payroll objects and values required for creating elements. These include tax year start date, period of service on rehire rules, default currency, element classifications, and payment types. Complete this task before the other tasks in this task list.

You must have at least one consolidation group for each legislative data group for which you are defining elements. A consolidation group is a required value when you create payroll definitions.

If you want to record personal payment methods for your employees, you must create organization payment methods and associate them with your payroll definitions. Organization payment methods define the combination of payment type and currency to use for payments to employees or external parties.

Employees must be assigned to a payroll if you want to create element entries for them. The payroll definition determines the payroll period end date, which is the end date of nonrecurring element entries. You create at least one payroll definition for each payroll frequency, such as weekly or semimonthly, within a legislative data group.

Note

If you are creating elements for coexistence only, to pass basic compensation data from your source application, you do not need to create payroll definitions. You must create recurring elements only.

Primary element classifications are predefined. If you run the Calculate Gross Earnings process (provided with Oracle Fusion Global Payroll Interface), you might create subclassifications to feed user-defined balances.

You can write formulas for a number of uses, including validating user entries into element input values, and configuring compensation, benefit, and accrual plan rules. If you use the Calculate Gross Earnings process, you can write payroll calculation and element skip rule formulas for earnings elements. The payroll calculation formula calculates the periodic value to be passed to the third-party provider.

Most of the balances you require are predefined. You can create additional balances for reporting or system extracts. If you are using Global Payroll Interface, additional balances are created automatically when you create earnings elements. You can edit the definition of these generated balances.

Use the Manage Elements task to create earnings and deductions. Create each element and then edit it to create or edit input values and at least one element eligibility record. You can also create balance feeds. If you run the Calculate Gross Earnings process, you can add a status processing rule to associate an earnings element with a formula.

Note

Make sure the Payroll License parameter in the default process configuration group is set to the appropriate value (HR_ONLY, PAYROLL_INTERFACE, or PAYROLL) before you start creating elements. This parameter determines which element templates are available to you and therefore which objects are generated when you create an element. The default process configuration group must be specified in the Process Configuration Group (ACTION_PARAMETER_GROUPS) profile option.

You can create object groups to specify subsets of elements or payroll relationships to include in a report or process, such as the Calculate Gross Earnings process.

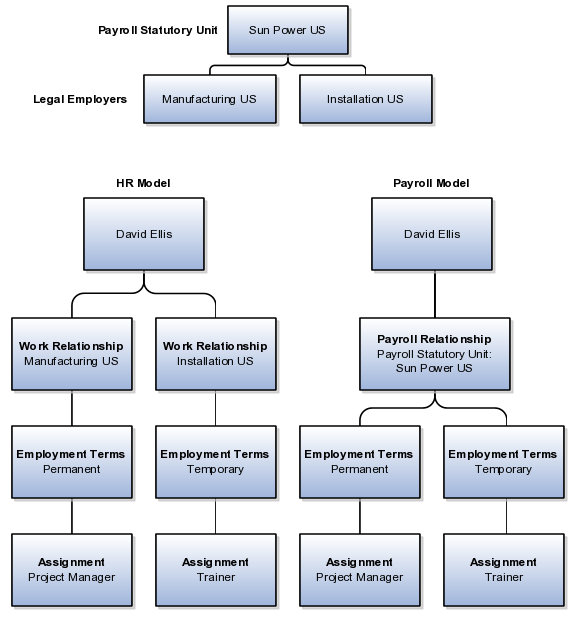

A payroll relationship exists between a person and a payroll statutory unit, which is the legal entity responsible for employee payment. Payroll relationships group person records based on payroll regulatory and statutory calculation and reporting requirements. This grouping enables the aggregation of balances across multiple employment terms and assignment records.

Important aspects of payroll relationships include:

Creation of payroll relationship records

Payroll employment model

Payroll calculation at the payroll relationship level

When an HR administrator processes a new hire, the application automatically creates a payroll relationship record for that person. As an administrator adds employment terms or assignments for that person, the application uses several factors, such as system person type, payroll statutory unit, and country-specific relationship mapping rules, to determine whether to create a new payroll relationship record. Predefined mapping rules for payroll relationships also define the payroll relationship types that indicate whether payroll processing can occur. These predefined rules can vary by localization. For example, in the US, the Employee person type maps to the payroll relationship type that is defined to be processed in payroll runs, whereas the Contingent Worker person type maps to a payroll relationship type that is not be processed in payroll runs.

Note

There is no direct association between payroll relationships and work relationships.

The structure of the payroll employment model provides the capability to have employment terms and assignments that can be linked together for calculations based on the payroll statutory unit. Therefore, information must be stored at the various levels of the payroll employment model. This information is used by the various payroll processes.

Your enterprise might be defined to use two-tier and three-tier employment models. The three payroll employment levels are:

Payroll relationship

The payroll relationship is the highest level for which to accumulate balances. Elements assigned at the payroll relationship level are processed in every payroll run. Payroll relationship elements are typically deduction elements, such as tax, pension, social insurance, or court orders.

Payroll relationships are also used outside of Oracle Fusion Global Payroll to facilitate the extraction of data from HCM that is sent to a third-party payroll provider for payroll processing. For example, payroll coordinators use Oracle Fusion Global Payroll Interface to extract benefits data from HCM and send that data through payroll relationships, along with payroll-related data.

Employment terms (three-tier model only)

Employment terms are commonly used as a middle layer in the payroll employment model to help manage multiple assignments and to satisfy tax and reporting requirements at a lower level than the payroll statutory unit. Elements assigned at the employment terms level are typically salary, pension, or social insurance elements that vary based upon the employment terms.

Note

Employees with multiple terms or assignments that are paid on payrolls using different frequencies, such as Monthly and Semimonthly, must have different employment terms or assignments for each payroll. In a two-tier configuration, payrolls can be assigned to the assignment record; in a three-tier configuration, payrolls can be assigned to the terms record.

Assignment

Because the assignment is the lowest level of the payroll employment model, elements assigned at this usually level vary from one assignment to another or are specifically for a single assignment. Elements at the Assignment level are typically used for monetary terms and conditions, such as overtime rules, rates, union dues or bonuses.

The following figure illustrates the comparison between the HR employment model and the payroll employment model in a US example with two legal employers belonging to one payroll statutory unit. In this example, David Ellis has two different employment terms and assignments, and therefore has two work relationships in the HR employment model and one payroll relationship in the payroll employment model.

Payroll relationships represent the association between a person and the payroll statutory unit. Payroll processing always occurs at the payroll relationship level. This means that to access the results of any payroll process, such as calculation or payment distribution, you start by selecting a payroll relationship record.

Note

Although a person may have multiple payroll relationships, payroll balances for that person cannot span payroll relationships.

Banks, branches, and accounts fit together on the premise of the Bank Account model. The Bank Account model enables you to define and keep track of all bank accounts in one place and explicitly grant account access to multiple business units, functions, and users. This eliminates the redundant duplicate bank account setup under different business units when these business units share the same bank account.

Creating a bank is the first step in the bank account creation. The user can search for existing banks, view and update them, or create new banks. You can create a new bank from an existing party. The option to create from an existing party is implicitly implemented by the matching option. The option is available only after the existing party has been found with the same bank. If you choose the matching option, the page repopulates the information from the matched party.

