11g Release 7 (11.1.7)

Part Number E20376-07

Home

Contents

Book

List

Contact

Us

|

Oracle® Fusion Applications Compensation Management Implementation Guide 11g Release 7 (11.1.7) Part Number E20376-07 |

Home |

Contents |

Book List |

Contact Us |

|

Previous |

Next |

This chapter contains the following:

Manage Benefit Programs and Plans

Define Benefit Rates and Coverage

Defining benefits involves three categories of setup tasks.

Set up benefits objects. Organize the objects into hierarchies to help efficiently configure and maintain benefits packages. While defining benefits objects, you can also make configurations to automate administration of corporate policies regarding eligibility, enrollment, rates, and coverages.

Set up benefits peripheral components. You typically use or reuse these components while defining different benefits objects.

Set up general components, such as third-party administrators, benefits carriers, regulatory bodies, and reporting groups.

Fusion Benefits configuration flexibly supports a wide variety of implementation strategies. While making trade-off decisions, such as processing time versus ongoing maintenance effort, you consider whether to control characteristics such as participant eligibility at a general level, at a detailed level, or at a combination of general and detailed levels.

Later documentation details the benefits object hierarchy, setup override rules, and configuration examples. At this point of this overview topic, the important points are:

A benefits object hierarchy organizes a benefits program, plan types, plans in program or plans not in program, and options from top to bottom, general to detailed.

Depending on the outcomes of strategic implementation trade-off decisions, you have the flexibility to configure most aspects of a benefits package at more than one level in the hierarchy.

Population of all four levels of a benefits object hierarchy is not required.

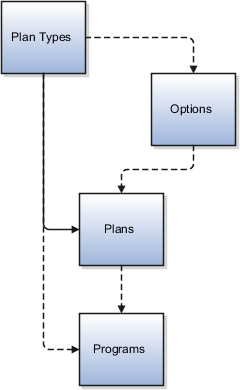

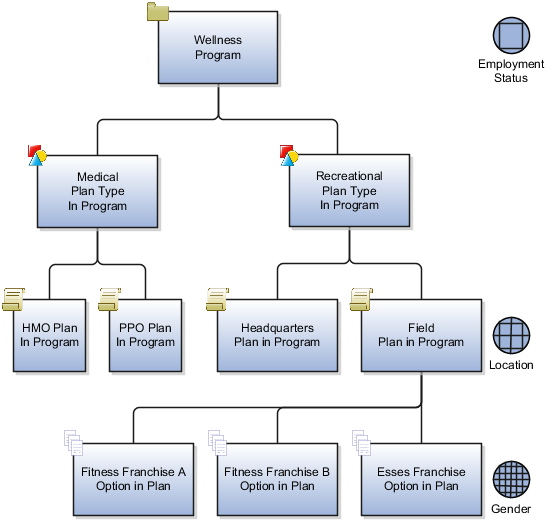

The following diagram shows the four levels of benefits object hierarchy: benefits program, plan types in program or not in program, plans in program or plans not in program, and options from top to bottom, general to detailed.

The sequence for creating benefits hierarchy objects differs from the resulting hierarchical order. You can create new objects as needed at any time. However, because some benefits hierarchy objects are referenced during the definition of other benefits hierarchy objects, it is more efficient to create these objects in the order shown in the figure. Benefits object hierarchy architecture is further described in the related topic: Benefits Hierarchy Objects: How They Work Together.

This figure illustrates the most efficient sequence for creating benefits hierarchy objects: plan types, options (if used), plans, then programs.

Begin by creating one or more plan types. Plan types organize plans into groups that provide similar categories of benefits, such as health, savings, education, and so on. At the plan type level of the hierarchy, you can efficiently administer corporate benefits policies that apply across all plans within that benefit category or type.

When creating an option, you can optionally associate one or more existing plan types. This restricts the availability of the option to plans that belong to the named plan types.

When using the plan configuration process to define benefit plan details, you must associate one existing plan type, and can optionally tie existing options to the plan.

When using the program configuration process to define program details, you can associate existing plan types and existing plans with the program.

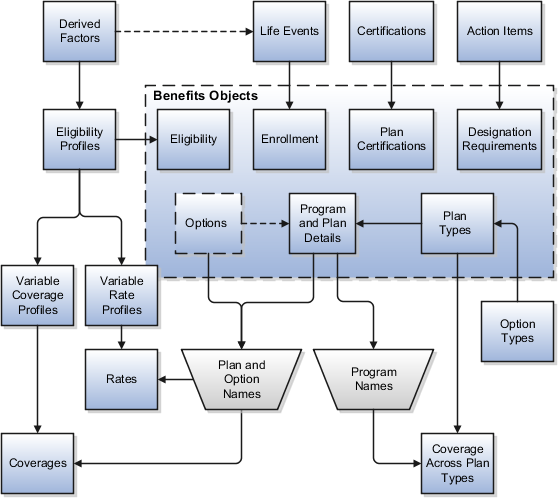

The following figure illustrates some of the dependencies among setup data components, showing several types of setup components organized around the periphery of the main benefits objects. Some types of components are delivered and some types are not.

Here is additional information about some of the setup components in the figure.

A lengthy list of derived factors is delivered.

Various combinations of derived factors can be used to define different eligibility profiles.

Some temporal and scheduled life events are delivered.

On the Create Life Events page, you can extend the list of available life events by creating as many of your own unique life events as you need. You can set up life events so that they will be triggered by certain temporal derived factors, such as age or length of service. Life events are reusable, and can be used to control enrollment at the program, plan, and option levels.

The enrollment certification types and determination rules are delivered.

You cannot extend the available list of certification types or determinations rules, but you can rename the existing lookup values that appear in those fields. You can select different combinations of types and rules, and then set up the association with plans on the plan configuration process certification page.

A set of action items is delivered.

You cannot extend the list of available action items, but you can rename them on the Manage Action Items page. You can associate action items with designation requirements at the plan type level or at the plan level, but not at both levels within the same object hierarchy.

No eligibility profiles are delivered.

You can create as many eligibility profiles as you need. Eligibility profiles are reusable. You can associate eligibility profiles at the following levels: option in plan, plan, plan in program, plan type in program, and program. Eligibility profiles are also used in definitions for variable rate and variable coverage profiles. An eligibility profile must be specified when you create variable rate or variable coverage profiles.

A set of option types is delivered for selection when you define your plan type objects.

Option types control internal processing. For example, plan types in the Health coverage category are processed differently than plan types for Savings . The delivered list of option types is not extensible.

Rates and coverages setup follows plan and option setup because rates and coverages are specific to named plans and options.

Rates and coverages can be associated at many levels in your configuration, such as plan, option in plan, and option in plan in program.

Variable rate and coverage profiles can be associated with rates and coverages, respectively, so that the calculated results vary with factors that change over time, such as age group or work location.

If you define coverage across plan types, that setup occurs after setting up the affected programs.

You must select one existing program and one or more existing plan types during setup of coverage across plan types.

Note

You will not always perform setup for all of the components shown in the figure.

The tasks included in the Define General Benefits task list are independent of specific benefit programs and plans, and are not required to deploy benefits. However, if you intend to use objects included in the task list, you should complete those tasks before setting up benefits programs and plans.

Some of these tasks are related to setting up organizations. For example, you set up beneficiary organizations so that employees can select them when they make benefits elections. You set up benefits carriers as external organizations to associate with benefits plans. You set up third-party administrators to identify organizations that are benefits suppliers or that provide services to your benefits programs.

Another organizational setup task is Manage Regulatory Bodies. After you complete it you might record and update statutory requirements, or the rules that are enacted by governmental bodies that regulate how you administer certain programs and plans.

Another task in this task list is Configure Enrollment Action Items. Complete this task before you enable enrollment. During this task, you can edit the text of action items to better conform to the needs of your organization. Enrollment actions include items such as beneficiary and dependent certification requirements and primary care physician designation.

