Modifying and Distributing Position Costs

This section provides an overview of how the system distributes position costs and discusses how to:

View and modify salary distributions.

Enter earnings.

View and modify distributions for earnings and allowance costs.

Enter benefits data.

View and modify distributions for benefit costs.

Enter employer-paid taxes.

View and modify distributions for employer-paid tax costs.

Pages Used to Modify and Distribute Position Costs

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Position Data - Salary Distribution |

BP_SALARY_DISTR |

|

View and modify dimension distributions for the salary costs of a position or for an employee assigned to a position. |

|

Position Data - Earnings/Allowance |

BP_EARN_CD |

|

View and modify earnings and allowance costs for a position or for an employee assigned to a position. Define earnings as part of gross pay. |

|

Position Data - Earnings/Allowance Distribution |

BP_EARN_DISTR |

Click Distribution on the Position Data - Earnings/Allowance page. |

View and modify dimension distributions for the earnings and allowance costs that are associated with a position or an employee who is assigned to a position. |

|

Position Data - Benefit Plan |

BP_BNFT_PLAN |

|

View and modify benefits for a position or for an employee assigned to a position. |

|

Position Data - Benefits Distribution |

BP_BNFT_DISTR |

Click Distribution on the Position Data - Benefit Plan page. |

View and modify dimension distributions for the benefits costs that are associated with a position or an employee who is assigned to a position. |

|

Position Data - Tax Rate |

BP_TAX_RATE |

|

View and modify employer-paid taxes for a position or for an employee who is assigned to a position. |

|

Position Data - Tax Distribution |

BP_TAX_DISTR |

Click the Distribution button on the Position Data - Tax Rate page. |

View and modify dimension distributions for the employer-paid tax costs that are associated with a position or an employee who is assigned to a position. |

Understanding How the System Distributes Position Costs

You can distribute position costs across multiple planning centers. For example, if your planning center is defined as Department, you can distribute position costs across multiple planning centers when one or more departments share the cost of a position. In the case of a shared position, you assign one planning center as the owner of the position. The planning center owner of the position must enter the distributions for other planning centers. Users of the other planning centers see the distributions in their personnel line item activity after the planning center owner copies or submits their master version and the system recalculates the planning model.

Distributions are a percentage of the position cost to be distributed. Dimensions and members that are available for use on the distribution pages are dependent on those defined for positions in the Activity Group and related account default setup.

Use the Position Data - Salary Distribution, Earnings/Allowance Distribution, Benefits Distribution, and Tax Distribution pages to view and modify distributions for a position or for an employee assigned to a position. If you are working with distributions for a position, the system uses the distribution definition for each whole and partial FTE that is assigned to the position. The total FTE for a position appears on the Position Data page. If you are defining distributions for an employee that is assigned to the position, the system uses the distribution definition for the FTE that is associated with the employee ID, employee record number, and position. The FTE for the employee appears on the Position Data - Employee Job Detail page. The Position Data - Salary Distribution page also displays the FTE for a position or employee.

Note: If you add a position but the coordinator has not defined a distribution profile for the job code default, then the salary, earnings, benefits, and tax distributions at the position level default to use 100 percent for the planning center dimension. You must enter any other dimension distributions for the position using the distribution pages.

If the coordinator sets up the system to use the default dimension values in a distribution profile, the system populates the dimension values on the Position Data - Salary Distribution, Earnings/Allowance Distribution, Benefits Distribution, and Tax Distribution pages after you save a new position.

There is no online validation for dimension combination in the position activity during save. If you select Enforce Budgets on the parent line item activity, the system validates dimension combinations when inserted into that activity. If the system finds an invalid dimension combination in line item, the system displays an error message. You will need to make the correction to the dimension combination in the position activity, the source of the combination in error.

Warning! If you distribute compensation costs for a position across different line item ledgers, you will need to enter the data into each of the scenarios separately with its prorated share of the position costs. One position activity is associated with only one parent line item activity that is tied to a single ledger ID for the scenario. For this reason, there is no system constraint on the distribution pages that force 100 percent distribution of the position costs. You can enter distribution percentages for the position that do not total 100 percent on the distribution pages. Therefore, ensure that the distribution percentages that you enter across multiple scenarios add up to 100 percent. Within a planning model, the system does validate that the entered distribution percentage does not exceed 100 percent.