Once you have created your bank, the next step is create a branch or branches associated to the bank. The matching option is also available when creating branches. To create a new branch without using the matching option, manually enter in the information required. You can define other branch-related attributes in the page. If you do not use the matching option when an existing party is found, a branch with the same party name is created.

Once the bank and branch are created, you can proceed to the bank account setup. Select the bank branch you want to associate to your bank account. Assign the owner of the bank account. There are four areas associated to defining the account: general information, control of the account, security access to the account, and business unit assignment. If this is a Payable or Receivable account, the accounts are identified by business unit, and if a Payroll account, by legal entity.

Banks, branches and accounts fit together on the premise of the Bank Account model. The Bank Account model allows you to define and keep track of all bank accounts in one place and explicitly grant account access to multiple business units, functions, and users. Consider the following when you set up bank accounts:

Assigning a unique general ledger cash account to each account and use it to record all cash transactions for the account. This will facilitate book to bank reconciliation

Granting bank account security; bank account security consists of bank account use security, bank account access security, and user and role security.

Account use refers to accounts created for Oracle Fusion Payables, Oracle Fusion Receivables and Oracle Fusion Payroll. When creating an account to be used in one or more of these applications you must select the appropriate use or uses.

Payables and Receivables account access is secured by business unit. In addition to selecting the appropriate application use or uses, one or more business units must be granted access before the bank account can be used by Payables and Receivables. Only business units who use the same ledger as the bank accounts owning legal entity can be assigned access

You have the option to further secure the bank account so that it can only be used by certain users and roles. The default value for secure bank account by users and roles is No. In Payables and Receivables even if the secure bank account by users and roles is no, you must have the proper Multi-Organization Access Control (also known as MOAC) to access a bank account. If the secure bank account by users and roles is set to Yes, you must be named or you must carry a role that is named expressly on the bank account in order to use it.

Note

The security role Bank and Branch Management Duty is used to set up banks and branches.

The security role Bank Account Management Duty is used to set up accounts.

Organization payment methods identify the payment type and the currency to use for payroll payments to workers and for disbursing employee deductions to third parties.

You must define at least one organization payment method for each type of payment and currency that you use to disburse wages and other compensation to your employees. You can also define rules for validating or processing the distribution of payments when you offer more than one option.

A typical configuration is to have one organization payment method for each combination of legislative data group, payment type, and currency.

Any payment method that you define must belong to one of the payment types that your enterprise supports.

Each payroll must have at least one valid organization payment method for each payment type available to employees on that payroll. There may be more than one payment method with the same payment type.

The most common payment types are:

Electronic funds transfer (EFT)

Check

Cash

Your enterprise may support a different range of types that are appropriate for your localization. For example, some localizations do not allow cash, some do not support checks, and very few support postal money orders.

The names of payment types can vary by localization. For example, in the US, the payment type for EFT is NACHA; in the UK it is BACS, and in Australia it is BECS.

Note

When you select the EFT payment type, you can enter EFT information at the organization payment method level, the payment source level, or both. Entries at payment source level take priority over entries at organization payment level.

Payment sources associate bank accounts and other sources of funds with organization payment methods. If you are using Oracle Fusion Global Payroll for payroll processing, each organization payment method that is in use must have at least one valid payment source.

For check and EFT payment methods processed by Global Payroll, the payment source must be associated with an active bank account defined in Oracle Fusion Cash Management. If an organization payment method is associated with multiple payment sources, then the payment method rules determine which payment source is to be used for each disbursement.

You can use the same bank account as a payment source in more than one organization payment method. For example, one checking account may be used to pay both check and EFT payments. The application will not prevent specifying the same name for different payment sources, but it is best practice to use different naming for each occurrence.

When you have one organization payment method for each combination of legislative data group and payment type, you can use payment rules to determine the appropriate payment source based on tax reporting unit. However, there are several reasons why a company might need multiple organization payment methods and multiple payment sources, such as these examples:

Company X has only one tax reporting unit, but prefers to pay its executive staff from a separate bank account for security and confidentiality.

Company Y must comply with state laws and union agreements requiring that checks are drawn on an in-state bank. It uses different organization payment methods for each bank used to pay people based upon their locale.

Company Z may use different currencies to pay foreign nationals and expatriates working in a different country than their home.

Note

You can use the same organization payment method for both employee payments and third-party payments, but you must define different payment sources for each of them and name them differently.

The first payment source defined is the default payment source. If you add more payment sources, you can add subsidiary information as payment rules. For example, if you have multiple tax reporting units, you can specify which payment source to use for each tax reporting unit.

Having a default payment source ensures that employees are paid if there is a change in tax reporting unit. For example, Company A has multiple independent franchises, each with its own tax reporting unit. If a franchise sells, it will have a new tax reporting unit number, and the payment rule will fail. Instead of issuing errors, payment is made using the default payment source.

You might rather not specify a default payment source when payments cannot be made from the specified payment source in the payment rule. For example, Company B has 30 bank accounts and is very careful not to comingle funds. They leave the default unspecified to instead receive notifications that they can resolve manually.

You can define as many payment methods as required for your enterprise. When you create a payroll, you can select which of these methods are valid for employees assigned to that payroll. You select one method as the default method for the payroll. The default payment method is used to determine how to disburse a payment when an employee does not have any personal payment methods specified.

Note

The application does not support EFT payment methods as default payment methods because each payee must have a personal payment method with account information to know where the money will be deposited.

You select organization payment methods when defining other objects, such as payroll definitions and other payment methods. Organization payment methods are only available for selection if they are effective as of the date the object is being defined or updated.

For example, if you create a payroll definition effective as of 4/1/2012 and want to associate a particular organization payment method as the default, the organization payment method must have an effective start date on or before 4/1/2012. Similarly, when updating or correcting objects to change the organization payment method, the organization must have an effective start date on or before the effective date of the change.

The functional relationship of organization payment methods with other objects is described in this table.

|

Object |

Functional Relationship |

|---|---|

|

Personal Payment Method |

Associates a person to a particular organization method. If the payment type is EFT, the person's bank information is included in the personal payment method. Employees manage personal payment methods from their portrait. Payroll managers, coordinators, and administrators use the Manage Personal Payment Methods task on the Payment Distribution work area. |

|

Third-Party Payment Method |

Enables separate payment information for payments to third parties who are not on the payroll. Payments to third parties, such as garnishments or other involuntary deductions, are typically check payments processed separately from the payroll. To manage third-party payment methods, payroll managers and administrators use the Manage Third-Party Payment Methods task on the Payment Distribution work area. |

|

Payroll Definition |

Establishes the default payment method for payments to employees who have no personal payment method defined. To manage payroll definitions, payroll managers and administrators use the Manage Payroll Definitions task on the Payroll Calculation work area. |

|

Run-Type Payment Method |

Overrides a payroll's default payment method for payments to employees with no personal payment method defined. For example, your regular payroll is by EFT but you issue check bonuses once a year. Using the Separate Payment run type, the payment method will overwrite the one of the payroll. However, if a personal payment method of type EFT has been defined for any employee on the payroll, the application will use the personal payment method instead. To manage run type payment methods, payroll managers and administrators use the Manage Run Types task on the Payroll Calculation work area. |

This example demonstrates how to set up payment sources when defining organization payment methods to be used in Oracle Fusion Global Payroll for payroll processing.