This topic identifies benefits extensible lookups. Review these lookups, and update them as appropriate to suit enterprise requirements.

Extensible benefits lookups are categorized as follows:

Benefits relationships lookups

Person factors lookups

Process name lookups

Regulations lookups

Health care services and primary care physician lookups

The extensible benefits relationships lookup is described in the following table:

|

Lookup Type |

Description |

|---|---|

|

BEN_BENEFIT_RELATION_NAME |

Benefits usage, such as absence, default, or unrestricted |

Extensible person factors lookups are described in the following table:

|

Lookup Type |

Description |

|---|---|

|

BEN_STUDENT_STATUS |

Student type, such as full-time or part-time |

|

REGISTERED_DISABLED |

Registered disabled values, such as yes, yes-fully disabled, yes-partially disabled, or no |

The extensible process name lookup is described in the following table:

|

Lookup Type |

Description |

|---|---|

|

BEN_PROCESS |

Benefits process name, such as evaluate absence plan participation, or assign corrective potential life event |

Extensible regulations lookups are described in the following table:

|

Lookup Type |

Description |

|---|---|

|

BEN_REGN_ADMN |

The type of regulatory administration by a governing agency, such as enforced by or issued by |

|

BEN_REGY_PL_TYP |

The type of regulatory plan, such as fringe, other, pension, or welfare |

|

BEN_REGY_PRPS |

The purpose of a regulatory body associated with a benefits object, such as audit, enforces, qualifies, or requires plan disclosure |

Extensible health care services type and primary care physician lookups are described in the following table:

|

Lookup Type |

Description |

|---|---|

|

BEN_PRDCT |

Provider category, such as exclusive provider organization, medium, point of service, or premium |

|

BEN_PCP_CD |

Requirement or ability of participants to select a primary care physician during enrollment, such as optional |

|

BEN_PCP_DSGN |

Primary care physician designation status for a plan, such as none, optional, or required |

|

BEN_PCP_SPCLTY |

Primary care physician specialty, such as emergency medicine |

|

BEN_PCP_STRT_DT |

Primary care physician started date, such as first of next month, first of next month occurring after 15 days, later of enrollment start or when designated |

|

BEN_PRMRY_CARE_PRVDR_TYP |

Primary care physician type, such as dentist, general practitioner, cardiologist, or pediatrician |

Record and update rules, policies, or statutory requirements enacted by regulatory bodies that govern benefit plans. You can record multiple regulations in a single integrated Microsoft Excel workbook and upload in volume. After recording them, you can associate regulations with benefit reporting groups for reporting purposes.

The basic process for managing benefit regulations using the workbook is:

Generate the workbook.

Record regulations and associate them with benefit reporting groups.

Upload edits.

Resolve errors.

On the Plan Configuration work area:

In the Tasks pane, under Manage General Benefits, click Manage Regulations.

In the Search Results section, click Prepare in Workbook.

Add new rules, policies, or statutory requirements in the Regulation section. Associate regulations with regulatory bodies in the Regulatory Body section. The workbook columns are the same as the fields in the Create Regulations dialog boxes.

The workbook uses the Changed cell to automatically identify the rows that you edit.

After you complete your edits, click Upload. Only those rows marked as changed are uploaded into the application tables.

Restriction

You cannot edit regulations in the workbook if they uploaded successfully. To edit the regulations after upload, you must search for the regulation on the Manage Regulations page. Then select the regulation and click the Edit icon.

The application automatically updates the Status value in each row of the workbook. If there are errors that require review, the upload rolls back the change in the application and sets the row status in the workbook to Upload Failed. It then continues to the next row in the workbook. Double-click Update Failed in the Status cell to view the error. Fix any data issues in the workbook and upload the new changes.

You can download person benefit group information to the integrated Microsoft Excel workbook. Use the integrated workbook to view and edit person benefit group assignments for multiple persons and groups. Then, upload your changes back into the application database. Repeat these steps as many times as required to accommodate revisions.

The basic process for managing person benefit groups using the workbook is:

Generate and populate the workbook.

Edit, add, and delete person benefit groups in the workbook.

Upload edits.

Resolve errors.

On the Plan Configuration work area:

In the Tasks pane, click Manage Benefit Groups.

In the Search Results section, click Upload Person Benefit Groups.

In the Upload Person Benefit Groups dialog box, enter a session effective date and click Prepare in Workbook.

After the download is complete, you can view, edit, add, and delete existing person benefit group assignments.

Editing person benefit group assignments: You may edit the Benefits Group column; edits in other columns are not uploaded.

Restriction

You cannot edit or enter the effective date in the workbook. To change the effective date, you must generate a new workbook with the new session effective date. You can also edit the date directly in the application, using the Plan Configuration work area, Manage Benefit Groups task.

Adding person benefit group assignments: You can insert a row to add a new person benefit group assignment. The workbook automatically adjusts the symbol in the Changed cell to mark the rows that you edit or add.

Deleting person benefit group assignments: To delete records from the application database, double-click the Mark for Deletion cell in the workbook rows that you want to delete. When you are ready, click Delete Selected Rows.

Warning

Deleted data cannot be retrieved.

When you are ready, in the workbook click Upload.

The rows that are marked as changed are uploaded into the application database. The session effective date that you set when generating the workbook becomes the start date for any edits or new group assignments that you entered in the workbook. Prior group assignments for each edited row are end dated as of the previous day and the history is retained.

For each row marked for deletion in the workbook, the application permanently deletes all of the related effective-dated records from the application database.

As the application processes the upload request, it updates the Status cell in each workbook row. If there are errors for a row, the process rolls back the change and sets the row status to Upload Failed. Then, it continues to the next row in the workbook. Double-click Update Failed to view the errors. Fix any data issues in the workbook and upload again.

This topic deals with using the integrated Microsoft Excel workbook to create and upload reporting groups. Use a reporting group to maintain a collection of benefit programs and plans that you group together for reporting purposes, such as for administrative use or to meet regulatory requirements.

The basic process for managing reporting groups using the integrated workbook is:

Generate the workbook.

Create reporting groups and add details to existing groups.

Upload edits.

Resolve errors.

On the Plan Configuration work area:

In the Tasks pane, click Manage Reporting Groups.

In the Search Results section, click Prepare in Workbook.

Create reporting groups: Add a new reporting group and associate benefit programs and plans with the reporting group using the provided choice lists. You can also select which regulatory bodies and regulations govern the reporting group. The columns and choice lists in the workbook are the same as the fields and choice lists on the Edit Reporting Groups page in the application.

Adding details to existing reporting groups: You cannot change existing data for a reporting group. However, you can add new details to an existing reporting group. For example, associate an additional program with an existing reporting group by entering the name of the reporting group in the Component Program section. Then, select the program and enter the effective start date.

Restriction

To edit existing reporting group data, in the application you must go to the Manage Reporting Groups page, search for and select the reporting group, and click the Edit icon.

The workbook uses the Changed cell to automatically identify the rows that you edit.

After you complete your edits, click Upload. Only those rows marked as changed are uploaded into the application database.

The application automatically updates the Status value in each row of the workbook. If there are errors that require review, the upload rolls back the change in the application and sets the row status in the workbook to Upload Failed. It then continues to the next row in the workbook. Double-click Update Failed in the Status cell to view the error. Fix any data issues in the workbook and upload the new changes.

You can download person benefit balance information to the integrated Microsoft Excel workbook. Use the integrated workbook to view and edit the benefit balance value, primary assignment, and benefits relationship entries for multiple persons. Also add and delete person benefit balances. Then, upload your changes back into the application database tables. Repeat these steps as many times as required to accommodate revisions.

The basic process for managing person benefit balances using the workbook is:

Generate and populate the workbook.