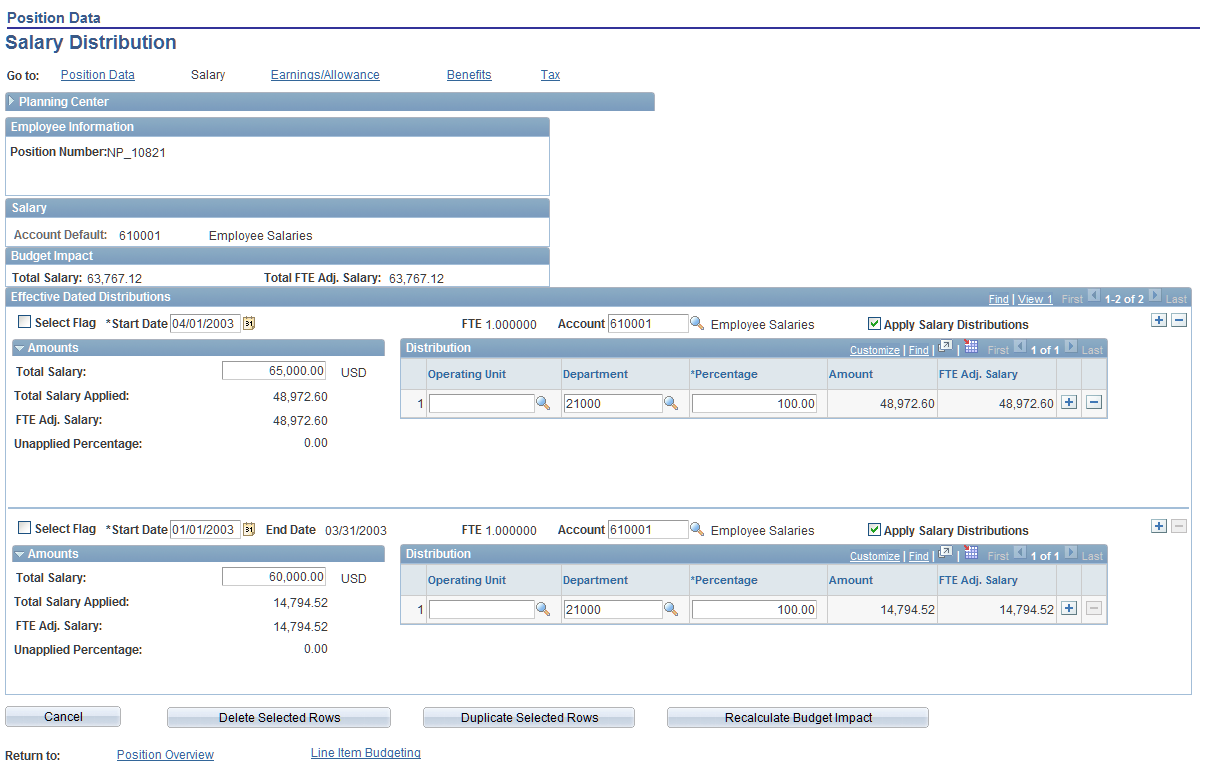

Position Data - Salary Distribution Page

Use the Position Data - Salary Distribution page (BP_SALARY_DISTR) to view and modify dimension distributions for the salary costs of a position or for an employee assigned to a position.

Click the Salary Distribution link on the Position Data page.

For an employee, click the Salary amount link on the Position Data - Employee Job History page.

Image: Position Data - Salary Distribution page

This example illustrates the fields and controls on the Position Data - Salary Distribution page. You can find definitions for the fields and controls later on this page.

Salary

| Account Default |

The default account that salary distribution amounts are associated with. You cannot edit this field. |

Budget Impact

Effective Dated Distributions

Use this section to view and modify salary distributions over time. If changes occur during the budgeting cycle, click the Add icon to insert additional effective-dated rows and enter the new values. Click View All button to view all of the distributions on a single page, or use the arrows to scroll through them individually. Each row contains distributions amounts for the period of time defined by the start date and end date for that row. Rows are arranged in descending order from top to bottom. The End Date field does not appear for the most current row, or if there is only one effective dated row. You can add future-dated rows but if the start date is beyond the last day of the budget year then no values are calculated since there is no budget impact, otherwise the amounts are calculated for the time period defined by that row. Each effective-dated distribution row includes the following fields:

Action Buttons

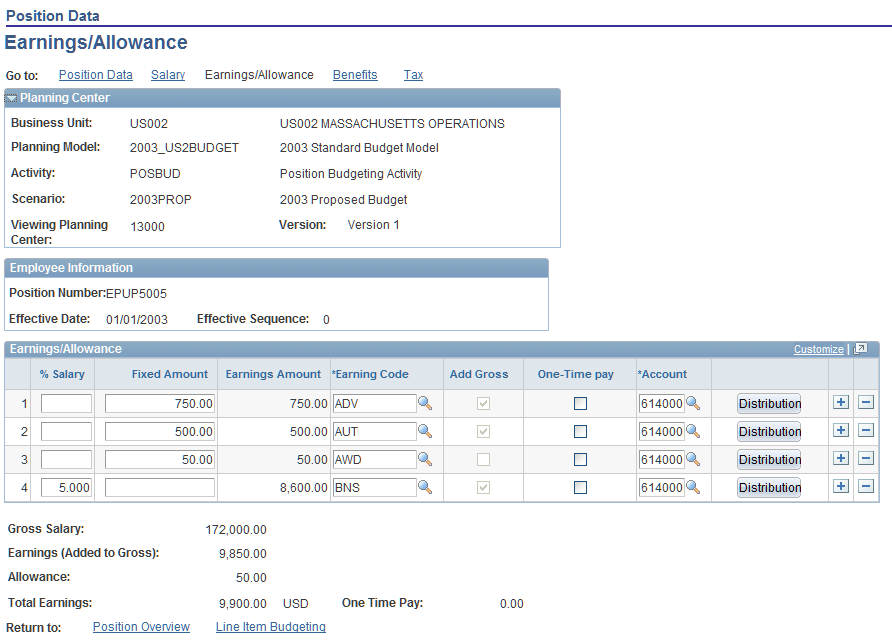

Position Data - Earnings/Allowance Page

Use the Position Data - Earnings/Allowance page (BP_EARN_CD) to view and modify earnings and allowance costs for a position or for an employee assigned to a position.

Define earnings as part of gross pay.

Click the Earnings/Allowance Defaults link on the Position Data page.

For an employee, click the Subject Earnings, Allowance, or OTP amount link on the Position Data - Employee Job History page.

Image: Position Data - Earnings/Allowance page

This example illustrates the fields and controls on the Position Data - Earnings/Allowance page. You can find definitions for the fields and controls later on this page.

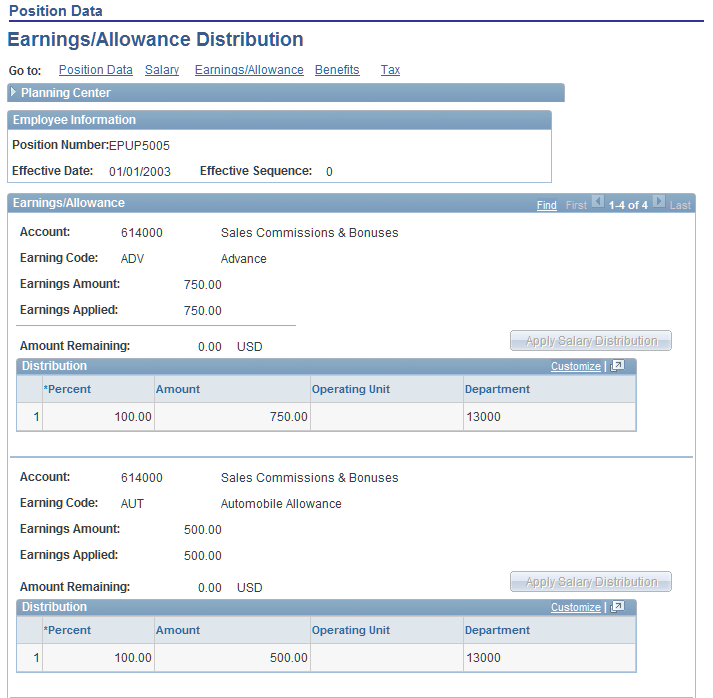

Position Data - Earnings/Allowance Distribution Page

Use the Position Data - Earnings/Allowance Distribution page (BP_EARN_DISTR) to view and modify dimension distributions for the earnings and allowance costs that are associated with a position or an employee who is assigned to a position.