The following table summarizes the key decisions for this scenario.

|

Decisions to Consider |

In This Example |

|---|---|

|

How many organization payment methods are needed? |

Two methods to pay employees by check and electronic funds transfer (EFT), and one method to pay external third-party consultants by check. |

|

How many payment sources are needed? |

One payment source for each of organization payment method to pay employees, and two payment sources for the organization payment method to pay external third-party consultants. |

|

How many bank accounts will be used? |

One for each payment source. |

|

What payment method rules will be used? |

Rules for in-state bank accounts used to pay third-party consultants. |

|

Is notification required to alert the source financial institution before processing EFT payments? |

Yes. Ten days before EFT payments to executive employees |

In this example, the InFusion US company pays its employees by check and EFT payments. Two bank accounts have been set up for funds used to pay the executive staff and the regular employees separately. The company occasionally distributes payments to external third-party consultants, but must comply with state regulations and pays them from two different banks based on their tax reporting unit.

Note

The available payment types for organization payment methods may be limited by the legislation.

This worked example assumes that the following prerequisites of organization payment methods have already been set up:

Perform the following steps three times, once for each of the three organization payment methods.

|

Field |

Non-Executive Value |

Executive Value |

Consultant Value |

|---|---|---|---|

|

Name |

Employee Payroll Check |

Executive Payroll Direct Deposit |

In-State Consultant Check |

|

Payment Type |

Check |

NACHA |

Check |

|

Currency |

US Dollar |

US Dollar |

US Dollar |

On the Create Payment Source page, complete the fields as shown in this table, and then click Continue.

|

Field |

Non-Executive Value |

Executive Value |

|---|---|---|

|

Name |

Employee Check Source |

Executive Direct Deposit Source |

|

Bank Account Name |

InFusion US Your Bank |

InFusion US Bank of America |

Note

Keep your payment source names as specific as possible for each scenario. This will help when managing more complicated combinations of organization payment methods and payment rules.

Perform this step twice, once for each payment source.

On the Create Payment Source page, complete the fields as shown in this table, and then click Continue.

|

Field |

First Source Value |

Second Source Value |

|---|---|---|

|

Name |

Texas Check Source |

California Check Source |

|

Bank Account Name |

Comerica Bank |

Bank of the West |

Note

If a single organization payment method has payment sources defined for both employees and third parties, the names of the payment sources must not be the same.

In this example, the organization payment method you set up for the external third-party payments with two different payment sources requires payment rules to determine how payments are distributed.

Perform these steps for the In-State Consultant Check organization payment method created in the previous task.

|

Field |

Texas Check Source |

California Check Source |

|---|---|---|

|

Default |

No |

No |

|

Tax Reporting Unit |

Texas TRU |

California TRU |

|

Payment Source |

Texas Check Source |

California Check Source |

In this example, the bank information for the EFT payments to executive employees must be added.

When you select the EFT payment type, you can enter EFT information at the organization payment method level, the payment source level, or both. Entries at payment source level take priority over entries at organization payment level. In this example, the EFT information is set at the organization payment method level because the US company requires notification of any electronic transfers of funds 10 days prior to the planned transfer date.

|

Field |

Value |

|---|---|

|

Prenotification Required |

Yes |

|

Prenote Days |

10 |

Use the Manage Third-Party Payment Methods task to create payment methods for all external payees who are not on the payroll. A third party can be either a person or an organization. Payments to third parties are normally involuntary deductions, such as court-ordered garnishments.

For all third-party payment methods, the organization method that determines the payment source to use must already be defined. Use the Manage Organization Payment Methods task in the Payment Distribution work area to define the payment source for third-party payments.

When you create a third-party payment method for a person, you select the payroll relationship for the employee whose pay is subject to the deduction. This makes the third-party person payment method available for selection as a payee on the employee's involuntary deduction card.

For example, you might set up an electronic funds transfer (EFT) payment to Mary Smith for a child-support deduction for employee John Smith. When you create the third-party payment method, you select the payroll relationship for John Smith. When you add the child support order to John Smith's involuntary deduction card, you can select Mary Smith in the Order Amount Payee field.

When you create a third-party payment method for an organization, you select External Payee in the Party Usage Code field to make the organization available for selection as a payee on the employee's deduction card.

For example, you might set up an EFT payment method for a County Sheriff that receives a processing fee on garnishment payments. When you create the payment method, you designate the County Sheriff as an External Payee. When you add the garnishment order to the employee's involuntary deduction card, you can select the County Sheriff in the Processing Fee Payee field.

Payroll definitions contain calendar and offset information, which determines when payments are calculated and costed. Using payroll definitions, you can specify payment frequency, processing schedule, and other parameters for a particular payroll. Payroll period types, such as weekly or monthly, determine the interval at which you pay employees.

Each payroll definition can use only one payroll period type, and you must set up at least one payroll definition for each payroll period type that you use to pay employees. For example, to pay employees semimonthly, create a payroll definition using the semimonthly payroll period type, ensuring that tax calculations and other calculations will produce correct results for those employees.

When you create a payroll definition, the complete payroll schedule is automatically generated, based on the payroll period type, any offsets or calendar adjustments, and the number of years that you specify. Once you have saved a payroll definition, you can assign employees to it on the Manage Payroll Relationships page.

A common scenario for modifying an existing payroll definition is to increase the number of years and generate more payroll time periods to extend the payroll calendar. A common scenario for creating a payroll definition is to replace one that is expired or end-dated.

Each payroll must belong to a consolidation group, which is required by the application for processing purposes. Before you can create a payroll definition, the legislative data group and the consolidation group to use for it must already be defined.

When you create or modify payroll definitions, the application automatically generates a calendar of payroll periods based on your selections. The choices you make for the following values determine exactly how the schedule of payroll periods is generated:

Effective start date

First period end date

Number of years

Offsets

Changes to specific dates

The effective start date is the first date that the payroll definition can be used for employee data. The start date must be on or before the earliest date of any historical data you want to load. For example if you want a payroll to be in use starting on 1/1/2013, and you have 5 years of historical payroll data to load, then the start date of the payroll definition must be on or before 1/1/2008.

The effective start date does not affect the generated calendar of payroll periods. The start date for the first payroll period is based on the first period end date.

The first period end date is the end date of the first payroll period that the application generates for a payroll definition. It is typically based on the date of implementation, tax year, benefits enrollments, or a particular payment cycle. For example, if your weekly payroll work week is Saturday through Friday, and your first payment date is planned to be on 1/6/12, you could use 12/30/11 as your first period end date.

The number of years you enter represents how many years of time periods to generate starting from the beginning of the first payroll period. For example, a payroll definition with an effective start date of 1/1/1985, a payroll period type of semimonthly, a first period end date of 6/15/2012, and the number of years as 5 would generate a calendar of payroll time periods from 6/1/2012 through 5/31/2017. Once you save a payroll definition, you can later only increase but not reduce its number of years because a calendar of time periods for the payroll has already been generated.

Depending on the payroll period type, you can elect for your payroll cycle events to occur on specific dates or be based on offsets from period start or end dates.