Edit, add, and delete person benefit balances in the workbook.

Upload edits.

Resolve errors.

On the Plan Configuration work area:

In the Tasks pane, click Manage Benefit Balances.

In the Search Results section, click Prepare in Workbook.

In the Upload Person Benefit Balances dialog box, enter a session effective date and click Prepare in Workbook.

After the download completes, you can view, edit, add, and delete person benefit balances.

Restriction

You cannot edit or enter the effective date in the workbook. To change the effective date, you must generate a new workbook with the new session effective date. You can also edit the date directly in the application, by searching for the person in the Enrollment work area, then going to the Manage Person Benefit Balances task.

Editing person balances: You may edit the Value, Primary Assignment, and Benefits Relationship columns; edits in any other columns are not uploaded.

Adding person balances: You can insert a row to add a new person balance. For each new balance, you must enter a value in either the Primary Assignment or Benefits Relationship cell, but not both. The workbook automatically adjusts the symbol in the Changed cell to mark the rows that you edit or add.

Deleting person balances: To delete records from the application database tables, double-click the Mark for Deletion cell in the workbook rows that you want to delete. When you are ready, click Delete Selected Rows.

Warning

Data deleted as part of the upload cannot be retrieved.

When you are ready, in the workbook click Upload.

The rows that are marked as changed are uploaded into the application database. The session effective date that you set when you generated the workbook becomes the start date for any edits or new person benefit balances that you entered in the workbook. Prior balances for each edited row are end dated as of the previous day and the history is retained.

For each row marked for deletion in the workbook, the application permanently deletes all of the related effective-dated records from the application database.

As the application processes the upload request, it updates the Status cell in each workbook row. If there are errors for a row, the process rolls back the change and sets the row status to Upload Failed. Then, it continues to the next row in the workbook. Double-click Update Failed to view the errors. Fix any data issues in the workbook and upload again.

Generate a new workbook after the successful upload to verify your edits.

Configure how benefits relationships are associated by default when you hire a worker or add additional assignments. Benefits professionals group worker assignments for benefits enrollment and processing. You must make the following choices for each combination of legal entity and benefits usage, such as unrestricted or life events:

Specify the default benefits relationship for new hire assignments.

Specify whether to use different benefits relationships for workers who have multiple assignments.

If you enable multiple assignment processing for benefits, you must also specify the pattern to associate additional worker assignments with benefits relationships by default. Benefits professionals can update or modify the default relationships for individual workers.

Every worker has at least one benefits relationship. Specify the default benefits relationship at the legal entity level for different usages, such as unrestricted or life events, within the enterprise for the initial worker assignment when a worker is hired.

Initially, you must make one choice between two mutually exclusive options for each combination of usage and legal entity within the enterprise:

Disable multiple assignment processing for benefits processing.

Enable and configure multiple assignment processing for benefits processing.

If you do not enable multiple assignment processing for benefits processing, then all worker assignments are associated with the default benefits relationship that you select for the combination of usage and legal entity. In this configuration, benefits professionals cannot select alternative benefits relationships because each worker has only one benefits relationship. Consequently, you cannot configure other options for multiple assignment processing for benefits for the usage and legal entity combination.

If you enable multiple assignment processing for benefits processing, configure the default pattern of associating the benefits relationships with additional worker assignments for each legal entity and usage.

Select one default option for new assignments from among these choices:

Include new assignments in the configured default benefits relationship.

Do not include new assignments in any benefits relationship.

Include new assignments in the primary benefits relationship for the worker, which might be the default benefits relationship or another benefits relationship designated as primary.

Additionally, if the newly created assignment can be included in a benefits relationship, configure whether or not it becomes the primary assignment in the benefits relationship when another assignment is already designated as the primary assignment.

Note

When you enable multiple assignment processing for benefits processing for a usage and legal entity combination, benefit relationship-related processing options and user interface fields are displayed on the user interface. User interface pages in benefits service center that display the option to select a benefits relationship for a worker include participant benefits summary, override enrollment, manage person life events, process open enrollment, and process life event.

Benefits relationships control how a worker's benefits are grouped for processing. A worker might have different sets of benefits attached to different benefits relationships.

Benefits entities that are affected by benefits relationships include:

Potential life events

Life events

Eligibility records

Electable choices

Enrollment options

Dependent coverage

Beneficiary designations

Primary care physician designations

Deductions

A default benefits relationship is configured for each legal entity and usage of benefits processing within the enterprise. It is automatically associated with new hires and workers with only one assignment. If multiple assignment processing is enabled for benefits processing, the pattern of benefits relationships associated with additional worker assignments by default is configured for each legal entity and usage. Benefits professionals can change the configuration of benefits relationships associated with individual workers and can change the work assignments associated with the worker's benefits relationships.

A worker might have assignments that are associated with different benefits relationships. The following six examples list different ways that worker assignments might be structured within an organization and how the benefits relationships would be associated. The configuration table for each example lists the legal entities, work relationships, employment terms, assignments, and benefits relationships. Each scenario lists the impact that each structure has on life events, electable choices or enrollment options, and benefits eligibility.

Configuration: Only one assignment and one benefits relationship exist.

|

Legal Entity |

Work Relationship |

Employment Terms |

Assignment |

Benefits Relationship |

|---|---|---|---|---|

|

Galaxy UK |

1 |

Architect |

Architect |

A (default) |

Processing: Life events, electable choices or enrollment options, and benefits eligibility are evaluated based on the assignment in this benefits relationship.

Configuration: Two sets of work relationships, employment terms and assignments exist, one for each legal entity. The person has two sets of benefits, one for each legal entity. Each assignment is associated with a different benefits relationship.

|

Legal Entity |

Work Relationship |

Employment Terms |

Assignment |

Benefits Relationship |

|---|---|---|---|---|

|

Galaxy UK |

1 |

Architect |

Architect |

A (default for the legal entity) |

|

Galaxy US |

2 |

Consultant |

Consultant |

B (default for the legal entity) |

Processing: This table shows the basis for benefits evaluation and processing for each data type:

|

Data Type |

Benefits Evaluation Processing Basis |

|---|---|

|

Life events |

Primary assignment from each legal entity |

|

Electable choices or enrollment options |

One set of data for each legal entity |

|

Eligibility |

Use eligibility to provide benefits from the appropriate legal entity. Eligibility criteria are defined at the legal entity level or globally. |

Configuration: One benefits relationship is associated with different employment terms and assignments.

|

Legal Entity |

Work Relationship |

Employment Terms |

Assignment |

Benefits Relationship |

|---|---|---|---|---|

|

Galaxy US |

1 |

Architect |

Architect |

A (default) |

|

Galaxy US |

1 |

Consultant |

Consultant |

A |

Processing: This table shows the basis for benefits evaluation and processing for each data type:

|

Data Type |

Benefits Evaluation Processing Basis |

|---|---|

|

Life events |

Primary assignment |

|

Electable choices or enrollment options |

One set of data for each life event |

|

Eligibility |

Attributes defined at global person level are used for both life events. Assignment-level attributes are used in the respective life events. |

Configuration: Separate benefits relationships are associated with each assignment.

|

Legal Entity |

Work Relationship |

Employment Terms |

Assignment |

Benefits Relationship |

|---|---|---|---|---|

|

Galaxy US |

1 |

Architect |

Architect |

A (default) |

|

Galaxy US |

1 |

Consultant |

Consultant |

B |

Processing: This table shows the basis for benefits evaluation and processing for each data type:

|

Data Type |

Benefits Evaluation Processing Basis |

|---|---|

|

Life events |

Separate life events created for Architect and Consultant assignments |

|

Electable choices or enrollment options |

One set of data for each life event |

|

Eligibility |

Attributes defined at global person level are used for both life events. Assignment-level attributes are used in the respective life events. |