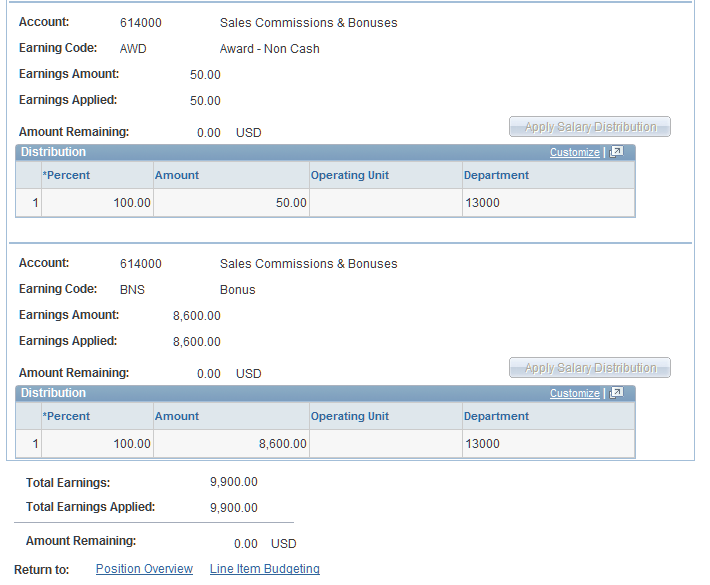

Image: Position Data - Earnings/Allowance Distribution page (1 of 2)

This example illustrates the fields and controls on the Position Data - Earnings/Allowance Distribution page (1 of 2). You can find definitions for the fields and controls later on this page.

Image: Position Data - Earnings/Allowance Distribution page (2 of 2)

This example illustrates the fields and controls on the Position Data - Earnings/Allowance Distribution page (2 of 2). You can find definitions for the fields and controls later on this page.

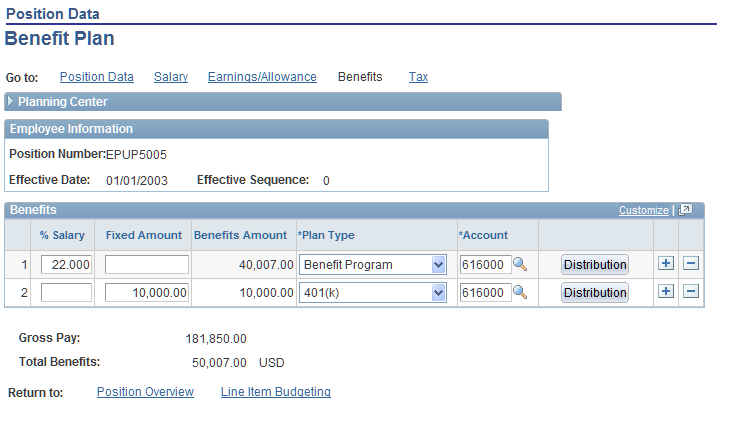

Position Data - Benefit Plan Page

Use the Position Data - Benefit Plan page (BP_BNFT_PLAN) to view and modify benefits for a position or for an employee assigned to a position.

Click the Benefits Defaults link on the Position Data page.

For an employee, click the Benefits amount link on the Position Data - Employee Job History page.

Image: Position Data - Benefit Plan page

This example illustrates the fields and controls on the Position Data - Benefit Plan page. You can find definitions for the fields and controls later on this page.

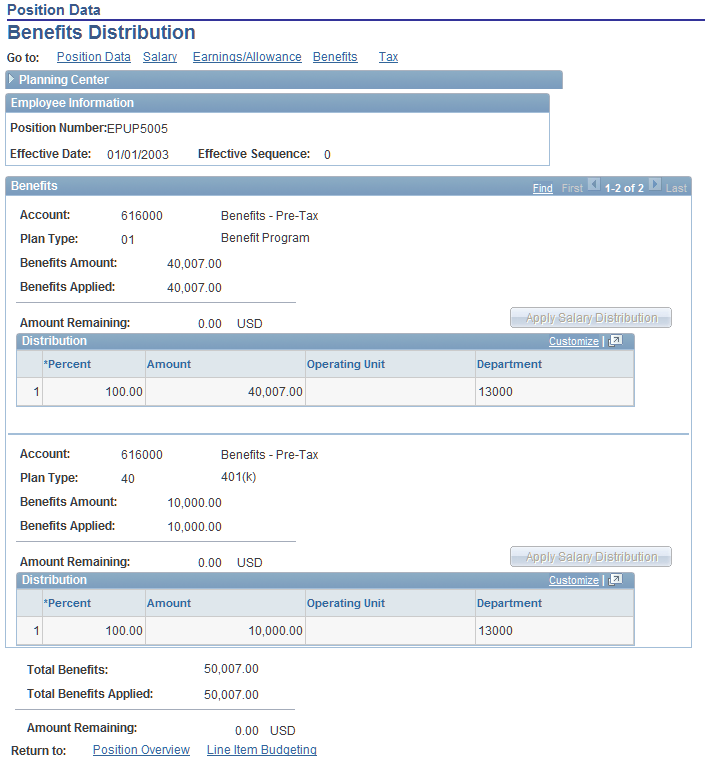

Position Data - Benefits Distribution Page

Use the Position Data - Benefits Distribution page (BP_BNFT_DISTR) to view and modify dimension distributions for the benefits costs that are associated with a position or an employee who is assigned to a position.