This table describes the predefined payroll cycle events that you can offset.

|

Date |

Meaning |

|---|---|

|

Cutoff Date |

Final date that payroll information can be entered for the payroll period. |

|

Payslip Availability Date |

Date on which the payslip is available for viewing. |

|

Payroll Run Date |

Date scheduled for the regular run of this payroll. |

|

Date Earned |

Date on which element entries are added to the payroll run. |

|

Date Paid |

Date the employee is marked as paid. For check payments, this is the date that the check can be cashed or deposited. For electronic funds transfer (EFT) payments, it is the transfer date. |

When creating a payroll definition, you can use dynamic offsets for payroll cycle events. All of the predefined payroll time periods you can use support dynamically generated dates for offsets. Using dynamic offsets, you have the option to offset each payroll cycle event by a specified number of calendar or work days before or after the start date or the end date of the payroll period. For example, you might want to set the payroll run date three work days before the payroll end date, which accommodates differences in the number of days in the payroll period and also accounts for weekends and holidays.

The predefined Monthly (Calendar) payroll time period supports using both dynamic offsets and fixed-date offsets. Using fixed dates, you can adjust the exact date of each of the payroll cycle events for the first payroll period and any adjustments that you make will be reflected in the payroll calendar for subsequent payroll time periods. For example, you might set the cutoff date as the 25th of the month and the payroll run date as the 26th of the month, then all payroll periods in the calendar will have those offsets.

Once you have generated the payroll time periods, you can further adjust any specific calendar dates, as desired. For example, if you know of a particular bank holiday that falls on a payroll run date or a payment date, you might want to adjust the dates manually on the payroll calendar's time period. You can make these adjustments when creating a payroll definition or any time after then, as long as the time period is in the future.

This example demonstrates how to create two payroll definitions for different payment frequencies that are associated with one consolidation group and one legislative data group.

The following table summarizes the key decisions for this scenario.

|

Decisions to Consider |

In This Example |

|---|---|

|

Which consolidation group should be used? |

User-defined consolidation group: InFusion US Emp Group |

|

What is the legislative data group for the consolidation group? |

User-defined legislative group: InFusion US LDG |

|

What are the payroll periods to use? |

Predefined payroll period types: Semimonthly Monthly (Calendar) |

|

What are the names of the new payroll definitions? |

InFusion US Emp Semimonthly InFusion US Emp Monthly |

|

What is the name of the organization payment method to use for all employees? |

User-defined payment methods: InFusion US Emp Check InFusion US Emp EFT |

|

What are the reporting names to be used as a basis for reports, such as extracted data for a third-party payroll provider? |

InFusion US Semimonthly InFusion US Monthly |

In this example, the InFusion US company is creating payrolls for its employees. There are two sets of employees, permanent employees who are paid a set amount on a semimonthly basis, and temporary employees that are paid using time card data on a monthly basis.

The business requires that a single monthly costing process be run against results from different payroll runs by using the consolidation group name as an input parameter in the costing run. This example creates two payroll definitions with different payment periods, but the same consolidation group. Both definitions are effective starting on 1/1/11 and will generate payroll time periods covering 5 years.

Create two payroll definitions:

One for permanent employees that are paid a flat amount by electronic funds transfer (EFT) on a semimonthly basis. This payroll definition includes dynamically generated offset dates.

One for temporary employees that are paid by check using time card data on a monthly calendar basis.

Perform the following steps twice, first using the semimonthly values and then using the monthly values.

In this example, all employees that will use this payroll definition are hired after 1/1/11, so there is no issue with loading historical employee data.

|

Field |

Semimonthly Value |

Monthly Value |

|---|---|---|

|

Name |

InFusion US Emp Semimonthly |

InFusion US Emp Monthly |

|

Reporting Name |

InFusion US Semimonthly |

InFusion US Monthly |

|

Consolidation Group |

InFusion US Emp Group |

InFusion US Emp Group |

|

Period Type |

Semimonthly |

Monthly (Calendar) |

|

First Period End Date |

6/15/12 |

6/30/12 |

|

Default Payment Method |

InFusion US Emp EFT |

InFusion US Emp Check |

|

Field |

Falls Value |

Day Type Value |

Offset Value |

Base Date Value |

|---|---|---|---|---|

|

Cutoff Date |

5 |

Work Days |

Before |

Period End Date |

|

Payroll Run Date |

3 |

Work Days |

Before |

Period End Date |

|

Field |

Value |

|---|---|

|

Fixed Date |

Yes |

|

Cutoff Date |

6/25/12 |

|

Date Earned |

6/30/12 |

|

Payroll Run Date |

6/27/12 |

|

Date Paid |

6/30/12 |

|

Column |

Semimonthly Value |

Monthly Value |

|---|---|---|

|

Payroll Run Date |

Old Value: 11/28/13 New Value: 11/27/13 |

Old Value: 5/27/13 New Value: 5/28/13 |

Closing a payroll period can interfere with changes to recurring entries. Payroll periods are not like General Ledger periods. You do not need to close payroll periods.

There are two reasons why you might not be able to view and select the payment method you are looking for. Either the start date of the payroll definition is before the start date of the organization payment method or the organization payment method has no associated payment source.

Fast formulas are generic expressions of calculations or comparisons that you want to repeat with different input variables.

You can use fast formulas to:

Calculate payrolls

Define the rules for paid time off accrual plans

Define custom calculations for benefits administration

Validate element inputs or user-defined tables

Edit the rules for object group population for elements or people

Calculate absence duration

Define custom configuration for compensation

Write payroll calculations and skip rules for elements that you define to represent earnings and deductions. Associate more than one formula with each element to perform different processing for employee assignments with different statuses. You can define elements and formulas for earnings and deductions with highly complex calculations requiring a number of different calls to the database.

Edit the delivered accrual type formulas or write your own. Each accrual plan needs two formulas: one to calculate the gross accrual and the other to return information to the PTO carry-over process.

Configure your plan design to the requirements of your enterprise. Formulas provide a flexible alternative to the delivered business rules for such purposes as:

Date calculations, such as enrollment start and end dates, rate or coverage start and end dates, waiting periods and enrollment periods, or action item due dates

Calculations of rate and coverage amount, minimum and maximum, or upper and lower limits

Certification requirements

Partial month and proration calculations

Eligibility and participation evaluation

For example, you can write a formula to calculate benefits eligibility for those cases where the provided eligibility criteria does not accommodate your particular requirements.

For more information, see Benefits Fast Formula Reference Guide (1456985.1) on My Oracle Support at https://support.oracle.com.

Validate user entries into element input values using lookups or maximum and minimum values. However, for more complex validations write a formula to check the entry. Also, use a formula to validate entries in user tables.

Define criteria to dynamically populate a payroll relationship group or work relationship group. When you create a formula of type Payroll Relationship Group or Work Relationship Group, the Create Fast Formula page provides an expression editor to help you build the selection criteria.

Calculate the duration of an absence from the start and end dates.

Extend the existing flexibility of compensation plan configuration by writing formulas to customize:

Start and end dates for compensation allocations under individual compensation plans

Person selection, hierarchy determination, column default values, and currency selection for workforce compensation plans

The source of items displayed in total compensation statements

This example demonstrates, using the text editor, how to create a fast formula that returns the range of scheduled hours for managers and a different range for other workers.