Configuration: Two assignments are associated with one benefits relationship, and another assignment with a second benefits relationship.

|

Legal Entity |

Work Relationship |

Employment Terms |

Assignment |

Benefits Relationship |

|---|---|---|---|---|

|

Galaxy US |

1 |

Architect |

Architect |

A (default) |

|

Galaxy US |

1 |

Product Manager |

Product Manager |

A |

|

Galaxy US |

1 |

Consultant |

Consultant |

B |

Processing: This table shows the basis for benefits evaluation and processing for each data type:

|

Data Type |

Benefits Evaluation Processing Basis |

|---|---|

|

Life events |

Separate life events are created for the assignments in benefits relationships A and B |

|

Electable choices or enrollment options |

One set of data for each life event |

|

Eligibility |

Attributes defined at the global person level and assignment level are used for life events. |

Configuration: Many assignments are associated with one or more benefits relationships.

|

Legal Entity |

Work Relationship |

Employment Terms |

Assignment |

Benefits Relationship |

|---|---|---|---|---|

|

Galaxy US |

1 |

Product Manager |

Orlando |

A |

|

Galaxy US |

1 |

Product Manager |

Dallas |

A |

|

Galaxy US |

1 |

Product Manager |

Atlanta |

B |

|

Galaxy US |

1 |

Consultant |

San Francisco |

C |

|

Galaxy US |

1 |

Consultant |

Los Angeles |

D |

Processing: This table shows the basis for benefits evaluation and processing for each data type:

|

Data Type |

Benefits Evaluation Processing Basis |

|---|---|

|

Life events |

Separate life events created for the assignments in each benefits relationship |

|

Electable choices or enrollment options |

One set of data for each life event |

|

Eligibility |

Attributes defined at global person level are used for all life events. Assignment-level attributes are used in the respective life events. |

Benefits extracts enable you create a file, or XML extract, that contains enrollment information about participants in a plan, or multiple plans that are provided by a specific carrier.

You generate one extract file for each carrier. If a carrier provides more than one plan, only one extract is required that contains information related to all plans provided by that carrier. For example, if ten plans are provided by four different carriers, you run four separate extracts, one for each carrier.

All extracts have the same format, regardless of which carrier receives the extract. Each extract contains only information relevant to the plans carried by a specific provider, but all have the same extract layout. You can contract with Oracle's partner, BenefitsXML, which provides a service to transform and deliver the extract data to the specification of each individual carrier.

For more information on BenefitsXML, see http://www.benefitsxml.com.

To configure the plan carrier details and extract options, use the Manage Plan Carriers task in the Plan Configuration work area.

If you choose not to use this partner, you can use your own resources to transform and deliver the output in the extract file directly to each plan carrier according to their specifications. The Upload Custom Layout button enables you to specify the layout for the individual carrier and accommodates additional file formats, such as CSV, XML, or fixed length. You must ensure that fields mapped in the custom layout equate to columns in the database tables.

To run and monitor extracts, use the Manage Extracts task in the Evaluation and Reporting work area. For a particular carrier, you select whether to run a full extract or an extract that includes only the changes since you ran the previous extract. Generally, you run a full extract after an enrollment period is closed and enrollments are completed. You run subsequent extracts on a periodic or scheduled basis, in either full or changes only mode. It is common practice to schedule your extracts to run after your regular payroll runs.

You can view, query, and download extracted records for a specific extract run when it is completed.

An implementor or developer can create a custom layout to transform the format of extracted benefits enrollment information into the exact specifications of a particular carrier. This topic provides a sample custom layout and descriptions of the tags you need to create a custom layout that meets the exact specifications supplied by the carrier. The custom layout that you upload to the plan carrier's extract options becomes the default layout for the plan carrier.

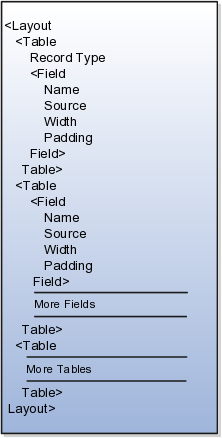

This figure sketches the structure of the XML tags in the custom layout.

The data source for a field on the custom layout can be:

A column on the benefits extract staging tables

A column on one of the other tables listed in the Source tag description

A constant into which you enter the exact value

Tip

To identify table column names, you can use the data model query builder in Oracle BI Publisher. Search for the table name and view the columns.

This topic provides:

Description of the XML tags

Table aliases

Sample custom layout

This section describes each XML tag and lists its attributes, elements (subtags), and parent tags.

Description: Root tag.

Attributes: None

|

Elements (Subtags) |

Parent Tag |

|---|---|

|

Table |

None |

Description: The Database table from which the data has to be extracted.

Attributes: 1. tableName: Supported values = {BEN_EXTRACT_REQ_DETAILS,BEN_EXTRACT_REQUEST, DUAL,PER_ALL_PEOPLE_F,PER_PERSONS,PER_ALL_ASSIGNMENTS_M,PER_PEOPLE_LEGISLATIVE_F,BEN_PL_F,BEN_PL_TYP_F,BEN_OPT_F,BEN_PGM_F }

|

Elements (Subtags) |

Parent Tag |

|---|---|

|

1. RecordType: 2. Field: See Field tag description |

Layout |

Description: Describes how the data should be delimited/laid out in the extract file.

Attributes: Supported values: {FIXEDWIDTH, CSV}

Note

Anything other than CSV will default to FIXEDWIDTH.

|

Elements (Subtags) |

Parent Tag |

|---|---|

|

None |

Table |

Description: A field corresponds to one column in the extracted document. The text in this column can be sourced from a database table, an SQL function, or a constant.

Attributes: None

|

Elements (Subtags) |

Parent Tag |

|---|---|

|

Table |

Description: Name of the field

Attributes: None

|

Elements (Subtags) |

Parent Tag |

|---|---|

|

None |

Field |

Description: Source of data for the current field. If the source is a table, the value passed will be the column name. If multiple tables are involved, a fully qualified column name is recommended. The aliases are given in the list of allowed tables.

SQL functions in place of column names: Values in this tag are considered as column names if the type is set to TABLE. The column name is directly used while constructing a query. Hence, an SQL function can be used on a column.

Example 1

<Source type="TABLE">GENDER_FLAG</Source>

Example 2

<Source type="TABLE">DECODE(GENDER_FLAG,'F',1,2)</Source>

Attributes:

type:

Supported values = {TABLE, CONSTANT}

TABLE means data should come from a database table.

CONSTANT means data should be what is given in the value column of this tag.

table: This tag should be used only if the intended column is not from the table given in 'tableName' attribute of this Table tag. If this tag is not used, the column will be searched for in the table given in 'tableName'.

Supported values:

{BEN_EXTRACT_REQ_DETAILS

PER_ALL_PEOPLE_F

PER_PERSONS

PER_ALL_ASSIGNMENTS_M

PER_PEOPLE_LEGISLATIVE_F

BEN_PL_F

BEN_PL_TYP_F

BEN_OPT_F

BEN_PGM_F

|

Elements (Subtags) |

Parent Tag |

|---|---|

|

None |

Field |

Description: Intended width of this field in the extract file. The number passed would be the number of character spaces on the file.

Attributes: Supported values = positive integers.

|

Elements (Subtags) |

Parent Tag |

|---|---|

|

None |

Field |

Description: This describes the alignment of data in each column.

