11g Release 7 (11.1.7)

Part Number E20376-07

Home

Contents

Book

List

Contact

Us

|

Oracle® Fusion Applications Compensation Management Implementation Guide 11g Release 7 (11.1.7) Part Number E20376-07 |

Home |

Contents |

Book List |

Contact Us |

|

Previous |

Next |

This chapter contains the following:

Salary Component Lookups: Explained

Configure compensation frequency values, grade rate validation data, and payroll elements for quoting and paying base pay. Also manage lookups, actions, and action reasons related to base pay management.

To define base pay, application implementors and compensation administrators start from the Setup and Maintenance Overview page. Select Navigator - Setup and Maintenance.

Salary components itemize new or adjusted salary into one or more components that reflect different reasons for the allocation. You can edit or add components to the Salary Component lookup type during initial implementation and at any later time.

The following salary components are predefined:

Merit

Cost of Living

Adjustment

General adjustment

Market

Adjustment due to salary being out of line with the market

Structured

Adjustment dictated by union or employment contract, such as an increase after three months

Equity

Adjustment to correct salary compression or inversion

Promotion

Location

Progression

Regular and automatic adjustment

To add to or edit these codes in the CMP_SALARY_COMPONENTS lookup type, use either the Navigator or Administration menu to go to the Setup and Maintenance work area and search for the Manage Common Lookups task in the Search: Tasks pane or All Tasks tab search area.

Note

Component itemization is for notification purposes only. When component values change, the payroll element holds the new salary value calculated from the component adjustment. Individual component values are not sent to payroll for processing.

Salary components enable you to itemize new or adjusted salary into one or more components that reflect different reasons for the allocation, such as merit, adjustment, and location. The following example illustrates one way to use salary components.

Workers in the US may be subject to the following salary adjustments:

Merit

Promotion

Adjustment components

A US worker who receives a salary of 4,000 USD per month might have the following salary components:

Merit: 6 percent

Promotion: 4 percent

Adjustment components: 2 percent

The salary basis specifies the frequency of the amount sent to payroll and stored as salary, such as annual or hourly amount. It also specifies the payroll element and input value that feeds the salary to payroll as well as the grade rate that provides the salary range for metrics and salary validation.

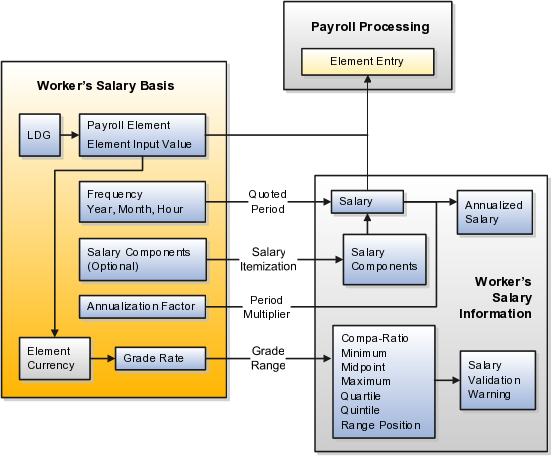

This figure shows how the data on a worker's salary basis contributes to salary information and payroll processing.

The legislative data group (LDG) restricts the payroll elements available to associate with the salary basis.

The salary basis holds the payroll element for base pay. When you define a base pay payroll element, you specify an input value that holds base pay on a worker's element entry.

For base pay salary the input value is Amount.

For hourly wages the input value is Rate.

When you enter or update a base pay amount for a worker, the application creates or updates the base pay element entry for that person. The monetary amount or rate recorded in the element entry is the salary value in the worker's salary information that is held on the assignment or employment terms.

For example:

If the salary basis frequency is Annually, the amount passed to the element entry is an annual amount.

If the salary basis frequency is Hourly, the amount of the element entry is the hourly rate.

The payroll run detects and processes the element entry for the worker in the current payroll period. The element's formula:

Converts the input value amount on the element entry to the appropriate payroll period amount

Multiplies the input value hourly rate by the number of hours reported for the payroll period

The resulting base pay earnings appear on the payslip for the payroll element associated with the salary basis.

Frequency defines the period of time in which a worker's base pay is quoted. Base pay is stored in this frequency on the salary record and is passed to payroll in this same frequency.

Salary components itemize new or adjusted salary into one or more components that reflect different reasons for the allocation, such as merit, adjustment, and location.

Component itemization is for salary calculation and reporting purposes only. Itemized amounts are not passed to payroll.

The annualization factor is the multiplier used to convert base pay at the selected frequency to an annualized salary amount.

The grade rate associated with the worker's salary basis supplies the worker's salary range information used to:

Calculate and display salary range metrics, such as compa-ratio or quartile

Validate salary amounts and adjustments entered for the worker

Only grade rates defined in the same currency as the currency of the payroll element can be associated with the salary basis.