The following table summarizes key decisions for this scenario:

|

Decisions to Consider |

In This Example |

|---|---|

|

Is the formula for a specific legislative data group? |

No, this is a global formula that can be used by any legislative data group. |

|

What is the formula type for this formula? |

Range of Scheduled Hours |

|

Are there any contexts used in this formula? |

No |

|

Are there any database item defaults? |

Yes, ASG_JOB |

|

Are there any input value defaults? |

No |

|

What are the return values? |

MIN_HOURS, MAX_HOURS, FREQUENCY |

|

Field |

Value |

|---|---|

|

Formula Name |

Manager Range of Scheduled Hours |

|

Formula Type |

Range of Scheduled Hours |

|

Description |

Manager's Range of Hours |

|

Effective Start Date |

1-Jan-2010 |

/* DATABASE ITEM DEFAULTS BEGIN */

DEFAULT FOR asg_job IS ' '

/* DATABASE ITEM DEFAULTS END */

JOB_1 = ASG_JOB

IF JOB_1 = 'Manager' then

(MIN_HOURS = 25

MAX_HOURS = 40

FREQUENCY = 'H')

else

(MIN_HOURS = 20

MAX_HOURS = 35

FREQUENCY = 'H')

return MIN_HOURS, MAX_HOURS, FREQUENCY

This example demonstrates how to create a fast formula that groups executive workers for reporting and processing. All executive workers are in department EXECT_10000. Once the formula is created it will be added as object group parameters so that only those workers in department EXECT_10000 are used in processing.

The following table summarizes key decisions for this scenario:

|

Decisions to Consider |

In This Example |

|---|---|

|

Is the formula for a specific legislative data group? |

Yes, InVision |

|

What is the formula type for this formula? |

Payroll Relationship Group |

|

Field |

Value |

|---|---|

|

Formula Name |

Executive Payroll Relationship Group |

|

Type |

Payroll Relationship Group |

|

Description |

Executive Workers |

|

Legislative Data Group |

Vision LDG |

|

Effective As-of Date |

1-Jan-2010 |

|

Conjunction |

Database Item Name |

Data Type |

Operand |

Literal Value |

|---|---|---|---|---|

|

IF |

DEPARTMENT |

Character |

= |

'EXECT_10000' |

|

Then |

SELECT_EMP |

Character |

= |

'YES' |

|

ELSE |

SELECT_EMP |

Character |

= |

'NO' |

Compilation errors display in the Manage Fast Formulas page when you compile the formula. The formula compiler returns line numbers starting at 1 from the beginning of a formula, and character positions starting at 1 from the beginning of a line in its error messages. The compiler aborts compilation when an error is encountered.

This table lists the type and description of several common formula compilation errors.

|

Formula Error |

Description |

|---|---|

|

Syntax Error |

The formula text violates the grammatical rules for

the formula language. An example is using |

|

Incorrect Statement Order |

|

|

Misuse of |

Occurs when any of these conditions occurs:

|

|

Misuse of |

An |

|

Missing |

A database item with defaulting specified must have

a |

|

Misuse of |

A DEFAULT statement is specified for a variable other than an input or database item. |

|

Uninitialized Variable |

The compiler detects that a variable is uninitialized when used. The compiler cannot do this in all cases. This error often occurs when you want to use a database item, but a database item is not available in the formula. |

|

Missing Function Call |

A function call is not recognized. The combination of return type, function name, and parameter types does not match any available function. |

|

Incorrect Operator Usage |

An instance of a formula operator use does not match the permitted uses of that operator. For example, the + operator has two permitted uses.

The operands are both of data type |

|

Inconsistent Data Type Usage |

A formula variable is being used as if it is of more than one data type. Or a database item or context is being used with the wrong data type. For example, Variable A is assigned a |

|

|

A condition that eventually becomes false, or an |

|

Misuse of Context |

A variable is used as a context, or a context is used as a variable. For example, |

Fast formula execution errors occur when a problem arises while a formula is running. The usual cause is a data problem, either in the formula or in the application database. These errors contain the formula line number where the error occurs.

This table lists the type and description of each formula execution error.

|

Formula Error |

Description |

|---|---|

|

Uninitialized Variable |

Where the formula compiler cannot fully determine if a variable or context is initialized when it is used, it generates code to test if the variable is initialized. When the formula executes and the variable or context is not initialized an error is raised. |

|

Divide by Zero |

Raised when a numeric value is divided by zero. |

|

No Data Found |

Raised when a non-array type database item unexpectedly fails to return any data. If the database item can return no data then it should allow defaulting. This error is also raised from within a formula function. The cause is an error in the formula function code. |

|

Too Many Rows |

Raised when a non-array type database item unexpectedly returns more than a single row of data. The cause is an incorrect assumption made about the data being accessed. This error can also be raised from within a formula function. The cause is an error in the formula function code. |

|

|

Raised when a database item unexpectedly returns a |

|

Value Exceeded Allowable Range |

Raised for a variety of reasons, such as exceeding the maximum allowable length of a string. |

|

Invalid Number |

Raised when an attempt is made to convert a non numeric string to a number. |

|

User Defined Function Error |

Raised from within a formula function. The error message text is output as part of the formula error message. |

|

External Function Call Error |

A formula function returned an error, but did not provide any additional information to the formula code. The function might have output error information to the logging destination for the executing code. |

|

Function Returned |

A formula function returned a |

|

Too Many Iterations |

A single |

|

Array Data Value Not Set |

The formula attempted to access an array index that has no data value. This is an error in the formula code. |

|

Invalid Type Parameter for |

An invalid data type was specified in the |

|

Incorrect Data Type For Stored Item |

When retrieving an item using |

|

Called Formula Not Found |

The called formula could not be resolved when attempting to call a formula from a formula. This could be due to an error in the calling formula, or because of installation issues. |

|

Recursive Formula Call |

An attempt was made to call a formula from itself. The call could be directly or indirectly via another called formula. Recursive formula calling is not permitted. |

|

Input Has Different Types In Called and Calling Formulas |

When calling a formula from a formula, the actual formula input data type within the called formula does not match the data type specified from the calling formula. |

|

Output Has Different Types In Called and Calling Formulas |

When calling a formula from a formula, the actual formula output data type within the called formula does not match the data type specified from the calling formula. |

|

Too Many Formula Calls |

There are two many formula from formula calls. This is due to a problem with the formulas. |

If you need to compile many fast formulas at the same time, you can run the Compile Formula process on the Submit a Process or Report page. Also, if you make any changes to a function after you have compiled a formula that uses it, you need to recompile the formula for the changes to take effect.

Compilation errors occur in the Manage Fast Formulas page when you compile the formula. An error message explains the nature of the error. Common compilation errors are syntax errors resulting from typing mistakes.

Execution errors occur when a problem arises while a formula is running. The usual cause is a data problem, either in the formula or in the application database.

Payroll balances show the accumulation of values over a period of time. The values can be currency, hours, or any other numeric value. You manage balance definitions from the Payroll Calculation work area. Most of the balances you require are predefined and additional balances are created automatically when you create elements. You can edit the definition of these generated balances, or create additional balances for calculations or reporting.

When you create a balance definition, you select the balance category and a unit of measure. Each balance definition is grouped in a predefined balance category for quicker processing. Balance categories are legislation-specific and cannot be modified. The predefined units of measure available for selection are Day, Hour (with different combinations of minutes and seconds), Integer, Money, and Number.

You can use the batch loader from the Payroll Administration work area or Data Exchange work area to create multiple balance definitions at the same time.