Attributes: Supported values: {LEFT, RIGHT}

|

Elements (Subtags) |

Parent Tag |

|---|---|

|

None |

Field |

|

Allowed Table |

Alias |

|---|---|

|

BEN_EXTRACT_REQ_DETAILS |

REQ |

|

PER_ALL_PEOPLE_F |

PEO |

|

PER_PERSONS |

PER |

|

PER_ALL_ASSIGNMENTS_M |

ASG |

|

PER_PEOPLE_LEGISLATIVE_F |

LEG |

|

BEN_PL_F |

PLN |

|

BEN_PL_TYP_F |

TYP |

|

BEN_OPT_F |

OPT |

|

BEN_PGM_F |

PGM |

<?xml version="1.0" encoding="utf-8"?>

<Layout>

<Table tableName="DUAL">

<RecordType>FIXEDWIDTH</RecordType>

<Field>

<Name>"Record Type"</Name>

<Source type="CONSTANT">001</Source>

<Width>3</Width>

<Padding>Left</Padding>

</Field>

</Table>

<Table tableName="BEN_EXTRACT_REQ_DETAILS">

<RecordType>CSV</RecordType>

<Field>

<Name>"Last Name"</Name>

<Source type="TABLE">LAST_NAME</Source>

<Width>25</Width>

<Padding>Left</Padding>

</Field>

<Field>

<Name>"First Name"</Name>

<Source type="TABLE">FIRST_NAME</Source>

<Width>50</Width>

<Padding>Left</Padding>

</Field>

<Field>

<Name>"Filler"</Name>

<Source type="CONSTANT">XXXXXXXXXX</Source>

<Width>10</Width>

<Padding>None</Padding>

</Field>

<Field>

<Name>"Plan Name"</Name>

<Source type="TABLE">PLAN</Source>

<Width>70</Width>

<Padding>Left</Padding>

</Field>

<Field>

<Name>"Coverage Start Date"</Name>

<Source type="TABLE">COVERAGE_START_DATE</Source>

<Width>15</Width>

<Padding>Left</Padding>

</Field>

<Field>

<Name>"SSN"</Name>

<Source type="TABLE">NATIONAL_IDENTIFIER</Source>

<Width>12</Width>

<Padding>Left</Padding>

</Field>

<Field>

<Name>"Gender"</Name>

<Source type="TABLE">DECODE(GENDER_FLAG,'F',1,2)</Source>

<Width>1</Width>

<Padding>Left</Padding>

</Field>

<Field>

<Name>"Person Number"</Name>

<Source type="TABLE" table="PER_ALL_PEOPLE_F">PERSON_NUMBER</Source>

<Width>30</Width>

<Padding>Left</Padding>

</Field>

<Field>

<Name>"Country of Birth"</Name>

<Source type="TABLE" table="PER_PERSONS">COUNTRY_OF_BIRTH</Source>

<Width>30</Width>

<Padding>Left</Padding>

</Field>

<Field>

<Name>"Assignment type"</Name>

<Source type="TABLE" table="per_all_assignments_m">assignment_type</Source>

<Width>30</Width>

<Padding>Left</Padding>

</Field>

<Field>

<Name>"Legislation code"</Name>

<Source type="TABLE" table="per_people_legislative_f">LEG.LEGISLATION_CODE</Source>

<Width>30</Width>

<Padding>Left</Padding>

</Field>

<Field>

<Name>"Legislation code"</Name>

<Source type="TABLE" table="ben_pl_f">PLN.PL_ID</Source>

<Width>30</Width>

<Padding>Left</Padding>

</Field>

</Table>

<Table tableName="DUAL">

<RecordType>FIXEDWIDTH</RecordType>

<Field>

<Name>"Record Type"</Name>

<Source type="CONSTANT">999</Source>

<Width>3</Width>

<Padding>Left</Padding>

</Field>

<Field>

<Name>"Record Type"</Name>

<Source type="SYSTEM">RECORDCOUNT</Source>

<Width>3</Width>

<Padding>Left</Padding>

</Field>

</Table>

</Layout>

Yes. Use the integrated Microsoft Excel workbook to view and edit person benefit group assignments for multiple persons and groups. Then, upload your changes back into the application database. To generate the integrated workbook, start on the Plan Configuration work area, Manage Benefit Groups page. In the Search Results section, click Prepare the Workbook.

Yes. Use the integrated workbook to view and edit the benefit balance value, primary assignment, and benefits relationship entries for multiple persons. Also, add and delete person benefit balances. Then, upload your changes back into the application database. To generate the workbook, start on the Plan Configuration work area, Manage Benefit Balances page. In the Search Results section, click Prepare in Workbook.

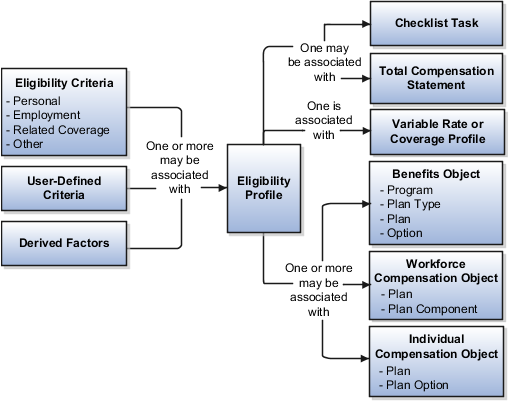

You add eligibility criteria to an eligibility profile, and then associate the profile with an object that restricts eligibility.

The following figure shows the relationships between eligibility components.

You can add different types of eligibility criteria to an eligibility profile. For many common criteria, such as gender or employment status, you can select from a list of predefined criteria values. However, you must create user-defined criteria and derived factors before you can add them to an eligibility profile.

When you add an eligibility criterion to a profile, you define how to use it to determine eligibility. For example, when you add gender as a criterion, you must specify a gender value (male or female) and whether to include or exclude persons who match that value.

You can associate an eligibility profile with different kinds of objects:

Associate an eligibility profile with a variable rate or variable coverage profile to establish the criteria required to qualify for that rate or coverage.

Associate an eligibility profile with a checklist task to control whether that task appears in an allocated checklist.

Associate an eligibility profile with a total compensation statement to apply additional eligibility criteria after statement generation population parameters.

Associate one or more eligibility profiles with a benefits or compensation object to establish the eligibility criteria for specific plans and options.

Derived factors define how to calculate certain eligibility criteria that change over time, such as a person's age or length of service. You add derived factors to eligibility profiles and then associate the profiles with objects that restrict eligibility.

You can create six different types of derived factors: age, compensation, length of service, hours worked, full-time equivalent, and a combination of age and length of service.

For each factor that you create, you specify one or more rules about how eligibility is determined. For example, the determination rule for an age derived factor specifies the day on which to evaluate the person's calculated age for eligibility. If the determination rule is set to the first of the year, then the person's age as of the first of the year is used to determine eligibility.

For the full-time equivalent factor, you specify the minimum and maximum full-time equivalent percentage and whether to use the primary assignment or the sum of all assignments when evaluating eligibility. For example, if the percentage range is 90 to 100 percent for the sum of all assignments, then a person who works 50 percent full-time on two different assignments is considered eligible.

Other settings define the unit of measure for time or monetary amounts, rounding rules, and minimums and maximums.