Create a salary basis by choosing a set of the following characteristics associated with a worker's base pay:

Legislative data group

Frequency of quoted base pay salary

Annualization factor of selected frequency

Payroll element and input value

(Optional) Grade rate for salary validation

(Optional) Salary components to itemize allocations

You must create a separate salary basis, with a unique name, for each unique combination of these factors. Using a descriptive name for the salary basis is a good practice if you require many salary bases in your organization.

Important

After you associate the salary basis with any worker, you cannot delete it or modify any characteristic other than component configuration.

You configure each salary basis for a specified legislative data group. If your organization has multiple legislative data groups, you must create a uniquely named salary basis for each unique set of characteristics applicable to each legislative data group.

Available frequencies are:

Hourly

Monthly

Annually

Payroll period frequency

A worker who has multiple assignments or employment terms on different payroll frequencies requires a different salary basis associated with each assignment or employment term.

To match the salary basis frequency to the payroll frequency, select Payroll period frequency on the salary basis.

The annualization factor is the multiplication factor used to convert base pay at the selected frequency to an annualized amount. The annualized amount:

Appears on compensation transaction pages

Shows how much a worker would be paid over a year, at the current rate

The following table shows the default factors supplied for the frequency options. You can override the supplied default values.

|

Frequency |

Default Annualization Factor |

|---|---|

|

Annually |

1 |

|

Monthly |

12 |

|

Hourly |

No default is supplied. Enter the number of hours in a work year to multiply by the hourly rate to calculate the annualized salary for this salary basis. |

|

Payroll Period |

Leave blank. Annualization is determined by the period type on the payroll linked to a worker's assignment or employment terms. |

You attach a single existing payroll element to each salary basis to hold base pay earnings. Only elements that are valid for the selected legislative data group are available for selection. You must select one input value from the list of valid values for the selected element.

The currency in which the worker is paid comes from the element currency.

Restriction

Recurring elements can be linked to multiple salary bases only if they are classified as earnings elements and configured to allow multiple entries in the same period.

You might use the same payroll element when two salary bases with the same frequency use different grade rates. For example:

Headquarters-based grades have base pay of X

Grades for all other locations have base pay of X - 2 percent

Component itemization is for informational purposes only. When component values change, the payroll element holds the new salary value calculated from the component adjustment. Individual component values are not sent to payroll for processing.

To configure the use of salary components during salary entry or adjustment, choose from the following options:

Do not use components.

Select specific components to display to managers and professionals during allocation.

Allow managers and professionals to select components during allocation.

You can optionally associate one existing grade rate with the salary basis for salary validation purposes. Only grade rates that are valid for the selected legislative data group are available. Also, the grade rate currency must match the salary basis currency, which is inherited from the payroll element. To help you determine how many different salary bases you require, if you are using grade rates, identify in how many different currencies you are defining your grade rates.

The grade range information on the grade is used to calculate salary metrics and provide a validation warning if the total salary entered is outside the range. Examples of salary metrics are compa-ratio, salary range position (minimum, midpoint, maximum), quartile, and quintile.

If you want calculated metrics to appear on the transactional pages:

You must include a grade rate on the salary basis.

Ensure that the persons associated with the salary basis have a grade in the selected grade rate.

The frequency of the grade rate does not have to match the frequency of the salary basis. For example, you can attach a grade rate defined with a monthly frequency to a salary basis with an annual frequency.

Salary validation helps you verify that salary allocations fall within the appropriate range for each worker. You can choose between two methods of validating salaries:

Grade range validation produces a warning.

Payroll element validation prevents approval.

Generate a warning message when a manager or compensation professional enters a new or adjusted salary that is outside the minimum or maximum values defined for the worker's grade in the grade rate attached to the salary basis.

Prevent approval of a new or adjusted salary that does not pass validation configured on the payroll element input. When you define an input value for the salary element, you can write and attach a formula to perform validation, or you can enter minimum and maximum valid values. If you want to vary the validation for different groups of workers, you can enter validation criteria as part of the element link.

The period type on the payroll linked to a worker's assignment or employment terms determines the number of payroll periods in a year.

Yes, if it is a recurring element that is classified as an earnings element and configured to allow multiple entries in the same period.

No. If the salary basis has been assigned to any worker, you cannot delete it. You can modify only the salary component configuration.

Yes, if edit capability is enabled for the salary basis. You can hide or show the edit capability for managers using personalization on the pages where managers enter salary allocations.

A warning message informs the manager or compensation professional that the salary is out of the valid range for the worker. The message can be ignored or the salary revised to fall within the valid range.