Important aspects of balance definitions are:

Balance Dimensions

Balance Feeds

Generated Balances and Database Items

Base Balances

Remuneration

Each balance can have multiple dimensions, which define the specific value to be retrieved. Balance dimensions are predefined and typically combine these components:

Time span, such as run, period to date, or fiscal year to date

Employment relationship level, either assignment, terms, or payroll relationship

Context, required for some balances only, such as tax reporting unit, element, or payroll

For example, if you select the dimension Core Assignment Tax Unit Year to Date for the balance Gross Earnings, you create the defined balance GROSS_EARNINGS_ASG_TU_YTD, which accumulates gross earnings for an assignment in a specific tax reporting unit from the beginning of the calendar year to date.

You can define balance feeds by element input values or by balance classification run results.

Balance Feeds by Element

Balance feeds by element indicate one or more element input values to add or subtract from a balance. For each balance feed, all elements must be of the same data type. For example, you would not mix money and hours in the same balance feed.

If a balance is fed by a single element, it is called a primary balance.

Balance Feeds by Classification

Balance feeds defined by primary or secondary element classification are always payroll run result values.

If you add a primary classification as a balance feed, you cannot add the children of this classification from the secondary or subclassifications. For example, if you use the Supplemental Earnings primary classification as a balance feed, you cannot also use any secondary or subclassification that are children of Supplemental Earnings. Also, you cannot use both secondary classifications and subclassifications in the same balance feed.

For any balance that you need to initialize, regardless of whether it is fed by elements or classifications during normal processing, you can select elements to feed it for balance initialization purposes only. Select one element for each level of the employment hierarchy associated with a dimension that you want to initialize.

When you create elements, balances and balance feeds are created automatically as determined by the element template. A database item is generated automatically for each balance dimension. You can use the database items in your formulas to check the value of a balance.

You can specify a base balance when there is a relationship between balances that can be relied on when processing and reporting. For example, Loan Repayment could be the base balance for Loan Repayment Arrears.

One balance in a legislation is predefined as the remuneration balance, which is used to generate payments for employees. For example, the remuneration balance might be Net Pay, which is a calculated balance that is the sum of standard earnings and supplemental earnings minus all the deductions calculated for the run.

Important

Setting the Use for Remuneration option to Yes means the balance will be defined as the remuneration balance. Only one balance in a legislation can be the remuneration balance.

Setting initial balances values is an essential task when you migrate payroll data from another system. First you load balance values into batch views then submit the Load Initial Balances process from the Payroll Calculation work area. The process validates then processes the batch.

For each balance to be initialized, you must create elements in the Balance Initialization classification and add them to the balance as balance feeds. You can create up to three elements: one to initialize assignment level balances, one for employment terms level, and one for payroll relationship level.

Each balance initialization element must:

Be nonrecurring and for balance adjustments only.

Be processable in the payroll run.

Have an input value to feed the balance and an input value for each context required by the balance. If you need to set initial values for a large number of balances you can define multiple input values for a single element with each input value feeding a different balance.

Have an eligibility record associated with it, with an early effective start date.

Populate the batch views with the balance values for the initialization date. You can use the Batch Loader spreadsheet, or populate the batch directly using the API in the PAY_BALANCE_BATCH_LINES_PKG API package. You can download the Batch Loader spreadsheet in the Payroll Administration work area.

The views are:

PAY_BALANCE_BATCH_HEADER

PAY_BALANCE_BATCH_LINES

Important

The PAY_BALANCE_BATCH_LINES view has a complex definition and cannot be directly inserted into. You must use the Batch Loader spreadsheet or API.

When you create the batch header and lines, consider the following points:

Divide your employees into separate batches to limit the size of each batch.

Within a batch, ensure that you include batch lines for every balance to be initialized for a person. You cannot split lines for a person across multiple batches.

The date you specify on the batch header applies to all lines unless you enter an override date at the line level. The date at line level must be on or before the date on the header.

You cannot initialize balances once you have run any payroll processes.

Every line must include a value for payroll relationship number. If the line is initializing a terms-level balance, you must also enter a term number. If the line is initializing an assignment-level balance, you must also enter a term number and an assignment number.

The Load Initial Balances process validates then processes the initial balance values you load into batch views. It creates balance adjustments to set the required values.

The data you load into the batch views determines which defined balances are initialized and the values used. Typically, you group employees into batches to manage the initialization of their balances.

The Load Initial Balances process validates that the entities referenced in the batch data exist, including balances, balance dimensions, tax reporting units, payrolls, payroll relationships, employment terms, and assignments. It checks that values are available for the contexts used by each balance dimension. It does not check, for example, that an employee is assigned to a specified organization. It sets the status of valid batch lines to V.

The process creates balance adjustments. For all the batch lines it successfully processes, the process sets the status to T and updates the PAYROLL_REL_ACTION_ID to point to the balance adjustment.

The following table shows a simple three-line batch loaded on 18 June.

|

Defined Balance |

Value |

|---|---|

|

Total_Earnings_PTD |

100 |

|

Total_Earnings_QTD |

250 |

|

Total_Earnings_YTD |

500 |

For this batch, the process creates an adjustment on the first day of the time period relevant to each dimension, as shown in the following table:

|

Adjustment Date |

Adjustment Value |

Balances Adjusted |

|---|---|---|

|

1 June |

100 |

Total_Earnings_PTD Total_Earnings_QTD Total_Earnings_YTD |

|

1 April |

150 |

Total_Earnings_QTD Total_Earnings_YTD |

|

1 Jan |

250 |

Total_Earnings_YTD |

The PAY_BALANCE_BATCH_HEADER and PAY_BALANCE_BATCH_LINES views hold the data used by the Load Initial Balances process to initialize balance values.

You must load data into these views using the Batch Loader spreadsheet or API in the PAY_BALANCE_BATCH_LINES_PKG PL/SQL package. Create each batch line with a BATCH_LINE_STATUS of U (unprocessed) and leave the PAYROLL_REL_ACTION_ID column blank. The batch upload process updates these two columns.

Note

You can view the full column listing by querying the view in the Oracle Enterprise Repository at https://fusionappsoer.oracle.com/oer/.

In PAY_BALANCE_BATCH_LINES, the columns shown in the following table are required. Where there is both an ID column and a name column for the same entity, for example, PAYROLL_ASSIGNMENT_ID and ASSIGNMENT_NUMBER, you can populate either column, but you must populate at least one. If the ID column is left blank, the batch upload process uses the name column value to derive the ID value.

|

Column |

Comments |

|---|---|

|

PAYROLL_RELATIONSHIP_ID + PAYROLL_RELATIONSHIP_NUMBER |

Identify the payroll relationship for this balance value. |

|

BALANCE_TYPE_ID + BALANCE_NAME |

Identify the balance for this balance value. |

|

BALANCE_DIMENSION_ID + DIMENSION_NAME |

Identify the balance dimension for this balance value. DIMENSION_NAME should be populated with the localization's dimension usage dimension name rather than the core DIMENSION_NAME held on PAY_BALANCE_DIMENSIONS. |

|

VALUE |

Identify the numerical value of the balance on the upload date. |

|

UPLOAD_DATE |

Identify the date of the balance value. This date must be on or before the upload date for the batch header. |

|

PAYROLL_ID + PAYROLL_NAME |

Identify the context required for evaluating a balance value, even though it may not be a context for the dimension. |

The core contexts shown in the following table must be populated if the balance dimension expects a value for this context.