Image: Position Data - Benefits Distribution page

This example illustrates the fields and controls on the Position Data - Benefits Distribution page. You can find definitions for the fields and controls later on this page.

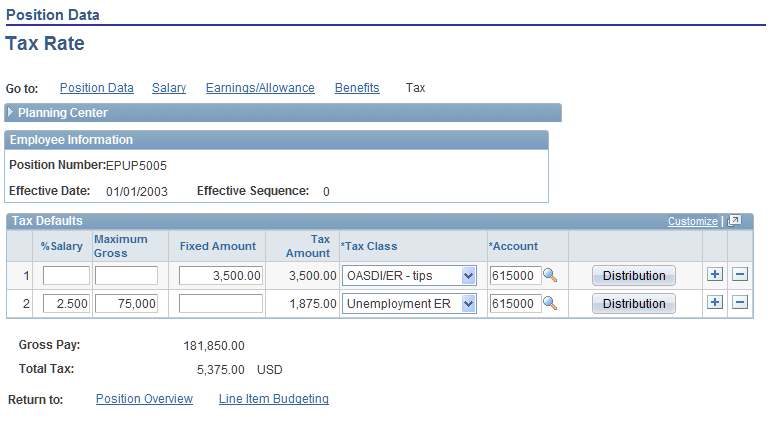

Position Data - Tax Rate Page

Use the Position Data - Tax Rate page (BP_TAX_RATE) to view and modify employer-paid taxes for a position or for an employee who is assigned to a position.

Click the Tax Default link on the Position Data page.

For employee, click the Tax amount link on the Position Data - Employee Job History page.

Image: Position Data - Tax Rate page

This example illustrates the fields and controls on the Position Data - Tax Rate page. You can find definitions for the fields and controls later on this page.

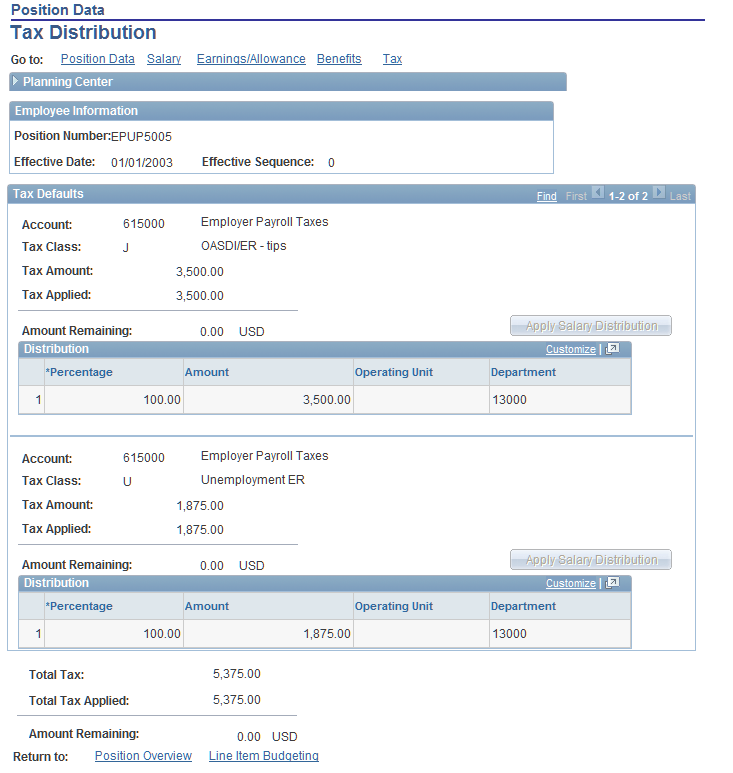

Position Data - Tax Distribution Page

Use the Position Data - Tax Distribution page (BP_TAX_DISTR) to view and modify dimension distributions for the employer-paid tax costs that are associated with a position or an employee who is assigned to a position.

Image: Position Data - Tax Distribution page

This example illustrates the fields and controls on the Position Data - Tax Distribution page. You can find definitions for the fields and controls later on this page.