The following scenarios illustrate how to define different types of derived factors:

Benefits administrators frequently use age factors to determine dependent eligibility. You can also use age as a factor when determining life insurance rates. Age factors typically define a range of ages, referred to as age bands, and rules for evaluating the person's age. The following table illustrates a set of age bands that could be used to determine eligibility for life insurance rates that vary based on age.

|

Derived Factor Name |

Greater Than or Equal To Age Value |

Less Than Age Value |

|---|---|---|

|

Age Under 25 |

1 |

25 |

|

Age 25 to 34 |

25 |

35 |

|

Age 35 to 44 |

35 |

45 |

|

Age 45 to 54 |

45 |

55 |

|

Age 55 to 64 |

55 |

65 |

|

Age 64 or Older |

65 |

75 |

The determination rule and other settings for each age band are the same:

|

Field |

Value |

|---|---|

|

Determination Rule |

First of calendar year |

|

Age to Use |

Person's |

|

Units |

Year |

|

Rounding |

None |

A derived factor for length of service defines a range of values and rules for calculating an employee's length of service. The following table illustrates a set of length-of-service bands that could be used to determine eligibility for compensation objects such as bonuses or severance pay.

|

Derived Factor Name |

Greater Than or Equal To Length of Service Value |

Less Than Length of Service Value |

|---|---|---|

|

Service Less Than 1 |

0 |

1 |

|

Service 1 to 4 |

1 |

5 |

|

Service 5 to 9 |

5 |

10 |

|

Service 10 to 14 |

10 |

15 |

|

Service 15 to 19 |

15 |

20 |

|

Service 20 to 24 |

20 |

25 |

|

Service 25 to 29 |

25 |

30 |

|

Service 30 Plus |

30 |

999 |

The determination rule and other settings for each length-of-service band are the same:

|

Field |

Value |

|---|---|

|

Period Start Date Rule |

Date of hire (This sets the beginning of the period being measured.) |

|

Determination Rule |

End of year (This sets the end of the period being measured.) |

|

Age to Use |

Person's |

|

Units |

Year |

|

Rounding |

None |

A derived factor for compensation defines a range of values and rules for calculating an employee's compensation amount. The following table illustrates a set of compensation bands that could be used to determine eligibility for compensation objects such as bonuses or stock options.

|

Derived Factor Name |

Greater Than or Equal To Compensation Value |

Less Than Compensation Value |

|---|---|---|

|

Less than 20000 |

0 |

20,000 |

|

Salary 20 to 34000 |

20,000 |

35,000 |

|

Salary 35 to 49000 |

35,000 |

50,000 |

|

Salary 50 to 75000 |

50,000 |

75,000 |

|

Salary 75 to 99000 |

75,000 |

100,000 |

|

Salary 100 to 200000 |

100,000 |

200,000 |

|

Salary 200000 Plus |

200,000 |

999,999,999 |

The determination rule and other settings for each compensation band are the same:

|

Field |

Value |

|---|---|

|

Determination Rule |

First of year |

|

Unit of Measure |

US Dollar |

|

Source |

Stated compensation |

|

Rounding |

Rounds to nearest hundred |

The Age to Use value that you select is an important aspect of an age derived factor. This value determines whose birth date is used to calculate the derived age.

In most cases, you use the Person's value in the Age to Use field to define an age derived factor for either a participant or dependent eligibility profile. In this case, each person's birth date is used to calculate the age criterion by which eligibility is evaluated for that person.

For example, if you select Person's as the Age to Use value, and associate the age derived factor with a dependent eligibility profile, each dependent's eligibility is evaluated based on the age calculated from his or her own birth date.

You might select another predefined value in the Age to Use field if you intend to evaluate participant or dependent eligibility or rates based on someone else's age, such as a spouse, child, or other dependent.

Note

If you choose Inherited Age, the evaluation is based on the date of birth as defined in the person extra information flexfield.

If you select Person's oldest child as the Age to Use value, and associate this derived factor with a dependent eligibility profile, eligibility for all dependents is evaluated based on the age of the participant's oldest child. Consequently, when the oldest child reaches the maximum age of eligibility, for instance, all dependents become ineligible.

You can define your own criteria to meet any special needs of your organization. For example, if your organization employs deep sea divers and offers different benefits or benefits rates based on how deep they dive, you can create Depth of Diving as a new eligibility criterion.

The data for the eligibility criterion must be stored in a table that is accessible to the application. If the data is stored in either the Person or Assignment table, you can select the table and column from a list, and then specify the lookup type used to validate input values. You can also allow a range of valid values if the field stores a numeric value or a date.

Note

To select the correct values for the column and lookup fields, you must have a basic understanding of the structure of the table that stores the eligibility criterion information.

If the data is stored in a table other than the Person or Assignment table, you must first create a formula to retrieve the data from the table, and then set the formula type to User-Defined Criteria.

You can define two sets of criteria on the User-Defined Criteria page. The participant must meet the criteria defined in either set to be considered eligible (or to be excluded from eligibility if the Exclude check box is selected when the criteria is added to an eligibility profile).

After you have created your user-defined criteria, you can add it to an eligibility profile.

The following scenarios illustrate how to define different types of user-defined criteria. In each example, you must first create the user-defined criteria and then add it to an eligibility profile and set the criteria values to use in the profile.

A commercial diving company wants to offer different benefit rates to employees who dive to depths greater than 330 feet. This data is stored for each employee in a custom attribute called Dive_Depth in the Person table. To define eligibility based on diving depth, set the following values on the Create or Edit User-Defined Criteria page:

|

Field |

Value |

|---|---|

|

Table |

Person |

|

Column |

Dive_Depth_Attribute |

|

Lookup |

Dive_Depth_Validation |

|

Enable range validation one |

Selected |

Save the user-defined criteria, and then add it to an eligibility profile. Set the following values on the User-Defined Criteria tab, which is under the Other tab on the Create or Edit Eligibility Profile page:

|

Field |

Value |

|---|---|

|

Set 1 Meaning |

329 |

|

Set 1 To Meaning |

9999 |

|

Exclude |

Deselected |

Save the eligibility profile and associate it with a variable rate profile.

An employer wants to exclude work-at-home assignment from eligibility for a transportation benefit option. To accomplish this, set the following values on the Create or Edit User-Defined Criteria page:

|

Field |

Value |

|---|---|

|

Table |

Assignment |

|

Column |

Work_at_home |

|

Lookup |

YES_NO |

|

Enable range validation one |

Deselected |

Save the user-defined criteria, and then add it to an eligibility profile. Set the following values on the User-Defined Criteria tab:

|

Field |

Value |

|---|---|

|

Set 1 Meaning |

Yes |

|

Exclude |

Selected |

Save the eligibility profile and associate it with the transportation benefit option.

A company wants to offer a spot incentive bonus to hourly employees who worked 100 percent of their scheduled shift hours in a three month period. To determine eligibility for the bonus, create a formula that calculates scheduled hours less worked hours for each week in the previous three months. If the result of successive calculations is less than or equal to zero, then the formula returns a result of Yes. The first step is to create the formula. Once the formula has been defined, create a user-defined criterion to run the formula. Enter the following values on the Create or Edit User-Defined Criteria page:

|

Field |

Value |

|---|---|

|

Access One Formula |

Worked_Sched_Hours_Percent |

|

Enable range validation one |

Deselected |

Save the user-defined criteria, and then add it to an eligibility profile. Set the following values on the User-Defined Criteria tab:

|

Field |

Value |

|---|---|

|

Set 1 Meaning |

Yes |

|

Exclude |

Deselected |

Save the eligibility profile and associate it with the bonus compensation object.

Note

For very complex scenarios, your organization or implementation team can write a custom program to evaluate eligibility, and then create a formula that calls the custom program.

This example illustrates how to define eligibility criteria based on the number of hours an employee is scheduled to work within a specified period of time.

You want to limit eligibility for a benefits offering to employees who were scheduled to work between 30 and 40 hours each week or between 130-160 each month as of the end of the previous quarter. To do this, add two different ranges on the Range of Scheduled Hours tab, which is under the Employment tab on the Create or Edit Eligibility Profile page.

Set the values for the first range as shown in this table:

|

Field |

Value |

|---|---|

|

Sequence |

1 |

|

Minimum Hours |

30 |

|

Maximum Hours |

40 |

|

Scheduled Enrollment Periods |

Weekly |

|

Determination Rule |

End of previous quarter |

Set the values for the second range as shown in this table:

|

Field |

Value |

|---|---|

|

Sequence |

2 |

|

Minimum Hours |

130 |

|

Maximum Hours |

160 |

|

Scheduled Enrollment Periods |

Monthly |

|

Determination Rule |

End of previous quarter |

An eligibility profile defines criteria used to determine whether a person qualifies for a benefits offering, variable rate profile, variable coverage profile, compensation object, checklist task, or other object for which eligibility must be established.