|

Column |

Comment |

|---|---|

|

PAYROLL_TERM_ID + TERM_NUMBER |

Identify the payroll terms for this balance value, if required. Where there is both an ID column and a number column for the same entity, you can populate either column, but you must populate at least one. |

|

PAYROLL_ASSIGNMENT_ID + ASSIGNMENT_NUMBER |

Identify the payroll assignment for this balance value, if required. |

|

LEGAL_EMPLOYER_ID + LEGAL_EMPLOYER_NAME |

|

|

TAX_UNIT_ID + TAX_UNIT_NAME |

|

|

AREA1 + AREA2 + AREA3 + AREA4 |

Identify state and country code information. In Oracle E-Business Suite these items were STATE_CODE, COUNTY_CODE and so on. |

|

THIRD_PARTY_PAYEE_ID + THIRD_PARTY_PAYEE_NAME |

|

|

TIME_DEFINITION_ID + TIME_DEFINITION_NAME |

|

|

RUN_TYPE_NAME + RUN_TYPE_ID |

|

|

ELEMENT_ENTRY_ID |

|

|

BALANCE_DATE |

|

|

CALC_BREAKDOWN_ID |

Identify the ID associated with the payroll terms. If the deduction card is the calculation breakdown, enter the PAY_DIR_CARDS_F.DIR_CARD_ID. If the deduction component is the calculation breakdown, enter the PAY_DIR_CARD_COMPONENTS_F.DIR_CARD_COMP_ID. |

There are six legislative or user-defined contexts, which must be populated if the balance dimension expects a value for these contexts. For each context, there is a context ID, name, and value. For example:

CONTEXT1_ID + CONTEXT1_NAME

CONTEXT1_VALUE if CONTEXT1 is used by the balance dimensions

Note

The values of the core contexts are the IDs themselves, while the values of the legislative contexts are separate from the ID of the context.

Populate CONTEXT[1-6]_NAME with the name of the context usage for that legislative or user-defined context, and CONTEXT[1-6]_VALUE with the actual value of that context.

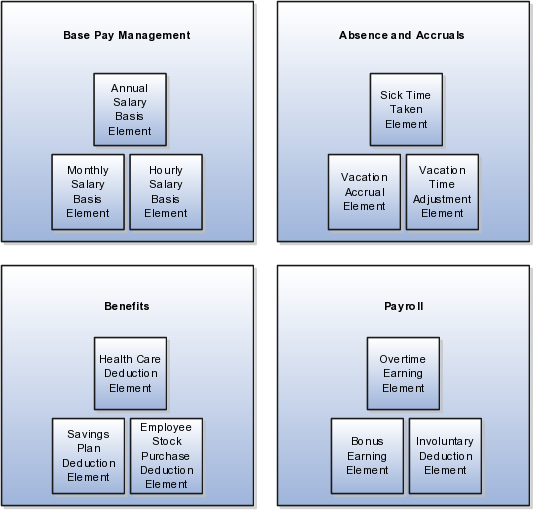

Elements are building blocks that help determine the payment of base pay, benefits, absences, and other earnings and deductions. The components of elements are set up differently based on how the element is to be used.

To manage base pay, you attach a single earning element to each salary basis to hold base pay earnings, and assign a salary basis to each worker. When a manager or compensation specialist enters a base pay amount for a worker, the amount is written to the payroll element input value associated with the worker's salary basis and used in payroll processing to generate payment amounts.

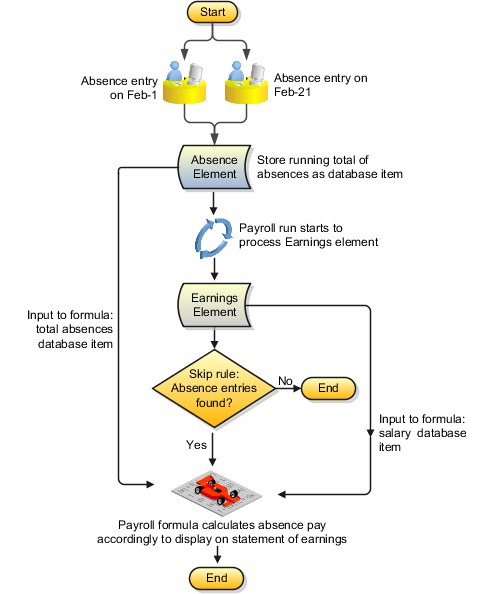

You can manage employee absences and leave time. To facilitate reporting and analysis of employee absences, you can distinguish between absence categories, absence types, and absence reasons. You can associate an absence type with an element to maintain an absence balance for an employee. You can associate absence types and other elements with accrual plans to determine the net accrual of an employee.

Attach elements at various levels in the benefits object hierarchy to create deductions and earnings that can be processed in a payroll run to calculate net pay.

For Oracle Fusion Global Payroll, you define earning and deduction elements, such as bonus and overtime earnings and involuntary deductions. These elements incorporate all the components required for payroll processing, including formulas, balances, and formula result rules.

Elements are the building blocks of payroll and benefits. There is no limit to the number of elements you can define. You define the policies or business rules that govern the allocation of these elements to your workers.

Elements can represent:

Earnings, such as salary, wages, and bonuses

Compensation, such as employee stock purchase and insurance plans

Absences from work

Tangible items distributed to persons, such as tools, uniforms, mobile phones, or computers

Statutory deductions, such as taxes, voluntary deductions, such as contributions to charities or savings plans, and involuntary deductions, such as court orders, as well as pretax deductions

Employer taxes and other employer liabilities

Oracle Fusion supplies many predefined elements while additional elements are generated when you define certain types of compensation and payroll elements through templates.

The predefined elements are specific to your localization. They typically include deductions for tax and wage attachments. You cannot make any changes to these predefined elements.

You can create many earnings and deductions from element templates. The templates include the elements, balances, balance feeds, and formulas required for payroll processing. You can configure any of these definitions to match your specific business requirements.

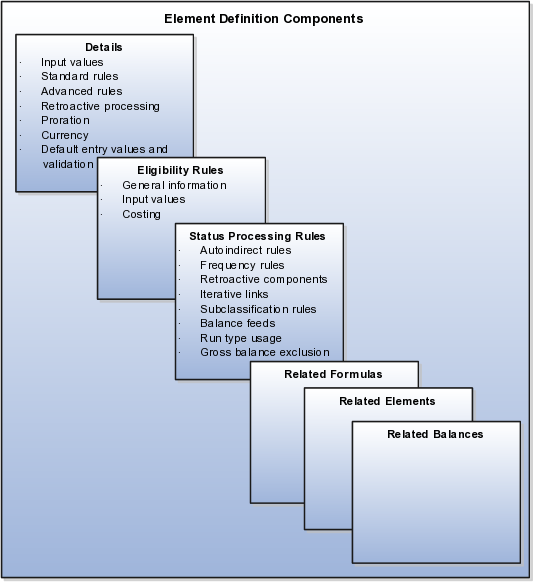

The components of an element's definition are available for entry based on the primary and secondary classification you select, for example a standard earning. This diagram illustrates element definition components and what is defined in each component.

For example, you can define an element called Wage, for hourly paid workers. You classify the element in the predefined classification Earnings, which determines when it is processed in the payroll run and what payroll balances it feeds.

You must specify at least one input value, in this case Hours Worked, which must be entered in each payroll period. If required, you can define multiple input values with fixed values, defaults, or validation.

You associate a formula with the element, to calculate the wage for the payroll period. A simple formula might be hours worked, from the input value, multiplied by an hourly rate, from compensation information on the employment record. You define who is eligible for the element by assigning eligibility criteria to various components in the persons employment record, such as grade, payroll, salary basis, or organization. In this example, the wage element is available to all persons on the weekly payroll.

You can use the batch loader from the Payroll Administration work area or the Data Exchange work area to load elements.

After you have defined and used an element, updates to the element are limited to ensure the integrity of the element for retroactive processing and the balances of the input values. You cannot remove existing input values or add new ones if you have created entries for the element. You must add an input value to an element before you create any element entries, or set the element entries effective date to the element's start date.

You can make the following changes to an element that has been previously processed:

Change a required input value to be optional.

Alter the sequence in which input values appear in the Element Entries flow.

Change the input value validation rules for minimum, maximum, lookup, or formula.

Change your specification of which input values create database items.

You can select rules for an element to define how you can update its element entries. The options include:

Automatic entry

Allow multiple entries in same period

Additional entry

When you create an element, you can select Yes for the question: Should every person eligible for the element automatically receive it? This setting selects the Automatic entry option by default for all eligibility records you create for that element. However, you can override the selection for any specific eligibility record before you save it.

When you select this option, saving the eligibility record initiates a payroll flow to create element entries for all eligible workers. You can view the progress of the process in the Automatic Entry Status field. If the status shows that an error occurred, you can save the eligibility record again to resubmit the flow. If you have access to payroll work areas, you can also monitor the progress of the Generate Automatic Element Entries flow by navigating to the Processes and Reports tab through the Payroll Dashboard, Checklists work area, or Payroll Calculation work area.

Afterward, any updates to the employment records of eligible workers, including hires and terminations, automatically update, create, or end the element entries, as appropriate.

If you select the Automatic entry option for an eligibility record, provide a default value for any required input values.

Important

An element with the Automatic entry option selected cannot allow multiple entries in the same period.

This option enables you to give a person more than one entry of the element in the same pay period. For example, if you enter overtime hours on a weekly basis for monthly-paid persons, you might need to give a person five entries of an overtime element in each period.

If you are creating a net-to-gross element, you must select Allow multiple entries in same period.

This option allows you to add an occasional one-time entry for recurring elements. This additional entry can override or add to the normal entry amount.

An element's latest entry date determines how element entries process after a person is terminated or transferred to another payroll. The options are:

Final close

Last standard earning date

Last standard process date

Note

These are the predefined options, you can create others that fit your business needs.

This option allows the element to stay open for entries beyond a persons last day worked. For example, you want the element to stay open to pay a severance package to a terminated person.

This option stops all element entries on the date the person leaves. It is recommended to use this option for recurring entries such as salary.

Note

When you select the Last Standard Earning Date, also select proration for the element. This ensures the element is processed for proration purposes, even if it is not active at the end of a payroll period.

The last standard process date defaults to the last day of the pay period in which the person is terminated, but you can set it to a later period when you terminate a person. It enables all element entries to stop on the last standard process date or on the date the assignment ends, if this is earlier.

Note

This option is only available for Oracle Fusion Global Payroll users.

An element's input values defines the entry values available on each entry of this element. Each input value has a unit of measure defined, and can have validations and conditions defined to control the data entry of the element entry assigned to a person. For example, an earnings element may have an input value for hours worked, which is defined as required and has a unit of measure of number.

When you create an element, some input values are created automatically if you use Oracle Fusion Global Payroll or Oracle Fusion Global Payroll Interface. For Global Payroll Interface, this applies to earnings elements only. You can create additional input values for any element, as needed.

For each input value created you can modify these attributes:

|

Field |

Purpose |

|---|---|

|

Display Sequence |

Control the order in which the entry value is displayed on element entries. |

|

Special Purpose |

Identify how an input value is used, irrespective of the name given to it. For example, it identifies if the input value holds a percentage value, a rate, or third-party payee details. It basically assists with processing the input value based on what type of information it holds. |

|

Unit of Measure |

Select the value that describes the type of value the entry value can hold, such as number or character. |

|

Displayed |

Select to display the input value on the element entry. |

|

Allow User Entry |

Select to enter values on element entries. |

|

Required |

Select to make the input value a required entry value on the element entry. If you select Required, you must also select Displayed and Allow User Entry. |

|

Create a Database Item |

Select to have a database item created for the input value to make the values available for formulas or system extract. |

|

Default |

Enter a value that appears as the default value for this entry value in element entries, if needed. |

|

Apply default at runtime |

Select to have the default set on the element entry when the payroll process is run. Changes to the default value are reflected in the next processing after the effective date of the change. You can replace the default at runtime functionality by manually providing an entry value on the element entry. |

|

Minimum |

Enter a minimum value for the element, if needed. |

|

Maximum |

Enter a maximum value for the element, if needed. |

|

Validation Formula |

Enter a formula that validates the entry value entered on element entries, if needed. |

|

Validation Source |

Use with the other input value options to select the valid validation method, such as lookups or formulas. |

|

Lookup Type |

Specify a lookup type to provide a list of values for an element entry value. |

|

Warning or Error |

Use when you are validating the input value or entering a minimum or maximum value. It specifies whether a warning or an error displays if the entry fails the validation condition or does not meet the minimum or maximum value indicated. |

|

Reference |

Use to associate a balance context with the run result. For example, if you want to associate a context, such as jurisdiction, with an element; create an input value for jurisdiction and select the jurisdiction context in the reference field. Then the run result value of the input value will work as context value when updating the balance. If you select a reference then the lookup type and validation source values should be automatically set to the reference context. You need to provide the reference field first for the validation source value to be automatically populated. |

Note

Once an element is processed, you cannot update certain input value attributes, such as unit of measure. This ensures that changing certain attributes will not invalidate prior results.

At minimum, an element needs one standard processing rule. This identifies the formula the payroll run uses to process the element for persons with an active employment record. It is also the default formula for other assignment statuses. However, you can define additional processing rules if you need to use different formulas for assignments at other statuses. For example, you could have two rules for a Wages element: Standard Wages and Paid Training Leave.

You can add one or more of the following optional results rules to an element:

Direct result

Indirect result

Message

Order indirect

Stop

Target indirect

For all formula result types except Direct Result or Message, select the target element name to which you want to pass the formula result. This element must have a processing priority causing it to process after the element sending the result.

For the formula result types Direct Result, Indirect Result, and Target Indirect, select the target input value to update.

This is the element's run result, or a direct result updating one of the element's input values.

This result passes as an element entry to another nonrecurring element not yet processed.

The formula issues messages under certain conditions. For example, a formula can check a loan repayment balance and, if the balance is zero, issue the message "Loan is repaid."

There are three severity levels for a message rule:

Error

This causes the run to roll back all processing for the employment record.

Warning

This does not affect payroll processing but warns you of a possible problem.

Information

This does not affect payroll processing.

This result updates the subpriority of the element you select in the Target Element Name field.

This formula result uses the Date Earned of the payroll run to put an end date on a recurring entry of this or another element (which must be defined with Allow Multiple Entries not selected).

This result updates recurring entries of this or another element on the effective date of the payroll run. The receiving element must be defined with Allow Multiple Entries not selected unless you are passing a recurring element's entries to itself, that is updating another entry of the same element. With this result rule, any future-dated changes to the entry will be overwritten by the results of the current payroll run.