The following are key aspects of working with eligibility profiles:

Planning and prerequisites

Specifying the profile type, usage, and assignment usage

Defining eligibility criteria

Excluding from eligibility

Assigning sequence numbers

Adding multiple criteria

Viewing the criteria hierarchy

Before you create an eligibility profile, consider the following:

If an eligibility profile uses derived factors, user-defined formulas, or user-defined criteria to establish eligibility, you must create these items before you create the eligibility profile.

If you are defining eligibility criteria for a checklist task, variable rate profile, or variable coverage profile, you must include all criteria in a single eligibility profile, because these objects can be associated with only one eligibility profile. You can, however, associate multiple eligibility profiles with benefits offerings , compensation objects and the Performance Management object.

Eligibility profiles are reusable, so use names that identify the criteria being defined rather than the object with which the profile is associated. For example, use "Age-20-25+NonSmoker" rather than "Supplemental Life-Min Rate."

When you create an eligibility profile, you specify whether the profile applies to participants or dependents.

Use participant profiles to define criteria for a person who has a work relationship with the legal employer as an employee, contingent worker, or nonworker.

Use dependent profiles for participants' spouses, family members, or other individuals who qualify as dependents. Dependent profiles can be associated with only benefit plans and plan types.

An eligibility profile's usage determines the type of objects with which the profile can be associated. For example, set the profile usage to:

Benefits to make the profile available to associate with benefits objects, such as programs, plans, plan types, options, variable rate profiles, and variable coverage profiles

Compensation to make the profile available to associate with individual and workforce compensation plans as well as total compensation statements

Global to make the profile available to multiple business processes

Goals to make the profile available to associate with goals when creating a goal plan or mass assigning goals, or to associate with goal plans

For Performance Management, you can select any usage.

When you create an eligibility profile, you specify which assignment to use with it. For profiles where usage is Compensation or Performance, select Specific Assignment. For Performance Management eligibility profiles, you must select the Participant type and Specific Assignment as the assignment to use.

Criteria defined in an eligibility profile are divided into categories:

Personal: Includes gender, person type, postal code ranges, and other person-specific criteria

Employment: Includes assignment status, hourly or salaried, job, grade, and other employment-specific criteria

Derived factors: Includes age, compensation, length of service, hours worked, full-time equivalent, and a combination of age and length of service

Other: Includes miscellaneous and user-defined criteria

Related coverage: Includes criteria based on whether a person is covered by, eligible for, or enrolled in other benefits offerings.

Some criteria, such as gender, provide a fixed set of choices. The choices for other criteria, such as person type, are based on values defined in tables. You can define multiple criteria for a given criteria type.

For each eligibility criterion that you add to a profile, you can indicate whether persons who meet the criterion are considered eligible or are excluded from eligibility. For example, an age factor can include persons between 20 and 25 years old or exclude persons over 65. If you exclude certain age bands, then all age bands not explicitly excluded are automatically included. Similarly, if you include certain age bands, then all age bands not explicitly included are automatically excluded.

You must assign a sequence number to each criterion. The sequence determines the order in which the criterion is evaluated relative to other criteria of the same type.

If you define multiple values for the same criteria type, such as two postal code ranges, a person needs to satisfy at least one of the criteria to be considered eligible. For example, a person who resides in either postal range is eligible.

If you include multiple criteria of different types, such as gender and age, a person must meet at least one criterion defined for each criteria type.

Select the View Hierarchy tab to see a list of all criteria that you have saved for this profile. The list is arranged by criteria type.

You can define multiple criteria in an eligibility profile or create separate profiles for individual criterion. To determine the best approach, consider the following:

Does the object you are defining eligibility for support multiple eligibility profiles?

What is the best approach in terms of efficiency and performance?

If you are defining eligibility criteria for a checklist task, variable rate profile, or variable coverage profile, you must include all criteria in a single eligibility profile, because these objects can be associated with only one eligibility profile. You can, however, associate multiple eligibility profiles with benefits offerings and compensation objects.

For optimum performance and efficiency, you should usually attach profiles at the highest possible level in the benefits object hierarchy and avoid duplicating criteria at lower levels. Plan types in program, plans in program, plans, and options in plans inherit the eligibility criteria associated with the program. For example, to be eligible for a benefits plan type, a person must satisfy eligibility profiles defined at the program level and at the plan type in program level.

However, it is sometimes faster to create more than one profile and attach the profiles at various levels in the hierarchy. For example, you might exclude employees from eligibility at the program level who do not have an active assignment. At the level of plan type in program, you might exclude employees who do not have a full-time assignment. Finally, at the plan level, you might exclude employees whose primary address is not within a service area you define.

Note

Eligibility criteria can be used to include or exclude persons from eligibility. Sequencing of criteria is more complicated when you mix included and excluded criteria in the same profile. For ease of implementation, try to keep all excluded criteria in a separate eligibility profile.

This example demonstrates how to create a participant eligibility profile used to determine eligibility for variable life insurance rates. The profile includes two eligibility criteria: age and tobacco. Once the eligibility profile is complete, you can associate it with a variable rate profile.

The following table summarizes key decisions for this scenario.

|

Decisions to Consider |

In this Example |

|---|---|

|

What is the profile type? |

Participant |

|

What type of object is associated with this profile? |

Variable rate for benefits offering |

|

What types of eligibility criteria are defined in this profile? |

Age derived factor (must have been previously defined) Uses Tobacco criteria |

|

What are the criteria values? |

Age: Under 30 Tobacco Use: None |

|

Should persons meeting these criteria be included or excluded from eligibility? |

Included |

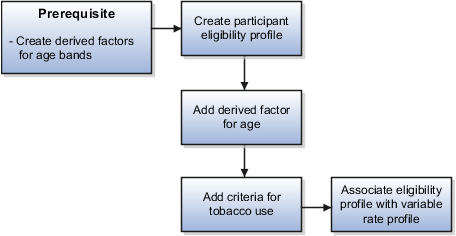

The following figure shows the tasks to complete in this example:

Note

In this example, you create one eligibility profile that defines the requirements for a single variable rate. Typically, you create a set of eligibility profiles, one for each variable rate. When you have completed all steps described in this example, you can repeat them, varying the age and tobacco use criteria, to create a separate profile for each additional rate.

|

Field |

Value |

|---|---|

|

Name |

Age Under 30+Non-Smoking |

|

Profile Usage |

Benefits |

|

Description |

Participant, age under 30, non smoker |

|

Status |

Active |

|

Assignment to Use |

Any assignment |

Note

You can reuse this eligibility profile by associating it with other objects that restrict eligibility, including benefits offerings, compensation plans, and checklist tasks.

The following examples illustrate scenarios where eligibility profiles are needed and briefly describe the setup required for each scenario.

A 401(k) savings plan is restricted to full-time employees under 65 years of age. To restrict eligibility for the plan, you must first create a derived factor for the age band of 65 and older, if one does not already exist. Then create an eligibility profile. Set the Profile Usage to Benefits and the Profile Type to Participant. Add the following criteria:

|

Criteria Type |

Name |

Values |

|---|---|---|

|

Employment |

Assignment Category |

Full-Time |

|

Derived Factor |

Age |

Select the age derived factor you created previously, and then select the Exclude check box. |

Associate the eligibility profile with the 401(k) plan.

A bonus is offered to all employees who received the highest possible performance rating in all rating categories. To restrict eligibility for the bonus, create an eligibility profile. Set the participant type to Participant, profile usage to Compensation or Global, and use in assignment to Specific Assignment. Add the following criteria for each rating category:

|

Criteria Type |

Name |

Values |

|---|---|---|

|

Employment |

Performance Rating |

Select the performance template and rating name, and then select the highest rating value. |

Associate the eligibility profile with the bonus compensation object.

A new hire checklist contains tasks that do not apply to employees who work in India. To restrict eligibility for the tasks, create a participant eligibility profile. Set the Profile Usage to Checklist and the Profile Type to Participant. Add the following criteria:

|

Criteria Type |

Name |

Values |

|---|---|---|

|

Employment |

Work Location |

Select India as the work location, and then select the Exclude check box. |

Associate the eligibility profile with each checklist task that does not apply to workers in India.

Grandfathered eligibility enables participants who have been enrolled in a benefit to retain eligibility to elect that benefit when they would otherwise not be eligible to elect it.

Setting up grandfathered eligibility involves creating a benefits group and an eligibility profile based on the benefits group. You associate the eligibility profile with the benefits offering, and associate the benefits group with the individuals who qualify to be grandfathered into the offering.

This figure shows creating a benefits group, using it in an eligibility profile, and associating the profile to a benefits offering and the group to its members.

These are the basic steps:

Create a benefits group named descriptively, such as Grandfathered Eligibility. Select Navigator - Plan Configuration. Then click Manage Benefit Groups in the task pane.

Select the Manage Eligibility Profiles task and create an eligibility profile using these criteria:

|

Criteria Type |

Criteria Name |

Value |

|---|---|---|

|

Other |

Benefit Groups |

Select the grandfathered benefits group that you created. |

On the eligibility step of the plan configuration process, select the grandfathered eligibility profile for the benefits offering and make it required.

Assign the benefits group to workers who qualify for the benefit.

Either assign to individuals using the Manage Person Habits and Benefit Groups task in the Benefits Service Center, or assign to many workers in a batch load.

Define postal code ranges and services areas to use as eligibility criteria using the integrated Microsoft Excel workbooks. You group postal codes into ranges, and in turn group ranges into service areas. Service areas define geographical regions as eligibility criteria when work location is not adequate. You can create multiple postal code ranges and service areas in a single integrated workbook. Then, upload them into the application database. Repeat these steps as many times as required to accommodate revisions.

The basic process for managing postal code ranges and services areas using the workbook is:

Generate the workbook.

Edit postal code ranges and service areas in their respective worksheets.

Upload edits.

Resolve errors.

On the Plan Configuration work area:

In the Tasks pane, under Manage Eligibility, click Manage Benefit Service Areas.

In the Search Results section of either the Postal Code Ranges or Service Areas tab, click Prepare in Workbook.

Add new postal code ranges in the Load Postal Code Ranges worksheet. The columns in the Postal Code Ranges section of the worksheet are the same as the Create Postal Code Ranges dialog box fields.

Add new service areas and edit existing ones in the Load Service Areas worksheet. The columns in the Service Areas section of the worksheet are the same as the Create Service Area dialog box fields. For each service area that you add, enter the postal code ranges that comprise the service area. You can enter multiple postal code ranges for a single service area. Do so by naming the service area in the first column of the Postal Code Ranges section of the worksheet for each postal code row.

Restriction

The postal code ranges must already be in the application database before you can enter them in the worksheet rows. Upload any new postal code ranges first, before uploading your service area edits.

The workbook uses the Changed cell in both worksheets to automatically identify the rows that you edit.

After you complete your edits, click Upload. Only those rows marked as changed are uploaded into the application tables.

The Worksheet Status field is updated only if the server or database becomes inaccessible during upload.

Restriction

You cannot edit postal code ranges in the worksheet if they uploaded successfully. To edit the postal code ranges after upload, you must search for the range on the Manage Postal Code Ranges and Service Areas page, Postal Code Ranges tab. Then, select the range and click Edit.

The application automatically updates the Status value in each row of the workbook. If there are errors that require review, the upload rolls back the change in the application and sets the row status in the workbook to Upload Failed. It then continues to the next row in the workbook. Double-click Update Failed in the Status cell to view the error. Fix any data issues in the workbook and upload the new changes.

When you upload the service area worksheet with postal code ranges that were not successfully uploaded, the data in the Service Area section may upload successfully. However, any rows in the Postal Code Ranges section of the worksheet with values not yet uploaded, have an error status indicating invalid postal code range.

If you define multiple values for the same criteria type, such as two postal code ranges, a person needs to satisfy at least one of the criteria to be considered eligible. For example, a person who resides in either postal range is eligible. If you include multiple criteria of different types, such as gender and age, a person must meet at least one criterion defined for each criteria type.

If you add only one eligibility profile to an object, then the criteria in that profile must be satisfied, even if the Required option is not selected. If you add multiple eligibility profiles, the following rules apply:

If all profiles are optional, then at least one of the profiles must be satisfied.

If all profiles are required, then all of the profiles must be satisfied.

If some but not all profiles are required, then all required profiles must be satisfied and at least one optional profile must also be satisfied.

A life event is a change to a person or a person's employment that affects benefits participation. Examples of life events are changes in worker assignment, anniversary of employment, and marriage. Life events affect benefits processing for a worker.

Aspects of life events that are related to benefits processing are:

Type

Status

The four types of life events are explicit, temporal, scheduled, and unrestricted. You configure explicit life events during implementation. They can include either personal or work-related changes, such as an address change or assignment transfer. Temporal life events occur with the passage of time, such as the sixth month of employment, and are predefined. For temporal events, you use derived factors associated with plan design eligibility factors. Scheduled life events are assigned. Open enrollment periods are an example of a scheduled life event. Unrestricted life events are for benefit enrollments that are not time-dependent, such as savings plan enrollments. Participants can make enrollment changes at any time.

Two life event statuses are important for benefits processing, potential and active. Potential life events are detected life events, but they do not generate enrollment actions. Potential life events are processed by the participation evaluation process. If potential life events meet plan design requirements, they become active life events, which can generate enrollment opportunities.

In addition to life events statuses that affect benefits processing, you can update individual life event statuses for a worker. Life events statuses that you can set include closed, backed out, and voided. Closing a life event prevents further enrollment processing of the life event. Backing out a life event rescinds any updates to worker records that are generated by the participation evaluation process. You can back out only life events in the started status or processed status. Voiding a life event rescinds any updates and prevents further processing.

You configure explicit life events during implementation. They can include either personal or work-related changes, such as an address change or assignment transfer. Define an explicit life event by specifying its processing characteristics and the database changes that generate it. Use criteria similar to those that define eligibility profiles and variable rate profiles.

Aspects of explicit life events include:

Type

Definition

Detection

The two types of explicit life events are person change and related person change. A person change is a change in HR data that you define to indicate that a person has experienced a life event. A related person change is a change in HR data that you define to indicate that a person has experienced a related-person life event.

To define changes to a person's record that generate a life event, you specify database table and column values that, when changed, are detected and processed as a life event. For example, you might define that a life event occurs when the database value of a person's marital status changes from single to married. An example of a related-person life event is when a participant's child, who is older than 26, becomes disabled. The participant's record can be updated to reflect this and the child can be designated as a dependent.

Note

If you do not find criteria among choices in selection lists of table and column objects, you can use a formula to generate a life event.

Associate the person change that you define with a life event. You can link multiple person changes to a single life event and you can link a single person change to more than one life event.

Specify the new value for this combination of database table and column that, when detected, indicates that a life event has occurred. A person change can be defined to be detected based on:

A new value

A change from a specific old value to a specific new value

Any change to a value

A change from any value to no value

A change from no value to any value

You can use a formula to define more complex conditions for detecting a life event.

If you define a life event based on changes to more than one table, the life event is detected when a data change in one of the tables meets the person change criteria. For life events that entail multiple changes to the same table, the person must satisfy all person change criteria associated with the table for the life event to be detected.

A scheduled life event is an assigned life event, such as an open enrollment period.

Types of scheduled life events are:

Administrative

Open enrollment